- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 04-09-2014

(raw materials / closing price /% change)

Light Crude 94.58+0.14%

Gold 1,261.70 -0.38%

(index / closing price / change items /% change)

S&P/ASX 200 5,631.3 -24.80 -0.44%

TOPIX 1,296.39 -5.13 -0.39%

SHANGHAI COMP 2,303.86 +15.23 +0.67%

FTSE 100 6,877.97 +4.39 +0.06%

CAC 40 4,494.94 +73.07 +1.65%

Xetra DAX 9,724.26 +97.77 +1.02%

S&P 500 1,997.65 -3.07 -0.15%

NASDAQ Composite 4,562.29 -10.28 -0.22%

Dow Jones 17,069.58 -8.70 -0.05%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2935 -1,65%

GBP/USD $1,6315 -0,88%

USD/CHF Chf0,9323 +1,58%

USD/JPY Y105,30 +0,44%

EUR/JPY Y136,21 -1,20%

GBP/JPY Y171,79 -0,44%

AUD/USD $0,9341 0,00%

NZD/USD $0,8302 -0,26%

USD/CAD C$1,0876 -0,09%

(time / country / index / period / previous value / forecast)

00:15 U.S. FOMC Member Richard Fisher Speaks

01:00 U.S. FOMC Member Narayana Kocherlakota

05:00 Japan Leading Economic Index July 105.5 107.2

05:00 Japan Coincident Index July 109.7

05:00 Japan BoJ monthly economic report

06:00 Germany Industrial Production s.a. (MoM) July +0.3% +0.5%

06:00 Germany Industrial Production (YoY) July -0.5%

07:00 United Kingdom Halifax house price index August +1.4% +0.2%

07:00 United Kingdom Halifax house price index 3m Y/Y August +10.2%

07:00 Switzerland Foreign Currency Reserves August 453.4

08:30 United Kingdom Consumer Inflation Expectations Quarter III +2.6%

09:00 Eurozone GDP (QoQ) (Finally) Quarter II 0.0% 0.0%

09:00 Eurozone GDP (YoY) (Finally) Quarter II +0.7% +0.7%

12:30 Canada Employment August 41.7 10.3

12:30 Canada Unemployment rate August 7.0% 7.0%

12:30 U.S. Average workweek August 34.5

12:30 U.S. Average hourly earnings August 0.0% +0.2%

12:30 U.S. Unemployment Rate August 6.2% 6.1%

12:30 U.S. Nonfarm Payrolls August 209 222

14:00 Canada Ivey Purchasing Managers Index August 54.1 55.7

Stock indices closed higher on a European Central Bank's interest rate cut. The European Central Bank (ECB) lowered its interest rate to 0.05% from 0.15%. The central bank also cut its deposit facility rate to -0.20% from -0.10% and its marginal lending rate to 0.30% from 0.40%.

The ECB President Mario Draghi said the central bank will start buying asset-backed securities, including covered bonds. Details of the asset-backed securities (ABS) program will be announced later.

German factory orders rose 4.6% in July, exceeding expectations for a 1.6% increase, after a 2.7% decline in June. June's figure was revised up from a 3.2% fall.

The Bank of England (BoE) kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion.

Bilfinger SE shares dropped 9.4% after the company lowered its full-year profit forecast.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,877.97 +4.39 +0.06%

DAX 9,724.26 +97.77 +1.02%

CAC 40 4,494.94 +73.07 +1.65%

The U.S. dollar traded mixed to higher against due to the solid U.S. economic data and as the European Central Bank cut its interest rate. According to the ADP employment report, the U.S. economy added 204,000 jobs in August, missing expectations for a rise of 216,000, after 218,000 jobs in July.

The ISM services index climbed to 59.6 in August from 58.7 in July, beating forecasts for a drop to 57.5.

The number of initial jobless claims in the U.S. last week climbed by 4,000 to 302,000 from 298,000 in the previous week. Analysts had expected initial jobless claims to remain at 298,000.

The U.S. trade deficit declined to $40.5 billion in July from $40.8 billion in June. That was the smallest gap since January 2014. June's trade deficit was revised from $41.5 billion. Analysts had expected the deficit to widen to $42.5 billion.

Final nonfarm productivity in the U.S. rose 2.3% in the second quarter, missing expectations for a 2.5% gain, after a 2.5% increase in the first quarter.

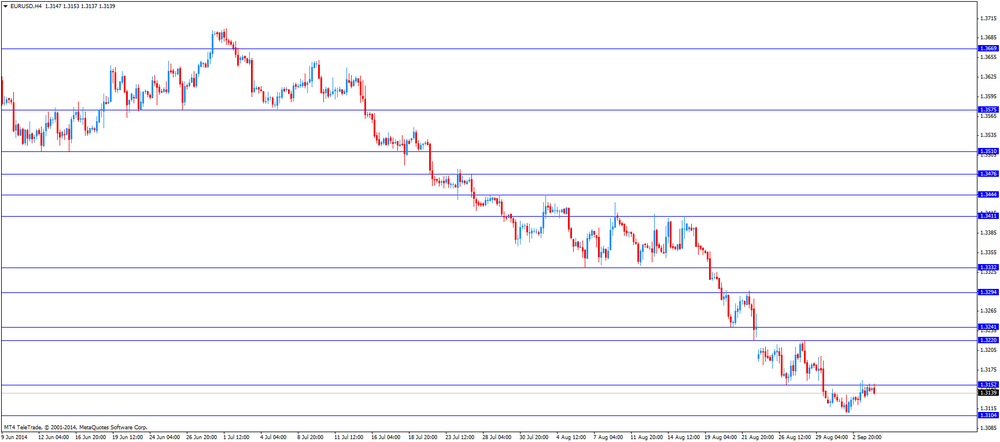

The euro plunged to 14-month low against the U.S. dollar as the European Central Bank (ECB) lowered its interest rate to 0.05% from 0.15%. The central bank also cut its deposit facility rate to -0.20% from -0.10% and its marginal lending rate to 0.30% from 0.40%.

The ECB President Mario Draghi said the central bank will start buying asset-backed securities, including covered bonds. Details of the asset-backed securities (ABS) program will be announced later.

German factory orders rose 4.6% in July, exceeding expectations for a 1.6% increase, after a 2.7% decline in June. June's figure was revised up from a 3.2% fall.

The British pound declined against the U.S. dollar after the Bank of England's interest rate decision. The Bank of England (BoE) kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion.

The Canadian dollar rose against the U.S. dollar after the better-than-expected Canadian trade data. Canadian trade surplus increased to C$2.58 billion in July from C$1.83 billion in June, beating expectations for a decline to C$0.9 billion. June's figure was revised down from a surplus of C$1.86 billion.

The New Zealand dollar traded mixed against the U.S dollar in the absence of any major economic reports from New Zealand.

The Australian dollar traded higher against the U.S. dollar. Retail sales in Australia increased 0.4% in July, in line with expectations, after a 0.6% gain in June.

On a yearly basis, retail sales in Australia rose 5.9% in July, after a 5.5% gain in June.

Australia's trade deficit fell to A$1.36 billion in July from a deficit of A$1.56 billion in June, beating expectations for a deficit of A$1.77 billion. June's figure was revised down from a deficit of A$1.68 billion.

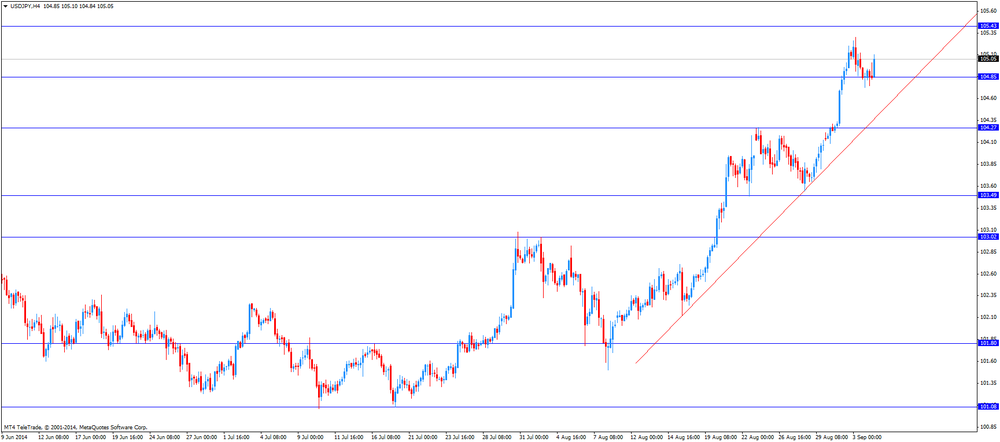

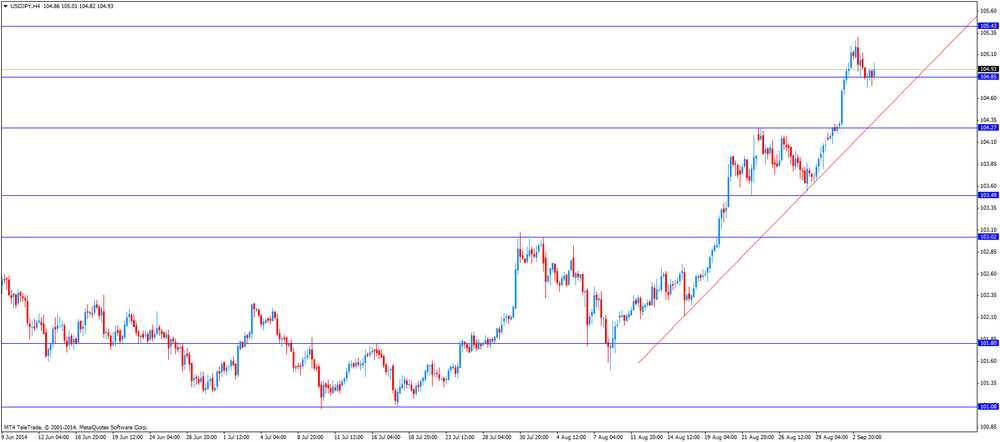

The Japanese yen traded lower against the U.S. dollar. The Bank of Japan (BoJ) kept its monetary policy unchanged. The BoJ said it will expand the monetary base at an annual pace of about ¥60 to ¥70 trillion. Japan's central bank added that it will continue with its quantitative and qualitative easing to achieve the 2% inflation target.

West Texas Intermediate and Brent crudes fell on speculation that U.S. refinery demand will decline as units are idled for maintenance and as the euro tumbled against the dollar.

Government data today will probably show U.S. refineries cut utilization rates by 0.4 percentage point last week, according to a Bloomberg survey of analysts. Refiners schedule maintenance for September and October as they transition to winter from summer fuels. The European Central Bank unexpectedly cut interest rates and announced a bond-buying program in an effort to bolster growth.

"WTI is coming under increased selling pressure as refiners prepare for fall maintenance, which will reduce crude demand," said Gene McGillian, an analyst and broker at Tradition Energy in Stamford, Connecticut.

WTI for October delivery dropped $1.03, or 1.1 percent, to $94.51 a barrel at 9:01 a.m. on the New York Mercantile Exchange. Futures settled at $92.88 on Sept. 2, the lowest settlement since Jan. 14. The volume of all futures traded was 33 percent above the 100-day average for this time of day. Prices have decreased 4 percent this year.

Brent for October settlement slipped 44 cents, or 0.4 percent, to $102.33 a barrel on the London-based ICE Futures Europe exchange. The European benchmark crude traded at a premium of $7.82 to WTI, up from $7.23 yesterday.

Gold prices fluctuate between growth and decline as the euro fell after the announcement of the European Central Bank plans to launch a program for the purchase of asset-backed securities and mortgage bonds.

In the eurozone, the European Central Bank lowered its benchmark interest rate to a record low of 0.05% to 0.15%, surprising most analysts do not expect any changes.

The central bank also lowered the rate on deposits of up to 0.20% to -0.10%, while the rate on margin loans - up to 0.30% from 0.40%.

Speaking at a press conference after the meeting, Draghi announced plans to launch a program for the purchase of asset-backed securities and mortgage bonds, which will begin in October.

This decision was made after the latest data showed that the annual rate of inflation in the euro area in the last month slowed to a five-year low of 0.3%. Inflation target bank is located just below 2%.

The euro fell more than 1% against the dollar and traded at $ 1.2970, its lowest level since July 2013.

Index USD, which tracks the performance of the greenback versus a basket of six other major currencies, rose 0.64% to 13-month peak of 83.48.

A strong dollar usually puts pressure on gold, as it reduces the metal's appeal as an alternative asset and increases in the price of dollar-denominated commodities for holders of other currencies.

Meanwhile, the United States Department of Labor reported that the number of initial claims for unemployment benefits rose by 4,000 to 302,000 last week. Analysts had expected the number of calls will remain unchanged.

The data came after ADP reported that the level of employment in the private sector rose by 204,000 last month, lower than expected increase in the 216000. In July, the economy grew by 212,000 jobs.

Despite the fact that these data are not considered as reliable a guide to a government report, scheduled for Friday, they still give an idea of hiring in the private sector.

The cost of the October gold futures on the COMEX to date is $ 1269.50 per ounce.

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said at the press conference after the BoJ kept its monetary policy unchanged. He played down almost every concern. Mr. Kuroda said that he does not believe that the weaker yen would be negative for the economy in Japan.

The government and parliament to decide whether Japan should proceed with a sales tax hike to 10% next year, so the BoJ governor. But he added that "it's very important for Japan's fiscal state and for its economy".

Mr. Kuroda pointed out that Japan's inflation has largely moved in line with BoJ's forecasts. The recently released weak economic data was driven by temporary factors, so Kuroda.

The European Central Bank (ECB) released its interest rate decision. The ECB lowered its interest to 0.05% from 0.15%. Analysts had not expected this decision.

The central bank also cut its deposit facility rate to -0.20% from -0.10% and its marginal lending rate to 0.30% from 0.40%.

The ECB President Mario Draghi said the central bank will start buying asset-backed securities, including covered bonds. Details of the asset-backed securities (ABS) program will be announced later.

The central bank lowered its growth forecast for 2014 to 0.9% down from 1.0%, while the forecast for 2015 was lowered to 1.6% from 1.7%.

The ECB cut its inflation forecast for this year to 0.6% from 0.7%. The 2015 inflation forecast remained unchanged at 1.1%.

EUR/USD $1.3000, $1.2900

EUR/GBP stg0.7945, stg0.7975, stg0.8000

USD/JPY Y103.75, Y104.00, Y105.00, Y105.15, Y105.45, Y105.55

USD/CAD C$1.0850, C$1.0870, C$1.0875, C$1.0890, C$1.0910, C$1.0915, C$1.0920, C$1.0925

AUD/USD $0.9230, $0.9250, $0.9280, $0.9295, $0.9300, $0.9305, $0.9350

NZD/USD $0.8400

U.S. stock futures rose after the European Central Bank unexpectedly cut interest rates and said it will buy asset-backed securities to stimulate growth.

Global markets:

Nikkei 15,676.18 -52.17 -0.33%

Hang Seng 25,297.92 -20.03 -0.08%

Shanghai Composite 2,306.86 +18.23 +0.80%

FTSE 6,887.88 +14.30 +0.21%

CAC 4,480.06 +58.19 +1.32%

DAX 9,678.39 +51.90 +0.54%

Crude oil $93.0 (-0.83%)

Gold $1271.60 (+0.10%)

(company / ticker / price / change, % / volume)

| The Coca-Cola Co | KO | 41.80 | +0.05% | 0.1K |

| Walt Disney Co | DIS | 91.00 | +0.07% | 4.1K |

| Johnson & Johnson | JNJ | 103.98 | +0.21% | 1.1M |

| Verizon Communications Inc | VZ | 49.99 | +0.22% | 3.3K |

| Intel Corp | INTC | 34.65 | +0.23% | 1.3K |

| Boeing Co | BA | 126.24 | +0.24% | 0.1K |

| Procter & Gamble Co | PG | 83.10 | +0.24% | 1.9K |

| Chevron Corp | CVX | 128.20 | +0.27% | 0.2K |

| General Electric Co | GE | 26.03 | +0.31% | 12.3K |

| Nike | NKE | 79.09 | +0.34% | 0.1K |

| JPMorgan Chase and Co | JPM | 59.90 | +0.34% | 77.1K |

| Pfizer Inc | PFE | 29.51 | +0.37% | 9.1K |

| E. I. du Pont de Nemours and Co | DD | 65.82 | 0.00% | 745.6K |

| Caterpillar Inc | CAT | 108.39 | -0.06% | 1.1K |

| Microsoft Corp | MSFT | 44.93 | -0.07% | 4.6K |

| McDonald's Corp | MCD | 93.00 | -0.15% | 0.8K |

| Cisco Systems Inc | CSCO | 25.00 | -0.16% | 12.9K |

| Home Depot Inc | HD | 88.85 | -0.17% | 56.4K |

| International Business Machines Co... | IBM | 191.60 | -0.18% | 0.7K |

| Merck & Co Inc | MRK | 60.04 | -0.73% | 0.2K |

The Bank of Japan (BoJ) released its interest rate decision today. The BoJ kept its monetary policy unchanged. The BoJ said it will expand the monetary base at an annual pace of about ¥60 to ¥70 trillion. Japan's central bank added that it will continue with its quantitative and qualitative easing to achieve the 2% inflation target.

The BoJ also said that the economy in Japan "has continued to recover moderately as a trend".

"Financial conditions are accommodative", so Japan's central bank.

The Bank of England released its interest decision today. The BoE kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion.

Investors are awaiting the release of the minutes of the meeting.

Two external members of the nine-strong Monetary Policy Committee (MPC), Martin Weale and Ian McCafferty, voted last month to hike interest rate from 0.5% to 0.75%. That was the first split vote since Mark Carney became a Bank of England governor.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia Retail sales (MoM) July +0.6% +0.4% +0.4%

01:30 Australia Retail Sales Y/Y July +5.5% +5.9%

01:30 Australia Trade Balance July -1.68 -1.77 -1.36

03:00 Japan BoJ Interest Rate Decision 0.10% 0.10% 0.10%

03:00 Japan Bank of Japan Monetary Base Target 270 270 270

03:00 Japan BoJ Monetary Policy Statement

06:00 Germany Factory Orders s.a. (MoM) July -2.7% Revised From -3.2% +1.6% +4.6%

06:00 Germany Factory Orders n.s.a. (YoY) July -2.0% Revised From -4.3% +4.9%

07:30 Japan BOJ Press Conference

11:00 United Kingdom Asset Purchase Facility 375 375 375

11:00 United Kingdom BoE Interest Rate Decision 0.50% 0.50% 0.50%

11:00 United Kingdom MPC Rate Statement

11:45 Eurozone ECB Interest Rate Decision 0.15% 0.15% 0.05%

The U.S. dollar traded mixed to higher against the most major currencies ahead of the U.S. economic data. The U.S. economy is expected to add 216,000 jobs in August according to the ADP employment report.

The euro dropped against the U.S. dollar as the European Central Bank (ECB) lowered its interest rate to 0.05% from 0.15%.

German factory orders rose 4.6% in July, exceeding expectations for a 1.6% increase, after a 2.7% decline in June. June's figure was revised up from a 3.2% fall.

The British pound declined against the U.S. dollar after the Bank of England's interest rate decision. The Bank of England (BoE) kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion.

The Canadian dollar rose against the U.S. dollar ahead of Canadian trade data. Canadian trade surplus is expected to decline to C$0.9 billion in July from C$1.86 billion in June.

EUR/USD: the currency pair decreased to $1.3036

GBP/USD: the currency pair fell to $1.6421

USD/JPY: the currency pair rose to Y105.10

The most important news that are expected (GMT0):

12:15 U.S. ADP Employment Report August 218 216

12:30 Eurozone ECB Press Conference

12:30 Canada Trade balance, billions July 1.9 0.9

12:30 U.S. International Trade, bln July -41.5 -42.5

12:30 U.S. Initial Jobless Claims August 298 298

12:30 U.S. Nonfarm Productivity, q/q (Finally) Quarter II +2.5% +2.5%

14:00 U.S. ISM Non-Manufacturing August 58.7 57.3

16:30 U.S. FOMC Member Mester Speaks

23:30 U.S. FOMC Member Jerome Powell Speaks

EUR/USD

Offers $1.322-40, $1.3200, $1.3175

Bids $1.3020, $1.3000

GBP/USD

Offers $1.6720, $1.6700, $1.6650, $1.6600, $1.6555

Bids $1.6420, $1.6400, 1.6380

AUD/USD

Offers $0.9415/20, $0.9400, $0.9370/80

Bids $0.9260, $0.9250, $0.9235

EUR/JPY

Offers Y139.00, Y138.40, Y138.25

Bids Y137.25, Y137.00, Y136.50, Y136.20

USD/JPY

Offers Y106.00, Y105.50

Bids Y104.30, Y104.00, Y103.80, Y103.50, Y103.20

EUR/GBP

Offers stg0.8035, stg0.8015

Bids stg0.7960, stg0.7890, stg0.7850, stg0.7820, stg0.7800

Most stock indices traded lower ahead of the European Central Bank's interest rate decision. Investors speculate that the European Central Bank will add further stimulus measures.

German factory orders rose 4.6% in July, exceeding expectations for a 1.6% increase, after a 2.7% decline in June. June's figure was revised up from a 3.2% fall.

Bilfinger SE shares dropped 11% after the company lowered its full-year profit forecast.

Current figures:

Name Price Change Change %

FTSE 100 6,884.05 +10.47 +0.15%

DAX 9,585.08 -41.41 -0.43%

CAC 40 4,413.9 -7.97 -0.18%

EUR/USD $1.3100 (E595mn), $1.3120(E381mn), $1.3170(E750mn), $1.3200(E322mn)

EUR/GBP stg0.7945(E175mn), stg0.7975(E120mn), stg0.8000(E170mn)

USD/JPY Y103.75($970mn), Y104.00($1.4bn), Y105.00($960mn), Y105.15($570mn), Y105.45($1.75bn), Y105.55($1.75bn)

USD/CAD C$1.0850($160mn), C$1.0870($142mn), C$1.0875($230mn), C$1.0890($405mn), C$1.0910($105mn), C$1.0915($150mn), C$1.0920($655mn), C$1.0925($135mn)

AUD/USD $0.9230(A$119mn), $0.9250(A$735mn), $0.9280(A$102mn), $0.9295(A$412mn), $0.9300(A$273mn), $0.9305(A$128mn), $0.9350(A$186mn)

NZD/USD $0.8400(NZ$280mn)

Most Asian stock indices closed lower as investors are awaiting the European Central Bank's interest rate decision. The ECB will released its interest rate decision today. Investors speculate that the European Central Bank will add further stimulus measures.

The Bank of Japan (BoJ) released its interest rate decision today. The BoJ kept its monetary policy unchanged. The BoJ said it will expand the monetary base at an annual pace of about ¥60 to ¥70 trillion. Japan's central bank added that it will continue with its quantitative and qualitative easing to achieve the 2% inflation target.

Indexes on the close:

Nikkei 225 15,676.18 -52.17 -0.33%

Hang Seng 25,297.92 -20.03 -0.08%

Shanghai Composite 2,306.86 +18.23 +0.80%

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia Retail sales (MoM) July +0.6% +0.4% +0.4%

01:30 Australia Retail Sales Y/Y July +5.5% +5.9%

01:30 Australia Trade Balance July -1.68 -1.77 -1.36

03:00 Japan BoJ Interest Rate Decision 0.10% 0.10% 0.10%

03:00 Japan Bank of Japan Monetary Base Target 270 270 270

03:00 Japan BoJ Monetary Policy Statement

06:00 Germany Factory Orders s.a. (MoM) July -2.7% Revised From -3.2% +1.6% +4.6%

06:00 Germany Factory Orders n.s.a. (YoY) July -2.0% Revised From -4.3% +4.9%

07:30 Japan BOJ Press Conference

The U.S. dollar traded mixed against the most major currencies. The greenback was supported by earlier released strong economic data from the U.S. that showed the U.S. economic recovery deepening. Investors speculate that the Fed will hike its interest rate sooner than expected.

The New Zealand dollar traded mixed against the U.S dollar in the absence of any major economic reports from New Zealand.

The Australian dollar traded mixed against the U.S. dollar after the solid economic data in Australia. Retail sales in Australia increased 0.4% in July, in line with expectations, after a 0.6% gain in June.

On a yearly basis, retail sales in Australia rose 5.9% in July, after a 5.5% gain in June.

Australia's trade deficit fell to A$1.36 billion in July from a deficit of A$1.56 billion in June, beating expectations for a deficit of A$1.77 billion. June's figure was revised down from a deficit of A$1.68 billion.

The Japanese yen traded mixed against the U.S. dollar after the Bank of Japan's interest rate decision. The Bank of Japan (BoJ) kept its monetary policy unchanged. The BoJ said it will expand the monetary base at an annual pace of about ¥60 to ¥70 trillion. Japan's central bank added that it will continue with its quantitative and qualitative easing to achieve the 2% inflation target.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

11:00 United Kingdom Asset Purchase Facility 375 375

11:00 United Kingdom BoE Interest Rate Decision 0.50% 0.50%

11:00 United Kingdom MPC Rate Statement

11:45 Eurozone ECB Interest Rate Decision 0.15% 0.15%

12:15 U.S. ADP Employment Report August 218 216

12:30 Eurozone ECB Press Conference

12:30 Canada Trade balance, billions July 1.9 0.9

12:30 U.S. International Trade, bln July -41.5 -42.5

12:30 U.S. Initial Jobless Claims August 298 298

12:30 U.S. Nonfarm Productivity, q/q (Finally) Quarter II +2.5% +2.5%

14:00 U.S. ISM Non-Manufacturing August 58.7 57.3

16:30 U.S. FOMC Member Mester Speaks

23:30 U.S. FOMC Member Jerome Powell Speaks

EUR / USD

Resistance levels (open interest**, contracts)

$1.3267 (5686)

$1.3231 (10782)

$1.3179 (975)

Price at time of writing this review: $ 1.3145

Support levels (open interest**, contracts):

$1.3115 (5876)

$1.3095 (5027)

$1.3067 (6066)

Comments:

- Overall open interest on the CALL options with the expiration date September, 5 is 83571 contracts, with the maximum number of contracts with strike price $1,3200 (10782);

- Overall open interest on the PUT options with the expiration date September, 5 is 62633 contracts, with the maximum number of contracts with strike price $1,3100 (6066);

- The ratio of PUT/CALL was 0.75 versus 0.94 from the previous trading day according to data from September, 3

GBP/USD

Resistance levels (open interest**, contracts)

$1.6700 (1184)

$1.6600 (834)

$1.6502 (727)

Price at time of writing this review: $1.6456

Support levels (open interest**, contracts):

$1.6398 (1227)

$1.6300 (672)

$1.6200 (413)

Comments:

- Overall open interest on the CALL options with the expiration date September, 5 is 32083 contracts, with the maximum number of contracts with strike price $1,7000 (2760);

- Overall open interest on the PUT options with the expiration date September, 5 is 34262 contracts, with the maximum number of contracts with strike price $1,6450 (4267);

- The ratio of PUT/CALL was 1.07 versus 1.03 from the previous trading day according to data from September, 3

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.