- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 03-06-2013

European stocks declined for a second day, extending a one-month low, amid speculation the Federal Reserve will scale back its debt-buying program.

In China, HSBC Holdings Plc and Markit Economics said their index of manufacturing in the world's second-largest economy fell to 49.2 in May from 50.4 in April. An official index for the industry, released on June 1, rose to 50.8 from 50.6.

National benchmark indexes retreated in 15 of the 17 western-European markets open today. The U.K.'s FTSE 100 slid 0.9 percent, while France's CAC 40 (CAC) dropped 0.7 percent. Germany's DAX lost 0.8 percent. Irish markets were closed for a public holiday.

Roche, the world's biggest maker of cancer drugs, slid 3.7 percent to 230.30 Swiss francs for the biggest decline since November 2011. Avastin failed to extend the survival of patients with deadly brain tumors in a study that found no advantage in using the drug as a first-line therapy against the cancer known as glioblastoma.

Munich Re, the world's biggest reinsurer, lost 2.7 percent to 140.80 euros and Hannover Re, the fourth-largest, dropped 3.3 percent to 56.39 euros.

Prague braced for the swollen Vltava River to crest today as the Czech government deployed hundreds of soldiers to avert a repeat of the 2002 floods that destroyed neighborhoods and caused $1.2 billion in damage. The German cities of Passau, about 30 miles from the Czech border, and Rosenheim declared a state of emergency and rivers in Saxony, Baden-Wuerttemberg and Bavaria burst their banks.

Ingenico SA, a French provider of payment terminals and services, decreased 3.4 percent to 50.92 euros for its biggest drop in three months. Berenberg Bank downgraded the stock to sell from hold, citing an increase in competition.

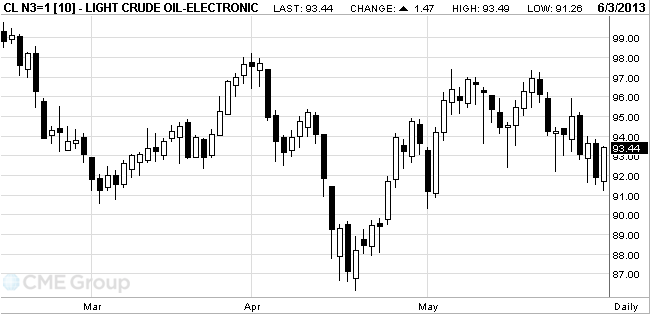

West Texas

Intermediate crude rose from the lowest level in one month as the U.S. dollar

weakened against a basket of major currencies after a report showed

Crude

gained as the Dollar Index fell as much as 0.5 percent, raising the investment

appeal of commodities priced in the currency. Manufacturing in the

WTI crude

for July delivery gained $1.33, or 1.5 percent, to $93.30 a barrel at 10:15

a.m. on the New York Mercantile Exchange. The volume of all futures traded was

5 percent below the 100-day average for the time of day. The futures ended at

$91.97 on May 31, the lowest settlement since May 1. Prices slid 1.6 percent in

May.

Brent oil

for July settlement rose $1.92, or 1.9 percent, to $102.31 a barrel on the

London-based ICE Futures Europe exchange after closing May 31 at the lowest

settlement since May 1. Volume for all contracts was 29 percent above the

100-day average.

During the last hours of gold

showed growth due to a weaker dollar after weak data from the

Institute for Supply Management (ISM).

Manufacturing activity in the U.S. unexpectedly fell in May for the first time since November 2012. Reported Purchasing Managers Index (PMI) for the manufacturing sector in the U.S. in May fell to 49.0 against 50.7 in April. Values above 50 indicate an increase in activity in the sector.

Economists had expected the May PMI index was 50.6. The May index was the lowest since June 2009.

In May, gold fell more than 6 percent as investors feared that the Fed will cut the amount of buying up bonds. However, consumer spending in the U.S. fell in April for the first time in nearly a year, and inflation fell, prompting hope for preservation of the policy of "quantitative easing."

Demand for gold in India in the second half of the year will be as high as last year, as the forecast assumes a significant amount of monsoon rains that will bring good income to farmers - the main buyers of gold, said the head of the World Gold Council.

Stocks of the world's largest exchange-traded fund backed by gold (ETF) SPDR Gold Trust stopped falling after almost three weeks. Stocks rose on Wednesday and unchanged since then.

The cost of the August gold futures on COMEX today rose to 1408.70 dollars an ounce.

EUR/USD $1.2800, $1.2940, $1.3000, $1.3005, $1.3050, $1.3085

USD/JPY Y99.50, Y100.00, Y100.50, Y101.00, Y101.30, Y101.50

GBP/USD $1.5000, $1.5100

EUR/GBP stg0.8550

AUD/USD $0.9550, $0.9600, $0.9700

U.S. stock

futures advanced as investors awaited a report that may show

manufacturing was little changed in May.

Crude oil:

Nikkei 13,261.82 -512.72 -3.72%

Hang Seng 22,282.19 -109.97 -0.49%

Shanghai Composite 2,299.25 -1.34 -0.06%

FTSE 6,557.14 -25.95 -0.39%

CAC 3,954.74 +6.15 +0.16%

DAX 8,348.82 -0.02 0.00%

Crude oil $92.41 +0.48%

Gold $1394.90 +0.14%

Upgrades:

Intel (INTC) upgraded to Outperform at FBR Capital; target raised from $23 to $28

Downgrades:

Other:

Google (GOOG) reiterated at Buy at Cantor Fitzgerald; target raised from $900 to $1030

Data

00:00 New Zealand Bank holiday

00:30 Australia MI Inflation Gauge, m/m May -0.5% +0.2%

00:30 Australia MI Inflation Gauge, y/y May +2.7% +2.2%

01:00 China Non-Manufacturing PMI May 54.5 54.3

01:30 Australia Retail sales (MoM) April -0.4% +0.3% +0.2%

01:30 Australia Retail Sales Y/Y April +3.2% +3.1%

01:30 Australia ANZ Job Advertisements (MoM) May -1.3% -2.4%

01:30 Australia Company Operating Profits Quarter I -1.0% +1.6% +3.0%

01:45 China HSBC Manufacturing PMI (Finally) May 49.6 49.6 49.2

01:50 U.S. FOMC Member Yellen Speaks

06:30 Australia RBA Commodity prices, y/y May -6.5% -8.6%

07:30 Switzerland Manufacturing PMI May 50.2 50.9 52.2

07:50 France Manufacturing PMI (Finally) May 45.5 45.5 46.4

07:55 Germany Manufacturing PMI (Finally) May 49.0 49.0 49.4

08:00 Eurozone Manufacturing PMI (Finally) May 47.8 47.8 48.3

08:30 United Kingdom Purchasing Manager Index Manufacturing May 49.8 50.3 51.3

The euro exchange rate fell back from the peak reached against the dollar, which contributed to the positive data on PMI. As the results of recent studies that have been presented Markit Economics, the decline in production in the euro area continued in the last month, but at a slower pace than originally anticipated. According to a report by the end of May the final month of the index of business activity in the manufacturing sector rose to 48.3 compared to 46.7 in April, reaching with a 15-month high. It is worth noting that, according to the average forecast of most experts, the value of this index was to remain unchanged from the initial estimate at 47.8. In addition, the data showed that all the sub-indices, except for the timing of deliveries of raw materials, since the last survey have improved, being higher than the preliminary estimate.

Meanwhile, we note that the data for May showed a decline of decline in all the countries studied, indicating that improvements in the conditions of production. Add that Spain and Greece, which are most affected by the debt crisis in the region showed the smallest decline over the past two years. In Germany, there is activity in the manufacturing sector showed the slowest rate of decline since February of this year, as the number of new orders was restored after the deterioration in the previous two months. The final index of business activity in the manufacturing sector, seasonally adjusted rose to 49.4 from 48.1 in April. It was expected that the rate will be unchanged from the preliminary estimate at 49.0. We add that the negative contribution from employment, inventories and delivery times kept PMI below the neutral mark of 50, which is fixed for the third consecutive month.

Value of the pound against the dollar has increased significantly, which was associated with the publication of the British data. As the results of recent studies that have been published Markit Economics, and the Chartered Institute of Purchasing and Logistics (CIPS), the results of last month the PMI for the manufacturing sector increased sharply, reaching thus the highest level in the past 14 months, as strong domestic market has led to a rapid increase in production and new orders.

According to the report, the seasonally adjusted purchasing managers' index rose to a level of 51.3, which is a 14-month high, from a revised April at around 50.2. It should be noted that, according to experts active secondary code should rise to the level was 50.1, compared with 49.8, which was originally reported for the previous month. Recall that Indicator values above 50 indicate growth while falling below indicates contraction. We add that this figure shows the growth for the second consecutive month. Studies have shown that the domestic market was a major factor in the inflow of new orders, although the increase in new export orders also contributed to a modest improvement.

It was also reported industrial production increased in all sub-sectors within a month, which stood at the head of an increase in production of consumer, intermediate and capital goods. New orders received by the British producers of goods showed the third monthly increase in a row under the guidance of a significant improvement in the home market. The data also showed that the company increased the number of the person that was the first time in four months, in line with the rise in production. Input prices fell, which was the second monthly decline in a row, while product prices increased again.

The Australian dollar rose, departing from the minimum levels today after Chinese PMI PMI in the manufacturing sector of the economy of the country for May 2013 reached 50.8, while in April the figure was 50.6. This was reported by the China Association of logistics and procurement.

For eight consecutive months, industrial production in China PMI steady at 50%. Recall that China is the largest trading partner of Australia.

EUR / USD: during the European session, the pair dropped rose to $ 1.3043, but then fell to $ 1.2990

GBP / USD: during the European session, the pair rose to $ 1.5288

USD / JPY: during the European session, the pair fell to Y100.00, then rose to Y100.51

At 14:00 GMT the United States will publish the ISM manufacturing index for May. At 23:01 GMT UK release BRC Retail Sales Monitor for May. At 23:50 GMT Japan will publish the change in the monetary base in May.

EUR/USD

Offers $1.3110/20, $1.3100, $1.3070/80, $1.3050/60, $1.3043

Bids $1.29835, $1.2950/40, $1.2920, $1.2905/890, $1.2860

GBP/USD

Offers $1.5350/60, $1.5320/25, $1.5300/10, $1.5280

Bids $1.5170/65, $1.5145/40, $1.5120/10, $1.5100, $1.5085/80

AUD/USD

Offers $0.9740/45, $0.9710, $0.9700, $0.9680, $0.9660

Bids $0.9620/10, $0.9590, $0.9570/60, $0.9550/45, $0.9500

EUR/JPY

Offers Y131.75/80, Y131.50, Y130.95/00, Y130.80/85

Bids Y130.20, Y130.00, Y129.64/59, Y129.50, Y129.20/15

USD/JPY

Offers Y101.70/80, Y101.50, Y101.25/30, Y100.95/00, Y100.70/75

Bids Y100.00, Y99.80/70, Y99.50, Y99.20, Y99.00

EUR/GBP

Offers stg0.8650/60, stg0.8620, stg0.8595/600, stg0.8575/80, stg0.8551

Bids stg0.8520, stg0.8500, stg0.8470, stg0.8445/40

European stocks declined for a second day, extending a one-month low, amid speculation the Federal Reserve will cut back its debt-buying program and as a gauge of Chinese manufacturing fell. Asian shares dropped while U.S. index futures were little changed.

The Stoxx Europe 600 Index slid 0.6 percent to 299.08 at 10:28 a.m. in London, the lowest level since

The Stoxx 600 has still fallen 3.8 percent since May 22 as investors weighed the likelihood of the Fed taking steps to reduce monetary stimulus. Fed Bank of San Francisco President John Williams, who has emphasized the need for policy flexibility, will speak at conference held by the Swedish Riksbank at 1:20 p.m. in Stockholm.

HSBC Holdings Plc and Markit Economics said their Chinese manufacturing index, released today, fell to 49.2 in May from 50.4 in April. A reading below 50 signals contraction. An official index for the world's second-biggest economy, released June 1, rose to 50.8 last month from 50.6 in April. In the U.S., the Institute for Supply Management's factory index held at 50.7 during the month, according to the median forecast of economists.

Roche, the world's biggest maker of cancer drugs, fell 1.4 percent to 235.70 Swiss francs for the longest losing strak since November 2011. Avastin failed to extend the survival of patients with deadly brain tumors in a study that found no advantage in using the drug as a first-line therapy against the cancer known as glioblastoma.

Sanofi (SAN) lost 1.6 percent to 81.21 euros. The Paris-based drugmaker will take a $285 million impairment as iniparib failed to help patients with lung cancer. It will also halt development of an anti-coagulant, otamixaban, after the drug showed no benefit over existing therapies in a study.

Renault SA led French carmakers lower, falling 1.6 percent to 58.81 euros. Registrations of cars and light vehicles for Renault fell 17 percent in May, according to the French carmakers association. PSA Peugeot Citroen's registrations dropped 8.2 percent. Peugeot declined 1 percent to 6.76 euros.

FTSE 100 6,556.27 -26.82 -0.41%

CAC 40 3,925.45 -23.14 -0.59%

DAX 8,285.27 -63.57 -0.76%

EUR/USD

$1.2800, $1.2940, $1.3000, $1.3005, $1.3050, $1.3085

USD/JPY Y99.50, Y100.00, Y100.50, Y101.00, Y101.30, Y101.50

GBP/USD $1.5000, $1.5100

EUR/GBP stg0.8550

AUD/USD $0.9550, $0.9600, $0.9700

Asian stocks

fell, with the regional benchmark index heading for a third-day of

losses, after improving U.S. economic reports added to concern the

Federal Reserve will scale back its stimulus and data painted a

mixed picture about China's manufacturing.

Nikkei 225 13,261.82 -512.72 -3.72%

S&P/ASX 200 4,888.3 -38.27 -0.78%

Shanghai Composite 2,299.25 -1.34 -0.06%

Nissan Motor Co., a Japanese carmaker that gets 34 percent of its sales in North America, slid 4 percent.

Nomura Holdings Inc. paced losses among Japanese brokerages.

Cochlear Ltd. slumped 18 percent after the maker of implant systems for the hearing impaired said sales were weaker in the second half.

China Foods Ltd., a maker of products including beverages, snacks and instant food, slumped 9 percent after saying it expects its operating profit will fall.

00:00 New Zealand Bank holiday

00:30 Australia MI Inflation Gauge, m/m May -0.5% +0.2%

00:30 Australia MI Inflation Gauge, y/y May +2.7% +2.2%

01:00 China Non-Manufacturing PMI May 54.5 54.3

01:30 Australia Retail sales (MoM) April -0.4% +0.3% +0.2%

01:30 Australia Retail Sales Y/Y April +3.2%

01:30 Australia ANZ Job Advertisements (MoM) May -1.3% -2.4%

01:30 Australia Company Operating Profits Quarter I -1.0% +1.6% +3.0%

01:45 China HSBC Manufacturing PMI (Finally) May 49.6 49.6 49.2

The euro remained lower after last month's declines before data forecast to show manufacturing in the currency bloc contracted for a 22nd month, adding to pressure on the European Central Bank to cut interest rates. The final reading on a Purchasing Managers' Index of manufacturing in the 17-nation euro area probably held at 47.8 in May, according to the median estimate of economists in a separate survey before London-based Markit Economics releases the data today.

The ECB meets on policy on June 6. The ECB will probably hold its key interest rate at a record low 0.5 percent this week, according to 54 of 56 economists surveyed by Bloomberg News. President Mario Draghi signaled last month he's prepared to cut rates if economic data worsen.

The Australian dollar rallied from the weakest in more than 1 1/2 years after an official manufacturing index in China showed a pickup in growth, boosting trade prospects. The 50.8 PMI reading released on June 1 by the National Bureau of Statistics and China Federation of Logistics and Purchasing in Beijing was higher than all estimates in a Bloomberg survey of analysts.

China's non-manufacturing PMI was at 54.3 in May from 54.5 the previous month, official data showed today. President Xi Jinping said expansion is on a "more stable footing," Xinhua News Agency reported May 31. China is Australia's biggest trading partner.

EUR / USD: during the Asian session the pair rose to $ 1.3015

GBP / USD: during the Asian session the pair rose to $ 1.5220

USD / JPY: during the Asian session the pair traded in the range of Y100.35-75

Monday sees the latest

snap look at the eurozone economies, with the release of the May

manufacturing sector PMI data. However, the week's main events are

towards the later end of the week, with RBA, ECB and BOE policy

meetings, followed by the release of the latest US employment

report on Friday. The Bank of England's meet is the last under the

stewardship of Governor Sir Mervyn King, who steps down at the end

of June. Monday's data gets underway at 0700GMT, with the release

of the French May car registrations data and Spanish May

unemployment numbers. The release of euro area manufacturing PMI

numbers for May start at 0713GMT, as Spanish numbers cross the

wires, followed by Italy at 0743GMT, France at 0748GMT and Germany

at 0753GMT. Eurozone consolidated PMI manufacturing numbers for May

will be released at 0758GMT.

00:00 New Zealand Bank holiday

00:30 Australia MI Inflation Gauge, m/m May -0.5%

00:30 Australia MI Inflation Gauge, y/y May +2.7%

01:00 China Non-Manufacturing PMI May 54.5

01:30 Australia Retail sales (MoM) April -0.4% +0.3%

01:30 Australia Retail Sales Y/Y April +3.2%

01:30 Australia ANZ Job Advertisements (MoM) May -1.3%

01:30 Australia Company Operating Profits Quarter I -1.0% +1.6%

01:45 China HSBC Manufacturing PMI (Finally) May 49.6 49.6

01:50 U.S. FOMC Member Yellen Speaks

06:30 Australia RBA Commodity prices, y/y May -6.5%

07:00 United Kingdom Halifax house price index May +1.1% +0.2%

07:00 United Kingdom Halifax house price index 3m Y/Y May +2.0% +2.5%

07:30 Switzerland Manufacturing PMI May 50.2 50.9

07:50 France Manufacturing PMI (Finally) May 45.5 45.5

07:55 Germany Manufacturing PMI (Finally) May 49.0 49.0

08:00 Eurozone Manufacturing PMI (Finally) May 47.8 47.8

08:30 United Kingdom Purchasing Manager Index Manufacturing May 49.8 50.3

13:00 U.S. Manufacturing PMI (Finally) May 51.9 52.0

14:00 U.S. Construction Spending, m/m April -1.7% +1.1%

14:00 U.S. ISM Manufacturing May 50.7 50.6

20:10 United Kingdom BOE Deputy Governor Andrew Bailey Speaks

23:01 United Kingdom BRC Retail Sales Monitor y/y May -2.2% +1.3%

23:50 Japan Monetary Base, y/y May +23.1% +24.3%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.