- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 18-07-2022

- EUR/JPY has witnessed a modest recovery after a sharp correction towards 140.00.

- The ECB to elevate its interest rates for the first time in 11 years.

- A dovish stance is expected by the BOJ to keep flushing liquidity into the market.

The EUR/JPY pair has displayed a less-confident rebound from the psychological support of 140.00. The cross has sensed barricades around 140.0 after a modest recovery. Going forward, the asset is expected to display wild moves as investors are shifting their focus towards the monetary policy announcement by the European Central Bank (ECB) and the Bank of Japan (BOJ) this week.

Considering the market chatters, the ECB is expected to break its 11-year-long status-quo maintenance and will announce a rate hike. Price pressures are impacting the households as a large real income slump has impacted their consumption and savings patterns significantly.

In order to tame the roaring inflation, the ECB has already announced the conclusion of the Asset Purchase Program (APP) to squeeze liquidity. Now, the focus will shift to interest rate elevation to chase down easy money available in the market.

Apart from that, this week the release of eurozone Consumer Confidence will be of utmost importance. A preliminary estimate for the eurozone Consumer Confidence data is -24.5 vs. -23.6 reported earlier.

On the Tokyo front, the Bank of Japan (BOJ) is expected to maintain the status quo in its interest rate decision announcement. A dovish stance is expected from BOJ Governor Haruhiko Kuroda as the BOJ is bound to revive overall demand in the economy. The BOJ is focusing on keeping the inflation rate above 2% and in order to address the same, it needs to elevate the wage prices simultaneously.

- USD/CAD corrects from out of the 1.2900s with the bullish trend still in place.

- The attention will be turning back to the Fed again.

At 1.2985, USD/CAD is flat ahead of the Tokyo cash open. The pair has been in the hands of the bulls at the start of the week despite the Bank of Canada last week surprised the market by raising rates 100bp to 2.50% which drove the CAD higher to test 1.29 the figure.

''The Bank of Canada continues to be the one of most aggressive developed world central bank having raised rates before the Fed, hiked 50bp before the Fed, and started QT before the Federal Reserve,'' analysts at Rabobank said.

''The Bank is still confident it can engineer a soft landing, and a front-loaded hiking cycle is the best way to achieve that. But, the path to a soft landing has narrowed and the reduction in the growth outlook does imply some pain.''

Meanwhile, speculators’ CAD net long positions edged lower for a second week and the bullish trend remains in place with the analysts at Rabobank saying this will continue to be ''unless 1.285 is broken, on the upside, we still look to 1.3070 as resistance, but a break above there would open up a move to 1.32.''

As for the US dollar, it has lost some shine to trade back below 107 on Monday as per the DXY index which measures the greenback vs. a basket of major currencies. It was trading as high as 109.29 in a fresh bull cycle high last week.

Fedspeak has pushed back against a 100bp hike from some notable hawks, raising the risk of a near-term short-squeeze on the Gold Price prior to the meeting. The Federal Reserve has moved into the blackout period before the next meeting leaving prior statements from Fed speakers following the last meeting and to date for the market to chew on.

At the June FOMC meeting, Chair Jerome Powell stated that he would need ‘compelling evidence’ that inflation is easing for the Fed to change course, which he defined as ‘a series of falling monthly inflation readings’. Since then, we have heard from Fed's Raphael Bostic who said “everything is in play” while Mester said there was no reason for a smaller hike. Mary Daly, CEO of San Francisco said 75 bp was her “most likely posture.”

- The NZD/USD edges lower on Tuesday, down by a minimal 0.02%, as the Asian session begins.

- Asian equity futures tumble, set for a lower open on a dismal market mood.

- NZD/USD Price Analysis: Downward-to-neutral, unless buyers reclaim 0.6200, the majors will be under selling pressure.

The NZD/USD is almost flat as the Asian Pacific session begins, clings above the 0.6150 mark after hitting a daily high above 0.6200 but tumbled on market mood shift, which dented the appetite for risk-sensitive currencies like the kiwi and bolstering the greenback. At the time of writing, the NZD/USD is trading at 0.6151.

Also read:

- NZD/USD struggles around 0.6150 despite hot NZ inflation, and further RBNZ tightening

- Forex Today: Optimism proved ephemeral

NZD/USD Price Analysis: Technical outlook

The NZD/USD is still downward-to-neutral biased, printing a successive series of lower lows and lower highs, further reinforcing the previously-mentioned. Also, the Relative Strength Index (RSI) exited from oversold conditions in mid-June and peaked around 45; since then, the RSI has been trending lower, indicating further selling pressure lies ahead. Nevertheless, NZD/USD buyers need to step in and achieve a daily close above the June 14 low at 0.6196 to shift the bias to neutral. Failure to do so, the NZD/USD will remain vulnerable.

NZD/USD Daily chart

NZD/USD price action formed a falling wedge, usually a sign of weak selling pressure. It means that the recent cycle lows have been recorded on less momentum, signaling that buyers might be outpacing sellers. Nevertheless, a flat RSI suggests NZD/USD sellers are booking profits, awaiting a fresh catalyst to record a new YTD low.

Therefore, the NZD/USD first support would be the 0.6150 figure. A break below will expose the 0.6100 figure. Once cleared, the next support would be the YTD low at 0.6060, followed by a test of the triple-zero mark at 0.6000.

NZD/USD Key Technical Levels

- AUD/USD is likely to pick bids around 0.6800 after the conclusion of the corrective move.

- The release of the RBA minutes will unfold the guidance for further monetary policies.

- Weak oil prices in July may barricade price pressures, however, hawkish Fed bets will remain stable.

The AUD/USD pair is juggling in a narrow range of 0.6808-0.6814 in the early Asian session. The asset has witnessed a steep fall after failing to overstep the crucial hurdle of 0.6850 on Monday. The major is eyeing a cushion around 0.6800 as the release of the minutes from the Reserve Bank of Australia (RBA) is expected to strengthen the aussie bulls. On a broader note, the antipodean is performing stronger against the greenback and the corrective phase is expected to get concluded sooner.

The minutes from the RBA for July’s monetary policy meeting will unveil the agenda behind the interest rate elevation. RBA Governor Philip Lowe announced a consecutive rate hike by 50 basis points (bps) so as to bring the inflation rate under the desired figure. The minutes will also provide a detailed study of the economic condition of Australia. Apart from that, the viewpoint on further guidance will be of utmost importance.

Meanwhile, the US dollar index (DXY) is struggling to sustain above 107.40 after a pullback move from near 107.00 as investors are expecting that the price pressures in the US economy are near their peak levels. The consensus is backed by vulnerable oil prices in July and likely lower aggregate demand. Expectations for slippage in the overall demand will shift the raw-material prices lower and therefore, result in a sigh of relief for the inflation rate. Although the odds for a mega rate hike by the Federal Reserve (Fed) will remain stable.

- EURUSD is oscillating around 1.0440, upside remains favored on weaker DXY.

- The ECB is set to elevate its interest rates for the first time in 11 years.

- Price pressures have impacted Consumer Confidence in Eurozone and the US.

EURUSD price is displaying back and forth moves in a minute range of 1.0139-1.0146 in the early Tokyo session. The asset has displayed a corrective phase after a sheer upside move. The pair turned into correction mode after failing to overstep the crucial resistance of 1.0200 on Monday. The major has renewed its weekly high at 1.0201 and is likely to extend gains as the corrective move will turn into a bullish impulsive wave ahead.

The US dollar index (DXY) has attempted a rebound after witnessing a vertical downside move. The asset has rebounded after picking bids from near 107.00. The pullback move by the DXY after a sharp correction is expected to over soon as the asset has reached near the potential resistance of 107.50 and may initiate its south-side move again. The market participants will capitalize on the bargain sell and will initiate shorts on the counter.

Also Read: EUR/USD Forecast: EUR corrects higher ahead of critical ECB decision

ECB to step up interest rates for the first time in 11 years

Price pressures trim Consumer Confidence in Eurozone and the US

Soaring price pressures in the Eurozone and the US have trimmed the Consumer Confidence in their respective economies. Higher inflation rates and lower earnings have resulted in a very real income shock for individuals. Their paychecks are unable to address their recurring savings and consumption pattern. The eurozone will report its Consumer Confidence data on Wednesday, which is seen at -24.5 vs. -23.6. The University of Michigan has already reported the Consumer Sentiment Index (CSI) data. The sentiment data improved minutely but remained near the two-year low.

-637937804531051886.png)

EURUSD to extend rally on hawkish ECB bets

EURUSD price is likely to recapture Monday’s high near 1.0200 as the odds of a rate hike by the European Central Bank (ECB) are advancing vigorously. Price pressures are impacting the paychecks of the households and ECB policymakers are left with no other choice than to tap for interest rate elevation. The ECB has already concluded its Asset Purchase Program (APP) to squeeze liquidity from the market. It is worth noting that the ECB is going to elevate its interest rates for the first time in the past 11 years.

Gas-related concerns escalate in Eurozone

The major catalyst that could turn the firm rally of the EURUSD price into turmoil is the escalating gas-related concerns in eurozone. The eurozone is already facing the heat of an energy crisis after its promise to lower its dependency on oil and energy imports from Russia after its invasion of Ukraine. The Russian Gazprom company has declared force majeure on supplies and said it could not guarantee gas supplies to Europe because of "extraordinary" circumstances.

Stable Eurozone HICP numbers are expected

EURUSD is expected to display wild moves as Eurostat will report the Harmonized Index of Consumer Prices (HICP) on Tuesday, which is seen stable at 8.6% on an annual basis. Steady HICP figures in the eurozone are expected to delight the European Central Bank (ECB) as they won’t require moving furiously toward raising interest rates. Other Western nations are reporting a steep rise in their inflation rates. Also, the expectations are also stalling higher.

-637937804687614703.png)

EURUSD technical analysis

EURUSD has attempted to kiss the 38.2% Fibonacci retracement (which is placed from June 28 high at 1.0615 to July 14 low at 0.9952) at 1.0207. The trendline placed from July 14 low at 1.0207 adjoining July 15 low at 1.0008 will act as major support for the counter.

The pair has crossed the 50- and 200-period Exponential Moving Averages (EMAs) at 1.0106 and 1.0130 respectively, which adds to the upside filters. It is worth noting that the 200-period EMA is still higher than the 50-EMA while the asset has crossed both firmly. This indicates a strong responsive buying action after a steep downside.

Meanwhile, the Relative Strength Index (RSI) (14) has slipped below the bullish range of 60.00-80.00 amid a correction.

EURUSD hourly chart

-637937801531105461.png)

Elliott Wave trading strategies: DAX 40, FTSE 100, STOXX 50, Dollar Index, EUR/USD

- GBP/JPY rose close to 190 pips but retraced almost 100 pips, on market mood turning soar.

- The cross-currency pair tumbled below substantial resistance, exposing the 165.00 mark to selling pressure.

- GBP/JPY Price Analysis: Neutral-upwards, but downside risks remain if sellers drag prices below 165.00.

The GBP/JPY finished Monday’s trading session in positive territory, up 0.45%, after reaching a daily high at 166.09, in the middle of the US session, to then tumble on recession fears that some US companies, namely Apple and Goldman Sachs, said that they would halt hiring, meaning that businesses are bracing for slower economic growth.

That said, the GBP/JPY is trading at 165.06 at the time of writing, as Tuesday’s Asian Pacific session begins, around the daily pivot and the 20-hour EMA.

GBP/JPY Price Analysis: Technical outlook

GBP/JPY Daily chart

The GBP/JPY is still neutral-upwards biased, with the daily EMAs below the spot price. GBP/JPY traders should notice that whilst the previously mentioned are still bullish positioned, they are closing to price action, meaning that the uptrend is losing steam. Also, the Relative Strength Index (RSI) turned from bullish to flat, meaning that the GBP/JPY price might be about to top, opening the door for shorts.

If that scenario plays out, the GBP/JPY first support would be 165.00. Break of the double-zero support will send the cross towards the 20-day EMA at 164.41, followed by the 50-day EMA at 163.11. Otherwise, if the GBP/JPY aims higher, the cross first resistance would be July’s 18 daily high at 166.09. Once cleared, the next resistance would be June’s 28 high at 166.94, followed by June 22 cycle high at 167.85.

GBP/JPY 1-hour chart

The GBP/JPY near-term perspective depicts the pair as also neutral-upwards. Nevertheless, the later drop in market mood shift sent the cross below July 14 daily high at 165.19, which could open the door for further selling pressure. GBP/JPY traders should be aware that the exchange rate is below the 20-hour EMA at 165.18, usually a sign of bearishness in the near term. Worth mentioning that the GBP/JPY is trading below the daily pivot point, suggesting some solid resistance lies above.

Therefore, the GBP/JPY path of least resistance is downwards. That said, the first support would be the double-zero at 165.00. Break below will expose the 50-hour EMA at 164.66, followed by the confluence of the S1 and the 100-hour EMA At 164.12. Once broken, the next support would be the 200-hour EMA at 163.58.

GBP/JPY Key Technical Levels

- AUD/JPY seesawed within 94.00-94.70s but finished Monday’s session around 94.11.

- Fears about a recession reignited by Apple’s company saying that it would halt hiring.

- AUD/JPY Price Analysis: Neutral-to-upwards, though failure around 94.70s, might open the door for further losses.

On Monday, the AUD/JPY finished almost flat, on a thin liquidity trading session, as Japan was in observance of Marina day, resuming activities on Tuesday, which would see an improvement in Japanese yen crosses, including the AUD/JPY.

The AUD/JPY is trading at 94.13 after opening near the day’s lows, witnessing some selling pressure entering the market at the weekly open, sending the cross towards a daily low below 94.00, followed by a bounce towards its daily highs at around 94.64. However, late news in the US session, stating that the tech giant Apple will halt hiring, fueled recession fears amongst investors.

Also read: Forex Today: Optimism proved ephemeral

AUD/JPY Price Analysis: Technical outlook

AUD/JPY Daily chart

The AUD/JPY depicts the pair as neutral-to-upward biased due to the location of the daily EMAs below the exchange rate. However, its neutral status is derived by price action in consolidation, alongside the Relative Strength Index (RSI), which tumbled from overbought territory towards the 50-midline, faltering to aim higher.

Therefore, the AUD/JPY’s first resistance would be July 18, high at 94.68. Break above will expose the 95.00 mark, followed by the June 21 high at 95.32, which once cleared will expose the YTD high at 96.88

Conversely, the AUD/JPY first support would be 94.00. A breach of the latter will send the cross sliding towards the 20-day EMA at 93.35, followed by the confluence of an upslope trendline and the 50-day EMA near 92.74.

AUD/JPY Key Technical Levels

- GBP/USD is being pressured back to test 1.1950.

- The bears have moved in and a run towards trendline support could be on the cards.

The daily chart's W-formation has seen the price hamstrung towards the neckline area where there is a price imbalance that could be mitigated in the coming sessions to test below 1.19 the figure again.

GBP/USD daily chart

GBP/USD M15 chart

The 15-min chart is accumulated around 1.1950 which could see a breakout to the downside and towards 1.1900 in the day ahead in order to take out the price imbalance within the 1.1880 rally. This will bring the price towards a test the trendline support for the coming days.

- New Zealand inflation topped RBNZ’s and economists’ expectations, will the bank hike 75 bps?

- Sentiment shifted mixed on Apple’s report that hiring will slowdown, reigniting US recession worries amongst investors.

- ANZ Bank expects the RBNZ Overnight Cash Rate (OCR) to end at 4% rather than 3.5%.

The NZD/USD barely recorded gains on Monday, courtesy of a late risk-off impulse spurred by news that the US tech giant Apple plans to slow hiring, fueling US recession fears amongst market participants, which sought safety, which in the FX space, some of the majors, witnessed a trim of its early gains vs. the greenback.

The NZD/USD is trading at 0.6151, up almost 0.06%, after hitting a daily high around 0.6200, but sellers stepped in and outweighed buyers and tumbled the pair towards current price levels.

NZD/USD remains positive on NZ’s high inflation, and expectations of additional hikes

The market mood turned sour, as shown by US equities. The greenback is recovering some ground, as shown by the US Dollar Index, rebounding from daily lows around 106.892 and climbing towards 107.354, though it stays negative by almost 0.60% during the day.

The lack of US economic data leaves traders looking toward last week’s US inflation reports, Retail Sales, and the UoM Consumer Sentiment Index (CSI). US inflation, led by consumer and producer price indices, rose to fresh multi-decade highs, sparked by high energy and food prices. However, the core CPI figure stood below the 6% threshold, falling for the third consecutive month, which would deter Fed officials from triggering a 100 bps rate hike. Further strengthening the case is UoM Consumer Sentiment inflation expectations, which descended from 3.1% to 2.8% in 5 years.

On the New Zealand side, the Consumer Price Index for Q2 rose by 7.3% YoY, higher than the 6.9% estimated by economists and topping the 7% estimated by the Reserve Bank of New Zealand (RBNZ). The NZD/USD reacted positively to the report, jumping from 0.6149 to 0.6170, as further tightening would be needed, as said by analysts at ANZ Bank.

“We have changed our OCR call and now expect the run of 50bp hikes to continue through to November, meaning an OCR endpoint of 4.0% rather than 3.5%. A 75bp hike at the August MPS is a very real possibility, particularly if the labour market data on 3 August delivers another hawkish surprise,” ANZ analysts wrote.

What to watch

The New Zealand economic docket will feature the Global Dairy Trade Price Index on Tuesday. On the US side, the calendar will feature June’s Building Permits and Housing Starts alongside the Redbook.

NZD/USD Key Technical Levels

What you need to take care of on Tuesday, July 19:

The dollar spent most of the first day of the week on the back foot, losing ground against most of its major rivals. However, it bounced back in the US afternoon, as Wall Street was unable to retain its early gains and turned red.

The greenback began easing on Friday as US encouraging data temporarily cooled recession-related concerns. A scarce macroeconomic calendar on Monday kept it on the downside ahead of central banks' decision. The US Federal Reserve entered its blackout period ahead of next week's meeting, while the European Central Bank will announce its monetary policy next Thursday.

The energy crisis in Europe could be a game changer in EUR/USD, which recovered up to 1.0200. The Russian Gazprom company has declared force majeure on supplies and said it could not guarantee gas supplies to Europe because of "extraordinary" circumstances. The International Energy Agency has warned the EU must reduce gas consumption ahead of the winter. The pair currently trades at around 1.0150.

A softer dollar helped GBP/USD to reach 1.2039, but the pair retreated towards the current 1.1960 area amid a worsening mood at the end of the day.

Commodity-linked currencies hold on to most of their early gains, with AUD/USD trading at 0.6815 and USD/CAD at 1.2965. Finally, safe-haven JPY and CHF posted modest gains against the USD.

Gold aimed to recover some ground, but ended the day at around $1,708 a troy ounce and is at risk of falling further. Crude oil prices, on the other hand, retain most of their early gains, with WTI now trading at $98.80 a barrel.

Ethereum Price Prediction: A true bull run or just another suckers' rally?

Like this article? Help us with some feedback by answering this survey:

- Gold Price s correcting the weekly and daily impulses.

- The focus is on the US dollar and the path of the Federal Reserve.

- The 50% mean reversion and a 38.2% Fibonacci retracement are brought into focus.

At $1,079.50c, the Gold Price (XAU/USD) has been attempting to correct as the US dollar pulled back slightly as markets weigh the the prospects of a 75-basis-point interest rate hike over a 100bp hike by the Federal Reserve at its upcoming meeting on July 26-27.

In turn, the US dollar has lost some shine to trade back below 107 on Monday as per the DXY index which measures the greenback vs. a basket of major currencies. It was trading as high as 109.29 in a fresh bull cycle high last week. Overall, both the technical and fundamental bias has been to the downside but a correction is in play in both the US dollar and gold.

To date, within gold's bear cycle, the break in daily market structure and prospects of a strong US dollar as well as higher yields, which gold does not offer to investors, have weighed on the precious metal into pre-pandemic levels. The greenback has tended to strengthen both when the US economy outperforms its peers and also when the US economy looks weak.

Weighing up the Fed

Fedspeak has pushed back against a 100bp hike from some notable hawks, raising the risk of a near-term short-squeeze on the Gold Price prior to the meeting. However, this could create the perfect storm for a downside continuation in gold on a hawkish outcome from the meeting.

The Fed has moved into the blackout period before the next meeting leaving prior statements from Fed speakers following the last meeting and to date for the market to chew on. Ahead of the blackout, the Fed’s Beige Book released last week noted that price increases remained “substantial” across the nation in recent weeks, though some regions saw signs of cooling inflation.

Meanwhile, Fed officials implied that nothing was off the table after the CPI report. US inflation surprised once again to the upside in June, both headline and core measures, with annual inflation jumping to a new four-decade high of 9.1%, up from 8.6% in May. Therefore, supportive of global yields and the US dollar as a headline for gold prices, the market expects that the Fed will be in no rush to signal a pivot from its current path of aggressive rate hikes and is pricing in steeper hikes of 100bs pints for not only in July but September's meeting as well.

At the June FOMC meeting, Chair Powell stated that he would need ‘compelling evidence’ that inflation is easing for the Fed to change course, which he defined as ‘a series of falling monthly inflation readings’. Since then, we have heard from Fed's Raphael Bostic who said “everything is in play” while Mester said there was no reason for a smaller hike. Mary Daly, CEO of San Francisco said 75 bp was her “most likely posture.”

Read more here: Central banks deliver hawkish surprises, what will the Fed do?

The US dollar loses some gloss, supports gold price

The dollar index (DXY) was off its near 20-year high, down 0.6%, making greenback-priced bullion less expensive for buyers holding other currencies. It made a low of 106.892 on Monday which is giving some support to the gold price. Nevertheless, earnings season is upon us. There are likely to be gyrations that could lead to some buying activity in the greenback for its save haven function stemming from its use as an invoicing currency and from the significant amounts of USD-denominated debt issued by non-US residents.

Simply put, in times of uncertainty various market participants take action to secure their access to USDs. In turn, the pull on the gold price is likely to persist, at least until the Fed’s front-loaded policy tightening cycle is near conclusion.

''There is no way around it, the Fed has an inflation problem on its hands and the USD will continue to remain king of FX,'' analysts at TD Securities argued.

Gold Price expectations from TD Securities

Gold prices have crossed the threshold for a trend reversal, marking confirmation of a bear market trading regime in the yellow metal, for the time being, the analysts at TD Securities said. Their ChartVision Trend analytics highlighted that a break below the $1821/oz level by September would cement a downtrend in the yellow metal.

''With gold bugs falling like dominoes, prices have since slashed through various support levels on their way towards the $1600/oz-handle. With prices now challenging pre-pandemic levels, the largest speculative cohort in gold will start to feel the pain under a hawkish Fed regime as their entry levels are tested.''

Finally, the analysts argue that considering the latest CFTC report highlights that although a massive amount of longs was liquidated over the past week, the prop-trader cohort continues to hold an extremely large position size. Therefore, ''in a liquidation vacuum, these massive positions are most vulnerable, which suggests the yellow metal remains prone to further downside still.''

Gold Price technical analysis

The Gold Price has broken structure on the daily chart but a correction is now in play:

From a weekly perspective, the price could also be regarded as extended and a correction is arguably feasible at this juncture. There are price imbalances as marked in grey in the chart below which could be mitigated in the coming days and or weeks. In doing so, the Fibonacci retracement scale can be drawn up to find confluences in these imbalances to help identify probable areas of interest. This brings in the 50% mean reversion and a 38.2% Fibonacci retracement before then into focus. However, the monthly lows of $1,676.86 as illustrated on the chart below could come within reach sooner than later:

Gold, Silver & Crude Oil Price Forecast: 18 - 22 July 2022

- XAGUSD marches firmly, gaining almost 0.50% on Monday.

- Market players’ sentiment shifted negatively on Apple’s news that would slow hiring, reigniting recession fears.

- Silver Price Forecast (XAGUSD): In the near term is neutral-to-upward biased and might test $19.00.

Silver (XAGUSD) barely recovers some ground but remains trading below the $19.00 mark on Monday, amidst a trading session characterized by a mixed sentiment, which turned sour, despite some solid US corporate earnings, though of late, news of the giant Apple saying that it plans to slow hiring, turned things upside down, reigniting investors recession fears.

XAGUSD is trading at $18.73, after opening near $18.60s, the lows of the day, and edged up, hitting a daily high at $19.01, before retracing below the 100-hour EMA at $18.79, which once broke, would exacerbate a move towards the daily pivot point at $18.55.

Silver remains steady, despite mood shifting mixed

Sentiment shifted from positive to negative. Silver traders should notice that Apple news regarding employment keeps recession worries lingering in investors’ minds and further reinforces the previously mentioned, is the inversion of the US 2s-10s yield curve for the tenth straight day at -0.201%. All that said, it might deter Fed policymakers from moving above the 75 bps rate hike, which could keep US Treasury yields lower, a tailwind for XAGUSD’s prices.

Last week’s data, led by US inflation at higher levels, namely consumer and producer price indices, was higher than expected and hit fresh multi-decade highs. Nevertheless, core CPI stood below the 6% threshold, falling for the third consecutive month, portraying a better-than-expected outlook for inflation. Further strengthening the case is UoM Consumer Sentiment inflation expectations, which descended from 3.1% to 2.8% in 5 years. That said, Fed officials, which entered the blackout period on Saturday, were vocal in supporting a 75 bps hike in July, except for Atlanta’s Fed President Bostic, which said: “everything is on the table” after a dismal CPI report.

In the meantime, the US Dollar Index, a gauge for the greenback’s value vs. its peers, slides 0.58%, sitting at 107.360, faltering to follow suit the US 10-year benchmark note, which is rising four basis points, yielding 2.965%, at the time of typing.

What to watch

The week ahead will reveal critical economic data in the Euro area. Eurostat will report inflation for the bloc on Tuesday, and the ECB will deliver its monetary policy decision. The ECB is expected to raise rates for the first time in 11 years.

On the US front, the calendar will be packed with Housing Starts, Building Permits, Existing Home Sales, Initial Jobless Claims, and July’s S&P Global PMIs.

Silver Price Forecast (XAGUSD): Technical outlook

From the daily chart perspective, XAGUSD is still downward biased, though the Relative Strength Index (RSI) at 31.00, just exited from oversold conditions, might open the door for a test of $19.40. However, silver traders would first need to reclaim $19.00 if they aim to increase prices.

XAGUSD, in the short term, is neutral-to-upward biased, capped by the 200-hour EMA at $18.99 and the 20-hour EMA at $18.85. However, on the flip side, the 100 and 50-hour EMAs, each at $18.79 and $18.62, respectively, are seen as solid buying levels, putting a lid on selling pressure.

If the XAGUSD heads downwards, the first support would be the 50-hour EMA at 18.62. Break below will expose the daily pivot at 18.55, followed by the S1 daily pivot point at 18.33. On the flip side, XAGUSD’s first resistance would be the confluence of the 20 and 200-hour EMAs around $18.85-99. A breach of the latter would expose the R2 daily pivot at $19.14, followed by July 13 high at $19.40.

- AUD/USD awaits a speech by RBA's Lowe that should shed some light.

- The Fed is in a blackout period ahead of the FOMC.

- A 50% mean reversion could unfold in the coming days.

At 0.6827, AUD/USD is trading between a 0.6784 and 0.6854 range but is higher by 0.5% on the first trading day of the week in midday New York trade. However, the pair is significantly higher than the fresh bear cycle low that was printed last week which was the lowest it has been since June 2020, at 0.6682.

Net AUD short positions have moved higher reflecting concerns over the outlook for commodity prices. However, the Aussie is showing some signs of resilience which could be down to the economic rebound from Covid lockdowns, as noted by analysts at Westpac.

''Australia's domestic economy continues to provide the Aussie with support. June business confidence and July consumer sentiment fell but hard data on the likes of retail spending and employment remain consistent with a strong rebound from Covid lockdowns,'' the analysts explained. ''Australian jobs surged 88K in June, slashing the Unemployment Rate from 3.9% to just 3.5%, the lowest since 1974.''

The data was important and the Aussie firmed the sentiment surrounding the reserve Bank of Australia. ''The booming jobs data sparked debate over whether the RBA might speed up the pace of tightening with a 75 basis point cash rate rise in August (especially in the wake of Q2 CPI data on 27 July),'' the analysts explained. However, they are maintaining their call for another 50bp move, to 1.85%. Market pricing is around +55bp. A speech coming up by Governor Lowe should shed some light on the debate.

Eyes on the Fed

As for the US dollar, markets are gearing up for the Federal Reserve meeting on 26-27 July FOMC meeting. The Fed speakers are now in the blackout period and the conclusion from the hawkish rhetoric in statements made by Fed speakers between the last meeting to date is that while US June inflation was even higher than expected, 9.1% year from 8.6% year in May, there is more of a bias of a 74bp move over a 100bp hike. In turn, the US dollar has lost some shine to trade back below 107 on Monday as per the DXY index which measures the greenback vs. a basket of major currencies. It was trading as high as 109.29 in a fresh bull cycle high last week.

AUD/USD technical analysis

The W-formation is a reversion pattern which can be expected to draw in the price to the area around the neckline as illustrated above. In this daily scenario, there are prospects of a retracement to the 38.2% Fibonacci and the 50% mean reversion target thereafter.

- USD/JPY wobbles in a 70-pip range but stays in losing territory, down 0.27%.

- Risk appetite dented demand for the greenback, which stumbles by almost 0.80%, as shown by the US Dollar Index.

- USD/JPY Price Analysis: Rising wedge in the daily chart might open the door toward July’s lows around 134.70s.

The USD/JPY falls for the second straight day, hitting a daily low near 137.89, amidst an upbeat sentiment, as shown by global equities climbing; while the greenback recoils from 108.000, as demonstrated by the US Dollar Index, tumbling almost 0.80%, at 107.192.

The USD/JPY is exchanging hands at 138.09, seesawing within a narrower 70-pip range, which witnessed the major hitting a daily high at 138.57 before diving and piercing below 138.00, but once the dust settled, buyers reclaimed the 138.00 mark on a thin liquidity day because Japanese markets were closed on Monday, and no economic data was released.

USD/JPY Price Analysis: Technical outlook

USD/JPY Daily chart

The USD/JPY daily chart depicts the major as upward biased, despite showing signs of losing steam after hitting a 24-year high of around 139.38. Traders should be aware that a rising wedge is still in play and, as portrayed by the price action, stays confined within the top-bottom trendlines of the aforementioned chart pattern, meaning the USD/JPY is about to break in either way.

If the USD/JPY ends upwards, the USD/JPY’s first resistance would be 139.00. A breach of the latter will expose the YTD high at 139.38. Once cleared, the 140.00 mark will be open for a challenge, on the USD/JPY way towards August 1998 high at 147.67.

On the flip side, the USD/JPY first support would be July 11, high at 137.75. Break below will expose the June 29 daily high at 137.00, followed by a test of the July 1 low at 134.74.

USD/JPY Key Technical Levels

- EURUSD begins a crucial week on the right foot, up by 0.82%.

- Last week’s US consumer-related data calmed traders’ expectations of a 100 bps Fed hike.

- EURUSD traders are awaiting the EU’s inflation data and ECB’s monetary policy decision.

EURUSD buyers extended the shared currency gains to two consecutive days after hitting a fresh 20-year low below parity. Since then, the EURUSD pair has not looked back and reached a new two-week high near 1.0200 before settling at around current price levels. The EURUSD is trading at 1.0167 at the time of writing.

The financial markets narrative remains unchanged. Worries of higher inflation, central banks tightening, and recession jitters linger on investors’ minds. Nevertheless, global equities climbed on positive US equity earnings, signaling that companies are preparing for further Fed tightening, while Investors shrugged off China’s coronavirus outbreak, which threatened to keep the supply chain disrupted and consequently higher prices. That said, the greenback is losing 0.73%, underpinning the EURUSD, which will be pressured due to EU inflation data, the ECB’s monetary policy decision, and US S&P Global PMIs by the end of the week.

US Inflation grabbed the attention, but Retail Sales and Consumer Sentiment tempered Fed intentions of going 100 bps

US Retail sales, dented Fed officials of going 100 bps

Last week’s data give USD buyers enough reasons to book profits ahead of the ECB’s monetary policy decision, one of the reasons for the EURUSD appreciation. US Retail Sales and the UoM Consumer sentiment exceeded estimations and tempered worries of a Federal Reserve 100 bps rate hike, which last Wednesday showed odds of an 80% chance, sparked by CPI topping above 9% YoY, further exacerbated by PPI above the 11% YoY threshold.

EURUSD traders are awaiting the ECB’s monetary policy decision

ECB's monetary policy meeting on Thursday

The EURUSD will have a volatile week as the ECB’s monetary policy decision lurks. The central bank is widely expected to hike rates by 25 bps, for the first time in 11 years, amidst a period of elevated inflation and energy bills soaring due to the Russian oil embargo. Despite ECB’s hawkish member’s expressions of looking for a 50 bps move, the ECB President Christine Lagarde expressed intentions of tiptoeing with a 25 bps move, opening the door for a larger hike in September, namely a 50 bps.

EU’s inflation in the spotlight ahead of the ECB meeting

On Tuesday, Eurostat is expected to unveil June’s HICP final inflation rate for the Euro area. Estimations lie around 8.6% YoY, higher than the 8.1% of the May reading. In the meantime, core inflation stood at 3.7% YoY, lower than May’s 3.8%. That shows that Europe’s and US inflation are underpinned by high energy and food prices, spreading worldwide, keeping central banks under pressure. If the report beats the expectations, EURUSD traders should be aware of surprises by the ECB, but due to the economic slowdown, the ECB would stick to 25 bps.

US recession fears remain as the US 2s-10s yield curve stays inverted

In the meantime, the US 2s-10-yield curve extends its inversion for the tenth straight day, though less profound than on previous days- At the time of writing, the spread reduced to -0.181%, as traders’ fears about recession calmed. Nonetheless, unless Fed policymakers express concerns about economic growth, that would not deter them from aggressive tightening, which is negative news for EURUSD longs in the future.

ECB vs. Fed differentials, a headwind for the EURUSD

In July, both banks, the ECB and the Federal Reserve will host their monetary policy meetings. Currently, the ECB’s deposit rate lies at minus 0.50%, while the US Federal Reserve’s Federal funds rate (FFR) is at 1.75%, bolstering the appetite for the greenback. With expectations of the ECB hiking 25 bps and the Fed to move at least by 75 bps, differentials would widen further, to -0.25% (ECB) vs. 2.50% (Fed), meaning that the greenback would keep the upper hand, opening the door for further selling pressure on the EURUSD.

EURUSD Price Technical outlook

EURUSD buyers have stepped in, though the major remains downward biased, with the daily moving averages (DMAs) residing well above the exchange rate. The ongoing upward correction is attributed to EURUSD shorts booking profits, causing a rally towards a fresh six-day high above 1.0200.

If EURUSD buyers keep control, the major’s first resistance would be 1.0200. A breach of the latter will expose the July 6 daily high at 1.0276, followed by the 20-day EMA at 1.0310.

On the flip side, the EURUSD first support would be 1.0100. Break below will expose the fresh 20-year low at 0.9952. Once cleared, EURUSD sellers’ next challenge will be December 2002 lows around 0.9859.

EURUSD Key Trading Levels For The Week Ahead

- AUD/NZD continues to move sideways, around the 20 and 55-day SMA.

- Medium-term bullish rally faces resistance at 1.1100.

- Key event ahead: RBA meeting on Tuesday.

The AUD/NZD cross continues moving sideways below 1.1100. The 1.1100 area caps the upside. A break higher should strengthen the aussie, and would target 1.1150 initially and then a test of 1.1180.

The 20 and 55-day Moving Simple Moving averages are flat near the current price, reflecting how the cross has been trading during the last thirty days. Technical indicators offer no clear signs, also affected by recent price action.

On the flip side, a consolidation below 1.1000 should expose an uptrend line at 1.0970. A break lower would open the doors to more losses, initially to 1.0950 (20-week SMA). A confirmation under 1.0920 would be a more solid bearish sign, targeting 1.0800.

While between the uptrend line and the 1.1100 area, volatility in AUD/NZD will likely remain limited. On Tuesday, the Reserve Bank of Australia will announce its decision on monetary policy, an event that could spark sharp moves in AUD crosses.

AUD/NZD daily chart

- The USD/CAD slid almost 0.80% on Monday on a risk-on mood, soft US dollar, and elevated oil prices.

- Last week’s US inflation data, mainly core-CPI, eased worries of a Fed 100 bps rate hike, as most policymakers pushed back against it.

- Canada's inflation and retail sales would shed some light, on the BoC’s forward path, after the BoC jumbo hike.

The USD/CAD slides for the second straight day, erasing last Thursday’s gains, and is back below last week’s low at 1.2936, due in part to a softer US dollar, retracing from 108.000, almost 1% amidst an upbeat market mood, cheered on speculation that the Fed would not tighten as aggressively as previously expected.

Therefore, the USD/CAD is trading at 1.2924, slumping below the 200-hour simple moving average (SMA), breaking under 1.3000, and hitting a daily low at around 1.2898, which would exacerbate a test of the MTD lows at 1.2837 on a week of a light US calendar, and also as Fed speakers entered the blackout period.

USD/CAD drops on a risk-on mood, a softer greenback, and elevated oil price

Global equities are rising sharply. US Treasury yields rise as the US 10-year T-note broke above the 3% threshold, as market players scale back flows to safety. Traders shrugged off worries about China’s recent Covid-19 outbreak, despite reporting 580 local cases on Saturday. In the meantime, high crude oil prices, mainly WTI, climbed 4.549%, exchanging hands at $98.92 BPD, bolstering the Canadian dollar, a headwind for the greenback.

The US calendar will feature housing data as the spotlight on Monday, though market players focus on inflation and growth, so their reaction would be interesting. During last week’s, US inflation kept at higher levels; in both readings, consumers and prices paid by producers. Nevertheless, core CPI stood below the 6% threshold, falling for the third consecutive month, illustrating that food and energy are the most significant contributors to the high inflation rate.

That said, Fed expectations of a 100 bps have faded so far. The CME FedWatchtool shows 30% odds of an extra-large rate rise, but stills show a priced-in 75 bps hike, in line with what most Fed policymakers expressed, namely Waller, Bullard, Mester, and Daly. The only exception was Atlanta’s Fed President Raphael Bostic, which stated that “everything is on the table” after the release of June’s CPI.

Elsewhere, the Bank of Canada surprisingly raised rates more than expected, a 100 bps, emphasizing that they would do what’s needed to tame inflation. Additionally, at the press conference, the BoC Governor Macklem said that front-loading rate increases now would help avoid even higher rates in the future while adding that front-loaded cycles tend to be followed by softer landings.

What to watch

The week ahead, the Canadian docket will feature Housing Starts, Inflation data, and Retail sales. The calendar will be packed on the US front, Housing Starts, Building Permits, Existing Home Sales, Initial Jobless Claims, and July’s S&P Global PMIs.

USD/CAD Key Technical Levels

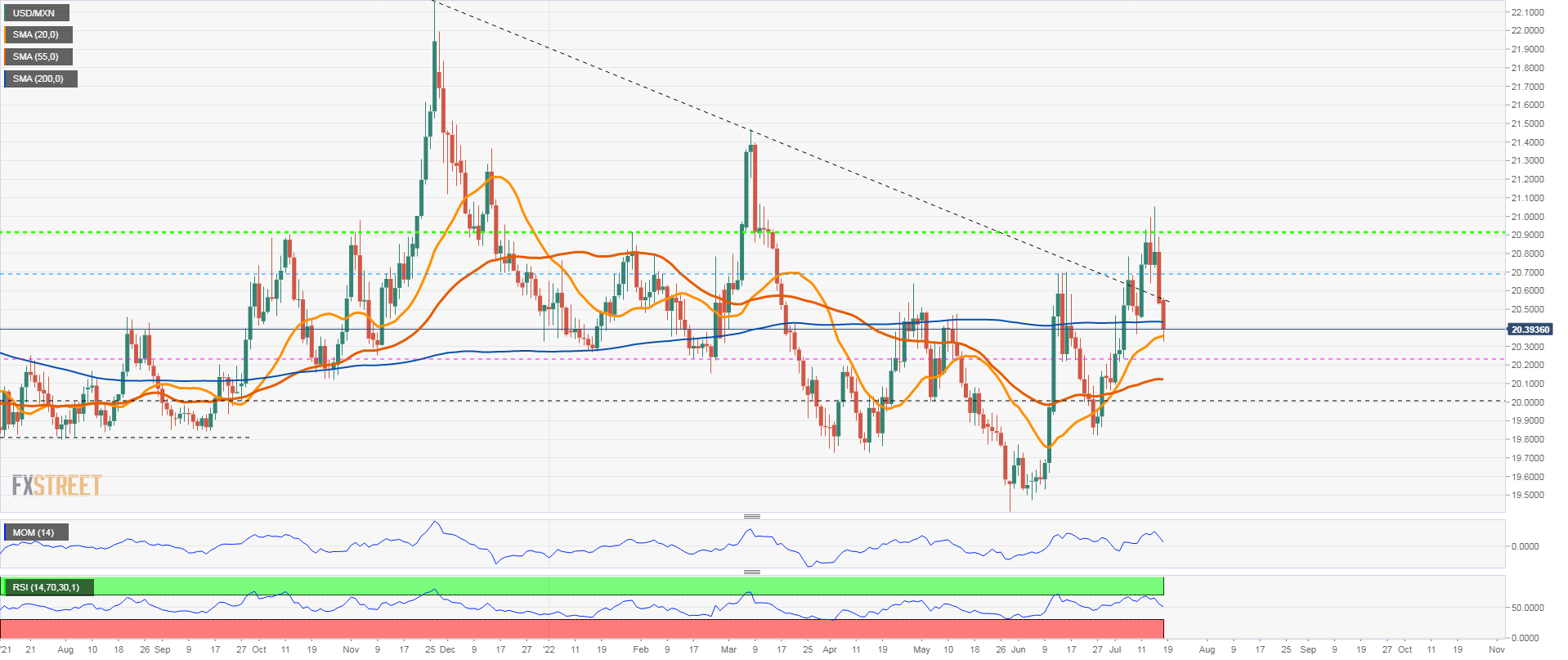

- Mexican peso extends recovery amid improvement in risk sentiment.

- USD/MXN drops for the second day in a row.

- Key support at 20.30/35, dollar to strengthen above 20.45.

Emerging market currencies are rising of the second day in a row on Monday, amid a global improvement in market sentiment. Steady US yields and higher commodity prices offer relief to riskier currencies, like the Mexican peso.

The USD/MXN peaked last week above 21.00, levels not seen since March. It failed to hold above 21.00 (also to post a daily close above 20.90) and it pulled back initially to 20.60. On Friday, it broke lower and bottomed on Monday at 20.32, near the 20-day Simple Moving Average.

During the American session, USD/MXN is rebounding from the key support area around 20.33. If it moves back above 20.45, the Mexican peso would lose strength, opening the doors for a test of 20.70 that is again a critical resistance.

The retreat from monthly highs so far, represents a correction in USD/MXN. The short-term bias remains bullish. A consolidation below 20.45 would keep the upside limited. A close under 20.22 could change the short-term bias to neutral.

USD/MXN daily chart

- Risk sentiment favors the pound on Monday.

- Busy week in the UK between politics and key data.

- Cable faces next resistance levels at 1.2050 and 1.2065.

The GBP/USD broke above 1.1990 during the American session and jumped to 1.2033, reaching the highest level since July 8. It is hovering around 1.2010/15, up 150 pips for the day, boosted by a weaker US dollar.

Improvement in risk sentiment

Equity prices ended higher in Europe and the Dow Jones gains 0.54% on Monday. The latest round of US economic data and signs the Federal Reserve will hike rates by “just” 75 basis points contribute to improving market sentiment. Investors are also looking at the first corporate results for the second quarter.

In the UK, the political drama continues. The final candidates to become Prime Minister should be clear by Thursday. Besides politics, UK economic data will be key during the week. On Tuesday, labor market is due. Later during the week, CPI, PMI and retail sales will be released.

Bank of England’s next meeting is on August 4. A 50 basis points rate hike is priced in. BoE Saunders said on Monday that interest rates could top 2% in 2023 and emphasized the central bank must act to prevent high inflation.

In the US is a quiet week regarding economic data. The attention is set on the Federal Reserve meeting next week. Market participants see a 75 basis point. The odds of a larger increase softened on Friday.

Looking at 1.2050

The very short term bias is bullish for GBP/USD. Although the pair is facing a strong resistance ahead around 1.2050 and also at 1.2065. So a firm break above is needed in order to clear the way to more gains. While below the mentioned area, the upside would be seen as limited. The immediate support might be seen at 1.1950 followed by 1.1920 and 1.1850.

Technical levels

Statistics Canada will release June Consumer Price Index (CPI) data on Wednesday, July 20 at 12:30 and as we get closer to the release time, here are the forecasts by the economists and researchers of six major banks regarding the upcoming Canadian inflation data.

The June Canada inflation rate is expected to rise by +0.9% MoM from +1.4% MoM, clocking in at +8.3% YoY from +7.7% YoY. The Bank of Canada's Core CPI, which excludes volatile food and energy prices, is estimated to rise 0.5% MoM, surging to 6.7% on yearly basis from the 6.1% previous.

TDS

“We look for CPI to firm to a new high of 8.3% in June with prices up 0.8% MoM. Food and energy will provide the main drivers, led by gasoline (+6.8%). Shelter will provide another source of strength as higher rates feed through to mortgage payments, while seasonal headwinds to clothing will provide a slight drag. Core inflation should firm by 0.2pp to 4.9% on average.”

RBC Economics

“We anticipate Canada’s inflation rate will edge up to 8.0% from a year ago. That would be the highest since 1982. This continued acceleration was likely largely driven by higher food and energy prices – both of which have been boosted by global pressures. Oil prices rose another 4.8% from May and consumer food prices have been surging in part due to higher commodity prices and acute supply chain disruptions. Roughly half of inflation recently has been driven by forces beyond our borders by our count. Inflation pressures are unlikely to ease sustainably to the BoC’s 1% to 3% target range until the economy, and labour markets, have cooled substantially.”

NBF

“The food component likely remained very strong given severe supply constraints globally and the increase in this segment may have been compounded by higher gasoline prices. As a result, headline prices could have increased 0.6% MoM before adjustments for seasonality, allowing the year-on-year rate to rise three ticks to 8.0%. The annual rate of common CPI, meanwhile, could move up from 3.9% to 4.2%.”

CIBC

“CPI inflation should have peaked in June at 8.5% year-over-year. While recent pullbacks in the prices of oil and some agricultural commodities should provide relief in the future, it will not be apparent in the June CPI data. There was a further increase in gasoline prices in the month relative to May, and with the long lag between changes in agricultural prices and food prices in stores, we are still living through the impact of past increases. But recent developments mean that we should start to see some relief in the months ahead. Outside of food and energy, we expect CPI inflation to have grown slower on the month and to be roughly stable at an annual rate. Prices linked to the housing market, though still increasing, are not exerting as much upward pressure on CPI as they were just a few months ago. Overall, while we see June as the peak, inflation should stay close to 8% through the summer months.”

Wells Fargo

“We expect Canada's CPI release to show persistently high inflation yet again. We expect Canada's headline CPI to quicken to 7.9% year-over-year and forecast inflation to average 6.6% in 2022.”

Citibank

“Canada June CPI NSA MoM (Jun) – Citi: 0.7%, prior: 1.4%, CPI YoY – Citi: 8.2%, prior: 7.7%. As in May data, inflationary pressures should be broad-based. The three core inflation measures averaged a very strong 4.7% in May and should also remain high and likely even climb higher in June.”

The European Central Bank (ECB) is set to announce its decision on monetary policy on Thursday, July 21 at 12:15 GMT and as we get closer to the release time, here are the expectations as forecast by the economists and researchers of 11 major banks.

The ECB is expected to elevate its key interest rate for the first time in 11 years by 25 basis points (bps). A signal of a 50 bps increase for September is also likely. Furthermore, the central bank is expected to unveil the contours of its new anti-fragmentation backstop.

Danske Bank

“We expect ECB to go ahead with its intention to hike all three policy rates by 25 bps in July. The pace of further rate increases will depend on how the economy evolves, but we do not anticipate any guidance for the Q4 monetary policy outlook at the July meeting. As visibility remains low, we expect increased market volatility to persist in the near-term, but still see ECB as priced too aggressively by the market for 2023, especially with the Federal Reserve priced for a 50 bps rate cut in 2023. Any frontloading ECB hikes is unlikely to support EUR/USD. Designing a credible anti-fragmentation tool is key, for markets not to call the bluff on ECB and send Italian yields sharply higher again. We expect the new instrument to be implemented in a flexible manner, with focus on shorter maturities, but without a pre-set intervention amount or timeframe. We also expect purchases to be sterilized in order not to interfere with the monetary policy stance, but we see only a small probability of ECB outright selling bonds.”

Rabobank

“We expect a 25 bps rate hike, applying symmetrically to the deposit facility rate and refi rate. The Council will probably reaffirm its guidance that a bigger move in September is likely. The ECB will unveil its ‘Transmission Protection Mechanism’. We expect an open-ended instrument with light/medium conditionality and sterilisation via liquidity-draining operations. We don’t expect changes affecting the TLTRO arbitrage.”

Commerzbank

“The ECB has only very rarely signaled its intentions in advance as clearly as it has now: It will raise its key interest rates by 25 bps on Thursday, it already declared at the press conference in June. That's why we expect exactly this move, although, in view of the recent renewed increase in inflation risks, a 50 bps hike seems more appropriate to us.”

TDS

“We expect the ECB to hike rates by 25 bps. But the focus will be on the likely announcement of an anti-fragmentation tool, which needs to be big enough for markets to see as being credible. A review of other measures may also be on the table. We will be interested to see to what extent the ECB draws a line in the sand, if any, on the currency. Parity should be a magnet, and we are wary that we may see a bit of a short-squeeze in EUR if the ECB surprises with more aggressive policy. Ultimately, however, this should be short-lived and the risk of a sub-parity paradigm grows.”

SocGen

“First rate hike in 11 years (25 bps) to be announced. Anti-fragmentation mechanism to be launched, to support vulnerable countries. While downside risks to growth have increased, for now,the guidance for a possible 50 bps hike in September is likely to remain in place, partly linked to the fact that the inflation forecast will need to be revised up again in September, at least with regard to the short-term. No new staff forecasts will be presented, but an updated assessment is likely to point to high uncertainty, in particular over the energy supply situation. Risks to inflation remain to the upside, while risks to growth remain to the downside.”

Wells Fargo

“We expect the ECB to kick off its rate hike cycle at its July monetary policy meeting with a 25 bps hike to -0.25%. Eurozone inflation recently reached a new high of 8.1% YoY in May. We expect inflation to trend even higher in the coming months and possibly peak later this year, and also expect that economic growth will be sturdy enough to take on larger rate hikes. We view the possibility of a 50 bps rate increase in September as more likely than not; however, we think it is unlikely the ECB will deliver multiple 50 bps rate hikes. As such, we forecast a 25 bps hike in July, a 50 bps hike in September, and a 25 bps hike in December, bringing the policy rate to +0.50% by the end of 2022. We then expect the ECB to deliver its last rate hike of the cycle by Q1 next year, finishing with a Deposit Rate of +0.75%.”

BBH

“Despite some hawks calling for a 50 bps hike, it seems clear that the bank will opt for a more cautious move. Updated macro forecasts won’t be released until the September 8 meeting. As usual, Madame Lagarde’s press conference is likely to provide the fireworks, whether good or bad. We know that the divide between the hawks and doves remains wide. A 50 bps hike is fully priced in for the next meeting September 8, with some odds seen of a 75 bps move. Expected moves at the subsequent meetings October 27 (50 bps) and December 15 (25 bps) would see the deposit rate near 1.0% at year-end. Looking ahead, the swaps market is now pricing in 200 bps of tightening over the next 12 months which would see the deposit rate peak near 1.5%. The ECB is also expected to reveal some more details about its new anti-crisis tool. As always, we are braced for disappointment but perhaps the ECB will surprise us. As things stand, it’s very apparent that there is the usual split between the debtor and creditor nations. As a result, it seems likely that the Governing Council will be unable to agree on the trigger and conditionality for the planned anti-crisis tool.”

Deutsche Bank

“The ECB meeting will likely deliver a 25 bps hike, the first rate increase since 2011. Our updated call retains the 2% terminal rate forecast but the hiking cycle is expected to be split. The first phase has hikes of 25 bps, 50 bps, 50 bps and 25 bps in July, September, October and December. By end-2022, the deposit rate will be 1%, helping to balance inflation and growth risks before the anticipated recession forces a pause. The second phase in H1 2024 is now expected to have four 25 bps hikes and push rates into moderately above neutral territory.”

Citibank

“ECB Deposit Facility Rate – Citi Forecast -0.25%, Prior -0.5% (first hike since 2011); Main Refinancing Rate: Citi Forecast 0.25%, Prior 0.0%; Marginal Lending Rate: Citi Forecast 0.5%, Prior 0.25%. We also expect ECB to announce details of its anti-fragmentation tool. This could include no limits in time and size (subject to the 50% issuer limit, and possibly to maturities), strings attached (similar to the recovery fund), and some form of balance-sheet sterilization. The team sees a serious risk that recession, bond market turmoil or the gas crisis shortens the time window for ECB policy normalization.”

MUFG

“We are still confident that the ECB wants to bring an end to the emergency policy settings of negative rates, and will stick to plans to begin raising rates by 25 bps followed by a larger 50 bps hike in September. Logically, we think it makes more sense though to deliver a larger 50 bps hike followed by a smaller hike in September but policymakers have displayed no signs recently of changing the guidance. Beyond September, we are less convinced than the European rate market that the ECB will keep raising rates through to Q1 2023 in light of the increasing risk of a sharper slowdown. The rate market is currently pricing in 158 bps of hikes by year-end and 172 bps of hikes by March 2023. The outcome of ECB’s rate decision could be overshadowed by market participants’ response to the announcement of further details of the new anti-fragmentation policy tool. It is of crucial importance that the ECB’s plans are viewed as credible to help contain fragmentation risks. If the plans disappoint in any way for example should the new facility be viewed as too small and/or the attached conditionality is judged as too stringent then downside risks will be reinforced further for the EUR in the near-term.”

Goldman Sachs

“We expect the Governing Council to hike policy rates by 25 bps and provide additional details of its sovereign backstop. Although the sharp depreciation of the euro, recent central bank actions abroad and the chance of a further rise in survey inflation expectations suggest that a 50 bps move is possible, we believe that a quarter-point increase remains likely. This is because the Council has strongly guided towards 25 bps, the growth outlook has weakened and the ECB has historically not delivered hikes that were less than 70% discounted.”

Economist at UOB Group Enrico Tanuwidjaja assesses the latest trade balance figures in Indonesia.

Key Takeaways

“Indonesia achieved a trade surplus of USD5.1bn in Jun, third highest compared to an all-time high of USD7.5bn in Apr 2022.”

“Exports soared 40.7% y/y in Jun (vs 27.0% in May), significantly higher than the market consensus of 30.3% y/y. Meanwhile, imports similarly sped up to 22.0% y/y in June (vs 30.7%% y/y in May), barely higher than the market consensus of 20.1% y/y.”

“Indonesia may record another small current account surplus in 2Q22 amidst much stronger than expected trade surplus in Mar-Jun period.”

- EUR/USD rebounds sharply from recent oversold levels.

- Extra gains are seen revisiting the 1.0200 neighbourhood soon.

EUR/USD advances further and adds to Friday’s bounce, retesting the 1.0170/75 band at the beginning of the week.

Further gains could revisit the 1.0200 zone sooner rather than later, although the pair’s bearish stance remains in place. Against that, the resumption of the downtrend should meet initial contention at the key parity level ahead of the 2022 low at 0.9952 (July 14).

As long as the pair navigates below the 5-month support line around 1.0540 further losses remain in store.

In the longer run, the pair’s bearish view is expected to prevail as long as it trades below the 200-day SMA at 1.1026.

EUR/USD daily chart

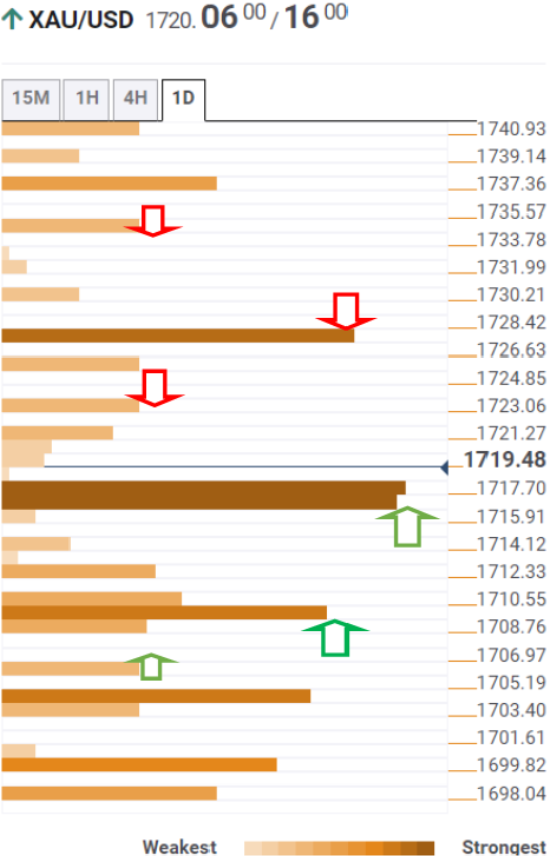

- Gold price gained some positive traction on Monday amid the ongoing USD profit-taking slide.

- Diminishing odds for more aggressive Fed rate hikes weighed on the buck and extended support.

- The risk-on impulse, rebounding US bond yields acted as a headwind and capped the commodity.

Gold price kicked off the new week on a positive note and moved away from a nearly one-year low touched last week. The intraday uptick, however, lacked bullish conviction and lost steam just ahead of the $1,725 level. The XAUUSD was last seen trading around the $1,715-$1,716 region during the early North American session, still up over 0.50% for the day.

Gold price supported by retreating USD

The US dollar extended last week's retracement slide from a two-decade high and witnessed heavy selling for the second straight day amid diminishing odds for a 100 bps Fed rate hike move in July. This, in turn, was seen as a key factor that offered some support to the dollar-denominated gold. Several Federal Reserve officials signalled last week that they did not favour the bigger rate hike that the markets had priced in. It is worth recalling investors lifted their bets for a supersized Fed rate hike move after the US consumer inflation in June accelerated to the highest level since November 1981.

Less hawkish FOMC members weighed on the USD

Two of the most hawkish FOMC members - Fed Governor Christopher Waller and St. Louis Fed President Jim Bullard - pushed back against expectations for more aggressive rate hikes by the US central bank. Adding to this, Atlanta Fed President Raphael Bostic cautioned on Friday that moving too dramatically could undermine positive aspects of the economy and add to the uncertainty. This, in turn, continued weighing on the greenback. That said, a combination of factors held back bullish traders from placing aggressive bets and kept a lid on any meaningful upside for the gold price, at least for the time being.

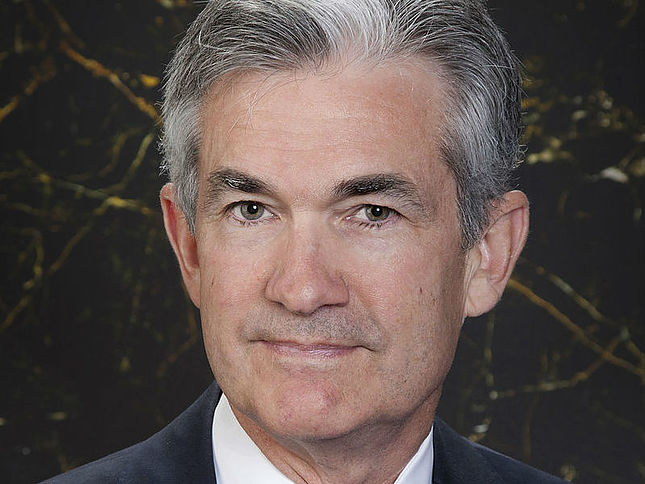

Fed Chair Jerome Powell

Risk-on impulse acted as a headwind for gold price

The global equity markets witnessed a counter-trend rally amid hopes that the Fed would be less aggressive at its upcoming meeting than previously feared. The risk-on impulse triggered a fresh leg up in the US Treasury bond yields, which, in turn, acted as a headwind for the safe-haven gold. In fact, the yield on the benchmark 10-year US government bond shot back above the 3.0% threshold. This helped limit deeper losses for the USD and further contributed to cap gains for the XAUUSD. Hence, it will be prudent to wait for strong follow-through buying before confirming that spot prices have bottomed out.

Gold price technical outlook

Gold price has repeatedly shown some resilience below the $1,700 round-figure mark. That said, the metal’s inability to gain any meaningful traction suggests that the near-term risks remain skewed to the downside. This, in turn, suggests that any subsequent strength beyond the $1,725-$1,726 immediate resistance might confront stiff resistance near the $1,734-$1,735 horizontal zone. A sustained move above might trigger a bout of short-covering and lift the XAUUSD towards the $1,749-$1,752 supply zone.

On the flip side, last week's swing low, around the $1,698-$1,697 area, now seems to protect the immediate downside. A convincing break below would make the XAUUSD vulnerable and accelerate the fall towards September 2021 low, around the $1,787-$1,786 region. Gold price could extend the downward trajectory towards testing the 2021 yearly low, near the $1,677-$1,676 area.

-637937482873164997.png)

Gold price: Where are commodities heading next?

Senior Economist at UOB Group Alvin Liew and Rates Strategist Victor Yong review the latest release of US inflation figures for the month of June.

Key Takeaways

“US headline consumer price inflation accelerated more than expected, to 9.1% y/y in Jun (from 8.6% y/y in May), ahead of Bloomberg estimates of 8.8% and a fresh 4-decade high since Nov 1981 (9.6%). On a m/m basis, the headline CPI rose at a faster clip of 1.3% in Jun (versus 1.0% in May), fastest since 2005 and matched the top end of the forecast range in the Bloomberg survey.”

“Core CPI inflation (which excludes food and energy) continued to ease from its high recorded in Mar (6.5% y/y), coming in at 5.9% y/y for Jun, from 6.0% y/y for May but it was nevertheless above Bloomberg estimate of 5.7%. But of greater concern was that on a sequential basis, core inflation rose by 0.7% m/m in Jun, above May’s 0.6% m/m and Bloomberg estimate of 0.5%.”

“We expect US inflationary pressures to stay elevated into 3Q 2022, underpinned by upside to commodity prices (especially energy and food), supply chain disruptions while housing costs pressure also remained on the upside although the jump in mortgage rates in recent months may help to slow the price increases. Most concerning is that inflation has yet to peak as it remains very broad-based, extending into higher services cost, and that certain CPI sub-indices which have been prominent inflation drivers and considered a bellweather of the latest round of inflation surge, such as the index for used cars and trucks, continued to see the spring in prices in them. We expect inflation to head higher in 3Q before some easing in 4Q 2022, and as such, we will further raise our headline CPI inflation forecast to average 8.5% (from 7.5% previously) while keeping our core CPI inflation forecast at 6.5% for 2022. Subsequently, we still expect both headline and core inflation to ease in 2023 to average 2.5%.”

“With Jun US headline CPI inflation coming in well above our and market forecasts, this will mean a stronger response from the Fed is required. As such, we expect the Fed Funds Target Rate (FFTR) to be hiked by 100bps in 26/27 Jul FOMC (previous forecast 50bps).”

- DXY adds to Friday’s pullback and revisits the 107.20 area.

- In case the downside picks up pace, the index could retest the 105.80 zone.

DXY tumbles further and prints new multi-day lows in the 107.20 zone on Monday.

The index retreats from the overbought territory and opens the door to extra decline in the very near term. That said, the deterioration of the short-term outlook could see the index revisit the post-FOMC highs near 105.80 (June 15).

As long as the index trades above the 5-month line near 103.30, the near-term outlook for DXY should remain constructive.

In addition, the broader bullish view remains in place while above the 200-day SMA at 98.87.

DXY daily chart

USD/IDR is forecast to navigate within the 14,920-15,020 range for the time being, suggested Quek Ser Leang at UOB Group’s Global Economics & Markets Research.

Key Quotes

“We highlighted last week that ‘the combination of weakening upward momentum and overbought conditions suggest USD/IDR is unlikely to advance much further’ and we expected USD/IDR to ‘trade between 14,872 and 15,050’. USD/IDR subsequently traded sideways within a narrower range than expected (14,943/14,997).”

“Shorter-term momentum indicators are mostly neutral and USD/IDR could continue to trade sideways. Expected range for this week, 14,920/15,020.”

Gold suffered heavy losses and registered its lowest weekly close in nearly a year. Strategists at TD Securities expect the yellow metal to sustain further losses.

Bear market trading regime in XAUUSD for the time being

“Gold prices have crossed the threshold for a trend reversal, marking confirmation of a bear market trading regime in the yellow metal for the time being.”

“Prices have since slashed through various support levels on their way towards the $1,600-handle.”

“Fedspeak has pushed-back against a 100 bps hike from some notable hawks, raising the risk of a near-term short-squeeze prior, which would create the ideal set-up for additional downside.”

The S&P 500 has gapped higher on increased volume. Analysts at Credit Suisse see scope for further strength in the broader consolidation range.

Resistance seen at 3902 initially, then 3946

“A positive end to last week has seen the S&P 500 gap higher on improved volume for a close back above the short-term 13-day exponential average. This should reinforce the sideways range of the past few weeks, with the immediate risk now for a deeper recovery within this range.”

“Resistance is seen initially at the top of the downtrend channel from April at 3902, a close above which should clear the way for strength back to 3919 then the late June high at 3946. Above here can see the recovery extend to 3974 next with more important and tougher price, gap and 63-day average resistance seen at 4010/19, which we expect to remain a major barrier.”

“Support is seen at 3833 initially, then the price gap from Friday morning at 3817/3790. Beneath here is needed to reassert a negative bias in the range again with support seen next at 3732/22.”

A spokesperson for Austrian energy firm OMV said on Monday that they are expecting the maintenance work on Nord Stream 1 to be completed as planned and added that deliveries are also expected to resume afterwards, as reported by Reuters.

Market reaction

Risk flows continue to dominate the financial markets after this headline. As of writing, Euro Stoxx 600 Index was up 1.15% on a daily basis. In the meantime, the EUR/USD pair continues to trade in positive territory near the 1.0150 area.

- EUR/JPY advances for the fourth consecutive session on Monday.

- The next hurdle emerges around the 140.30 region.

EUR/JPY keeps the recovery well and sound and surpasses the 140.00 barrier, or 2-week peaks, on Monday.

Further upside appears the 4-month resistance line around 140.70, above which the cross is seen accelerating its gains to, initially, the weekly high at 142.37 (July 5). Once cleared, the next hurdle of relevance is seen at the 2022 top at 144.27 (June 28).

In the longer run, the constructive stance in the cross remains well propped up by the 200-day SMA at 133.36.

EUR/JPY daily chart

Quek Ser Leang at UOB Group’s Global Economics & Markets Research notes USD/MYR could still advance further.

Key Quotes

“In our weekly update from last Tuesday (12 Jul, spot at 4.4350), we highlighted that ‘upward momentum has improved considerably and USD/MYR is likely to advance to the 2020 high at 4.4410’. We added, ‘the next major resistance at 4.4500 is likely out of reach for now’. Our view was not wrong as USD/MYR soared to a high of 4.4480 on Friday (15 Jul). Upward momentum remains strong and the risk for this week is still on the upside.”

“However, in view of the overbought shorter-term conditions, USD/MYR may not be able to maintain a foothold above 4.4500. The next resistance at 4.4590 is unlikely to come into the picture. The major support at 4.4120 is unlikely to come under threat for this week. On a shorter-term note, 4.4250 is already quite a strong support level.”

- NZD/USD edged higher for the second straight day amid the ongoing USD profit-taking slide.

- Stronger-than-expected quarterly inflation data from New Zealand also offered some support.

- Rebounding US bond yields helped limit the USD losses and capped the upside for the major.

The NZD/USD pair built on last week's bounce from the 0.6060 area, or its lowest level since May 2020 and gained traction for the second successive day on Monday. The momentum lifted spot prices to over a one-week low, though lacked any follow-through and faltered near the 0.6200 round-figure mark.

Several Federal Reserve officials signalled last week that they did not favour the bigger rate hike that the markets priced in following the release of red-hot US consumer inflation. This, in turn, forced investors to trim their bets for a supersized 100 bps Fed rate hike move in July, which continued undermining the US dollar and offered some support to the NZD/USD pair.

Apart from this, a generally positive tone around the equity markets dragged the safe-haven USD away from a two-decade high. This, along with stronger-than-expected quarterly inflation data from New Zealand benefitted the risk-sensitive kiwi. The risk-on impulse, meanwhile, pushed the US Treasury bond yields higher, which helped limit the USD losses and capped any further gains.

Spot prices have now retreated to the 0.6165 region, warranting some caution before positioning for any meaningful upside. In the absence of any major market-moving US economic data, the NZD/USD remains at the mercy of the USD price dynamics. This further makes it prudent to wait for a strong follow-through buying to confirm that the pair has formed a near-term bottom.

Technical levels to watch

USD/CAD jumped above 1.3100/23 last week but did not manage to close above this level. Analysts at Credit Suisse expect the pair to continue to consolidate from here.

Break below 1.2816/01 to signal a deeper move lower

“USD/CAD spiked sharply above 1.3100/23 late last week but has not managed to close above this level. Given this development and the mean-reverting environment that the market has been in since H2 of 2021, we stay with our neutral outlook and look for further consolidation below 1.3100/23.”

“A close below 1.2935/11 is still needed to reduce the upside risk, though only a break below the recent low at 1.2816/01 would signal a mean-reversion back towards the bottom of the channel, with next support then seen at 1.2771/52.”

“Only a sustained move above 1.3127 would make room for further upside to the new YTD high at 1.3200/23. Nonetheless, with the current volatile environment in mind, we would stay wary of a potential mean-reversion back lower.”

GBP/USD is seeing a fresh rebound. Cable is expected to consolidate near-term, ahead of an eventual fall to Credit Suisse’s core technical objective at 1.15/1.1409.

Resistance at 1.1968 ideally caps ahead of an eventual fall to 1.15/1.1409

“Key near-term resistance is seen at the recent reaction high and 13-day exponential average at 1.1968. Our bias is for this to ideally cap for a low-level consolidation phase ahead of a move back to 1.1805, then 1.1760.”

“An eventual move below 1.1760 in due course should see a fall to our core objective at 1.1500/1.1409, the bottom of the six-year range and potential long -term trend support stretching back to 1985. Our bias remains to then look for a more important floor to be found here.”

“A close above 1.1968 would be seen to clear the way for a deeper corrective recovery to emerge with resistance seen next at the early July reaction high at 1.2057.”

Markets remain risk-positive at the beginning of the week and the greenback is having a tough time finding demand. Economists at ING expect the US dollar to consolidate around current levels this week.

Consolidation time?

“We see no reason for markets to doubt their 75 bps conviction call for July, and that should continue to put a floor under the dollar in the near term.”

“Expect the large majority of dollar moves this week to be linked to swings in global risk sentiment driven by non-US developments.”

“We could see some consolidation around current levels in the dollar this week, with DXY oscillating around the 107.00-109.00 region although the balance of risks remains tilted to the upside given the numerous threats to the global outlook.”

EUR/USD adds to Friday’s advance and surpasses the 1.0150 level. However, the probability of the pair testing parity again is high, according to economists at ING.

EUR/USD downside risks persist

“The chances of parity being retested remain high, and we struggle to see a significant rebound in EUR/USD for the moment.”

“Expect exacerbated volatility around the 1.00 level.”

Analysts at ING are going to keep an eye on a busy UK data calendar. Nonetheless, global sentiment is likely to play a bigger role in driving GBP/USD which is set to remain below the 1.20 level.

A very busy data calendar this week

“Another round of voting in the Tory leadership contest will cut another candidate from the list and tell us whether Rishi Sunak has managed to hold on to his position as front-runner. Markets will keep an eye on this, but for now, the implications for sterling are likely to remain quite contained.”

“Headline CPI is expected to have accelerated to 9.3% year-on-year in June, while the core rate may have inched lower. Later this week, retail sales and PMIs should also have some market impact.”

“We expect this week’s data flow to help markets fully price in a 50 bps rate hike by the Bank of England (currently, 42 bps is priced in), which could offer some moderate support to sterling.”

“Still, global risk sentiment is expected to play a bigger role in driving GBP/USD for now, and we suspect that a return above 1.20 is not likely at this stage.”

“EUR/GBP may keep oscillating around the 0.85 gravity line this week.”

AUD/USD maintains its pause upon reaching support at 0.6757. Analysts at Credit Suisse think that a potentially lengthier corrective pause is likely to take place for now.