- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 12-07-2022

- GBP/JPY prints three-day downtrend, stays pressured of late.

- Clear downside break of 50-DMA, bearish MACD signals favor sellers.

- 21-DMA holds the key to buyer’s return, monthly triangle restricts short-term moves.

GBP/JPY justifies the previous day’s downside break of the 50-DMA inside a monthly symmetrical triangle during Wednesday’s Asian session. That said, the cross-currency pair drops to 162.53 while printing the three-day downtrend by the press time.

Given the quote’s recent break of the key DMA, as well as the bearish MACD signals, GBP/JPY prices are likely to decline further.

In that case, the 100-DMA level surrounding 161.20 could lure the sellers before the stated triangle’s lower line, around 160.50 by the press time, could test further downside.

Also acting as a downside filter is the previous monthly low around the 160.00 threshold.

Alternatively, recovery remains elusive until the quote stays below the immediate triangle’s upper line, close to 163.25 at the latest. It’s worth noting that the 50-DMA level near 162.85 guards the quote’s immediate upside.

Should the GBP/JPY prices rally beyond 163.25 hurdle, the 21-DMA level of 164.47 can act as the last defense of the bears.

Overall, GBP/JPY is likely to witness further weakness in prices inside the nearby triangle.

GBP/JPY: Daily chart

Trend: Further weakness expected

- EUR/USD remains pressured around 20-year low, fade corrective pullback.

- Fears of economic slowdown, central banks’ aggression weigh on sentiment.

- US CPI for June will be crucial considering recently mixed data/events and Fed’s hawkish mood.

EUR/USD fails to extend the previous day’s rebound from the lowest levels in two decades, retreating to 1.0030 during Wednesday’s Asian session. In doing so, the major currency pair struggles for clear directions as the bears appear running out of steam while the bulls fear taking entries ahead of the key US Consumer Price Index (CPI) for June, not to forget Germany’s key inflation number for June, namely Harmonized Index of Consumer Prices (HICP). In addition to the pre-data caution, the market’s fears of recession and aggressive central bank actions also weigh on the EUR/USD prices.

US Dollar Index (DXY) refreshed its 20-year high the previous day before retreating from 108.55. The pullback joined cautious optimism spread by comments from the White House (WH) and softer US data to favor the corrective pullback before the latest weakness.

Also read: EUR/USD Forecast: Tepid bounce hints at a bearish breakout

Businessman calculating tax with coins on desk

Slowdown fears renew

Market’s slowdown fears remain on the table despite the White House (WH) Memo that appeared to have triggered cautious optimism the previous day. “The US economic data, including the June jobs report, are not consistent with a recession in the first or second quarters,” the White House said in a memo released on Tuesday, as reported by Reuters. The news contributed to the market’s profit booking moves ahead of the key data/events.

Downbeat data favor bears via risk-off mood

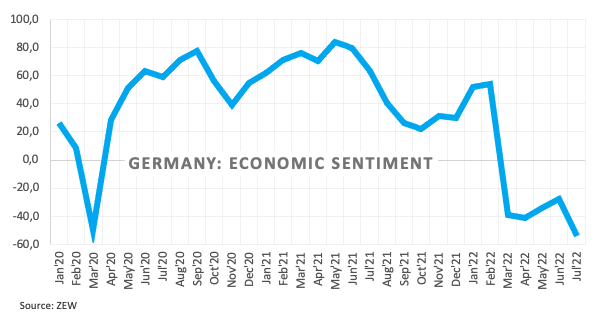

Softer economics from the US and Europe add strength to the recession fears. That said, a slump in the US NFIB Business Optimism Index for June, to the lowest since early 2013, appears to weigh on the EUR/USD prices amid fears of recession. Additionally, ZEW Survey data for July showed that German Economic Sentiment slumped to -53.8 while missing estimates of -38.3. Its counterpart for Eurozone also dropped to -51.1 versus the -28.0 previous reading and -32.8 expected. Further, Germany’s ZEW Survey Current Situation sub-index arrived at -45.8 in July compared to -34.5 expectations.

China’s covid woes

Covid fears from China exert additional downside pressure on the EUR/USD prices. The reason could be linked to the virus variant’s faster spread in Shanghai and the announced lockdown in Wugang city of Henan Province. With the latest economic unlock not being too far, fresh activity restrictions could recall the market fears of economic slowdown and favor the pair bears.

IMF Forecasts

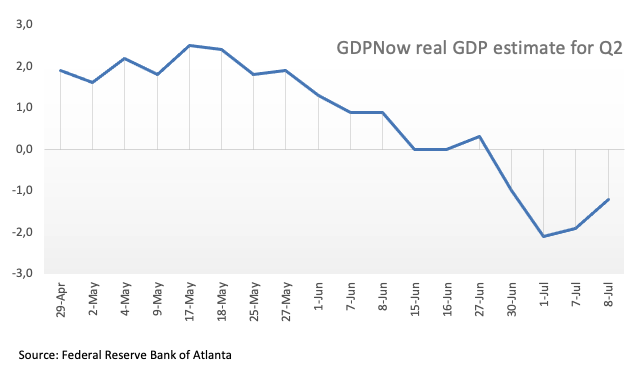

The latest economic projections from the International Monetary Fund (IMF) appear to have renewed fears of a slowdown and renewed the risk-aversion wave. IMF cuts US 2022 GDP growth projection to 2.3% from 2.9% in late June, due to revised US data. “The Fund included the new forecasts in the full report of its annual assessment of the U.S. economy, which highlighted the challenges of high inflation and the steep Federal Reserve interest rate hikes needed to control prices,” said Reuters.

Pre-inflation anxiety

Be it US CPI or German HICP both the inflation gauges are important for the EUR/USD traders as the European Central Bank (ECB) and the US Federal Reserve (Fed) are both up for faster rate hikes to battle the inflation. That said, the US CPI is expected to rise to 8.8% YoY from 8.6% whereas the final prints of the German HICP may match the initial forecasts of 8.2% YoY.

EUR/USD technical analysis

EUR/USD remains inside a four-month-old bearish megaphone formation, nearing the bearish trend widening the formation’s support line of late.

That said, the oversold RSI conditions could test the EUR/USD pair’s further weakness around the stated formation’s support line, close to 0.9920 at the latest.

Failing to do so could drag the major currency pair towards the December 2020 low near 0.9860.

Meanwhile, recovery moves need validation from two-month-old previous support near 1.0350. Even so, the stated formation’s resistance line and the 100-DMA, respectively near 1.0530 and 1.0710, could challenge the EUR/USD bulls afterward.

To sum up, EUR/USD has limited downside room but the corrective pullback is likely to reverse the bearish trend.

EUR/USD: Daily chart

Trend: Corrective pullback expected

EUR/USD rejected by 1.0000 psychological level, bearish bias intact

- USD/CAD is juggling above 1.3020 on higher expectations for BOC interest rate and US Inflation.

- Escalating recession fears in the global economy have pushed oil prices comfortably below $100.00.

- A higher inflation rate in Canada is bolstering the odds of a 75 bps rate hike by the BOC.

The USD/CAD pair has turned sideways around 1.3020 as investors are focusing on the interest rate decision by the Bank of Canada (BOC) and the release of the US Consumer Price Index (CPI). The asset has faced barricades around 1.3050 twice in the past two trading sessions, which could also be termed as exhaustion signals after a firmer rally from July 5 low near 1.2850.

Considering the market consensus, investors should brace for a bumper rate hike announcement by the BOC. The central bank is expected to elevate its interest rates by 75 basis points (bps). Apart from the Federal Reserve (Fed), no Western central bank has announced a three-quarter-to-a-percent rate hike yet.

The rate of increasing inflation in the loonie zone is extremely high. In May, Canada's inflation soared to 7.7% from the prior release of 6.8%. An increment by 90 basis points in the inflation rate is not a cakewalk situation for the economy. This has elevated the expectations for a rate hike of 75 bps by the BOC.

On the oil front, escalating recession fears have established the oil prices below $100.00 comfortably. Western central banks are accelerating their interest rates vigorously, which will squeeze out liquidity from the market, and the corporate will be left with costly money to invest. Also, the lockdown worries in China due to the resurgence of Covid-19 have hammered the oil bulls.

Meanwhile, the US dollar index (DXY) is expected to remain subdued ahead of inflation figures. The DXY is expected to regain strength on pre-anxiety of the US Consumer Price Index (CPI). The inflation rate is expected to climb to 8.8% from the prior release of 8.6%. This will strengthen the odds of a consecutive 75 bps rate hike announcement by the Fed.

- AUD/USD fades bounce off 26-month low as traders brace for the key data.

- IMF projections, China’s covid woes add strength to the risk-off mood.

- Fears of economic slowdown, central bank aggression stay in the driver’s seat.

- Second-tier data from Australia and China can entertain traders, US CPI for June will be crucial.

AUD/USD portrays the market’s anxiety ahead of the key data/events as it retreats to 0.6750 during Wednesday’s initial Asian session. In doing so, the risk-barometer pair justifies the cautious mood ahead of the US Consumer Price Index (CPI) for June while reversing the previous day’s corrective pullback from a two-year low.

The Aussie pair cheered the upbeat White House (WH) statement to bounce off the multi-day low amid cautious optimism. On the same line were downbeat US second-tier data and the market’s preparations for today’s US inflation figures.

“The US economic data, including the June jobs report, are not consistent with a recession in the first or second quarters,” the White House said in a memo released on Tuesday, as reported by Reuters. The news contributed to the market’s profit booking moves ahead of the key data/events.

Talking about the data, a slump in the US NFIB Business Optimism Index for June, to the lowest since early 2013, should have also helped the AUD/USD buyers. It should be noted that National Australia Bank’s (NAB) Business Conditions and Business Confidence figures for June earlier weighed on the pair. That said, the Business Conditions rose to 13, versus 9 expected and prior 16, whereas the Business Confidence dropped to 1 from 8 expected and 6 previous.

Alternatively, the latest economic projections from the International Monetary Fund (IMF) appear to have renewed fears of a slowdown and renewed the risk-aversion wave. IMF cuts US 2022 GDP growth projection to 2.3% from 2.9% in late June, due to revised US data. “The Fund included the new forecasts in the full report of its annual assessment of the U.S. economy, which highlighted the challenges of high inflation and the steep Federal Reserve interest rate hikes needed to control prices,” said Reuters.

On the same line were covid fears from China as virus variant spreads in Shanghai and announced lockdown in Wugang city of Henan Province.

With this backdrop, Wall Street benchmarks closed in the red, despite the intermediate recovery, while the US 10-year Treasury yields printed the second day of the downside at around 2.97%. Further, the S&P 500 Futures begin Wednesday’s moves under pressure.

Looking forward, Australia’s Westpac Consumer Confidence for June, prior -4.5%, will precede HIA New Home Sales for June, prior -5.5%, to entertain AUD/USD traders. However, major attention will be given to the US CPI, expected to rise to 8.8% YoY from 8.6%. It's worth noting that China trade numbers for June may also offer intermediate entertainment to the pair traders.

Also read: US June CPI Preview: Dollar rally could lose steam on soft inflation data

Technical analysis

AUD/USD pair’s corrective pullback from the monthly support line, around 0.6700 by the press time, needs validation from a downward sloping trend line resistance from June 16, close to 0.6875 at the latest.

- AUD/JPY juggles around 92.50 after a mild correction from near 92.60 ahead of aussie labor market data.

- Aussie Unemployment Rate may slip to 3.8% from the prior release of 3.9%.

- BOJ’s ultra-loose monetary policy will keep the yen bulls on the tenterhooks.

The AUD/JPY pair is displaying back-and-forth moves in a narrow range of 92.35-92.52 in the Asian session after a mild correction from a tad above 92.60. The risk barometer has shown a vulnerable performance this week after failing to sustain above the critical hurdle of 93.50. The asset is expected to display volatile moves as investors are shifting their focus on the aussie employment data, which is due on Thursday.

As per the market consensus, the Australian Bureau of Statistics will report the Employment Change data at 25k, extremely lower than the prior release of 60.6k. The economy has not been able to generate decent employment opportunities, which is necessary to support the upcoming policy tightening measures by the Reserve Bank of Australia (RBA).

It is worth noting that the RBA maintained its status-quo in the first week of July and elevated its Official Cash Rate (OCR) by 50 basis points (bps) to 1.35%. For further elevation in the interest rates, support from the labor market and upbeat growth prospects is highly required. Also, the Unemployment Rate may slip to 3.8% from the prior print of 3.7%.

On the Tokyo front, the continuation of the ultra-loose monetary policy by the Bank of Japan (BOJ) will keep the yen bulls on the tenterhooks. The BOJ is committed to doing more monetary easing as the economy is still finding ways to elevate its inflation on a broader basis. On Thursday, Japan’s Ministry of Economy, Trade, and Industry will release the Industrial production data, which is seen as stable at -2.8% and -7.2% on an annual and a monthly basis respectively.

- The shared currency tripped down vs. the Japanese yen on fears of Japanese authorities’ intervention in the FX markets.

- Risk aversion weighed heavily on the EUR as appetite for safety increased.

- EUR/JPY Price Analysis: The trendline break opened the door for further downside, as sellers eye the S2 daily pivot point around 136.50.

The EUR/JPY slipped for the second consecutive day on Tuesday, almost 0.48%, sparked by a fragile market mood, as Wall Street recorded losses for the second successive day on recession worries, while Asian equities are set to open mixed, as shown by the futures market.

The EUR/JPY, Tuesday price action, opened near the highs of the day around 138.00 and tumbled on news that the Japanese Finance Minister reunited with US Secretary of Treasure Janet Yellen to discuss the yen’s rapid fall. Hence, EUR/JPY traders sent the pair to the daily low at around 137.00. At the time of writing, the EUR/JPY is trading at 137.24.

EUR/JPY Daily chart

The EUR/JPY remains upward biased, but a break below a two-month-old upslope support trendline on Tuesday near 137.83, and the Relative Strength Index (RSI), sitting in bearish territory, opened the door for further downside. Therefore, the EUR/JPY path of least resistance in the near term is downwards.

That said, the EUR/JPY’s first support will be the July 8 daily low of around 136.85. The break below will expose the 100-day EMA at 136.23, followed by the May 22 cycle low at 133.92.

EUR/JPY 1-hour chart

In the short term, the EUR/JPY is also tilted to the downside, confined to a descending channel, but it is approaching a solid support level at the July 12 daily low of around 137.02, just above Wednesday’s S1 daily pivot at around 136.88. Nevertheless, it EUR/JPY sellers, break below, that would clear the way towards the confluence of the bottom-trendline of the descending channel and the S2 pivot point at around 136.40-50 area, followed by a drop towards 136.00.

EUR/JPY Key Technical Levels

- NZD/USD fades corrective pullback from two-year low as risk dwindles.

- Inflation, recession fears exert downside pressure but pre-US CPI mood, WH Memo helped consolidate losses.

- RBNZ is likely to announce 50 bps rate hike but eyes will be on the Rate Statement.

- US CPI for June will be important considering the WH optimism.

NZD/USD fails to extend Tuesday’s profit booking from a two-week low, easing back to 0.6125 during Wednesday’s initial Asian session. While the White House (WH) memo could be linked to the quote’s previous rebound, cautious sentiment ahead of the Reserve Bank of New Zealand (RBNZ) Monetary Policy Meeting and the US Consumer Price Index (CPI) appears to weigh on the Kiwi pair of late.

The US economic data, including the June jobs report, are not consistent with a recession in the first or second quarters, the White House said in a memo released on Tuesday, as reported by Reuters. The news contributed to the market’s profit booking moves ahead of the key data/events.

However, the latest economic projections from the International Monetary Fund (IMF) appear to have renewed fears of a slowdown and renewed the risk-aversion wave. IMF cuts US 2022 GDP growth projection to 2.3% from 2.9% in late June, due to revised US data. “The Fund included the new forecasts in the full report of its annual assessment of the U.S. economy, which highlighted the challenges of high inflation and the steep Federal Reserve interest rate hikes needed to control prices,” said Reuters.

On the same line were covid fears from China as virus variant spreads in Shanghai and announced lockdown in Wugang city of Henan Province.

It’s worth noting that a slump in the US NFIB Business Optimism Index for June, to the lowest since early 2013, also adds strength to the economic slowdown fears and exerts downside pressure on the NZD/USD prices.

Amid these plays, Wall Street benchmarks closed in the red, despite the intermediate recovery, while the US 10-year Treasury yields printed the second day of the downside at around 2.97%.

Moving on, NZD/USD traders will have a busy day as the RBNZ and the US CPI for June are on the cards. While the RBNZ is up for a 0.50% rate hike, the Rate Statement will be critical for the Kiwi pair traders to watch as New Zealand’s central bank failed to please bulls despite announcing a rate lift in the last few times.

Also read: Reserve Bank of New Zealand Preview: Hitting the repeat button despite hard-landing fears

Elsewhere, the US CPI is expected to rise to 8.8% YoY from 8.6% and can entertain the pair bears should the details also favor the Fed’s aggression.

Also read: US June CPI Preview: Dollar rally could lose steam on soft inflation data

Technical analysis

The 10-DMA level surrounding 0.6170 precedes a three-week-old resistance line, close to 0.6180 at the latest, to restrict short-term NZD/USD upside.

Alternatively, downward sloping support lines from June 22 and January 27 coincide at 0.6025 to make it the key support.

That said, oscillators are less favorable to the NZD/USD bears.

- GBP/USD has sensed offers around 1.1900 as investors await US Inflation.

- The number of suitable candidates for the leader of the US Conservative Party is increasing.

- Plain-vanilla CPI is seen at 8.8% while the core CPI is expected to slip to 5.7%.

The GBP/USD pair has witnessed selling pressure after attempting to sustain above the crucial level of 1.1900. On a broader note, the asset went through a steep fall after surrendering the weekly support at 1.1876 and printed fresh weekly support at 1.1807. The cable has attempted a pullback, however, the downside remains favored ahead of the US Inflation.

Investors are expecting that the US Consumer Price Index (CPI) will elevate to 8.8% from the prior release of 8.6%. However, the core CPI will slip to 5.7% from the prior print of 6%. A divergence in the two critical catalysts indicates two outcomes. Volatile food products and energy prices are driving the plain-vanilla CPI figure higher. And, products in core CPI such as durable goods, automobiles, and other necessary goods are experiencing a cool-off in their heated price rise.

This indicates that the policy tightening measures, which have been deployed by the Federal Reserve (Fed) in their past three monetary policy meetings, have started reflecting their impact now.

On the UK front, ongoing political turmoil after the announcement of resignation by current PM Boris Johnson has spooked the sentiment of the market participants. The list of participants for being the leader of the Conservative Party is getting wide each passing day. Apart from that, investors will focus on the UK economic data. The Gross Domestic Product (GDP) is seen at 0% vs. -0.3% printed earlier. While the annual Manufacturing Production may slip to 0.3% from the former release of 0.5%.

The International Monetary Fund has cut the US 2022 growth projection to 2.3% from 2.9% in late June, due to revised US data.

Key notes

IMF cuts US 2022 GDP growth projection to 2.3% from 2.9% in late June, due to revised US data.

IMF cuts US 2023 GDP growth projection to 1.0% from 1.7% in late June.

IMF says expects Fed policy actions to slow u.s. consumer spending growth to zero by early 2023, increase unemployment rate to about 5% by end 2023.

IMF directors say passing rest of biden administration reform agenda is crucial to fostering supply side of economy, contributing to lower inflation.

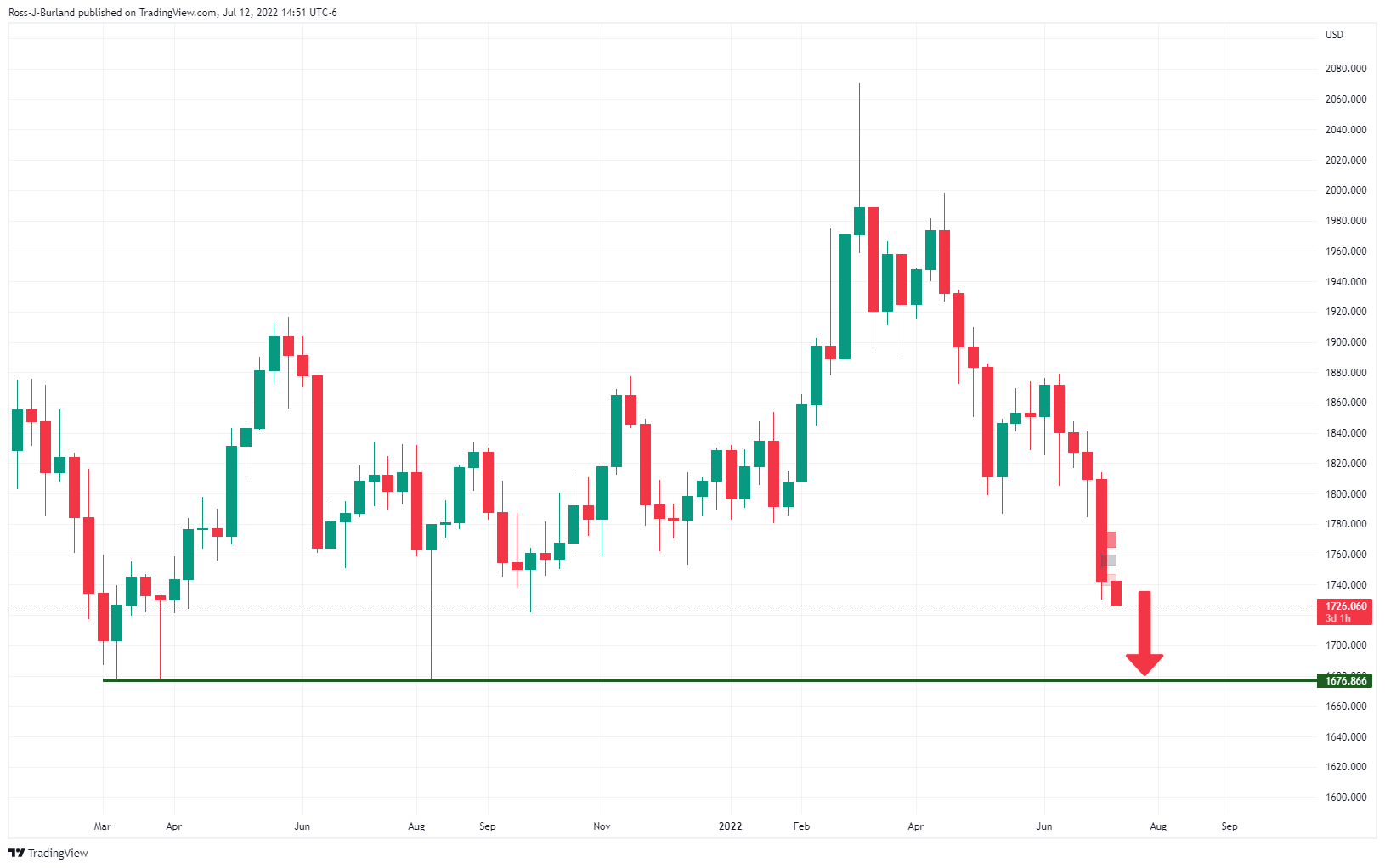

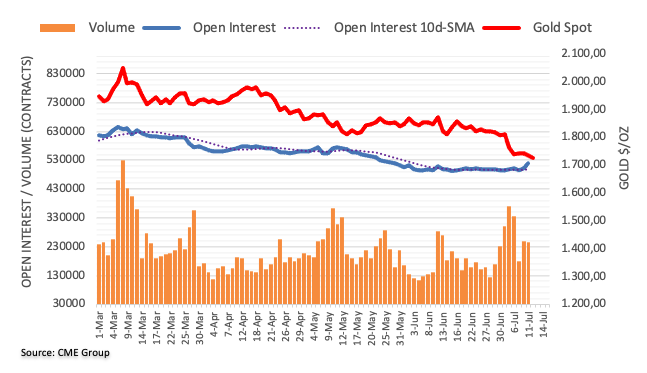

- Gold is under pressure as the greemback contiunues to pick up the bids.

- The US CPI event is stacking up to be critical for markets this week.

Gold is back under pressure and establishing fresh lows for the week within the bearish cycle as markets flip risk-off in the latter part of the New York session with the Dow printing fresh lows and down 1% at the time of writing. In turn, the US dollar is climbing the board in a correction as per the DXY index. At $1,725.00, gold is down 0.5% while DXY is moving back towards a flat position for the day at 108.15.

The US dollar's strength comes ahead of this week's key US inflation data, both of which are headwinds for the US stock market during the earnings season. Should the US dollar continue on its bullish trajectory, this will be a headwind for the company's results and in turn, the recession fears would be expected to continue supporting the greenback and pressuring gold.

The event to watch will be Wednesday's Consumer Price Index report which is expected to show the largest jump since 1981, to 8.8% YoY. The expectations have led to a massive liquidation in the gold market. ''While the steepest outflows from broad commodity funds since the Covid-19 crisis sparked a cascade of selling, including from CTA funds, another strong inflation print could still fuel additional downside,'' analysts at TD Securities said.

''Indeed, the coming data could be particularly concerning for gold prices given the still extremely bloated length remaining in gold markets from proprietary traders. We have previously cautioned that the substantial size accumulated by this cohort during the pandemic appears complacent in the face of a steadfastly hawkish Fed. In a liquidation vacuum, these positions are now vulnerable, which suggests the yellow metal remains prone to further downside still.''

Gold technical analysis

The consolidation is being drawn out but could well be turning into a breakout of redistribution indicating lower prices to come for the foreseeable future. In prior analysis, a potential spring in a phase of possible accumulation was identified on the 4-hour chart which has now been invalidated with lower closes:

As illustrated, the price has deteriorated into fresh lows which pits the emphasis on the downside, although does not completely invalidate the prospects of continued sideways action.

There is still the possibility of a move higher if the bulls commit but the likelyhood is gearing up to be a move lower in an extension of supply following the bullish correction:

This will put the focus on the weekly lows from a longer term perspective:

- The AUD/USD is bearish biased, but US dollar weakness pushed the major price upwards.

- Investor’s flight toward safe-haven did little to boost the greenback on Tuesday, as it fell.

- AUD/USD Price Analysis: The daily chart illustrates a falling wedge emerging, which targets a rally towards 0.7000.

The AUD/USD rose from YTD lows around 0.6714 on Tuesday, amidst a fragile market mood that shifted sour as the Wall Street close approached, a reflection of US recession worries as traders feared the Federal Reserve tightening cycle might tip the US economy into a recession.

The AUD/USD is trading at 0.6759 at the time of writing after hitting a daily high around 0.6779, bolstered by a weaker US dollar, and despite China’s covid-19 resurgence, particularly in Shanghai, as authorities ordered massive testings across the city.

AUD/USD Daily chart

The AUD/USD stays heavy, albeit recovering some ground during the day. But sellers remain in control due to some factors: the daily moving averages (DMAs) reside above the exchange rate, oscillators are in bearish territory, and AUD buyers’ failure to reclaim the 0.7000 figure opened the door for further selling pressure. Therefore, the AUD/USD path of least resistance is downwards.

The AUD/USD first demand area would be the YTD low, around 0.6714. Break below will expose the figure at 0.6700, followed by a dip toward May 22, 2020, swing low at 0.6505.

Nevertheless, there is a ray of hope for AUD buyers. The AUD/USD formed a falling wedge in a downtrend, meaning a break above the top trendline might open the door for further gains. Hence, the AUD/USD first resistance would be the ti trendline around 0.6830. A breach of the latter will expose the 20-day EMA around 0.6884, followed by the 100-day EMA shy of the 0.7000 area, near 0.6997.

AUD/USD Key Technical Levels

What you need to take care of on Wednesday, July 13:

Risk aversion amid slowing economic growth and soaring inflation remained the main theme across financial markets. The American currency appreciated throughout the first half of the day, reaching fresh 20-year highs against the EUR, as the pair touched 0.9999.

The greenback lost steam ahead of Wall Street’s opening, giving up some of its latest gains to end the day marginally lower against most major rivals. The better market mood came from a White House memo, which noted that US macroeconomic data, including the June jobs report, are not consistent with a recession. The document added that “labor market strength puts the US in a better position than many other countries to transition to lower inflation and steady growth.”

US indexes bounced with the news but turned red ahead of the close, and as investors await US inflation figures scheduled for Wednesday.

GBP/USD bottomed at 1.1806, later settling just below the 1.1900 threshold. The UK Conservative 1922 Committee announced eight candidates for the Tory leadership contest. Meanwhile, Bank of England Governor Andrew Bailey said there are alternatives to 25 bps rate hikes in the table, adding he expects inflation to fall sharply next year.

Commodity-linked currencies managed to recover ground but trimmed part of their gains ahead of the close, following Wall Street’s slump. The AUD/USD pair trades around 0.6750, while USD/CAD hovers in the 1.3020 price zone.

Safe-haven currencies appreciated against the greenback, with USD/CHF trading at 0.9810 and USD/JPY at 136.80.

Gold is near a fresh 2022 low of $1,723.15 a troy ounce and seems poised to extend its slump. Crude oil prices edged firmly lower, with WTI now trading at $95.50 a barrel.

The focus is now on inflation as Germany, and the US will release updates on their respective Consumer Price Indexes. German annual inflation is expected to be confirmed at 7.6% in June, while US one is foreseen to jump to 8.8%, a new multi-decade record.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Being Wrong Is Healthy, Staying Wrong Is Deadly!

Like this article? Help us with some feedback by answering this survey:

- EUR/USD trims some of its Monday losses and clings above parity but just above July’s 10 low.

- Recession fears persist as the US 2s-10s yield curve stays inverted for the second consecutive day.

- Fed’s Barkin is undecided about going 50 or 75 bps in July’s Fed monetary policy meeting.

- EU and German ZEW missed expectations, spurring a EUR/USD fall close to parity.

The EUR/USD bounces off fresh 20-year lows around the parity area, trimming some of Monday’s losses, as market sentiment wobbles, reflected by US equities fluctuating between gainers and losers, ahead of the US June Consumer Price Index (CPI) to be released on Wednesday.

At 1.0052, the EUR/USD grinds higher after tripping towards 1.0000, during the European session on worst than expected German data, followed by a jump towards the daily highs around 1.0073, 10 pips shy of the 50-hour EMA around 1.0082, which put a lid on upward EUR/USD prices.

EUR/USD rises despite investors’ fragile mood

The market mood is mixed, as portrayed by US equities fluctuating as recession fears persist. The US 2s-10s yield curve stays inverted for the second time in the week, reaching -0.107%, a level last seen in 2007. Meanwhile, the US Dollar Index, a gauge of the greenback’s value, takes a breather, down 0.20% at 107.986, a tailwind for the EUR/USD, which dropped close to the parity on weaker than expected EU news.

In the meantime, Fed speakers did little to nothing during the New York session to boost the greenback. Richmond’s Fed President Thomas Barkin said that he was reserving judgment on a 50 or 75 bps rate hike in the July meeting and reiterated that he would like real rates positive across the curve. Furthermore added that a negative Q2 GDP would take it “seriously” while adding that he expects another elevated inflation report.

The White House (WH) expects US CPI to remain elevated but downplayed recession worries in a memo reported by Reuters. The White House added that the “Impact of energy and food prices on annual headline CPI in June will likely exceed 40%, based on market expectations.”

Also read:

- Fed’s Barkin: A path to cool inflation but a recession ‘is possible

- White House: Impact of energy and food prices on annual CPI in June to likely exceed 40%

During the European session, the EU and German ZEW Surveys of Economic Sentiment missed expectations, sparked by the bloc’s energy crisis, supply chain disruptions, and the ECB’s intentions to hike interest rates. according to ZEW President Achim Wambach, “Experts assess the current economic situation significantly more negatively than in the previous month and have further lowered their already unfavorable forecast for the next six months.”

What to watch

The Eurozone economic docket will feature the Industrial Production for the Eurozone and Germany’s Inflation Rate. Across the pond, the US economic calendar will report June’s inflation rate, expected at 8.8% YoY, while core CPI is estimated at 5.8% YoY. Later, EUR/USD traders will get some clues in the Fed’s Beige Book, which the Fed uses in its monetary policy meetings.

EUR/USD Key Technical Levels

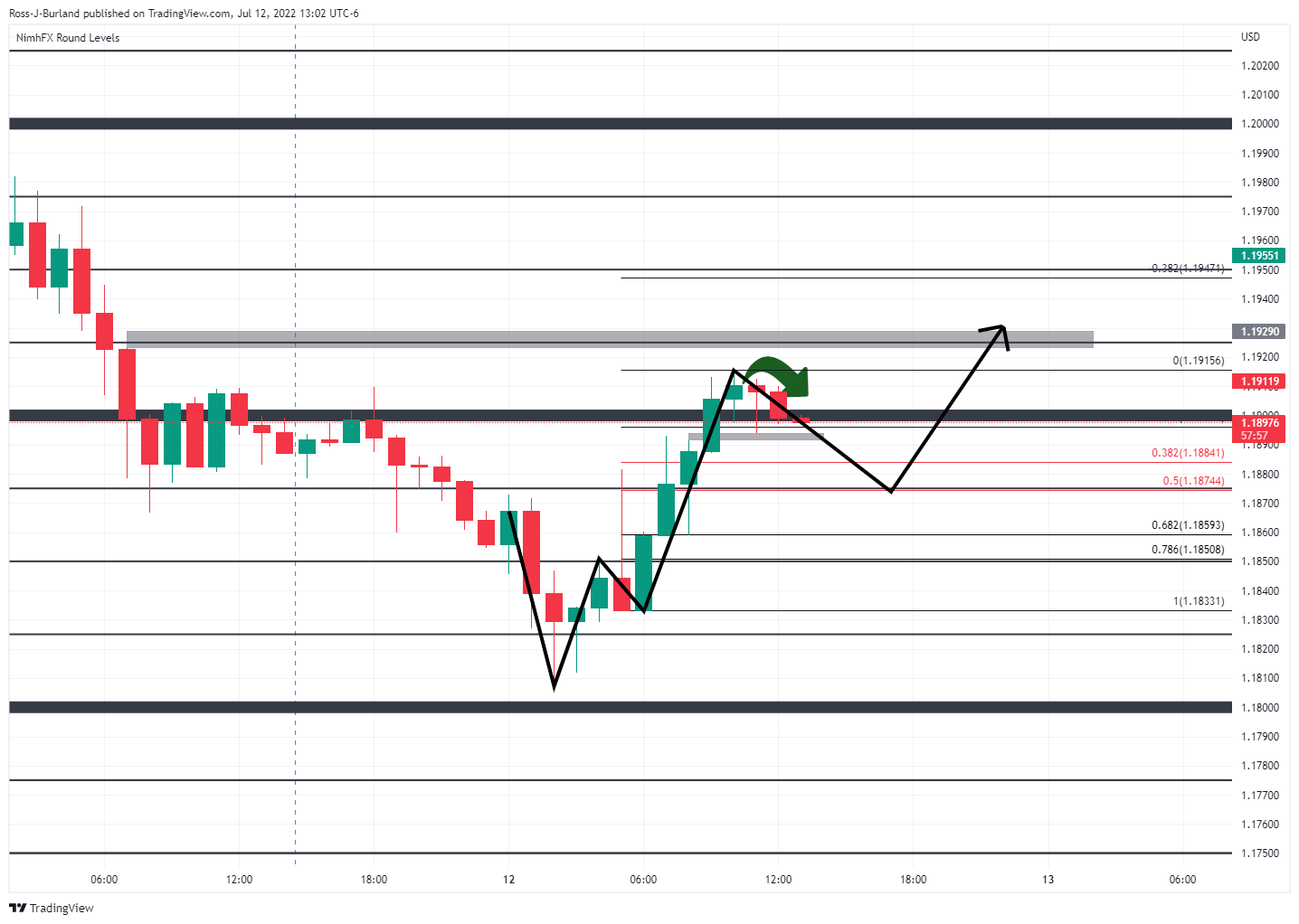

- GBP/USD bears have moved in as the greenback strengthens.

- Bulls could be lurking near a 50% mean reversion.

GBP/USD has started to give back the gains made in the New York open which ran up to break 1.1900 in a strong impulsive move to take on Tokyo's highs but fell just shy of Friday's low.

This leaves 1.1950 vulnerable for the day's ahead if bulls were to commit and emerge again from within any pullback over the coming sessions.

GBP/USD H1 chart

In the hourly chart above, the price is moving in to mitigate the price imbalance below, grey area, and a 50% mean reversion might occur to meet prior high volumes of transactions as per the volume profile of the bullish rally. If this acts as support, then there will be prospects of a bullish continuation for a run on liquidity towards 1.1920/50.

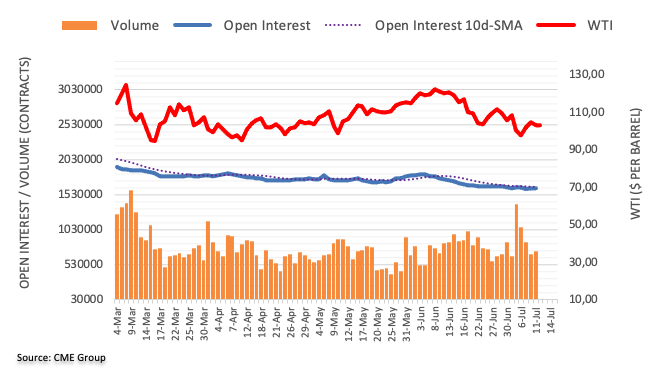

- WTI is falling further in the New York session to fresh lows on Tuesday.

- Investors fret over holding commodity longs into economic uncertainty as China goes back into lockdown.

Oil prices continue to sag in the New York day following a brief bid in mid-day trade. The price of West Texas Intermediate crude is carving out a fresh low for Tuesday of $95.47 so far and it is falling with momentum at the time of writing. The US dollar reached fresh 20-year highs on concerns China could enter another round of Covid-19 lockdowns, even as OPEC issued a bullish forecast for 2023 demand, so the demand side is pressuring oil prices.

However, OPEC on Tuesday said it expects 2023 demand to rise, even as production capacity remains limited. In a Monthly Oil Market Report, the group said it expects demand to rise by 2.7-million barrels per day next year to 103-million bpd, as it expects the global economy to rise by 3.2% "supported by a still solid economic performance in major consuming countries, as well as improved geopolitical developments and containment of COVID-19 in China".

China is set to lock down cities again just weeks after lifting a two-month quarantine on Shanghai that cut the country's oil demand by more than one million barrels per day. Close to 30 million people are already under some form of movement restrictions as the nation seeks to quell resurgent Covid-19 outbreaks. The nation reported 352 new cases for Sunday, with the daily figure hovering over 300 for the past week, the highest level since late May. Mainland China has had more than 300 cases a day for past nine days.

As for positioning in the oil market, Speculators also have turned more bearish. Money managers cut net-long positions in both Brent and WTI to the lowest level since 2020, according to the CFTC data released Friday as investors fret over holding commodity longs into economic uncertainty.

Reuters is reporting that Governor Andrew Bailey spoke on Tuesday and said the Bank of England's Monetary Policy Committee will bring inflation back down to its 2% target from more than 9% now.

"The Committee will be particularly alert to indications of more persistent inflationary pressures, and will if necessary act forcefully in response," Bailey said in a speech hosted by OMFIF, a central banking think tank."Bringing inflation back down to the 2% target sustainably is our job, no ifs or buts about that," he added.

Key comments

Bank of England's bailey: still the case that UK businesses are very focused on difficulty of hiring.

Pick-up in pay still largely being driven by one-off bonuses rather than higher base rate.

Inflation should come down rapidly next year.

If we see evidence of inflation persistence, we will act forcefuly.

Options other than 25 bp rises are on the table.

We will set out our thinking on gilt sales on Aug. 4.

We would not sell gilts into distressed markets.

BoE balance sheet should not remain permanently large.

UK finance ministry's approval of qe is a 'very mechanical' process.

I have never had any dialogue with UK finance ministry on substance of qe decisions.

BoE independence on qe decisions has never been called into question.

We will clearly need an open market tool during qt when we get close to equilibrium.

GBP/USD update

Despite the hawkishness, the pound has started to give back the gains made in the New York open which ran up to break 1.1900 in a strong impulsive move to take on Toyo's highs but falling just shy of Friday's low. This leaves 1.1950 vulnerable for the day's ahead if bulls were to commit and emerge again from within any pullback over the coming sessions.

- Silver slides on safe-haven flows towards US Treasuries as bond yields fall

- The greenback takes a breather after reaching a 24-year high above 108.000, a respite for silver traders.

- The US 2s-10s yield curve screams recession, falling to 2007 levels at around -0.107%.

Silver (XAGUSD) remains on the defensive as Tuesday’s North American session progresses, down by 0.48%, due to increased concerns of the US getting into a recession, as the US 2s-10s yield curve remains inverted at -0.107%, reaching levels last seen in February of 2007.

At the time of writing, XAGUSD is trading at $19.01, after reaching a fresh two-year low around $18.75, bouncing off to the confluence of the 50 and 100-hourly EMAs around the $19.14-19 area, which put a lid on buying pressure.

Silver slides on safe-haven flows towards US Treasuries as bond yields fall

Risk-off dominates the session for a second consecutive day due to some factors. The inversion in the US 2s-10s yield curve deepened, below -0.10%, for the first time since February of 2007, accentuating recession fears that the Fed might tip the US economy into a recession. Also, the reemergence of China’s coronavirus crisis in Shanghai threatens to trigger additional lockdowns.

Silver traders are bracing for the US inflation report. The June Consumer Price Index (CPI) is expected to hit 8.8% YoY, while the core inflation, which excluded volatile items like food and energy, is estimated at 5.7% YoY, lower than May’s reading. In the meantime, the White House (WH) expects CPI to remain elevated, but downplayed recession fears, they said in a memo, as reported by Reuters. They added that the “Impact of energy and food prices on annual headline CPI in June will likely exceed 40%, based on market expectations.” They said the economy “appears” to be transitioning to a slower economic and job growth.

Elsewhere, the US Dollar Index, a gauge of the greenback’s value vs. six counterparts, falls for the first time in four days, down at 107.920, losing 0.27%, while the US 10-year Treasury yield sits at 2.937%, losing six bps.

What to watch

During the week, the US economic docket will feature the US Consumer Price Index and the Beige Book on Wednesday, followed by Thursday’s PPI and Initial Jobless Claims. On Friday, the University of Michigan Consumer Sentiment will portray the American people’s economic expectations.

Silver (XAGUSD) Key Technical Levels

Federal Reserve's Tom Barkin has crossed the wires and said that the pace of policy change may be making markets ‘skittish’.

He adds that there is a path to cool inflation but a recession ‘is possible’.

More to come

On Wednesday, June inflation data is due in the US. The CPI is expected to rise to a new post-COVID high. According to analysts from TD Securities, the annual inflation will show an increase from 8.6% to 8.9% while the core rate a decline to 5.7%.

Key Quotes:

“We look for core prices to have stayed strong on a m/m basis despite our expectation of modest slowing vs May. Indeed, we forecast a still-solid 0.5% m/m gain in the core series for June. In terms of the headline, we expect inflation (+1.2% m/m) to also be boosted by strong food prices and higher energy costs.”

“Our m/m projections imply that headline inflation likely gained speed on a y/y basis in June, despite likely softening in the core segment: We look for annual inflation to rise to 8.9% for the headline, but to decline to 5.7% for core prices.”

“Shock value into FX may be less acute given a much higher but almost evenly split forecast distribution for m/m core. Nonetheless, we think it remains premature to fade the USD if either scenario pans out. EURUSD rallies are a fade.”

- AUD/NZD continues to move sideways, around 1.1030.

- Risks appear to be tilted to the downside with technical indicators pointing modestly to the downside.

- The correction could extend below the support at 1.0970.

The AUD/NZD cross is moving sideways below 1.1100. The 1.1100 area caps the upside. A break higher should strengthen the aussie, and would target 1.1150 initially and then a test of 1.1180.

The daily chart shows Momentum turning south and the RSI flat at 50 reflecting the lack of directional moves. The chart looks biases to the downside.

On the flip side, a consolidation below 1.1000 should expose an uptrend line at 1.0970. A break lower would open the doors to more losses, initially to 1.0950. The next support is located at 1.0920.

While between the uptrend line and the 1.1100 area, volatility in AUD/NZD will likely remain limited. A break of one of the critical levels could trigger trading opportunities.

AUD/NZD daily chart

The US economic data, including the June jobs report, are not consistent with a recession in the first or second quarters, the White House said in a memo released on Tuesday, as reported by Reuters.

Key takeaways

"US labor market strength puts the US in a better position than many other countries to transition to lower inflation and steady growth."

"Impact of energy and food prices on annual headline CPI in June will likely exceed 40%, based on market expectations."

"Gasoline prices likely to account for more than 100% of the expected increase in annual CPI in June report due on Wednesday."

"US gasoline prices can be expected to decline in weeks ahead."

"US economy appears to be transitioning to a period of slower job and economic growth."

Market reaction

The US Dollar Index showed no immediate reaction to these remarks and was last seen losing 0.25% on the day at 107.95.

The cure oil output of the United States is expected to rise by 720,000 barrels per day (bpd), down from 730,000 in the previous forecast, in 2022 to 11.91 million bpd, the US Energy Information Administration (EIA) said in its monthly report.

Key takeaways via Reuters

- US crude output to rise 860,000 bpd to 12.77 million bpd in 2023 (vs rise of 1.05 million bpd forecast last month).

- US total petroleum consumption to rise 700,000 bpd to 20.48 million bpd in 2022 (vs rise of 750,00 bpd last month).

- US petroleum demand to rise 320,000 bpd to 20.8 million bpd in 2023 (vs rise of 200,000 bpd last month) - eia.

Market reaction

Crude oil prices continue to trade deep in negative territory after this report with the barrel of West Texas Intermediate (WTI) losing 6.7% on the day at $96.50.

- The Japanese yen strengthened on verbal intervention by the Japanese Finance Minister Suzuki.

- On Tuesday, the USD/JPY tumbled towards a daily low of around 136.50 before settling near the June 21 highs.

- USD/JPY Price Analysis: The major remains upward biased, but a rising wedge has formed, which targets a fall towards 129.50.

The USD/JPY retreats from 24-year highs around 137.75, falling more than 100-pips during the North American session, due to falling US bond yields and talks between the US Treasury Secretary Janet Yellen and Japan’s Finance Minister Suzuki, in which he told her about the weakening of the yen and agreed to continue consulting in foreign exchange.

At the time of writing, the USD/JPY is trading at 136.73, down by more than half percent, after reaching a daily high of around 137.53, to stumble towards fresh daily lows below 136.50 before settling around current price levels.

USD/JPY Daily chart

The USD/JPY daily chart illustrates the pair as upward biased, though forming a rising wedge, meaning selling pressure might be around the corner, to step in on the pair and drag it lower. Also, with the Relative Strength Index (RSI) stepping out of overbought conditions and about to cross under the RSI’s 7-day SMA, that would open the door for further downside.

If the USD/JPY break below the rising wedge, its first support would be the 20-day EMA at 135.56. Once cleared, the next demand zone to test would be the July 1 low at 134.74, followed by the 50-day EMA at 132.23, on its way, towards the measured target, using the top-bottom trendlines that form the rising wedge at around 129.50.

USD/JPY Key Technical Levels

- GBP/JPY is moving sideways in the short-term with a bearish bias.

- Daily close under 162.00 to open the doors to more losses.

- Key resistance is seen at 163.70 and 164.50.

The GBP/JPY is falling on Tuesday, trading around 162.50. It bottomed at 161.85 and quickly rose back above 162.00. The 162.00 area has become a critical level and a daily close below should open the doors for an extension of the decline, initially to 161.20 (100-day Simple Moving Average). Below, there is not much support until 160.00.

Technical indicators in the daily chart are biased to the downside. RSI and Momentum are pointing south, and the price is below the 20-day SMA. A recovery above 164.70 could change the short-term outlook.

While the pound resists above 162.00, the odds of more range trading between that level and 163.80. A daily close above the mentioned level should clear the way for 164.70. Above the next critical target is a downtrend line from June highs currently at 166.55.

GBP/JPY daily chart

- The precious metals complex remains on the defensive, with gold reaching two-month lows and silver at two-year lows.

- Risk aversion dominates Tuesday’s trading session as investors brace for June’s US CPI report.

- Commerzbank analysts commented that a solid US dollar and gold ETF’s outflows keep XAUUSD heavy.

- Gold Price Forecast (XAUUSD): Tilted to the downside and might test $1700; otherwise, a correction towards $1750 is on the cards.

Gold (XAUUSD) spot declined during Tuesday’s North American session due to risk-aversion, courtesy of China’s coronavirus reemergence, the EU’s energy crisis, and recession fears. That usually lifts the yellow metal price, though haven flows are going towards the greenback and US Treasuries, as US bond yields are falling across the board.

Gold declines on a firm US dollar, a dismal sentiment, and on ETF’s outflows

XAUUSD is trading at around $1731 a troy ounce after seesawing between the high/low of the day during the Asian session. The yellow metal recorded its low around $1722, followed by a rally towards the daily high near $1744, and then gold’s price stayed range-bound within the $1728-1740 for the rest of the day.

Sentiment remains dismal as traders brace for the US inflation report on Wednesday. A day later, prices paid by producers would shed some light on raw materials and commodity prices and could be a prelude to what could happen during the Q2 earnings season. According to Press Secretary Jean-Pierre, the White House expressed that the new CPI would be elevated.

- Also read: US CPI Preview: Forecasts from 11 major banks, new peak but at headline

Additionally fueling investors’ worries is China’s Covid-19 resurgence witnessed the lockdown of Wugang for three days due to 1 Covid case, while Shanghai remains doing massive tests across the city.

Elsewhere, analysts at Commerzbank expressed that a firm US dollar is not the only reason weighing on lower gold prices but also the ongoing and solid ETF outflows.

“The gold ETFs tracked by Bloomberg registered outflows of 29 tons last week, their most pronounced in eight weeks and the fourth week in a row (with growing momentum). Speculative financial investors have likewise been withdrawing further from the gold of late. According to the CFTC’s statistics, their net long positions are at their lowest level in over three years,” Commerzbank analysts wrote.

What to watch

In the week ahead, the US economic calendar will feature the US Consumer Price Index and the Beige Book on Wednesday, followed by Thursday’s PPI and Initial Jobless Claims. On Friday, the University of Michigan Consumer Sentiment could be again the spotlight ahead of the Federal Reserve July meeting.

Gold Price Forecast (XAUUSD): Technical outlook

XAUUSD is downward biased, despite remaining in choppy trading conditions, as sellers cannot challenge the $1700 figure. Gold traders should be aware that oscillators are showing oversold readings, indicating that selling pressure eases, though the RSI’s slope keeps aiming downwards, opening the door for a challenge of $1700.

Therefore, XAUUSD’s break below September 29, 2021 low at $1721.71 would expose the $1700 figure. On the upside, XAUUSD’s first resistance would be $1750. A breach of the latter would expose the 20-day EMA at around $1800.

How low can EUR/USD go? Economists at TD Securities note that the world’s most popular currency pair could test the 0.90/0.85 region.

More EUR downside to be had

“With EUR/USD near parity, the more pressing question is whether this will offer solid support. While we expect some defense at this level, EUR/USD may not escape a sub-parity paradigm and 0.85/0.90 could soon become reality.”

“It is too much to ask for capital flows to offset the erosion in trade, leaving EUR's much-heralded current account a drag for the currency.”

“EUR/USD is following a similar profile to the last Fed cycle, suggesting more EUR downside to be had.”

“Relative curve pricing and equity performance keep the prospects of EUR upside remote.”

The US Bureau of Labor Statistics will release the June Consumer Price Index (CPI) data on Wednesday, July 13 at 12:30 GMT and as we get closer to the release time, here are the forecasts by the economists and researchers of 11 major banks regarding the upcoming US inflation print.

Headline inflation at 8.6% is worrying, but it could get even worse. Economists expect an increase to 8.8% as energy prices continued advancing last month.

Core CPI was already high in June 2021, the figure which now falls out of the series. The calendar is pointing to a drop from 6% to 5.8%. Expectations for the monthly price increase stand at 0.6%.

ANZ

“We expect US core CPI to have risen by 0.5% MoM in June and headline by 1.0%. Higher energy prices explain the gap between headline and core. A 1% MoM rise in CPI inflation in May triggered a 75 bps hike from the Fed in June. But with commodity prices easing substantively since then, there may be less pressure on the Fed to repeat with a 75 bps hike in July as inflation expectations are unlikely to be as worrisome.”

Commerzbank

“We expect consumer prices to have risen 1.2% from May, and 0.5% excluding energy and food. Headline inflation would then reach a new 40-year high of 8.8%. In the coming months, inflation is likely to climb even above 9%.

ING

“The market is favouring a 75 bps rate hike from the Federal Reserve on 27 July and we agree given the tight jobs market and inflation running at more than four times the 2% targeted rate. In fact, inflation is likely to move even further above target this coming week as gasoline, food, shelter and airline fares continue to rise apace. Core inflation may slow marginally to 5.8% from 6%, but this too is well above target.”

RBC Economics

“US CPI likely ticked higher to 8.8% in June on the back of surging food and gas prices. Rent prices have been rising faster over the past year and should continue to support growth in core prices, given its high relative weight.”

Deutsche Bank

“We note that while gas prices fell in the second half of June, the first half strength will still be enough to help the headline CPI print (+1.33% forecast vs. +0.97% previously) be strong on the month but with core (+0.64% vs. +0.63%) also strong. We have the headline YoY rate at 9.0% (from 8.6%) while core should tick down from 6.0% to 5.8%.”

TDS

“Core prices likely stayed strong in June, with the series registering a 0.5% MoM gain. Shelter inflation likely maintained momentum, but we look for airfares to retreat following double-digit m/m expansions in March-May. Separately, we expect gasoline prices to remain a notable force, accelerating to an 11% MoM pace. Our MoM forecasts imply 8.9%/5.7% YoY for total/core prices.”

SocGen

“The core inflation rate is expected to rise 0.4% MoM and 5.6% YoY. The pace is slowing but is not slow enough. Travel costs remain high and are likely to subside in the coming months, but the much greater issue is rents and shelter costs that are likely to continue their upward push and keep a floor on inflation near 4.5%. We expect a decline from the peak to be rapid should energy prices stabilize. A retreat from peak is not enough. The Fed goal is 2%. The Fed acknowledges that it may take a couple of years to return to 2%. Rents are the major factor preventing a return to 2%.”

NBF

“The food component likely remained very strong given severe supply constraints globally, and this increase may have been compounded by sharply higher gasoline prices. As a result, headline prices could have increased 1.2% MoM, lifting the YoY rate to a 40-year high of 8.8%. Core prices, meanwhile, should have continued to be supported by rising rent prices and advanced 0.6%. Thanks to a strongly negative base effect, this healthy gain should still translate into a three-tick drop of the 12-month rate to 5.7%.”

CIBC

“Total CPI inflation likely accelerated to 8.8% YoY in the US. Higher prices at the pump would also feed through to core inflation (ex. food and energy) in the transportation services component, helping to drive a likely 0.6% monthly increase in that group, and leaving annual core inflation at 5.8%. Shelter costs likely continued to add to price pressures, as the lagged impact of higher home prices is captured in the index, offsetting any easing in the pace of used car price growth, or relief in goods prices stemming from the end of lockdowns in China. We are in line with consensus forecast and market reaction should therefore be limited.”

Wells Fargo

“We look for a 1.1% monthly gain for the CPI, which will push the year-ago pace of inflation to yet another fresh 40-year high of 8.8%. June could be the peak in the year-ago pace of inflation, but that will depend highly on how commodity prices play out over the next few months. Even if June marks a peak, we are likely to continue to see very high inflation rates for the next few months through September. When excluding food and energy, we expect core prices rose 0.5% MoM. Core goods prices likely moved higher but at a slower rate in June, while core services are set to moderate a bit after the meteoric rise in travel prices the past few months. Primary shelter costs, however, are expected to advance at a similar pace to May. Core prices should increase around 0.5% in the next few months as the eventual step-down in inflation will be gradual.”

Citibank

“US June CPI MoM – Citi: 1.2%, prior: 1.0%; CPI YoY – Citi: 8.9%, prior: 8.6%; CPI ex Food, Energy MoM – Citi: 0.6%, prior: 0.6%; CPI ex Food, Energy YoY – Citi: 5.7%, prior: 6.0%. Ffollowing another upside surprise to core CPI in May, we expect a similar 0.6% MoM increase in the June data (although just barely at 0.56% unrounded). Very strong shelter prices in May data are likely to persist for at least a few months, and we expect a strong 0.61% increase in primary rents and a 0.57% increase in owners’ equivalent rent in June. The clearest downside risks for CPI in June and over the rest of the year comes from goods prices, particularly auto prices which are a substantial weight in CPI inflation. Generally, goods prices should continue to slow in the coming months as demand for goods eases.”

- USD/CAD trimmed a part of its intraday gains amid modest USD pullback from a 20-year high.

- Aggressive Fed rate hike bets, the risk-off mood should limit the USD losses and lend support.

- A slump in crude oil prices weighed on the loonie and further acted as a tailwind for the major.

The USD/CAD pair struggled to make it through an intermediate resistance near mid-1.3000s and has now trimmed a part of its intraday gains. Spot prices retreated to the 1.3020-1.3015 region during the early North American session, though the near-term bias still seems tilted in favour of bullish traders.

A further decline in the US Treasury bond yields prompted some US dollar profit-taking following the early uptick to a fresh two-decade high. That said, aggressive Fed rate hike bets, along with the prevalent risk-off mood, helped limit any deeper USD pullback and should act as a tailwind for the USD/CAD pair.

On the other hand, a sharp fall in crude oil prices undermined the commodity-linked loonie and supports prospects for the emergence of some dip-buying around the USD/CAD pair. The black liquid was weighed down by fresh COVID-19 curbs in China, which, along with recession fears, have raised concerns about the fuel demand outlook.

From a technical perspective, the 1.3050 area might continue to act as an immediate hurdle ahead of the YTD peak, around the 1.3080-1.3085 region. This is closely followed by the 1.3100 mark, which if cleared decisively would be seen as a fresh trigger for bulls and set the stage for a further near-term appreciating move.

The USD/CAD pair would then aim to surpass an intermediate barrier near the 1.3155-1.3160 region and accelerate the momentum towards the 1.3200 mark. Bulls might eventually lift spot prices to the next relevant resistance near the 1.3270 zone.

On the flip side, weakness back below the 1.3000 psychological mark could be seen as a buying opportunity and remain limited near the 1.2940-1.2935 support zone. The said region represents the 100-period SMA on the 4-hour chart and should act as a pivotal point, which if broken might prompt aggressive technical selling.

The next relevant support is pegged near the 1.2900 round-figure mark, which if broken decisively would negate any near-term positive bias and make the USD/CAD pair vulnerable. The subsequent fall has the potential to drag spot prices back towards testing monthly low, around the 1.2835 region, en-route the 1.2820-1.2815 support zone.

USD/CAD 4-hour chart

-637932309439317388.png)

Key levels to watch

While speaking at the Devex Forum on Tuesday, International Monetary Fund (IMF) Managing Director Kristalina Georgieva said that she sees a "debt crisis in the making" with rising interest rates and debt, as reported by Reuters.

"Global central banks are rightly focusing on putting a lid on inflation but this adds pressure to debt-burdened countries," Georgieva added. "I'm cautiously optimistic that G20 countries are starting to grasp the huge problem of debt restructuring for developing countries."

Market reaction

These comments don't seem to be having a significant impact on risk sentiment. As of writing, the S&P 500 Index was virtually unchanged on the day at 3,858.

Additional takeaways

"30% of developing and emerging markets are at or near debt distress; distress rate doubles for low income countries to 60%."

- EUR/USD bounces off lows in the parity level on Tuesday.

- Occasional rebounds follow the current overbought conditions.

EUR/USD drops and bounces off new lows in the parity zone on turnaround Tuesday.

The pair’s bearish stance remains everything but abated for the time being. Against that, intermittent bullish attempts could be deemed as selling opportunities, with the next target at the December 2002 low at 0.9859.

As long as the pair navigates below the 5-month support line near 1.0570, further losses remain in store.

In the longer run, the pair’s bearish view is expected to prevail while below the 200-day SMA at 1.1055.

EUR/USD daily chart

Following the recent price action, USD/IDR could now embark on a consolidative phase, likely between 14,872 and 15,050, suggested FX Strategist Quek Ser Leang at UOB Group’s Global Economics & Markets Research.

Key Quotes

“USD/IDR soared to a high of 15,020 last Wednesday (06 Jul) before easing. The combination of weakening upward momentum and overbought conditions suggest USD/IDR is unlikely to advance much further.”

“For this week, USD/IDR is more likely to trade between 14,872 and 15,050.”

- DXY comes under pressure after hitting new cycle tops.

- Overbought conditions should prompt a technical move.

DXY climbs to new nearly 20-year peaks around 108.60 on Tuesday, although it loses some ground afterwards.

Further upside in the dollar remains in store in the short-term horizon, with the next target at the October 2002 top at 108.74. However, overbought conditions could spark a technical correction to, initially, the June post-FOMC high at 105.78 (June 15).

As long as the index trades above the 5-month line around 103.00, the near-term outlook for DXY should remain constructive.

In addition, the broader bullish view remains in place while above the 200-day SMA at 98.59.

DXY daily chart

- AUD/USD bounced off over a two-year low touched on Tuesday amid a modest USD pullback.

- A further decline in the US bond yields prompted some USD profit-taking near a 20-year peak.

- Aggressive Fed rate hike bets, recession fears should limit the USD losses and cap the major.

The AUD/USD pair staged a modest bounce from over a two-year low touched on Tuesday and steadily climbed to mid-0.6700s during the early European session.

The global flight to safety continued dragging the US Treasury bond yields lower, which forced the US dollar to surrender its intraday gains to a fresh two-decade high. This, in turn, was seen as a key factor that assisted the AUD/USD pair to attract some buying in the vicinity of the 0.6700 round-figure mark. That said, the attempted recovery is more likely to remain short-lived and runs the risk of fizzling out rather quickly.

The prospects for a more aggressive policy tightening by the Fed, along with the prevalent risk-off mood, should limit any meaningful USD corrective pullback and cap the AUD/USD pair. Investors seem convinced that the Fed would stick to a faster rate hike path to curb soaring inflation. The bets were reaffirmed by last week's FOMC minutes, which emphasized the need to fight inflation even if it results in an economic slowdown.

Furthermore, rapidly rising interest rates, along with a prolonged Russia-Ukraine and fresh COVID-19 lockdowns in China, have been fueling recession fears and continued weighing on investors' sentiment. This was evident from an extended selloff in the equity markets, which could further lend support to the safe-haven greenback. Apart from this, the recent slump in commodity prices should act as a headwind for the resources-linked aussie.

Hence, it will be prudent to wait for strong follow-through buying before confirming that the AUD/USD pair has formed a near-term bottom and positioning for any further gains ahead of the key macro data. The latest US consumer inflation figures are due on Wednesday and will influence the USD price dynamics. Traders will further take cues from Thursday's release of Australian employment details before placing fresh directional bets.

In the meantime, the US bond yields might drive the USD demand amid absent relevant market-moving economic releases from the US on Tuesday. Apart from this, the broader market risk sentiment should provide some impetus to the AUD/USD pair and allow traders to grab short-term opportunities.

Technical levels to watch

- EUR/JPY adds to Monday’s losses and challenges 137.00.

- Immediately to the downside emerges the 100-day SMA.

EUR/JPY keeps the bearish note unchanged in the second half of the week so far.

While below the 4-month resistance line around 140.00, extra losses should remain on the table with the initial target at the 100-day SMA, today at 136.16. The loss of this levels exposes a deeper pullback to the minor support at 133.92 (low May 19).

In the longer run, the constructive stance in the cross remains well propped up by the 200-day SMA at 133.16.

EUR/JPY daily chart

- GBP/USD witnessed some follow-through selling for the second successive day on Tuesday.

- Retreating US bond yields led to a modest USD pullback and helped limit any further losses.

- Traders now await Wednesday’s release of the monthly UK GDP print and the US CPI report.

The GBP/USD pair added to the previous day's heavy losses and witnessed some follow-through selling for the second successive day on Tuesday. The downward trajectory dragged spot prices to the lowest level since March 2020, though stalled just ahead of the 1.1800 round-figure mark.

The US dollar trimmed a part of its intraday gains to a fresh two-decade high amid a further decline in the US Treasury bond yields, pressured by the global flight to safety. Modest intraday USD pullback was seen as a key factor that offered some support to the GBP/USD pair, though any meaningful recovery still seems elusive.

Growing acceptance that the Fed would retain its aggressive policy tightening path, despite fears about a possible recession, should continue to act as a tailwind for the buck. In fact, the minutes of the June 14-15 FOMC meeting released last week emphasized the need to fight inflation even if it results in an economic slowdown.

Adding to this, Atlanta Fed President Raphael Bostic said that the US economy can cope with higher interest rates and reiterated his support for another interest rate hike at the July FOMC meeting. Hence, the market focus will remain glued to the release of the latest US consumer inflation figures, due on Wednesday.

In the meantime, the prevalent risk-off environment should underpin the greenback's relative safe-haven status. Apart from this, worries that the UK government's controversial Northern Ireland Protocol Bill could trigger a trade war with the European Union and expectations for a less hawkish Bank of England should cap the GBP/USD pair.

The fundamental backdrop supports prospects for a further near-term depreciating move, through traders might prefer to wait on the sidelines ahead of the key macro data from the UK and the US. The monthly UK GDP report is scheduled to be published on Wednesday and would be followed by the latest US consumer inflation figures.

This week's US economic docket also highlights the release of monthly Retail Sales data and Prelim Michigan Consumer Sentiment on Friday, which will influence the USD price dynamics. Traders will further take cues from the broader market risk sentiment to determine the next leg of a directional move for the GBP/USD pair.

Technical levels to watch

The continuation of the uptrend in USD/MYR is predicted to meet a major hurdle around 4.4500, according to FX Strategist Quek Ser Leang at UOB Group’s Global Economics & Markets Research.

Key Quotes

“USD/MYR opened on a strong note this week and soared above last week’s 4.4260 high. Upward momentum has improved considerably and USD/MYR is likely to advance to the 2020 high at 4.4410.”

“For this week, the next major resistance at 4.4500 is likely out of reach. Support is at 4.4200 but only a break of the solid support at 4.4100 would indicate that the current upward pressure has eased.”

- A combination of factors prompted some profit-taking around USD/JPY on Tuesday.

- Intervention speculations, along with the risk-off mood offered support to the JPY.

- Retreating US bond yields acted as a headwind for the USD and exerted pressure.

- The Fed-BoJ policy divergence to limit losses ahead of the US CPI on Wednesday.

The USD/JPY pair witnessed some profit-taking on Tuesday and eroded a part of the previous day's strong gains to its highest level since September 1998. The retracement slide dragged spot prices closer to mid-136.00s heading into the North American session and was sponsored by a modest US dollar pullback from a two-decade high.

Japanese Finance Minister Shunichi Suzuki expressed concerns about the recent sharp decline in the yen and said to take appropriate measures if necessary. Apart from this, the prevalent risk-off environment - as depicted by an extended selloff in the equity markets amid fears about a possible global recession - drove some haven flows towards the Japanese yen. This, in turn, prompted bulls to take some profits off the table and exerted downward pressure on the USD/JPY pair.

The flight to safety was reinforced by a further decline in the US Treasury bond yields, which resulted in the narrowing of the US-Japan rate differential and offered additional support to the JPY. In fact, the yield on the benchmark 10-year US government bond slipped further below the 3.0% threshold and failed to assist the US dollar to preserve its modest intraday gains to a fresh two-decade high. This further contributed to the USD/JPY pair's intraday corrective pullback.

The downside, however, seems limited, at least for the time being, amid the divergent monetary policy stance adopted by the Bank of Japan and the Federal Reserve. In fact, BoJ Governor Haruhiko Kuroda reiterated on Monday that the central bank remains ready to take additional monetary easing steps as necessary. In contrast, the FOMC minutes released last week reaffirmed market bets that the US central bank would retain its aggressive policy tightening cycle to curb soaring inflation.

Policymakers indicated that another 50 or 75 bps rate hike is likely at the upcoming FOMC meeting in July and emphasized the need to fight inflation even if it results in an economic slowdown. Hence, the market focus would remain on the latest US consumer inflation figures, due on Wednesday. The US CPI report will play a key role in influencing the near-term USD price dynamics and help investors determine the next leg of a directional move for the USD/JPY pair.

In the meantime, the US bond yields will drive the USD demand and provide some impetus to the USD/JPY pair amid absent relevant market-moving economic releases from the US on Tuesday. Apart from this, traders will take cues from the broader market risk sentiment to grab short-term opportunities around the major.

Technical levels to watch

The Reserve Bank of New Zealand (RBNZ) will announce its monetary policy decision on Wednesday, July 13 at 02:00 GMT and as we get closer to the release time, here are the expectations as forecast by the economists and researchers of six major banks.

The RBNZ is seen raising the Official Cash Rate (OCR) by 50 basis points (bps) from 2% to 2.5% in July. As FXStreet’s Dhwani Mehta notes, RBNZ forward guidance holds the key.

ANZ

“We expect the RBNZ will raise the OCR 50 bps to 2.50%. On balance, the data since the May MPS has not suggested any meaningful easing in inflation pressure. Indeed, if the RBNZ did publish forecasts at interim meetings, the OCR track would likely be a little higher, if anything.”

Westpac

“We expect the RBNZ to raise the OCR by another 50 bps to 2.50%. Developments since the May statement have been mixed for the monetary policy outlook. Near-term inflation is still running hot, but the risks of a global slowdown have increased and early signs of a cooling in domestic activity have started to emerge. For now, the RBNZ will need to carry through with the interest rate hikes it has signalled, or risk undoing its good work so far on bringing inflation pressures under control. But at some point in the coming months, it will be appropriate to signal that the end of the tightening cycle is near.”

Standard Chartered

“We expect the central bank to proceed with a 50 bps hike given a hawkish RBNZ, higher inflation and a weaker NZD (which places upward pressure on tradables inflation). We see only one more 25 bps hike in August and project the terminal rate at 2.75% (more dovish than market expectations and the RBNZ’s forecast) as we expect growth concerns to take priority over inflation fears in H2. Markets will be watching for any signs of a change in the hawkish rhetoric given rising concerns about a recession and as the central bank was the first among developed markets to hike rates in this cycle.”

ING

“Another 50 bps hike seems likely. But a trembling housing market and deteriorating economic picture suggest the RBNZ may have to recalibrate its hawkish message soon – probably not at this meeting, but potentially in August. And the rest of the world will likely take note. NZD to remain weak for now.”

TDS

“The surprise contraction in Q1 GDP wouldn't deter the RBNZ's hawkish stance just yet and we expect a third straight 50 bps hike to tame inflation.”

Citibank

“We expect the RBNZ MPC to deliver another 50 bps increase in the OCR to take it to 2.50%, a level broadly associated with a neutral level of monetary policy. But taking policy to neutral is unlikely to satisfy the MPC, it is likely to be only a step towards a policy level that is restrictive. Domestic hard activity data since the last OCR decision on May 25 shows a solid core of domestic demand while house prices declines have been small, with prices arguably still higher than what the RBNZ would prefer. In addition, the NZ labor market remains consistent with the RBNZ’s assessment that it is stronger than what would be consistent with full employment. Citi analysts do not however, expect the MPC to respond with a 75 bps increase in the OCR as the RBNZ remains ahead of other central banks in terms of the policy cycle.”

The firm US dollar has caused gold to drop temporarily to $1,720 today. Ongoing and robust ETF outflows are weighing on the yellow metal as well, economists at Commerzbank report.

Speculative financial investors have been withdrawing further from gold

“Any significant or lasting rise in the gold price is being precluded not only by the firm US dollar but also by the ongoing and robust ETF outflows.”

“The gold ETFs tracked by Bloomberg registered outflows of 29 tons last week, their most pronounced in eight weeks and the fourth week in a row (with growing momentum).”

“Speculative financial investors have been withdrawing further from gold of late. According to the CFTC’s statistics, their net long positions are at their lowest level in over three years.”

In its monthly report published on Tuesday, the Organization of the Petroleum Exporting Countries (OPEC) left the 2022 world oil demand growth forecast unchanged at 3.36 million barrels per day (bpd), as reported by Reuters.

Additional takeaways

"OPEC forecasts world oil demand will grow by 2.7 million bpd in 2023."

"OPEC forecasts 2023 global economic growth of 3.2%, leaves 2022 view unchanged at 3.5% and says uncertainty remains skewed to downside."

"OPEC forecasts non-OPEC oil supply will rise by 1.7 million bpd in 2023, led by the US."

"OPEC oil output rose by 234,000 bpd to 28.72 million bpd in June."

"Global demand for OPEC's crude forecast at 30.1 million bpd in 2023, up 900,000 bpd from 2022."

Market reaction

Crude oil prices continue to fall following this report and the barrel of West Texas Intermediate (WTI) was last seen trading at $99.40, where it was down nearly 4% on a daily basis.

- PepsiCo announced FQ2 earnings that beat on top and bottom lines.

- Revenue grew 5% YoY to $20.2 billion, against forecasts of $19.5 billion.

- Adjusted EPS grew 8% YoY to $1.86, above consensus of $1.74.

PepsiCo (PEP) stock has advanced 0.7% in Tuesday's premarket to $171.77 on the back of a robust earnings release for the fiscal second quarter. PepsiCo offered up adjusted earnings per share of $1.86, which beat the consensus of $1.74. Revenue of $20.2 billion also beat consensus by about $720 million. Revenue grew about 5% YoY, and adjusted EPS rose more than 8%.

“Given our year-to-date performance, we now expect our full-year organic revenue to increase 10 percent (previously 8 percent), and we continue to expect core constant currency earnings per share to increase 8 percent," said Chairman and CEO Ramon Laguarta.

Consistent with previous guidance, PepsiCo still expects the following achievements for the full-year 2022: 8% increase in core constant currency EPS; an effective tax rate of 20%, and total cash returns to shareholders of approximately $7.7 billion. The shareholder return is comprised of $6.2 billion in dividends and $1.5 billion worth of share repurchases.

PepsiCo's earnings beat did not shock the market as it normally beats consensus. The last time it missed consensus on earnings was the fourth quarter of 2022.

PepsiCo Stock Forecast: $177.24 holds price action in place

PepsiCo stock has been in an uptrend since October 2020, judging by the last time the 50-week moving average was above its 20-week counterpart. This year, however, $177.24 has been the resistance level that just will not quit. Several attempts to overtake it have failed – once in mid-January and twice in mid and late April. Stuck in the low $170s now, PEP will likely make another run at the level fairly soon.

If bulls fail once again, then PEP stock will drop to the ascending support line at $157. This support feature has been working since September 2021. A beat of $177.24 would allow PepsiCo stock to make a run at the top of the price channel near $187.

PEP weekly chart

Money markets on Tuesday scaled back European Central Bank (ECB) rate hike bets to 137 basis points (bps) by the end of the year from 145 bps on Monday amid recession fears, Reuters reported.

Market reaction

This headline doesn't seem to be having a noticeable impact on the shared currency's performance against its rivals. As of writing, the EUR/USD pair was trading at 1.0010, where it was down 0.28% on a daily basis.

Meanwhile, markets remain cautious on Tuesday with the Euro Stoxx 600 Index losing 0.3% on the day.

- NZD/USD staged a modest recovery from sub-0.6100 levels, or over a two-year low.

- Sustained USD buying and the risk-off mood capped gains for the risk-sensitive kiwi.

- Investors also seemed reluctant ahead of the RBNZ and the US CPI on Wednesday.

The NZD/USD pair showed resilience below the 0.6100 round-figure mark and gained some positive traction on Tuesday. The uptick assisted spot prices to recover a part of the previous day's sharp decline to the lowest level since May 2020, though lacked any follow-through buying.

The relentless US dollar buying remained unabated amid expectations that the Fed would stick to its aggressive policy tightening path. Apart from this, the prevalent risk-off environment - fueled by growing recession fears - pushed the safe-haven USD to a fresh 20-year high and acted as a headwind for the risk-sensitive kiwi.

Looking at the broader picture, the NZD/USD pair has been declining along a descending channel over the past four weeks or so. This points to a well-established short-term bearish trend and supports prospects for a further depreciating move for the NZD/USD pair. Traders, however, seemed reluctant ahead of this week's key event/data risk.

The Reserve Bank of New Zealand (RBNZ) is scheduled to announce its monetary policy decision during the Asian session on Wednesday. Apart from this, the market focus will remain on the latest US consumer inflation figures, which will influence the near-term USD price dynamics and provide a fresh directional impetus to the NZD/USD pair.