- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 15-08-2011

Stocks have worked their way out of their recent trading range. The effort has enabled the S&P 500 to make an incremental push past the 1200 line, which was a point of resistance this morning.

So far, though, stocks haven't backed down from the psychologically significant line. That said, many market watchers want to see the stock market confirm the move not just by climbing above the 1200 line, but by actually closing above it. Such a feat could go toward helping the stock market build a base to begin a longer-term climb after suffering such harsh losses during the past couple of weeks.

Stocks have spent the past hour in a relatively narrow trading range near afternoon highs. Despite the stock market's strong gains this session, Treasuries really haven't suffered from much selling pressure. In fact, only recently has the benchmark 10-year Note made anything more than a slight slip into the red. Even still, its yield remains below 2.30%.

The euro rose for a third day versus the dollar on speculation a meeting tomorrow between French President Nicolas Sarkozy and German Chancellor Angela Merkel in Paris may result in action to contain the region’s debt crisis.

The Swiss franc tumbled against the euro, headed for its biggest three-day decline since the European currency’s 1999 debut on speculation Switzerland will take further action to counter recent gains.

The franc slid for a fourth day versus the dollar after the SonntagsZeitung newspaper said the Swiss government and central bank are in “intense” talks over setting a target for their currency. The yen dropped the most in a week against the euro after Japan indicated it’s ready to intervene in foreign- exchange markets again.

“Market participants look like they are avoiding the franc and the yen, but they cannot take risks infinitely,” said Mamoru Arai, a senior currency trader at Mizuho Financial Group Inc. in New York. “For this week or so, they may choose that over the risk of intervention. We cannot predict what will be, but everybody is concerned over some kind of action.”

Manufacturing in the New York region shrank for a third month in August. The Federal Reserve Bank of New York’s general economic index fell to minus 7.7, a report showed today. The median forecast was for a reading of zero, the dividing line between expansion and contraction.

“We’re now recovering risk appetite,” said Sebastien Galy, a senior foreign-exchange strategist at Societe Generale SA in London. “The market knows it’s going to be negatively surprised, but it couldn’t care less at this point in time.”

In June, global demand for U.S. stocks, bonds and other financial assets weakened as the White House and Congress wrangled over raising the debt limit, government figures show. Net buying of long-term equities, notes and bonds totaled $3.7 billion, compared with net buying of $24.2 billion in May, according to Treasury Department data issued today.

The cross trades back to session high Y111.03. Offers seen around the 21DMA at Y111.10 ahead of Y111.25/30 (09 August high) Further offers noted at Y112.05/10. Initial support at Y110.40/30, small bids at Y110.05/00 ahead of more bids at Y109.65/60.

The broad averages are reclaiming their gains. They still have a ways to go before they will have returned to session highs, however.

Discretionary plays have been unable to recover from the recent downturn. As such, the sector has been left to trade near the neutral line -- it is currently up only 0.1%. Retailers have been a particularly heavy drag on the discretionary space. Pressure against retailers has the SPDR S&P Retail ETF (XRT 46.74, -0.41) down nearly 1% to a session low.

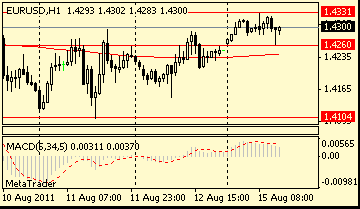

Trades back to $1.4440 or so as stock backdrop deflates risk a little and as some book profits ahead of the London close, euro likely to find some demand interest on dips with breakout area of $1.4400/10 suggested as nearby support. Offers remain $1.4475/00.

"-7.7 Aug Empire index "is the first time that the index has printed below zero for three straight months since May, June, and July 2009 as the economy emerged from recession. Unlike last month, there are few positive elements."

EUR/USD: $1.4200, $1.4250, $1.4425

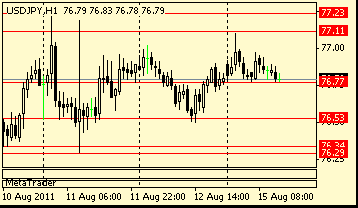

USD/JPY: Y77.00, Y78.50

EUR/JPY: Y109.00

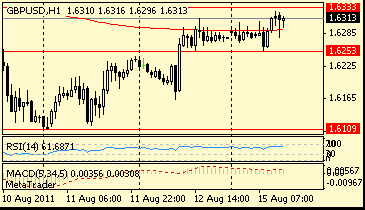

GBP/USD: $1.6350, $1.6355, $1.6400

AUD/USD: $1.0495, $1.0400, $1.0200, $1.0165

The Swiss franc fell against the euro and headed for its biggest three-day decline since the European currency’s 1999 debut on speculation Switzerland will take further action to counter recent gains.

Now DB expects ECB's Refi rate to stay on hold at 1.50% "until at the least the end of 2012" on back of weaker growth and inflation outlook.

The yen and Swiss franc weakened against most of their major counterparts amid speculation policy makers in Japan and Switzerland will take further action to stem gains in their currencies.

The yen dropped the most in a week against the euro after Japanese Finance Minister Yoshihiko Noda indicated he’s ready to intervene in markets again.

The franc fell for a fourth day versus the dollar after the SonntagsZeitung newspaper said the Swiss government and the central bank are in “intense” talks over setting a target for their currency.

The franc soared 11% in the past three months and the yen added 3.3%.

Japan’s economy shrank at a 1.3% annual pace in the three months through June, the third quarter of contraction, government data showed today. The median forecast of economists was for a 2.5% drop.

EUR/USD initially rose from $1.4250 to highs on $1.4320. Rate failed to set above the figure and retreated to $1.4280. Later rate back to earlier highs.

GBP/USD held within the range, limited by $1.6270/$1.6310 before it refreshed lows around $1.6250. Rate currently holds around $1.6300.

USD/JPY fell from Y77.10 to Y76.77 before it recovered to Y77.00.

On Monday, attention will be on US Jun Total Net TIC Flows come at 13:00 GMT. According to analysts' outlook Net Long-Term TIC Flows rose to $30.4B after $23.6B in May.

- debt crisis can't be solved through monetary policy;

- ECB will do what is needed to ensure price stability;

- have no target for exchange rate.

- debt crisis can't be solved through monetary policy;

- ECB will do what is needed to ensure price stability;

- have no target for exchange rate.

EUR/USD

Offers: $1.4340/50, $1.4370

Bids: $1.4280/70, $1.4255/50, $1.4240

GBP/USD

Offers: $1.6300/10

Bids: $1.6260, $1.6250/40, $1.6210/00

USD/JPY

Offers: Y77.10, Y77.40

Bids: Y76.65/70, Y76.50/55, Y76.25

AUD/USD

Offers: $1.0450

Bids: $1.0395/00, $1.0350/60

EUR/CHF

Offers: Chf1.1460, Chf1.1480, Chf1.1500

EUR/USD: $1.4200, $1.4250, $1.4425

USD/JPY: Y77.00, Y78.50

EUR/JPY: Y109.00

GBP/USD: $1.6350, $1.6355, $1.6400

AUD/USD: $1.0495, $1.0400, $1.0200, $1.0165

Gold continued it's slide from a recent fresh all time highs of around $1815. Prices fell back on Friday, retreating back from $1768 to $1723.50 before rallying into the weekend close around $1747. Today in Asia prices dropped to $1738 before recovering to around $1741. Support is now seen towards $1720.25 and $1692 with resistance levelled at $1768 and $1795.

Asian stock markets ended the week significantly lower.

By the end of the week the Japan’ Nikkei 225 fell by 3.61% to 8,963.72.

The Hong Kong’ Hang Seng shed 6.33% to 19,620.

The Australia’ S&P/ASX 200 closed higher 1.64% at 4,173.

The China’ Shanghai Composite Index dropped by 1.27% to 2,593.

Last week stock market dynamics in Asia mostly coincided with the mood of U.S. markets day before. First, the markets sharply fell amid U.S. credit downgrade by rating agency S&P. Then there was concern that the same international agency may downgrade debt rating of France, the second largest economy in Europe behind Germany. Another pressure was decision of the Federal Reserve to keep rates low through mid-2013.

In the second half of the week Seoul’ stocks gained after the government there banned short-selling for three months, in the wake of extreme losses.

Japanese exporters declined as the dollar dropped below the 77-yen mark (Panasonic Corp., Sony Corp., Nissan Motor Co.).

The Shanghai Composite index suffered losses as the country's consumer price index rose to a higher-than-expected 6.5% in July from a year earlier and above the 6.4% rate in June. But market participants said they don't expect Beijing to launch further tightening measures given the tumultuous global markets.

Most European markets also suffered losses.

By the end of the week the pan-European FTSEurofirst 300 index tumbled 0.70% to 968.21.

The Britain's FTSE 100 added 1.39% to 5,320.03.

The Frence’ CAC 40 decreased by 1.97% to 3,213.88.

The Germany’ Xetra DAX fell by 3.82% to 5,997.74.

European stocks dropped to their lowest level since August 2009 as Standard & Poor’s downgraded the U.S. sovereign debt rating. Then markets rebounded as the European Central Bank started to purchase Italian and Spanish debt in an attempt to curb the nation’s surging borrowing costs and prevent the crisis spreading further.

The next substantial factors to fall were worries about the French bank Societe Generale, France's second-largest bank, and concern that France, the second largest economy in Europe after Germany, may face a rating cut even though the major rating agencies have reiterated France's AAA rating. These news fueled concerns about EU debt crisis.

The markets buoyed by data showed an unexpected drop in weekly jobless claims in U.S.

Another support received from decision by France, Italy, Spain and Belgium to ban naked short-selling for 15 days.

Last week Egan-Jones ratings agency downgraded France's AAA rating. However, market participants didn’t attach importance to the lowering.

As a result, banking shares were very volatile and ended the week mostly lower. Market players especially focused on BNP Paribas, Societe Generale and Credit Agricole in Paris, UniCredit SpA and Intesa Sanpaolo in Milan, Banco Santander in Madrid.

In Frankfurt shares of E.On AG and RWE AG declined due to Germany’s plan to shut down some its nuclear power stations.

"Blue Chips" were unable to recoup their weekly losses.

At the end of the week the S&P 500 sang by 1.72% to 1,178.81.

NASDAQ Composite closed the week lower by 0.96% at 2,507.98.

Dow Jones Industrial Average tumbled 1.53% to 11,269.00.

The markets have been plummeting down on concerns over slowdown in economic recovery of US and Europe for all last week.

On Monday U.S. stocks tumbled, extending the biggest slump for the Standard & Poor’s 500 Index since 2008’s bear market, amid concern that a downgrade of the nation’s credit rating by S&P may worsen an economic slowdown. It was a roller coaster ride for U.S. markets, jumping 3-6% per day. Dow Industrial changed between 400 and 600 points every day excluding Friday.

Financial stocks led the sell-off in U.S markets, as investors worried that problems in the European banking sector could spillover into the U.S. banks.

The markets were supported amid calming concerns in European markets, strong corporate earnings of such large companies as Cisco Systems (CSCO), encouraging data on US labor market, slowing rise in June business inventories and beating July data on retail sales.

The markets went up even despite dropping Reuters/Michigan consumer sentiment index. The August index is at 54.9 versus estimated 63.2 and previous figure of 63.7, lowest level since 1980.

In spite of significant rebound on Friday, all S&P groups excluding conglomerates sustained losses this week. On the week the U.S. financial sector fell by 2.5%. Bank of America (BAC) lost 12%, JPMorgan Chase (JPM) sang by 4.5%, Morgan Stanley (MS) - 16%.

AOL Inc.’ (AOL) shares tumbled 27% despite the internet company authorized a $250 million stock buyback.

Dow component Cisco Systems Inc (CSCO) jumped 7% on the week as the company reported better-than-expected fiscal Q4 results on profit and sales and forecast the current quarter higher than expected as well.

Shares of News Corp. (NWSA) soared 11% on the week amid beating earnings and sales expectations despite recent phone-hacking allegations.

Shares of the world’s biggest theme-park operator Walt Disney Co. (DIS) sang 6% on the week as it posted a weak third-quarter studio revenue of $1.62 billion, compared with the average analyst estimate of $1.83 billion.

Shares of Molycorp Inc. (MCP) added 9% on the week as the company posted higher than expected Q2 earnings of $0.52 per share versus estimated $0.40.

Last week concerns about the slowdown in U.S. economy and debt crisis in Europe were the main factors of pressure on the U.S. dollar and other currencies.

Results of FOMC Fed meeting failed to convince investors that global growth will be sustained.

On Wednesday the FOMC redefined "extended period" as "at least through mid-2013" left its rates unchanged (0% -0.25%). Fed expects slower pace ahead than in June.

The markets went up even despite the weak Reuters/Michigan consumer sentiment index. The index fell to 54.9 in August versus expected 63.2 and previous figure of 63.7, lowest level since 1980.

The euro sharply reacted to the fundamentals from the U.S. and Europe, jumping 300 points against the U.S. dollar per day, and declined last week.

The euro rebounded after the European Central Bank started to purchase Italian and Spanish debt in an attempt to curb the nation’s surging borrowing costs and prevent the crisis spreading further. On Friday another support was received from decision by France, Italy, Spain and Belgium to ban naked short-selling for 15 days.

The currency fell sharply amid U.S. credit downgrade by rating agency S&P. Then there was concern that France, the second largest economy in Europe after Germany, may face a rating cut even though the major rating agencies have reiterated France's AAA rating.

Then the 17-nation currency fell as traders bet the European Central Bank may cut its key interest rate as austerity measures crimp growth.

Last week the Egan-Jones ratings agency downgraded France's AAA rating. However, market participants didn’t attach importance to the downgrade.

The Swiss franc declined following its Wednesday fresh historical high against the dollar as investors favored the safest assets amid concern global growth is faltering. Another driver to fall was the comments and acts of the Swiss National Bank, which said it would “significantly increase” the supply of liquidity to the money market and expand banks’ sight deposits to fight the currency’s “massive overvaluation.” The Swiss franc continue falling after Swiss National Bank Deputy President Thomas Jordan said that a temporary tie between the franc and the euro to curb the Swiss currency’s gains would be legal under the central bank’s mandate.

The yen also gained versus the dollar as “save haven” currency from the lows after the nation’s unilateral intervention on The Bank of Japan added 10 trillion yen ($129 billion) of monetary stimulus on Aug. 4. However, the yen retreated each time, touching the life-time low.

The pound significantly slumped versus the greenback last week despite a substantial growth by the end of the week. The pound tumbled amid the worst civil unrest in 30 years spread in the country and weaker-than-expected U.K. manufacturing. At the turn of the month sterling strengthened against the dollar amid weak consumer sentiment index from Reuters/Michigan.

The Australian and New Zealand dollars showed a sharp rise versus the dollar, but ended the week lower due to their drop on Monday. Earlier the Australian currency fell versus US dollar after a report showed the jobless rate unexpectedly rose to 5.1% in July, up from forecast and June figure of 4.9%.

The Canadian dollar shed against the US dollar on concern about faltering economy of U.S., Canada’s biggest trade partner. At the beginning of the week the loonie harshly dropped amid declining crude oil prices, Canada’s biggest export.

Resistance 3: Y78.20

Resistance 2: Y77.80

Resistance 1: Y77.10

Current price: Y76.86

Support 1:Y76.30

Support 2:Y75.00

Support 3:Y72.10

Comments: Rate remains under pressure with support remains around Aug 1 and 11 lows on Y76.30. Below dollar may loose till Y75.00. Clean break under opens the room for Y72.10/15 (trend line from May'2010). Resistance comes at session high on Y77.10. Above there is a likelyhood of challenging the Y77.80 Fibo level (38.2% of Y80.20 - Y76.30 move).

Nikkei -18.22 (-0.20%) 8,963.72

Topix -2.69 (-0.35%) 768.19

Hang Seng +24.87 (+0.13%) 19,620.00

DAX +200.08 (+3.45%)5,997.74

CAC 124.22 (+4.02%) 3,213.88

FTSE-100 +157.20 (+3.04%) 5,320.03

Dow +125.71 (+1.13%) 11,269.00

Nasdaq +15.30 (+0.61%) 2,507.98

S&P500 +6.17 (+0.53%) 1,178.81

10-Years 2.26% -0.084

Oil -0.340 (-0.40%) 85.380

Gold -8.900 (-0.51%) 1,742.60

Resistance 3: Chf0.8360

Resistance 2: Chf0.8040

Resistance 1: Chf0.8000

Current price: Chf0.7949

Support 1: Chf0.7780

Support 2: Chf0.7680

Support 3: Chf0.7500/90

Comments: Dollar refreshed session high on Chf0.8000 (minor resistance) and retreated. Rate continues to go higher on intervention speculations. Next resistance is around late Juky highs on Chf0.8040, then - at trend line from Jun 01'2010 at Chf0.8360. If correction comes rate may retreat to Chf0.7780 firstly and then - to Chf0.7680 (Aug 11 high).

Resistance 3:$1.6480

Resistance 2:$1.6440

Resistance 1: $1.6310

Current price: $1.6274

Support 1: $1.6240

Support 2: $1.6160

Support 3: $1.6100

Comments: Pound weakens after it earlier tried to recover and failed. Support comes at recent lows on $1.6240/50 with a break under widens losses to $1.6160 (Friday's lows). Further support is near Aug 11 lows on $1.6100/10. Resistance is placed at Friday's highs on $1.6310, then - on $1.6440 (channel line from Apr 28) and $1.6475/80.

Resistance 3: $1.4440

Resistance 2: $1.4400

Resistance 1: $1.4330

Current price: $1.4301

Support 1: $1.4210

Support 2: $1.4100

Support 3: $1.4050

Comments: Rate refreshed session highs around $1.4330 (minor resistance), but failed to do ahead and retreated to current around the figure. Stronger resistance remains at $1.4400 (recent daily highs). Stronger level comes at channel line from May 4 at $1.4440. As to supports we should mention the first one is at $1.4210 (Friday's hourly low), below - at $1.4100 (Aug 11 lows) and $1.4050/55 (Aug 05 lows).

12:30 USA NY Fed Empire State manufacturing index (August) -0.2 -3.8

13:00 USA TICS net flows (June), bln - -67.5

13:00 USA TICS net long-term flows (June), bln 28.0 23.6

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.