- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 05-03-2015

(time / country / index / period / previous value / forecast)

05:00 Japan Leading Economic Index January 105.6 105.9

05:00 Japan Coincident Index January 110.7

07:00 Germany Industrial Production s.a. (MoM) January +0.1% +0.6%

07:00 Germany Industrial Production (YoY) January -0.7%

07:45 France Trade Balance, bln January -3.4

08:00 Switzerland Foreign Currency Reserves February 498.4

08:15 Switzerland Consumer Price Index (MoM) February -0.4% +0.1%

08:15 Switzerland Consumer Price Index (YoY) February -0.5% -0.6%

09:30 United Kingdom Consumer Inflation Expectations Quarter I +2.5%

10:00 Eurozone GDP (QoQ) (Revised) Quarter IV +0.3% +0.3%

10:00 Eurozone GDP (YoY) (Revised) Quarter IV +0.8% +0.9%

13:30 Canada Building Permits (MoM) January +7.7% +5.5%

13:30 Canada Trade balance, billions January -0.6 0.3

13:30 Canada Labor Productivity Quarter IV +0.1% +0.2%

13:30 U.S. International Trade, bln January -46.6 -41.6

13:30 U.S. Average hourly earnings February +0.5% +0.2%

13:30 U.S. Nonfarm Payrolls February 257 241

13:30 U.S. Unemployment Rate February 5.7% 5.6%

20:00 U.S. Consumer Credit January 14.8 15.1

Stock indices closed higher on comments by the ECB President Mario Draghi. The European Central Bank (ECB) President Mario Draghi said at the press conference on Thursday that the central bank will start its 60 billion euro-a-month bond purchases on March, 9. He noted that the ECB will buy euro-dominated public sector securities in the secondary market, and it will also continue to purchase asset-backed securities and covered bonds.

The ECB upgraded its growth estimate to 1.5% for 2015, up from 1% in December last year. Gross domestic product (GDP) is expected to be 1.9% in 2016 and 2.1% in 2017.

The ECB downgraded its inflation forecast for this year to 0%, down from its previous inflation forecast of 0.7%, but upgraded the 2016 forecast to 1.5% from 1.3%.

The ECB released its interest decision today. The central bank kept its interest rate unchanged at 0.05%.

German seasonal adjusted factory orders plunged 3.9% in January, missing expectations for a 0.8% decrease, after a 4.4% rise in December. December's figure was revised up from a 4.2% gain.

The Bank of England's (BoE) kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion. This decision was widely expected.

Analysts expect that the BoE will start to raise interest rate later in early 2016.

The U.K. Halifax house price index declined 0.3% in February, after a 1.9% gain in January. January's figure was revised up from a 0.3% rise.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,961.14 +41.90 +0.61 %

DAX 11,504.01 +113.63 +1.00 %

CAC 40 4,963.51 +46.16 +0.94 %

The U.S. dollar traded higher against the most major currencies despite the weaker-than-expected U.S. economic data. Factory orders in the U.S. declined 0.2% in January, missing expectations for a 0.1% increase, after a 3.5% drop in December. That was the sixth straight decline.

December's figure was revised down from a 3.4% fall.

The decline was driven by lower orders for non-durable goods.

The number of initial jobless claims in the week ending February 28 in the U.S. climbed by 7,000 to 320,000 from 313,000 in the previous week, missing expectations for a rise by 6,000.

Final non-farm business sector labour productivity fell by 2.2% in the fourth quarter, missing expectations for a 0.4% rise, down from a preliminary estimate of a 1.8% decline.

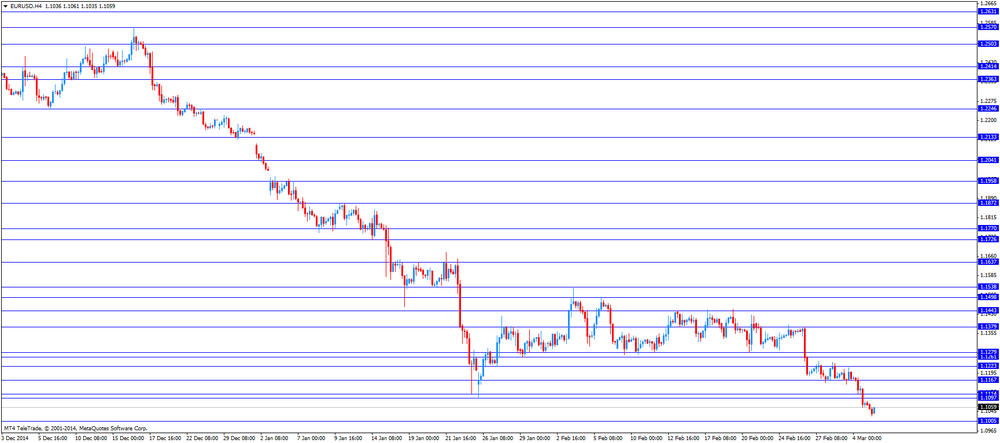

The euro traded lower against the U.S. dollar after the European Central Bank's (ECB) press conference. The European Central Bank (ECB) President Mario Draghi said at the press conference on Thursday that the central bank will start its 60 billion euro-a-month bond purchases on March, 9. He noted that the ECB will buy euro-dominated public sector securities in the secondary market, and it will also continue to purchase asset-backed securities and covered bonds.

The ECB upgraded its growth estimate to 1.5% for 2015, up from 1% in December last year. Gross domestic product (GDP) is expected to be 1.9% in 2016 and 2.1% in 2017.

The ECB downgraded its inflation forecast for this year to 0%, down from its previous inflation forecast of 0.7%, but upgraded the 2016 forecast to 1.5% from 1.3%.

The ECB released its interest decision today. The central bank kept its interest rate unchanged at 0.05%.

German seasonal adjusted factory orders plunged 3.9% in January, missing expectations for a 0.8% decrease, after a 4.4% rise in December. December's figure was revised up from a 4.2% gain.

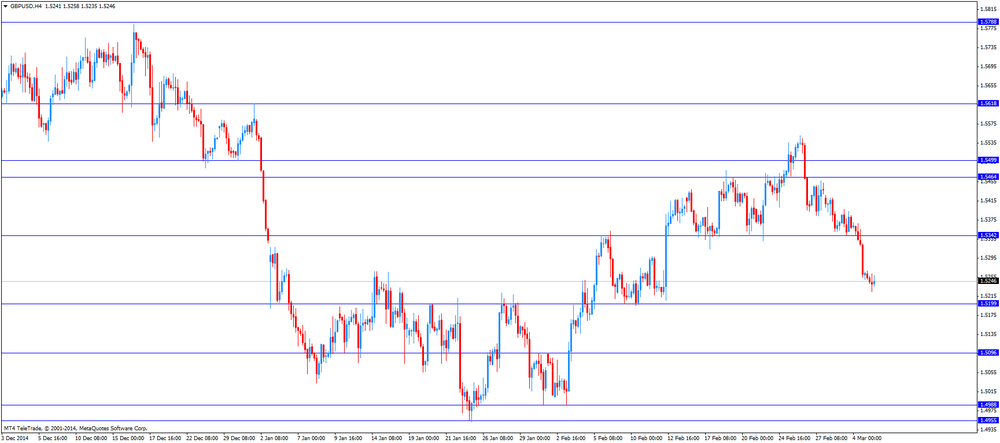

The British pound traded lower against the U.S. dollar. The Bank of England's (BoE) kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion. This decision was widely expected.

Analysts expect that the BoE will start to raise interest rate later in early 2016.

The U.K. Halifax house price index declined 0.3% in February, after a 1.9% gain in January. January's figure was revised up from a 0.3% rise.

The Canadian dollar traded lower against the U.S. dollar despite the better-than-expected Canadian Ivey purchasing managers' index. Canada's seasonally adjusted Ivey purchasing managers' index rose to 49.7 in February from 45.4 in January. Analysts had expected the index to increase to 46.2.

A reading above 50 indicates a rise in the pace of activity, below 50 indicates a contraction in the pace of activity.

The New Zealand dollar fell against the U.S. dollar. In the overnight trading session, the kiwi dropped against the greenback in the absence of any major economic reports from New Zealand.

The Australian dollar declined against the U.S. dollar. In the overnight trading session, the Aussie traded lower against the greenback after the mixed Australian economic data. Retail sales in Australia rose 0.4% in January, in line with expectations, after a 0.2% gain in December.

Australia's trade deficit widened to A$0.98 billion in January from A$0.50 billion in December. December's figure was revised down from a deficit of A$0.44 billion. Analysts had expected the trade deficit to rise to A$0.93 billion.

The Reserve Bank of Australia Deputy Governor Philip Lowe said on Wednesday that interest rate cut is less effective than in the past, but it weakened the exchange rate and encouraged housing construction.

The Japanese yen traded lower against the U.S. dollar. In the overnight trading session, the yen traded lower against the greenback in the absence of any major economic reports from Japan.

The U.S. Commerce Department released factory orders data on Thursday. Factory orders in the U.S. declined 0.2% in January, missing expectations for a 0.1% increase, after a 3.5% drop in December. That was the sixth straight decline.

December's figure was revised down from a 3.4% fall.

The decline was driven by lower orders for non-durable goods. Non-durable goods orders plunged by 3.1% in January.

Durable goods orders jumped by 2.8% in January.

Canada's seasonally adjusted Ivey purchasing managers' index rose to 49.7 in February from 45.4 in January. Analysts had expected the index to increase to 46.2.

A reading above 50 indicates a rise in the pace of activity, below 50 indicates a contraction in the pace of activity.

The supplier deliveries index fell to 47.3 from 47.9, while employment index declined to 47.3 from 50.0, lowest level since June 2014.

Inventories index climbed to 47.4 from 46.4.

The European Central Bank (ECB) President Mario Draghi said at the press conference on Thursday that the central bank will start its 60 billion euro-a-month bond purchases on March, 9. He noted that the ECB will buy euro-dominated public sector securities in the secondary market, and it will also continue to purchase asset-backed securities and covered bonds.

The ECB upgraded its growth estimate to 1.5% for 2015, up from 1% in December last year. Gross domestic product (GDP) is expected to be 1.9% in 2016 and 2.1% in 2017.

The ECB downgraded its inflation forecast for this year to 0%, down from its previous inflation forecast of 0.7%, but upgraded the 2016 forecast to 1.5% from 1.3%.

Draghi pointed out that the ELA (Emergency Lending Assistance) has been increased by 500 million euros.

The ECB president also said that there are some improvements in economic activity at the beginning of this year.

The Reserve Bank of Australia Deputy Governor Philip Lowe said in a speech in Sydney on Wednesday that interest rate cut is less effective than in the past, but it weakened the exchange rate and encouraged housing construction.

Lowe reiterated that further interest rate cut "may be appropriate".

The deputy governor explained that February's interest cut was necessary because things ad turned for the worse.

U.S. stock-index futures rose as investors weighed details of the European Central Bank's bond-buying program.

Global markets:

Nikkei 18,751.84 +48.24 +0.26%

Hang Seng 24,193.04 -272.34 -1.11%

Shanghai Composite 3,249.46 -30.07 -0.92%

FTSE 6,951.63 +32.39 +0.47%

CAC 4,962.31 +44.96 +0.91%

DAX 11,493.23 +102.85 +0.90%

Crude oil $51.65 (+0.27%)

Gold $1202.50 (+0.14%)

(company / ticker / price / change, % / volume)

| Merck & Co Inc | MRK | 57.89 | +0.02% | 0.9K |

| The Coca-Cola Co | KO | 42.52 | +0.05% | 0.1K |

| Exxon Mobil Corp | XOM | 87.25 | +0.08% | 14.5K |

| Procter & Gamble Co | PG | 84.42 | +0.08% | 0.4K |

| Wal-Mart Stores Inc | WMT | 82.65 | +0.08% | 0.5K |

| Microsoft Corp | MSFT | 43.10 | +0.10% | 0.7K |

| Apple Inc. | AAPL | 128.70 | +0.12% | 126.7K |

| Verizon Communications Inc | VZ | 49.14 | +0.14% | 2.9K |

| Yahoo! Inc., NASDAQ | YHOO | 44.06 | +0.16% | 19.4K |

| Pfizer Inc | PFE | 34.70 | +0.17% | 1.0K |

| Citigroup Inc., NYSE | C | 53.76 | +0.17% | 44.8K |

| AMERICAN INTERNATIONAL GROUP | AIG | 55.48 | +0.18% | 0.6K |

| General Electric Co | GE | 25.71 | +0.19% | 32.2K |

| International Business Machines Co... | IBM | 159.72 | +0.19% | 1.2K |

| Ford Motor Co. | F | 16.06 | +0.19% | 1.2K |

| Cisco Systems Inc | CSCO | 29.39 | +0.20% | 6.4K |

| Amazon.com Inc., NASDAQ | AMZN | 383.50 | +0.20% | 0.6K |

| Home Depot Inc | HD | 115.00 | +0.21% | 0.1K |

| Google Inc. | GOOG | 574.55 | +0.21% | 1.2K |

| Chevron Corp | CVX | 105.40 | +0.23% | 3.2K |

| Johnson & Johnson | JNJ | 101.90 | +0.25% | 0.2K |

| Tesla Motors, Inc., NASDAQ | TSLA | 202.94 | +0.25% | 2.5K |

| Starbucks Corporation, NASDAQ | SBUX | 93.30 | +0.26% | 0.9K |

| Walt Disney Co | DIS | 105.85 | +0.27% | 0.6K |

| ALCOA INC. | AA | 14.63 | +0.27% | 3.4K |

| Twitter, Inc., NYSE | TWTR | 47.70 | +0.27% | 13.0K |

| AT&T Inc | T | 34.10 | +0.29% | 11.4K |

| Intel Corp | INTC | 34.22 | +0.29% | 2.2K |

| JPMorgan Chase and Co | JPM | 62.33 | +0.32% | 0.4K |

| General Motors Company, NYSE | GM | 37.70 | +0.35% | 1.1K |

| American Express Co | AXP | 80.93 | +0.37% | 5.2K |

| ALTRIA GROUP INC. | MO | 56.00 | +0.38% | 1.1K |

| Nike | NKE | 97.90 | +0.39% | 0.2K |

| Facebook, Inc. | FB | 81.22 | +0.40% | 86.3K |

| HONEYWELL INTERNATIONAL INC. | HON | 103.57 | +0.50% | 9.0K |

| Barrick Gold Corporation, NYSE | ABX | 12.26 | +0.91% | 24.5K |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 21.06 | +0.91% | 28.5K |

| Boeing Co | BA | 155.92 | +1.02% | 0.1K |

| Yandex N.V., NASDAQ | YNDX | 16.00 | +1.52% | 59.7K |

| Deere & Company, NYSE | DE | 90.06 | -0.43% | 1.3K |

| McDonald's Corp | MCD | 99.80 | -0.45% | 13.5K |

| Caterpillar Inc | CAT | 80.70 | -1.26% | 3.4K |

Upgrades:

Downgrades:

McDonald's (MCD) downgraded to Neutral from Overweight at Piper Jaffray

Other:

UnitedHealth (UNH) target raised to $149 from $121 at Piper Jaffray

USD/JPY 119.00 (USD 948m) 119.25 (USD 800m) 119.50 (USD 385m) 120.00 (3bln)

EUR/USD 1.1100 (EUR 911m) 1.1150 (EUR 1bln) 1.1200 (EUR 1.2bln)

GBP/USD 1.5300 (GBP 150m)

USD/CHF 0.9645-50 (USD 930m)

AUD/USD 0.7850 (AUD 1.87bln)

NZD/USD 0.7355-60 (NZD 375m)

AUD/JPY 0.9650-55 (AUD 450m)

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Retail Sales, M/M January +0.2% +0.4% +0.4%

00:30 Australia Retail Sales Y/Y January +4.1% +3.1%

00:30 Australia Trade Balance January -0.50 Revised From -0.44 -0.93 -0.98

01:30 Australia RBA Assist Gov Lowe Speaks

07:00 Germany Factory Orders s.a. (MoM) January +4.4% Revised From +4.2% -0.8% -3.9%

07:00 Germany Factory Orders n.s.a. (YoY) January +3.9% Revised From +3.4% -0.1%

08:00 United Kingdom Halifax house price index February +1.9% Revised From +0.3% -0.3%

08:00 United Kingdom Halifax house price index, y/y February +6.8% +8.3%

12:00 United Kingdom BoE Interest Rate Decision 0.50% 0.50% 0.50%

12:00 United Kingdom Asset Purchase Facility 375 375 375

12:00 United Kingdom MPC Rate Statement

12:45 Eurozone ECB Interest Rate Decision 0.05% 0.05% 0.05%

The U.S. dollar traded mixed against the most major currencies ahead of the U.S. economic data. The number of initial jobless claims in the U.S. is expected to rise by 6,000 to 319,000.

Factory orders in the U.S. are expected to increase 0.1% in January, after a 3.4% drop in December.

The euro traded higher against the U.S. dollar ahead of the European Central Bank's (ECB) press conference The European Central Bank (ECB) will unveil details of its quantitative easing programme. The ECB will also provide new economic forecasts for the Eurozone.

The ECB released its interest decision today. The central bank kept its interest rate unchanged at 0.05%.

German seasonal adjusted factory orders plunged 3.9% in January, missing expectations for a 0.8% decrease, after a 4.4% rise in December. December's figure was revised up from a 4.2% gain.

The British pound traded mixed against the U.S. dollar after the Bank of England's (BoE) interest rate decision. The BoE kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion. This decision was widely expected.

Analysts expect that the BoE will start to raise interest rate later in early 2016.

The U.K. Halifax house price index declined 0.3% in February, after a 1.9% gain in January. January's figure was revised up from a 0.3% rise.

The Canadian dollar traded higher against the U.S. dollar ahead of Canadian Ivey purchasing managers' index. The Ivey purchasing managers' index is expected to increase to 46.2 in February from 45.4 in January.

EUR/USD: the currency pair rose to $1.1061

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair increased to Y120.21

The most important news that are expected (GMT0):

13:30 Eurozone ECB Press Conference

13:30 U.S. Initial Jobless Claims February 313 319

13:30 U.S. Nonfarm Productivity, q/q (Finally) Quarter IV -2.2% +0.4%

15:00 Canada Ivey Purchasing Managers Index February 45.4 46.2

15:00 U.S. FOMC Member Williams Speaks

15:00 U.S. Factory Orders January -3.4% +0.1%

EUR/USD

Offers 1.1100 1.1150 1.1220 1.1250-45 1.1300

Bids 1.1000 1.0900 1.0800

GBP/USD

Offers 1.5315 1.5400-95 1.5420 1.5455 1.5475-80 1.5500 1.5530 1.5550-55 1.5580

Bids 1.5200-95 1.5140 1.5100 1.5000-90 1.4950

EUR/JPY

Offers 133.00 133.40 134.00 134.60 134.80 135.00 135.50 136.00

Bids 132.00 131.00 130.85 130.10-00

USD/JPY

Offers 120.00 120.25-30 120.50 120.85 121.00

Bids 119.40 119.00-10 118.85 118.60 118.40 118.20 118.00 117.85

EUR/GBP

Offers 0.7300 0.7320-25 0.7345-50 0.7385 0.7400

Bids 0.7230 0.7200-10 0.7180-85 0.7160

AUD/USD

Offers 0.7860 0.7880 0.7900-10 0.7930

Bids 0.7750-40 0.7720 0.7700 0.7640

The Bank of England (BoE) released its interest rate decision on Thursday. The BoE kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion. This decision was widely expected.

Low inflation weighed on the BoE's interest rate decision. The consumer price inflation dropped to an annual rate of 0.3% in January and expected to turn negative in coming months.

Analysts expect that the BoE will start to raise interest rate later in early 2016.

Investors are awaiting the minutes of the monetary policy committee (MPC). The minutes of the meeting will be released on March 18.

All members voted in January to keep the central bank's monetary policy unchanged, according to MPC's meeting minutes.

Stock indices traded higher ahead of the ECB'S and BoE's interest rate decision. The European Central Bank (ECB) will unveil details of its quantitative easing programme. The ECB will also provide new economic forecasts for the Eurozone.

German seasonal adjusted factory orders plunged 3.9% in January, missing expectations for a 0.8% decrease, after a 4.4% rise in December. December's figure was revised up from a 4.2% gain.

The Bank of England (BoE) will also release its interest rate decision on Thursday. Analysts expect the BoE will keep unchanged its monetary policy.

The U.K. Halifax house price index declined 0.3% in February, after a 1.9% gain in January. January's figure was revised up from a 0.3% rise.

Current figures:

Name Price Change Change %

FTSE 100 6,945.96 +26.72 +0.39 %

DAX 11,476.75 +86.37 +0.76 %

CAC 40 4,960.74 +43.39 +0.88 %

Gold prices traded lower on Thursday. Spot gold was at $1,199.50 a troy ounce in morning European trade.

A stronger greenback weighed on gold price. The U.S. dollar traded higher against the most major currencies. The greenback remained supported by yesterday's non-manufacturing purchasing managers' index. The Institute for Supply Management's non-manufacturing purchasing managers' index for the U.S. climbed to 56.9 in February from 56.7 in January, beating expectations for a decline to 56.5.

The U.S. labour market data on Friday might provide the further direction of gold price.

MarketWatch

European stocks rise, euro drops as investors wait for QE details

LONDON (MarketWatch) - European stocks gained Thursday, with investors gearing up to hear more on monetary policy and the state of the eurozone economy from the European Central Bank.

Reuters

UPDATE 3-Brent above $61 as Iran news offsets U.S. stockpiles

LONDON, March 5 (Reuters) - Brent crude future prices rose above $61 a barrel on Thursday, as investors brushed aside bearish U.S. inventories data to focus on the lack of a deal in talks over Iran's nuclear programme.

Source: http://uk.reuters.com/article/2015/03/05/markets-oil-idUKL4N0W72AP20150305

Reuters

UPDATE 1-World food prices continue to fall in February - U.N. FAO

(Reuters) - Global food prices fell 1 percent in February to their lowest in more than four-and-a-half years, with cereals, meat and sugar declining, oils steady and only dairy prices rebounding sharply, the United Nations food agency said on Thursday.

Source: http://www.reuters.com/article/2015/03/05/food-fao-idUSL5N0W71YE20150305

The Dow Jones Industrial Average declined 0.58% to 18,096.9 points on Wednesday, while the S&P 500 decreased 0.44% to 2,098.53 points. Investors are awaiting the release of the U.S. labour market data on Friday.

The Fed's Beige Book survey showed on Wednesday that optimism prevailed in most Federal Reserve districts.

Europe's stock indices traded higher. Investors are awaiting the European Central Bank's interest rate decision on Thursday. The European Central Bank (ECB) will unveil details of its quantitative easing programme. The ECB will also provide new economic forecasts for the Eurozone.

UK's FTSE 100 index was up 0.14% to 6,928.67 points. Germany's DAX 30 increased 0.29% to 11,423.69 points, while France's CAC 40 rose 0.41% to 4,937.68.

The Bank of England (BoE) will also release its interest rate decision on Thursday. Analysts expect the BoE will keep unchanged its monetary policy.

The U.K. Halifax house price index declined 0.3% in February, after a 1.9% gain in January. January's figure was revised up from a 0.3% rise.

Hong Kong's Hang Seng fell 1.11% to 24,193.04, China's Shanghai Composite declined 0.92% to 3,249.46. Chinese stocks declined as China lowered its annual GDP growth target to around 7% for 2015. That was the lowest level in 15 years.

Japan's Nikkei 225 rose 0.26% to 18,751.84 on corporate earnings. There were released no major economic reports in Japan on Wednesday.

USD/JPY 119.00 (USD 948m) 119.25 (USD 800m) 119.50 (USD 385m) 120.00 (3bln)

EUR/USD 1.1100 (EUR 911m) 1.1150 (EUR 1bln) 1.1200 (EUR 1.2bln)

GBP/USD 1.5300 (GBP 150m)

USD/CHF 0.9645-50 (USD 930m)

AUD/USD 0.7850 (AUD 1.87bln)

NZD/USD 0.7355-60 (NZD 375m)

AUD/JPY 0.9650-55 (AUD 450m)

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Retail Sales, M/M January +0.2% +0.4% +0.4%

00:30 Australia Retail Sales Y/Y January +4.1% +3.1%

00:30 Australia Trade Balance January -0.50 Revised From -0.44 -0.93 -0.98

01:30 Australia RBA Assist Gov Lowe Speaks

07:00 Germany Factory Orders s.a. (MoM) January +4.4% Revised From +4.2% -0.8% -3.9%

07:00 Germany Factory Orders n.s.a. (YoY) January +3.9% Revised From +3.4% -0.1%

08:00 United Kingdom Halifax house price index February +1.9% Revised From +0.3% -0.3%

08:00 United Kingdom Halifax house price index, y/y February +6.8% +8.3%

The U.S. dollar traded higher against the most major currencies. The greenback remained supported by yesterday's non-manufacturing purchasing managers' index. The Institute for Supply Management's non-manufacturing purchasing managers' index for the U.S. climbed to 56.9 in February from 56.7 in January, beating expectations for a decline to 56.5.

The New Zealand dollar dropped against the U.S. dollar in the absence of any major economic reports from New Zealand.

The Australian dollar traded lower against the U.S. dollar after the mixed Australian economic data. Retail sales in Australia rose 0.4% in January, in line with expectations, after a 0.2% gain in December.

Australia's trade deficit widened to A$0.98 billion in January from A$0.50 billion in December. December's figure was revised down from a deficit of A$0.44 billion. Analysts had expected the trade deficit to rise to A$0.93 billion.

The Reserve Bank of Australia Deputy Governor Philip Lowe said on Wednesday that interest rate cut is less effective than in the past, but it weakened the exchange rate and encouraged housing construction.

The Japanese yen traded lower against the U.S. dollar in the absence of any major economic reports from Japan.

EUR/USD: the currency pair fell to $1.1025

GBP/USD: the currency pair decreased to $1.5224

USD/JPY: the currency pair rose to Y119.90

The most important news that are expected (GMT0):

12:00 United Kingdom BoE Interest Rate Decision 0.50% 0.50%

12:00 United Kingdom Asset Purchase Facility 375 375

12:00 United Kingdom MPC Rate Statement

12:45 Eurozone ECB Interest Rate Decision 0.05% 0.05%

13:30 Eurozone ECB Press Conference

13:30 U.S. Initial Jobless Claims February 313 319

13:30 U.S. Nonfarm Productivity, q/q (Finally) Quarter IV -2.2% +0.4%

15:00 Canada Ivey Purchasing Managers Index February 45.4 46.2

15:00 U.S. FOMC Member Williams Speaks

15:00 U.S. Factory Orders January -3.4% +0.1%

EUR / USD

Resistance levels (open interest**, contracts)

$1.1173 (908)

$1.1141 (1626)

$1.1100 (143)

Price at time of writing this review: $1.1037

Support levels (open interest**, contracts):

$1.1008 (5439)

$1.0975 (6282)

$1.0937 (1375)

Comments:

- Overall open interest on the CALL options with the expiration date March, 6 is 116818 contracts, with the maximum number of contracts with strike price $1,1500 (6216);

- Overall open interest on the PUT options with the expiration date March, 6 is 114279 contracts, with the maximum number of contracts with strike price $1,1100 (6282);

- The ratio of PUT/CALL was 0.98 versus 1.04 from the previous trading day according to data from March, 4

GBP/USD

Resistance levels (open interest**, contracts)

$1.5500 (2817)

$1.5401 (2152)

$1.5303 (2212)

Price at time of writing this review: $1.5227

Support levels (open interest**, contracts):

$1.5198 (2304)

$1.5099 (1608)

$1.5000 (1917)

Comments:

- Overall open interest on the CALL options with the expiration date March, 6 is 30384 contracts, with the maximum number of contracts with strike price $1,5500 (2817);

- Overall open interest on the PUT options with the expiration date March, 6 is 35546 contracts, with the maximum number of contracts with strike price $1,5200 (2304);

- The ratio of PUT/CALL was 1.17 versus 1.18 from the previous trading day according to data from March, 4

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.