- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 18-11-2011

The euro strengthened for the first time in a week against the dollar and yen amid speculation European Central Bank buying of Italian and Spanish bonds will stem surging borrowing costs in the region.

Europe’s shared currency rose from yesterday’s five-week low versus the yen amid reports the ECB may start talks to lend to the International Monetary Fund for sovereign bailouts. Italian bonds rose. ECB President Mario Draghi today slammed governments for failing to implement policy commitments as holders of Greek debt began talks in Athens on structuring a 50 percent writeoff that was the cornerstone of a deal reached last month. The accord, which finance ministers aim to implement next month, was at least the fourth plan billed as a comprehensive strategy to end the crisis born in Greece in 2009, none of which provided a lasting fix.

The dollar declined against the majority of its 16 most- traded counterparts today after the index of U.S. leading indicators climbed more than forecast in October, encouraging risk appetite. Reports yesterday signaled improvement in the weakest areas of the U.S. economy, with claims for unemployment benefits dropping to the lowest level in seven months and housing starts exceeding forecasts.The Dollar Index, which IntercontinentalExchange Inc. uses to track the greenback against the currencies of six major U.S. trading partners, fell 0.3 percent to 78.032.

The Canadian dollar appreciated 0.3 percent to C$1.0258 to the greenback after Statistics Canada said today in Ottawa that consumer prices rose 0.2 percent in October, matching the previous month’s increase.

European stocks declined for a second day as a spat between Germany and France over the role of the region’s central bank in ending the debt crisis outweighed better-than-forecast U.S. economic data. German Chancellor Angela Merkel yesterday rejected French calls to deploy the ECB as a crisis backstop, defying global leaders and investors calling for more urgent action to halt the turmoil. Merkel listed using the ECB as lender of last resort alongside joint euro-area bonds and a “snappy debt cut” as proposals that won’t work.

Europe is running out of options to fix its debt crisis and it is now up to Italy and Greece to convince markets they can deliver the necessary austerity measures, Finnish Prime Minister Jyrki Katainen said. Greek Prime Minister Lucas Papademos won approval for the final 2012 budget designed to regain the confidence of creditors and secure resumption of international financing. The budget forecasts Greece’s debt as a proportion of gross domestic product will fall to 145.5 percent in 2012 from 161.7 percent this year.

In Italy, Prime Minister Mario Monti won a final parliamentary confidence vote, granting full power to his new government after pledging to attack the euro-region’s second- biggest debt and spur growth.

National benchmark indexes fell in 15 of the 18 western- European markets today, with Italy, Portugal and Spain the only gainers. U.K.’s FTSE 100 Index slid 1.1 percent, while France’s CAC 40 Index fell 0.4 percent. Germany’s DAX Index lost 0.9 percent.

Kemira Oyj, the Finnish maker of water-treatment chemicals, sank 14 percent after cutting its forecasts. Annual revenue will probably reach the same level as last year and operating profit excluding one-time items will be at or slightly below the level in 2010, the Helsinki- based company said.

Chemring Group Plc, the U.K. maker of missile-avoidance gear, slumped the most in 14 years as profit missed estimates. The company said full-year revenue was 745 million pounds ($1.18 billion), 5 percent less than management expectations, leaving operating profit below analyst estimates.

ARM Holdings Plc fell 3.9 percent to 498 pence. The maker of processor chips for Apple Inc.’s iPhone expects slower growth in research spending in 2012, the Wall Street Journal reported, citing an interview with President Tudor Brown.

SGL Carbon rose 1.2 percent to 43.68 euros after BMW, the world’s largest maker of luxury cars, bought a 15 percent stake in the maker of carbon products. BMW said it’s “satisfied” with its current holding, though can’t rule out additional share purchases in the future.

Deutsche Boerse AG, the operator of the Frankfurt exchange, added 2.8 percent to 42.52 euros. Deutsche Boerse and NYSE Euronext offered to sell overlapping single-equity derivatives businesses and give access to clearing services to soothe European regulators’ concerns over their proposed merger.

Holcim Ltd., the world’s second-biggest cement maker, jumped 2.2 percent to 51.30 francs after Paul Roger, an analyst at Exane BNP Paribas SA, raised the stock to “outperform” from “underperform.”

U.S. stocks swung between gains and losses, with the Standard & Poor’s 500 Index at a one-month low, as a drop in technology and energy shares overshadowed optimism the world’s largest economy will weather Europe’s debt crisis.

Chancellor Angela Merkel and U.K. Prime Minister David Cameron failed to reconcile their differences on German plans for European Union treaty change and a financial transaction tax, as Cameron called for “decisive action” to stem the euro-area debt crisis. Merkel said changes to EU treaties to allow for greater fiscal integration should be approved only by the 17 nations that share the euro, while Cameron wants changes to be approved more widely to allow him to take back powers from Brussels. Cameron also suggested Germany support calls to allow the European Central Bank to fund purchases of troubled sovereign debt.

Stocks erased gains earlier today after Deutsche Presse- Agentur reported that Germany’s Foreign Ministry said the nation was considering the possibility of “orderly defaults” beyond Greece.

Dow 11,788.44 +17.71 +0.15%, Nasdaq 2,576.12 -11.87 -0.46%, S&P 500 1,215.24 -0.89 -0.07%

Halliburton Co. and Schlumberger Ltd. dropped at least 1.6 percent as oil sank 2 percent.

Salesforce.com Inc. (CRM), the largest maker of online customer-management software, lost 9.6 percent after billings missed some estimates.

Boeing Co. (BA) rose 1.7 percent after winning a provisional order for 230 planes from Lion Air.

H.J. Heinz Co. fell 3.3 percent as the world’s biggest ketchup maker affirmed its forecast current fiscal year earnings of no more than $3.32 a share. Analysts are on average estimating $3.34 a share, according to a Bloomberg survey.

Hewlett-Packard Co. (HPQ) rose the most in the Dow Jones Industrial Average, gaining 2.5 percent. The largest computer maker appointed activist shareholder Ralph Whitworth of Relational Investors LLC to its board after he accumulated an almost 1 percent stake.

Oil in New York declined as investors widened the discount to Brent futures on speculation that the reversal of the Seaway pipeline won’t be enough to handle a glut in the U.S. Midwest.

West Texas Intermediate oil, the benchmark on the New York Mercantile Exchange, erased earlier gains as Brent rose. Brent’s premium to WTI narrowed to an eight-month low of $9.28 on Nov. 16 after Enbridge Inc. (ENB) and Enterprise Products Partners LP (EPD) said they will reverse the direction of the Seaway pipeline.

Crude for December delivery slid to $96.64 a barrel on the New York Mercantile Exchange. The December contract expires today. The more actively traded January contract fell 84 cents to $98.09.

Brent oil for January settlement advanced 13 cents to $108.35 a barrel on the London-based ICE Futures Europe exchange.

Gold prices rose today by the weak dollar, but eventually may show the greatest decline from September to the week. This week gold can go down in value by 3.4%. Gold prices rise due to increased investor interest considerably cheapened the eve of the metal. Gold prices on Thursday fell sharply - the price of metal has lost more than $ 50, or 3.1%, amid falling global stock markets, which prompted investors to the metal-sale to obtain funds needed to cover losses.

In recent weeks, gold has behaved not as a low-risk assets, and followed the stock market, but the deepening debt crisis in the euro zone could help the gold to return to record rates. Meanwhile, the fundamentals are favorable for gold. Demand for it rose in the third quarter by six percent to a maximum of more than a year due to demand in Europe and central bank purchases, said in a quarterly report to the World Gold Council (WGC).Stocks of the world's largest gold ETF-secured fund SPDR Gold Trust on Thursday rose to 0.95 percent, while the stocks of the largest secured silver ETF iShares Silver Trust has not changed.

Today, December gold futures trading at the New York on the Comex in a range of 1711.4 - 1738.5 dollars / ounce.

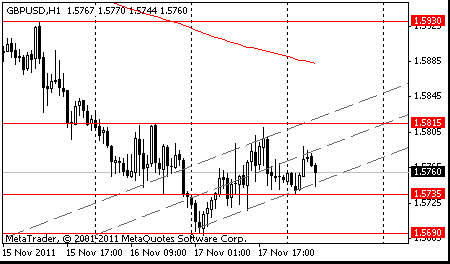

GBP/USD

Offers $1.5980/85, $1.5970, $1.5930/40, $1.5900

Bids $1.5775/70, $1.5725/20, $1.5680, $1.5660, $1.5630

USD/JPY Y76.20, Y76.65, Y77.00, Y77.15, Y77.50, Y78.00

AUD/USD $0.9825, $1.0160

GBP/USD $1.5850, $1.5500, $1.5400

USD/CAD C$1.0350

Italian two-year yields declined 19 basis points to 6.07 percent. They have fallen from a euro-era record of 7.48 percent on Nov. 10. Spanish two-year rates dropped four basis points to 5.45 percent. There were as high as 5.83 percent yesterday.

World markets: Nikkei -1.23%, Hang Seng -1.73%, Shanghai Composite -1.89%, FTSE -0.69%, CAC +0.10%, DAX +0.18%.

Crude oil: $99.71 (+0,9%).

Gold: $1727,20 (+0,4%).

Data:

07:00 Germany PPI (October) 0.2%

07:00 Germany PPI (October) Y/Y 5.3%

The euro strengthened the most in a week against the dollar amid speculation European Central Bank buying of Italian and Spanish bonds will stem surging borrowing costs in the region.

Europe’s currency rose as ECB President Mario Draghi called on politicians to accelerate the implementation of agreed reforms of the region’s rescue fund.

The Dollar Index dropped for a second day on concern U.S. lawmakers are running out time to agree on deficit reduction measures. Switzerland’s franc appreciated versus all its major counterparts.

Italian two-year yields declined 19 basis points to 6.07 percent. They have fallen from a euro-era record of 7.48 percent on Nov. 10. Spanish two-year rates dropped four basis points to 5.45 percent. There were as high as 5.83 percent yesterday.

EUR/USD: the pair showed high above $1,3600. Later the rate receded.

GBP/USD: the pair showed high in $1,5880 area. Later the rate decreased.

USD/JPY: the pair fell in Y76,60 area.

EUR/USD

Offers $1.3720/25, $1.3700, $1.3670/80, $1.3640/50, $1.3620

Bids $1.3550, $1.3505/00, $1.3485/80

Resistance 3: Y77.30 (МА(200) for Н1)

Resistance 2: Y77.00 (session high)

Resistance 1: Y76.80 (Nov 14 low)

Current price: Y76.61

Support 1:Y76.60 (session low)

Support 2:Y76.30 (area of Nov 25-26 highs)

Support 3:Y75.60 (area of historic low)

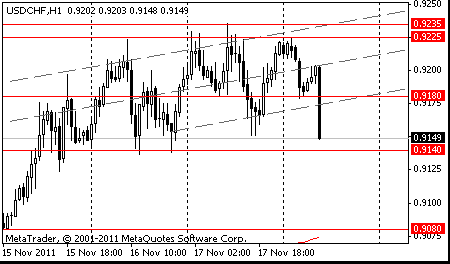

Resistance 3: Chf0.9230 (Nov 17 high)

Resistance 2: Chf0.9200 (high of european session)

Resistance 1: Chf0.9140 (Nov 16 low)

Current price: Chf0.9111

Support 1: Chf0.9100 (session low, 50,0 % FIBO of growth from Chf0,8960)

Support 2: Chf0.9060 (61,8 % FIBO of growth from Chf0,8960)

Support 3: Chf0.9010 (support line from Nov 9)

Resistance 3: $ 1.5930/40 (61,8 % FIBO $1,6090-$ 1,5690, Nov 15 high)

Resistance 2: $ 1.5890 (50,0 % FIBO $1,6090-$ 1,5690)

Resistance 1: $ 1.5860 (session high)

Current price: $1.5848

Support 1 : $1.5810 (Nov 17 high)

Support 2 : $1.5770 (support line from Nov 17)

Support 3 : $1.5690 (Nov 17 low)

Resistance 3: $ 1.3660 (61,8 % FIBO $1,3800-$ 1,3420)

Resistance 2: $ 1.3610 (50.0 % FIBO $1,3800-$ 1,3420)

Resistance 1: $ 1.3560 (session high, Nov 16-17 high, 38,2 % FIBO $1,3800-$ 1,3420)

Current price: $1.3516

Support 1 : $1.3470 (low of european session, support line from Nov 16)

Support 2 : $1.3420 (Nov 17 low)

Support 3 : $1.3370 (area of Okt 7-10 low)

- debt crisis doesn't justify extending cbank mandate;

- no bailout clause key to incentivize sound pub finances;

- hails Germany's attempts at more fiscal integration;

- leaders must come up with credible crisis solution.

EUR/USD $1.3425, $1.3500(large), $1.3570, $1.3660, $1.3685

USD/JPY Y76.20, Y76.65, Y77.00, Y77.15, Y77.50, Y78.00

AUD/USD $0.9825, $1.0160

GBP/USD $1.5850, $1.5500, $1.5400

USD/CAD C$1.0350

- Activity Expected To Weaken In Most Advanced Economies

- Downside Economic Risks In Euro Area Have Increased

- Weaker Euro Zone Activity Will Moderate Price, Wage Pressures

- No Advanced Economy To Be Spared

- ECB Cut Rates In Nov Due To Econ Outlook

- ECB Aware Of Current Difficulties For Banks From Debt Crisis

- Stresses Continuity In Maintaining Price Stability Objective

- ECB Takes Decisions In Full Independence

- Euro Area Helped By Emerging Econ Demand

- Must Resist Temptation To Resort To Unilateral Policies

- "Must Work Together" With Emerging Economies

- Emerging Economies' CPI Hasn't Fed Into Euro Area Prices

- Activity Expected To Weaken In Most Advanced Economies

- Downside Economic Risks In Euro Area Have Increased

- Weaker Euro Zone Activity Will Moderate Price, Wage Pressures

- No Advanced Economy To Be Spared

- ECB Cut Rates In Nov Due To Econ Outlook

- ECB Aware Of Current Difficulties For Banks From Debt Crisis

- Stresses Continuity In Maintaining Price Stability Objective

- ECB Takes Decisions In Full Independence

- Euro Area Helped By Emerging Econ Demand

- Must Resist Temptation To Resort To Unilateral Policies

- "Must Work Together" With Emerging Economies

- Emerging Economies' CPI Hasn't Fed Into Euro Area Prices

Breaks above the earlier high at $1.3535, extends recovery to $1.3450 before faltering ahead of reported stronger sell interest placed between $1.3550/60. Above $1.3560 exposes stops, with $1.3567 offering a near term target (1.618% FIBO $1.3535-$1.3480).

Nikkei 225 8,375 -104.72 -1.23%

Hang Seng 18,470 -347.84 -1.85%

S&P/ASX 4,177 -81.26 -1.91%

Shanghai Composite 2,417 -46.48 -1.89%

Dollar Declines on Speculation Fed to Ease Policy, Before U.S. Home Sales. The dollar weakened against most major counterparts amid speculation the Federal Reserve will introduce more measures to lower borrowing costs to stimulate the economy. The Dollar Index retreated before a private report that economists say will show U.S. sales of existing homes dropped last month. Fed Bank of New York President William C. Dudley said yesterday there’s more the central bank could do to boost the economy.

The euro is poised for its second-straight weekly drop against the yen amid concern European policy makers can’t stop the region’s debt crisis from spreading to larger economies including Spain, Italy and France.

Canada’s dollar depreciated to the lowest level in five weeks as sovereign-debt turmoil in Europe and a decline in stocks and commodities overshadowed foreign investments in Canadian securities. The Canadian currency fell versus the U.S. dollar for a fourth day in the longest stretch of losses in more than a month on demand for a refuge.

EUR/USD: on Asian session the pair gain.

GBP/USD: on Asian session the pair advanced.

USD/JPY: on Asian session the pair fell.

On Friday US events start at 1315GMT, when New York Fed President William Dudley delivers a speech on the economic outlook at policy at SUNY Albany. At 1500GMT, the index of leading indicators is expected to rise 0.6% in October, with positive contributions from a steepening of the yield curve, rising stock prices, lower jobless claims and a longer manufacturing workweek. These should be offset by faster vendor deliveries. Later on, at 1815GMT, Dallas Fed President Richard Fisher delivers a speech on the Fed and the Texas economy to the Texas Teach Alumni Association in Dallas.

The euro rose against the majority of its most-traded counterparts as Italian bond yields reversed course and fell, easing concern the region’s third-largest economy will be unable to handle its debt crisis.The 17-nation currency gained from the lowest in five weeks versus the dollar and the yen as two people with knowledge of the trades said the European Central Bank bought more Italian government bonds, following purchases earlier. The euro fell earlier as Spanish and French borrowing costs rose at auctions. Italy’s credit rating may be cut to low investment grade should the country lose market access, while the nation’s economy may already be in a recession, Fitch Ratings said. Italy’s new government has a “window of opportunity” to carry out urgent measures together with ECB support to bring down borrowing costs, the ratings company said in a special report. The euro erased gains versus the yen and euro as stocks and commodities tumbled.

The Dollar Index, which IntercontinentalExchange Inc. uses to track the greenback against the currencies of six major U.S. trading partners, dropped for the first time in four days as builders broke ground on more American homes than forecast in October, an annualized 628,000 . Fewer first-time claims for unemployment insurance payments were filed in the U.S. last week, 388,000, an indication the job market may be gaining traction, Labor Department data showed.

The pound strengthened against the dollar, snapping a three-day decline, after British retail sales unexpectedly rose in October.

The Australian dollar reached parity with the greenback for the first time in more than a month as appetite for risk faded.

EUR/USD: yesterday the pair has closed day at a level of opening.

GBP/USD: yesterday the pair advanced.

USD/JPY: yesterday the pair traded nearby Y77.00.

On Friday US events start at 1315GMT, when New York Fed President William Dudley delivers a speech on the economic outlook at policy at SUNY Albany. At 1500GMT, the index of leading indicators is expected to rise 0.6% in October, with positive contributions from a steepening of the yield curve, rising stock prices, lower jobless claims and a longer manufacturing workweek. These should be offset by faster vendor deliveries. Later on, at 1815GMT, Dallas Fed President Richard Fisher delivers a speech on the Fed and the Texas economy to the Texas Teach Alumni Association in Dallas.

Most Asian stocks fell as China’s pledge to keep inflation controls sent mainland developers lower and Fitch Ratings said a further spread of Europe’s debt crisis poses a “serious risk” to U.S. banks.

Japan’s Nikkei 225 (NKY) Stock Average rose 0.2 percent, reversing an earlier decline of as much as 0.7 percent. Australia’s S&P/ASX 200 added 0.3 percent. Hong Kong’s Hang Seng Index dropped 0.8 percent after China’s central bank said it can’t loosen control over prices and reiterated Premier Wen Jiabao’s pledge to “fine-tune” policies when needed.

China Resources fell 4.1 percent to HK$11.14 in Hong Kong. China Overseas Land & Investment Ltd. slid 1.8 percent to HK$13.06. Industrial & Commercial Bank of China Ltd., the world’s No. 1 lender by market value, dropped 1.5 percent to HK$4.58. China Life Insurance Co., the country’s biggest insurer, declined 2.1 percent to HK$20.80.

Lenders declined on concern that Europe’s debt crisis will increase financing costs and crimp earnings. National Australia Bank dropped 1.1 percent to A$24.34 in Sydney. HSBC Holdings Plc, Europe’s No. 1 bank by market value, retreated 0.8 percent to HK$60.25 in Hong Kong.

Esprit Holdings Ltd. declined 6.1 percent to HK$9.02 amid signs economic growth is slowing in Europe, where the clothier gets 79 percent of sales. The Bank of England yesterday said Britain’s economy faces a “markedly weaker” outlook and Spain cut its economic forecast.

Energy companies rose after oil yesterday traded above $100 a barrel. Crude for December delivery slipped today as much as 97 cents to $101.62 a barrel in electronic trading on the New York Mercantile Exchange.

BHP Billiton Ltd., an Australian miner and oil producer, rose 1.1 percent to A$37.04. Inpex advanced 1.2 percent to 492,500 yen. Rival Japan Petroleum Exploration Co. climbed 3.6 percent to 3,050 yen.

Among other stocks that rose, TDK Corp. jumped 8.8 percent to 3,535 yen in Tokyo after a regulatory filing showed a unit of Western Digital Corp. has agreed to buy components from the Japanese maker of disk drive heads.

European stocks fell after Spain’s borrowing costs surged to a euro-era record on waning demand at a bond sale, adding to concern the region’s sovereign debt crisis is deepening.

Spanish bonds sank, driving 10-year yields to as much as 6.78 percent, the highest since before the euro was introduced, as borrowing costs climbed to the most in at least seven years at an auction of securities. The benchmark yield was trading at 6.49 percent at 4:39 p.m.

In France, the extra yield, or spread, investors receive for holding 10-year French debt instead of benchmark German bunds reached 2 percentage points for the first time in the shared currency’s history as the country sold 8.01 billion euros of notes and bonds.

National benchmark indexes fell in all but one of the 18 western-European markets today. France’s CAC 40 slid 1.8 percent, the U.K.’s FTSE 100 dropped 1.6 percent and Germany’s DAX lost 1.1 percent.

A gauge of European banks declined 2.2 percent as the three-month cross-currency basis swap, the rate banks pay to convert euro payments into dollars, reached 131 basis points below the euro interbank offered rate in London, the most expensive since December 2008.

BNP Paribas, France’s largest lender, fell 4.6 percent to 28.49 euros. Societe Generale slid 3.9 percent to 16.95 euros. Credit Agricole SA lost 4.7 percent to 4.43 euros. Deutsche Bank AG, Germany’s largest bank, declined 3.7 percent to 27.29 euros.

Copper tumbled the most in a week in London on concern Europe’s debt crisis may spread to other economies, potentially eroding demand for metals. Antofagasta Plc paced a selloff in mining shares, falling 6.1 percent to 1,103 pence, while Vedanta Resources Plc lost 6.9 percent to 1,014 pence and Xstrata Plc retreated 3.9 percent to 958.8 pence.

Voestalpine AG plunged 9.2 percent to 20.84 euros after Austria’s biggest steelmaker cut its profit outlook for the full year, citing a “difficult economic environment.”

ASML Holding NV, Europe’s biggest semiconductor-equipment maker, dropped 3.2 percent to 28.65 euros after Applied Materials Inc., the world’s largest producer of semiconductor- making equipment, forecast first-quarter earnings that missed analyst estimates.

U.S. stocks fell, sending the Standard & Poor’s 500 Index to the lowest level in a month, as concern grew that Europe’s debt crisis will worsen and lawmakers will fail to agree on plans to cut the American deficit.

Stocks fell as Reuters reported a euro-area official as saying there are no aid plans Italy from the European Financial Stability Facility. Spanish bonds sank, driving 10-year yields to the highest since the euro was introduced, as borrowing costs climbed at an auction. Republicans and Democrats on Congress’s supercommittee hardened their positions with less than a week until the deadline to propose deficit cuts.

Earlier today, economic reports helped push stocks higher. The fewest Americans in seven months filed for unemployment benefits. Builders broke ground on more homes than forecast in October and construction permits climbed to the highest level since March 2010. Another report showed that manufacturing in the Philadelphia region expanded less than forecast in November as orders and sales cooled.

Alcoa Inc., the largest U.S. aluminum producer, retreated 3.5 percent to $9.62. Intel Corp., the world’s biggest chipmaker, lost 2.4 percent to $24.34.

Sears Holdings Corp. slid 4.6 percent as the retailer reported a steeper loss. Retailers are having a harder time attracting shoppers, with consumer confidence at the lowest in more than two years.

Applied Materials Inc., a producer of chipmaking equipment, sank 7.5 percent as forecasts trailed estimates. Profit before certain costs will be 8 cents to 16 cents a share, the company said. Revenue will decline up to 15 percent from the prior quarter, Applied said, indicating sales of as little as $1.85 billion. Analysts on average predicted profit of 18 cents on sales of $2.07 billion, data compiled by Bloomberg show.

NetApp Inc. tumbled 12 percent, the most in the S&P 500, to $35.73 The maker of data-storage products forecast third-quarter adjusted earnings of no more than 60 cents a share, 4 cents less than the average analyst estimate.

Resistance 3: Y77.80 (resistance line from Nov 2)

Resistance 2: Y77.50 (Nov 15 high)

Resistance 1: Y77.15 (Nov 16 high)

The current price: Y76.73

Support 1:Y76.30 (area of Nov 25-26 low)

Support 2:Y75.60 (area of historical low)

Comments: the pair is on downtrend. In focus support Y76.80.

Resistance 3: Chf0.9340 (Apr 1 high)

Resistance 2: Chf0.9300 (resistance line from Nov 4)

Resistance 1: Chf0.9225/35 (area of Nov 16-17 high, session high)

The current price: Chf0.9149

Support 1: Chf0.9140 (Nov 16 low)

Support 2: Chf0.9080 (Nov 15 low)

Comments: the pair is on uptrend. In focus resistance Chf0.9230.

Resistance 3 : $1.6090 (Nov 11-14 high)

Resistance 2 : $1.5930 (Nov 15 high)

Resistance 1 : $1.5815 (Nov 16 high)

The current price: $1.5760

Support 1 : $1.5735 (session low)

Support 2 : $1.5690 (Nov 17 low)

Support 3 : $1.5630 (Oct 18 low)

Comments: the pair is corrected but remains in downtrend. In focus support $1.5815.

Resistance 3: $1.3720 (76.4 % FIBO $1.3420-$ 1.3810)

Resistance 2: $1.3640 (Nov 15 high)

Resistance 1: $1.3540 (Nov 17 high)

The current price: $1.3475

Support 1 : $1.3445 (session low)

Support 2 : $1.3360 (Oct 7 low)

Support 3 : $1.3310 (low of the Asian session on Oct 6)

Comments: the pair holds in range. In focus support $1.3445.

Change % Change Last

Nikkei 225 8,480 +16.47 +0.19%

Hang Seng 18,817 -143.43 -0.76%

S&P/ASX 200 4,258 10.80 +0.25%

Shanghai Composite 2,463 -3.91 -0.16%

FTSE 100 5,423 -85.88 -1.56%

CAC 40 3,010 -54.61 -1.78%

DAX 5,850 -63.19 -1.07%

Dow 11,770.73 -134.86 -1.13%

Nasdaq 2,587.99 -51.62 -1.96%

S&P 500 1,216.13 -20.78 -1.68%

10 Year Yield 1.96% -0.07 --

Oil $98.96 +0.14 +0.14%

Gold $1,719.60 -0.60 -0.03%

07:00 Germany Producer Price Index (MoM) October +0.3% +0.2%

07:00 Germany Producer Price Index (YoY) October +5.5% +5.3%

12:00 Canada Consumer Price Index m /m October +0.2% +0.1%

12:00 Canada Consumer price index, y/y October +3.2% +2.7%

12:00 Canada Bank of Canada Consumer Price Index Core, m/m October +0.7% +0.1%

12:00 Canada Bank of Canada Consumer Price Index Core, y/y October +1.9% +1.9%

13:15 U.S. FOMC Member Dudley Speak

13:30 Canada Leading Indicators, m/m October -0.1% +0.1%

15:00 U.S. Leading Indicators October +0.2% +0.6%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.