- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 19-07-2022

- AUD/USD is holding in bullish territory around 0.6900.

- RBA sentiment has boosted the Aussie this week so far.

AUD/USD has been consolidating around 0.6900 for the best part of New York day and in early Asia. The pair rallied on US dollar weakness on Tuesday but that came to a head at 0.6912 the high for the day.

Currently, the Reserve Bank of Australia's governor Phillip Lowe is speaking who says that there will be further increases to the cash rate for the months ahead. Traders are looking for any word of a 75bp hike from the governor but so far in the speech there has been no mention of such magnitude and AUD/USD is stuck around 0.6900.

The Aussie already climbed on Tuesday following the RBA's signal in its minutes that it is primed for further monetary tightening to add to its recent surprisingly large rate hike, as policymakers vowed to stay firm in their fight against soaring inflation. The board said the current level of interest rates "was still very low for an economy with a tight labour market and facing a period of higher inflation."

The governor touched on the recent Jobs data that was released last week. This showed net employment in Australia surged 88,400 in June from May, nearly thrice that of market forecasts of a 30,000 increase, while the Unemployment Rate dived to a 48-year low of 3.5%. Coupled with rising inflation risks on a global scale, the bias is on a firmer Aussie.

- The greenback bulls are facing barricades around 50% Fibo retracement at 0.9690.

- A death cross, represented by the 50- and 200-EMAs signal more downside ahead.

- The RSI (14) has shifted into the bearish range of 20.00-40.00.

The USD/CHF pair has moved gradually towards 0.9690 after an intraday low of 0.9673 in early Tokyo. The rebound seems less confident and may attract offers after experiencing momentum loss in a small timeframe. On Tuesday, the asset extended its losses after violating Tuesday’s low at 0.9731.

The availability of barricades around 50% Fibonacci retracement (which is placed from June 29 low 0.9495 to July 14 high at 0.9886) at 0.9690 indicates that a bearish reversal is highly confirmed. The pair extended its losses after slipping below 38.2% Fibo retracement placed at 0.9738.

A death cross, represented by the 50- and 200-period Exponential Moving Averages (EMAs) at 0.9765 adds to the downside filters.

Adding to that, the Relative Strength Index (RSI) (14) is oscillating in a bearish range of 20.00-40.00, which indicates more downside ahead.

A decisive move below Tuesday’s low at 0.9654 will further strengthen the Swiss franc bulls to drag the asset towards the round-level support at 0.9600, followed by July 4 low at 0.9562.

On the flip side, an upside move above July 13 low at 0.9758 will send the asset towards July 13 high at 0.9827. A breach of the latter will drive the asset towards July 14 high at 0.9886.

USD/CHF hourly chart

-637938705587378482.png)

Developing story

Reserve Bank of Australia's governor, Phillip Lowe, is speaking on topics related to Inflation, Productivity and the Future of Money. The event is ''The Australian Strategic Business Forum – Melbourne''.

The event can be listened to here.

Key comments so far

- Stronger productivity growth is likely to mean a higher neutral real interest rate.

- Recent trends in productivity growth have not been particularly encouraging.

- CPI for the june will show a further step-up in the inflation rate, another step-up is expected later this year.

- We don't need to return inflation to target immediately.

- Possible to do this, but the path ahead is a narrow one and it is clouded in uncertainty.

- Emphasise that the concept of the neutral rate is no more than one reference point for the board.

- Neutral is not the basis of a mechanical rule and we are not on a pre-set path to achieve any specific level of the cash rate

- Board expects that further increases will be required over the months ahead

Meanwhile, AUD/USD is a touch higher on the day so far by 0.15% and oscillates at around 0.6900.

- GBP/USD has recaptured the psychological resistance of 1.2000 amid a positive market mood.

- Lower earnings and higher inflation rates may create more hitches for the households in the UK.

- Declining inflation expectations in the US may hurt DXY further.

The GBP/USD pair has rebounded firmly after picking bids below 1.2000 in the early Tokyo session. The cable has remained in the grip of bulls amid a risk-on market impulse, which has improved the favorability of the risk-perceived assets.

The pound bulls have remained upbeat on Tuesday despite the release of the subdued UK employment data. The Unemployment Rate remained flat at 3.8%. However, the Claimant Count Change tumbled to 20K from the prior release of -34.7k.

The catalyst that is haunting the market participants is the downbeat Average Hourly Earnings, which plunged to 6.2% from the expectations of 6.9% and the prior release of 6.8%. The investing community is aware of the fact that the UK economy is facing the headwinds of higher price pressures led by higher energy bills and food prices. Lower earnings along with price pressures are going to hurt the sentiment of the market participants dramatically.

Meanwhile, the US dollar index (DXY) is likely to see more downside as inflation expectations to trim further amid vulnerable oil prices in July. This has trimmed expectations for a 1% rate hike by the Federal Reserve (Fed) in its July monetary policy meeting.

In today’s session, the release of the UK Consumer Price Index (CPI) will be of utmost importance. The economic data is seen at 9.3%, higher than the prior release of 9.1%. However, the core CPI that excludes oil and food may trim to 5.8% by 10 bps from its prior release.

- EURUSD price is juggling in an 11-pips range as bulls are gearing up for a further upside.

- Dollar sell-off is expected to continue further as inflation is expected to reach its full potential sooner.

- First-time rate hike by ECB in 11 years will trim the Fed-ECB policy divergence.

EURUSD price has turned sideways after a perpendicular upside move recorded on Tuesday from a low of 1.0119. The asset is displaying back and forth moves in a narrow range of 1.0222-1.0233 and is expected to resume the north-side move amid broader strength in the shared currency bulls. The pair has recorded a fresh weekly high at 1.0270 and may extend its gains after violation of the same.

Meanwhile, the US dollar index (DXY) has established below 107.00 comfortably. The DXY witnessed a steep fall on Tuesday after violating Monday’s low at 106.89. The asset has shifted into a consolidation phase and is displaying topsy-turvy moves in a range of 106.40-106.78. It is worth noting that the asset has registered a fall of more than 2.60% from its recent 19-year high of 109.30. Considering the downside momentum, more losses are on the table and the asset may find a cushion around 105.50.

Also Read: EUR/USD Forecast: Bears on pause ahead of the ECB

ECB President Christine Lagarde to elevate interest rates by 25 or 50 bps

Dollar sell-off to continue as inflation sees peak

The DXY is expected to continue its downside rush as the market participants are expecting that inflation has reached its potential. Oil prices have remained vulnerable in the month of July and lower valued ‘paychecks’ received by the households have forced them to drop their consumption quantity-wise. A slippage in overall demand and oil-driven inflation will result in a lower inflation rate.

Odds of a 1% rate hike by the Fed have tumbled

The chances of a 100 basis points (bps) rate hike announcement by the Federal Reserve (Fed) have tumbled as long-run inflation expectations have slipped to 2.8% from the June print of 3.1%. As per CME’s FedWatch Tool, the expectations of a rate hike by 1% were as high as 80% last week, which have trimmed to near 30%. This has been a major reason behind the firmer rally in the EURUSD price.

S&P Global PMI to remain in focus

Due to a light economic calendar this week, investors’ focus will remain on the release of the S&P Global PMI data. As per the market consensus, the economic catalysts are expected to deliver a weak performance. The Global Composite data is seen at 51.7, lower than the prior release of 52.3. The Manufacturing PMI may slip to 52 vs. 52.7 recorded earlier. While the Services PMI is expected to display a mild correction to 52.6 against the former figure of 52.7. This will keep the DXY on the back foot and may support the shared currency bulls.

-637938667011795607.png)

EURUSD price to benefit from hawkish ECB bets

EURUSD price is going to remain upbeat as investors are expecting a rate hike by the European Central Bank (ECB) on Thursday. The central bank is keeping a neutral stance on the interest rates for the past 11 years. A rate hike by 25 or 50 basis points (bps) is expected this time as investors believe that the ECB is left with no other alternative than to paddle up its borrowing rates in order to fix the inflation mess. A rate hike announcement by the ECB will trim the Fed-ECB policy divergence.

EURUSD technical analysis

EURUSD is forming a Bullish Flag on an hourly scale that signals an inventory distribution after a sheer upside move. The ongoing inventory distribution in a range of 1.0221-1.0268 is indicating the execution of longs by those market participants, which prefer to enter a trend after the establishment of a bullish bias.

Advancing 20- and 50-period Exponential Moving Averages (EMAs) at 1.0217 and 1.0173 respectively add to the upside filters.

Also, the Relative Strength Index (RSI) (14) is oscillating in the 60.00-80.00 range, which signals the continuation of a bullish momentum ahead.

A breach of Tuesday’s high at 1.0269 will drive the asset towards the round-level resistance at 1.0300, followed by July 1 low at 1.0366.

Alternatively, the greenback bulls could gain control if the asset drops below Monday’s low at 1.0081. An occurrence of the same will drag the asset towards the psychological support at 1.0000. A breach of the psychological support will expose the greenback bulls to recapture its two-year low at 0.9952.

EURUSD hourly chart

-637938665542055408.png)

Elliott Wave Trading Strategies: DAX 40, FTSE 100, STOXX 50, DXY, EUR/USD

- GBP/JPY extends its weekly rally for three consecutive days, up 0.90%.

- Positive UK economic data, alongside a break above Tuesday’s Asian high, exacerbated a test of the 166.00 figure.

- GBP/JPY Price Analysis: Approaches a break above a two-month-old downslope trendline; otherwise would fall towards the 20-day EMA around 164.40s.

The GBP/JPY rises for six straight days as Wednesday’s Asian Pacific session begins, with the GBP/JPY barely up by 0.06%, courtesy of positive UK economic data, to the detriment of the Japanese yen, pressured by an upbeat market mood, and higher US Treasury yields. At the time of writing, the GBP/JPY is trading at 165.80.

GBP/JPY Price Analysis: Technical outlook

GBP/JPY Tuesday’s price action depicts the pair opening near the daily pivot point at 165.00, followed by a fall below the 20-hour EMA, on the way to the daily low at 164.71, capping the fall just above the 50-hour EMA. Then, the GBP/JPY bounced off and rallied above 165.00, back above the 20-day EMA, and on its way up, hit a daily high at around 166.00 before easing towards current levels.

GBP/JPY Daily chart

The GBP/JPY depicts the pair as upward biased, with the daily moving averages (DMAs) below the exchange rate and about to break a two-month-old downslope trendline, above the 166.00 mark. Additionally, the GBP/JPY’s RSI at 58.29 suggests further upside, but its slope begins to shift almost horizontally, meaning buying pressure tempering ahead of the previously-mentioned trendline.

Using the above mentioned as a base case scenario, the GBP/JPY first resistance would be 166.00. A breach of the latter will expose June’s 28 high at 166.94. once cleared, the cross-currency will aim towards June’s 22 swing high at 167.85.

On the other hand, if GBP/JPY sellers step in, the first support would be the figure at 165.00. A decisive break will send the pair towards the 20-day EMA at 164.38, followed by the 50-day EMA at 163.25.

GBP/JPY Key Technical Levels

- The USD/JPY break below the rising wedge might open the door for additional losses.

- USD/JPY Price Analysis: A break below 138.00 could send the pair towards 133.21, just below the rising wedge’s target.

The USD/JPY snaps two consecutive days of losses and remains subdued, recording a minimal gain of 0.05%, amidst an upbeat market mood after investors shrugged off recession fears, as US companies reported earnings, which had shown some resilience, even though the Federal Reserve is hiking rates aggressively. At the time of writing, the USD/JPY is trading at 138.16.

USD/JPY Price Analysis: Technical outlook

The USD/JPY Tuesday’s price action witnessed the pair opening near the highs of the day at 138.12 but tumbled as risk appetite shifted sour towards the 200-hour EMA at 137.51, which also intersected around that area with the S2 pivot point. The major bounced off those lows and rose to the daily pivot point at 138.20.

USD/JPY Daily chart

From a technical perspective, the USD/JPY is upward biased, but a break below the rising wedge, achieved on Tuesday, might open the door for further downside. USD/JPY traders should be aware that the Relative Strength Index (RSI) exited from overbought conditions and is in bullish territory but crossed below the RSI’s 7-day SMA, meaning it has a bearish reading.

If the USD/JPY accelerates downwards and sellers break the 138.00 figure, that would open the door for further losses. That said, the USD/JPY first support would be the 20-day EMA at 136.60. Break below will send the pair sliding to the July 1 low at 134.74, followed by the 50-day EMA at 133.21.

USD/JPY Traders Sentiment

Ahead of official government data on Wednesday, the privately surveyed oil stock data has been released:

Crude +1.860M vs. +1.4M barrels expected.

Gasoline +1.290M vs. +0.1M bbls expected.

Distillate -2.153M vs +1.2M expected.

Cushing +0.523M.

- NZD/USD holds in positive territory ahead of the RBNZ and Fed.

- The possibility that the RBNZ hikes by 75bps in August cannot be ruled out.

NZD/USD was a significant amount higher on Tuesday reaching its best level since around the 4th July US holidays. The pair rallied from 0.6114 to 0.6240 and traded into the Wall Street close some 1.15% higher.

''Markets trended higher overnight as investors now fear markets may have over-assessed the risk of recession,'' analysts at ANZ bank explained. This led to broad US dollar weakness with Fed speakers in the blackout period ahead of next week’s FOMC meeting and a growing consensus that the Fed may be priced too aggressively in money markets.

The US 10-year yield was up 1.24% to 3.026% turning higher into the final hours of North American trade as the S&P 500 burst into life for a close to 3% day in the green with high beta currencies, such as the kiwi, following in tow.

Meanwhile, it could be a quieter day in Asia with a lack of top-tier events scheduled. Still, if APAC equities take a leaf out of Wall Street, then that should be supportive for the antipodeans.

Meanwhile, the sentiment that surrounds the Reserve Bank of New Zealand that has been elevating the kiwi is here to stay. The Analysts at ANZ Bank who are anticipating a 50 bps hike said the possibility that the RBNZ hikes by 75bps in August cannot be ruled out. ''The second quarter labour market statistics on August 3 will be watched very closely.''

- WTI is advancing during the week and is erasing last week’s losses, gaining almost 7%.

- A risk-on impulse augmented the appetite for the black gold, which remained below $100 for three days.

- WTI Price Analysis: It is upward biased, and if buyers reclaim $104.00, that would open the door for further gains.

Western Texas Intermediate, also known as WTI, rallied sharply on Tuesday, almost 2% amidst an upbeat market mood, despite Monday’s Apple news that will halt hiring, viewed by investors as recession fears increasing amongst US companies. However, investors shrugged off those worries and are lifting US crude oil prices. At the time of writing, WTI is trading at $104.08 BPD.

Investors’ sentiment remains positive as US equities rise. A softer US Dollar and supply fears due to the Russian oil embargo bolstered the black gold. Oil markets have been trading volatile in recent weeks, as fears of a worldwide recession would diminish demand, but also weighed by a strong US Dollar.

In the meantime, US President Joe Biden’s visit to Saudi Arabia did not result as expected. Saudi ministers insisted that policy decisions would be taken according to supply and demand and within the OPEC+ members’ agreements.

In the meantime, a power outage at a pump station in South Dakota disrupted oil delivery from Canada to the US -via the Keystone pipeline-and propelled traders to bid up WTI price.

WTI Price Analysis: Technical outlook

From a technical perspective, WTI is upward biased, as shown by the daily chart. The US crude oil is trading within a $10.00 range, supported by the 200-day EMA at $94.41 on the downside, while on the upside, the 20-day EMA at $103.68, initially was resistance. However, a leg up towards the daily high at around $104.44 shifted the 20-day EMA from a resistance level to support.

Therefore, the WTI path of least resistance is headed upwards. That said, the WTI's first resistance would be the July 8 high at $105.21. Break above will expose the 100-day EMA at $107.62, followed by the 50-day EMA at $110.12.

What you need to take care of on Wednesday, July 20:

The American dollar remained under selling pressure, falling to fresh July lows against most major rivals. The dollar sell-off was coupled with some optimistic news coming from Europe.

The EUR/USD pair soared to 1.0268 on headlines suggesting the European Central Bank could discuss a 50 bps rate hike when it meets this week. Additionally, the European Commission has decided to ease some of the sanctions on Russian banks to allow food trade. Finally, headlines suggested that Russian gas giant Gazprom would resume its gas provision to the EU as planned on July 21. Overall, recession concerns cooled a bit, but the picture is still gloomy, and optimism may soon fade.

Bank of England Governor Bailed said that if they see signs of greater persistence of inflation, and price and wage setting are such signs, they would have to act “forcefully.” GBP/USD surged to 1.2045 but settled a few pips below the 1.2000 threshold. UK employment figures were generally positive, as the unemployment rate held steady at 3.8% while the number of people claiming unemployment benefits decreased to -20K.

The dollar edged lower vs the CHF, with the pair plunging to 0.9652. USD/JPY posted a modest advance and settled at 138.19. Commodity-linked currencies were firmly up on the day, with the AUD/USD pair trading around the 0.6900 figure and USD/CAD pressuring daily lows in the 1.2870 price zone.

Gold Price remained unchanged for a third consecutive day, trading around $1,710 a troy ounce. Oil prices were up, with WTI now at $100.60 a barrel.

Stocks posted substantial gains in Europe and the US, hinting at gains in their Asian counterparts.

The US Treasury yield curve, however, remains inverted.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Making profit vs chasing profit

Like this article? Help us with some feedback by answering this survey:

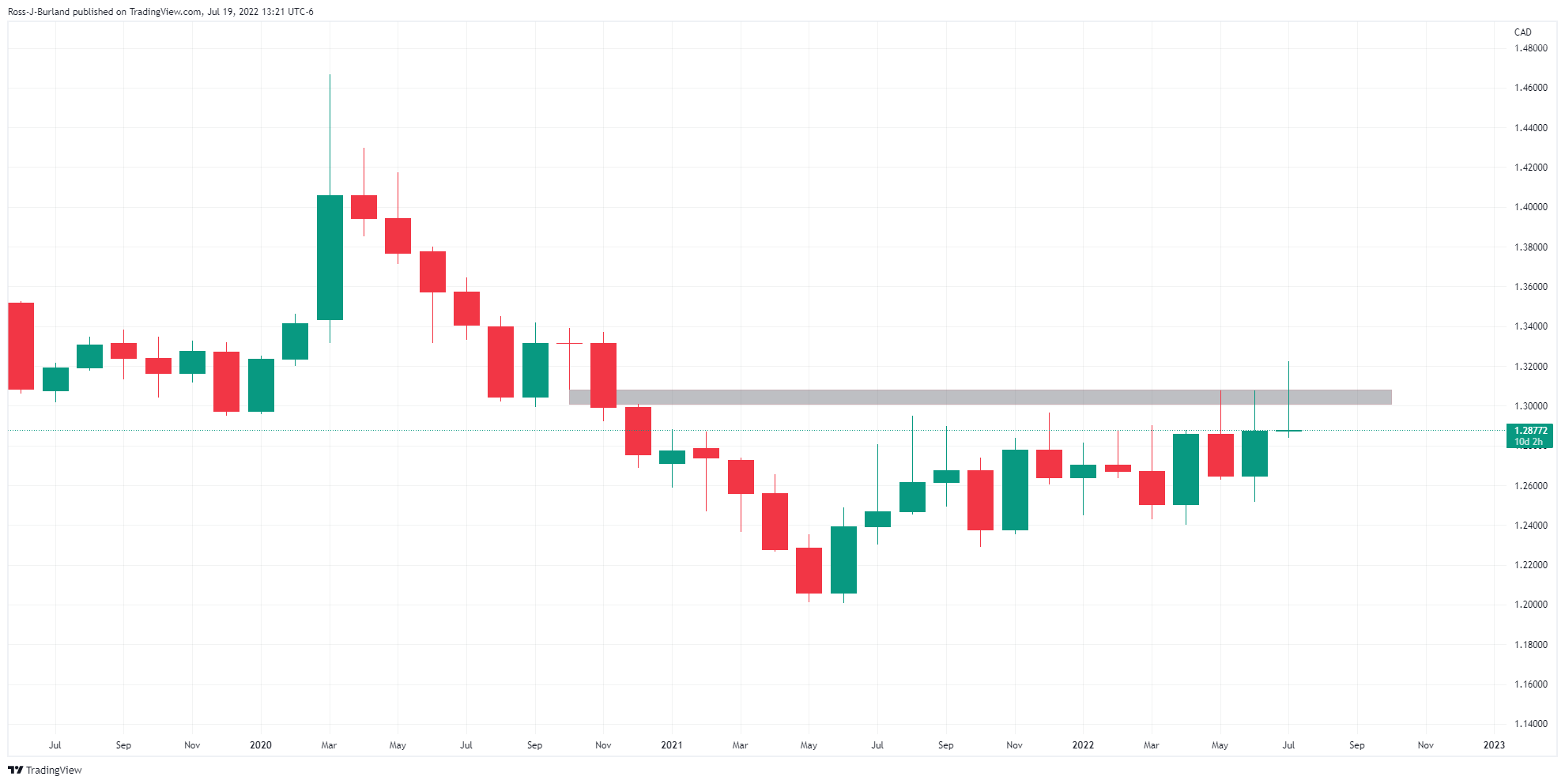

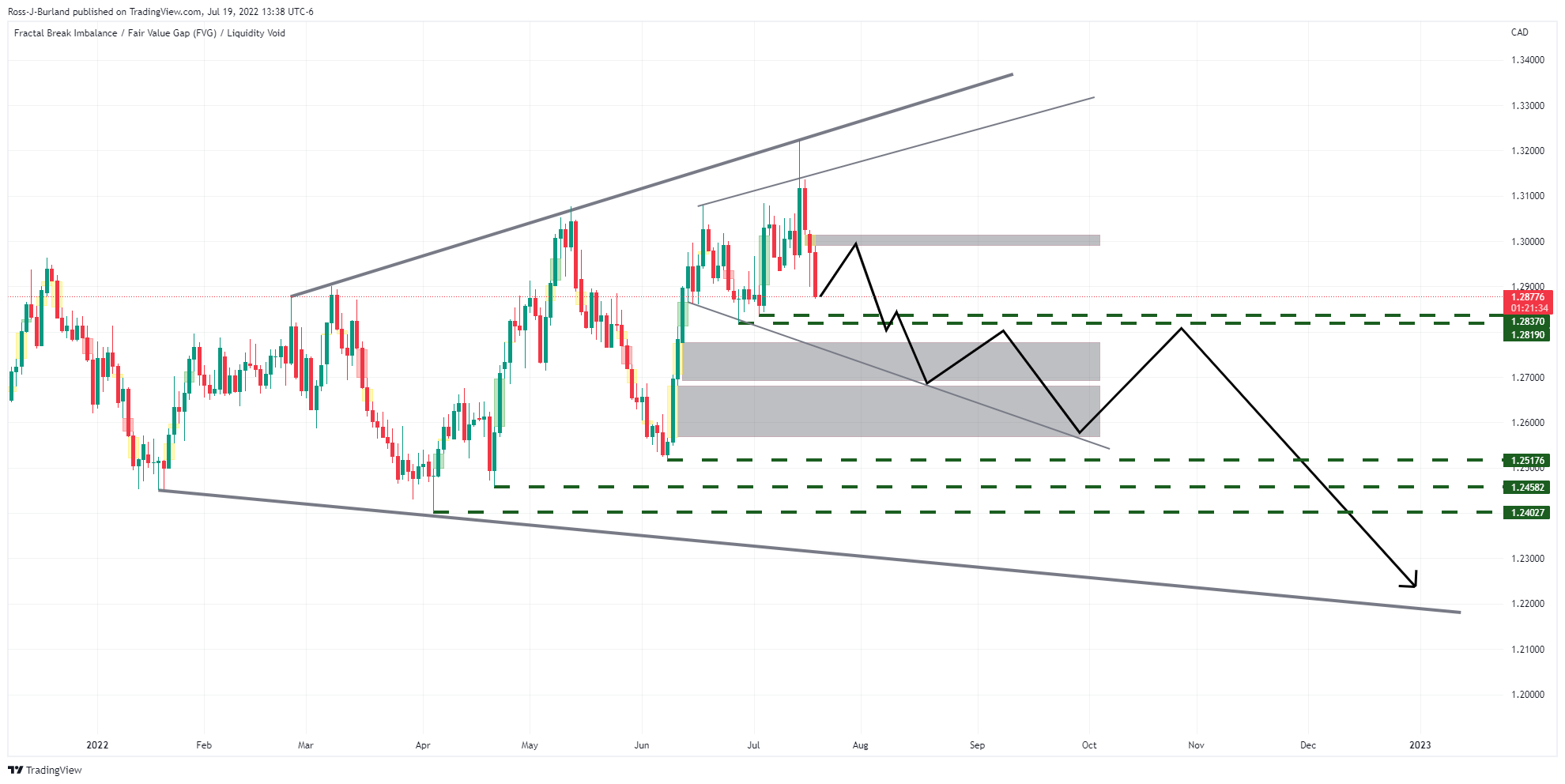

- USD/CAD's broadening formation on the daily chart is compelling.

- USD/CAD could be on the verge of a significant move lower.

USD/CAD has moved in on a monthly price imbalance to fill the void which raises the prospects of a move lower according to lower time frame broadening formations as illustrated in the following charts:

USD/CAD monthly chart

The wicks on the last few months not only represent a price extreme on lower time frames but have mitigated a price imbalance from the November 2020 supply. This leaves scope for a move to the downside for the foreseeable weeks and days ahead.

USD/CAD daily chart

As illustrated above, the increasing price volatility can be shown as two diverging trend lines, one rising and one falling and here we have a broadening formation within another. The great areas are price imbalances that would be expected to be mitigated in time to come. The emphasis in the diagram above is to the downside with price exhaustion at the top of the expanding range and volatility and a void of price action to the downside.

The pivot points at 1.2837 and 1.2819 could be important for the days ahead. If they were to give way, then the focus will be on mitigation of the price imbalance from the bullish impulse. This leaves 1.26 the figure vulnerable for the days ahead. The pivots thereafter will be critical in defending against an expansion of the price below 1.2400.

- Gold Price is bid as bulls move in for the kill following extreme supply.

- A 50% mean reversion on the weekly chart is eyed.

- Federal Reserve sentiment, ECB and US data are all eyed as potential catalysts.

Gold price leans bullish with time frame continuity in the favour of the bulls as XAUUSD inches higher within a bullish correction of the recent leg of supply from $1,750 that took out the $1,700 level last week. However, in general, a pullback in the US dollar continues to support the gold price as investors move to the sidelines ahead of key central bank meetings.

US dollar pauses for breath below a 20-year peak

The US dollar rested on Tuesday below the 20-year highs, as per the DXY index, as it corrects towards a potential area of support in the longer-term time frames, an area that XAUUSD traders will be watching. The index, which measures the greenback vs. a basket of currencies has moved in on the 50% mean reversion level of the last weekly bullish impulse.

Read more: US Dollar Index outlook: Dollar remains at the back foot on calmer tones from Fed

From a daily perspective, the price is hovering over a void of offers that leaves 105.27 vulnerable should DXY bears continue to hit the bids. Gold traders will be keeping a close eye on price action at this juncture. As for catalysts that could tip the balance, the biggest risk to the US dollar and the gold price this week might well be the European Central Bank, ECB, on Thursday, although US PMI Surveys for July will be keenly watched ahead of the Federal Reserve meeting next week.

ECB and US PMI Surveys are key

ECB President, Christine Lagarde

The ECB and US PMI Surveys have the potential to kick start moves in the gold price. The ECB has firmly telegraphed a 25bps rate hike and while it is unlikely to surprise, the meeting will coincide with news related to the Nord Stream pipe. After a shutdown, gas is supposed to resume flowing. However, Berlin is growing concerned that Moscow may not resume the flow of gas as scheduled. Russia's Gazprom declared force majeure on gas supplies to Europe to at least one major customer, in a letter dated July 14 and seen by Reuters at the start of this week.

Heated inflation risks had already seen money markets punting for a half-point hike. The uncertainty is indeed a cloud over the ECB event. However, if the central bank goes ahead with a rate hike, be it 25 or 50bps, regardless, it will be the first time in more than a decade and the outcome of the event could have a material impact on the euro, US dollar and gold price.

As for US PMIs, analysts at TD Securities explained ''business surveys fell markedly in June, led by broad declines in the S&P Global PMIs. The mfg index, in particular, posted a large retreat to 52.7 from 57.0 in May.''

-637938532289769428.png)

''While we look for relief in the pace of declines in the mfg PMI, we still expect it to register a new drop in the flash estimate. Conversely, we expect a steady number for the services index after recent declines.''

Fed day looms

The Federal Reserve is around the corner. It will take place on July 26-27 and for the time being, ''gold prices are being supported by the markets' repricing for odds of a 100bp hike after Fedspeak from notable hawks has pushed back against this narrative, which is raising the risk of a near-term short-squeeze,'' analysts at TD Securities argued. ''Notwithstanding, this scenario would create the ideal set-up for additional downside in the yellow metal.''

Gold price technical analysis

Gold price, from a weekly perspective, the bull correction is underway. However, the monthly lows of $1,676.86, as illustrated on the chart below, could come within reach sooner than later:

The grey areas on the chart above are void of bids which could draw in the gold price to test the commitments of bears in a 50% mean reversion. On the way there, however, we have a couple of major pivot points that could offer resistance at $1,721 and $1,753.

- Silver extends its gains to three straight days but remains beneath $19.00.

- The white metal remains on the defensive as US Treasury yields rise.

- Silver Price Forecast (XAGUSD): Buyers need to reclaim $20.46; otherwise, downside risks remain.

Silver (XAGUSD) seesaws around $18.76 amidst a risk-on impulse that kept the white metal almost unchanged, despite broad US dollar weakness, which usually lifts precious metal prices, but higher US Treasury yields put a lid on XAGUSD price. At the time of writing, XAG USD is trading at 18

XAGUSD began Tuesday’s trading session around $18.69 but dipped towards the daily low at $18.50 before bouncing off to the confluence of the 200-hour EMA and the R1 pivot daily high at around $18.90-95. Nevertheless, once the dust settled, the XAGUSD retreated to current levels. At the time of writing, XAGUSD is trading at $18.76.

XAGUSD is almost unchanged due to high US bond yields

Global equities are trading in positive territory, shrugging off Apple’s news that will slow hiring. US corporate earnings dominate the headlines, particularly what they are expressing in the earnings calls that could update businesses’ outlooks amidst a global central bank tightening. In the meantime, the US Dollar Index continues its nose-dive, losing 0.70%, sitting at106.662.

In the meantime, XAGUSD remains on the defensive due to US Treasury yields, led by the US 10-year benchmark note rate, which yields 3.012%, gaining three bps. Additionally, US Real yields, as depicted by the US 10-year TIPS, sit at 0.614%, up almost three bps.

Data-wise, the US economic docket featured US housing data, showing an ongoing slowdown in higher mortgage rates, sparked by the US Federal Reserve lifting rates. US Housing Starts shrank by 2% MoM in June, while Building Permits followed suit, contracting 0.6%. At the time of writing, a 30-year fixed-rate mortgage sits at 6%, up from 3.3% at the beginning of the year.

What to watch

In the week ahead, the US economic docket will feature Existing Home Sales expected to contract, in line with Housing Starts and Building Permits.

Silver Price Forecast (XAGUSD): Technical outlook

Silver (XAGUSD) remains downward biased. The daily EMAs above the spot price confirm the aforementioned. Furthermore, XAGUSD’s price action remaining below the May 13 cycle low at $20.46 keeps the white metal exposed to selling pressure unless XAGUSD buyers reclaim the previously mentioned price level.

IF XAGUSD would like to reclaim $20.46, first, they need to conquer the $19.00 figure. Once cleared, the next resistance would be the 20-day EMA at $19.74, followed by the $20.00 figure. A breach of the latter will send silver towards $20.46. Otherwise, XAGUSD’s first support would be YTD low at $18.14. Once cleared, the next support would be $18.00.

- GBP/USD is recording solid gains in the week of 1.19%.

- BoE’s Governor Bailey said that 50 bps rate hikes are on the table in the next meeting.

- GBP/USD Price Analysis: Upside pressure if buyers reclaim the 50-DMA, followed by 1.2400; otherwise, downside risks remain.

The GBPUSD grinds higher during the New York session, extending its rally to three straight days after falling close to 3.50% during the month, though the major trimmed some of its losses, thanks to a goodish UK employment report, a risk on impulse, and also to BoE’s Governor Andrew Bailey stating that 50 bps will be on the table for the next meeting.

The GBP/USD opened near 1.1940s before sliding to the daily lows around 1.1920. However, the factors abovementioned lifted the pair towards its daily high at 1.2040 before retreating to current price levels. At the time of writing, the GBP/USD is trading at 1.2004, up 0.46%.

GBP/USD rises on upbeat UK data and a weaker US dollar

Global equities are taking advantage of risk appetite. The GBP/USD got boosted by the greenback, which remains heavy, as depicted by the US Dollar Index, stumbling below the 107.000 mark, down by 0.73%. US Treasuries followed suit, with the US 10-year Treasury yield rising above the 3% threshold, signaling that US bond sellers are in control.

On Tuesday, the Bank of England Governor Andrew Bailey said that a 50 bps rate increase would be among the choices while also commenting that the BoE Monetary Policy Committee (MPC) will begin to discuss a strategy to sell gilts in the Asset Purchase Facility (APF) portfolio.

In the meantime, during the European session, UK employment data was released. The Office for National Statistics (ONS) reported that 296K new jobs were added to the UK economy, exceeding expectations. At the same time, the Unemployment rate remained steady at around 3.8% YoY in the three-month average. Average earnings, including bonuses, rose less than estimated.

Elsewhere, the US economic docket featured June’s US Housing starts, which dropped 2% MoM showing signs of softening caused by an aggressive tightening of the Federal Reserve. Following suit was Building Permits, which shrank by 0.6% on its June reading,

What to watch

In the week ahead, the UK economic docket will feature inflation readings, namely consumer, producer, and retail price indices. On the US front, the calendar will be light, with the release of Existing Home Sales expected to contract, in line with Housing Starts and Building Permits.

GBP/USD Price Analysis: Technical outlook

The GBP/USD remains downward biased, despite recording a leg-up towards a fresh two-week high. The daily moving averages (DMAs) staying above the exchange rate, alongside an exchange rate below June 16 high at 1.2406, will keep the major vulnerable to selling pressure.

If GBP/USD buyers would like to regain control, they would need to reclaim the 50-day moving average (DMA) at 1.2266 to challenge the June 16 daily high at 1.2406. On the flip side, the GBP/USD first support would be 1.2000. Break below will expose the July 18 swing low at 1.1925, followed by a test of the 1.1900 figure.

The European Central Bank meeting on Thursday is grabbing more attention amid rising speculations about a 50 basis points rate hike. According to analysts from TD Securities, the EUR/USD is showing a buy-the-rumour, pattern and they warn this week could be a pretext to reinstate short positions from large investors.

Key Quotes:

“EURUSD is displaying classic signs of a buy-the-rumor/sell-the-fact dynamic. As we warned last week, we were wary of 'ECB sources' stories emerging ahead of the decision to help manage expectations. Given EUR's flirtation below parity, we thought a short-squeeze was likely.”

“Speculation has grown that the ECB may deliver 50bp hike instead of the 'intended' 25bp. Given how far behind the curve the ECB is, it is prudent to respect this 'surprise' scenario. It is the first line of defense to stave off a weak euro. But, it would pull forward the ECB's limitations to hike aggressively later in its cycle as energy constraints intensify. We think a pushback on 100bp hike by Fed officials was partially to offer relief to the euro. But, as we have noted recently, the implosion of the current account will be hard to ignore.”

“There is concern that the anti-fragmentation tool will not be ready this week. We think it must be to begin lifting rates, or else it risks peripheral spread widening. The ECB suffers from institutionalized dovishness, so this week could be a pretext to reinstate shorts. 1.0340-1.0400 in EURUSD as key lines in the sand.”

- US dollar consolidates daily losses for the third consecutive day.

- Risk appetite weighs on the greenback, S&P rises 1.97%.

- AUD/USD back above key SMA, breaks short-term downtrend line.

The AUD/USD climbed above 0.6800 for the first time in more than two weeks, supported by a weaker US dollar and as stocks rise 2% in Wall Street.

From RBA to risk appetite

Early on Tuesday, the Reserve Bank of Australia (RBA) released the minutes of its latest policy meeting. The central bank noted that the current level of the cash rate is well below the lower range of estimates for the nominal neutral rate. This suggests that further increases in interest rates will be needed to return inflation to the target over time.

“Given the rapid fire developments and stronger data outcomes, this implies that the RBA's forecast rate path is unlikely to resemble anything like 'business as usual' as the RBA Governor may have preferred. As such, we will watch for his replies on the possibility of a 75bps move at the August meeting”, explained analysts at TD Securities.

The minutes offered a modest impulse to the aussie that later received a stronger boost from a board-based dollar slide. The greenback continues to correct lower from multi-year highs as market sentiment improves further.

The AUD/USD peaked during the American session at 0.6908, reaching the highest level in twenty days.

Back above the 20-day SMA

The current rally pushed the price above the 20-day Simple Moving Average and of a short-term downtrend line. While above 0.6840, the outlook seems positive for the aussie. A slide below would point to further weakness, possibly falling to 0.6760.

The daily chart shows the RSI and Momentum moving higher, supporting the current recovery from multi-year highs.

AUD/USD daily chart

- EURUSD climbs above the 1.0200 figure, extending its weekly gains to more than 1.50%.

- The Eurozone inflation rose by 8.6% YoY, in line with estimations and previous readings.

- The EURUSD got a boost by ECB sources commenting that policymakers might discuss 50 bps rate hikes.

EURUSD advances sharply, carrying out earlier sentiment during the European session, courtesy of a “leak” that the ECB might hike rates more than 25 bps in the July meeting, which caused a jump in the EURUSD from 1.0160 towards daily highs shy of the 1.0270 area. However, as the New York session began, the EURUSD sudden bounce retreated towards the 1.0240 area, up by almost 1%.

The EURUSD got bolstered by a risk-on impulse, as shown by worldwide equities climbing. The greenback remains on the backfoot, as demonstrated by the US Dollar Index (DXY), tumbling 0.82%, at 106.542, during the day. Worth noticing that once the DXY reached a fresh 24-year high, the index sank more than 2.50%, as safety outflows ignited a US Dollar selloff. In the meantime, the US 10-year Treasury yield ascends above the 3% threshold, up by three bps.

Also read:

- Eurozone final inflation confirmed at 0.8% MoM in June

- ECB policymakers to discuss rate hike worth 25 bps or 50 bps at Thursday’s meeting – Reuters

Eurozone inflation in line with estimations

EU Inflation rose by 8.6% annually based

Earlier in the European session, Eurostat reported the EU HICP for June, unveiling that inflation rose by 8.6% YoY, aligned with estimates and with May’s reading. The core figures showed an expansion of 3.7% YoY, signaling that for two consecutive months, HICP has stabilized. However, EURUSD traders should be aware that in the US, something similar happened before seeing a resumption of US inflation to the upside.

ECB sources leak a possible 50 bps rate hike

ECB sources "leaked" a 50 bps hike

In the meantime, Reuters reported that ECB policymakers might discuss a 25 of 50 bps rate hike. The money market future STIRs immediately have an 82% chance of the ECB increasing 50 bps while pricing in a 100% of 25 bps, something that EURUSD traders should be aware of. Alongside that, the ECB is preparing an anti-fragmentation tool for peripheral countries like Italy as the ECB scrambles to tighten the spreads between the German Bund and the BTPs.

EU’s energy crisis put a lid on the EURUSD rally

Financial analysts remain concerned regarding the ongoing energy crisis in the Euro area. The EU Commission was worried that flows from Russia in the Nord Stream 1 pipe would be halted, increasing the bloc’s chances of recession. Nevertheless, positive news emerged, as gas flows through the Nord Stream 1 will resume following the annual maintenance on July 21, but at reduced levels, according to Reuters. The news was positive for the EURUSD, easing recession tensions, which could trigger upside pressure on the major, which will benefit bulls, as USD buyers are still booking profits ahead of the ECB and Fed monetary policy meetings.

US recession fears remain as the US 2s-10s yield curve stays inverted

In the meantime, the US 2s-10-yield curve extends its inversion for the eleventh straight day, though less profound than on previous days. At the time of writing, the spread widened to -0.201%, as traders’ fears about recession remain. Nonetheless, unless Fed policymakers express concerns about economic growth, that would not deter them from aggressive tightening, which is negative news for EURUSD longs in the future.

ECB vs. Fed differentials will tighten if the ECB surprises the market

The ECB and the Federal Reserve will host their monetary policy meetings in July. Currently, the ECB’s deposit rate lies at minus 0.50%, while the US Federal Reserve’s Federal funds rate (FFR) is at 1.75%, bolstering the appetite for the greenback. With expectations of the ECB hiking 50 bps and the Fed to move at least by 75 bps, differentials would tighten further, to 0.00% (ECB) vs. 2.50% (Fed), meaning that the greenback would keep the upper hand. Nevertheless, sources leaking that the ECB might go 50 bps might open the door for further gains on the EURUSD.

EURUSD Price Technical outlook

EURUSD buyers have stepped in the major, which rallied above the 1.0250 mark for the first time since July 6. Nevertheless, the major remains downward biased, with the daily moving averages (DMAs) residing well above the spot price. However, the EURUSD bounce on Tuesday gave shorts a better entry price if the ECB fails to deliver a 50 bps rate hike. Additionally, the ECB meeting could be a “buy the rumor, sell the fact” event, in which either way the ECB goes, the EURUSD might fall further, as traders have discounted an ECB going 50.

That said, if the EURUSD aims upwards, it will find resistance at 1.0300, followed by the May 13 low at 1.0348 and then 1.0400. On the flip side, the EURUSD’s first support would be 1.0200. A breach of the latter will expose the 1.0100 figure, followed by the 20-year low at 0.9952.

EURUSD price: reversal targeting 1.0340 monthly resistance

Bank of England (BOE) Governor Andrew Bailey said on Tuesday that a 50 basis points rate increase will be among the choices at the next policy meeting, as reported by Reuters.

Key takeaways

"Will publish more details on gilt sales in August."

"We have the option to commence a sales programme shortly after a confirmatory vote by the MPC, which could be as early as at our September meeting."

"50 bps hike is not locked in and anyone who predicts that is doing so based on their own view."

"We do not pre-announce bank rate decisions."

"If we see signs of greater persistence of inflation, and price and wage setting would be such signs, we will have to act forcefully."

"We recognise a trade-off in a situation of high inflation and weakening growth."

"We can already see the economy slowing."

"I would urge caution in interpreting the May GDP number as strong."

Market reaction

GBP/USD extended its daily rally and touched its highest level in more than 10 days at 1.2045. As of writing, the pair was up 0.67% on a daily basis at 1.2035.

According to the Federal Reserve Bank of Atlanta's GDPNow model, the US economy is expected to contract by 1.6% in the second quarter, down from the July 15 forecast of -1.5%.

"After this morning's housing starts report from the US Census Bureau, the nowcast of second-quarter real residential investment growth decreased from -8.8% to -10.1%," Atlanta Fed explained in its publication.

Market reaction

The greenback stays on the back foot following this report. The US Dollar Index, which tracks the dollar's performance against a basket of six major currencies, was last seen losing 0.75% on the day at 106.60.

- ECB meeting: speculations about a 50 bps rate hike boost the euro.

- Europe faces an energy crisis and political uncertainty in UK and Italy.

- EUR/GBP finds resistance at the 20 and 55-day SMA.

The euro is among the top performers on Tuesdays ahead of the European Central Bank meeting. The EUR/GBP cross rose to 0.8540, the highest level in 12 days.

ECB meets on Thursday

Reports on Tuesdays suggested that ECB officials will debate hiking interest rates by 50 basis points at the meeting this week and they are still negotiating the "antifragmentation" tool. The odds of a 50bps rose, boosting the euro. Still, market consensus is for 25bps.

The German 10-year yield is up 3% at 1.24% while the Italian reference is flat as it stands at 3.38%. Italy will face a crucial day on Wednesday. PM Mario Draghi will speak at the Parliament following his resignation. The outcome could be Draghi staying in power, or President Sergio Mattarella being forced to call early elections.

The euro also benefited after the European Union softened sanctions on Russian banks. More recently, Reuters informed that Russia is expected to restart Nord Stream 1 gas flows on Thursday as planned.

In the UK, economic data showed the unemployment rate remained at 3.8% in the three months ending in May. Average weekly earnings rose 6.2% from a year ago, below the 6.9% of market consensus. Inflation data will be released on Wednesday. The CPI June print will be a key input for the Bank of England. Analysts at TD Securities said that labor numbers “does not change anything for our overarching BoE call, and we still expect a strong June CPI print to push the Bank to hike Bank Rate by 50bps in August.”

Only three contenders remain at the Tory race leadership. Kemi Badenoch was eliminated in the fourth round with 59 votes. Rishi Sunak received 118 votes (+3 from Monday’s vote), Penny Mordaunt 92 (+10) and Liz Truss 86 (+15). On Wednesday, the two names of the final battle will be decided after another round.

EUR/GBP bullish, facing resistance at 0.8545

The EUR/GBP continues to recover after falling last week to the 0.8400 zone. Price is approaching the 20-day Simple Moving Average that stands at 0.8542; so far it failed to hold above the 55-day SMA at 0.8532. A daily close clearly above both lines should point to more strength for the euro. The bullish tone will likely remain in place in the short-term while above 0.8485.

Below 0.8460 a test of 0.8430 seems likely. A consolidation under 0.8430 should clear the way to more losses and for a new test of 0.8400.

Technical levels

Citing two sources familiar with the matter, Reuters reported on Tuesday that Russia is expected to restart Nord Stream 1 gas flows on Thursday as planned.

"The sources, speaking on condition of anonymity because of the sensitivity of the issue, told Reuters the pipeline was expected to resume operation on time, but at less than its capacity of some 160 million cubic metres (mcm) per day," the article read.

Market reaction

The market mood remains upbeat following this development and the S&P 500 Index was last seen rising 1.5% on a daily basis.

- USD/JPY witnessed selling for the third successive day amid broad-based USD weakness.

- Weakness below the 137.50-45 confluence would pave the way for a deeper correction.

- A sustained strength back above the 138.00 mark is needed to negate any negative bias.

The USD/JPY pair prolonged its corrective pullback from a 24-year high touched last week and continued losing ground for the third successive day on Tuesday. The downward trajectory dragged spot prices to a three-day low, around the 137.50-137.45 area during the early North American session and was sponsored by the prevalent US dollar selling bias.

Investors continue scaling back their bet for a 100 bps Fed rate hike move later this month, which, in turn, was seen as a key factor that exerted downward pressure on the USD/JPY pair. That said, the divergent Fed-Bank of Japan policy stance, along with the risk-on impulse, could undermine the safe-haven Japanese yen and help limit deeper losses.

From a technical perspective, the USD/JPY pair was seen flirting with confluence support comprising the 38.2% Fibonacci retracement level of the 134.25-139.39 rally and the 200-period SMA on the 1-hour chart. A convincing break below the said support might prompt aggressive technical selling and drag the pair further below the 137.00 round-figure mark.

The latter is closely followed by support marked by the 50% Fibo. level, around the 136.80 region. Some follow-through selling would be seen as a fresh trigger for bearish traders and set the stage for an extension of the downfall. Spot prices could then drop towards the next relevant support near the 61.8% Fibo. level, just ahead of the 136.00 mark.

On the flip side, the 138.00 round figure, nearing the 23.6% Fibo. level, now seems to act as an immediate hurdle. A sustained strength beyond would suggest that the corrective slide has run its course and allow the USD/JPY pair to reclaim the 139.00 mark. Bulls might eventually aim back to challenge the YTD peak, around the 139.40 region.

USD/JPY 1-hour chart

-637938356553791119.png)

Key levels to watch

- US dollar under pressure amid risk appetite.

- Crude oil prices correct on Tuesday, after rising sharply on Monday.

- USD/CAD reaffirms bearish bias after a brief rebound.

The USD/CAD is falling for the third consecutive day. After a brief rebound from the 1.2900 area toward 1.3000, the pair resumed the decline and it is hovering below 1.2930.

During the American session, USD/CAD trades at 1.2922 (fresh daily low) as it continues to move toward the 1.2900 zone, a critical area. The move lower is being driven by a weaker US dollar and risk appetite.

The DXY is seen at the lowest level in two weeks at 106.50, down 0.80%. It is falling for the third time, moving further away from multi-year highs. US yields show no clear direction on Tuesday. The US 10-year yield stands at 2.98% and the 30-year at 3.14%. Stocks in Wall Street are up 1% on average. Crude oil prices are falling around 1%, after a sharp rally on Monday. API inventory data is due later on Tuesday.

The combination of a weaker dollar and risk appetite weighs on USD/CAD. Other currencies, like the Australian dollar and the New Zealand dollar, are posting larger gains versus the greenback.

Economic data released on Tuesday showed Housing Starts dropped to 1.559K in June and Building Permits declined to 1.685K. In Canada, the key report of the week is the June CPI due on Wednesday. Market consensus is for an increase in the index of 0.9% (monthly) and for the annual rate to rise from 7.7% to 8.4%. “A slight disappointment on CPI adds to our belief that CAD outperformance is living on borrowed time”, warn analysts at TD Securities.

Technical levels

- Gold price struggled to gain any meaningful traction and remained confined in a range.

- The ongoing USD profit-taking slide continued lending some support to the commodity.

- Hawkish major central banks, the risk-on impulse acted as a headwind and capped gains.

Gold price attracted some dip-buying near the $1,705 region on Tuesday, though seemed to struggle to capitalize on the modest intraday gains. The XAUUSD, so far, has struggled to gain any meaningful traction and remained confined in a familiar trading range, just above the $1,700 round-figure mark.

Gold price drew support from sustained USD selling

The US dollar prolonged its retracement slide from a two-decade high touched last week, which, in turn, was seen as a key factor that offered some support to the dollar-denominated gold. In fact, the USD Index dropped to its lowest level since July 6 amid receding bets for a massive 100 bps rate hike move by the Federal Reserve in July. Several FOMC members signalled recently that they will likely stick to a 75 bps rate increase at the upcoming policy meeting on July 26-27.

US housing market data did little to impress USD bulls

The mixed US housing market data, meanwhile, did little to impress the USD bulls or provide any meaningful impetus to the gold price. The US Census Bureau reported that Housing Starts declined by 2% to a seasonally adjusted annual rate of 1,685,000, while Building Permits fell by 0.6% in the same period following the 7% contraction reported in May.

Aggressive tightening plans by major central banks acted as a headwind

That said, the prospects for a more aggressive move by major central banks continued acting as a headwind for the non-yielding yellow metal. The Fed is still expected to deliver a larger rate hike later this year to curb soaring inflation, which accelerated to a four-decade high in June. Adding to this, the European Central Bank (ECB) reportedly will discuss whether to raise interest rates by 25 bps or 50 bps to tame inflation at its upcoming policy meeting on Thursday.

Moreover, the minutes from the Reserve Bank of Australia policy meeting released earlier this Tuesday indicated that further increases in interest rate will be needed to return inflation to the target over time. This comes a day after Bank of England policymaker Michael Saunders said that the current tightening cycle may still have some way to go and the benchmark rate could reach 2% or higher next year.

Inflation fears

Risk-on impulse contributed to cap XAUUSD

This, along with a positive tone around the equity markets, further contributed to capping the upside for the safe-haven gold. Results from a number of major US banks generally have been solid. Apart from this, the recent decline in crude oil prices led to a modest rebound in investors' appetite for riskier assets.

Gold price technical outlook

-637938328771629400.png)

Gold price, so far, has struggled to register any meaningful recovery from a nearly one-year low touched last week, suggesting that the near-term risks remain skewed to the downside. Hence, any attempted recovery beyond the $1,725-$1,726 immediate resistance might still be seen as a selling opportunity. This, in turn, should cap the XAUUSD near the $1,734-$1,735 horizontal resistance. Some follow-through buying might trigger a bout of short-covering and lift the commodity towards the $1,749-$1,752 supply zone.

On the flip side, last week's swing low, around the $1,698-$1,697 area, might continue to act as immediate support. A convincing break below would make the XAUUSD vulnerable to testing September 2021 low, around the $1,787-$1,786 region. Gold price could extend the downward trajectory towards 2021 yearly low, near the $1,677-$1,676 area.

Gold price: Bearish risks still intact

- US Housing Starts fell by 2% on a monthly basis in June.

- US Dollar Index stays deep in negative territory below 107.00.

The data published by the US Census Bureau revealed on Tuesday that Housing Starts declined by 2% to a seasonally adjusted annual rate of 1,685,000. Building Permits fell by 0.6% in the same period following the 7% contraction reported in May.

"Privately‐owned housing completions in June were at a seasonally adjusted annual rate of 1,365,000," the publication further read. "This is 4.6% below the revised May estimate of 1,431,000, but is 4.6% above the June 2021 rate of 1,305,000."

Market reaction

The greenback stays under heavy bearish pressure following this report and the US Dollar Index was last seen losing 0.7% on a daily basis at 106.63.

- GBP/USD scaled higher for the third straight day and climbed to over a one-week high.

- Receding bets for more aggressive Fed rate hikes continued weighing on the greenback.

- Hawkish BoE expectations overshadowed mixed UK jobs data and remained supportive.

The GBP/USD pair gained traction for the third successive day on Tuesday and shot to a one-and-a-half-week high, around the 1.2040 region during the mid-European session. The momentum assisted spot prices to build on the recent recovery from the vicinity of mid-1.1700s, or the lowest level since March 2020 and was sponsored by broad-based US dollar weakness.

Investors continue scaling back their bet for a 100 bps Fed rate hike move later this month. Apart from this, the risk-on impulse dragged the safe-haven USD to its lowest level since July 6. The GBP bulls, meanwhile, seemed unaffected by the mixed UK jobs report, instead took cues from expectations for a further policy tightening by the Bank of England.

From a technical perspective, Tuesday's positive move validated the overnight breakout through a multi-week-old descending trend-channel resistance. The subsequent strength, however, struggled to find acceptance above the 100-period SMA on the 4-hour chart and stalled near the 50% Fibonacci retracement level of the 1.2332-1.1760 downfall.

The latter is pegged near the 1.2040-1.2045 region and should act as a pivotal point, which if cleared decisively would set the stage for a further near-term appreciating move. The GBP/USD pair might then aim to reclaim the 1.2100 mark, which coincides with the 61.8% Fibo. level, before eventually climbing to the 1.2155-1.2160 horizontal resistance.

On the flip side, the 38.2% Fibo. level, around the 1.1980 area, now seems to protect the immediate downside. Sustained weakness below might prompt some technical selling and accelerate the slide back towards the 1.1900 mark, or the 23.6% Fibo. level. Some follow-through selling would negate the near-term positive bias and make the GBP/USD pair vulnerable.

The next relevant support is pegged near the 1.1835-1.1830 region ahead of the 1.1800 round figure, below which the GBP/USD pair could aim to challenge the YTD low, around the 1.1760 region.

GBP/USD 4-hour chart

-637938292567098385.png)

Key levels to watch

International Monetary Fund (IMF) warned of heavy damage to the European economy from the Russian gas embargo, the Financial Times reported.

The IMF said that eastern Europe and Italy would likely suffer serious recessions unless countries managed to pool resources. In case Russia were to stop supplying gas to Europe, the economies of the Czech Republic, Hungary, Slovakia and Italy could contract by more than 5%, the IMF added.

Market reaction

Investors remain cautious after this headline and the Euro Stoxx Index was last seen losing 0.1% on a daily basis.

Previewing the Bank of Japan's (BoJ) upcoming policy meeting, Rabobank analysts said that they expect the BoJ to revise up its inflation forecasts and lower its growth expectations.

We see USD/JPY returning to the 130 area in Q2 next year

"If USD/JPY were to spike to 145 or beyond, the inflationary impact of the BoJ’s easy policy would become greater and market speculation that the BoJ may capitulate on its YCC policy would likely increase."

"In our view, the prospect of lower US yields and the JPY’s own safe haven credentials could allow USD/JPY to back away from the 140 area in the coming months. This would allow the BoJ further breathing space. It is possible that signs of wage inflation could allow the BoE to adjust its YCC policy as soon as this autumn, though the signs of slower global growth could strengthen the BoJ’s resolve to hold out on any policy adjustment until next year."

"We see USD/JPY holding around current levels on a 1 month view. We see USD/JPY returning to the 130 area in Q2 next year on the assumption the market may be then looking ahead to easier policy from the Fed."

The European Central Bank (ECB) is reportedly still negotiating the conditionality and the legal aspects of the new anti-fragmentation tool.

ECB President Lagarde is said to redoubling efforts to finalize a deal by this week's policy meeting.

Market reaction

The shared currency, which gathered bullish momentum on reports claiming that ECB policymakers were going to discuss a 50 basis points (bps) rate hike, preserves its strength following this headline. The EUR/USD pair was last seen trading at 1.0256, where it was up 1.15% on a daily basis.

The European Commission said on Tuesday that they are working on all scenarios regarding Nord Stream 1, including the possibility that the pipeline does not restrat after the planned maintenance is completed, as reported by Reuters.

Earlier in the day, citing European Budget Commissioner Johannes Hahn, the Wall Street Journal reported that the EU Commission was not expecting the pipeline to come back online.

Market reaction

Markets remain cautious following this headline and the Euro Stoxx 600 Index was last seen trading flat on the day.

According to Kit Juckes, Macro Strategist at Societe Generale, the euro rallied around 1% after a Reuters headline told us that the ECB will discuss the option of a 50 bps rate hike at their meeting this week.

Key Quotes

“The ECB has twisted itself into knots around its forward guidance. You could make a stronger case for a 50bp hike today (inflation) or for doing nothing (Russian gas) than for hiking by 25bp. Still, the headline has increased the pressure to cut euro shorts, and shorts across the European currency market, where HUF, PLN, SEK and NOK are leading the charge.”

According to Jan von Gerich, Chief Analyst at Nordea, the European Central Bank (ECB) is likely to start its rate hiking cycle with a 25bp move on Thursday despite clear signs of weakening growth momentum.

Focus will be on the anti-fragmentation tool

“With inflation much too high and price pressures broadening, the ECB has no room to soften its rhetoric at Thursday’s meeting – despite clearly weakening economic data. Even though some hawks have wanted to leave the door open for a bigger increase, and recent media stories have suggested the ECB will discuss also a bigger move this week, we think the ECB still follow its earlier guidance and hike rates by 25bp on Thursday.”

“On the anti-fragmentation tool, dubbed Transmission Protection Mechanism, we think the details will not convince markets. Even if they do, the ECB is unlikely to be willing to use the full firepower of the instrument, unless absolutely necessary. Many Governing Council members have emphasised the backstop nature of the tool, which will be used only if necessary.”

“Gold has not been living up to its reputation as an inflation hedge and safe haven in times of crisis of late,” Analysts at Commerzbank Research noted in their latest Commodities Update published on Tuesday.

Additional quotes

“Although inflation rates in the US and Europe are higher than they have been for decades, and have been rising further recently, the gold price has been under selling pressure for weeks.”

“Even the growing concerns about a recession, as evidenced by sharp falls on the stock markets and an inverse yield curve, have not benefited gold.”

“On the contrary, its price even dipped below the $1,700 per troy ounce mark at the end of last week, the first time this has happened in eleven months. What is more, gold has chalked up weekly losses in five consecutive weeks, which has also not been seen in nearly four years.”

“During these five weeks, gold shed almost 9% of its value. More and more disappointed investors are throwing in the towel and jettisoning their gold investments, thereby exerting additional pressure on the price.”

“This is especially visible in the case of gold ETFs: within the past nearly four weeks, 95 tons of gold have been withdrawn from the ETFs tracked by Bloomberg.”

“That’s almost twice as much as the net outflows seen in the entire second quarter. Around two-thirds of the outflows were registered by the world’s largest gold ETF, the SPDR Gold Trust, which is primarily used as an investment vehicle by institutional investors.”

- USD/CHF witnessed heavy selling on Tuesday and dropped to a nearly two-week low.

- The ongoing USD retracement slide from a two-decade high continued to exert pressure.

- Elevated US bond yields, the risk-on impulse could help limit deeper losses for the major.

The USD/CHF pair met with a fresh supply near the 0.9785 area on Tuesday and extended its retracement slide from a multi-week high touched last Thursday. The intraday selling picked up pace during the European session and dragged spot prices to sub-0.9700 levels, or a nearly two-week low.

The US dollar prolonged its profit-taking slide from a two-decade high amid receding bets for a massive 100 bps rate hike move by the Federal Reserve in July. In fact, several FOMC members said last week that they were not in favour of a bigger rate increase that the markets priced in following the release of red-hot US consumer inflation.

The USD was further pressured by a strong pickup in demand for the shared currency, bolstered by reports that the ECB will discuss whether to raise rates by 25 bps or 50 bps at its meeting on Thursday. This, in turn, continued exerting downward pressure on the USD/CHF pair, though a combination of factors might help limit any further losses.

The risk-on impulse - as depicted by a generally positive tone around the equity markets - could undermine the safe-haven Swiss franc and offer some support to the USD/CHF pair. Furthermore, investors seem convinced that the recent surge in US consumer inflation to a four-decade high would force the Fed to deliver a larger rate hike later in the year.

The speculations remained supportive of elevated US Treasury bond yields, which should act as a tailwind for the USD. The fundamental backdrop supports prospects for the emergence of some buying around the USD/CHF pair, warranting some caution for bearish traders and before positioning for any further depreciating move.

Market participants now look forward to the US housing market data - Building Permits and Housing Starts - due later during the early North American session. This, along with the US bond yields, might influence the USD. Traders will further take cues from the broader risk sentiment to grab short-term opportunities around the USD/CHF pair.

Technical levels to watch

Economists at TD Securities (TDS) take note of the significant US economic data due for release later this week.

Key quotes

“The focus this week will shift to activity indicators as market participants continue to contrast a high-inflation profile against signs of slowing economic activity. We look for the Philly Fed to register a rebound and for the PMIs to arrest their recent declines.”

“While business surveys might provide a glimmer of hope regarding the broad momentum of economic activity, the housing market is likely to continue offering signs of rolling over. In particular, we forecast existing home sales to have dropped markedly in June.”

“Jobless claims data are yet to show any signs of weakening in the labor market. We look for the data out this week to continue to lend credence to that view.”

Heading towards Thursday’s European Central Bank (ECB) interest rate decision, economists at ABN Amro believe that the bank will stick to its pre-commitment of a 25 bps rate hike.

Key quotes

“The ECB will almost certainly raise its key policy rates by 25bp this week. The Governing Council’s communication has not given it much flexibility in this respect. The two key issues that will receive a lot of focus are the future path of rate hikes and the announcement of the details of its new anti-fragmentation tool.”

“With regards to future interest rate hikes, the current guidance does build in optionality based on the way the outlook develops.”

“The ECB has signalled that the September move would be a 50bp step ‘If the medium-term inflation outlook persists or deteriorates’. Whereas ‘based on the current assessment’ after September it anticipates ‘a gradual but sustained path of further increases in interest rates’. This implies 25bp steps, but this depends on ‘the incoming data and how it assesses inflation to develop in the medium term’.”

European Union (EU) commissioner for budget and administration Johannes Hahn said on Tuesday, the European Commission doesn't expect gas supplies to Europe from Russia through the Nord Stream pipeline to restart from this Thursday, according to the Wall Street Journal (WSJ).

Hahn said: "We're working on the assumption that it doesn't return to operation.”

The reopening of Russia’s Nord Stream 1 pipeline is critical for the euro to sustain its recovery momentum. The Nord Stream 1 pipeline, Germany’s main source of Russian gas, is scheduled to be out of action until July 21 for routine work that the operator says includes “testing of mechanical elements and automation systems”.

But markets remain suspicious about Russia’s intentions, particularly after Russia’s Gazprom last month reduced the gas flow through Nord Stream 1 by 60%.

Should Russia delay the pipeline reopening, in response to the Ukraine crisis, it could escalate the dire gas situation in Europe, reviving the bearish interest in the shared currency.

At the time of writing, EURUSD price is trading 0.90% higher on the day at 1.0232, having hit two-week highs of 1.0253 on talks of a larger ECB rate hike this week.

- AUD/USD gained strong positive traction on Tuesday and shot to over a two-week high.

- The prevalent USD selling bias and hawkish RBA meeting minutes remained supportive.

- Descending trend-channel breakout supports prospects for additional near-term gains.

The AUD/USD pair caught aggressive bids on Tuesday and built on its recent recovery move from a two-year low, around the 0.6680 region touched last week. The momentum lifted spot prices to over a two-week high during the first half of the European session, with bulls now awaiting sustained strength beyond the 0.6900 mark.

The US dollar prolonged its corrective pullback from a two-decade high and continued losing ground for the third straight day. In fact, the USD Index dropped to its lowest level since July 6 amid receding bets for a 100 bps rate hike move by the Federal Reserve in July. This, in turn, was seen as a key factor that acted as a tailwind for the AUD/USD pair.

The Australian dollar drew additional support from the unsurprisingly hawkish Reserve Bank of Australia meeting minutes. The RBA noted that the current level of the cash rate is well below the lower range of estimates for the nominal neutral rate. This suggests that further increases in interest rates will be needed to return inflation to the target over time.

Apart from this, signs of stability in the financial markets further benefitted the risk-sensitive aussie. Tuesday's strong move up could further be attributed to some technical buying above the top boundary of a one-month-old descending trend channel. This might already have set the stage for a further near-term appreciating move for the AUD/USD pair.

That said, growing fears about a possible global recession might continue to weigh on investors' sentiment and limit any further losses for the safe-haven USD, at least for the time being. Apart from this, fresh COVID-19 restrictions in China warrant some caution before placing aggressive bullish bets around the China-proxy Australian dollar.

Market participants now look forward to the US housing market data - Building Permits and Housing Starts - due for release later during the early North American session. Traders would further take cues from the broader market risk sentiment, which could drive the USD demand and produce short-term opportunities around the AUD/USD pair.

Technical levels to watch

Saudi Arabian Foreign Minister Prince Faisal bin Farhan Al Saud comforted the oil market on Tuesday, as he said that there is no shortage of oil in the market but a lack of oil refining capacity.

Key quotes

"As of today, we don't see a lack of oil in the market. There is a lack of refining capacity, which is also an issue, so we need to invest more in refining capacity."

“Russia is an integral part of OPEC+.”

“Without OPEC+ cooperation as a collective it would be impossible to properly ensure adequate oil supplies.”

Market reaction

WTI is finding some support on the above headlines, currently trading at $98.40, down 0.31% on the day.

- Eurozone inflation arrives at 8.6% YoY in June, meets estimates.

- Monthly HICP in the bloc stands at 0.8% in June.

- EUR/USD preserves gains above 1.0200 on the expected Eurozone data.

Eurozone’s Inflation surged 8.6% in June, on an annualized basis, according to Eurostat’s final reading of the Eurozone Harmonised Index of Consumer Prices (HICP) report for the month.

The reading matched expectations of 8.6% while against the 8.6% previous. Core figures rose by 3.7%, meeting the 3.7% market estimates and 3.7% last.

The bloc’s HICP rose by 0.8% versus 0.8% expected and 0.8% first readout while the core HICP numbers came in at 0.2% versus 0.2% expected and 0.2% seen previously.

Key details (via Eurostat):

The lowest annual rates were registered in Malta (6.1%), France (6.5%) and Finland (8.1%). The highest annual rates were recorded in Estonia (22.0%), Lithuania (20.5%) and Latvia (19.2%).

Compared with May, annual inflation fell in two Member States and rose in twenty-five. In June, the highest contribution to the annual euro area inflation rate came from energy (+4.19 percentage points, pp), followed by food, alcohol & tobacco (+1.88 pp), services (+1.42 pp) and non-energy industrial goods (+1.15 pp).

FX implications:

At the press time, EUR/USD is trading at 1.0238, higher by 0.95% on the day.

- EURUSD price jumped to a nearly two-week high and was supported by a combination of factors.

- Receding bets for a more aggressive Fed rate hike in July continued exerting pressure on the USD.

- Reports that the ECB will discuss hiking rates by 50 bps provided an additional boost to the euro.

EURUSD price attracted fresh buying near the 1.0120 region on Tuesday and shot to a nearly two-week high during the early part of the European session. The pair was last seen trading around mid-1.0200s, up over 1.0% for the day.

Sustained USD selling continued lending support

The US dollar prolonged its corrective pullback from a two-decade high for the third straight day amid receding bets for a more aggressive rate hike by the Federal Reserve in July. In fact, several FOMC members said last week that they were not in favour of a bigger rate increase that the markets priced in following the release of red-hot US consumer inflation. This, in turn, dragged the USD to its lowest level since July 6 and offered some support to the EUR/USD pair.

50 bps ECB rate hike news boosted shared currency

The European Central Bank (ECB) reportedly will discuss whether to raise interest rates by 25 bps or 50 bps to tame inflation at its upcoming policy meeting on Thursday. A Reuters report added that policymakers were homing in on a deal to provide bond market assistance to countries like Italy if they stick to European Commission rules on reforms and budget discipline. The headlines pushed the European bond yields higher, alongside the euro. This was seen as another factor behind the latest leg of a sudden spike witnessed over the past hour or so.

Recession fears could act as a headwind for euro

Investors remain concerned that a halt to gas flows from Russia could trigger an energy crisis in the Eurozone. This could drag the region's economy faster and deeper into recession, curtailing the ECB's ability to raise interest rates any further. The economic risks could hold back bulls from placing aggressive bets around the shared currency and keep a lid on any further gains for the EURUSD price, at least for the time being.

Hawkish Fed expectations to limit USD losses

The Fed, on the other hand, is still expected to deliver a larger rate hike later in the year to tame inflation, which accelerated to a fresh four-decade high in June. The speculations remained supportive of elevated US Treasury bond yields and support prospects for the emergence of some dip-buying around the USD. This might further contribute to capping the upside for the EURUSD price. Hence, it will be prudent to wait for strong follow-through buying before positioning for an extension of the recent recovery from the 0.9950 area, or the lowest level since December 2002 touched last week.

Traders eye Eurozone CPI, US housing market data

Tuesday's economic docket features the release of the final Eurozone Harmonised Index of Consumer Prices (HICP) and the US housing market data - Building Permits and Housing Starts. This, along with the US bond yields, might influence the USD price dynamics and allow traders to grab short-term opportunities around the EURUSD pair.

EURUSD price technical outlook

-637938161372688607.png)

EURUSD price might now confront some resistance near the 1.0275-1.0280 region ahead of the 1.0300 mark. This is closely followed by the top boundary of a short-term descending channel extending from late May, currently around the 1.0320 area, which if cleared would be seen as a fresh trigger for bulls. The pair might then accelerate the momentum and aim to reclaim the 1.0400 round figure.

On the flip side, the 1.0200 level now seems to protect the immediate downside, which if broken could drag the EURUSD price back towards the 1.0155-1.0145 region. Some follow-through selling would negate any near-term positive bias and make the pair vulnerable to breaking below the 1.0100 mark. The subsequent downfall would expose the parity market and the YTD low, around the 0.9950 region.

EURUSD price: reversal targeting 1.0340 monthly resistance

- EURUSD price jumped to a nearly two-week high and was supported by a combination of factors.

- Receding bets for a more aggressive Fed rate hike in July continued exerting pressure on the USD.

- Reports that the ECB will discuss hiking rates by 50 bps provided an additional boost to the euro.

EURUSD price attracted fresh buying near the 1.0120 region on Tuesday and shot to a nearly two-week high during the early part of the European session. The pair was last seen trading around mid-1.0200s, up over 1.0% for the day.

Sustained USD selling continued lending support

The US dollar prolonged its corrective pullback from a two-decade high for the third straight day amid receding bets for a more aggressive rate hike by the Federal Reserve in July. In fact, several FOMC members said last week that they were not in favour of a bigger rate increase that the markets priced in following the release of red-hot US consumer inflation. This, in turn, dragged the USD to its lowest level since July 6 and offered some support to the EUR/USD pair.

50 bps ECB rate hike news boosted shared currency

The European Central Bank (ECB) reportedly will discuss whether to raise interest rates by 25 bps or 50 bps to tame inflation at its upcoming policy meeting on Thursday. A Reuters report added that policymakers were homing in on a deal to provide bond market assistance to countries like Italy if they stick to European Commission rules on reforms and budget discipline. The headlines pushed the European bond yields higher, alongside the euro. This was seen as another factor behind the latest leg of a sudden spike witnessed over the past hour or so.

Recession fears could act as a headwind for euro

Investors remain concerned that a halt to gas flows from Russia could trigger an energy crisis in the Eurozone. This could drag the region's economy faster and deeper into recession, curtailing the ECB's ability to raise interest rates any further. The economic risks could hold back bulls from placing aggressive bets around the shared currency and keep a lid on any further gains for the EURUSD price, at least for the time being.

Hawkish Fed expectations to limit USD losses

The Fed, on the other hand, is still expected to deliver a larger rate hike later in the year to tame inflation, which accelerated to a fresh four-decade high in June. The speculations remained supportive of elevated US Treasury bond yields and support prospects for the emergence of some dip-buying around the USD. This might further contribute to capping the upside for the EURUSD price. Hence, it will be prudent to wait for strong follow-through buying before positioning for an extension of the recent recovery from the 0.9950 area, or the lowest level since December 2002 touched last week.

Traders eye Eurozone CPI, US housing market data

Tuesday's economic docket features the release of the final Eurozone Harmonised Index of Consumer Prices (HICP) and the US housing market data - Building Permits and Housing Starts. This, along with the US bond yields, might influence the USD price dynamics and allow traders to grab short-term opportunities around the EURUSD pair.

EURUSD price technical outlook

-637938161372688607.png)