- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 23-11-2011

The euro fell to a six-week low against the dollar after Germany received insufficient bids at a debt auction, adding to concern Europe’s sovereign-debt crisis is driving away investors from the region’s assets. Germany missed its 6 billion-euro ($8 billion) maximum sales target at a 10-year bond auction today by 35 percent, prompting investors to question the status of the securities as a haven from the region’s debt crisis. The bunds drew a yield of 1.98 percent.

A composite index based on a survey of purchasing managers in European manufacturing and services rose to 47.2 from 46.5 in October, Markit Economics said in an initial estimate today, suggesting the sovereign-debt crisis is starting to affect economic growth in the region’s core nations.

The dollar rose versus all of its 16 most-traded peers as a gauge of European services and manufacturing output shrank and data signaled China’s manufacturing will tumble. The HSBC Flash Manufacturing PMI for China, Australia’s biggest trading partner, fell to 48 this month, predicting the biggest contraction since March 2009. That compares with a final reading of 51 in October.

The Dollar Index rose to its strongest level in almost seven weeks after Commerce Department data showed consumer spending in the U.S. rose 0.1 percent in October, less than forecast, indicating the biggest part of the economy may contribute less to the recovery. Orders for durable goods fell, another report showed, indicating manufacturing may also cool.

The gauge of the greenback, which is weighted 57.6 percent to movements in the euro, rose 1 percent to 79.004. It reached 79.027, the highest since Oct. 6. Intercontinental Exchange Inc. uses the index to track the greenback against the currencies of six major U.S. trade partners.

The pound declined 0.7 percent to $1.5522, after being as low as $1.5511, the least since Oct. 7. It fell for a third day after minutes of the central bank’s rate-setting meeting this month showed increased support for additional stimulus. Bank of England policy makers at the meeting unanimously kept the target for asset purchases at 275 billion pounds, after raising it by 75 billion pounds in October, the minutes showed.

European stocks declined, with the benchmark Stoxx Europe 600 Index posting its longest losing streak since August, as Germany failed to attract sufficient bids at an auction of benchmark 10-year bunds. Germany failed to reach its maximum sales target of 6 billion euros ($8 billion) at an auction of securities due in January 2022. Total bids amounted to 3.889 billion euros, falling short by 35 percent, according to data from the Bundesbank. The securities were sold at a yield of 1.98 percent.

The European Central Bank bought Italian government bonds, according to three people with knowledge of the transactions, who declined to be identified because the trades are confidential. A spokesman for the ECB in Frankfurt declined to comment today on asset purchases.

A preliminary reading of a euro-area composite index from a survey of purchasing managers in manufacturing and services rose to 47.2 in November from 46.5 in October, London-based Markit Economics said today.

National benchmark indexes fell in 17 of the 18 western- European markets. France’s CAC 40 Index slipped 1.7 percent. Germany’s DAX Index dropped 1.4 percent. The U.K.’s FTSE 100 Index slid 1.3 percent.

Rio Tinto slipped 2.3 percent to 2,985.5 pence and BHP Billiton Ltd. declined 1.4 percent to 1,741 pence. The world’s two largest mining companies (BLT) and other commodity producers face A$11 billion ($10.7 billion) of extra charges in the first three years of Australia’s tax on iron-ore and coal profits.

Logica fell 4.2 percent to 67.6 pence after the stock was cut to “underperform” from “hold” at Jefferies and Co.

Halfords Group Plc dropped 5.1 percent to 314.1 pence. The shares were cut to “sell” from “neutral” at UBS, which cited the company’s limited strategic options for growth.

Dexia jumped 13 percent to 26.9 euro cents. Luxembourg’s Finance Minister Luc Frieden said that talks about the government-backed funding of the remaining assets do not face “insurmountable difficulties.”

Tui Travel Plc, Europe’s largest tour operator, rallied 13 percent to 154 pence, its biggest advance since October 2008, as analysts said concern over the future of rival Thomas Cook Group Plc may present an opportunity to gain market share.

Staying with 2% inflation target, sees Canada inflation falling to 1% area mid-'12.

U.S. stocks slumped, sending the Standard & Poor’s 500 Index down for a sixth straight day, as the cost of insuring European government debt against default rose to a record on concern the region’s crisis is worsening. The debt crisis that began more than two years ago now risks engulfing Germany. The Markit iTraxx SovX Western Europe Index of credit-default swaps on 15 governments rose to an all- time high as Germany failed to find buyers for 35 percent of the bonds offered at an auction.

Equities also fell after reports indicated more signs of a slowing American economy. Consumer spending rose less than forecast in October, while orders for durable goods sank. More Americans than forecast filed for unemployment benefits last week. The Thomson Reuters/University of Michigan preliminary index of consumer sentiment for November rose to 64.1, less than economists estimated.

All 10 groups in the S&P 500 fell as commodity and financial shares had the biggest declines. Bank of America lost 4 percent to $5.16, while Citigroup decreased 4.3 percent to $23.42. Both are among lenders that may have to temper plans to raise dividends and buy back stock next year as the Federal Reserve toughens capital tests for the biggest U.S. banks.

The Fed imposed a tougher capital test on the 31 largest U.S. banks yesterday, releasing the criteria for measuring their wherewithal if the U.S. economy sours and major trading partners default on their debt. Lenders need to prove they have the capital to withstand a “severe” U.S. recession with 13 percent unemployment and an 8 percent decline in gross domestic product before they can increase dividends or repurchase shares.

Raw material shares had the biggest decline in the S&P 500 among 10 industries, dropping 2.6 percent. JPMorgan Chase & Co. downgraded commodities to “underweight,” citing policy failures in the U.S. and Europe. Alcoa Inc. (AA) slid 3.5 percent amid concern about slower demand for commodities as a preliminary gauge indicated China’s manufacturing shrank by the most since March 2009. Halliburton Co. fell 4 percent to $32.35.

Deere & Co. rallied 3.7 percent as the largest farm-equipment maker reported profit that topped analysts’ projections. The company, led by Chief Executive Officer Sam Allen, has benefited as U.S. farmers used cash from rising corn and soybean prices to buy high-horsepower equipment. U.S. farm income will jump 31 percent this year to a record $103.6 billion, the U.S. Department of Agriculture said in August.

Boston Scientific Corp. rose 2.5 percent to $5.44 after gaining U.S. approval for a new version of its drug-coated heart stent. The second-biggest heart-device maker by revenue will immediately begin manufacturing and selling the Promus Element stent system, the Natick, Massachusetts-based company said in a statement late yesterday.

Need to resolve EFSF leverage by the Eurogroup meeting next Tues.

Need to bring forward the permanent bailout facility (ESM)

US needs to solve deficit problem.

China should intensify its efforts to boost domestic

Gold prices decreasing rate with the euro as investors' concerns increase the debt crisis in the eurozone.

Gold has fallen in price by 12 percent compared with the historical maximum of $ 1.920,30per ounce, reached in September, but this is not scared off investors. Since early November, prices fell by 1 percent in October rose 5.5 percent. This year, gold can rise by almost 20 percent.

Stocks ETF backed by gold funds rose in November to 2 million ounces, which was the most significant growth since July, when stocks rose by 2.95 million ounces. At the European ETF accounts for 10 percent of growth stocks, which indicates a high demand for safe assets among European investors.

Gold futures for December delivery fell to $1,677.10 an ounce on the Comex in New York.

Oil pared losses after the Energy Department reported a decline of more than 6 million barrels in inventories.

Supplies dropped 6.22 million barrels to 330.8 million in the week ended Nov. 18, the Energy Department said today. Inventories were forecast to rise 500,000 barrels, according to the median of 13 analyst estimates.

Crude oil for January delivery dropped $1.83, or 1.9 percent, to $96.18 a barrel at 10:36 a.m. on the New York Mercantile Exchange. The price was $95.60 before the inventory report.

Oil also declined as a shortfall of bids in a German bond sale signaled a deepening of Europe’s debt crisis and U.S. government said orders for durable goods fell in October.

Germany failed to get enough bids at an auction of benchmark 10-year bunds to reach its sales target, signaling the two-year-old debt crisis that began in Greece and snared Ireland, Portugal, Italy and Spain has closed in on France and now Germany, the world’s fourth-biggest economy.

U.S. bookings for equipment meant to last at least three years declined 0.7 percent, less than forecast, after a 1.5 percent drop the prior month that was more than twice as large as originally reported, data from the Commerce Department showed today in Washington.

A Chinese preliminary purchasing managers’ index conducted by HSBC Holdings Plc and Markit Economics shows a reading of 48, compared with a final number of 51 last month. A number below 50 indicates a contraction.

Brent oil for January settlement decreased as much as $1.70 to $107.33 a barrel on the London-based ICE Futures Europe exchange. The European contract’s premium to West Texas crude widened to $11.42 a barrel from $11.02 at yesterday’s settlement. The spread rose to a record of $27.88 on Oct. 14.

EUR/USD $1.3400, $1.3470, $1.3500, $1.3550, $1.3600

USD/JPY Y76.25, Y76.95, Y77.70, Y78.00AUD/USD $0.9795, $0.9800, $0.9850, $0.9950

EUR/CHF Chf1.2300

Data:

07:45 France Business confidence (November) 95

08:00 France PMI (November) flash 47.6

08:00 France PMI services (November) flash 49.3

08:30 Germany PMI (November) flash 47.9

08:30 Germany PMI services (November) flash 51.4

09:00 EU(17) PMI (November) flash 46.4

09:00 EU(17) PMI services (November) flash 47.8

09:30 UK BoE meeting minutes (09-10.11)

10:00 EU(17) Industrial orders (September) -6.4%

10:00 EU(17) Industrial orders (September) Y/Y 1.6%

The euro fell to a six-week low against the dollar as reports added to signs that Europe’s failure to resolve its debt crisis is weighing on economic growth and Germany received insufficient bids at a debt auction.

The euro slid as London-based Markit Economics said a gauge of European services and manufacturing output shrank for a third month.

Investors bid 3.889 billion euros at Germany’s offering of 6 billion euros of 10-year bunds, according to data from the Bundesbank, prompting investors to question the status of the securities as a haven from the euro area’s debt crisis. The securities were sold at a yield of 1.98 percent.

The dollar rose as a report signaled China’s manufacturing will shrink amid a faltering global economy.

The HSBC Flash Manufacturing PMI for China, Australia’s biggest trading partner, fell to 48 this month, predicting the biggest contraction since March 2009. That compares with a final reading of 51 in October.

EUR/USD: during european session the pair decreased below $1.3400.

GBP/USD: during europen session the pair was trading in $1,5550-$ 1,5600 area.

USD/JPY: the pair has grown in Y77,20 area.

- German opposition to Eurobonds mainly about timing;

- Commission not decided the Eurobond option it prefers.

- German opposition to Eurobonds mainly about timing;

- Commission not decided the Eurobond option it prefers.

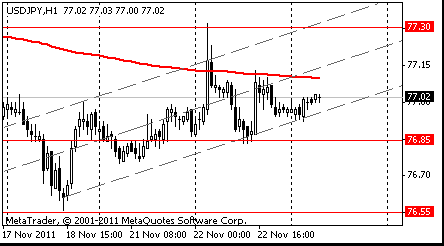

Resistance 3: Y77.90 (Nov 9 high)

Resistance 2: Y77.50 (Nov 15 high)

Resistance 1: Y77.30 (Nov 22 high)

Current price: Y77.19

Support 1:Y77.00 (support line from Nov 18, МА (200) for Н1)

Support 2:Y76.80 (Nov 22 low)

Support 3:Y76.55 (Nov 18 low)

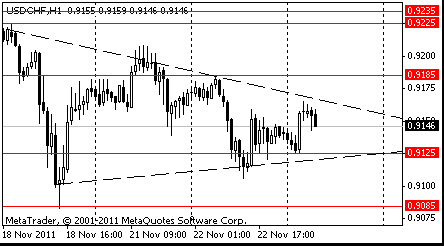

Resistance 3: Chf0.9300/10 (area of high of October)

Resistance 2: Chf0.9230 (Nov 17 high)

Resistance 1: Chf0.9200/10 (session high, Nov 21 high)

Current price: Chf0.9185

Support 1: Chf0.9130 (session low)

Support 2: Chf0.9090 (50,0 % FIBO Chf0,8950-Chf0,9230)

Support 3: Chf0.9060 (61,8 % FIBO Chf0,8950-Chf0,9230)

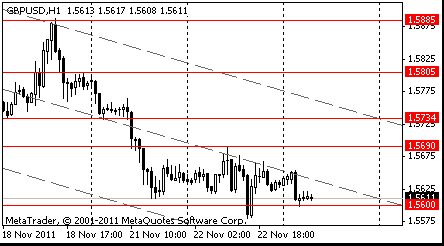

Resistance 3: $ 1.5720 (50,0 % FIBO $1,5890-$ 1,5550, the top border of downchannel from Nov 14)

Resistance 2: $ 1.5680/90 (38,2 % FIBO $1,5890-$ 1,5550, Nov 22 high)

Resistance 1: $ 1.5630 (high of european session)

Current price: $1.5580

Support 1 : $1.5550/40 (session low, Oct 12 low, the bottom border of downchannel from Nov 14)

Support 2 : $1.5380 (support line from May’2010)

Support 3 : $1.5270 (Oct 6 low)

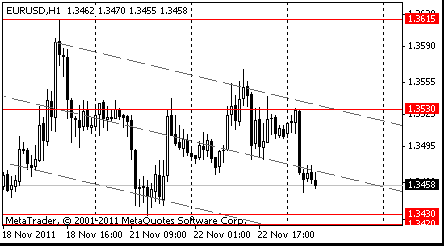

Resistance 3: $ 1.3530 (session high)

Resistance 2: $ 1.3480 (high of european session, resistance line from Oct 27)

Resistance 1: $ 1.3420 (Nov 17 low)

Current price: $1.3402

Support 1 : $1.3370 (session low, Oct 10 low)

Support 2 : $1.3240 (Oct 6 low)

Support 3 : $1.3150 (low of October)

EUR/USD $1.3400, $1.3470, $1.3500, $1.3550, $1.3600

USD/JPY Y76.25, Y76.95, Y77.70, Y78.00AUD/USD $0.9795, $0.9800, $0.9850, $0.9950

EUR/CHF Chf1.2300

Nikkei 225 closed

Hang Seng 17,864 -387.16 -2.12%

S&P/ASX 4,051 -81.98 -1.98%

Shanghai Composite 2,395 -17.56 -0.73%

The euro slid for the sixth time in eight days against the dollar before data that may add to signs that Europe’s debt crisis is damping economic growth. The 17-nation euro dropped versus the yen ahead of reports forecast to show that manufacturing in Germany and France, Europe’s two biggest economies, weakened this month.

Canada’s dollar advanced against the majority of its most-traded counterparts after a report showed retail sales grew in September at the fastest pace in a year, improving the outlook for economic growth. Canada’s currency rose from almost the lowest level in more than six weeks versus the U.S. dollar, rallying after the International Monetary Fund revamped its credit-line program to help countries facing outside shocks.

The Australian dollar declines after HSBC Holdings Plc and Markit Economics said a China purchasing managers’ index was at 48.0 for November, according to a preliminary reading, compared with a final reading for October of 51. A number below 50 indicates a contraction. China is Australia’s largest trading partner and New Zealand’s second-biggest export market. The Aussie has dropped 7.3 percent against the U.S. currency this month and the kiwi has declined 7.8 percent.

EUR/USD: on Asian session the pair fell.

GBP/USD: on Asian session the pair decreases.

USD/JPY: on Asian session the pair holds in range Y76.95-Y77.05.

A full calendar Wednesday, with a slew of US data ahead of the Thanksgiving break. European data gets under way at 0700GMT, with the release of the German Sept construction orders data. A host of French data is released at 0745GMT, with the release of Oct manufacturing, services and construction sentiment. At 0750GMT, French November flash PMI data is released. At 0800GMT, German Chancellor Angela Merkel gives a budget speech in the German parliament. More flash PMI data from 0820GMT, with the release of German data, with EMU flash data expected at 0850GMT. Further EMU data is up from 1000GMT, with the release of the EMU Sep industrial orders data. European speakers are up from 1100GMT, with the ECB Vice President Vitor Constancio lecturing on the International Monetary System, in London. At 1130GMT, the European Commission adopts new economic governance proposals, presents a green paper on Eurobonds, and presents 2012 Annual Growth Survey. UK data starts at 0930GMT, with the release of the October BBA banking data and the UK BOE minutes. The BOE voted for unchanged policy at this month's meet and the vote was likely to have been unanimous, However, many members are appearing to up their calls for further QE and many will be looking from hints in the minutes of any future timing.

Asian stocks rose as Moody’s Investors Service and Standard & Poor’s affirmed the U.S.’s credit ratings even after a deficit-cutting committee failed to reach an agreement. Japan’s exporters gained as the yen weakened against the dollar. The U.S. deficit-cutting congressional committee said that it failed to reach an agreement, setting the stage for automatic spending cuts in 2013 and fueling concern that economic-stimulus measures that are set to expire will not be renewed. Losses in stocks were limited as Standard & Poor’s and Moody’s Investors Service said they won’t lower credit ratings on the U.S. due to the committee’s failure. S&P, which stripped the U.S. of its top AAA grade in August, said the political gridlock didn’t merit another downgrade because the inaction will trigger $1.2 trillion in automatic spending cuts.

Japan’s Nikkei 225 Stock Average fell 0.4 percent and Hong Kong’s Hang Seng Index added 0.1 percent. Australia’s S&P/ASX 200 slid 0.7 percent, while South Korea’s Kospi Index added 0.3 percent.

HSBC Holdings Plc, Europe’s biggest bank, fell 0.8 percent in Hong Kong, leading declines among companies which receive revenue from the region. Esprit Holdings Ltd., a clothier, dropped 3.2 percent to HK$8.38.

Some Japanese exporters rebounded from multi-year lows as the yen weakened against the dollar and euro, easing concern about their earnings outlook. Sony rose 3.1 percent to 1,305 yen after closing yesterday at the lowest level since 1987. Toyota edged up 0.1 percent to 2,387 yen after touching its lowest intraday level since 1996 today.

Tokyo Stock Exchange Group will acquire Osaka Securities Exchange in a transaction that values the smaller bourse operator at $1.68 billion. The companies agreed to a purchase price of 480,000 yen for each Osaka Securities Exchange share, which will be acquired in a tender offer, according to a statement from the Osaka Securities Exchange distributed through the Tokyo Stock Exchange. Osaka Securities rose 4.6 percent to 440,500 yen.

OneSteel Ltd. slumped 11 percent to 83 Australian cents after Chief Executive Officer Geoff Plummer said yesterday he won’t rule out shutting the steelmaker’s main Whyalla steel plant in South Australia should the company fail to improve performance using other measures.

Fosun International Ltd., the biggest stakeholder in Focus Media Holding Ltd. according to Bloomberg data, dropped 6.5 percent to HK$4.16 in Hong Kong after Muddy Waters LLC recommended investors sell Focus Media shares.

Olympus Corp. surged 20 percent to 869 yen. An independent committee investigating inflated payments to advisers for acquisitions by the scandal-hit company said it has found no links to organized crime so far in its probe, according to a statement by the endoscope maker.

European stocks declined, extending their biggest drop in three weeks, as borrowing costs rose in the euro area, outweighing rating companies’ reaffirmation of America’s credit grades. The Stoxx 600 slumped the most yesterday since Nov. 1 amid signs U.S. lawmakers would fail to reach an agreement on budget cuts, increasing the likelihood that the country would face another credit downgrade. Banks sank as dollar funding costs and euro-area bond yields surged. S&P and Moody’s maintained their U.S. credit ratings even as Congress’s special debt-reduction committee failed to reach an agreement, setting the stage for $1.2 trillion in automatic spending cuts. Spain’s three-month borrowing costs more than doubled at auction today, sending two-year yields toward the highest level since 2003, while Belgium’s 10-year bond yields rose to more than 5 percent, adding to concern the euro crisis is spreading.

National benchmark indexes retreated in all of the 18 markets in western Europe. France’s CAC 40 Index slipped 0.8 percent, Germany’s DAX Index lost 1.2 percent and the U.K.’s FTSE 100 Index slipped 0.3 percent.

Dexia led a selloff in banks, tumbling 8.1 percent to 23.9 euro cents in Brussels. UniCredit SpA fell 4.2 percent to 70.05 euro cents in Milan, while BNP Paribas SA lost 4.9 percent to 25.53 euros in Paris.

Commerzbank dropped 15 percent to 1.15 euros after Reuters reported that Germany’s second-biggest lender may need about about 5 billion euros ($6.8 billion) in additional capital if the European Banking Authority toughens its requirements for lenders. The newswire cited unidentified people familiar with the bank’s own estimates.

Danske Bank A/S still advanced, rising 1.4 percent to 75 kroner after Cevian Capital AB, a Swedish investment company, bought a 5.02 percent stake in Denmark’s largest lender on behalf of itself and Carl Icahn.

Nokia dropped 8.8 percent to 4.19 euros as Pacific Crest Securities Ltd. said in a report that the Finnish phone maker shipped fewer devices running Windows Phone 7 than predicted, while sales for the company’s Lumia product were “disappointing.”

Thomas Cook Group Plc plunged 75 percent to 10.2 pence as Europe’s second-largest tour operator said it has held talks with banks on financing. The company agreed to relaxed loan conditions a month ago. Rival TUI Travel Plc slid 9.2 percent to 136.7 pence.

Pandora A/S jumped 10 percent to 55.05 kroner for the biggest jump on the Stoxx 600 after the Danish jewelry maker reported a third-quarter profit of 341 million kroner ($62 million), beating most analysts’ estimates.

Zodiac Aerospace rallied 4.6 percent to 55.29 euros after the maker of aeronautical equipment forecast about 20 percent growth in sales on a like-for-like basis in its first quarter, as the company supplies parts to new aircraft programs at Boeing Co. and Airbus SAS. Zodiac also plans to increase its dividend payment by 20 percent to 1.20 euro apiece.

British Land Co. rose 1.5 percent to 461 pence after Bank of America Corp. upgraded the U.K.’s second-largest REIT to “buy” from “neutral.” Separately, UBS AG cited British Land as the “most defensive of the U.K. majors.”

U.S. stocks fell, driving the Standard & Poor’s 500 Index to its longest slump in almost four months, as slower-than-estimated economic growth overshadowed signs the Federal Reserve may provide more stimulus. Stocks fell as revised Commerce Department figures showed that gross domestic product climbed at a 2 percent annual rate from July through September, less than projected and down from a 2.5 percent prior estimate. Equities briefly turned higher as some Fed officials said the central bank should consider easing policy further, according to minutes of their Nov. 1-2 meeting.

Benchmark gauges also rose earlier today after the International Monetary Fund revamped its credit-line program to encourage countries facing outside shocks to turn to the fund with few conditions attached, as European leaders fail to end their debt turmoil. Michael Meister, finance spokesman for German Chancellor Angela Merkel’s Christian Democratic party, said “we haven’t any new bazooka to pull out of the bag.”

Dow 11,493.72 -53.59 -0.46%, Nasdaq 2,521.28 -1.86 -0.07%, S&P 500 1,188.04 -4.94 -0.41%

Alcoa Inc. (AA) and Bank of America Corp. (BAC) slid at least 2.1 percent to pace losses in the Dow Jones Industrial Average.

Campbell Soup lost 5.3 percent to $31.84. The company reported fiscal first-quarter sales of $2.16 billion, trailing the average analyst estimate by 2.4 percent, according to Bloomberg data.

Zero-Coupon

Hewlett-Packard Co. slipped 0.8 percent to $26.65 after losing as much as 6 percent following profit forecasts that missed analysts’ estimates.

Gilead Sciences Inc. rose the most in the S&P 500, climbing 6.9 percent to $38.76. The world’s largest maker of HIV medicines was boosted to “outperform” from “Market Perform” at BMO Capital Markets, which said the company’s acquisition of Pharmasset Inc. “is a positive step toward longer-term sustainable growth.”

Medtronic Inc. climbed 4.5 percent, the most since Aug. 23, to $34.75. The world’s biggest maker of heart-rhythm devices reported second-quarter earnings that beat analysts’ expectations on rising international sales of cardiovascular and spinal products.

Netflix Inc. slipped 5.4 percent to $70.45, the lowest price since March 2010. The video-streaming and DVD subscription service agreed to sell $400 million in stock and convertible notes to bolster cash as it increases spending for online rights to films and TV shows. Wedbush Securities Inc. cut its 12-month price estimate to $45 a share, saying the move was probably “prompted by deteriorating performance and liquidity.”

Yesterday the euro gained versus the yen as appetite for safety declined amid speculation officials were tackling Europe’s sovereign-debt crisis. The 17-nation currency rose against the dollar after the International Monetary Fund revamped its credit-line program to help countries facing outside shocks. It fluctuated earlier as the U.S. economy grew less than estimated and ratings companies affirmed U.S. credit grades. The dollar remained lower after the Federal Reserve released minutes of its last meeting. Canada’s dollar climbed on a rise in oil, the nation’s biggest export.

Europe’s shared currency gained as European Commission President Jose Barroso said he expected the Italian government under Prime Minister Mario Monti to succeed in narrowing its budget deficit and bolstering the economy. Michel Barnier, the European Union’s financial-services chief, said he was putting finishing touches on a draft law on creditor writedowns at failing banks.

The Washington-based IMF said its new Precautionary and Liquidity Line can be tapped by countries with strong economies currently facing short-term liquidity needs. Countries with potential needs can also apply, it said.

The Dollar Index, which IntercontinentalExchange Inc. uses to track the greenback against the currencies of six major U.S. trading partners, retreated 0.3 percent to 78.170. The gauge, which is weighted 57.6 percent to movements in the euro.

U.S. gross domestic product grew at a 2 percent annual rate from July through September, less than projected and down from a 2.5 percent prior estimate, Commerce Department figures showed in Washington.

EUR/USD: yesterday the pair advanced.

GBP/USD: yesterday the pair showed new week’s low.

USD/JPY: yesterday the pair grown.

A full calendar Wednesday, with a slew of US data ahead of the Thanksgiving break. European data gets under way at 0700GMT, with the release of the German Sept construction orders data. A host of French data is released at 0745GMT, with the release of Oct manufacturing, services and construction sentiment. At 0750GMT, French November flash PMI data is released. At 0800GMT, German Chancellor Angela Merkel gives a budget speech in the German parliament. More flash PMI data from 0820GMT, with the release of German data, with EMU flash data expected at 0850GMT. Further EMU data is up from 1000GMT, with the release of the EMU Sep industrial orders data. European speakers are up from 1100GMT, with the ECB Vice President Vitor Constancio lecturing on the International Monetary System, in London. At 1130GMT, the European Commission adopts new economic governance proposals, presents a green paper on Eurobonds, and presents 2012 Annual Growth Survey. UK data starts at 0930GMT, with the release of the October BBA banking data and the UK BOE minutes. The BOE voted for unchanged policy at this month's meet and the vote was likely to have been unanimous, However, many members are appearing to up their calls for further QE and many will be looking from hints in the minutes of any future timing.

Resistance 3: Y77.90 (Nov 9-10 high)

Resistance 2: Y77.50 (Nov 15 high)

Resistance 1: Y77.30 (session high)

The current price: Y77.02

Support 1: Y76.85 (Nov 22 low)

Support 2: Y76.55 (Nov 18 low)

Support 3: Y75.30 (Oct 12 low)

Comments: the pair is on uptrend. In focus resistance Y77.30.

Resistance 3: Chf0.9300 (psychological level)

Resistance 2: Chf0.9225/35 (area of Nov 16-18 high)

Resistance 1: Chf0.9185 (Nov 22 high)

The current price: Chf0.9146

Support 1: Chf0.9125 (session low)

Support 2: Chf0.9085 (Nov 18 low)

Support 3: Chf0.9020 (76.4% FIBO Chf0.9235-Chf0.8950)

Comments: the pair is in a triangle. In focus resistance Chf0.9185.

Resistance 3 : $1.5805 (Nov 21 high)

Resistance 2 : $1.5735 (50.0% FIBO $1.5580-$1.5885)

Resistance 1 : $1.5690 (Nov 22 high)

The current price: $1.5611

Support 1 : $1.5600 (session low)

Support 2 : $1.5540 (Oct 12 low)

Support 3 : $1.5485 (76.4% FIBO $1.6160-$1.5270)

Comments: the pair is on downtrend. In focus support $1.5600.

Resistance 3: $1.3665 (61.8% FIBO $1.3810-$1.3422)

Resistance 2: $1.3615 (Nov 18 high)

Resistance 1: $1.3530 (session high)

The current price: $1.3458

Support 1 : $1.3420/30 (area of Nov 16-21 low)

Support 2 : $1.3400 (psychological level)

Support 3 : $1.3360 (Oct 7 low)

Comments: the pair is on downtrend. In focus support $1.3420.

Change % Change Last

Nikkei 225 8,315 -33.53 -0.40%

Hang Seng 18,252 +25.74 +0.14%

S&P/ASX 200 4,133 -30.03 -0.72%

Shanghai Composite 2,413 -2.50 -0.10%

FTSE 100 5,207 -15.78 -0.30%

CAC 40 2,871 -24.26 -0.84%

DAX 5,537 -68.61 -1.22%

Dow 11,493.72 -53.59 -0.46%

Nasdaq 2,521.28 -1.86 -0.07%

S&P 500 1,188.04 -4.94 -0.41%

10 Year Yield 1.94% -0.02 --

Oil $97.97 -0.04 -0.04%

Gold $1,700.10 -2.30 -0.14%

02:30 China HSBC Manufacturing PMI November 51.0

08:00 France Manufacturing PMI November 48.5 47.6

08:00 France Services PMI November 44.6 44.5

08:30 Germany Purchasing Manager Index Manufacturing November 49.1 48.4

08:30 Germany Purchasing Manager Index Services November 50.6 50.2

09:00 Eurozone Purchasing Manager Index Manufacturing November 47.1 46.6

09:00 Eurozone Purchasing Manager Index Services November 46.4 46.1

09:30 United Kingdom BBA Mortgage Approvals October 33.1K 32.3K

09:30 United Kingdom Bank of England Minutes

10:00 Eurozone Industrial New Orders s.a., m/m September +1.9% -2.4%

10:00 Eurozone Industrial New Orders, y/y September +6.2% +6.1%

13:30 U.S. Durable Goods Orders October -0.6% -0.9%

13:30 U.S. Durable Goods Orders ex Transportation October +1.7% +0.1%

13:30 U.S. Durable goods orders ex defense October -1.1%

13:30 U.S. Personal Income, m/m October +0.1% +0.3%

13:30 U.S. Personal spending October +0.6% +0.4%

13:30 U.S. PPI excluding food and energy, m/m October 0.0% +0.1%

13:30 U.S. PPI excluding food and energy, Y/Y October +1.6%

13:30 U.S. Initial Jobless Claims 388 387

13:55 U.S. Reuters/Michigan Consumer Sentiment Index (Final) November 64.2 64.1

15:30 U.S. EIA Crude Oil Stocks change -1.1

17:40 Canada BOC Gov Carney Speaks

21:45 New Zealand Trade Balance October -751 -454

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.