- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 08-08-2011

Stocks have eased down to new session lows. Neither the stock market, Treasuries, nor the dollar has showed a real response to recent comments from President Obama, who said that the downgrade of US debt by S&P came because of doubts about the political system. He also said that the problem is not because of confidence in US credit, but the long-term deficit.

Stocks have been gradually grinding lower. In turn, the stock market is now back near its session low. At its current level, the S&P 500 is down 14% in just 11 sessions. It is down almost 16% from its May high.

As for overseas action, China's Shanghai Composite fell almost 4% in its latest round of trade. That has the Composite deeper into bear market territory, since it is now down by about 25% from its November high. Japan's Nikkei fell 2.2% overnight so that it is now down almost 17% from its February high. In Europe, Britain's FTSE fell 3.4% on Monday. It is now down 17% from its February high. Germany's DAX dropped 5.0% today, leaving it 22% below its May high so that it is now in bear market territory.

The yen and the Swiss franc gained versus all of their most-traded peers as Standard & Poor’s downgrade of the U.S., coupled with a deepening euro-region sovereign debt crisis, lifted demand for the safest assets.

S&P’s outlook on the U.S. rating remains “negative” and may be cut to AA from AA+ within two years if spending reductions are lower than agreed to, interest rates rise or “new fiscal pressures” increase debt, the New York-based company said on Aug. 5 as it announced the downgrade.

The dollar rose to a four-month high against Australia’s currency and gained versus the euro as investors sought the refuge of U.S. government debt even after the rating cut as stocks fell. Treasury two-year note yields reached a record low. Canada’s dollar reached a four-month low versus the greenback as crude oil, the nation’s biggest export, plunged.

U.S. two-year note yields decreased as much as six basis points, or 0.06 percentage point, to an all-time low of 0.23 percent. Yields on 10-year notes tumbled 19 basis points to 2.37 percent. The Standard & Poor’s 500 Index dropped 3.6 percent following the biggest weekly fall since 2008.

Moody’s Investors Service reiterated that it affirmed the U.S.’s top Aaa ranking because the dollar’s status as the main reserve currency allows it to support higher debt levels than other countries, Moody’s analyst Steven Hess wrote in a report.

S&P expects the dollar, “for lack of alternative if no other reason,” to retain its reserve-currency role, John Chambers, chairman of the company’s sovereign-debt committee, said in an conference call today. Even so, the U.S. is unlikely to regain its AAA rating quickly, David Beers, managing director of S&P’s sovereign ratings group, and Chambers said in the call.

Stocks failed to extend their recent rebound attempt. Instead, they have been hit with renewed selling pressure that has left the S&P 500 to continue trading with a loss of more than 3%.

Stocks recently registered fresh session lows that translate to losses of almost 4% for both the Nasdaq and S&P 500. The Dow is down little more than 3%.

Consumer staples giant Procter & Gamble (PG 60.92, +0.33) is the only name in the 30-member Dow that has managed to put together any kind of a gain. The stock has been helped by some positive analyst commentary following its quarterly report late last week. Meanwhile, fellow blue chip Bank of America (BAC 7.32, -0.84) has dropped 10% amid news that some investment funds have liquidated their position in the diversified financial services giant.

EUR/USD: $1.4250, $1.4300

USD/JPY: Y78.00, Y80.00

EUR/JPY: Y111.20, Y112.00

EUR/GBP: stg0.8625

AUD/USD: $1.0300

AUD/JPY: Y81.00

An unprecedented downgrade of U.S. debt has prompted a precipitous drop in stock futures, such that the cash market is expected to open with a loss of at least 2%. The news has also driven aggressive selling abroad, where many of the major bourses of Europe are down in excess of 1% and most of Asia's averages fell more than 2%. The global sell-off has spurred strong buying in precious metals. In turn, gold prices are up more than 3% to a new record high above $1700 per ounce, while silver is up about 4% to $39.74 per ounce. Silver is still shy of the multi-month high above $40 per ounce that it set last week, though. Want for safety has sent traders into Treasuries, too, despite the US debt downgrade. The action has taken the yield on the 2-year Note to a new record low closer to 0.24% and the yield on the benchmark 10-year Note back below 2.50%. The dollar has maintained a buying bid this morning; after easing off of its morning high, the greenback is clinging to a 0.2% gain against a collection of competing currencies. Outside of the downgrade headline, there isn't much news for traders to digest -- the economic calendar is empty and the pace of quarterly earnings announcements has begun to slow.

Data:

There is no key news for today.

Offers $1.4400, $1.4350/60, $1.4320/25, $1.4300/05, $1.4275/80

"Given our lower growth outlook, we were already inclined to expect the Fed to remain on hold through at least the middle of 2013. We still do not expect the Fed to announce additional steps of monetary accommodation."

Data released:

05:00 Japan Eco Watchers Survey: Outlook (Jul) 48.5

The dollar dropped to a record low against the Swiss franc and fell for a second day versus the yen after Standard & Poor’s downgrade of the U.S. added to concern the fiscal health of the world’s biggest economy is slipping.

The greenback weakened against the euro before the Federal Reserve meets tomorrow on monetary policy after S&P cut the U.S. one level on Aug. 5. S&P kept the outlook on the U.S. rating at “negative”. The rating may be cut to AA from AA+, the company said on Aug. 5 after markets closed.

Moody’s Investors Service and Fitch Ratings affirmed their AAA credit ratings for the U.S. on Aug. 2, the day President Barack Obama signed a bill. Moody’s and Fitch also said downgrades were possible if lawmakers fail to enact debt-reduction measures and the economy weakens.

Fed policy makers may address chances of further slowdown when the Federal Open Market Committee releases a statement tomorrow. Chairman Ben S. Bernanke told Congress on July 14 that central bank officials want to see if the economy rebounds and that they are keeping a close eye on inflation.

The euro also advanced after the European Central Bank signaled it’s ready to start buying Italian and Spanish bonds to curb the region’s debt crisis.

The yen gained versus most major peers as Asian shares slid for a fifth day, supporting demand for Japan’s currency as a refuge.

Gold jumped to a record, rising to more than $1,700 an ounce.

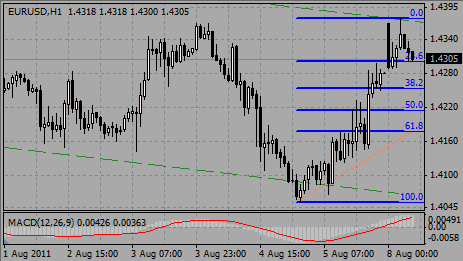

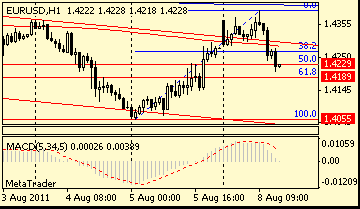

EUR/USD tested $1.4400, but failed to break above the figure to spurr correction. Rate was dragged lower after a release of weak Sentix index to print lows around $1.4325.

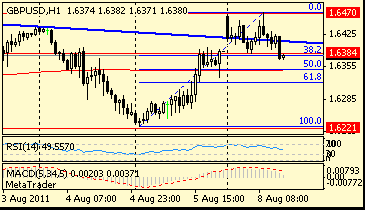

GBP/USD initially tested highs on $1.6470 before retreated to $1.6400. Rate currentl tries to recover.

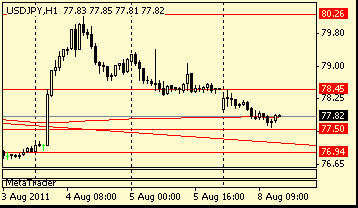

USD/JPY holds within the Y77.70/90 range.

There is no key news for today.

USD/JPY holds at Y77.79, while rate is contained in a tight Y77.74-94 range. Bids seen at Y77.50/40, with reported stops through Y77.20. More bids seen at Y77.00/95. Offers at Y78.00/10 and Y78.50/60.

GBP/USD retreats from the European morning recovery high around $1.6470 to the lows below $1.6420. Support seen in place between $1.6410/00 ($1.6407 - 76.4% $1.6386/1.6470), a break below to expose the overnight low at $1.6386.

EUR/USD: $1.4250, $1.4300

USD/JPY: Y78.00, Y80.00

EUR/JPY: Y111.20, Y112.00

EUR/GBP: stg0.8625

AUD/USD: $1.0300

AUD/JPY: Y81.00

EUR/USD

Offers: $1.4400, $1.4430/40

Bids: $1.4300, $1.4280

GBP/USD

Offers: $1.6480, $1.6500, $1.6520

Bids: $1.6385/75

USD/JPY:

Offers: Y78.00/10, Y78.50/60

Bids: Y77.40/50

AUD/USD

Bids: $1.0280, $1.0250

Asian stock markets ended the week significantly lower.

By the end of the week the Japan’ Nikkei 225 fell by 5.42% to 9,299.88.

The Hong Kong’ Hang Seng shed 6.66% to 20,946.10.

The Australia’ S&P/ASX 200 closed lower 7.22% at 4,169.70.

The China’ Shanghai Composite Index dropped by 2.79% to 2,626.42.

Fears of a slowdown in global growth also drove down the shares of stocks, carmakers and electronics groups. The sell-off in global markets hit Asian stocks hard this week as the region’s banks slid under the weight of the heavy selling of financial assets.

Japan's yen-selling intervention couldn’t support the Nikkei index. In addition the currency erased the effect of Japan's yen-selling intervention nearly by half at the turn of the week. Earlier The Bank of Japan expanded its asset-purchase fund to 15 trillion yen ($189 billion) from 10 trillion yen and left the benchmark interest rate unchanged at the level of 0-0.1%.

The region’s energy sector stocks suffered losses amid falling oil prices. At the end of the week shares of Inpex declined by 11% in Japan, Cnooc dropped 10.9% in Hong Kong, Woodside Petroleum lost 9.9% in Australia.

Among the financials, ICBC fell 7.9% and Tokyo’s Shinsei Bank shed 6.1%.

Mitsubishi UFJ Financial, Japan’s largest publicly traded bank, limited its weekly losses after a threefold increase in first-quarter net profit.

It worth moted some automakers, which released quarterly financial reports this week.

Among the financials, ICBC fell 7.9 per cent to HK5.46 and Tokyo’s Shinsei Bank shed 6.1 per cent to Y92.

Mitsubishi UFJ Financial , Japan’s largest publicly traded bank, limited its weekly losses after a threefold increase in first-quarter net profit.

Sentiment towards the bank was also helped by the conversion of its preferred shares in Morgan Stanley into common stock, which increased a stake in its Wall Street peer to 22 per cent.

Its shares outperformed to fall just 2.6 per cent over the week to Y382.

Toyota Motor, the world’s biggest carmaker by sales, said that the stronger yen had cut its fiscal first-quarter operating profit by Y50bn. Although it later raised its full-year net profit forecast by 40 per cent on Tuesday, its shares were down 3.6% on the week at Y3,040.

Honda Motor fell by 6.3% over the week after posting a sharp decline in second-quarter profit.

Korea’s Hyundai Motor sang by 13.2% as US carmakers warned of fragile demand as hopes of a strong economic rebound in the second half faded. Hyundai’s affiliate, Kia Motors , lost 6%.

European markets also suffered substantial losses for the week ended Aug 5.

By the end of the week the pan-European FTSEurofirst 300 index tumbled 9.90% to 975.02.

The Britain's FTSE 100 closed down 9.77% tat 5,246.99.

The Frence’ CAC 40 decreased by 10.70% to 3,280.50.

The Germany’ Xetra DAX fell by 12.89% to 6,257.50.

European markets also shed after ECB President Jean-Claude Trichet acknowledged a “particularly high” level of uncertainty said inflation expectations “must remain firmly anchored.” He said the ECB will offer banks additional cash as the region’s debt crisis spreads increasing pressure on policy makers to resume bond purchases.

The oil prices have been plummeting down on concerns over slowdown in economic recovery of US and Europe for all this week. Reports on US macroeconomic statistics have showed the worst figures during a long time and the approved legislation plan of cutting federal spending by $2.4 trillion triggered worries about prospects of the world's largest economy. Widened spread between Italian, Spain, French and Belgium bonds and German 10-year bonds fueled concerns about EU debt crisis.

On Friday the stocks exchanges began to rebound after news that the ECB is willing to buy Italian and Portugal bonds if Italy advances reforms.

Increased government borrowing costs sent Italian banks tumbling. Intesa Sanpaolo dropped 19.1% over the week and UniCredit shed 18.5%. The banks did manage a brief rally on Wednesday proceeding a political address by Silvio Berlusconi. The Italian PM said the nation's banks - having passed the stress tests – “are solid”, and noted that “Italy is well capitalized and can finance the economy”. However, investors remained unconvinced that Italy could avoid being drawn into the deepening eurozone debt crisis.

Fiat fell by 19.4% on a drop in domestic July car sales. Rising costs of raw materials and projections of slower growth in previously fast growing markets, such as China and Brazil, have weighed heavily on car manufacturers in Europe. Fiat Industrial, the Italian truck and tractor maker, was down 18.7%.

Italian phone company Telecom Italia defied trends this week, climbing 13.3% as its Brazilian division TIM Participacoes exceeded profit expectations and an Italian newspaper reported a possible takeover of mobile operator 3 Italia.

Veolia Environnement was the week’s biggest faller, plunging 29.4%. The French water company fell to a record low following a first-half loss and plans to halve its geographic reach. Concerns focused on the possibility that the company could cut pay-outs to shareholders.

Wacker Chemie, the German polysilicon maker, tumbled 20.5% after reporting lower-than-expected profits for the second quarter. The company warned of slower economic growth in the second half of the year and blamed high raw material costs.

German retailer Metro suffered a loss of 15.6%. The company said second-quarter income had missed expectations and risks to its 2011 profit target had grown. It cited a faltering global economic recovery and fretful shoppers following higher food prices.

"Blue Chips" suffered the worst weekly losses since 2008.

At the end of the week the S&P 500 collapsed 7.19% to 1,199.38.

NASDAQ Composite closed the week lower by 3.58% at 2,756.38.

Dow Jones Industrial Average tumbled 5.75% to 12,143.24.

The markets have been plummeting down on concerns over slowdown in economic recovery of US and Europe for all this week.

The Wall Street suffered Thursday their worst day since the 2008 financial crisis. On Thursday the US stock equities collapsed 4%-5%, erasing their gains for the year. The Dow Jones industrial average plunged more than 500 points.

Earlier this week, U.S. markets were down amid the "debt ceiling drama". The Senate and President Obama approved the legislation plan to hike the U.S. debt limit at the last minute. If the deal hadn’t been passed by Aug 2, the US might have been faced a technical default and lost its AAA debt rating immediately. However, the risk of downgrade remained real.

The approved legislation plan of cutting federal spending by $2.4 trillion triggered worries about prospects of the world's largest economy.

At the last day of the week the markets were supported by strong US labor market statistics and reports that the ECB is willing to buy Italian and Portugal bonds if Italy advances reforms.

Market participants also concerned as reports on US macroeconomic statistics have showed the worst figures during a long time, including weak July data on manufacturing and non-manufacturing indices from ISM.

At the last day of the week the markets were supported by strong US labor market statistics and reports that the ECB is willing to buy Italian and Portugal bonds if Italy advances reforms.

As for corporate news, financial, basic materials and industrial goods S&P groups were hit the hardest.

Bank of America-Merrill Lynch fell by 15.9% for the week, while Citigroup lost 12.8% over the week.

But the volatile session still left the Nasdaq Composite down 0.9 per cent to 2532.41, compounding a heavy week of losses which saw it hit its lowest point since November 2010.

The Dow Jones Industrial Average managed to edge up 0.5 per cent on Friday to 11,444.61 but lost 5.8 per cent for the week. Energy shares were among the biggest losers on Friday.

Sunoco, the petroleum group, shed 5.2%, Alpha Natural Resource, the coal supplier, dropped 2.8% and AK Steel sang 1% over the week amid missing quarterly reports.

The week’s top gainer was Priceline.com, which added 10.6%.

Kraft Foods Inc. increased 3.4% for the week, the biggest gainer among companies of Dow Jones Industrial. The food maker said it would split into two separate publicly traded companies: a snacks business and a North American grocery business.

The Senate and President Obama approved the legislation plan to hike the U.S. debt limit at the last minute. If the deal hadn’t been passed by Aug 2, the US might have been faced a technical default and lost its AAA debt rating immediately. However, the risk of downgrade remained real.

The approved legislation plan of cutting federal spending by $2.4 trillion triggered worries about prospects of the world's largest economy.

Market participants also concerned as reports on US macroeconomic statistics have showed the worst figures during a long time, including weak July data on manufacturing and non-manufacturing indices from ISM.

On Friday the dollar declined versus a majority of its most-traded counterparts as U.S. employers added more jobs than forecast in July and the unemployment rate fell, damping demand for refuge.

The European currency also suffered substantial losses amid worries about EU debt crisis. ECB President Jean-Claude Trichet acknowledged a “particularly high” level of uncertainty said inflation expectations “must remain firmly anchored.” He said the ECB will offer banks additional cash as the region’s debt crisis spreads increasing pressure on policy makers to resume bond purchases. Widened spread between Italian, Spain, French and Belgium bonds and German 10-year bonds fueled concerns about EU debt crisis.

On Friday the euro began to rebound after news that the ECB is willing to buy Italian and Portugal bonds if Italy advances reforms.

The Canadian dollar shed to the lowest level over 5 weeks amid declining crude oil prices, Canada’s biggest export.

Switzerland’s franc reached new life-time highs several times this week as “save haven” amid weakness of the dollar and the yen. The franc’ rise has been curbing as the Swiss National Bank said it won’t exclude any measures to curb the currency’s advance.

The Japan's yen strengthened against the US dollar, but its increase also was curbed by the nation’s central bank. The Bank of Japan expanded its asset-purchase fund to 15 trillion yen ($189 billion) from 10 trillion yen and left the benchmark interest rate unchanged at the level of 0-0.1%. However, the currency erased the effect of Japan's yen-selling intervention nearly by half at the turn of the week.

Resistance 3: Y80.20

Resistance 2: Y79.40

Resistance 1: Y79.00

Current price: Y77.76

Support 1: Y76.70

Support 2:Y76.30

Support 3:Y75.60

Comments: Rate continues retreating after it sharply rally last Wednesday, when BOJ intervened. Strong support comes at Y76.70 (Aug 03 lows), then - at Y76.30 (Aug 01 lows). If losses widens the decline may dip to a channel line from Apr 07 at Y75.60. Resistance is around Y79.00 (local Friday's high), then - at Y79.40 (Friday's high). Stronger level is near Aug 04 highs at Y80.20 (also channel line from Apr 07).

Nikkei -359.3 (-3.72%) 9299.88

Topix -25.20 (-3.14%) 801.16

DAX -178.60 (-2.78%) 6,236

CAC -41.79 (-1.26%) 3,279

FTSE-100 -146.15 (-2.71%) 5,247

Dow +60.93 (+0.54%) 11,445

Nasdaq -52.00 (-2.38%) 2,135.00

S&P500 -0.69 (-0.06%) 1,199

10-Years +0.10 2.56%

Oil -3.28 (-3.78%) $83.60

Gold +49.50 (+3.00%) $1,701.30

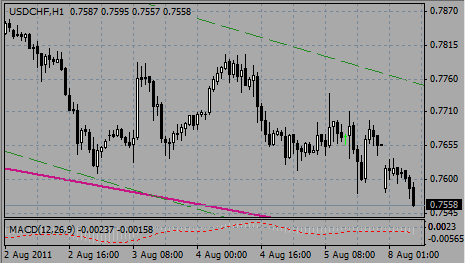

Resistance 3: Chf0.7800

Resistance 2: Chf0.7740/50

Resistance 1: Chf0.7630

Current price: Chf0.7537

Support 1: Chf0.7500

Support 2: Chf0.7440

Support 3: Chf0.7400

Comments: Dollar heads for support at channel line from Jul 08 at Chf0.7500 despite the speculations on possible intervention. Below losses may widen to channel line from Jul 22 at Chf0.7440. Resistance comes at session highs on Chf0.7630, stronger one - at Chf0.7740/50 (Friday's high, also channel line from Jul 22). Further resistance comes at Chf0.7800 (Aug 04 high).

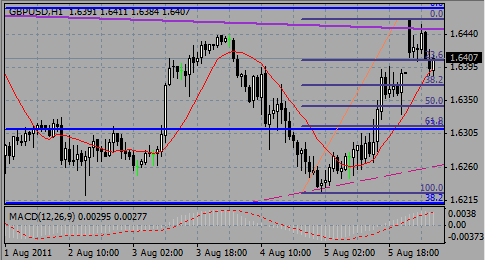

Resistance 3: $1.6640

Resistance 2: $1.6540/45

Resistance 1: $1.6460

Current price: $1.6423

Support 1: $1.6380

Support 2: $1.6310/15

Support 3: $1.6220/25

Comments: Pound tries to recover after it overnight correction. Resistance comes at $1.6460 (overnight high), then the rise may extend to $1.6540/45 (May 31 high) and $1.6640 (channel line from Jul 12). Support comes at session lows on $1.6380 with a break under widens losses to $1.6310/15 (61.8% Fibo of $1.6225 - $1.6460). Strong support comes at Friday's lows on $1.6220/25.

Resistance 3: $1.4535/40

Resistance 2: $1.4480

Resistance 1: $1.4370/80

Current price: $1.4340

Support 1: $1.4300

Support 2: $1.4255/60

Support 3: $1.4210/15

Comments: Rate corrected after earlier rise, but failed to break under the support at $1.4300 (23.6% Fibo of $1.4050 - $1.4370/80 rise). Below support comes at $1.4255/60 (38.2%) with stronger one - on $1.4210/15 (50%). Resistance is near $1.4370/80 (channel line from Jul 27, also Asian high). If break above there is a room for challenging trend line from May 04 at $1.4480). Further resistance is around $1.4535/40 (Jul 27 highs).

01:30 Australia ANZ Job Advertisements (Jul) -0.7% 3.8%

05:00 Japan Eco Watchers Survey: Current (Jul) 52.6

23:50 Japan (M2+CDs) money supply (July) Y/Y 2.9% 2.9%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.