- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 09-03-2015

(raw materials / closing price /% change)

Oil 50.00 +0.79%

Gold 1,166.30 -0.02%

(index / closing price / change items /% change)

Nikkei 225 18,790.55 -180.45 -0.95%

Hang Seng 24,123.05 -40.95 -0.17%

Shanghai Composite 3,302.16 +60.98 +1.88%

FTSE 100 6,876.47 -35.33 -0.51%

CAC 40 4,937.2 -27.15 -0.55%

Xetra DAX 11,582.11 +31.14 +0.27%

S&P 500 2,079.43 +8.17 +0.39%

NASDAQ Composite 4,942.44 +15.07 +0.31%

Dow Jones 17,995.72ь+138.94 +0.78%

(pare/closed(GMT +2)/change, %)

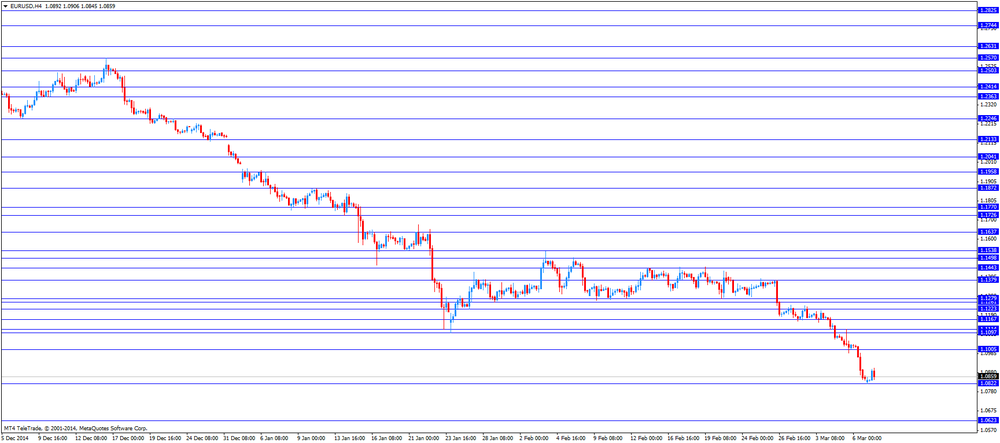

EUR/USD $1,0852 +0,03%

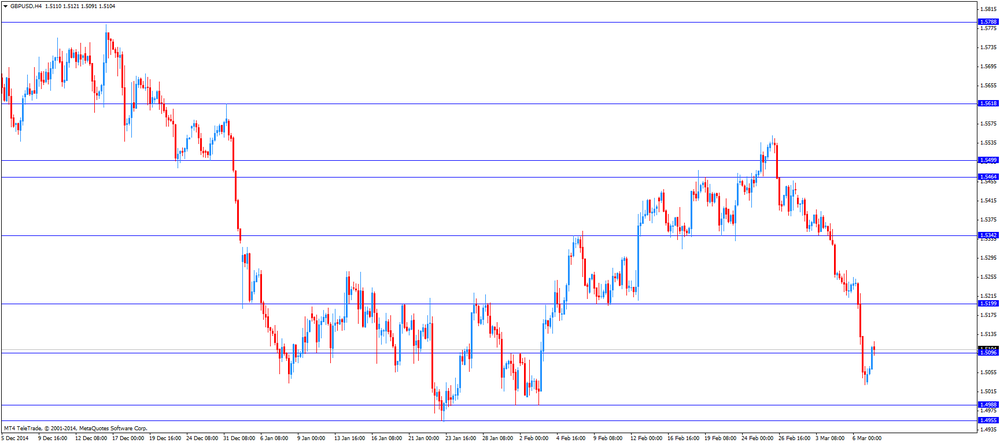

GBP/USD $1,5128 +0,50%

USD/CHF Chf0,9855 +0,05%

USD/JPY Y121,20 +0,43%

EUR/JPY Y131,52 +0,45%

GBP/JPY Y183,34 +0,93%

AUD/USD $0,7703 -0,18%

NZD/USD $0,7353 -0,12%

USD/CAD C$1,2601 -0,08%

(time / country / index / period / previous value / forecast)

0:01 United Kingdom BRC Retail Sales Monitor y/y February +0.2%

00:30 Australia National Australia Bank's Business Confidence February 3

01:30 China PPI y/y February -4.3% -4.2%

01:30 China CPI y/y February +0.8% +1.0%

06:00 Japan Prelim Machine Tool Orders, y/y February +20.4%

06:45 Switzerland Unemployment Rate February 3.1% 3.2%

07:45 France Industrial Production, m/m January +1.5% +0.8%

07:45 France Industrial Production, y/y January -1.3%

10:00 Eurozone ECOFIN Meetings

14:00 U.S. Wholesale Inventories January +0.1% 0.0%

14:00 U.S. JOLTs Job Openings January 5028 5030

20:30 U.S. API Crude Oil Inventories March +2.9

22:05 Australia RBA Assist Gov Kent Speaks

23:30 Australia Westpac Consumer Confidence March +8.0%

23:50 Japan Core Machinery Orders January +8.3% -3.8%

23:50 Japan Core Machinery Orders, y/y January +11.4%

Most stock indices closed lower. People with knowledge of the transactions said that the European Central Bank (ECB) has purchased German, Italia, French and Belgian bonds.

A spokesman for the ECB declined to comment.

The Sentix investor confidence index for the Eurozone rose to 18.6 in March from 12.4 in February, exceeding expectations for an increase to 15.0.That was the highest level since August 2007.

The index benefited from a weaker euro, lower oil prices and quantitative easing.

Germany's trade surplus narrowed to €19.7 billion in January from €21.6 billion in December, missing expectations for a rise to €22.3 billion. December's figure was revised down from a surplus of €21.8 billion.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,876.47 -35.33 -0.51 %

DAX 11,582.11 +31.14 +0.27 %

CAC 40 4,937.2 -27.15 -0.55 %

The U.S. dollar traded mixed to higher against the most major currencies in the absence of any major U.S. economic reports on Monday.

The greenback remained supported by Friday's labour market data. The U.S. economy added 295,000 jobs in February, exceeding expectations for a rise of 241,000 jobs, after a gain of 239,000 jobs in January. J

The U.S. unemployment rate fell to 5.5% in February from 5.7% in January, beating forecast of a decline to 5.6%. That was lowest level since May 2008.

Investors expect that the Fed might start to raise its interest rate sooner than expected.

The euro traded lower against the U.S. dollar. The Sentix investor confidence index for the Eurozone rose to 18.6 in March from 12.4 in February, exceeding expectations for an increase to 15.0.That was the highest level since August 2007.

The index benefited from a weaker euro, lower oil prices and quantitative easing.

Germany's trade surplus narrowed to €19.7 billion in January from €21.6 billion in December, missing expectations for a rise to €22.3 billion. December's figure was revised down from a surplus of €21.8 billion.

People with knowledge of the transactions said that the European Central Bank (ECB) has purchased German, Italia, French and Belgian bonds.

A spokesman for the ECB declined to comment.

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports in the U.K.

The Canadian dollar traded mixed against the U.S. dollar. Housing starts in Canada decreased to a seasonally adjusted annualized rate of 156,276 units in February from a revised reading of 187,025 units in January. January's figure revised down from 187,276 units. Analysts had expected an increase to 191,000 units.

The New Zealand dollar traded mixed against the U.S. dollar. In the overnight trading session, the kiwi traded lower against the greenback in the absence of any major economic reports from New Zealand.

The Australian dollar traded lower against the U.S. dollar. In the overnight trading session, the Aussie traded lower against the greenback. Job advertisements in Australia increased 0.9% in February, after a 1.2% rise in January. January's figure was revised down from a 1.3% gain.

The Japanese yen traded lower against the U.S. dollar. In the overnight trading session, the yen traded mixed against the greenback after the mixed economic data from Japan. Japan's gross domestic product (GDP) was revised down to an annual increase of 1.5% in the fourth quarter from the preliminary estimate of a 2.2% rise.

Japan's adjusted current account surplus rose to 1,058.1 billion yen in January from 850.0 billion yen in December.

Japan's economy watchers' current conditions index climbed to 50.1 in February from 45.6 in January, exceeding expectations for an increase to 46.7.

Japan's economy watchers' future conditions index rose to 53.2 in February from 50.0 in January.

Prices for WTI crude oil rose moderately, while entrenched above $ 50, as new data pointed to the small increase in inventories in Cushing terminal. Meanwhile, Brent crude oil fell slightly, came under pressure OPEC secretary general comments.

Genscape reported that oil reserves in Cushing last week rose by 1.7 million barrels. Increase in reserves was smaller than previously expected. Concern that the capacity of the terminal Cushing exhausted, were not confirmed. "These Genscape show much less significant increase in reserves than previously expected. It seems much more oil out of Cushing to the Gulf Coast than we thought. In storage tanks on the coast of the Gulf of Mexico stock levels high, but there is storage capacity is not as close to the complete exhaustion, as in other parts of the United States, "- said Carl Larry from Frost & Sullivan

As for the statements OPEC secretary general Abdullah al-Badri, he noted that the members of the Organization of Petroleum Exporting Countries should not reduce production to "subsidize" more expensive shale oil. Recall oil prices in recent months have fallen sharply as the Organization of Petroleum Exporting Countries refused to reductions in production, while production rates in the US were the highest in the past more than 30 years, creating an increased level of supply in the world oil market .

Also affected the course of trading forecasts Goldman Sachs. According to a recent report in the short term, oil prices could fall to US $ 40 mark as the world's oil reserves begin to grow again. Falling prices almost 60%, which took place last year, was replaced by a moderate rise in prices in January and February. "While we continue to forecast a decent recovery in demand in 2015, we believe that the consistent weakening of activity, the end of winter and reduced demand due to restocking, will cause a slowdown in demand in the spring," - said the Goldman Sachs.

Market participants also continue to analyze data from Baker Hughes, which showed that the number of drilling oil installations in the US fell by 63 last week to 923, its lowest level since June 2011. Experts note that the shrinking number of drilling rigs in recent months is a sign that in the end the excess supply of oil on the market is reduced.

April futures price for US light crude oil WTI (Light Sweet Crude Oil) rose to 50.22 dollars per barrel on the New York Mercantile Exchange.

April futures price for North Sea Brent crude oil mix fell $ 0.52 to 59.30 dollars a barrel on the London Stock Exchange ICE Futures Europe.

Gold lost previously earned a position at the same time returning to opening levels. Support prices have expectations of the meeting of eurozone finance ministers, who will discuss the proposed economic reforms Greece.

"It seems that the markets are still unable to ignore the situation in Greece," - said Commerzbank analyst Carsten Commodities Fritsch. The expert suggested that the financial condition of the country is more dangerous than previously thought, which means that Greece may require financial assistance earlier than expected.

The rise in prices is constrained by expectations of higher interest rates in the United States, which intensified after the release of a positive report on the labor market. Recall, the report showed that the number of people employed in non-agricultural sectors increased by 295 thousand. In February against expectations at the level of 241 thousand. Meanwhile, the figures for January and December were revised downward - as a whole by 18 thousand .. Unemployment rate, the time down to 5.5% from 5.7% in January. Experts predicted that the rate will drop to 5.6%.

Positive data underlined expectations that the Fed will raise interest rates in the middle of this year. It should be emphasized, after the release of the report, President of the Federal Reserve Bank of Richmond Jeffrey Lacker said he believes the June meeting of the central bank the best time to raise interest rates. Lacker also said that as the economy corresponds to his expectations, he seems to June "prime candidate" for the onset of action and increase short-term interest rates from the current near-zero levels.

Small effect has also statistics on China. It is learned that the trade surplus in January-February was $ 60.60 billion, compared with expectations of $ 7.8 billion and $ 60.0 billion since January. In annual terms, exports grew last month at 48.3%, while imports decreased by 20.5%. Reduction in imports points to the continued weakness in the economy, causing speculation that Beijing policymakers need to take additional measures to stimulate economic growth.

Meanwhile, it became known that the gold reserves in the SPDR Gold Trust fell on Friday to its lowest level in more than a month.

April futures price of gold on the COMEX today rose to 1166.80 dollars per ounce.

People with knowledge of the transactions said that the European Central Bank (ECB) has purchased German, Italia, French and Belgian bonds.

A spokesman for the ECB declined to comment.

EUR/USD: $1.0900(E372mn), $1.1000(E837mn)

USD/JPY: Y119.75($308mn), Y121.00($235mn)

GBP/USD: $1.5250(Gbp230mn)

AUD/USD: $0.7700(A$1.15bn)

USD/CAD: C$1.2550($400mn), C$1.2800($220mn)

The Canada Mortgage and Housing Corporation (CMHC) released housing starts data on Monday. Housing starts in Canada decreased to a seasonally adjusted annualized rate of 156,276 units in February from a revised reading of 187,025 units in January. January's figure revised down from 187,276 units.

Analysts had expected an increase to 191,000 units.

The CMHC's Chief Economist Bob Dugan said that "the trend in housing starts decreased for a fifth consecutive month in February and reflects a decreasing trend in multiple starts".

U.S. stock-index futures are mixed.

Apple Inc. (AAPL) climbed 1% as investors await details of its smartwatch that starts shipping to stores in April.

General Motors Co. (GM) advanced more than 3% after announcement a share buyback program.

Global markets:

Nikkei 18,790.55 -180.45 -0.95%

Hang Seng 24,123.05 -40.95 -0.17%

Shanghai Composite 3,302.16 +60.98 +1.88%

FTSE 6,879.45 -32.35 -0.47%

CAC 4,946.72 -17.63 -0.36%

DAX 11,564.66 +13.69 +0.12%

Crude oil $49.29 (-0.29%)

Gold $1171.40 (+0.61%)

(company / ticker / price / change, % / volume)

| Pfizer Inc | PFE | 33.98 | +0.03% | 8.8K |

| General Electric Co | GE | 25.43 | +0.04% | 10.9K |

| Wal-Mart Stores Inc | WMT | 82.62 | +0.04% | 0.3K |

| Goldman Sachs | GS | 187.01 | +0.05% | 45.9K |

| Google Inc. | GOOG | 567.96 | +0.05% | 1.5K |

| American Express Co | AXP | 80.40 | +0.11% | 6.5K |

| Caterpillar Inc | CAT | 80.15 | +0.11% | 30.2K |

| Nike | NKE | 97.02 | +0.11% | 22.0K |

| Intel Corp | INTC | 33.23 | +0.12% | 3.9K |

| Facebook, Inc. | FB | 80.11 | +0.13% | 31.5K |

| Cisco Systems Inc | CSCO | 28.98 | +0.19% | 4.2K |

| The Coca-Cola Co | KO | 41.60 | +0.19% | 0.7K |

| ALTRIA GROUP INC. | MO | 53.47 | +0.19% | 0.9K |

| Citigroup Inc., NYSE | C | 53.17 | +0.21% | 8.3K |

| Ford Motor Co. | F | 15.97 | +0.25% | 45.2K |

| Exxon Mobil Corp | XOM | 85.85 | +0.26% | 22.1K |

| Merck & Co Inc | MRK | 57.00 | +0.28% | 0.2K |

| Starbucks Corporation, NASDAQ | SBUX | 92.49 | +0.30% | 0.3K |

| Hewlett-Packard Co. | HPQ | 33.15 | +0.39% | 1.3K |

| Yahoo! Inc., NASDAQ | YHOO | 43.67 | +0.53% | 2.0K |

| Visa | V | 270.80 | +0.54% | 4.7K |

| Apple Inc. | AAPL | 127.85 | +0.99% | 472.1K |

| Barrick Gold Corporation, NYSE | ABX | 11.47 | +1.14% | 16.0K |

| Twitter, Inc., NYSE | TWTR | 47.39 | +1.37% | 79.5K |

| General Motors Company, NYSE | GM | 37.73 | +3.26% | 385.8K |

| E. I. du Pont de Nemours and Co | DD | 78.14 | 0.00% | 2.3K |

| International Business Machines Co... | IBM | 158.50 | 0.00% | 7.3K |

| Johnson & Johnson | JNJ | 100.11 | 0.00% | 0.2K |

| JPMorgan Chase and Co | JPM | 60.89 | 0.00% | 1.2K |

| Microsoft Corp | MSFT | 42.36 | 0.00% | 7.9K |

| Walt Disney Co | DIS | 103.82 | 0.00% | 1.2K |

| Deere & Company, NYSE | DE | 90.26 | 0.00% | 0.2K |

| HONEYWELL INTERNATIONAL INC. | HON | 101.87 | 0.00% | 0.2K |

| International Paper Company | IP | 55.19 | 0.00% | 0.2K |

| Boeing Co | BA | 153.10 | -0.01% | 0.1K |

| Verizon Communications Inc | VZ | 48.28 | -0.02% | 0.4K |

| AT&T Inc | T | 33.47 | -0.03% | 15.6K |

| Tesla Motors, Inc., NASDAQ | TSLA | 193.72 | -0.08% | 7.5K |

| Chevron Corp | CVX | 103.40 | -0.14% | 16.1K |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 19.41 | -0.15% | 179.1K |

| Amazon.com Inc., NASDAQ | AMZN | 377.75 | -0.62% | 18.7K |

| McDonald's Corp | MCD | 96.10 | -1.06% | 0.9K |

| ALCOA INC. | AA | 13.93 | -3.80% | 39.9K |

Upgrades:

Downgrades:

Amazon.com (AMZN) downgradd from Buy to Neutral at Sun Trust Rbsn Humphrey

Other:

Apple (AAPL) target raised to $145 from $130 at Macquarie

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia ANZ Job Advertisements (MoM) February +1.3% +0.9%

05:00 Japan Eco Watchers Survey: Current February 45.6 46.7 50.1

05:00 Japan Eco Watchers Survey: Outlook February 50.0 53.2

07:00 Germany Trade Balance January 21.6 Revised From 21.8 22.3 19.7

09:30 Eurozone Sentix Investor Confidence March 12.4 15.0 18.6

10:00 Eurozone Eurogroup Meetings

12:15 Canada Housing Starts February 187 191 156

The U.S. dollar traded mixed against the most major currencies. There will be released no major U.S. economic reports on Monday.

The greenback remained supported by Friday's labour market data. The U.S. economy added 295,000 jobs in February, exceeding expectations for a rise of 241,000 jobs, after a gain of 239,000 jobs in January. J

The U.S. unemployment rate fell to 5.5% in February from 5.7% in January, beating forecast of a decline to 5.6%. That was lowest level since May 2008.

Investors expect that the Fed might start to raise its interest rate sooner than expected.

The euro traded mixed against the U.S. dollar after the mixed economic data from the Eurozone. The Sentix investor confidence index for the Eurozone rose to 18.6 in March from 12.4 in February, exceeding expectations for an increase to 15.0.That was the highest level since August 2007.

The index benefited from a weaker euro, lower oil prices and quantitative easing.

Germany's trade surplus narrowed to €19.7 billion in January from €21.6 billion in December, missing expectations for a rise to €22.3 billion. December's figure was revised down from a surplus of €21.8 billion.

The Eurogroup of euro zone finance ministers will discuss proposed Greek economic reforms.

The British pound traded higher against the U.S. dollar in the absence of any major economic reports in the U.K.

The Canadian dollar traded mixed against the U.S. dollar after the weaker-than-expected Canadian housing starts data. Housing starts in Canada decreased to a seasonally adjusted annualized rate of 156,276 units in February from a revised reading of 187,025 units in January. January's figure revised down from 187,276 units. Analysts had expected an increase to 191,000 units.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair rose to $1.5111

USD/JPY: the currency pair increased to Y121.06

EUR/USD

Offers 1.0900 1.0925 1.0940 1.0965 1.0980 1.1000 1.1020

Bids 1.0860 1.0840 1.0825 1.0800 1.0785 1.0750

GBP/USD

Offers 1.5100 1.5120-25 1.5150 1.5180 1.5200

Bids 1.5060 1.5040 1.5025 1.5000 1.4985 1.4965 1.4950

EUR/JPY

Offers 131.80 132.00 132.20 132.50 132.80 133.00

Bids 131.20 131.00 130.80 130.50 130.30 130.00

USD/JPY

Offers 121.00 121.20 121.45-50 121.80 122.00

Bids 120.60-65 1.2025-30 120.00 119.80 119.50 119.20 119.00

EUR/GBP

Offers 0.7220-25 0.7245-50 0.7265 0.7285 0.7300-05 0.7320-25

Bids 0.7195 0.7180 0.7165 0.7150 0.7130 0.7100-10

AUD/USD

Offers 0.7740 0.7760 0.7785 0.7800 0.7815

Bids 0.7700 0.7685 0.7665 0.7650

European stocks recovered slightly over the course of the day after a negative start tracking losses in the U.S. Greece remains in the focus as the proposed list of measures is far from complete, the head of Eurogroup Jeroen Dijsselbloem said on Sunday. Today Eurozone finance ministers will further discuss on how to proceed with Greece and its reform plans. Time is running out for the country as it is expected to run out of money by the end of the month.

Today Destatis reported data on the Trade Balance of Eurozone's biggest economy that showed a decline from January's balance and was below expectations. The Trade Balance narrowed from revised 21.6 billion euros (21.8) to 19.7 billion. Economist expected a rise to 22.3 billion euros.

Exports showed the sharpest decline in five months and slumped by 2.1% after strong gains in December although the weaker euro should bolster exports in the future. Imports declined by 0.3%.

Market research group Sentix reported data on Investor Confidence today. The survey was conducted among 1000 private and institutional investors. Investor Confidence for March came in at 18.6, climbing 6.2 points, compared to forecasts of 15 points and a previous reading of 12.4, reaching the highest reading since August 2007.

The stronger-than-expected data eases concerns over the economic outlook of the Eurozone. A weaker Euro, Quantitative Easing and lower oil prices boost the European economy. A level above zero shows that optimism prevails, below zero indicates pessimism.

The FTSE 100 index is currently trading -0.70% quoted at 6,863.39. Germany's DAX 30 lost -0.20% trading at 11,528.09. France's CAC 40 is currently trading at 4,931.88 points, -0.65%.

Oil traded mixed on Monday with Brent Crude declining by -0.55%, currently trading at USD59.40 a barrel and West Texas Intermediate gaining +0.40% currently quoted at USD49.81.

On Sunday OPEC Secretary-General Abdullah al-Badri said that OPEC members should not lower production as this would only help U.S. producers with their higher-cost shale. Data from Baker Hughes on Friday showed that U.S. rig-numbers further declined.

Oil prices declined by almost 60% between June 2014 and January 2015 and recovered by almost 35% in 2015.Although prices rebounded after setting new lows, worldwide supply still exceeds demand in a period of low global economic growth, pushing stockpiles to record highs and weighing on prices.

Gold recovered moderately from Friday's selloff but still trades close to 3-month lows. Better-than-expected U.S. jobs data reported on Friday added to expectations that the FED will hike interest rates rather sooner than later sending the precious metal down to intraday-lows not seen since December.

A stronger U.S. dollar and the prospect for higher U.S. rates recently weighed on the precious metal as the precious metal is dollar-denominated and not yield-bearing.

Today Eurogroup meetings will be in the focus where the Eurozone finance ministers meet to discuss on how to proceed with Greece as the proposed list of measures is far from complete, the head of Eurogroup Jeroen Dijsselbloem said on Sunday.

Gold is currently quoted at USD1,174.60, +0,71% a troy ounce. On Thursday the 22nd of January gold reached a five-month high at USD1,307.40.

Market research group Sentix reported data on Investor Confidence today. The survey was conducted among 1000 private and institutional investors. Investor Confidence for March came in at 18.6, climbing 6.2 points, compared to forecasts of 15 points and a previous reading of 12.4, reaching the highest reading since August 2007.

The stronger-than-expected data eases concerns over the economic outlook of the Eurozone. A weaker Euro, Quantitative Easing and lower oil prices boost the European economy. A level above zero shows that optimism prevails, below zero indicates pessimism.

EUR/USD: $1.0900(E372mn), $1.1000(E837mn)

USD/JPY: Y119.75($308mn), Y121.00($235mn)

GBP/USD: $1.5250(Gbp230mn)

AUD/USD: $0.7700(A$1.15bn)

USD/CAD: C$1.2550($400mn), C$1.2800($220mn)

BLOOMBERG

RBNZ Likely Looking at New Tools to Avoid Rate Rises, Key Says

(Bloomberg) -- New Zealand's central bank is probably investigating new tools to slow housing demand because it is unable to raise interest rates in a low-inflation environment, Prime Minister John Key says.

The Reserve Bank said last week it was seeking views on how to define property investment loans, adding to signs it may tighten rules in an attempt to cool surging house prices. Key said he hadn't been briefed on the issue by the RBNZ while a spokesman for the central bank declined to comment.

"It's clearly trying to ensure there's not a bubble emerging in the housing market," Key told reporters in Wellington Monday. "It's doing so in such a way that it's not having to lift interest rates."

REUTERS

Eurogroup's Dijsselbloem: Greece reform outline 'far from complete'

(Reuters) - A list of reforms proposed by Greece last week to help it win creditor support is "far from complete," the head of the Eurogroup said.

Speaking at an event in Amsterdam on Sunday, Jeroen Dijsselbloem, who is also Dutch finance minister, said the Greek proposal was "serious" but not enough.

Dijsselbloem, whose Eurogroup of euro zone finance ministers will discuss Greece at a meeting on Monday, said Athens had submitted six proposals, with more expected to come.

Source: http://www.reuters.com/article/2015/03/09/us-eurozone-greece-dijsselbloem-idUSKBN0M50IY20150309

BLOOMBERG

ECB Said to Begin Buying German Government Bonds in QE

(Bloomberg) -- The European Central Bank was said to start buying euro-area government bonds as it took the first step of its expanded quantitative-easing plan designed to boost price growth in the region.

Central banks from the region bought German bonds, said two traders in government debt, who asked not to be identified because the transactions are confidential. Sovereign securities across the region advanced. A spokesman for the ECB declined to comment on the purchases.

Bonds rallied. The yield on Germany's 10-year bunds fell four basis points, or 0.04 percentage point, to 0.35 percent at 8:54 a.m. London time, approaching the record-low 0.283 percent set on Feb. 26. Italy's 10-year yield dropped four basis points to 1.28 percent.

European stocks follow the Wall Street and fall at the start. On Friday strong U.S. jobs data led U.S. shares lower on expectations that the Federal Reserve might raise interest rates rather sooner than later.

Greece remains in the focus as the proposed list of measures is far from complete, the head of Eurogroup Jeroen Dijsselbloem said on Sunday.

Today Destatis reported data on the Trade Balance of Eurozone's biggest economy that showed a decline from January's Balance and was below expectations. The Trade Balance fell from revised 21.6 billion euros (21.8) to 19.7 billion. Economist expected a rise to 22.3 billion euros.

Exports showed the sharpest decline in five months and slumped by 2.1% after strong gains in December although the weaker euro should bolster exports in the future. Imports declined by 0.3%.

Markets look forward to Eurozone's Sentix Investor Confidence data due at 09:30 GMT and the Eurogroup meetings scheduled for 10:00 GMT where Eurozone finance ministers will further discuss on how to proceed with Greece. Time is running out for the country as it is expected to run out of money by the end of the month.

The FTSE 100 index is currently trading -0.60% quoted at 6,870.67. Germany's DAX 30 lost -0.55% trading at 11,487.80, France's CAC 40 is currently trading at 4,928.83 points, -0.72%.

Today Destatis reported data on the Trade Balance of Eurozone's biggest economy that showed a decline from January's Balance and was below expectations. The Trade Balance fell from revised 21.6 billion euros (21.8) to 19.7 billion. Economist expected a rise to 22.3 billion euros.

Exports showed the sharpest decline in five months and slumped by 2.1% after strong gains in December although the weaker euro should bolster exports in the future. Imports declined by 0.3%.

U.S. stocks slumped on Friday after the better-than-expected U.S. labour market data reported on Friday. The U.S. economy added 295,000 jobs in February, exceeding expectations for a rise of 241,000 jobs, after a gain of 239,000 jobs in January. January's figure was revised down from a rise of 257,000 jobs - the data fuelled expectations of the Federal Reserve to hike interest rates rather sooner than later.

The S&P 500 closed -1.42% with a final quote of 2,071.26 points with the financial sector as top performer although all 10 sectors declined. The DOW JONES index declined by -1.54% closing at 17,856.78 points.

Chinese stocks traded mixed at the start of the week. Hong Kong's Hang Seng is trading moderately lower -0.04% at 24,155.27 points. China's Shanghai Composite closed at 3,336.14 points rising +1.88% at the close. Gains were led by banks after the China Securities Regulatory Commission announced that lenders might be allowed to act as brokerages.

The Nikkei lost ground on Monday following Wall Street with low volumes traded. The Nikkei closed -0.95% with a final quote of 18,790.55 points. . Data on the Japanese Eco Watchers Survey was reported. The Current Survey showed an increase from 45.6 to 50.1, beating an estimated increase to 46.7 points. -the Outlook came in at 53.2 in February coming from 50.0 in January.

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia ANZ Job Advertisements (MoM) February +1.3% +0.9%

05:00 Japan Eco Watchers Survey: Current February 45.6 46.7 50.1

05:00 Japan Eco Watchers Survey: Outlook February 50.0 53.2

07:00 Germany Trade Balance January 21.8 22.3 19.7

The U.S. dollar traded mixed against its major peers on Monday after the better-than-expected U.S. labour market data reported on Friday. The U.S. economy added 295,000 jobs in February, exceeding expectations for a rise of 241,000 jobs, after a gain of 239,000 jobs in January. January's figure was revised down from a rise of 257,000 jobs - the data fuelled expectations of a mid-year rate hike by the Federal Reserve.

The euro and sterling rebounded slightly after Friday's slump versus the greenback.

The Australian dollar declined traded almost flat against the greenback currently quoted at USD0.7713. ANZ Job Advertisements (MoM) came in at +0.9% in February compared to +1.3% in January.

New Zealand's dollar lost ground against the greenback and is trading at three-wekk lows in the absence any major economic reports from New Zealand.

The Japanese yen traded lower against the greenback on Monday not far from Friday's three-month low of USD121.28 and close to a 7-1/2 year low hit in December. Data on the Japanese Eco Watchers Survey was reported. The Current Survey showed an increase from 45.6 to 50.1, beating an estimated increase to 46.7 points. -the Outlook came in at 53.2 in February coming from 50.0 in January.

EUR/USD: the euro traded higher against the greenback

(time / country / index / period / previous value / forecast)

09:30 Eurozone Sentix Investor Confidence March 12.4 15.0

10:00 Eurozone Eurogroup Meetings

12:15 Canada Housing Starts February 187 191

EUR / USD

Resistance levels (open interest**, contracts)

$1.1033 (425)

$1.0982 (284)

$1.0929 (139)

Price at time of writing this review: $1.0854

Support levels (open interest**, contracts):

$1.0808 (4194)

$1.0766 (3028)

$1.0711 (2956)

Comments:

- Overall open interest on the CALL options with the expiration date April, 2 is 37511 contracts, with the maximum number of contracts with strike price $1,1600 (2987);

- Overall open interest on the PUT options with the expiration date April, 2 is 45537 contracts, with the maximum number of contracts with strike price $1,1000 (4194);

- The ratio of PUT/CALL was 1.21 versus 0.96 from the previous trading day according to data from March, 6

GBP/USD

Resistance levels (open interest**, contracts)

$1.5303 (356)

$1.5206 (389)

$1.5110 (803)

Price at time of writing this review: $1.5073

Support levels (open interest**, contracts):

$1.4989 (1620)

$1.4893 (802)

$1.4795 (1094)

Comments:

- Overall open interest on the CALL options with the expiration date April, 2 is 14805 contracts, with the maximum number of contracts with strike price $1,5600 (1365);

- Overall open interest on the PUT options with the expiration date April, 2 is 20183 contracts, with the maximum number of contracts with strike price $1,5000 (1620);

- The ratio of PUT/CALL was 1.36 versus 1.14 from the previous trading day according to data from March, 6

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.