- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 03-03-2023

- EUR/USD to finish the week above 1.0600 after hitting a weekly low of 1.0533.

- A risk-on impulse and falling UST bond yields are a headwind for the US Dollar.

- US ISM Non-Manufacturing data showed the US economy remains resilient.

EUR/USD reversed its course and is set to finish the week with gains of more than 0.80% on a softer US Dollar (USD) amidst speculations that the US Federal Reserve (Fed) would not hike rates beyond what money market futures expect. The EUR/USD exchanges hands at 1.0635 after hitting a daily low at 1.0588.

EUR/USD trimmed Wednesday’s losses as investors downplayed hawkish Fed commentary

US equities are set to finish the week with gains. The US Dollar Index (DXY), a measure of the buck’s value vs. a basket of peers, slides from a two-and-a-half-month high down to 104.526 after US data reaffirmed a solid economic status in the United States (US).

Business activity in the US improved, as shown by the US ISM Non-Manufacturing PMI for February was 55.1, a tick lower than the previous month’s 55.2, but exceeded expectations of 54.5, indicating that business activity is still strong. The prices index subcomponent, sought by investors for clues about inflation, jumped to 65.5, exceeding estimates of 64.5 but trailing Janiary’s data.

Meanwhile, Federal Reserve officials crossed newswires, with Fed Governor Michelle Bowman and Dallas Fed President Lorie Logan did not comment on monetary policy. The Boston Fed President Susan Collins commented that inflation remains too high and added that

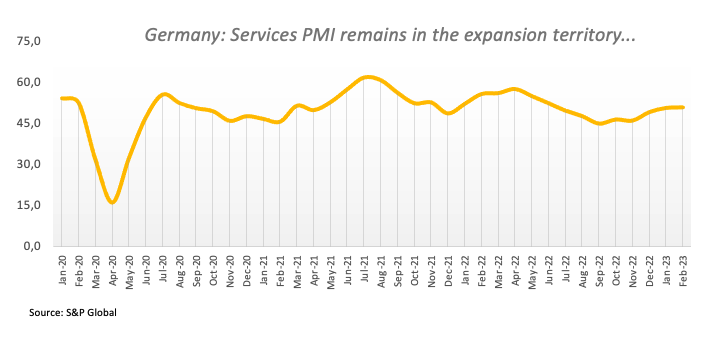

Aside from this, the Eurozone (EU) revealed S&P Global Services and Composite PMIs came above previous readings. Meanwhile, inflationary figures announced on Thursday came below last month’s data but above estimates, a reason for the ECB to continue to hike interest rates.

Even though figures were higher than expected, investors had already priced in a 50 bps rate hike by the European Central Bank (ECB) as announced by its President Christine Lagarde in its last meeting presser. However, recent data have ECB policymakers split on what signal the bank should send to the markets.

EUR/USD Technical levels

Next week, the Bank of Canada (BoC) will have its monetary policy meeting. No change in rates is seen. Analysts at TD Securities point out that the forward guidance is not expected to change significantly from the January meeting.

BoC: Live to hold another day

"The downside surprise on Q4 GDP should allow the BoC to look past the blockbuster January jobs number and keep the overnight rate unchanged at 4.50%. The forward guidance is not expected to change too much from January, though the BoC might want to put more emphasis on the conditional nature of its pause."

"A low-energy BoC meeting would likely direct CAD's focus to the evolving global narratives. We see USDCAD holding the 1.33/1.37 range unless US inflation goes awry this month. In turn, we prefer to play CAD on crosses (recently closing NZDCAD) where scaling into AUDCAD longs appeals to the shift in global growth drivers."

The National Bank of Canada revised its year-end target for the USD/CAD pair from 1.27 to 1.32. however, they warn that the reopening of the Chinese economy, coupled with the disruption of commodity supplies due to the war in Ukraine, will help limit the depreciation of the Canadian Dollar.

Weak Canadian GDP = BoC pause

“While job creation remains strong, a lacklustre GDP report and slower than expected inflation point to a divergence in monetary policy between Canada and the US. While our new spread forecast is not good news for the Canadian dollar in the near term, we still believe that the reopening of the Chinese economy, coupled with the disruption of commodity supplies due to the war in Ukraine, will help limit the depreciation of the CAD.”

“Under our new US scenario for growth and interest rates, we see USD/CAD lingering in the 1.36-1.39 range through the first half of 2023, before making comeback in the second half of the year when the Fed finally ends its tightening campaign. Our new year-end target is 1.32 (1.27 previously).”

- US Dollar weakness further as stocks jump in Wall Street.

- Crude oil prices rise by more than 2%, Gold breaks above $1,850.

- US bonds extend recovery ahead of NFP week.

The US Dollar dropped further late on Friday with EUR/USD reaching fresh highs above 1.0630 and GBP/USD soaring above 1.2000. Risk appetite and a recovery in Treasuries weighed on the Dollar.

Dollar adds to weekly losses in the American session

The DXY broke below European session lows late on Friday and fell below 104.50 as stocks on Wall Street rose further. The Dow Jones was on its way to gain more than 1% and the Nasdaq was up by almost 2%.

In a low liquidity environment, risk appetite pushed the Dollar further lower. After a positive February, the Greenback posted the first weekly loss in a month even as US yields held near monthly highs and after upbeat US economic data.

The Pound gained momentum with GBP/USD soaring toward 1.2050. EUR/GBP trimmed weekly losses falling below 0.8830. EUR/USD rose above 1.0630 while USD/JPY fell to two-day lows below 135.80. Emerging market currencies also appreciated during Friday’s American session. USD/MXN dropped further below 18.00, to test 2018 lows.

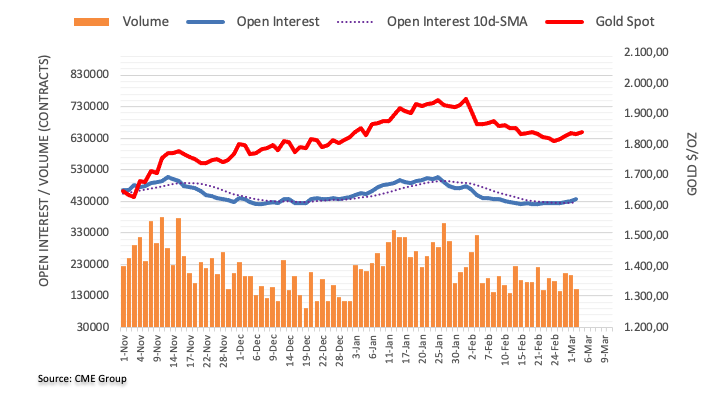

Gold broke above $1,850 to the highest level in two weeks. Silver rose to $21.25, the strongest level since February 24. US yields pulled back further with the 10-year to 3.96%.

DXY Technical levels

On Friday, the US February ISM Service PMI was released. Analysts at Wells Fargo point out the report showed that activity is not slowing much and that is keeping pressure on prices and on margins. They argue that it is happening alongside an upswing in hiring, giving the Federal Reserve the green light for further rate increases.

Stop underestimating the Service sector

“The resilience of the service sector was on full display for a second straight month in February. The ISM services index had previously dipped into contraction territory at the end of last year amid a two-month slowing in real consumer spending. A jump to 55.2 in January took most forecasters by surprise and set the stage for a run of better-than-expected January economic data on jobs, spending and production.”

“The continued hiring in services and more neutral stance of maintaining employees in manufacturing suggests employers added jobs at a decent clip in February. When nonfarm employment data are released next Friday, we expect to see employers added 270K net new jobs during the month.”

“The resilience of service sector activity may turn up the pressure on policymakers at the Federal Reserve to do more to combat inflation. The prices paid component cooled, but only slightly, and a reading of 65.6 is consistent with prices continuing to rise. Services inflation will be slower to abate, but still-high price pressure combined with continued tightness in the labor market means the Fed's job of getting inflation on a sustained path back to 2% inflation is not yet done.”

Analysts at MUFG Bank consider the Brazilian Real has room to climb versus the US dollar in the short term. They have a trade idea of shorting USD/BRL at 5.22 with a target at 4.90.

Real not fully pricing improvement in Brazil’s Terms of Trade

“Unlike other EM currencies, the BRL has not benefitted as much so far from China reopening optimism since it emerged towards the end of last year.”

“The further improvement in Brazil’s terms of trade at the start of this year has not fully fed through to a stronger BRL. It reflects in part heightened concerns at the start of this year over domestic policymaking under new President Lula relating to both fiscal and monetary policy. We are assuming that these concerns will not escalate significantly in the near-term, and allow the BRL to be driven more by renewed China reopening optimism.”

“Long BRL positions continue to benefit from the favourable carry pick-up. The BCB is expected to keep rates elevated in the near-term at 13.75% despite government pressure to lower rates.”

“Volatility in the FX market remains at lower levels as well at the start of this year providing support for carry trades. The main risks to the trade include: i) a sharp increase in the domestic policy risk premium priced into the BRL, and ii) rising US yields eventually trigger a bout of higher volatility in FX & financial markets.”

What you need to take care of on Monday, March 6:

The Greenback lost ground on Friday and finished the week lower. Positive data from China and a retreat in US yields kept the DXY in negative territory. US Stocks posted weekly gains after sharp losses in February. The improvement in market sentiment contributed to weakening the Dollar, which posted the first weekly loss in a month after a positive February.

It could be a quiet start of a btoy week that will bring new information, interest rate decisions and fresh guidance from central banks. The Reserve Bank of Australia will have its meeting on Tuesday (25 bps rate hike expected) and the Bank of Canada on Wednesday; Fed Chair Powell will testify to Congress (Tue/Wed) on the Semiannual Monetary Policy Report. China will report trade (Tuesday) and inflation (Thursday).

The key day will be Friday with the Non-farm payrolls report; Canada will also release employment data. During the weekend, China’s annual “Two Session” (parliamentary meeting) kicks off. The Chinese government is set to formalize government titles and announce its GDP target.

EUR/USD posted a modest weekly gain, enough to become the best performance since early January. The rebound occurred from the 20-week Simple Moving Average and was capped below 1.0700. Eurozone inflation data triggered a decline in European bonds. Rising EZ yields helped the Euro.

The benefit from the agreement between the United Kingdom and the European Union was short-lived for the Pound. GBP/USD continues to move sideways, supported by 1.1900, unable to retake 1.2000. EUR/GBP rebounded back to the 0.8850 area.

The Japanese Yen finished the week mixed despite higher yields. USD/JPY is facing a strong resistance around 137.00. EUR/JPY posted the highest weekly close since November, but it was far from the highs below 145.00.

Among majors, the New Zealand Dollar was the best performer. Back in February, the Reserve Bank of New Zealand raised the OCR by 50 basis points to 4.75%, signalsignallinghikes ahead. NZD/USD rose after four weekly slides, still unable to rise above the 20-day SMA at 0.6260.

Considering the most traded currencies acrossgloballyChilean Peso (CLP) and the Mexican Peso (MXN) were the biggesweek's biggest gainersMXN dropped below 18.00 for the first time since 2018.

Yields remainremainnd relevant for currencies, with the US 10-year around 4% and the German 10-year at 2.70%, the highest weekly close since 2011. Bond market volatility expected to continue next week.

Gold had the best week since January, recovering from two-motwo-monthto the $1,850 area despite higher yields. Price rose constantly since Monday. Silver ended a negative six-week streak, rose from four-month lows, back above the $21.00 area. The outlook for metals has improved with the bond market still represents a critical risk in both directions.

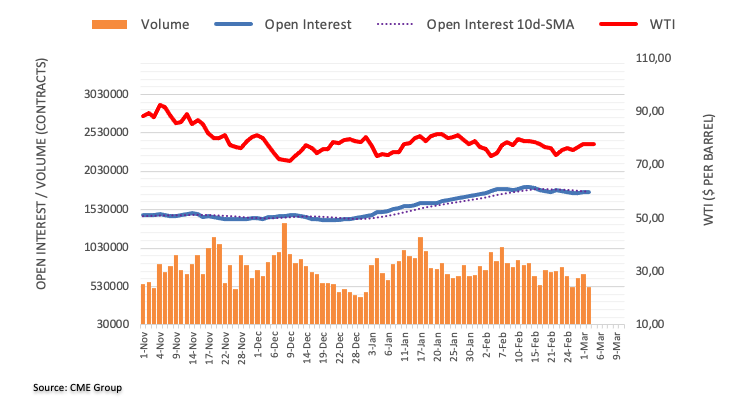

Oil prices finished the week up by around 4%. On Friday price,s rose almost 2% after being down 3% on reports that the United Arab Emirates (UAE) is having an internal debate about leaving the Organization of the Petroleum Exporting Countries (OPEC). The latest round of US and Chinese economic activity data helped prices hold above YTD lows but not enough to boost WTI back above $80.00.

Cryptocurrencies failed to benefit from higher equity prices and a weaker Dollar. Bitcoin lost more than 4% on Friday, to the lowest level in four weeks, hit by Silvergate woes.

Like this article? Help us with some feedback by answering this survey:

- USD/JPY retreats from weekly highs amidst an offered US Dollar.

- Upbeat US economic data failed to bolster the US Dollar.

- USD/JPY Price Analysis: Bullish above 136.00; otherwise, a retest of 134.00 is on the cards

The USD/JPY slides from 136.70s toward the 136.00 area on Friday amidst broad US Dollar (USD) weakness even though data cemented the US economy resilience. At the time of writing, the USD/JPY exchanges hands at 136.02.

USD/JPY Price Action

From a daily chart perspective, the USD/JPY is neutral upward biased, despite dropping from weekly highs toward the 136.10s area. If the USD/JPY bears reclaim the 136.00 figure, that would open the door for further losses. The first support would be the March 1 low of 135.25, followed by strong support below 135.00. Firstly the 100-day EMA at 134.90, followed by the 20-day EMA at 134.39, and then the 134.00 mark.

On the other hand, a bullish continuation would continue if USD/JPY bulls hold prices above 136.00. The first resistance would be the December 20 high at 136.77, followed by the psychological 137.00 mark.

USD/JPY Daily chart

USD/JPY Technical levels

- US crude oil benchmark advanced more than 2%, sponsored by China’s data.

- The US Dollar remains offered across the board after the US ISM Services PMI.

Western Texas Intermediate (WTI) resumed its uptrend after a report by the Wall Street Journal (WSJ) spurred a fall of 3% on speculations that one of the largest oil producers worldwide threatened to leave the Organization of the Petroleum Exporting Countries (OPEC). However, those rumors were dismissed, according to Reuters. At the time of writing, WTI is trading at $79.06, up 2.50%.

During the Wall Street opening, rumors that the United Arabe Emirates (UAE) discussed leaving OPEC as the country has been seeking authorization to increase its crude output. Consequently, WTI fell 3% towards three-day lows before recovering some ground.

Oil prices have been bolstered throughout the week by a shortage of crude oil, on speculations that China’s reopening would increase demand for crude. Additionally, business activity in China gathered momentum with Caixin’s Manufacturing and Services PMI’s re-entering expansionary territory.

WTI prices shrugged off an increase in US stockpiles for the tenth straight week, as record exports of US crude made for a smaller increase than in recent weeks.

Meanwhile, US data revealed in the week showed that business activity in the manufacturing and services segment improved to expansionary territory. Although it’s positive news for growth, Federal Reserve officials would continue to tighten monetary conditions to curb inflation to its 2% target.

In the meantime, the US Dollar Index, a gauge of the buck’s value against a basket of peers, is retreating 0.16%, down at 104.752, a tailwind for the US dollar-denominated oil price.

WTI Technical levels

- AUD/USD is set to finish the week with solid gains of 0.28%.

- The US ISM Services PMI was a tick lower than the previous month’s data, signaling the US economy is solid.

- AUD/USD traders eye Federal Reserve speeches throughout the day.

The AUD/USD jumped from around weekly lows below 0.6700 and climbed 0.44% on Friday. Factors like a risk-on impulse and an offered US Dollar (USD) keep the Australian Dollar (AUD) positive in the day. At the time of typing, the AUD/USD is trading at 0.6745.

AUD/USD creeps higher toward 0.6750

Sentiment remains upbeat, a headwind for the safety of the US Dollar. The US ISM Non-Manufacturing PMI for February was 55.1, slightly lower than the previous month’s 55.2. However, it exceeded expectations of 54.5, indicating that business activity is still strong. The Prices Paid Index subcomponent, looked by investors for inflationary pressures, increased to 65.6, above estimates of 64.5. Although it was lower than January’s 67.8, data would keep traders tracking Federal Reserve’s (Fed) officials’ speakers throughout the day.

US Federal Reserve’s (Fed) speakers highlighted the importance of tackling inflation towards the 2% target. On Thursday, Fed Governor Christopher Waller commented that inflation was not easing as expected and signaled his openness to increase rates if price pressures don’t reduce.

Following the release, the greenback weakened as the US Dollar Index recovered from daily lows and reached 104.924. As of writing, it resumed its downtrend at 104.848, down 0.11%.

The AUD/USD recovered after dropping toward 0.6732 and advanced towards 0.6760 before settling at around current exchange rates.

On the Australian side, the S&P Global Services PMI exceeded estimates, while the S&P Global Composite PMI was 50.6, higher than January’s 49.2, signaling the Australian economy is doing far better than expected.

Additionally, the Caixin Services PMI improved in China at 55, compared to 50.5 consensus, expanded at the fastest rhythm in six months in February as removing harsh COVID-19 restrictions revived customer demand, driving a solid increase in employment, a private sector survey showed on Friday.

What to watch?

Federal Reserve speakers will be crossing wires led by the Dallas Fed President Lorie Logan, Atlanta’s Fed Raphael Bostic, Fed Governor Michell Bowman, and the Richmond Fed President Thomas Barkin.

AUD/USD Technical levels

Below are the key takeaways from the US Federal Reserve's semi-annual Monetary Policy Report published on Friday, per Reuters.

Key takeaways

"Financial conditions have tightened further since June and are significantly tighter than a year ago."

"Ongoing increases in the fed funds rate target are necessary."

"Strongly committed to getting inflation back to 2%."

"Business credit quality remains strong, but some indicators of future business defaults are somewhat elevated."

"Financial vulnerabilities remain moderate overall."

"Net negative income does not impede monetary policy work."

"Expecting to return to net positive income at some point."

"Market liquidity remained low in Treasury and other key markets versus pre-pandemic levels."

"Bringing inflation back to 2% likely requires period of below-trend growth, some softening of labor market conditions."

"Underlying momentum in the economy likely remains subdued."

"Valuation pressures in equity markets have increased modestly."

"For core services ex-housing sector, inflation remains elevated; prospects for it slowing may depend in part on an easing of tight labor market conditions."

"Core foreign inflation remains high and inflationary pressures are broad."

"Some signs of increased stress for lower-income households as near-prime, subprime delinquency rates have risen."

"Fed rate control toolkit effective at maintaining federal funds rate."

"Will adjust balance sheet drawdown process if there is a need to."

"Strong reverse repo takeup reflects market rates and investor caution."

"Labor market has remained extremely tight and there is a significant labor supply shortfall relative to the levels expected before the pandemic."

"Tight labor market conditions have largely erased pandemic-induced widening of employment gaps across demographic groups."

"Officials mindful of monetary policy rules, don’t use them to drive policy."

"Rate hikes have narrowed gap between policy rule settings and real-world level."

"Labor force participation rate is likely to remain well below its level from before the pandemic."

Market reaction

The US Dollar Index showed no immediate reaction to this publication and was last seen trading flat at 104.93.

- US Dollar rises marginally after US ISM Service PMI.

- GBP/USD drops to 1.1960 and rebounds toward 1.2000.

- Pair remains sideways around the 20-week SMA.

The GBP/USD fell to 1.1960 after the release of the US ISM Service PMI and then rebounded. The pair continues to move sideways, near 1.2000, virtually flat for the week.

US data lifts Dollar marginally

The last first-tier release of the week was the US ISM Service PMI for February which came at 55.1, below January's 55.2, and slightly above the market consensus of 54.5. The Prices Paid Index sub-component dropped from 67.8 to 65.6, still above expectations for a slide to 64.5. The Employment Index jumped to 54, versus expectations of a decline to 49.8.

The numbers gave the US Dollar some momentum, but price action remain subdued on Friday with major pairs consolidating. The greenback is moving with a positive intraday bias supported by a rebound in US yields. The US 10-year yield rose from 3.97% to 4.02%.

The GBP/USD is off highs as it keeps moving in a range above 1.1900. It is trading marginally higher for the week, hovering around the 20-week Simple Moving Average. A firm break under 1.1900 should open the doors to more losses.

While on the upside, the immediate resistance emerges at 1.2055 (20-day SMA) followed by the 1.2150 area. A firm break above should clear the way for 1.2200 and more.

Technical levels

Gold is likely to track shifting market expectations around the Fed tightening in the short term, according to strategists at ANZ Bank.

USD is likely to weaken in the second half of 2023

“The Gold market remains vulnerable to market expectations around the Fed’s monetary policy. Strong economic data from the US with sticky inflation raise the risk of more rate hikes; this is likely to be a headwind in the short term.”

“Nevertheless, we see limited upside in the USD, which is a tailwind for gold prices. Even with higher terminal rates, the USD is likely to weaken in H2 2023.”

Hawkish Banxico stance sparked MXN appreciation in February. Looking ahead, economists at MUFG Bank do not see much room for further strengthening.

Banxico will promote more moderate 25 bps hikes in upcoming meetings

“Higher rates for longer will keep the MXN attractive as a carry currency helping to explain further MXN appreciation registered during February. However, we don´t see much room for further strengthening, assuming that Banxico will promote more moderate 25 bps hikes in upcoming meetings. Later this year when it sees clear signs of a more significant inflation slowdown, we expect Banxico to start cutting its policy rate.”

“We keep our view that two major risk factors might contribute to some MXN weakening ahead. Firstly, the slowdown/recession in the US might hit inflows into Mexico from trade, direct investments and wage remittances. Secondly, Lopez Obrador’s nationalistic policies especially on the energy sector may deter private investments. However, the MXN might continue to be supported by investment and exports from companies reallocating global supply chains into Mexico.”

“USD/MXN – Q1 2023 18.400 Q2 2023 18.600 Q3 2023 18.800 Q4 2023 19.000”

- USD/CAD is set to finish the week flat after solid US economic data.

- US ISM Services PMI came slightly below estimates, though it remained at expansionary territory.

- The Bank of Canada is expected to keep rates unchanged at 4.50% at the upcoming monetary policy meeting.

The USD/CAD cements its bullish case by staying above the 1.3600 figure, courtesy of falling oil prices. Heated discussions within the Organization of the Petroleum Exporting Countries (OPEC) sent WTI prices down almost 3%, a headwind for the Canadian Dollar (CAD). At the time of writing, the USD/CAD is trading at 1.3625.

USD/CAD reached 1.3630s post US ISM Non-Manufacturing PMI

Wall Street opened in positive territory. The US ISM Non-Manufacturing PMI for February came at 55.1, below the prior’s month 55.2, but exceeded estimates of 54.5, signaling that activity remains firm. The Prices Paid Index subcomponent, estimated to drop to 64.5, rose by 65.6, below January’s 67.8, higher than expected, but it shows an improvement compared to the last month.

After the ISM’s release, the US Dollar Index (DXY), a measure of the buck’s value, improved toward 104.924, trimmed some of its earlier losses, and is almost flat, while the USD/CAD jumped 15 pips from around 1.3615 to 1.3630s.

US Federal Reserve’s (Fed) speakers highlighted the importance of tackling inflation towards the 2% target. On Thursday, Fed Governor Christopher commented that inflation was not easing as expected and signaled his openness to increase rates if price pressures don’t reduce.

In the meantime, the Wall Street Journal reported that the United Arab Emirates (UAE) is having an internal debate about leaving OPEC, as the country has been seeking authorization to increase its crude output. Consequently, WTI fell 3% towards three-day lows before recovering some ground.

On the Canadian front, Building Permits fell by 4% in January from December and were down 5% YoY, according to data revealed by Statistics Canada. The fall was spurred by aggressive rate hikes of the Bank of Canada (BoC).

The BoC announced that it would pause its tightening cycle and is expected to hold it at around 4.50% at its next meeting.

Therefore, the USD/CAD is expected to appreciate further, even though analysts estimate a stronger Canadian dollar for the year. Improving the global economic outlook would undermine USD/CAD, as traders seeking return will turn to high beta currencies, like the Loonie (CAD). In an alternate scenario, interest rate differentials between the Fed and the BoC would likely favor the US Dollar; hence further upside in the USD/CAD is foreseen.

USD/CAD Technical levels

- US Service sector data surpass expectations, no significant surprises.

- Treasury yields rebound from daily lows.

- XAU/USD retreats further from two-week highs, tests $1,840.

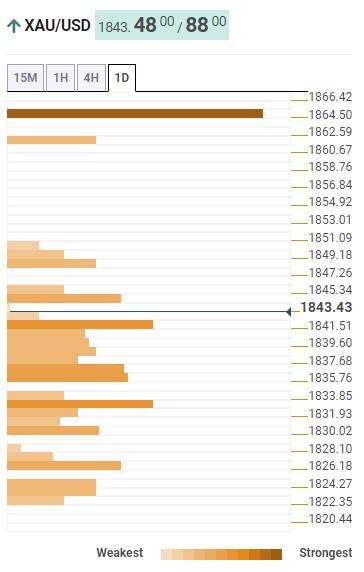

Gold prices weakened after the US data, however remained positive for the day and the week. XAU/USD fell to the $1,840/oz area, pulling back from the two-week high it hit earlier near $1,850.

US ISM Services PMI shows numbers above expectations

The ISM Services PMI came in at 55.1 in February, above the 54.5 expected and slightly under the 55.2 of January. The Prices Paid Index pulled back from 67.8 to 65.5, above the 64.5 of market consensus. Ahead of the NFP week, the Employment Index jumped to 54, against expectations of a slide to 49.8.

Previously, the final reading of the US S&P Global Services PMI showed a positive revision from 50.5 of the flash estimate to 50.6.

The US Dollar edged higher following the report, turned positive versus the Euro and the NZD and trimmed losses versus the Pound and the Yen. US yields rebounded from daily lows. The US 10-year yield rose from 3.97% to 4.02%.

XAU/USD dropped to as low as $1,840/oz, still holding in positive ground for the day. Gold continues to back away from the two-week high it hit earlier on Friday at $1,849.

On a daily basis, Gold is still up for the day but off highs. An intraday support emerges around $1,837. A break lower would expose the $1,830 area. On the upside, the key barrier remains the $1,845/$1,850 range.

Technical levels

Economists at ABN Amro believe that the EUR/USD pair is set to advance nicely over the coming months.

More upside in EUR/USD for 2023 and 2024

“As long as EUR/USD is above 1.0325 the long-term trend is positive.”

“We think there is more upside in EUR/USD for 2023 and 2024. This is mainly driven by a narrowing of the difference in policy rates and government bond yields between the US and the Eurozone as a result of more the more aggressive rate cuts we expect for the Fed compared to the ECB at the end of 2023.”

“Our forecast for the end of 2023 for EUR/USD is 1.12 and to 1.16 end of 2024.”

Business activity in the US service sector continued to expand at a robust pace in February with the ISM Services PMI arriving at 55.1. Although this reading was slightly lower than January's print of 55.2, it came in above the market expectation of 54.5.

The inflation component of the PMI survey, the Price Paid sub-index, edged lower to 65.6 in February from 67.8 but surpassed analysts' estimate of 64.5. The New Orders sub-index rose to 62.6 from 60.4 and the Employment Index advanced to 54 from 50 in the same period.

Market reaction

The US Dollar Index gained traction with the initial reaction and was last seen trading flat on the day at 104.90.

- EUR/USD regains some buying interest beyond 1.0600.

- There is an initial up-barrier at the 55-day SMA near 1.0715.

EUR/USD pick up pace and reverses, albeit partially, Thursday’s decline at the end of the week.

Occasional bullish attempts need to clear the provisional hurdle at the 55-day SMA, today at 1.0714, to allow for extra gains to, initially, the weekly top at 1.0804 (February 14).

Looking at the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0326.

EUR/USD daily chart

Will February’s Dollar gains be quickly reversed? A hawkish Fed can keep the Dollar supported a little further, in the view of economists at ING.

Fed will have little choice but to sound hawkish

“The Fed will have little choice but to sound hawkish. And some upward revisions to the Dot Plot fed funds expectation should support the recent hawkish re-pricing of the Fed curve. A severely inverted US yield curve is not conducive to the kind of benign USD decline that seemed likely in January.”

“Central banks tightening into slowdowns will generate greater headwinds for risk assets. This again is not a particularly positive story for pro-cyclical currencies such as the Euro – at least in the immediate future.”

- USD/MXN plunges to multi-year lows around $18.01, despite Banxico’s cutting growth in Mexico.

- An upbeat US ISM Non-Manufacturing PMI could trigger a recovery in the USD/MXN; otherwise, a fall below $18.00 is on the cards.

- USD/MXN Price Analysis: Bad US economy data could trigger a break below $18.00

The Mexican Peso (MXN) appreciates against the US Dollar (USD), as the USD/MXN falls to multi-year lows last seen in April 2018 at 18.0148, despite Banxico (Mexican Central Bank) cutting the growth forecast for Mexico in 2023 and 2024. At the time of writing, the USD/MXN exchanges hand at 18.0479, with losses of 0.39%.

USD/MXN falls to 5-year lows at $18.01, US ISM Services PMI eyed

Wall Street is set for a higher open. Global S&P Services and Composite PMIs improved globally, a sign that the worldwide economy is in better shape than foreseen, as traders moved to riskier assets as bond yields eased. A measure of the greenback, the US Dollar Index, drops 0.25% to 104.657.

On Wednesday, Banxico revealed that Mexico’s economy in 2023 and 2024 would grow at a slower pace than initially expected, blamed on the deterioration of US expectations, namely in the industrial sector, according to an inflation report. Banxico forecasts economic growth of 1.6% for Mexico in 2023, lower than the 1.8% estimated, while for 2024, the projection is reduced to 1.8% from 2.1%.

At around 15:00 GMT, the Institute for Supply Management (ISM) would reveal the Non-Manufacturing PMI for February, expected to come at 54.5, below January’s 55.2. Due to high inflationary readings in the United States (US), the prices subcomponent would be closely monitored by investors, with the ISM Prices Paid Index expected to rise to drop from 67.8 in January to 64.5 in February.

An upbeat US ISM Non-Manufacturing report could trigger flows to the US Dollar, which means the USD/MXN could rise from YTD lows. In addition, speculations that Banxico is near pausing its tightening cycle would reduce the interest rate differentials between the US and Mexico. Also, sentiment deterioration would play an important piece of the puzzle in the future of the USD/MXN pair.

Also read: When is the US ISM Services PMI, and how could it affect EUR/USD?

USD/MXN Technical analysis

The USD/MXN daily chart portrays the pair as downward biased. After the USD/MXN pair consolidated around $18.30, Wednesday’s fall opened the door to test the 18.0000 psychological barriers. A breach of the latter will expose April’s 2018 swing low at 17.9388, followed by July’s 2017 lows of 17.4498. On the other hand, if the USD/MXN recovers above 18.1930, March’s 2 high, that would open the door to test the MTD high at 18.3296.

USD/MXN Technical levels

- DXY keeps the choppy trade well and sound below 105.00.

- Recent tops near 105.30 continue to limit the upside in the dollar.

DXY surrenders part of Thursday’s marked advance and returns to the area well south of the 105.00 yardstick on Friday.

So far, the continuation of the range bound theme seems the most likely scenario in the very near term for the index. In the meantime, the dollar needs to clear the February peak at 105.35 (February 27) to allow for extra recovery and a potential challenge of the 2023 top at 105.63 (January 6).

In the longer run, while below the 200-day SMA at 106.54, the outlook for the index remains negative.

DXY daily chart

According to the Wall Street Journal, the United Arab Emirates (UAE) is having an internal debate about leaving the Organization of the Petroleum Exporting Countries (OPEC). Crude oil prices are falling sharply.

UAE has been looking for OPEC+ to authorize an increase in its production. The report from the WSJ adds that UAE is clashing with Saudi Arabia over production levels and Yemen.

Market reaction

Following the report, WTI lost almost 3%. As of writing, it is moving off lows, trading back above 76.00$. Before the rebound, WTI hit three day lows near $75.75.

Economists at Wells Fargo expect the USD/CNY pair to head gradually lower over the coming months.

USD/CNY and USD/CNH to end Q1-2023 at 6.92

“For the time being, we forecast the USD/CNY and USD/CNH exchange rates to end Q1-2023 at 6.92 as broad USD appreciation is still likely, although we forecast only modest Renminbi weakness as the PBoC remains on hold.”

“With the Fed likely to ease monetary policy at a quicker pace than the PBoC over the medium to longer term, the outlook for Renminbi strength over time remains intact, although risks to China's economy and financial markets are abundant as geopolitical tensions with the US have been renewed.”

“We forecast the Chinese currency to reach 6.84 per Dollar by the end of this year and break below 6.80 by mid-2024.”

The Canadian Dollar was the third best performing G10 currency in February. Underperformance should emerge later in the year, economists at MUFG Bank report.

USD/CAD to be more driven by external factors for now

“Stronger domestic data but weaker inflation will be enough to keep the BoC on the sidelines and hence USD/CAD is likely to be more driven by external factors for now and with 2yr UST bond yields at cyclical highs and Fed rhetoric so hawkish, we see upside USD/CAD risks over the short-term before CAD can recover.”

“Slower US growth will likely see USD/CAD lower later in H2 with CAD underperforming non-USD G10 FX.”

“USD/CAD – Q1 2023 1.3600 Q2 2023 1.3500 Q3 2023 1.3400 Q4 2023 1.3200.”

“EUR/CAD – Q1 2023 1.4280 Q2 2023 1.4580 Q3 2023 1.4740 Q4 2023 1.4780.”

“CAD/JPY – Q1 2023 100.00 Q2 2023 98.520 Q3 2023 97.010 Q4 2023 96.210.”

US ISM Services PMI Overview

The Institute of Supply Management (ISM) will release the Non-Manufacturing Purchasing Managers' Index (PMI) - also known as the ISM Services PMI – at 15:00 GMT this Friday. The gauge is expected to come in at 54.5 for February, down from 55.2 in the previous month. Given that the Fed looks more at inflation than growth, investors will keep a close eye on the Prices Paid sub-component, which is anticipated to decelerate from 67.8 in January to 64.5 during the reported month.

Economists at ING offer a brief preview of the important macro data and write: “Consensus is centred around a marginal decrease from 55.2 to 54.5, which would confirm speculation on recession is too premature and would continue to endorse the Fed’s hawkish rhetoric. We think this should allow further stabilisation of the Dollar around current levels.”

How Could it Affect EUR/USD?

Ahead of the key release, retreating US Treasury bond yields prompts some selling around the US Dollar. This, along with the overnight hawkish comments by ECB President Christine Lagarde, assists the EUR/USD pair to regain positive traction on the last day of the week. Any disappointment from the US ISM Services PMI could exert additional downward pressure on the Greenback and continue pushing the pair higher. That said, the market reaction is more likely to remain limited amid growing acceptance that the Fed will continue to tighten its monetary policy to combat stubbornly high inflation.

Hence, a stronger headline print and higher-than-expected Prices Paid Index should be enough to trigger a fresh leg up in the US bond yields, which, in turn, should help revive the USD demand. Apart from this, looming recession risks should continue to act as a tailwind for the safe-haven buck. This, in turn, suggests that the path of least resistance for the EUR/USD pair is to the downside and any subsequent move up might still be seen as a selling opportunity.

Eren Sengezer, Editor at FXStreet, offers a brief technical outlook and outlines important technical levels to trade the major: “EUR/USD is currently trading slightly above the descending regression channel coming from early February. The 20-period and the 50-period Simple Moving Averages (SMA) reinforce that resistance area that aligns at 1.0610/1.0620. Once the pair stabilizes above that hurdle, it could target 1.0650/60 (Fibonacci 23.6% retracement of the latest downtrend, 100-period SMA), 1.0700 (psychological level) and 1.0720 (Fibonacci 38.2% retracement)..”

“On the other hand, if the pair returns within the descending channel, sellers could take action and cause EUR/USD to slide toward 1.0560 (mid-point of the descending channel), 1.0540 (static level) and 1.0500 (psychological level, lower limit of the descending channel), .” Eren adds further.

Key Notes

• ISM Services PMI Preview: Strong figure set to catapult US Dollar to new highs

• US February ISM Services PMI Preview: Will it influence Fed rate hike bets?

• EUR/USD Forecast: Investors struggle to make up their minds about Euro's direction

About the US ISM manufacturing PMI

The Institute for Supply Management (ISM) Manufacturing Index shows business conditions in the US manufacturing sector. It is a significant indicator of the overall economic condition in the US. A result above 50 is seen as positive (or bullish) for the USD, whereas a result below 50 is seen as negative (or bearish).

- USD/JPY comes under selling pressure on Friday and retreats from a fresh YTD peak.

- Retreating US bond yields prompts some USD profit-taking and drags the pair lower.

- The divergent Fed-BoJ policy outlook should help limit deeper losses for the major.

The USD/JPY pair comes under some selling pressure on Friday and reverses the previous day's positive move to the 137.10 area, or its highest level since December 20. The pair maintains its offered tone through the early North American session and is currently placed near the lower end of its daily range, just a few pips above the 136.00 round-figure mark.

An intraday retracement slide in the US Treasury bond yields weighs on the US Dollar (USD), which turns out to be a key factor dragging the USD/JPY pair lower. That said, hawkish Fed expectations should act as a tailwind for the US bond yields and the Greenback. Apart from this, the divergent Fed-BoJ policy outlook should contribute to liming losses for the major.

From a technical perspective, the USD/JPY pair struggled to find acceptance above the 100-day Simple Moving Average (SMA) and failed ahead of the very important 200-day SMA. The said barriers are currently pegged near the 136.75-136.80 region and the 137.25 area, respectively, which if cleared decisively will be seen as a fresh trigger for bullish traders.

The subsequent move-up will further confirm a breakout through the 38.2% Fibonacci retracement level of the recent pullback from over a three-decade high and pave the way for additional gains. The USD/JPY pair might then accelerate the move to reclaim the 138.00 mark en route to the 138.75 zone, the 139.00 round figure and the 139.60 region (50% Fibo. level).

On the flip side, sustained weakness below the 136.00 level might prompt some technical selling and drag the USD/JPY pair to the weekly low, around the 135.25 region. Some follow-through selling below the 135.00 psychological mark will set the stage for a slide towards the next relevant support near the 134.40-134.20 zone en route to the 134.00 round figure.

The latter should act as a strong base for the USD/JPY pair ahead of the Bank of Japan (BoJ) policy meeting next week. That said, a convincing break below could make spot prices vulnerable to sliding further towards the 23.6% Fibo. level support, just ahead of the 133.00 mark.

USD/JPY daily chart

Key levels to watch

EUR/USD edges higher but modest gains encounter selling pressure. Economists at Scotiabank analyze the pair’s technical picture.

Resistance aligns at 1.0650

“EUR/USD has recovered from yesterday’s low around 1.0577 but gains have been slight and the short-term chart suggests that the EUR is running into firm selling pressure in the low 1.06s.

“Renewed weakness and a push under minor support intraday at 1.0580 might see a bit more downward pressure on the EUR develop.”

“Resistance is 1.0650.”

See – EUR/USD: Volatility in a 1.05-1.10 range depending on the data in Q2 – ING

- GBP/USD regains positive traction on Friday and reverses a major part of the overnight losses.

- The four-week-old trading range warrants caution before placing aggressive directional bets.

- Bearish oscillators on the daily chart support prospects for a break below the 200-day SMA.

The GBP/USD pair attracts some dip-buying on Friday and recovers a major part of the previous day's slide to the 1.1920-1.1915 support zone. The pair maintains its bid tone around the 1.2000 psychological mark through the early North American session and is supported by broad-based US Dollar weakness.

Looking at the broader picture, the two-way price moves witnessed over the past four weeks or so constitute the formation of a rectangle on the daily chart. The lower end of the trading band coincides with a technically significant 200-day Simple Moving Average (SMA) and should now act as a pivotal point.

A convincing break below will make the GBP/USD pair vulnerable to weaken further below the 1.1900 mark and test the YTD low, around the 1.1840 region touched in January. Some follow-through selling will complete a bearish double-top pattern formed near the 1.2445-1.2450 area and pave the way for deeper losses.

On the flip side, the overnight swing high, around the 1.2035 area, might act as an immediate hurdle ahead of the 1.2065-1.2070 supply zone. Any subsequent move-up could attract fresh sellers near the 1.2100 mark and remain capped near the 50-day SMA strong barrier, currently around the 1.2135-1.2140 area.

Some follow-through buying could lift the GBP/USD pair towards the 1.2200 mark en route to the February 14 peak, around the 1.2265-1.2270 region. A sustained strength beyond the latter will suggest that the slide from the 1.2445-1.2450 zone has run its course and shift the near-term bias back in favour of bullish traders.

GBP/USD daily chart

Key levels to watch

USD/CAD has eased modestly. A break under the 1.3535 is required to trigger additional losses, economists at Scotiabank report.

CAD shows signs of decoupling from stocks

“CAD’s correlation with equities is weakening and currently stands just below 60%, the weakest since last Jul. If the CAD is decoupling from equity trends, other (typical) fundamental drivers are not obviously supportive.”

“USD/CAD losses would need to extend through the mid-1.35s and below 1.3535 (Monday’s low and potential double top trigger) to extend meaningfully.”

“Solid resistance remains at 1.3665 (the potential double top).”

Lee Sue Ann, Economist at UOB Group, sees the RBA raising the OCR by 25 bps at the March 7 meeting.

Key Takeaways

“The RBA has stated that its priority is to return inflation to target, and that further increases in interest rates will be needed over the months ahead.”

“We are penciling in another two more 25bps hike, which will take the OCR to 3.85%, before looking for a pause.”

GBP/USD holds key support in low-1.19s. Economists at Scotiabank analyze the pair technical outlook.

Paring back BoE rate bets will weigh on the Pound

“Markets continue to imply solid expectations that the policy cycle will extend, with three more 25 bps hikes priced in through Sep; paring back of these rate bets (while the Fed and ECB remain relatively hawkish) will weigh on the Pound.”

“Cable has rebounded from the low 1.19 area for a third time since mid-Feb. While this area is important support on the short-term charts, recall that 1.1916 (currently) is where the 200-DMA lies and provides additional support for the GBP.”

“More range-trading around the 1.20 point may develop from here (resistance is 1.2150) in the short run.”

- EUR/JPY extends the pessimism below 145.00 on Friday.

- The next target stays unchanged at the 146.70 region.

EUR/JPY adds to Thursday’s losses and retreats below the 145.00 mark at the end of the week.

The continuation of the current upside momentum faces the next hurdle at the 2023 high at 145.56 (March 2). Once this level is cleared, the par could then confront the December 2022 top at 146.72 (December 15) ahead of the 2022 high at 148.40 (October 21 2022).

In the meantime, while above the 200-day SMA, today at 141.63, the outlook for the cross is expected to remain positive.

EUR/JPY daily chart

S&P 500 has revisited the 3930/3880 support zone. Economists at Société Généraleanalyze the index's technical outlook.

Scope for a short-term bounce

“Formation of a daily bullish engulfing pattern highlights the possibility of a short-term bounce.”

“Recent bearish gap at 4090 is the first layer of resistance; overcoming this can lead to an extended up move towards 4218 and perhaps even towards last August's high of 4320/4370.”

“Defending the 200-DMA at 3930/3880 – which is also the descending trend line drawn since last year and the 38.2% retracement from October – is crucial to avert a deeper pullback.”

- Silver attracts fresh buying on Friday and steadily moves back closer to the weekly peak.

- The technical setup supports prospects for the emergence of fresh selling at higher levels.

- A sustained move beyond the $22.00 mark is needed to negate the near-term bearish bias.

Silver regains positive traction on Friday and climbs back to the top end of its weekly trading range, around the $21.15-$21.20 region during the mid-European session. Bulls now await a sustained strength beyond the 200-hour SMA before positioning for any further intraday appreciating move.

Any subsequent move up, however, is likely to confront stiff resistance just ahead of the mid-$21.00s, marking the 23.6% Fibonacci retracement level of the recent pullback from the $24.65 zone, or a multi-month top touched in February. A sustained strength, however, might trigger a short-covering move and lift the XAG/USD further towards the 38.2% Fibo. level, around the $22.00 round-figure mark.

That said, technical indicators on the daily chart are still holding deep in bearish territory and have also recovered from the oversold zone. This, in turn, supports prospects for the emergence of fresh selling at higher levels and suggests that the ongoing recovery move from the YTD low, around the $20.40 region set earlier this week, runs the risk of fizzling out rather quickly near the aforementioned handle.

On the flip side, the $20.70-$20.60 zone seems to protect the immediate downside ahead of the $20.40 level. Failure to defend the said support levels will be seen as a fresh trigger for bearish traders and pave the way for further losses. The XAG/USD could then turn vulnerable to weaken further below the $20.00 psychological mark and test the next relevant support near the $19.75-$19.70 region.

The downward trajectory could get extended towards the $19.20-$19.15 intermediate support en route to the $19.00 round figure before the XAG/USD eventually drops to the $18.25-$18.20 strong horizontal support.

Silver 1-hour chart

Key levels to watch

Gold price shed more than 5% in February. XAU/USD is currently trading at a good $1,840, which puts it around $40 or 2% higher than on Tuesday. It appears that the yellow metal has bottomed out, strategists at Commmerzbank report.

There is no longer any expectation of rate cuts this year

“Weighing on Gold was a combination of an appreciating USD and sharply rising bond yields due to a massive upward correction of US interest rate expectations.”

“By the end of the month the expected rate peak had been pushed back into the autumn – what is more, it is now set to total almost 5.5%, which is around 70 bps higher than envisaged at the start of the month. Moreover, there is no longer any expectation of rate cuts this year.”

“The price increase seen this week despite even higher interest rate expectations could indicate that the correction of the gold price is more or less complete and that the price may have bottomed out at the beginning of the week.”

GBP/USD suffered heavy losses and closed below 1.2000 on Thursday. A break under the 1.1920 mark could trigger another leg lower, economists at OCBC Bank report.

Descending triangle?

“Daily momentum and RSI indicators are not showing a clear bias. But on the weekly chart, bullish momentum is fading fast while RSI fell.”

“A potential descending triangle could be forming with support at 1.1920 levels (200-DMA, triangle support). A decisive break to the downside could fuel more downward pressure. Next support at 1.1840, 1.1720 levels.”

“Resistance at 1.2045 (21-DMA), 1.2140 (50-DMA).”

Economist at UOB Group Enrico Tanuwidjaja reviews the latest inflation figures in Indonesia.

Key Takeaways

“Indonesia’s headline inflation rate rebounded higher to 5.5% y/y in Feb from 5.3% in Jan, beating consensus forecast slightly. On month basis, it gained by 0.2%, tad faster than Jan’s pace.”

“Significantly higher food prices and relatively elevated level of prices in key consumer baskets such as transportation, utilities, and clothing underpinned the pick-up in headline inflation last month.”

“Today’s inflation data reinforces our 2023 average inflation forecast of 4% (2022: 4.2%). Our view remains for inflation to edge back to be within BI’s target range of 2-4% only in 2H23.”

ISM will release the February US Services PMI report later in the day. Economists at ING the impact on markets can be sizeable.

Consensus expects a stabilisation in ISM Services

“Consensus is centred around a marginal decrease from 55.2 to 54.5, which would confirm speculation on recession is too premature and would continue to endorse the Fed’s hawkish rhetoric. We think this should allow further stabilisation of the Dollar around current levels.”

“A return to sub-50 levels is seen as rather unlikely and would cause a significant unwinding of hawkish Fed bets and probably the start of a new Dollar downtrend.”

“A read in the 50-53 area would probably be enough to generate some dovish repricing and should weigh on the Dollar. However, as long as jobs data remain strong (payrolls are released next week), we shouldn’t see a USD downtrend fully materialise.”

Economists at MUFG analyze the GBP outlook. The British Pound sees brighter prospects later in the year.

Short-term downside risks

“We maintain our view of short-term downside risks as inflation remains a concern and risk conditions remain fragile. However, assuming inflation falls notably and the Brexit deal just agreed improves relations with Europe, we see scope for some GBP outperformance after a sustained period of negativity for the UK.”

“EUR/GBP – Q1 2023 0.8800 Q4 2023 0.8700 Q3 2023 0.8650 Q4 2023 0.8500”

“GBP/USD – Q1 2023 1.1930 Q2 2023 1.2410 Q3 2023 1.2720 Q4 2023 1.3180”

- EUR/GBP meets with some supply and moves away from a nearly two-week high set on Thursday.

- Bets for more interest rate hikes by the BoE and the ECB warrant caution for aggressive traders.

- A sustained weakness below the 100-day SMA is needed to support prospects for deeper losses.

The EUR/GBP cross comes under some selling pressure on Friday and extends the previous day's pullback from the vicinity of the 0.8900 mark, or a nearly two-week high. The intraday downtick picks up pace during the first half of the European session and drags spot prices to a fresh daily low, around the 0.8845 region in the last hour.

The British Pound draws support from rising bets for additional rate hikes by the Bank of England (BoE) and turns out to be a key factor dragging the EUR/GBP cross lower. It is worth recalling that the BoE Governor Andrew Bailey said on Wednesday that some further increase in bank rates may turn out to be appropriate, though added that nothing is decided. This was followed by hawkish remarks by the BoE Chief Economist Huw Pill on Thursday, noting that Britain's economy is showing slightly more momentum than expected and pay growth is proving a bit faster than the central bank forecast last month.

The downside for the EUR/GBP cross, however, seems cushioned amid expectations that the European Central Bank (ECB) will continue hiking rates in the coming months. In fact, the minutes of the ECB meeting held in February reflected a very hawkish debate and a clear determination to hike rates beyond March. Adding to this, ECB Governing Council member Boštjan Vasle said on Friday that he expects the March rate hike to be followed by additional increases. Separately, ECB policymaker Madis Muller noted that rates will have to remain high for a while, supporting prospects for a 50 bps rate hike in March.

On the economic data front, the composite Eurozone Services PMI for February was revised lower to 52.7 from the 53.0 anticipated. In contrast, the UK Services PMI was finalized at 53.5 against the flash estimate for a reading of 53.3. This further contributes to the offered tone surrounding the EUR/GBP cross. That said, the aforementioned mixed fundamental backdrop warrants some caution before placing aggressive bearish bets and confirming that this week's bounce from the 100-day Simple Moving Average (SMA) has run out of steam.

Technical levels to watch

EUR/GBP has stabilised after Wednesday’s big rally. Economists at ING believe that the pair could trade beyond the 0.8900 mark for now

Unstable risk sentiment should hit GBP harder than EUR

“Yesterday’s Decision Makers Panel survey signalled that firms now expect to raise prices and wages at a slower pace, which favours a more cautious monetary policy approach.”

“We still think the BoE will hike by 25 bps on 23 March, but the market’s pricing for an additional 50 bps of tightening after that seems too aggressive.”

“EUR/GBP may continue to find support beyond the 0.8900 level for now as the Euro may gain more momentum in the crosses and unstable risk sentiment should hit GBP harder.”

In opinion of UOB Group’s Economist Lee Sue Ann and Markets Strategist Quek Ser Leang, the likelihood of USD/CNH grinding lower to 6.8400 appears now diminished.

Key Quotes

24-hour view: “We highlighted yesterday that ‘after such a sharp drop, further sustained decline is unlikely’. However, we were of the view that ‘there is scope for the USD weakness to extend to 6.8550 before stabilization is likely’. Instead of weakening further, USD staged a surprisingly robust rebound to 6.9340 before closing at 6.9229 (+0.62%). The price actions are likely part of a broad consolidation range and USD is likely to trade between 6.8800 and 6.9300 today.”

Next 1-3 weeks: “Yesterday (02 Mar, spot at 6.8800), we noted that the month-long USD weakness has ended. We held the view that while there is room for USD to weaken, any decline is likely to face solid support at 6.8400. USD subsequently popped to a high of 6.9340, just below our ‘strong resistance’ level of 6.9350. We continue to hold the same view but after yesterday’s price actions, the chance of a decline to 6.8400 has diminished. Looking ahead, if USD were to break above 6.9350, it would indicate that it could trade in a broad consolidation range for a period of time.”

- EUR/USD prints decent gains beyond the 1.0600 level.

- ECB De Guindos reiterated that inflation is expected to fall by H2 2023.

- US ISM Non-Manufacturing takes centre stage later in the NA session.

Renewed selling pressure in the greenback allows EUR/USD to pick up pace and reclaim the area beyond 1.0600 the figure at the end of the week.

EUR/USD now looks at US data

EUR/USD keeps the choppy price action well and sound so far this week amidst an equally vacillating performance in the greenback, while yields on both sides of the ocean now give away some gains and investors continue to monitor messages from both the ECB and the Fed.

On the latter, ECB’s Vice-President De Guindos suggested earlier that headline inflation should fall below 6% at some point in mid-year, at the time when he reiterated that decisions on future rate hikes will remain data-dependent and that the economy of the region is doing better than expected.

His colleague Vasle left the door open to further rate raises after the March event, a view shared by Board member Müller. In addition, Müller was unable to predict how far up rates may go.

In the domestic calendar, final figures saw Services PMI in Germany and the broader Euroland at 50.9 and 52.7, respectively, for the month of February. In addition, Producer Prices in the euro area contracted 2.8% MoM in January and rose 15% from a year earlier and earlier data saw Germany’s trade surplus widen to €16.7B in January.

In the US, all the attention will be on the release of the ISM Manufacturing seconded by the final prints of the Manufacturing PMI. In addition, FOMC’s Logan, Bostic, Barkin and Bowman are all due to speak later in the NA session.

What to look for around EUR

EUR/USD regains some balance and looks to extend the trade beyond the 1.0600 yardstick amidst the broad-based consolidative mood.

In the meantime, price action around the European currency should continue to closely follow dollar dynamics, as well as the potential next moves from the ECB after the bank has already anticipated another 50 bps rate raise at the March event.

Back to the euro area, recession concerns now appear to have dwindled, which at the same time remain an important driver sustaining the ongoing recovery in the single currency as well as the hawkish narrative from the ECB.

Key events in the euro area this week: Germany Balance of Trade, Final Services PMI, EMU Final Services PMI (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle amidst dwindling bets for a recession in the region and still elevated inflation. Impact of the Russia-Ukraine war on the growth prospects and inflation outlook in the region. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is advancing 0.16% at 1.0614 and the breakout of 1.0714 (55-day SMA) would target 1.0804 (weekly high February 14) en route to 1.1032 (2023 high February 2). On the other hand, there is an immediate support at 1.0532 (monthly low February 27) seconded by 1.0481 (2023 low January 6) and finally 1.0326 (200-day SMA).

Both AUD and NZD have given up ground to a firmer USD over recent weeks. Economists at CIBC Capital Markets anticipate some further consolidation before lows are established.

Further consolidation before lows are established

“We retain a medium-term positive outlook for both the Australian and New Zealand Dollars. But we anticipate further downside is possible in both AUD/USD and NZD/USD before eventual basing and rebounds develop.”

“The greater degree of tightening still to be delivered by RBA relative to RBNZ is something we see supporting AUD vs NZD, and we target a move to 1.1200.”

“Both also continue to have risks from overall slower global growth. A confirmed recovery in China and eventual turn lower in the USD does provide some counter to that risk. Though we see that more of a 2Q-3Q story than during the current period.”

- AUD/SUD catches fresh bids on Friday and draws support from a combination of factors.

- The upbeat Chinese data benefits the Aussie amid the emergence of some USD selling.

- Recession fears, hawkish Fed expectations should limit the USD losses and cap the major.

The AUD/USD pair regains positive traction on the last day of the week and builds on its steady intraday descent through the first half of the European session. The momentum lifts spot prices to a fresh daily high, around the 0.6765 region in the last hour, and is sponsored by the emergence of fresh selling around the US Dollar.

A modest pullback in the US Treasury bond yields is turning out to be a key factor exerting some downward pressure on the buck. Adding to this, the upbeat Chinese macro data fueled optimism about a strong recovery in the world's second-largest economy, which further dents the Greenback's safe-haven status and provides an additional boost to the China-proxy Australian Dollar. That said, a combination of factors might hold back bulls from placing aggressive bets around the AUD/USD pair and keep a lid on any further gains, at least for the time being.

Firming expectations that the Federal Reserve will stick to its hawkish stance for longer in the wake of stubbornly high inflation should act as a tailwind for the US bond yields and lend support to the USD. The bets were lifted by hawkish commentary by a slew of influential FOMC members, stressing the need for higher rate hikes to fully gain control over inflation. This had pushed the yield on the benchmark 10-year US government bond to its highest level since last November and the rate-sensitive two-year Treasury note to levels last seen in July 2007 on Thursday.

Furthermore, worries about economic headwinds stemming from rapidly rising borrowing costs continue to weigh on investors' sentiment. This is evident from the prevalent cautious mood around the equity markets, which should further help limit losses for the Greenback and contribute to capping the upside for the AUD/USD pair. Even from a technical perspective, the recent breakdown below the very important 200-day Simple Moving Average (SMA) favours bearish trades and suggests that the path of least resistance for spot prices remains to the downside.

Market participants might also refrain from placing aggressive bets ahead of next week's Reserve Bank of Australia (RBA) monetary policy meeting. In the meantime, traders on Friday will take cues from the US ISM Services PMI, due for release later during the early North American session. This, along with the US bond yields and the risk sentiment, will drive the USD demand and produce short-term trading opportunities around the AUD/USD pair.

Technical levels to watch

In February, the Yen weakened versus the US Dollar from 130.08 to 136.15. But the underperformance of the Yen in February is unlikely to become sustained, in the opinion of economists at MUFG Bank.

Yields globally are close to peaking, which points to JPY recovery

“The underperformance of the Yen in February is unlikely to become sustained and we maintain that the inflation angst that has emerged globally will not return to anything like during period of last year when JPY depreciated sharply.”

“Since the Dollar peaked at the end of September, JPY has been 2nd best performing G10 currency to end-January. Some retracement in that context is understandable. But we maintain inflation will subside from here and yields globally are close to peaking which points to JPY recovery, especially with BoJ policy set to change as well.”

“USD/JPY – Q1 2023 136.00 Q2 2023 133.00 Q3 2023 130.00 Q4 2023 127.00”

European Central Bank (ECB) Governing Council member Madis Muller said on Friday, “it is probably not the final hike in March.”

“Rates will have to remain high for a while,” Muller added.

The ECB policymakers added that “high core more worrisome than headline inflation.

Related reads

- ECB’s de Guindos: Interest rate path after March will be data-dependent

- Euro at risk of recording significant losses if core inflation eases over next year – Commerzbank

European Central Bank (ECB) Vice President Luis de Guindos is delivering a speech to CUNEF University students, titled "Prospects for the Euro Zone and the Future of Monetary Policy" this Friday. A Q&A session will follow.

Key quotes

Interest rate path after March will be data-dependent.

Headline inflation will continue to decline, could fall below 6% around mid-year.

But core inflation could however have a more stable performance.

Market reaction

These comments fail to move the needle around the Euro. The EUR/USD pair is trading at 1.0616, adding 0.20% on the day, as of writing.

European Central Bank (ECB) Governing Council member Boštjan Vasle said in a statement on Friday that he expects the March rate hike to be followed by additional increases.

Key quotes

"My personal expectations is that the increase we intend for our March meeting -- that is 0.5 percentage points -- will not be the last one.”

"We will have to continue with increases of our interest rates in the following months.”

"My expectations is that the increase we intend for our March meeting will be followed by additional increases before we reach a level that will be sufficient to bring inflation back to the trajectory towards our goal of 2% inflation.”

“The ECB will also continue to reduce the size of its balance sheet after ending the full reinvestment of maturing debt earlier this month.”

Market reaction

EUR/USD is unfazed by the above comments, keeping its range play intact at around 1.0615, up 0.19% on the day.

A probable advance in USD/JPY to the 137.90 region could be running out of steam, according to UOB Group’s Economist Lee Sue Ann and Markets Strategist Quek Ser Leang.

Key Quotes

24-hour view: “Yesterday, we expected USD to trade sideways between 135.40 and 136.60. However, USD rose briefly above 137.00 (high of 137.09) before retreating quickly. Despite the advance, upward momentum has barely improved. Today, there is scope for USD to edge higher but a break of 137.30 is unlikely. On the downside, a breach of 136.20 would indicate that the current mild upward pressure has eased.”

Next 1-3 weeks: “We have held a positive USD view for more than 2 weeks now. In our most recent narrative from two days ago (01 Mar, spot at 136.35), we noted that USD ‘must break and hold above 136.90 in the next 1-2 days or the chances of a move to 137.90 will rapidly diminish’. While USD rose to a high of 137.09 in NY trade, it retreated and closed at 136.76. Upward momentum has improved a tad but while the outlook for USD is still positive, the major resistance at 137.90 could be out of reach this time around. On the downside, a break of 135.50 (‘strong support’ level previously at 135.00) would indicate that USD is not strengthening further.”

- GBP/USD once again finds support near the 200-day SMA and regains positive traction on Friday.

- Retreating US bond yields prompts some selling around the USD, which is seen as lending support.

- Rising bets for additional rate hikes by the BoE and the Fed warrant caution for aggressive traders.

The GBP/USD pair attracts fresh buyers in the vicinity of a technically significant 200-day Simple Moving Average (SMA) and reverses a part of the overnight losses back closer to the weekly low. The pair sticks to its intraday gains and is currently placed near the top end of the daily range, just a few pips below the 1.2000 psychological mark.

A modest pullback in the US Treasury bond yields prompts some selling around the US Dollar, which, in turn, is seen as a key factor pushing the GBP/USD pair higher. The British Pound draws additional support from rising bets for additional rate hikes by the Bank of England (BoE). It is worth recalling that the BoE Governor Andrew Bailey said on Wednesday that some further increase in bank rates may turn out to be appropriate, though added that nothing is decided. This was followed by hawkish remarks by the BoE Chief Economist Huw Pill on Thursday, noting that Britain's economy is showing slightly more momentum than expected and pay growth is proving a bit faster than the central bank forecast last month.

The downside for the USD, however, seems cushioned, at least for the time being, amid firming expectations for further policy tightening by the Federal Reserve. The US CPI, PPI and the PCE Price Index released recently indicated that inflation isn't coming down quite as fast as hoped. Moreover, the incoming upbeat US macro data, including the Initial Jobless Claims on Thursday, pointed to an economy that remains resilient, which should allow the US central bank to stick to its hawkish stance for longer. Adding to this, a slew of FOMC members backed the case for higher rate hikes to tame stubbornly high inflation. This should act as a tailwind for the US bond yields and continue to lend some support to the Greenback.

It is worth recalling that the yield on the benchmark 10-year US government bond rose to its highest level since last November and the rate-sensitive two-year Treasury note had shot to levels last seen in July 2007 on Thursday. This, along with the GBP/USD pair's two-way price action witnessed over the past four weeks or so, warrants some caution for aggressive traders and positioning for a firm near-term direction. Next on tap is the release of the final UK Services PMI, which will be followed by the US ISM Non-Manufacturing PMI later during the early North American session. The data might provide some impetus to the major and allow traders to grab short-term opportunities on the last day of the week.

Technical levels to watch

Further appreciation potential for EUR/USD is likely to be limited for now, in the view of economists at Commerzbank.

ECB rate expectations have gone far

“The market expects interest rates to peak at just under 4%. In our view, current market expectations are already quite aggressive. A large share of the upside risks for inflation that emerged over the past weeks is likely to be priced into the rate outlook already, which limits the Euro’s future appreciation potential.”

“In view of stubbornly high underlying inflation momentum dovish resistance within the ECB might prevent a sufficient tightening of monetary policy, in particular if core inflation tends downwards over the course of next year. If signs indicating this increase, the Euro would be at risk of recording significant losses.”

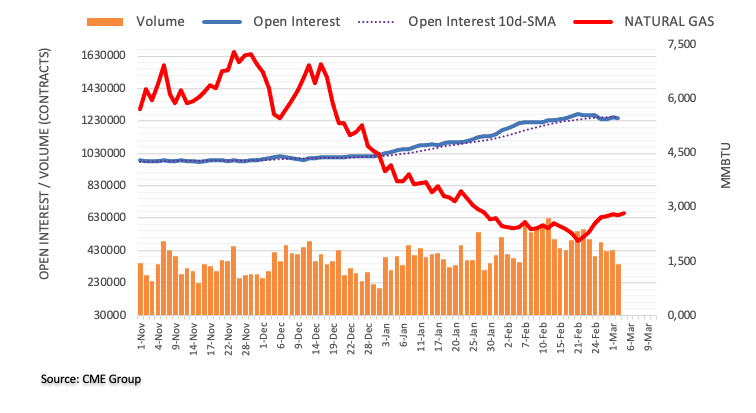

Open interest in natural gas futures markets resumed the downtrend and dropped by around 6.8K contracts on Thursday according to preliminary readings from CME Group. Volume followed suit and shrank by around 91.3K contracts, keeping the erratic performance well in place.

Natural Gas seem to have reached a plateau

Prices of natural gas retreated marginally amidst diminishing open interest and volume on Thursday. So far, further consolidation appears likely around the $2.80 region in the very near term. The breakout of this theme faces the next hurdle at a Fibo retracement around $3.20 per MMBtu.

- Gold price bulls come alive in a bullish reversal week.

- US Dollar retraced a bit despite surging US Treasury 10-year bond yields.

- ISM Services PMI release is still awaited for fresh impulse on XAU/USD.

Gold price bulls have returned to action this week, helping the bright metal break out of a bearish trend that had dominated XAU/USD price action during February. What has been more impressive is that Gold has been able to rally despite US Treasury bond yields gathering strength, which usually supports the US Dollar and weighs on yield-less commodities.

Gold news: Chinese PMI boost

Strong PMI data from China, both in Manufacturing and Services sectors, has really helped Gold price to pick up demand, as the Asian giant is a huge yellow-metal market. Gold traders now await more Federal Reserve clues, which could come from Fed officials' speeches and Friday's ISM Services PMI.

In the meantime, investors keep watching the US 10-year Treasury bond yield market, which rallied past the round 4% resistance on Wednesday and remains above this crucial level. The usual inverse correlation of Gold price with the US Treasury yields could provide downward pressures on XAU/USD if yields stay high, but a retracement in that bond market could propel the bright metal on a notable surge.

United States Services PMIs on the way, watch for inflation clues

The Institute of Supply Management (ISM) will publish the Services PMI on Friday at 15 GMT. If this report reaffirms that rising wage costs are feeding into accelerating price pressures in the sector, the US Dollar is likely to hold its ground against Gold. Hence, the Prices Paid Index component will be watched closely by market participants.

It's worth noting, however, that the CME Group FedWatch Tool shows that markets are fully pricing in at least two more 25 basis points Federal Reserve rate hikes in March and May. Additionally, the probability of the Fed holding the policy rate unchanged in June stands at 25%.

The market turnaround has confirmed that the US Dollar does not have a lot of room on the upside, at least until the February jobs report and inflation data confirm or refute one more 25-bps hike in June.

Gold price targets key resistance

Dhwani Mehta, Senior Analyst at FXStreet, points at a key moving average as the main resistance to beat by Gold price bulls:

At that level, the bearish 21-Daily Moving Average (DMA) coincides, making it a powerful resistance. Gold bulls yearn for a daily candlestick closing above the latter to add extra legs to the ongoing recovery in the bright metal.

Fresh buying opportunities will be created above the 21 DMA hurdle, fuelling a rally toward the mildly bullish 50 DMA at $1,858.

Gold price in 2023: Up-and-down action

Financial markets have been a two-tale story for the early part of 2023, in which Gold price has reflected in its price action like no other asset. XAU/USD rode an uptrend during all of January with the market optimism about inflation slowing down and constant Federal Reserve dovish talk, only to see a drastic turnaround back to the old dynamics in February after a hot US Nonfarm Payrolls (NFP) report. The US economy adding more than 500K jobs in the month of January shifted the market expectations for the Fed easing its monetary policy, and the US Dollar has come back to the market King throne.

Gold price opened the year at $1,823.76 and reached a year-to-date high of $1,960 on February 2, right in between the first Federal Reserve meeting of the year and the surprising release of the US jobs report for January. Gold price went on a big downtrend from there, reaching year-to-date lows just above $1,800, where it found support.

-638134300260205114.png)

Gold price daily chart

Widening policy rate differential with ECB suggests CHF weakness ahead, in the opinion of economists at CIBC Capital Markets.

SNB to remain potentially activist in the FX space

“Beyond the prospect of ongoing monetary tightening, we can expect the central bank to remain potentially activist in the FX space. However, we would expect any activity to be commensurate with the pursuance of the goal of price stability rather than attempting to reduce the balance sheet.”

“We expect additional SNB policy activity, resulting in a 1.75% terminal rate. However, in view of the assumption of the ECB hiking rates towards 3.50%, the widening in nominal rate differential favours a modest uptrend in EUR/CHF.”

“Q2 2023: 1.00 | Q3 2023: 1.01 (EUR/CHF)”

- USD/JPY retreats from the YTD peak touched on Thursday amid a modest USD weakness.

- A softer risk tone benefits the safe-haven JPY and also contributes to the intraday decline.

- The divergent Fed-BoJ policy outlook could lend support and help limit any further losses.

The USD/JPY pair comes under some selling pressure on Friday and reverses the previous day's positive move to its highest level since December 20 - just above the 137.00 mark. The intraday downfall picks up pace during the early European session and drags spot prices to a fresh daily low, around the 136.25-136.20 area in the last hour.

Retreating US Treasury bond yields trigger a modest US Dollar pullback and turn out to be a key factor dragging the USD/JPY pair lower. Apart from this, a softer risk tone benefits the safe-haven Japanese Yen (JPY) and contributes to the offered tone surrounding the major. Any meaningful corrective pullback, however, still seems elusive amid hawkish Fed expectations, which should act as a tailwind for the US bond yields and the Greenback.

In fact, the markets seem convinced that the US central bank will keep interest rates higher for longer to tame stubbornly high inflation. Moreover, a slew of FOMC members this week opened the door for a jumbo 50 bps lift-off at the March policy meeting. This lifted the yield on the benchmark 10-year US government bond to its highest level since last November and the rate-sensitive two-year Treasury note to levels last seen in July 2007 on Thursday.