- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 13-07-2022

San Francisco Federal Reserve Bank President Mary Daly on Wednesday that her most likely posture is a 75bp hike in July but a 100bp is possible she said as reported by the New York Times.

On Tuesday Daly said she believes the US economy will slow to below 2% annual growth as the Fed raises interest rates, but there's enough momentum that it won't stop growing.

"I do expect the unemployment rate to rise slightly, but nothing (like).... what people would think of as a recession," Daly said in an interview on LinkedIn.

USD/CHF takes the bids to refresh intraday high around 0.9810 to post the first daily gains in three during Thursday’s Asian session.

In doing so, the Swiss currency (CHF) pair justifies the hawkish bias portrayed by the USD/CHF options traders.

That said, the one-month risk reversal (RR) for the USD/CHF, a spread between the call options and the put options, brace for the second weekly run-up with the latest print of 0.140.

The options market’s optimism for the USD/CHF pair could be linked to the broad US dollar rally amid fears of higher Fed rates and recession. The market’s risk-aversion amplified the previous day after the US Consumer Price Index (CPI) for June jumped to the highest level in 40 years to 9.1% YoY versus 8.8% expected and 8.6% prior.

- Silver fades corrective pullback from yearly low, takes offers to renew daily bottom of late.

- 200-HMA, weekly descending trend line restricts short-term upside.

- Nearby ascending trend line holds the key to mid-$18.00s.

Silver (XAG/USD) remains pressured at around $19.15, reversing the previous day’s rebound during Thursday’s Asian session.

In doing so, the bright metal extends pullback from the 200-HMA and a one-week-old resistance line while refreshing the intraday low.

Given the impending bear cross of the MACD, the XAG/USD prices are likely to extend the latest weakness towards a three-day-old support line, near $18.90 by the press time.

Should the quote fails to rebound from $18.90, the recent multi-month low of $18.74 could offer an intermediate halt before directing the commodity bears towards the 61.8% Fibonacci Expansion (FE) of July 05-13 moves, near $18.50.

Alternatively, a clear upside break of the $19.35 resistance confluence could propel the silver prices towards the 50% Fibonacci retracement (Fibo.) of July 05-12 moves, at $19.47.

Following that, a run-up towards the July 05 peak of $20.20 can’t be ruled out.

That said, silver prices are likely to decline further to the lowest levels since the mid-2020s.

Silver: Hourly chart

Trend: Further weakness expected

- NZDUSD takes offers to reverse the previous day’s gains.

- US CPI propelled odds of the higher Fed rate, recession.

- RBNZ’s repeated commentary, economic fears disappointed bulls.

- Second-tier US data may entertain traders, risk catalysts will be crucial for fresh impulses.

NZD/USD remains pressured around 0.6120, snapping the two-day rebound from the yearly low, as risk-aversion weighs on the Antipodeans during Thursday’s Asian session. The Kiwi pair’s latest weakness could also be linked to the Reserve Bank of New Zealand’s (RBNZ) failure to impress bulls even with the 50 basis points (bps) rate hike.

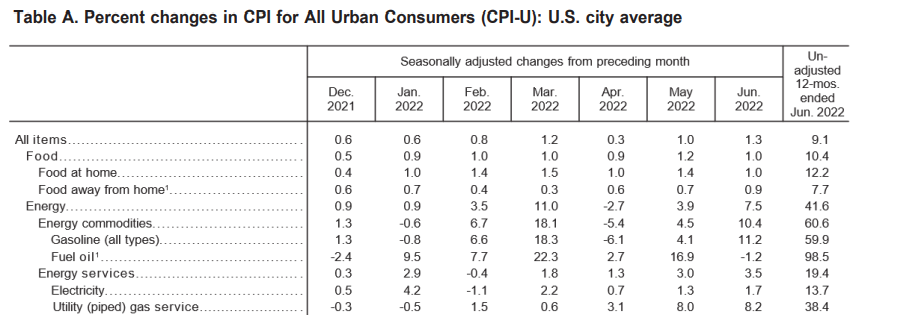

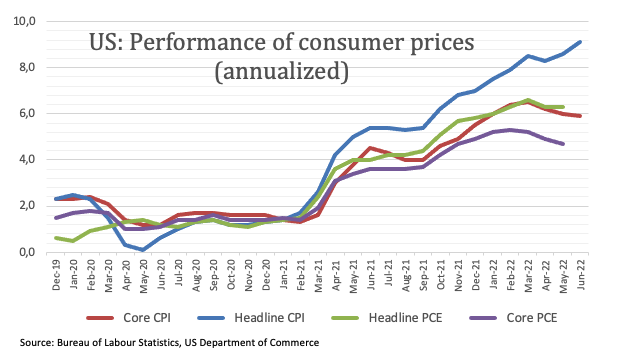

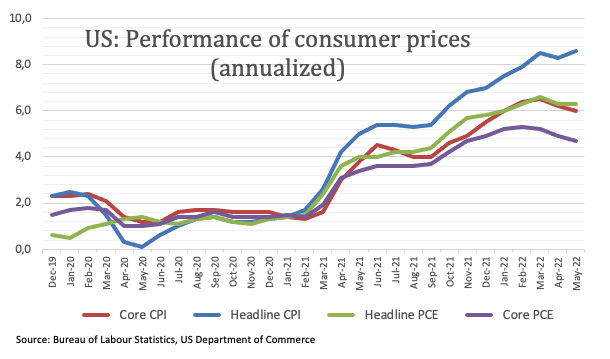

A 40-year high in the US inflation joined a larger-than-life rate hike from the Bank of Canada (BOC) propelled market fears of inflation and recession of late. That said, US Consumer Price Index (CPI) for June jumped to the highest level in 40 years to 9.1% YoY versus 8.8% expected and 8.6% prior. The Core CPI, which excludes volatile food and energy prices, eased to 5.9% from 6% prior but crossed analysts' forecast of 5.8%. It should be noted that the BOC announced a 100 bps rate hike by crossing the market forecasts the previous day.

Following the US data, White House (WH) Economic Adviser Brian Deese told CNBC that the CPI data shows the urgency for Congress to pass legislation to spur semiconductor manufacturing in the US, as reported by Reuters. On the other hand, US President Joe Biden mentioned that CPI data is ‘out of data’ as gas prices have fallen.

Recently, Richmond Federal Reserve President Thomas Barkin conveyed his support for higher rates in the last meeting. On the same line, Cleveland Federal Reserve President Loretta Mester also said, “The data on CPI does not suggest a rate hike in July any smaller than that in June.”

It should be noted that RBNZ matched market expectations of lifting the benchmark rates to 2.5% from 2.0% the previous day. However, the reason for the Kiwi pair’s pullback could be linked to the RBNZ Rate Statement as it said, “Committee noted that while there are near-term upside risks to consumer price inflation, there are also medium-term downside risks to economic activity,” per Reuters. It’s worth noting that the New Zealand central bank’s repeat of May’s Official Cash Rate (OCR) track of peaking just below 4.00% in 2023 also weighed on the NZD/USD prices after the release.

Amid these plays, the Wall Street benchmarks closed negative despite paring most losses while the US 10-year Treasury yields fell four basis points (bps) to 2.93%. It’s worth noting that the US 2-year Treasury yields rose 3.5% on a day to reach the 3.15% level and widened the inversion with the 10-year mark, which in turn hints at recession.

Moving on, NZD/USD traders should pay attention to the inflation and recession updates, as well as the second-tier US data for fresh impulse. Though, major attention will be given to the risk catalysts for clear directions.

Technical analysis

Any recovery remains elusive until NZD/USD trades successfully beyond the 0.6175 resistance confluence including the previous support line from early May and a monthly descending trend line.

- The EUR/JPY remains heavy in the week, down 0.25%.

- Sentiment remains negative, meaning that the EUR/JPY might be under selling pressure.

- EUR/JPY is neutral-bearish, and a break below 138.00 might send the pair towards 136.00.

The EUR/JPY is almost flat as the Asian Pacific session begins, though on Wednesday finished on a higher note, gaining 0.57% despite a dampened market sentiment spurred by hot US inflation at 41-year highs, Fed stakes of hiking 100 bps elevated, and consequently, a possible recession due to restrictive monetary policy worldwide. At the time of writing, the EUR/JPY is trading at 138.13, slightly up 0.09%.

EUR/JPY’s Wednesday price action illustrates the cross-currency beginning trading around 137.30s, consolidating around the 137.30s-75 area before European traders got to their offices. At that time, the pair seesawed between 137.22-137.96 on mixed EU economic data but rallied in tandem with the EUR/USD. Once the latter tumbled below parity and quickly recovered, it rallied towards daily highs above 1.0100. So, the EUR/JPY followed suit and reached a Wednesday’s high at 138.79, and once the dust settled down, the cross dived towards the 138.10s area.

EUR/JPY Daily chart

From a technical analysis perspective, the EUR/JPY is neutral. On the upside, it has the 20 and 50-day EMAs, but on the downside, the 100 and 200-day EMAs. Oscillators, led by the Relative Strength Index (RSI), are in bearish territory, tilting the pair slightly to the downside and further cementing that, is EUR/JPY buyers’ failure to conquer the 50-day EMA at 139.07, exposing the pair to selling pressure.

Therefore, the EUR/JPY first support would be the 138.00 figure. Once cleared, the next support would be the confluence of the July 6 and July 12 swing lows around the 136.85-137.01 area, followed by a challenge to the 100-day EMA at 136.33.

EUR/JPY Key Technical Levels

- AUD/USD fades the previous day’s recovery moves after a volatile day.

- US dollar gained on multi-year high inflation data before Wall Street gains saved Aussie.

- Yield curve inverted sharply and propeled recession fears, keeping bears hopeful.

- Aussie data for June hints at softer Employment Change, Unemployment Rate.

AUD/USD fails to extend the corrective bounce off the two-year low as it takes offers to renew the intraday low around 0.6745 during Thursday’s initial Asian session. In doing so, the Aussie pair portrays the market’s fears of recession, as well as the Fed’s aggression, ahead of the key Australia employment data for June.

Having seen a four-decade high US inflation, markets were bombarded with calls for higher rates and the yield curve spread recession fears by widening further. However, mixed reactions from the US politicians appeared to have helped the AUD/USD recover some of the losses before recalling the bears.

That said, US Consumer Price Index (CPI) for June jumped to the highest level in 40 years to 9.1% YoY versus 8.8% expected and 8.6% prior. The Core CPI, which excludes volatile food and energy prices, eased to 5.9% from 6% prior but crossed analysts' forecast of 5.8%.

Following the data, White House (WH) Economic Adviser Brian Deese told CNBC that the CPI data shows the urgency for Congress to pass legislation to spur semiconductor manufacturing in the US, as reported by Reuters. On the other hand, US President Joe Biden mentioned that CPI data is ‘out of data’ as gas prices have fallen.

Recently, Richmond Federal Reserve President Thomas Barkin conveyed his support for higher rates in the last meeting. On the same line, Cleveland Federal Reserve President Loretta Mester also said, “The data on CPI does not suggest a rate hike in July any smaller than that in June.”

That said, the Wall Street benchmarks closed negative despite paring most losses while the US 10-year Treasury yields fell four basis points (bps) to 2.93%. It’s worth noting that the US 2-year Treasury yields rose 3.5% on a day to reach the 3.15% level and widened the inversion with the 10-year mark, which in turn hints at recession.

Moving on, Australia’s Consumer Inflation Expectations for July will precede the June month employment report to direct short-term AUD/USD moves. Forecasts suggest an easing in the headline Employment Change figure to 25L versus 60.6K prior whereas Unemployment Rate is expected to ease to 3.8% versus 3.9% previous readings.

Also read: Australian Employment Preview: Could it save the aussie?

Technical analysis

Unless crossing the monthly resistance line, around 0.6870, AUD/USD stays on the bear’s radar. However, a downward sloping trend line from late January, at 0.6738 by the press time, followed by the latest low near 0.6710, could limit the short-term downside of the pair. It’s worth noting that RSI holds lower grounds while MACD teases bull cross.

“I haven't seen any solid proof that inflation has reached its peak,” said Cleveland Federal Reserve President Loretta Mester said while speaking at the Bloomberg interview.

Key comments

The CPI report was uniformly negative.

We don't need to decide on rates today.

Says she is not seeing any convincing evidence that inflation has peaked.

At the July meeting, we'll talk about the policy path.

Tightening must be done carefully, purposefully.

Fed will need to extend well beyond the neutral rate.

The data on CPI does not suggest a rate hike in July any smaller than that in June.

FX implications

The news exerts downside pressure on the EUR/USD as it fades the previous day’s corrective pullback while retreating to 1.0050 during the early Asian session on Thursday.

“When looking at Germany and Italy, the immediate economic repercussions of Russia's plan to restrict supply in mid-June are likely to be limited,” said global rating agency Moody’s on late Wednesday.

Additional comments

Russian gas cuts will prevent reserves from amassing quickly before the winter season.

If Russian supplies don't begin when maintenance on Nord Stream I is finished at the end of July there will be an increase in energy prices.

If Russian supplies stop flowing when the maintenance on Nord Stream I is complete, governments will be compelled to implement some type of rationing.

When Russian gas supplies are cut off, negative economic impacts that will increase both countries' debt burdens.

Italy's financial situation, which is currently difficult, will probably get worse if it is completely cut off from Russian supplies.

Italy could surpass its goal of becoming free of Russian gas by 2025.

Germany's target of reducing its dependency on Russian gas to 10% by 2024 seems ambitious.

Market reaction

The analytics from the global rating giant adds strength to the bearish bias over the EUR/USD. That said, the pair was last seen pressured around 1.0050.

Also read: EU cuts Euro-Area GDP forecast, sees 7.6% inflation, draft shows – Bloomberg

- The confluence of trendline and 100-MA has acted as a hurdle for the pound bulls.

- A (40.00-60.00) range by the RSI (14) hints at a consolidation ahead.

- An establishment below the psychological support of 1.2000 has activated a longer-term downside bias.

The GBP/USD pair is displaying a lackluster performance in the early Tokyo session as the traded range is peanuts against usual. After a volatile Wednesday, the cable looks to turn sideways to ease-off standard deviation first and then will look for a decisive move. On a broader note, after surrendering the psychological support of 1.2000, odds are favoring for a downside bias. Therefore, investors should take more precautions on taking longs.

The greenback bulls have comfortably defended the confluence of the downward sloping trendline plotted from June 27 high at 1.2324 and the 100-period Simple Moving Average (SMA) near 1.1950. Also, the cable has slipped below the 20-period Exponential Moving Average (EMA) at 1.1900, which signals that the short-term trend has also turned southwards.

Meanwhile, the Relative Strength Index (RSI) (14) has shifted into the 40.00-60.00 range, which signals a consolidation ahead.

The cable is expected to display more losses if the asset drops below Monday’s low at 1.1866. An occurrence of the same will drag the asset to the round-level support of 1.1800, followed by a 26 March 2020 low at 1.1777.

Alternatively, a decisive move above Friday’s high of 1.2056 will send the asset towards July 4 high at 1.2161. A breach of the latter will drive the cable towards June 28 high at 1.2292.

GBP/USD hourly chart

-637933485043504023.png)

“The euro area’s rebound from the pandemic will be weaker than anticipated while inflation will be faster because of Russia’s war in Ukraine, according to draft projections by the European Commission,” per Bloomberg.

More details

With surging prices crimping demand and the danger of winter energy shortages draining confidence, gross domestic product is likely to advance 2.6% this year and 1.4% in 2023 -- down from May predictions for gains of 2.7% and 2.3%, according to new forecasts from the European Union executive arm seen by Bloomberg.

Inflation, already at a record that’s more than four times the European Central Bank’s 2% target, is now seen at 7.6% in 2022 and 4% next year, up from 6.1% and 2.7%.

The predictions may still change before they are officially published Thursday.

Some economists see a recession in Europe as inevitable, even without the Kremlin halting energy supplies, with inflation also likely to remain elevated. That’s complicating the task of the ECB, which is only just embarking on a first interest-rate increase in more than a decade.

FX implications

EUR/USD remains pressured around the lowest levels since December 2002 by the press time. The major currency pair was last seen around 1.0057.

- USD/CAD is facing barricades around 1.2980 amid a rangebound DXY.

- The BOC has paddled its interest rates by 1% to tame the soaring inflation.

- An inflation rate above 9% in the US economy has opened doors for a 100 bps rate hike by the Fed.

The USD/CAD pair attempted a rebound from 1.2940 in the New York session and is now facing barricades around 1.2980 as the US dollar index (DXY) has stabilized around 108.00. Earlier, the asset displayed wild swings after the Bank of Canada (BOC) elevated its interest rate by 100 basis points (bps). Adding to that, the strong Consumer Price Index (CPI) report by the US also added fuel to the fire.

BOC Governor Tiff Macklem announced a rate hike by a whopping figure of 1% to 2.5%. The consensus for the extent of the rate hike was 75 basis points (bps). It takes a cold heart to announce a mega rate hike. To tame the inflation, the BOC was forced to create difficulties for the borrowers.

The extent of a rate hike is itself dictating that the inflation monster is no more a joke now. Costly fossil fuels and food products are accelerating the price pressures swiftly and the central bank was left with no other option than to announce the unusual.

Meanwhile, the DXY rebounded firmly after hitting a low of 107.48 on Wednesday. The inflation rate in the US economy has climbed to 9.1%, much higher than the estimates and the prior release of 8.8% and 8.6% respectively. Apart from that, the core CPI has been trimmed to 5.9% from the former print of 6%.

The higher inflation rate has bolstered the odds of one more 75 bps rate hike by the Federal Reserve (Fed). No doubt, the Fed could also follow the footprints of the BOC and may announce a rate hike by 100 bps as the plain-vanilla CPI has surpassed 9% and prior rate hikes have managed to bring a minute trim in the core CPI.

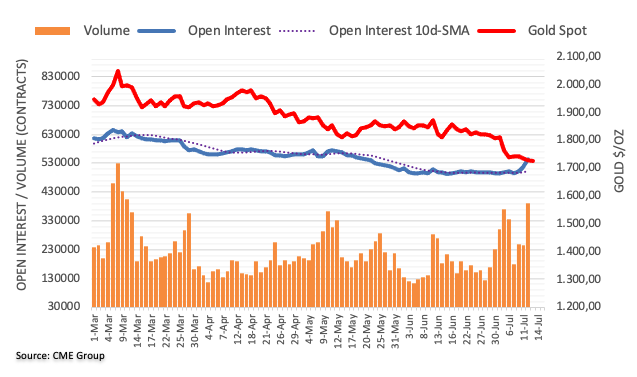

- Gold price has been a volatile asset on a mixed day of sentiment in markets.

- US CPI data has been a catalyst for volatility in the financial and commodities pace.

- The US dollar is sucking up the flow in forex and weighing gold.

Gold Price (XAU/USD) is higher by 0.4% in the late New York trade on Wednesday. The yellow metal has rallied from a low of $1,707.16 to reach a high of $1,745.42 so far on the day. The outlook is mixed for the yellow metal following a technical move lower that has corrected sharply in North American trade while the fundamentals open up further downside for precious metals and the Federal Reserve will need to remain aggressive at a time when global growth concerns are elevated.

Gold driver of the day, US inflation, CPI

It has all been about the US inflation report on Wednesday. The US June Consumer Price Index climbed 1.3% MoM, leaving the annual rate at 9.1% YoY. This is much stronger than May’s 8.6% print. The consensus was expectations for an 8.8% lift in prices. However, there was a big jump in last month’s gasoline prices that surged and added 0.5% to the CPI. Analysts at ANZ bank argued that the more worrying aspect of the report was the intensification in core inflation pressures. ''Services, less energy services which account for 57% of the CPI, rose 5.5% YoY. Outside of volatility in energy prices, inflation pressures are broadening. All items less food, shelter and energy rose 0.8% vs 0.6% MoM in May.'' The data least to the yield curve to invert sharply as the risk of the Federal reserve hiking by 75bps blitz financial and commodities markets.

US yields invert, Fed expectations are elevated

The US yield curve inverted sharply as CPI inflation in the US exceeded expectations, with the yield on the US 2-year yield now 3.13%, versus 2.91% for the 10-year. The markets now anticipate that the Fed will raise by another 75bps in not only July's meeting, but as far out as September as well. In fact, analysts at TD Securities note that the market is now pricing in 85bp of hikes in July and 68bp in September.'' We think the Fed will hike 75bp in July and 50bp in September, but see the risk of a 75bp in September. We took off our short 2y Treasury position but remain long 2y TIPS BE and long 30y real rates.'' For gold, which yields nothing for investors, has come under pressure in the face of higher global rates. ''There is no way around it, the Fed has an inflation problem on its hands and the USD will continue to remain king of FX,'' the analysts at TDS argued.

US dollar sucking up the flows

With US inflation surging to a 40-1/2-year high in June, the US dollar has surged to a 20-year high against a basket of currencies and the euro broke below parity against the greenback for the first time since November 2002. The US dollar smile theory has been in play for many months and the DXY topped at 108.583 on Wednesday for a fresh bull cycle high. The USD tends to strengthen both when the US economy outperforms its peers but also when the US economy is extremely weak, so while there are concerns that the Fed is between a rock and hard place, the greenback would be expected to suck up the flow either way which is a headwind for gold as the Fed will need to remain extremely aggressive at a time when growth concerns are becoming more prominent. ''There is no way around it, the Fed has an inflation problem on its hands and the USD will continue to remain king of FX,'' analysts at TD Securities argued.

Also read: Gold Price Forecast: Post-CPI recovery stalls below critical resistance

Gold outflows steepest since Covid-19 crisis

The analysts at TD Securities explained that while the steepest outflows from broad commodity funds since the Covid-19 crisis sparked a cascade of selling, including from CTA funds, the strong inflation print could still fuel additional downside. ''Indeed, the still extremely bloated length remaining in gold markets from proprietary traders that was accumulated during the pandemic appears complacent in the face of a steadfastly hawkish Fed. In a liquidation vacuum, these positions are now vulnerable, which suggests the yellow metal remains prone to further downside still.''

Gold Price technical outlook

From a weekly perspective, the price could be regarded as extended and a correction is arguably feasible at this juncture. There is a price imbalance from the current week's highs to the week commencing June 27 low. This area meets a 50% mean reversion and a 38.2% Fibonacci retracement before then. However, the focus in the main is on the downside towards monthly lows as illustrated on the chart above.

Can gold prices hold above $1700 as focus shifts to inflation data?

- The inversion of the US yield curve for the 7th straight day exacerbated recession fears, capping AUD/JPY’s upward move.

- AUD/JPY is upward biased, but failures to break above 93.00 opened the door for sellers to send the pair lower.

- The AUD/JPY might tumble towards the 92.20 area in the short term.

The AUD/JPY curtails two days of consecutive losses and rises modestly on Wednesday, close to 0.39%, amidst a dismal market mood. Higher global inflation, US recession fears, and the EU’s energy crisis could begin triggering a flight to safety in the financial markets and helped to put a lid on the AUD/JPY advance, which reached a daily high of around 93.38 before settling around the current price levels. At the time of writing, the AUD/JPY is trading at 92.86.

US equities finished Wednesday’s session with minimal losses but weighed by the further inversion in the US 2s-10s yield curve and money market futures swaps showing the likelihood of a 100 bps rate hike in July, sparked safe-haven flows. So in the last couple of hours, the AUD/JPY slid from around 93.15 to 92.78.

AUD/JPY Daily chart

The AUD/JPY depicts an upward bias, though AUD buyers’ failure to break above the falling wedge illustrated inside a larger rising wedge might open the door for sellers to step in and drag prices lower. Traders should notice that oscillators like the Relative Strength Index (RSI) in negative territory begin to aim lower, further cementing the case for a downward break of both wedges.

Therefore, the AUD/JPY first support would be the 50-day EMA at 92.55. A breach of the latter would expose the July 12 daily low at 91.96, followed by the 100-day EMA at 91.33 and then the 200-day EMA at 87.06.

AUD/JPY 1-hour chart

From a short-term perspective, the AUD/JPY is upwards-to-neutral biased, though the formation of an ascending channel about to be broken to the downside, alongside the breach of the daily pivot point, around the 92.70-80 area, might trip the AUD/JPY pair towards lower prices. Hence, the AUD/JPY path of least resistance is tilted to the downside. The first support would be the 200-hour EMA at 92.65. Break below ill expose the 40-hour EMA at 92.60, followed by the confluence of July’s 12 low and the S1 daily pivot around 92.20-30.

AUD/JPY Key Technical Levels

What you need to take care of on Thursday, July 14:

The American dollar settled marginally lower on Wednesday after the release of the US Consumer Price Index, which soared by 9.1% YoY in June, much worse than the 8.8% expected. The core reading printed at 5.9%, below the previous 6%, but above the 5.8% expected, signaling price pressures are far from over.

The numbers initially spurred risk aversion, with equities diving and government bond yields soaring amid speculation the US Federal Reserve may put larger rate hikes on the table, and hence, increase the risk of a recession.

Germany also published its CPI figure, which was confirmed at 7.6% YoY, as previously estimated.

The EUR/USD pair peaked at 1.0121 but currently trades at around 1.0055, hurt by central banks’ imbalances. The US Federal Reserve has hiked rates multiple times and will likely add another 75 bps this month. The European Central Bank, on the other hand, will start with its modest tightening in July by hiking 25 bps.

Upbeat UK data supported the Pound during European trading hours, as the monthly Gross Domestic Product surged to 0.5% in May, much better than the previous -0.3%. Additionally, Industrial Production in the same month rose by 1.4% YoY, while Manufacturing Production increased by 2.3% YoY, beating expectations. The pair lost ground as the day went by, ending the day at around 1.1890.

The Bank of Canada hiked its policy rate by 100 bps to 2.5% in July, compared to the market expectation for a rate increase of 75 bps. In its policy statement, the BOC acknowledged that it had underestimated inflation since the spring of last year mainly because of global factors. USD/CAD fell to 1.2933, now trading around 1.2980 amid the weak tone of US equities.

The AUD/USD pair holds on to modest gains near 0.6760 ahead of the release of Australian employment data. The country will report June employment data in the upcoming Asian session and is expected to have added a modest 25K new jobs after gaining 60.6K in the previous month, while the Unemployment Rate is foreseen down to 3.8% from 3.9% in May. Ahead of the figures, Australia will also unveil July Consumer Inflation Expectations, with analysts expecting it at 5.9%, down from 6.7% previously.

Gold Price settled at $1,733 a troy ounce, while crude oil prices saw little action, and WTI currently trades at $95.80 a barrel.

Bitcoin Price Prediction: A falling knife or Michael Saylor’s sword in stone pt.2

Like this article? Help us with some feedback by answering this survey:

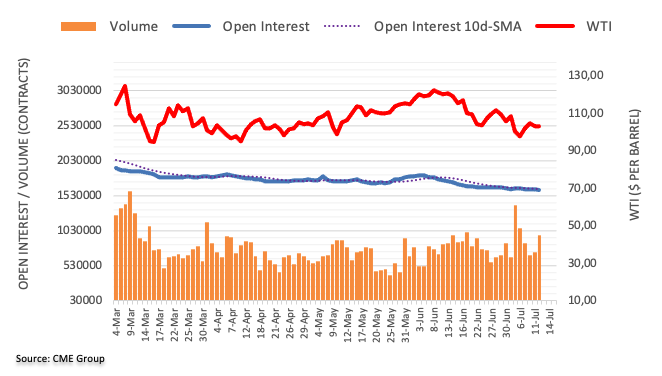

- WTI bulls are pressured on bearish features in fundamentals.

- However, both OPEC and the IEA have issued warnings that the global energy supply crunch is here to stay.

West Texas Intermediate (WTI) spot crude oil is on the bid on the day but is running into some supply during midday New York. The price is up 0.5% at $96.05 during the time of writing but has fallen from a high of $97.94 and ranged from $93.69 the day's low made in Asia on recession worries.

The price was heavy to start the day despite an unexpectedly strong rise in US inventories. However, the US reported inflation continued to accelerate last month. The Consumer Price Index increased 1.3% last month as gasoline and food costs remained elevated, more than the 1.1% expected by economists polled by Reuters. This morning's number is very high and the dollar index reached 108.59, the best since Oct. 2002, from around 107.9 before the data was released.

Meanwhile, in futures, WTI crude oil for August delivery ended up US$0.46 to settle at US$96.30 per barrel, while September Brent crude, the global benchmark, was last seen up US$0.11 to US$99.60. This outcome follows the plunge to the lowest since April that was made the prior day despite tight supplies on worries rising interest rates will lead to a demand-destroying recession.

Additionally, China's fresh lockdowns due to the tests for the Covid-19 omicron variant in the city, with CNN reporting most of the city of 25 million will be subjected to a new round of testing, is adding to the concerns and is a weight on oil prices. This comes following a two-month lockdown of Shanghai in early June, which cut oil demand by more than one million barrels per day,

Elsewhere, bearish data came from the International Energy Agency that said oil production rose by 690,000 barrels per day last month on higher output from the United States and Russia as it cut its forecast for 2022 oil demand to a rise of 1.7-million barrels per day from its June forecast that expected a 1.8-million barrel increase.

The agency stated that "a worsening macroeconomic outlook and fears of a recession are weighing on market sentiment, while there are ongoing risks on the supply side. For now, weaker-than-expected oil demand growth in advanced economies and resilient Russian supply has loosened headline balances."

In other data, in the agency's weekly inventory survey, showed a rise in stocks last week of 3.3-million barrels, while the consensus analyst estimate predicted a drop of 1.93-million barrels. Also, product inventories rose, with gasoline up 5.8-million barrels and distillates rising by 2.7-million barrels.

Furthermore, both OPEC and the IEA have issued warnings that the global energy supply crunch is here to stay and could still get worse. ''These latest warnings are in line with our view that energy supply risks will continue to rise, and remain the most prominent factor driving energy markets,'' analysts at TD Securities said. They also noted that considering that little progress has been made towards solving structural supply challenges, US President Biden's meetings with Saudi Arabia will garner plenty of attention.

- Silver Price shows signs of bottoming as the US 2s-10s yield curve inversion deepens further towards negative territory.

- Gold and Silver prices stage a recovery after reaching YTD lows in the last couple of days.

- Richmond’s Fed Thomas Barkin commented that the high CPI print makes the case to fight inflation even harder.

Silver (XAGUSD) advances sharply, approaching weekly highs near $19.36 on Wednesday, after tumbling below $19.00 in the early New York session in the release of higher than estimated US inflation data sparked an upward reaction in US Treasury yields, a headwind for XAGUSD prices. However, as the New York session progressed, the white metal recovered some ground and is trading around $19.17.

Recession fears increase, and traders begin to seek safety in precious metals

Risk-aversion is the game’s name, but precious metals appear to have found a bottom. Worries about recession had increased substantially amongst investors, as shown by the US 2s-10s yield curve inversion for the last seventh days, at -0.236%, levels last seen since 2001s. In the meantime, the greenback remains weak, but stages a comeback, as shown by the US Dollar Index losing 0.16%, at 107.995, a tailwind for the silver price.

Also read: AUD/USD climbs above 0.6750s after hot US CPI on a weak US dollar

Before Wall Street opened, the US Bureau of Labor Statistics reported that prices paid by consumers rose the most since 1981, by 9.1% YoY, higher than the 8.8% expected and topping the 8.6% May reading. Meanwhile, inflation excluding volatile items like food and energy, the so-called core CPI, expanded at a rate of 5.9% YoY, less than the previous number, but above estimations of 5.7%, further cementing the case for the Fed 75 bps rate hike.

With US inflation data in the rearview mirror, STIRs money market futures have begun to price in an 84% chance that the Federal Reserve would hike 100 bps while fully pricing a 75 bps increase.

Of late in the New York session, Richmond’s Fed President Thomas Barkin, in an interview with the Wall Street Journal (WSJ), said the high CPI print “makes the case even stronger to continue to be resolute to fight inflation” when asked if he would favor a 100 bps rate hike. Barkin added that the size of the hike “is not nearly as important to me as the destination, which is, where do you want to take forward-looking real rates?”

What to watch

Data-wise, on Thursday, the US economic calendar will feature Initial Jobless Claims, inflation on the producer side, and Fed speakers will update the status of the US economy.

Silver (XAGUSD) Key Technical levels

Richmond Federal Reserve president Thomas Barkin said on Tuesday that headline and core inflation is too high.

Key quotes

- Want to have positive real rates at two-year horizon.

- Supported 0.75-point June rate increase.

- Elevated inflation readings make that harder to achieve.

The US economy is slowing as consumers are buffeted by inflation and pandemic-driven demand for goods returns to more normal levels, he said earlier.

“I definitely see signs of softening,” Barkin said, with the evidence “most pronounced in lower income households” and in parts of the economy that saw demand surge during the pandemic.

Barkin also said he was still trying to determine if that is driven by underlying economic strength, or employers scarred by earlier hiring difficulties and determined to stockpile workers.

- A risk-off impulse was no excuse for the AUD/USD to rise but remains negative in the week.

- US inflation above 9%, for the first time since 1981; Fed odds of a 100 bps hike lie at 84%.

- US 2s-10s yield curve inverted the most since 2001; is recession around the corner?

- The Australia business and consumer confidence surveys show pessimism is increasing amongst Australians.

The Australian dollar found bids during the North American session and is edging up 0.33% on Wednesday after a US Department of Labor report showed US inflation refreshing new 40-year highs amidst a mixed market sentiment, as shown by US equities fluctuating but at a brink of turning negative.

Investors’ sentiment is mixed; the US 2s-10s yield curve signals recession

The AUD/USD is trading at 0.6776 after seesawing on a volatile trading session that witnessed the major dipping towards the 0.6725 daily low, followed by a short-lived rally above the 0.6800 figure, until settling down at around the current price level.

During the New York session, the US Bureau of Labor Statistics (BLS) reported that June’s inflation in the US hit 9.1% YoY, the highest reading since 1981, topping the previous reading at 8.6%. At the same time, inflation that strips volatile items like food and energy, the so-called core CPI, rose by 5.9% YoY, less than May’s 6%, but above expectations of 5.7%, further cementing the case for the Fed 75 bps rate hike.

In the meantime, STIRs money market futures have begun to price in an 84% chance that the Federal Reserve would hike 100 bps whilst fully pricing a 75 bps increase.

US 2s-10s yield curve inverted the most since 2001

Of late during the session, its worth noticing that the US 2s-10s yield curve touched levels last seen in the late 2001s, currently at -0.225%, while the US 3months-10-year curve plunges more than 30 bps, to 0.528%, both signaling that investors recession fears are increasing.

Regarding the Australian economy, last Monday’s Business confidence showed that businesses are becoming more pessimistic, dropping to their lowest level in six months. Despite a bad reading, the report disclosed some positives regarding capacity utilization and forward orders. Concerning Australia’s consumer confidence slipped by 2.5% last week.

What to watch

The Australian economic docket will feature employment reports and consumer inflation expectations. Australia’s Employment Change for June is expected at 30K, less than May’s 60.6K, while Consumer Inflation Expectations are foreseen at 6.8%, more than the previous reading. Across the pond, the US economic calendar will feature Initial Jobless Claims, inflation on the producer side, and Fed speakers will update the status of a battered US economy, with inflation above 9%.

AUD/USD Key Technical Levels

- GBP/USD has been pressured despite hawkish UK data.

- US CPI has been the showdown event for the day, propelling the greenback higher within its bullish cycle.

At the time of writing, GBP/USD is trading at 1.1907 and now higher by some 0.20%, rising from a low of 1.1905 to a high of 1.1966 on what has been a volatile day for financial markets with a lot of important economic data.

Firstly, UK Gross Domestic Product (GDP) was climbing 0.5% in May (estimates were 0.0%) and Industrial Production in June climbed 1.4% (estimates - 0.3%). This is a hawkish set of data with both numbers coming out faster than expected with the latest GDP data showing upward revisions across many sectors.

However, the pound has been hamstrung as the markets were in anticipation of the showdown event from the US in June's Consumer Price Index. The greenback has rallied to a 20-year high against a basket of currencies after data on Wednesday showed US CPI surged to a 40-1/2-year high in June.

The consumer price index increased 1.3% last month as gasoline and food costs remained elevated, more than the 1.1% expected by economists polled by Reuters. This morning's number is staggeringly high and the dollar index reached 108.59, the highest since Oct. 2002, from around 107.9 before the data was released. It is now back down to 107.90 which is lending a hand to the British pound.

However, political pressures could reach a climax Tuesday next week as the new 1922 executive meets, risking further pressures on the pound. Nevertheless, the BoE will likely tighten its monetary policy more than we had previously forecast. On the other hand, in view of high inflation, it could be viewed as staying too cautious, which will not help the bulls. The central bank currently assumes that the additional fiscal aid from the government will have a positive economic effect, while the inflationary effect should be low. Nevertheless, traders are taking note that the economy is likely to weaken significantly in the coming quarters and past data, such as June's, is a mere drop in the ocean.

The BoE's dilemma

Analysts at Commerzbank explained that the example of the BoE is a good illustration of the dilemma that many central banks are facing:

''Uncertainty has been very high for quite some time. The war in Ukraine is adding to this uncertainty. And the problem is that the war, with all its consequences, has an inflationary effect on the one hand, but could also weaken the economy on the other hand.''

''Hawkish comments on the part of BoE members increased, which is probably due to the persistently high inflation,'' the analysts explained.

''In the short term, inflation concerns are likely to be decisive in the BoE's monetary policy decisions. A tighter stance is quite possible in the coming months. After all, the BoE held out the prospect of a 50 bp rate hike for the August meeting at its last meeting.'' However, the analysts argued that ''this is not necessarily positive for the pound, because rising interest rates exacerbate the risk of a stronger economic downturn.''

GBP/USD technical analysis

The monthly chart is heavily bearish but a meanwhile correction could be on the cards from the monthly demand area.

As for the daily chart, below, the price could be on the verge of a higher move in this bullish correction. The bulls will need to break the prior highs and in doing so, expose the 38.2% Fibo on the monthly chart and price imbalances, grey zones, above there.

- Gold Price following wild moves in the Treasury market.

- US CPI rises above expectations in June, PPI data on Thurday.

- Stocks decline but trim losses, caution tone prevails among market participants.

Gold Price (XAUUSD) bounced sharply during the last hours and turned positive for the day. The metal bottomed at $1,706 following US inflation data and then redounded rising $40 in a few minutes. It peaked at $1,745, the highest level in three days. Volatility in prices is set to remain elevated on the back of market concerns and wild moves in the Treasury market.

Gold Price not out of the woods yet

Stocks in Wall Street are falling, but are off lows. In money markets, prices reflect inflation as the main concern for Federal Reserve officials in the short-term and a growth crisis later as the main issue. While in the short-term bets for more aggressive rate hikes are rising, prices reflect odds of rate cuts for 2023.

Also read: Gold Price Forecast: Post-CPI recovery stalls below critical resistance

Inflation data triggers volatility

Unwelcome data

The US Labor Department reported Wednesday that the Consumer Price Index (CPI) rose 1.3% in June and 9.1% compared to the previous years, the fastest pace since late 1981. The Core CPI (excludes food and energy) increased 5.9% (y/y), below the 6% of the previous month. The figures were above expectations. The US dollar jumped after the report and then turned negative.

Gold Price initially reacted to a stronger US dollar and higher US yields, falling toward $1,700. When the price looked ready for a slide below to approach the 2021 bottom near $1,675, everything changed. The US 10-year yield fell from 3.07% to 2.90% and the 30-year from 3.22% to 3.08%. The US Dollar Index (DXY) hit a multi-year high at 108.58 and dropped to 107.50. The yellow metal bounced sharply, alleviating the bearish pressure.

Data to hold the key

Later on Wednesday, the Federal Reserve will release the Beige Book about the state of the economy. On Thursday, the Bureau of Labor Statistics will release the Producer Price Index for June. Another strong reading would contribute to raise expectations of a 100 basis point rate hike in July, currently above 60%. Such scenario could be negative for Gold Price. The Labor Department will also release the Weekly Jobless Claims report. Positive news regarding the labor market or growth could be not positive for the yellow metal.

Gold Price shows some not so negative signs

Gold Price rose back above $1,730 and also above the 20-Simple Moving Average in the four-hour chart, currently at $1,735. While above, XAUUSD could holds a positive momentum in the very short-term. The key resistance ahead is $1,750. Above, gold could extend the recovery.

The spike to $1,706 followed by the rebound is a potential reversal that could anticipate further gains, particularly if it breaks above $1,750. A failure, could keep XAUUSD between $1,750 and $1,730.

Despite signs of some consolidation in the short-term, the main trend in Gold Price is bearish. A slide below $1,720 should expose again $1,700. Below the round number there is not much support until the area of the 2021 lows of $1,650.

-637933316139337474.png)

Gold Price Can it hold above $1700?

- EURUSD snaps two days of losses, regaining some ground on a weak US dollar.

- The US Consumer Price Index expanded at 1.3% in May, the highest since 2005.

- Interest rate differentials between the Fed and the ECB will give the upper hand to the greenback.

EURUSD rebounds after an intraday dive below parity at around 0.9997, for the first time in 20 years, and is staging a recovery during Wednesday’s North American session, sparked by a hot US inflation report revealed by the US Department of Labour, which lifted the major towards the daily high at around 1.0122, before sliding back below the 1.0100 mark. At the time of writing, the EURUSD is trading at around the 1.0080 area, up 0.50%.

EUR/USD bounces off parity on soft US dollar

Sentiment-wise, investors remain pessimistic, as shown by global equities tumbling across the board. in the meantime, the US Dollar Index, a measurement of the greenback’s value against a basket of six currencies, slumps by 0.30%, underpinned by falling US Treasury yields, and is sitting at 107.827. Also, recession fears loom as the US 2s-10s yield curve remains inverted for the seventh consecutive day, at -0161%.

Also read: EUR/USD: Panic takes over post-US CPI data

Inflation in the US rises

US Inflation breaks above 9%

On Wednesday, the US Bureau of Labor Statistics reported that June’s Consumer Price Index (CPI) topped estimations of 8.8% YoY and rose by 9.1% YoY in May. Regarding the so-called core CPI, which excludes volatile items like food and energy at 5.9%, lower than in May but higher than estimated. The main contributors to the jump in inflation were gasoline, shelter, and food, as shown by the US CPI report.

Inflation split by components

Federal Reserve to hike 100 bps?

In the meantime, the US inflation report has fueled the possibility of a jumbo rate hike by the Federal Reserve. The short-term interest rates (STIRs) money market futures show that traders have fully priced a 75 bps rate hike by the July 26-27 meeting. However, the odds of a 100 bps rate hike lie at 82%, leaving the door open for a jumbo move due to the stickiness and persistently high inflation.

Germany’s inflation report wound not deter the ECB

Earlier during the European session, Germany’s inflation, as measured by the Harmonised Index of Consumer Prices (HICP) rose 8.2% YoY, aligned with the estimated and prior release. Albeit easing fears of higher readings, odds of the European Central Bank (ECB) hiking rates remain fully priced a 25 bps, but chances of a 50 bps have been increasing of late to 58% odds, as shown by STIRs.

ECB vs. Fed interest rate differentials, a headwind for the EURUSD

In July, both banks, the ECB and the Federal Reserve will host their monetary policy meetings. Currently, the ECB’s deposit rate lies at minus 0.50%, while the US Federal Reserve’s Federal funds rate (FFR) is at 1.75%, bolstering the appetite for the greenback. With expectations of the ECB hiking 25 bps and the Fed to move at least by 75 bps, differentials would widen further, to -0.25% (ECB) vs. 2.50% (Fed), meaning that the greenback would keep the upper hand, opening the door for further selling pressure on the EURUSD.

EURUSD Price Technical outlook

EURUSD remains heavy, as shown by the daily chart, with the daily moving averages (DMAs) residing well above the exchange rate. Nevertheless, due to the pair’s price action overextending to the downside and the Relative Strength Index (RSI) in oversold conditions indicates that the EURUSD might print a leg-up before launching another assault below the parity.

Therefore, the EURUSD first resistance would be the 1.0100 figure. Brak above will expose the July 11 high at 1.0183, followed by a test of the 1.0200 figure. On the flip side, the EURUSD’s first support would be parity. A breach of the latter would expose December 2002 lows around 0.9859.

Elliott Wave trading strategies: DAX 40, FTSE 100, STOXX 50, Dollar Index, EUR/USD [Video]

The US Consumer Price Index rose in June by 9.1% compared to the previous year, the highest rate since 1981. The number was above the 8.6% reading of market consensus. The drivers behind the upside miss were broad-based and mostly in the "core" components, explained analysts at Wells Fargo. According to them, it will take at least several consecutive monthly inflation readings of slowing price growth for the Federal Reserve to believe that it has inflation in check.

Key Quotes:

“The June CPI was expected to be hot, but today's report downright burns. Consumer price inflation came in ahead of what were already lofty expectations, increasing 1.3%. Year-over-year, prices are up a scorching 9.1% which marks yet another new cycle-high. Disturbingly for the Fed, the beat can largely be tied to greater strength in core inflation.”

“The resilient upward pressure on core goods prices over the past two months is an unwelcome development for the Federal Reserve. Easing core goods inflation was supposed to be the lone port in the storm in the second quarter amid surging food and energy prices and core services inflation that keeps marching higher.”

“The Fed was already worried about inflation becoming entrenched, hence the super-sized 75 bps rate hike in June. Today's report is likely to further fan those fears. If the choice set for the Fed's next move remains between a 50 or 75 bps rate hike, 75 bps is the clear pick. However, with inflation getting even further offsides, the Fed may be looking at third option at its upcoming meeting: a 100 bps hike. To be clear, a 100 bps rate hike is not our base case at present, but yet another surprisingly strong CPI report cracks the door to such a move should the FOMC decide to bang that door wide open.”

- Japanese yen drops across the board despite the slide in stocks.

- US inflation number above expectations boosts US yields

- USD/JPY peaks at 137.86, then slides back under 137.50.

The USD/JPY jumped after the release of the US June CPI to 137.86, reaching a fresh 24-year high. After the beginning of the American session pulled back to 137.10. As of writing, it is moving back to the 137.50 area.

Inflation keeps rising, so does the dollar

Inflation in June rose in the US to 9.1% (y/y), the highest since 1981. The number was above the 8.8% of market consensus. Immediately after the report the dollar surged to fresh highs across the board and then pulled back.

The reading keeps the Fed on its way of aggressive interest rate hikes. “It will take at least several consecutive monthly inflation readings of slowing price growth for the Federal Reserve to believe that it has inflation in check”, said analysts at Well Fargo.

US yields hit weekly highs after the numbers and then pulled back, even below the level they had before inflation figures. While in the short-term, market participants see the Fed raising rates, the odds of rate cuts in 2023 are growing.

In Wall Street, the Dow Jones is falling 0.75%, and the Nasdaq drops by 0.45%. Despite risk aversion, the Japanese yen is among the worst performers.

The USD/JPY initial support is located at 137.00/10 followed by 136.45 (July 12 low). On the upside, 137.60 is becoming a critical resistance and a consolidation above should open the doors to a new record and 138.00.

Technical levels

Following the Bank of Canada's (BOC) decision to hike the policy rate by 100 basis points to 2.5% in July, Governor Tiff Macklem is delivering his remarks on the policy outlook and responding to questions from the press.

Key takeaways

"Front-loading interest rate response will help cool domestic inflationary pressures."

"100-bp hike reflects concern that the risk that high inflation could become entrenched has gone up."

"Our aim is to get rates to the top-end or slightly above neutral range quickly."

"Economic slowdown is needed, there's lots of room to reduce job vacancies without materially reducing employment."

Market reaction

USD/CAD trades deep in negative territory following these comments and was last seen losing 0.5% on the day at 1.2955.

Following the Bank of Canada's (BOC) decision to hike the policy rate by 100 basis points to 2.5% in July, Governor Tiff Macklem is delivering his remarks on the policy outlook and responding to questions from the press.

Key takeaways

"There are good reasons a soft landing is achievable."

"High commodity prices not affecting Canada as much as many other countries."

Meanwhile, Senior Deputy Governor Carolyn Rogers argued that part of restoring the balance of supply and demand in the economy depends on restoring the balance in the housing market.

Market reaction

USD/CAD continues to push lower on these comments and was last seen losing 0.6% on the day at 1.2944.

Following the Bank of Canada's (BOC) decision to hike the policy rate by 100 basis points to 2.5% in July, Governor Tiff Macklem is delivering his remarks on the policy outlook and responding to questions from the press.

Key takeaways

"Front-loading rate increases now helps avoid the need for even higher interest rates down the road."

"Front-loaded tightening cycles tend to be followed by softer landings."

"100-basis-point rate increase is very unusual and reflects unusual economic circumstances of inflation at nearly 8%."

"Strain of higher interest rates in short term will get us to the other side of this difficult period and back to normal."

"Goal is to get inflation back to 2% with a soft landing for the economy; quick rate hikes prevent inflation from becoming entrenched."

"Over half of components in the Consumer Price Index are rising above 5%."

"We are projecting a soft landing, but the path to that has narrowed because of elevated and persistent inflation."

"Credibility of the bank's inflation target is being tested but remains credible overall."

Market reaction

USD/CAD continues to push lower on these comments and was last seen losing 0.6% on the day at 1.2944.

- The USD/CAD trades within a 120 pip range, courtesy of tier 1 data from both countries.

- The Bank of Canada (BoC) hiked rates by 100 bps and will keep tightening further.

- June's US Consumer Price Index (CPI) rose by 9.1% YoY, the highest in 40 years.

- STIRs money market futures odds of the Federal Reserve hiking 100 bps increased to 82%.

The USD/CAD slumps after the Bank of Canada (BoC) delivered an unexpected rate hike of 100 bps in the ira July meeting, lifting rates to 2.50% vs. 2.25% estimated by market participants, and following a hot US inflation reading topping the 9%.

The USD/CAD is trading at 1.2958 at the time of writing on Wednesday, with the pair seesawing in a volatile trading session, reaching a daily low/high around 1.2945-1.3060 range, an area where the major would keep trading unless a fresh catalysts break the range.

The USD/CAD is trading volatile due to a surprise 1% rate hike by the BoC and US inflation above 9%

In its monetary policy statement, the Bank of Canada said that the Governing Council (GC) decided to front-load interest rates and emphasized that rates will need to rise further. The BoC stated that inflation is expected to persist at around 8% in the few months and has further broadened, with more than half of the components of CPI, rising more than 5%. Although the war in Ukraine and supply chain disruptions are to blame, domestic price pressures from excess demand are becoming more prominent. The BoC also acknowledged that the labor market is tight and increasing wage pressures would keep inflation high.

Regarding economic growth, the Bank expects the economy to grow by 3.5% in 2022, while for Q2, it estimates a 4% growth and a downtick in Q3 to 2%.

In the meantime, earlier in the day, US inflation topped the charts rising by 9.1% YoY, at a fresh 4-decade high, as shown by the US Labor Department, which also revealed the so-called core CPI, which excludes volatile items like food and energy at 5.9%, lower than in May, but higher than estimated. Concerning the higher inflation reading, STIRs money market futures have fully priced a 75 bps rate hike by the Fed. However, the odds of a 100 bps rate raise are 82%, leaving the door open for a jumbo move due to the stickiness and persistently high inflation.

in the meantime, the US Dollar Index retreated from daily highs, down 0.51%, at 107.628, while US Treasury yields, led by the US 10-year yield down 4 bps, sitting below the 3% threshold.

What to watch

On Thursday, the Canadian docket will feature Manufacturing Sales MoM for May. On the US front, Initial Jobless Claims, inflation on the producer side, and Fed speakers would update the status of a battered US economy, with inflation above 9%.

USD/CAD Key Technical Levels

Following the Bank of Canada's (BOC) decision to hike the policy rate by 100 basis points to 2.5% in July, Governor Tiff Macklem will deliver his remarks on the policy outlook and respond to questions from the press. Macklem's presser will start at 1500 GMT.

"Interest rates will need to rise further and the pace will be guided by the bank's assessment of the economy and inflation," the BOC noted in its policy statement.

Breaking: BOC hikes policy rate by 100 bps to 2.5%.

In view of high inflation, the Bank of England (BoE) remains too cautious. This should weigh on the pound. Economists at Commerzbank expect the GBP to weaken against the EUR in the coming quarters.

EUR should benefit from the ECB's monetary policy turnaround

“Since inflation will probably rise further and the labor market is very tight, further monetary tightening is necessary in the short term. We now also expect more rate hikes. However, the BoE is still likely to act too cautiously when it comes to fighting inflation. This, coupled with the risk of significant economic slowdown, will weigh on the pound.”

“We assume that the ECB will also initiate its monetary policy turnaround in July. This should support EUR/GBP.”

“We now also expect GBP to weaken further against EUR next year. The BoE is likely to pause, while the ECB will tighten for a bit longer. At the same time, inflation in the UK is unlikely to fall as quickly, while at the same time the economy should weaken significantly.”

The Bank of Canada (BOC) hiked its policy rate by 100 basis points (bps) to 2.5% in July, compared to the market expectation for a rate increase of 75 bps.

In its policy statement, the BOC acknowledged that it has underestimated inflation since the spring of last year mainly because of global factors.

Market reaction

The USD/CAD pair fell sharply with the initial reaction and was last seen losing 0.4% on a daily basis at 1.2970.

Key takeaways as summarized by Reuters

"Higher commodity prices, increased supply shortages and rising shipping costs explain about two-thirds of missed inflation."

"About a quarter of the inflation forecast miss came from underestimating domestic factors, mostly housing costs."

"In past, the strong correlation between higher oil prices and an appreciation of the dollar helped offset energy impact on inflation, but recently correlation is not holding."

"Wanted to 'front-load' path to higher interest rates amid excess demand and high, broadening and persistent inflation."

"Inflation is higher and more persistent than had been expected in April forecasts and will likely remain around 8% in the next few months."

"Interest rates will need to rise further and the pace will be guided by the bank's assessment of the economy and inflation."

"Quantitative tightening continues and is complementing interest rate increases."

"Governing council is resolute in commitment to price stability and will continue to take action to achieve the 2% inflation target."

- AUD/USD surrendered its intraday gains in reaction to the hotter-than-expected US CPI.

- The formation of descending trend-channel points to a well-established bearish trend.

- Attempted recovery could attract fresh sellers and remain capped near the mid-0.6800s.

The AUD/USD pair witnessed a dramatic turnaround on Wednesday and witnessed aggressive selling near the 0.6200 mark during the early North American session. The pair has now surrendered its intraday gains and was last seen trading around the mid-0.6700s region, nearly unchanged for the day.

The US dollar regained positive traction and shot to a fresh 20-year high in reaction to red-hot US consumer inflation figures, which reaffirmed hawkish Fed expectations. Apart from this, a fresh bout of selling in the equity markets further underpinned the safe-haven buck and drove flows away from the risk-sensitive aussie.

From a technical perspective, the AUD/USD pair has been trending lower over the past four weeks or so along a downward-sloping channel. This points to a well-established bearish trend and supports prospects for additional near-term losses. The emergence of fresh selling at higher levels further validates the negative outlook.

Hence, a subsequent slide back towards the 0.6710 area, or over a two-year low touched on Tuesday, remains a distinct possibility. Some follow-through selling below the 0.6700 mark would be seen as a fresh trigger for bearish traders and make the AUD/USD pair vulnerable to testing the descending channel support, around the 0.6660 area.

The latter should act as a strong base for spot prices, which if broken decisively should pave the way for an extension of the near-term downward trajectory. The AUD/USD pair might then accelerate the fall towards and challenge the 0.6600 round-figure mark before eventually dropping to the 0.6570 horizontal support zone.

On the flip side, the daily peak, around the 0.6200 mark, now seems to act as immediate resistance. Any subsequent move up could still be seen as a selling opportunity and remain capped near the 0.6850-0.6860 confluence hurdle, comprising 100-period SMA on the 4-hour chart and the top end of the aforementioned descending channel.

AUD/USD 4-hour chart

-637933168239989029.png)

Key levels to watch

White House (WH) Economic Adviser Brian Deesetold CNBC on Wednesday that the Consumer Price Index (CPI) data shows the urgency for Congress to pass legislation to spur semiconductor manufacturing in the US, as reported by Reuters.

"Another area of focus is boosting refinery capacity," Deese added.

Earlier in the day, the US Bureau of Labor Statistics reported that the annual CPI in June jumped to its highest level in four decades at 9.1%.

Market reaction

Safe-haven flows continue to dominate the financial markets following these comments. As of writing, the S&P 500 and the Nasdaq Composite indexes were down 0.9% and 1.1%, respectively.

After the EUR/USD pair dropped to parity for the first time in nearly 20 years on hot US inflation data on Wednesday, a spokesperson for the European Central Bank (ECB) reiterated that the ECB does not target a particular exchange rate.

"However, we are always attentive to the impact of the exchange rate on inflation, in line with our mandate for price stability," the spokesperson added in an emailed statement, as reported by Reuters.

Market reaction

EUR/USD stays on the back foot after this statement and was last seen losing 0.2% on the day at 1.0016.

- The index fully fades the earlier pullback and regains the upside.

- The dollar prints new nearly 20-year tops around 108.60.

- US inflation tracked by the CPI rose more than expected in June.

The greenback, in terms of the US Dollar Index (DXY), manages to leave behind the initial pessimism and leaps to new cycle tops near 108.60 on Wednesday.

US Dollar Index remains bid post-US CPI

The index advances to the 108.60 region, an area las seen back in October 2002, after US inflation figures showed consumer prices rose at an annualized 9.1% in June, surpassing initial estimates. The Core CPI, which excludes food and energy costs, also rose above expectations at 5.9% from a year earlier.

The higher-than-expected CPI prints continue to reinforce the case for a more aggressive tightening path from the Federal Reserve in the next months. Indeed, and tracked by CME Group’s FedWatch Tool, the probability of a 75 bps rate hike receded to around 57%, while the possibility of a full-point increase is nearly 43%.

What to look for around USD

The index pushed higher and clinched new cycle highs well north of 108.00 on Wednesday. The recent sharp move in the dollar, however, could be seen largely in response to the accelerated decline in the European currency.

Further support for the dollar is expected to come from the Fed’s divergence vs. most of its G10 peers (especially the ECB) in combination with bouts of geopolitical effervescence and the re-emergence of the risk aversion among investors. On the flip side, market chatter of a potential US recession could temporarily undermine the uptrend trajectory of the dollar somewhat.

Key events in the US this week: MBA Mortgage Applications, Inflation Rate, Fed Beige Book (Wednesday) – Producer Prices, Initial Claims (Thursday) – Retail Sales, Industrial Production, Flash Consumer Sentiment, Business Inventories (Friday).

Eminent issues on the back boiler: Hard/soft/softish? landing of the US economy. Escalating geopolitical effervescence vs. Russia and China. Fed’s more aggressive rate path this year and 2023. US-China trade conflict. Future of Biden’s Build Back Better plan.

US Dollar Index relevant levels

Now, the index is up 0.22% at 108.40 and a break above 108.58 (2022 high July 13) would expose 108.74 (monthly high October 2002) and then 109.00 (round level). On the flip side, the next support aligns at 103.67 (weekly low June 27) seconded by 103.41 (weekly low June 16) and finally 101.29 (monthly low May 30).

BoC Monetary Policy Decision – Overview

The Bank of Canada (BoC) is scheduled to announce its monetary policy decision this Wednesday at 14:00 GMT. The Canadian central bank is anticipated to deliver a jumbo, 75 bps rate hike in an effort to keep inflation expectations anchored. Investors will further take cues from the BoC’s quarterly Monetary Policy Report and Governor Tiff Macklem's comments at the post-meeting press conference.

According to analysts at Citibank: “A 75 bps rate hike in July is the most likely scenario, taking policy rates to 2.25% this week. Beyond this week, we expect 50 bps hikes from both the BoC and the Fed at their September meetings and for policy rates in Canada to reach 3.5% by year-end. Given the recent market focus on recession risks, this is likely to be a key topic of questions at Governor Macklem’s press conference.”

How Could it Affect USD/CAD?

Ahead of the key event risk, a goodish rebound in oil prices from a nearly five-month low offered some support to the commodity-linked loonie. This, along with modest US dollar profit-taking, kept the USD/CAD pair depressed near the 1.3000 psychological mark. A more hawkish BoC stance is already priced in the markets, increasing the risk of disappointment. On the other hand, a neutral stance, or a dovish message, would be enough to inspire the CAD bears. This, along with the US CPI-led USD volatility and oil price dynamics, should help determine the next leg of a directional move for the major.

From current levels, any subsequent decline could attract some buying near the 1.2940-1.2935 support zone. The next relevant support is pegged near the 1.2900 round-figure mark, which if broken would negate any near-term positive bias and make the USD/CAD pair vulnerable. The downward trajectory could then drag spot prices towards the monthly low, around the 1.2835 area, en-route the 1.2820-1.2815 support.

On the flip side, the 1.3050 region might continue to act as an immediate strong hurdle ahead of the 1.3080-1.3085 supply zone. Some follow-through buying beyond the 1.3100 mark would be seen as a fresh trigger for bulls and set the stage for a move towards the 1.3155-1.3160 intermediate resistance. The USD/CAD pair could appreciate further to the 1.3200 mark before climbing to the 1.3270 area.

Key Notes

• BOC Preview: USD/CAD set to surge on a dovish message after a 75 bps hike

• BoC Preview: Forecasts from nine major banks, hiking interest rates aggressively

• USD/CAD: Spikes to the 1.31-1.33 area in the near term are possible – ING

About the BoC Interest Rate Decision

BoC Interest Rate Decision is announced by the Bank of Canada. If the BoC is hawkish about the inflationary outlook of the economy and raises the interest rates it is positive, or bullish, for the CAD. Likewise, if the BoC has a dovish view on the Canadian economy and keeps the ongoing interest rate, or cuts the interest rate it is seen as negative, or bearish.

- Gold price turned lower for the third straight day and dropped to a fresh YTD low.

- A stronger US CPI print reaffirmed hawkish Fed expectations and exerted pressure.

- A sharp spike in the US bond yields, a bullish USD contributed to the selling bias.

Gold price attracted fresh selling near the $1,732 region during the early North American session and turned lower for the third successive day on Wednesday. The latest leg down followed the release of hotter-than-expected US consumer inflation figures and dragged the XAUUSD to its lowest level since August 2021, around the $1,710-$1,705 zone.

Gold price shrug off persistently high inflation

Gold, which is typically considered a hedge against rising inflation, failed to impress bulls after data released from the US showed that the headline CPI accelerated to a new four-decade high in June. In fact, the gauge accelerated to 9.1% on yearly basis from 8.6% in May and rose 1.3% MoM, surpassing expectations. Meanwhile, core inflation, which excludes food and energy prices, came in at 0.7% MoM in June and tick down to the 5.9% YoY rate, again beating consensus estimates.

US CPI historical chart

Fed rate hikes bets continue to weigh

Against the backdrop of unsurprisingly hawkish FOMC minutes released last week, the stronger-than-expected US CPI report reaffirmed bets for more aggressive rate hikes by the Federal Reserve. The markets are pricing in nearly 80% chances of a 75 bps rate increase on July 27 and the implied odds of 100 bps are up to 35% now. This, in turn, pushed the US Treasury bond yields sharply higher and was seen as a key factor that exerted heavy downward pressure on the non-yielding gold.

Stronger USD exerts additional pressure

The prospects for a faster policy tightening by the Fed assisted the US dollar to reverse its modest intraday losses and hitting a fresh two-decade high. This further contributed to driving flows away from the dollar-denominated gold. That said, a fresh wave of the global risk-aversion trade could offer some support to the safe-haven XAUUSD amid growing recession fears.

Also Read: Gold Futures: Scope for further decline

Recession fears could limit losses

Investors remain concerned that worried that a more aggressive move by major central banks to curb inflation, the ongoing Russia-Ukraine war and the latest COVID-19 outbreak would pose challenges to global economic growth. This had led to an extended selloff across the global equity markets and tends to benefit traditional safe-haven assets, including gold.

Gold price technical outlook

Gold price now looks to the $1,700 round-figure mark to lend some support. A convincing break below the said handle would be seen as a fresh trigger for bearish traders and drag the XAUUSD to September 2021 low, around the $1,787-$1,786 region. The downward trajectory could further get extended towards challenging the 2021 yearly low, near the $1,677-$1,676 area.

On the flip side, any meaningful recovery attempt now seems to confront stiff resistance near the daily peak, around the $1,732 region. Sustained strength beyond could trigger a short-covering move towards the $1,744 area en-route the $1,752 region and the $1,767-$1,770 strong horizontal support breakpoint.

-637933142939524694.png)

Gold Price: Can gold prices hold above $1,700?

EUR/CHF has reached Credit Suisse’s long-held objective at 0.9839/30. However, the analyst's team sees scope for the downside to extend to 0.9609/00.

Potential to reach 0.9609/00 in due course

“With the 200-day and 55-day moving averages continuing to fall, and daily and weekly MACD momentum indicators staying outright bearish, we continue to look for further direct downside.”

“Next formidable support is seen at 0.9787/75, which we nonetheless look to break to support a move to the ‘measured triangle objective’ of the confirmed bearish ‘triangle’ formation from mid-June at 0.9609/00.”

“Resistance is now seen at 0.9864 initially and then at 0.9898. Should we see a sharp recovery above here, we would look for resistance at 0.9971/72 and then at 1.0032/46 to hold any further upside to avoid a potential sideways movement around parity.”

EUR/USD at parity – where now? Economists at Credit Suisse look for a floor here and for a consolidation/recovery phase to emerge.

Do not look to chase weakness for now below 0.99

“Our base case remains that parity/0.99 will essentially remain a floor for now and a consolidation/recovery phase can emerge, with the market also at the lower end of its 5-month channel and also oversold (right-hand chart below).

“Resistance for recovery is seen at 1.0185/92 initially, with tougher resistance seen starting at 1.0350 and stretching up to the 55-day average, currently at 1.0520.”

“We continue to identify the broader trend as lower and we thus look to fade a consolidation/recovery (if indeed seen) and our bias is for an eventual sustained break of 0.99 to be eventually achieved. This would then clear the way for further weakness, with support seen next at 0.9750 and with the next meaningful support seen at 0.9609/0.9592 – September 2002 low and high of 2001.”

“Whilst we would look for a fresh consolidation phase at 0.9609/0.9592, a direct break can see support next at 0.9331.”

Inflation in the US, as measured by the Consumer Price Index (CPI), jumped to its highest level in four decades at 9.1% on a yearly basis in June from 8.6% in May, the data published by the US Bureau of Labor Statistics showed on Wednesday. This print came in higher than the market expectation of 8.8%.

The Core CPI, which excludes volatile food and energy prices, edged lower to 5.9% in the same period from 6% but still surpassed analysts' forecast of 5.8%.

Follow our live coverage of market reaction to US inflation data.

Market reaction

The US Dollar Index regained its traction after hot inflation data and was last seen posting small daily gains at 108.35.

Senior Economist at UOB Group Alvin Liew assesses the release of US Nonfarm Payrolls for the month of June.

Key Takeaways

“The US economy beat expectations, adding 372,000 jobs in Jun while the unemployment rate stayed at 3.6%, unchanged since Mar 2022. Wage growth continued but the pace slowed for the third straight month to 0.3% m/m, 5.1% y/y.”

“The US employment gains were broad-based while wage growth was good but manageable in 2022 to date, both will anchor the Fed’s confidence in the labor market and keep them on the hiking path. The question of 50 or 75bps will depend on Jun CPI this Wed (13 Jul).”

- EUR/USD keeps the trade just above the parity zone.

- Below parity comes the December 2002 low at 0.9859.

EUR/USD gathers some upside traction and puts some distance from recent lopws in the parity area.

The pair’s bearish stance stays everything but abated for the time being. Against that, there are no support levels of note until the critical parity zone. Further south comes the December 2002 low at 0.9859.

As long as the pair navigates below the 5-month support line near 1.0560, further losses remain in store.

In the longer run, the pair’s bearish view is expected to prevail as long as it trades below the 200-day SMA at 1.1048.

EUR/USD daily chart

- DXY comes under further pressure below the 108.00 mark.

- Extra advances could meet the next target at 108.74.

DXY deflates further following Tuesday’s cycle highs near 108.60 on Wednesday.

Further upside in the dollar remains in store in the short-term horizon. That said, once the 2022 high is cleared, the index could attempt a move to the October 2002 peak at 108.74.

As long as the index trades above the 5-month line near 103.06, the near-term outlook for DXY should remain constructive.

In addition, the broader bullish view remains in place while above the 200-day SMA at 98.66.

Of note, however, is that the index still trades in the overbought territory and it therefore could extend the corrective decline to, initially, the 105.80 region (high June 15).

DXY daily chart

- EUR/JPY fades two consecutive daily drops on Wednesday.

- The resistance line around 140.00 caps the upside so far.

EUR/JPY manages to gather some upside traction around 138.00 on Wednesday.

In the meantime, the cross remains under pressure amidst the ongoing rebound from July lows in the 136.80 region (July 8). As long as the cross keeps trading below the 4-month resistance line around 140.00, extra losses should remain in the pipelie.

That said, further downtrend could revisit the 100-day SMA at 136.24 ahead of the minor support at 133.92 (low May 19).

In the longer run, the constructive stance in the cross remains well propped up by the 200-day SMA at 133.21.

EUR/JPY daily chart

EUR/USD has come within a whisker of parity. How low the pair goes is likely to depend on whether or not Russia wants to worsen the economic war with Europe, economists at Rabobank report.

USD strength may not relent until next year

“From a fundamental perspective, it is not difficult to paint a scenario in which EUR/USD could break below 1.00 and hold at lower levels into the winter months. That has been the case for a while.”

“If the Nord Stream 1 natural gas pipeline is switched back on, in time next week after its scheduled maintenance, the EUR is likely to be granted a reprieve. That said, even if the EUR is boosted, we expect USD strength to dominate into next year suggesting upside for EUR/USD could be limited even on good news regarding Nord Stream.”

“For now, we retain our one-month forecast of EUR/USD 1.03. Evidence that Russian gas supplies into Europe will be further disrupted into the winter would cause us to downgrade our forecasts for the EUR further.”

Economist at UOB Group Ho Woei Chen, CFA, comments on the latest inflation figures in the Chinese economy.

Key Quotes