- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 14-07-2022

- AUD/JPY is aiming to recapture its weekly high at 94.26.

- The upbeat Aussie employment data has empowered the RBA to accelerate rates unhesitatingly.

- Australia’s Consumer inflation expectations have trimmed to 6.3% vs. 6.7% recorded earlier.

The AUD/JPY pair is advancing firmly to reclaim its weekly high at 94.26 as the odds of a wider Reserve Bank of Australia (RBA)-Bank of Japan (BOJ) policy divergence is underpinning the aussie bulls. Broadly, the risk barometer is sideways in a wider range of 91.42-94.26 in July and is awaiting a potential trigger that could bring a decisive move.

The antipodean is performing well against the yen bulls on the release of the upbeat Australian employment data. The Australian Bureau of Statistics reported the Employment Change at 88.4k while the Unemployment Rate has trimmed to 3.5%. As per the market consensus, the Australian economy was expected to report an addition of 25k jobs in its labor market. Also, the jobless rate was seen at 3.8%.

This has delighted the RBA to tighten its policy further without much hesitation. Last week, the RBA elevated its Official Cash Rate (OCR) by 50 basis points (bps) to 1.35%. The inflation rate is sky-rocketing in the aussie zone and in order to tame the same, the RBA will elevate its OCR continuously.

Apart from that, the consumer inflation expectations have been trimmed on a decent note. The inflation indicator landed at 6.3%, lower than the prior release of 6.7% but remained higher than the expectations of 5.9%. This indicates that the policy tightening measures have started showing their multiplier effects.

On the Tokyo front, the BOJ’s ultra-loose monetary policy will widen the policy divergence with other nations. BOJ governor Haruhiko Kuroda is committed to its dovish commentary in order to spurt the aggregate demand in its respective economy.

- Silver Price remains sidelined after bouncing off two-year low.

- Oversold RSI favors buyers but $19.10 appears a tough nut to crack.

- Support line of the short-term falling wedge restricts the immediate downside.

Silver Price (XAG/USD) struggles to extend corrective pullback from the lowest level since July 2020, taking rounds to $18.45 during Friday’s initial Asian session.

In doing so, the bright metal keeps the previous day’s rebound from a one-month-old falling wedge’s support line amid oversold RSI (14).

However, the support-turned-resistance trend line from May 13, around $18.60 by the press time, probes the XAG/USD buyers.

Also acting as the key hurdle is the convergence of the stated bullish chart pattern falling wedge’s upper line and the 10-DMA, near $19.10.

Should silver rises past $19.10, it can rally towards a downward sloping resistance line from April, close to $20.30.

Meanwhile, silver’s fresh declines may aim to retest the aforementioned wedge’s bottom, surrounding $18.00 by the press time.

Following that, lows marked during June 2020, around $16.95, will gain the market’s attention.

Overall, silver bears appear to have run out of steam but the buyers need validation to retake control.

Silver: Daily chart

Trend: Further weakness expected

- EURUSD Price struggles to extend corrective pullback from a two-decade low.

- Easing hawkish Fed bets, mixed comments from policymakers allowed bears to take a breather ahead of blackout period.

- US Retail Sales will be important, Fed speakers may also try to use force before pre-meeting silence.

EURUSD Price seesaws around 1.0020 after bouncing off the lowest levels since December 2002, near 0.9950, as traders seek fresh clues during Friday’s Asian session. The major currency pair’s latest rebound also marks the traders’ indecision, as well as chances of a rebound amid recently mixed signals.

The mixed comments from the Fed speakers who tried to talk down the odds of the 100 bps rate hike are the key catalyst to triggering the EURUSD Price recovery. On the same line was the CME’s FedWatch tool that showed receding probabilities favoring the 75 basis points (bps) of Fed rate hike during July. Additionally, the receding difference between the 2-year and the 10-year US Treasury yields also helped ease the EURUSD trader’s pain of late.

Also read: EUR/USD Forecast: Battle around parity continues, bulls to be disappointed

EURUSD Price bounced on Fedspeak

Fedspeak talked down 100-bps rate hike.

Receding hawkish bias of the Fed policymakers, known as Fedspeak, appears to have recently tamed the risk-aversion wave. Among the key hurdles for the hawks were comments from St. Louis Federal Reserve President James Bullard and Federal Reserve Governor Christopher Waller. That said, Fed’s Bullard said, "So far, we've framed this mostly as 50 versus 75 at this meeting." On the same line, Fed’s Waller mentioned that markets may have gotten ahead of themselves by pricing a 100 basis points rate hike in July, as reported by Reuters.

Yield curve inversion also favored bulls

It’s worth noting that a reduction in the US Treasury yield curve inversion also underpinned the EURUSD Price recovery from the 20-year low. That said, the US 10-year Treasury yields ended Thursday around 2.95%, up 0.95% intraday, whereas the 2-year bond coupon dropped 0.75% to 3.12% at the latest. With this, the difference between the near-term and the longer-term bond coupons eased, which in turn allowed EURUSD bears to step back, mainly due to the reduction in the recession fears that initially favored the US dollar bulls.

Hawkish Fed forecasts eased as well

Markets curtailed bets for the heavier Fed rate hikes in the July meeting, after witnessing a reduction in the hawkish calls from the Fed policymakers and mixed performance of the yields. That said, the latest print from the CME’s FedWatch tool suggests nearly 52% chance of a 75 bps rate hike in July versus showing an almost certain case for the said rate lift the previous day.

US data keep EURUSD bears hopeful

Despite the recently mixed catalysts, firmer US data favored the EURUSD bears to remain hopeful of refreshing the multi-year low. On Thursday, the US Bureau of Labor Statistics mentioned that the Producer Price Index (PPI) for final demand in the US climbed to 11.3% on a yearly basis in June from 10.9% in May. This print surpassed the market expectation of 10.7%. Additionally, there were 244,000 Initial Jobless Claims in the week ending July 9 versus the previous week's print of 235,000 and market expectation of 235,000. The Weekly Jobless Claims were the highest in five months and raised market fears of the start of the recession.

Downbeat EU projections weigh on quote

Pessimistic economic forecasts from the European Commission also drown the EURUSD Price. As per the latest quarterly EU projections, published the previous day, EU Commission expects GDP growth of 2.6% in the euro area in 2022, down from 2.7% in the previous outlook. The predictions also expect euro area inflation of 7.6% in 2022, up from 6.1% prior forecast.

US Retail Sales is the key

Given the recently firmer US inflation data and mixed Fedspeak, today’s US Retail Sales will be crucial for EURUSD traders. Market forecasts suggest that the US Retail Sales could rise to 0.8% MoM in June from -0.3% marked in May. In this regard, analysts at the Australia and New Zealand Banking Group said, “A strong retail sales number would be illustrative of strong demand and the need for the FOMC to maintain, and possibly intensify, its hawkish guidance.”

EURUSD Price technical outlook

EURUSD Price remains inside the monthly bearish channel despite bouncing off the 61.8% Fibonacci Expansion (FE) of March-May 2022 moves, around 0.9950.

Even if the major currency pair manages to cross the resistance line of the aforementioned descending trend channel, around 1.0055 by the press time, the 50-SMA level of 1.0140 could test the EURUSD buyers before directing them to the last Friday’s peak of 1.0190.

It’s worth noting that the bearish bias needs validation from the monthly high near 1.0475 to push back the EURUSD sellers.

Alternatively, the 61.8% FE level near 0.9950 and the December 2002 low surrounding 0.9860 appear the immediate support levels to watch during the pair’s fresh downside.

Following that, the oversold RSI (14) and the lower line of the stated channel, near 0.9825, will be important to watch.

Overall, EURUSD is likely to witness a further rebound but the trend reversal is far.

Elliott Wave view: Bearish trend in EUR/USD remains intact

- USD/JPY extended its rally for the seventh consecutive week, gaining some 2.19%.

- The USD/JPY negative divergence in the daily chart might pave the way for a pullback.

- A rising wedge remains in play and, once broken, targets the USD/JPY might fall towards 130.00.

The USD/JPY reached a fresh 24-year high around 139.38, though of late dipped near the 139.10s area, as market participants scaled back expectations of a 100 bps rate hike following Wednesday’s hot US CPI reading, which opened the door for speculations of the aforementioned. At the time of writing, the USD/JPY is trading at 139.03, recording a minimal gain of 0.03%.

USD/JPY Thursday’s session began around the 137.50 figure, near the bottom of a rising wedge, and rallied sharply towards a fresh 24-year high at 139.38. However, the major retreated near 138.50 before launching a renewed assault above 139.00, where the price settled near the end of the New York session.

USD/JPY Daily chart

The USD/JPY daily chart remains upward biased, though price action looks overextended due to the parabolic rally, which began around March 2022. Oscillators are again entering overbought conditions, illustrating a negative divergence, which means that price action is printing higher highs, while the Relative Strength Index (RSI) is registering lower peaks, opening the door for a pullback.

Therefore, if the above scenario plays out, the USD/JPY's first support would be July 14 daily low at 137.28. A breach of the latter will send the pair tumbling towards the July 6 low at 134.94, followed by the June 16 cycle low at 131.49.

USD/JPY Key Technical Levels

- Pound bulls have rebounded after hitting the lower portion of the Falling Channel.

- The cable is expecting a pullback as the RSI (14) has displayed momentum loss.

- Declining 50-EMA is still favoring the greenback bulls.

The GBP/USD pair is oscillating in a narrow range of 1.1817-1.1828 in early Asia after a firmer rebound from Thursday’s low at 1.1760. On a broader note, the cable has remained in the grip of bears after failing to sustain above the critical resistance of 1.1900.

The cable has rebounded after sensing a cushion from the lower portion of the falling channel formed on an hourly scale. The upper portion of the above-mentioned hart pattern is placed from July 4 high at 1.2165 while the lower portion is plotted from July 5 low at 1.1900. A rebound from the lower portion of the above-mentioned chart pattern doesn't resemble a bullish reversal but a pullback move, which may meet offers soon.

The greenback bulls are defending the 20-period Exponential Moving Average (EMA) at 1.1831. While the 50-EMA is still higher than the cable prices and indicates the short-term trend is still down.

Meanwhile, the Relative Strength Index (RSI) (14) has displayed signs of momentum loss as the asset is continuously forming lower highs while the momentum oscillator is forming higher lows. The formation of a bullish negative divergence dictates a bullish reversal but needs more filters for validation.

The cable is expected to display more losses if the asset drops below the round-level support of 1.1800. An occurrence of the same will drag the asset towards the 26 March 2020 low at 1.1777, followed by a 25 March 2020 low at 1.1638.

Alternatively, a decisive move above the July 8 high of 1.2056 will send the asset towards July 4 high at 1.2161. A breach of the latter will drive the cable towards June 28 high at 1.2292.

GBP/USD hourly chart

-637934371427804501.png)

- AUD/USD struggles to extend the corrective pullback from two-year low.

- Risk-aversion takes clues from fears of recession, aggressive Fed actions.

- US PPI offered strength to inflation fears but yield curve inversion eased afterwards on mixed Fedspeak.

- China’s Q2 GDP, Retail Sales and US Retail Sales will be important for fresh impulse.

AUD/USD steadies around the mid-0.6700s after bouncing off the lowest levels since June 2020. In doing so, the Aussie pair portrays the market’s cautious mood ahead of important data from the key customer China, as well as from the US. However, risk-aversion due to the fears of the economic slowdown and faster rate hikes by the US Federal Reserve (Fed) keeps the pair sellers hopeful.

The quote’s latest rebound could be linked to the mixed comments from the Fed speakers who tried to talk down the odds of the 100 bps rate hike. On the same line was the CME’s FedWatch tool that showed receding probabilities favoring the 75 basis points (bps) of Fed rate hike during July. Additionally, the receding difference between the 2-year and the 10-year US Treasury yields also helped ease the AUD/USD trader’s pain of late.

At home, the upbeat jobs report for June and Consumer Inflation Expectations for July helped AUD/USD to battle the bears when got the chance. Australia’s Employment Change rose to 88.4K versus 25K expected and 60.6K prior. Further, the Unemployment Rate dropped to 3.5% from 3.9% previous readouts and 3.8% market consensus. Earlier in the day, Australia’s Consumer Inflation Expectations for July came out as 6.3% versus 5.9% expected and 6.7% prior.

Even so, the markets remain dicey as recession fears remain on top ahead of the crucial economics, which in turn exert downside pressure on the AUD/USD pair. The reason for the economic slowdown woes could be linked to Thursday’s firmer US data. That said, the US Bureau of Labor Statistics mentioned that the Producer Price Index (PPI) for final demand in the US climbed to 11.3% on a yearly basis in June from 10.9% in May. This print surpassed the market expectation of 10.7%. Additionally, there were 244,000 Initial Jobless Claims in the week ending July 9 versus the previous week's print of 235,000 and market expectation of 235,000. The Weekly Jobless Claims were the highest in five months.

Amid these plays, Wall Street closed mixed and the US 10-year Treasury yields ended the day around 2.95%, up 0.95% intraday, whereas the 2-year bond coupon dropped 0.75% to 3.12% at the latest.

Moving on, China’s Q2 Gross Domestic Product (GDP) is expected to drop to -1.5% QoQ versus 1.3% prior while the Retail Sales may print a 0.0% YoY figure for June compared to -6.7% previous reading. Further, the US Retail Sales is likely to rise to 0.8% MoM in June from -0.3% marked in May. Should the scheduled data print upbeat figures in China and marked a negative surprise in the US, the AUD/USD may extend the latest rebound.

Also read: US June Retail Sales Preview: Has the consumer turning point arrived?

Technical analysis

Unless providing a daily closing below the one-month-old descending support line, at 0.6695 by the press time, AUD/USD can offer intermediate bounces towards the downward sloping resistance line, around 0.6860 at the latest.

- USD/CAD is juggling around 1.3120 as investors await the release of US Michigan CSI.

- A preliminary estimate for the Michigan CSI says a minute slippage that is not lucrative for the DXY.

- Oil prices have rebounded strongly after slipping below the critical support of $90.00.

The USD/CAD pair is oscillating in a narrow range of 1.3090-1.3140 from the New York session after displaying a corrective action. The major attracted significant offers after failing to hold the fresh yearly highs above 1.3200. The asset has followed the footprints of the US dollar index (DXY) and has turned sideways ahead of the US Michigan Consumer Sentiment Index (CSI).

As per the market consensus, the US Michigan CSI is expected to slip minutely to 49.9 from the prior release of 50. It is worth noting that the prior release of 50 was the lowest in the past 15 years and even an expectation of a minute slippage this time may bolster the statements of critics.

The economic data resembles the confidence of the consumers in the financial prospects of the country. A slippage in the economic data dictates a drop in the buying conditions for real estate and durable goods in the economy. No doubt, the persistent price rise has trimmed the demand for durable goods and higher interest rates are becoming a nightmare for home buyers. Also, the announcement of a rate hike by 1% from the Federal Reserve (Fed) will bring a serious slump in the demand for real estate.

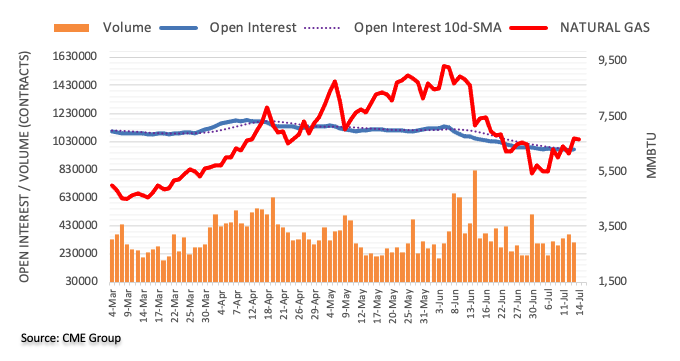

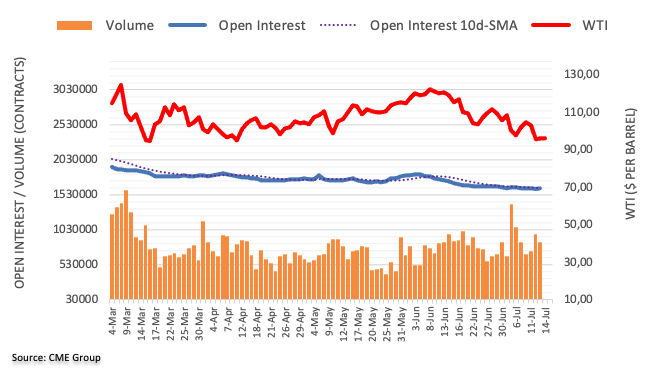

On the loonie front, investors are still in the hangover of the 1% rate hike announcement by the Bank of Canada. Energy bills and food products are driving the inflation rate higher vigorously, which forced the BOC to announce the unusual and has set an example for other central bankers that a sky-rocketing rate hike can be announced.

Meanwhile, the oil prices have rebounded strongly as a responsive buying action pushed the black gold higher after slipping below the critical support of $90.00. This indicates that the extremely oversold signals have supported the oil prices, however, the downside is still warranted.

- USD/CHF is expected to display more downside after violating 0.9820 amid a correction in DXY.

- The DXY has renewed its 19-year high at 109.20 on soaring hawkish Fed bets.

- A 1% rate hike by the Fed may put an extreme burden on the growth prospects of the US economy.

The USD/CHF pair is declining gradually after failing to kiss the crucial resistance of 0.9900 on Thursday. The asset has displayed a squeeze in volatility and is likely to display an expansion in the same after surrendering the cushion of 0.9820

The US dollar index (DXY) has entered into a correction phase after failing to sustain above the dynamic hurdle of 109.00. The asset is refreshing its 19-year high in each trading session, which is sufficient to claim that the bulls' party is not over and the correction would turn into a bullish impulsive wave sooner.

The odds of a 100 basis points (bps) rate hike by the Federal Reserve (Fed) are advancing firmly and eventually are haunting the market participants as it is not necessary that the economy may handle the unusual burden. Fed policymakers are empowered by solid growth prospects and employment generation to sound hawkish in their interviews. The rate hike by 1% could test the strength of the economy and there is no surety that it may handle the burden more comfortably this time. Failing to do the same may drive the economy towards recession.

In today’s session, the release of the US Retail Sales will remain in focus. A preliminary estimate for the economic data is 0.8%, and outperformance is expected in comparison to the prior release of -0.3%.

On the Swiss franc front, the less dependency of the Swiss economy on oil imports from Russia is making it a lucrative bet as the economy won’t face the energy issues despite being in Europe. The focus will remain on commentary over interest rates by the Swiss National Bank (SNB), which will guide the market participants.

- NZD/USD continues extending its fall during the week, set to finish with losses for the third straight week.

- A risk-off impulse weighed on the NZD/USD, courtesy of the red hot US PPI report.

- Fed officials push back against 100 bps; investors scale back 100-bps rate hike.

The New Zealand dollar snapped two days of consecutive gains on Thursday and is trading with minimal losses of 0.12% amidst a dampened market mood, spurred by another high US inflation report, in this case, the Producer Price Index for June, which exceeded expectations, while the greenback rises.

The NZD/USD is exchanging hands at 0.6125, almost pairing its earlier losses, after dipping to a fresh YTD low around 0.6060, though buyers stepped in, and the major rose shy of the daily high around 0.6134.

The main drivers are the US Dollar and a dismal mood

Risk aversion is still dominating the financial markets. US equities finished Thursday’s session with losses, reflecting worries about a stickier than expected inflation, recession jitters, and expectations of a larger-than-expected US Federal Reserve hike.

During the New York session, which had just finished, the US Department of Labour reported the June Producer Price Index, also known as the PPI, which showed that prices rose by 11.3% YoY, higher than the 10.7% estimated. Although portraying persistent cost pressures, producers got a respite as commodity prices recoil on concerns about global demand. That, alongside consumer inflation overshooting 9% annually, further cemented the case for a Fed’s 75 bps rate hike.

Fed speaking continued throughout the day as officials will enter a blackout period ahead of the July meeting. Fed’s Christopher Waller and James Bullard downplayed the chance of a 100 bps hike, with both backing up a 75 rate rise. Later in the day, the new Boston Fed President, Susan Collins, expressed that inflation is “too high” and said she would address it as her priority.

Investors’ reaction to that was felt in Eurodollars money market futures, with the July contract pricing in 268 bps of tightening, meaning that it’s fully priced in a 75 bps, while odds of a 100 bps are down at 44%, a tailwind for the NZD/USD, which staged a late recovery, erasing some earlier losses.

In the meantime, the NZD/USD capped its losses due to the recent RBNZ rate hike and market participants scaling back Fed interest rate rises.

What to watch

The New Zealand economic calendar will feature Business PMI for June on Friday. The economic docket is packed on the US front, led by Retail Sales, the University of Michigan (UoM) Consumer Sentiment, and further Fed speaking, ahead of entering the blackout period.

NZD/USD Key Technical Levels

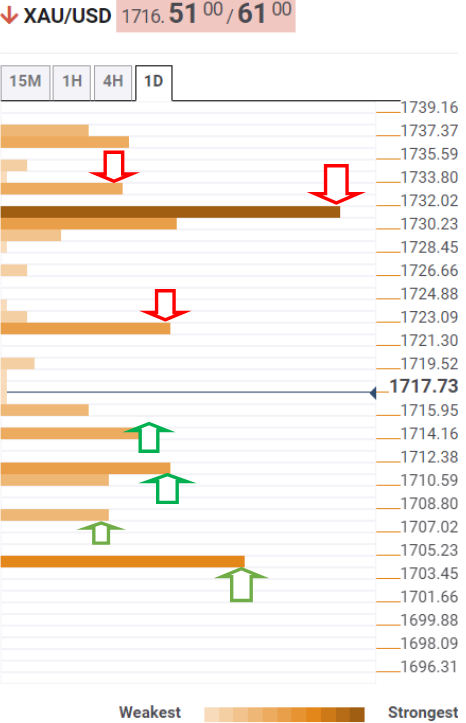

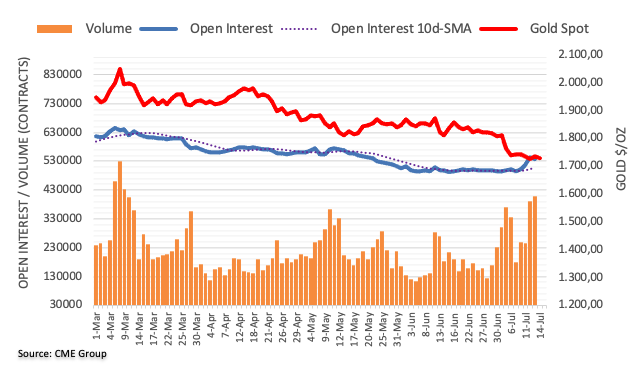

- The Gold Price is offered below critical market structure and the focus in the main is on the downside towards monthly lows of $1,676.86.

- Price pressures are still much too strong to delay Fed rate hikes.

- US dollar could continue to derive support from the fears of a recession at home and away.

The Gold Price (XAU/USD) has been pressured on Thursday due to a rising US dollar and hawkish sentiment surrounding the Federal Reserve which is widely expected to raise the federal funds rate by 75 basis points at its July 26-27 meeting. trading at $1,710.10, the price is 1.47% lower at the time of writing, sliding from a high of $1,736.60 to a low of $1,697.64. Overall, both the technical and fundamental bias has been to the downside.

The break in daily market structure and prospects of a strong US dollar as well as higher yields, which gold does not offer to investors, have weighed on the precious metal. The greenback has tended to strengthen both when the US economy outperforms its peers and also when the US economy looks weak.

Gold Price weighed by Fed sentiment

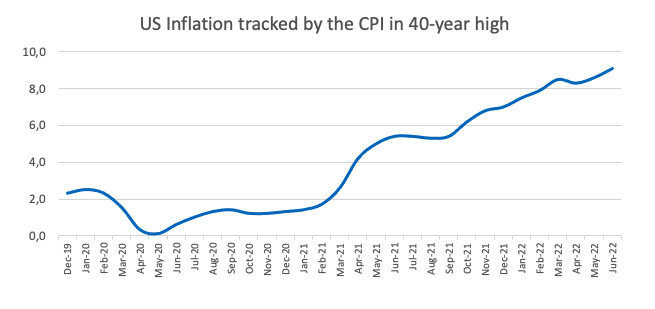

There are concerns that the Federal Reserve is caught between a rock and hard place, but overall, the Gold Price is being weighed into pre-pandemic levels and there are risks of a significant capitulation event in precious metals. Firstly, US inflation surprised once again to the upside in June, both headline and core measures, with annual inflation jumping to a new four-decade high of 9.1%, up from 8.6% in May. Therefore, supportive of global yields and the US dollar as a headline for gold prices, the market expects that the Fed will be in no rush to signal a pivot from its current path of aggressive rate hikes and is pricing in steeper hikes of 100bs pints for not only in July but September's meeting as well. At the June FOMC meeting, Chair Powell stated that he would need ‘compelling evidence’ that inflation is easing for the Fed to change course, which he defined as ‘a series of falling monthly inflation readings’.

Fears of global recession, support of the US dollar

The US dollar could continue to derive support from the fears of a recession at home and away. Despite the slowing in demand that we are now seeing and the risk of recession, the Fed is clearly more worried about a de-anchoring of inflation expectations, which would be much harder to deal with. A global recession could stem from no other than the second largest economy in the world, China which is battling with Covid infections. Barely six weeks after Shanghai fully lifted a prolonged and harshly enforced lockdown, China's biggest city is again grappling with a surge of the virus.

The worries that the Middle Kingdom could miss its official growth forecast this year have been mingling with recession fears for both the Eurozone and the US. This is expected to continue to play into the hands of the US dollar bulls. The US dollar smile theory has been playing out since the advent of Covid and is sucking up the world's capital.

The greenback’s safe haven function also stems from its use as an invoicing currency and from the significant amounts of USD-denominated debt issued by non-US residents. Simply put, in times of uncertainty various market participants take action to secure their access to USDs. In turn, the pull on the gold price is likely to persist, at least until the Fed’s front-loaded policy tightening cycle is near conclusion.

''There is no way around it, the Fed has an inflation problem on its hands and the USD will continue to remain king of FX,'' analysts at TD Securities argued.

Gold Price expectations from TD Securities

''The single largest speculative cohort in gold appears to be holding a complacent position, with the average trader holding twice their expected position size,'' analysts at TD Securities said.

Key quotes:

''The epicentre of speculative gold markets has shifted away from money managers and towards the often-ignored prop-trader cohort. Their length was accumulated in 2020 and does not appear to be correlated to inflation or Fed narrative, which instead points to some complacency in this legacy position.''

''The latest data suggests that prop-trader bulls were still adding on the dip, as the breadth of traders long grew, but the pressure is building towards a capitulation if prices trade below their pandemic-era entry levels. In a liquidation vacuum, these massive positions are most vulnerable, which suggests the yellow metal remains prone to further downside still.''

Gold Price technical analysis

The Gold Price has broken structure on the daily chart although there are prospects of a correction in order to mitigate the imbalance of price above resistance as illustrated above. The downside target, however, is in play.

From a weekly perspective, the price could also be regarded as extended and a correction is arguably feasible at this juncture. There is a price imbalance from the current week's highs to the week commencing June 27 low. This area meets a 50% mean reversion and a 38.2% Fibonacci retracement before then. However, the focus in the main is on the downside towards monthly lows of $1,676.86 as illustrated on the chart above.

What you need to take care of on Friday, July 15:

Fears of recession maintained the dollar on the bullish path throughout the first half of the day, although cooling expectations of a 100 bps rate hike in the US triggered a corrective slide.

Federal Reserve Governor Christopher Waller noted that markets may have gotten ahead of themselves by pricing a 100 basis points rate hike in July, adding that a 75 bps hike will bring them to be neutral. CME FedWatch is now showing a 52% chance of a 75 bps rate hike in July.

Global indexes plummeted at the beginning of the day, although Waller's words helped Wall Street to trim most of its intraday losses. As a result, high-yielding currencies recovered some of the ground lost against the greenback.

The EUR/USD pair plunged to 0.9951 but finished the day at around 1.0020. Turmoil in Europe added to the shared currency's weakness. Gazprom, the Russian energy giant, said that it would not guarantee to resume the functioning of the Nord Stream 1 pipeline after it was shut down for repairs. German Economy Minister Robert Habeck said that the uncertainty around gas deliveries "is clouding the economic outlook considerably heading into the second half of the year." Also, Italian Prime Minister Mario Draghi announced he is resigning.

The GBP/USD pair fell to 1.1759, its lowest since March 2020, and now trades around 1.1820. Political noise in the United Kingdom, after Prime Minister, announced his resignation and Tories began an election process, weighed on the pound.

The USD/CAD pair soared to 1.3223, weighed by equities and falling oil prices but retreated towards the 1.3100 price zone. The barrel of WTI traded as low as $90.53 a barrel, now hovering around $96.30.

The AUD/USD pair edged modestly lower and trades at 0.6750, despite upbeat Australian employment figures.

Gold reached a fresh 2022 low of $1,697.56 a troy ounce, now hovering around $1,710.

Ripple's XRP price is a dangerous bull-trap until this level is touched

Like this article? Help us with some feedback by answering this survey:

- The EUR/JPY erases its weekly losses and is up 0.50%.

- A risk-off impulse was no excuse for the euro to rally against the JPY.

- EUR/JPY is neutral-upwards as buyers stepped in, reclaiming the 139.00 mark.

The EUR/JPY rises during the North American session, refreshing weekly highs around 139.76, but retreated some as the Wall Street session winds down on Thursday, amidst a dampened investors’ mood, sparked by another US elevated inflation report, in this time, the PPI. At the time of writing, the EUR/JPY is trading at 139.22, gaining 0.78%.

EUR/JPY’s price action portrays the cross, opening near the daily pivot point of the day, around 138.10s, dipping to the daily low at 137.99, before rallying more than 150 pips, hitting a fresh weekly high at the R2 daily pivot at 139.76. After that, the EUR/JPY dipped towards the 139.10 lows but stayed positive in the day, as the EUR/USD is also back above parity at around 1.0020s.

EUR/JPY Daily chart

From a technical perspective, the EUR/JPY shifted from neutral to neutral-upwards as EUR/JPY buyers reclaimed the 50-day EMA around 139.05, as well as breaking above a descending channel, which has opened the door for further upside. EUR/JPY traders should notice that oscillators are aiming higher, particularly the Relative Strength Index (RSI), closing to the 50 line at 47.57.

Therefore, the EUR/JPY path of least resistance is upwards, and its first resistance would be July 6 daily high at around 139.50. Break above will expose the 140.00 figure, followed by a challenge of the 20-day EMA at 140.83. Once cleared, the EUR/JPY’s next resistance would be the July 5 high at 142.37.

EUR/JPY Key Technical Levels

- GBP/USD is suffering in the hands of a firm US dollar and UK political uncertainties.

- Traders have ramped up bets that the U.S. central bank could raise rates by 100 basis points.

GBP/USD is trading down on the day by some 0.7% at the time of writing with the pair falling from a high of 1.1892 to a low of 1.1759. The US dollar resumed its relentless move higher on Thursday, charting new 24-year highs in the DXY index that tracks the greenback against six counterparts up more than 13% this year. It was last up 0.64% on the day at 108.710.

Markets are fixated on the Federal Reserve which is widely expected to raise the federal funds rate by 75 basis points at its July 26-27 meeting. The Consumer Price Index data for June that was released Wednesday morning surprised to the upside, coming in far stronger than expected. The Fed's Beige Book report on Wednesday afternoon also indicated that inflation remains brisk and labour markets tight, but there were signs that demand has slowed. This is concerning investors in anticipation of a recession which too is supporting the US dollar on safe-haven flows.

As for domestic fundamentals, the pound will be subject to political uncertainties. ''The combination of slow growth, debt and high inflation is likely to provide very tricky for the new Tory leadership,'' analysts at Rabobank explained. ''Several candidates have proposed sweeping tax cuts that threaten both public finances and the inflation outlook.''

''On the other hand, if used carefully tax cuts could boost investment that would increase productivity, growth potential and tax revenue. That said, Sunak, the former Chancellor has accused the pledges of many of his rivals in the leadership race as “comforting fairy tales” and is expected to argue that his approach during his tenure was “responsible”. The UK had been on course to see the highest tax burden in 70 years by the end of the current parliament.''

- Silver plummets during the week, extending its losses by almost 5%.

- Risk-aversion, rising US Treasury yields, and a buoyant US dollar weighed on XAGUSD.

- Fed’s Waller and Bullard backed a 75 bps rate hike; money market futures expectations for 100 bps fall.

Silver (XAGUSD) is tumbling on Thursday during the North American session as US Treasury yields rise, led by 2s and 5s, keeping the US 2s-10s yield curve inverted for the eighth consecutive day, meaning traders’ recession fears are increasing. However, high US inflation readings on the consumer and producer side continued their upward trajectory, making the Fed’s job even harder. At the time of writing, the XAGUSD is trading at $18.35, losing more than 4% in the day.

Pessimism surrounds the markets; cheered by US dollar bulls

Global equities remain under pressure, extending their fall as investors seek safety. Weighed by a hot US Producer Price Index for June, topping above 11% YoY, added fuel to higher inflation expectations, following Wednesday’s CPI at 41-year highs above the 9% YoY threshold.

Investors’ reaction to that can be seen in the greenback’s strength. The US Dollar Index, a gauge of the buck’s value vs. six currencies, reached a 20-year high around 109.200s, though, at the time of writing, it sits at 108.765, up 0.69%. US T-bond yields are also rising, exerting further downward pressure on precious metals, with the US 10-year T-note coupon at 2.959%, up two bps.

In the meantime, the Fed parade continues with Fed’s Waller, Collins, and Bullard crossing wires. Fed’s Waller and Bullard still back a 75 bps rate hike. Waller added that if retail sales and housing data come stronger than expected, he would lean toward a higher July hike. In the meantime, the newest Boston Fed President, Susan Collins, said that inflation is too high and addressing it is her priority. Traders should notice that Collins is a voter in 2022 and will participate in the July FOMC meeting.

Also read: Fed’s Waller: Markets may have gotten ahead of themselves on 100 bps hike in July

XAGUSD traders should also take clues about gold prices, which remain heavy at around $1709 a troy ounce. At the same time, the Bloomberg Commodity Index is falling almost 2%, portraying traders’ worries about current and future demand, spurred by China’s Covid-19 reemergence during the week.

Also read: Fed's Bullard calls for a 75bp hike in July

What to watch

On Friday, the US economic docket will feature Tier 1 data, with Retail Sales, the NY Empires State Manufacturing Index, and the University of Michigan (UoM) Consumer Sentiment survey.

XAGUSD Key Technical Levels

Reuters reported that St. Louis Federal Reserve President James Bullard would prefer to lift interest rates by 75 basis points at the central bank's next meeting later this month, was telling the Japanese news service Nikkei in an interview released on Thursday that he does not back a larger increase for now.

"So far, we've framed this mostly as 50 versus 75 at this meeting," Bullard said. "I think 75 has a lot of virtue to it, because the long-run neutral that the committee has, according to the Summary of Economic Projections, is actually about 2.5%."

Asked if the Fed's policy rate, currently in a range of 1.5-1.75%, could exceed 4% by year end, Bullard said: "I suppose it's possible," but cautioned that would require data on inflation to continue coming in in "an adverse way."

- AUD/USD remains heavy during the week, extending its losses by almost 1.80%.

- Sentiment remains negative due to high US inflation reports, further cementing aggressive Fed tightening.

- AUD/USD Price Analysis: Tilted to the downside; unless buyers reclaim 0.6800, the further downside pressure remains.

The AUD/USD trims two consecutive days of gains and slides during the North American session, on dismal market sentiment, following a report that prices paid by producers continued high, following suit the path of consumer inflation, further cementing the case for further aggressive tightening by the Fed.

The AUD/USD is trading at 0.6732 after recovering from an early trip towards daily lows at 0.6681 on broad US dollar strength, though it recovered some ground once the dust settled, stabilizing at current price levels.

AUD/USD falls on USD strength, despite upbeat Australia job report

Early in the New York session, the US Department of Labour reported that the Producer Price Index heightened above the 11% threshold on a year-over-year reading. Although it was a negative report, it shows that producers are getting a respite as commodity prices recoil on concerns about global demand. Following Wednesday’s CPI, that report might open the door for a larger than expected 75 bps rate hike by the Fed, as Eurodollars July money market futures contract shows 271.50 bps of tightening.

All that weighed on the AUD/USD, which tumbled towards 0.6680s in the release. At the same time, US Initial Jobless Claims, for the week ending on July 9, rose by 244K, though was mainly ignored by investors, which are focused on inflation.

In the meantime, during the Asian session, the AUD/USD got bolstered by a better-than-expected employment report, which showed that the unemployment rate dropped to its lowest level in 50 years. In the meantime, expectations of a Reserve Bank of Australia (RBA) 50 bps rate hike are fully priced in. Although the AUD/USD climbed on the release, the appetite for US dollar safety weighed on the major.

What to watch

The Australian economic calendar will feature New Home Sales for June on Friday. The economic docket is packed on the US front, led by Retail Sales, the University of Michigan (UoM) Consumer Sentiment, and further Fed speaking, ahead of entering the blackout period.

AUD/USD Price Analysis: Technical outlook

The Aussie dollar remains tilted to the downside, though remains capped by the July 12 daily low at 0.6710, which in case of being broken again in the day, sellers would step, paving the way for further losses. Additionally to that, oscillators remain favoring shorts, further cementing the case. Therefore, the AUD/USD first support would be 0.6700. Break below will expose the YTD Low at 0.6681, followed by May 2020 lows at 0.6616.

AUD/USD Key Technical Levels

Reuters reports that Mario Draghi said he would resign as Italian prime minister on Thursday after a party in his ruling coalition did not participate in a confidence vote.

"I will tender my resignation to the president of the republic this evening," Draghi told the cabinet, according to a statement released by his office."The national unity coalition that backed this government no longer exists," he added.

Key notes

- 5-star's non-participation in the confidence vote was "very significant from a political point of view".

- The "national unity" coalition that backed this government no longer exists.

- The conditions are no longer in place for me to carry on.

- I will tender my resignation to the president this evening.

Meanwhile, the euro remains pressured around 1.0000 vs the greenback on Thursday after falling to its lowest level yet to 0.9952 on Thursday.

The Bank of England will announce its next monetary policy decision on August 4. According to analysts from Danske Bank, the EUR/GBP could move higher if the BoE does not hike interest rates as it is priced in by investors. They forecast EUR/GBP at 0.85 in one month, at 0.86 in three months, at 0.85 in three months and at 0.84 in a year.

Key Quotes:

“Over the past month, EUR/GBP moved back below 0.85, as GBP benefitted from the broad USD appreciation (GBP/USD is now trading below 1.19).”

“We still see a case for a slight move higher in EUR/GBP near-term if we are right that the Bank of England will not hike as aggressively as priced in by investors.”

“Looking further ahead, on the one hand, the positive USD environment is usually benefitting GBP relative to EUR. On the other hand, relative rates now seem supportive for EUR relative to GBP. Overall, we still expect the cross to trade around 0.84 in 12M.”

The Bank of Canada hiked the key interest rate by 100 bps on Wednesday to 2.50%. Despite the larger-than-expected hike, analysts at Danske Bank continue to see the USD/CAD pair moving to the upside over the next quarters, reaching 1.34 in six months.

Key Quotes:

“We still consider USD/CAD as a low beta version of USD/NOK. With our expectations of a stronger USD and a general continued pressure on cyclically sensitive assets we continue to see risks skewed to the topside for the cross. Bank of Canada has now joined the camp of central banks front-loading monetary tightening by delivering both earlier and larger rate hikes. Meanwhile, paradoxically, larger rate hikes pose a headwind to CAD via the CAD asset market taking a hit. According to the CFTC IMM data speculative positioning in USD/CAD is fairly neutral.”

“We forecast USD/CAD at 1.31 in 1M (from 1.31), 1.33 in 3M (1.33), 1.34 in 6M (1.34) and 1.34 in 12M (1.34).”

The US Dollar hit a fresh 20-year high on Thursday versus the euro and the yen. Analysts at Wells Fargo, continue to forecast dollar strength over the remainder of 2022 and into 2023. They warn the greenback could peak by early next year and then soften against G10 and emerging market currencies through much of 2023.

Key Quotes:

“The tight stance of policy alongside still high inflation suggests a recession is more likely than not next year. We look for the U.S. economy to enter a mild recession in the first quarter of 2023. The downturn should help alleviate inflation pressures enough to where the Fed begins easing policy in the second half of 2023.”

“Given the outlook for U.S. recession and a quicker end to the Fed tightening cycle at a slightly lower terminal rate than we had in our forecast last month, our outlook for the U.S. dollar has also changed. We still expect the greenback to gain against most foreign currencies through 2022 until early 2023 as the Fed tightens more quickly than most foreign central banks. However, that shorter Fed rate hike cycle, accompanied by U.S. recession and followed by Fed easing, means we now see a peak in the U.S. dollar by Q1-2023. Beyond that, we expect the greenback to soften steadily during most of next year.”

- EURUSD erased Wednesday’s losses, diving below parity, reaching a daily low below 0.9960.

- US PPI rose as well as consumer inflation; will the Fed go 100 bps?

- Federal Reserve interest rates expectations of a rate hike lie at around 89%.

- Interest rate differentials between the Fed and the ECB boost the EURUSD fall.

EURUSD gave up on sellers and broke below parity for the first time since December of 2002, finishing a period of 20 years above the €1/$1 figure, reaching a fresh 20-year low around 0.9952, before recovering some ground and trimming its earlier losses of 0.43%, on Thursday. At the time of writing, the EURUSD is seesawing around 1.0004.

Global equities are tumbling, displaying investors’ pessimistic mood. In the meantime, the US Dollar Index, a measurement of the greenback’s value against a basket of six of the G8 currencies, printed a fresh 20-year high, around 109.294, before retreating some, but remains up 0.67% underpinned by higher US Treasury yields, and is sitting at 108.720, a headwind for the EURUSD.

Also read: EUR/USD Forecast: Third time a charm? Parity under pressure again

US inflation remains high, as PPI exceeds estimates

US PPI report continues high

Before Wall Street opened, the US docket reported prices paid by producers, also known as PPI. The PPI continued its upward trajectory, topping the 11% mark at 11.3%, beating expectations of 10.7%. Albeit a negative reading, showing persistent cost pressures, producers get a respite as commodity prices recoil on concerns about global demand. This adds to Wednesday, Consumer’s Price Index (CPI), which at 9.1% YoY, inflicts substantial pressure on the Federal Reserve to move quickly and aggressively if they would not like inflation expectations to anchor at higher levels. Consequently, this would be a headwind for the EURUSD, despite the ECB’s guidance that it would begin raising rates for the first time in 11 years.

Fed speakers began to be vocal about rate hikes and emphasized that inflation is high

Meanwhile, EURUSD traders should be aware of additional Fed speakers piling up before entering the blackout period. On Wednesday, after the lousy inflation report in the US, Atlanta’s Fed President Raphael Bostic said everything is in play when asked about raising rates 100 bps in the July meeting. Later, the Cleveland Fed President Loretta Mester said they don’t need to decide on rates today but emphasized that inflation is “too high,” and the CPI report was uniformly negative. In the meantime, backing 75 bps is San Francisco’s Fed Mary Daly, but she also said that 100 bps is within the range of possibilities.

US 2s-10s yield curve remains inverted; a Fed 100 bps hike in July is possible

The US 2s-10-yield curve is still inverted for the eighth consecutive day, deepening into further negative territory towards -0.243%, a level last seen in 2000. However, at the time of writing, the spread reduced to -0.172%, as traders’ fears about recession easied a tone. Nevertheless, that would not deter the Federal Reserve from aggressive tightening, which is terrible news for EURUSD longs. According to money market futures STIRs, the eurodollars July’s futures contract, at 97.295, displays 270 bps of tightening, implying that the Fed could hike rates close to 100 bps in the July meeting.

Eurodollars discount a 270 bps tightening by July

ECB vs. Fed differentials, a headwind for the EURUSD

In July, both banks, the ECB and the Federal Reserve will host their monetary policy meetings. Currently, the ECB’s deposit rate lies at minus 0.50%, while the US Federal Reserve’s Federal funds rate (FFR) is at 1.75%, bolstering the appetite for the greenback. With expectations of the ECB hiking 25 bps and the Fed to move at least by 100 bps, differentials would widen further, to -0.25% (ECB) vs. 2.75% (Fed), meaning that the greenback would keep the upper hand, opening the door for further selling pressure on the EURUSD.

Also read: EURUSD Price holds parity on hawkish Fedspeak, EU Economic Forecasts eyed

EURUSD Price Technical outlook

EURUSD remains heavy, as shown by the daily chart, with the daily moving averages (DMAs) residing well above the exchange rate. Wednesday’s correction offered EURUSD shorts a better entry price after hitting a daily high around 1.0122, but on Thursday, the major extended its losses, pushing below the parity. Therefore the EURUSD path of least resistance might continue to the downside.

Therefore, the EURUSD first support would be 1.0000. A breach of the latter will expose the fresh 20-year low at 0.9952. Once cleared, EURUSD sellers’ next challenge will be December 2002 lows around 0.9859.

EURUSD Key Trading Levels

- USD/JPY back under 139.00 after hitting a fresh high since 1998.

- US PPI shows inflation remains the main concern.

- US dollar retreats during American hours, still up for the day across the board.

Despite risk aversion, the USD/JPY is rising more than a hundred pips on Thursday. The monetary policy divergence between the Bank of Japan and the Federal Reserve is keeping the pair on demand. After it hit a new high at 139.38, it pulled back to 138.80.

Inflation data justifies divergence in monetary policy

The US Consumer Price Index rose 9.1% (annual) in June, reaching the highest since 1981. The Producer Price Index climbed 11.3%. Both numbers came in above expectations and did not show a slowdown. With inflation running hotter-than-expected, the Federal Reserve (Fed) is seen raising rate aggressively. A 100 bps rate hike at the next meeting is now not a distant possibility.

At the same time, the Bank of Japan (BoJ) is seen continuing its ultra-easing monetary policy. The divergence between the BoJ and the Fed remains the main fuel behind the USD/JPY rally.

Not even risk aversion is helping the yen. On Thursday, the Dow Jones is falling by 1.09% (at one-month lows) and US yields are steady. Still, the Japanese yen is among the worst performers and USD/JPY is up by more than a hundred pips.

If the pair rises back above 139.00, a test of the top seems likely. Above 139.40, the next resistance could emerge at 139.70. Then attention would turn to the psychological area around 140.00. On the flip side, a consolidation below 138.80 could trigger a correction. The next support could be located at 138.15, followed by a stronger area at 137.70.

Technical levels

Federal Reserve Governor Christopher Waller argued on Thursday that markets may have gotten ahead of themselves by pricing a 100 basis points rate hike in July, as reported by Reuters.

Additional takeaways

"It is a very hard game to predict a recession."

"The labor market would have to deteriorate incredibly fast to throw us into recession."

"Yesterday's inflation number was not a big surprise."

"To go above 75 bps at next meeting, I need to assess data over next couple of weeks."

"We don't want to take a knee-jerk reaction to yesterday's inflation data."

Market reaction

The US Dollar Index continued to retrace its daily rally on these comments and was last seen rising 0.45% on the day at 108.48.

"I think it is plausible that we have a growth recession where it goes below longer-run average but doesn't go negative," Federal Reserve Governor Christopher Waller said on Thursday, as reported by Reuters.

Additional takeaways

"For me, 75 bps hike at this meeting gets us to neutral."

"Recent jobs numbers are amazing figures."

"Inflation expectations data before next meeting will help shape my view on the size of hike needed at July meeting."

"Retail sales on Friday will show the level of strength in consumer spending."

"If we get a good report, that will tell me consumer demand is still strong and we can keep tightening."

"A large amount of excess savings still in US bank accounts."

"75 bps hike is my base case."

"We knew this inflation report would be ugly, but it was uglier than thought."

"You don't want to overdo rate hikes but if incoming data over the next two weeks shows me demand is still robust, I would lean into a higher rate hike."

Market reaction

The US Dollar Index edged lower after these comments and was last seen gaining 0.5% on the day at 108.55.

"I support another 75 basis points (bps) rate hike in July," Federal Reserve Governor Christopher Waller said on Thursday, as reported by Reuters. Waller further noted that he could lean toward a bigger rate increase if retail sales and housing data come in stronger than expected.

Additional takeaways

"I expect rate increases will continue after July at a pace that's dependent on incoming data."

"After July, further increases will be restricting demand."

"I expect policy to be restrictive until there has been a sustained reduction in core PCE inflation."

"A soft landing is very plausible, based on strong labor market; recession can be avoided."

"Until I see a significant moderation in core prices, I support further rate hikes."

"Fed is now, and must be, utterly focused on inflation fight."

"US labor market is very strong, data does not show weakening."

"Inflation is far too high, we are far from our goal of stable prices."

"June inflation report was a major league disappointment."

"There are signs of slowing in economic activity, but not convinced it will damage the labor market."

"Causes of inflation don't affect approach to policy."

"Financial market response to Fed's actions show Fed retains credibility."

"With inflation so high, there is a virtue in front-loading policy tightening."

Market reaction

The US Dollar Index edged lower from multi-decade highs it set earlier in the day after these comments but was last seen still rising 0.7% on the day at 108.80.

- USD/CAD posts biggest daily gain in months.

- Loonie is under pressure despite a larger-than-expected BoC rate hike.

- US dollar firm across the board amid risk aversion.

The USD/CAD made an impressive reversal during the latest sessions, rising from weekly lows to the highest since November 2020. Recently it climbed to 1.3223 before pulling back toward 1.3150.

CAD weakens the day after BoC's surprise

On Wednesday, the Bank of Canada rose the key interest rate by 100 basis points to 2.50%, a larger-than-expected move. The loonie rose across the board after the decision. It started to decline during Thursday’s Asian session and accelerated the move higher in European hours.

After breaking above the key resistance at 1.3080 it jumped above 1.3100 and then peaked at 1.3223. As of writing, it trades at 1.3140, up almost 200 pips for the day.

A stronger US dollar across the board, a decline in crude oil prices and risk aversion boosted USD/CAD. The greenback, measured by the DXY, reached the highest level in almost 20 years at 109.29 before trimming losses.

Data from the US showed the Produce Price Index rose 1.1% in June above the 0.8% of market consensus. Inflation concerns remain the top priority for central bankers.

Technical levels

The US Census Bureau will release the June Retail Sales report on Friday, July 15 at 12:30 GMT and as we get closer to the release time, here are the forecasts of economists and researchers of six major banks regarding the upcoming data.

Retail Sales are forecast to rebound to 0.8% in June with the ex-autos to 0.6% and control rising to 0.3%.

Commerzbank

“We expect June retail sales to rise by 1.0%, but higher prices, especially at gas stations, are largely responsible for this.”

TDS

“We look for retail sales to recover in June (0.5%), following the series' first contraction this year in May. Spending was likely aided by another firm showing in gasoline station sales and a rebound in the auto segment. We also look for another gain in the eating/drinking segment as consumers continue to transition away from goods. That said, control group sales likely fell again (-0.5%).”

SocGen

“We expect an increase in real consumption of 1.0-1.5%, which is a further slowing of consumption back to a longer-term trend. Largely this is as expected. In June, new motor vehicle sales recovered to 13 m.u. pace from 12.68 in May. Gasoline prices soared in June, which lifts the retail sales excluding autos measure. The control group strips out vehicles and gasoline sales, and we expect a more moderate 0.4% increase.”

NBF

“Car dealers likely contributed positively to the headline number, as auto sales increased during the month. Gasoline station receipts, for their part, may have expanded steeply judging from a sharp increase in pump prices. All told, headline sales could have advanced 0.9% MoM. Spending on items other than vehicles may have been a tad weaker, rising 0.8%.”

CIBC

“With higher gas prices and auto unit sales in June, retail sales likely more than made up for the weakness seen in May and rose by 0.9%. However, things likely won’t look as rosy elsewhere, as higher prices for essential goods will likely squeeze discretionary spending volumes, while the slowdown in housing activity could have weighed on furniture and appliance sales. The 0.3% advance expected in the control group (ex. gasoline, autos, restaurants, and building materials) will therefore reflect price increases, and implies a contraction in real spending.”

Wells Fargo

“We forecast retail sales rose 0.8% last month. But price gains were again likely a key factor boosting these nominal sales estimates, as we expect goods prices continued to rise. While inflation continues to cloud this nominal read on sales, the retail data remain an important indication of how goods spending is evolving. Auto sales should provide a decent boost to overall sales in June based on previously reported vehicle sales data. Supply chains have shown notable signs of improvement, but until there is a further thawing in supply, we view it as unlikely for a sustained recovery in the hard-hit sector. More broadly, we forecast goods spending to decline on-trend as households continue to dedicate more wallet share to services this summer. The dwindling demand for goods has sparked concern of the potential for retail inventories being overbuilt. It is true that inventories are starting to be rebuilt, but there is little indication of a large enough overstocking to cause discounting and consequently sharp goods disinflation anytime soon.”

- GBP/USD witnessed aggressive selling on Thursday amid the relentless USD buying interest.

- Descending channel formation supports prospects for a further near-term depreciating move.

- A slightly oversold RSI on the daily chart suggests that bears could pause near the 1.1700 mark.

The GBP/USD pair added to its heavy intraday losses and dropped to its lowest level since March 2020, further below the 1.1800 mark in the last hour. The relentless US dollar buying picked up pace during the early North American session, which, in turn, was seen as a key factor behind the latest leg down.

From a technical perspective, Wednesday's attempted recovery move faltered near the 1.1965-1.1970 confluence resistance. The said region comprises the top end of a two-and-a-half-week-old descending channel and the 50-period SMA on the 4-hour chart. The subsequent downfall could be seen as a fresh trigger for bearish traders and supports prospects for an extension of the ongoing depreciating move.

Hence, some follow-through weakness towards challenging the descending channel support, around the 1.1700 round-figure mark, remains a distinct possibility. That said, RSI (14) on the daily chart is already flashing slightly oversold conditions. This, in turn, suggests that bearish traders could pause near the said handle, which might prompt some near-term short-covering move around the GBP/USD pair.

Any attempted recovery, however, might now confront stiff resistance near the 1.1800 mark. This is followed by resistance near the 1.1830-1.1835 region, above which the GBP/USD pair could aim to reclaim the 1.1900 round figure. Any further move up could be seen as a selling opportunity and runs the risk of fizzling out quickly near the aforementioned confluence, currently around the 1.1925-1.1930 area.

GBP/USD 4-hour chart

-637934034432286976.png)

Key levels to watch

GBP/USD has just lost the 1.18 handle. Thus, economists at Scotiabank see considerable downside risk for cable towards the 1.15 area.

Resistance seen at 1.1875/85

“The GBP is holding a broad long-lasting bearish trajectory that points to an eventual break under 1.18 with little to hold it up until the 1.15 area as a big psychological trigger with the 2020 low of 1.1412 following.”

“Resistance is 1.1875/85, the 1.19 figure area, and the mid-1.19s.”

The EUR is tracking losses against the strong USD. Economists at Scotiabank expect the world’s most popular currency pair to suffer a sustained move below 1.00, targeting 0.96.

Resistance aligns at 1.0050/60

“Price action suggests it’s only a matter of time for a sustained move below 1.00, targeting the 0.96 figure zone as key support – with intermediate at mid/big-figure areas.”

“Resistance is 1.0050/60 followed by the 1.01 big figure and yesterday’s peak of 1.0122.”

EUR/USD finally broke below parity during the American trading hours on Thursday and was last seen losing 0.8% on the day at 0.9975.

Developing story...

- Gold price dropped to a fresh 11-month low during the early North American session.

- The USD shot to a nearly two-decade high and continued exerting downward pressure.

- Aggressive Fed rate hike bets, rising US bond yields contributed to the intraday selling.

- Recession fears, the risk-off mood failed to impress bulls or lend support to the metal.

Gold price struggled to capitalize on the previous day's goodish recovery move from the $1,707 area and came under renewed selling pressure on Thursday. The intraday downfall extended through the early North American session and dragged the XAUUSD to its lowest level since August 2021, with bears still awaiting a sustained break below the $1,700 mark.

Gold price pressured by sustained USD buying

The US dollar resumed its relentless rise and shot to a fresh two-decade high amid the prospects for a more aggressive policy tightening by the Federal Reserve. A stronger USD was seen as a key factor that exerted heavy downward pressure on the dollar-denominated gold. The US Labor Department reported that the headline US CPI accelerated to 9.1% in June - the highest level since November 1981. The data sealed the case for another supersized Fed rate hike move and continued underpinning the buck.

Also Read: Gold Price Forecast: For how long can XAUUSD defend $1,700?

Elevated bond yields further weighed on XAUUSD

The US Treasury bond yields moved higher after Atlanta Fed President Raphael Bostic said on Wednesday that everything is in play to curb the persistent rise in inflationary pressures. The markets were quick to react and started pricing in the possibility of a historic 100 bps rate hike later this month and pushed the yield on the benchmark 10-year US government bond back closer to the 3.0% threshold. Elevated US Treasury bond yields further contributed to driving flows away from the non-yielding gold.

Stronger PPI print validated hawkish Fed expectations

Thursday's release of the US Producer Price Index (PPI), which surpassed expectations by a big margin, reaffirmed hawkish Fed expectations. Data published by the US Bureau of Labor Statistics showed that the gauge for final demand goods accelerated to 11.3% on a yearly basis in June as against consensus estimates pointing to a modest downtick to 10.7% from 10.9% in May. This, to a larger extent, helped offset a rise in the US Weekly Initial Jobless Claims to the highest level since November 2021.

-637934018062336492.png)

US PPI historic chart

Recession fears failed to lend any support

Even the worsening global economic outlook failed to impress bulls or lend support to the safe-haven gold. Investors remain concerned that rapidly rising higher borrowing costs, the ongoing Russia-Ukraine war and fresh COVID-19 lockdowns in China would pose to global economic growth. In fact, Bank of America economists forecast a “mild recession” in the US this year. This continued taking its toll on the risk sentiment, which was evident from an extended selloff in the equity markets.

Gold price technical outlook

Gold price, for now, has managed to hold above the $1,700 mark to lend some support, which if broken decisively would be seen as a fresh trigger for bearish traders. The XAUUSD could then accelerate the downfall towards testing September 2021 low, around the $1,787-$1,786 region. The downward trajectory could further get extended towards the 2021 yearly low, near the $1,677-$1,676 area.

On the flip side, the overnight swing high, around the $1,745 region, now seems to act as an immediate strong barrier ahead of the $1,749-$1,752 supply zone. Sustained strength beyond could trigger a short-covering move towards the $1,767-$1,770 strong horizontal support breakpoint, above which bulls might aim to reclaim the $1,800 round-figure mark.

-637934017667481815.png)

Gold Price: Can gold prices hold above $1,700?

Economist at UOB Group Lee Sue Ann comments on the recent RBNZ event.

Key Takeaways

“The Reserve Bank of New Zealand (RBNZ) decided to raise its official cash rate (OCR) by 50bps to 2.50%. Today’s decision was an interim review rather than a quarterly Monetary Policy Statement (MPS), so no new forecasts were issued and there was no press conference by RBNZ Governor Adrian Orr.”

“We had previously expected the RBNZ to tune back to the more usual pace of 25bps hikes from Jul onwards. Today’s 50bps move to a 2.50% policy rate would make the RBNZ ahead of most other central banks in lifting borrowing costs to combat rising inflation, but also seen taking the benchmark rate above a neutral level, which it deems to be 2%.”

“It is now looking likely that the RBNZ may hike by 50bps at the Aug and Oct meetings, after which we think it will tune back to the more usual pace of 25bps hikes. We will, however, be finalising our OCR forecasts only following the CPI release.”

- EUR/USD flirts once again with the key parity level.

- Below parity comes the December 2002 low at 0.9859.

EUR/USD quickly fades Wednesday’s bullish attempt to the 1.0120 region and re-focuses on the downside, particularly on the parity zone.

The pair’s bearish stance remains everything but abated for the time being. Against that, a convincing breakdown of the parity level should open the door to the triggering of massive stop-loss orders, while the next support level of note is expected to appear at the December 2002 low at 0.9859.

As long as the pair navigates below the 5-month support line near 1.0550, further losses remain in store.

In the longer run, the pair’s bearish view is expected to prevail as long as it trades below the 200-day SMA at 1.1040.

EUR/USD daily chart

- Initial Jobless Claims rose by 9,000 in the week ending July 9.

- The greenback continues to outperform its rivals on Thursday.

There were 244,000 initial jobless claims in the week ending July 9, the weekly data published by the US Department of Labor (DOL) showed on Thursday. This print followed the previous week's print of 235,000 and came in worse than the market expectation of 235,000.

Further details of the publication revealed that the advance seasonally adjusted insured unemployment rate was 0.9% and the 4-week moving average was 235,750, an increase of 3,250 from the previous week's average.

"The advance number for seasonally adjusted insured unemployment during the week ending July 2 was 1,331,000, a decrease of 41,000 from the previous week's revised level," the DOL said in its publication.

Market reaction

The dollar preserves its strength after this report with the US Dollar Index rising 0.65% on the day at 108.70.

Economists at Rabobank have revised lower their AUD/USD forecasts across the board to take account of USD strength. They expect the pair to march forward on a six-to-twelve month horizon.

AUD/USD could again struggle to advance in the near term

“While we see AUD/USD as remaining range bound for the remainder of this year, we continue to see the currency pair edging higher on a 6 to 12 mth horizon. This is on the anticipation that USD strength will have peaked and in consideration of robust Australian fundamentals.”

“While we expect AUD/USD to hold around current levels on a 1-to-3-month view, we see scope for the currency pair to edge up to 0.70 on a 6-month view and 0.74 in 12 months.”

- Annual PPI in US jumped above 11% in June.

- US Dollar Index clings to strong daily gains above 108.50.

The Producer Price Index (PPI) for final demand in the US climbed to 11.3% on a yearly basis in June from 10.9% in May, the data published by the US Bureau of Labor Statistics revealed on Thursday. This print surpassed the market expectation of 10.7%.

The annual Core PPI edged lower to 8.2% in the same period from 8.3% but came in slightly higher than analysts' estimate of 8.1%. On a monthly basis, Core PPI was 0.4%.

Market reaction

The US Dollar Index showed no immediate reaction to these figures and was last seen rising 0.65% on the day at 108.70.

Economist at UOB Group Ho Woei Chen, CFA, reviews the latest interest rate decision by the Bank of Korea (BoK).

Key Takeaways

“Bank of Korea (BOK) raised the benchmark base rate by 50 bps to 2.25% at its meeting today (13 Jul), in line with expectation. This marks the first time the BOK hiked by a 50bps quantum and the 6th rate increase since Aug 2021 with a cumulative 175 bps hike since then.”

“Governor Rhee Chang-yong said the decision was unanimous but the 50 bps hike was an ‘exception’, indicating that it will be ‘desirable’ to keep future rate increase in clips of 25 bps. However, he also warned that the stance could change if there are unexpected developments that sharply increase inflation risks. Notably, the government is also stepping up measures to contain inflation such as expanding a zero percent quota tariff for imported food items.”

“The BOK also highlighted its view of a higher inflation and lower growth forecast for this year, compared to its forecasts in May.”

“On the assumption that inflation will peak in 2H22, we maintain our forecast for the BOK to revert to 25 bps hike for the remaining meetings this year in Aug, Oct and Nov to bring the benchmark base rate to 3.00% by year-end. With an expected moderation in inflation rate next year, the BOK is likely to stay on hold thereafter, or even begin to trim interest rate should growth risks mount.”

- DXY resumes the upside with strong conviction on Thursday.

- The index surpasses the December 2002 top at 108.74.

DXY rapidly leaves behind the weakness seen in the last couple of sessions and resumes the upside to new cycle highs near 108.80 on Thursday.

Further upside in the dollar remains in store in the short-term horizon. That said, once the 2022 high is cleared, the index could attempt a move to the round level at 109.00 ahead of the September 2002 top at 109.77 (September 16).

As long as the index trades above the 5-month line near 103.15, the near-term outlook for DXY should remain constructive.

In addition, the broader bullish view remains in place while above the 200-day SMA at 98.73.

Of note, however, is that the index trades well into the overbought territory and it therefore could trigger a corrective decline in the not-so-distant future.

DXY daily chart

- AUD/USD came under renewed selling pressure on Thursday and dropped to a fresh two-year low.

- A fresh wave of the USD buying and the risk-off mood exerting pressure on the risk-sensitive aussie.

- The formation of a descending channel supports prospects for an extension of the depreciating move.

The AUD/USD pair struggled to capitalize on the upbeat Australian jobs data-inspired modest gains and witnessed a turnaround from the 0.6800 neighbourhood on Thursday. The downward trajectory dragged spot prices to the lowest level since June 2020, with bears still awaiting a sustained break below the 0.6700 round figure.

The US dollar resumed its relentless rise and climbed to a fresh two-decade high, which, in turn, was seen as a key factor that acted as a headwind for the AUD/USD pair. Apart from this, a fresh bout of intense selling around the equity markets underpinned the safe-haven buck and weighed on the risk-sensitive aussie.

From a technical perspective, the emergence of fresh selling at higher levels and sustained weakness below the 0.6700 mark would be seen as a fresh trigger for bearish traders. The negative outlook is reinforced by the fact that the AUD/USD pair has been trending lower along a four-week-old downward-sloping channel.

Furthermore, oscillators on the daily chart are holding deep in the bearish territory and are still far from being in the oversold zone. The set-up remains titled firmly in favour of bearish traders and supports prospects for a slide towards challenging the lower end of the descending channel, near the 0.6665-0.6660 area.

The latter should act as a strong base for spot prices, which if broken decisively should pave the way for an extension of the near-term downward trajectory. The AUD/USD pair might then accelerate the fall towards and challenge the 0.6600 round-figure mark before eventually dropping to the 0.6570 horizontal support zone.

On the flip side, the 0.6190-0.6210 region now seems to have emerged as an immediate strong barrier. Any subsequent move up might still be seen as a selling opportunity and remain capped near the 0.6850-0.6860 confluence, comprising 100-period SMA on the 4-hour chart and the top end of the aforementioned descending channel.

AUD/USD 4-hour chart

-637933974000138160.png)

Key levels to watch

The Canadian dollar had a slow-burn response to the larger-than-expected Bank of Canada (BoC ) rate hike. Economists at Scotiabank feel the Bank’s decision to “front-load” rate hikes should provide the loonie with some clear support and, at the very least, strengthen the cap on USD/CAD that has developed above 1.30.

BoC’s tightening should support the CAD against the likes of the EUR, GBP and JPY

“The bottom line for the CAD for us is that the BoC’s tightening should support the CAD broadly – particularly against the likes of the EUR, GBP and JPY where policy tightening will lag.”

“Against the USD, more CAD-favourable short-term yield spreads should reinforce the cap on USD/CAD above 1.30 and potentially launch spot towards 1.28 in the next few weeks. CAD gains may be limited beyond that point for now as markets assess the peak in the rate cycle and the impact of tighter policy on the domestic economy.”

“External factors – the broader USD tone, the risk backdrop – may limit deeper USD/CAD losses for now.”

The USD/JPY pair has reached fresh multi-decade highs above 139.00. Economists at Credit Suisse expect USD/JPY to extend its race higher towards the 142.00 level.

USD/JPY to move towards 142 over the coming weeks

“One view that we are not inclined to change yet is our call for USD/JPY to test 142.00 in coming weeks. When we initially targeted this level, we were not expecting US yields to drop back as far as they have done in recent weeks. In that context, we are pleasantly surprised by how resilient USD/JPY has proved to be despite that retracement.”

“With our core logic for a bullish USD/JPY view having been the expectation that the Bank of Japan would hang tight with its current stance, we see no reason to shift position after these events gave new reasons to hold that view.”

- EUR/JPY adds to the weekly rebound beyond the 139.00 mark.

- Further gains look likely above the resistance line near 140.30.

EUR/JPY adds to Wednesday’s uptick and regains the 139.00 hurdle and beyond on Thursday.

Further upside should surpass the 4-month resistance line around 140.30 to allow for the continuation of the recovery to, initially, the weekly high at 142.37 (July 5). Beyond the latter, the cross could attempt a visit to the 2022 top at 144.27 (June 28).

In the longer run, the constructive stance in the cross remains well propped up by the 200-day SMA at 133.26.

EUR/JPY daily chart

- USD/JPY caught aggressive bids and surged past the 139.00 mark, to a fresh 24-year high.

- Rising bets for a supersized Fed rate hike in July boosted the USD and remained supportive.

- The prevalent risk-off mood offered some support to the safe-haven JPY and capped gains.

The USD/JPY pair stalled its strong intraday positive move near the 139.35-139.40 region and retreated a few pips from a new 24-year high touched earlier this Thursday. The pair was last seen trading just below the 139.00 mark, still up over 1% for the day.

The US dollar resumed its relentless rise and climbed to a fresh two-decade high, which, in turn, was seen as a key factor that provided a strong boost to the USD/JPY pair. The red-hot US consumer inflation figures released on Wednesday reaffirmed bets that the Fed would stick to its faster policy tightening path. In fact, the markets have now started pricing in the possibility of a supersized, historic 100 bps rate hike move on July 27.

Hawkish Fed expectations kept the US Treasury bond yields elevated and continued acting as a tailwind for the greenback. In contrast, the Bank of Japan has promised to conduct unlimited bond purchase operations to defend its near-zero target for 10-year yields. This has resulted in a further widening of the US-Japan yield differential, which continued weighing on the Japanese yen and lifted the USD/JPY pair beyond the 139.00 mark.

That said, an extended selloff in the equity markets offered some support to the safe-haven JPY and held back bulls from placing fresh bets around the USD/JPY pair. This, in turn, was seen as the only factor that led to an intraday pullback of over 50 pips amid slightly overbought RSI (14) on the daily chart. The downside, however, remains cushioned amid a big divergence in the monetary policy stance adopted by the Fed (hawkish) and the BoJ (dovish).

Market participants now look forward to the US US economic docket - featuring the release of the Producer Price Index and the usual Weekly Initial Jobless Claims. This, along with the US bond yields, will influence the USD price dynamics later during the early North American session. Apart from this, the broader market risk sentiment will drive demand for the safe-haven JPY and produce short-term trading opportunities around the USD/JPY pair.

Technical levels to watch