- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 16-11-2011

The euro against the dollar shows a high volatility. Today, the euro reached a five-week low against the dollar and the yen amid growing fears of investors about the ability of European countries to cope with the debt crisis. Yields on ten-year gosbondam Italy at auction on Wednesday fell by 29 basis points - to 6.79%, the papers in Spain - 9 points - to 6.25%. According to the sources to Bloomberg, most of these papers concern the European countries became the ECB. The pressure on the single currency has also information that a representative of the EU Juncker called the "high" and "an alarming" levels of debt in Germany. A new Greek Prime Papademosa said that the crisis has spread from the periphery to the core of the regional economy, and said that the need for a more radical intervention, since the existing EU mechanisms are not adequate.

Over time, the euro rebounded against the dollar, along with an increase in major U.S. stock indices, influenced by favorable macro data and the sharp increase in oil prices.Published today in the U.S. statistics reported to investors that consumer prices fell in October by 0.1%, while industrial growth was 0.7%. Net investments of nonresidents in U.S. assets in September was higher than analysts' expectations.

The British pound fell against the dollar after the Bank of England lowered forecasts for economic growth and inflation, as expected, signaling the introduction of a new fiscal stimulus in coming months. As the market was ready for such statements, the pound was able to hold their positions. At the same time in the UK in October, the number of complaints of employment increased by 5.3 million with the expected 21.0 thousand, as a percentage of the number of jobseekers was 5.0%, forecast 5.1%.

European stocks ended the day unchanged, after swinging between gains and losses, as Mario Monti became Italy’s new prime minister amid concern the sovereign-debt crisis is hurting the global economy. The European Central Bank was said to buy Italian and Spanish bonds and the Bank of England warned that failure to tackle the debt crisis could affect economic growth.

National benchmark indexes rose in 11 of the 18 western- European markets today. France’s CAC 40 Index added 0.5 percent, the U.K.’s FTSE 100 Index slid 0.2 percent and Germany’s DAX Index lost 0.3 percent.

Infineon Technologies AG, Europe’s second-largest semiconductor maker, fell after saying sales will decline in 2012. The company expects sales in fiscal 2012 to decline by a “mid-single digit percentage” compared with 2011 as customers hold off on making orders.

BMW and Daimler, the world’s biggest makers of luxury cars, lost 3.2 percent to 55.71 euros and 0.9 percent to 32.23 euros, respectively. Carmakers posted the worst performance among the 19 industry groups in the Stoxx 600 today, losing 1.4 percent.

Vivendi advanced 5.6 percent to 16.34 euros. The owner of the world’s largest video-game and music companies reported third-quarter profit that exceeded analysts’ estimates, helped by its Activision Blizzard and GVT divisions.

Michael Page International Plc, the recruiter that operates across 32 countries, climbed 5.8 percent to 385.4 pence. Randstad Holding NV, a provider of temporary employees, rose 4.3 percent to 23.05 euros. Adecco SA, the world’s biggest supplier of temporary workers, jumped 3.2 percent to 38.59 Swiss francs. HSBC raised its recommendation on all three stocks to “overweight” from “neutral.”

Home Retail Group Plc, which owns the Argos catalog stores, sank 7.5 percent to 72.7 pence as Deloitte LLP predicted that this Christmas may be the first in the U.K. with no growth in retail sales since 2008. December retail revenue in the country will be no better than last year’s 36.2 billion pounds ($57 billion), Deloitte said.

U.S. stocks fell, retreating after yesterday’s gains, as concern Europe’s debt crisis and higher oil prices will hamper growth overshadowed increases in industrial production and confidence among homebuilders.

Stocks fell after the Bank of England Governor Mervyn King said Britain faces a ‘‘markedly weaker’’ outlook for the economy amid danger from Europe’s crisis. German Chancellor Angela Merkel said the nation is prepared to cede some national sovereignty to the European Union to achieve closer economic and political ties. Italian Prime Minister Mario Monti was sworn in.

Losses were limited after industrial production in the U.S. rose 0.7 percent in October, more than the 0.4 percent median forecast. Confidence among U.S. homebuilders unexpectedly rose in November to the highest level since May 2010. The cost of living in the U.S. unexpectedly fell for the first time in four months, a sign inflationary pressures may be starting to recede.

Dow 12,034.18 -61.98 -0.51%, Nasdaq 2,672.56 -13.64 -0.51%, S&P 500 1,251.26 -6.55 -0.52%

Diversified financial companies slumped amid concern that a global financial crisis could hurt profits. Citigroup Inc. and Morgan Stanley dropped at least 2.6 percent.

Dell Inc. sank 2.2 percent as the third-largest maker of personal computers told investors to expect more slow sales growth for the rest of the year. The company missed third-quarter revenue estimates after walking away from $2 billion in potential PC sales to focus on more profitable technology. It gave up billions in ‘‘low-value’’ PC opportunities because it wanted to preserve margins, Vice Chairman Jeff Clarke told analysts yesterday.

Abercrombie & Fitch tumbled 14 percent, the biggest decline in the S&P 500, to $47.79. The company’s cost of goods sold rose 34 percent to $429.3 million in the three months ended Oct. 29. Abercrombie, along with other apparel retailers, is contending with higher prices for materials such as cotton and oil and higher labor costs in Asia.

Research In Motion Ltd. added 2.2 percent to $19.55. The maker of BlackBerry smartphones was raised to ‘‘neutral” from “sell” at Goldman Sachs Group Inc., which cited valuation.

Autodesk Inc. jumped 4.7 percent, the most in the S&P 500, to $35.64. The maker of design software reported third-quarter profit of 44 cents a share, exceeding the 41-cent average analyst estimate.

Economics still at risk from fin'l shocks here and abroad

High reserves not infl'ry because banks not lending

Fiscal problems have increasingly limited' recovery

Germany has higher debt than Spain

Don't see eurozone collapsing

Gold prices continued to fall today due to the fact that the rise of the dollar against global currencies reduces the demand for the metal as an investment alternative, due primarily to reduced demand in the euro due to debt problems in Europe.

Dollar against the basket of six currencies of countries - major trade partners of the United States rose to 78.07 points, while the euro fell to 1.3428 dollars per euro.

Yields on ten-year Italy’s bonds at auction today fell by 29 basis points - to 6.79%, the papers in Spain - 9 points - to 6.25%. According to the sources to Bloomberg, most of these papers concern the European countries became the ECB.

Portugal posted a three-month treasury bills at 1.123 billion euros, with the yield securities fell slightly compared with the previous auction and was 4.895% per annum.

Bank of England today called on senior European leaders for effective steps to bring the region out of crisis, as well as special measures in Europe will support economic growth in the Kingdom.

December futures for gold in the course of trading on Comex in New York fell to 1753.9 dollars per troy ounce.

Oil in New York climbed above $100 a barrel to a five-month high as Enbridge Inc. said it would reverse the direction of the Seaway pipeline, opening an outlet for crude from the central U.S. and Canada.

Futures rose as much as 2.9 percent after Enbridge agreed to acquire ConocoPhillips (COP)’s share of the pipeline that runs between Cushing, Oklahoma, and the Gulf Coast and announced the reversal. The change may alleviate a bottleneck at the Cushing storage hub that had lowered the price of West Texas Intermediate, the grade traded in New York, versus other oils. The pipeline will enable more oil from Canada and North Dakota to reach the Gulf Coast, home to about half of U.S. refining capacity.

Oil briefly pared gains after the U.S. Energy Department reported that crude supplies at Cushing rose 890,000 barrels to 32 million last week. Total crude oil stockpiles fell 1.06 million barrels to 337 million in the week ended Nov. 11, according to the report released at 10:30 a.m. in Washington.

Crude oil for December delivery on the New York Mercantile Exchange reached $102.28, the highest level since June 9. The contract traded at $99.70 before the Seaway announcement.

Brent oil for January settlement dropped 24 cents to $112.42 a barrel on the ICE Futures Europe exchange in London. The European contract’s premium to West Texas crude narrowed to as little as $8.32 a barrel, the smallest spread since March 9. The spread surged to a record high of $27.88 on Oct. 14.

EUR/USD $1.3450, $1.3500, $1.3600, $1.3650

USD/JPY Y76.65, Y79.00AUD/USD $1.0150, $1.0160, $1.0200

EUR/CHF Chf1.2370

GBP/USD $1.5500, $1.5950, $1.6050

EUR/GBP stg0.8530

U.S. equity investors have been closely watching European sovereign debt prices and the euro currency, currently barometers of risk aversion for the wider market. Trading has been volatile, with large intraday swings as sentiment oscillates with developments is Europe.

World markets: Nikkei -0.92%, Hang Seng -2.00%, Shanghai Composite -2.48%, FTSE -0.94%, CAC -0.23%, DAX -1.27% .

Crude oil: $100.05 (+0,7%).

Golds: $1770,50 (-0,7%).

China +$11.3b

Japan +$20.2 bn

UK +$24.4bn

OPEC -$6.4 bn

Brazil -$3.8 bn

France +$14.9 bn

Data:

09:30 UK Claimant count (October) 5.3K

09:30 UK Claimant count rate (October) 5.0%

09:30 UK Average earnings (3 months to September) Y/Y 2.3%

09:30 UK Average earnings ex bonuses (3 months to September) Y/Y 1.7%

09:30 UK ILO Jobless rate (September) 8.3%

10:00 EU(17) Harmonized CPI (October) final 0.3%

10:00 EU(17) Harmonized CPI (October) final Y/Y 3.0%

10:00 EU(17) Harmonized CPI ex EFAT (October) Y/Y 1.6%

10:30 UK BoE quarterly inflation report

The euro fell against the dollar as European Commission President Jose Barroso said the region is facing a “truly systemic crisis.”

The euro pared declines from a five-year low after the European Central Bank was said to be buying Spanish and Italian government bonds, narrowing their yield gap over benchmark German bunds.

The pound fell for a third day against the dollar as U.K. unemployment increased and joblessness among young people climbed above 1 million for the first time since at least 1992.

The Dollar gained for a third day as European stocks fell, boosting demand for the U.S. currency as a haven.

The pound depreciated versus the dollar as the Bank of England said Britain faces a “markedly weaker” outlook for economic growth, signaling it may expand stimulus.

Growth may be “broadly flat” in the first half of 2012, central bank Governor Mervyn King said in a press conference after the quarterly Inflation Report.

The pound also fell after the Office for National Statistics said British unemployment rose the most since 2009, with the rate climbing to a 15-year high of 8.3 percent and joblessness among young people reached more than 1 million for the first time since at least 1992.

EUR/USD: the pair fell in $1.3430 area, later restored above $1,3550.

GBP/USD: the pair holds in $1.5740-$ 1,5810 area.

USD/JPY: the pair holds in Y76,90 area.

Resistance 3: Y77.80 (resistance line from Nov 2)

Resistance 2: Y77.50 (Nov 15 high)

Resistance 1: Y77.15 (session high)

Current price: Y76.93

Support 1:Y76.80 (Nov 14 low)

Support 2:Y76.30 (area of Nov 25-26 low)

Support 3:Y75.60 (area of a historical low)

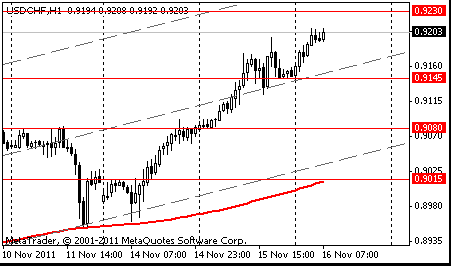

Resistance 3: Chf0.9310 (high of October)

Resistance 2: Chf0.9270 (Oct 10 high)

Resistance 1: Chf0.9220 (session high)

Current price: Chf0.9185

Support 1: Chf0.9140 (session low)

Support 2: Chf0.9090 (50,0 % FIBO of growth from Chf0,8960)

Support 3: Chf0.9060 (61,8 % FIBO of growth from Chf0,8960

Resistance 3: $ 1.5930 (Nov 15 high)

Resistance 2: $ 1.5875 (38,2 % FIBO $1,6090-$ 1,5740)

Resistance 1: $ 1.5820 (session high)

Current price: $1.5770

Support 1 : $1.5740 (session low)

Support 2 : $1.5720 (50,0 % FIBO $1,5270-$ 1,6170)

Support 3 : $1.5680 (Oct 20 low)

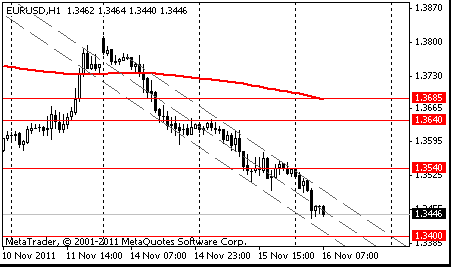

Resistance 3: $ 1.3660 (61,8 % FIBO $1,3800-$ 1,34310)

Resistance 2: $ 1.3620 (50.0 % FIBO $1,3800-$ 1,3430)

Resistance 1: $ 1.3560/70 (session high, 38,2 % FIBO $1,3800-$ 1,3430)

Current price: $1.3471

Support 1 : $1.3460 (low of european session)

Support 2 : $1.3430 (session low)

Support 3 : $1.3370 (area of Oct 7-10 lows)

- UK banks in much healthier state than many in eurozone;

- UK growth likely broadly flat until mid 2012;

- Reasonably confident inflation to fall sharply start 2012.

- UK banks in much healthier state than many in eurozone;

- UK growth likely broadly flat until mid 2012;

- Reasonably confident inflation to fall sharply start 2012.

and market expectations for Bank Rate.

GDP is seen significantly weaker in the near term vis-a-vis the August forecast, but climbs steadily back to just a tad over 3% at the 2-year point.

BOE 3-Year CPI forecast shows inflation still only around 1.5%.

GDP forecast aroun 1% y/y by end 2011, climbing to 3.1% 2yrs ahead.

EUR/USD $1.3450, $1.3500, $1.3600, $1.3650

USD/JPY Y76.65, Y79.00

AUD/USD $1.0150, $1.0160, $1.0200

EUR/CHF Chf1.2370

GBP/USD $1.5500, $1.5950, $1.6050

EUR/GBP stg0.8530

Nikkei 225 8,463 -78.77 -0.92%

Hang Seng 18,961 -387.54 -2.00%

S&P/ASX 4,247 -38.24 -0.89%

Shanghai Composite 2,467 -62.80 -2.48%

00:30 Australia Wage Price Index, y/y Quarter III +3.6%

04:00 Japan BoJ Interest Rate Decision 0.00%-0.10%

07:00 Japan BOJ Press Conference

The euro sank to five-week lows against the dollar and the yen as Spain and France prepare to sell securities tomorrow after a slump in euro-area debt signaled the region’s debt crisis is spreading.The 17-nation currency weakened for a third day after the extra yield investors demand to hold bonds from France, Belgium, Spain and Austria instead of German bunds climbed to euro-era records.

The dollar rose against 15 of its 16 major peers as investors sought safer assets.The euro fell to $1.3428 from the close in New York, after touching $1.3433, the weakest level since Oct. 10.

The Bank of Japan (8301) cut its economic assessment as a global slowdown erodes exports, underscoring the nation’s vulnerability to Europe’s deepening debt crisis. Governor Masaaki Shirakawa and his policy board left the BOJ’s asset-buying fund unchanged at 20 trillion yen ($260 billion) after increasing it by 5 trillion yen on Oct. 27. It also held the overnight lending rate between zero and 0.1 percent, the central bank said in a statement released today in Tokyo. The decisions were unanimous.

EUR/USD: on Asian session the pair fell.

GBP/USD: on Asian session the pair decreased.

USD/JPY: on Asian session the pair fell.

On Wednesday UK data includes labour market data at 0930GMT, which is expected to make grim reading. The lowest forecast from any analyst in our survey was for a 15,000 rise in claimant count jobless on the month. The median forecast is 25k and the unemployment rate is expected to hit 8.2%. Faced with a deteriorating business outlook, employers appear to be switching to hiring temporary workers. The Bank of England Quarterly Inflation Report is due at 1030GMT and is set to be a dovish report, with inflation shown falling back sharply from its current 5% level. In an open letter Tuesday BOE Governor Mervyn King predicted inflation would drop rapidly in the next six months and "continue falling thereafter to around target by the end of next year." The Inflation Report forecasts extend out to end 2013 on unchanged policy and end 2014 on market rates, and analysts expect they will show CPI moving below the 2% target both two and three years ahead.US data starts at 1200GMT with the weekly MBA Mortgage Application Index, which is followed at 1330GMT by the October CPI data. Consumer prices are expected to rise 0.1% in October, based on early forecasts. Core CPI is expected to rise 0.2%. US data continues with the Treasury International Capital System (TICS) data at 1400GMT and then Industrial Production at 1415GMT. Industrial production is expected to rise 0.3% in October after rising 0.2% in September, based on early estimates. At 1745GMT, Boston Fed President Eric Rosengren delivers a speech to the Boston Economic Club.

The euro fell to a one-month low against the yen as European bond yields surged at auctions and Mario Monti, Italy’s premier-in-waiting, faced resistance to forming a cabinet. The 17-nation currency slid below $1.35 as Italy’s 10-year yields surpassed the 7 percent threshold that prompted other nations to seek bailouts. Italian 10-year yields climbed as high as 7.07 percent after rising to a euro-era record of 7.48 percent on Nov. 9. The extra yield investors demand to hold the 10-year debt of Spain, France, Austria and Belgium instead of German bunds widened to the most since the euro was introduced in 1999. The ZEW Center for European Economic Research said its index of German investor and analyst expectations, which aims to predict developments six months in advance, decreased to minus 55.2 this month, the lowest since October 2008.

The Swiss franc dropped versus the dollar after the central bank’s Vice Chairman Thomas Jordan said the currency remains “very strong.” Hans Hess, president of the country’s industry group Swissmem, told reporters in Bern that the central bank should raise the ceiling. Fair value, the measure for currencies using prices for similar goods and services in two countries, is 1.35 to 1.40 francs per euro.

The dollar got a boost as Federal Reserve Bank of Dallas President Richard Fisher said he sees decreasing odds the central bank will need to ease policy further on signs the U.S. economy is poised for growth. U.S. retail sales rose in October more than forecast, and manufacturing in the New York region unexpectedly expanded this month, reports showed yesterday.

EUR/USD: yesterday the pair fell and lost figure.

GBP/USD: yesterday the pair decrease.

USD/JPY: yesterday the pair traded nearby Y77.00.

On Wednesday UK data includes labour market data at 0930GMT, which is expected to make grim reading. The lowest forecast from any analyst in our survey was for a 15,000 rise in claimant count jobless on the month. The median forecast is 25k and the unemployment rate is expected to hit 8.2%. Faced with a deteriorating business outlook, employers appear to be switching to hiring temporary workers. The Bank of England Quarterly Inflation Report is due at 1030GMT and is set to be a dovish report, with inflation shown falling back sharply from its current 5% level. In an open letter Tuesday BOE Governor Mervyn King predicted inflation would drop rapidly in the next six months and "continue falling thereafter to around target by the end of next year." The Inflation Report forecasts extend out to end 2013 on unchanged policy and end 2014 on market rates, and analysts expect they will show CPI moving below the 2% target both two and three years ahead.US data starts at 1200GMT with the weekly MBA Mortgage Application Index, which is followed at 1330GMT by the October CPI data. Consumer prices are expected to rise 0.1% in October, based on early forecasts. Core CPI is expected to rise 0.2%. US data continues with the Treasury International Capital System (TICS) data at 1400GMT and then Industrial Production at 1415GMT. Industrial production is expected to rise 0.3% in October after rising 0.2% in September, based on early estimates. At 1745GMT, Boston Fed President Eric Rosengren delivers a speech to the Boston Economic Club.

Asian stocks fell, paring yesterday’s advance, after Italian borrowing costs surged, reviving concern Europe’s sovereign-debt crisis is spreading, damping the outlook for earnings. Stocks also fell after German Finance Minister Wolfgang Schaeuble said Europe’s permanent bailout fund may not be implemented before 2013. German Chancellor Angela Merkel’s Christian Democratic Union party voted to offer euro states a “voluntary” means of exiting the currency bloc.

Japan’s Nikkei 225 (NKY) Stock Average fell 0.7 percent as turnover on the Tokyo bourse’s first section fell to the lowest this year. Hong Kong’s Hang Seng Index declined 0.8 percent. Australia’s S&P/ASX 200 dropped 0.4 percent.

Asian banks and exporters fell, with Standard Chartered, the U.K.’s No 2 lender by market value, sliding 4.1 percent to HK$168 in Hong Kong. HSBC Holdings Plc, Europe’s biggest lender, lost 1.9 percent to HK$62.05.

Nintendo Co., a maker of video-game consoles that gets more than 40 percent of its sales in Europe, fell 2.5 percent to 12,070 yen. Hyundai Motor Co., South Korea’s biggest carmaker by market value, lost 0.7 percent to 230,000 won. Esprit Holdings Ltd., a clothier that counts Europe as its biggest market, fell 2.9 percent to HK$10.04.

Elpida Memory Inc. slumped 9.1 percent on speculation the chipmaker will be removed from the MSCI Asia Pacific Index after a membership review.

China’s developers fell in Hong Kong with Evergrande Real Estate Group Ltd. sliding 6 percent to HK$3.15 after the firm’s chairman told Radio Television Hong Kong the company has no plans to acquire land for residential or commercial use for the remainder of the year as the outlook for home prices in China is “difficult.” China Overseas Land & Investment Ltd. lost 1.3 percent to HK$13.94.

China Railway Group Ltd. dropped 3.2 percent to HK$2.70 after the official People’s Daily reported that portions of a 2.3 billion yuan ($362 million) construction project were illegally subcontracted to unqualified builders, including a former cook.

Among stocks that rose, Paladin Energy gained 3.1 percent to A$1.66 after Prime Minister Julia Gillard said she would seek to overturn a ban on uranium shipments to India in a bid to strengthen ties and boost Australia’s resource-driven economy. Gillard will call for the policy shift at her Labor Party’s national conference next month and said exports to Asia’s third- largest economy would boost jobs.

Sumitomo Mitsui Financial Group Inc., Japan’s second- biggest lender, led Japan’s banks higher after it raised its full-year net-income forecast to 500 billion yen ($6.5 billion) from 400 billion yen as lower bad-loan costs outweigh a drop in lending income, it said in a statement. The bank gained 1.4 percent to 2,094 yen.

European stocks declined as Italy’s premier in waiting Mario Monti struggled to get political parties to help form his new Cabinet and the country’s biggest defense company forecast an unexpected loss. Monti, a former European Union competition commissioner, struggled to get political parties to agree to participate in his so-called technical Cabinet during talks in Rome yesterday and today. A government lacking political representation will find it harder to muster support from the parties in parliament to pass unpopular laws.

The euro area’s inability to contain its sovereign-debt crisis has led to a surge in Italian borrowing costs with yields on the country’s benchmark 10-year bonds climbing above 7 percent today. Monti will try to reassure investors that Italy can cut its 1.9 trillion-euro debt and spur economic growth that has lagged behind the euro-region average for more than a decade.

A report today showed German investor confidence fell to a three-year low in November. The ZEW Center for European Economic Research in Mannheim, Germany, said its index of investor and analyst expectations, which aims to predict developments six months in advance, declined to minus 55.2 from minus 48.3 in October. That’s the lowest since October 2008.

A separate report showed the euro area’s economic expansion failed to accelerate in the third quarter. Gross domestic product increased 0.2 percent from the previous three months, when it rose at the same pace, the European Union’s statistics office in Luxembourg said.

European stocks pared their losses after a U.S. Commerce Department report showed that retail sales climbed more in October than predicted as Americans bought iPhones and cars. A separate report showed manufacturing in the New York region unexpectedly expanded in November. The Federal Reserve Bank of New York’s general economic index rose to 0.6 from minus 8.5 in October.

National benchmark indexes fell in 14 of the 18 western- European markets today. France’s CAC 40 Index lost 1.9 percent, the U.K.’s FTSE 100 Index slipped less than 0.1 percent and Germany’s DAX Index dropped 0.9 percent.

Finmeccanica slumped 20 percent to 3.57 euros, its lowest price in 15 years. The company forecast an adjusted loss before interest, taxes, amortization and restructuring of 200 million euros. The maker of helicopters and plane parts booked writedowns of 753 million euros.

Europe’s banking shares slid 2 percent as a group, extending yesterday’s drop. National Bank of Greece SA retreated 12 percent to 1.86 euros and Alpha Bank SA plummeted 11 percent to 96 euro cents. UniCredit, Italy’s biggest bank, lost 4.5 percent to 73.95 euro cents.

Vienna Insurance Group AG sank 4.5 percent to 26.74 euros. The insurer said third-quarter net income rose 3.9 percent to 98.2 million euros. That missed the average estimate of 102.8 million euros in a Bloomberg survey of six analysts. The insurer wrote down its Italian government bonds by 10 percent.

Cable & Wireless Worldwide plunged 26 percent to 22.31 pence, its largest drop since March 2010 and the biggest retreat on the Stoxx 600. The company, which provides telecommunications services to the U.K. police force, will pay an interim dividend of 0.75 pence per share in January 2012 and then suspend future dividend payments to “improve balance-sheet strength and to enable investment in the business,” it said.

Electrolux AB lost 6.3 percent to 113.40 kronor as the world’s second-biggest appliance maker said it will close factories in Europe and North America to cut costs amid weak demand.

Kabel Deutschland AG slipped 3.2 percent to 40.79 euros as Germany’s largest cable operator predicted sales growth in 2011 at the lower end of its forecast range of 6.25 percent to 6.75 percent.

U.S. stocks rose, rebounding from earlier losses, on speculation Italian Prime Minister designate Mario Monti will succeed in forming a new government to battle the debt crisis and after growth in retail sales beat estimates.

Equities recovered as Monti, an economist and former adviser to Goldman Sachs Group Inc., said he’s “convinced” that the country can overcome the current crisis as he prepares to meet with President Giorgio Napolitano tomorrow to present his new government. Stocks had fallen earlier after borrowing costs rose at an auction of Spanish debt. Italian 10-year yields topped 7 percent and rates on French, Belgian, Spanish and Austrian debt rose to euro-era records above German bunds.

Benchmark gauges also rose after the Commerce Department reported a 0.5 percent gain in retail sales, compared with the median economist forecast that called for 0.3 percent growth. The Federal Reserve Bank of New York’s general economic index showed growth for the first time since May.

Dow 12,096.16 +17.18 +0.14%, Nasdaq 2,686.20 +28.98 +1.09%, S&P 500 1,257.80 +6.02 +0.48%

Intel Corp. spurred a rally in semiconductor companies, climbing 2.9 percent, after Warren Buffett’s Berkshire Hathaway Inc. said it invested in the world’s largest chipmaker. Technology shares in the S&P 500 rose 1.3 percent. Intel gained 2.9 percent to $25.34. Apple Inc., the world’s biggest technology company by market value, added 2.5 percent to $388.83.

Computer and software makers may extend gains after a gauge of the industry surged to the highest ratio versus the S&P 500 in more than nine years, according to Brown Brothers

Wal-Mart lost 2.4 percent to $57.46. It didn’t pass higher prices charged by suppliers along to customers struggling with persistent unemployment, Bill Simon, Wal-Mart’s U.S. chief, said. That hurt gross profit margin, or the percentage of net sales left after subtracting the cost of goods sold, which shrank to 24.6 percent, narrower than the 24.8 percent estimate of Colin McGranahan at Sanford C. Bernstein & Co.

Energy shares had the only decline in the S&P 500 among 10 industries, falling 0.2 percent. Chevron Corp. slumped 2.7 percent, the most in the Dow, to $103.27. The company said it appears to have halted a leak at the Frade project offshore Brazil after plugging a well. It said it has seen a significant decrease in the amount of oil seeping from the development.

LinkedIn Corp. slumped 4.6 percent to $74.86 after saying shareholder Bain Capital Ventures will sell all of its 3.71 million shares of the professional-networking website in a secondary stock offering.

Resistance 3: Y77.90 (Nov 9-10 high)

Resistance 2: Y77.50 (Nov 15 high)

Resistance 1: Y77.15 (session high)

The current price: Y76.98

Support 1: Y76.90 (Nov 15 low)

Support 2: Y76.65 (area of Oct 17-20 low)

Support 3: Y76.30 (Oct 12 low)

Comments: the pair is on downtrend. In focus support Y76.90.

Resistance 3: Chf0.9315 (Oct 6 high)

Resistance 2: Chf0.9265 (resistance line from Nov 4)

Resistance 1: Chf0.9230 (high of the European session on Oct 10)

The current price: Chf0.9203

Support 1: Chf0.9145 (session low)

Support 2: Chf0.9080 (Nov 15 low)

Support 3: Chf0.9015 (MA (233) H1)

Comments: the pair is on uptrend. In focus resistance Chf0.9230.

Resistance 3 : $1.5930 (Nov 15 high)

Resistance 2 : $1.5870 (MA (55) H1)

Resistance 1 : $1.5825 (session high)

The current price: $1.5764

Support 1 : $1.5745 (middle line from Nov 14)

Support 2 : $1.5680 (Oct 20 low)

Support 3 : $1.5630 (Oct 18 low)

Comments: the pair is on downtrend. In focus support $1.5745.

Resistance 3: $1.3685 (MA (233) H1)

Resistance 2: $1.3640 (Nov 15 high)

Resistance 1: $1.3540 (session high)

The current price: $1.3446

Support 1 : $1.3400 (support line from Nov 14)

Support 2 : $1.3360 (Oct 7 low)

Support 3 : $1.3310 (low of the Asian session on Oct 6)

Comments: the pair is on downtrend. In focus support $1.3400.

Change % Change Last

Nikkei 225 8,542 -61.77 -0.72%

Hang Seng 19,348 -159.74 -0.82%

S&P/ASX 200 4,286 -18.93 -0.44%

Shanghai Composite 2,530 +1.05 +0.04%

FTSE 100 5,517 -1.60 -0.03%

CAC 40 3,049 -59.82 -1.92%

DAX 5,933 -51.88 -0.87%

Dow 12,096.16 +17.18 +0.14%

Nasdaq 2,686.20 +28.98 +1.09%

S&P 500 1,257.80 +6.02 +0.48%

10 Year Yield 2.06% +0.01 --

Oil $99.55 +0.18 +0.18%

Gold $1,784.90 +2.70 +0.15%

00:30 Australia Wage Price Index, q/q Quarter III +0.9% +0.9%

00:30 Australia Wage Price Index, y/y Quarter III +3.8% +3.8%

04:00 Japan BoJ Interest Rate Decision 0.00%-0.10% 0.00%-0.10%

07:00 Japan BOJ Press Conference

09:30 United Kingdom Average earnings ex bonuses, 3 m/y September +1.8% +1.6%

09:30 United Kingdom ILO Unemployment Rate September 8.1% 8.2%

09:30 United Kingdom Claimant count October 17.5K 20.8K

09:30 United Kingdom Claimant Count Rate October 5.0% 5.1%

09:30 United Kingdom Average Earnings, 3m/y September +2.8% +2.5%

10:00 Eurozone Harmonized CPI October +0.8% +0.3%

10:00 Eurozone Harmonized CPI, Y/Y October +3.0% +3.0%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y October +1.6% +1.6%

10:30 United Kingdom BOE Gov King Speaks

10:30 United Kingdom Bank of England Quarterly Inflation Report

13:30 U.S. CPI, m/m October +0.3% 0.0%

13:30 U.S. CPI, Y/Y October +3.9% +3.6%

13:30 U.S. CPI excluding food and energy, m/m October +0.1% +0.1%

13:30 U.S. CPI excluding food and energy, Y/Y October +2.0% +2.1%

14:00 U.S. Net Long-term TIC Flows September 57.9 63.4

14:00 U.S. Total Net TIC Flows September 89.6

14:15 U.S. Industrial Production (MoM) October +0.2% +0.5%

14:15 U.S. Capacity Utilization October 77.4% 77.7%

15:30 U.S. EIA Crude Oil Stocks change неделя 11 октября -1.37

17:45 U.S. FOMC Member Rosengren Speaks

21:30 Australia RBA's Governor Glenn Stevens Speech

21:45 New Zealand PPI Input (QoQ) Quarter III +0.9% +0.6%

21:45 New Zealand PPI Output (QoQ) Quarter III +1.4% +0.8%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.