- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 29-08-2014

Stock indices closed slightly higher as tensions over Ukraine and the weak economic data from Eurozone weighed on markets. Ukrainian president said yesterday Russian forces had entered the country.

Eurozone's unemployment rate remained unchanged at 11.5% in July, in line with expectations.

Eurozone's preliminary harmonized consumer price index declined to an annual rate of 0.3% in August from 0.4% in July, in line with expectations.

German retail sales fell 1.4% in July, missing expectations for a 0.1% gain, after a 1.0% rise in June. June's figure was revised down from a 1.3% increase.

Investors speculate that the European Central Bank will add new stimulus measures to support the economy.

Tesco Plc shares fell 6.9% after the company cut its full-year profit forecast.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,819.75 +13.95 +0.20%

DAX 9,470.17 +7.61 +0.08%

CAC 40 4,381.04 +15.00 +0.34%

The U.S. dollar traded mixed to higher against the most major currencies after the mixed U.S. economic data. The Reuters/Michigan consumer sentiment index was revised up to 82.5 in August from a preliminary reading of 79.2, exceeding expectations a final reading of 80.1.

The Chicago purchasing managers' index rose to 64.3 in August from 52.6 in July, beating forecasts for a rise to 56.3.

Personal spending in the U.S. fell 0.1% in July, missing forecasts of a 0.2% gain, after a 0.4% rise in June. That was the first decline since January.

Personal income increased 0.2% in July, missing expectations for a 0.3% rise, after a 0.5% gain in June. June's figure was revised up from a 0.4% increase. That was the smallest monthly gain of this year.

The personal consumption expenditures price index, excluding food and energy, climbed at an annual rate of 1.5% in July. The index is the preferred inflation gauge of the Fed. The Fed's inflation target is 2.0%.

On a monthly basis, the personal consumption expenditures price index, excluding food and energy, rose 0.1% in July.

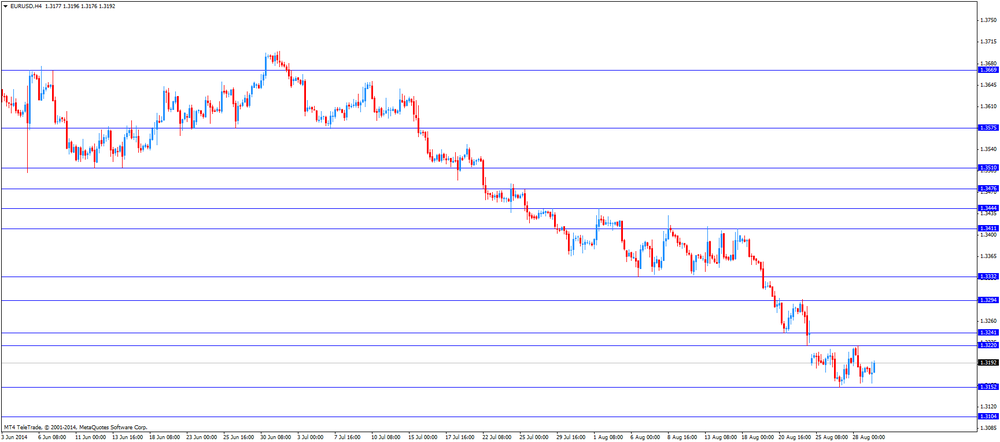

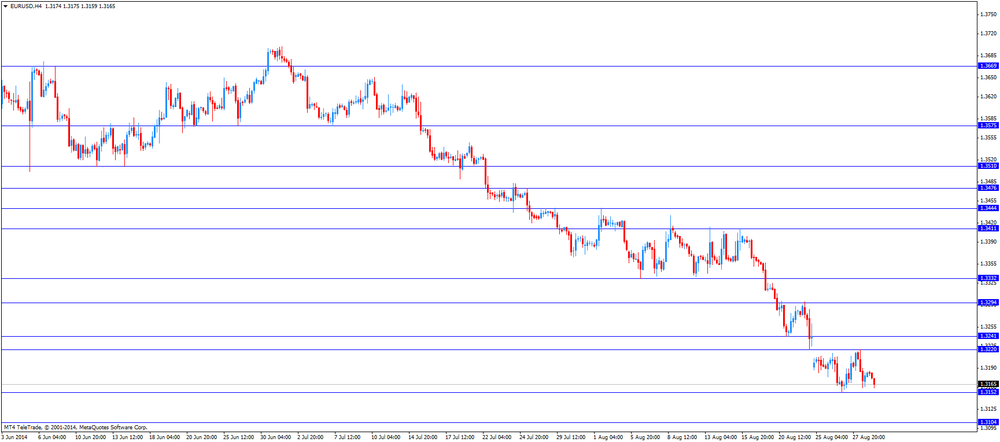

The euro declined against the U.S. dollar despite the weak economic data from the Eurozone. Eurozone's unemployment rate remained unchanged at 11.5% in July, in line with expectations.

Eurozone's preliminary harmonized consumer price index declined to an annual rate of 0.3% in August from 0.4% in July, in line with expectations.

German retail sales fell 1.4% in July, missing expectations for a 0.1% gain, after a 1.0% rise in June. June's figure was revised down from a 1.3% increase.

Investors speculate that the European Central Bank will add new stimulus measures to support the economy.

The British pound traded mixed against the U.S. dollar after the better-than-expected Nationwide house price index. The Nationwide house price index increased 0.8% in August, after a 0.2% gain in July. July's figure was revised up from a 0.1% rise. Analysts had expected the index to be flat.

On a yearly basis, the Nationwide house price index climbed 11.0% in August, after a 10.6% increase in July.

The Swiss franc traded lower against the U.S. dollar. The KOF leading indicator rose to 99.5 in August from 97.9 in July. July's figure was revised down from 98.1.

The Canadian dollar traded mixed against the U.S. dollar ahead of the Canadian gross domestic product (GDP). The GDP rose at an annual rate of 3.1% in the second quarter, after a 0.9% gain in the first quarter. The first quarter's figure was revised down from a 1.2% rise.

That was the largest quarterly increase since the third quarter of 2011. The increase was driven by household spending.

On a monthly basis, Canadian GDP rose 0.3% in June, in line with expectations, after a 0.5% increase in May. May's figure was revised up from a 0.4% gain. The monthly rise was driven by mining, oil and gas, construction, wholesale and retail trade.

Canadian raw material price index decreased 1.4% in July, missing expectations for a 0.7% increase, after a 1.1% gain in June.

The New Zealand dollar traded mixed against the U.S dollar. The ANZ business confidence index in New Zealand fell to 24.4 in August from 39.7 in July. That was the sixth straight decrease in six months.

The total number of building permits in New Zealand rose 0.1% in July, after a 3.5% gain in June.

The Australian dollar traded lower against the U.S. dollar. Private sector credit in Australia increased 0.4% in July, missing expectations for a 0.5% rise, after a 0.7% gain in June.

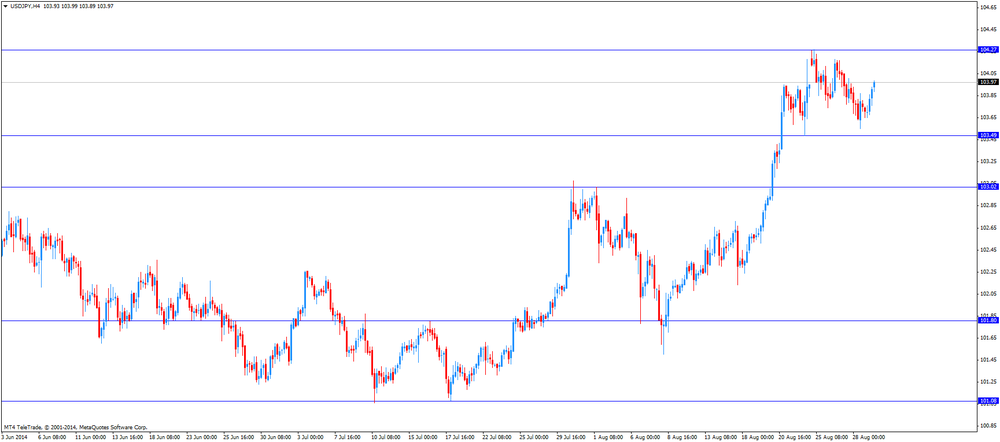

The Japanese yen traded mixed against the U.S. dollar. Japan's national consumer price index (CPI), excluding fresh food, climbed at an annual rate of 3.3% in July, in line with expectations, after a 3.3% gain in June.

Japan's national CPI rose 3.4% in July, after a 3.6% rise in June.

Household spending in Japan dropped 5.9% in July, missing forecasts of a 2.7% decline, after 3.0% decrease in June.

Retail sales in Japan increased 0.5% in July, exceeding expectations for a 0.1% decline, after a 0.6% fall in June.

Japan's unemployment rate rose to 3.8% in July from 3.7% in June. Analysts had expected the unemployment rate to remain unchanged at 3.7%.

Preliminary industrial production in Japan climbed 0.2% in July, missing expectations for a 1.4% rise, after a 3.4% decline in June.

Housing starts in Japan plunged 14.1% in July, missing forecasts of a 10.5% decrease, after a 9.5% drop in June.

Oil has risen moderately today, due to the escalation of tensions in Ukraine. However, prices are still on the way to the monthly fall, as an ample supply and weak demand outweighs political problems. In August, both brands fell more than 3%.

Analysts believe that the market will support the deterioration of the situation in Ukraine. President of Ukraine Petro Poroshenko accused Russia of supporting separatists counteroffensive in the south-east of the country; the leaders of Germany, Britain, France and Italy after NATO also called Russia guilty of escalating military conflict and threatened new sanctions.

"If tensions increase, in the price of oil is likely to be laid small margin" - the analyst said OptionsXpress in Sydney Ben Le Brun.

Little impact on the course of today's trading had American data. The final results of studies presented Thomson-Reuters and the Institute of Michigan, in August of American consumers feel more optimistic about the economy than had been recorded in the last month. According to the data, in August, the final index of consumer sentiment rose to 82.5 compared with a final reading in July at 81.8 and the initial estimate for August at around 79.2. It is worth noting that, according to the average estimates of experts, the index was down compared with the July to reach a value of 80.4. Meanwhile, another report showed:

seasonally adjusted purchasing managers' index for August Chicago rose to 64.3 against 52.6 in July. According to the average forecasts of experts, the value of this indicator was to rise to the level of 56.3.

Positive dynamics is also due to expectations of maintaining stable global energy demand. The market continues to have a strong and published on the eve of macroeconomic statistics for the United States, primarily in the American GDP for the II quarter of 2014. Increased demand for WTI crude oil today is due to additional upcoming September 1 absence of the trading session on the NYMEX in connection with a holiday day off in the United States. Recall, September 1, in the United States will celebrate Labor Day a federal holiday. For oil traders this holiday traditionally marks the end of the summer driving season and a noticeable decline in demand for gasoline and diesel fuel.

The cost of the October futures on American light crude oil WTI (Light Sweet Crude Oil) to the present moment has increased to $ 95.09 per barrel on the New York Mercantile Exchange (NYMEX).

October futures price for North Sea Brent crude oil mixture rose $ 0.20 to $ 102.73 a barrel on the London exchange ICE Futures Europe.

The price of gold has grown considerably, returning with almost all previously lost ground since yesterday's upbeat economic reports the United States continues to support demand for the American currency, but the tension between Russia and Ukraine has forced investors to seek safe-haven assets.

Experts point out that the United States GDP data showed accelerated growth of the economy. In addition, the number of applications for unemployment benefits was lower than analysts had forecast. This statistic has supported the American dollar, which has a negative impact on the dynamics of gold

We also recall that yesterday the president of Ukraine Petro Poroshenko on Thursday accused Russia of supporting separatists counteroffensive in the south-east of the country; the leaders of Germany, Britain, France and Italy after NATO also called Russia guilty of escalating military conflict and threatened new sanctions.

"If prices rise above $ 1,300, will begin selling. Need to monitor the situation in Ukraine. The mood in the gold market is not very optimistic, forward to the increase in interest rates, "- said a senior dealer at Lee Cheong Gold Dealers in Hong Kong Ronald Leung.

Market participants are also watching the situation in the eurozone. Today's report showed: inflation in the euro zone in August, as expected, has slowed amid falling energy prices. Inflation fell to 0.3 percent from 0.4 percent in July. The result coincided with economists' expectations. Inflation has moved further down on the target level of the European Central Bank "below but close to 2 percent." Meanwhile, core inflation, which excludes prices of energy, food, alcohol and tobacco, rose slightly by 0.9 percent in August from 0.8 percent in July.

We also add that the probability of reducing the price of gold will continue in the coming months due to low demand in the physical market of China. Delivery of gold from Hong Kong to China in July fell to a three-year minimum 22,107 tons with 40,543 tons in June. Margins on gold bars in Hong Kong rose to $ 0,80- $ 1.10 per ounce to the price in London. Margins in Singapore held at $ 0,80- $ 1.00 to London prices, and the price in Tokyo is the same as London.

Experts point out that today and in the coming days, the price of gold will be limited to the level of support $ 1,285.0 an ounce resistance level $ 1300.0 per ounce.

The cost of the October gold futures on the COMEX to date is $ 1288.30 per ounce.

EUR/USD: $1.3150(E346mn), $1.3200(E1.14bn), $1.3215(E300mn), $1.3235-40(E677mn), $1.3250(E2.0bn)

USD/JPY: Y102.50-102.90($3.0bn), Y103.00($2.5bn), Y103.20($600mn), Y103.25($1.27bn), Y103.35($275mn), Y103.50($267mn), Y103.75-85($450mn), Y104.00($580mn), Y104.50($1.0bn)

EUR/JPY: Y136.50(E676mn), Y136.75(E200mn), Y138.15(E646mn)

GBP/USD: $1.6550(stg110mn), $1.6600(stg110mn), $1.6690($211mn)

EUR/GBP: stg0.7900(E140mn), stg0.7950(E120mn), stg0.8005(E334mn)

USD/CHF: Chf0.9120($220mn), Chf0.9150($355mn)

AUD/USD: $0.9290-95(A$265mn), $0.9310-15(A$270mn), $0.9350(A$232mn)

NZD/USD: $0.8350(NZ$110mn), $0.8400(NZ$600mn), $0.8440-50($310mn)

USD/CAD: C$1.0800($230mn), C$1.0870($870mn), C$1.0900($305M), C$1.0915-25($500M), C$1.0940-50($250mn)

The U.S. Commerce Department released personal spending and personal income data on Friday. Personal spending in the U.S. fell 0.1% in July, missing forecasts of a 0.2% gain, after a 0.4% rise in June. That was the first decline since January.

Personal income increased 0.2% in July, missing expectations for a 0.3% rise, after a 0.5% gain in June. June's figure was revised up from a 0.4% increase. That was the smallest monthly gain of this year.

The personal consumption expenditures price index, excluding food and energy, climbed at an annual rate of 1.5% in July. The index is the preferred inflation gauge of the Fed. The Fed's inflation target is 2.0%.

On a monthly basis, the personal consumption expenditures price index, excluding food and energy, rose 0.1% in July.

U.S. stock futures pared gains as consumer spending unexpectedly dropped and fighting intensified in Ukraine.

Global markets:

Nikkei 15,424.59 -35.27 -0.23%

Hang Seng 24,742.06 +1.06 0.00%

Shanghai Composite 2,217.2 +21.38 +0.97%

FTSE 6,809.68 +3.88 +0.06%

CAC 4,363.25 -2.79 -0.06%

DAX 9,437 -25.56 -0.27%

Crude oil $95.00 (+0.48%)

Gold $1286.40 (-0.32%)

(company / ticker / price / change, % / volume)

| Exxon Mobil Corp | XOM | 99.61 | +0.04% | 0.1K |

| Caterpillar Inc | CAT | 108.79 | +0.13% | 0.7K |

| Wal-Mart Stores Inc | WMT | 76.00 | +0.13% | 0.1K |

| International Business Machines Co... | IBM | 192.34 | +0.18% | 0.1K |

| Visa | V | 215.00 | +0.19% | 0.3K |

| General Electric Co | GE | 26.06 | +0.19% | 12.8K |

| American Express Co | AXP | 89.20 | +0.20% | 1.1K |

| JPMorgan Chase and Co | JPM | 59.29 | +0.22% | 33.7K |

| Intel Corp | INTC | 34.73 | +0.23% | 0.1K |

| Pfizer Inc | PFE | 29.46 | +0.27% | 1.0K |

| Walt Disney Co | DIS | 90.50 | +0.30% | 1.5K |

| Cisco Systems Inc | CSCO | 24.93 | +0.32% | 0.1K |

| Microsoft Corp | MSFT | 45.03 | +0.33% | 22.4K |

| Home Depot Inc | HD | 92.85 | +0.37% | 0.3K |

| Merck & Co Inc | MRK | 60.00 | 0.00% | 1.3K |

| Verizon Communications Inc | VZ | 49.40 | -0.02% | 4.3K |

Statistics Canada released Canadian gross domestic product (GDP) on Friday. The GDP rose at an annual rate of 3.1% in the second quarter, after a 0.9% gain in the first quarter. The first quarter's figure was revised down from a 1.2% rise.

That was the largest quarterly increase since the third quarter of 2011. The increase was driven by household spending.

On a monthly basis, Canadian GDP rose 0.3% in June, in line with expectations, after a 0.5% increase in May. May's figure was revised up from a 0.4% gain. The monthly rise was driven by mining, oil and gas, construction, wholesale and retail trade.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:00 New Zealand ANZ Business Confidence August 39.7 24.4

01:30 Australia Private Sector Credit, m/m July +0.7% +0.5% +0.4%

01:30 Australia Private Sector Credit, y/y July +5.1% +5.1%

05:00 Japan Housing Starts, y/y July -9.5% -10.5% -14.1%

06:00 United Kingdom Nationwide house price index August +0.1% 0.0% +0.8%

06:00 United Kingdom Nationwide house price index, y/y August +10.6% +11.0%

06:00 Germany Retail sales, real adjusted July +1.0% Revised From +1.3% +0.1% -1.4%

06:00 Germany Retail sales, real unadjusted, y/y July +0.4% +0.7%

07:00 Switzerland KOF Leading Indicator August 98.1 97.9 99.5

09:00 Eurozone Unemployment Rate July 11.5% 11.5% 11.5%

09:00 Eurozone Harmonized CPI, Y/Y (Preliminary) August +0.4% +0.3% +0.3%

The U.S. dollar traded mixed against the most major currencies ahead of the U.S. economic data. Personal income in the U.S. is expected to rise 0.3% in July, after a 0.4% gain in June.

Personal spending in the U.S. is expected to increase 0.2% in July, after a 0.4% rise in June.

The euro traded higher against the U.S. dollar despite the weak economic data from the Eurozone. Eurozone's unemployment rate remained unchanged at 11.5% in July, in line with expectations.

Eurozone's preliminary harmonized consumer price index declined to an annual rate of 0.3% in August from 0.4% in July, in line with expectations.

German retail sales fell 1.4% in July, missing expectations for a 0.1% gain, after a 1.0% rise in June. June's figure was revised down from a 1.3% increase.

Investors speculate that the European Central Bank will add new stimulus measures to support the economy.

The British pound traded mixed against the U.S. dollar after the better-than-expected Nationwide house price index. The Nationwide house price index increased 0.8% in August, after a 0.2% gain in July. July's figure was revised up from a 0.1% rise. Analysts had expected the index to be flat.

On a yearly basis, the Nationwide house price index climbed 11.0% in August, after a 10.6% increase in July.

The Swiss franc traded higher against the U.S. dollar after the better-than-expected KOF leading indicator. The KOF leading indicator rose to 99.5 in August from 97.9 in July. July's figure was revised down from 98.1.

The Canadian dollar traded slightly higher against the U.S. dollar ahead of the Canadian gross domestic product (GDP). The Canadian GDP is expected to climbs 0.3% in June, after a 0.4% rise in May.

EUR/USD: the currency pair rose to $1.3196

GBP/USD: the currency pair traded mixed

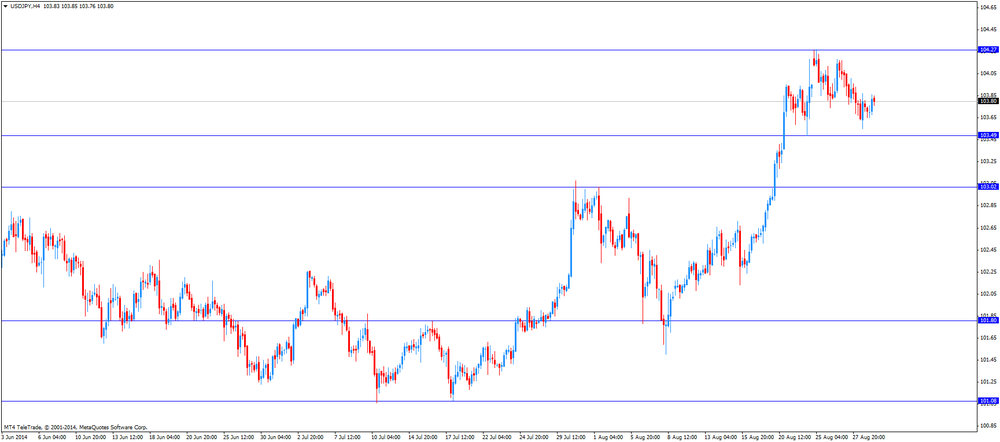

USD/JPY: the currency pair increased to Y103.99

The most important news that are expected (GMT0):

12:30 Canada Raw Material Price Index July +1.1% +0.7%

12:30 Canada GDP (m/m) June +0.4% +0.3%

12:30 U.S. Personal Income, m/m July +0.4% +0.3%

12:30 U.S. Personal spending July +0.4% +0.2%

12:30 U.S. PCE price index ex food, energy, m/m July +0.1% +0.1%

12:30 U.S. PCE price index ex food, energy, Y/Y July +1.5%

13:45 U.S. Chicago Purchasing Managers' Index August 52.6 56.3

13:55 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) August 79.2 80.4

EUR/USD

Offers $1.3350, $1.3325/35, $1.3250/60, $1.3220-40

Bids $1.3160-50, $1.3135, $1.3110-00

GBP/USD

Offers $1.6700

Bids $1.6500

AUD/USD

Offers $0.9450, $0.9415/20, $0.9400, $0.9370/80

Bids $0.9325/20, $0.9300, $0.9280, $0.9255/50

EUR/JPY

Offers Y138.20, Y137.90/00, Y137.50

Bids Y136.50, Y136.20, Y136.00, Y135.50

USD/JPY

Offers Y105.00, Y104.50, Y104.20/25, Y104.00

Bids Y103.50, Y103.20, Y103.00, Y102.80

EUR/GBP

Offers stg0.7980-85, stg0.7970

Bids stg0.7900

Stock indices traded little changed after the weak economic data from the Eurozone. Eurozone's unemployment rate remained unchanged at 11.5% in July, in line with expectations.

Eurozone's preliminary harmonized consumer price index declined to an annual rate of 0.3% in August from 0.4% in July, in line with expectations.

German retail sales fell 1.4% in July, missing expectations for a 0.1% gain, after a 1.0% rise in June. June's figure was revised down from a 1.3% increase.

Investors speculate that the European Central Bank will add new stimulus measures to support the economy.

Market participants also monitor developments in Ukraine. Ukrainian president said Russian forces had entered the country.

Tesco Plc shares fell 5.3% after the company cut its full-year profit forecast.

Current figures:

Name Price Change Change %

FTSE 100 6,817.01 +11.21 +0.16%

DAX 9,478.85 +16.29 +0.17%

CAC 40 4,371.05 +5.01 +0.11%

Asian stock indices traded mixed due to escalating tensions over Ukraine. Market participants monitor developments in Ukraine. Ukrainian president said Russian forces had entered the country.

The economic data from Japan has shown that Japan's economy is struggling to recover from a sales tax hike. Japan's national consumer price index (CPI), excluding fresh food, climbed at an annual rate of 3.3% in July, in line with expectations, after a 3.3% gain in June.

Japan's national CPI rose 3.4% in July, after a 3.6% rise in June.

Household spending in Japan dropped 5.9% in July, missing forecasts of a 2.7% decline, after 3.0% decrease in June.

Retail sales in Japan increased 0.5% in July, exceeding expectations for a 0.1% decline, after a 0.6% fall in June.

Japan's unemployment rate rose to 3.8% in July from 3.7% in June. Analysts had expected the unemployment rate to remain unchanged at 3.7%.

Preliminary industrial production in Japan climbed 0.2% in July, missing expectations for a 1.4% rise, after a 3.4% decline in June.

Indexes on the close:

Nikkei 225 15,424.59 -35.27 -0.23%

Hang Seng 24,742.06 +1.06 0.00%

Shanghai Composite 2,217.2 +21.38 +0.97%

EUR/USD: $1.3150(E346mn), $1.3200(E1.14bn), $1.3215(E300mn), $1.3235-40(E677mn), $1.3250(E2.0bn)

USD/JPY: Y102.50-102.90($3.0bn), Y103.00($2.5bn), Y103.20($600mn), Y103.25($1.27bn), Y103.35($275mn), Y103.50($267mn), Y103.75-85($450mn), Y104.00($580mn), Y104.50($1.0bn)

EUR/JPY: Y136.50(E676mn), Y136.75(E200mn), Y138.15(E646mn)

GBP/USD: $1.6550(stg110mn), $1.6600(stg110mn), $1.6690($211mn)

EUR/GBP: stg0.7900(E140mn), stg0.7950(E120mn), stg0.8005(E334mn)

USD/CHF: Chf0.9120($220mn), Chf0.9150($355mn)

AUD/USD: $0.9290-95(A$265mn), $0.9310-15(A$270mn), $0.9350(A$232mn)

NZD/USD: $0.8350(NZ$110mn), $0.8400(NZ$600mn), $0.8440-50($310mn)

USD/CAD: C$1.0800($230mn), C$1.0870($870mn), C$1.0900($305M), C$1.0915-25($500M), C$1.0940-50($250mn)

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:00 New Zealand ANZ Business Confidence August 39.7 24.4

01:30 Australia Private Sector Credit, m/m July +0.7% +0.5% +0.4%

01:30 Australia Private Sector Credit, y/y July +5.1% +5.1%

05:00 Japan Housing Starts, y/y July -9.5% -10.5% -14.1%

06:00 United Kingdom Nationwide house price index August +0.1% 0.0% +0.8%

06:00 United Kingdom Nationwide house price index, y/y August +10.6% +11.0%

06:00 Germany Retail sales, real adjusted July +1.0% Revised From +1.3% +0.1% -1.4%

06:00 Germany Retail sales, real unadjusted, y/y July +0.4% +0.7%

07:00 Switzerland KOF Leading Indicator August 98.1 97.9 99.5

The U.S. dollar traded mixed to higher against the most major currencies. The greenback was supported by Thursday' better-than-expected U.S. economic data. The U.S. revised gross domestic product jumped 4.2% in the second quarter instead of the previously reported 4.0%. That was the fastest increase since the third quarter of 2013. Analysts had expected an increase of 3.9%.

The number of initial jobless claims in the week ending August 22 fell by 1,000 to 298,000 from 299,000 in the previous week.

The U.S. pending home sales rose 3.3% in July, exceeding expectations for a 0.6% gain, after a 1.3% fall in June. That was the highest level since August 2013.

The New Zealand dollar traded lower against the U.S dollar due to the weak economic data from New Zealand. The ANZ business confidence index in New Zealand fell to 24.4 in August from 39.7 in July. That was the sixth straight decrease in six months.

The total number of building permits in New Zealand rose 0.1% in July, after a 3.5% gain in June.

The Australian dollar traded mixed against the U.S. dollar after the weaker-than-expected economic data from Australia. Private sector credit in Australia increased 0.4% in July, missing expectations for a 0.5% rise, after a 0.7% gain in June.

The Japanese yen traded slightly lower against the U.S. dollar after mixed economic reports from Japan. Japan's national consumer price index (CPI), excluding fresh food, climbed at an annual rate of 3.3% in July, in line with expectations, after a 3.3% gain in June.

Japan's national CPI rose 3.4% in July, after a 3.6% rise in June.

Household spending in Japan dropped 5.9% in July, missing forecasts of a 2.7% decline, after 3.0% decrease in June.

Retail sales in Japan increased 0.5% in July, exceeding expectations for a 0.1% decline, after a 0.6% fall in June.

Japan's unemployment rate rose to 3.8% in July from 3.7% in June. Analysts had expected the unemployment rate to remain unchanged at 3.7%.

Preliminary industrial production in Japan climbed 0.2% in July, missing expectations for a 1.4% rise, after a 3.4% decline in June.

Housing starts in Japan plunged 14.1% in July, missing forecasts of a 10.5% decrease, after a 9.5% drop in June.

EUR/USD: the currency pair fell to $1.3173

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair rose to Y103.86

The most important news that are expected (GMT0):

09:00 Eurozone Unemployment Rate July 11.5% 11.5%

09:00 Eurozone Harmonized CPI, Y/Y (Preliminary) August +0.4% +0.3%

12:30 Canada Raw Material Price Index July +1.1% +0.7%

12:30 Canada GDP (m/m) June +0.4% +0.3%

12:30 U.S. Personal Income, m/m July +0.4% +0.3%

12:30 U.S. Personal spending July +0.4% +0.2%

12:30 U.S. PCE price index ex food, energy, m/m July +0.1% +0.1%

12:30 U.S. PCE price index ex food, energy, Y/Y July +1.5%

13:45 U.S. Chicago Purchasing Managers' Index August 52.6 56.3

13:55 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) August 79.2 80.4

EUR / USD

Resistance levels (open interest**, contracts)

$1.3279 (3028)

$1.3249 (2504)

$1.3210 (343)

Price at time of writing this review: $ 1.3174

Support levels (open interest**, contracts):

$1.3136 (6049)

$1.3109 (4357)

$1.3075 (6426)

Comments:

- Overall open interest on the CALL options with the expiration date September, 5 is 65467 contracts, with the maximum number of contracts with strike price $1,3400 (6599);

- Overall open interest on the PUT options with the expiration date September, 5 is 63116 contracts, with the maximum number of contracts with strike price $1,3100 (6426);

- The ratio of PUT/CALL was 0.96 versus 0.99 from the previous trading day according to data from August, 28

GBP/USD

Resistance levels (open interest**, contracts)

$1.6800 (2560)

$1.6701 (910)

$1.6604 (808)

Price at time of writing this review: $1.6581

Support levels (open interest**, contracts):

$1.6498 (2002)

$1.6400 (1001)

$1.6300 (705)

Comments:

- Overall open interest on the CALL options with the expiration date September, 5 is 30508 contracts, with the maximum number of contracts with strike price $1,7000 (2760);

- Overall open interest on the PUT options with the expiration date September, 5 is 29884 contracts, with the maximum number of contracts with strike price $1,6800 (4025);

- The ratio of PUT/CALL was 0.98 versus 0.98 from the previous trading day according to data from August, 28

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.