- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 24-11-2011

Euro zone must solve problems with structural reforms

No member should leave euro zone

Sees enough political will to preserve euro

Stability bonds could be contribution in fiscal union

No doubts about balanced budget target for 2013

Oil rose from the lowest price in two weeks after a surprise drop in U.S. stockpiles, and as an unexpected advance in German business confidence countered concern that Europe’s debt crisis will threaten growth.

New York futures gained as much as 0.7 percent after earlier swinging between gains and losses. Crude inventories declined last week to the lowest since January 2010, according to an Energy Department report yesterday. German business confidence unexpectedly rose for the first time in five months in November.

Crude for January delivery rose as much as 71 cents to $96.88 a barrel in electronic trading on the New York Mercantile Exchange. It was at $96.64 at 11:33 a.m. London time. The contract earlier lost as much 53 cents. Prices have gained 5.8 percent this year.

Floor trading is closed today for the U.S. Thanksgiving holiday and electronic transactions will be booked with tomorrow’s trades for settlement purposes.

Brent oil for January settlement on the London-based ICE Futures Europe exchange was at $107.74 a barrel, up 72 cents. The European benchmark crude was at a premium of $11.10 to New York-traded West Texas contracts. The spread reached a record $27.88 on Oct. 14.

Today gold is trading in a narrow range, somewhat recovered after falling to month lows earlier this week.

The dollar index fell by 0.13% to a basket of currencies at a reduced volume of trading due to the celebration of Thanksgiving Day in the U.S.

Investors watch the meeting in Strasbourg, German Chancellor Angela Merkel, French President Nicolas Sarkozy and Italian Prime Minister, Mario Monti, to assess in which direction the euro area. Observers expect that Sarkozy will be able to convince Merkel is not willing to give the European Central Bank greater freedom of action to combat the debt crisis in the eurozone. But judging by recent statements by the heads of France and Germany, their positions remained unchanged, and Germany is still against Eurobonds and empowerment ECB.

Will do everything we can to defend Euro

But situation is not easy

Need EFSF leverage guidelines swiftly

Still oppose Eurobonds

ECB only responsible for mon pol

Not seeking treaty change on ECB role

Proposals for treaty change before December 9

EUR/USD $1.3400, $1.3450, $1.3470, $1.3500

USD/JPY Y76.80, Y77.00, Y77.10, Y77.15, Y77.40, Y77.50, Y77.70

AUD/USD $0.9600, $0.9750, $0.9775, $0.9800, $0.9900, $0.9955

EUR/CHF Chf1.2500

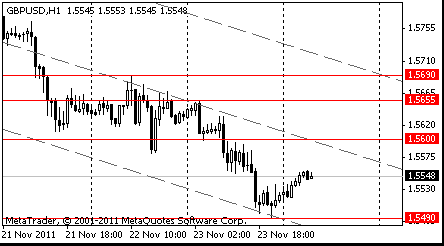

GBP/USD $1.5605

Through here opens a deeper move towards bids at $1.5465/60. Rate bounces back to $1.5499 at typing.

France,Germany to propose changes in treaty

Confidence in ECB and its directors

W/Germany must not make demands on ECB

Convinced Monti can deal with situation in Italy

- Sees Portugal 2012 GDP falling 3%

- Cites Portugal high debt,large fiscal imbalances

- Portugal could be further downgraded if growth disappoints

Data:

07:00 Germany GDP (Q3) revised 0.5%

07:00 Germany GDP (Q3) revised Y/Y 2.6%

09:00 Germany IFO business climate index (November) 106.6

09:30 UK GDP (Q3) revised 0.5%

09:30 UK GDP (Q3) revised Y/Y 0.5%

The euro strengthened from a seven- week low against the dollar as German reports showed business confidence improved and economic growth accelerated even with Europe’s worsening debt crisis.

The Munich-based Ifo institute said its business climate index increased to 106.6 this month from 106.4 in October.

The euro also advanced versus the pound amid signs Germany is softening its opposition to allowing issuance of common euro-area bonds.

Yesterday Germany received insufficient bids at a bond auction, fueling concern that Europe’s sovereign-debt crisis is driving away investors from the region’s assets.

German newspaper editorials and opposition politicians stepped up bids for Chancellor Angela Merkel to shift from an incremental approach after the government sold 35 percent less bonds than its maximum target at yesterday’s auction. Bild newspaper reported Merkel’s coalition is concerned it may have to agree to euro bonds under certain conditions.

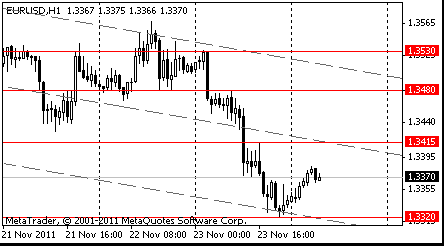

EUR/USD: during european session the pair was trading in $1.3350-$ 1.3410 area.

GBP/USD: during european session the pair was trading in $1.5500-$ 1.5570 area.

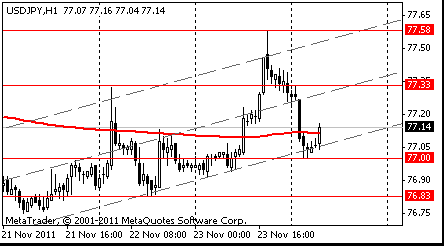

USD/JPY: during european session the pair was trading in Y77.00-Y77.20 area.

Resistance 3: Y77.90 (Nov 9 high)

Resistance 2: Y77.60 (Nov 23 high)

Resistance 1: Y77.20 (high of european session)

Current price: Y77.05

Support 1:Y77.00 (session low, МА (200) for Н1)

Support 2:Y76.80 (Nov 22 low)

Support 3:Y76.55 (Nov 18 low)

Resistance 3: Chf0.9300/10 (area of high of October)

Resistance 2: Chf0.9230 (Nov 17 high)

Resistance 1: Chf0.9200/10 (session high)

Current price: Chf0.9166

Support 1: Chf0.9160 (session low, МА (200) for Н1, support line from Nov 22 low)

Support 2: Chf0.9130 (Nov 23 low)

Support 3: Chf0.9090 (50,0 % FIBO Chf0,8950-Chf0,9230)

Resistance 3: $ 1.5690 (50,0 % FIBO $1,5890-$ 1,5490, the top border of down channel from Nov 14, Nov 22 high)

Resistance 2: $ 1.5640 (38,2 % FIBO $1,5890-$ 1,5490)

Resistance 1: $ 1.5570 (session high)

Current price: $1.5553

Support 1 : $1.5490 (Oct 23 low)

Support 2 : $1.5440 (the bottom border of down channel from Nov 14)

Support 3 : $1.5380 (support line from May’2010)

Resistance 3: $ 1.3475 (61.8 % FIBO $1.3570-$ 1.3320)

Resistance 2: $ 1.3440 (50.0 % FIBO $1.3570-$ 1.3320)

Resistance 1: $ 1.3421 (session high, 38.2 % FIBO $1.3570-$ 1.3320)

Current price: $1.3385

Support 1 : $1.3350 (low of european session)

Support 2 : $1.3320 (Nov 23 low)

Support 3 : $1.3240 (Oct 6 low)

EUR/USD $1.3400, $1.3450, $1.3470, $1.3500

USD/JPY Y76.80, Y77.00, Y77.10, Y77.15, Y77.40, Y77.50, Y77.70AUD/USD $0.9600, $0.9750, $0.9775, $0.9800, $0.9900, $0.9955

EUR/CHF Chf1.2500

GBP/USD $1.5605

QE funds should enable banks to make additional lending

Right to see current inflation as temporary

Eurozone crisis has impacted UK corporate funding costs

UK banks remain in relative strong position

however, banks could could suffer funding difficulties due EZ

Good that UK can still borrow in market at low interest rates

QE funds should enable banks to make additional lending

Right to see current inflation as temporary

Eurozone crisis has impacted UK corporate funding costs

UK banks remain in relative strong position

however, banks could could suffer funding difficulties due EZ

Good that UK can still borrow in market at low interest rates

Nikkei 225 8,165 -149.56 -1.80%

Hang Seng 17,935 +70.67 +0.40%

S&P/ASX 4,044 -6.81 -0.17%

Shanghai Composite 2,398 +2.49 +0.10%

The yen rose against most of its 16 major counterparts before a German report forecast to show a gauge of business confidence dropped for a fifth month, increasing the allure of the Japanese currency as a haven.

The yen briefly pared gains after Standard & Poor’s said Japan’s lack of progress in tackling its public debt burden risks a credit rating downgrade.

The U.S. dollar dropped against the euro as speculation increased that the greenback’s 1.2 percent jump yesterday was excessive.

The Ifo institute’s business climate index for Germany dropped to 105.2 in November, the lowest since March 2010, according to the median forecast of economists in a Bloomberg News survey. The Munich-based group will release the data today.

U.S. financial markets will be closed today for the national holiday.

British pound rose. Bank of England policy maker David Miles said there’s a risk a country may leave the 17-nation euro area and that the threat from the region’s crisis has increased uncertainty about the outlook for the U.K. economy.

“I don’t think any of us can feel confident one way or another about whether all the countries that are currently in the euro zone will still be in it,” Miles said in an interview on ITV broadcast late yesterday.The Office for National Statistics will publish the GDP data at 9:30 a.m. in London. The median of 32 economists in a Bloomberg News survey is for a 0.5 percent increase, unchanged from an estimate published on Nov. 1.

EUR/USD: on Asian session the pair restored.

GBP/USD: on Asian session the pair gain.

USD/JPY: on Asian session the pair fell.

US markets are closed Thursday, as the nation enjoys the annual Thanksgiving Day holiday. However, Europe provides a full calendar for the day.At 0815/0530 European Commission President Jose Barroso gives a speech at a conference, in Brussels, with observers looking for any expansion of the previous day's euro bond comments. Data starts at 0900GMT, Germany's November IFO business survey is released, along with Italian November ISTAT consumer survey. At 0930GMT, Bundesbank Board member Rudolf Boehmler gives a speak on the debt crisis, in Hohenheim, Germany. The main event for the day is likely to be the summit when French President Nicolas Sarkozy meets German Chancellor Angela Merkel and Italian Prime Minister Mario Monti, in Strasbourg. A press conference is provisionally slated for 1300GMT. UK data is slated for 0930GMT, with the release of Q3 GDP, Second Estimate and the Sep Index of Services.

Asian stocks fell, with a regional gauge heading for its lowest close in a month, as a mining tax was approved in Australia and reports showed the U.S. economy grew slower than expected and China’s manufacturing may have contracted.

Exporters fell after a revised Commerce Department report showed that U.S. gross domestic product climbed at a 2 percent annual rate from July through September, less than a 2.5 percent prior estimate. Some Fed officials said the central bank should consider easing monetary policy further, according to minutes of their Nov. 1-2 meeting.

Australia’s S&P/ASX 200 sank 2 percent, while Hong Kong’s Hang Seng Index dropped 2.1 percent and China’s Shanghai Composite Index fell 0.7 percent, erasing gains of as much as 0.3 percent. Japanese markets are closed today for a holiday.

Samsung Electronics, South Korea’s biggest exporter of consumer electronics, fell 2.9 percent to 935,000 won in Seoul on speculation exports will drop as growth in the world’s biggest economy slows. Li & Fung Ltd., a toy and clothing supplier that counts the U.S. as its largest market, slid 2.9 percent to HK$14.30 in Hong Kong. James Hardie Industries SE, a building materials supplier that gets about 68 percent of sales from the U.S., slipped 1.9 percent to A$6.38 in Sydney.

Australian raw material producers dropped as BHP Billiton, Rio Tinto Group and other iron-ore and coal suppliers face paying about A$11 billion ($10.8 billion) in extra charges in the first three years of the mining tax passed by the lower house of Australia’s parliament yesterday.

BHP Billiton dropped 3.1 percent to A$34.51. Rio Tinto, the world’s second-largest mining company by sales, fell 3.4 percent to A$62.30. OneSteel Ltd., Australia’s second-biggest producer of the metal, sank 7.2 percent to 77 Australian cents.

Chinese lenders declined after HSBC Holdings Plc and Markit Economics said a preliminary survey showed a Chinese manufacturing index may fall to 48 in November from 51 last month. A reading below 50 indicates a contraction.

Industrial & Commercial Bank of China Ltd., the nation’s largest lender, fell 2.8 percent after the report showing China’s manufacturing may have shrunk. China Construction Bank Corp., the country’s second-largest lender, lost 1.7 percent to HK$5.20.

European stocks declined, with the benchmark Stoxx Europe 600 Index posting its longest losing streak since August, as Germany failed to attract sufficient bids at an auction of benchmark 10-year bunds. Germany failed to reach its maximum sales target of 6 billion euros ($8 billion) at an auction of securities due in January 2022. Total bids amounted to 3.889 billion euros, falling short by 35 percent, according to data from the Bundesbank. The securities were sold at a yield of 1.98 percent.

The European Central Bank bought Italian government bonds, according to three people with knowledge of the transactions, who declined to be identified because the trades are confidential. A spokesman for the ECB in Frankfurt declined to comment today on asset purchases.

A preliminary reading of a euro-area composite index from a survey of purchasing managers in manufacturing and services rose to 47.2 in November from 46.5 in October, London-based Markit Economics said today.

National benchmark indexes fell in 17 of the 18 western- European markets. France’s CAC 40 Index slipped 1.7 percent. Germany’s DAX Index dropped 1.4 percent. The U.K.’s FTSE 100 Index slid 1.3 percent.

Logica fell 4.2 percent to 67.6 pence after the stock was cut to “underperform” from “hold” at Jefferies and Co.

Halfords Group Plc dropped 5.1 percent to 314.1 pence. The shares were cut to “sell” from “neutral” at UBS, which cited the company’s limited strategic options for growth.

Dexia jumped 13 percent to 26.9 euro cents. Luxembourg’s Finance Minister Luc Frieden said that talks about the government-backed funding of the remaining assets do not face “insurmountable difficulties.”

Tui Travel Plc, Europe’s largest tour operator, rallied 13 percent to 154 pence, its biggest advance since October 2008, as analysts said concern over the future of rival Thomas Cook Group Plc may present an opportunity to gain market share.

U.S. stocks slumped, sending the Standard & Poor’s 500 Index down for a sixth straight day, as the cost of insuring European government debt against default rose to a record on concern the region’s crisis is worsening.

The crisis that began more than two years ago now risks engulfing Germany. The Markit iTraxx SovX Western Europe Index of credit-default swaps on 15 governments rose to an all-time high today as Germany failed to find buyers for 35 percent of the bonds offered at an auction. German Finance Minister Wolfgang Schaeuble said market turbulence sparked by the euro region’s sovereign-debt crisis will last for “a few months.”

European services and manufacturing output shrank for a third month, while a preliminary gauge indicated China’s manufacturing contracted by the most since March 2009. Americans pulled back on spending in October and manufacturers received fewer orders for durable goods.

All 10 groups in the S&P 500 fell as commodity and financial shares had the biggest declines. A gauge of financial stocks in the S&P 500 fell for a third straight day. Goldman Sachs Group Inc. sank 1.7 percent to $87.89, the lowest level since March 2009. American International Group Inc. dropped 4.3 percent to $20.10.

The Fed imposed a tougher capital test on the 31 largest U.S. banks yesterday, releasing the criteria for measuring their wherewithal if the U.S. economy sours and major trading partners default on their debt.

Bank of America (BAC) Corp. dropped 4.3 percent to the lowest since March 2009, the most in the Dow, to $5.14, while Citigroup Inc. decreased 3.9 percent to $23.51. Both are among lenders that may have to temper plans to raise dividends and buy back stock next year as the Federal Reserve toughens capital tests for the biggest U.S. banks.

Commodity shares in the S&P 500 fell at least 2.7 percent. JPMorgan Chase & Co. downgraded commodities to “underweight,” citing policy failures in the U.S. and Europe. Alcoa Inc. (AA) and Halliburton Co. tumbled at least 4.1 percent as data indicated China manufacturing will shrink, sparking concern about slower demand for commodities. U.S. Steel Corp. erased 7.6 percent to $22.41.

Groupon Inc., the largest Internet daily-deal site, plunged 16 percent to below its initial public offering price. The stock was dragged down on concern that profit margins will be squeezed by surging marketing costs and competition from rivals such as LivingSocial.com, backed by Amazon.com Inc. Signs that Europe’s credit crisis may be worsening also fueled speculation that Groupon’s international operations will suffer.

Walgreen Co. rose 4.4 percent, the most in the S&P 500, to $32.09, on speculation it resolved a dispute with Express Scripts Inc. that could preserve more than $5 billion in annual drug sales for the retailer. Walgreen’s contract to provide prescriptions for Express Scripts’ customers expires at the end of the year.

Deere & Co. rallied 3.9 percent to $74.72. The largest farm-equipment maker reported fiscal fourth-quarter profit and forecast 2012 earnings that topped analysts’ estimates as U.S. farmers flush with cash buy more tractors and combines.

Boston Scientific Corp. rose 0.2 percent after gaining U.S. approval for a new version of its drug-coated heart stent. The second-biggest heart-device maker by revenue will immediately begin manufacturing and selling the Promus Element stent system, the Natick, Massachusetts-based company said in a statement late yesterday.

Yesterday the euro fell to a six-week low against the dollar after Germany received insufficient bids at a debt auction, adding to concern Europe’s sovereign-debt crisis is driving away investors from the region’s assets. Germany missed its 6 billion-euro ($8 billion) maximum sales target at a 10-year bond auction today by 35 percent, prompting investors to question the status of the securities as a haven from the region’s debt crisis. The bunds drew a yield of 1.98 percent.

A composite index based on a survey of purchasing managers in European manufacturing and services rose to 47.2 from 46.5 in October, Markit Economics said in an initial estimate, suggesting the sovereign-debt crisis is starting to affect economic growth in the region’s core nations.

The dollar rose versus all of its 16 most-traded peers as a gauge of European services and manufacturing output shrank and data signaled China’s manufacturing will tumble. The HSBC Flash Manufacturing PMI for China, Australia’s biggest trading partner, fell to 48 this month, predicting the biggest contraction since March 2009. That compares with a final reading of 51 in October.

The pound declined 0.7 percent to $1.5522, after being as low as $1.5511, the least since Oct. 7. It fell for a third day after minutes of the central bank’s rate-setting meeting this month showed increased support for additional stimulus. Bank of England policy makers at the meeting unanimously kept the target for asset purchases at 275 billion pounds, after raising it by 75 billion pounds in October, the minutes showed.

EUR/USD: yesterday the pair has lost two figures.

GBP/USD: yesterday the pair has lost a figure.

USD/JPY: yesterday the pair has grown, updated a week’s high.

US markets are closed Thursday, as the nation enjoys the annual Thanksgiving Day holiday. However, Europe provides a full calendar for the day.At 0815/0530 European Commission President Jose Barroso gives a speech at a conference, in Brussels, with observers looking for any expansion of the previous day's euro bond comments. Data starts at 0900GMT, Germany's November IFO business survey is released, along with Italian November ISTAT consumer survey. At 0930GMT, Bundesbank Board member Rudolf Boehmler gives a speak on the debt crisis, in Hohenheim, Germany. The main event for the day is likely to be the summit when French President Nicolas Sarkozy meets German Chancellor Angela Merkel and Italian Prime Minister Mario Monti, in Strasbourg. A press conference is provisionally slated for 1300GMT. UK data is slated for 0930GMT, with the release of Q3 GDP, Second Estimate and the Sep Index of Services.

Resistance 3: Y77.90 (Nov 9-10 high)

Resistance 2: Y77.60 (Nov 23 high)

Resistance 1: Y77.30 (session high)

The current price: Y77.14

Support 1: Y77.00 (session low)

Support 2: Y76.85 (Nov 22 low)

Support 3: Y76.55 (Nov 18 low)

Comments: the pair is corrected but remains in uptrend. In focus support Y77.00.

Resistance 3: Chf0.9285 (Oct 7 high)

Resistance 2: Chf0.9235 (Nov 17 high)

Resistance 1: Chf0.9210 (Nov 23 high)

The current price: Chf0.9193

Support 1: Chf0.9180 (session low)

Support 2: Chf0.9155 (support line from Nov 22)

Support 3: Chf0.9125 (Nov 23 low)

Comments: the pair is on uptrend. In focus resistance Chf0.9210.

Resistance 3 : $1.5690 (Nov 22 high)

Resistance 2 : $1.5655 (Nov 23 high)

Resistance 1 : $1.5600 (high of the American session on Nov 23)

The current price: $1.5548

Support 1 : $1.5490 (session low)

Support 2 : $1.5420 (Oct 7 low)

Support 3 : $1.5340 (Oct 4 low)

Comments: the pair is corrected but remains in downtrend. In focus resistance $1.5600.

Resistance 3: $1.3530 (Nov 23 high)

Resistance 2: $1.3480 (high of the European session on Nov 23)

Resistance 1: $1.3415 (high of the American session on Nov 23)

The current price: $1.3370

Support 1 : $1.3320 (Nov 23 high)

Support 2 : $1.3240 (Oct 6 low)

Support 3 : $1.3145 (Oct 4 low)

Comments: the pair is corrected but remains in downtrend. In focus resistance $1.3415.

Change % Change Last

Nikkei 225 8,315 -33.53 -0.40%

Hang Seng 17,864 -387.16 -2.12%

S&P/ASX 200 4,051 -81.98 -1.98%

Shanghai Composite 2,395 -17.56 -0.73%

FTSE 100 5,140 -67.04 -1.29%

CAC 40 2,822 -48.25 -1.68%

DAX 5,458 -79.62 -1.44%

Dow 11,259.37 -234.35 -2.04%

Nasdaq 2,460.08 -61.20 -2.43%

S&P 500 1,161.81 -26.23 -2.21%

10 Year Yield 1.88% -0.06 --

Oil $96.28 +0.11 +0.11%

Gold $1,694.60 -1.30 -0.08%

00:00 U.S. Thanksgiving Day

07:00 Germany GDP (QoQ) Quarter III +0.5% +0.5%

07:00 Germany GDP (wda) (YoY) Quarter III +2.5% +2.5%

09:00 Germany IFO - Business Climate November 106.4 105.5

09:00 Germany IFO - Current Assessment November 116.7 115.0

09:00 Germany IFO - Expectations November 97.0 96.0

09:30 United Kingdom GDP revised m/m Quarter III +0.5% +0.5%

09:30 United Kingdom GDP revised Y/Y Quarter III +0.5% +0.5%

11:00 United Kingdom CBI industrial order books balance November -18 -19

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.