- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 05-07-2022

- AUD/JPY remains pressured after reversing from monthly resistance line.

- Bearish MACD signals, downbeat RSI adds strength to the downside bias.

- 100-day EMA act as additional support, bulls need validation from April’s peak.

AUD/JPY remains on the back foot at around 92.00 as sellers keep the previous day’s U-turn from the monthly resistance line during Wednesday’s sluggish Asian session.

In addition to the pullback from the key resistance line, bearish MACD signals and the downward sloping RSI (14), not oversold, also favor sellers to expect further downside.

However, an upward sloping support line from January 28 and the 100-day EMA, respectively near 91.00 and 90.70, could challenge the AUD/USD bears.

In a case where AUD/JPY drops below 90.70, the 90.00 threshold may probe the sellers before directing them to May’s low of 87.30.

On the flip side, recovery remains elusive until the quote stays below the one-month-old descending resistance line, around 93.85 at the latest.

Even so, the late June swing low and April’s high, respectively near 95.30 and 95.75 in that order, could challenge the AUD/JPY bulls before questioning the yearly high of 96.88.

Overall, AUD/JPY remains pressured towards the key support with limited downside expected. However, sour sentiment and recession fears can drown the risk-barometer pair.

AUD/JPY: Daily chart

Trend: Further downside expected

US inflation expectations, as per the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data, drop to the lowest levels since September 2021 by the end of Tuesday’s North American session. That said, the inflation gauge recently flashed the 2.30% mark, reversing the previous rebound from the yearly low of 2.33%.

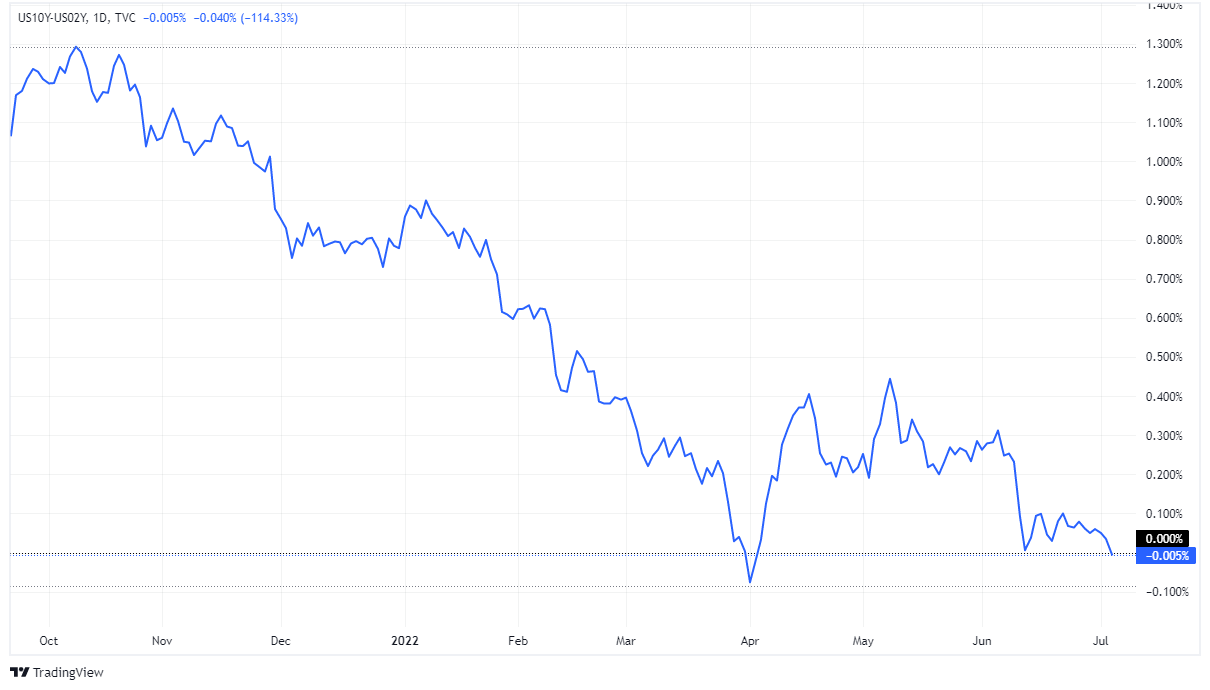

The recently downbeat inflation expectations don’t rule out the inflation fears as the inversion of the 2-year and 10-year Treasury yield curve appears to hint at the global economic slowdown.

That said, Germany’s energy crisis, Italy’s drought and the Bank of England’s grim economic outlook, not to forget the strong prints of the US Factory Orders for May, were the latest catalysts that propelled the economic woes.

Amid these plays, US Dollar Index (DXY) jumped to the highest levels in two years while equities dropped, before a mild recovery, whereas the US Treasury yields refreshed one-month low while inverting the yield curve between the two-year and 10-year coupons. The S&P 500 Futures, however, struggle for clear directions of late.

Moving on, the Federal Open Market Committee (FOMC) Minutes and the US ISM Services PMI for June will be crucial for short-term market directions.

Also read: US 2s-10s Treasury Yield curve inverts, as recession fears build up

- GBP/JPY may deliver more losses on slippage below 161.50 on negative market sentiment.

- The pound bulls have faced significant offers on political instability in the UK economy.

- The inflation outlook in Tokyo may accelerate on a broad-based decline in yen.

The GBP/JPY pair is carry-forwarding the downside bias of Tuesday and is expected to extend losses after violating Tuesday’s low at 161.59. The cross has given a downside break of the minor consolidation formed in a narrow range of 161.27-161.46 in the early hour of Tokyo.

On Tuesday, the pound bears tested their two-day low at 161.57 after the warning commentary from the Bank of England (BOE). The statement from the Bank of England (BOE) that the outlook for the global economy has deteriorated materially and that volatility in the energy and raw materials cost is hinting at significant risk of disruption, which could amplify economic shocks in the future as per ANZ Research, spooked the market sentiment.

This has escalated the recession fears in the global economy and stagflation fears in the UK economy as their inflation rate has climbed above 9%. This has underpinned the risk-off impulse in the global market. Adding to that, market participants punished the sterling bulls on signs of political instability in their economy. The vice-chair of the UK Conservative Party, Bim Afolami, resigned and calls for PM Boris Johnson to stand down. The event has added severe volatility to the asset.

On the Tokyo front, rising expectations for higher price pressures have infused fresh blood in the yen bulls. Seisaku Kameda, a former chief economist at the Bank of Japan (BOJ) said that the sharp decline in yen on a broader note will lift the inflation outlook and it may remain well above 2% this year.

- The EUR/JPY extends its losses during the week by 1.37%.

- EU recession fears and risk aversion are a headwind for the EUR/JPY.

- EUR/JPY Tuesday’s price action opened the door for a corrective pullback towards 140.60s before resuming downwards.

The EUR/JPY refreshes three-week lows below the 139.00 mark, for the first time since June 16, amidst a mixed market mood, which later progressed as US equities erased earlier losses. At the time of writing, the EUR/JPY is trading at 139.11.

EU recession fears, a headwind for the EUR/JPY

Futures of Asian stocks prepare to open mixed, carrying on Wall Street’s mood. Fears of a worldwide recession amidst inflation at around 40-year high levels spurred a flight to safety. Safe-haven peers, like the Japanese yen, got bolstered by the previously mentioned. Contrarily a gloomy economic outlook in the EU was a headwind for the EUR/JPY.

The EUR/JPY, Tuesday open, was near the Monday highs, followed by a rally towards the 200-H1 simple moving average (SMA) at around 142.35. However, once the cross approached that price level, sellers stepped in and sent the EUR/JPY nosediving towards the daily low around 138.94, reached late in the North American session.

EUR/JPY Daily chart

On the Monday analysis, I wrote that “EUR/JPY traders should note that albeit a bullish harami has formed, sellers begin to mount around 142.00, which might send the cross-currency pair tumbling toward the July 1 low at 139.80.” During the Tuesday session, the EUR/JPY achieved the target mentioned previously as sellers piled around the 200-H1 SMA, sending the pair tumbling beyond the July 1 low. Nevertheless, the magnitude of the fall opened the door for a corrective pullback, at least a 50% retracement towards 140.65, before resuming the ongoing downtrend.

If that scenario plays out, the EUR/JPY first support would be 140.00. The break below will expose the 50-day EMA at 138.96, followed by the June 16 daily low at around 137.83.

EUR/JPY Key Technical Levels

- WTI holds onto the corrective pullback from the lowest levels since late April.

- Bears take a breather after a volatile day, fears of economic slowdown drowned commodities.

- OPEC’s Barkindo failed to impress buyers amid market pessimism.

- Weekly API inventories, Fed Minutes and US ISM Services PMI will be important to watch for clear directions.

WTI crude oil picks up bids to $99.00 as it pares the biggest daily loss since March during Wednesday’s Asian session. The black gold dropped the most in many ways while refreshing the three-month low as recession fears outweighed supply-crunch concerns.

Growing fears of global recession joined speculations that China may recall covid-led lockdowns to drown the energy benchmark the previous day. The pessimism intensified after policymakers from the major central banks signaled further hardships for the global economy. On the same line was China’s mass covid testing announcement.

The bearish bias failed to cheer news that the US is up for removing the Trump-era tariffs on China, as well as comments from the Secretary-General of the Organization of the Petroleum Exporting Countries (OPEC). OPEC Secretary-General Mohammad Barkindo said on Tuesday that the energy sector is facing huge challenges on multiple fronts. "Refining capacity in OECD countries declined by 3.3% globally in 2021," added OPEC’s Barkindo per Reuters.

It should be noted that the news conveying an end to the Norwegian oil and gas workers’ strike and hopes of further oil output from Venezuela and Iran also exert downside pressure on the quote.

That said, the US dollar’s strength and the downbeat risk profile were the main catalysts behind the WTI’s biggest slump in many days. US Dollar Index (DXY) jumped to the highest levels in two years while equities dropped, before a mild recovery, whereas the US Treasury yields refreshed one-month low while inverting the yield curve between the two-year and 10-year coupons.

Looking forward, the Federal Open Market Committee (FOMC) Minutes and the US ISM Services PMI for June will be important for fresh impulse. Further, API Weekly Crude Oil Stock for the week ended on July 01, prior -3.799M, will also be crucial to follow.

Technical analysis

A clear downside break of an upward sloping trend line from February 18, around $101.30 by the press time, keeps WTI bears hopeful of witnessing further declines.

- Gold price is establishing below $1,770.00 as soaring recession fears underpinned the DXY.

- The BOE noted that volatility in the oil and raw material prices may amplify economic shocks in the future.

- Going forward, the release of the FOMC minutes will provide further direction in the gold prices.

Gold price (XAU/USD) has turned sideways after displaying a vertical downside move. The precious metal is displaying back and forth moves in a narrow range of $1,763.90-1,771.37 in early Tokyo. The asset witnessed a steep fall after the market participants channelize their liquidity into the US dollar index (DXY) amid soaring recession fears.

The statement from the Bank of England (BOE) that the outlook for the global economy has deteriorated materially and that volatility in the energy and raw materials cost is hinting for a significant risk of disruption, which could amplify economic shocks in the future as per ANZ Research.

The gold prices closed below the psychological support of $1,800.00 for the first time in the past five months and plunged to a fresh six-month low at $1,763.93. The follow-up oscillating seems lucrative for the gold bears and more downside in the counter is on the cards.

In today’s session, the release of the Federal Open Market Committee (FOMC) minutes will remain in focus. June’s monetary policy minutes will provide a detailed viewpoint of Federal Reserve (Fed) policymakers on supporting the 75 basis points (bps) interest rate hike by the Fed.

Gold technical analysis

On a daily scale, the gold prices accelerated their losses after violating the horizontal support line placed from January’s low at $1,782.68. The 20-period Exponential Moving Average (EMA) at $1,817.42 is acting as a major barricade for the counter. Meanwhile, the Relative Strength Index (RSI) has slipped below 40.00 and is indicating more downside ahead. The momentum oscillator is not displaying any signs of divergence and an oversold situation. Therefore, more downside cannot be ruled out.

Gold daily chart

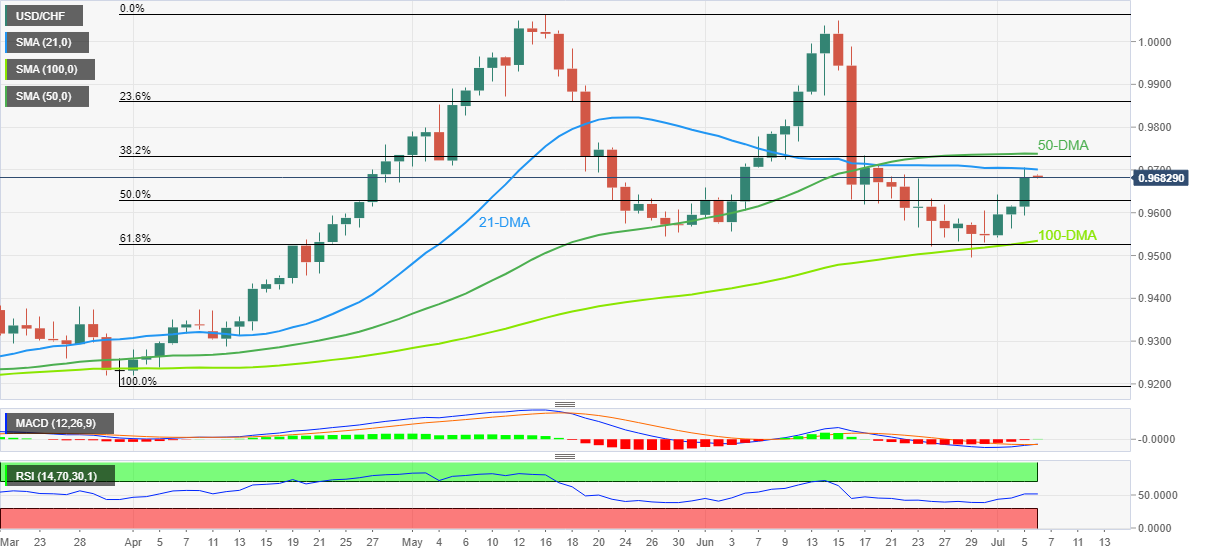

- USD/CHF consolidates the biggest daily gains in three week around a fortnight top.

- Impending bull cross on MACD, sustained trading beyond 100-DMA favor buyers.

- 50-DMA, 38.2% Fibonacci Retracement appears important nearby hurdle to watch.

USD/CHF eases from a fortnight high as buyers take a breather around 0.9680, after rising the most in three weeks, during Wednesday’s Asian session. In doing so, the Swiss currency (CHF) pair prints the first intraday loss in four while reversing from the 21-DMA.

Despite the U-turn from the 21-DMA resistance of 0.9700, the USD/CHF remains on the bull’s radar due to the looming bullish signals on the MACD, as well as firmer RSI (14).

Also keeping USD/CHF buyers hopeful is the pair’s successful rebound from the 100-DMA and the 61.8% Fibonacci retracement (Fibo.) of March-May upside.

That said, the quote’s upside break of the 0.9700 DMA resistance isn’t an open invitation to the bulls as a convergence of the 50-DMA and the 38.2% Fibo highlights 0.9740 as an important hurdle for the buyers to cross.

Following that, a run-up towards the 23.6% Fibonacci retracement and the yearly high, respectively near 0.9860 and 1.0065, can’t be ruled out.

Alternatively, pullback moves may revisit the 50% Fibonacci retracement level surrounding 0.9630.

However, the 100-DMA and the 61.8% gold ratio, near 0.9530, appear crucial for the USD/CHF bears to watch to retake control.

USD/CHF: Daily chart

Trend: Further upside expected

- GBP/USD lacks momentum near the lowest levels since March 2020, pares the biggest daily loss in three weeks.

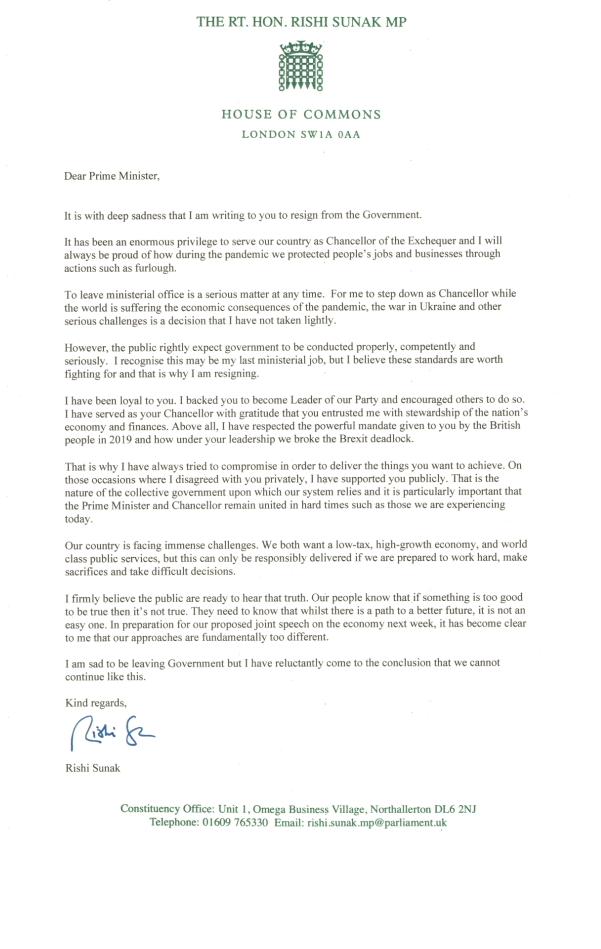

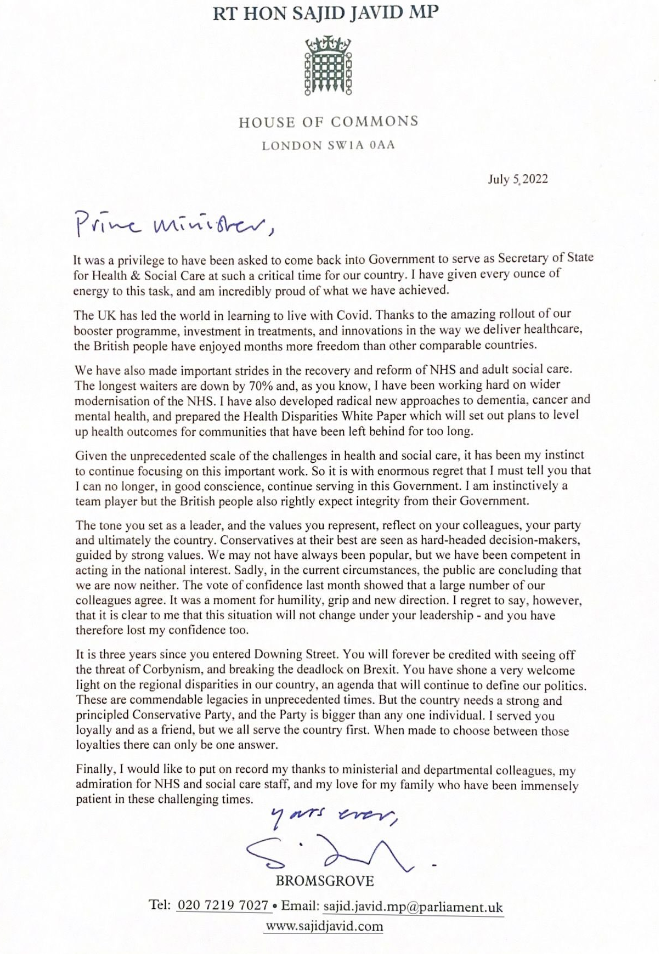

- British Health Secretary Sajid Javid, Finance Minister Rishi Sunak and Vice-Chair of Conservative Party Bim Afolami resigned.

- UK PM Johnson refrains from leaving and eyes to building new cabinet, recession fears also strengthen bearish bias.

- Risk catalysts will be important to watch, Fed Minutes, US ISM Services PMI and BOE speak to decorate calendar.

GBP/USD surprises traders by paying little heed to the severe political plays at Downing Street, after refreshing the two-year low on recession woes, during Wednesday’s initial Asian session. That said, the Cable pair seesaws around 1.1960 by keeping the latest rebound from the 28-month low of 1.1898.

UK PM Boris Johnson had a tough Tuesday as senior members of his cabinet, as well as the Tory Party, resigned after he decided to keep former Conservative party whip Chris Pincher in his post after sexual misconduct allegations were made against him. The British Leader, however, regretted his decision and took steps but it was too late. Even so, UK PM Johnson remained determined to keep his post and form the new cabinet.

Among the key resignations were British Health Secretary Sajid Javid, Finance Minister Rishi Sunak and Vice-Chair of Conservative Party Bim Afolami. It’s worth noting that multiple politicians are standing in the line to leave the boat as it appears sinking.

Elsewhere, the recession fears were in the talks and joined the firmer US Factory Orders for May, to 1.6% MoM versus 0.5% expected, to propel the US Dollar Index (DXY) to the highest levels in two years.

It’s worth noting that Germany’s energy crisis, Italy’s drought and the Bank of England’s grim economic outlook are the key catalysts that drowned the GBP/USD prices earlier, before the latest corrective pullback. On the same line could be hopes of an end to the British pessimism after the dissolution of the current cabinet, which is more likely soon.

Against this backdrop, the equities dropped, before a mild recovery, whereas the US Treasury yields refreshed one-month low while inverting the yield curve between the two-year and 10-year coupons.

Given the popularity of the political plays in the UK, GBP/USD traders should pay attention to the political news for fresh impulse. Also important will be the Federal Open Market Committee (FOMC) Minutes and the US ISM Services PMI for June.

Technical analysis

GBP/USD rebound hinges on its ability to confirm the short-term falling wedge bullish chart pattern, by crossing the 1.2200 hurdle. Until then, the quote is vulnerable to refreshing multi-month low under 1.2000.

- The greenback bulls have faced correction after testing a three-week high at 1.3080.

- Advancing 20- and 50-period EMAs add to the upside filters.

- The RSI (14) is oscillating in a bullish range of 60.00-80.00 which indicates more upside ahead.

The USD/CAD pair is going through a correction phase after displaying a perpendicular upside move from Tuesday’s low at 1.2844. The asset extended its recovery on Tuesday after overstepping the critical hurdle of 1.2965.

On an hourly scale, the asset has faced barricades while surpassing its three-week high at 1.3080. A violation of an old resistance fetches a reversal in the counter. However, the upside remains favored as the upside move towards 1.3080 was extremely firmer. Going forward, the corrective move may turn into a bullish impulsive wave.

The 20- and 50-period Exponential Moving Averages (EMAs) at 1.2990 and 1.2938 respectively are scaling higher, which adds to the upside filters.

Meanwhile, the Relative Strength Index (RSI) (14) is oscillating in a bullish range of 60.00-80.00, which indicates more upside ahead. A minor correction has been witnessed in the greenback bulls after the momentum oscillator turned overbought. The overall trend is still bulls and the RSI (14) may find support around 60.00.

Should the asset surpass the three-week high at 1.3080 decisively, the greenback bulls will drive the asset towards the round-level resistance and 4 November 2020 at 1.3200 and 1.3300 respectively.

Alternatively, the loonie bulls could regain control if the asset drops below the critical support of the June 28 low at 1.2819. This will drag the asset towards June 9 high at 1.2705, followed by June 6 high at 1.2619.

USD/CAD hourly chart

-637926574377866888.png)

- Silver prices plunged more than 3.76% on Tuesday as the greenback rose to a new twenty-year high.

- Recession fears and high inflation re-ignited nervousness around the financial markets.

- Silver Price Forecast (XAGUSD): The break below the 200-week SMA paved the way for a fall towards June’s 2020 lows just below $17.00.

Silver (XAGUSD) plummets as the New York session winds down after a risk-off impulse spurred safe-haven flows toward the greenback, which is having its best single-trading gain since March 19, 2020, when it rallied 2%. At $19.27, XAGUSD is trading just $0.10 above the YTD low, down 3.76%.

The market sentiment is mixed, as US equities pared earlier losses late in the North American session. Slower growth in the Euro area, alongside the deceleration of the US economy, stoked recession fears worldwide. Additionally, soaring energy prices in the EU and Russia threatening to halt natural gas flows to Europe kept investors nervous, who shifted toward safe-haven assets as a reaction to that.

During the Asian session, newswires reported that US President Joe Biden might roll back some tariffs imposed on Chines imports as they struggle to help alleviate inflation/recession worries.

In the meantime, the US Dollar Index is up by 1.28%, at 160.507. Contrarily, the US 10-year Treasury yield plunged eleven basis points, finishing the New York session at 2.818%.

During the US session, May’s Factory Orders rose by 1.6% MoM, more than the 0.5% expected. In the same report, orders excluding Transports jumped by 1.7%.

Later in the week, the US economic docket will feature FOMC meeting minutes alongside ISM Non-Manufacturing Indices, and some Fed speakers will cross the wires.

Silver Price Forecast (XAGUSD): Technical outlook

The XAGUSD’s weekly chart illustrates the pair as bearish biased. The last week’s silver price broke below the 200-week simple moving average (SMA), exposing the white metal to further selling pressure. Also, oscillators are still in negative territory but with some room to spare before entering the oversold area.

Therefore, XAGUSD’s first support would be $19.00. Break below will expose $18.94, followed by June’s 2020 lows around $16.95.

XAGUSD Key Technical Levels

- EUR/USD bears take a breather around the lowest levels since December 2020 after the biggest daily slump in 28 months.

- Recession fears joined upbeat US data to offer warm welcome to the USD after a long weekend.

- Yields dropped to five-week low, equities dwindled as well.

- EU Commission’s economic forecasts, Eurozone Retail Sales are extra catalysts to watch for fresh impulse.

EUR/USD moves stabilize near the lowest levels in two decades after falling the most since March 2020, as bears await fresh clues to extend the fierce south-run. In addition to the anxiety ahead of the key data/events, the initial hours of the Asian trading session also restrict the pair’s moves around 1.0370-60 on Wednesday.

Be it Germany’s energy crisis or Italy’s drought, not forgetting the bank of England’s grim economic outlook, everything contributed to the pessimism surrounding the economic conditions in the old continent. Adding to the downside pressure was the hawkish bias of the European Central Bank (ECB) policymakers, which in turn suggested aggressive central bank action and further strain on the bloc.

While the EUR struggled due to the economic fears, the US dollar was equally cheering the same as the US Dollar Index (DXY) rallied to the highest levels in two years as the US traders returned from the long weekend. In addition to the rush for risk safety, the DXY also benefited from the better-than-forecast US Factory Orders for May, to 1.6% MoM versus 0.5% expected and upwardly revised 0.7% previous readings.

On the other hand, an improvement in the final readings of the Eurozone’s S&P Global PMIs couldn’t help the bloc’s currency as German Economy Minister Robert Habeck hints at more pain due to the energy crisis. Further, the German Retail Association also blamed rising inflation and energy costs and poor consumer sentiment for the outlook.

Amid these plays, the equities dropped, before a mild recovery, whereas the US Treasury yields refreshed one-month low while inverting the yield curve between the two-year and 10-year coupons.

Moving on, European Commission’s economic forecasts and Eurozone Retail Sales for May will offer immediate directions ahead of the Federal Open Market Committee (FOMC) Minutes and the US ISM Services PMI for June.

Also read: FOMC June Minutes Preview: Opportunity for dollar correction?

Technical analysis

A clear downside break of the horizontal area comprising the yearly low, around 1.0360-50, keeps EUR/USD bears hopeful of extending the south-run towards the 1.0000 psychological magnet.

- AUD/USD is expected to turn sideways after a rebound from 0.6762.

- Investors are on the sidelines ahead of the release of the Fed minutes.

- The aussie bulls failed to capitalize on a 50 bps rate hike by the RBA.

The AUD/USD pair displayed a responsive buying action after hitting a low of 0.6762 in the late New York session. The responsive buying action came after the aussie bears re-tested the weekly lows at 0.6764, recorded on July 1. Usually, this kind of action results in a sideways move or a mild correction in the counter. Therefore, the asset will keep auctioning around 0.6800 ahead.

Also, the forward release of the Federal Open Market Committee (FOMC) minutes will keep investors on the sidelines. The release of the FOMC minutes will provide a detailed clarification on the prior rate hike announcement by the Federal Reserve (Fed). Fed chair Jerome Powell in June monetary policy announced a rate hike by 75 basis points (bps).

Adding to the clarification on the rate hike announcement, the FOMC minutes will dictate the economic indicators to understand the growth prospects of the US economy.

On the aussie front, the aussie bulls failed to capitalize on the 50 bps rate hike announcement by the Reserve Bank of Australia (RBA) on Tuesday. RBA Governor Philip Lowe elevated the Official Cash Rate (OCR) to 1.35%. No doubt, the RBA is aggressively working on containing its price pressures, which were recorded at 5.1% in the first quarter of CY2022. This is the consecutive 50 bps rate hike announcement by the RBA.

- NZD/USD bears are moving in following a firm recovery rally.

- The US dollar will be a focus and US events could be the catalyst.

At 0.6797, NZD/USD has recovered from New York session lows near 0.6762 following a drop in the US dollar that came as embattled Us stocks bounced back to life later in the day on Wall Street.

The turn-around on Tuesday followed a three-day holiday weekend after last Friday's sharp rally, as investors waited for economic data due later this week. Nevertheless, the US bulls could be treading carefully in the wake of the greenback's surge to fresh bull cycle highs that marked up 106.79 in the DXY.

''Once again it was global recession fears at work, with the consequent safe-haven demand favouring the USD as oil prices and bond yields both retreated lower,'' analysts at ANZ Bank argued. ''Looking ahead, it is difficult to see FX markets shifting from current USD-centric perspectives ahead of yet more key US data between now and Saturday morning. Technically, the Kiwi’s collapse overnight looks ominous; some caution is required.''

Meanwhile, non-local events are going to be the driver for the antipodeans. US Nonfarm Payrolls is expected to show that Employment likely continued to advance firmly in June but at a more moderate pace after three consecutive job gains of around 400k in March-May, analysts at TD Securities said.

Minutes of the Federal Reserve's June meeting will also be eyed. ''Persistent high CPI inflation and nascent signs of de-anchoring inflation expectations forced the Fed to amp the pace of rate tightening. The meeting minutes are likely to offer further colour around the Fed's more hawkish reaction function,'' the analysts at TD Securities said.

NZD/USD technical analysis

The W-formation is a compelling feature of the hourly chart that could be regarded as a reversion opportunity for days traders that might wish to approach the pattern from a lower time frame such as the 1-min chart as follows:

- Gold is pressured below a key monthly trendline and continues to bleed out.

- A sustained downtrend could form in gold should the large CTA selling program catalyze a breakdown in price, bank analysts argue.

At $1,767, the price of gold is down on the day by some 2.2% after falling from a high of $1,812.19 to a low of $1,763.92 so far. The precious metal has been under water for the start of July due to a rebound in the US dollar and has collapsed to the lowest levels since early December while the greenback takes off to a fresh 20-year high.

Global equities have been under pressure due to recessionary fears that have dominated the markets this month so far. European exchanges weakened which has weighed on stocks on Wall Street supporting the bid in the greenback and offers in gold. However, bond yields have moderated which could be a lifeline for the gold bugs since gold offers no interest. The US 10-year note was last seen paying 2.82%, down 3.45% on the day so far.

''Gold is being weighed down by substantial CTA trend followers, analysts at TD Securities explained. ''The margin of safety is razor-thin,'' the analysts added.

''A sustained downtrend could form in gold should the large CTA selling program catalyzes a breakdown in prices. After all, as central banks face a credibility crisis, they could remain committed to their battle against inflation and keep rates elevated for longer than recession odds would otherwise imply,'' the analysts argue.

''The massive amount of speculative length from proprietary traders in the yellow metal also appears complacent, given that this length was accumulated as early as 2020. The bias remains to the downside in gold.''

Gold technical analysis

The price of the precious metal is trading below the rising supporting trendline on the monthly time frame but the critical fractal lows are located at $1,676.

- US Treasury yields plunged on Tuesday on what is seen as a “recession trade” by financial analysts.

- The US Q1 GDP on its final reading contracted by -1.6%.

- The US Federal Reserve Chair Jerome Powell committed to bringing inflation downs, even if the US economy slows down.

Fears of recession and elevated prices sent US Treasury bond yields nosediving, inverting the US 2s-10s yield curve, one of the most popular “leading indicators” of a recession, sitting at -0.006%, on Tuesday amidst a hopeless market sentiment as reflected by US equities registering losses between 0.28% and 0.91%. At the time of writing, the US 2-year Treasury bill rate sits at 2.822%, six basis points higher than the US 10-year Treasury note, which yields 2.816%.

Given that the US inflation has remained stubbornly higher at around 8.6%, the US Federal Reserve hiked rates by 150 bps since March 2022. That has been felt in the economy, as the US Q1 final GDP dropped by -1.6%, while also showing that consumer spending has softened and inventories remained higher than reported in May.

Meanwhile, US Fed chair Jerome Powell acknowledged that growth risks are skewed to the downside. Last Wednesday, he said that the Fed would not let the economy get into a “higher inflation regime,” even if it puts growth at risk. He reiterated that while “there is a risk” that the Fed might get the US economy into a recession, he pledged that its biggest commitment is to “restore price stability.”

In the meantime, sources quoted by Bloomberg said, “We’re not in (a recession) one right now, but the markets are a discounting mechanism, and I think the markets see the economy potentially going into one or getting closer to being one.”

Meanwhile, the US Dollar Index, a gauge of the greenback’s value against a basket of its rivals, continues advancing, despite retracing from YTD highs around 106.792 toward 106.534, up 1.30%.

US Dollar Index Daily chart

US Dollar Index Key Levels

What you need to take care of on Wednesday, July 6:

Fears of a globalized recession take their toll on financial markets. The greenback took advantage of the risk-averse scenario and soared. The risk of a US recession is above 70%, according to analysts.

The EUR/USD pair fell to a 20-year low of 1.0234, recovering some ground later in the day but settling below the 1.0300 threshold. EU growth slowed to a 16-month low, while Germany struggles to get gas amid mounting tensions with Russia.

German Economy Minister Robert Habeck noted that the energy industry crisis could have a negative impact on financial markets. He did not rule out intervening gas prices. Since Russia curbed its gas flows to the country, Germany fears a complete blackout of Moscow’s provision, as Russia will temporarily shut down the NordStream-1 pipeline on July 11 for annual maintenance. The country moved to alert level two in June and may soon move over intervening energy markets.

Eurozone money markets now expect the European Central Bank to hike rates by 130 bps by year-end.

The GBP/USD pair currently traded as low as 1.1897, now hovering around 1.1950. Turmoil in Downing Street will likely take its toll on the Pound as two senior cabinet ministers resigned, Sajid Javid and Rishi Sunak, quickly followed by vice-chair of the UK Conservative Party, Bim Afolami, Parliamentary Private Secretary Saqib Bhatti, and Parliamentary Private Secretary to Secretary of State for N. Ireland Jonathan Gullis.

The resignations came as Johnson kept former Conservative party whip Chris Pincher in his post after sexual misconduct allegations were made against him. The count may not be over yet, and Prime Minister Boris Johnson is working on replacing them all.

Meanwhile, and with a global energy crisis, the Norwegian oil and gas association reported offshore workers began a strike on Tuesday in demand of wage hikes. It means an estimated 341K barrels lost on output per day. Crude oil prices edged lower amid risk-off flows, with WTI now trading at around $99.60 a barrel. US coal prices, on the other hand, reached all-time highs.

Gold Price plummeted to a fresh 2020 low of $1,764.99 a troy ounce, now trading a couple of bucks above such a low.

USD/CAD trades at 1.3030 after peaking at 1.3083, while AUD/USD nears 0.6800 after bottoming at 0.6760. The late recoveries are related to Wall Street, as US indexes trimmed a good part of their intraday losses ahead of the close.

Like this article? Help us with some feedback by answering this survey:

UK PM Johnson reportedly plans to stay on and appoint new Cabinet ministers, according to Bloomberg sources.

More to come...

The vice-chair of the UK Conservative Party, Bim Afolami, has resigned and calls for Boris Johnson to stand down.

This follows a series of earlier key resignations from UK Tories as follows:

- UK parliamentary private secretary Saqib Bhatti resigns.

-

UK political Tory resignations at Downing Street are dropping like bombs

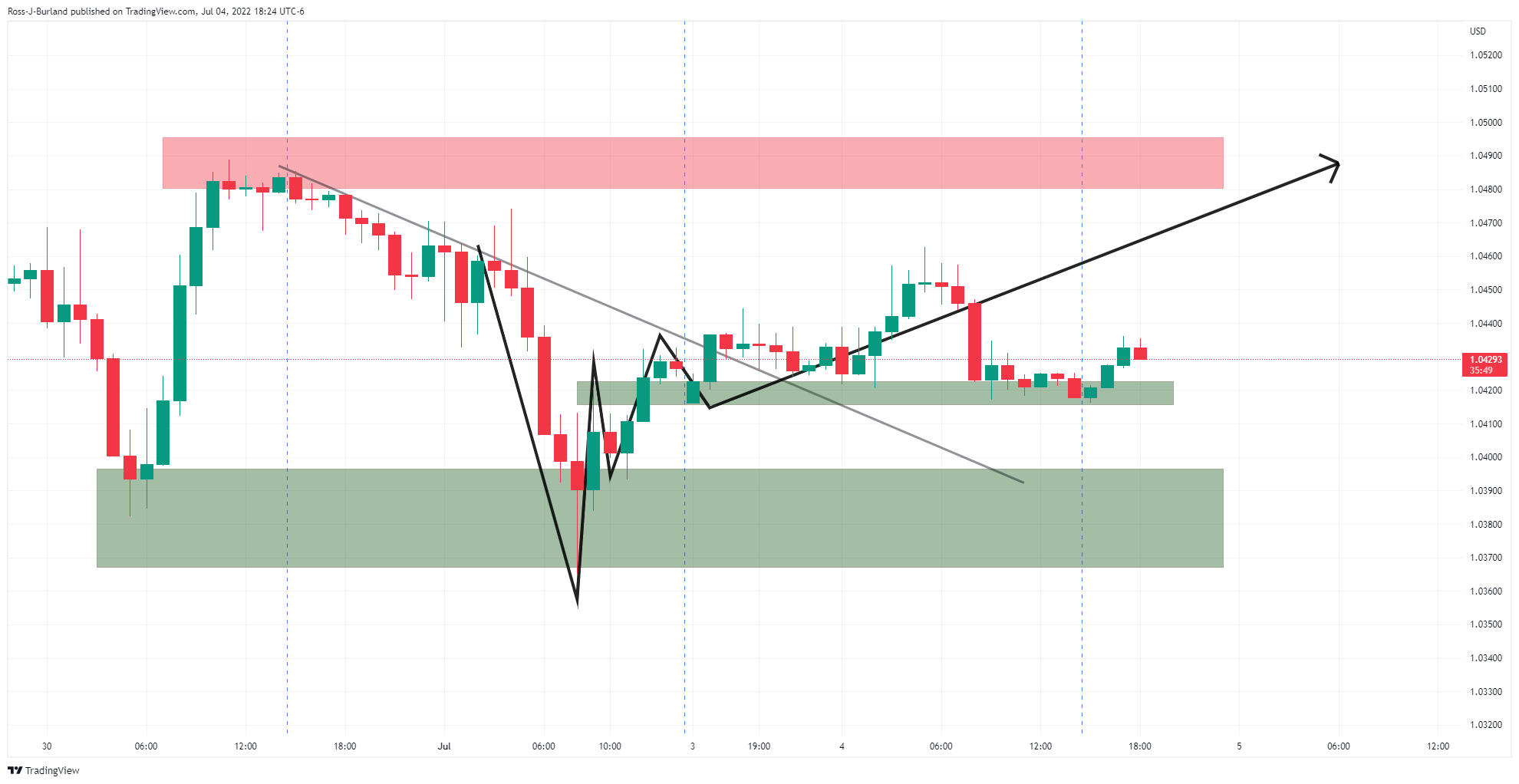

In forex, however, the pound is holding up and testing the commitments of the bears into a critical area on the charts as follows:

The price is headed towards a 1-min time frame order block (grey areas) and an area of imbalance that could serve to be the last area of liquidity that the market is hunting down prior to a correction of the bullish trend into the price imbalances (grey areas) below. Bears will be looking for a peak formation at this juncture.

- The Swiss franc weakened against the greenback, despite safe-haven flows, down almost 1%.

- Sentiment and a stronger US Dollar lift the pair as buyers step in, eyeing a break of the 50-DMA.

- The USD/CHF double top is still in play, but upside risks remain.

The USD/CHF advances sharply for the third straight day, snapping two days of consecutive losses that dragged the major to print a fresh two-month low of around 0.9495, gaining almost 1% on Tuesday. At the time of writing, the USD/CHF is trading at 0.9687.

Investors’ fears that the global economy might enter a recession sent US equities sliding, except for the Nasdaq Composite. The US Treasury yields followed suit, sliding, led by the US 10-year Treasury yield descending close to 4%, sitting at 2.804%. Meanwhile, the US Dollar Index is rallying close to 1.50%, at 106.646, a tailwind for the USD/CHF.

On Tuesday, the USD/CHF opened near Monday highs. Nevertheless, it dipped as the London session opened, towards the daily pivot point around 0.9590, to never look back, overcoming on its way up some resistance levels, like the R1 pivot point at 0.9630, the July 1 high at 0.9641, before settling around just shy of the 0.9700 figure.

USD/CHF Daily chart

The USD/CHF daily chart illustrates the pair as upward biased; however, the double top remains in play. If the greenback extends its gains throughout the week and if USD/CHF buyers step in, a break above the 50-day moving average (DMA) at 0.9733 is on the cards and could accelerate a rally towards the 0.9900 mark. However, on its way north, USD/CHF buyers will need to reclaim April 2020 high at around 0.9802.

USD/CHF Key Technical Levels

- WTI drops like a stone on fears of a global recession and a strong US dollar.

- Bulls note that product inventories are at critically low levels, which suggests restocking will keep crude oil demand strong.

At 98.73, the price of oil is down 10.6% on the day after falling from a high of $111.42 to a low of $97.46. The black gold has drop like a stone on Tuesday due to the worries over the global recession and curtailing demand overshadowed a strike by Norwegian oil and gas workers that could cut exports and exacerbate supply shortages. However, the Union leaders have announced that the strike is over.

Investors are concerned over central banks across the world that is taking aggressive actions to limit inflation. Overnight, the Reserve Bank of Australia hiked by 50 basis points with more in the pipeline to come as per its hawkish statement. We are seeing safe-haven demand for US Treasuries that have also boosted the US dollar DXY by about 1.37% at the time of writing with traders taking it to a high of 106.792 on the day. This has also weighed on greenback-denominated oil as it becomes more expensive for buyers holding other currencies.

Bullish case for oil

Analysts at TD Securities noted, however, that ''product inventories are at critically low levels, which also suggests restocking will keep crude oil demand strong. Considering that little progress has been made towards solving structural supply challenges, even a slow rate of demand growth can endanger energy supply.''

In this context, the analysts argued that ''brent crude and distillates prices are also exhibiting strong asymmetry towards upside moves in demand, which could point to an uncoiling process should commodity demand rebound.''

In recent trade, UK political Tory resignations are dropping like bombs due to the incompetence of the PM.

Firstly, British Health Secretary Sajid Javid resigned from Prime Minister Boris Johnson's government on Tuesday, he said in a statement.

We then had news across Twitter that the UK's Finance Minister Rishi Sunak resigned.

UK PM Boris Johnson says ''it seemed to me that it was 'reasonable grounds' for pincher to continue in his post after a complaint was raised, but in retrospect that was the wrong decision.''

''Past complaint against pincher brought to johnson didn't come 'anywhere near the threshold of criminality'''

So far, GBP is holding up after the initial 12 pip move to the downside vs the US dollar.

Letters of resignation:

More to come...

- The USD/JPY seesaws in a 100 pip range on Tuesday, limited by a mighty US dollar and falling US Treasury yields.

- Risk-off impulse increased appetite for safe-haven assets, with the greenback taking the upper hand.

- US Treasury yields drop more than 13 bps and are back below 2.80%.

The USD/JPY is almost unchanged in a trading session dominated by risk aversion, triggering flows toward safe-haven assets, and in the FX space, the USD, the JPY, and the CHF are the winners. Nevertheless, due to its risk-off nature, the USD/JPY is barely up 0.07%, trading around the 135.70s area.

USD/JPY range-bound capped by factors that boosts both currencies, to remain steady

Recession and high inflation worries are the headlines of the session. That said, European and US equities tumbled while safe-haven flows dominated the session, with the US Dollar Index, which pairs the greenback vs. six currencies, gaining 1.50%, sitting at 106.716. in the meantime, the USD/JPY seesawed in the 135.50-136.40 area during the day, within familiar ranges.

On the downside, the USD/JPY was capped by the strength of the greenback, but on the upside, falling US Treasury yields, mainly the US 10-year Treasury yields, are nose-diving thirteen basis points, sitting at 2.794%, well below the 3.50% YTD high.

In the meantime, Tuesday’s Asian Pacific session’s upbeat mood spurred by talks between US/Chinese officials was short-lived. Despite newswires stating that US President Biden is expected to roll back tariffs on Chinese imports soon, it could not overshadow the looming stagflation scenario in the worldwide economy.

In the meantime, the Japanese economic docket featured the Jibun Bank Services and Composite PMIs, for June, which showed the economy’s resilience, printing better than expected figures. Across the pond, the US calendar featured positive data, with Durable Goods Orders and Factory Orders beating forecasts.

Later in the week, an absent Japanese economic docket will leave USD/JPY traders adrift to US data. The US macroeconomic calendar will reveal the ISM Non-Manufacturing PMIs, JOLTs Job Openings, and FOMC Minutes. Furthermore, Fed officials will be crossing newswires, led by the New York Fed President John Williams on Wednesday, while Christopher Waller and the St. Louis Fed President Bullard on Thursday.

USD/JPY Key Technical Levels

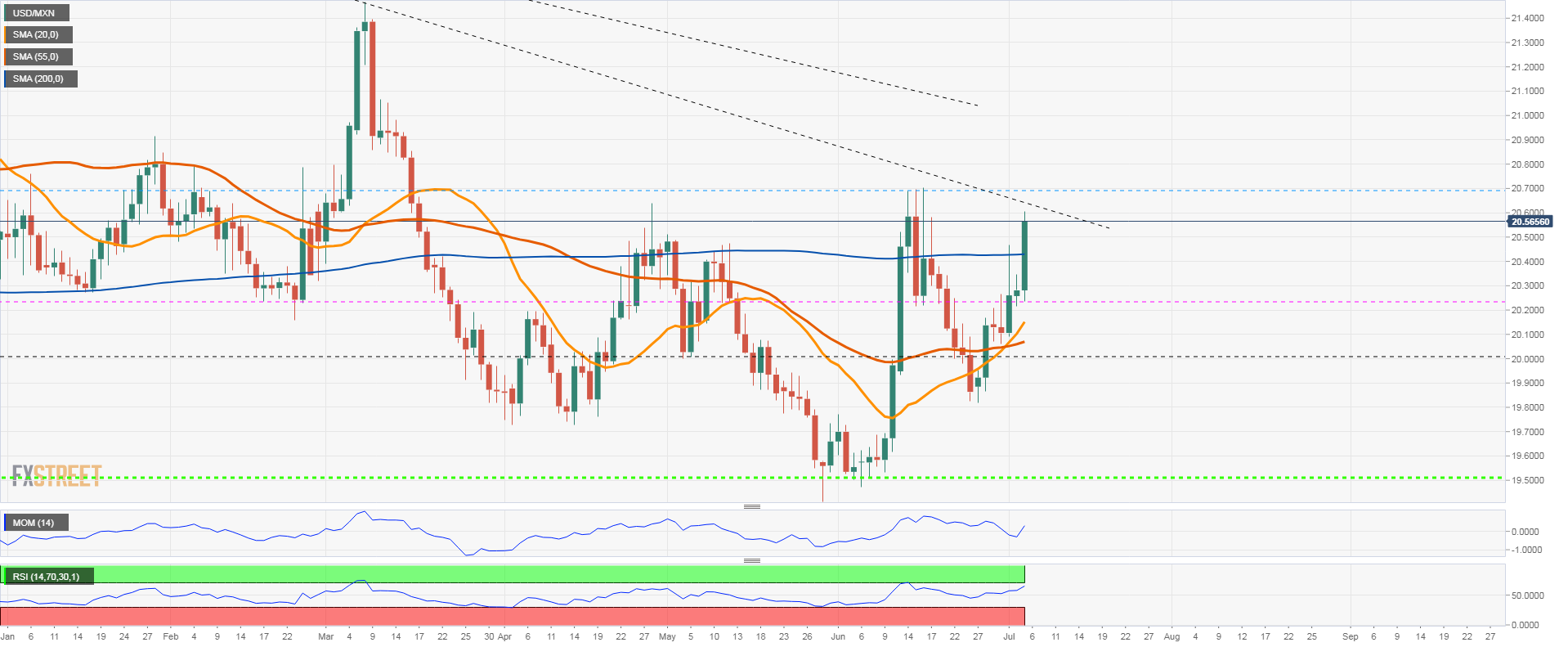

- Emerging market currencies are under pressure amid risk aversion.

- Mexican peso heads for the lowest daily close since March versus the US dollar.

- Next resistance in USD/MXN seen at 20.70.

The USD/MXN accelerated the move to the upside on Tuesday amid a sharp decline in equity markets across the globe. Fears about a recession weighed on Emerging market currencies, pushing the greenback to the upside.

During the American session the USD/MXN peaked at 20.60, the highest level since June 16. It remains near the top, with the bullish pressure still elevated. Some technical indicators are approaching overbought levels, like the daily RIS near 70; however, no signs of exhaustion are seen at the moment.

The next strong barrier is the 20.70 that capped the upside in June. A break higher would open the doors to more gains, targeting 20.90. A slide under 20.45 would alleviate the bullish bias.

Fear drives dollar higher

The greenback is trading at multi-year highs. The US Dollar Index stands at levels not seen since 2002. At the same time, Treasuries are rallying. The US 10-year plummets and stands at 2.79%, while the 30-year is approaching 3%.

The Dow Jones is falling by almost 600 points and the S&P 500 by 1.54%. In Mexico, the IPC index falls by 2%. Among emerging market currencies, the worst performer is the Russian ruble (USD/RUB +10%) followed by the Polish zloty (USD/PLN +2.80%) and the Chilean peso (USD/CLP +2.35% at 950, new record high). Crude oil tumbles nearly 9%.

USD/MXN daily chart

- Pound under pressure, among worst performers of the American session.

- GBP/USD heads for the lowest close since March 2020.

- US dollar holds onto significant daily gains as Wall Street tumbles.

Risk aversion continues to weigh on GBP/USD. The pair fell further, reaching at 1.1897, the lowest level since March 2020. It remains under pressure around 1.1900, unable to find support as markets tumble.

Fears about a global recession and a worsening growth outlook in the UK continue to drive the pound lower, in line with many analysts’ forecasts. At the same time, it boosts the demand for the greenback. The DXY is trading at the highest level since 2002, at 106.70, up 1.46% for the day.

Equity prices in Wall Street are falling 1.70% on average. The FTSE 100 dropped almost 3% and the DAX 2.75%. Commodity prices are sinking, with gold down 2% and silver 2.95%. Crude oil collapses, falling by 8.50%.

Adding to concerns, Norway just warned that gas exports to the UK could be shut off this weekend. A strike threatens production in the Scandinavian country.

The pound is among the worst performers of the American session. EUR/GBP has erased daily losses and is back around 0.8600 after falling earlier to 0.8540.

Economic data came in above expectation in the UK and the US. The UK S&P Global Service PMI in June was revised higher from 53.4 to 54.3. In the US, Factory Orders rose by 1.6% in May, surpassing the 0.5% of market consensus. Market participants ignored the numbers. On Wednesday, the FOMC minutes will be released, and on Friday, the Non-farm payroll.

GBP/USD weekly chart

- The AUD/USD tumbled more than 100-pips during the day and probed the YTD low around 0.6763.

- The RBA hiked rates by 0.50%, but it wasn’t enough to overcome a dampened sentiment spurred by the stagflation economic outlook, so the AUD/USD dived.

- US-China tussles ease as US President Biden evaluates tariffs imposed by the Trump administration.

The Australian dollar followed its fellow peers and is tanking to fresh two-year-lows amidst renewed concerns of a recession looming worldwide, amidst a high inflation scenario, bolstering the appetite for safe-haven peers in the FX complex. At the time of writing, the AUD/USD is trading at 0.6767.

King dollar is back as risk appetite takes a hit on recession fears

The market mood remains dismal, as portrayed by European and US equities tumbling. The AUD/USD got a lift during the Asian session, printing the daily high at 0.6894, spurred by the Reserve Bank of Australia (RBA), hiking rates by 50 bps in back-to-back meetings. Nevertheless, the major began tumbling post-Euro area S&P Global PMIs releases, depicting a gloomy economic outlook in the EU block.

Regarding the RBA’s decision, the bank said that the size and timing of further interest rates would be guided by the incoming data and the Board’s assessment of the inflation outlook. The RBA noted that strong demand, a tight labor market, and capacity constraints in some sectors put upward pressure on prices while emphasizing that inflation is foreseen to peak later this year.

On the US front, US President Joe Biden is assessing removing tariffs imposed by the Trump presidency on some Chinese products as a solution to help the Federal Reserve to tackle inflation. However, it was outweighed by US recession fears, despite positive economic data released on Tuesday.

Data-wise, the US calendar showed that Durable Goods Orders and Factory Orders rose more than expected in May.

In the calendar ahead, the Australian docket will feature the RBA Chart Pack, while on the US front, ISM Non-Manufacturing PMIs, JOLTs Job Openings, and FOMC Minutes will be unveiled. Also, AUD/USD traders should take note of New York Fed President Williams on Wednesday.

AUD/USD Key Technical Levels

- US Dollar Index jumps to highest level since December 2002.

- Wall Street indexes tumble more than 1%.

- NZD/USD vulnerable to more losses while under 0.6200.

The NZD/USD is losing almost 90 pips on Tuesday, hit by a stronger US dollar amid risk aversion. The greenback is rising sharply as stocks and commodities tumble. The pair fell to as low as 0.6123 on Tuesday, the lowest since May 2020. The rebound from the lows is facing resistance at 0.6150.

Fears about a global recession weigh on equity prices. In Wall Street, the Dow Jones is falling more than 550 points and the S&P 500 drops by 1.53%. Crude oil prices sank 5%. Gold is at $1,775 down 1.85% at the lowest since December.

The negative environment is pushing the dollar and government bonds to the upside. The DXY trades at 106.50, the highest level in two decades. The worst performers are emerging market currencies and the euro.

Under pressure below 0.6200

The NZDUSD failed to hold above 0.6200 and while it remains under it seems vulnerable to more losses. A recovery back above should alleviate the negative pressure. If the slide continues, the next support are could be seen at 0.6100 and then the area around 0.6070

NZD/USD weekly chart

- The shared currency is trading below 1.0300, accelerating towards the 1.0250 area.

- The EUR/USD nose-dived to a fresh 20-year-low at 1.0246 as the market asses parity’s chances.

- EU S&P Global Services and composite PMIs, decelerated sharply as Natural gas higher prices struck the Eurozone.

The EUR/USD plummets to fresh twenty-year-lows, below the 1.0350 previous low printed on May 13, accelerating towards the 1.0250s region courtesy of a stronger US dollar. At 1.0256, the EUR/USD loses almost 1.60% during the day.

Risk aversion and the King-dollar weighs on the euro

A risk-off impulse has the safe-haven peers on the right foot. The US Dollar Index, a gauge of the greenback’s measurement, also advances to twenty-year-highs, above the 106.500 mark, up almost 1.30%, on renewed concerns of a recession, amidst an inflationary scenario. All that despite the chances that US President Joe Biden might lift tariffs imposed on China’s products during the Trump presidency.

In the meantime, on Monday, the Bundesbank President and ECB member Joachim Nagel warned the ECB against lowering borrowing costs for EU members in the southern area. He emphasized that the central bank should focus on fighting inflation, which according to him, may require more rate hikes than projected.

Meanwhile, weakness in the single currency is mainly attributed to a further surge in European gas prices, which triggered fresh concerns of a recession across the Eurozone. According to Reuters, the reduction in pipeline supplies from Russia has accelerated the adjustment in stockpiles, generating upward pressure on European LNG prices.

Data-wise, the EU economic docket featured S&P Global Services and Composite PMIs for June, in Spain, Italy, France, and Germany. Most readings missed expectations and are showing the economy slowing at a faster pace. In the case of the Euro area as a whole, the Services PMI reading came at 53, while the Composite stayed around 52.

Across the pond, the calendar is light, and Factory Orders for May, rose by 1.6% MoM, beating the street’s estimations.

EUR/USD Key Technical Levels

Gold came under heavy selling pressure in the second half of the day on Tuesday and touched its lowest level since late 2021 below $1,770.

The precious metal is having a difficult time finding demand despite the risk-averse market environment. The dollar seems to be capitalizing on safe-haven flows with the US Dollar Index trading at its strongest level in nearly two decades above 106.50.

In the meantime, the S&P 500 Index is down nearly 2% following the three-day weekend in the US. Investors continue to stay away from risk-sensitive assets amid growing recession fears and the Federal Reserve's willingness to continue to tighten its policy at an aggressive pace.

There won't be any high-impact data releases in the remainder of the day and XAU/USD remains at the mercy of the dollar's valuation.

The fact that the bearish momentum picked up pace after gold broke below $1,800 also suggests that the yellow metal is facing technical selling pressure as well.

On Wednesday, the Federal Reserve will release the minutes of its June meeting. The US Bureau of Labor Statistics' jobs report for June will also be watched closely by market participants later in the week.

Gold 15-minute chart

During June, the pound weakened notably against the US dollar from 1.2613 to 1.2155. As we enter the second half of the year, some analysts have updated their British pound forecasts. Here you can find the expectations of seven major banks regarding GBP’s outlook for the coming months.

Wells Fargo

“The mix of measured monetary tightening and rapid inflation, combined with a UK economic downturn, provides an underwhelming backdrop for the UK currency. We have revised our forecast for the pound lower, and now see a trough in the GBP/USD exchange rate around 1.17 in mid-2023.”

Credit Suisse

“A central bank that sets a high bar to keeping pace with not just the Fed but even the likes of SNB and maybe ECB going forward, against a backdrop of weak trade dynamics and ambiguous long-term government policy, keeps the door open for GBP/USD to slip towards 1.17 and for EUR/GBP to rise towards 0.90.”

TDS

“The near-term GBP trajectory is biased to the downside, even though it maintains a pretty heft discount. The EURGBP rally reflects GBP's relatively higher beta to risk assets. At the same time, the ECB has turned more hawkish. The BoE plus fiscal support may help to put a floor in cable but not before a near-term break below 1.20. Still, BoE pricing seems too aggressive relative to our forecast, leaving GBP vulnerable on the crosses.”

MUFG

“The risks for GBP/USD over Q3 is to the downside given GBP tends to perform poorly as financial conditions tighten. Beyond then, even as GBP/USD recovers, GBP will remain weak versus EUR.”

HSBC

“Over the medium-term, we continue to expect the GBP to weaken further against the USD, built on more measured steps at the BOE compared to the Fed’s ongoing marked tightening. The UK may also face structural challenges over a longer-term.”

CIBC

“Building macro headwinds suggest that the BoE will not be as aggressive as the market discounts. We expect a protracted policy pause post once rates reach 1.75% in September. As the growth versus inflation trade-off remains challenging, expect the bank to prioritize growth. This favours GBP downside, especially as ongoing political risks, including a potential trade spat with the EU, remains real.”

Scotiabank

“We think market bets on 150 bps+ of additional BoE hikes this year are stretched and a slashing of these will act as a GBP headwind in the months ahead.”

- Factory Orders in the US increased at a stronger pace than expected in May.

- The greenback continues to outperform its rivals after the data.

The data published by the US Census Bureau revealed on Tuesday that new orders for manufactured goods, Factory Orders, rose by 1.6%, or $8.4 billion to $543 billion in May. This print followed April's increase of 0.7% and came in much better than the market expectation for a growth of 0.5%.

"Inventories, up twenty-one of the last twenty-two months, increased $10.0 billion or 1.3%, to $797.9 billion," the publication further read. "This followed a 0.8% April increase. The inventories-to-shipments ratio was 1.47, unchanged from April."

Market reaction

The US Dollar Index extended its impressive rally in the early American session and was last seen trading at its highest level since December 2002 at 106.60, rising 1.4% on a daily basis.

- USD/CAD gathered bullish momentum and climbed above 1.3000 on Tuesday.

- Crude oil prices are down more than 6% amid the worsening demand outlook.

- The dollar benefits from risk-aversion, fueling the pair's rally.

The USD/CAD pair advanced beyond 1.3000 and touched its strongest level in two weeks. The broad-based dollar strength and falling crude oil prices allow the pair to preserve its bullish momentum during the American trading hours.

Falling oil prices hurt CAD

Investors grow increasingly concerned over a global recession and the energy demand outlook. The barrel of West Texas Intermediate (WTI) was last seen losing 6.6% on the day at $103.20, weighing in on the commodity-sensitive CAD.

While speaking at an energy conference in Nigeria, "the ongoing war in Ukraine, a COVID-19 pandemic which is still with us, and the inflationary pressures across the globe have come together in a perfect storm that is causing significant volatility and uncertainty in the commodity markets in general," OPEC Secretary-General Mohammad Barkindo said on Tuesday.

On the other hand, the intense flight to safety is helping greenback outperform its rivals. Following Monday's choppy action, the US Dollar Index turned north on Tuesday and was last seen sitting at its highest level in nearly two decades at 106.50, rising 1.3% on a daily basis. Reflecting the souring market mood, major equity indexes in the US are down between 1.5% and 2%.

In the meantime, the data from the US revealed that Factory Orders rose by 1.6% in May, surpassing the market expectation for an increase of 0.5%.

Technical levels to watch for

- Gold Price continued losing ground for the second straight day and slipped below the $1,800 mark.

- Aggressive Fed rate hike bets, along with a blowout USD rally, exerted pressure on the commodity.

- The prevalent risk-off mood amid growing recession fears could offer support and limit the decline.

Gold Price drifted lower for the second successive day on Tuesday and weakened further below the $1,800 mark during the early North American session. The intraday decline was sponsored by a combination of factors, hawkish Fed expectations and a stronger US dollar, though the prevalent risk-off environment could help limit the downside.

Fed Chair Jerome Powell said last week that the US central bank remains focused on getting inflation under control and added that the US economy is well-positioned to handle tighter policy. This was seen as a key factor that continued acting as a headwind for the non-yielding yellow metal. Apart from this, a blowout USD rally to a fresh two-decade high further contributed to driving flows away from the dollar-denominated gold.

The greenback remained well supported by expectations for more aggressive Fed rate hikes and seemed rather unaffected by a steep decline in the US Treasury bond yields. Concerns about a potential economic recession forced investors to take refuge in traditional safe-haven assets and dragged the yield on the benchmark 10-year US government bond to a fresh multi-week low. This, in turn, could offer some support to gold.

Nevertheless, spot prices have now drifted back closer to the $1,786-$1,784 support zone, which if broken decisively would mark a fresh breakdown. That said, bearish traders might refrain from placing aggressive bets ahead of the FOMC meeting minutes, due on Wednesday. Apart from this, the release of the closely-watched US monthly jobs report (NFP) will influence the USD and determine the near-term trajectory of gold price.

Technical levels to watch

- USD/TRY regains upside traction and surpasses 17.00.

- The upside bias in the greenbacks weighs on the lira.

- Inflation fears continue to hurt the currency.

Further depreciation of the Turkish currency lends extra wings to USD/TRY and motivates it to break above the 17.00 yardstick on Tuesday.

USD/TRY now targets the 2022 highs near 17.40

USD/TRY extends the advance for the fourth consecutive session on Tuesday amidst the solid performance of the greenback, the pick-up of the risk aversion and recession chatter.

Indeed, the greenback saw its upside momentum gather extra steam in response to rising speculation of a global recession, which has been recently intensified after final Services PMIs in the euro area dropped further in June.

In addition, Monday’s higher-than-expected inflation figures in Türkiye also weigh on the sentiment around the lira and prompted the pair to almost fully recover the ground lost following the ban on Turkish lira loans to some companies by the banking watchdog (BDDK) on Friday 24.

What to look for around TRY

USD/TRY looks to consolidate the sharp rebound from 16.00 neighbourhood, as investors continue to digest the latest announcement by the Turkish banking watchdog (BDDK) on June 27.

So far, the lira’s price action is expected to keep gyrating around the performance of energy prices, the broad risk appetite trends, the Fed’s rate path and the developments from the war in Ukraine.

In addition, the effects of this new measure aimed at supporting the de-dolarization of the economy will also have its say, at least in the very short term.

Extra risks facing the Turkish currency also come from the domestic backyard, as inflation gives no signs of abating, real interest rates remain entrenched in negative figures and the political pressure to keep the CBRT biased towards low interest rates remain omnipresent.

Key events in Türkiye this week: Inflation Rate, Producer Prices (Monday) – Current Account (Friday).

Eminent issues on the back boiler: FX intervention by the CBRT. Progress (or lack of it) of the government’s new scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Presidential/Parliamentary elections in June 23.

USD/TRY key levels

So far, the pair is gaining 1.40% at 17.0208 and faces the immediate target at 17.3759 (2022 high June 23) seconded by 18.2582 (all-time high December 20) and then 19.00 (round level). On the other hand, a breach of 16.0365 (monthly low June 27) would pave the way for a test of 15.6684 (low May 23) and finally 15.3361 (100-day SMA).

Gold has dipped below $1,800. A break under critical support at $1,780 would signal a trend change, strategists at TD Securities report.

Bias remains to the downside

“For the time being, gold prices are managing to hold onto a critical threshold for a change in trend by year-end at $1,780, as rising recession odds fuel inflows for gold as a safe-haven asset.”

“The margin of safety is razor-thin as a break below $1,780 would imply that gold would succumb to the weight of the most hawkish central bank regime since the 1980s. This scenario implies that a sustained downtrend could form in gold should the large CTA selling program catalyze a breakdown in prices.”

“As central banks face a credibility crisis, they could remain committed to their battle against inflation and keep rates elevated for longer than recession odds would otherwise imply.”

“A break below the $1,780 critical threshold could spark additional outflows on the horizon, which suggests the bias remains to the downside in gold.”

Recession fears have contributed to the recent consolidation in oil prices. Still, strategists at TD Securities highlight their confidence in the uptrend in energy markets.

Supply risk insulation

“Recession fears are weighing on energy markets, leading to a consolidation, but the uptrend in oil markets benefits from a substantial margin of safety.”

“As long as Brent crude prices remain above the $87/bbl mark, oil bulls should hold onto their conviction in oil's uptrend.”

“The margin of safety also remains elevated into year-end, reflecting our view that even in a recession, oil prices could remain elevated as energy supply risk continues to soar.”

- GBP/USD came under intense selling pressure on Tuesday and dived to a three-week low.

- A combination of factors lifted the USD to a fresh 20-year peak and weighed on the major.

- Brexit woes, less hawkish BoE expectations further exerted downward pressure on the GBP.

The GBP/USD pair remained under intense selling pressure through the early North American session and dived to the 1.1965-1.1960 area, or a three-week low in the last hour.

The US dollar caught aggressive bids on Tuesday and rallied to a fresh two-decade high, which, in turn, was seen as a key factor that exerted heavy downward pressure on the GBP/USD pair. The Federal Reserve’s non-stop chatter about rate hikes to curb soaring inflation continued lending support to the USD. Apart from this, the prevalent risk-off environment provided an additional boost to the safe-haven greenback.

The market sentiment remains fragile amid concerns that rapidly rising interest rates and tightening financial conditions would pose challenges to global economic growth. Apart from this, the ongoing Russia-Ukraine war and the COVID-19 outbreak in China have been fueling recession fears. This, in turn, tempered investors' appetite for perceived riskier assets, which was evident from a fresh leg down in the equity markets.

The British pound was further pressured by domestic issues and worried that the UK government's controversial Northern Ireland Protocol Bill could trigger a trade war with the European Union. Apart from this, expectations that the Bank of England would adopt a gradual approach towards raising interest rates amid the ongoing cost of living crisis further contributed to the GBP/USD pair's steep decline.

The sharp intraday downfall took along some short-term trading stops near the 1.2000 psychological mark. This might have already set the stage for a further near-term depreciating move. Some follow-through selling below the YTD low, around the 1.1935-1.1930 region, would reaffirm the negative bias and make the GBP/USD vulnerable.

Technical levels to watch

- AUD/USD came under renewed selling pressure on Tuesday despite a 50 bps rate hike by the RBA.

- The recent fall in commodity prices, recession fears continued weighing on the risk-sensitive aussie.

- Aggressive Fed rate hike bets lifted the USD to a fresh 20-year high and added to the selling bias.

The AUD/USD pair struggled to capitalize on the overnight recovery gains and met with a fresh supply in the vicinity of the 0.6900 mark on Tuesday. The intraday selling pressure dragged spot prices closer to the YTD low, around the 0.6780 region heading into the North American session.

The Australian dollar weakened broadly after the Reserve Bank of Australia (RBA), as was anticipated, hiked its key interest rate by 50 bps to 1.35% - the highest since May 2019. This marked the third successive month of a rate increase, though did little to impress bullish traders and was largely overshadowed by the worsening global economic outlook.

Investors remain concerned that rapidly rising interest rates and tightening financial conditions would pose challenges to global economic growth. Apart from this, the ongoing Russia-Ukraine war and the COVID-19 outbreak in China have been fueling recession fears. This led to a further decline in commodity prices and weighed on the resources-linked aussie.

This, along with the emergence of aggressive US dollar buying, exerted additional downward pressure on the AUD/USD pair. In fact, the USD shot to a fresh 20-year peak and continued drawing support from the prospects for more aggressive rate hikes by the Fed. Apart from this, the prevalent risk-off mood provided an additional boost to the safe-haven greenback.

The latest leg down validates the recent bearish breakdown and supports prospects for an extension of the recent depreciating move. Some follow-through selling below the YTD low, around the 0.6765 region touched last Friday, will reaffirm the negative outlook and drag the AUD/USD pair towards testing the next relevant support near the 0.6700 mark.

Market participants now look forward to the US economic docket, featuring the release of Factory Orders data. This, along with the broader market risk sentiment, will influence the USD price dynamic and provide some impetus to the AUD/USD pair. The focus, however, will remain on Wednesday's release of the FOMC minutes and the US monthly jobs report on Friday.

Technical levels to watch

Gold is benefiting from rising recession odds. However, if central banks keep rates elevated to combat high inflation, the yellow metal could struggle to sustain an uptrend, strategists at TD Securities report.

XAUUSD needs to hold onto $1,780 to sustain an uptrend by year-end

“Gold prices are struggling to hold onto the critical threshold near $1,780 required to sustain an uptrend by year-end.”

“Trend signals in the yellow metal clash with those in industrial precious metals, which trade well below the threshold for an uptrend to form with price action most consistent with a strengthening downtrend. This divergence in the face of the most hawkish central bank regime since the 1980s reflects growing odds of a recession, supporting the yellow metal, as traders anticipate a pivot in policy.”

“In this cycle, however, a sustained downtrend could form in gold if central banks, facing a credibility crisis, remain committed to their battle against inflation and keep rates elevated for longer than they otherwise would.”

S&P 500 remains in a short-term consolidation phase. Key short-term support is seen at 3739/15, below which would open up a retest of the 2022 low at 3637, analysts at Credit Suisse report.

Recent consolidation phase to extend further

“The S&P 500 remains in a short-term consolidation phase after recently holding above the bottom of its trend channel from April, however, the market remains below key moving averages and momentum indicators stay negative, which points to further short-term weakness over the next 2-4 weeks.”

“Support is seen at 3739/15, below which would open up a retest of the 3637/33 2022 low. We note that the next support below here is seen at 3600/3594, then the key 50% retracement support at 3519/3500.”

“Resistance is seen at 3946, then the price gap from earlier in June, starting at 3974 and stretching up to 4017/19, which also coincides with the 38.2% retracement of the March/June fall and the top of the trend channel from April. We look for a cap here if reached to maintain the short-term downward pressure on equity markets. A break would significantly improve the short-term technical outlook, with the next key resistance seen at 4088/4101.”

In the view of economists at Natixis, China’s economic strategy must now change. China’s growth strategy will revert to a mercantilist strategy – which requires a weak currency.

Why should China move to a weak currency (renminbi) strategy?

“The structural weakness of domestic demand in China due to population ageing is forcing China to revert to an export-based mercantilist strategy.”

“This strategy requires a weak currency (renminbi), while the previous domestic demand-stimulus strategy required a strong renminbi. We can therefore expect further depreciation of the renminbi.”

German Economy Minister Robert Habeck said on Tuesday that they will stick to their plan of prioritizing private households in case of a gas emergency, as reported by Reuters.

"The gas market situation is tense, cannot say whether more protection measures will be needed," Habeck added. "We want to prevent a domino effect in the gas market."

Market reaction

Safe-haven flows continue to dominate the financial markets following these remarks. As of writing, Germany's DAX 30 Index was down 1.5% on the day at 12,580.50 points.

- EUR/USD collapses below the 1.0300 yardstick.

- A probable drop to parity slowly emerges on the horizon.

EUR/USD plummets to levels last seen back in December 2002 around 1.0280 on turnaround Tuesday.

Recession fears seem to dominate the sentiment around investors and keep the mood around the European currency well depressed. Against that gloomy backdrop, further losses should not be ruled out in the near term, with the next target of note at the parity level. Down from here comes the December 2002 low at 0.9859 (December 2)

In the longer run, the pair’s bearish view is expected to prevail as long as it trades below the 200-day SMA at 1.1092.

EUR/USD daily chart

USD/CNH keeps the 6.6600-6.7400 range well in place for the time being, said FX Strategists at UOB Group Quek Ser Leang and Peter Chia.

Key Quotes

24-hour view: “Yesterday, USD traded in a relatively quiet manner between 6.6810 and 6.7072 before closing largely unchanged at 6.6956 (-0.02%). The price actions are likely part of a consolidation. USD could continue to consolidate, likely between 6.6800 and 6.7100.”

Next 1-3 weeks: “We have expected USD to trade sideways between 6.6600 and 6.7400 for about 2 weeks now. Our view was not wrong as USD traded well within the expected range. There is no change in our view and only a break below 6.6600 or above 6.7400 would indicate that USD is ready to move in a directional manner.”

- DXY quickly left behind the YTD peaks and broke below the 106.00 mark.

- Further upside now targets the round level at 107.00.

DXY picks up extra pace and surpasses the 106.00 yardstick to print new cycle tops on Tuesday.

Further upside in the dollar remains in store in the short-term horizon. Against that, the index could attempt a visit to the round level at 107.00 before the December 2002 high at 107.31.

As long as the 5-month line near 102.50 holds the downside, the near-term outlook for the index should remain constructive.

The broader bullish view remains in place while above the 200-day SMA at 98.25.

DXY daily chart

USD/JPY is now seen navigating the 134.75-137.00 range in the next weeks, commented FX Strategists at UOB Group Quek Ser Leang and Peter Chia.

Key Quotes

24-hour view: “USD traded between 134.77 and 135.77 before closing at 135.69 (+0.37%). USD traded on a firm note upon opening and upward momentum is beginning to build. From here, USD could edge higher to 136.50. The major resistance at 137.00 is unlikely to come under threat. Support is at 135.60 followed by 135.25.”

Next 1-3 weeks: “Last Friday (01 Jul, spot at 135.90), we indicated, ‘waning upward momentum suggests that the odds for USD to move to 137.50 have diminished’. USD subsequently dropped and took out our ‘strong support’ level at 135.50 (low of 134.74). Despite the strong rebound from 134.74, upward momentum has not improved by much. The current movement appears to be part of a broad consolidation phase and USD is likely to trade between 134.75 and 137.00 for now. Looking ahead, USD has to break clearly above 137.00 before a sustained rise is likely.”

The energy sector is facing huge challenges on multiple fronts, OPEC Secretary-General Mohammad Barkindo said on Tuesday and added that the oil and gas industries are "under siege," as reported by Reuters.

"Years of underinvestment in the oil sector help explain market tightness in OPEC and outside OPEC," Barkindo further elaborated. "Venezuelan and Iranian oil is held hostage by geopolitics."

Market reaction

Crude oil prices remain under pressure following these comments and the barrel of West Texas Intermediate (WTI) was last seen trading at $108,15, where it was down 2.15% on a daily basis.

- A combination of factors assisted USD/CAD to regain strong positive traction on Tuesday.

- Sliding oil prices undermined the loonie and extended support amid aggressive USD buying.

- Hawkish Fed expectations, recession fears continued underpinning the safe-haven greenback.

The USD/CAD pair attracted fresh buying in the vicinity of the 50-day SMA on Tuesday and rallied nearly 100 pips from the daily low, around the 1.2840 region. The momentum lifted spot prices back to the 1.2930-1.2935 area during the first half of the European session and was sponsored by a combination of factors.

Crude oil prices came under renewed selling pressure and snapped a two-day winning streak to a four-day high amid the worsening global economic outlook, which could stall fuel demand recovery. This, in turn, undermined the commodity-linked loonie and provided a goodish lift to the USD/CAD pair amid the emergence of aggressive US dollar buying.

The Federal Reserve’s non-stop chatter about rate hikes to curb soaring inflation turned out to be a key factor that continued lending support to the USD. In fact, Fed Chair Jerome Powell said last week that the US central bank remains focused on getting inflation under control and that the US economy is well-positioned to handle tighter policy.

Apart from this, an intraday turnaround in the equity markets pushed the safe-haven greenback to a fresh 20-year peak. The early optimism led by reports that US president Joe Biden was leaning toward a decision on easing tariffs on goods from China faded quickly amid worries about a recession, which continued weighing on investors' sentiment.

The fundamental backdrop supports prospects for additional gains, though bulls might prefer to wait for a fresh catalyst from the FOMC meeting minutes, due for release on Wednesday. Apart from this, traders will take cues from Friday's release of the monthly jobs report from the US and Canada to determine the near-term trajectory for the USD/CAD pair.

Technical levels to watch

- EUR/JPY resumes the downside following the EUR sell-off.

- The near-term outlook could shift to negative below 139.25.

EUR/JPY quickly fades Monday’s uptick and breaks below the 140.00 mark to record new 3-week lows.

If the selling pressure accelerates, it could challenge the current short-term bullish bias. That said, if the cross breaches the 4-month support line near 139.25, it could open the door to a deeper pullback to, initially, the 55-day SMA, today at 138.80 prior to the June low at 137.83 (June 16).

In the longer run, the constructive stance in the cross remains well propped up by the 200-day SMA at 132.94.

EUR/JPY daily chart

FX option expiries for July 5 NY cut at 10:00 Eastern Time, via DTCC, can be found below.

- EUR/USD: EUR amounts

- 1.0450 764m

- 1.0500-05 600m

- 1.0520 357m

- 1.0570 235m

- 1.0600 508m

- GBP/USD: GBP amounts

- 1.22280 231m

- USD/JPY: USD amounts

- 134.95-00 1.44b

- 135.40-45 338m

- 136.05 265m

- 136.40 235m

- 136.75 240m

- 137.00 1.68b

- AUD/USD: AUD amounts

- 0.6850 204m

- 0.6875 290m

- 0.7030 316m

According to FX Strategists at UOB Group Quek Ser Leang and Peter Chia, further decline looks likely in NZD/USD in the near term.

Key Quotes

24-hour view: “NZD consolidated yesterday and closed little change at 0.6209 (+0.06%). Momentum indicators are mostly neutral and NZD is likely to continue to consolidate. Expected range for today, 0.6190/0.6245.”

Next 1-3 weeks: “Our latest narrative was from last Thursday (30 Jun, spot at 0.6220) where NZD could drop below 0.6200 but it has to close below this solid support before further sustained decline is likely. On Friday, NZD cracked 0.6200, plunged to 0.6150 before staging a strong rebound to close at 0.6205. While further NZD weakness is not ruled out, downward momentum is beginning to wane and the chance for NZD to break below 0.6150 is not high. On the upside, a breach of 0.6280 (no change in ‘strong resistance’ level) would indicate that NZD is unlikely to weaken further.”

- USD/JPY gained traction for the second straight day, though the intraday uptick ran out of steam.

- A turnaround in the risk sentiment benefitted the safe-haven JPY and capped the upside for the pair.

- The Fed-BoJ policy divergence should limit the downside ahead of the FOMC minutes on Wednesday.

The USD/JPY pair struggled to capitalize on the intraday positive move and met with some supply near the 136.35 region on Tuesday. Spot prices surrendered a major part of the early gains and retreated to the 135.70-135.65 region during the first half of the European session.

The initial optimism led by reports that US president Joe Biden was leaning toward a decision to ease tariffs on goods from China faded rather quickly amid the worsening economic outlook. Investors remain concerned that rapidly rising interest rates and tightening financial conditions would pose challenges to global economic growth. Apart from this, the ongoing Russia-Ukraine war and the COVID-19 outbreak in China have been fueling recession fears. This, in turn, led to a fresh leg down in the equity markets, which offered some support to the safe-haven Japanese yen.

The anti-risk flow dragged the US Treasury bond yields back closer to a multi-week low touched on Friday, narrowing the US-Japan rate differential. This was seen as another factor that benefitted the JPY and acted as a headwind for the USD/JPY pair. The downside, however, remains cushioned amid the divergent monetary policy stance adopted by the Bank of Japan (BoJ) and the Federal Reserve. It is worth recalling that the BoJ has repeatedly signalled that it would stick to its ultra-accommodative policy and pledged to keep borrowing costs at "present or lower" levels.