- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 15-07-2022

- USD/JPY gained 1.80% in the week, extending its rally to the seventh consecutive week.

- USD/JPY Price Analysis: Divergence between price action and RSI spurred a pullback, though a daily close below 137.70 would tumble the USD/JPY towards 134.26.

The USD/JPY retreats from YTD highs at around 139.38, towards the middle of the 138.00-139.00 range on Friday, as Wall Street closes the week with gains between 1.83% and 2.15%, underpinned by upbeat data that could deter Federal Reserve members from hiking 100 bps in the July meeting.

The USD/JPY is trading at 138.48, down 0.33% after beginning Friday’s session around the 139.00 figure, nearly daily highs, to then slide to the daily’s central pivot point at 138.54, where the major stabilized, ahead into the weekend.

USD/JPY Price Analysis: Technical outlook

USD/JPY Daily Chart

The USD/JPY remains upward biased, but price action remains overextended. That means that USD/JPY still favors longs, but the Relative Strength Index (RSI) formed a negative divergence and exited from overbought conditions. That said, the USD/JPY could retrace from the YTD highs to its next support level at July 11 high-turned-support at 137.75.

If the above scenario plays out, the USD/JPY next support would be 137.00. The break below will expose the July 1 daily low at 134.74, followed by the June 23 low at 134.26. on the other hand, the USD/JPY’s first resistance would be the 139.00 figure. A breach of the latter would expose the YTD high at 139.38, followed by 140.00.

USD/JPY Key Technical Levels

- Silver climbs and pares some of its weekly losses, but not enough to end the week higher; it is losing 3.37% in the week.

- University of Michigan inflation expectations tempered from around 3.1% to 2.8%; San Francisco Fed President Daly noticed.

- Money market futures illustrates that traders expect a Fed 75 bps rate hike in July and are pricing an additional 80 bps by year-end.

Silver (XAGUSD) is trimming some of Thursday’s losses late in the North American session but remains short of reclaiming the $19.00 barrier on Friday, despite taking advantage of a weaker US dollar, sliding 0.50% as portrayed by the US Dollar Index at 108.093, despite upbeat US economic data.

XAGUSD exchanges hands at $18.66, up 1.36% on Friday, in a calm session that witnessed the white metal dipping to $18.17, a fresh daily low, followed by a jump towards the daily high at $18.77.

Silver climbs but falters to conquer $19.00

Global equities are trading with gains, despite that the narrative of high inflation and recession fears is unchanged. US Retail sales advanced by 1% YoY in June, beating forecasts of 0.&. May’s figures were at -0.3%, displaying consumer’s resilience. Later, the University of Michigan Consumer Sentiment for July hit 51.1, exceeding estimations of 49.9 and higher than June’s 50. The UoM survey highlighted that inflation expectations over a 5-year projection were lower from 3.1% to 2.8%.

XAGUSD has also been bolstered by falling US Treasury yields. The US 10-year benchmark note yields 2.934%, down by three bps. Meanwhile, the US 2s-10s yield curve remains inverted for the ninth consecutive trading day, illustrating that investors remain pessimistic and are discounting a US recession.

Elsewhere, Fed officials crossed newswires. The St. Louis Fed President James Bullard said it would not make any difference to hike 100 or 75 bps while adding that the pace could be adjusted for the rest of the year. Later, San Francisco’s Fed President Mary Daly said that inflation is too high, the US economy is strong, and the labor market remains solid. She added that the Univesity of Michigan inflation expectations were a “good thing” and that recession is not her base scenario.

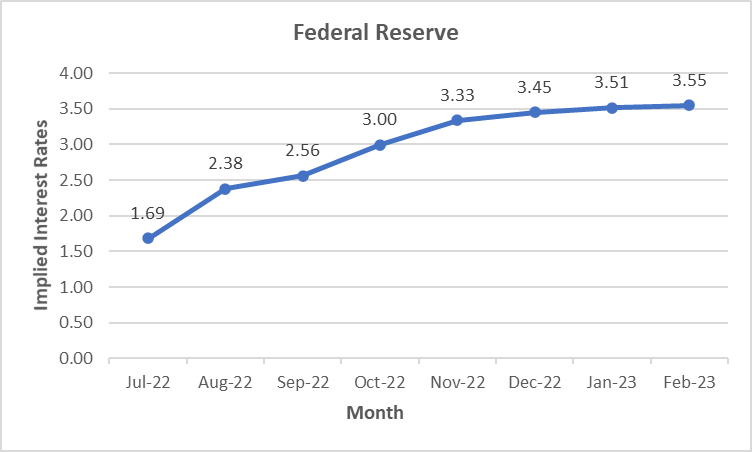

Federal fund rates expectations

30-Day Federal fund rates futures

At the time of writing, market participants expect a 75 bps rate hike, as shown by the 30-day Federal funds rate (FFR) futures, and foreseen it would end at around 3.45% by December of 2022.

What to watch

The week ahead, the Canadian docket will feature Housing Starts, Inflation data, and Retail sales. The calendar will be packed on the US front, Housing Starts, Building Permits, Existing Home Sales, Initial Jobless Claims, and July’s S&P Global PMIs.

Silver (XAGUSD) Key Technical Levels

- The USD/CHF retreats from 0.9886 in a volatile session, despite positive US data.

- The Swiss franc has gained almost 1% in the last two trading days.

- USD/CHF Price Analysis: Sellers are eyeing 0.9700, which would open the door for buyers to lift the pair towards 0.9800.

The USD/CHF dives after reaching a weekly high on Thursday, around 0.9900, and plunges towards the 0.9770s region on upbeat US data, which pared expectations of a Federal Reserve larger-than-expected rate hike, which was cheered by investors, as reflected by global equities rising.

The USD/CHF is trading at 0.9775, near the daily lows, after hitting a 0.9840 daily high, just above the daily pivot, which once broken, paved the way for a free fall below 0.9800, and further extending towards the S1 pivot area around 0.9773.

USD/CHF Price Analysis: Technical outlook

USD/CHF Daily chart

The USD/CHF daily chart shows that it is still favoring longs. The ongoing pullback from weekly highs near 0.9900 could be capped around the 50-day moving average (DMA) at 0.9735, though the Relative Strength Index (RSI) at 56.03 keeps pushing lower, which means that sellers might be eyeing the 50% Fibonacci retracement at around 0.9690, looking forward for an RSI’s uptick, that could give buyers a go, to re-enter USD/CHF longs.

If that scenario plays out, USD/CHF’s first resistance would be 0.9700, followed by 0.9735 and 0.9800. Otherwise, the USD/CHF pullback could continue its fall towards the 61.8% Fibonacci level at 0.9644, followed by the figure at 0.9600.

USD/CHF Key Technical Levels

- USD/CAD is set to end the week with solid gains of 0.76% after a volatile week.

- Positive US retail sales and UoM Consumer Sentiment easied Fed intentions of a larger-than 75 bps hike.

- USD/CAD Price Analysis: Daily close below 1.3076 might pave the way for a correction toward 1.2930s.

USD/CAD extends its decline from weekly highs around 1.3220s reached on Thursday, spurred by elevated US PPI data, which showed that inflation is far from peaking, triggering an uptick in expectations of a Fed 100 bps hike, which later easied as Fed policymakers pushed back against those assumptions.

The USD/CAD is exchanging hands at 1.3029, dropping almost 0.70%, on a day where the USD/CAD started trading around 1.3110s, near the daily highs, and plunged on a soft US dollar, hitting a daily low at around 1.3013, early in the North American session.

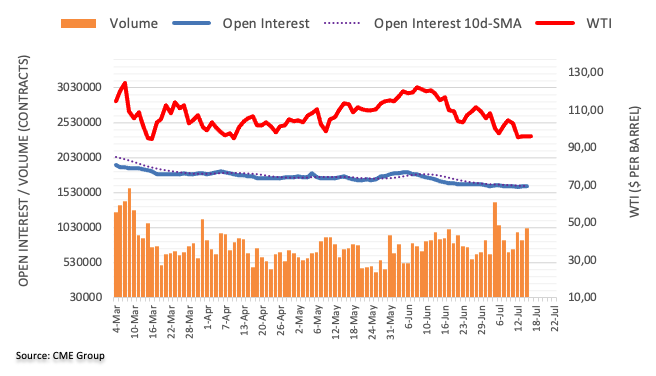

USD/CAD drops on risk-on, soft US dollar, and high oil prices

Global equities portray an upbeat market mood. Nevertheless, the market narrative stays the same, with high inflation, worldwide central banks hiking rates, and recession fears lingering in traders’ minds. The greenback remains heavy, down by almost 0.50%, as portrayed by the US Dollar Index, at 108.111. in the commodities space, US crude oil, namely WTI, rises 1.49%, at $97.90 PBD, a headwind for the USD/CAD, due to the close correlation between the Canadian dollar and oil prices.

On Friday, the US Department of Commerce reported that US Retail Sales rose by 1% YoY, beating the estimations of 0.8%, and also topped May’s dismal reading of -0.3%, a signal of consumers’ resilience and strength, despite Fed hikes. Additionally, the University of Michigan Consumer Sentiment at 51.1 vs. 49.9 estimated, exceeding forecasts, while inflation expectations tempered, with consumers seeing inflation at 2.8% over a 5-year horizon, lower than 3.1% in June.

On the Canadian side, the Friday docket was empty. However, the Bank of Canada’s decision to hike rates by 100 bps caught the markets by surprise and capped any further gains by the greenback. At the press conference, the BoC Governor Macklem said that front loading rate increases now would help avoid even higher rates in the future while adding that front-loaded cycles tend to be followed by softer landings.

What to watch

The week ahead, the Canadian docket will feature Housing Starts, Inflation data, and Retail sales. The calendar will be packed on the US front, Housing Starts, Building Permits, Existing Home Sales, Initial Jobless Claims, and July’s S&P Global PMIs.

Also read: USD/CAD trades volatile, after an unexpected BoC 1% rate hike, and US inflation above 9%

USD/CAD Price Analysis: Technical outlook

From a technical perspective, the USD/CAD favors longs, but a daily close below the May 12 high at 1.3076, might open the door for a pullback before resuming upwards. Also, traders should note that the Relative Strength Index (RSI) at 56.68 pierced below the RSI’s 7-day SMA, triggering a sell signal that a cross below the 50-mid line could further confirm.

Therefore, the USD/CAD first support will be 1.3000. A break below will send the pair sliding towards July 13 low at 1.2936, followed by a push lower to the 50-day moving average (DMA) at 1.2862.

According to the Federal Reserve Bank of Atlanta's GDPNow model, the US economy is expected to contract by 1.5% in the second quarter, down from the July 8 forecast of -1.2%.

"After recent releases from the US Bureau of Labor Statistics, the US Census Bureau, the Federal Reserve Board of Governors, and the US Department of the Treasury's Bureau of the Fiscal Service, the nowcast of second-quarter real personal consumption expenditures growth and real gross private domestic investment growth decreased from 1.9% and -13.7%, respectively, to 1.5% and -13.8%, respectively," Atlanta Fed explained in its publication.

Market reaction

The US Dollar Index showed no immediate reaction to this report and was last seen losing 0.5% on the day at 108.10.

University of Michigan’s Consumer Confidence preliminary July report showed an unexpected modest rebound in the main index. Analysts at Wells Fargo point out the main takeaway is that inflation expectations cooled. They explain that represents welcome news for Federal Reserve policymakers “and it makes the pressure to "go big" at the next meeting less intense after this week's scorching CPI report.”

Key Quotes:

“At 2.8%, consumer inflation expectations for the next 5-10 years are well within the past decades range, or what is considered well-anchored. This is welcome news after expectations rose to the top end of their recent range in the preliminary June release and raised concerns that expectations were becoming unhinged.”

“It also takes some of the heat off the fire for the Fed to hike rates a full 100 bps at its next policy meeting on July 27 and suggests the Fed may again opt instead for a still-large 75 bp hike. St. Louis Fed President James Bullard and Federal Reserve Governor Christopher Waller in separate public appearances on Thursday both backed raising rates by 75 basis points this month, and we expect this fresh data supports that view.”

“Anchored expectations are welcome news for the Fed, there's no doubt about it. But importantly, they have to remain anchored, and with prices set to decline only slowly, the Fed will continue to closely monitor expectations.”

Analysts at MUFG Bank still have a conviction that the EUR/USD pair will break decisively below parity. They point out energy supply fears in Europe are set to remain a heavy weight on the euro as the Federal Reserve sticks to hawkish rate hike plans. They add Italian politics to downside risks.

Key Quotes:

“We expect the EUR to remain under downward pressure in the near-term driven by ongoing fears over disruption to the euro-zone economy from energy supply constraints and fragmentation risks. Those fears are unlikely to ease in the coming weeks and will be tested by the re-opening of the NordStream 1 gas pipeline on 21st July.”

“The ECB also faces a key test in the week ahead when it is expected to announce details of their new anti-fragmentation policy tool. The pick-up in political risk in Italy in recent days has made it even more timely that the ECB steps up to the plate and delivers a credible response to contain fragmentation risks. If there is any disappointment amongst market participants over the new tool then it will reinforce EUR weakness in the near-term especially if an early election is called in Italy as well.”

“Fed’s job remains less complicated at this stage as they are free to focus on lifting rates to dampen inflation risks. The stronger US CPI report increases the risk of further large Fed hikes at upcoming policy meetings which is encouraging an even stronger USD.”

The USD/CLP jumped from 850 to record highs above 1050. According to analysts at Wells Fargo, the move could be identified as overshooting and the currency could be oversold. They see a potential appreciation ahead for the Chilean peso of around 6% in the short term.

Key Quotes:

“Our analysis reveals the Chilean peso may be oversold at current levels. In fairness, the Chilean peso has rightfully come under pressure. Copper prices have dropped significantly, and given Chile's reliance on copper, the drop in prices has spilled over onto the currency. In addition, Central Bank of Chile policymakers have underwhelmed markets on multiple occasions when it comes to monetary policy.”

“As depreciation pressure mounted, policymakers have resisted any form of FX intervention, and as of now, seem unwilling to use FX reserves to support the currency. This combination has the Chilean peso in free-fall and hitting new lows against the greenback on a daily basis. However, we believe the currency is oversold and now misaligned with country fundamentals.”

“From a technical perspective, we believe market participants will notice this imbalance and the peso can recover. In addition, we believe the recent selloff will force Central Bank of Chile policymakers to raise policy rates more aggressively and extend the tightening cycle, as well as intervene in FX markets and defend the currency.”

“As policymakers step up policy tightening and intervention efforts, the currency can rebound back toward the upper bound of its potential depreciation range. In that sense, we believe the Chilean peso can rally 6% in the short-term.”

The Canadian dollar is likely to be hurt more by intensifying global growth fears and from negative spill-over risks from higher rates, according to analysts at MUFG Bank. They see the USD/CAD moving higher in the short-term.

Key Quotes:

“CAD will weaken further in the near-term on the back of intensifying fears over a sharper slowdown in global growth. After testing resistance at the 1.3000-level, the pair finally broke decisively higher hitting a high of 1.3224 over the past week. The bullish price action supports our trade idea and points to further upside ahead.”

“The CAD weakened sharply even after the BoC hiked rates by a larger 100bps and signalled further hikes this year. Higher yields alone are not sufficient to prevent the CAD from weakening against the USD in the current environment. Support from higher yields has been more than offset by intensifying fears over global growth which has resulted in the price of Brent crude oil dropping sharply back below USD100/barrel.”

“There are building concerns that the BoC could be overdoing it in hiking rates so quickly so that it increases the risk of sharper domestic slowdown as well. The BoC already noted that the housing market activity is clearly slowing. We still expect the Fed to keep raising rates for longer than the BoC given Canada’s economy should prove sensitive to higher rates in our view.”

- EURUSD trades above 1.0060 and trims its weekly losses, now up 0.50% in the week.

- US Retail Sales and UoM Consumer sentiment exceed estimations, easing prospects of a 100 bps Fed hike.

- Interest rate differentials between the Fed and the ECB boost the EURUSD fall.

EURUSD buyers stepped in vigorously, defending the euro from falling below parity, with the major trading above the July 14 high 1.0058, though before dipped towards 1.0006, at the brink of the €1/$1 mark, but bounced off daily lows, and climbed towards current price levels. At the time of writing, the EURUSD is trading at 1.0095.

The financial markets narrative remains unchanged. Worries of higher inflation, central banks tightening, and recession jitters linger on investors’ minds. Nevertheless, global equities edge up in positive US economic data related to consumers, which would further cement the Fed’s case for a 75 bps hike. That said, the EURUSD will be at the mercy of interest rate differentials between the ECB and the Fed, which could favor the shared currency. However, the greenback recoils 0.52%, as shown by the US Dollar Index falling towards 108.070, a tailwind for the euro.

Also read: EUR/USD Forecast: Euro remains vulnerable despite reclaiming parity

US Inflation remains high

US Retail sales and UoM Consumer sentiment beat forecasts.

In the meantime, upbeat economic data give traders a respite, but not to USD buyers, which are booking profits ahead of the weekend. The US Department of Commerce reported that US Retail Sales rose by 1% YoY, exceeding expectations of 0.8%, and also left behind May’s dismal reading of -0.3%. Of late, the University of Michigan Consumer Sentiment came better than expected, with the index toping 51.1 vs. 49.9 estimated. The positive in the report is that inflation expectations tempered, with consumers seeing inflation at 2.8% over a 5-year horizon, lower than 3.1% in June. Although data is positive, that could boost the EURUSD because the data may ease Fed officials from hiking more than 75 bps.

US inflation remains high; additional Fed hikes ahead

Given that US inflation readings in the week remained higher, with the CPI and the PPI hitting 9.1% and 11.3% in year-over-year readings, EURUSD traders need to be aware of that. Further rate hikes from the Fed are expected, with money market futures STIRs portraying the Federal funds rate (FFR) at 3.55% by December, meaning that market participants expect at least 225 bps of tightening by the year’s end. Consequently, this would be a headwind for the EURUSD, despite the ECB’s guidance that it would begin raising rates for the first time in 11 years.

Fed speakers began to be vocal about rate hikes and emphasized that inflation is high

Elsewhere, Fed speakers have been entertaining EURUSD traders throughout the week. On Friday, the St. Louis Fed President James Bullard said it would not make any difference to hike 100 or 75 bps while adding that the pace could be adjusted for the rest of the year. Earlier in the week, Atlanta’s Fed President Raphael Bostic said everything is in play when asked about raising rates 100 bps in the July meeting. Later, the Cleveland Fed President Loretta Mester said they don’t need to decide on rates today but emphasized that inflation is “too high,” and the CPI report was uniformly negative. In the meantime, backing 75 bps is San Francisco’s Fed Mary Daly, but she also said that 100 bps is within the range of possibilities.

Recession fears remain as the US 2s-10s yield curve remains inverted

The US 2s-10-yield curve is still inverted for nine consecutive days, though less profound than in previous days- At the time of writing, the spread reduced to -0.189%, as traders’ fears about recession easied a tone. However, unless Fed officials express worries about economic growth, that would not deter them from aggressive tightening, which is negative news for EURUSD longs in the future.

ECB vs. Fed differentials, a headwind for the EURUSD

In July, both banks, the ECB and the Federal Reserve will host their monetary policy meetings. Currently, the ECB’s deposit rate lies at minus 0.50%, while the US Federal Reserve’s Federal funds rate (FFR) is at 1.75%, bolstering the appetite for the greenback. With expectations of the ECB hiking 25 bps and the Fed to move at least by 75 bps, differentials would widen further, to -0.25% (ECB) vs. 2.50% (Fed), meaning that the greenback would keep the upper hand, opening the door for further selling pressure on the EURUSD.

EURUSD Price Technical outlook

EURUSD remains heavy, as shown by the daily chart, with the daily moving averages (DMAs) residing well above the exchange rate. Wednesday’s correction offered EURUSD shorts a better entry price after hitting a daily high around 1.0122, but on Thursday, the major extended its losses, pushing below the parity. However, on Friday, the EURUSD buyers stepped in and kept the price above the July 14 high of 1.0058, meaning that achieving a daily close above it might open the door for a correction.

In the near term, the EURUSD is headed upwards. That said, the major’s first resistance would be 1.0100. Break above will expose the July 13 high at 1.0122, followed by July 11 daily high at 1.0183.

On the flip side, the EURUSD first support would be 1.0000. A breach of the latter will expose the fresh 20-year low at 0.9952. Once cleared, EURUSD sellers’ next challenge will be December 2002 lows around 0.9859.

EURUSD: Weekly forex analysis video: EUR/USD, GBP/USD, AUD/USD and more [Video]

Data released on Friday showed Retail Sales rose 1% in June, above the 0.8% of market consensus; May’s numbers were revised higher. The June retail sales report showed that consumers are still spending more but getting less, explained analysts at Wells Fargo. They warn the staying power of consumer goods spending is waning.

Key Quotes:

“The June retail sales report shows that people are paying more but getting less. The total dollar amount of retail sales grew 1.0%, which topped consensus estimates, but after applying our inflation adjustment, we estimate that real retail sales actually fell by 1.0%.”

“Our latest forecast has the FOMC raising rates by 100 bps at its policy meeting on July 27. St. Louis Fed President James Bullard and Federal Reserve Governor Christopher Waller in separate public appearances on Thursday both backed raising rates by 75 basis points this month, though Waller said, “If that data come in materially stronger than expected it would make me lean towards a larger hike at the July meeting.”

“Continued moderation in real goods consumption should help alleviate pressure on supply chains and contribute to a decline in goods inflation. Ultimately that is what the Fed is trying to achieve: slower demand to bring down inflation. But with real retail sales still more than 6% above pre-pandemic levels through June, we expect more tightening yet before demand meaningfully declines to facilitate a reprieve in goods prices.”

- US Dollar drops across the board, moves off multi-year highs.

- US economic data mostly above expectations.

- AUD/USD up on Friday, still heads for the lowest weekly close since May 2020.

The AUD/USD is rising more than 50 pips on Friday as it moves off the multi-year low it hit on Thursday at 0.6697. Recently the pair hit the highest level since Monday at 0.6805.

Near the end of the week, AUD/USD is hovering around 0.6800, far from the recent low but still in negative for the week. The weekly close could be the lowest since May 2020; however, the sharp rebound from 0.6700 is a positive sign for the Aussie.

Dollar correct lower amid risk appetite

The greenback is pulling back across the board as stocks in the US post strong gains. The Dow Jones is up by 2.00% and S&P 500 by 1.75%. US yields are modestly lower, unaffected by US economic data. The DXY is falling 0.62% on Friday, the worst performance in a month.

Data released on Friday showed Retail Sales rose above expectation in June, the Empire Manufacturing index climbed unexpectedly to 11.1 and the Consumer Confidence report also surpassed market consensus. The odds of a 100 basis points rate hike from the Federal Reserve at the July meeting rose after the numbers; and were partially offset by Fedspeak, suggesting a 75bps hike seems more likely.

Technical levels

San Francisco Fed President Mary Daly said on Friday that she is cont concerned above "over cooking things" on rate hikes, as reported by Reuters.

Additional takeaways

"Consumers continue to spend."

"Labor market remains strong."

"Inflation is too high."

"Fed is working on getting down inflation without stalling economy."

"Inflation has lasted longer than hoped, that's because covid is still rampant, and the war."

"Price of gas is a market-based price, based on supply and demand."

"We are dialing back support to economy."

"July meeting will be a good discussion."

"Bringing down inflation will help Americans."

"We're not talking about raising rates to extreme highs, more like in the 3% range."

"I don't expect mortgage rates to keep marching up as they have been."

"It's a little painful now, but better in the long run."

"This will cool the frothy housing market."

"We are starting to see signs that inflation is coming down."

"UOM data on consumer inflation expectations was a good thing."

"I want inflation to be less painful by end of the year than it is now."

"I don't have recession high on list of possible outcomes."

"Job market is very strong."

Market reaction

The US Dollar Index stays deep in negative territory near 108.10 following these comments.

Statistics New Zealand will release Q2 Consumer Price Index (CPI) inflation data on Sunday, July 17 at 22:45 GMT and as we get closer to the release time, here are forecasts from economists and researchers of four major banks regarding the upcoming growth data.

Economists expect the CPI to have jumped from 6.9% YoY to 7.1%. Meanwhile, the QoQ pace may have moderated to 1.5% from 1.8%.

ANZ

“We’re forecasting that annual CPI inflation hit 7.1% in Q2 – a slight increase from Q1’s already-strong 6.9% print. Uncertainty remains high, with global commodity prices being buffeted by geopolitical developments, and trading-partner inflation continuing to surge. Domestic inflation risks are firmly to the upside, given still-high inflation expectations and an extremely tight labour market. We expect annual non-tradables inflation remained high at 6.0%, while tradables are expected to have nudged up to 8.7% YoY (8.5% previously). The RBNZ is unlikely to find any comfort – and that should see another 50 bps hike delivered at the August MPS, despite downside growth risks piling up. If we were to see a non-negligible upside surprise to the CPI print, another 50 bps in October would be game on. The RBNZ has no leeway to take any chances on the inflation front.”

Westpac

“We expect the upcoming Consumers Price Index will show that New Zealand consumer prices rose by 1.4% in the June quarter. That would take annual inflation to 7.0%, up from 6.9% last quarter and the highest annual inflation rate in more than three decades. There have been particularly large increases in the prices of food, fuel and housing related costs. However, price pressures are bubbling over in every corner of the economy. Businesses are continuing to grapple with shortages of staff and supplies. But what has really lit a fire under consumer prices has been the strength of demand. Our forecast is in line with the RBNZ’s last set of published forecasts.”

Standard Chartered

“We expect YoY inflation to have remained elevated at 6.9%; however, on a QoQ basis, inflation likely moderated to 1.3% from 1.8% previously. Median house prices were down 3.4% QoQ in Q2, more than the 2.5% QoQ decline in Q1. Dubai oil prices rose at a slower pace of 12.3% QoQ in Q2 versus 24.9% QoQ in Q1. The NZD trade-weighted index depreciated by a slower pace of 0.7% QoQ in Q2 versus 2.2% QoQ in Q1. Finally, the food price index rose 1.4% QoQ in Q2 versus 3% QoQ in Q1. Our forecast is similar to the central bank’s forecast of 7.0% YoY in Q2.”

TDS

“The RBNZ expects CPI inflation to peak at 7.0% YoY in Q2'22 but we struggle with this optimistic view. We see further upside risks to NZ inflation from the passthrough of elevated PPIs to CPIs by offshore trading partners. We think another red-hot CPI print (we forecast 7.3% YoY) reinforces our call for a fourth consecutive 50 bps hike by the Bank at its August meeting.”

- UOM Consumer Confidence Index edged slightly higher in early July.

- US Dollar Index is pushing lower toward 108.00.

Consumer sentiment in the US improved slightly in early July with the University of Michigan's Consumer Confidence Index edging higher to 51.5 in July's flash estimate from 50 in June. This print came in slightly better than the market expectation of 49.9.

On a negative note, the Index of Consumer Expectations declined to its lowest level since May 1980 at 47.3.

"The median expected year-ahead inflation rate was 5.2%, little changed from the past five months," the publication further revealed. "Median long-run expectations fell to 2.8%, just below the 2.9-3.1% range seen in the preceding 11 months."

Market reaction

Pressured by falling long-term inflation expectations, the US Dollar Index edged lower and was last seen losing 0.5% on the day at 108.12.

St. Louis Federal Reserve Bank President James Bullard argued on Friday that it wouldn't make too much of a difference to do a 100 basis points (bps) or a 75 bps rate hike at the next meeting, as reported by Reuters.

Additional takeaways

"Inflation can come down relatively quickly down to 2% over the next 18 months if Fed plays its cards right."

"Base case is still that we can get a relatively soft landing."

"I am an advocate of frontloading rate hikes."

"Fed has been trying to not do too much at once."

"Our commitment to getting to 2% inflation is unconditional."

Market reaction

The US Dollar Index extended its recovery on these comments and was last seen losing 0.25% on a daily basis.

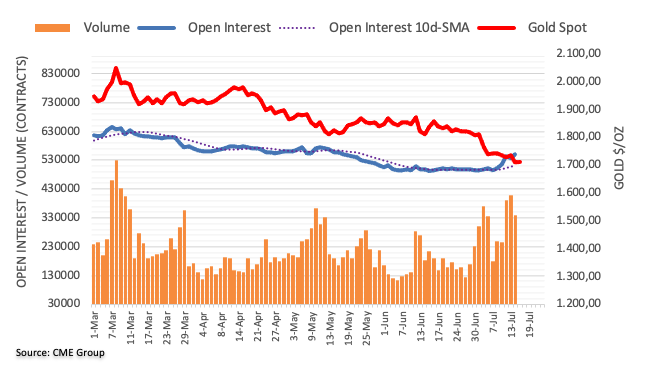

- Gold price oscillated in a range and consolidated the recent downfall to a nearly one-year low.

- The ongoing USD profit-taking slide from a 20-year low, weaker US bond yields offered support.

- Aggressive Fed rate hike bets, a positive risk tone acted as a headwind and capped the upside.

Gold price seesawed between tepid gains/minor losses on Friday and consolidated its recent decline to its lowest level since August 2021. The XAUUSD, however, managed to defend the $1,700 mark through the early North American session, though any meaningful recovery still seems elusive.

Gold price drew support from weaker USD

The US dollar extended the previous day's retracement slide from a two-decade high and edged lower on the last day of the week. Fed Governor Christopher Waller and St. Louis Fed President Jim Bullard - the two most hawkish FOMC members - said that they were not in favour of the bigger rate hike at the upcoming meeting in July. Adding to this, Atlanta Fed President Raphael Bostic noted that moving too dramatically could undermine positive aspects of the economy and add to the uncertainty. This, in turn, continued weighing on the USD and offered some support to the dollar-denominated gold.

Upbeat US macro data failed to impress USD bulls

The US Census Bureau reported that Retail Sales increased by 1% in June as against the 0.8% rise anticipated and the 0.1% fall in the previous month (revised higher from -0.3%). Excluding autos, core retail sales also surpassed estimates and climbed 1% during the reported month, up from the 0.5% increase in May. Separately, the New York Fed's Empire State Manufacturing Index rebounded sharply from -1.2 in June to 11.1 for the current month, beating expectations for a reading of -2. The upbeat data, however, failed to impress the USD bulls or provide any impetus to the gold price.

-637934890587383680.png)

US Retail Sales historic chart

Aggressive Fed rate hike bets capped XAUUSD

The odds for a 100 bps Fed rate hike move jumped following the release of stronger-than-expected US economic data. It is worth mentioning that Fed Governor Christopher Waller said on Thursday that his decision to back the case for an aggressive rate hike depends on incoming data and specifically cited retail sales as one of the key metrics. This, to a larger extent, helped offset a softer tone surrounding the US Treasury bond yields and continued acting as a headwind for the non-yielding gold.

Positive risk tone also weighed on gold price

A goodish recovery in the risk sentiment - as depicted by a generally positive tone around the equity markets - dented demand for traditional safe-haven assets. This was seen as another factor that contributed to capping the upside for gold price. That said, growing fears about a possible recession should keep a lid on any optimistic move in the markets. This, in turn, warrants some caution for aggressive bearish traders and before positioning for any further depreciating move for the metal.

Gold price technical outlook

Gold price, so far, has struggled to find acceptance below the $1,700 round-figure mark. That said, the metal’s inability to gain any meaningful traction suggests that the near-term selling bias might still be far from being over and risks remain skewed to the downside. Hence, any attempted recovery move is likely to confront resistance near the $1,725-$1,726 region. This is followed by the $1,734-$1,735 horizontal barrier, above which a bout of short-covering could lift the XAUUSD towards the $1,749-$1,752 supply zone.

On the flip side, weakness below the overnight swing low, around the $1,698-$1,697 area, would be seen as a fresh trigger for bearish traders and make the XAUUSD vulnerable. Gold price could then accelerate the fall towards September 2021 low, around the $1,787-$1,786 region. The downward trajectory could further get extended towards testing the 2021 yearly low, near the $1,677-$1,676 area.

-637934893697553696.png)

Gold price: Top-down analysis on XAUUSD

- The index loses further ground and revisits 108.00.

- US Retail Sales expanded more than expected in June.

- Flash Consumer Sentiment comes next in the NA session.

The US Dollar Index (DXY), which gauges the greenback vs. a bundle of its main competitors, drops further to 2-day lows near 108.00 at the end of the week.

US Dollar Index now looks to U-Mich index

The index keeps the bearish note well and sound on Friday, although it remains en route to close the third consecutive week with gains on Friday.

In the meantime, the greenback remained apathetic following comments from St. Louis Fed Bullard, who now left a 100 bps rate hike on the table (he almost ruled out it on Thursday) and added that a “relatively soft landing” remains his base case.

The corrective downside in the dollar comes in response to the improvement in the sentiment surrounding the risk complex, while the overbought condition of DXY also adds to the ongoing correction.

The leg lower in the buck also comes after US headline Retail Sales expanded at a monthly 1.0% in June as well as Core Sales. In addition, Industrial Production contracted 0.2% MoM in June and expanded 4.2% over the last twelve months.

Later in the session, the flash Consumer Sentiment figures are due along with Business Inventories.

What to look for around USD

The index pushed higher and clinched new cycle highs past 109.00 on Thursday. It is worth noting, however, that the recent sharp move in the dollar comes largely in response to the accelerated decline in the euro and persistent uncertainty around a potential recession in the old continent.

Further support for the dollar is expected to come from the Fed’s divergence vs. most of its G10 peers (especially the ECB) in combination with bouts of geopolitical effervescence and the re-emergence of the risk aversion among investors. On the flip side, market chatter of a potential US recession could temporarily undermine the uptrend trajectory of the dollar somewhat.

Key events in the US this week: Retail Sales, Industrial Production, Flash Consumer Sentiment, Business Inventories (Friday).

Eminent issues on the back boiler: Hard/soft/softish? landing of the US economy. Escalating geopolitical effervescence vs. Russia and China. Fed’s more aggressive rate path this year and 2023. US-China trade conflict. Future of Biden’s Build Back Better plan.

US Dollar Index relevant levels

Now, the index is down 0.31% at 108.29 and faces next contention at 107.47 (July 13) followed by 103.67 (weekly low June 27) and finally 103.41 (weekly low June 16). On the other hand, a break above 109.29 (2022 high July 15) would expose 109.77 (monthly high September 2002) and then 110.00 (round level).

GBP/USD managed a close above 1.18 on Thursday. Nevertheless, economists at Scotiabank expect cable to drift below the figure towards key support at 1.15.

Bank of England’s policy prospects remain a negative risk

“A more cautious BoE than traders are expecting underpins our expectation for a weaker GBP in the months ahead towards 1.15.”

“Intraday support after the 1.18 zone is 1.1775 and the Thu low of 1.1760.”

“Resistance past 1.18 is 1.1875/85 and the figure area followed by the mid-1.19s.”

EUR/USD rebounds from sub-par levels but headwinds remain. In the view of economists at Scotiabank, its steep break under parity marked a key development in the downtrend that signals further losses ahead.

Bearish price action in the near term

“The EUR is facing a multitude of headwinds that are bound to see it close under, and extend losses beyond, the parity mark.”

“The EUR has conveniently held in oversold territory over most of the week, which may be keeping it supported and preventing a sustained drop under 1.00. But the broader trend and limited gains through the mid-1.00s (aside from its short-lived push through 1.01 on Wed) are aligned for bearish price action in the near term.”

“Support past 1.0000/10 is 0.9985 and the Thu low of 0.9952.”

“Resistance is ~1.0050, 1.0074, and the 1.01 big figure zone.”

Gold Price struggles for clear directions above the $1,700 threshold. In the view of strategists at TD Securities, a liquidation event is simmering in the yellow metal.

Strong retail sales print and empire manufacturing data could spark fears of additional hikes

“With gold bugs falling like dominoes, prices are now challenging pre-pandemic levels raising risks that the largest speculative cohort in gold will start to feel the pain under a hawkish Fed regime.”

“The massive prop-trader longs appear to be complacent, but the average trader is still holding nearly twice their expected position size. Now, pressure is building towards a capitulation as prices start to challenge their pandemic-era entry levels. In a liquidation vacuum, these massive positions are most vulnerable, which suggests the yellow metal remains prone to further downside still.”

“Additional fedspeak could be expected ahead of tonight's blackout period, but the strong retail sales print combined with the strong empire manufacturing data could spark fears of additional hikes.”

- Industrial Production in the US unexpectedly contracted in June.

- US Dollar Index stays in negative territory below 108.50.

Industrial Production in the US contracted by 0.2% on a monthly basis in June, the US Federal Reserve reported on Friday. This reading came in weaker than the market expectation for an expansion of 0.1%.

"Manufacturing output declined 0.5% for a second consecutive month in June; even so, it rose at an annual rate of 4.2% in the second quarter," the Fed further added in its press release. "Capacity utilization decreased 0.3 percentage point in June to 80.0%, a rate that is 0.4 percentage point above its long-run (1972–2021) average."

Market reaction

The US Dollar Index stays in negative territory at around 108.20 after this report.

St. Louis Federal Reserve Bank President James Bullard said on Friday that he expects to see good employment reports through the second half of this year, as reported by Reuters.

Additional takeaways

"GDP number is likely currently misleading."

"GDI is a better measure at the moment."

"I don't think recession models are particularly accurate."

"The US economy is slowing to trend pace of growth."

"This week's inflation report was hot."

"Inflation has continued to surprise to the upside."

"Based on these inflation numbers, Core PEC inflation hasn't peaked yet."

"We have a ways to go on inflation."

"I think most recent inflation report means Fed should now target 3.75% policy rate by end of 2022."

"We could do more rates sooner, or spread out over the remaining meetings of the year."

"Inflation proving broader and more persistent; we must have a stronger path for Q2 accordingly."

Market reaction

These comments don't seem to be helping the dollar find demand. As of writing, the US Dollar Index was down 0.52% on a daily basis at 108.07.

Atlanta Fed President Raphael Bostic said on Friday that June's 75 basis points rate hike was a "big move" and added that the Fed wants policy transition to be orderly, as reported by Reuters.

Additional takeaways

"No historical context for what the US is facing today."

"Source of both higher aggregate demand and hiring, other supply difficulties, rooted in pandemic."

"Trying to get out of the business of looking too far ahead on policy, given the number of surprises on inflation, other data."

"Moving too dramatically could undermine positive aspects of the economy, add to the uncertainty."

"Approach Fed is taking now gives highest likelihood of success."

Market reaction

The US Dollar Index stays on the back foot after these comments and was last seen losing 0.5% on a daily basis at 108.12.

- GBP/USD gained some positive traction on Friday amid subdued USD price action.

- The USD bulls seemed rather unimpressed by stronger monthly US Retail Sales data.

- Weaker US bond yields, a positive risk tone undermined the safe-haven greenback.

The GBP/USD pair held on to its modest intraday gains, below the 1.1850 region, through the early North American session and moved little in reaction to upbeat US macro data.

The US Census Bureau reported this Friday that Retail Sales rose 1% in June, better than estimates for a 0.8% increase. Adding to this, the previous month's reading was also revised higher to show a 0.1% decline as against the 0.3% fall reported earlier. Furthermore, excluding autos, core retail sales also surpassed expectations and climbed 1% in June, up from the 0.5% increase in the previous month.

Fed Governor Christopher Waller said on Thursday that his decision to back the case for an aggressive rate hike at the upcoming meeting depends on incoming data. Waller specifically cited retail sales and housing as two key metrics. Hence, the stronger data might have lifted bets for a 100 bps rate hike move on July 27, though failed to impress the US dollar bulls and provide any impetus to the GBP/USD pair.

A rather muted reaction in the money markets turned out to be a key factor that held back the US D bulls on the defensive. Apart from this, a goodish recovery in the global risk sentiment, as depicted by a generally positive tone around the equity markets, continued denting the greenback's safe-haven status. This, in turn, offered some support to the GBP/USD pair and remained supportive of the modest intraday gains.

Technical levels to watch

Retail Sales in the US increased by 1% on a monthly basis in June, the data published by the US Census Bureau showed on Friday.

Developing story...

- EUR/USD regains some composure following new cycle lows.

- The breach of the 2022 low at 0.9952 should trigger extra losses.

EUR/USD attempts a bull run after dropping to the mid-0.9900s on Thursday, levels last seen in December 2002.

Despite the ongoing bounce, the pair’s bearish stance remains everything but abated for the time being. Against that, another convincing breakdown of the parity level should expose the YTD low at 0.9952 (July 14) ahead of the December 2002 low at 0.9859.

As long as the pair navigates below the 5-month support line around 1.0545, further losses remain in store.

In the longer run, the pair’s bearish view is expected to prevail as long as it trades below the 200-day SMA at 1.1033.

EUR/USD daily chart

The prospect that grains exports from Ukraine might be resumed has exerted noticeable pressure on wheat prices this week. If agreement were to be reached on resuming grains exports from Ukraine, wheat prices could fall further, strategists at Commerzbank report.

A lot of new supply is reaching the market

“According to Turkey, an agreement could be signed next week. It would apparently include joint controls for checking shipments in the ports and Turkey ensuring the safety of Black Sea export routes. Wheat would then become even cheaper.”

“If hopes are quashed yet again, wheat prices are likely to recoup only part of their losses. This is because harvesting is now underway in the major producing countries in the northern hemisphere, meaning that a lot of new supply is reaching the market.”

UOB Group’s Senior Economist Julia Goh and Economist Loke Siew Ting comment on the recent decision by the BSP to unexpectedly hike rates by 75 bps.

Key Takeaways

“In a regular but not scheduled monetary policy setting meeting this morning (14 Jul), Bangko Sentral ng Pilipinas (BSP) raised its overnight reverse repurchase (RRP) rate by 75bps to 3.25%. Likewise, both the overnight deposit and lending rates were also raised to 2.75% and 3.75% respectively. It was a rare move with the biggest rate hike since Oct 2000, and followed two back-to-back rate increases of 25bps each in May and Jun.”

“BSP saw an urgent need to get ahead of the inflationary threat and stressed that this urgent policy action is intended to help manage spillovers from other countries that could potentially disanchor inflation expectations. It also believes that favourable domestic economic conditions so far this year can accommodate a further tightening of monetary policy.”

“We believe that the latest large off-cycle rate hike will not mark the end of the BSP’s monetary policy normalisation as yet. In fact, we see the central bank hinting for more interest rate rises ahead, depending on the incoming domestic inflation and GDP data as well as global and regional central banks’ rate decision in the near term. Given that BSP has escalated its rate hike pace faster than we had anticipated for 2H22, we now bring forward our BSP rate hike projections for 1H23 to this year, taking the RRP rate back to the pre-pandemic level of 4.00% by the end of 2022.”

Brent has dipped noticeably below $100 per barrel this week. Economists at Commerzbank expect this trend to continue.

Few supply concerns, but many demand concerns

“Brent is likely to continue sliding given that the recession fears will presumably not abate for the time being.”

“Not only has the IEA downwardly revised its demand forecasts, but it is also more optimistic about supply.”

- DXY comes under pressure after hitting new highs on Thursday.

- Further decline could revisit the minor support at 107.47 (July 13).

DXY trades on the defensive as investors seem to be cashing up part of the recent strong gains in the dollar.

While further upside in the dollar remains in store in the short-term horizon, the current overbought condition carries the potential to meet an initial contention at 107.47 (low July 13) prior to the June top at 105.78 (June 15).

As long as the index trades above the 5-month line near 103.20, the near-term outlook for DXY should remain constructive.

In addition, the broader bullish view remains in place while above the 200-day SMA at 98.80.

DXY daily chart

- USD/JPY witnessed some selling on Friday and moved away from a 24-year high touched on Thursday.

- The overnight less hawkish remarks by Fed officials, falling US bond yields weighed on the greenback.

- The Fed-BoJ policy divergence helped limit losses as the focus now shifts to the key US macro releases.

The USD/JPY pair edged lower on Friday and eased further from a 24-year high, around the 139.35-139.40 area touched the previous day. The pair remained depressed heading into the North American session and was last seen trading around the 138.70-138.65 region, just a few pips above the daily low.

The US dollar extended the overnight retracement slide from a two-decade high amid diminishing odds for a more aggressive policy tightening by the Federal Reserve. This, in turn, was seen as a key factor that exerted some downward pressure on the USD/JPY pair, though any meaningful corrective pullback still seems elusive.

Fed Governor Christopher Waller and St. Louis Fed President Jim Bullard - two of the most hawkish FOMC members - pushed back against market expectations for a supersized, 100 bps rate hike in July. This led to a further decline in the US Treasury bond yields, which narrowed the US-Japan rate differential and underpinned the Japanese yen.

Despite the less hawkish remarks by Fed officials, a big divergence in the US central bank and Bank of Japan policy stance should cap gains for the JPY. Apart from this, a slight improvement in the global risk sentiment - as depicted by a positive tone around the equity markets - could further keep a lid on the safe-haven JPY.

The fundamental backdrop supports prospects for the emergence of some dip-buying around the USD/JPY pair. Traders, however, preferred to wait on the sidelines ahead of Friday's US macro releases - the monthly Retail Sales data, the Empire State Manufacturing Index, Industrial Production figures and Michigan Consumer Sentiment Index.

This, along with the US bond yields, should influence the USD price dynamics and provide some impetus to the USD/JPY pair. Apart from this, traders would take cues from the broader market risk sentiment to grab short-term opportunities on the last day of the week. Nevertheless, the pair remains on track to end the week with strong gains.

Technical levels to watch

There have been a lot of developments in factors that have driven both USD strength and EUR weakness. Thus, economists at Rabobank are minded to push their outlook for the EUR/USD pair further down.

Eurozone is likely to fall into recession this winter

“Not only do we see the EUR vulnerable to Eurozone recession risks, but we expect that the value of the USD is likely to remain elevated into 2023.”

“If the Nord Stream 1 natural gas pipeline is switched back on fully, in time next week after its scheduled maintenance, the EUR is likely to be granted a reprieve. However, politicians are fearing that the flow may be insufficient for Europe to fully strength their gas reserves ahead of the winter.”

“Natural gas flows will be instrument in guiding the outlook for the EUR in the months ahead. That said, even if the EUR is boosted, we expect USD strength to dominate into next year suggesting upside for EUR/USD could be limited even on good news regarding Nord Stream.”

The strong US dollar, which is the mirror opposite of the weak euro, is depressing the gold price. Nonetheless, economists at Commerzbank expect the yellow metal to recover in the coming months.

Upcoming recession in the US

“If it emerges from the ECB meeting that a more resolute approach to tackle inflation will be taken, gold could profit indirectly even though higher interest rates per se are bad news for gold as a non-interest-bearing investment.”

“Market participants increasingly appear to expect a recession in the US. Gold should really benefit from this as a safe haven. This is one reason why we anticipate higher gold prices in the coming months and quarters. That said, for this to happen the still strong ETF outflows would need to end and buying interest would need to return to the market.”

- EUR/JPY pushes higher and extends the weekly rebound near 140.00.

- Next on the upside comes the resistance line near 140.50.

EUR/JPY advances for the third session in a row and targets the 140.00 barrier on Friday.

Further upside should surpass the 4-month resistance line around 140.50 to allow for the continuation of the current move to, initially, the weekly high at 142.37 (July 5). Beyond the latter, the cross could attempt a visit to the 2022 top at 144.27 (June 28).

In the longer run, the constructive stance in the cross remains well propped up by the 200-day SMA at 133.31.

EUR/JPY daily chart

US Monthly Retail Sales Overview

Friday's US economic docket highlights the release of monthly Retail Sales figures for June, scheduled later during the early North American session at 12:30 GMT. The headline sales are estimated to grow by a seasonally adjusted 0.8% during the reported month as against the 0.3% fall recorded in May. Excluding autos, core retail sales probably climbed by 0.6% in June, up slightly from the 0.5% increase in the previous month.

Analysts at TD Securities, however, were slightly less optimistic about the report and explained: “We look for retail sales to recover in June (0.5%), following the series' first contraction this year in May. Spending was likely aided by another firm showing in gasoline station sales and a rebound in the auto segment. We also look for another gain in the eating/drinking segment as consumers continue to transition away from goods. That said, control group sales likely fell again (-0.5%).”

How Could it Affect EURUSD?

Fed Governor Christopher Waller said on Thursday that his decision to back the case for an aggressive rate hike at the upcoming FOMC meeting later this month depends on incoming data. Wallerspecifically cited retail sales and housing as two key metrics. Hence, a stronger-than-expected reading would lift bets for a supersized 100 bps Fed rate hike move on July 27 and boost the US dollar. Conversely, any disappointment would further add to worries about a possible recession, which should continue to weigh on investors' sentiment and benefit the greenback's safe-haven status.

Furthermore, investors remain concerned that a halt to gas flows from Russia could trigger an economic crisis in the Eurozone. This would curtail the European Central Bank’s ability to raise rates and act as a headwind for the shared currency. The fundamental backdrop suggests that the path of least resistance for the EURUSD pair is to the downside. Hence, any attempted recovery move might still be seen as a selling opportunity and runs the risk of fizzling out rather quickly.

Eren Sengezer, Editor at FXStreet, offered a brief technical outlook and wrote: “EUR/USD is moving sideways on the outside of the descending regression channel coming from late June. The Relative Strength Index (RSI) indicator on the four-hour chart, however, stays well below 50, suggesting that buyers remain on the sidelines.”

Eren also outlined important technical levels to trade the EUR/USD pair: “On the upside, 1.0050 (20-period SMA) aligns as immediate resistance ahead of 1.0080 (static level), 1.0100 (psychological level) and 1.0120 (50-period SMA). In case the pair returns within the descending channel below parity, it could target 0.9950 (static level, July 14 low) and 0.9900 (psychological level).”

Key Notes

• US June Retail Sales Preview: Has the consumer turning point arrived?

• US Retail Sales Preview: Forecasts from six major banks, slowing in core spending

• EUR/USD Forecast: Euro remains vulnerable despite reclaiming parity

About US Retail Sales

The Retail Sales released by the US Census Bureau measures the total receipts of retail stores. Monthly per cent changes reflect the rate of changes in such sales. Changes in Retail Sales are widely followed as an indicator of consumer spending. Generally speaking, a high reading is seen as positive (or bullish) for the USD, while a low reading is seen as negative (or bearish).

Economist at UOB Group Lee Sue Ann reviews the publication of the latest labour market report in Australia.

Key Takeaways

“Australia’s job market continues to tighten, with the latest figures showing the unemployment rate falling to 3.5% in Jun, the lowest level since Aug 1974. Seasonally adjusted employment growth was strong at 88,400 over the month, well above expectations for 30,000, and May’s reading of 60,600, making this the eighth consecutive monthly rise.”

“Overall, the labour market strength has given the green light for the Reserve Bank of Australia (RBA) to continue pushing interest rates higher, after delivering a 50bps hike earlier this month on 5 Jul. Indeed, in light of the RBA’s persistent reference to ensure that inflation in Australia returns to target over time; we believe the RBA is open to a third 50bps rise in Aug.”

“While financial markets have priced in aggressive tightening, with the expectation for OCR rising above 3.5% by 2Q23. we think the Australian economy does not require such aggressive tightening, and our view is also based on several uncertainties flagged by the RBA. The next RBA meeting is on 2 Aug, and 2Q22 CPI data, to be published on 27 Jul, will be a crucial update that comes a little less than a week prior to that meeting.”

The European Central Bank's Governing Council will likely raise its key interest rate by 0.25 percentage points next week and 0.5 percentage points in September, ECB Governing Council member Olli Rehn said on Friday, as reported by Reuters.

This comment is in line with a recently conducted Reuters poll on the ECB's rate outlook.

Reuters Poll: ECB forecast to raise deposit rate by 25 basis points in July.

Market reaction

The shared currency showed no immediate reaction to this comment and the EUR/USD pair was last seen rising 0.2% on a daily basis at 1.0040.

All but one of the 63 economists polled by Reuters expect the European Central Bank (ECB) to hike its policy rate by 25 basis points in July.

"A majority of economists in the poll forecast a 50 basis point hike in September, followed by a quarter-point rise in October and December, taking the deposit rate to 0.75%. It is expected to reach 1.50% in the third quarter of next year," Reuters wrote. "Poll medians showed a 45% chance of a recession within a year, much higher than the 34% in the previous poll."

Market reaction

The EUR/USD pair showed no immediate reaction to this article and was last seen posting modestly daily gains near 1.0050.

- USD/CAD extended the overnight pullback from a 20-month high and edged lower on Friday.

- The overnight less hawkish remarks by Fed officials weighed on the USD and exerted pressure.

- Bearish sentiment around oil prices could undermine the loonie and help limit the downside.

- Investors now look forward to important US macro data for short-term trading opportunities.

The USD/CAD pair attracted some selling near the 1.3135 region on Friday and retreated further from its highest level since November 2020 touched the previous day. The modest intraday downtick extended through the first half of the European session and dragged spot prices back below the 1.3100 mark, though lacked follow-through.

The US dollar extended the overnight pullback from a two-decade high and was pressured by diminishing odds for a more aggressive policy tightening by the Fed. On Thursday, two of the Federal Reserve's most policymakers pushed back against market expectations for a 100 bps rate hike later this month. This led to a further decline in the US Treasury bond yields, which, in turn, acted as a headwind for the USD and exerted some downward pressure on the USD/CAD pair.

Apart from this, a slight recovery in the global risk sentiment - as depicted by signs of stability in the equity markets - further dented the greenback's safe-haven status. That said, the worsening global economic outlook could keep a lid on any optimism and continue lending support to the buck. Investors remain concerned that rapidly rising borrowing costs, the ongoing Russia-Ukraine war and fresh COVID-19 curbs in China would pose challenges to global growth.

The fears were further fueled by the dismal Chinese Q2 GDP print released earlier this Friday. This comes after Bank of America economists forecast a “mild recession” in the US this year. This, in turn, has raised concerns about the fuel demand outlook and capped the attempted recovery in oil prices from a five-month low touched on Thursday. The bearish sentiment surrounding the black liquid might undermine the commodity-linked loonie and further lend support to the USD/CAD pair.

Traders might also be reluctant to place aggressive bets and prefer to wait on the sidelines ahead of key US macro data. Friday's US economic docket features the monthly Retail Sales, the Empire State Manufacturing Index, Industrial Production and Michigan Consumer Sentiment Index. This, along with the US bond yields and the broader market risk sentiment, will influence the USD. Apart from this, oil price dynamics should provide a fresh impetus to the USD/CAD pair.

Technical levels to watch

- AUD/USD struggled to gain any meaningful traction on Friday despite subdued USD demand.

- Dismal Chinese GDP fueled recession fears and capped the upside for the risk-sensitive aussie.

- Investors now look forward to important US macro data for short-term trading opportunities.

The AUD/USD pair failed to capitalize on the previous day's modest rebound from over a two-year low and attracted fresh selling near the 0.6765 region on Friday. The pair remained on the defensive through the first half of the European session, though has managed to hold its neck comfortably above the 0.6700 mark.

Following the previous day's pullback from a fresh 20-year high, the US dollar witnessed a subdued price move amid reduced bets for a more aggressive policy tightening by the Fed. Fed Governor Christopher Waller and St. Louis Fed President Jim Bullard - two of the most hawkish FOMC members - pushed back against market expectations for a 100 bps rate hike later this month. This, in turn, led to a further decline in the US Treasury bond yields, which acted as a headwind for the USD and offered some support to the AUD/USD pair.

That said, growing fears about a possible global recession helped limit the downside for the safe-haven buck and continued weighing on the risk-sensitive aussie. Investors remain concerned that rapidly rising borrowing costs, along with the ongoing Russia-Ukraine war and fresh COVID-19 curbs in China, would pose challenges to global economic growth. The fears were further fueled by the dismal Chinese Q2 GDP print released on Friday. The fundamental backdrop supports prospects for additional losses for the AUD/USD pair.

Bearish traders, however, seemed reluctant to place aggressive bets ahead of important US macro data. Friday's US economic docket features the monthly Retail Sales, the Empire State Manufacturing Index, Industrial Production and Michigan Consumer Sentiment Index. This, along with the US bond yields and the broader market risk sentiment, will influence the USD price dynamics and provide some impetus to the AUD/USD pair.

Technical levels to watch

- USD/CHF moved further away from a multi-week high amid subdued USD price action.

- Less hawkish remarks by Fed officials, declining US bond yields weighed on the USD.

- The downside seems cushioned as traders await US macro data for a fresh impetus.

The USD/CHF pair extended the previous day's late pullback from the 0.9885 region, or a multi-week high and witnessed some follow-through selling on Friday. The steady descent extended through the early European session and dragged spot prices to the 0.9800 round-figure mark.

The US dollar was seen consolidating below a two-decade high touched on Thursday, which, in turn, was seen as a key factor exerting downward pressure on the USD/CHF pair. Two of the Federal Reserve's most hawkish policymakers said on Thursday they favoured another 75 bps rate hike late this month, rather than an even bigger move priced in the markets and prompted some USD profit-taking.

In fact, investors raised their bets for a supersized Fed rate hike move after data released on Wednesday showed that the US consumer inflation in June accelerated to a four-decade high. The less hawkish remarks by Fed Governor Christopher Waller and St. Louis Fed President Jim Bullard, however, forced investors to scale back their expectations for a more aggressive policy tightening.

Apart from this, a further decline in the US Treasury bond yields was seen as another factor that kept the USD bulls on the defensive. The downside, however, remains cushioned as investors preferred to wait on the sidelines ahead of the key US macro releases - the monthly Retail Sales data, Empire State Manufacturing Index, Industrial Production data and Michigan Consumer Sentiment Index.

Hence, it will be prudent to wait for strong follow-through selling before confirming that the recent strong rebound from sub-0.9500 levels has run out of steam. Nevertheless, the USD/CHF pair remains on track to end in the green for the third straight week, though would need to find acceptance above the 0.9855-0.9860 area before traders start positioning for any further gains.

Technical levels to watch

- EUR/USD puts some distance from Thursday’s sub-parity lows.

- The dollar now appears offered following recent cycle highs.

- US Retail Sales, flash Consumer Sentiment take centre stage later.

EUR/USD regains a small smile and advances to the 1.0020 region at the end of the week.

EUR/USD up on USD-selling

EUR/USD manages to reclaim some ground lost after bottoming out in new cycle lows in the mid-0.9900s on Thursday, an area last seen back in December 2002.

Renewed selling bias in the greenback allows the current small recovery in spot, all following diminished bets for a 100 bps interest rate hike by the Fed at its meeting later in the month. Indeed, prospects for such a scenario were talked down by FOMC’s Waller and Bullard on Thursday.

In the domestic calendar, EMU Balance of Trade will be the sole release later in the session, whereas Retail Sales, Industrial Production, Business Inventories and the flash U-Mich Index are all due across the pond.

What to look for around EUR

Despite the current bounce, EUR/USD remains under pressure near the parity level.

The ongoing technical rebound in the pair follows current oversold conditions, although it is unlikely to gather serious traction in this context, and especially before the ECB gathering due next week.

In the meantime, the price action around the single currency continues to follow increasing speculation of a probable recession in the euro area, dollar dynamics, geopolitical concerns, fragmentation worries and the Fed-ECB divergence.

Key events in the euro area this week: EMU Balance of Trade (Friday).

Eminent issues on the back boiler: Fragmentation risks. Kickstart of the ECB hiking cycle in July? Asymmetric economic recovery post-pandemic in the euro bloc. Impact of the war in Ukraine on the region’s growth prospects and inflation.

EUR/USD levels to watch

So far, spot is up 0.12% at 1.0026 and a breakout of 1.0489 (55-day SMA) would target 1.0615 (weekly high June 27) en route to 1.0773 (monthly high June 9). On the flip side, the next contention emerges at 0.0052 (2022 low July 14) seconded by 0.9859 (low December 2002) and finally 0.9685 (low October 2002).

The EUR/USD break of parity was more compelling yesterday with a low of 0.9952 before recovering quickly. As economists at MUFG Bank note, EUR sentiment remains poor and political uncertainty in Italy is now set to reinforce that negative sentiment.

Italy and China add to EUR woes

“The 10-year BTP/Bund spread widened out by about 7 bps only but we could see further widening into the weekend which will only add to EUR downside pressure.”

“The developments in Italy only underline the importance of the periphery bonds buying support program that the ECB intends to announce the details of next week. Given the likely increased BTP selling pressures, the risk next week could well be one of disappointment given the probable divisions within the Governing Council over the scale of the support program.”

“EUR sentiment today will not be helped by the data released from China earlier. Real GDP slowed sharply in Q2 to 0.4% QoQ, much weaker than the consensus 1.2%. The 5.5% GDP growth target for 2022 is now out of reach and even getting a print of 4.0% will prove challenging. Global growth recession fears will remain elevated which will keep EUR/USD under downward pressure.”

FX Strategists at UOB Group Lee Sue Ann and Quek Ser Leang see USD/CNH advancing further with the next target at 6.8000 in the short-term.

Key Quotes

24-hour view: “Our expectations for USD to ‘trade in a choppy manner between 6.7130 and 6.7430’ turned out to be incorrect as USD surged to high of 6.7910 before pulling back sharply. Despite the pullback, upward momentum still appears to be firm and USD could retest the 6.7900 level. For today, the chance for USD to move to the major resistance at 6.8000 is not high. Support is at 6.7460 followed by 6.7330.”

Next 1-3 weeks: “We turned positive USD on Tuesday (12 Jul, spot at 6.7255). On Wednesday (13 Jul, spot at 6.7400), we highlighted that USD could consolidate for 1 to 2 days first before moving higher to 6.7700. Yesterday (14 Jul), USD surged past 6.7700 and rose to 6.7910 before pulling back. The improved upward momentum suggests that USD is likely to advance further. The next level to monitor is at 6.8000. Overall, the positive outlook for USD is intact as long as it does not move below 6.7190 (‘strong support’ level was at 6.7050 yesterday). Looking ahead, if USD breaks above 6.8000, it would increase the risk of a move towards the May’s high near 6.8390.”

- NZD/USD reversed modest intraday losses amid subdued USD price action on Friday.

- The overnight less hawkish remarks by Fed officials kept the USD bulls on the defensive.

- Recession fears might limit losses for the safe-haven buck and cap the risk-sensitive kiwi.

The NZD/USD pair attracted some dip-buying on Friday and climbed back above the 0.6100 mark during the early European session. The pair was last seen trading near the daily high, around the 0.6130-0.6135 area and might now be looking to build on the overnight late rebound from over a two-year low.

Thursday's less hawkish remarks by Fed Governor Christopher Waller and St. Louis Fed President Jim Bullard forced investors to scale back bets for a supersized 100 bps rate hike on July 27. Both Waller and Bullard - the biggest Fed hawks - said they were not in favour of the bigger rate hike that the markets priced in following the release of red-hot US consumer inflation on Wednesday. This, along with a further decline in the US Treasury bond yields, kept the US dollar below a 20-year high touched the previous day and offered some support to the NZD/USD pair.

That said, any meaningful upside still seems elusive amid growing worries about a possible global recession. Investors remain concerned that rapidly rising borrowing costs, along with the ongoing Russia-Ukraine war and fresh COVID-19 curbs in China, would pose challenges to global economic growth. The fears were further fueled by Friday's disappointing release of the Chinese Q2 GDP print. This, in turn, should act as a tailwind for the safe-haven USD and keep a lid on any meaningful upside for the risk-sensitive kiwi, at least for the time being.

Investors might also refrain from placing aggressive bets and prefer to wait for important US macro data. Friday's US economic docket features the Empire State Manufacturing Index, Industrial Production figures and Michigan Consumer Sentiment Index later during the early North American session. Apart from this, a scheduled speech by Atlanta Fed President Raphael Bostic, the US bond yields and the broader market risk sentiment will influence the USD price dynamics. This, in turn, should allow traders to grab short-term opportunities around the NZD/USD pair.

Technical levels to watch

- The index comes down after hitting cycle peaks on Thursday.

- US yields resume the downside across the curve.

- Retail Sales, Industrial Production, Consumer Sentiment next on tap.

The greenback, when measured by the US Dollar Index (DXY), appears offered in the 108.50 region at the end of the week.

US Dollar Index looks to data, Fed

After hitting nearly 20-year peaks north of the 109.00 mark on Thursday, the index comes under some selling pressure and hovers around the 108.50 zone on Friday.

The pullback from almost 2-decade highs in the dollar comes as Fed’s rate-setters dialled down the probability of a full point interest rate hike at the July 27 gathering. Indeed, Fed’s Waller and Bullard – both hawks – favoured on Thursday a 75 bps raise at the upcoming meeting, adding that markets appear to have overreacted to higher-than-expected inflation figures in June.

On this, and according to FedWatch Tool by CME Group, the probability of a 100 bps hike now retreated to around 46% from over 80% on Thursday. A 75 bps hike now looks favoured by almost 54%.

Interesting session in the US calendar on Friday, as Retail Sales are due in the first turn seconded by Industrial Production, Business Inventories and the advanced prints of the Consumer Sentiment for the current month.

What to look for around USD

The index pushed higher and clinched new cycle highs past 109.00 on Thursday. It is worth noting, however, that the recent sharp move in the dollar comes largely in response to the accelerated decline in the euro and persistent uncertainty around a potential recession in the old continent.

Further support for the dollar is expected to come from the Fed’s divergence vs. most of its G10 peers (especially the ECB) in combination with bouts of geopolitical effervescence and the re-emergence of the risk aversion among investors. On the flip side, market chatter of a potential US recession could temporarily undermine the uptrend trajectory of the dollar somewhat.

Key events in the US this week: Retail Sales, Industrial Production, Flash Consumer Sentiment, Business Inventories (Friday).

Eminent issues on the back boiler: Hard/soft/softish? landing of the US economy. Escalating geopolitical effervescence vs. Russia and China. Fed’s more aggressive rate path this year and 2023. US-China trade conflict. Future of Biden’s Build Back Better plan.

US Dollar Index relevant levels

Now, the index is down 0.12% at 108.50 and faces next contention at 107.47 (July 13) followed by 103.67 (weekly low June 27) and finally 103.41 (weekly low June 16). On the other hand, a break above 109.29 (2022 high July 15) would expose 109.77 (monthly high September 2002) and then 110.00 (round level).

Here is what you need to know on Friday, July 15:

The dollar rally that was fueled by the hot inflation data on Wednesday extended further on Thursday and the US Dollar Index reached its strongest level in nearly two decades at 109.29. Dovish Fed commentary, however, caused the greenback to lose interest ahead of the key Retail Sales data from the US. Additionally, the Fed will release its Index of Common Inflation Expectations (CIE) for the second quarter and the University of Michigan will publish the Consumer Sentiment Survey for July. Meanwhile, the European economic docket will feature the May Trade Balance data.

Federal Reserve Governor Christopher Waller argued on Thursday that markets may have gotten ahead of themselves by pricing a 100 basis points (bps) rate hike in July. Waller also added that he is in favour of a 75 bps hike in July but noted that he could lean toward a bigger rate increase if retail sales and housing data come in stronger than expected. According to the CME Group FedWatch Tool, markets are now pricing a 50% probability of a 100 bps rate hike in July, compared to 80% during the European session on Thursday.

US June Retail Sales Preview: Has the consumer turning point arrived?

Earlier in the day, the data from China showed that the Gross Domestic Product (GDP) contracted by 2.6% on a quarterly basis in the second quarter. This reading came in worse than analysts' estimate for a contraction of 1.5%. On a positive note, Retail Sales in China expanded by 3.7% on a yearly basis in June. Markets remain cautious in the European morning with US stock index futures losing between 0.25% and 0.3% on a daily basis.

EUR/USD plunged to its lowest level in nearly twenty years at 0.9952 on Thursday but managed to recover above parity.

GBP/USD fluctuates in a relatively tight range above 1.1800 on Friday following Thursday's selloff. On a weekly basis, the pair is down nearly 200 pips.

USD/JPY jumped to fresh multi-decade highs above 139.00 on Thursday but lost its bullish momentum. The benchmark 10-year US Treasury bond yield is down more than 1% on a daily basis, not allowing the pair to gain traction.

Gold fell below $1,700 for the first time in nearly a year on Thursday. Although XAUUSD rose above that level on falling yields, it is having a difficult time finding demand early Friday.

Bitcoin closed the second straight day in positive territory on Thursday and started to push higher toward $21,000 early Friday. Ethereum is up nearly 2% in the early European session, trading above $1,200.

Global risk sentiment continues to be challenged. Economists at ING expect the US Dollar Index (DXY) to stabilize and see limited scope for a correction.

Balance of risks tilted to upside

“With fears of global recession adding pessimism to the overall picture, we struggle to see a material recovery in sentiment for now.”