- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 16-08-2016

(raw materials / closing price /% change)

Oil 46.49 -0.19%

Gold 1,351.50 -0.40%

(index / closing price / change items /% change)

Nikkei 225 16,596.51 -273.05 -1.62%

Shanghai Composite 3,110.48 -14.72 -0.47%

S&P/ASX 200 5,531.98 -7.98 -0.14%

FTSE 100 6,893.92 -47.27 -0.68%

CAC 40 4,460.44 -37.42 -0.83%

S&P 500 2,178.15 -12.00 -0.55%

Dow Jones 18,552.02 -84.03 -0.45%

S&P/TSX Composite 14,703.44 -73.58 -0.50%

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1274 +0,81%

GBP/USD $1,3042 +1,24%

USD/CHF Chf0,9619 -1,14%

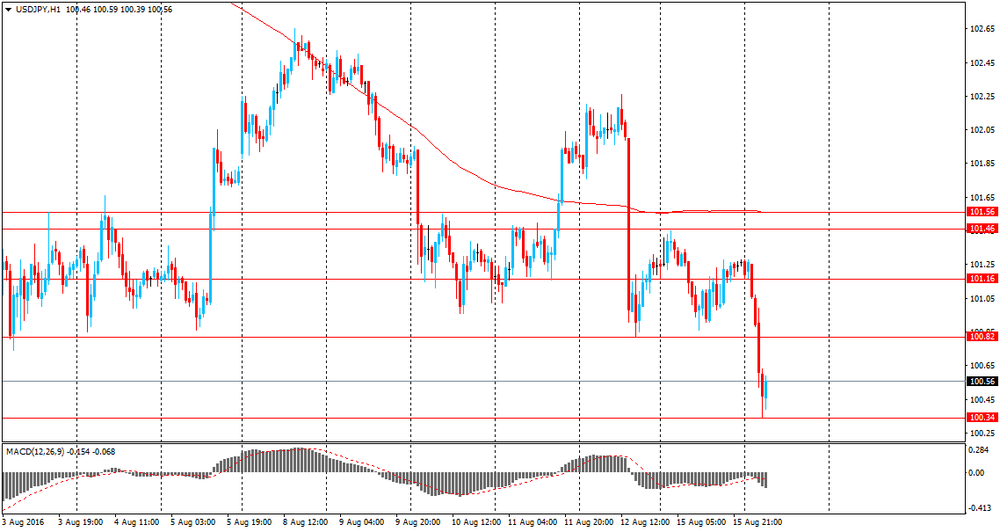

USD/JPY Y100,26 -1,00%

EUR/JPY Y113,03 -0,19%

GBP/JPY Y130,75 +0,26%

AUD/USD $0,7697 +0,31%

NZD/USD $0,7280 +0,89%

USD/CAD C$1,2856 -0,54%

(time / country / index / period / previous value / forecast)

00:30 Australia Leading Index July -0.2%

01:30 Australia Wage Price Index, q/q Quarter II 0.4% 0.5%

01:30 Australia Wage Price Index, y/y Quarter II 2.1% 2%

08:30 United Kingdom Average earnings ex bonuses, 3 m/y June 2.2% 2.3%

08:30 United Kingdom Average Earnings, 3m/y June 2.3% 2.4%

08:30 United Kingdom ILO Unemployment Rate June 4.9% 4.9%

08:30 United Kingdom Claimant count July 0.4 10

09:00 Switzerland Credit Suisse ZEW Survey (Expectations) August 5.9

14:30 U.S. Crude Oil Inventories August 1.055

17:00 U.S. FOMC Member James Bullard Speaks

18:00 U.S. FOMC meeting minutes

23:50 Japan Trade Balance Total, bln July 693 283.7

Major US stock indexes fell moderately Tuesday amid mixed economic data and comments of a number of Fed officials.

According to the Ministry of Labor, consumer prices in the US remained unchanged in July, after rising 0.2% in June and May, as the cost of gasoline has fallen for the first time in five months. At the same time, core inflation has been moderate, which can further reduce prospects for increasing interest rates the Fed this year. During the 12 months to July, the consumer price index rose by 0.8% after rising 1.0 percent in June. Economists forecast that the consumer price index will be unchanged last month and will increase by 0.9% compared to last year. The so-called core CPI, which excludes food and energy, rose by 0.1% in July. The base consumer price index increased by 2.2% after rising by 2.3% year on year.

At the same time, the establishment of new homes in July rose to 1211 thousand. Against 1189 thousand. And June, and analysts forecast at the level of 1180 thousand. At the same time, the number of building permits dropped to 1152 thousand. To 1153 thousand. Analysts expected 1160 thousand.

In addition, the industrial production growth rate in the US in July accelerated to 0.7% after rising 0.6% in June. Analysts expected an increase of 0.3%. Compared to July of the previous year, industrial production fell by 0.5% after declining by 0.7% y / y in the previous month.

With regard to the statements made by the Fed, Dudley noted that allows increase in the interest rate the Federal Reserve is already September. "We are approaching the moment when it is appropriate to re-raise the rate, - said Dudley -. In US employment in the last 3 months is growing at an average rate at the level of 190 thousand per month, and economic growth should accelerate in the 2nd half of the year we started.. see the signals accelerating wage growth. overall, the US economy is in good condition. "

Meanwhile, the head of the Federal Reserve Bank of Atlanta, Lockhart said that optimistic about the economic outlook, and therefore feel justified in raising rates. He added that the weak data on US GDP for the 2nd quarter should be viewed in the context of other factors. "Most of the fundamental factors right now a positive effect on consumer spending in the United States," - he said, adding that he remains confident in the prospects for the economy in the 2nd half of 2016 and 2017.

Gradually, investors' attention shifted to the protocols of the July meeting of the Fed, which could shed light on the Central Bank plans for the timing of rate hikes.

Most DOW components of the index closed in negative territory (21 of 30). Most remaining shares rose Intel Corporation (INTC, + 0.40%). Outsider were shares of Johnson & Johnson (JNJ, -1.44%).

Almost all sectors of the S & P index fell. The leader turned out to be the basic materials sector (+ 0.4%). Most utilities sector fell (-1.0%).

At the close:

Dow -0.45% 18,552.19 -83.86

Nasdaq -0.66% 5,227.11 -34.91

S & P -0.55% 2,178.18 -11.97

The cost of oil futures rose more than a percent, reaching the highest level in more than five weeks. Support to the markets was expectations of reaching an agreement between the oil-producing countries, as well as concerns about the situation in Venezuela.

Market participants believe that at the September meeting, OPEC could decide to freeze the growth of production. In the past two years, some OPEC members building up oil production despite low prices, resulting in oversupply.

Meanwhile, the oil minister of Nigeria Emmanuel Kachikvu pointed out that he considers unlikely to reach agreement on the reduction of production by OPEC member countries. Earlier this year, an attempt to freeze the level of production was not a success because of Iran's refusal to participate in the initiative. However, analysts at JPMorgan view moderate optimism about the production freeze. In their view, Saudi Arabia is likely to be more compliant with other manufacturers at the upcoming meeting of OPEC

With regard to the situation in Venezuela, the volume of oil production in the country is collapsing because of the political and economic crisis. Over the past 12 months the volume of crude oil production decreased by 9%, reaching a level of 2.36 million barrels a day.

Investors are also awaiting the publication of weekly data on US oil and petroleum products. In recent weeks, the cumulative US crude stocks and petroleum products grew, and their further increase can put pressure on prices. Today we have inventory data from the American Petroleum Institute, and tomorrow the official report from the US Department of Energy

The cost of September futures on US light crude oil WTI rose to 46.33 dollars per barrel.

September futures for North Sea petroleum mix of Brent crude rose to 48.91 dollars a barrel on the London Stock Exchange ICE Futures Europe.

Quotes of gold increased significantly updating the 10 of August high, but then lost most of the positions on the background of mixed US economic data and optimistic statements by Fed officials.

The US Department of Labor said that US consumer prices remained unchanged in July, as the cost of gasoline has fallen for the first time in five months. Consumer price index was the weakest since February, and followed two consecutive monthly increases of 0.2 percent. During the 12 months to July, the consumer price index rose 0.8 percent after rising 1.0 percent in June. Economists forecasted that the consumer price index will be unchanged last month and will grow at 0.9 percent y/y. The coreCPI, which excludes food and energy, rose 0.1 percent in July. It grew by 0.2 percent in the previous three consecutive months. Core increased by 2.2 percent y./y, after rising 2.3 percent in June. In July, the price of gasoline fell by 4.7 percent, the first decline since February. Gasoline prices rose 3.3 percent in June. Food prices have not changed, but the cost of food consumed at home fell 0.2 percent.

At the same time, a separate report from the Commerce Department showed that new homes in the US unexpectedly rose in July, as construction activity increased across the board. New home sales index rose by 2.1 percent to a seasonally adjusted annual rate of 1.2 million units, the highest level since February. Building permits fell 0.1 percent to 1.15 million units.

Investors are watching economic data to determine whether the US economy has strengthened enough to make the Fed aise interest rates later this year. Recall, higher interest rates tend to have a downward pressure on gold. According to the futures market, the likelihood of a Fed hike is September is 18%. Meanwhile, the probability of a rate hike in December is estimated at 50.3% versus 44.8% yesterday.

From a technical point of view, the next support level for gold is $ 1335 per ounce, while strong resistance lies at around $ 1,355- $ 1,360 per ounce.

The cost of gold futures on COMEX rose to $ 1,349.30 an ounce.

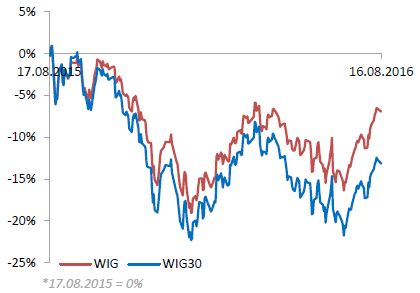

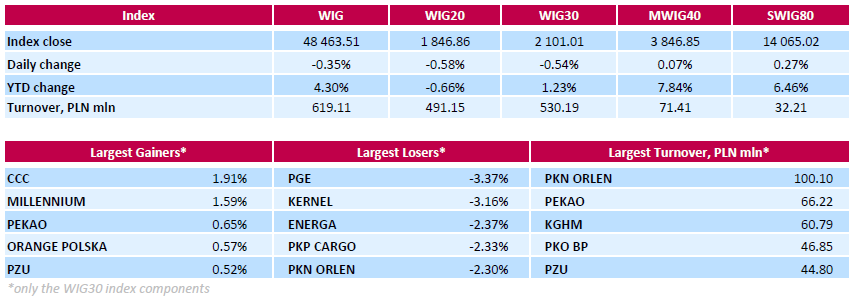

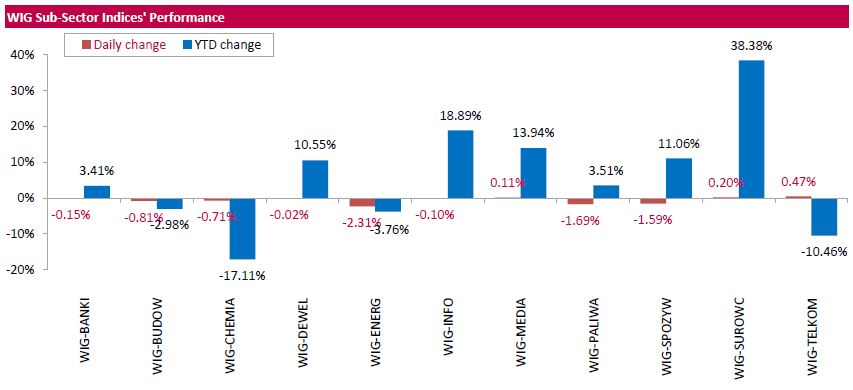

Polish equity market closed lower on Tuesday. The broad market benchmark, the WIG Index, dropped by 0.35%. Sector-wise, utilities names (-2.31%) were the worst-performing group, while telecommunication sector stocks (+0.47%) outpaced.

The large-cap stocks' measure, the WIG30 Index, fell by 0.54%. In the index basket, genco PGE (WSE: PGE) led the underperformers with a 3.37% drop, followed by agricultural producer KERNEL (WSE: KER) plunging by 3.16%. Other largest decliners were genco ENERGA (WSE: ENG), railway freight transport operator PKP CARGO (WSE: PKP) and oil refiner PKN ORLEN (WSE: PKN), losing between 2.3% and 2.37%. It should be noted that ENERGA, reportedly, may start negotiations with its bondholders in September over covenants requiring that net debt to EBITDA ratio does not exceed 3.5, as the plan to revive investment in the coal-fueled power plant in Ostroleka had triggered a risk that the covenants could be breached. On the other side of the ledger, footwear retailer CCC (WSE: CCC) and bank MILLENNIUM (WSE: MIL) were the session's best performers, jumping by 1.91% and 1.59% respectively.

Wall Street sharply lower on Tuesday, with indexes pulling away from record levels, after New York Federal Reserve President William Dudley said an interest rate in September was possible.

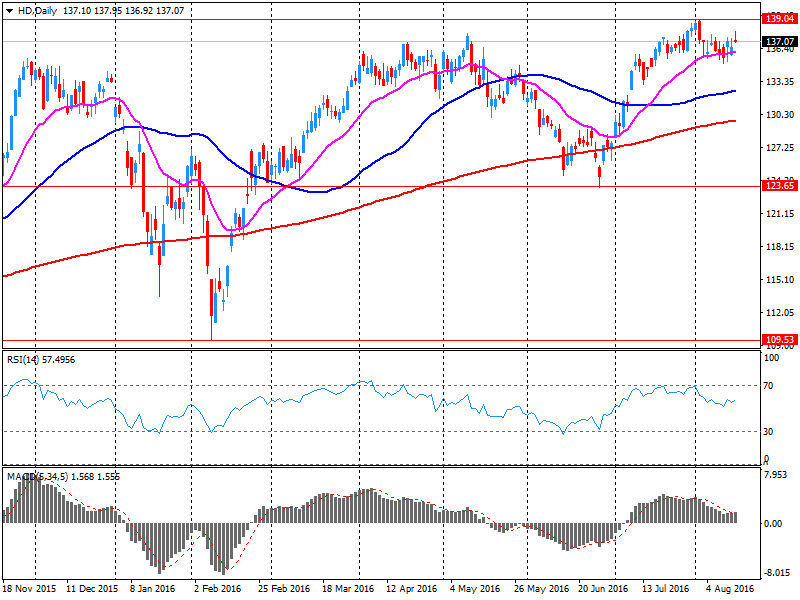

Most of all Dow stocks in negative area (26 of 30). Top gainer - The Home Depot, Inc. (HD, +0.56%). Top loser - Intel Corporation (INTC, -1.19%).

Most of S&P sectors also in negative area. Top gainer - Basic Materials (+0.2%). Top loser - Utilities (-0.7%).

At the moment:

Dow 18540.00 -42.00 -0.23%

S&P 500 2178.50 -7.50 -0.34%

Nasdaq 100 4802.75 -20.00 -0.41%

Oil 45.95 +0.21 +0.46%

Gold 1351.80 +4.30 +0.32%

U.S. 10yr 1.58 +0.03

-

Aussie housing is not in a risky category

-

Housing debt is significant

-

Housing slump would not lead to systemic risk and would not trigger bank failures

-

Stronger GDP growth rates would be welcomed

Today we have very interesting situation for the US dollar. In the first part of the day USD lost clearly against most major currencies, generally without much fundamental reason and sentiment towards USD was so clearly weak and was also supported by data from the US, which, especially for inflation, surprised slightly negative. After a few minutes after the data appeared words of important representative of the Federal Reserve, William Dudley, head of the New York Fed, which stated that approaching the time for a rate hike and it does not interfere with the presidential elections. This strengthened slightly the dollar. These types of statements are detrimental to the Warsaw Stock Exchange, because it may reduce the inflow of funds to the parquets of stock exchanges in emerging markets. The next set of US data concerning industrial production (+0,7% m/m) was more consistent with the vision of William Dudley about the possibility of rate hike in September. The market in the United States began from discount of 0.25%, what may be a result of fears about a rate hike in September, as previously was not expected.

EUR/USD 1.1100 (EUR 324m) 1.1200 (351m) 1.1250 (515m) 1.1300 (210m)

USD/JPY 103.00 (USD 246m)

GBP/USD 1.2600 (GBP 849m) 1.2950 (532m) 1.2995 (340m)

AUD/USD 0.7400 (AUD 200m) 0.7625 (279m) 0.7690 (210m) 0.7715 (311m)

USD/CAD 1.3150 (USD 250m)

NZD/USD 0.7180 (NZD 451m) 0.7200-01 (417m)

AUD/NZD 1.0600 (AUD 809m)

U.S. stock-index futures fell.

Global Stocks:

Nikkei 16,596.51 -273.05 -1.62%

Hang Seng 22,910.84 -21.67 -0.09%

Shanghai 3,110.48 -14.72 -0.47%

FTSE 6,922.63 -18.56 -0.27%

CAC 4,468.58 -29.28 -0.65%

DAX 4,468.58 -29.28 -0.65%

Crude $44.77 (+0.63%)

Gold $1345.50 (+0.17%)

Industrial production rose 0.7 percent in July after moving up 0.4 percent in June. The advance in July was the largest for the index since November 2014. Manufacturing output increased 0.5 percent in July for its largest gain since July 2015. The index for utilities rose 2.1 percent as a result of warmer-than-usual weather in July boosting demand for air conditioning. The output of mining moved up 0.7 percent; the index has increased modestly, on net, over the past three months after having fallen about 17 percent between December 2014 and April 2016. At 104.9 percent of its 2012 average, total industrial production in July was 0.5 percent lower than its year-earlier level. Capacity utilization for the industrial sector increased 0.5 percentage point in July to 75.9 percent, a rate that is 4.1 percentage points below its long-run (1972-2015) average.

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 180.56 | -0.00(-0.00%) | 6690 |

| ALCOA INC. | AA | 10.54 | 0.02(0.1901%) | 76468 |

| ALTRIA GROUP INC. | MO | 66.1 | -0.16(-0.2415%) | 715 |

| Amazon.com Inc., NASDAQ | AMZN | 767.61 | -0.88(-0.1145%) | 13199 |

| American Express Co | AXP | 65.6 | -0.03(-0.0457%) | 373691 |

| AMERICAN INTERNATIONAL GROUP | AIG | 59.22 | 0.00(0.00%) | 246421 |

| Apple Inc. | AAPL | 109.64 | 0.16(0.1461%) | 209632 |

| AT&T Inc | T | 43.02 | 0.00(0.00%) | 3520 |

| Barrick Gold Corporation, NYSE | ABX | 21.73 | 0.22(1.0228%) | 81440 |

| Boeing Co | BA | 134.66 | 0.00(0.00%) | 168001 |

| Caterpillar Inc | CAT | 84.1 | -0.05(-0.0594%) | 7287 |

| Chevron Corp | CVX | 102.73 | -0.04(-0.0389%) | 5021 |

| Cisco Systems Inc | CSCO | 31.2 | 0.01(0.0321%) | 9263 |

| Citigroup Inc., NYSE | C | 46.25 | -0.14(-0.3018%) | 820 |

| Deere & Company, NYSE | DE | 78.28 | 0.00(0.00%) | 29728 |

| E. I. du Pont de Nemours and Co | DD | 68.64 | 0.00(0.00%) | 232952 |

| Exxon Mobil Corp | XOM | 88 | 0.19(0.2164%) | 2119 |

| Facebook, Inc. | FB | 123.6 | -0.30(-0.2421%) | 56398 |

| FedEx Corporation, NYSE | FDX | 166.4 | 0.00(0.00%) | 6924 |

| Ford Motor Co. | F | 12.43 | 0.00(0.00%) | 25382 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 12.35 | 0.18(1.479%) | 131839 |

| General Electric Co | GE | 31.23 | -0.01(-0.032%) | 4735 |

| General Motors Company, NYSE | GM | 31.37 | -0.49(-1.538%) | 1700 |

| Goldman Sachs | GS | 164.9 | -0.65(-0.3926%) | 600 |

| Google Inc. | GOOG | 781 | -1.44(-0.184%) | 1109 |

| Hewlett-Packard Co. | HPQ | 14.52 | 0.00(0.00%) | 52519 |

| Home Depot Inc | HD | 137.31 | 0.25(0.1824%) | 135104 |

| HONEYWELL INTERNATIONAL INC. | HON | 116.84 | 0.00(0.00%) | 44123 |

| Intel Corp | INTC | 34.91 | 0.00(0.00%) | 586032 |

| International Business Machines Co... | IBM | 161.62 | -0.26(-0.1606%) | 2453 |

| International Paper Company | IP | 46.32 | 0.00(0.00%) | 79595 |

| Johnson & Johnson | JNJ | 122.53 | 0.22(0.1799%) | 624418 |

| JPMorgan Chase and Co | JPM | 65.4 | -0.32(-0.4869%) | 22053 |

| McDonald's Corp | MCD | 118.2 | -0.32(-0.27%) | 2048 |

| Merck & Co Inc | MRK | 63 | -0.32(-0.5054%) | 685 |

| Microsoft Corp | MSFT | 57.78 | 0.02(0.0346%) | 6999 |

| Nike | NKE | 57.12 | 0.35(0.6165%) | 3719 |

| Pfizer Inc | PFE | 35.02 | -0.09(-0.2563%) | 1132 |

| Procter & Gamble Co | PG | 86.71 | -0.31(-0.3562%) | 770 |

| Starbucks Corporation, NASDAQ | SBUX | 55.24 | -0.01(-0.0181%) | 2389 |

| Tesla Motors, Inc., NASDAQ | TSLA | 225.07 | -0.52(-0.2305%) | 11135 |

| The Coca-Cola Co | KO | 44.28 | 0.04(0.0904%) | 248162 |

| Travelers Companies Inc | TRV | 118.35 | 0.00(0.00%) | 16794 |

| Twitter, Inc., NYSE | TWTR | 20.67 | -0.19(-0.9108%) | 112743 |

| United Technologies Corp | UTX | 109.69 | 0.00(0.00%) | 39165 |

| UnitedHealth Group Inc | UNH | 141.54 | -0.08(-0.0565%) | 79749 |

| Verizon Communications Inc | VZ | 53.73 | 0.12(0.2238%) | 193 |

| Visa | V | 80.75 | -0.16(-0.1978%) | 203584 |

| Wal-Mart Stores Inc | WMT | 72.82 | -0.50(-0.6819%) | 11479 |

| Walt Disney Co | DIS | 97 | -0.10(-0.103%) | 1341 |

| Yahoo! Inc., NASDAQ | YHOO | 42.35 | -0.32(-0.7499%) | 28110 |

| Yandex N.V., NASDAQ | YNDX | 23.43 | 0.02(0.0854%) | 1600 |

-

September hike is possible

-

Headline inflation is drifting up a bit

-

We seem to be on a trajectory for 2% inflation

-

Core inflation has been flat

-

Economy will be generally better in H2

-

If we raise rates this year it will be good news

-

Still expects more than one hike before the end of 2017

-

US Treasury yields are pretty low given the economic environment

-

Election won't weigh on Fed rate decisions

-

It's premature to talk about raising the Fed's inflation target

Upgrades:

Downgrades:

JPMorgan Chase (JPM) downgraded to Market Perform from Outperform at Bernstein

Other:

Home Depot (HD) reiterated with an Outperform at TAG; target $150

IBM (IBM) initiated with a Perform at Oppenheimer

Manufacturing sales rose 0.8% to $50.2 billion in June, following a 1.0% decline in May.

Higher sales of machinery and transportation equipment products were largely responsible for the gain. Nearly three-quarters of the increase in June was attributable to these two industries.

Overall, sales were up in 15 of 21 industries, representing 62% of the manufacturing sector. Durable goods rose 1.6% to $27.0 billion, while non-durable goods decreased 0.1% to $23.2 billion. Constant dollar sales increased 0.5%, indicating a higher volume of goods sold.

The Consumer Price Index was unchanged in July on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index rose 0.8 percent before seasonal adjustment.

The energy index declined in July and the food index was unchanged. The index for all items less food and energy rose, but posted its smallest increase since March. As a result, the all items index was unchanged after rising in each of the 4 previous months.

The energy index fell 1.6 percent after rising in each of the last four months. The decline was due to a sharp decrease in the gasoline index; other energy indexes were mixed. The food at home index declined 0.2 percent as four of the six major grocery store food group indexes decreased, while the index for food away from home rose 0.2 percent.

The all items index rose 0.8 percent for the 12 months ending July, a smaller increase than the 1.0 percent rise for the 12 months ending June. Similarly, the index for all items less food and energy rose 2.2 percent for the 12 months ending July, a smaller increase than the 2.3 percent rise for the 12 months ending June.

The following data was published:

(Time / country / index / period / previous value / forecast)

8:30 UK Producer Price Index (m / m) July 0.3% Revised to 0.2% 0.2% 0.3%

8:30 UK producers selling prices index, y / y in July -0.2% Revised to -0.4% 0% 0.3%

8:30 UK producers purchase prices index m / m in July 1.7% Revised to 1.8% 1% 3.3%

8:30 UK purchasing producer prices index, y / y in July -0.5% 4.3% 2%

8:30 UK Retail Price Index m / m in July to 0.4% -0.1% 0.1%

08:30 UK retail price index y / y in July 1.6% 1.7% 1.9%

8:30 UK Consumer Price Index m / m in July 0.2% -0.1% -0.1%

8:30 UK Consumer Price Index y / y in July 0.5% 0.5% 0.6%

8:30 UK consumer price index base value, y / y in July 1.4% 1.3% 1.3%

9:00 Eurozone index of sentiment in the business environment from the ZEW Institute in August -14.7 -6.3 4.6

9:00 The Eurozone trade balance, without seasonal adjustments in June 24.6 25.8 29.2

9:00 Germany Sentiment Index in the business environment of the institute ZEW August -6.8 2 0.5

The euro rose against the US dollar, supported by strong data on the index of sentiment in the business environment of the ZEW Institute in Germany and the euro zone.

The index of sentiment in the business environment from the ZEW Institute in Germany rose less than expected to 0.5 in August from -6.8 in July. The index was expected to rise to 2 in August.

Similarly, the current conditions rose to 57.6 compared to 49.8 in July. Economists had forecast that the indicator improved to 50.2.

"The indicator of economic sentiment from the ZEW partially recovered from Brexit shock," said ZEW President Achim Wambach.

"Political risks within and outside the European Union, however, continues to hamper a more optimistic economic outlook in Germany. In addition, uncertainty about the stability of the EU banking sector is maintained," said Wambach.

Economic confidence index in the euro zone rose by 19.3 points to 4.6 points in August. Increased by 2.1 points, the current economic situation indicator reached a value of minus 10.3 points in August.

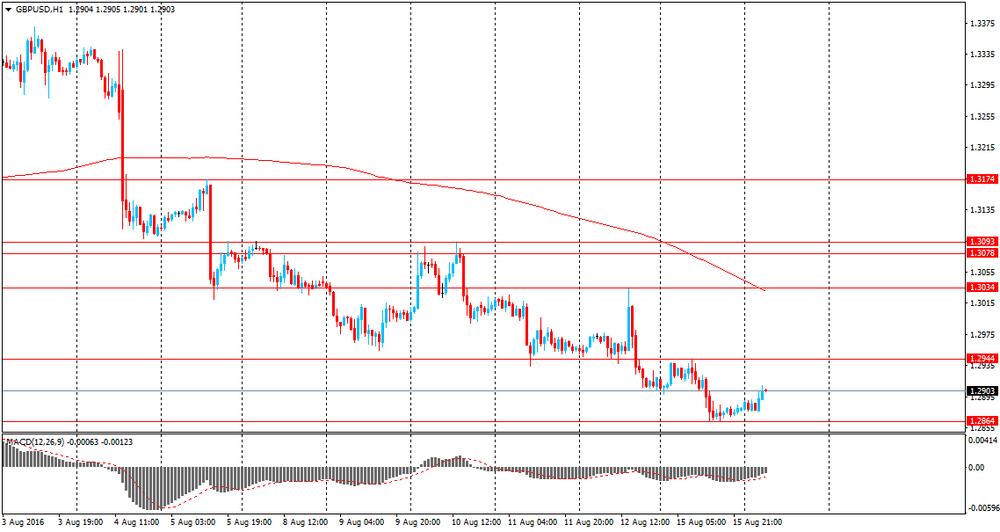

The pound rose against the US dollar after the release of positive inflation data while the demand for the US currency remained under pressure.

In the UK, inflation increased slightly in July to its highest level since November 2014, showed the Office for National Statistics on Tuesday.

Consumer prices rose 0.6 percent year on year in July, after rising 0.5 percent in June. Economists had forecast that inflation will remain at 0.5 percent.

On a monthly basis, consumer prices fell by 0.1 percent, as expected, which was the first drop in six months. In June, prices rose by 0.2 percent.

Core inflation, which excludes energy, food, alcoholic beverages and tobacco, slowed slightly to 1.3 percent in July compared with 1.4 percent in June.

Another ONS report shows that manufacturers selling prices increased for the first time since June, 2014. Prices for finished goods advanced by 0.3 percent year on year, after a decline by 0.2 percent in June. Prices were expected to remain unchanged in July.

On a monthly basis, producer prices rose 0.3 percent in July, showing the same growth rate as in June and slightly faster than expected growth of 0.2 percent.

At the same time, the purchase prices have increased markedly by 4.3 percent per year after easing 0.5 percent a month ago, and also faster than the expected 2 percent rise.

The monthly increase in purchase prices accelerated to 3.3 percent from 1.7 percent. Economists had forecast an increase of 1 percent.

Comments by president of the Federal Reserve of San Francisco John Williams led to a large-scale reduction in the US dollar on Tuesday.

On Monday he said that the central bank executives should either increase the target level of inflation, which currently stands at 2%, and start using any new reference-based pricing levels or on the economic growth.

A higher target for inflation rate may give the Fed more room to keep the interest rates at current levels.

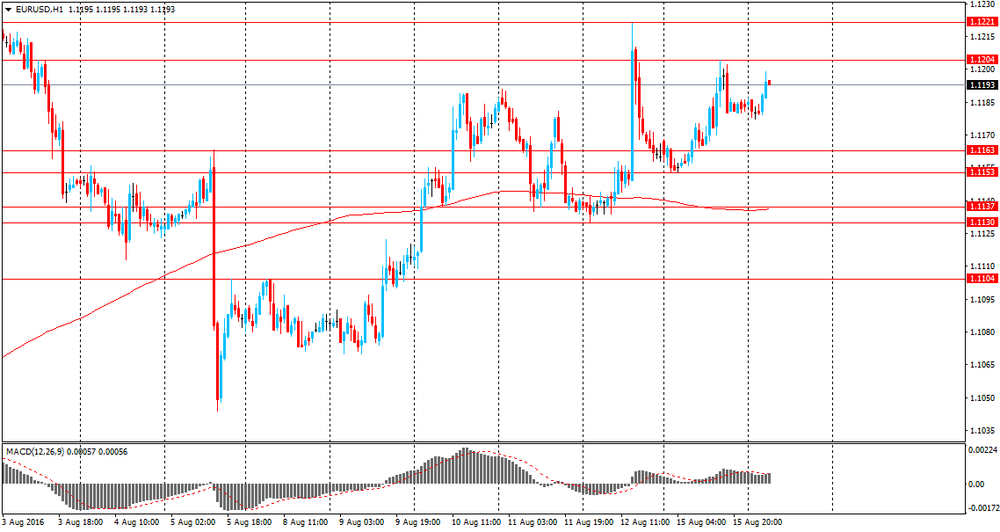

EUR / USD: during the European session, the pair rose to $ 1.1303

GBP / USD: during the European session, the pair rose to $ 1.2994

USD / JPY: during the European session, the pair fell to Y99.79

Home Depot reported Q2 FY 2017 earnings of $1.98 per share (versus $1.71 in Q2 FY 2016), beating analysts' consensus estimate of $1.97.

The company's quarterly revenues amounted to $26.472 bln (+6.6% y/y), generally in-line with analysts' consensus estimate of $26.489 bln.

HD rose to $137.89 (+0.61%) in pre-market trading.

EUR/USD

Offers : 1.1250-60 1.1280 1.1300-05 1.1325-30 1.1350 1.1365 1.1380 1.1400

Bids : 1.1200 1.1200 1.1185 1.1150 1.1130 1.1115 1.1100 1.1070 1.1050-55

GBP/USD

Offers : 1.2920-25 1.2950 1.2980 1.3000 1.3020-25 1.3065 1.3080 1.3095-05

Bids : 1.2880 1.1265 1.2850 1.2830 1.2800 1.2780 1.2750 1.2730 1.2700

EUR/GBP

Offers : 0.8725-30 0.8750 0.8765 0.8785 0.8800 0.8830 0.8860

Bids : 0.8700 0.8680 0.8650 0.8620 0.8600 0.8585 0.8570 0.8550

EUR/JPY

Offers : 113.00 113.25 113.50 113.80 114.00 114.50

Bids : 112.50 112.30 112.00-10 111.85 111.50 111.00

USD/JPY

Offers : 100.50-60 100.80 101.00 101.25-30 101.50 101.80 102.00

Bids : 100.00 99.85 99.50 99.30 99.00 98.80 98.50 98.00

AUD/USD

Offers : 0.7720 0.7750-55 0.7785 0.7800

Bids : 0.7700 0.7685 0.7660 0.7635-40 0.7620 0.7600 0.7585 0.7565

European stocks fall on fears that the recent rally in stock price was excessive.

Last week, the European indices rose and completely leveled the drop since June 24, when the results of the referendum were announced in the UK, where the country's citizens voted for withdrawal from the EU.

Meanwhile, investors fears about a slowdown in the European economy and efficiency of the European Central Bank measures.

Focus was also on the UK inflation data and indexes in the business environment sentiment from the ZEW Institute in Germany and the euro zone.

In the UK, inflation increased slightly in July to its highest level since November 2014, showed data of the Office for National Statistics on Tuesday. Consumer prices rose 0.6 percent year on year in July, after rising 0.5 percent in June. Economists had forecast that inflation will remain at 0.5 percent. On a monthly basis, consumer prices fell by 0.1 percent, as expected, which was the first drop in six months. In June, prices rose by 0.2 percent. Core inflation, which excludes energy, food, alcoholic beverages and tobacco, slowed slightly to 1.3 percent in July compared with 1.4 percent in June.

Economic sentiment in Germany improved in August, showed results of a survey by the Centre for European Economic Research (ZEW) on Tuesday. The index of sentiment in the business environment from the ZEW Institute in Germany rose less than expected to 0.5 in August from -6.8 in July. The index was expected to rise to 2 in August. Similarly, current conditions rose to 57.6 compared to 49.8 in July. Economists had forecast that the indicator improved to 50.2.

"The indicator of economic sentiment from the ZEW partially recovered from Brexit shock," said ZEW President Achim Wambach. "Political risks within and outside the European Union, however, continues to hamper a more optimistic economic outlook in Germany. In addition, uncertainty about the stability of the EU banking sector is maintained," said Wambach.

The composite index of Europe's largest enterprises Stoxx 600 fell by 0.2% - to 345.49 points.

Swedish Electrolux AB fell 2.2% on the majority of sales of household appliances in the US fell in July. The company gets more than a third of revenue in the US market.

The cost of Schindler Holding AG shares fell 3.7%. The Swiss company has given a negative outlook for the world market of elevator and escalator equipment.

The capitalization of Linde AG jumped 6% on rumors that Praxair Inc intends to acquire the German manufacturer of industrial gases.

Shares of mining company Antofagasta rose by 4%. The company reported an increase in profits in the first half.

Quotes of Svenska Handelsbanken AB securities dropped to 1.7% after one of the largest Swedish bank dismissed its CEO Frank Vang-Jensen.

Rotork Paper Industry slowed down 2.8%, the most among Stoxx 600 components, after HSBC downgraded the rating.

Swiss Geberit shares rose 4.8% to a record peak, as the quarterly results of the manufacturer of sanitary ware was better than expected.

Shares of St. James's Place PLC tumbled 1.2% after the asset management company reported a slight decline in profit for the last six months compared to the same period last year, but 15% increase in dividend payments.

At the moment:

FTSE 6934.00 -7.19 -0.10%

DAX 10709.85 -29.36 -0.27%

CAC 4494.94 -2.92 -0.06%

The morning reading of the ZEW index for the German economy proved to be much better than expected and rose from 49.8 points up to 57.6 points in anticipation of slight twitch to 50.2 points. Thus, analysts and managers quite noticeably revised their earlier pessimistic visions of the immediate impact of Brexit on the condition of the German economy. The data become to be support for the earlier downward image in Europe and both the DAX and the CAC40 virtually erased earlier losses. Unfortunately the Warsaw Exchange did not react on these impulses and declines are sustained. In the halfway of today's trading the WIG20 index was at the level of 1,847 points (-0,55%) ant with the turnover of PLN 210 mln.

USDJPY remained largely range-bound around the post-BoJ lows of 101-102 in a quiet summer week with a Japanese public holiday last Thursday. Although the BoJ disappointment against some excessive easing expectations is weighing on USDJPY, the BoJ did double up its annual ETF purchases to JPY6trn from JPY3.3trn. This is likely supporting Nikkei and USDJPY, given their correlations; furthermore, expectations of further easing at September's BoJ meeting will likely persist as the BoJ conducts comprehensive reviews.

A notable move this week was in 3m USDJPY basis, which has now completely reversed the post-BoJ tightening. However, as we noted in No breakthrough from BoJ, 29 July, the BoJ's USD Funds-Supplying Operations under central bank FX swap lines are an emergency liquidity backstop rather than a pool of USD liquidity for Japanese investors to tap to fund foreign bond investments. Indeed, the outstanding balance of the CB swap line as of 10 August declined to zero from a very small positive in previous weeks.

We believe solid portfolio rebalancing outflows and upcoming MMF reform will likely to continue to exert widening pressure on short-end USDJPY basis.

Target: USD/JPY at 92 by end of Q3 and at 87 by end of the year".

Copyright © 2016 Barclays Capital, eFXnews™

The ZEW Indicator of Economic Sentiment for Germany increased in August 2016. The index gained 7.3 points compared to the previous month, now standing at 0.5 points (long-term average: 24.2 points). "The ZEW Indicator of Economic Sentiment has partly recovered from the Brexit shock. Political risks within and outside the European Union, however, continue to inhibit a more optimistic economic outlook for Germany. Furthermore, uncertainty about the resilience of the EU banking sector persists," comments ZEW-President Professor Achim Wambach.

The first estimate for euro area (EA19) exports of goods to the rest of the world in June 2016 was €178.8 billion, a decrease of 2% compared with June 2015 (€182.8 bn). Imports from the rest of the world stood at €149.5 bn, a fall of 5% compared with June 2015 (€157.4 bn). As a result, the euro area recorded a €29.2 bn surplus in trade in goods with the rest of the world in June 2016, compared with +€25.5 bn in June 2015. Intra-euro area trade fell to €150.2 bn in June 2016, down by 1% compared with June 2015. These data are released by Eurostat, the statistical office of the European Union.

The price of goods bought and sold by UK manufacturers, as estimated by the Producer Price Index, rose in the year to July 2016 following 2 years of falls.

Factory gate prices (output prices) for goods produced by UK manufacturers rose 0.3% in the year to July 2016, compared with a fall of 0.2% in the year to June 2016.

This is the first time that factory gate prices have increased on the year since June 2014. The index has been following an upward trend since August 2015. The increase of 0.3% in the year to July 2016 is therefore a continuation of the trend over the past 11 months.

Core factory gate prices, which exclude the more volatile food, beverage, tobacco and petroleum products, rose 1.0% in the year to July 2016, compared with a rise of 0.7% in the year to June 2016.

The overall price of materials and fuels bought by UK manufacturers for processing (total input prices) rose 4.3% in the year to July 2016, compared with a fall of 0.5% in the year to June 2016.

Similar to factory gate prices, total input prices have also been following an upward trend in recent months. With the exception of April 2016, the annual rate has been trending upwards since November 2015.

- the average price of a property in the UK was £213,927

- the annual price change for a property in the UK was 8.7%

- the monthly price change for a property in the UK was 1.0%

- the monthly index figure for the UK was 112.2 (January 2015 = 100)

Continuing price pressures in the housing market reflect stronger demand relative to supply in the housing market. However, there are also indications that the housing market pressure softened recently, with falls in both demand and supply.

EUR/USD 1.1100 (EUR 324m) 1.1200 (351m) 1.1250 (515m) 1.1300 (210m)

USD/JPY 103.00 (USD 246m)

GBP/USD 1.2600 (GBP 849m) 1.2950 (532m) 1.2995 (340m)

AUD/USD 0.7400 (AUD 200m) 0.7625 (279m) 0.7690 (210m) 0.7715 (311m)

USD/CAD 1.3150 (USD 250m)

NZD/USD 0.7180 (NZD 451m) 0.7200-01 (417m)

AUD/NZD 1.0600 (AUD 809m)

The reporting period for this release covers the calendar month of July 2016, therefore, the data refers to the period after the EU referendum.

The Consumer Prices Index (CPI) rose by 0.6% in the year to July 2016, compared with a 0.5% rise in the year to June.

Although the small increase in the rate between June 2016 and July 2016 takes it to the highest seen since November 2014, it is still relatively low in the historic context.

The main contributors to the increase in the rate were rising prices for motor fuels, alcoholic beverages and accommodation services, and a smaller fall in food prices than a year ago.

These upward pressures were partially offset by falls in social housing rent, and falling prices for certain games and toys.

CPIH (not a National Statistic) rose by 0.9% in the year to July 2016, up from 0.8% in June.

This morning, New York crude oil futures for WTI fell by -0.72% to $ 45.41 and Brent oil futures were down -0.77% to $ 47.98 per barrel. Thus, the black gold is trading lower on the background of profit taking as well as expectations of a possible meeting between the largest oil producers. Analysts at ANZ bank note: "the price of oil rose to a four-week high amid talk of a possible restriction of OPEC production. Russia has also stated that it is ready for such negotiations.".The Minister of Energy, Industry and Mineral Resources of Saudi Arabia last week said they were ready to support the action of OPEC and other major exporting countries to balance the markets. He believes that oil producers are to hold a meeting on the sidelines of the International Energy Forum in September 2016 in Algiers. Analysts also believe that the global oil market is affected by concerns about the extraction of raw materials in Venezuela. Due to the economic and political crisis, underfunding industry and mismanagement in the country that has the largest oil reserves in the world.

-

impact on FX supply and demand remains under control

-

pace of companies reduction of foreign debt continues to slow

-

cross border capital flows remain stable in the medium to long term

The futures market (WSE: FW20U1620) started from decline by 0.32% to 1,857 points. In Germany contracts for the DAX fell a similar scale.

In this passage, we may see a small disappointment, because it is worth to remember that we return after 1-day absence from the market, and yesterday ended with a more or less such increases, which in theory would mean for us zero balance changes.

WIG20 index opened at 1856.22 points (-0.08%) *

WIG 48605.94 -0.05%

Wig30 2109.36 -0.15%

mWIG40 3855.46 0.29%

* / - Change to previous close

The cash market (the WIG20 index) opened with cosmetic exit down by 0.08% to 1,856 points at low turnover. The environment is weak and the DAX shortly after the opening went down by 0.6% pulling futures market in Frankfurt. After the first quarter of trading the WIG20 index drops by 0.37%

The Kredyt Inkaso (WSE: KRI) stands out of the market after it has been increased price in the tender offer for the shares.

At 15:30 GMT the United States will hold an auction of 4-week bills

At 16:30 GMT Statement by US Fed's Dennis Lockhart

At 20:30 GMT the report of the American Petroleum Institute (API) on oil stocks

During the Asian session, the yen strengthened against the dollar and other major currencies. According to some analysts the decline of USD / JPY to a one-month low could be due to low trading volumes and sales by exporters. During the session the pair reached the Y100,20 level.

Also the weakening dollar hit by the extremely weak data on US retail sales, which increased doubts about the fact that the economy is not so strong that the Fed will raise interest rates soon. According to the futures market, the probability of a Fed hike in September is 12%. Meanwhile and in December is estimated at 41.3% against 44.9% on Friday.

Now, investors' attention shifted to today's report on inflation in the US. In addition, on Wednesday are expected the protocols of the July FOMC meeting, which could also shed light on the central bank's plans for the timing of rate hikes.

The pound fell against the US dollar. Later this week, economists will monitor the British inflation data, the number of applications for unemployment benefits, and retail sales for July to assess the initial effects of Brexit. Recall before the referendum GDP growth in the UK expected to be close to 0.6%, but now economists surveyed by Reuters forecast that the economy will shrink by 0.1%. If the estimates are confirmed, the UK economy will be in a technical recession. Reuters surveys also showed that, on average, analysts expect the Central Bank of England to cut rates by only 0.1% at the meeting in November.

The Australian dollar fell on negative data on vehicle sales in Australia. According to the report by the Australian Bureau of Statistics, in July, sales of new vehicles fell by 1.3%, after rising 3.5% in June. The value in June was revised from 3.1%. The annual sales on year increased by 1.6%, but the rate was lower than the previous value of 2.6%. The report on sales of new vehicles reflects the number of sales of new vehicles and is an indicator of consumer confidence.

During the session, the Australian currency gained after the publication RBA minutes as well as the weakening of the US dollar.

As stated in the minutes of the July meeting of the RBA, there is potential for faster growth in the Australian economy. Also in the minutes was noted that credit growth and housing prices slowed and recent inflation data confirm the weakening of inflation. RBA forecast GDP growth to be higher than the potential in the mid-2017

EUR / USD: during the Asian session, the pair was trading in $ 1.1180-1.1230 range

GBP / USD: during the Asian session, the pair was trading in $ 1.2880-1.2915 range

USD / JPY: the pair fell to Y100.20

EUR/USD

Resistance levels (open interest**, contracts)

$1.1339 (4543)

$1.1306 (4988)

$1.1255 (3344)

Price at time of writing this review: $1.1214

Support levels (open interest**, contracts):

$1.1141 (1825)

$1.1091 (3291)

$1.1021 (5378)

Comments:

- Overall open interest on the CALL options with the expiration date September, 9 is 50303 contracts, with the maximum number of contracts with strike price $1,1250 (4988);

- Overall open interest on the PUT options with the expiration date September, 9 is 56185 contracts, with the maximum number of contracts with strike price $1,1000 (5811);

- The ratio of PUT/CALL was 1.12 versus 1.11 from the previous trading day according to data from August, 15

GBP/USD

Resistance levels (open interest**, contracts)

$1.3203 (2253)

$1.3105 (1278)

$1.3008 (979)

Price at time of writing this review: $1.2899

Support levels (open interest**, contracts):

$1.2791 (2439)

$1.2694 (1153)

$1.2597 (728)

Comments:

- Overall open interest on the CALL options with the expiration date September, 9 is 31944 contracts, with the maximum number of contracts with strike price $1,3300 (2500);

- Overall open interest on the PUT options with the expiration date September, 9 is 25903 contracts, with the maximum number of contracts with strike price $1,2800 (2439);

- The ratio of PUT/CALL was 0.81 versus 0.81 from the previous trading day according to data from August, 15

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

Yesterday Wall Street indices gained 0.3% to 0.6% and established new record levels. In Europe also dominated rise, albeit at a smaller scale. During our absence nothing special had happened, and investors are waiting for Wednesday, when are going to be published the minutes of the last FOMC meeting.

Today's macro calendar includes data on inflation in the UK for July and in Europe will be published the ZEW index, which earlier surprised negatively and now is expected to be reflected. In the afternoon, from the US the most important information will be industrial production data, which may cause the biggest reaction, although Friday's weaker retail sales data did not lead to larger perturbations, and may be considered more important than production, which already generates less than 20% of the US GDP.

The US futures quotations in the morning went down approx. 0,10% and with declines on the Nikkei (-1,7%) may mean an offset of yesterday's light increases.

From the point of view of the Warsaw Stock Exchange, this means that a larger gap at the opening should not be expected. The WIG20 index on Friday admittedly fell, but remained above the level of 1850 points and a broad market still prevailed good mood.

"GBPUSD has to break the 1.2798 Brexit low to gather downside momentum taking its closer towards our 1.24 target.

The July RICS house price index fell 1.2% which should not surprise. The 'Sunday Times' suggested the British government may be not anywhere near in its logistical efforts to draw Article 50 as the government's 'Brexit department' run by Davis is not yet functional. Sources close to the British government also cite French and German General Elections, due in May and October respectively as stumbling blocks.

All in all, there seems to be no desire to draw Article 50 early. Hence Brexit negotiations will be delayed. When Theresa May speaks at the Conservative Party Conference next month she may address her plans and time table for the start of the Brexit negotiations. BoE's chief economist Haldane laid down the reasoning for the BoE's drastic monetary policy response suggesting that 'hundreds of thousands' of jobs were at risk

Therefore we will put little attention towards the July retail sales report due on Thursday. Within the post Brexit world it is the supply side of the economy what matters. Due to the delayed labour market response, retail sales could hold up for longer, but this would come at the prices of a further widening of the British 7% current account deficit.

*Morgan Stanley maintains a short GBP/USD position from around 1.3107 targeting a move to 1.24".

The July 2016 trend estimate an increased by 0.1% when compared with June 2016. When comparing national trend estimates for July 2016 with June 2016, sales for passenger vehicles increased by 0.4% and sales for Other vehicles decreased by 0.4%. There was no movement in sales for sports utility vehicles. The largest upward movement across all states and territories, on a trend basis, was in Victoria (0.5%), continuing an upward trend which commenced in March 2016.

Members of the Reserve Bank of Australia's monetary policy board said that additional stimulus likely would aid the prospects for the country's economic, minutes from the central bank's August 2 revealed on Tuesday.

Inflation was below the target range and was expected to remain there for the foreseeable future, giving the bank the means to cut rates.

Inflation was just 1 percent in the June quarter, well below the RBA's target band of 2-3 percent.

"Underlying inflation was expected to remain low for a time before picking up gradually as spare capacity in labor and many product markets diminished," the minutes said.

In particular, it was weakness in the housing market that convinced the board to take action.

At the meeting, the board trimmed its benchmark lending rate by 25 basis points, to a fresh record low 1.50 percent from 1.75 percent following two months of no action.

The bank last reduced its rate by 25 basis points in May, which was the first reduction in a year.

The RBA noted the possibility that it may not be the only bank to provide stimulus.

"Monetary policy had continued to be highly accommodative in most economies and there was a reasonable likelihood of further stimulus by a number of the major central banks," the minutes said. - RTT

European stocks ended a choppy session in the red on Friday after weaker-than-expected U.S. retail sales cast doubt on the health of the world's largest economy.

The Stoxx Europe 600 SXXP, -0.01% dropped 0.2% to close at 346.09, partly erasing a 0.8% gain from Thursday, which was fueled by higher oil prices. For the week, it ended 1.4% higher.

U.K. stocks rose Monday, with gains in energy shares helping to lift the FTSE 100 to a new high for the year, as the benchmark extended its run of winning sessions.

The FTSE 100 UKX, +0.36% finished up 0.4% at 6,941.19, its best close since early June 2015, according to FactSet data. The index has risen for eight straight sessions, matching the longest string of wins since October 2015.

The Dow Jones Industrial Average, the S&P 500 index, and the Nasdaq Composite Index all closed at record highs on Monday for the second time since 1999, thanks in part to a sharp uptick in oil prices, which boosted energy and materials shares.

The S&P 500 SPX, +0.28% rose 6.10 points, or 0.3%, to close at 2,190.15, with seven of the 10 main sectors trading higher. The materials, industrial, and energy sectors led the gains, while so-called defensive sectors, such as utilities, consumer staples and telecom were in negative territory. On Thursday, the index closed at a high of 2,185.79.

The Dow Jones Industrial Average DJIA, +0.32% gained 59.58 points, or 0.3%, to 18,636.05, with shares of DuPont DD, +1.45% and Goldman Sachs Group Inc. GS, +1.41% leading the gains. Back on Thursday, the Dow closed at a high of 18,613.52.

The Nasdaq Composite COMP, +0.56% logged its third record closing high in a row, advancing 29.12 points, or 0.6%, to finish at 5,262.02, topping Friday's previous closing high of 5,232.89.

Aug 16 Japan's Nikkei share average edged down on Tuesday morning as weakness in domestic demand-driven stocks offset gains in cyclicals such as exporters in a relatively quiet holiday-thinned market.

The Nikkei dropped 0.2 percent to 16,837.98 in midmorning trade.

Traders said that with many investors away for Japan's 'bon' holidays, activity will likely be subdued again. On Monday, trading volume stood at only 1.24 billion shares on the broader market, the lowest level since April 2014.

The downside for the broader market, however, will likely be limited thanks to strong performances in overseas stocks, they said.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.