- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 10-07-2022

- Gold price is oscillating below 1,750.00 as odds of soaring price pressures are supporting the greenback.

- The collaboration of lower paychecks and the higher inflation rates will bring a serious slump in the overall demand.

- Consolidation is expected ahead as the RSI is oscillating in a 40.00-60.00 range.

Gold price (XAU/USD) is displaying back-and-forth moves in a narrow range of $1,742.93-1,744.62 in the Asian session. The precious metal is auctioning below the round-level resistance of $1,750.00 as the market participants are expecting an acceleration in the price pressures.

The gold prices may face severe heat as the higher inflation print by the US Bureau of Labor Statistics will strengthen the greenback. As per the market consensus, the US Consumer Price Index (CPI) is seen higher at 8.7% than the prior estimate of 8.6%. This will compel the Federal Reserve (Fed) to feature a consecutive 75 basis point (bps) interest rate hike.

However, the inflation rate in conjunction with the lower Average Hourly Earnings is not painting a rosy picture for the greenback. Soaring price pressures are highly required to be equalized with higher earnings and stagnancy in the wage rates is hurting the ‘paychecks’ of the households. This may have a significant impact on the aggregate demand as lower-valued paychecks will result in lower consumption and savings for the households.

Gold technical analysis

On an hourly scale, the gold prices have turned sideways in a range of $1,730.73-1,752.49 after a downside move. The 20-period Exponential Moving Average (EMA) at $1,742.35 is overlapping with the prices of the precious metal. Meanwhile, the Relative Strength Index (RSI) (14) is oscillating in the 40.00-60.00 range, which bolsters the odds of consolidation ahead.

Gold hourly chart

- USD/CAD oscillates below the critical support of 1.2960 as BOC is expected to hike rates by 75 bps.

- Canada’s lower Unemployment Rate may support the BOC to announce the bumper rate hike.

- This week, the US CPI will be of utmost importance, which is seen at 8.7%.

The USD/CAD pair is auctioning below the critical support of 1.2960 as investors are supporting loonie against the greenback on upbeat Canada’s Unemployment data. On a broader note, the pair has declined gradually after re-testing the critical resistance of 1.3083 on Wednesday.

The jobless rate in Canada landed at 4.9%, lower than the estimates and the prior release of 5.1%. This has strengthened the Bank of Canada (BOC) to elevate its interest rates to a decent extent, which is due on Wednesday. As per the market consensus, the BOC may announce a rate hike by 75 basis points (bps). The occurrence of the same will drive the interest rates officially to 2.25%.

Soaring price pressures in the Canadian economy are demanding a bumper rate hike announcement by BOC Governor Tiff Macklem. The inflation rate in Canada was recorded at 7.7% for May, extremely higher than the print of 6.8% recorded in April.

On the dollar front, the US dollar index (DXY) has displayed a minor rebound at the open. The DXY will remain on the tenterhooks ahead of the US Consumer Price Index (CPI), which will release of Wednesday. A preliminary estimate for US inflation is 8.7%, 10 bps higher than the prior print of 8.6%. A higher inflation print will bolster the odds of an extreme hawkish stance by the Federal Reserve (Fed) in its July monetary policy meet.

The Shadow Board of the Reserve Bank of New Zealand stated that the central bank should increase the Official Cash Rate (OCR) by 50bp at the upcoming meeting in July.

''Only one member from the business community was divided on whether such a large hike was necessary at the next meeting, given the fine balance between the surge in inflation and signs of slowing economic activity.''

''Beyond the July meeting, Shadow Board members believed further OCR increases were warranted, citing the very intense inflation pressures in the New Zealand economy.''

''There was a wide range of views on the degree of monetary tightening required. While many members pointed to the need for the Reserve Bank to rein in inflation pressures by lifting interest rates, emerging signs of an easing in demand raised concerns about the longer-term growth outlook.''

''These concerns meant some Shadow Board members saw limited further tightening as necessary over the coming year. The release of the latest June quarter NZIER Quarterly Survey of Business Opinion highlighted the tricky balancing act faced by the Reserve Bank as inflation pressures intensify against a backdrop of slowing demand in the New Zealand economy.''

NZD/USD update

Meanwhile, the kiwi is trying to make tracks to the upside and has the round 0.6200 in its sights. A break of that will open risk to the 0.6210 imbalance area on the hourly chart.

- GBP/USD is expected to display more gains above 1.2050 ahead of US CPI.

- Lower Average Hourly Earnings and higher US CPI will bring a slump in the aggregate demand.

- Political turmoil in the UK economy has not strengthened the pound bears.

The GBP/USD pair is aiming northwards as the opening hour is displaying the strength of the pound bulls. The cable is expected to extend its gains after overstepping the critical hurdle of 1.2050 amid exhaustion in the US dollar index (DXY).

The DXY remained vulnerable on Friday as a failure to sustain near the 19-year high of 107.79 resulted in a steep fall. The DXY closed near the critical support of 106.84 and more downside is expected as lower Average Hourly Earnings are warranting a slump in the aggregate demand ahead.

A higher inflation rate in the US economy should be met by higher ‘paychecks’ by the households as lower earnings may force the households to cope with lower consumption and savings. This may result in lower aggregate demand by the households, which may result in lower Gross Domestic Product (GDP). The occurrence of the same will affect the US economy in a significant manner.

Going forward, investors’ focus will remain on the US Consumer Price Index (CPI), which is due on Wednesday. The US CPI is seen at 8.7%, higher than the prior print of 8.6% on an annual basis. However, the core CPI is seen lower at 5.7% vs. 6% recorded on a yearly basis.

On the pound front, the political turmoil has not strengthened the sterling bears. Former British Finance Minister Rishi Sunak, on Friday, showed his intentions of running in the contest to replace Prime Minister Boris Johnson. The news wires from the UK’s administration state that the ongoing stance of political instability won’t affect the progression of the Northern Ireland Protocol (NIP), as per Reuters.

- AUD/USD aims to establish above 0.6880 as the DXY may deliver a sluggish performance.

- The US NFP remained stronger however the Average Hourly Earnings have ruined the market sentiment.

- Aussie jobless rate may skid to 3.8% from the prior release of 3.9%.

The AUD/USD pair is attempting to cross the critical resistance of 0.6850 at the open as Friday’s exhaustion in the US dollar index (DXY) is expected to turn into a sluggish performance. The asset is aiming to for more gains and more upside will be warranted on overstepping the major hurdle of 0.6880.

The greenback bulls are expected to underperform despite the upbeat US Nonfarm Payrolls (NFP) data. The US economy added 372k jobs in June, significantly higher than the estimates of 268k but a little lower than the prior release of 384k. The Unemployment Rate remained in line with estimates and the prior print at 3.6%. No doubt, the outperformance of the US economy on the labor market front will empower the Federal Reserve (Fed) to announce extreme rate hikes with much less hesitation.

However, the catalyst which will hurt the US economy is the lower Average Hourly Earnings (AHE) recorded on Friday. On an annual basis, the economic data landed at 5.1%, higher than the estimates of 5% but lower than the former release of 5.3%. When the inflation rate is operating at a runaway pace, lower AHE is not lucrative for US households. Lower AHEs will hurt their paychecks vigorously in times of soaring price pressures. This may result in lower aggregate demand.

On the aussie front, investors are focusing on the employment data which will release on Thursday. The Employment Change is seen severely lower at 25k than the prior release of 60.6K. However, the Unemployment Rate will slip to 3.8% vs. 3.9% reported previously.

- EUR/USD bulls could be about to make their move.

- Traders are watching the US dollar for the start of the week and opening sessions.

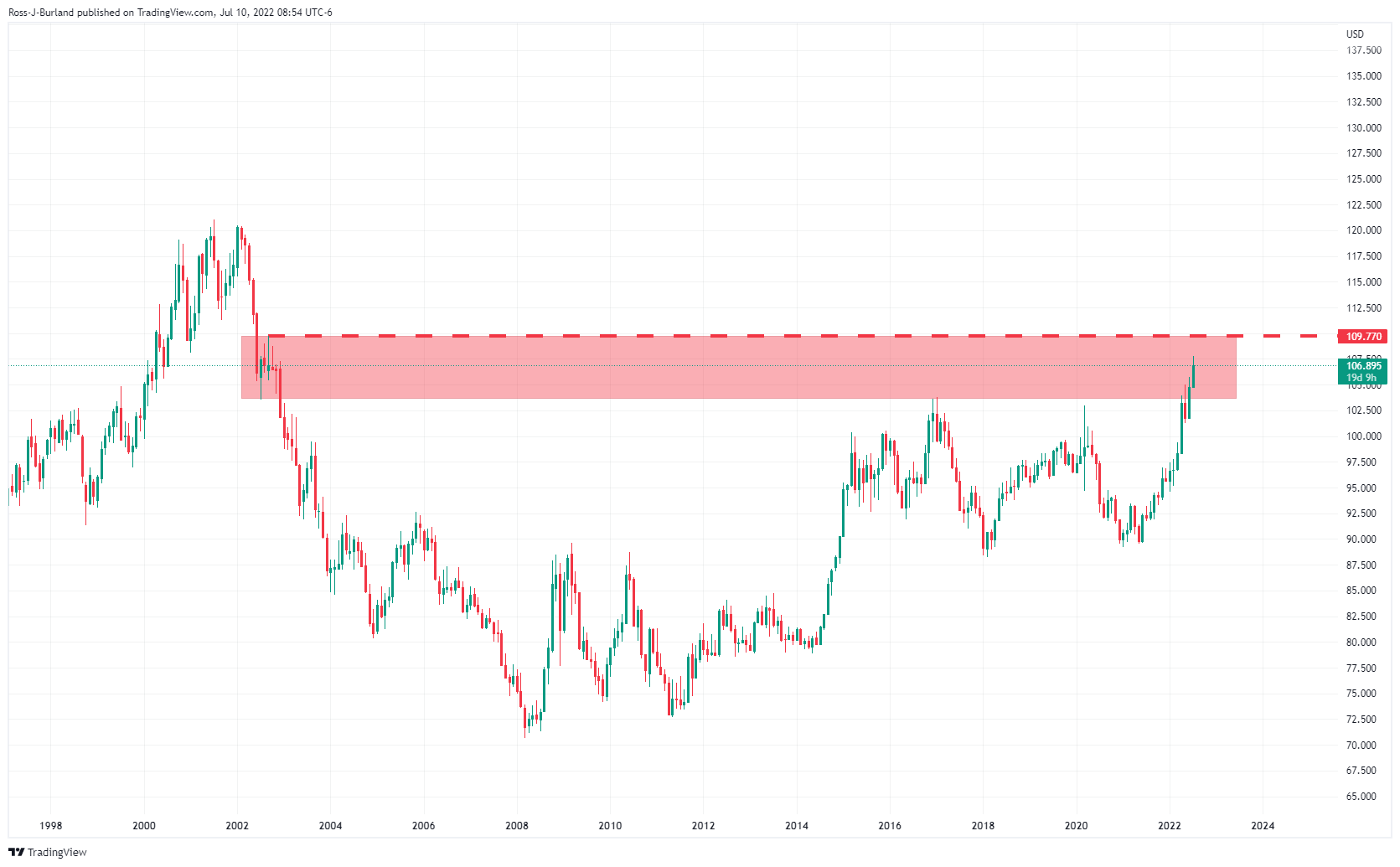

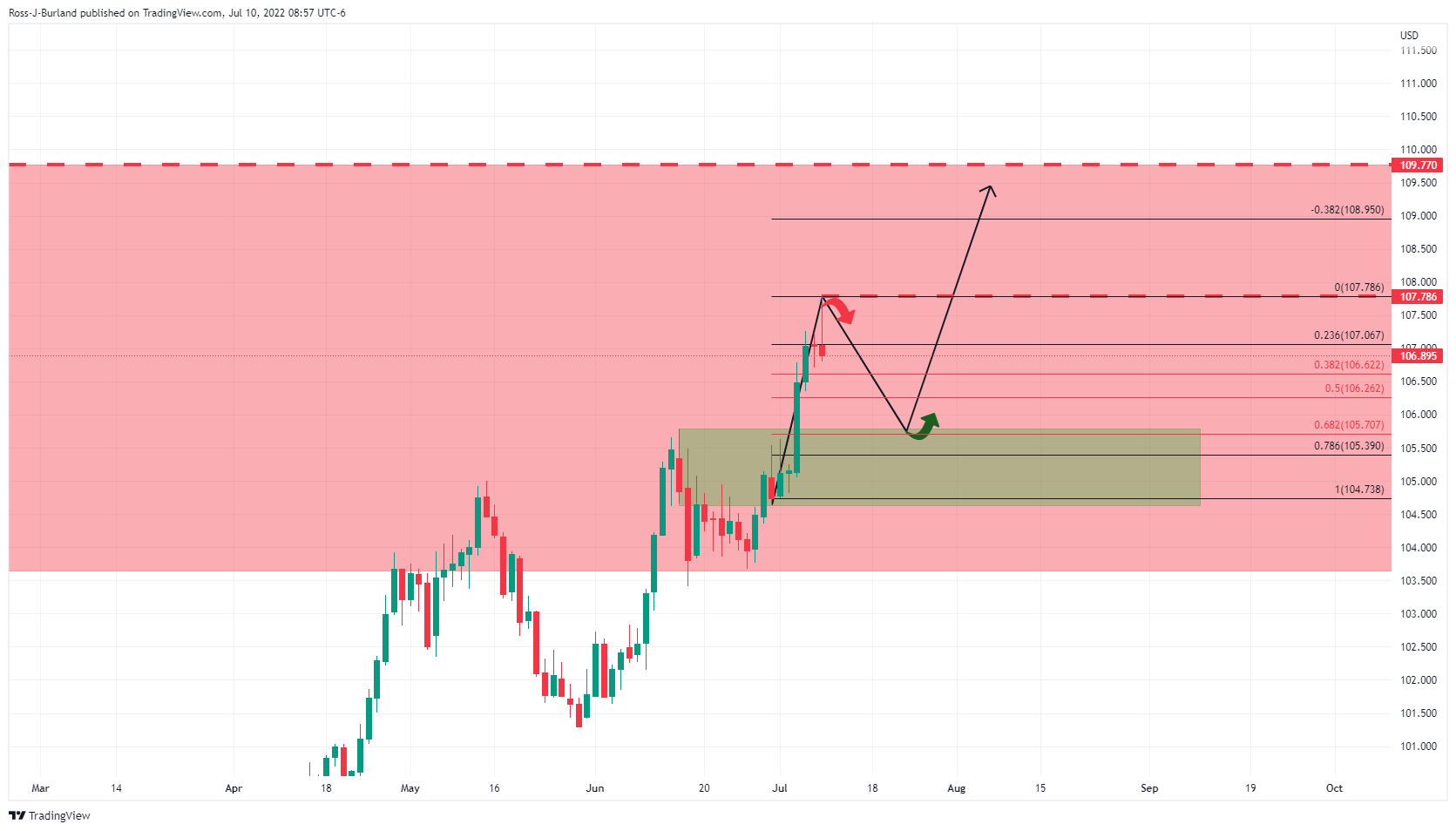

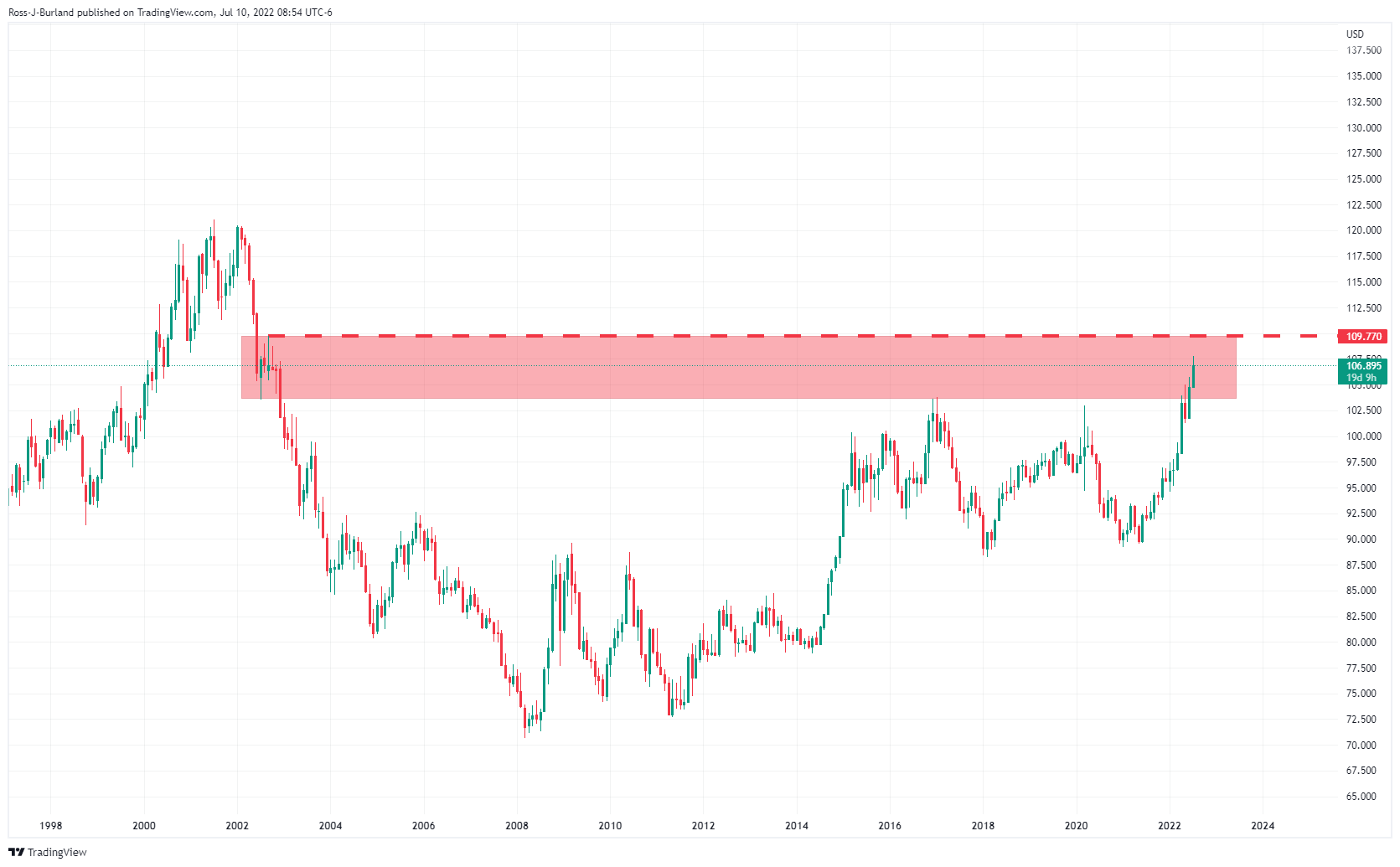

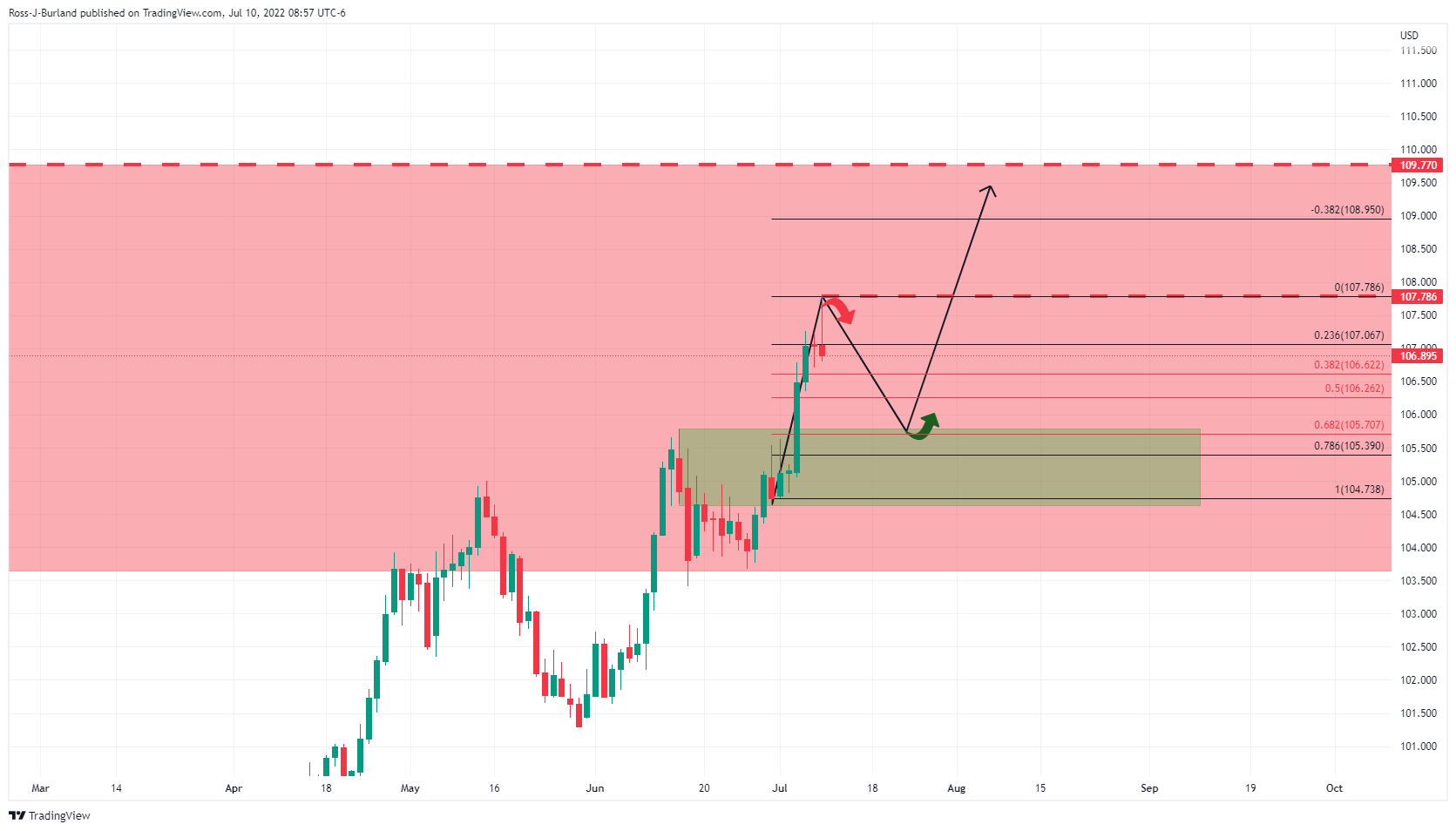

The euro could benefit at the start of the week so long as the greenback continues to correct to the downside. In the charts below, it is illustrated that the DXY is meeting a monthly supply area that could hold off the bulls for a moment giving a rise to prospects of a correction on the daily chart.

The DXY appears to top out near 107.80. A 61.8% Fibonacci retracement sits near prior swing highs near 105.70. If this were to play out, we would have had a bullish setup in the euro for the week ahead.

DXY monthly & daily chart

EUR/USD daily chart

A move lower in the greenback will see the euro climb the Fibo scale, potentially all the way towards the prior lows that meets a 61.8% Fibo.

The Nikkei Asia has reported that Japan's ruling coalition won the majority of seats contested in Sunday's upper house election, with counting still ongoing in some districts.

''But while citizens validated Prime Minister Fumio Kishida's government, the mood among the victors was mostly joyless, as the vote came just two days after the assassination of former leader Shinzo Abe.''

''The ruling Liberal Democratic Party and its smaller partner Komeito together secured more than half the 125 available seats, according to Nikkei projections.''

In other news, the Japanese yen and the US dollar rose in Asia on Friday as investors leapt to safe assets after former Japanese prime minister Shinzo Abe was shot. Abe was shot on Friday while campaigning, a government spokesman said.

The yen fell nearly 16% on the dollar through the first half of 2022 but has lately found support on a safe haven bid and from the risk of a central bank policy shift.

- Gold could be on the verge of a deeper correction to the upside.

- The US dollar is showing signs of topping out in the monthly supply area.

The gold price has corrected to a 23.6% Fibonacci retracement and has left two daily dojis on the charts but a stronger than expected US Services ISM and a solid US Labor report have seen the market add 14bp to end-2022 Fed Funds pricing.

This leaves the US dollar in charge and will keep pressure on gold which hovers above a fresh nine-month low as investors continue to slash their holding of the precious metal. Gold-backed ETFs have seen their holdings fall by 39t over the past week to their lowest level in almost four months.

Nevertheless, the spot market is attempting to correct both on the DXY and gold charts as follows:

DXY daily chart

The DXY is meeting a monthly supply area that could hold off the bulls for a moment giving rise to prospects of a correction on the daily chart as it appears to top out near 107.80. A 61.8% Fibonacci retracement sits near prior swing highs near 105.70. If this were to play out, we would have had a bullish setup in gold for the week ahead.

Gold daily chart

Gold, H4 chart

The question is whether the last low was the spring, otherwise known as the final test lower and commitments from the bulls. A break of $1,750 will be encouraging. On the hourly chart, we have seen a 50% mean reversion and retest of what could be the spring so a bullish open could set the stage for a significant bullish breakout as per the hourly chart:

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.