- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 10-09-2014

(raw materials / closing price /% change)

Light Crude 91.77 +0.11%

Gold 1,250.20 +0.39%

(index / closing price / change items /% change)

Nikkei 225 15,788.78 +39.63 +0.25%

Hang Seng 24,705.36 -485.09 -1.93%

Shanghai Composite 2,318.31 -8.22 -0.35%

FTSE 100 6,830.11 +1.11 +0.02%

CAC 40 4,450.79 -1.58 -0.04%

Xetra DAX 9,700.17 -10.53 -0.11%

S&P 500 1,995.69 +7.25 +0.36%

NASDAQ Composite 4,586.52 +34.24 +0.75%

Dow Jones 17,068.71 +54.84 +0.32%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2915 -0,19%

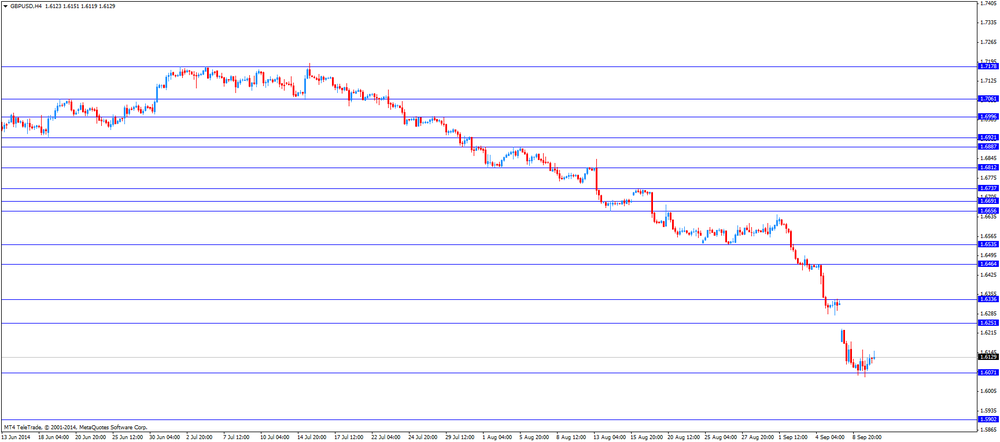

GBP/USD $1,6101 -0,02%

USD/CHF Chf0,9366 +0,43%

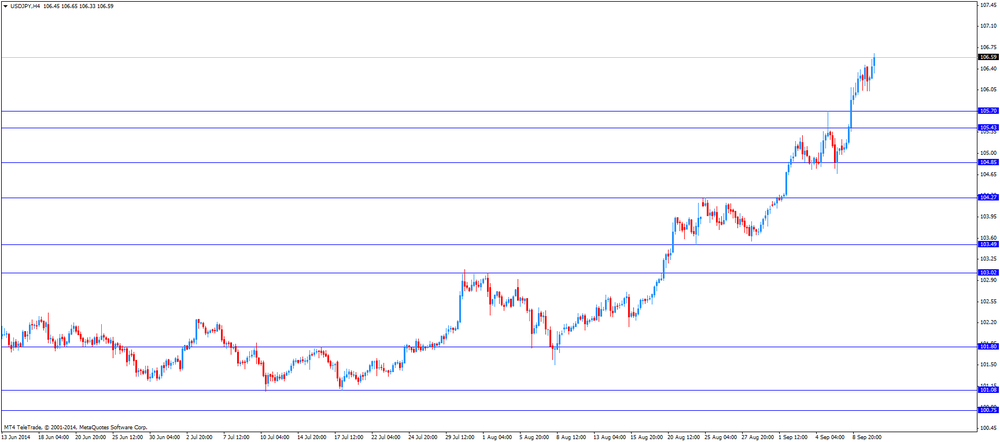

USD/JPY Y106,83 +0,59%

EUR/JPY Y137,97 +0,40%

GBP/JPY Y173,07 +1,18%

AUD/USD $0,9157 -0,50%

NZD/USD $0,8198 -0,57%

USD/CAD C$1,0944 -0,34%

(time / country / index / period / previous value / forecast)

01:00 Australia Consumer Inflation Expectation September +3.1%

01:30 Australia Unemployment rate August 6.4% 6.3%

01:30 Australia Changing the number of employed August -0.3 +15.2

01:30 China PPI y/y August -0.9% -1.1%

01:30 China CPI y/y August +2.3% +2.2%

02:00 China New Loans August 385 710

06:00 Germany CPI, m/m (Finally) August 0.0% 0.0%

06:00 Germany CPI, y/y (Finally) August +0.8% +0.8%

06:45 France CPI, m/m August -0.3% +0.4%

06:45 France CPI, y/y August +0.5% +0.5%

08:00 Eurozone ECB Monthly Report

12:30 Canada New Housing Price Index July +0.2% +0.2%

12:30 U.S. Initial Jobless Claims September 302 306

18:00 U.S. Federal budget August -94.6 -132.8

22:30 New Zealand Business NZ PMI August 53.0

22:45 New Zealand Food Prices Index, m/m August -0.7%

22:45 New Zealand Food Prices Index, y/y August -0.1%

Oil fell after U.S. crude stockpiles fell less than analysts projected in a government report and OPEC cut estimates for supplies.

Crude inventories fell 1 million barrels to 358.6 million last week, the Energy Information Administration said. Average forecast of analysts was for 1.5 million-barrel drop.

The Organization of Petroleum Exporting Countries (OPEC) expects it will need to pump an average of 29.2 million barrels a day of crude in 2015, about 200,000 a day less than it forecast in August. The change implies OPEC will need to cut output by about 1.1 million barrels a day from the 30.3 million it produced last month.

WTI for October delivery fell 1.41% to $91.57 a barrel on the New York Mercantile Exchange.

Most stock indices closed lower as concerns over the outcome of Scotland's independence referendum and the timing of interest rate hike by the Fed weighed on markets.

A weekend Scotland's independence poll showed 47% said "yes" to independence, while 45% said "no", with the rest undecided. That was the first time lead for "yes" campaign.

The San Francisco Federal Reserve released a research report on Monday. The report showed that investors were underestimating the start of interest rate hike by the Fed.

Market participants continued to monitor tensions between Russia and Ukraine. European Union approved new sanctions against Russia on Monday, but put it on hold.

France's industrial production rose 0.2% in July, beating forecasts of a 0.4% decline, after a 1.2% rise in June. June's figure was revised down from a 1.3% gain.

On a yearly basis, France's industrial production climbed 0.1% in July, after a 0.4% drop in June.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,830.11 +1.11 +0.02%

DAX 9,700.17 -10.53 -0.11%

CAC 40 4,450.79 -1.58 -0.04%

The U.S. dollar traded mixed against the most major currencies. The greenback remained supported by Monday's San Francisco Federal Reserve research report. The report showed that investors were underestimating the start of interest rate hike by the Fed. Market participants have concerns the Fed may raise its interest rate sooner than expected.

The euro traded slightly lower against the U.S. dollar. France's industrial production rose 0.2% in July, beating forecasts of a 0.4% decline, after a 1.2% rise in June. June's figure was revised down from a 1.3% gain.

On a yearly basis, France's industrial production climbed 0.1% in July, after a 0.4% drop in June.

The British pound traded mixed against the U.S. dollar after the speech of the Bank of England Governor Mark Carney before Parliament's Treasury committee. The Bank of England Governor Mark Carney said before Parliament's Treasury committee today that the timing to rise interest rate has moved closer. He added the central bank has a contingency plan for financial stability if Scotland votes for independence.

A weekend Scotland's independence poll still weighed on the pound. The poll showed 47% said "yes" to independence, while 45% said "no", with the rest undecided. That was the first time lead for "yes" campaign.

The New Zealand dollar traded mixed lower against the U.S dollar in the absence of any major economic reports from New Zealand. Market participants are awaiting the Reserve Bank of New Zealand's interest rate decision today. Interest rate is expected to remain unchanged at 3.50%.

The Australian dollar dropped against the U.S. dollar after the weaker-than-expected consumer confidence data from Australia, but recovered a part of its losses in the day trading session. The Westpac Banking Corporation released its consumer confidence for Australia today. The consumer confidence in Australia fell by 4.6% in September, after a 3.8% gain in August.

The Japanese yen traded mixed against the U.S. dollar. Core machinery orders in Japan rose 3.5% in July, missing expectations for a 4.1% gain, after a 8.8% rise in June.

On a yearly basis, Core machinery orders in Japan climbed 1.1% in July, beating expectations for a 0.6% increase, after a 3.0% decline in June.

EUR/USD $1.2925(E120mn), $1.2950(E153mn), $1.3000(E533mn)

USD/JPY Y105.35-50($631mn), Y105.75($300mn), Y106.10($185mn)

AUD/USD $0.9200(A$436mn), $0.9250(A$155mn), $0.9300(A$508mn), $0.9325(A$407mn)

U.S. stock-index futures were little changed as investors considered the timing of possible interest-rate increases by the Federal Reserve.

Global markets:

Nikkei 15,788.78 +39.63 +0.25%

Hang Seng 24,705.36 -485.09 -1.93%

Shanghai Composite 2,318.31 -8.22 -0.35%

FTSE 6,830.17 +1.17 +0.02%

CAC 4,449.07 -3.30 -0.07%

DAX 9,694.33 -16.37 -0.17%

Crude oil $92.90 (+0.16%)

Gold $1249.50 (+0.09%)

(company / ticker / price / change, % / volume)

| JPMorgan Chase and Co | JPM | 59.09 | +0.05% | 0.4K |

| Goldman Sachs | GS | 177.51 | +0.06% | 0.5K |

| Verizon Communications Inc | VZ | 48.94 | +0.08% | 0.2K |

| Nike | NKE | 81.92 | +0.10% | 0.5K |

| General Electric Co | GE | 25.93 | +0.12% | 6.5K |

| United Technologies Corp | UTX | 108.80 | +0.12% | 0.1K |

| Boeing Co | BA | 128.41 | +0.16% | 0.3K |

| Microsoft Corp | MSFT | 46.87 | +0.24% | 11.6K |

| Cisco Systems Inc | CSCO | 24.86 | 0.00% | 11.7K |

| Walt Disney Co | DIS | 89.58 | -0.02% | 0.7K |

| Johnson & Johnson | JNJ | 103.63 | -0.16% | 0.3K |

| The Coca-Cola Co | KO | 41.87 | -0.17% | 1.2K |

| McDonald's Corp | MCD | 90.90 | -0.21% | 1.3K |

| Chevron Corp | CVX | 124.85 | -0.26% | 2.8K |

| Home Depot Inc | HD | 88.55 | -0.43% | 2.3K |

Upgrades:

Twitter (TWTR) upgraded to Buy from Neutral at UBS, target raised to $65 from $50

Downgrades:

Apple (AAPL) downgraded to Sector Perform from Outperform at Pacific Crest

eBay (EBAY) downgraded to Neutral from Overweight at Piper Jaffray, targte lowered to $55 from $63

Other:

Apple (AAPL) target raised to $116 from $110 at Barclays

EUR/USD

Offers $1.3050, $1.3000/10

Bids $1.2880/74, $1.2860/50, $1.2800

GBP/USD

Offers $1.6350, $1.6290-300, $1.6250/55

Bids $1.6050, 1.6000

AUD/USD

Offers $0.9375/80, $0.9350, $0.9300, $0.9280/90, $0.9250/60

Bids $0.9100, $0.9020, $0.9000

EUR/JPY

Offers Y139.00, Y138.50, Y138.25/30

Bids Y136.50, Y136.20, Y136.05/00

USD/JPY

Offers Y108.00, Y107.50, Y107.00, Y106.80

Bids Y105.50, Y105.20, Y105.00

EUR/GBP

Offers stg0.8160/65, stg0.8150, stg0.8100

Bids stg0.7900

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Westpac Consumer Confidence September +3.8% -4.6%

05:30 France Non-Farm Payrolls (Finally) Quarter II +0.1% +0.1% +0.1%

06:45 France Industrial Production, m/m July +1.2% Revised From +1.3% -0.4% +0.2%

06:45 France Industrial Production, y/y July -0.4% +0.1%

The U.S. dollar traded mixed against the most major currencies. The greenback remained supported by Monday's San Francisco Federal Reserve research report. The report showed that investors were underestimating the start of interest rate hike by the Fed. Market participants have concerns the Fed may raise its interest rate sooner than expected.

The euro traded mixed against the U.S. dollar. France's industrial production rose 0.2% in July, beating forecasts of a 0.4% decline, after a 1.2% rise in June. June's figure was revised down from a 1.3% gain.

On a yearly basis, France's industrial production climbed 0.1% in July, after a 0.4% drop in June.

The British pound traded mixed against the U.S. dollar. A weekend Scotland's independence poll still weighed on the pound. The poll showed 47% said "yes" to independence, while 45% said "no", with the rest undecided. That was the first time lead for "yes" campaign.

The Bank of England Governor Mark Carney will speak before Parliament's Treasury committee later in the day.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair rose to Y106.80

The most important news that are expected (GMT0):

13:45 United Kingdom Inflation Report Hearings

21:00 New Zealand RBNZ Interest Rate Decision 3.50% 3.50%

21:00 New Zealand RBNZ Rate Statement

21:00 New Zealand RBNZ Press Conference

23:50 Japan BSI Manufacturing Index Quarter III -13.9% -10.3%

Stock indices traded little changed as Ukraine weighed again on markets. Market participants monitor tensions between Russia and Ukraine. European Union approved new sanctions against Russia on Monday, but put it on hold.

France's industrial production rose 0.2% in July, beating forecasts of a 0.4% decline, after a 1.2% rise in June. June's figure was revised down from a 1.3% gain.

On a yearly basis, France's industrial production climbed 0.1% in July, after a 0.4% drop in June.

A weekend Scotland's independence poll still weighed on British markets. The poll showed 47% said "yes" to independence, while 45% said "no", with the rest undecided. That was the first time lead for "yes" campaign.

Current figures:

Name Price Change Change %

FTSE 100 6,845.26 +16.26 +0.24%

DAX 9,713.53 +2.83 +0.03%

CAC 40 4,458.16 +5.79 +0.13%

Most Asian stock closed lower following decline on Wall Street. Concerns the Fed may raise rates sooner than expected weighed on markets. The San Francisco Federal Reserve released a research report on Monday. The report showed that investors were underestimating the start of interest rate hike by the Fed.

Comments by China's Premier Li Keqiang weighed on markets in China. He indicated money-supply growth slowed in August.

Core machinery orders in Japan rose 3.5% in July, missing expectations for a 4.1% gain, after a 8.8% rise in June.

On a yearly basis, Core machinery orders in Japan climbed 1.1% in July, beating expectations for a 0.6% increase, after a 3.0% decline in June.

Indexes on the close:

Nikkei 225 15,788.78 +39.63 +0.25%

Hang Seng 24,705.36 -485.09 -1.93%

Shanghai Composite 2,318.31 -8.22 -0.35%

EUR/USD $1.2925(E120mn), $1.2950(E153mn), $1.3000(E533mn)

USD/JPY Y105.35-50($631mn), Y105.75($300mn), Y106.10($185mn)

AUD/USD $0.9200(A$436mn), $0.9250(A$155mn), $0.9300(A$508mn), $0.9325(A$407mn)

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Westpac Consumer Confidence September +3.8% -4.6%

05:30 France Non-Farm Payrolls (Finally) Quarter II +0.1% +0.1% +0.1%

06:45 France Industrial Production, m/m July +1.2% Revised From +1.3% -0.4% +0.2%

06:45 France Industrial Production, y/y July -0.4% +0.1%

The U.S. dollar traded mixed to higher against the most major currencies on speculation the Fed will start to hike its interest rate sooner than expected. The San Francisco Federal Reserve released a research report on Monday. The report showed that investors were underestimating the start of interest rate hike by the Fed.

The New Zealand dollar traded slightly lower against the U.S dollar in the absence of any major economic reports from New Zealand. Market participants are awaiting the Reserve Bank of New Zealand's interest rate decision today. Interest rate is expected to remain unchanged at 3.50%.

The Australian dollar dropped against the U.S. dollar after the weaker-than-expected consumer confidence data from Australia. The Westpac Banking Corporation released its consumer confidence for Australia today. The consumer confidence in Australia fell by 4.6% in September, after a 3.8% gain in August.

The Japanese yen traded slightly lower against the U.S. dollar after the core machinery orders from Japan and due to the stronger U.S. dollar. Core machinery orders in Japan rose 3.5% in July, missing expectations for a 4.1% gain, after a 8.8% rise in June.

On a yearly basis, Core machinery orders in Japan climbed 1.1% in July, beating expectations for a 0.6% increase, after a 3.0% decline in June.

EUR/USD: the currency pair fell to $1.2921

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair rose Y106.56

The most important news that are expected (GMT0):

13:45 United Kingdom Inflation Report Hearings

21:00 New Zealand RBNZ Interest Rate Decision 3.50% 3.50%

21:00 New Zealand RBNZ Rate Statement

21:00 New Zealand RBNZ Press Conference

23:50 Japan BSI Manufacturing Index Quarter III -13.9% -10.3%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.