- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 12-09-2014

Stock indices closed mixed. New sanctions against Russia weighed on markets. European Union will implement new sanctions against Russia tomorrow. European Union approved new sanctions against Russia on Monday, but put it on hold.

The U.S. is joining the European Union in imposing new sanctions on Russia.

Russia responded it may ban some U.S. and European imports.

Scotland's independence referendum continued to weigh on markets. A Wednesday Scotland's independence poll showed 53% said "no" to independence.

Market participants are awaiting the Fed meeting next week. They speculate that the Fed will hike its interest rate sooner than expected.

Eurozone's industrial production rose 1.0% in July, beating forecasts of a 0.6% gain, after a 0.3% decline in June.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,806.96 +7.34 +0.11%

DAX 9,651.13 -40.15 -0.41%

CAC 40 4,441.7 +0.80 +0.02%

Crude oil fell amid speculation that global fuel consumption is slowing while production climbs.The International Energy Agency cut its global oil demand forecast for 2015. The IEA also said Saudi Arabia exported the least in almost three years as purchases slowed from China and Europe. Global oil demand will increase by 1.2 million barrels a day, or 1.3 percent, to 93.8 million barrels a day next year, the Paris-based IEA said in a report yesterday. The expansion is 165,000 barrels a day less than it predicted a month ago.

WTI for October delivery fell 0.26% to $92.67 a barrel on the New York Mercantile Exchange.

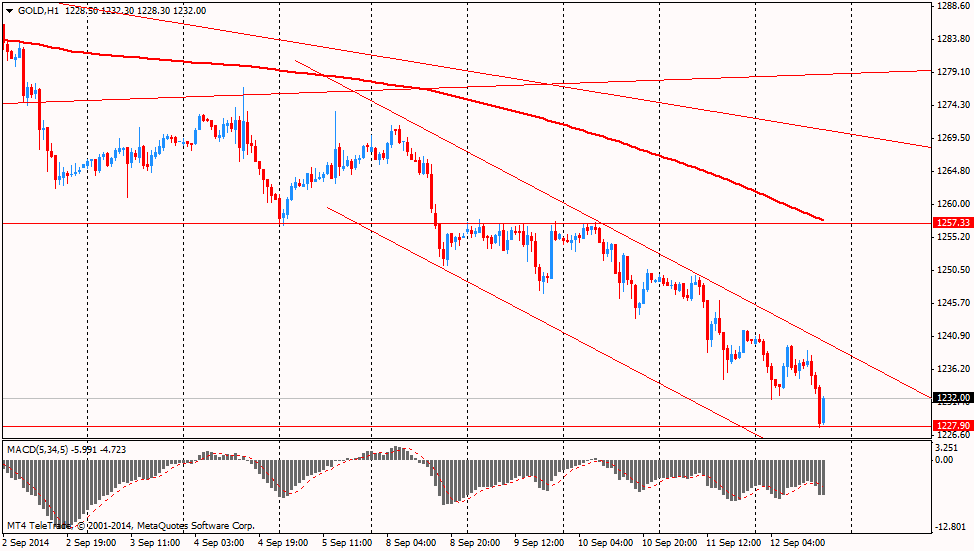

Gold futures fell to the lowest in eight months as improving U.S. economic growth curbed demand for the metal as a haven asset.

Investor interest that pushed prices as much as 16 percent higher this year is waning as economic expansion bolsters the case for the Federal Reserve to raise interest rates, cutting the appeal of the metal as a hedge against inflation. Money mangers pared their bullish wagers on the metal for three straight weeks, while open interest in New York futures and options is near the lowest in five years.

Fed policy makers will meet Sept. 16-17. Research this week from the Fed Bank of San Francisco suggested investors may be underestimating how quickly policy makers could raise rates.

Gold for December delivery fell to $1232.10 an ounce (-0.72%) on the Comex in New York.

The U.S. dollar traded mixed to higher against the most major currencies after the U.S. retail sales and the Reuters/Michigan consumer sentiment index. The U.S. retail sales climbed 0.6% in August, exceeding expectations for a 0.3% gain, after a 0.3% rise in July. July's figure was revised up from 0.0%. That was the fastest pace in four months.

Retail sales excluding automobiles rose 0.3% in August, beating expectations of a 0.2% increase, after a 0.3% gain in July. July's figure was revised up from a 0.1% increase.

The Reuters/Michigan consumer sentiment climbed to 84.6 in September from 82.5 in August, exceeding expectations for a rise to 83.2.

Import prices fell 0.9% in August, missing expectations for a 0.8% decrease, after a 0.2% drop in July.

The business inventories in the U.S. rose 0.4% in July, missing forecasts of a 0.5% gain, after a 0.4% rise in June.

The greenback remained supported on speculation the Fed will start to hike its interest rate sooner than expected. The San Francisco Federal Reserve released a research report on Monday. The report showed that investors were underestimating the start of interest rate hike by the Fed.

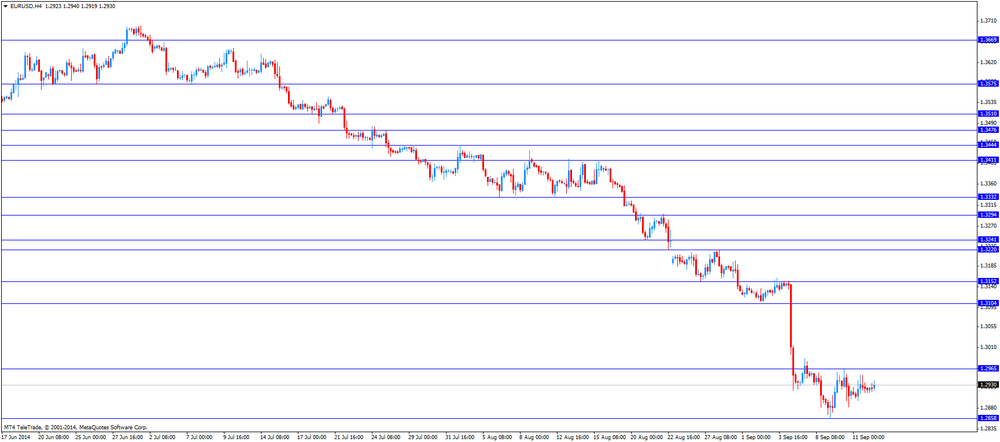

The euro traded slightly higher against the U.S. dollar. Eurozone's industrial production rose 1.0% in July, beating forecasts of a 0.6% gain, after a 0.3% decline in June.

On a yearly basis, the industrial production in the Eurozone climbed 2.2% in July, exceeding expectations for a 1.3%, after 0.0% in June.

Eurozone's employment change increased to 0.2% in the second quarter from 0.1% in the previous quarter. Analysts had expected a 0.1% rise.

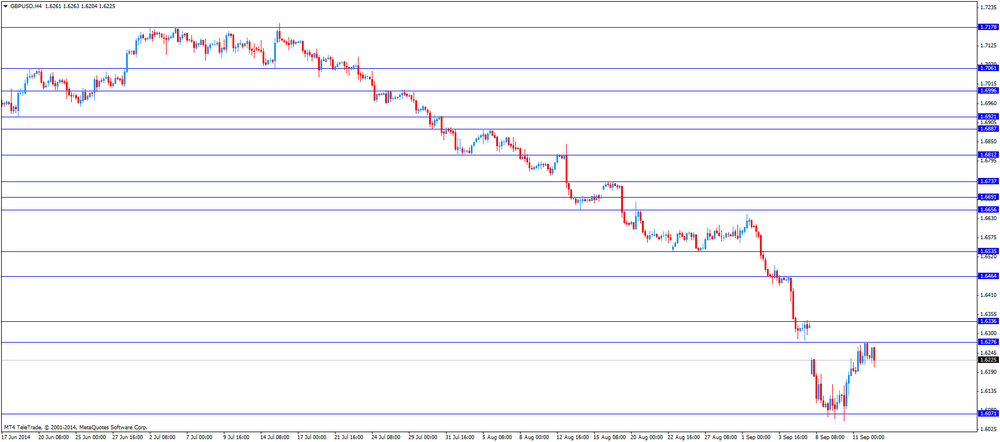

The British pound traded mixed against the U.S. dollar. Scotland's independence referendum continued to weigh on the pound. A Wednesday Scotland's independence poll showed 53% said "no" to independence.

The New Zealand dollar traded lower against the U.S dollar despite the solid economic data from New Zealand. The Business NZ purchasing managers' index climbed to 56.5 in August from 53.5 in July. July's figure was revised up from 53.0.

The food prices index rose 0.3% in August, after a 0.7% decline in July.

Wednesday's comments by the Reserve Bank of New Zealand (RBNZ) Graeme Wheeler still weighed on the kiwi. The RBNZ governor said the strength of the kiwi is still "unjustified and unsustainable". He added that the central bank expects further significant depreciation.

The Australian dollar traded lower against the U.S. dollar in the absence of any major economic data reports from Australia. The greenback put downward pressure on the Aussie.

The Japanese yen traded near the lowest level since September 2008 against the U.S. dollar. The divergence between the monetary policies of the US and those of Japan weighed on the yen.

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said to the Japan's Prime Minister Shinzo Abe on Thursday that the central bank is ready to expand monetary easing measures to reach 2 percent inflation target.

The industrial production in Japan increased 0.4% in July, exceeding expectations for a 0.2% rise, after a 0.2% gain in June.

EUR/USD: $1.2850(E415mn), $1.2900(E1.6bn), $1.2960-65(E650mn), $1.3000(E2.2bn)

GBP/USD: $1.6175(stg150mn), $1.6310(stg306mn), $1.6330-40(stg309mn)

EUR/GBP: stg0.8050(E270mn)

AUD/USD: $0.9100(A$150mn), $0.9160(A$125mn), $0.9200(A$880mn)

NZD/USD: $0.8275(NZ$228mn), $8400(NZ$374mn)

USD/CAD: C$1.0905($1.0bn), C$1.0910($484mn), C$1.0955-60($396mn), C$1.0975($531mn), C$1.1000($807mn), C$1.1035($150mn), C$1.1050($210mn)

U.S. stock-index futures were little changed after data showed sales at retailers climbed in August at the fastest pace in four months.

Global markets:

Nikkei 15,948.29 +39.09 +0.25%

Hang Seng 24,595.32 -67.32 -0.27%

Shanghai Composite 2,331.95 +20.27 +0.88%

FTSE 6,816.02 +16.40 +0.24%

CAC 4,435.02 -5.88 -0.13%

DAX 9,665.38 -25.90 -0.27%

Crude oil $92.80 (-0.03%)

Gold $1236.60 (-0.20%)

The U.S. Commerce Department released retail sales data today. The U.S. retail sales climbed 0.6% in August, exceeding expectations for a 0.3% gain, after a 0.3% rise in July. July's figure was revised up from 0.0%. That was the fastest pace in four months.

Retail sales excluding automobiles rose 0.3% in August, beating expectations of a 0.2% increase, after a 0.3% gain in July. July's figure was revised up from a 0.1% increase.

(company / ticker / price / change, % / volume)

| Walt Disney Co | DIS | 90.00 | +0.03% | 0.4K |

| McDonald's Corp | MCD | 93.00 | +0.04% | 0.3K |

| Home Depot Inc | HD | 89.30 | +0.09% | 2.9K |

| General Electric Co | GE | 26.06 | +0.15% | 1.7K |

| Cisco Systems Inc | CSCO | 25.23 | +0.20% | 6.2K |

| American Express Co | AXP | 88.70 | +0.32% | 0.3K |

| Chevron Corp | CVX | 124.50 | +0.54% | 3.3K |

| 3M Co | MMM | 144.35 | 0.00% | 0.1K |

| AT&T Inc | T | 34.85 | 0.00% | 14.4K |

| Verizon Communications Inc | VZ | 49.00 | -0.02% | 0.4K |

| Pfizer Inc | PFE | 29.62 | -0.03% | 0.2K |

| Nike | NKE | 81.79 | -0.04% | 0.2K |

| Microsoft Corp | MSFT | 46.96 | -0.09% | 8.3K |

| JPMorgan Chase and Co | JPM | 59.61 | -0.25% | 153.8K |

| Intel Corp | INTC | 34.93 | -0.26% | 1.0K |

| Goldman Sachs | GS | 180.47 | -0.29% | 0.3K |

| Exxon Mobil Corp | XOM | 96.63 | -0.41% | 4.9K |

| Merck & Co Inc | MRK | 59.83 | -0.45% | 0.1K |

| Caterpillar Inc | CAT | 104.90 | -0.65% | 1.8K |

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

02:00 China New Loans August 385 710 702.5

04:30 Japan Industrial Production (MoM) (Finally) July +0.2% +0.2% +0.4%

04:30 Japan Industrial Production (YoY) (Finally) July -0.9% -0.9% -0.7%

06:05 Japan BOJ Governor Haruhiko Kuroda Speaks

09:00 Eurozone Industrial production, (MoM) July -0.3% +0.6% +1.0%

09:00 Eurozone Industrial Production (YoY) July 0.0% +1.3% +2.2%

09:00 Eurozone Employment Change Quarter II +0.1% +0.1% +0.2%

09:00 Eurozone ECOFIN Meetings

The U.S. dollar traded mixed against the most major currencies ahead of the U.S. retail sales and the Reuters/Michigan consumer sentiment index. The U.S. retail sales are expected to rise by 0.3% in August.

Retail sales excluding automobiles are expected to increase by 0.2% in August.

The Reuters/Michigan consumer sentiment index is expected to climb to 83.2 in September from 82.5 in August.

The greenback remained supported on speculation the Fed will start to hike its interest rate sooner than expected. The San Francisco Federal Reserve released a research report on Monday. The report showed that investors were underestimating the start of interest rate hike by the Fed.

The euro traded mixed against the U.S. dollar. Eurozone's industrial production rose 1.0% in July, beating forecasts of a 0.6% gain, after a 0.3% decline in June.

On a yearly basis, the industrial production in the Eurozone climbed 2.2% in July, exceeding expectations for a 1.3%, after 0.0% in June.

Eurozone's employment change increased to 0.2% in the second quarter from 0.1% in the previous quarter. Analysts had expected a 0.1% rise.

The British pound traded mixed against the U.S. dollar. Scotland's independence referendum continued to weigh on the pound. A Wednesday Scotland's independence poll showed 53% said "no" to independence.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 U.S. Retail sales August 0.0% +0.3%

12:30 U.S. Retail sales excluding auto August +0.1% +0.2%

12:30 U.S. Import Price Index August -0.2% -0.8%

13:55 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) September 82.5 83.2

14:00 U.S. Business inventories July +0.4% +0.5%

Stock indices traded mixed as new sanctions against Russia weighed on markets. European Union will implement new sanctions against Russia tomorrow. European Union approved new sanctions against Russia on Monday, but put it on hold.

The U.S. is joining the European Union in imposing new sanctions on Russia.

Russia responded it may ban some U.S. and European imports.

Scotland's independence referendum continued to weigh on markets. A Wednesday Scotland's independence poll showed 53% said "no" to independence.

Eurozone's industrial production rose 1.0% in July, beating forecasts of a 0.6% gain, after a 0.3% decline in June.

Current figures:

Name Price Change Change %

FTSE 100 6,830.32 +30.70 +0.45%

DAX 9,669.27 -22.01 -0.23%

CAC 40 4,437.29 -3.61 -0.08%

Asian stock closed mixed as Chinese lending data weighed on markets. Chinese banks made 702.5 billion yuan of new loans in August, missing expectations for 710 billion yuan, after 385.2 billion yuan in July.

Japanese stocks were driven by the weaker yen. The yen reached the lowest level since September 2008 against the U.S. dollar. The divergence between the monetary policies of the US and those of Japan weighed on the yen.

The Bank of Japan Governor Haruhiko Kuroda said to the Japan's Prime Minister Shinzo Abe on Thursday that the central bank is ready to expand monetary easing measures to reach 2 percent inflation target.

The industrial production in Japan increased 0.4% in July, exceeding expectations for a 0.2% rise, after a 0.2% gain in June.

Market participants continued to monitor tensions between Russia and Ukraine. The U.S. is joining the European Union in imposing new sanctions on Russia.

Indexes on the close:

Nikkei 225 15,948.29 +39.09 +0.25%

Hang Seng 24,595.32 -67.32 -0.27%

Shanghai Composite 2,331.95 +20.27 +0.88%

EUR/USD: $1.2850(E415mn), $1.2900(E1.6bn), $1.2960-65(E650mn), $1.3000(E2.2bn)

GBP/USD: $1.6175(stg150mn), $1.6310(stg306mn), $1.6330-40(stg309mn)

EUR/GBP: stg0.8050(E270mn)

AUD/USD: $0.9100(A$150mn), $0.9160(A$125mn), $0.9200(A$880mn)

NZD/USD: $0.8275(NZ$228mn), $8400(NZ$374mn)

USD/CAD: C$1.0905($1.0bn), C$1.0910($484mn), C$1.0955-60($396mn), C$1.0975($531mn), C$1.1000($807mn), C$1.1035($150mn), C$1.1050($210mn)

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

02:00 China New Loans August 385 710 702.5

04:30 Japan Industrial Production (MoM) (Finally) July +0.2% +0.2% +0.4%

04:30 Japan Industrial Production (YoY) (Finally) July -0.9% -0.9% -0.7%

06:05 Japan BOJ Governor Haruhiko Kuroda Speaks

The U.S. dollar traded mixed to higher against the most major currencies on speculation the Fed will start to hike its interest rate sooner than expected. The San Francisco Federal Reserve released a research report on Monday. The report showed that investors were underestimating the start of interest rate hike by the Fed.

The New Zealand dollar hits 7-month low against the U.S dollar despite the solid economic data from New Zealand. The Business NZ purchasing managers' index climbed to 56.5 in August from 53.5 in July. July's figure was revised up from 53.0.

The food prices index rose 0.3% in August, after a 0.7% decline in July.

Wednesday's comments by the Reserve Bank of New Zealand (RBNZ) Graeme Wheeler still weighed on the kiwi. The RBNZ governor said the strength of the kiwi is still "unjustified and unsustainable". He added that the central bank expects further significant depreciation.

The Australian dollar declined toward 6-month low against the U.S. dollar in the absence of any major economic data reports from Australia. The greenback put downward pressure on the Aussie.

The Japanese yen reached the lowest level since September 2008 against the U.S. dollar. The divergence between the monetary policies of the US and those of Japan weighed on the yen.

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said to the Japan's Prime Minister Shinzo Abe on Thursday that the central bank is ready to expand monetary easing measures to reach 2 percent inflation target.

The industrial production in Japan increased 0.4% in July, exceeding expectations for a 0.2% rise, after a 0.2% gain in June.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair rose Y107.40

The most important news that are expected (GMT0):

09:00 Eurozone Industrial production, (MoM) July -0.3% +0.6%

09:00 Eurozone Industrial Production (YoY) July 0.0% +1.3%

09:00 Eurozone Employment Change Quarter II +0.1% +0.1%

09:00 Eurozone ECOFIN Meetings

12:30 U.S. Retail sales August 0.0% +0.3%

12:30 U.S. Retail sales excluding auto August +0.1% +0.2%

12:30 U.S. Import Price Index August -0.2% -0.8%

13:55 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) September 82.5 83.2

14:00 U.S. Business inventories July +0.4% +0.5%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.