- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 02-09-2014

(raw materials / closing price /% change)

Light Crude 93.25 +0.40%

Gold 1,266.50 +0.12%

(index / closing price / change items /% change)

Nikkei 225 15,668.6 +192.00 +1.24 %

Hang Seng 24,749.02 -3.07 -0.01 %

Shanghai Composite 2,266.05 +30.54 +1.37 %

FTSE 100 6,829.17 +3.86 +0.06 %

CAC 40 4,378.33 -1.40 -0.03 %

Xetra DAX 9,507.02 +27.99 +0.30 %

S&P 500 2,002.28 -1.09 -0.05 %

NASDAQ 4,598.19 +17.92 +0.39 %

Dow Jones 17,067.56 -30.89 -0.18 %

(pare/closed(GMT +2)/change, %)

EUR/USD $1,3132 +0,04%

GBP/USD $1,6468 -0,84%

USD/CHF Chf0,9190 -0,04%

USD/JPY Y105,09 +0,74%

EUR/JPY Y138,01 +0,78%

GBP/JPY Y173,05 -0,10%

AUD/USD $0,9274 -0,61%

NZD/USD $0,8318 -0,71%

USD/CAD C$1,0927 + 0,48%

(time / country / index / period / previous value / forecast)

01:00 China Non-Manufacturing PMI August 54.2

01:30 Australia Gross Domestic Product (QoQ) Quarter II +1.1% +0.4%

01:30 Australia Gross Domestic Product (YoY) Quarter II +3.5% +3.0%

01:45 China HSBC Services PMI August 50.0

03:20 Australia RBA's Governor Glenn Stevens Speech

07:00 United Kingdom Halifax house price index August +1.4% +0.2%

07:00 United Kingdom Halifax house price index 3m Y/Y August +10.2%

07:48 France Services PMI (Finally) August 51.1 51.1

07:53 Germany Services PMI (Finally) August 56.4 56.4

07:58 Eurozone Services PMI (Finally) August 53.5 53.5

08:30 United Kingdom Purchasing Manager Index Services August 59.1 58.6

09:00 Eurozone Retail Sales (MoM) July +0.4% -0.3%

09:00 Eurozone Retail Sales (YoY) July +2.4% +0.9%

14:00 Canada Bank of Canada Rate 1.00% 1.00%

14:00 Canada BOC Rate Statement

14:00 U.S. Factory Orders July +1.1% +10.9%

18:00 U.S. Fed's Beige Book

19:30 U.S. Total Vehicle Sales, mln August 16.5 16.5

20:30 U.S. API Crude Oil Inventories August -1.3

Stock indices traded little changed. Market participants speculate that the European Central Bank (ECB) will add further stimulus measures. The ECB will released its interest rate decision on Thursday.

USA and the European Union threatened further economic sanctions on Russia. Investors have concerns that sanctions against Russia would have a negative impact on the economic growth in the Eurozone.

Eurozone's producer price index fell 0.1% in July, after a 0.2% gain in June. June's figure was revised up from a 0.1% increase. Analysts had expected the producer price index to be flat.

On a yearly basis, Eurozone's producer price index dropped 1.1% in July, in line with expectations, after a 0.8% decline in June.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,829.17 +3.86 +0.06%

DAX 9,507.02 +27.99 +0.30%

CAC 40 4,378.33 -1.40 -0.03%

West Texas Intermediate crude retreated for the first time in five days amid speculation that the end of the peak driving season and start of refinery maintenance will curb demand.

WTI fell as much as 1.5 percent as gasoline futures reached the lowest level for a front-month contract since November. The main driving season in the U.S. typically runs through Labor Day and refineries slow operations during scheduled maintenance that peaks in September and October.

"It's the typical post-holiday selloff," said Stephen Schork, president of the Schork Group Inc. in Villanova, Pennsylvania. "We are going into refinery turnaround pretty soon. All that bullish exuberance has been exorcised out of the market right now."

WTI for October delivery declined $1.25, or 1.3 percent, to $94.71 a barrel at 10:30 a.m. on the New York Mercantile Exchange. The volume of all the futures was 27 percent above the 100-day average. Floor trading was closed yesterday for the Labor Day holiday and electronic trading will be booked for settlement purposes today.

Brent for October settlement dropped $1.03, or 1 percent, to $101.76 a barrel on the London-based ICE Futures Europe exchange. The European benchmark crude traded at a premium of $7.11 to WTI on the ICE, compared with a close of $7.23 on Aug. 29.

The U.S. dollar traded mixed to higher against the most major currencies after the better-than-expected ISM manufacturing purchasing managers' index (PMI). The ISM manufacturing PMI in the U.S. rose to 59.0 in August from 57.1 in July, beating forecasts of a decline to 57.0.

The euro traded mixed against the U.S. dollar. Market participants speculate that the European Central Bank (ECB) will add further stimulus measures. The ECB will released its interest rate decision on Thursday.

Investors have also concerns that sanctions against Russia would have a negative impact on the economic growth in the Eurozone.

Eurozone's producer price index fell 0.1% in July, after a 0.2% gain in June. June's figure was revised up from a 0.1% increase. Analysts had expected the producer price index to be flat.

On a yearly basis, Eurozone's producer price index dropped 1.1% in July, in line with expectations, after a 0.8% decline in June.

The British pound dropped against the U.S. dollar despite the better-than-expected construction PMI from the UK. The U.K. construction PMI increased to 64.0 in August from 62.4 in July, exceeding expectations for a decline to 61.5.

A YouGov poll weighed on the pound. A poll showed that there is a substantial shift toward Scottish independence. The "Yes" campaign (support for Scottish independence) is just six points behind the "No" campaign. Support of "No" campaign was down from 14 points in mid-August and 22 points less than a month ago, excluding undecided voters.

The Swiss franc traded mixed against the U.S. dollar. The Swiss economy stagnated in the second quarter. Switzerland's gross domestic product (GDP) rose 0.6% in the second quarter, after a 2.1% rise in the first quarter. The first quarter's figure was revised down from 2.5% gain.

On a quarterly basis, the Swiss GDP was flat in the second quarter, after a 0.5% rise in the first quarter. Analysts had expected the GDP to remain unchanged.

The New Zealand dollar declined against the U.S dollar in the absence of any major economic reports from New Zealand.

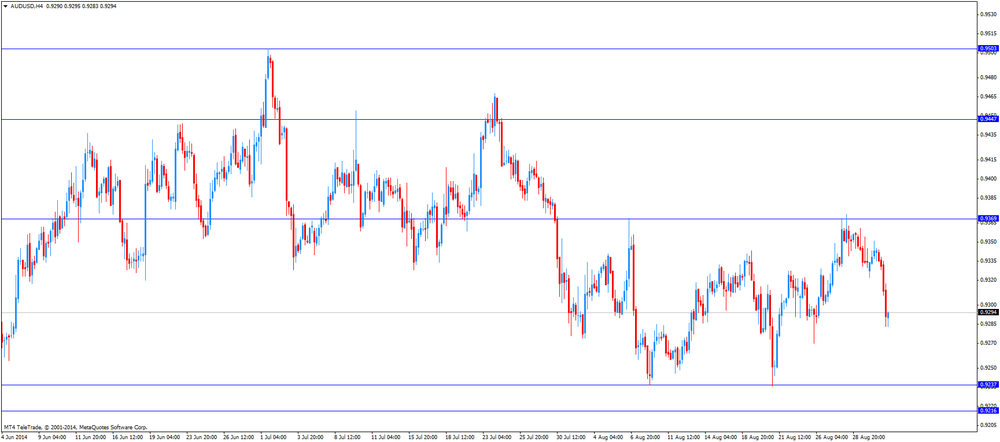

The Australian dollar dropped against the U.S. dollar after the Reserve Bank of Australia' interest rate decision. The RBA kept its interest rate unchanged at 2.50%. The RBA Governor Glenn Stevens reiterated the Aussie remains too high. He added that "accommodative monetary policy should provide support to demand and help growth to strengthen over time".

Building permits in Australia climbed 2.5% in July, exceeding expectations for a 1.7% gain, after a 3.8 decline in June. June's figure was revised up from a 5.0% fall.

Australia's current account deficit widened to A$13.7 billion in the second quarter from a deficit of A$7.8 billion in the first quarter. The first quarter's figure was revised down from a deficit of A$5.7 billion. That was the largest deficit since late 2012.

The Japanese yen declined to 7-month low against the U.S. dollar due to reform hopes. Japan's Prime Minister Shinzo Abe plans to reshuffle the cabinet. Japanese media reports said that Shinzo Abe may appoint Yasuhisa Shiozaki, member of the ruling Liberal Democratic Party, to head the health ministry in charge of reforming the Government Pension Investment Fund (GPIF).

Reuters reported last month that GPIF plans to buy more domestic stocks in its portfolio and to change the weighting of domestic stocks to more than 20% from a current 12% target.

Japan's monetary base grew 40.5% in August, missing expectations for a 43.7% rise, after a 42.7% gain in July.

Labour cash earnings in Japan increased 2.6% in July, after a 1% rise in June. June's figure was revised up from a 0.4% increase. Analysts had expected a 0.9% gain.

Gold prices continue to decline, falls to more than two-month low as the dollar weakened markedly got stronger investor demand for the precious metal.

Index USD, which tracks the performance of the greenback versus a basket of six other major currencies, peaked at 83.02 on Tuesday, the strongest level since July 2013.

The Euro is trading at an annual low against the dollar amid rising expectations that the ECB will implement new mitigation measures to strengthen the long-term inflation expectations in the euro area.

Fears that sanctions against Russia will act as resistance to economic growth in the euro zone also continue to put pressure on the single currency.

The dollar rose to a seven-month high against the yen and the ten-month highs against the Swiss franc, with the support of the weak euro.

Got stronger dollar shifted the demand for gold-seekers resulting from heightened tensions between Russia and Ukraine.

A report published today by the Institute for Supply Management (ISM), revealed in August manufacturing activity in the United States improved, beating the forecasts of economists who had expected a slight decrease in the index. PMI index for the industrial sphere of the United States rose in August to 59.0 against 57.1 in July. A reading above 50 indicates expansion of industrial activity. Note that the latter value was higher than the estimates of experts - is expected to decrease to 57.0.

On Friday, investors expect the release of American employment data, as they may provide further understanding of the strength of the recovery in the labor market, which is a key factor in deciding on the future path of monetary policy.

The cost of the October gold futures on the COMEX today dropped to $ 1262.50 per ounce.

The Reserve Bank of Australia (RBA) released its interest rate decision on Tuesday. The RBA kept its interest rate unchanged at 2.50%. This decision was widely expected by investors.

The RBA Governor Glenn Stevens said:

- The Aussie remains too high;

- "Accommodative monetary policy should provide support to demand and help growth to strengthen over time";

- Australia's central bank "still expects growth to be a little below trend";

- The labour market in Australia has "a degree of spare capacity",

- Growth in wages decreased;

- Inflation is expected to be with 2-3% target over the next two years,

- "The most prudent course is likely to be a period of stability in interest rates".

U.S. stock-index futures were little changed as investors speculated data will show manufacturing in the world's biggest economy continued to expand in August.

Global markets:

Nikkei 15,668.6 +192.00 +1.24%

Hang Seng 24,749.02 -3.07 -0.01%

Shanghai Composite 2,266.05 +30.54 +1.37%

FTSE 6,822.94 -2.37 -0.03%

CAC 4,383.16 +3.43 +0.08%

DAX 9,510.37 +31.34 +0.33%

Crude oil $94.88 (-1.13%)

Gold $1267.80 (-1.54%)

(company / ticker / price / change, % / volume)

| Visa | V | 212.58 | +0.03% | 1.2K |

| Intel Corp | INTC | 34.93 | +0.03% | 3.7K |

| Caterpillar Inc | CAT | 109.11 | +0.04% | 0.3K |

| Home Depot Inc | HD | 93.08 | +0.05% | 0.3K |

| American Express Co | AXP | 89.60 | +0.06% | 0.1K |

| International Business Machines Co... | IBM | 192.50 | +0.10% | 0.3K |

| Walt Disney Co | DIS | 90.00 | +0.13% | 0.2K |

| Microsoft Corp | MSFT | 45.43 | 0.00% | 2.5K |

| Verizon Communications Inc | VZ | 49.80 | -0.04% | 17.6K |

| Goldman Sachs | GS | 179.00 | -0.06% | 0.4K |

| Exxon Mobil Corp | XOM | 99.36 | -0.10% | 1K |

| Chevron Corp | CVX | 129.28 | -0.13% | 0.4K |

| Procter & Gamble Co | PG | 83.00 | -0.13% | 0.1K |

| AT&T Inc | T | 34.90 | -0.17% | 23.8K |

| E. I. du Pont de Nemours and Co | DD | 66.00 | -0.17% | 0.3K |

| JPMorgan Chase and Co | JPM | 59.35 | -0.17% | 2.0K |

| Cisco Systems Inc | CSCO | 24.93 | -0.24% | 2.1K |

| Nike | NKE | 78.33 | -0.28% | 0.2K |

| General Electric Co | GE | 25.90 | -0.31% | 17.0K |

| Wal-Mart Stores Inc | WMT | 75.25 | -0.33% | 0.3K |

| McDonald's Corp | MCD | 93.31 | -0.44% | 0.4K |

| Pfizer Inc | PFE | 29.26 | -0.44% | 4.4K |

| Johnson & Johnson | JNJ | 103.23 | -0.48% | 2.4K |

| The Coca-Cola Co | KO | 41.51 | -0.50% | 0.4K |

| Merck & Co Inc | MRK | 59.78 | -0.55% | 0.1K |

| Boeing Co | BA | 125.91 | -0.70% | 1.5K |

Upgrades:

Tesla (TSLA) upgraded to Buy from Hold at Stifel, target $400

Downgrades:

Boeing (BA) downgraded to Underperform from Neutral at Buckingham Research

Other:

Apple (AAPL) target raised to $120 from $105 at Piper Jaffray

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia Building Permits, m/m July -5.0% +1.7% +2.5%

01:30 Australia Building Permits, y/y July +16.0% +9.4%

01:30 Australia Current Account, bln Quarter II -5.7 -13.8 -13.7

01:30 Japan Labor Cash Earnings, YoY July +1.0% Revised From +0.4% +0.9% +2.6%

04:30 Australia Announcement of the RBA decision on the discount rate 2.50% 2.50% 2.50%

04:30 Australia RBA Rate Statement

05:45 Switzerland Gross Domestic Product (QoQ) Quarter II +0.5% +0.5% 0.0%

05:45 Switzerland Gross Domestic Product (YoY) Quarter II +2.1% Revised From +2.5% +0.6%

08:30 United Kingdom PMI Construction August 62.4 61.5 64.0

09:00 Eurozone Producer Price Index, MoM July +0.1% 0.0% -0.1%

09:00 Eurozone Producer Price Index (YoY) July -0.8% -1.1% -1.1%

The U.S. dollar traded higher against the most major currencies ahead of the ISM manufacturing purchasing managers' index (PMI). The ISM manufacturing PMI in the U.S. is expected to decline to 57.0 in August from 57.1 in July.

The euro traded lower against the U.S. dollar on speculation that the European Central Bank (ECB) will add further stimulus measures. The ECB will released its interest rate decision on Thursday.

Investors have also concerns that sanctions against Russia would have a negative impact on the economic growth in the Eurozone.

Eurozone's producer price index fell 0.1% in July, after a 0.2% gain in June. June's figure was revised up from a 0.1% increase. Analysts had expected the producer price index to be flat.

On a yearly basis, Eurozone's producer price index dropped 1.1% in July, in line with expectations, after a 0.8% decline in June.

The British pound dropped against the U.S. dollar despite the better-than-expected construction PMI from the UK. The U.K. construction PMI increased to 64.0 in August from 62.4 in July, exceeding expectations for a decline to 61.5.

A YouGov poll weighed on the pound. A poll showed that there is a substantial shift toward Scottish independence. The "Yes" campaign (support for Scottish independence) is just six points behind the "No" campaign. Support of "No" campaign was down from 14 points in mid-August and 22 points less than a month ago, excluding undecided voters.

The Swiss franc traded lower against the U.S. dollar as the Swiss economy stagnated in the second quarter. Switzerland's gross domestic product (GDP) rose 0.6% in the second quarter, after a 2.1% rise in the first quarter. The first quarter's figure was revised down from 2.5% gain.

On a quarterly basis, the Swiss GDP was flat in the second quarter, after a 0.5% rise in the first quarter. Analysts had expected the GDP to remain unchanged.

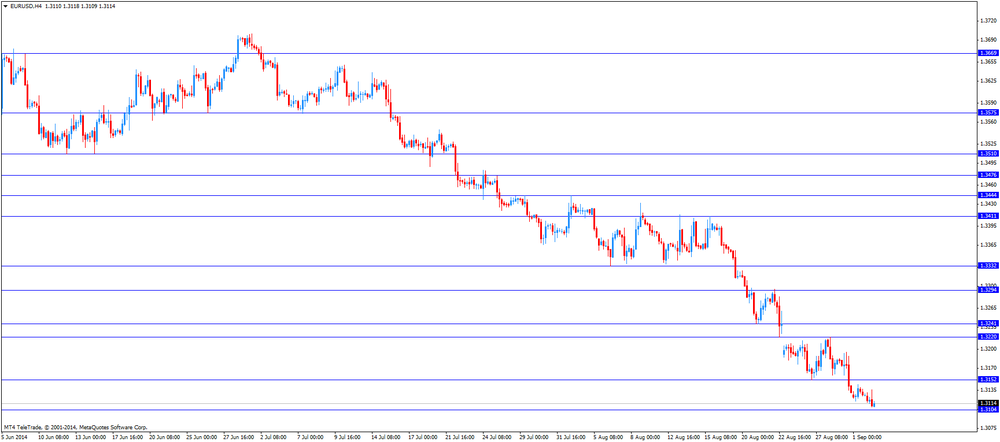

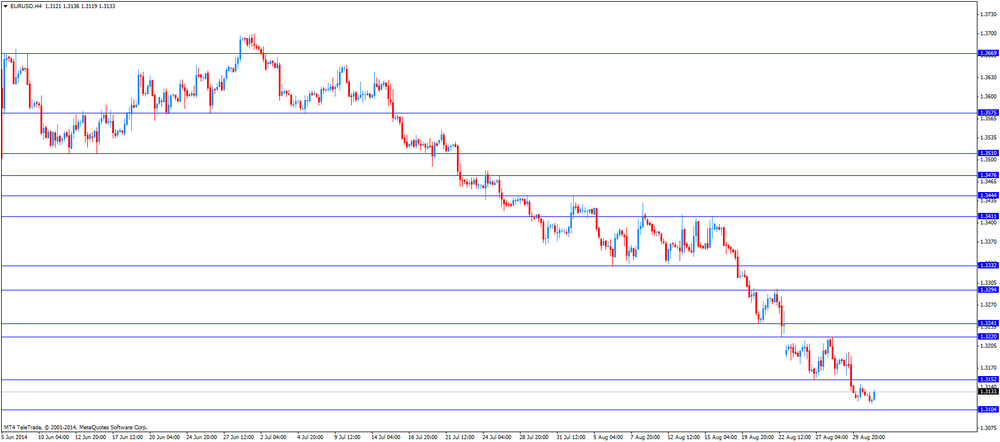

EUR/USD: the currency pair fell to $1.3109

GBP/USD: the currency pair decreased to $1.6516

USD/JPY: the currency pair increased to Y105.01

The most important news that are expected (GMT0):

14:00 U.S. ISM Manufacturing August 57.1 57.0

EUR/USD

Offers $1.322-40, $1.3200, $1.3160

Bids $1.3100, $1.3080, $1.3050, $1.3020, $1.3000

GBP/USD

Offers $1.6720, $1.6700, $1.6650, $1.6580

Bids $1.6510, $1.6500, $1.6465, $1.6400

AUD/USD

Offers $0.9415/20, $0.9400, $0.9370/80, $0.9320

Bids $0.9280, $0.9270, $0.9255/50

EUR/JPY

Offers Y138.40, Y138.20, Y137.90/00

Bids Y137.20, Y137.00, Y136.50, Y136.20

USD/JPY

Offers Y106.00, Y105.50, Y105.00

Bids Y104.00, Y103.80, Y103.50, Y103.20, Y103.00

EUR/GBP

Offers stg0.7970, stg0.7950, stg0.7920

Bids stg0.7890, stg0.7850, stg0.7820, stg0.7800

Stock indices traded little changed on speculation that the European Central Bank (ECB) will add further stimulus measures. The ECB will released its interest rate decision on Thursday.

USA and the European Union threatened further economic sanctions on Russia. Investors have concerns that sanctions against Russia would have a negative impact on the economic growth in the Eurozone.

Eurozone's producer price index fell 0.1% in July, after a 0.2% gain in June. June's figure was revised up from a 0.1% increase. Analysts had expected the producer price index to be flat.

On a yearly basis, Eurozone's producer price index dropped 1.1% in July, in line with expectations, after a 0.8% decline in June.

Current figures:

Name Price Change Change %

FTSE 100 6,834.6 +9.29 +0.14%

DAX 9,561.71 +82.68 +0.87%

CAC 40 4,398.58 +18.85 +0.43%

Most Asian stock indices closed higher.

Japanese stocks were driven by the weaker yen. The yen weakened on reform hopes. Japan's Prime Minister Shinzo Abe plans to reshuffle the cabinet. Japanese media reports said that Shinzo Abe may appoint Yasuhisa Shiozaki, member of the ruling Liberal Democratic Party, to head the health ministry in charge of reforming the Government Pension Investment Fund (GPIF).

Reuters reported last month that GPIF plans to buy more domestic stocks in its portfolio and to change the weighting of domestic stocks to more than 20% from a current 12% target.

Chinese stocks were driven by the by defence and technology companies. Investors speculate that the government will increase military spending to boost economic growth.

Escalating tensions between Russia and Ukraine continued to weigh on markets.

Hyundai Motor Co. shares fell 2.8% after the company reported that car sales declined 5.9% in August from a year earlier.

Nintendo Co. shares rose 2.9%.

Samsung Electronics Co. decreased 2.6% due to reports that the company's operating profit will decline in this quarter.

Indexes on the close:

Nikkei 225 15,668.6 +192.00 +1.24%

Hang Seng 24,749.02 -3.07 -0.01%

Shanghai Composite 2,266.05 +30.54 +1.37%

EUR/USD $1.3100 (E495mn), $1.3125(E392mn), $1.3200(E1.1bn)

EUR/JPY Y137.75(E150mn)

USD/JPY Y103.90($250mn), Y104.00($795mn), Y104.30($100mn)

USD/CAD C$1.0870($140mn), C$1.0900($165mn)

AUD/USD $0.9250(A$452mn), $0.9400(A$152mn)

NZD/USD $0.8400(NZ$234mn)

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia Building Permits, m/m July -5.0% +1.7% +2.5%

01:30 Australia Building Permits, y/y July +16.0% +9.4%

01:30 Australia Current Account, bln Quarter II -5.7 -13.8 -13.7

01:30 Japan Labor Cash Earnings, YoY July +1.0% Revised From +0.4% +0.9% +2.6%

04:30 Australia Announcement of the RBA decision on the discount rate 2.50% 2.50% 2.50%

04:30 Australia RBA Rate Statement

05:45 Switzerland Gross Domestic Product (QoQ) Quarter II +0.5% +0.5% 0.0%

05:45 Switzerland Gross Domestic Product (YoY) Quarter II +2.1% Revised From +2.5% +0.6%

08:30 United Kingdom PMI Construction August 62.4 61.5 64.0

09:00 Eurozone Producer Price Index, MoM July +0.1% 0.0% -0.1%

09:00 Eurozone Producer Price Index (YoY) July -0.8% -1.1% -1.1%

The U.S. dollar traded higher against the most major currencies. Market participants continue to monitor tensions between Russia and Ukraine.

U.S. markets were closed for the Labor Day holiday on Monday.

The New Zealand dollar declined against the U.S dollar in the absence of any major economic reports from New Zealand.

The Australian dollar dropped against the U.S. dollar despite after the Reserve Bank of Australia' interest rate decision. The RBA kept its interest rate unchanged at 2.50%. The RBA Governor Glenn Stevens reiterated the Aussie remains too high. He added that "accommodative monetary policy should provide support to demand and help growth to strengthen over time".

Building permits in Australia climbed 2.5% in July, exceeding expectations for a 1.7% gain, after a 3.8 decline in June. June's figure was revised up from a 5.0% fall.

Australia's current account deficit widened to A$13.7 billion in the second quarter from a deficit of A$7.8 billion in the first quarter. The first quarter's figure was revised down from a deficit of A$5.7 billion. That was the largest deficit since late 2012.

The Japanese yen fell to 7-month low against the U.S. dollar due to reform hopes. Japan's Prime Minister Shinzo Abe plans to reshuffle the cabinet. Japanese media reports said that Shinzo Abe may appoint Yasuhisa Shiozaki, member of the ruling Liberal Democratic Party, to head the health ministry in charge of reforming the Government Pension Investment Fund (GPIF).

Reuters reported last month that GPIF plans to buy more domestic stocks in its portfolio and to change the weighting of domestic stocks to more than 20% from a current 12% target.

Japan's monetary base grew 40.5% in August, missing expectations for a 43.7% rise, after a 42.7% gain in July.

Labour cash earnings in Japan increased 2.6% in July, after a 1% rise in June. June's figure was revised up from a 0.4% increase. Analysts had expected a 0.9% gain.

EUR/USD: the currency pair fell to $1.3114

GBP/USD: the currency pair decreased to $1.6576

USD/JPY: the currency pair rose to Y104.86

AUD/USD: the currency pair declined to $0.9283

The most important news that are expected (GMT0):

14:00 U.S. ISM Manufacturing August 57.1 57.0

EUR / USD

Resistance levels (open interest**, contracts)

$1.3262 (3176)

$1.3224 (3079)

$1.3193 (700)

Price at time of writing this review: $ 1.3121

Support levels (open interest**, contracts):

$1.3092 (5472)

$1.3065 (6385)

$1.3031 (3530)

Comments:

- Overall open interest on the CALL options with the expiration date September, 5 is 67966 contracts, with the maximum number of contracts with strike price $1,3400 (6758);

- Overall open interest on the PUT options with the expiration date September, 5 is 63918 contracts, with the maximum number of contracts with strike price $1,3100 (6385);

- The ratio of PUT/CALL was 0.94 versus 0.96 from the previous trading day according to data from August, 29

GBP/USD

Resistance levels (open interest**, contracts)

$1.6900 (2308)

$1.6800 (2560)

$1.6701 (1037)

Price at time of writing this review: $1.6586

Support levels (open interest**, contracts):

$1.6498 (2061)

$1.6400 (992)

$1.6300 (702)

Comments:

- Overall open interest on the CALL options with the expiration date September, 5 is 31113 contracts, with the maximum number of contracts with strike price $1,7000 (2760);

- Overall open interest on the PUT options with the expiration date September, 5 is 32008 contracts, with the maximum number of contracts with strike price $1,6800 (4025);

- The ratio of PUT/CALL was 1.03 versus 0.98 from the previous trading day according to data from August, 29

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.