- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 13-04-2021

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 (GMT) | Australia | Westpac Consumer Confidence | April | 111.8 | |

| 02:00 (GMT) | New Zealand | RBNZ Interest Rate Decision | 0.25% | ||

| 08:00 (GMT) | France | IEA Oil Market Report | |||

| 09:00 (GMT) | Eurozone | Industrial production, (MoM) | February | 0.8% | |

| 09:00 (GMT) | Eurozone | Industrial Production (YoY) | February | 0.1% | |

| 12:30 (GMT) | U.S. | Import Price Index | March | 1.3% | 1% |

| 14:00 (GMT) | Eurozone | ECB President Lagarde Speaks | |||

| 14:30 (GMT) | U.S. | Crude Oil Inventories | April | -3.522 | |

| 16:00 (GMT) | U.S. | Fed Chair Powell Speaks | |||

| 18:00 (GMT) | U.S. | Fed's Beige Book | |||

| 18:30 (GMT) | U.S. | FOMC Member Williams Speaks | |||

| 19:45 (GMT) | U.S. | FOMC Member Clarida Speaks | |||

| 20:00 (GMT) | U.S. | FOMC Member Bostic Speaks | |||

| 22:05 (GMT) | U.S. | FOMC Member Kaplan Speak | |||

| 22:45 (GMT) | New Zealand | Visitor Arrivals | February | -98.7% | |

| 22:45 (GMT) | New Zealand | Food Prices Index, y/y | March | 1.2% |

- Causes of inflation increase are only temporary

- 2% inflation is not a ceiling

- Time to exit from exceptional measures has not yet arrived

- Flexible average inflation targeting leaves many questions unanswered

According to ActionForex, analysts at TD Bank Financial Group note that the NFIB’s small business optimism index rose by 2.4 points to 98.2 in March, marking the second consecutive monthly improvement. The reading was a hair higher than market expectations for a 98.0 print.

"Gains were broad-based under the hood, with seven of the ten subcomponents improving on the month and only three falling."

"Expectations regarding an improvement in the economy (up 11 points to -8%), higher real sales (up 8 points to 0%) and the belief that now is a good time to expand up (5 points to 11%) all recorded sizable gains in March."

"Labor market indicators were also broadly positive."

"Among the remaining sub-indicators, earnings trends, current inventory and plans to make capital outlays all eased on the month. The uncertainty sub-index, meanwhile, rose six points to a reading of 81."

"The NFIB small business report adds to the string of positive data last month, as confidence among American small business owners improved further in March. While gains in the sub-components were broad-based, the strength in labor market indicators is striking. Employment demand for workers remains strong, with job openings rising to a new record high last month. Small business owners are raising worker compensation in order to attract the right talent, and are passing down some of the added costs through higher prices – a theme that lines up with a stronger inflation outlook this year."

Bank of England (BoE) announced that its MPC member and chief economists Andy Haldane is to leave his post in June.

According to the Bank's release, Haldane is leaving the BoE to become chief executive of the Royal Society for Arts, Manufactures and Commerce (RSA). The BoE added it would advertise for a successor to Haldane in due course.

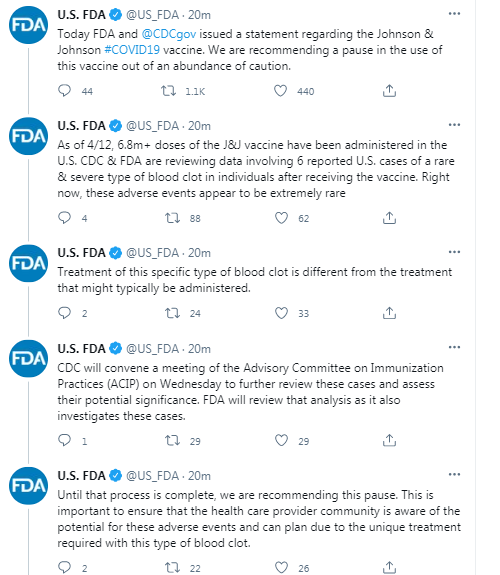

Johnson & Johnson (JNJ) issued a statement on its COVID-19 vaccine, responding to the FDA/CDC's recommendations to pause its use.

"The safety and well-being of the people who use our products is our number one priority. We are aware of an extremely rare disorder involving people with blood clots in combination with low platelets in a small number of individuals who have received our COVID-19 vaccine. The United States Centers for Disease Control (CDC) and Food and Drug Administration (FDA) are reviewing data involving six reported U.S. cases out of more than 6.8 million doses administered. Out of an abundance of caution, the CDC and FDA have recommended a pause in the use of our vaccine.

In addition, we have been reviewing these cases with European health authorities. We have made the decision to proactively delay the rollout of our vaccine in Europe.

We have been working closely with medical experts and health authorities, and we strongly support the open communication of this information to healthcare professionals and the public."

Before the bell: S&P futures 0.00%, NASDAQ futures +0.49%

U.S. stock-index futures traded mixed on Tuesday, as investors digested the U.S. March CPI data, which turned out not as bad as some feared, and the reports about Johnson & Johnson's (JNJ) vaccine pause in the U.S.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 29,751.61 | +212.88 | +0.72% |

Hang Seng | 28,497.25 | +43.97 | +0.15% |

Shanghai | 3,396.47 | -16.48 | -0.48% |

S&P/ASX | 6,976.90 | +2.90 | +0.04% |

FTSE | 6,881.67 | -7.45 | -0.11% |

CAC | 6,179.46 | +17.78 | +0.29% |

DAX | 15,247.90 | +32.90 | +0.22% |

Crude oil | $60.27 | +0.95% | |

Gold | $1,738.30 | +0.32% |

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 196.98 | -0.85(-0.43%) | 169272 |

ALCOA INC. | AA | 31.79 | 0.02(0.06%) | 19754 |

ALTRIA GROUP INC. | MO | 51.69 | -0.06(-0.12%) | 520230 |

Amazon.com Inc., NASDAQ | AMZN | 3,407.00 | 27.61(0.82%) | 35391 |

AMERICAN INTERNATIONAL GROUP | AIG | 47.11 | -0.05(-0.11%) | 22195 |

Apple Inc. | AAPL | 131.8 | 0.56(0.43%) | 988029 |

AT&T Inc | T | 29.9 | -0.06(-0.20%) | 1380613 |

Boeing Co | BA | 248.05 | -1.47(-0.59%) | 324985 |

Caterpillar Inc | CAT | 230.3 | -0.63(-0.27%) | 1713 |

Chevron Corp | CVX | 101.6 | -0.18(-0.18%) | 12649 |

Cisco Systems Inc | CSCO | 51.55 | -0.02(-0.04%) | 451647 |

Citigroup Inc., NYSE | C | 72.32 | -0.37(-0.51%) | 66816 |

Deere & Company, NYSE | DE | 378.75 | 0.49(0.13%) | 1113 |

E. I. du Pont de Nemours and Co | DD | 76.34 | 0.14(0.18%) | 537 |

Exxon Mobil Corp | XOM | 55.53 | 0.03(0.05%) | 352834 |

Facebook, Inc. | FB | 313.1 | 1.56(0.50%) | 62061 |

FedEx Corporation, NYSE | FDX | 294.49 | 3.70(1.27%) | 15465 |

Ford Motor Co. | F | 12.35 | -0.03(-0.24%) | 732695 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 33.82 | 0.15(0.45%) | 73888 |

General Electric Co | GE | 13.52 | -0.07(-0.52%) | 528494 |

General Motors Company, NYSE | GM | 59.35 | -0.31(-0.52%) | 41158 |

Goldman Sachs | GS | 330.71 | -1.13(-0.34%) | 16189 |

Google Inc. | GOOG | 2,256.90 | 2.11(0.09%) | 3175 |

Hewlett-Packard Co. | HPQ | 32.75 | 0.01(0.03%) | 1379357 |

HONEYWELL INTERNATIONAL INC. | HON | 228.25 | -0.35(-0.15%) | 9151 |

Intel Corp | INTC | 65.7 | 0.30(0.45%) | 374349 |

International Business Machines Co... | IBM | 134.25 | -0.34(-0.25%) | 122767 |

Johnson & Johnson | JNJ | 157.25 | -4.39(-2.72%) | 696356 |

JPMorgan Chase and Co | JPM | 155.41 | -0.54(-0.35%) | 89546 |

Merck & Co Inc | MRK | 76.23 | 0.01(0.01%) | 279936 |

Microsoft Corp | MSFT | 257.57 | 1.66(0.65%) | 141057 |

Nike | NKE | 136.66 | 0.02(0.01%) | 153424 |

Pfizer Inc | PFE | 37.33 | 0.36(0.97%) | 2270905 |

Procter & Gamble Co | PG | 136.5 | -0.42(-0.31%) | 1864 |

Starbucks Corporation, NASDAQ | SBUX | 113.87 | 0.06(0.05%) | 9181 |

Tesla Motors, Inc., NASDAQ | TSLA | 711.4 | 9.42(1.34%) | 453967 |

The Coca-Cola Co | KO | 53.2 | -0.15(-0.28%) | 278336 |

Twitter, Inc., NYSE | TWTR | 71.25 | 0.39(0.55%) | 27048 |

UnitedHealth Group Inc | UNH | 374.4 | -1.88(-0.50%) | 967 |

Verizon Communications Inc | VZ | 57.49 | -0.05(-0.09%) | 25798 |

Visa | V | 221.15 | -0.32(-0.14%) | 8601 |

Wal-Mart Stores Inc | WMT | 139.65 | -0.15(-0.11%) | 9473 |

Walt Disney Co | DIS | 185.81 | -0.68(-0.36%) | 156439 |

Yandex N.V., NASDAQ | YNDX | 62.77 | -0.08(-0.13%) | 925 |

Caterpillar (CAT) initiated with an Outperform at Wolfe Research; target $265

Coca-Cola (KO) initiated with a Peer Perform at Wolfe Research

Deere (DE) initiated with an Outperform at Wolfe Research; target $425

NVIDIA (NVDA) target raised to $675 from $665 at Cowen

FedEx (FDX) upgraded to Overweight from Sector Weight at KeyBanc Capital Markets; target $350

The

Labor Department announced on Tuesday the U.S. consumer price index (CPI) rose

0.6 percent m-o-m in March, following an unrevised 0.4 percent m-o-m gain in

the previous month. This was the largest one-month rise in headline CPI since August

2012.

Over

the last 12 months, the CPI climbed 2.6 percent y-o-y, accelerating noticeably from

+1.7 percent y-o-y reported for the period ending in February.

Economists

had forecast the CPI to increase 0.5 percent m-o-m and 2.5 percent y-o-y in the

12-month period.

According

to the report, a surge in gasoline index (+9.1 percent m-o-m) accounted for

nearly half of the seasonally adjusted increase in the all items index in

March. The natural gas index (+2.5 percent m-o-m) also rose, contributing to a

5.0-percent m-o-m gain in the energy index over the month. In addition, the

food index edged up 0.1 percent m-o-m, helped by marginal advances in both the

food at home index (+0.1 percent m-o-m) and the food away from home index (+0.1

percent m-o-m).

Meanwhile,

the core CPI excluding volatile food and fuel costs increased 0.3 percent m-o-m

in March after an unrevised 0.1 percent m-o-m uptick in the previous month.

In

the 12 months through March, the core CPI rose 1.6 percent compared to an

unrevised 1.3 percent advance for the 12 months ending February.

Economists

had forecast the core CPI to increase 0.2 percent m-o-m and to jump 1.5 percent

y-o-y last month.

FXStreet says that the Reserve Bank of New Zealand (RBNZ) is likely to keep all policy settings unchanged and analysts at TD Securities see a similarly neutral reaction in the kiwi.

“We expect the MPC to keep all policy settings unchanged. Specifically, that means the OCR will remain at 0.25%, LSAP to total NZ$100b through August 2022, and for the FLP commitment to stay intact.”

“We anticipate a neutral statement. We expect the Bank to reiterate the need for ‘considerable time and patience’ to meet its inflation/employment goals and for it to be open to deploy negative interest rates if necessary. Market reaction should prove similarly neutral.”

“In our base case, we look for NZD/USD to hold steady and track broader market direction overall. A hawkish surprise could see the NZD/USD pair test resistance around the 0.7105 mark, but we see this as quite unlikely. A dovish outcome could see the kiwi lower toward 0.6965.”

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 06:00 | United Kingdom | Manufacturing Production (YoY) | February | -5% | -5.1% | -4.2% |

| 06:00 | United Kingdom | Industrial Production (YoY) | February | -4.3% | -4.5% | -3.5% |

| 06:00 | United Kingdom | Industrial Production (MoM) | February | -1.8% | 0.5% | 1% |

| 06:00 | United Kingdom | Manufacturing Production (MoM) | February | -2.2% | 0.5% | 1.3% |

| 06:00 | United Kingdom | GDP m/m | February | -2.2% | 0.6% | 0.4% |

| 06:00 | United Kingdom | Total Trade Balance | February | -3.4 | -7.1 | |

| 06:00 | United Kingdom | GDP, y/y | February | -9.2% | -7.8% | |

| 09:00 | Eurozone | ZEW Economic Sentiment | April | 74 | 66.3 | |

| 09:00 | Germany | ZEW Survey - Economic Sentiment | April | 76.6 | 79 | 70.7 |

European session review: USD firms, as markets digest reports about Johnson & Johnson's (JNJ) vaccine pause while awaiting U.S. inflation data

USD strengthened against its major counterparts in the European session on Tuesday as market participants digested the reports that the U.S. Food and Drug Administration (FDA) and the Centers for Disease Control (CDC) had called for a pause in using Johnson & Johnson's (JNJ) single-dose COVID vaccine due to some blood clotting issues.

The FDA notes in its tweets that these issues "appear to be extremely rare", having affected only six people in the U.S., nonetheless, the recommendation to pause the use of the J&J vaccine is being made "out of an abundance of caution."

The U.S. Dollar Index (DXY), measuring the U.S. currency's value relative to a basket of foreign currencies, went up 0.14% to 92.27.

The U.S. currency is also supported by an advance in U.S. Treasury yields ahead of the release of the U.S. inflation data for March, which is due at 12:30 GMT and is anticipated to show an acceleration in inflation to +2.5% y/y in March from +1.7% y/y in the previous month. The yield on the 10-year U.S. Treasury rose to 1.68% early Tuesday.

FXStreet reports that the next Scottish parliamentary election is coming up on 6 May, in just over three weeks. So far, at least, the FX market has been content to ignore potential risks of Scotland's upcoming election. With investors still focused on the pandemic recovery, economists at TD Securities think sentiment has grown more resilient against these shocks. That can change quickly, however, if the underlying political dynamic begins to shift in the final days of the campaign.

“Recent polling suggests that it's nearly a certainty that the SNP will be the largest party, and is on the cusp of winning a majority mandate. But even if the SNP underperforms at the polls, it will still be able to form a substantial pro-independence majority with the support of the Greens and possibly Alba.”

“The primary implication of a clearly pro-independence Scottish government is that they will now be pushing for a new independence referendum. However, this is going to be a multi-month, dragged through the courts, constitutional issue. Our base case sees the UK government successfully denying Scotland the ability to hold a referendum, at least for the duration of this (UK) parliament, but this outcome is not a certainty and will bear close watching.”

“The FX market is not particularly concerned with Scottish election risks. The question, of course, quickly becomes whether the FX market will start to care in the remaining days before the vote. From our perspective, we cannot dismiss this as a possibility. We must, of course, stand ready for the market to pivot quickly to these concerns, particularly as the noise in the press picks up.”

“We are currently inclined to downplay the risks that the upcoming election in Scotland and its immediate aftermath will become a sustained driver for sterling. That said, we readily acknowledge the issue can bubble quickly to the surface in the short-term. With that in mind, we see merit in having some degree of exposure to (or protection against) potential GBP downside over the next several weeks. Importantly, however, this simply ties in with our pre-existing view for a weaker pound over the next several weeks against a range of major currencies.”

FXStreet notes that S&P 500 strength has extended to the top of its multi-year channel at 4125/30, with the index now seen moving into typical “extreme” territory. Credit Suisse’s bias though is for the rally to extend further yet to 4200, where the market would then be highly alert to signs of a potential top and correction/consolidation.

“We maintain an immediate bullish stance for now and continue to look for the rally to extend further, ideally to our 4200 Q2 objective, we now hold a more cautious footing given the market is seen in “extreme” territory.”

“We see resistance next at 4138 ahead of Fibonacci projection resistance at 4175/79. Our ‘ideal’ roadmap remains for a push to our 4200 target but we essentially now look for a top in this 4175/4200 zone.”

FXStreet reports that Derek Halpenny, Head of Research, Global Markets EMEA & International Securities at MUFG Bank, suggests that vaccination roll-out in key EU countries surges, improving the outlook for the EUR/USD pair.

“Former French Finance Minister and EU vaccine coordinator, Thierry Breton confirmed an ‘extremely rapid increase’ in vaccine production in the EU that leaves the EU on track for vaccinating 70% of adults by July. That appears a long shot at this stage but levels between 50% and 60% remain feasible.”

“The infection rates in France, Italy and Germany are providing some relief that the current wave may be easing.”

“The higher yields in the US and the evidence of better COVID-19 vaccination roll-outs in Europe may well limit EUR/USD downside if we do see the US dollar bid following higher inflation leading to higher yields. We’d still expect a EUR/USD decline but the euro should outperform other G10 currencies versus the dollar.”

FXStreet reports that strategists at OCBC Bank estimate gold’s fair value range at $1625-$1725. With spot gold currently trading at around $1730, there is scope for XAU/USD to correct downwards.

“We have been highlighting gold’s appeal as an inflationary hedge since the start of the year but the market appears to place that feature as a low priority, preferring to ride along the inflation/reflation theme by piling into risk assets.”

“The mood surrounding Treasury yields has shifted and the market is now looking at how much higher rates can go, which in essence is negative for gold prices.”

“We see fair value at $1625-$1725 based on current inputs.”

FXStreet reports that according to FX Strategists at UOB Group, USD/CNH is expected to keep the 6.5400-6.5800 range unchanged for the time being.

24-hour view: “While downward momentum has not improved by much, there is room for USD to test 6.5400 first before a recovery can be expected. On the upside, a break of 6.5620 would indicate that the current mild downward pressure has eased.”

Next 1-3 weeks: “We continue to hold the same view from yesterday (12 Apr, spot at 6.5630). As indicated, the current movement is viewed as part of a consolidation and USD is expected to trade between 6.5400 and 6.5800 for now. Shorter-term downward momentum has improved somewhat but USD has to close below 6.5400 before a more sustained decline can be expected.”

Reuters reports that investment bank JPMorgan recommended selling emerging market currencies.

“We take another step down in our EM risk allocation, moving EM FX to underweight” the bank’s analysts said.

They cited the likelihood of an extended period of EM growth underperformance versus developed markets like the United States, renewed “idiosyncratic risks in large EMs” as well as rising COVID cases and slower vaccination programmes in developing economies.

“Having cut CNY and RUB overweights last week, and CEE exposure before that, our GBI-EM Model Portfolio is now underweight EM FX,” the bank said.

FXStreet reports that Jeffrey Kleintop, Senior Vice President and Chief Global Investment Strategist at Charles Schwab, said that a theme with the potential to become the next bubble is “green” infrastructure.

“Alternative energy and other green stocks could benefit from proposed US, European and Chinese climate and green energy legislation and spending including electric vehicles, renewable power generation, eco-friendly infrastructure, and home energy efficiency. The scope of the initiatives is bold and includes wide-ranging goals.”

“Green stocks now appear to have given up last year’s gains and the recovery and stimulus driven gains in oil prices and interest rates appears to be moderating. This could mean it may be time for ‘green’ stocks to begin to inflate again as progress is made on the Biden infrastructure plan and Europe gets closer to deploying its green funding initiatives.”

Reuters reports that ZEW economic research institute said that investor sentiment in Germany fell unexpectedly in April, citing rising fears that Europe's largest economy will go into a stricter lockdown, depressing private consumption.

The economic sentiment fell to 70.7 points, its first drop since November 2020. That compared with 76.6 in the previous month. A Reuters poll had forecast a rise to 79.0.

A separate gauge of current conditions rose to -48.8 points from -61.0 the previous month. That compared with a consensus forecast for -53.0 points

"The financial market experts are somewhat less euphoric than in the previous month," ZEW President Achim Wambach said in a statement. "The ZEW indicator of economic sentiment is, however, still at a very high level and the current situation is assessed much more positively than in March."

FXStreet reports that economists at HSBC believe the global growth recovery should remain supportive for the AUD this year.

“The post-meeting statement by the RBA’s Governor Philip Lowe contained both hawkish and dovish elements, but there was nothing really new for FX markets to digest.”

“The AUD movements are still driven by ‘Risk On-Risk Off’ (RORO) dynamics rather than local factors. We are conscious of rising US Treasury yield volatility over the near-term, as higher US yields may dent risk appetite and spur bouts of USD strength.”

“We still believe the global growth recovery remains supportive for the AUD this year. The currency’s correlation to broad commodity indices has picked up to at least a five-year high and rising terms of trade saw the current account surplus balloon out to 2.6% of GDP in 2020. This strong tailwind should persist in the coming months, particularly as Australia’s export commodity prices have risen a further 11.8% in the first quarter this year.”

According to the report from ISTAT, in February 2021 the seasonally adjusted industrial production index increased by 0.2% compared with the previous month. Economists had expected a 0.7% increase. The change of the average of the last three months with respect to the previous three months was +0.6%.

The index measures the monthly evolution of the volume of industrial production (excluding construction). With effect from January 2018 the indices are calculated with reference to the base year 2015 using the Ateco 2007 classification (Italian edition of Nace Rev. 2).

The calendar adjusted industrial production index decreased by 0.6% compared with February 2020 (calendar working days in February 2021 being the same as in February 2020).

The unadjusted industrial production index decreased by 1.3% compared with February 2020

Reuters reports that BofA's April fund manager survey found that fund managers increased their cash allocations as expectations of higher inflation, taxation changes and a "taper tantrum" leave equities vulnerable to pullbacks.

Though the majority of investors in the survey said equities were not in a bubble, BofA said positioning was peaking with a near-record 62% of investors "overweight" on stocks.

Investors' cash allocation rose to 4.1% last week versus 3.8% in February, the survey showed.

After soaring 82% from March 2020 lows and scaling $90 trillion in market capitalisation, world stocks are holding up near record highs.

Still, two-thirds of the 200 panellists with $553 billion in assets under management said U.S. equities were in a late-stage bull market. Only 7% think U.S. stocks were in a bubble.

Six out of ten investors surveyed by BofA now expect a rise short-term rates in the next 12 months, the highest since January 2019. But they expect a more than 10% pullback in stocks if U.S. 10-year Treasury yields hit above 2.1%.

FXStreet reports that strategists at Capital Economics expect that supply will remain constrained and that demand will continue to recover, which should push prices higher in the coming quarters.

“The ongoing easing of restrictions in the US should increase transport mobility and boost gasoline and kerosene (jet fuel) consumption there. The decision by OPEC+ to ease recent production cuts means that supply should rebound in earnest from May. But elsewhere, we expect output to remain constrained. This is especially true in the US, where weak drilling activity suggests that production will be slow to rebound.”

“We still think that the global oil market will remain in a deficit for the rest of 2021. However, this deficit is likely to be smaller than we previously envisaged. As a result, we have revised down our Brent forecasts for Q2 and Q3 to $70 and $75 per barrel, respectively.”

According to the report from Destatis, in March 2021 the selling prices in wholesale trade rose by 4.4% compared with March 2020. The most recent price increase compared to the previous year was in April 2017 (+4.8 %). In February 2021 the annual rate of change had been 2.3%, in January 2021 the index had not changed compared with January 2020. From February 2021 to March 2021 the index rose by 1.7%.

The biggest impact on the rate of change in the wholesale price index compared to the same month of the previous year was the increase in the wholesale price of petroleum products (+13.7%).

However, there were particularly strong price increases compared to the previous year in the wholesale trade of waste materials and residual materials (+76.3 %) as well as ores, metals and semi-finished metal products, with an increase of 20.9% compared to March 2020. Cereals, raw tobacco, seeds and animal feed were also significantly more expensive (+19.8%) compared to the previous year.

On the other hand, prices for live animals (-21.4%) were lower at wholesale level than in March 2020. However, since the beginning of 2021, live animals have become more expensive due to demand, up 14.5% on February 2021 alone.Compared with March 2020 cheaper including meat and meat products (-5,3 %), as well as data processing equipment, peripheral equipment and software (-5,0%).

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 01:30 | Australia | National Australia Bank's Business Confidence | March | 18 | 15 | |

| 03:00 | China | Trade Balance, bln | March | 103.25 | 52.05 | 13.8 |

| 06:00 | United Kingdom | Manufacturing Production (YoY) | February | -5% | -5.1% | -4.2% |

| 06:00 | United Kingdom | Industrial Production (YoY) | February | -4.3% | -4.5% | -3.5% |

| 06:00 | United Kingdom | Industrial Production (MoM) | February | -1.8% | 0.5% | 1% |

| 06:00 | United Kingdom | Manufacturing Production (MoM) | February | -2.2% | 0.5% | 1.3% |

| 06:00 | United Kingdom | GDP m/m | February | -2.2% | 0.6% | 0.4% |

| 06:00 | United Kingdom | Total Trade Balance | February | -3.4 | -7.1 | |

| 06:00 | United Kingdom | GDP, y/y | February | -9.2% | -7.8% |

During today's Asian trading, the US dollar strengthened on the back of rising US Treasuries yields.

The market is focused on the March data of the US Department of Labor on the consumer price index, which will be released at 12:30 GMT. Experts expect increased inflation in the United States against the background of new fiscal stimulus and the continuation of the soft monetary policy of the Federal Reserve System (Fed). The forecast calls for an acceleration in consumer price growth in March to 2.5% in annual terms, compared with 1.7% in February.

Experts note that the increase in inflation will strengthen expectations of a faster than currently projected reduction in the Federal Reserve's stimulus measures, which will support the dollar. If the rate of inflation is below expectations, we can expect a reverse reaction of the dollar, analysts say

U.S. Treasury bond yields are rising in anticipation of the Labor Department's inflation data. An increase in interest rates on US treasury bonds traditionally supports the dollar - the higher the rates, the more attractive the US currency is for buyers. The yield on 10-year US Treasuries on Tuesday is 1.701%, compared with 1.669% at the close of the previous session.

The ICE index, which tracks the dollar's performance against six currencies (euro, swiss franc, yen, canadian dollar, pound sterling and swedish krona), rose 0.08%.

According to the report from Office for National Statistics, monthly production increased by 1.0% in February 2021 meaning it was 3.5% below its level in February 2020, the last month of "normal" trading conditions prior to the coronavirus (COVID-19) pandemic. Economists had expected a 0.5% increase.

The increase in production was driven by increases of 1.3% in manufacturing, 1.4% in water supply and sewage, and 0.5% in electricity and gas; these were offset partially by a fall in mining and quarrying of 2.1%.

The 1.3% rise in manufacturing means it was 4.2% below its level in February 2020; the rise in manufacturing over the month was driven by higher output in 7 of the 13 manufacturing subsectors, the largest being a rise of 9% in manufacturing of computer, electronic and optical products.

Production output for the three months to February 2021 fell by 0.1% compared with the three months to November 2020.

Production output for the three months to February 2021 fell by 3.3% compared with the three months to February 2020.

According to the report from Office for National Statistics, UK gross domestic product (GDP) is estimated to have grown by 0.4% in February 2021, as government restrictions affecting economic activity remained broadly unchanged. Economists had expected a 0.6% increase.

The service sector grew by 0.2% in February 2021, as wholesale and retail trade sales picked up a little but, overall, consumer-facing services industries remain well below pre-pandemic (February 2020) levels.

Output in the production sector grew by 1.0% in February 2021, as manufacturing grew 1.3% following contraction in January.

The construction sector grew by 1.6% in February 2021, driven by growth in both new work and repair and maintenance.

February’s GDP is 7.8% below the levels seen in February 2020, compared with 3.1% below the initial recovery peak in October 2020.

Latest estimates show that January’s GDP fell by 2.2%, an upward revision from negative 2.9%.

EUR/USD

Resistance levels (open interest**, contracts)

$1.2007 (1724)

$1.1981 (915)

$1.1961 (744)

Price at time of writing this review: $1.1895

Support levels (open interest**, contracts):

$1.1839 (1495)

$1.1809 (1198)

$1.1773 (2176)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date May, 7 is 46439 contracts (according to data from April, 12) with the maximum number of contracts with strike price $1,2000 (3223);

GBP/USD

$1.3944 (2200)

$1.3879 (527)

$1.3831 (141)

Price at time of writing this review: $1.3748

Support levels (open interest**, contracts):

$1.3644 (1864)

$1.3616 (1960)

$1.3585 (963)

Comments:

- Overall open interest on the CALL options with the expiration date May, 7 is 12760 contracts, with the maximum number of contracts with strike price $1,4200 (3731);

- Overall open interest on the PUT options with the expiration date May, 7 is 15734 contracts, with the maximum number of contracts with strike price $1,3700 (1960);

- The ratio of PUT/CALL was 1.23 versus 1.25 from the previous trading day according to data from April, 12

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 63.2 | -0.08 |

| Silver | 24.788 | -1.65 |

| Gold | 1732.019 | -0.6 |

| Palladium | 2667.6 | 1.68 |

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 01:30 (GMT) | Australia | National Australia Bank's Business Confidence | March | 16 | |

| 03:00 (GMT) | China | Trade Balance, bln | March | 103.25 | 52.55 |

| 06:00 (GMT) | United Kingdom | Manufacturing Production (YoY) | February | -5.2% | |

| 06:00 (GMT) | United Kingdom | Industrial Production (YoY) | February | -4.9% | |

| 06:00 (GMT) | United Kingdom | Industrial Production (MoM) | February | -1.5% | |

| 06:00 (GMT) | United Kingdom | Manufacturing Production (MoM) | February | -2.3% | |

| 06:00 (GMT) | United Kingdom | GDP m/m | February | -2.9% | |

| 06:00 (GMT) | United Kingdom | Total Trade Balance | February | -1.6 | |

| 06:00 (GMT) | United Kingdom | GDP, y/y | February | -9.2% | |

| 09:00 (GMT) | Eurozone | ZEW Economic Sentiment | April | 74 | |

| 09:00 (GMT) | Germany | ZEW Survey - Economic Sentiment | April | 76.6 | |

| 12:30 (GMT) | U.S. | CPI, m/m | March | 0.4% | 0.5% |

| 12:30 (GMT) | U.S. | CPI excluding food and energy, m/m | March | 0.1% | 0.2% |

| 12:30 (GMT) | U.S. | CPI excluding food and energy, Y/Y | March | 1.3% | 1.5% |

| 12:30 (GMT) | U.S. | CPI, Y/Y | March | 1.7% | 2.4% |

| 13:00 (GMT) | United Kingdom | NIESR GDP Estimate | March | -2.0% | |

| 16:00 (GMT) | U.S. | FOMC Member Esther George Speaks | |||

| 16:00 (GMT) | U.S. | FOMC Member Daly Speaks | |||

| 16:00 (GMT) | U.S. | FOMC Member Harker Speaks | |||

| 19:15 (GMT) | U.S. | FOMC Member Bostic Speaks | |||

| 22:45 (GMT) | New Zealand | Visitor Arrivals | February | -98.7% | |

| 23:50 (GMT) | Japan | Core Machinery Orders | February | -4.5% | |

| 23:50 (GMT) | Japan | Core Machinery Orders, y/y | February | 1.5% |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.76197 | 0.05 |

| EURJPY | 130.276 | -0.14 |

| EURUSD | 1.19106 | 0.12 |

| GBPJPY | 150.297 | 0.03 |

| GBPUSD | 1.37401 | 0.29 |

| NZDUSD | 0.70273 | -0.03 |

| USDCAD | 1.2561 | 0.27 |

| USDCHF | 0.9222 | -0.28 |

| USDJPY | 109.371 | -0.26 |

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.