- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 06-06-2014

Stock

indices climbed due to the better-than-excepted U.S. jobs. The U.S. economy

added 217,000 in May, missing expectations for a 218,000 rise, after a 282,000

gain in April. April’s figure was revised down from a 288,000 increase.

The

unemployment rate in the U.S. remained unchanged at 6.3% in May. Analysts had

expected an increase to 6.4%.

Earlier in

the trading session, German economic data was released. Germany's trade surplus

climbed to €17.7 billion in April from €15.0 billion in March. March’s figure

was revised up from a surplus of €14.8 billion. Analysts had expected Germany’s

trade surplus to increase to €15.2 billion.

German

industrial production rose 0.2% in April, missing expectations for a 0.4% gain,

after a 0.5% decline in March. On a yearly basis, the industrial production in

Germany increased 1.8% in April, after a 3.0% rise in March.

Germany’s

current account surplus declined to €18.4 billion in April from €19.5 billion

in March.

Indexes on

the close:

Name Price Change Change %

FTSE

100 6,858.21 +44.72 +0.66%

DAX 9,987.19 +39.36 +0.40%

CAC 40 4,581.12 +32.39 +0.71%

Commerzbank

AG rose 4.2% after the company’s CEO said the ECB’s audit would not be a

problem for the bank.

Oil prices stabilized today, supported by optimism that the monetary stimulus in the euro zone will raise economic growth and fuel demand.

"At best, we can assume that demand could grow by investors who are in pursuit of profit can benefit from additional liquidity for the purchase of futures contracts. On the other hand, the number of net long speculative positions on Brent and WTI has reached very significant levels, limit the potential for growth. Meanwhile any significant impact on demand for physical oil from measures announced yesterday the ECB is unlikely "- believed to Commerzbank.

Investors also focused on the U.S. data, which almost coincided with the forecast and increased confidence that the world's largest economy is on the road to recovery.

According to the report the Ministry of Labour in the United States in May was created 217 thousand new jobs outside agriculture against 288 thousand jobs in the previous month. Meanwhile, analysts predicted that the reporting month will be created 219 thousand new jobs. We also add that the U.S. unemployment rate at the end of May was 6.3% from the previous month and has not changed. Analysts had forecast a rise in unemployment to 6.4%.

Positive dynamics of today is also largely due to their speculative purchases. Brent crude on the eve quotes first time in nearly four weeks slipped below the price level of $ 108 per barrel, while WTI crude oil quotes first time in three weeks dropped below $ 102 per barrel, providing favorable conditions for opening long positions.

Market participants are also watching the situation in Ukraine. "Tensions between Russia and Ukraine slept a little after the elections in Ukraine", - said the director of the analysis of commodity markets Asia Societe Generale Mark Keenan.

It should also be noted that U.S. President Barack Obama on Thursday advised the Russian leader Vladimir Putin to recognize the new government of Ukraine to enter into dialogue with them and to stop "provocations" along the Ukrainian border threatened new sanctions by the "Group of Seven".

Today, Russian President Vladimir Putin met with Petro Poroshenko during the celebrations of the 70th anniversary of the landing Hitler allies in Normandy. Media reported that Poroshenko said Putin in the presence of German Chancellor Angela Merkel. As it became known later, Poroshenko and Vladimir Putin held a meeting that lasted 15 minutes, and it was after she shook hands. According to the report, Poroshenko discussed with Putin economic consequences of the crisis in Ukraine, and soon they can move on to discussing the details of the peace settlement of the situation in Ukraine.

The cost of the July futures on U.S. light crude oil WTI (Light Sweet Crude Oil) rose to $ 102.70 per barrel on the New York Mercantile Exchange (NYMEX).

July futures price for North Sea Brent crude oil mixture fell 30 cents to $ 108.52 a barrel on the London exchange ICE Futures Europe.

The U.S.

dollar traded higher against the most major currencies after the mixed U.S.

jobs market data. The unemployment rate in the U.S. remained unchanged at 6.3%

in May. Analysts had expected an increase to 6.4%.

The U.S.

economy added 217,000 in May, missing expectations for a 218,000 rise, after a

282,000 gain in April. April’s figure was revised down from a 288,000 increase.

These

figures seem to be another sign that the U.S. economy gaining the kind of

sustained momentum.

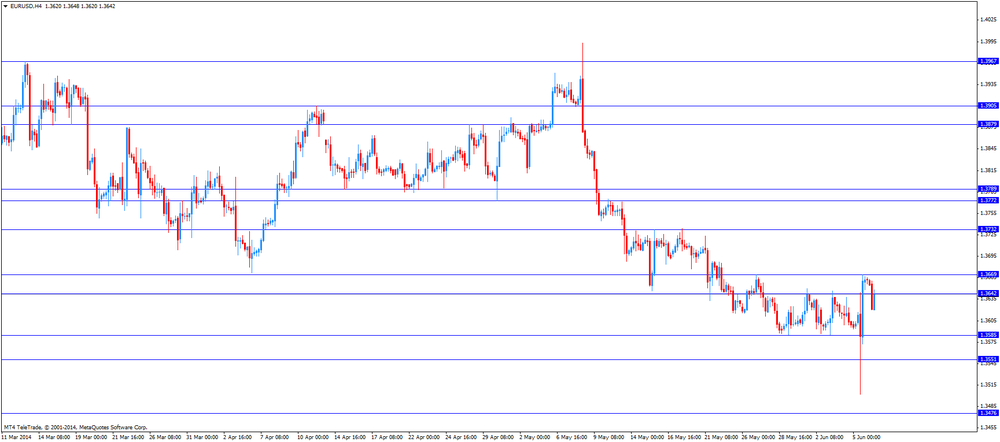

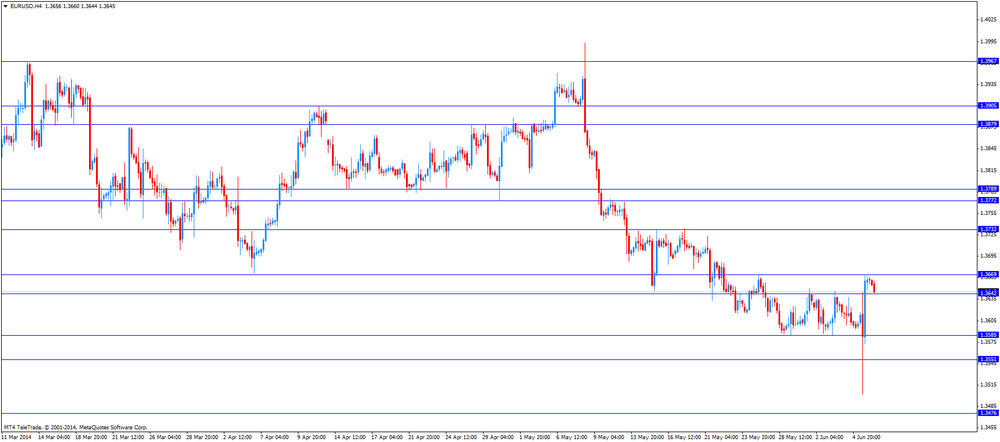

The euro

traded lower against the U.S. dollar. Market participants seemed to be

unimpressed by the stimulus measures by the European Central Bank.

German

economic data was released. Germany's trade surplus climbed to €17.7 billion in

April from €15.0 billion in March. March’s figure was revised up from a surplus

of €14.8 billion. Analysts had expected Germany’s trade surplus to increase to

€15.2 billion.

German

industrial production rose 0.2% in April, missing expectations for a 0.4% gain,

after a 0.5% decline in March. On a yearly basis, the industrial production in

Germany increased 1.8% in April, after a 3.0% rise in March.

Germany’s

current account surplus declined to €18.4 billion in April from €19.5 billion

in March.

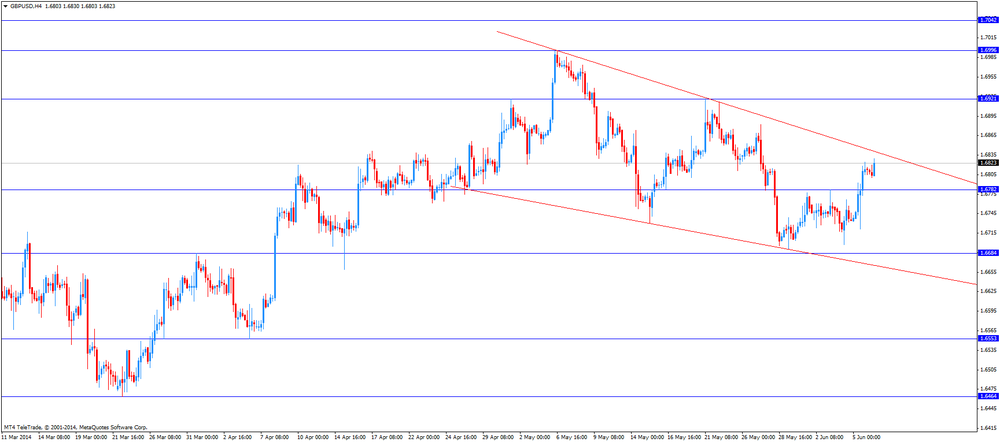

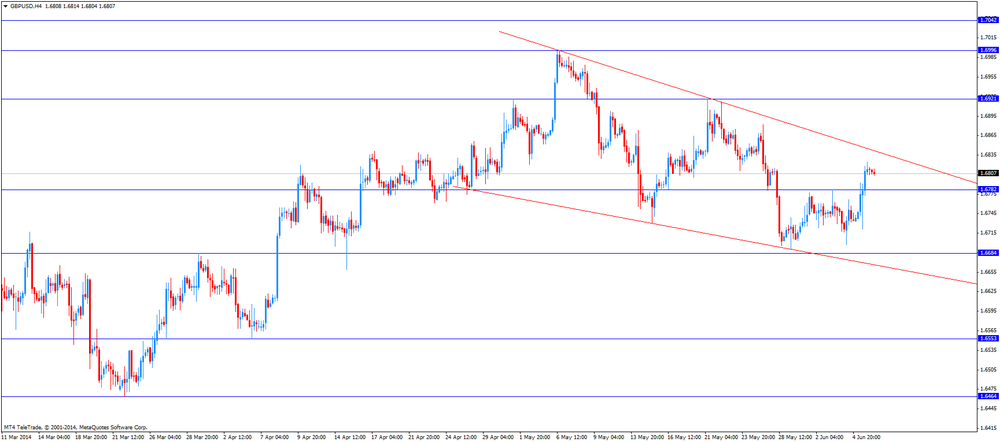

The British

pound traded lower against the U.S. dollar. The U.K. trade deficit rose to

£8.92 billion in April, from £8.29 billion in March. March’s figure was revised

up from a deficit of £8.48 billion. Analysts had expected the U.K. trade

deficit to increase to £8.65 billion.

The U.K.

consumer inflation expectations declined to 2.6% from 2.8%.

The Swiss

franc traded lower against the U.S. dollar. Switzerland’s consumer price index

climbed 0.3% in May, exceeding expectations for a 0.2% gain, after a 0.1% rise

in April.

The

Canadian dollar declined against the U.S. dollar due to the higher unemployment

rate in Canada. Canada's unemployment rate climbed to 7.0% in May, from 6.9% in

April. Analysts had expected the unemployment rate to remain unchanged.

The

Canadian economy added 25,800 in May, exceeding expectations for a 25,000 gain,

after a 28,900 decline in April. Most of the gains were in part-time work. The

job growth in the private sector was flat.

The New

Zealand dollar traded mixed against the U.S dollar in the absence of any major reports

in New Zealand.

The

Australian dollar traded mixed against the U.S. dollar. The AI Group/HIA

construction index for Australia increased to 46.7 in May from 45.9 in April.

The index still remained in contractionary territory due to the weakness in engineering

and commercial construction. Figures above 50 indicate expansion while figures

below signal contraction.

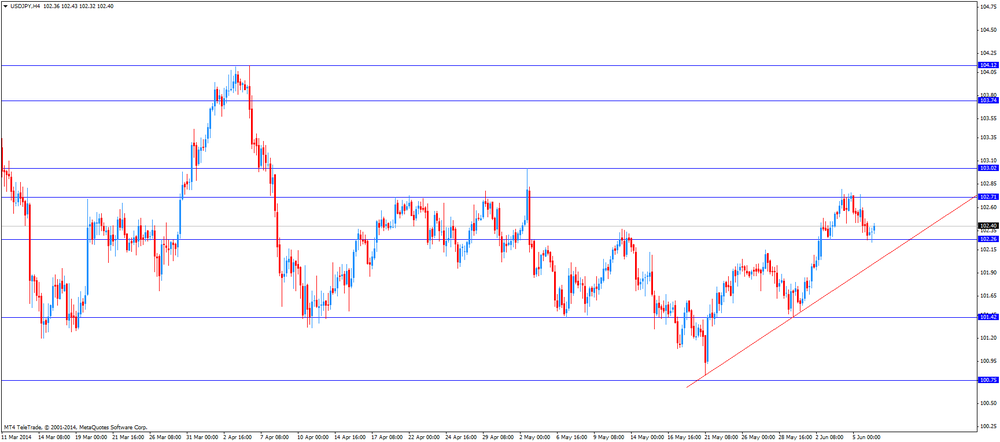

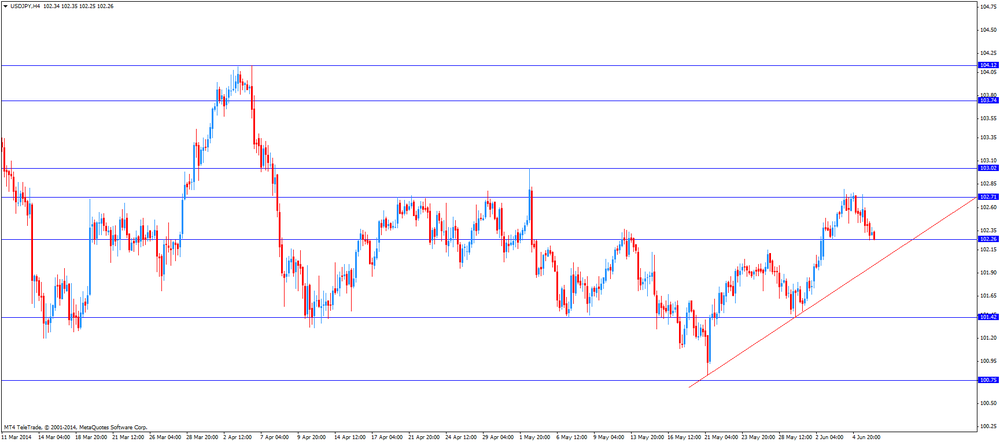

The

Japanese yen declined against the U.S. dollar after the U.S. labour market data.

Japan’s leading economic index declined to 106.6 in April from 107.1 in March,

but exceeding expectations for a decline to 106.2.

Japan’s

coincident index slid to 111.1 in April from 114.5 in March.

Gold prices declined moderately today as the dollar index returned to positive territory after the publication of U.S. employment data, which almost coincided with forecasts.

It is worth noting that traders tried not to open new positions before and after the data significant rally in the previous session. Recall that yesterday, gold prices rose by more than 1% on Thursday after European Central Bank President Mario Draghi said the bank is ready to act quickly for further easing of monetary policy, including the purchase of assets in the event of a prolonged period of low inflation. During the press conference after the monthly meeting of the ECB Draghi also said that the central bank will hold several rounds of target long-term lending program (TLTRO) to support bank lending.

As for today's employment report in the U.S., he showed that the U.S. economy added jobs at a solid pace in May, again confirming that the five-year recovery accelerated this spring. Employment in the non-agricultural sector increased from a seasonally adjusted 217,000 last month. On this Labor Department said. Growth in April was revised down slightly to an increase of 282,000 from the initially reported a gain of 288,000. Nevertheless, the increase in April was the best for more than two years. Gain in March remained unchanged at 203,000. Last month the total number of people employed in the United States reached 138.5 million, surpassing the previous peak level of employment of the country, made in January 2008. The unemployment rate, derived from a separate survey of households, remained unchanged at 6.3% in May. This corresponds to the lowest level since September 2008 .. Economists forecast that employment will increase by 219,000 and the unemployment rate will rise to 6.4% ..

If you evaluate a technical point of view, gold futures were likely to find support at $ 1242.80 per ounce, the low of June 4 and resistance at $ 1267.50, a maximum of 28 May. According to analysts, while gold is trading below the breached support at 1278 dollars per ounce, to talk about a trend reversal is not necessary, and reduce the risks of renewed saved.

The cost of the June gold futures on the COMEX today dropped to $ 1248.3 per ounce.

Statistics

Canada released the labour market data on Friday. Canada's unemployment rate climbed

to 7.0% in May, from 6.9% in April. Analysts had expected the unemployment rate

to remain unchanged.

The Canadian

economy added 25,800 in May, exceeding expectations for a 25,000 gain, after a

28,900 decline in April. Most of the gains were in part-time work. The job

growth in the private sector was flat.

Full-time

employment slid by 29,100 in May while part-time jobs rose by 54,900.

EUR/USD $1.3500, $1.3545-50, $1.3600, $1.3650

USD/JPY Y102.25, Y102.35, Y102.50, Y102.75-80, Y102.90-103.00

GBP/USD $1.6725, $1.6765, $1.6850

EUR/GBP stg0.8150, stg0.8220

USD/CHF Chf0.8905

AUD/USD $0.9275-80, $0.9300

USD/CAD C$1.0900-15, C$1.0925, C$1.0945-50, C$1.0985-90

The Labor

Department released its monthly report on hiring and joblessness on Friday. The

unemployment rate remained unchanged at 6.3% in May. Analysts had expected an

increase to 6.4%.

The U.S.

economy added 217,000 in May, missing expectations for a 218,000 rise, after a

282,000 gain in April. April’s figure was revised down from a 288,000 increase.

Total U.S. payrolls reached 138.5 million in May, exceeding the previous peak level of employment in the U.S. set in January 2008.

These

figures seem to be another sign that the U.S. economy gaining the kind of

sustained momentum.

U.S. stock futures rose as data showed employers added 217,000 jobs in May to push payrolls past their pre-recession peak.

Global markets:

Nikkei 15,077.24 -2.13 -0.01%

Hang Seng 22,951 -158.66 -0.69%

Shanghai Composite 2,029.96 -10.92 -0.54%

FTSE 6,843.52 +30.03 +0.44%

CAC 4,583.22 +34.49 +0.76%

DAX 9,988.73 +40.90 +0.41%

Crude oil $102.90 (+0.42%)

Gold $1256.20 (+0.23%)

(company / ticker / price / change, % / volume)

Intel Corp | INTC | 27.68 | +0.07% | 0.2K |

AT&T Inc | T | 35.15 | +0.14% | 10.9K |

E. I. du Pont de Nemours and Co | DD | 69.44 | +0.14% | 0.1K |

Johnson & Johnson | JNJ | 103.36 | +0.14% | 0.3K |

Procter & Gamble Co | PG | 80.22 | +0.14% | 1.4K |

Cisco Systems Inc | CSCO | 24.74 | +0.16% | 1.0K |

Nike | NKE | 76.00 | +0.17% | 4.0K |

Walt Disney Co | DIS | 84.94 | +0.19% | 8.5K |

Home Depot Inc | HD | 80.55 | +0.21% | 2.9K |

Microsoft Corp | MSFT | 41.30 | +0.22% | 1.2K |

The Coca-Cola Co | KO | 40.98 | +0.22% | 0.2K |

Pfizer Inc | PFE | 29.83 | +0.24% | 0.8K |

Goldman Sachs | GS | 163.04 | +0.28% | 1.4K |

JPMorgan Chase and Co | JPM | 56.79 | +0.28% | 16.7K |

Exxon Mobil Corp | XOM | 100.87 | +0.32% | 0.1K |

Caterpillar Inc | CAT | 107.32 | +0.34% | 3.9K |

United Technologies Corp | UTX | 118.58 | +0.35% | 0.1K |

General Electric Co | GE | 26.87 | +0.37% | 2.8K |

Chevron Corp | CVX | 124.00 | +0.39% | 0.1K |

Verizon Communications Inc | VZ | 49.47 | +0.39% | 0.9K |

Boeing Co | BA | 136.55 | -0.20% | 0.2K |

Economic

calendar (GMT0):

05:00 Japan Leading Economic Index April 107.1 106.2

106.6

05:00 Japan Coincident Index April 114.5 111.1

06:00 Germany Trade Balance April 14.8 14.3

17.7

06:00 Germany Industrial Production s.a. (MoM) April -0.5% +0.4%

+0.2%

06:00 Germany Industrial Production (YoY) April +3.0% +1.8%

06:00 Germany Current Account April 19.5 18.4

06:45 France Trade Balance, bln April -4.9 -5.0 -3.9

07:00 Switzerland Foreign Currency Reserves April 438.9 444.4

07:15 Switzerland Consumer Price Index (MoM) May +0.1% +0.2%

+0.3%

07:15 Switzerland Consumer Price Index (YoY) May 0.0% +0.1%

+0.2%

08:30 United Kingdom Consumer Inflation Expectations Quarter II +2.8% +2.6%

The U.S.

dollar traded mixed against the most major currencies ahead of the U.S. jobs

market data. The unemployment rate in the U.S. should increase to 6.4% in May,

after 6.3% in April.

The number

of additional jobs in the private sector should climb by 218,000 jobs in May,

after 288,000 jobs in April.

The euro traded

lower against the U.S. dollar, but recovered a part of its losses. Market participants seemed to be unimpressed by

the stimulus measures by the European Central Bank.

German

economic data was released. Germany's trade surplus climbed to €17.7 billion in

April from €15.0 billion in March. March’s figure was revised up from a surplus

of €14.8 billion. Analysts had expected Germany’s trade surplus to increase to

€15.2 billion.

German

industrial production rose 0.2% in April, missing expectations for a 0.4% gain,

after a 0.5% decline in March. On a yearly basis, the industrial production in

Germany increased 1.8% in April, after a 3.0% rise in March.

Germany’s

current account surplus declined to €18.4 billion in April from €19.5 billion

in March.

The British

pound traded mixed against the U.S. dollar. The U.K. trade deficit rose to

£8.92 billion in April, from £8.29 billion in March. March’s figure was revised

up from a deficit of £8.48 billion. Analysts had expected the U.K. trade

deficit to increase to £8.65 billion.

The U.K. consumer

inflation expectations declined to 2.6% from 2.8%.

The Swiss

franc traded mixed against the U.S. dollar. Switzerland’s consumer price index climbed

0.3% in May, exceeding expectations for a 0.2% gain, after a 0.1% rise in April.

The Canadian dollar traded mixed against the U.S. dollar ahead of the Canadian labour market data. The unemployment rate in the Canada should remain unchanged at 6.9% in May.

EUR/USD:

the currency pair traded mixed

GBP/USD:

the currency pair traded mixed

USD/JPY:

the currency pair traded mixed

The most

important news that are expected (GMT0):

12:30 Canada

Labor Productivity

Quarter I +1.0% +0.7%

12:30 Canada

Employment

May -28.9 +12.3

12:30 Canada

Unemployment rate May 6.9% 6.9%

12:30 U.S.

Average hourly earnings May 0.0% +0.2%

12:30 U.S.

Nonfarm Payrolls

May 288 219

12:30 U.S.

Unemployment Rate May 6.3% 6.4%

EUR/USD

Offers $1.3695/700, $1.3688, $1.3670/80

Bids $1.3605/00, $1.3500

GBP/USD

Offers $1.6890-900, $1.6860, $1.6835/40

Bids $1.6800

AUD/USD

Offers $0.9450, $0.9420, $0.9400

Bids $0.9300, $0.9255/50, $0.9235/30

EUR/JPY

Offers Y140.80, Y140.50, Y140.00

Bids Y139.10/00, Y138.50

USD/JPY

Offers Y103.50, Y103.00, Y102.75/80, Y102.50

Bids Y102.00, Y101.60, Y101.50

EUR/GBP

Offers stg0.8160/65, stg0.8150

Bids stg0.8050, stg0.8035/30, stg0.8005/000

Stock

indices climbed ahead the U.S. labour market data. The European Central Bank’s stimulus

measures still weighed on stocks.

Earlier in

the trading session, German economic data was released. Germany's trade surplus

climbed to €17.7 billion in April from €15.0 billion in March. March’s figure

was revised up from a surplus of €14.8 billion. Analysts had expected Germany’s

trade surplus to increase to €15.2 billion.

German

industrial production rose 0.2% in April, missing expectations for a 0.4% gain,

after a 0.5% decline in March. On a yearly basis, the industrial production in

Germany increased 1.8% in April, after a 3.0% rise in March.

Germany’s current

account surplus declined to €18.4 billion in April from €19.5 billion in March.

Current

figures:

Name Price Change Change %

FTSE

100 6,832.24 +18.75 +0.28%

DAX 9,975.52 +27.69 +0.28%

CAC 40 4,565.94 +17.21 +0.38%

EUR/USD $1.3500, $1.3545-50, $1.3600, $1.3650

USD/JPY Y102.25, Y102.35, Y102.50, Y102.75-80, Y102.90-103.00

GBP/USD $1.6725, $1.6765, $1.6850

EUR/GBP stg0.8150, stg0.8220

USD/CHF Chf0.8905

AUD/USD $0.9275-80, $0.9300

USD/CAD C$1.0900-15, C$1.0925, C$1.0945-50, C$1.0985-90

Asian stock

indices declined ahead of the U.S. labour market data. Reaction from Asian

markets to the stimulus measures by the European Central Bank was more muted

than in Europe and in the U.S.

Japan’s

leading economic index declined to 106.6 in April from 107.1 in March, but

exceeding expectations for a decline to 106.2.

Japan’s

coincident index slid to 111.1 in April from 114.5 in March.

Indexes on

the close:

Nikkei

225 15,077.24 -2.13 -0.01%

Hang

Seng 22,951.00 -158.66 -0.69%

Shanghai

Composite 2,029.96 -10.92 -0.54%

Sumco

Corp., silicon wafer maker, gained 11% after a report the company’s plants are near

at full capacity.

Prada SpA dropped

6.9% in Hong Kong after the company’s profit missed analysts’ forecasts.

Economic

calendar (GMT0):

05:00 Japan Leading Economic Index April 107.1 106.2 106.6

05:00 Japan Coincident Index April 114.5 111.1

06:00 Germany Trade Balance April 14.8 14.3 17.7

06:00 Germany Industrial Production s.a. (MoM) April -0.5% +0.4% +0.2%

06:00 Germany Industrial Production (YoY) April +3.0% +1.8%

06:00 Germany Current Account April 19.5 18.4

06:45 France Trade Balance, bln April -4.9 -5.0 -3.9

07:00 Switzerland Foreign Currency Reserves April 438.9 444.4

07:15 Switzerland Consumer Price Index (MoM) May +0.1% +0.2% +0.3%

07:15 Switzerland Consumer Price Index (YoY) May 0.0% +0.1% +0.2%

08:30 United Kingdom Consumer Inflation Expectations Quarter II +2.8% +2.6%

The U.S.

dollar traded lower against the most major currencies after the European

Central Bank’ interest rate cut. The European Central Bank cut its interest rate

to 0.15% from 0.25%. Analysts had expected a cut to 0.1%.

The ECB

also cut its marginal lending to 0.40% from 0.75% and reduced its deposit rate

to -0.10% from 0.0%. The European Central Bank is the world’s first major

central bank to use a negative rate. The deposit rate of -0.10% means that

commercial bank will be charged for holding their reserves. This measure should

spur commercial banks to ramp up lending.

Investors

are awaiting the U.S. jobs market data later in the day.

The New

Zealand dollar increased against the U.S dollar. The kiwi was supported by after

the European Central Bank’ interest rate cut. No economic data was published in

New Zealand.

The Australian

dollar traded lower against the U.S. dollar after the release of the AI

Group/HIA construction index in Australia, but later recovered its losses. The AI

Group/HIA construction index for Australia increased to 46.7 in May from 45.9

in April. The index still remained in contractionary territory due to the

weakness in engineering and commercial construction. Figures above 50 indicate

expansion while figures below signal contraction.

The

Japanese yen traded higher against the U.S. dollar after the European Central

Bank’ interest rate cut. Japan’s leading economic index declined to 106.6 in

April from 107.1 in March, but exceeding expectations for a decline to 106.2.

Japan’s coincident

index slid to 111.1 in April from 114.5 in March.

EUR/USD:

the currency pair traded mixed

GBP/USD:

the currency pair traded mixed

USD/JPY:

the currency pair declined to Y102.25

The most

important news that are expected (GMT0):

12:30 Canada Labor Productivity Quarter I +1.0% +0.7%

12:30 Canada Employment May -28.9 +12.3

12:30 Canada Unemployment rate May 6.9% 6.9%

12:30 U.S. Average hourly earnings May 0.0% +0.2%

12:30 U.S. Nonfarm Payrolls May 288 219

12:30 U.S. Unemployment Rate May 6.3% 6.4%

EUR / USD

Resistance levels (open interest**, contracts)

$1.3751 (4505)

$1.3720 (4418)

$1.3674 (1351)

Price at time of writing this review: $ 1.3657

Support levels (open interest**, contracts):

$1.3638 (5646)

$1.3584 (4462)

$1.3544 (5474)

Comments:

- Overall open interest on the CALL options with the expiration date June, 6 is 62208 contracts, with the maximum number of contracts with strike price $1,3850 (6552);

- Overall open interest on the PUT optionswith the expiration date June, 6 is 78666 contracts, with the maximum number of contractswith strike price $1,3500 (8454);

- The ratio of PUT/CALL was 1.26 versus 1.30 from the previous trading day according to data from June, 5.

GBP/USD

Resistance levels (open interest**, contracts)

$1.7100 (1852)

$1.7000 (2704)

$1.6901 (2117)

Price at time of writing this review: $1.6809

Support levels (open interest**, contracts):

$1.6700 (2602)

$1.6600 (2477)

$1.6500 (974)

Comments:

- Overall open interest on the CALL options with the expiration date June, 6 is 24576 contracts, with the maximum number of contracts with strike price $1,7000 (2704);

- Overall open interest on the PUT optionswith the expiration date June, 6 is 26897 contracts, with the maximum number of contracts with strike price $1,6700 (2602);

- The ratio of PUT/CALL was 1.09 versus 1.09 from the previous trading day according to data from June, 5.

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.