- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 07-11-2014

Stock indices closed lower after the mixed U.S. job report. The U.S. economy added 214,000 jobs in October, missing expectations for a rise of 229,000 jobs, after a gain of 256,000 jobs in September. September's figure was revised up from a rise of 248,000 jobs.

The U.S. unemployment rate declined to 5.8% in October from 5.9% in September. That was the lowest level since July 2008.

Analysts had expected the unemployment rate to remain unchanged.

Germany's trade surplus climbed to €18.5 billion in September from €17.5 billion in August, exceeding expectations for a rise to €18.3 billion.

German adjusted industrial production rose 1.4% in September, missing expectations for a 2.1% gain, after a 3.1% drop in August. August's figure was revised up from a 4.0% fall.

France's trade deficit narrowed to €4.7 billion in September from €5.0 billion in August, beating expectations for an increase to a deficit of €5.2 billion. August's figure was revised up from a deficit of €5.8 billion

French industrial production was flat in September, beating expectations for a 0.1% decline, after a 0.2% fall in August.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,567.24 +16.09 +0.25%

DAX 9,291.83 -85.58 -0.91%

CAC 40 4,189.89 -37.79 -0.89%

Oil futures rose today, restoring previously lost ground, as the data on the US labor market, reported an increase in employment of more than 200 million, improved the prospects of demand for fuel. Nevertheless, by the end of this week the price is still showing a negative trend.

Restrain the growth of yesterday's statements by the President of the European Central Bank, Mario Draghi, who noted that in a short time the bank will purchase the securities, and pointed to the implementation of innovative measures to support in the future.

Market participants are also watching developments in Libya, as local officials said they hope to soon resume work on the south field El Shararah after the country resolve the conflict between the local tribes after the attack militants who on Wednesday closed the place of production .

"The direction of the market will depend on the decision of OPEC production at a meeting on November 27. Chance of production cuts of 30-40%, "- said the director of the analysis of commodity markets, Societe Generale Singapore Mark Keenan. Add OPEC predicts the decline of its share of the global oil market by 5% by 2018 due to rapid growth of shale oil in the US. The Secretary General of the cartel, Abdullah al-Badri expressed confidence that prices will rise in the coming year.

Meanwhile, experts The Wall Street Journal citing representatives of the organization said that OPEC is likely to take action to stop the decline in oil prices, as soon as its price drops to $ 70 per barrel. Some members of OPEC, which was composed of 12 members met informally this week, ahead of a full meeting of the organization on November 27. This meeting took place against the backdrop of the severe decline in oil prices, at least for four years. Prices have fallen by more than 25% compared with summer rates, which leads to conversations that OPEC countries agreed to reduce the production ceiling to support prices. Especially because some of the group members are growing concerns about a possible attack on their budget.

The cost of December futures on US light crude oil WTI (Light Sweet Crude Oil) rose to $ 78.85 a barrel on the New York Mercantile Exchange (NYMEX).

December futures price for North Sea petroleum mix of mark Brent rose $ 0.81 to $ 83.59 a barrel on the London exchange ICE Futures Europe.

The U.S. dollar traded lower against the most major currencies after the mixed U.S. labour market data. The U.S. economy added 214,000 jobs in October, missing expectations for a rise of 229,000 jobs, after a gain of 256,000 jobs in September. September's figure was revised up from a rise of 248,000 jobs.

The U.S. unemployment rate declined to 5.8% in October from 5.9% in September. Analysts had expected the unemployment rate to remain unchanged.

Average hourly earnings climbed 0.1% in October, missing forecasts of a 0.2% gain, after the flat reading in September.

These figures are signs that the labour market in the U.S. is strengthening.

The euro climbed against the U.S. dollar. Germany's trade surplus climbed to €18.5 billion in September from €17.5 billion in August, exceeding expectations for a rise to €18.3 billion.

German adjusted industrial production rose 1.4% in September, missing expectations for a 2.1% gain, after a 3.1% drop in August. August's figure was revised up from a 4.0% fall.

France's trade deficit narrowed to €4.7 billion in September from €5.0 billion in August, beating expectations for an increase to a deficit of €5.2 billion. August's figure was revised up from a deficit of €5.8 billion

French industrial production was flat in September, beating expectations for a 0.1% decline, after a 0.2% fall in August.

The British pound traded higher against the U.S. dollar. The U.K. trade deficit rose to £9.8 billion in September from £8.95 billion in August, missing expectations for a deficit of £9.4 billion. August's figure was revised from a deficit of £9.10 billion.

The Canadian dollar increased against the U.S. dollar ahead of the Canadian labour market data. Canada's unemployment rate fell to 6.5% in October from 6.8% in September. That was the lowest level since November 2008. Analysts had expected the unemployment rate to remain unchanged at 6.8%.

The number of employed people increased by 43,100 in October, exceeding expectations for a gain of 400, after a 74,100 rise in September.

The Swiss franc rose against the U.S. dollar. Retail sales in Switzerland increased at an annual rate of 0.3% in September, missing expectations for a 2.2% rise, after a 1.4% gain in August. August's figure was revised down from a 1.9% increase.

Switzerland's unemployment rate remained unchanged at 3.2% in October.

The Swiss National Bank's foreign exchange reserves declined to 460.427 billion Swiss francs in October from 462.117 billion francs in September. September's figure was revised from 462.194 billion Swiss francs.

The New Zealand dollar traded higher against the U.S. dollar in the absence of any major economic reports from New Zealand.

The Australian dollar was up against the U.S. dollar. In the overnight trading session, the Aussie traded mixed against after the release of the Reserve Bank of Australia's (RBA) quarterly monetary policy statement. The central bank said that the Australian gross domestic product is expected to grow below trend until mid-2015.

The RBA reiterated that the Aussie remains high by historical standards despite the recent declines.

The AiG (Australian Industry Group) performance of construction index declined to 53.4 in October from 59.1 in September.

The Japanese yen increased against the U.S. dollar in the absence of any major economic reports from Japan.

Gold prices rose more than 1 percent, departing from the 4.5-year low, which was associated with the release of weak data on the US labor market.

As previously reported, a number of US non-farm payrolls rose moderately in October, but the unemployment rate fell and wages rose, a sign of the strengthening of the labor market. Non-agricultural employment increased from a seasonally adjusted 214,000 last month. Since the beginning of the year, employers added more than 220 000 employees on average each month, it is the pace, which in the past has always maintained almost ten years ago. The revised data showed that in the previous two months, the economy has added more than 31,000 jobs than previously estimated. Employers added 256,000 jobs in September compared with the original estimate of 248,000. August reading was revised up to 203,000 from the previously announced 180 000. The unemployment rate, obtained from a separate household survey, fell to 5.8% last month. This is the lowest level since 2008. Economists had expected employment to increase by 229 000 in October, and the unemployment rate will remain at 5.9%.

It is worth emphasizing the price of gold under strong selling pressure in recent weeks amid speculation that the first time in eight years, the Federal Reserve closer to raising interest rates after the last month of its bond-buying program, also known as quantitative easing.

Meanwhile, the data showed the world's largest reserves of the gold-traded exchange-traded fund SPDR Gold Trust on Thursday fell by 0.41 percent - up to 732.83 tons, which is a six-year low.

Analysts also note the weak demand for gold in China, where demand for gold jewelry, bars and coins usually increases with a decrease in prices, but this time it did not. On the Shanghai Gold Exchange in the precious metal is trading Friday on $ 1-2 per ounce more global benchmark, whereas before, the margin reached $ 50.

According to experts, in the near future on the precious metals market conditions do not improve. Now, most central banks have developed measures to stimulate the economy, so to bind to gold assets is no reason. The price of gold is estimated to be around in the near future to around $ 1,100. Experts Goldman Sachs, meanwhile, noted that the precious metal may go down in value and up to $ 1050 per ounce.

The cost of December gold futures on the COMEX today rose to 1162.00 dollars per ounce.

The Reserve Bank of Australia (RBA) released its quarterly monetary policy statement on Friday:

- Australian gross domestic product is expected to grow below trend until mid-2015;

- "The very accommodative monetary policy settings will continue to provide support to demand and help growth to strengthen, in time";

- The Australian dollar remains high by historical standards despite the recent declines;

- "A gradual strengthening of economic growth should, in time, lead to stronger growth of employment;

- Inflation is expected to be within the RBA's 2-3% target over the next two years.

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said at a Bank of France conference in Paris on Friday that Japan's government had committed to provide short-term fiscal support and to implement structural reforms.

Kuroda also said that there is some progress made by Japan's government, but "this path is somewhat delayed".

The BoJ governor reiterated that the central bank want to achieve its 2% inflation target in two years.

The U.S. Labor Department released the labour market data today. The U.S. economy added 214,000 jobs in October, missing expectations for a rise of 229,000 jobs, after a gain of 256,000 jobs in September. September's figure was revised up from a rise of 248,000 jobs.

The U.S. unemployment rate declined to 5.8% in October from 5.9% in September. Analysts had expected the unemployment rate to remain unchanged.

Average hourly earnings climbed 0.1% in October, missing forecasts of a 0.2% gain, after the flat reading in September.

The labour-force participation rate was up to 62.8% in October from 62.7% in September. The rate remained near the lowest level since the late 1970s.

These figures are signs that the labour market in the U.S. is strengthening.

U.S. stock futures fluctuated as data showed companies hired fewer workers than forecast in October while the jobless rate unexpectedly fell to a six-year low.

Global markets:

Nikkei 16,880.38 +87.90 +0.52%

Hang Seng 23,550.24 -99.07 -0.42%

Shanghai Composite 2,419.15 -6.72 -0.28%

FTSE 6,581.31 +30.16 +0.46%

CAC 4,206.16 -21.52 -0.51%

DAX 9,339.08 -38.33 -0.41%

Crude oil $78.42 (+0.63%)

Gold $1148.10 (+0.48%)

(company / ticker / price / change, % / volume)

| McDonald's Corp | MCD | 94.70 | +0.04% | 2.9K |

| Procter & Gamble Co | PG | 88.99 | +0.10% | 3.1K |

| Travelers Companies Inc | TRV | 102.01 | +0.10% | 0.4K |

| Verizon Communications Inc | VZ | 50.33 | +0.10% | 6.1K |

| Wal-Mart Stores Inc | WMT | 77.90 | +0.12% | 0.4K |

| Intel Corp | INTC | 33.87 | +0.15% | 4.5K |

| AT&T Inc | T | 34.78 | +0.17% | 5.1K |

| International Business Machines Co... | IBM | 161.75 | +0.18% | 6.1K |

| Home Depot Inc | HD | 97.47 | +0.19% | 1.1K |

| JPMorgan Chase and Co | JPM | 61.36 | +0.21% | 0.1K |

| United Technologies Corp | UTX | 108.85 | +0.25% | 1.1K |

| Goldman Sachs | GS | 191.56 | +0.29% | 0.1K |

| Boeing Co | BA | 124.94 | +0.29% | 22.4K |

| Exxon Mobil Corp | XOM | 95.85 | +0.29% | 1.7K |

| Pfizer Inc | PFE | 30.13 | +0.30% | 0.1K |

| Johnson & Johnson | JNJ | 109.35 | +0.31% | 2.2K |

| Merck & Co Inc | MRK | 59.48 | +0.37% | 1.2K |

| Microsoft Corp | MSFT | 48.88 | +0.37% | 7.7K |

| Chevron Corp | CVX | 118.98 | +0.38% | 0.1K |

| The Coca-Cola Co | KO | 42.46 | +0.40% | 11.1K |

| Caterpillar Inc | CAT | 101.32 | +0.41% | 1.4K |

| Cisco Systems Inc | CSCO | 25.46 | +0.79% | 15.1K |

| American Express Co | AXP | 91.58 | 0.00% | 1.4K |

| UnitedHealth Group Inc | UNH | 96.21 | 0.00% | 0.4K |

| General Electric Co | GE | 26.30 | -0.23% | 10.4K |

| Walt Disney Co | DIS | 89.77 | -2.42% | 102.9K |

Statistics Canada released the labour market data today. Canada's unemployment rate fell to 6.5% in October from 6.8% in September. That was the lowest level since November 2008.

Analysts had expected the unemployment rate to remain unchanged at 6.8%.

The number of employed people increased by 43,100 in October, exceeding expectations for a gain of 400, after a 74,100 rise in September.

Full-time jobs climbed by 26,500 in October, while part-time positions increased by 16,500.

Retail and wholesale trade, finance, insurance and real estate and manufacturing added jobs, while public administration and natural resources lost jobs.

EUR/USD: $1.2400(E1.3bn), $1.2450(E525mn), $1.2500(E5.5bn), $1.2550(E4.6bn)

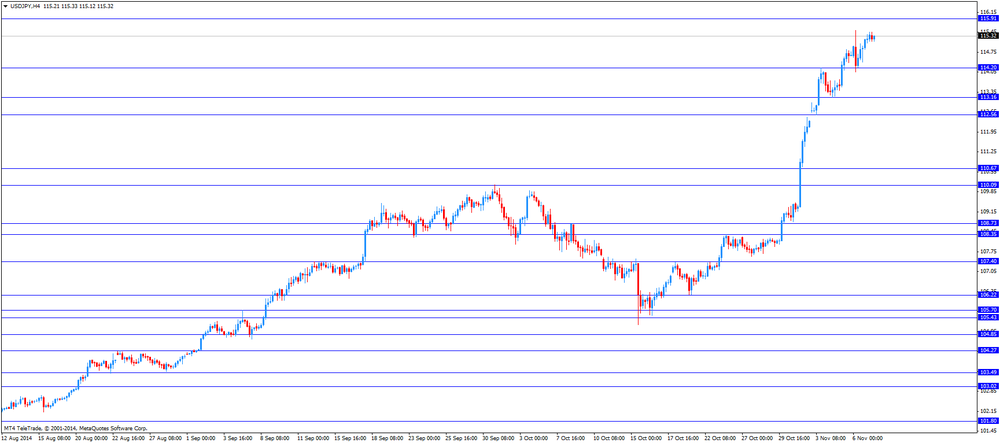

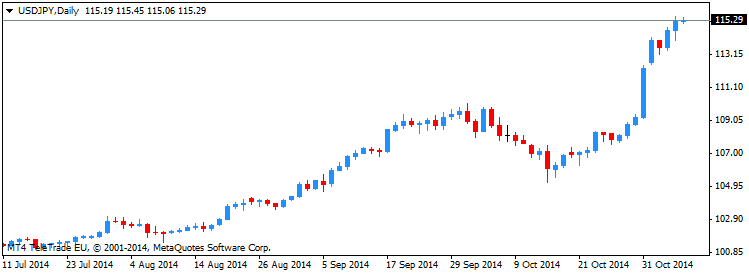

USD/JPY: Y114.00($525mn), Y115.00($300mn)

GBP/USD: $1.5900-05(stg440mn)

EUR/GBP: stg0.7750(E200mn), stg0.7900(E100mn), stg0.7950(E220mn)

USD/CHF: Chf0.9460($1.65bn)

AUD/USD: $0.8600(A$1.1bn), $0.8650(A$700mn), $0.8675(A$796mn), $0.8700(A$467mn), $0.8750 A$2.1bn

NZD/USD: $0.7720(NZ$200mn), $0.7800(NZ$201mn)

USD/CAD: C$1.1300($1.2bn), C$1.1350($600mn), C$1.1500($675mn)

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:05 U.S. FOMC Member Mester Speaks

00:30 Australia RBA Monetary Policy Statement

06:45 Switzerland Unemployment Rate October 3.2% 3.2% 3.2%

07:00 Germany Current Account September 10.3 22.3

07:00 Germany Industrial Production s.a. (MoM) September -3.1% Revised From -4.0% +2.1% +1.4%

07:00 Germany Industrial Production (YoY) September -2.8% -0.1%

07:00 Germany Trade Balance September 17.5 18.3 18.5

07:45 France Trade Balance, bln September -5.8 -5.2 -4.7

07:45 France Industrial Production, m/m September -0.2% Revised From 0.0% -0.1% 0.0%

07:45 France Industrial Production, y/y September -0.3% -0.3%

08:00 Switzerland Foreign Currency Reserves October 462.2 460.4

08:15 Switzerland Retail Sales Y/Y September +1.4% Revised From +1.9% +2.2% +0.3%

09:30 United Kingdom Trade in goods September -9.0 Revised From -9.1 -9.4 -9.8

10:00 Eurozone ECOFIN Meetings

The U.S. dollar traded mixed to lower against the most major currencies ahead of the U.S. labour market data. The U.S. unemployment rate is expected to remain unchanged at 5.9% in October. The U.S. economy is expected to add 229,000 jobs in October.

The euro traded higher against the U.S. dollar after the mostly better-than-expected economic data from the Eurozone. Germany's trade surplus climbed to €18.5 billion in September from €17.5 billion in August, exceeding expectations for a rise to €18.3 billion.

German adjusted industrial production rose 1.4% in September, missing expectations for a 2.1% gain, after a 3.1% drop in August. August's figure was revised up from a 4.0% fall.

France's trade deficit narrowed to €4.7 billion in September from €5.0 billion in August, beating expectations for an increase to a deficit of €5.2 billion. August's figure was revised up from a deficit of €5.8 billion

French industrial production was flat in September, beating expectations for a 0.1% decline, after a 0.2% fall in August.

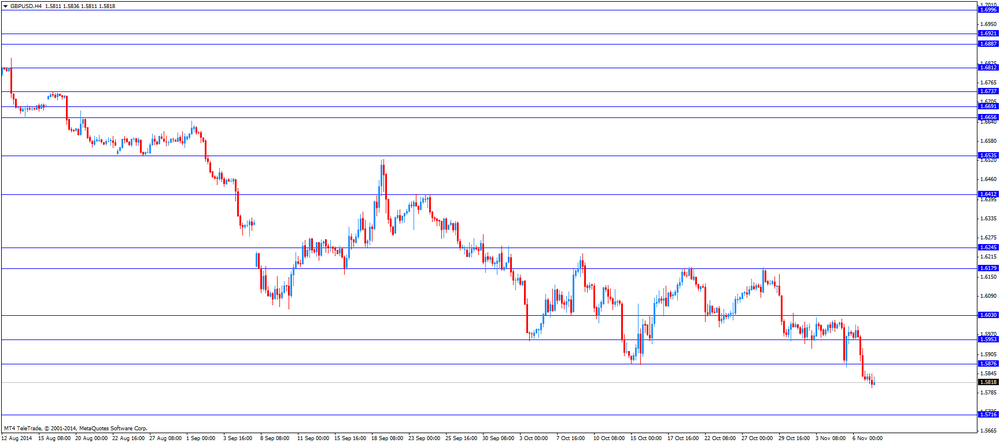

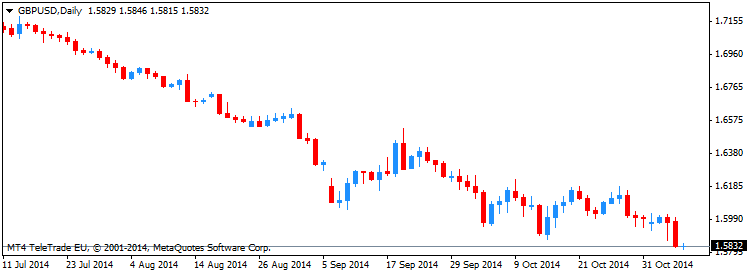

The British pound traded mixed against the U.S. dollar after the trade data from the U.K. The U.K. trade deficit rose to £9.8 billion in September from £8.95 billion in August, missing expectations for a deficit of £9.4 billion. August's figure was revised from a deficit of £9.10 billion.

The Canadian dollar traded mixed against the U.S. dollar ahead of the Canadian labour market data. The unemployment rate in Canada is expected to remain unchanged at 6.8% in October.

Canada's economy is expected to add 400 jobs in October.

The Swiss franc traded higher against the U.S. dollar. Retail sales in Switzerland increased at an annual rate of 0.3% in September, missing expectations for a 2.2% rise, after a 1.4% gain in August. August's figure was revised down from a 1.9% increase.

Switzerland's unemployment rate remained unchanged at 3.2% in October.

The Swiss National Bank's foreign exchange reserves declined to 460.427 billion Swiss francs in October from 462.117 billion francs in September. September's figure was revised from 462.194 billion Swiss francs.

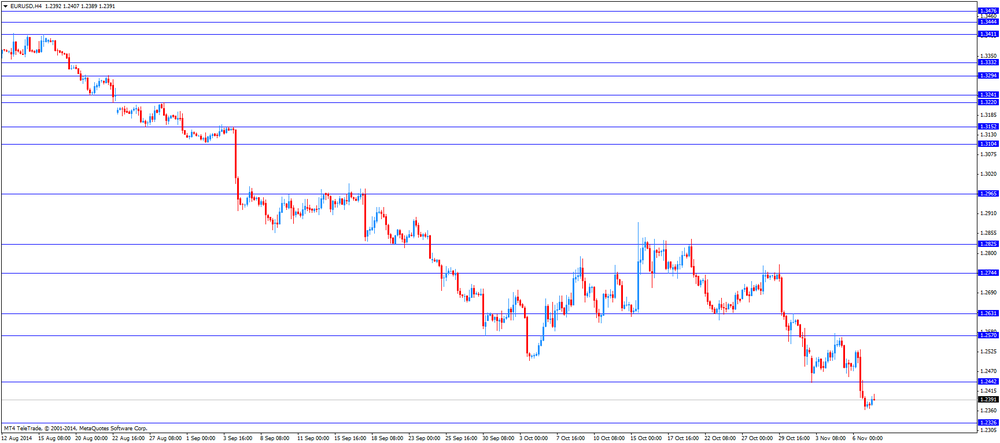

EUR/USD: the currency pair rose to $1.2407

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

13:30 Canada Employment October 74.1 0.4

13:30 Canada Unemployment rate October 6.8% 6.8%

13:30 U.S. Average hourly earnings October 0.0% +0.2%

13:30 U.S. Nonfarm Payrolls October 248 229

13:30 U.S. Unemployment Rate October 5.9% 5.9%

EUR/USD

Offers $1.2550, $1.2500, $1.2425

Bids $1.2350/40, $1.2300, $1.2250

GBP/USD

Offers $1.5950/60, $1.5930/35, $1.5900/10

Bids $1.5800

AUD/USD

Offers $0.8750, $0.8700, $0.8640/50

Bids 0.8520, $0.8500, 0.8450

EUR/JPY

Offers Y144.50

Bids Y142.00, Y141.55/50, Y141.00, Y140.50

USD/JPY

Offers Y116.50, Y116.00

Bids Y115.10/00, Y113.80/70, Y113.50/40

EUR/GBP

Offers

Bids stg0.7755/45, stg0.7700

Oil prices rose moderately during today's trading after being under further pressure on Thursday due to concerns about supply disruptions in Libya after the seizure of Libya's El Sharara field by armed militia and a damaged pipeline in Saudi Arabia.

Prizes declined this week after Saudi Arabia's announcement to cut official prices for oil destined to the U.S. markets and signs that global supply will stay ahead of demand in the time to come and due to the U.S. shale boom.

"We don't see that much of change in fundamentals. The decline is 28 percent, it's a little bit too much.", OPEC Secretary-General Abdullah al-Badri said on Thursday further stating that the price drop cannot continue as it's threatening investment in production.

Brent Crude, set for a seventh week of consecutive price drops, is currently trading +0.18% at USD83.01, WTI Crude +0.35% at USD78.18.

Gold, set to fall a third consecutive week, was able to recover from early market losses to 4 ½ year lows at USD1,131.70 in the wake of U.S. non-farm payrolls and a stronger U.S. dollar. If payrolls fail to fuel optimism in the world's largest economy a rally could be triggered after the losses earlier this week. Gold has been bearish for the whole week after breaking the important support at USD1,180.00 last Friday.

GOLD recovered from new low at USD1,131.70 currently trading at USD1,144.70

EUR/USD: $1.2400(E1.3bn), $1.2450(E525mn), $1.2500(E5.5bn), $1.2550(E4.6bn)

USD/JPY: Y114.00($525mn), Y115.00($300mn)

GBP/USD: $1.5900-05(stg440mn)

EUR/GBP: stg0.7750(E200mn), stg0.7900(E100mn), stg0.7950(E220mn)

USD/CHF: Chf0.9460($1.65bn)

AUD/USD: $0.8600(A$1.1bn), $0.8650(A$700mn), $0.8675(A$796mn), $0.8700(A$467mn), $0.8750 A$2.1bn

NZD/USD: $0.7720(NZ$200mn), $0.7800(NZ$201mn)

USD/CAD: C$1.1300($1.2bn), C$1.1350($600mn), C$1.1500($675mn)

REUTERS

U.S. regulators to join UK in forex fines for banks

U.S. regulators plan to join their UK peers in a multi-billion-dollar settlement with a group of the biggest global banks accused of manipulating the foreign exchange market, sources familiar with the matter said, adding the deal could come as early as next week.

Source: http://www.reuters.com/article/2014/11/07/forex-manipulation-fines-idUSL1N0SX02M20141107

BLOOMBERG

Dollar Set for Biggest Weekly Gain in 16 Months Before Payrolls

A gauge of the dollar headed for its biggest weekly gain in more than 16 months before a U.S. government report forecast to show employers added more jobs in October than this year's average.

The U.S. currency approached a seven-year high against the yen set yesterday after Bank of JapanGovernor Haruhiko Kuroda said this week the central bank will maintain stimulus as long as needed. The euro was poised for a third weekly decline after European Central Bank President Mario Draghi deepened his commitment to stimulus yesterday.

REUTERS

SNB forex reserves down in October

The Swiss National Bank's foreign exchange reserves fell in October, data showed on Friday.

The SNB held 460.427 billion Swiss francs in foreign currency at the end of October, compared with 462.117 billion francs in September, revised from an originally reported 462.194 billion francs, preliminary data calculated according to the standards of the International Monetary Fund showed.

Source: http://www.reuters.com/article/2014/11/07/swiss-snb-forex-idUSL6N0SW4O420141107

REUTERS

OPEC concerned, not panicking about oil price: Badri

Fundamental factors do not justify the sharp drop in oil prices, OPEC Secretary-General Abdullah al-Badri said on Thursday, forecasting a price rebound by the second half of 2015.

"We are concerned but we are not panicking," he told reporters at a news conference on the group's 2014 World Oil Outlook.

Source: http://www.reuters.com/article/2014/11/06/us-opec-oil-badri-idUSKBN0IQ1QR20141106

European stock indices were mostly trading higher at the start helped by positive corporate earnings reports and awaiting U.S. Nonfarm Payrolls and Unemployment Rate being published 13:30 GMT. German exports (18.5 - forecast 18.3) and industrial production (-0.1% - prior -2.8%) were better in September after declining in August. Positive signs for Europe's largest economy to avoid falling into recession in the third quarter. UK's FTSE 100 index is up 0.52% trading at 6514.79 points, Germany's DAX 30 gained 0.16% currently trading at 9,392.71 points while France's CAC 40 lost -0.02% trading around its opening at 4,226.83 points.

The DOW Jones and S&P 500 continued to rise in yesterday's volatile trading session hitting new record closing highs. The DOW Jones was up +0.40% closing at 17,554.47 points, the S&P500 +0.38% closing at 2,031.21 as the ECB was showing its will to further help the weakening European economy. Telecommunications and utilities were the weakest sectors while industrial shares were the strongest sector.

Hong Kong's Hang Seng lost -0.42% closing at 23,550.24, China's Shanghai Composite lost -0.28% closing at 2,419.15 whereas Japan's Nikkei was up 0.52% and rose to 16,880.48 after yesterday's decline mainly caused by investors taking profits after recent gains after BoJ's stimulus.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/

Actual

00:05 U.S. FOMC Member Mester Speaks

00:30 Australia RBA Monetary Policy Statement

06:45 Switzerland Unemployment Rate October 3.2% 3.2% 3.2%

07:00 Germany Current Account September 10.3 22.3

07:00 Germany Industrial Production s.a. (MoM) September -4.0% +2.1%

+1.4%

07:00 Germany Industrial Production (YoY) September -2.8% -0.1%

07:00 Germany Trade Balance September 17.5 18.3 18.5

The U.S. dollar traded stronger against its

major peers. Investors are awaiting U.S. Nonfarm Payrolls as employment rates

are projected to go up which could lead to further speculation the FED is going

to increase interest rates in the future. The euro traded at USD1.2363 near its two-year low after European

Central Bank President Mario Draghi is expected to take more easing steps to

help economic growth in the euro zone leaving interest rates at the current

record-low level of 0.05%. As long as there is a risk of ECB additional easing

the euro will be under pressure.

The New Zealand dollar currently trading at

USD0.7686 continued to fall after breaching the important support level of

USD0.7700

The Australian dollar reached new record

lows since 2010 against the U.S. dollar

as the Australian Central Bank forecasts weak domestic growth.

The Japanese yen currently trading at

USD115.17 close to its new record-low of USD115.51 after the BoJ’s economic

stimulus from last week.

EUR/USD: the currency pair declined to USD1.2381

USD/JPY: the U.S. dollar appreciated

against the Japanese yen and is currently trading at Y115.29

GPB/USD: the currency pair decreased to

USD1.5832

The most important news that are

expected (GMT0):

07:45 France Trade Balance, bln September

-5.8 -5.2

07:45 France Industrial Production, m/m

September 0.0% -0.1%

07:45 France Industrial Production, y/y September -0.3%

08:00 Switzerland Foreign Currency Reserves

October 462.2

08:15 Switzerland Retail Sales Y/Y

September +1.9% +2.2%

09:30 United Kingdom Trade in goods

September -9.1 -9.4

10:00 Eurozone ECOFIN Meetings

13:30 Canada Employment October 74.1 0.4

13:30 Canada Unemployment rate October 6.8%

6.8%

13:30 U.S. Average hourly earnings October

0.0% +0.2%

13:30 U.S. Nonfarm Payrolls October 248 229

13:30 U.S. Unemployment Rate October 5.9% 5.9%

19:00 U.S. Consumer Credit September 13.5

16.6

EUR / USD

Resistance levels (open interest**, contracts)

$1.2555 (3169)

$1.2512 (2853)

$1.2445 (1129)

Price at time of writing this review: $ 1.2377

Support levels (open interest**, contracts):

$1.2345 (8165)

$1.2312 (4720)

$1.2283 (4173)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 71395 contracts, with the maximum number of contracts with strike pric $1,2900 (6968);

- Overall open interest on the PUT options with the expiration date November, 7 is 68618 contracts, with the maximum number of contracts with strike price $1,2400 (8165);

- The ratio of PUT/CALL was 0.96 versus 0.98 from the previous trading day according to data from November, 6

GBP/USD

Resistance levels (open interest**, contracts)

$1.6100 (1620)

$1.6001 (606)

$1.5902 (506)

Price at time of writing this review: $1.5830

Support levels (open interest**, contracts):

$1.5797 (1815)

$1.5699 (1481)

$1.5600 (1086)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 30066 contracts, with the maximum number of contracts with strike price $1,6200 (2849);

- Overall open interest on the PUT options with the expiration date November, 7 is 36545 contracts, with the maximum number of contracts with strike price $1,5900 (4447);

- The ratio of PUT/CALL was 1.22 versus 1.19 from the previous trading day according to data from November, 6

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.