- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 10-06-2014

Gold $1,259.80 +5.80 +0.46%

ICE Brent Crude Oil $109.64 -0.35 -0.32%

NYMEX Crude Oil $104.31 -0.36 -0.34%

Nikkei 14,994.8 -129.20 -0.85%

Hang Seng 23,315.74 +198.27 +0.86%

Shanghai Composite 2,052.53 +22.03 +1.08%

S&P 1,950.79 -0.48 -0.02%

NASDAQ 4,338 +1.75 +0.04%

Dow 16,945.92 +2.82 +0.02%

FTSE 1,398.18 +4.47 +0.32%

CAC 4,595 +5.88 +0.13%

DAX 10,028.8 +20.17 +0.20%

EUR/USD $1,3544 -0,34%

GBP/USD $1,6753 -0,29%

USD/CHF Chf0,8991 +0,24%

USD/JPY Y102,35 -0,19%

EUR/JPY Y138,62 -0,55%

GBP/JPY Y171,45 -0,48%

AUD/USD $0,9369 +0,21%

NZD/USD $0,8524 +0,38%

USD/CAD C$1,0902 +0,01%

00:30 Australia Westpac Consumer Confidence June -6.8%

00:30 New Zealand REINZ Housing Price Index, m/m May +0.1%

08:30 United Kingdom Average Earnings, 3m/y April +1.7% +1.2%

08:30 United Kingdom Average earnings ex bonuses, 3 m/y April +1.3% +1.2%

08:30 United Kingdom Claimant count May -25.1 -25.0

08:30 United Kingdom Claimant Count Rate May 3.3%

08:30 United Kingdom ILO Unemployment Rate April 6.8% 6.7%

09:00 OPEC OPEC Meetings

14:30 U.S. Crude Oil Inventories June -3.4

18:00 U.S. Federal budget May 106.9 -142.8

21:00 New Zealand RBNZ Interest Rate Decision 3.00% 3.25%

21:00 New Zealand RBNZ Rate Statement

21:00 New Zealand RBNZ Press Conference

23:01 United Kingdom RICS House Price Balance May 54% 52%

23:50 Japan Core Machinery Orders April +19.1% -10.8%

23:50 Japan Core Machinery Orders, y/y April +16.1%

Stock traded

mixed. Last week’s ECB interest rate decision weighed on stock markets. The

European Central Bank cut its interest rate to 0.15% from 0.25% last Thursday.

The ECB also cut its marginal lending to 0.40% from 0.75% and reduced its

deposit rate to -0.10% from 0.0%.

Markets

were also supported by the strong economic data. Manufacturing output in the

U.K. increased 0.4% in April, meeting expectations, after 0.5% gain in March.

On a yearly basis, manufacturing production in the U.K. rose 4.4% in April,

exceeding expectations for a 4% increase, after a 3.3% increase in March.

Industrial

production in the U.K. climbed 0.4% in April, in line with forecasts, after a

0.1% decline in March. On a year-over-year basis, industrial production in the

U.K. rose 3.0% in April, after a 2.3% increase in March. Economists had

expected a 2.7% gain.

The

National Institute of Economic and Social Research (NIESR) released their

monthly U.K. GDP estimates. They forecasted that GDP increased by 0.9% in the

three months ending in May after rise of 1.1% in the three months ending in

April 2014.

Industrial

production in France rose 0.3% in April, meeting expectations, after a 0.4%

decline in March. March’s figure was revised up from a 0.7% decrease.

On a yearly

basis, industrial production in France was flat in April, after a 0.8% fall in

March.

Indexes on

the close:

Name Price Change Change %

FTSE

100 6,873.55 -1.45 -0.02%

DAX 10,028.80 +20.17 +0.20%

CAC 40 4,595.00 +5.88 +0.13%

The U.S.

dollar traded mixed against the most major currencies. The U.S. dollar was

still supported by Friday’s nonfarm payrolls report. The U.S. economy added

217,000 in May, missing expectations for a 218,000 rise, after a 282,000 gain

in April. April’s figure was revised down from a 288,000 increase.

The U.S.

Labor Department released the Job Openings and Labor Turnover Survey or JOLTS today.

Job openings in the U.S. climbed by 289,000 to 4.46 million in April. That was

the highest figure since September 2007. Analysts had expected an increase to 4.04

million. The pace of firing also rose.

The euro slid

to 4-month lows against the U.S. dollar despite the strong industrial

production in France. Industrial production in France rose 0.3% in April,

meeting expectations, after a 0.4% decline in March. March’s figure was revised

up from a 0.7% decrease.

On a yearly

basis, industrial production in France was flat in April, after a 0.8% fall in

March.

The euro

suffers due to bond yield gap between some euro area government bonds and U.S.

Treasuries. While the currency in the Eurozone is to remain permanently cheap,

the first interest rate hike by the Fed in the United States and by the Bank of

England in the U.K. is more likely.

The

European Central Bank cut its interest rate to 0.15% from 0.25% last Thursday.

The ECB also cut its marginal lending to 0.40% from 0.75% and reduced its

deposit rate to -0.10% from 0.0%. The European Central Bank is the world’s

first major central bank to use a negative rate. The deposit rate of -0.10%

means that commercial bank will be charged for holding their reserves. This

measure should spur commercial banks to ramp up lending.

The British

pound traded lower against the U.S. dollar. Manufacturing output in the U.K.

increased 0.4% in April, meeting expectations, after 0.5% gain in March. On a

yearly basis, manufacturing production in the U.K. rose 4.4% in April,

exceeding expectations for a 4% increase, after a 3.3% increase in March.

Industrial

production in the U.K. climbed 0.4% in April, in line with forecasts, after a

0.1% decline in March. On a year-over-year basis, industrial production in the

U.K. rose 3.0% in April, after a 2.3% increase in March. That was the biggest

annual increase since 2011. Economists had expected a 2.7% gain.

The

National Institute of Economic and Social Research (NIESR) released their

monthly U.K. GDP estimates. They forecasted that GDP increased by 0.9% in the

three months ending in May after rise of 1.1% in the three months ending in

April 2014.

The Swiss

franc declined against the U.S. dollar. Switzerland’s unemployment rate

remained unchanged at 3.2% in May, as expected.

Retail

sales in Switzerland increased 0.4% in April, missing expectations for a 3.5%

gain, after a 3.4% rise in March. March’s figure was revised up from a 3.0%

increase.

The New

Zealand dollar traded higher against the U.S dollar in the absence of any major

economic reports. The kiwi was supported by expectations the Reserve Bank of

New Zealand will raise interest rates again this Wednesday.

The

increasing consumer price inflation in China supported the New Zealand and

Australian dollar. The Chinese consumer price index increased 2.5% in May,

after a 1.8% gain in April. Analysts had expected a 2.4% rise.

The Chinese

producer price index declined 1.4% in May, after a 2.0% decrease in April.

Analysts had expected a 1.5% fall.

The

Australian dollar traded higher against the U.S. dollar due to the

better-than-expected Australian business confidence data and the Chinese

consumer price inflation. The National Australia Bank released its business

confidence index for Australia. The index climbed to 7 in May, from 6 in April.

Job

advertisements in Australia fell 5.6% in May, after a 1.9% increase in April.

April’s figure was revised down from a 2.2% gain.

Home loans

in Australia were flat in April, after a 0.8% fall in March. March’s figure was

revised up from a 0.9% decline. Analysts had expected a 0.3% gain.

The

Japanese yen traded higher against the U.S. dollar ahead of the Bank of Japan

(BoJ) meeting this Friday. Investors speculate that the BoJ’s monetary policy

will support the Japanese currency.

Japan’s

preliminary machine tool orders decreased to 24.1% in May from 48.7% in April.

April’s figure was revised down from 48.8%.

Japanese

tertiary industry activity index dropped to -5.4% in April from 2.4% in March.

Analysts had expected the index to fall -3.3%.

The gap

between West Texas Intermediate and Brent narrowed to the least in almost two

months as U.S. crude stockpiles were forecast to fall and Ukraine said peace

talks with Russia yielded progress.

Futures

rose as much as 0.5 percent in New York and Brent was steady in London. U.S.

crude stockpiles probably shrank by 1.5 million barrels in the week ended June

6, according to a Bloomberg News survey before data from the Energy Information

Administration tomorrow. Two days of talks with Russia led to an agreement to

implement parts of President Petro Poroshenko’s peace plan, Ukraine’s Foreign

Ministry said in a statement.

“U.S.

oil stocks are now likely to fall every week until mid-August,” Bjarne Schieldrop,

chief commodities analyst at SEB AB in Oslo, said by e-mail. “No one should be

surprised that the WTI-Brent spread is tightening up.”

WTI for

July delivery gained as much as 48 cents to $104.89 a barrel in electronic

trading on the New York Mercantile Exchange and was at $104.73 at 12:47 p.m.

London time. The contract climbed $1.75 to $104.41 yesterday, the highest close

since March 3. The volume of all futures traded was about 46 percent above the

100-day average for the time of day. Prices have increased 6.5 percent this

year.

Brent for July settlement was 18 cents higher at $110.17 a barrel on the London-based ICE Futures Europe exchange. The European benchmark crude’s premium dropped to as little as $5.15 to WTI on ICE, the least since April 15. It was at $5.49 a barrel at 12:47 p.m.

The price of gold is rising in price after consolidation in the previous session amid evidence the U.S. wholesale inventories.

The volume of wholesale inventories in the United States has grown significantly in April, exceeding forecasts of experts in this and increase the likelihood of accelerating economic growth in the second quarter.

Ministry of Commerce announced that wholesale inventories rose 1.1 percent after the same growth in March. Many economists had expected an increase of this index by 0.6 percent.

It is worth noting that inventories are a key component of gross domestic product changes. Component that goes into the calculation of GDP - wholesale inventories excluding automobiles - increased by 1.1 percent.

Sharp slowdown in growth stocks in enterprises put pressure on economic growth in the first quarter. Recall that the economy contracted by 1.0 per cent per annum in the period from January to March (stocks reduced GDP by 1.6 percentage points). Growth in this quarter is forecast to accelerate to 3.0 percent, but strong gains in wholesale inventories in April could push some economists to raise their estimates of GDP.

Also, the data showed sales at wholesalers rose 1.3 percent in April after rising 1.6 percent the previous month. With recent changes in the ratio of inventories to sales was 1.18 months in April, unchanged compared with March.

The cost of the August gold futures on the COMEX today rose to $ 1263.8 per ounce.

EUR/USD $1.3500, $1.3550, $1.3600, $1.3635, $1.3650, $1.3700

USD/JPY Y101.75, Y102.50, Y103.10

USD/CAD Cad1.0920, Cad1.0935

AUD/USD $0.9250, $0.9300, $0.9330

EUR/CHF Chf1.2185

EUR/GBP stg0.8125

U.S. stock-index futures fell as investors weighed equity valuations.

Global markets:

Nikkei 14,994.8 -129.20 -0.85%

Hang Seng 23,315.74 +198.27 +0.86%

Shanghai Composite 2,052.53 +22.03 +1.08%

FTSE 6,854.1 -20.90 -0.30%

CAC 4,589.45 +0.33 +0.01%

DAX 10,021.34 +12.71 +0.13%

Crude oil $104.66 (+0.24%)

Gold $1261.10 (+0.57%)

(company / ticker / price / change, % / volume)

Boeing Co | BA | 138.20 | +0.17% | 0.3K |

Visa | V | 213.24 | +0.31% | 0.1K |

Cisco Systems Inc | CSCO | 24.79 | -0.04% | 2.4K |

Procter & Gamble Co | PG | 80.06 | -0.04% | 0.2K |

Caterpillar Inc | CAT | 108.69 | -0.06% | 0.1K |

Merck & Co Inc | MRK | 57.88 | -0.10% | 15.8K |

The Coca-Cola Co | KO | 40.87 | -0.10% | 0.5K |

JPMorgan Chase and Co | JPM | 57.32 | -0.17% | 1.0K |

American Express Co | AXP | 95.40 | -0.18% | 1.5K |

Nike | NKE | 76.50 | -0.22% | 146.3K |

Pfizer Inc | PFE | 29.28 | -0.24% | 1.2K |

Verizon Communications Inc | VZ | 49.45 | -0.24% | 32.5K |

AT&T Inc | T | 34.91 | -0.29% | 1.4K |

General Electric Co | GE | 27.36 | -0.29% | 2.1K |

Exxon Mobil Corp | XOM | 101.19 | -0.33% | 0.4K |

Walt Disney Co | DIS | 85.20 | -0.33% | 9.0K |

Goldman Sachs | GS | 165.40 | -0.36% | 0.2K |

Intel Corp | INTC | 27.81 | -0.36% | 1.1K |

Microsoft Corp | MSFT | 41.12 | -0.36% | 0.6K |

Upgrades:

Twitter (TWTR) upgraded to Market Perform from Underperform at Wells Fargo

Downgrades:

Other:

Intel (INTC) resumed with a Hold at Canaccord Genuity

Exxon Mobil (XOM) initiated with Hold at Deutsche Bank

PepsiCo (PEP) initiated with a Buy at Jefferies

Coca-Cola (KO) initiated with a Hold at Jefferies

Economic

calendar (GMT0):

01:30 Australia National Australia Bank's

Business Confidence May 6 7

01:30 Australia ANZ Job Advertisements

(MoM) May +2.2% -5.6%

01:30 Australia Home Loans

April -0.8% +0.3%

0%

01:30 China PPI y/y

May -2.0% -1.5%

-1.4%

01:30 China CPI y/y

May +1.8%

+2.4% +2.5%

05:45 Switzerland Unemployment Rate May 3.2%

3.2% 3.2%

06:00 Japan Prelim Machine Tool Orders,

y/y May 48.7%

24.1%

06:45 France Industrial Production,

m/m

April -0.4% +0.3%

+0.3%

06:45 France Industrial Production,

y/y

April -0.8% 0.0%

07:15 Switzerland Retail Sales Y/Y

April +3.4% +3.5%

+0.4%

08:30 United Kingdom Industrial Production (MoM) April -0.1%

+0.4% +0.4%

08:30 United Kingdom Industrial Production (YoY) April +2.3%

+2.7% +3.0%

08:30 United Kingdom Manufacturing Production (MoM) April +0.5%

+0.4% +0.4%

08:30 United Kingdom Manufacturing Production (YoY) April +3.3%

+4.0% +4.4%

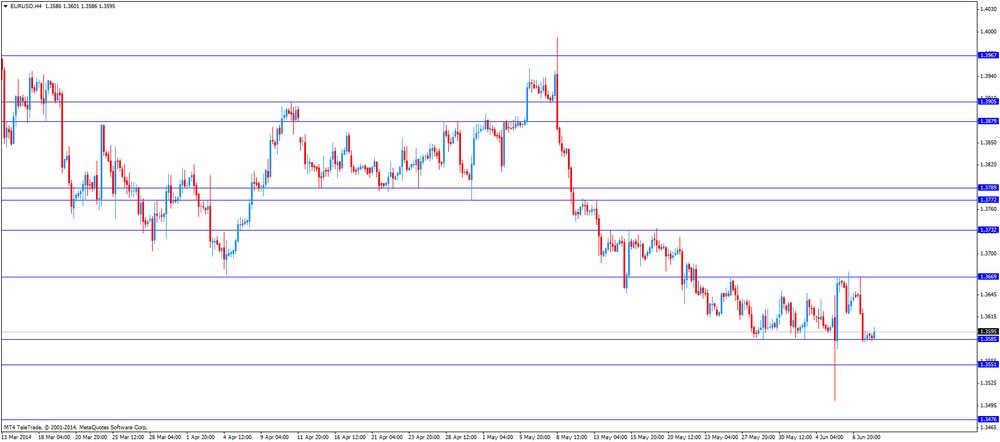

The U.S.

dollar traded higher against the most major currencies. The U.S. dollar was

still supported by Friday’s nonfarm payrolls report. The U.S. economy added

217,000 in May, missing expectations for a 218,000 rise, after a 282,000 gain

in April. April’s figure was revised down from a 288,000 increase.

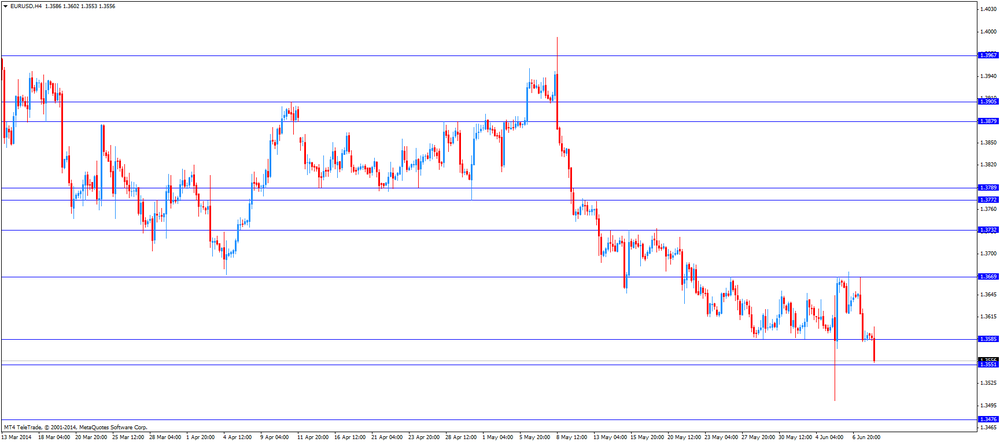

The euro dropped

against the U.S. dollar despite the strong industrial production in France. Industrial

production in France rose 0.3% in April, meeting expectations, after a 0.4%

decline in March. March’s figure was revised up from a 0.7% decrease.

On a yearly

basis, industrial production in France was flat in April, after a 0.8% fall in

March.

The

European Central Bank’s interest rate decision weighed on the euro. The

European Central Bank cut its interest rate to 0.15% from 0.25% last Thursday.

The ECB also cut its marginal lending to 0.40% from 0.75% and reduced its

deposit rate to -0.10% from 0.0%. The European Central Bank is the world’s

first major central bank to use a negative rate. The deposit rate of -0.10%

means that commercial bank will be charged for holding their reserves. This

measure should spur commercial banks to ramp up lending.

The British

pound traded lower against the U.S. dollar. Manufacturing output in the U.K.

increased 0.4% in April, meeting expectations, after 0.5% gain in March. On a

yearly basis, manufacturing production in the U.K. rose 4.4% in April,

exceeding expectations for a 4% increase, after a 3.3% increase in March.

Industrial

production in the U.K. climbed 0.4% in April, in line with forecasts, after a

0.1% decline in March. On a year-over-year basis, industrial production in the

U.K. rose 3.0% in April, after a 2.3% increase in March. That was the biggest annual

increase since 2011. Economists had expected a 2.7% gain.

The Swiss

franc declined against the U.S. dollar. Switzerland’s unemployment rate

remained unchanged at 3.2% in May, as expected.

Retail

sales in Switzerland increased 0.4% in April, missing expectations for a 3.5%

gain, after a 3.4% rise in March. March’s figure was revised up from a 3.0%

increase.

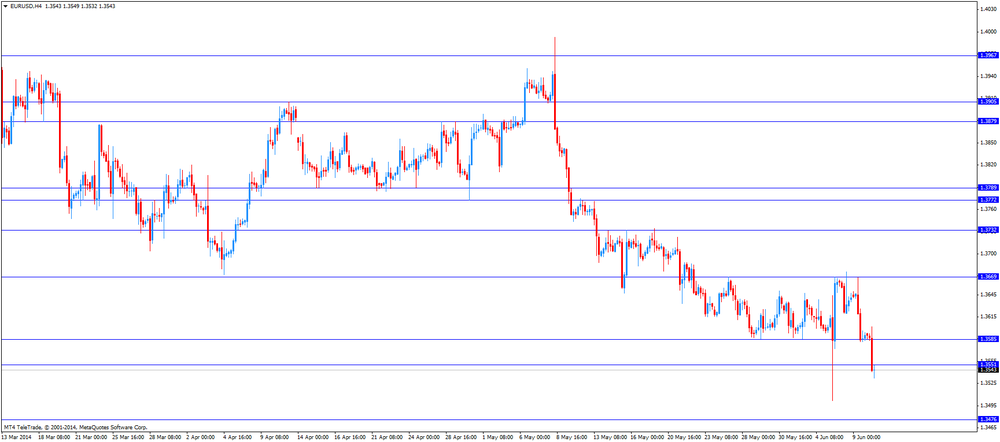

EUR/USD:

the currency pair declined to $1.3532

GBP/USD:

the currency pair decreased to $1.6764

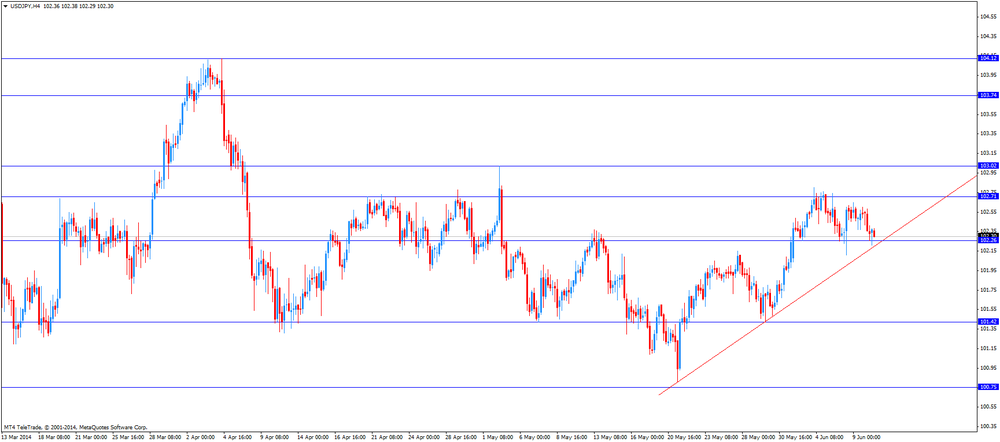

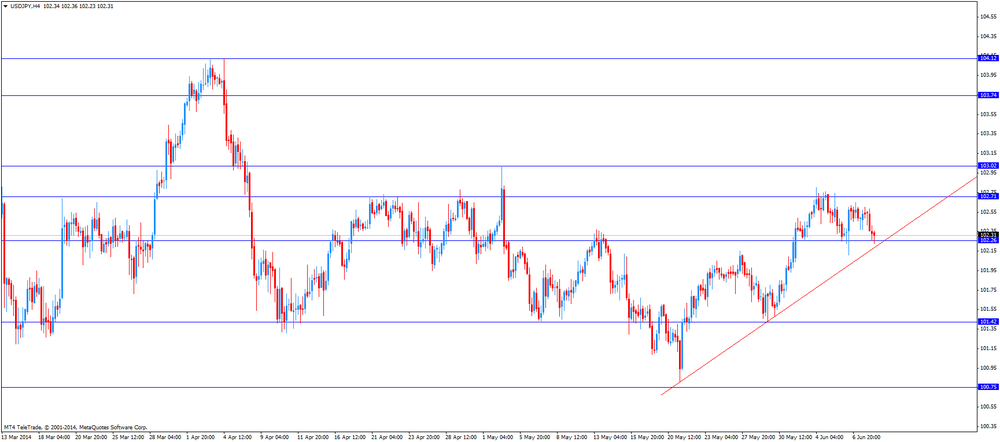

USD/JPY:

the currency pair traded mixed

The most

important news that are expected (GMT0):

14:00 United Kingdom NIESR GDP Estimate May +1.0%

14:00 U.S. JOLTs Job Openings April 4014 4040

23:50 Japan BSI Manufacturing Index

Quarter II 12.5 14.1

EUR/USD

Offers $1.3775, $1.3735, $1.3695/700, $1.3675, $1.3620

Bids $1.3550, $1.3500, $1.3480

GBP/USD

Offers $1.6920, $1.6900, $1.6880, $1.6845

Bids $1.6760, $1.6700, $1.6690

AUD/USD

Offers $0.9450, $0.9420, $0.9400

Bids $0.9335, $0.9300, $0.9255/50, $0.9235/30

EUR/JPY

Offers Y140.80, Y140.50, Y140.00, Y139.40

Bids Y138.65, Y138.00,

USD/JPY

Offers Y103.50, Y103.00, Y102.75/80

Bids Y102.00, Y101.60, Y101.50

EUR/GBP

Offers stg0.8160/65, stg0.8150, stg0.8100

Bids stg0.8050, stg0.8035/30, stg0.8005/000

Stock

indices traded little changed after the U.K. and French economic data. Manufacturing

output in the U.K. increased 0.4% in April, meeting expectations, after 0.5%

gain in March. On a yearly basis, manufacturing production in the U.K. rose

4.4% in April, exceeding expectations for a 4% increase, after a 3.3% increase

in March.

Industrial

production in the U.K. climbed 0.4% in April, in line with forecasts, after a

0.1% decline in March. On a year-over-year basis, industrial production in the

U.K. rose 3.0% in April, after a 2.3% increase in March. Economists had

expected a 2.7% gain.

Industrial

production in France rose 0.3% in April, meeting expectations, after a 0.4%

decline in March. March’s figure was revised up from a 0.7% decrease.

On a yearly

basis, industrial production in France was flat in April, after a 0.8% fall in

March.

Current

figures:

Name Price Change Change %

FTSE

100 6,847.88 -27.12 -0.39%

DAX 10,025.87 +17.24 +0.17%

CAC 40 4,598.26 +9.14 +0.20%

The European

Central Bank’s interest rate decision weighed on the euro. The European Central

Bank cut its interest rate to 0.15% from 0.25% last Thursday. The ECB also cut

its marginal lending to 0.40% from 0.75% and reduced its deposit rate to -0.10%

from 0.0%. The European Central Bank is the world’s first major central bank to

use a negative rate. The deposit rate of -0.10% means that commercial bank will

be charged for holding their reserves. This measure should spur commercial

banks to ramp up lending.

EUR/USD $1.3500, $1.3550, $1.3600, $1.3635, $1.3650, $1.3700

USD/JPY Y101.75, Y102.50, Y103.10

USD/CAD Cad1.0920, Cad1.0935

AUD/USD $0.9250, $0.9300, $0.9330

EUR/CHF Chf1.2185

EUR/GBP stg0.8125

Most Asian

stock rose due to the increasing consumer price inflation in China. The Chinese

consumer price index increased 2.5% in May, after a 1.8% gain in April.

Analysts had expected a 2.4% rise.

The Chinese

producer price index declined 1.4% in May, after a 2.0% decrease in April.

Analysts had expected a 1.5% fall.

Japan’s

preliminary machine tool orders decreased to 24.1% in May from 48.7% in April.

April’s figure was revised down from 48.8%.

Japanese

tertiary industry activity index dropped to -5.4% in April from 2.4% in March.

Analysts had expected the index to fall -3.3%.

Indexes on

the close:

Nikkei

225 14,994.80 -129.20 -0.85%

Hang

Seng 23,315.74 +198.27 +0.86%

Shanghai

Composite 2,052.53 +22.03 +1.08%

LG Innotek

Co., a supplier of camera modules for smartphones, rose 7.6%.

LG Display

Co., a supplier of panels for Apple Inc., climbed 6.4%.

Economic

calendar (GMT0):

01:30 Australia National Australia Bank's Business Confidence May 6 7

01:30 Australia ANZ Job Advertisements (MoM) May +2.2% -5.6%

01:30 Australia Home Loans April -0.8% +0.3% 0%

01:30 China PPI y/y May -2.0% -1.5% -1.4%

01:30 China CPI y/y May +1.8% +2.4% +2.5%

05:45 Switzerland Unemployment Rate May 3.2% 3.2% 3.2%

06:00 Japan Prelim Machine Tool Orders, y/y May 48.7% 24.1%

06:45 France Industrial Production, m/m April -0.4% +0.3% +0.3%

06:45 France Industrial Production, y/y April -0.8% 0.0%

07:15 Switzerland Retail Sales Y/Y April +3.4% +3.5% +0.4%

08:30 United Kingdom Industrial Production (MoM) April -0.1% +0.4% +0.4%

08:30 United Kingdom Industrial Production (YoY) April +2.3% +2.7% +3.0%

08:30 United Kingdom Manufacturing Production (MoM) April +0.5% +0.4% +0.4%

08:30 United Kingdom Manufacturing Production (YoY) April +3.3% +4.0% +4.4%

The U.S.

dollar traded mixed against the most major currencies. The U.S. dollar was still

supported by Friday’s nonfarm payrolls report. The U.S. economy added 217,000

in May, missing expectations for a 218,000 rise, after a 282,000 gain in April.

April’s figure was revised down from a 288,000 increase.

The New

Zealand dollar rose against the U.S dollar in the absence of any major economic

reports. The kiwi was supported by expectations the Reserve Bank of New Zealand

will raise interest rates again this Wednesday.

The

increasing consumer price inflation in China supported the New Zealand and

Australian dollar. The Chinese consumer price index increased 2.5% in May,

after a 1.8% gain in April. Analysts had expected a 2.4% rise.

The Chinese

producer price index declined 1.4% in May, after a 2.0% decrease in April.

Analysts had expected a 1.5% fall.

The

Australian dollar traded higher against the U.S. dollar due to the

better-than-expected Australian business confidence data and the Chinese

consumer price inflation. The National Australia Bank released its business

confidence index for Australia. The index climbed to 7 in May, from 6 in April.

Job

advertisements in Australia fell 5.6% in May, after a 1.9% increase in April.

April’s figure was revised down from a 2.2% gain.

Home loans

in Australia were flat in April, after a 0.8% fall in March. March’s figure was

revised up from a 0.9% decline. Analysts had expected a 0.3% gain.

The

Japanese yen increased against the U.S. dollar ahead of the Bank of Japan (BoJ)

meeting this Friday. Investors speculate that the BoJ’s monetary policy will

support the Japanese currency.

Japan’s

preliminary machine tool orders decreased to 24.1% in May from 48.7% in April.

April’s figure was revised down from 48.8%.

Japanese

tertiary industry activity index dropped to -5.4% in April from 2.4% in March. Analysts

had expected the index to fall -3.3%.

EUR/USD:

the currency pair traded mixed

GBP/USD:

the currency pair climbed to $1.6815

USD/JPY:

the currency pair declined to Y102.35

The most

important news that are expected (GMT0):

14:00 United Kingdom NIESR GDP Estimate May +1.0%

14:00 U.S. JOLTs Job Openings April 4014 4040

23:50 Japan BSI Manufacturing Index Quarter II 12.5 14.1

EUR / USD

Resistance levels (open interest**, contracts)

$1.3698 (1450)

$1.3670 (2727)

$1.3631 (152)

Price at time of writing this review: $ 1.3586

Support levels (open interest**, contracts):

$1.3558 (1642)

$1.3519 (3848)

$1.3491 (4215)

Comments:

- Overall open interest on the CALL options with the expiration date July, 3 is 24396 contracts, with the maximum number of contracts with strike price $1,3600 (2727);

- Overall open interest on the PUT optionswith the expiration date July, 3 is 38921 contracts, with the maximum number of contractswith strike price $1,3500 (5302);

- The ratio of PUT/CALL was 1.60 versus 1.62 from the previous trading day according to data from June, 9.

GBP/USD

Resistance levels (open interest**, contracts)

$1.7101 (1281)

$1.7002 (899)

$1.6904 (1240)

Price at time of writing this review: $1.6806

Support levels (open interest**, contracts):

$1.6695 (842)

$1.6598 (1893)

$1.6499 (1584)

Comments:

- Overall open interest on the CALL options with the expiration date July, 3 is 13271 contracts, with the maximum number of contracts with strike price $1,7100 (1281);

- Overall open interest on the PUT optionswith the expiration date July, 3 is 15259 contracts, with the maximum number of contracts with strike price $1,6600 (1893);

- The ratio of PUT/CALL was 1.15 versus 1.08 from the previous trading day according to data from June, 9.

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.