- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 08-07-2022

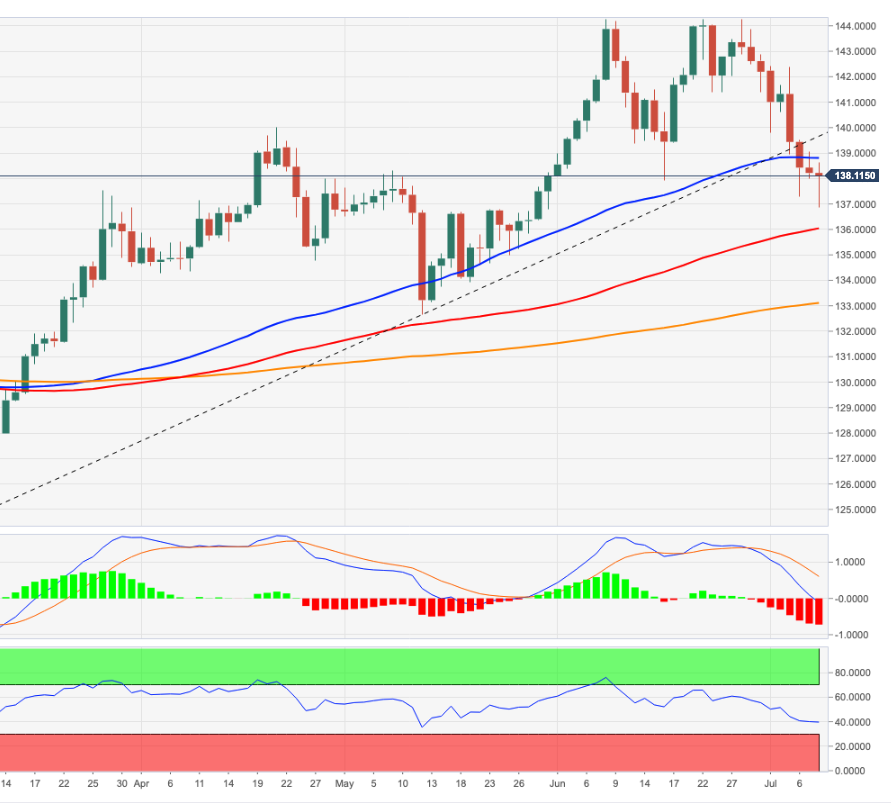

- The USD/JPY has been trading in a choppy 100 pip range for the last five days.

- The major seesawed spurred by the assassination of Japan’s ex-PM Abe and upbeat US economic data.

- USD/JPY Price Analysis: Range-bound, but the RSI’s aiming lower and USD/JPY uptrend overextended, might pave the way for further downside.

USD/JPY is subdued as the North American session winds down, consolidating in the 135.00-136.00 range amidst the lack of a catalyst that could trigger an upward/downward break of the previously-mentioned area after news of the assassination of the Japanese ex-Prime Minister Shinzo Abe.

The USD/JPY began the last day of the week trading around 136.00, followed by an aggressive fall toward 135.32 on the breaking news of the attack on Shinzo Abe. However, favorable US employment data lifted the major towards the weekly high around 136.56 before retreating toward current levels. At the time of writing, the USD/JPY is trading at 136.04.

USD/JPY Daily chart

The USD/JPY daily chart illustrates that the price is overextended and the uptrend has lost steam. However, USDJPY sellers’ failure to break below the 20-day EMA at 135.35 has exposed the pair to some upside pressure, but the Relative Strenght Index (RSI) at 41.89 begins to aim downwards, meaning that a pullback might be on the cards.

That said, the USD/JPY first support would be136.00. Break below will expose the 20-day EMA, followed by the June 23 daily low at 134.26, followed by 50-day EMA at 131.95.

USD/JPY Key Technical Levels

- June’s US Nonfarm Payrolls report exceeded expectations, further cementing the case for a Fed’s 75 bps rate hike.

- The consensus amongst ECB policymakers is for a 25 bps rate hike in July; September is still open.

- EUR/USD Price Analysis: Sellers in control might take a breather before launching an assault towards parity.

EUR/USD remains subdued as North American traders prepared for the weekend, in choppy trading within the 1.0150-80 range after June’s employment report and further Fed speakers crossing wires.

The EUR/USD is trading at 1.0182, having hit a fresh 20-year low at 1.0071 during the European session, though recovered after the release of the US Nonfarm Payrolls report, bouncing off late towards daily highs near 1.0190, before losing steam and settling at around current levels.

EUR/USD rallied despite solid US job report, EU’s energy crisis

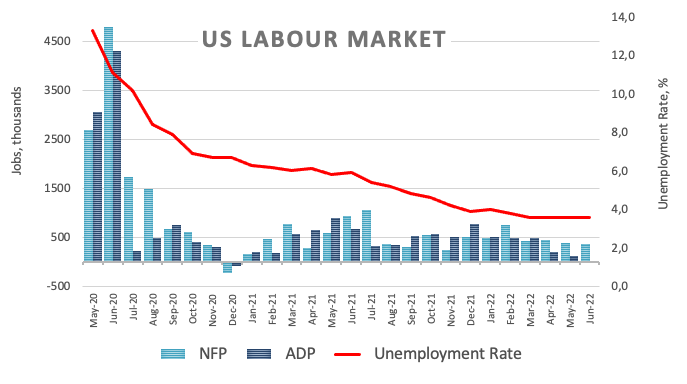

Earlier in the North American session, the US Department of Labour reported that June’s Nonfarm Payrolls added 372K jobs to the economy, exceeding estimations of 268K. Average Hourly Earnings, and an indication of a wage-price spiral, remained contained at 5.1% YoY, above estimates, while the Unemployment rate prevailed unchanged at 3.6%. At the same time Fed speakers, namely Waller, Bullard, Bostic, and Williams, reiterated the case for a 75 bps rate hike to the Federal funds rate (FFR), while downplaying recession fears.

On the Eurozone side, ECB speakers remain vocal about hiking rates this month, and the consensus remained around a 25 bps rate hike. However, a 50 bps could be in play, but it is not the case scenario, as mentioned on its June minutes. Despite all that, the EU’s ongoing energy crisis hit the shared currency hard during the week, as the EUR/USD weekly chart illustrates the major is losing 2.47% in the week

Therefore, the EUR/USD path of least resistance is tilted to the downside, and a parity test is on the cards.

EUR/USD Price Analysis: Technical outlook

The EUR/USD daily chart indicates that sellers are in control, despite buyers’ effort to hold the fort around 1.0100. As the New York session waned, they achieved their task so far. However, oscillators like the Relative Strength Index (RS) exited oversold conditions, meaning sellers might be taking a breather before exerting additional pressure to drag prices lower.

Therefore, the EUR/USD first support would be 1.0100. Once cleared, the next support would be the current YTD low at 1.0071, followed by the EUR/USD parity at 1.0000. A decisive break would clear the way for September 2002 lows around 0.9608.

- The EUR/GBP cross-currency tumbled since Tuesday close to 200 pips.

- Fragile market mood shows investors’ nervousness in an uncertain scenario.

- EUR/GBP Price Analysis: Pressured around the 200-day EMA; once cleared, a fall towards 0.8300 is on the cards.

On Friday, the EUR/GBP trims some of Thursday’s losses, though braced for the confluence of the 100 and 200-day EMAs around 0.8440-44 during the North American session. At 0.8455, the EUR/GBP is up by a minimal 0.10%.

US equities wobble, reflecting a downbeat market mood. The EU’s energy crisis linked to Russia’s invasion of Ukraine, and signs of EU economic contagion or even contraction, weigh heavily in the shared currency, particularly in the EUR/GBP pair. Meanwhile, BoE’s Pill and Mann expressed the need for faster rate hikes in the UK amidst the resignation of UK’s Prime Minister Boris Johnson.

In the meantime, the cross-currency opened near 0.8445 and slid towards the daily low below 0.8440 before printing the daily high at 0.8475.

EUR/GBP Daily chart

The EUR/GBP is about to change its bias, due in part to fundamental reasons attached to a Euro area economic slowdown, but also for the presence of the 200-day EMA just 12 pips below the current exchange rate. The EUR/GBP fall from 0.8600 to current price levels shifted the Relative Strength Index (RSI) to bearish conditions, meaning that selling pressure lies ahead.

Therefore, the EUR/GBP bias in the near term is neutral but slightly tilted to the downside. Break below the 200-day EMA will expose the 0.8400 figure. Once cleared, EUR sellers’ next stop will be the May 2 swing low at 0.8367, followed by the 0.8300 figure.

EUR/GBP Key Technical Level

- During the week, the Swiss franc is still under heavy pressure, losing more than 2%.

- Broad US dollar strength across the board underpins the USD/CHF.

- USD/CHF Price Analysis: The pave towards parity is clear, but 0.9800 and 0.9975 are still on the way for USD/CHF buyers; otherwise, a re-test of 0.9700 is on the cards.

The USD/CHF marches firmly for the sixth straight day, trading near weekly highs around 0.9790s, after falling from around YTD highs at parity, though since then, the major is up by almost 300 pips, though shy of reaching 0.9800. At the time of writing, the USD/CHF is trading at 0.9785.

Sentiment shifted for the worse in the last hour or so for no fundamental reason. However, traders should not tat US President Biden was due to meet with advisers on China’s tariffs late on Friday, though it remains unclear if he would make a decision or not, according to Reuters sources. Meanwhile, US equities trade in negative territory, and the greenback shifted positive, as shown by the US Dollar Index up 0.01%, at 107.044.

Aside from this, the USD/CHF began Friday’s session trading around 0.9730s and dipped toward the daily low around 0.9720 before rallying to the daily high at 0.9797.

USD/CHF Daily chart

The USD/CHF broke above the 50-day moving average (DMA), clearing the way for a re-test of parity. However, April’s 2020 high around 0.9802 has been a tough nut to crack, but once done, a rally towards USD/CHF’s parity is on the cards. Nevertheless, on its way north, the USD/CHF traders must overcome the May 10 high at 0.9975.

Otherwise, the major would be vulnerable to selling pressure, and a fall towards the 50-DMA at 0.9735 is on the cards, and then the USD/CHF could slip to the 0.9700 figure.

USD/CHF Key Technical Levels

- Wall Street turns positive on Friday, helping MXN.

- US jobs report shows better-than-expected numbers.

- USD/MXN corrects lower, the trend is still bullish.

The USD/MXN is modestly lower on Friday still up for the week. It bottomed at 20.36, a three-day low before bouncing to the 20.45 zone. The outlook remains bullish for the pair.

Fed and Banxico: rate hikes to continue

On Friday, the US dollar lost momentum after the beginning f the American session amid an improvement in market sentiment, following the US jobs report. “Another robust gain in payrolls should squash discussions that the economy is already in a recession. Employers added 372K jobs in June, with the unemployment rate holding steady at 3.6%. Wage growth eased up a touch, advancing 0.3%, but with hiring still solid, we believe the June jobs report bolsters the case for another 75 bps rate hike at the FOMC's July 27 meeting”, explained analysts at Wells Fargo.

Equity markets are about to post weekly gains still the caution stance prevails amid a worsening economic outlook and higher interest rates ahead. The current environment makes it difficult for the Mexican peso to sustain any rebound. The Bank of Mexico is expected to raise again by 75 bps the key interest rate, offering some support to the peso, although the reasons for the aggressive hike are negative. Inflation hit in June 7.99%, the highest level since 2001.

The MXN remains among the few currencies to be still up against the US dollar on the year.

Still bullish but limited under 20.70

The USD/MXN is about to post another weekly gain. It is hovering around 20.45, far from the weekly top. A recovery above 20.45, would keep the door open for another test of 20.70. A daily close above 20.75 is likely to signal a test of 20.90, the last defense to 21.00.

On the flip side, a consolidation below 20.40 would strengthen the Mexican peso, paving the way to the 20-day Simple Moving Average, currently at 20.25; below await the 200-day SMA at 20.18.

Technical levels

- The AUD/USD is still up during the week by 0.37%.

- An upbeat mood, a soft US dollar, and higher commodity prices underpinned the AUD/USD.

- Fed speakers backed a 75 bps rate hike and said the US economy is strong.

The AUD/USD is almost unchanged on Friday, amidst a positive tone in the market, as US equities rise but remain at the brink of turning red, on sudden market sentiment shift after June’s US employment report exceeded expectations, signaling that recession fears are overblown. At the time of writing, the AUD/USD is trading at 0.6837.

Upbeat mood and a soft US dollar, a tailwind for the AUD/USD

A risk-on impulse spreads to the FX space as risk-sensitive currencies rally. The US Labor Department reported that June’s Nonfarm Payrolls added 372K jobs to the economy, more than the 268K estimated. Despite a favorable report, the Unemployment Rate remained unchanged at 3.6%, as wage growth remained firm. Traders sold off equities as a reaction that could motivate the Fed to keep hiking rates aggressively to tame inflation.

The AUD/USD reacted to the downside, printing the daily low at around 0.6791, but bounced off as investors dissected the report, breaking towards fresh three-day highs around 0.6870s. Furthermore, higher commodity prices underpinned the major, as shown by the Bloomberg Commodity Index, up 0.88%, contrarily to Iron Ore prices, down 1.22%, at $113.74 a ton.

At the time of writing, New York’s Fed President John Williams said that the central bank is 100% committed to goals and expected GDP to grow by less than 1% this year.

Elsewhere a raft of Fed speakers, namely Waller, Bullard, and Bostic, reiterated their view backing up 75 bps rate hikes in the Fed’s July meeting. They also expressed that the US economy is strong and can withstand higher rates while downplaying recession fears.

What to watch

The Australian economic calendar will feature June’s NAB Business Confidence, the July Consumer Confidence, and the Employment Report for June. On the US front, June’s Consumer Price Index (CPI), the Producer Price Index (PPI), and the University of Michigan (UoM) Consumer Sentiment would update the status of the US economy.

Also, Fed speakers will cross wires before entering the blackout period of the July monetary policy meeting.

AUD/USD Key Technical Levels

According to the Federal Reserve Bank of Atlanta's GDPNow model, the US economy is expected to contract by 1.2% in the second quarter, up from the July 7 forecast of -1.9%.

"After this morning's employment situation report by the US Bureau of Labor Statistics and the wholesale trade report from the US Census Bureau, the nowcasts of second-quarter real personal consumption expenditures growth and real gross private domestic investment growth increased from 1.3% and -14.9%, respectively, to 1.9% and -13.7%, respectively," Atlanta Fed explained in its publication.

Market reaction

The US Dollar Index showed no immediate reaction to this report and was last seen trading flat on the day near 107.00.

The net change in employment in Canada was negative in June by 43K, against expectations of an increase of 23K. Analysts at CIBC point out that other details of the report keep the Bank of Canada on its way to a 75 basis points rate hike next week.

Key Quotes:

“At a time in which modestly bad news would be good news, Canada's June jobs data weren't really bad enough to generate a sigh of relief for those concerned about an inflationary overheating. The 43,000 jobs decline was certainly a break from a run of hefty hiring since February, but other signposts, from brisk year-on-year wage gains, a climb in hours worked, and a new low in the unemployment rate, should be enough to have the Bank of Canada hiking rates by an outsized 75 basis points next week.”

“The Bank of Canada's concerns over labour market tightness won't be eased given that the unemployment rate dropped two ticks to a new cycle low of 4.9%. That reflected a drop in labour force participation, as fewer of those not working were actively seeking jobs.”

“Economic growth in the second quarter should still be in the 4% range, and even with the drop in employment, other signposts in today's data are consistent with the need to tighten monetary policy further. We're sticking to our call for a 75 basis point rate hike next week, with the overnight rate peaking at 3% this year.”

Data released on Friday showed the US economy added 372K non-farm payroll in June, surpassing expectations. According to analysts at Wells Fargo, the “robust gain in payrolls should squash discussions that the economy is already in a recession.” They believe the June jobs report bolsters the case for another 75 bps rate hike at the FOMC's July 27 meeting.

Key Quotes:

“If the economy is in a recession, employers have not seemed to notice. Despite clamors that the economy may already be in a recession due to the possibility of two consecutive negative quarters of GDP growth (a view we do not share), the labor market continues to plow forward, supporting aggregate income and limiting the havoc wrought on spending by high inflation.”

“Nonfarm payrolls put up another robust gain in June, increasing by 372K. Even accounting for a net downward revision of 74K over the past two months, that still puts the number of jobs in the economy ahead of where forecasters expected it to be heading into today's report. Payrolls are now 0.3% below their pre-COVID peak, with gains remarkably steady the past three months in the narrow range of 368-384K.”

“Inflation remains paramount for the Fed, but the jobs market is also an important piece of the puzzle to the path ahead for policy as growth concerns mount. Today's report indicates that the jobs market remains extraordinarily strong. While the size of the FOMC's next move hangs primarily on this upcoming Wednesday's June CPI report, the June jobs report bolsters the case for another 75 bps hike at the July 27 meeting.”

Former British Finance Minister Rishi Sunak announced on Friday that he will be running in the contest to replace Prime Minister Boris Johnson.

"I’m standing to be the next leader of the Conservative Party and your Prime Minister," Sunak tweeted out. "Let’s restore trust, rebuild the economy and reunite the country."

Market reaction

This announcement doesn't seem to be having a noticeable impact on the British pound's performance against its rivals. As of writing, the GBP/USD pair was posting modest daily gains at 1.2035.

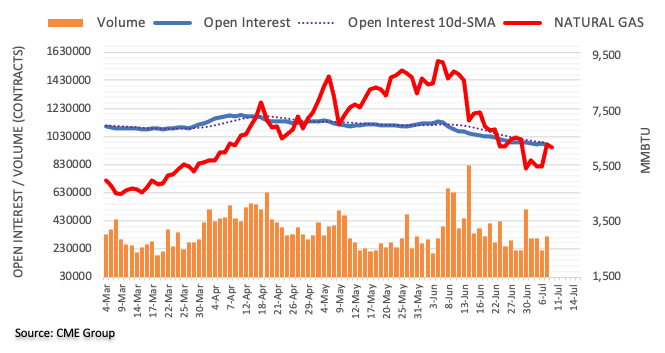

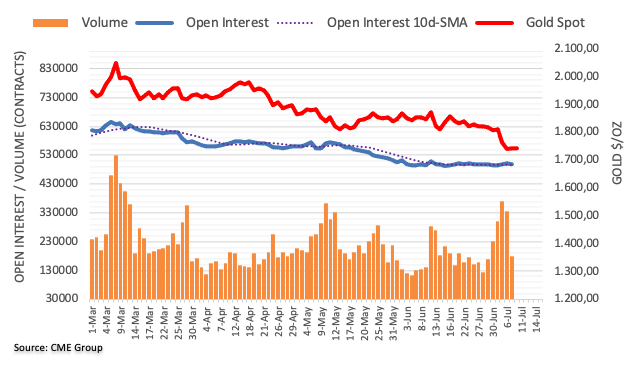

- On Friday, Gold rises almost 0.40% but is still down by 3.53% in the week.

- The bright metal recovered some of its shine due to a weaker US dollar and a mixed sentiment.

- Gold Price Forecast (XAUUSD): A falling wedge suggests upward pressure might be building, but buyers need to reclaim $1773; otherwise, gold can fall toward $1700.

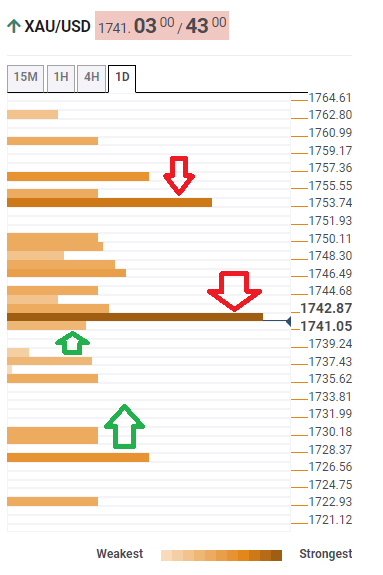

Gold spot (XAUUSD) climbs during the North American session, bouncing from fresh YTD lows at around highs $1720s, eyeing a break above the $1750 figure as the US dollar weakens across the board. At the time of writing, XAUUSD is trading at $1744.27.

The yellow metal rebounds from weekly lows on a soft US dollar

Sentiment remains fragile, fluctuating on an upbeat US jobs report. The US Department of Labour reported that Nonfarm Payrolls for June rose by 372K, beating estimates of 268K, while the previous reading was downward revised to 384K. That clears the way for the Federal Reserve to remain tightening aggressively. At the time of writing, money market futures STIRs odds of a 75 bps hike to the Federal funds rate (FFR) lie at 97%, while investors expect a 50 bps rate raise for the September meeting.

Reflection of the aforementioned is US stocks mixed. In the meantime, the greenback erases earlier gains after reaching a fresh YTD high, tumbling below the 107.000 mark, down 0.07%, while the US 10-year Treasury rate is rising six bps, yielding 3.063%.

Lingering recession fears remain fueled by the inversion of the US 2s-10s yield curve, which sits at -0.021%, up from -0.03% at around 14:15 GMT.

Fed speakers will continue crossing news wires, led by New York Fed President John Williams. However, Atlanta’s Fed President Raphael Bostic said that the US jobs report shows the economy is strong, and he backs a 75 bps rate hike. On Thursday, Fed’s FOMC 2022 voters, Christopher Waller and James Bullard expressed that they favor a 75 bps rate hike in July, and downplayed recession fears, stating that the US economy remains solid.

What to watch

In the next week, the US economic docket will feature additional Fed speakers before entering the blackout period of the July monetary policy meeting. The Regional Fed Presidents Williams, Barkin, and Bostic will speak on Monday, Tuesday, and Friday, respectively. Meanwhile, Christopher Waller will take the stand on Thursday.

Data-wise, the June’s Consumer Price Index (CPI), the Producer Price Index (PPI), and the University of Michigan (UoM) Consumer Sentiment will shed some light on the status of the US economy.

Gold Price Forecast (XAUUSD): Technical outlook

Gold’s daily chart depicts a falling wedge forming, suggesting that the yellow metal could turn bullish in the near term. Nevertheless, oscillators are in oversold conditions, with the RSI at 28.70, far from supporting a bullish bias, but once it exits from that area, gold might consolidate before challenging the rising wedge top trendline around the $1800 mark.

- Improvement in risk sentiment weighs on the US dollar.

- US yields higher after a better-than-expected jobs report.

- NZD/USD recovers from 2-year lows, heads for a weekly gain.

The NZD/USD is trading above 0.6200, at the highest level in three days. The pair rose more than 70 pips from the daily low boosted by a weaker US dollar across the board.

Risk-on, NZD up

An improvement in risk sentiment triggered a reversal of the US dollar. Stocks in Wall Street are up after a negative opening. The Dow Jones rises by 0.37% and the Nasdaq 0.43%. US yields are at weekly highs, with the 10-year at 3.07%.

Regarding economic data released on Friday, the US June jobs report showed the economy added 372K payroll against expectations of 268K. The unemployment rate held steady at 3.6%, in line with market consensus.

The NZD/USD bottomed at 0.6130 after NFP and then rebounded more than 70 pips. It printed a fresh daily high at 0.6206. As of writing, it remains near the top, with a positive momentum.

The 4-hour chart shows the pair breaking above a short-term downtrend line and the 0.6190 resistance. If it remains above, more gains seem likely. The next resistance stands at 0.6220 followed by 0.6250. A slide back under 0.6190 would expose again 0.6130.

-637928902299599288.png)

The NZD/USD is about to end the week with modest gains and far from the two-year low it reached on Tuesday at 0.6123. Next Wednesday, the Reserve Bank of New Zealand will announce its decision on monetary policy. A rate hike from 2% to 2.50% is expected.

Technical levels

The sky-high inflation is the number one danger to the US economy, New York Fed President John Williams said on Friday, as reported by Reuters.

Additional takeaways

"We are 100% committed to goals."

"We must be resolute, and cannot fall short."

"Price stability is absolutely essential for a strong economy."

"Fed is strongly committed to bringing inflation back down to 2% goal."

"I expect unemployment rate to reach somewhat above 4% next year."

"GDP to grow less than 1% this year, rebound to 1.5% next year."

"Some signs job growth has slowed, but labor market remains incredibly tight."

"We will be data-dependent, nimble in our policy approach."

"High inflation is incredibly harmful; I am resolutely focused on restoring price stability."

"May take some time to get inflation to 2%, may well be a bumpy road."

Market reaction

The US Dollar Index showed no immediate reaction to these comments and was last seen posting small daily losses at 106.95.

A strong and above consensus payrolls report offers a reminder that the US is still on a firm footing. USD strength this week has come off the back of a breakdown in EUR, and this narrative is set to continue, according to strategists at TD Securities.

Not the recession you are looking for

“A solid payrolls report calls into question the repricing of the fed funds curve since the June meeting and more recently, recession talk. While we see the latter as likely in the next 12m, the timing of this could be further than the market currently thinks. Consequently, we believe that the market is far too premature on betting on a lower and earlier end to the tightening cycle.”

“The economy is standing strong, especially compared to some of its G7 peers (like the Eurozone) and it will be very difficult to displace the USD – especially with the EUR to remain very weak.”

“EUR/USD came perilously close to hitting parity; and while we would expect that to offer some natural defense (particularly in the options space), the macro headwinds are immense in Europe and the balance of payments is experiencing an epic deterioration that is likely to continue. And without a EUR offset, the USD remains king of FX.”

USD/CAD holds fairly well against a strong US Nonfarm Payrolls and disappointing Canadian jobs report. That said, economists at TD Securities think the pair is in the midst of forming a higher base, and a topside break above key resistance at 1.3080 is inevitable.

Disappointing jobs number does not do the CAD any favors

“A disappointing jobs number does not do the CAD any favors, particularly against a much stronger payrolls report in the US. The data mix is supportive of a higher USD/CAD, but we are not convinced that it will break the 1.3080 resistance in the near-term. More dominoes need to fall before that happens. But make no mistake, it will.”

“We think USD/CAD is forming a higher base, and we believe that holding risk into US inflation and the Fed's Index of Common Inflation Expectations (CIE) next week is playing with fire (US CPI is expected to be as strong as the last report while the CIE likely rose).”

“We are long USD/CAD and target 1.35.”

See – Canadian dollar: Forecasts from five major banks, best G10 currency only means modest recovery

- USD/JPY shot to over a one-week high in reaction to the upbeat NFP report for June.

- The widening US-Japan rate differential weighed on the JPY and remained supportive.

- The fundamental backdrop supports prospects for a move towards the 137.00 mark.

The USD/JPY pair recovered its early lost ground to the 135.30 area and turned positive for the fifth successive day on Friday. The intraday uptick picked up pace during the early North American session and pushed spot prices to over a one-week high, around the 136.55 region.

The US dollar stood tall near a two-decade high after the US monthly jobs report that the US economy added 372K jobs in June, far more than the 268K anticipated. The upbeat headline NFP was accompanied by a steady Unemployment rate, which came in at 3.6% for the reported month. Adding to this, Atlanta Fed President Raphael Bostic backed the case for a 75 bps rate hike move at the upcoming FOMC meeting in July.

Speaking to CNBC, Bostic - one of the most dovish policymakers - said that the Fed needs to move aggressively and that the core of the US economy is still strong. This, in turn, pushed the US Treasury bond yields and further widened the US-Japan rate differential. Apart from this, the divergent policy stance adopted by the Fed and Bank of Japan undermined the Japanese yen, which, in turn, lifted the USD/JPY pair.

The USD bulls, however, seemed reluctant to place fresh bets amid slightly overstretched conditions, especially after the recent strong bullish runup. This was seen as the only factor that kept a lid on any meaningful upside for the USD/JPY pair, at least for the time being. That said, the fundamental backdrop supports prospects for a move back towards testing a 24-year high, around the 137.00 mark set in June.

Technical levels to watch

- EUR/USD’s price action remains depressed on Friday.

- Further weakness could test the parity zone soon-ish.

EUR/USD drops and rebounds from fresh cycle lows around 1.0070 on Friday.

The pair’s bearish stance stays everything but abated for the time being. Against that, there is a minor support level at 1.0060 (low December 11 2002). The loss of this level could lead up to a visit to parity for the first time since December 2002.

In the longer run, the pair’s bearish view is expected to prevail as long as it trades below the 200-day SMA at 1.1071.

EUR/USD daily chart

- USD/CAD edged higher in reaction to the upbeat US NFP report and mixed Canadian jobs report.

- An uptick in oil prices underpinned the loonie and continued acting as a headwind for the major.

- A sustained strength beyond the 1.3075-1.3080 barrier is needed to confirm a bullish breakout.

The USD/CAD pair caught fresh bids during the early North American session and shot to the daily high, around the 1.3035 region following the release of the US/Canadian jobs report.

The headline NFP showed that the US economy added 372K jobs in June as against an increase of 384K (revised down from 390K) reported in May. This, however, surpassed consensus estimates of 268K by a big margin. Adding to this, the Unemployment Rate held steady at 3.6% and reaffirmed expectations for a more aggressive policy tightening by the US central bank. The prospects for faster Fed rate hikes triggered a sharp spike in the US Treasury bond yields. Apart from this, a softer risk tone continued lending support to the safe-haven US dollar and pushed the USD/CAD pair higher.

In contrast, Statistics Canada reported a 43.2K decline in Net Change in Employment, which exerted some pressure on the domestic currency and provided an additional lift to spot prices. The disappointment, however, was offset by that the fact that the Unemployment Rate in Canada declined to 4.9% in June from 5.1% in the previous month. Adding to this, some follow-through uptick in crude oil prices underpinned the commodity-linked loonie and capped any meaningful upside for the USD/CAD pair. This, in turn, warrants some caution before placing aggressive bullish bets around the major.

Hence, it will be prudent to wait for strong follow-through buying and sustained strength beyond the 1.3075-1.3085 supply zone before positioning for any further gains. Nevertheless, the USD/CAD pair remains on track to end the week on a positive note and might continue to take cues from the US/oil price dynamics.

Technical levels to watch

In an interview with CNBC on Friday, Atlanta Fed President Raphael Bostic said that he is "fully supportive" of one more 75 basis points rate hike in July, as reported by Reuters.

Additional takeaways

"This jobs report shows economy is strong."

"Still a lot of labor market momentum."

"Economy is starting to slow."

"We will get inflation under control."

"These job numbers show just minor signs of slowing."

"We need to see more sustained, more significant slowing."

"Starting to inch in right direction, but need to see a lot more."

"I've had to adapt on where I think policy should go, we need to move aggressively."

"Tremendous momentum in economy shows 75 bps move in economy won't mean protracted damage to economy."

"Will take wait and see attitude, will observe and adapt."

"This may be the labor market catching up to output, but doesn't necessarily represent recessionary issue."

Market reaction

The dollar preserves its strength after these comments with the US Dollar Index holding in positive territory above 107.00.

- DXY extends the upside and prints new cycle highs near 107.80.

- Immediately to the upside emerges the minor hurdle at 108.00.

DXY has quickly left behind Thursday’s small correction and advanced to new cycle peaks near 107.80 at the end of the week

Further upside in the dollar remains in store in the short-term horizon. That said, the surpass of the 2022 high at 107.78 (July 8) should pave the way for a move to the round level at 108.00 prior to the October 2002 top at 108.74.

As long as the 5-month line near 102.75 holds the downside, the near-term outlook for the index should remain constructive.

In addition, the broader bullish view remains in place while above the 200-day SMA at 98.45.

Of note, however, is that the index trades in the overbought territory and it therefore could extend the corrective decline to, initially, the 105.80 region (high June 15).

DXY daily chart

- Unemployment Rate in Canada fell unexpectedly in June.

- USD/CAD trades in positive territory above 1.3000 after Canadian jobs report.

The Unemployment Rate in Canada declined to 4.9% in June from 5.1% in May despite a 43.2K decline in Net Change in Employment, the data published by Statistics Canada showed on Friday. Investors were expecting the Unemployment Rate to remain unchanged at 5.1%.

The Participation Rate fell to 64.9% from 65.3% in the same period, explaining the lower Unemployment Rate despite falling employment. Finally, the Average Hourly Wages rose by 5.57% on a yearly basis in June, up from 4.45% in May.

Market reaction

The USD/CAD pair gained traction after this report and was last seen rising 0.5% on the day at 1.3030.

- GBP/USD edged lower during the early North American session in reaction to the upbeat US NFP report.

- The US economy added 372K new jobs in June (268K expected) and the jobless rate held steady at 3.6%.

- The data reaffirmed bets for aggressive Fed rate hikes and continued lending support to the greenback.

The GBP/USD pair struggled to capitalize on its intraday bounce from the 1.1920 region and attracted fresh selling in reaction to mostly upbeat US employment details. The pair was last seen trading around the 1.1985-1.1980 region, down nearly 0.35% during the early North American session.

The intraday US dollar pullback from a two-decade high was quickly bought into after the headline NFP showed that the US economy added 372K jobs in June. This was slightly below the previous month's downwardly revised reading of 384K, though was well above the 268K anticipated. Adding to this, the Unemployment Rate held steady at 3.6%, as expected, and cemented expectations for a more aggressive policy tightening by the Fed.

Apart from this, the prevalent cautious mood around the equity markets offered some support to the safe-haven greenback. That said, weaker US Treasury bond yields held back the USD bulls from placing fresh bets and offered some support to the GBP/USD pair, at least for the time being. The near-term bias, however, remains tilted in favour of bearish traders amid Brexit woes and expectations for a less hawkish Bank of England.

Investors remain concerned that the UK government's controversial Northern Ireland Protocol Bill could trigger a trade war with the European Union amid the cost-of-living crisis. Furthermore, recession fears could force the BoE to adopt a gradual approach toward raising interest rates and act as a headwind for the British pound.

Technical levels to watch

- EUR/USD extends the rebound from earlier cycle lows.

- US Non-farm Payrolls rose by 372K jobs in June.

- The unemployment rate remained at 3.6%.

Despite the rebound from lows, the selling interest around the single currency remains well and sound and motivates EUR/USD to keep the price action subdued around 1.0100/15 at the end of the week.

EUR/USD still faces a potential drop to parity

EUR/USD keeps the negative stance on Friday after the release of the Nonfarm Payrolls showed the US economy created 372K jobs during June, surpassing initial estimates for a gain of 268K jobs. The May reading was revised down to 384K (from 390K).

Further data saw the jobless rate unchanged at 3.6% and the key Average Hourly Earnings – a proxy for inflation via wages – rise 0.3% MoM and 5.1% from a year earlier. Additionally, the Participation Rate, eased a little to 62.2%.

What to look for around EUR

Bears maintain the EUR/USD under heavy pressure and the acceleration of the downside opens the door to a probable visit to the parity level sooner rather than later.

Indeed, the pair’s price action remains depressed and keeps closely following rising speculation around a probable recession in the region, dollar dynamics, geopolitical concerns, fragmentation worries and the Fed-ECB divergence.

Key events in the euro area this week: ECB Lagarde (Friday).

Eminent issues on the back boiler: Fragmentation risks. Kickstart of the ECB hiking cycle in July? Asymmetric economic recovery post-pandemic in the euro bloc. Impact of the war in Ukraine on the region’s growth prospects and inflation.

EUR/USD levels to watch

So far, spot is down 0.16% at 1.0140 and faces the next contention at 1.0071 (2022 low July 8) seconded by 1.0060 (low December 11 2002) and finally 1.0000 (psychological level). On the upside, a breakout of 1.0538 (55-day SMA) would target 1.0615 (weekly high June 27) en route to 1.0773 (monthly high June 9).

The CAD weakened in June along with nearly all G10 currencies. As we enter the second half of the year, some analysts have updated their Canadian dollar forecasts. Here you can find the expectations of five major banks regarding loonie’s outlook for the coming months. Although the CAD is set to stay resilient, it is unlikely to enjoy substantial gains.

Wells Fargo

“We believe the Bank of Canada will maintain a relatively hawkish stance on monetary policy, while elevated energy prices and relatively sound consumer finances are also favorable factors. In addition, we expect the Bank of Canada to hold policy rates steady even as the Fed eventually begins to ease monetary policy. We look for modest CAD strength against the dollar by mid-2023, the most optimistic view on any G10 currency.”

MUFG

“The BoC meeting in July will be important and if the BoC follows the Fed’s lead, it will limit near-term downside risks. However, the global backdrop for risk is set to remain unfavourable and that points to broader US dollar strength. However, aggressive BoC action and a rebound in crude oil prices like we expect should limit the scope for USD/CAD to move higher in Q3. The risk of a downturn in 2023 is increasing and given Canada’s closer links to the US where the Fed’s actions make a recession there more likely, it could result in a more muted recovery for the Canadian dollar. We expect crude oil prices to decline in Q4 which could further undermine the extent of CAD recovery. So while we expect CAD recovery from current levels, we have become a little more cautious over the extent of the recovery.”

CIBC

“A likely 75 bps hike by the Bank of Canada in July, and the potential for another move of that magnitude in September if we don't see enough of an inflation deceleration by then, should be aggressive enough to allow USD/CAD to remain around current levels over the next three months. Markets appear to be overpricing both BoC and Fed tightening this year, but comparatively more for the BoC, and that recalibration will lead the CAD to end the year weaker, with USD/CAD expected to reach 1.31 by then. In 2023, the loonie could weaken further on a global slowdown in growth as interest rate hikes take a toll on activity, which will weigh on commodity prices and dent nominal exports for Canadian natural resource producers. Look for USD/CAD to reach 1.33 in early 2023, before recouping some of that ground further into the year as the USD loses favour globally.”

Credit Suisse

“CAD is well positioned within the G10 commodity FX complex: BoC is seen as credible, activity data are solid, but housing represents a near-term risk. A range approach remains valid: we widen our USD/CAD target range slightly from 1.2650-1.3100 to 1.2670-1.3340, with a midpoint range target of 1.3000.”

TDS

“USD/CAD should continue to maintain the 1.27/1.31 range in the short-term. The bias, though, remains to the upside, especially as BoC rate hikes start to rattle the housing market and risk appetite remains shaky. We also downplay the importance of the oil factor given limited longer-term investment implications. While the consensus view around USD/CAD seems less varied than other pairs, we're generally more bearish CAD in the months ahead.”

Nonfarm Payrolls in the US rose by 372,000 in June, the data published by the US Bureau of Labor Statistics revealed on Friday. This reading followed May's increase of 384,000 (revised from 390,000) and came in better than the market expectation of 268,000. The Unemployment Rate remained unchanged at 3.6% as expected.

Further details of the publication revealed that the annual wage inflation, as measured by the Average Hourly Earnings, edged lower to 5.1% from 5.3% in May and the Labor Force Participation declined to 62.2% from 62.3.

Follow our live coverage of market reaction to the US jobs report.

Market reaction

The greenback gathered strength against its major rivals with the initial reaction and the US Dollar Index was last seen rising 0.32% on a daily basis at 107.38

Economist at UOB Group Enrico Tanuwidjaja comments on the recently published FX reserves figures in Indonesia.

Key Takeaways

“Indonesia’s foreign exchange reserves jumped to USD136.4bn in Jun 2022, reversing decline and was highest in 3 months following an increase of USD0.8bn.”

“The latest reserve level was equivalent to finance 6.6 months of import or 6.4 months of imports and servicing the government’s external debt, well above the international adequacy standard of 3 months of imports.”

“Bank Indonesia (BI) maintains their view that the official reserve assets will remain adequate, supported by the stability and solid domestic economic outlook in line with several responsive policies to support long-term economic recovery.”

- EUR/JPY trades without direction in the 138.00 region.

- Next on the downside comes the 100-day SMA.

EUR/JPY printed news multi-week lows in the 136.80 region, although it managed to regain composure afterwards.

The cross remains under pressure, particularly after breaking below the 4-month support line, today around 139.65. That said, further downtrend could revisit the 100-day SMA at 136.00 ahead of the minor support at 133.92 (low May 19).

In the longer run, the constructive stance in the cross remains well propped up by the 200-day SMA at 133.07.

EUR/JPY daily chart

- AUD/USD reversed an intraday dip to the 0.6800 mark amid a modest intraday USD pullback.

- The upside remains capped near a resistance marked by the top end of a descending channel.

- Investors now seem to have moved on the sidelines and await the US monthly jobs report (NFP).

The AUD/USD pair attracted some dip-buying near the 0.6800 mark on Friday and has now recovered its modest intraday losses. The pair was last seen trading in the neutral territory, around the 0.6830 area, as traders now await the release of the US monthly jobs data for a fresh impetus.

The US dollar surrendered a major part of its intraday gains to a fresh two-decade high amid some repositioning trade ahead of the NFP report. Apart from this, a generally positive tone around the equity markets undermined the safe-haven buck and offered support to the risk-sensitive aussie.

From a technical perspective, the AUD/USD pair, so far, has failed to capitalize on this week's rebound from a two-year low and the upside remains capped near a descending trend channel resistance. The said barrier, currently around the 0.6855-0.6860 region, should now act as a pivotal point.

This is closely followed by the 0.6900 mark, which coincides with the 100-period SMA on the 4-hour chart, which if cleared would suggest that the AUD/USD pair has formed a bottom. This, in turn, could trigger a short-covering move and lift spot prices towards the 0.6955-0.6960 supply zone.

On the flip side, the 0.6800 mark now seems to have emerged as immediate support, below which the AUD/USD pair could slide back to the 0.6765-0.6760 area. Some follow-through selling would pave the way for a slide towards the ascending channel support, currently around the 0.6715-0.6710 area.

A convincing break through the latter, leading to a subsequent fall below the 0.6700 mark would be seen as a fresh trigger for bearish traders and pave the way for additional losses. The AUD/USD pair might then accelerate the fall towards the next relevant support near the 0.6655-0.6650 region.

AUD/USD 4-hour chart

-637928787785792831.png)

Key levels to watch

UOB Group’s Senior Economist Julia Goh and Economist Loke Siew Ting assess the latest labour market report in the Malaysian economy.

Key Takeaways

“Malaysia’s labour market recovery continued to gain traction in May, supported by the full reopening of economic and social activities as well as country borders since Apr. Both the labour force participation rate and employment increased further to a fresh high of 69.5% and 15.90mn persons respectively (Apr: 69.4% and 15.85mn persons). This helped to keep the unemployment rate unchanged at 3.9% in May.”

“Record hiring was again propelled by the continuing recruitment in almost all economic sectors, expect for the mining & quarrying industry which recorded a decline in employment for the 22nd straight month. Services sector, which made up about 58% of the national GDP, remained the key driver of overall employment in Malaysia with wholesale & retail trade, information & communication, and food & beverage services sub-sectors taking the lead during the month.”

“Although the labour market showed persistent improvement, it is still unlikely to fully recover back to pre-pandemic levels at this juncture given multiple headwinds on the horizon. Worsening supply chain disruptions, elevated cost and consumer price pressures, as well as mounting fears of global recession may soon see more firms hitting the brakes on recruitment. We reiterate our year-end unemployment rate forecast of 3.6% for 2022 (BNM est: ~4.0%, end-2021: 4.2%, end-2019: 3.3%).”

Canadian employment details overview

Statistics Canada is scheduled to publish the monthly employment details for June later this Friday at 12:30 GMT. The Canadian economy is anticipated to have added 22.5K jobs during the reported month, down from the 39.8K rise reported in May. Meanwhile, the unemployment rate is expected to hold steady at 5.1% in June.

Analysts at Citibank sounded slightly more optimistic and offered a brief preview of the report: “We expect a solid 45K increase in employment in June, similar to the rise in May but with two-sided risks. The path of wage growth however will likely be more important to determine

whether the BoC starts to ease up on aggressive rate hikes later this year or if they remain more hawkish in line with the Fed.”

How could the data affect USD/CAD?

The data is likely to be overshadowed by the simultaneous release of the closely-watched US jobs report - popularly known as NFP. That said, a significant divergence from the expected readings should influence the Canadian dollar and provide some meaningful impetus to the USD/CAD pair.

Heading into the key data risks, spot prices regained positive traction amid an extension of the recent strong US dollar bullish run. That said, some follow-through uptick in crude oil prices underpinned the commodity-linked loonie and caped the upside for the USD/CAD pair.

Stronger domestic data should lend additional support to the Canadian dollar and exert some downward pressure on the major. That said, the daily swing low, around the 1.2955-1.2950 area, might continue to act as immediate support, below which the USD/CAD pair could slide further towards the 1.2900 mark. The latter should act as a strong base for the major, which if broken decisively would negate any near-term positive outlook and prompt aggressive technical selling.

Conversely, a weaker-than-expected report would be enough to assist the USD/CAD pair to build on this week's strong rally from the vicinity of the 50-day SMA. Bulls, however, might wait for a sustained move beyond the 1.3075-1.3085 region before placing fresh bets. Spot prices would then aim to surpass an intermediate barrier near the 1.3155-1.3160 region and reclaim the 1.3200 mark before eventually climbing to the 1.3270 resistance zone.

Key Notes

• Canadian Jobs Preview: Forecasts from five major banks, fairly moderate employment growth in June

• USD/CAD Outlook: Bulls have the upper hand, US/Canadian jobs data awaited

• USD/CAD: A move to the 1.31-1.32 area is surely possible – ING

About the Employment Change

The employment Change released by Statistics Canada is a measure of the change in the number of employed people in Canada. Generally speaking, a rise in this indicator has positive implications for consumer spending which stimulates economic growth. Therefore, a high reading is seen as positive, or bullish for the CAD, while a low reading is seen as negative or bearish.

About the Unemployment Rate

The Unemployment Rate released by Statistics Canada is the number of unemployed workers divided by the total civilian labour force. It is a leading indicator for the Canadian Economy. If the rate is up, it indicates a lack of expansion within the Canadian labour market. As a result, a rise leads to weaken the Canadian economy. Normally, a decrease of the figure is seen as positive (or bullish) for the CAD, while an increase is seen as negative or bearish.

US monthly jobs report overview

Friday's US economic docket highlights the release of the closely-watched US monthly jobs data for June. The popularly known NFP report is scheduled for release at 12:30 GMT and is expected to show that the economy added 268K jobs during the reported month, down from the 390K in May. The unemployment rate, however, is expected to hold steady at 3.6% in June. Apart from this, investors will take cues from Average Hourly Earnings, which could offer fresh insight into the possibility of a further rise in inflationary pressures.

Analysts at ING offered a brief preview of the report and explained: “We think payrolls may grow somewhere in the 250-300K range, which should still be enough to keep the unemployment rate at 3.6% and wages continuing to tick higher. For us to seriously consider changing our July Fed call we would need to see payrolls growth fall with the unemployment rate moving a couple of tenths higher and wage growth showing signs of stagnating. Even then we would still probably need to see a surprisingly large decline in inflation the following week.”

How could the data affect EUR/USD?

Heading into the key release, the US dollar shot to a fresh two-decade high amid growing acceptance that the Fed would retain its aggressive policy tightening path. This, in turn, dragged the EUR/USD pair below the 1.0100 mark for the first time since December 2002. Against the backdrop of the hawkish FOMC meeting minutes released earlier this week, a stronger NFP print would reaffirm bets for faster rate hikes by the Fed and further lift the buck.

Conversely, a weaker reading could add to worries about a possible global recession and might do little to trigger any meaningful USD corrective pullback. This, along with the energy crisis in Europe, which might drag the Eurozone economy faster and deeper into recession, suggests that the path of least resistance for the EUR/USD pair is to the downside.

According to Eren Sengezer, Editor at FXStreet: “EUR/USD remains extremely oversold in the near term with the Relative Strength ındex (RSI) indicator on the four-hour chart staying well below 30. The descending regression channel coming from late-June stays intact and the pair's technical correction is likely to meet resistance at the upper limit of that channel at 1.0150.”

Eren further outlined important technical levels to trade EUR/USD: “With a four-hour close above that level, the pair could extend its recovery toward 1.0200 (psychological level, static level, 20-period SMA). On the downside, interim support seems to have formed at 1.0070 (static level) before the pair could target the all-important parity.”

Key Notes

• Nonfarm Payrolls Preview: Three dollar-positive scenarios, only one negative one

• NFP Preview: Forecasts from 10 major banks, labour market loses momentum

• EUR/USD Forecast: Door opens to parity

About the US monthly jobs report

The nonfarm payrolls released by the US Department of Labor presents the number of new jobs created during the previous month, in all non-agricultural business. The monthly changes in payrolls can be extremely volatile, due to its high relation with economic policy decisions made by the Central Bank. The number is also subject to strong reviews in the upcoming months, and those reviews also tend to trigger volatility in the forex board. Generally speaking, a high reading is seen as positive (or bullish) for the USD, while a low reading is seen as negative (or bearish), although previous months reviews and the unemployment rate are as relevant as the headline figure.

British Prime Minister Boris Johnson's spokesperson said on Friday that the latest political events will not affect the progression of the Northern Ireland Protocol bill, as reported by Reuters.

"The government will continue to move ahead with already agreed policies such as Rwanda immigration flights," the spokesman added. When asked about fiscal policy, "a responsible government does need to react to emerging issues," he noted.

Market reaction

Markets remain risk-averse following these comments and the UK's FTSE 100 Index was last seen losing 0.45% on a daily basis.

Senior Economist at UOB Group Alvin Liew reviews the latest release of the FOMC Minutes of the June 14-15 gathering.

Key Takeaways

“The key takeaway from the 14/15 Jun FOMC minutes was that Fed policymakers agreed interest rates may need to keep rising for longer and into a restrictive policy stance to prevent higher inflation from becoming entrenched, even if it came at the cost of slower US economic growth “for a time”. Policymakers also warned of "a significant risk" if the Fed cannot maintain its credibility to fight inflation.”

“The other key takeaway was there was broad agreement among the policy makers as ‘participants judged that an increase of 50 or 75 basis points would likely be appropriate at the next meeting [Jul]’.”

“As evident from the minutes, the overarching message from the Fed was still centered on inflation with 90 references to inflation and that ‘many participants’ were concerned that ‘longer-run inflation expectations could be beginning to drift up to levels inconsistent with the 2 percent objective.’ There was not a single mention of ‘recession’ in the minutes, only the acknowledgement of slower growth. The policymakers also broadly agreed with the assessment of a ‘very tight [US] labor market’.”

“FOMC Outlook – Jun CPI inflation the key determinant for Jul FOMC policy action: FOMC Chair Powell highlighted the importance of headline CPI inflation to inflation expectations (and by that extension, to Fed policy). We will mark the Jun CPI (due on 13 Jul 2022, 8:30pm SGT) as the key determinant of whether we get a 50bps or 75bps hike for the next FOMC on 26/27 Jul. Currently, we are projecting US CPI inflation coming in at 0.8% m/m, 8.4% y/y in Jun (from 1% m/m, 8.6% y/y in May). Thus, inflation is still elevated and accelerating sequentially but the headline print will be off its peak (i.e. lower at 8.4% versus 8.6%), so that will warrant a 50bps hike for July, in our view. However, if inflation accelerates more than our expectation and prints above May’s 8.6% inflation rate, then that will mean a stronger response from the Fed is required, i.e. 75bps.”

“In addition to the move in Jul, we expect another two more 50bps rate hikes in Sep and Nov FOMC before ending the year with a 25bps hike in Dec. Including the 150bps of hikes to date, this implies a cumulative 325bps of increases in 2022, bringing the FFTR higher to the range of 3.25-3.50% by end of 2022, a range largely viewed as above the neutral stance (which is seen as 2.25-2.50%, the Fed’s long run projection of FFTR). We maintain our forecast for two more 25bps rate hikes in 2023, but likely to be brought forward to the first three months of 2023, bringing our terminal FFTR to 3.754.00% by end 1Q-2023.”

Italy economy minister Daniele Franco said on Friday, inflation doesn't seem likely to decline quickly.

Additional quotes

Italy economy minister franco says q2 probably saw "robust" GDP growth in Italy.

Italy economy minister franco says govt will continue to take steps to limit impact of high energy prices on firms and households.

Market reaction

- EUR/USD: Bears don’t give up and open the door to parity

- EUR/USD shows no signs of a convincing recovery, parity in the crosshairs

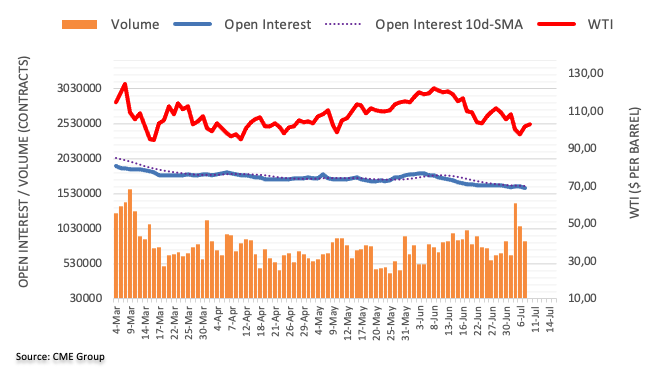

- Gold Price gives up recovery gains, as the US dollar rebounds firmly.

- Risk-aversion backs the USD ahead of the critical US NFP.

- XAUUSD extends its journey towards the $1,700 mark.

Gold Price is trading with mild losses, attacking nine-month lows of $1,732, as the US dollar finds renewed demand amid a risk-off market profile.

Investors digest the news of the former Japanese Prime Minister Shinzo Abe passing away due to a rare incident that happened in Japan. He was shot twice from behind by a shotgun in the chest and was rushed to the hospital. But succumbed to the wounds a few hours later.

Further, looming recession concerns, aggressive Fed rate hike expectations and the sell-off in the EUR/USD pair towards parity are all boding well for the greenback at gold’s expense. Amidst risk-off flows dominated, the US Treasury yields are losing their appeal, as government bonds remained favored.

Markets are eagerly awaiting the release of the all-important US Nonfarm Payrolls data, with the headline number seen arriving at 300K in June vs. 268K reported in May. The US unemployment rate is likely to hold steady at 3.6% in the previous month.

The dollar is likely to remain in a win-win situation whatever the outcome of the US labor market data may be. That said, the Fed will continue with its hawkish tightening stance, as it remains committed to tackling the inflation monster. The bright metal remains exposed to downside risks in the near term.

Gold Price: Daily chart

Gold price slipped further after facing rejection below $1,751, which is the 23.6% Fibonacci Retracement (Fibo) level of this week’s sell-off from $1,815 levels.

Daily closing above the latter is required to initiate any meaningful recovery from multi-month troughs of $1,732. Further up, the 38.2% Fibo level at $1,763 will challenge the bearish commitments.

Powerful resistance at $1.770 will be the next stop for XAU bulls. That level is the confluence of the psychological mark and the 50% Fibo level of the same decline.

Also read: Gold Price Forecast: XAUUSD remains non-committal below $1,750, awaiting US NFP

The 14-day Relative Strength Index (RSI) is flattening while within the oversold territory.

On the downside, the $1,732 will be the initial support, below which the rising channel target at $1,722 will come into play. A sustained move below the latter will expose the $1,700 threshold.

Gold Price: Additional levels to consider

- A combination of supporting factors assisted USD/CAD to regain positive traction on Friday.

- Aggressive Fed rate hike bets amidst a cautious mood pushed the USD to a fresh 20-year peak.

- Recession fears capped oil prices, which undermined loonie and further extended support.

- Traders now look forward to the release of the monthly jobs report from the US and Canada.

The USD/CAD pair attracted fresh buying in the vicinity of mid-1.2900s on Friday and continued scaling higher through the first half of the European session. The pair has now reversed a major part of the overnight losses and was last seen trading just above the 1.3000 psychological mark.

Following the previous day's brief pause, the US dollar was back in demand and shot to a fresh two-decade high amid the prospects for faster rate hikes by the Fed. The market bets were reaffirmed by hawkish minutes of the June 14-15 FOMC meeting released on Wednesday, indicating that another 50 or 75 bps rate hike is likely at the July meeting. Apart from this, the prevalent cautious market mood also benefitted the safe-haven greenback, which, in turn, assisted the USD/CAD pair to regain positive traction on the last day of the week.

The market sentiment remains fragile amid concerns that rapidly rising interest rates and tightening financial conditions would pose challenges to global growth. Apart from this, the ongoing Russia-Ukraine war and the latest COVID-19 outbreak in China have been fueling recession fears. Meanwhile, the worsening economic outlook has raised concerns about the fuel demand recovery. This, in turn, acted as a headwind for crude oil prices, which undermined the commodity-linked loonie and provided an additional lift to the USD/CAD pair.

It would now be interesting to see if bulls are able to maintain their dominant position or refrain from placing fresh bets ahead of Friday's release of monthly jobs data from the US and Canada. The popularly known NFP report might infuse some volatility in the financial markets and drive the USD demand. Apart from this, traders will further take cues from oil price dynamics to grab short-term opportunities around the USD/CAD pair.

Technical levels to watch

- EUR/USD breaches below 1.0100 and clinches new lows.

- ECB Visco advocated for a 50 bps (?) rate hike in September.

- It is Payrolls’ day across the Atlantic, yay!

EUR/USD accelerates losses and breaks below the 1.0100 level for the first time since December 2002.

EUR/USD weaker on USD-strength, looks to data

EUR/USD extends the decline for the sixth consecutive session so far on Friday amidst deteriorating conditions in the risk-associated universe, rising speculation of a recession in the euro bloc and intense dollar gains.

No effects on the single currency from hawkish comments by ECB’s Visco, who suggested a larger than 25 bps rate hike at the September event in case inflation conditions do not improve (which looks like the most probable scenario). He also expects (wishes) that inflation could return to the bank’s 2% target in 2024.

In the German money market, the 10y Bund yields appear slightly on the defensive above 1.25% following Thursday’s decent uptick.

In the docket, Italian Industrial Production contracted 1.1% MoM in May and expanded 3.4% vs. May 2021. Later in the session, Chair Lagarde will participate in an event in France.

In the NA session, June’s Nonfarm Payrolls will steal the show seconded by Wholesale Inventories and Consumer Credit Change as well as the speech by NY Fed J.Williams.

What to look for around EUR

Bears maintain the EUR/USD under heavy pressure and the acceleration of the downside opens the door to a probable visit to the parity level sooner rather than later.

Indeed, the pair’s price action remains depressed and keeps closely following rising speculation around a probable recession in the region, dollar dynamics, geopolitical concerns, fragmentation worries and the Fed-ECB divergence.

Key events in the euro area this week: ECB Lagarde (Friday).

Eminent issues on the back boiler: Fragmentation risks. Kickstart of the ECB hiking cycle in July? Asymmetric economic recovery post-pandemic in the euro bloc. Impact of the war in Ukraine on the region’s growth prospects and inflation.

EUR/USD levels to watch

So far, spot is down 0.37% at 1.0118 and faces the next contention at 1.0071 (2022 low July 8) seconded by 1.0060 (low December 11 2002) and finally 1.0000 (psychological level). On the upside, a breakout of 1.0538 (55-day SMA) would target 1.0615 (weekly high June 27) en route to 1.0773 (monthly high June 9).

EUR/USD has dropped below 1.0100 for the first time in nearly 20 years. In the view of FXStreet’s Eren Sengezer, it would not be surprising to see the euro hit parity against the dollar at this point.

Focus shifts to June Nonfarm Payrolls data from the US

“An upbeat NFP print coupled with strong wage inflation could provide a boost to the dollar. On the other hand, disappointing figures could trigger a dollar selloff but the currency's weakness is likely to remain short-lived with investors seeking refuge in that scenario.”

“The descending regression channel coming from late-June stays intact and the pair's technical correction is likely to meet resistance at the upper limit of that channel at 1.0150. With a four-hour close above that level, EUR/USD could extend its recovery toward 1.0200 (psychological level, static level, 20-period SMA).”

“On the downside, interim support seems to have formed at 1.0070 (static level) before the pair could target the all-important parity.”

See – NFP Preview: Forecasts from 10 major banks, labour market loses momentum

The upside bias on USD/CNH seems to have ebbed somewhat and the pair could now trade between 6.6600 and 6.7400 in the next few weeks.

Key Quotes

24-hour view: “Our expectations for USD to ‘trade sideways between 6.7050 and 6.7250’ was incorrect as it dropped to a low of 6.6919. While downward momentum has not improved by much, USD could decline but a break of 6.6820 is unlikely. Resistance is at 6.7040 followed by 6.7140.”

Next 1-3 weeks: “Two days ago (06 Jul, spot at 6.7140), we highlighted that shorter-term upward momentum is beginning to build and the risk of a break of 6.7400 has increased. However, USD has not been able to make any headway on the upside and the build-up in momentum has fizzled out. In other words, USD is likely to continue to consolidate and trade between 6.6600 and 6.7400 for now.”

- Sustained USD buying interest pushed USD/CHF to a fresh multi-week high on Friday.

- The cautious market mood underpinned the safe-haven CHF and acted as a headwind.

- Traders also seemed reluctant to place aggressive bets ahead of the key US jobs report.

The USD/CHF pair prolonged its recent strong bounce from sub-0.9500 levels and gained some follow-through traction for the seventh successive day on Friday. The momentum pushed spot prices to over a three-week high during the first half of the European session, though stalled just ahead of the 0.9800 round-figure mark.

Following the previous day's brief pause, the US dollar was back in demand and shot to a fresh two-decade high amid expectations for more aggressive Fed rate hikes. The market bets were reaffirmed by hawkish minutes of the June 14-15 FOMC meeting released on Wednesday, indicating that another 50 or 75 bps rate hike is likely at the July meeting. This, in turn, was seen as a key factor that continued pushing the USD/CHF pair higher and contributed to the ongoing positive move.

That said, the prevalent cautious mood around the equity markets offered some support to the safe-haven Swiss franc and kept a lid on any further gains for the USD/CHF pair, at least for now. Traders also seemed reluctant to place aggressive bets and might prefer to wait for Friday's release of the closely-watched US monthly jobs data. The popularly known NFP report will play a key role in influencing the near-term USD price dynamics and provide a fresh directional impetus to the major.

The US economy is expected to have added 268K jobs in June, down from 390K in the previous month. Meanwhile, the unemployment rate is expected to hold steady at 3.6% during the reported month. Any significant divergence from the expected reading would infuse some volatility in the financial markets. This, in turn, will drive demand for the USD and produce short-term trading opportunities around the USD/CHF pair on the last day of the week.

Technical levels to watch

USD/JPY witnessed a quick drop to the 135.50 psychological level after NHK Broadcaster reported that the former Japanese Prime Minister Shinzo Abe passed away.

Although the latest downtick was quickly bought into, as investors were anticipating the bad news following the fateful incident that occurred early Friday.

The former Prime Minister Abe was shot in the chest and collapsed during an election campaign speech in Nara. He was immediately taken to the hospital but an hour later, the Japanese media outlets reported that he was showing no vital signs.

USD/JPY: 15-minutes chart

European Central Bank (ECB) Governing Council member Ignazio Visco said on Friday, “rate hike bigger than 25 bps could be appropriate in September if medium-term inflation expectations don't improve.”

Key quotes

Pace of further "gradual but lasting" tightening will hinge on data and how they affect inflation prospects.

Markets affected in June by unwarranted perception of "particularly aggressive" monetary policy stance.

10-yr btp/bund spread peak of 250 bps hit in early June is not consistent with Italy’s economic fundamentals.

No signs at present of "dangerous wage-price spiral".

Anchored inflation expectations support view monetary policy normalisation can be gradual.

Market reaction

EUR/USD is extending its recovery from fresh two-decade lows of 1.0072, finding some demand on the above comments.

The pair was last seen trading at 1.0116, down 0.41% on the day.

Gold has come under considerable pressure of late and has dropped to a nine-month low.However, the slide in the gold price is excessive in the view of economists at Commerzbank, so the yellow metal is expected to recover.

Main factor weighing on XAUUSD is the firm US dollar

“The main factor weighing on gold price is the strong US dollar, which on a trade-weighted basis has appreciated to its highest level in nearly 20 years.”

“ETF investors are turning their backs on gold. The gold ETFs tracked by Bloomberg registered outflows of around 60 tons in the past two weeks alone.”

“We regard the current price weakness as exaggerated. The persistently high inflation and the risk of a recession argue in favour of gold, which suggests that the price will recover.”

- GBP/USD witnessed fresh selling on Friday and eroded a major part of the overnight gains.

- Domestic issues continued weighin on the British pound and acted as a headwind for the pair.

- Fed rate hike bets lifted the USD to a fresh 20-year high and contributed to the selling bias.

- Investors now look forward to the US monthly employment report (NFP) for a fresh impetus.

The GBP/USD pair attracted fresh selling near the 1.2055 region on Friday and has now reversed a major part of the previous day's positive move. The intraday downfall picked up pace during the early European session and dragged spot prices to a fresh daily low, back closer to the 1.1900 mark in the last hour.

The British pound did get a minor lift on Thursday after Boris Johnson announced that he would quit as British Prime Minister and ended the recent political drama at 10 Downing Street. The market reaction, however, turned out to be short-lived as Johnson's departure was almost a certainty and was largely priced in by markets. Furthermore, other domestic issues continued acting as a headwind for sterling, which, along with a fresh bout of the US dollar buying, exerted fresh downward pressure on the GBP/USD pair.

Investors remain concerned that the UK government's controversial Northern Ireland Protocol Bill could trigger a trade war with the European Union amid the cost of living crisis. Furthermore, the Bank of England is expected to adopt a gradual approach toward raising interest rates amid growing recession fears, which further undermined the GBP. In contrast, minutes of the June 14-15 FOMC meeting released on Wednesday reinforced bets for a faster policy tightening and continued lending support to the US dollar.

In fact, policymakers emphasized the need to fight inflation even if it meant slowing an economy and indicated that another 50 or 75 bps rate hike is likely at the July meeting. Apart from this, the prevalent cautious market mood pushed the safe-haven greenback to a fresh two-decade high, which further contributed to the GBP/USD pair's intraday decline. Market participants now look forward to the US monthly jobs report (NFP), due later during the early North American session, for a fresh trading impetus.

Technical levels to watch

Here is what you need to know on Friday, July 8:

Following Thursday's choppy market action, investors seem to have turned cautious ahead of the US June jobs report on Friday. The US Dollar Index continues to edge higher above 107.00, US stock index futures are down between 0.4% and 0.6% and the 10-year US T-bond yield stays calm near 3% following the two-day rebound. The European economic docket will not be featuring any high-impact data releases ahead of the weekend. Statistics Canada will release the Unemployment Rate data for June as well.

Nonfarm Payrolls Preview: Three dollar-positive scenarios, only one negative one.

Wall Street's main indexes closed decisively higher on Thursday as risk flows dominated the markets. Growing concerns over China going into another lockdown and recession fears, however, don't allow a steady risk rally to take place.

EUR/USD slumped below 1.0100 during the European trading hours on Friday and touched its lowest level in nearly 20 years. The pair managed to recover a small portion of its daily losses but continues to trade deep in negative territory. The European Central Bank's (ECB) June policy meeting showed on Thursday that Governing Council members agreed the revised medium-term inflation outlook required further steps to be taken in normalising monetary policy.

GBP/USD came under heavy bearish pressure early Friday and fell below 1.1950. British Prime Minister Boris Johnson announced his resignation on Thursday. Bank of England (BOE) policymaker Catherine Mann argued on Thursday that the uncertainty about the inflation process was strengthening the case for front-loading interest rate rises.

USD/JPY continues to move sideways below 136.00 following a steep drop with the initial reaction to reports of Japanese former Prime Minister Shinzo Abe getting shot on Friday while campaigning in the city of Nara.

Gold closed virtually unchanged on Thursday and stays relatively quiet at around $1,740 on Friday.

US June Nonfarm Payrolls Preview: Analyzing gold's reaction to NFP surprises.

Bitcoin benefited from the risk-positive market environment and rose to its highest level in three weeks above $22,000 early Friday before erasing a large portion of its daily gains. Ethereum closed the previous two days in positive territory and climbed above $1,200 on Friday.

- GBP/JPY came under fresh selling pressure on Friday and was pressured by a combination of factors.

- Reviving safe-haven demand boosted the JPY and triggered the initial leg of the intraday downfall.

- Domestic issues continued undermining the British pound and also contributed to the selling bias.

The GBP/JPY cross witnessed an intraday turnaround from the vicinity of the 164.00 mark on Friday and has now erased a major part of the previous day's gains. Spot prices continued losing ground through the early European session and dropped to a fresh daily low, around the 162.00 round figure in the last hour.

The Japanese yen drew haven flows on Friday after former Japanese Prime Minister Shinzo Abe was shot while delivering a speech in the western city of Nara. This, along with the emergence of fresh selling around the British pound, exerted downward pressure on the GBP/JPY cross on the last day of the week.

The overnight market reaction to UK Prime Minister Boris Johnson's resignation turned out to be short-lived as his departure was almost a certainty and largely priced in by markets. Furthermore, Brexit woes, along with expectations for a less hawkish Bank of England, acted as a headwind for sterling.

Investors remain concerned that the UK government's controversial Northern Ireland Protocol Bill could trigger a trade war with the European Union amid the cost of living crisis. Adding to this, growing recession fears could force the BoE to adopt a gradual approach toward raising interest rates.

The fundamental backdrop supports prospects for the resumption of a nearly three-week-old downtrend. That said, repeated bounces from the 200-day SMA warrant caution for bearish traders amid a big divergence in the monetary policy stance adopted by the Bank of Japan and other major central banks.

Technical levels to watch

Following a brief consolidation phase during the Asian trading hours on Friday, EUR/USD came under heavy bearish pressure in the European morning and touched its weakest level since December 2002 below 1 .0100. The pair is now less than 100 pips away from hitting parity.

The risk-averse market environment on Friday seems to be providing a boost to the greenback and causing the pair to continue to push lower. US stock index futures are down between 0.2% and 0.3% while the US Dollar Index rises 0.65% at 107.75.

Later in the day, the US Bureau of Labor Statistics will release the June jobs report. Nonfarm Payrolls are expected to rise by 268,000 in June following May's better-than-forecast increase of 390,000.

Nonfarm Payrolls Preview: Three dollar-positive scenarios, only one negative one.

EUR/USD 15-min chart

The dollar has remained close to its recent highs. Today's Nonfarm Payrolls data in the US should show a slowdown in hiring, but economists think only a big miss can trigger a dovish re-pricing in the Fed's rate expectations, and the dollar should be able to consolidate around recent highs.

NFP unlikely a game-changer

“We think that only a very weak reading today can trigger a sizeable re-pricing in the market’s Fed rate expectations given the Bank’s explicit strong focus on fighting inflation and CPI numbers next week will surely carry a much bigger weight.”

“The Fed's underlying narrative should continue to provide some support to the dollar, which incidentally seems to embed a larger risk of a global slowdown now, and likely some growing divergence between the economic outlook for North America and the rest of the world (Europe, above all).”

“We expect the dollar to consolidate around current levels today, and DXY to close the week around 107.00.”

See – NFP Preview: Forecasts from 10 major banks, labour market loses momentum

Canada’s jobs numbers should show a modest slowdown in hiring. However, USD/CAD is set to be moved by external factors, which could lift the pair to the 1.31/32 area, economists at ING report.

Jobs data unlikely to impact BoC rate expectations

“Consensus is centred around a 22K headline reading today. We think only a markedly weak reading today can force a dovish re-pricing of BoC rate expectations. Markets are fully pricing in a 75 bps rate hike, and marginally speculating on an even larger increase next week. We expect 75 bps and a lingering hawkish statement.”

“USD/CAD should remain primarily a function of global factors: risk sentiment and commodities above all.”

“Upside risks for the pair persist in the short term, despite the constructive domestic picture, and a move to the 1.31-1.32 area is surely possible.”

See – Canadian Jobs Preview: Forecasts from five major banks, fairly moderate employment growth in June

The euro received very little support from the recovery in sentiment in the eurozone (EuroStoxx up 2%) on Thursday. In the view of economists at ING, EUR/USD remains at risk of hitting parity soon as concerns about a gas crunch in the EU persist.

EUR still looking vulnerable

“Concerns about a gas crunch in the EU remain elevated, as the Nord Stream 1 pipeline is due to shut for 10 days of annual maintenance on Monday and some fear Russia may not resume flows at the end of that period.”

“We expect to hear more on euro weakness from ECB members, but the predominance of external downside risks still suggests a somewhat limited ability for hawkish rhetoric to lift the currency.”