- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 06-04-2020

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 01:30 | Australia | ANZ Job Advertisements (MoM) | March | 0.7% | -2.9% |

| 01:30 | Australia | Trade Balance | February | 5.21 | |

| 04:30 | Australia | Announcement of the RBA decision on the discount rate | 0.25% | ||

| 04:30 | Australia | RBA Rate Statement | |||

| 05:00 | Japan | Leading Economic Index | February | 90.5 | 90.4 |

| 05:00 | Japan | Coincident Index | February | 95.2 | 95.1 |

| 06:00 | Germany | Industrial Production s.a. (MoM) | February | 3% | -0.8% |

| 06:45 | France | Trade Balance, bln | February | -5.887 | -4.93 |

| 07:00 | Switzerland | Foreign Currency Reserves | March | 769 | |

| 07:30 | United Kingdom | Halifax house price index | March | 0.3% | 0.2% |

| 07:30 | United Kingdom | Halifax house price index 3m Y/Y | March | 2.8% | |

| 08:00 | Eurozone | Eurogroup Meetings | |||

| 14:00 | U.S. | JOLTs Job Openings | February | 6.963 | 6.476 |

| 14:00 | Canada | Ivey Purchasing Managers Index | March | 54.1 | |

| 19:00 | U.S. | Consumer Credit | February | 12.02 | 14 |

| 23:50 | Japan | Core Machinery Orders | February | 2.9% | -2.7% |

| 23:50 | Japan | Current Account, bln | February | 612 | 3061.9 |

| 23:50 | Japan | Core Machinery Orders, y/y | February | -0.3% | -2.9% |

- Says White House advisers have been discussing the possibility of a coronavirus-related U.S. Treasury bond

- Thinks "war bond" is great idea

- Says this would be a long-term investment into "future of American health, safety and the economy"

- Thinks the concept is "exactly right", technical considerations aside

- Sales have collapsed for businesses in some consumer-oriented industries and energy firms have experienced a dramatic increase in economic and financial stress;

- Sales outlook for businesses tied to the energy sector had weakened significantly because of falling oil prices

- Amid softening domestic demand, businesses planned modest increases in capital spending on machinery and equipment in next 12 months;

- Balance of opinion on employment intentions has continued to trend downward since mid-2018 to below its historical average;

- While businesses anticipated input prices to grow slightly faster, they expected to increase their output prices at a marginally slower pace due to competitive pressures;

- Inflation expectations continued to edge up toward 2 percent target midpoint of BoC's inflation-control range;

- BOS indicator fell below zero (to -0.68 from +0.75 in previous survey), signaling that business sentiment had softened even before the COVID‑19 shock intensified. Results for several BOS questions fell to levels slightly below or near their historical average, often reflecting widespread weakness in the energy-producing regions and an easing in activity, sometimes from high levels.

- Says Norway was invited to attend Thursday's OPEC+ meeting

- Says no ongoing talks with oil companies about cuts

FXStreet reports that strategists at TD Securities note that risk markets are enjoying some recovery this morning but, as expected, the balance of risks have been to the downside for crude oil.

“The Monday global OPEC+ meeting was too optimistic for the group to reach a negotiated agreement, and the meeting has been pushed to Thursday.”

“Prices are still holding relatively firm as optimism is high that an eventual deal will be struck, with many referencing the 10m bpd figure.”

“In our view, a double-digit cut is only plausible should the United States participate in the cuts, which at this point, seems to have a high hurdle for success as President Trump's communications suggest the country is not ready to commit to such an agreement.

“With negotiations ongoing, two-way risks remain particularly high. Nonetheless, the longer it takes to come to an agreement the more inventories swell and the more detrimental the demand shock will prove to be, which suggests even a large cut will not be enough to offset the shock, at least in the near-term.”

The BoE says its Term Funding Scheme with additional incentives for small and medium-sized enterprises (SMEs) will open to drawings on 15 April 2020, sooner than previously anticipated.

FXStreet reports that analysts at Raobank note European investors have seen value in the pound this morning after it was sold off overnight with EUR/GBP pulling back to levels held around the European close on Friday.

“The UK GfK consumer confidence survey unsurprisingly showed a sharp fall. The headline figure for the final March reading was -34, down from a February reading of -9.”

“Fears that this year’s virus-associated recession could be lengthened by the inability of the UK and the EU to sort out a trade deal before the start of 2021 could enhance downside potential for GBP.”

“Tomorrow, there will be a call between Eurozone finance ministers. A continued failure to compromise could widen the perceived cracks in the Eurozone and weigh on the EUR.”

“While Eurozone politics could limit downside pressure for EUR/GBP in the coming weeks, we expect cable will remain soft. We see scope for another dip to 1.19 on a 3-month view.”

- It marks the first rate cut in five years

- Announces it will expand plan through which repo transactions are carried out vis-à-vis financial entities, so that the agreements can include corporate bonds (in addition to government bonds) as security

- Says it will also provide monetary loans to banks for three-year term, with fixed interest rate of 0.1%

FXStreet reports that according to economists at the National Bank of Canada (NBF), the Canadian dollar lost 6% against the USD in March, its worst monthly performance in five years. Granted, the economy is now in recession and GDP growth this year is set to be the worst ever recorded.

“The downgrade to our 2020 forecasts for world GDP growth and OPEC/Russia price war prompted us to lower our projections for oil prices. WTI oil is now expected to average around $28/barrel this year.”

“Lower oil prices translate to a lower path for the Canadian dollar than anticipated earlier. We now see USD/CAD heading past 1.45 by mid-year before moving back down later in the year as WTI recovers.”

U.S. stock-index futures surged on Monday, as investors digested signs that the COVID-19 situation could be improving.

Global Stocks:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Nikkei | 18,576.30 | +756.11 | +4.24% |

| Hang Seng | 23,749.12 | +513.01 | +2.21% |

| Shanghai | 2,763.99 | -16.65 | -0.60% |

| S&P/ASX | 5,286.80 | +219.30 | +4.33% |

| FTSE | 5,529.75 | +114.25 | +2.11% |

| CAC | 4,297.70 | +143.12 | +3.44% |

| DAX | 9,959.13 | +433.36 | +4.55% |

| Crude oil | $27.26 | | -3.81% |

| Gold | $1,674.10 | | +1.73% |

FXStreet reports that Head of Research at UOB Group Suan Teck Kin reviewed the recently announced RRR cut by the PBoC.

“PBoC last Friday (3 Apr) announced the third reserve requirement ratio (RRR) of the year, targeting at smaller banks to support small and medium enterprises (SMEs). This comes as no surprise because it was flagged at the State Council meeting just days earlier."

“PBoC also announced the lowering of the interest rate paid on excess reserves to 0.35% from 0.72%. This is the first reduction of since 2008, and the magnitude is also larger compared to the 27bps move twelve years ago. As this rate acts as a lower bound in the interest rate corridor, the latest cut will effectively “force” other interest rates to move lower as well.”

“With the COVID-19 pandemic continues to spread outside of mainland China, we see scope for another one to two rounds of RRR cut in the next 3-6 months, along with a gradual decline in the benchmark 1Y loan prime rate (LPR).”

- UK will not extend Brexit transition period

- Both sides continue to analyze legal texts, talks continue remotely

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 137.7 | 3.91(2.92%) | 16751 |

| ALCOA INC. | AA | 6.22 | 0.25(4.19%) | 48799 |

| ALTRIA GROUP INC. | MO | 38.69 | 1.28(3.42%) | 12285 |

| Amazon.com Inc., NASDAQ | AMZN | 1,939.00 | 32.41(1.70%) | 61928 |

| American Express Co | AXP | 77.29 | 3.69(5.01%) | 19026 |

| AMERICAN INTERNATIONAL GROUP | AIG | 21.5 | 1.04(5.08%) | 11815 |

| Apple Inc. | AAPL | 249.95 | 8.54(3.54%) | 535865 |

| AT&T Inc | T | 28.2 | 0.74(2.69%) | 302916 |

| Boeing Co | BA | 131.01 | 6.49(5.21%) | 504187 |

| Caterpillar Inc | CAT | 117.57 | 2.90(2.53%) | 6831 |

| Chevron Corp | CVX | 76.38 | 1.27(1.69%) | 52187 |

| Cisco Systems Inc | CSCO | 40.66 | 1.60(4.10%) | 201086 |

| Citigroup Inc., NYSE | C | 39.15 | 1.66(4.43%) | 190011 |

| Deere & Company, NYSE | DE | 139.99 | 4.47(3.30%) | 180 |

| E. I. du Pont de Nemours and Co | DD | 33 | 1.13(3.55%) | 3063 |

| Exxon Mobil Corp | XOM | 40.22 | 1.01(2.58%) | 190373 |

| Facebook, Inc. | FB | 159.95 | 5.77(3.74%) | 155464 |

| FedEx Corporation, NYSE | FDX | 112 | 2.78(2.55%) | 3030 |

| Ford Motor Co. | F | 4.43 | 0.19(4.48%) | 544960 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 6.63 | 0.31(4.90%) | 45288 |

| General Electric Co | GE | 7.02 | 0.29(4.31%) | 813723 |

| General Motors Company, NYSE | GM | 18.85 | 0.81(4.49%) | 68527 |

| Goldman Sachs | GS | 152.99 | 6.06(4.12%) | 12613 |

| Google Inc. | GOOG | 1,138.22 | 40.34(3.67%) | 15738 |

| Hewlett-Packard Co. | HPQ | 15 | 0.52(3.59%) | 18588 |

| Home Depot Inc | HD | 185 | 6.30(3.53%) | 12449 |

| HONEYWELL INTERNATIONAL INC. | HON | 131.5 | 4.05(3.18%) | 2862 |

| Intel Corp | INTC | 56.49 | 2.36(4.36%) | 148006 |

| International Business Machines Co... | IBM | 109.5 | 3.16(2.97%) | 16855 |

| International Paper Company | IP | 30.25 | 0.88(3.00%) | 250 |

| Johnson & Johnson | JNJ | 137.25 | 3.08(2.30%) | 30028 |

| JPMorgan Chase and Co | JPM | 87.59 | 3.54(4.21%) | 186047 |

| McDonald's Corp | MCD | 166.74 | 6.41(4.00%) | 15276 |

| Merck & Co Inc | MRK | 79 | 2.75(3.61%) | 13155 |

| Microsoft Corp | MSFT | 159.85 | 6.02(3.91%) | 529188 |

| Nike | NKE | 81.6 | 2.74(3.47%) | 129653 |

| Pfizer Inc | PFE | 34.56 | 0.92(2.73%) | 42692 |

| Procter & Gamble Co | PG | 117.76 | 2.68(2.33%) | 9593 |

| Starbucks Corporation, NASDAQ | SBUX | 64.77 | 1.72(2.73%) | 136588 |

| Tesla Motors, Inc., NASDAQ | TSLA | 503.6 | 23.59(4.91%) | 408966 |

| The Coca-Cola Co | KO | 45.4 | 1.57(3.58%) | 40043 |

| Twitter, Inc., NYSE | TWTR | 23.95 | 0.86(3.72%) | 171499 |

| UnitedHealth Group Inc | UNH | 236.3 | 6.81(2.97%) | 5674 |

| Verizon Communications Inc | VZ | 55.79 | 1.09(1.99%) | 31518 |

| Visa | V | 158.12 | 6.27(4.13%) | 54359 |

| Wal-Mart Stores Inc | WMT | 120.36 | 0.88(0.74%) | 21382 |

| Walt Disney Co | DIS | 97.65 | 3.77(4.02%) | 103401 |

| Yandex N.V., NASDAQ | YNDX | 33.6 | 1.22(3.77%) | 35214 |

Walmart (WMT) target raised to $135 from $132 at Telsey Advisory Group

Starbucks (SBUX) downgraded to Neutral from Overweight at JP Morgan; target lowered to $55

Intel (INTC) upgraded to Mkt Perform from Underperform at Raymond James

Tesla (TSLA) upgraded to Buy from Hold at Jefferies; target lowered to $650

eBay (EBAY) upgraded to Buy from Neutral at Guggenheim

FXStreet reports that economist at UOB Group Lee Sue Ann believes the RBA will keep the overnight cash rate (OCR) unchanged at this week’s meeting.

“We think the RBA will not be changing the OCR for at least some time. In terms of QE, RBA Governor Philip Lowe emphasised that the Board did not take the latest decisions lightly. We believe this is probably the start, and not the end, of measures the RBA will eventually have to undertake to cushion the impact from COVID-19.”

- Says Johnson is in good spirits and is undergoing routine tests

- Issue is that PM's symptoms have remained persistent

FXStreet reports that analysts at Westpac Institutional Bank take a look at the outlook of the kiwi against the US dollar and the Aussie.

“NZD/USD is vulnerable to falling below 0.5845 near-term USD remains strong amid global risk aversion.”

“NZD/AUD should consolidate around 1.0200 while market digests RBNZ QE, but should eventually retest 1.0000 as the Aussie is more sensitive to global sentiment.”

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 06:00 | Germany | Factory Orders s.a. (MoM) | February | 4.8% | -2.4% | -1.4% |

| 08:30 | Eurozone | Sentix Investor Confidence | April | -17.1 | -42.9 | |

| 08:30 | United Kingdom | PMI Construction | March | 52.6 | 44 | 39.3 |

JPY fell against other major currencies in the European session on Monday after Japan's Prime Minister Shinzo Abe told Japanese media he plans to declare the state of emergency in 7 prefectures to stop coronavirus on Tuesday. According to the PM, emergency will last about a month but it will not lead to lockdown steps like seen in overseas cities. The seven prefectures involved will be Tokyo, Osaka, Chiba, Kanagawa, Hyogo, Saitama and Fukuoka.

Abe also announced a larger-than-expected stimulus package of JPY 108 trillion to support households and businesses, struggling from the impact of COVID-19.

In addition, investors are awaiting the announcement of the details of a massive package of economic measures, recommended by Abe's ruling party last week, which are expected to be announced on Tuesday as well.

Japan's PM will hold a press briefing tomorrow at 10:00 GMT.

Meanwhile, GBP strengthened against most its major rivals, including USD, EUR, JPY and CHF, after the UK's housing minister Robert Jenrick said that Prime Minister Boris Johnson, who was admitted to hospital on Sunday night due to persistent symptoms of Covid-19, is "doing well" and is expected to be back at his office "shortly".

FXStreet reports that in opinion of FX Strategists at UOB Group, the chances of USD/CNH to break above the 7.1700 area have lost traction as of late.

24-hour view: “USD traded between 7.0929 and 7.1195 last Friday, much narrower than our expected range of 7.0650/7.1250. The price action offers no fresh clues and USD is likely to continue to consolidate for now. Expected range for today, 7.0900/7.1250.”

Next 1-3 weeks: “There is not much to add to the update from Monday (30 Mar). As highlighted, the chance for USD to break above 7.1700 has diminished. However, only a breach of 7.0450 (‘strong support’ level previously at 7.0350) would indicate that the current upward pressure has eased. Looking ahead, a break of 7.0450 would suggest USD could spend trade in a broad range for a period.”

- Transmission of lockdown to pandemic control should be as quick as possible

- Hospitals should have enough capacity to treat people

- Infection rate must remain below 1, can be done without extensive lockdown

- Suspected cases should stay at home or in quarantine hotels if the infection rate is maintained below 1

- Proposing opening of retail stores and restaurants but limiting the number of people in closed rooms if the infection rate is maintained below 1

- Proposing a regional opening of schools and educational institutions if the infection rate is maintained below 1

- Proposing developing a system of controls at the EU borders, open borders within the Schengen area

Currencies: The last thing the world needs is a stronger USD – Nordea

FXStreet reports that analysts at Nordea note that with the massive issuance upcoming in the U.S., either the Fed will have to buy almost everything or else the USD needs to weaken to attract foreign purchases of U.S. Treasuries again.

“Essentially no one wants a strong USD currently, but that doesn’t necessarily mean that it will weaken. A stronger dollar generally tightens financial conditions outside of the US, which is kind of counterintuitive since weaker currencies outside of the US in principle should lead to a competitive advantage.”

“Some reasons why a strong USD is bad news for growth are that EM countries have borrowed in USD, firms who have borrowed in dollars see debt burdens grow in local currency and the financial sector also empirically becomes less keen to lend out when the USD is strong.”

“The last thing the world needs right now is an even stronger USD; in such case, we wouldn’t rule out a new Plaza accord like attempt to weaken the USD in a coordinated way. Everyone’s in the same boat now.”

FXStreet reports that FX Strategists at UOB Group believe USD/JPY could be headed to the 110.40 area in the near term.

24-hour view: “We expected USD to ‘extend its gains’ last Friday but were of the view “108.75 could be out of reach”. USD subsequently rose to 108.67 and closed at 108.45 but has since moved above 108.75 this morning. Rapid improvement in upward momentum suggests further USD gains towards 109.40 from here. The next resistance at 110.00 is likely out of reach. Support is at 108.40 followed by 108.00.”

Next 1-3 weeks: “We highlighted last Friday (03 Apr, spot at 108.00) that ‘risk of a short-term bottom has increased’. The breach of the 108.75 ‘strong resistance’ level earlier this morning indicates that last Tuesday (01 Apr) low of 106.89 is a short-term bottom. The near-term bias is for USD to test the 110.40 level from here. A clear break of this level would indicate USD could extend towards last month’s top at 111.71. On the downside, only a breach of 107.30 (‘strong support’ level) would indicate that the current upward pressure has eased.”

- Seven prefectures involved will be Tokyo, Osaka, Chiba, Kanagawa, Hyogo, Saitama and Fukuoka

- Says emergency will last about a month

- It will give governors authority to call on people to stay at home and businesses to close, but not to order kind of lockdowns seen in other countries

- The official declaration will be made as soon as Tuesday

- Plans to announce stimulus package of around JPY108 trillion to support households and businesses struggling from impact of coronavirus

- Will spend over JPY6 trillion for payouts to households, firms

- Says preparation for talks are ongoing

- Moscow is ready for cooperation with other oil exporters to help stabilize oil market

- Russia's president Putin has no plans so far for talks with Saudi, Trump; has no plans to meet Russian oil producers

FXStreet reports that the Reserve Bank of Australia (RBA) is set to announce its Interest rate Decision on Tuesday, 7 April at 04:30 GMT. Economists at TD Securities analyze three possible scenarios and the implications for the AUD/USD pair.

"We expect the RBA to keep the cash rate on hold at 0.25%. We don't anticipate the RBA to announce any adjustments to policy, but any indication on volume and frequency of purchases will garner attention."

"Dovish (20% prob): The RBA implies the pace of bond buying could increase. Points to risks of inflation falling sharply lower. AUD/USD at 0.59."

"Neutral Base Case (60% prob): The RBA had not been able to develop a set of forecasts given the heightened uncertainty and its confidence on the timing of the recovery still remains uncertain. Don't expect the Bank to reveal any information on the pace of bond buying, will assess and monitor. AUD/USD at 0.6050."

"Hawkish (20% prob): The pace of bond buying is expected to decrease. Global Central bank initiatives have made a difference, and are expected to see further improvements going ahead. The Bank indicates buying longer-dated bonds is NOT on the agenda. AUD/USD at 0.6185."

CNBC reports that according to Fitch Solutions forecasts Brent crude futures could plunge to "single-digit lows" if major oil producers fail to reach a deal to cut output at a time when demand has collapsed due to the coronavirus pandemic.

The Organization of the Petroleum Exporting Countries and its allies are expected to meet on Thursday - a delay from Monday - in an attempt to agree on production cuts. A previous deal by the group - commonly known as OPEC+ - expired in March after Saudi Arabia and Russia failed to reach an agreement. The fallout sent oil prices plummeting to multi-year lows.

The expiry of the deal means that producers are free to increase output this month, with Saudi Arabia, United Arab Emirates and Russia among those saying that they would do so.

Analysts from Fitch Solutions said a fall in demand and an increase in supply could result in more than 20 million barrel per day of excess oil. That would put the oil market under "extreme physical pressure," they wrote in the report published before the OPEC+ meeting was postponed.

"While it is unlikely that nominal storage capacity will be breached, it is possible that the sheer scale of the oversupply will overwhelm global logistics chains, plunging Brent into single-digit lows," the analysts added.

FXStreet reports that the most common question received by Neil Shearing from Capital Economics was whether the Coronavirus shock would be inflationary or disinflationary. The answer depends in part on the timeframe under consideration.

"Over the next month or so, while economies are in lockdown, for many parts of the CPI basket the shock will be neither inflationary or deflationary."

"If oil levels out at around $25pb, we estimate that the drop in prices will knock around 1.5%-pts off headline inflation in advanced economies by the end of Q2."

"Over 2020 as a whole, we've pushed down our forecasts for headline inflation in advanced economies from 1.6% to 0.3%, and core inflation down from 1.6% to 1.2%."

According to the report from Sentix, the corona virus is holding the world economy in a stranglehold. Never before has the assessment of the current situation collapsed so sharply in all regions of the world within one month. In Euroland, the overall index is falling to an all-time low. The USA is now also in a full downward spiral. The region Asia ex Japan (China) sends the only glimmer of hope: economic expectations there at least signal no deterioration. A quick V-recovery of the economy is not to be expected.

The economy in Euroland is in a deep recession. The corona crisis and the simultaneous worldwide shutdown is essentially bringing economic activity to a standstill. Never before has the current situation in Euroland (-66.0 points) been assessed so negatively as at the current edge. We also note a negative record of -42.9 points in the overall index. The massive deterioration of the previous month is thus continuing, and the full force of the recession is only much stronger!

The outline of the current assesment component is unparalleled in the history of sentix: The monthly change of -51.75 points is an absolute record since the beginning of the sentix data collection in 2003. The figures underscore the dramatic economic situation in the euro zone.

When analysing such breakdowns, not only the rate of change should be taken into account, but also the level at which this change takes place. The disruption takes place from a negative previous value of -14.3 (already recessive) to -66 points. The situation is therefore much worse than in 2009. Economic forecasts to date underestimate the shrinking process. The recession will go much deeper and longer! There is an enormous need for revision in the already reduced forecasts of many institutes.

March data from IHS Markit/CIPS pointed to the fastest downturn in UK construction output for almost eleven years as emergency public health measures to halt the spread of coronavirus 2019 (COVID-19) led to stoppages of work on site and a slump in new orders.

The headline seasonally adjusted UK Construction Total Activity Index dropped to 39.3 in March from 52.6 in February, to signal the steepest fall in construction output since April 2009. Survey respondents overwhelmingly attributed reduced activity to the impact of the COVID-19 pandemic.

All three broad categories of construction work recorded a fall in output during March. Civil engineering activity (index at 34.4) saw the steepest rate of decline, followed closely by commercial building work (index at 35.7). Residential activity dropped at a comparatively modest pace in March, with the equivalent index posting 46.6. However, construction companies often commented on an expected slump in house building from stoppages on site amid increasing measures to slow the spread of COVID-19.

New work received by construction companies fell at a sharp rate in March, with the downturn in order books the fastest recorded by the survey since August 2019. Lower workloads and business closures resulted in a marked reduction in staffing numbers across the construction sector during March. The latest survey indicated the steepest pace of job shedding since September 2010.

Meanwhile, latest data indicated a slump in business expectations across the UK construction sector. Survey respondents are more pessimistic about the year ahead outlook than at any time since October 2008, which was almost exclusively attributed to the economic impact of the COVID-19 pandemic.

According to the report from Society of Motor Manufacturers and Traders (SMMT), the UK new car market declined -44.4% in March. In the important plate change month 203,370 fewer cars were registered than in March 2019, as showrooms closed in line with government advice to contain the spread of the coronavirus.

The performance represented a steeper fall than during the 2009 financial crisis and the worst March since the late nineties when the market changed to the bi-annual plate change system. With lockdowns taking place in many European countries earlier than the UK, even more dramatic falls have been reported elsewhere, with Italy down -85%, France -72% and Spain down -69% in March.

In total, 254,684 new cars were registered in the month, with demand from private buyers and larger fleets falling by -40.4% and -47.4% respectively. Meanwhile the numbers of petrol and diesel cars joining the road were down -49.9% and 61.9%.

There was some good news for early adopters, who were able to take delivery of the latest alternatively fuelled cars before the crisis took hold in the UK. Registrations of battery electric vehicles (BEVs) rose almost three-fold in the month to 11,694 units, accounting for 4.6% of the market, while plug-in hybrids (PHEVs) grew 38.0%. Uptake of hybrid electric vehicles (HEVs), however, fell -7.1%.

FXStreet reports that an oil supply cut would likely be dependent on non-OPEC participation including the US, which in effect, is happening already given the difficult conditions facing producers, strategists at Rabobank apprise.

"We see strong support for a global coordinated cut to occur, as in effect, it is already happening."

"We see scope for higher oil prices in the near-term should a global production deal come to fruition."

"The speculative interest is largely 'short' at the moment including trend followers, momentum traders, and 'carry' strategies. These 'shorts' are now at risk of giving back a large portion of recent gains should a global supply cut be put in place but much will depend on how quickly the virus-related demand losses begin to recover in the weeks and months ahead."

According to the report from IHS Markit, measures to limit the spread of the coronavirus disease 2019 (COVID-19) severely impacted the eurozone construction sector in March, with construction activity falling sharply as new orders slumped. The downturn in the sector was accompanied by job shedding. Input purchases plummeted as construction work fell, with firms also facing great difficulty securing inputs due to supply chain disruptions. Delivery times lengthened at a pace not seen in the 20-year survey history. Business expectations turned negative for the first time for nearly four-and-a-half years.

The Eurozone Construction PMI plunged from 52.5 in February to 33.5 in March, pointing to the steepest decline in construction activity across the currency area since February 2009 during the global financial crisis. The downturn in construction activity was broad based across the eurozone, with Italy recording the sharpest decline. Germany registered the slowest contraction of construction output, albeit still marked overall.

CNBC reports that President Donald Trump on Sunday reiterated his threat to target foreign oil as global producer infighting continues to impact the price of crude, saying he could impose 'very substantial tariffs' to protect the American energy industry but doesn't think he will need to do so.

"I would use tariffs, if I had to. I don't think I'm going to have to," Trump said at a White House briefing on the coronavirus. Trump on Saturday also signaled a willingness to implement tariffs on foreign oil.

The president said he thought there would ultimately be an agreement on production levels between Saudi Arabia and Russia.

Along with a sharp reduction in demand from the coronavirus pandemic, disagreements on production cuts between Saudi Arabia and Russia that began in early March has caused the price of crude oil to fall dramatically. "It's obviously very bad for them," Trump said of low oil prices.

Last week, Trump told that he was anticipating a production cut of up to 15 million barrels to be announced by the leaders of Russia and Saudi Arabia.

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 00:00 | Australia | MI Inflation Gauge, m/m | March | 0.3% | ||

| 06:00 | Germany | Factory Orders s.a. (MoM) | February | 4.8% | -2.4% | -1.4% |

During today's Asian trading, the euro rose against the US dollar and the yen, the pound fell on reports of the hospitalization of the country's Prime Minister Boris Johnson, who was previously diagnosed with a coronavirus.

Johnson, who is being treated for the COVID-19 coronavirus, was taken to hospital on Monday night, British media reported. Johnson is expected to undergo medical tests and tests there.

The ICE index, which tracks the dollar's performance against six currencies (Euro, Swiss franc, yen, canadian dollar, pound sterling and Swedish Krona), rose 0.05%.

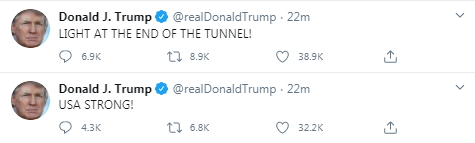

US President Donald Trump hopes that the US will be able to overcome the spread of COVID-19 in the country soon and not reach the previously predicted 100,000 deaths. "We are beginning to see light at the end of the tunnel and hope that in the near future we will be very proud of the work that we have all done," Trump said during a white house briefing.

Authorities in New York, the US state most affected by the virus, said on Sunday that for the first time in a week, the death rate fell slightly.

Meanwhile, James Bullard, the president of the Federal Reserve Bank of St. Louis, said that universal testing for the disease can support the economy in the face of an epidemic. According to him, this will allow people to "interact with each other with more confidence."

Bullard also noted that it is not necessary to compare the latest data on the American labor market with previous recessions, since the reduction in the number of jobs was the result of the actions of the authorities.

FXStreet reports that EUR/USD risks further downside, although a move to YTD lows at 1.0635 could be premature for the time being, according to FX Strategists at UOB Group.

24-hour view: "We highlighted last Friday that EUR 'is likely to weaken to 1.0785' but added, 'the next support at 1.0750 is likely out of reach'. EUR subsequently dropped to 1.0771 before recovering. Downward pressure has eased with the rebound and the risk of a break of 1.0750 remains low. From here, EUR could edge higher towards 1.0860. For today, a move above 1.0900 is unlikely. On the downside, 1.0775 is acting as a strong support ahead of 1.0750."

Next 1-3 weeks: "The ease by which EUR took out the strong support at 1.0840 came as a surprise (overnight low of 1.0819). The rapid decline and the subsequent weak daily closing in NY (1.0856, -0.96%) suggest there is room for EUR to weaken further in the coming days. At this stage, it is premature to expect EUR to revisit last month's low at 1.0635 (there is a relatively strong support at 1.0700). Meanwhile, EUR is expected to stay under pressure unless it can move above 1.0980 ('strong resistance' level)."

According to the report from Federal Statistical Office (Destatis), in February, the coronavirus pandemic did not yet have any notable impact on new orders in Germany. Price adjusted new orders in manufacturing fell a seasonally and calendar adjusted 1.4% in February 2020 on the previous month. Economists had expected a 2.4% decrease.

Price-adjusted new orders without major orders in manufacturing increased in February 2020 a seasonally and calendar adjusted 1.1% on the previous month. The data on new orders and turnover do not include the current results of the local units in Rheinland-Pfalz; these figures were estimated.

Domestic orders increased by 1.7% and foreign orders fell by 3.6% in February 2020 on the previous month. New orders from the euro area went down 5.0%, and new orders from other countries decreased by 2.7% compared with January 2020.

In February 2020 the manufacturers of intermediate goods saw new orders increase by 0.9% compared with January 2020. The manufacturers of capital goods saw a decrease of 3.4% on the previous month. Regarding consumer goods, new orders rose 1.7%.

For January 2020, revision of the preliminary outcome resulted in an increase of 4.8% compared with December 2019 (provisional: +5.5%)..

-

CNBC reports that Singapore's health ministry said that around 19,800 foreign resident workers housed in two dormitories have been placed under a 14-day quarantine due to the growing number of confirmed infection cases from those places.

-

Apple will produce 1 million face shields per week for medical workers, CEO Tim Cook said.

-

At least 69,309 people worldwide have died from coronavirus-related complications, according to the latest numbers from Johns Hopkins University.

-

South Korea reported 47 new cases of infection, one of the lowest daily reported numbers for the country since late February when the outbreak spread exponentially.

-

Global cases: More than 1.27 million

-

Global deaths: At least 69,300

-

Most cases reported: United States (337,072), Spain (131,646), Italy (128,948), Germany (100,123), and France (93,773)

EUR/USD

Resistance levels (open interest**, contracts)

$1.1028 (659)

$1.0997 (576)

$1.0970 (223)

Price at time of writing this review: $1.0811

Support levels (open interest**, contracts):

$1.0714 (1730)

$1.0687 (1679)

$1.0656 (1454)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date May, 8 is 60268 contracts (according to data from April, 2) with the maximum number of contracts with strike price $1,0600 (2971);

GBP/USD

Resistance levels (open interest**, contracts)

$1.2555 (203)

$1.2504 (285)

$1.2463 (129)

Price at time of writing this review: $1.2219

Support levels (open interest**, contracts):

$1.2127 (570)

$1.2078 (400)

$1.2019 (292)

Comments:

- Overall open interest on the CALL options with the expiration date May, 8 is 11318 contracts, with the maximum number of contracts with strike price $1,3550 (780);

- Overall open interest on the PUT options with the expiration date May, 8 is 12969 contracts, with the maximum number of contracts with strike price $1,2850 (1073);

- The ratio of PUT/CALL was 1.15 versus 1.15 from the previous trading day according to data from April, 2

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 33.22 | 18.77 |

| WTI | 27.56 | 15.85 |

| Silver | 14.34 | -0.76 |

| Gold | 1615.007 | 0.2 |

| Palladium | 2147.62 | -2.79 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | 1.47 | 17820.19 | 0.01 |

| Hang Seng | -43.95 | 23236.11 | -0.19 |

| KOSPI | 0.58 | 1725.44 | 0.03 |

| ASX 200 | -86.8 | 5067.5 | -1.68 |

| FTSE 100 | -64.72 | 5415.5 | -1.18 |

| DAX | -45.05 | 9525.77 | -0.47 |

| CAC 40 | -66.38 | 4154.58 | -1.57 |

| Dow Jones | -360.91 | 21052.53 | -1.69 |

| S&P 500 | -38.25 | 2488.65 | -1.51 |

| NASDAQ Composite | -114.23 | 7373.08 | -1.53 |

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:00 | Australia | MI Inflation Gauge, m/m | March | 0.3% | |

| 01:30 | Australia | ANZ Job Advertisements (MoM) | March | 0.7% | -2.9% |

| 06:00 | Germany | Factory Orders s.a. (MoM) | February | 5.5% | -2.4% |

| 08:30 | Eurozone | Sentix Investor Confidence | April | -17.1 | |

| 08:30 | United Kingdom | PMI Construction | March | 52.6 | 44 |

| 14:30 | Canada | Bank of Canada Business Outlook Survey | |||

| 22:00 | New Zealand | NZIER Business Confidence | Quarter I | -21% | |

| 22:30 | Australia | AIG Services Index | March | 47.0 | |

| 23:30 | Japan | Labor Cash Earnings, YoY | February | 1.5% | 2.1% |

| 23:30 | Japan | Household spending Y/Y | February | -3.9% | -3.9% |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.5993 | -1.06 |

| EURJPY | 117.262 | 0.18 |

| EURUSD | 1.08114 | -0.37 |

| GBPJPY | 133.058 | -0.48 |

| GBPUSD | 1.22681 | -1.01 |

| NZDUSD | 0.58569 | -0.94 |

| USDCAD | 1.42012 | 0.53 |

| USDCHF | 0.97615 | 0.38 |

| USDJPY | 108.452 | 0.58 |

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.