- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 29-11-2011

The euro dropped versus the majority of its most-traded counterparts amid speculation Europe’s effort to expand its bailout fund to 1 trillion euros ($1.3 trillion) is falling short. The 17-nation currency pared gains versus the dollar after the European Central Bank failed to offset the extra liquidity created by its bond purchase program. Euro-area finance ministers are meeting today. Europe’s efforts to expand its rescue fund are flagging, forcing renewed consideration of a role for the ECB in insulating Spain and Italy from the debt crisis, two officials familiar with the discussions said. Finance ministers will have an initial discussion today on channeling ECB loans to cash-strapped euro nations through the International Monetary Fund, aiming to bring the central bank onto the front lines without violating its ban on direct lending to governments, said the people, who declined to be identified because the talks are at an early stage.

Australia’s dollar was the biggest winners versus the greenback as investors sought higher-yielding assets. Australia’s dollar rallied for a second day against the greenback, rising as much as 1.8 percent before trading at $1.0008, up 1 percent. It fell for the past four weeks. The Aussie pared its drop for November to 4.8 percent. The Aussie was the best performer against the U.S. dollar yesterday among the most-traded currencies, rising 2 percent as equities rallied worldwide.

Americans were less pessimistic on the outlook for jobs and wages this month, a report showed. The Conference Board’s index increased to 56 from a revised 40.9 reading in October in the biggest monthly gain since April 2003, figures from the New York-based private research group showed today. The Dollar Index, which IntercontinentalExchange Inc. uses to track the greenback against the currencies of six major U.S. trading partners, was down 0.3 percent to 78.985 after earlier dropping as much as 0.9 percent.

European stocks advanced for a third day as euro-area finance ministers met to discuss insuring a portion of bonds issued by debt-stricken countries and U.S. consumer confidence unexpectedly rose in November.

Finance ministers from the 17-member monetary union met in Brussels to debate using their bailout fund, the European (SXXP) Financial Stability Facility, to insure sovereign debt with guarantees. Italian 10-year bonds fell, pushing yields for the benchmark securities toward euro-era records as the country sold 7.5 billion euros ($10 billion) of debt maturing in 2014, 2020 and 2022.

National benchmark indexes rose in 14 of the 18 western- European markets. France’s CAC 40 Index and the U.K.’s FTSE 100 Index climbed 0.5 percent, while Germany’s DAX Index advanced 1 percent.

BASF, the world’s largest chemical company, climbed 2.1 percent to 50.56 euros after the company raised its sales target for the end of this decade as Chief Executive Officer Kurt Bock laid out his strategy after seven months in charge.

K+S, Europe’s biggest potash supplier, increased 3 percent to 39.46 euros. The company will develop a Canadian mineral deposit that it acquired this year.

G4S Plc, the world’s largest security company, rose 3.2 percent to 246.8 pence after Alex Magni, an analyst at HSBC Holdings Plc upgraded the stock to “overweight” from “neutral.”

Remy Cointreau SA, the maker of Remy Martin cognac, climbed 2.9 percent to 61.90 euros after the company forecast (RCO) “a substantial increase” in full-year earnings. Remy Cointreau also posted first-half current operating profit that jumped 27 percent to 106.2 million euros, topping analysts’ estimates.

Oriflame Cosmetics SA, the Swedish maker of cosmetics, surged 7 percent to 207.70 kronor after Svenska Handelsbanken AB raised the company’s shares to “buy” from “accumulate.”

Colruyt plunged 8 percent to 27.22 euros after reporting a steeper-than-estimated drop in fiscal first-half profit as its expansion in France turned unprofitable because of price cuts and accelerated store openings. The company said its forecast (COLR) for full-year profit close to last year’s 338 million euros “remains a challenge.”

Transocean Ltd., the world’s largest offshore oil driller, slumped 8.7 percent to 39.20 Swiss francs after announcing it will sell shares to help refinance its acquisition of Aker Drilling ASA.

Sees possible fiscal, hsg, EZ drags ahead but baseline est is "the U.S. economy will continue to grow at a moderate pace in 2012. Unemployment will come down slowly. Inflation will stay in acceptable bounds." Says currently, "my notion of "appropriate monetary policy" is one of holding steady the current policy rate (federal funds rate) of zero to 25 basis points and the balance sheet steady at current scale."

U.S. stocks rose, following the biggest gain in a month for the Standard & Poor’s 500 Index, as the largest increase since 2003 in a gauge of consumer confidence bolstered optimism in the American economy.

Stocks extended gains as the Conference Board’s index increased to 56 from a revised 40.9 reading in October.

Europe’s effort to expand its bailout fund to 1 trillion euros ($1.3 trillion) is falling short, forcing renewed consideration of a role for the European Central Bank in insulating Spain and Italy from the debt crisis, two officials familiar with the discussions said.

Finance ministers will tonight hold an initial discussion on channeling ECB loans to cash-strapped euro nations through the International Monetary Fund, aiming to bring the central bank onto the front lines without violating its ban on direct lending to governments, said the people, who declined to be identified because the talks are at an early stage.

Dow 11,609.78 +86.77 +0.75%, Nasdaq 2,527.63 +0.29 +0.01%, S&P 500 1,201.46 +8.91 +0.75%

Yahoo! Inc. climbed 2.8 percent as two people with knowledge of the matter said private-equity firm Thomas H. Lee Partners is considering a bid for the Internet company.

Hewlett-Packard Co. (HPQ) gained 2.9 percent after RBC Capital Markets raised its recommendation for the computer maker’s shares.

Seagate Technology Plc jumped 3.6 percent to $16.56. The company forecast higher sales than analysts had estimated, saying it withstood flooding in Thailand better than much of the disk-drive industry.

Research In Motion Ltd. (RIM) rose 6.6 percent to $17.57. The BlackBerry maker was raised to “market perform” from “underperform” at Stanford C. Bernstein & Co., which said shareholder activism may lead to management change or a takeover.

Tiffany & Co. tumbled 8.5 percent to $67.38. The world’s second-largest luxury jewelry retailer cited “weaknesses” in sales in Europe and the eastern U.S. as the holiday season began.

Gold prices are stable after a strong growth on Monday by nearly 2%, while gold rose in price in the framework of general optimism in global financial markets on hopes for the imminent debt problems in the eurozone.

Stocks ETF backed by gold funds last week rose to a record 69.993 million ounces, adding just over 2.2 million ounces per month, which indicates the high investor demand for assets, alternative currencies, stocks and bonds.

Experts note that prices are unlikely to update the historical high this year, as trading activity is reduced before the New Year, when traders try to take profits and step aside.

In September, prices reached a historical high of $ 1.920,30 per ounce and has since declined to 10.7%. From the beginning, gold has risen in price by more than 20%.

Today, December gold futures on the Comex in New York is kept in the range 1704 - 1718 dollars per troy ounce.

US unemployment to remain painfully high for many yrs, deterioration in fin'l conds intensify headwinds.

There's a strong case for more US hsg policies to spur demand.

Crude oil climbed for a second day in New York after U.S. consumer confidence increased in November by the most in more than eight years.

The Conference Board’s index rose to 56 from a revised 40.9 reading in October as Americans grew more upbeat about employment and income prospects. It was the biggest monthly gain since April 2003, figures from the New York-based private research group showed today.

Crude oil for January delivery climbed to $99.79 and dropped as low as $97.23 during the session. Prices are up 8.8 percent this year.

Brent oil for January settlement climbed $1.67, or 1.5 percent, to $110.67 a barrel on the London-based ICE Futures Europe Exchange.

American Airlines parent AMR Corp. filed for bankruptcy after failing to secure cost-cutting labor agreements and sitting out a round of mergers that dropped it from the world’s largest airline to No. 3 in the U.S.

With the filing, American became the final large U.S. full- fare airline to seek court protection from creditors. The Fort Worth, Texas-based company, which traces its roots to 1920s air- mail operations in the Midwest, listed $24.7 billion in assets and $29.6 billion in debt in Chapter 11 papers filed today in U.S. Bankruptcy Court in Manhattan. Chairman Gerard Arpey will retire and be replaced by Thomas Horton, AMR said.

Resistance 3:1223 (61,8 % FIBO 1270-1147)

Resistance 2:1215 (border of upchannel from Nov 28, close price of Nov 18)

Resistance 1:1206/09 (session high, 50,0 % FIBO 1270-1147, Nov 21 high)

The current price: 1201,00

Support 1 : 1193 (the bottom border of upchannel from Nov 28)

Support 2 : 1186 (session low)

Support 3 : 1170 (weekly low)

Offers $1.5770, $1.5740/50, $1.5710, $1.5690/700, $1.5660

Bids $1.5580/70, $1.5565/60, $1.5540, $1.5520/10, $1.5465/60, $1.5450, $1.5425/20

EUR/USD $1.3300, $1.3320, $1.3390, $1.3500, $1.3575, $1.3600

USD/JPY Y77.10, Y77.45, Y77.50, Y77.65, Y78.00AUD/USD $1.0000, $0.9875, $0.9830, $0.9750

EUR/CHF Chf1.2600

EUR/GBP stg0.8560

USD/CAD C$1.0250, C$1.0235

Hewlett-Packard (HPQ) was upgraded to Outperform from Sector Perform at RBC Capital.

U.S. stock futures rose as demand increased at Italy’s debt sale and finance ministers meet to discuss the credit crisis.

Hang Seng 18,256 +218.39 +1.21%

Shanghai Composite 2,412 +29.36 +1.23%

FTSE 5,294 -18.73 -0.35%

CAC 3,005 -7.51 -0.25%

DAX 5,746 +0.78 +0.01%

Crude oil: $98.73 (+0,5%).

Gold|: $1708,30 (+0,2%).

Offers $1.3480/85, $1.3450, $1.3415/20, $1.3400

Bids $1.3300, $1.3280/70, $1.3250, $1.3210/00

Data:

07:00 UK Nationwide house price index (November) 0.4%

07:00 UK Nationwide house price index (November) Y/Y 1.6%

09:30 UK M4 money supply (October) final -0.3%

09:30 UK M4 money supply (October) final Y/Y -2.7%

09:30 UK Consumer credit (October), bln 0.0

10:00 EU(17) Economic sentiment index (November) 93.7

10:00 EU(17) Business climate indicator (November) -0.44

The euro rose sharply against the dollar on Tuesday, boosted by relief among investors that Italy managed to sell government bonds to the market even though it was forced to pay record high auction yields.

Traders said speculation of good demand at the auction started to drive the euro higher ahead of the results, while buying by hedge funds also drove the single currency higher.

Italy sold 7.5 billion euros of three- and 10-year government bonds, close to the upper end of its target range.

EUR/USD: the pair has shown high in $1.3440 area, but later has fallen in $1,3340 area.

GBP/USD: the pair has grown above $1.5600.

USD/JPY: the pair has fallen in Y77.80 area.

At 1500GMT, the FHFA Home Price Index is due at the same time as the index of consumer confidence is forecast to rebound to a reading of 44.4 in November after plunging in October to a reading of 39.8. The Michigan Sentiment index rose solidly in November. This is followed at 1530GMT by the Dallas Fed Services Outlook Survey. At 1630GMT, Fed Vice Chair Janet Yellen makes remarks on the global recovery at the San Francisco Fed's Asia Economic Policy Conference in San Francisco. At 0100GMT Wednesday (8pm Eastern), Minneapolis Fed President Narayana Kocherlakota delivers a speech on monetary policy to the Stanford Institute for Economic Policy Research in Stanford.

- OBR cuts UK 2011 GDP to 0.9% vs 1.7%;

- OBR cuts 2012 GDP to 0.7% vs 2.5%;

- OBR cuts 2013 GDP to 2.1% vs 2.9%;

- OBR cuts 2014 GDP to 2.7% vs 2.9%.

- OBR cuts UK 2011 GDP to 0.9% vs 1.7%;

- OBR cuts 2012 GDP to 0.7% vs 2.5%;

- OBR cuts 2013 GDP to 2.1% vs 2.9%;

- OBR cuts 2014 GDP to 2.7% vs 2.9%.

Resistance 2: Chf0.9300/10 (area of Nov 28 high)

Resistance 2: Chf0.9240 (session high)

Resistance 1: Chf0.9180 (area of Nov 28 low)

Current price: Chf0.9175

Support 1: Chf0.9140 (session low)

Support 2: Chf0.9100 (resistance line from Nov 9)

Support 3: Chf0.9080 (Nov 18 low)

Resistance 3: $ 1.5710 (61,8 % FIBO $1,5890-$ 1.5420)

Resistance 2: $ 1.5690 (Nov 22 high)

Resistance 1: $ 1.5650 (session high, 50,0 % FIBO of falling $1,5890-$ 1.5420)

Current price: $1.5629

Support 1 : $1.5590 (Nov 28 high)

Support 2 : $1.5550 (resistance line from Nov 14)

Support 3 : $1.5460 (area of session low and Nov 28 low)

Resistance 3: $ 1.3600/10 (Nov 18 high, 38.2 % FIBO $1,4240-$ 1,3210)

Resistance 2: $ 1.3570 (Nov 22 high)

Resistance 1: $ 1.3440 (session high)

Current price: $1.3392

Support 1 : $1.3375 (high of asian session)

Support 2 : $1.3215 (low of european session)

Support 3 : $1.3270 (Nov 28 low)

Sold E3.5bn new 6% 2014 BTP;avg yield 7.89% (4.93%), cover 1.5 (1.35).

Sold E2.5bn 5.00% 2022 BTP;avg yield 7.56% (6.02%), cover 1.34 (1.27).

Sold E1.5bn 4.00% 2020 BTP;avg yield 7.28% (5.47%), cover 1.54 (1.49).

EUR/USD $1.3300, $1.3320, $1.3390, $1.3500, $1.3575, $1.3600

USD/JPY Y77.10, Y77.45, Y77.50, Y77.65, Y78.00AUD/USD $1.0000, $0.9875, $0.9830, $0.9750

EUR/CHF Chf1.2600

EUR/GBP stg0.8560

USD/CAD C$1.0250, C$1.0235

Nikkei 225 8,478 +190.33 +2.30%

Hang Seng 18,256 +218.39 +1.21%

S&P/ASX 4,102 +43.90 +1.08%

Shanghai Composite 2,412 +29.36 +1.23%

The dollar dropped after U.S. lost its last stable outlook from the three biggest credit-ranking companies after Fitch Ratings lowered the nation to negative following a congressional committee’s failure to agree on deficit cuts.

Fitch’s outlook on the U.S., which it still assigns its top AAA grade, reflects “declining confidence that timely fiscal measures necessary to place U.S. public finances on a sustainable path will be forthcoming,” making the probability of a downgrade greater than 50 percent over two years, the company said yesterday in a statement. Standard & Poor’s and Moody’s Investors Service said Nov. 21 that the so-called supercommittee’s inability to reach an agreement didn’t merit downgrades because the inaction will trigger $1.2 trillion in automatic spending cuts.

The Australian and New Zealand dollars rose toward the highest in a week before euro-area officials meet in Brussels amid optimism leaders are working to fast-track a solution to the region’s debt crisis.

The so-called Aussie gained for a fourth day against the yen as Asian stocks extended a global rally, boosting demand for higher-yielding assets. The currency earlier weakened after the government said it will cut spending by A$6.8 billion ($6.7 billion) to deliver a budget surplus, adding pressure on the Reserve Bank of Australia to lower interest rates. Fitch Ratings upgraded Australia’s long-term foreign- currency issuer default rating to AAA from AA+ before the release of the budget review. The nation now holds the top grade at all three main credit assessors for the first time.

EUR/USD: on Asian session the pair gain.

GBP/USD: on Asian session the pair gain.

USD/JPY: on Asian session the pair showed new week’s high, but receded later.

On Tuesday EMU data includes the 0900GMT release of both the business climate indicator and the economic sentiment survey for November. UK data starts at 0930GMT with the BOE Lending to Individuals, M4, Bankstats and Effective Rates data, while also in the UK today, the UK OBR forecast and Autumn statement from the Chancellor George Osborne are due with the UK Autumn Budget Statement at 1230GMT.US data starts at 1245GMT with the weekly ICSC-Goldman Store Sales data, which is followed at 1355GMT by the weekly Redbook Average and then at 1400GMT by the S&P/Case-Shiller Home Price Index. At 1500GMT, the FHFA Home Price Index is due at the same time as the index of consumer confidence is forecast to rebound to a reading of 44.4 in November after plunging in October to a reading of 39.8. The Michigan Sentiment index rose solidly in November. This is followed at 1530GMT by the Dallas Fed Services Outlook Survey. At 1630GMT, Fed Vice Chair Janet Yellen makes remarks on the global recovery at the San Francisco Fed's Asia Economic Policy Conference in San Francisco. At 0100GMT Wednesday (8pm Eastern), Minneapolis Fed President Narayana Kocherlakota delivers a speech on monetary policy to the Stanford Institute for Economic Policy Research in Stanford.

- Eurobonds not solution at moment

- Eurobonds only if have stability union

- but that won't be in the short term

- Oppose idea of issuing elite bonds

The euro rose in early U.S. session amid falling yields of government bonds from the Italian medium term and there were rumors that the IMF is preparing a preemptive bailout for Italy in the amount of 400-600 million euros. But then quickly followed by denials,including an official from the IMF. Negative background outweighed the sentiment and the euro fell. Thus, Moody's warned that the rapid development of the sovereign and banking crisis threatening the region's rankings of European government bonds. The Organization for Economic Cooperation and Development (OECD) said that France needed to take more stringent economic measures in order to achieve the goal of a budget deficit for 2012, as GDP growth may not reach projected levels due to the recession.

Investors are awaiting meeting of Ministers of the euro area, which may adopt the rules of the European Foundation for financial stability. Their approval would allow the fund to $ 440 billion euros to attract funds from investors.

The pound weakened versus higher- yielding peers after data showed U.K. house prices dropped last month and retail sales fell, and as the British Chambers of Commerce cut its economic-growth forecasts. Chancellor of the Exchequer George Osborne presents updated economic and fiscal forecasts to Parliament tomorrow amid speculation government growth estimates will be cut and budget shortfalls will be greater than predicted. The central bank said last week that the threat of the euro-area debt crisis on the U.K. economy has increased. Minutes of the central bank’s Nov. 9-10 meeting released on Nov. 23 showed some policy makers said an increase in stimulus may be needed to support the economy. The minutes also revealed the nine-member Monetary Policy Committee voted unanimously to keep its key interest rate at a record low of 0.5 percent.

EUR/USD: yesterday the pair advanced.

GBP/USD: yesterday the pair grew.

USD/JPY: yesterday the pair advanced.

On Tuesday EMU data includes the 0900GMT release of both the business climate indicator and the economic sentiment survey for November. UK data starts at 0930GMT with the BOE Lending to Individuals, M4, Bankstats and Effective Rates data, while also in the UK today, the UK OBR forecast and Autumn statement from the Chancellor George Osborne are due with the UK Autumn Budget Statement at 1230GMT.US data starts at 1245GMT with the weekly ICSC-Goldman Store Sales data, which is followed at 1355GMT by the weekly Redbook Average and then at 1400GMT by the S&P/Case-Shiller Home Price Index. At 1500GMT, the FHFA Home Price Index is due at the same time as the index of consumer confidence is forecast to rebound to a reading of 44.4 in November after plunging in October to a reading of 39.8. The Michigan Sentiment index rose solidly in November. This is followed at 1530GMT by the Dallas Fed Services Outlook Survey. At 1630GMT, Fed Vice Chair Janet Yellen makes remarks on the global recovery at the San Francisco Fed's Asia Economic Policy Conference in San Francisco. At 0100GMT Wednesday (8pm Eastern), Minneapolis Fed President Narayana Kocherlakota delivers a speech on monetary policy to the Stanford Institute for Economic Policy Research in Stanford.

Asian stocks rose, sending the MSCI Asia Pacific Index toward its biggest gain in three weeks, after Black Friday sales in the U.S. rose to a record, boosting the outlook for exporters, and as commodity prices advanced.

German Finance Minister Wolfgang Schaeuble called for fast- track treaty changes to tighten budget discipline to calm markets in an interview with ARD television in Berlin yesterday. Italian Prime Minister Mario Monti is set to propose more austerity measures this week to balance the country’s budget by 2013, the Wall Street Journal reported yesterday.

Moody’s Investors Service said the “rapid escalation” of Europe’s debt and banking crisis is threatening all of the region’s sovereign ratings. The probability of multiple defaults by euro-area countries is no longer negligible, Moody’s said in a statement today, adding that the longer the liquidity crisis continues, the more rapidly the probability of defaults will continue to rise.

In the U.S., Black Friday sales increased 6.6 percent to a record. Consumers spent $11.4 billion, ShopperTrak said in a statement on Nov. 26. Foot traffic rose 5.1 percent on Black Friday, according to the Chicago-based research firm.

Japan’s Nikkei 225 Stock Average rose 1.6 percent, while Australia’s S&P/ASX 200 gained 1.9 percent. Hong Kong’s Hang Seng Index rose 2 percent.

Li & Fung Ltd., a clothing and toy supplier that gets 65 percent of its sales in the U.S., rose 10 percent in Hong Kong. Anta Sports Products Ltd., a Chinese sportswear maker, rose 9.5 percent to HK$7.98 in Hong Kong. LG Electronics Inc., a South Korean handset maker that gets more than 80 percent of its revenue overseas, jumped 8.6 percent. Nintendo Co., the maker of video-game machines that receives more than three-quarters of its revenue outside Japan, advanced 2.2 percent to 11,450 yen in Osaka.

Crude oil for January delivery gained 2.5 percent in New York today. Copper for three-month delivery increased 2.9 percent on the London Metal Exchange, while aluminum advanced 1.4 percent.

Alumina Ltd., which produces the material used to make aluminum, jumped 6.4 percent in Sydney, while BHP Billiton Ltd., the largest global mining company, gained 2.4 percent to A$34.85 in Sydney. Inpex Corp., Japan’s No. 1 energy explorer increased 3.8 percent to 497,500 yen in Tokyo. Cnooc Ltd, China’s biggest offshore oil producer, climbed 2.7 percent to HK$13.86, snapping a record streak of daily losses.

European stocks surged, rebounding from their biggest selloff in two months, amid speculation euro- area policy makers are intensifying their efforts to contain the sovereign-debt crisis.

Welt am Sonntag reported that the euro area’s two biggest economies plan for member states to commit to greater fiscal discipline without waiting to change European Union treaties. The newspaper did not say where it got the information.

The euro climbed as German Finance Minister Wolfgang Schaeuble urged fast-track treaty changes to tighten budget discipline and as speculation mounted that policy makers are planning to provide more aid for Italy.

Schaeuble said in an interview with ARD television in Berlin yesterday that treaty change is necessary to give veto power over member states’ budgets to the European Commission.

Separately, La Stampa reported that the International Monetary Fund is preparing a 600-billion euro ($800 billion) loan for Italy in case the sovereign-debt crisis worsens, without saying where it got the information.

An IMF official today said the Washington-based lender is not in talks with Italy about a loan program.

National benchmark indexes climbed in every western- European market except Iceland. France’s CAC 40 Index gained 5.5 percent, the U.K.’s FTSE 100 Index rose 2.9 percent and Germany’s DAX Index increased 4.6 percent.

A gauge of bank shares rallied 5.7 percent, its biggest advance in a month, as borrowing costs fell in Spain and Italy before euro-area finance ministers meet in Brussels on Nov. 29 as governments bid to regain the confidence of financial markets.

The European Financial Stability Facility may insure the bonds of debt-stricken countries with guarantees of 20 percent to 30 percent of each issue, depending on financial markets, according to EFSF guidelines that finance ministers will discuss this week.

BNP Paribas SA surged 10 percent to 28.52 euros as the Financial Times reported that France’s biggest bank (BNP) may plan to sell a portfolio of more than 50 private-equity fund interests for $700 million.

Commerzbank AG advanced 4.1 percent to 1.31 euros as Financial Times Deutschland reported that Germany’s second- largest lender is planning to repurchase so-called hybrid bonds and pay holders with new shares at it seeks ways to boost capital and reduce risk.

Dexia and KBC, Belgium’s biggest bank and insurer, soared 15 percent to 42.7 euro cents and 14 percent to 8.93 euros respectively, after Belgium sold 2 billion euros of bonds maturing between 2018 and 2041. The 10-year bond yield dropped after the auction, which followed the country’s first credit downgrade in almost 13 years.

BHP Billiton Ltd. rallied 4.4 percent to 1,836.5 pence and Total SA rose 3.7 percent to 37.01 euros, leading a rally in mining and energy companies, as copper led base metals higher in London and crude oil climbed in New York.

Rio Tinto Group also rose after the world’s second-largest mining company (RIO) said it expects to increase capital spending 17 percent next year. The company also raised its iron-ore target to meet demand from China. The shares rallied 4.4 percent to 3,164 pence.

Elsewhere, Thomas Cook Group Plc soared 21 percent to 21.73 pence after its banks agreed to provide a 200 million-pound ($311 million) loan, giving Europe’s second-largest tour operator time to reorganize its business.

Rolls-Royce Holdings Plc increased 3 percent to 698.5 pence after the company signed a contract with Deutsche Bank AG (DBK) to lower the risk on its 3 billion pounds in pension liabilities.

U.S. stocks rose, snapping a seven- day decline in the Standard & Poor’s 500 Index, after Thanksgiving retail sales climbed to a record amid speculation European leaders will boost efforts to end the debt crisis. U.S. retail sales during the Thanksgiving weekend increased 16 percent to $52.4 billion, the National Retail Federation said, citing a survey conducted by BIGresearch. The average shopper spent $398.62, up from $365.34 a year earlier. Consumer spending, which accounts for about 70 percent of the economy, grew at a 2.3 percent annual rate in the third quarter, the fastest pace in 2011, the Commerce Department said Nov. 22.

U.S. stocks maintained gains after a report showed fewer new homes were purchased in October than forecast. Sales increased 1.3 percent to a 307,000 annual pace, the Commerce Department reported today in Washington.

In Europe, German newspaper Welt am Sonntag reported German Chancellor Angela Merkel and French President Nicolas Sarkozy are discussing an agreement under which member states will commit to tighter budget discipline without waiting for treaty changes. The newspaper did not say where it got the information.

German Finance Minister Wolfgang Schaeuble called for fast- track treaty changes to tighten budget discipline among member states of the euro area. He spoke in an interview with ARD television in Berlin yesterday. The European Financial Stability Facility may insure the bonds of debt-stricken countries with guarantees of 20 percent to 30 percent of each issue, depending on market circumstances, according to EFSF guidelines that finance ministers will discuss this week. Euro-area finance ministers meet in Brussels tomorrow as governments bid to regain the confidence of financial markets.

The increased severity of the debt crisis is threatening the credit standing of the region’s countries, Moody’s Investors Service said in a report today. More than $1.2 trillion has been erased from U.S. stocks since Nov. 15 on mounting concern that the crisis will spread and American policy makers failed to reach agreement on reducing the federal budget.

After financial markets closed in New York, Fitch Ratings affirmed the U.S.’s AAA long-term foreign and local currency issuer default ratings. The outlook on the long-term rating was revised to negative from stable, with Fitch saying that a failure to reach a “credible deficit reduction plan” in 2013 and a worsening economy could lead to a downgrade.

Dow 11,523.01 +291.23 +2.59%, Nasdaq 2,527.34 +85.83 +3.52%, S&P 500 1,192.55 +33.88 +2.92%

Companies most-tied to the economy rose, sending the Morgan Stanley Cyclical Index up 3.8 percent after a 6.2 percent decline last week. Caterpillar, the world’s largest construction and mining-equipment maker, increased 5.5 percent to $91.48 for the second-biggest gain in the Dow.

Energy and raw-material producers in the S&P 500 rallied at least 3.5 percent, as crude oil rose above $100 a barrel for the first time in more than a week on signs of economic recovery in the U.S., while sanctions on Syria stoked concern Middle East crude supplies may be threatened.

Alcoa gained 5.7 percent to $9.46. The largest U.S. aluminum producer rose the most in the Dow as copper, lead, nickel and zinc advanced on the London Metal Exchange. Freeport- McMoRan Copper & Gold Inc., the world’s biggest publicly traded copper producer, surged 6.3 percent to $35.94. Molycorp Inc. climbed 14 percent to $30.65.

Suncor Energy Inc. gained 3.4 percent to $27.98. Marathon Oil Corp. increased 5.4 percent to $25.98. Halliburton Co. (HAL) advanced 3.1 percent to $32.77.

JPMorgan jumped 2.4 percent to $29.16. Goldman Sachs Group Inc. surged 2.3 percent to $90.78. A gauge of European banking shares climbed 5.7 percent, among the best performances in the benchmark Stoxx Europe 600 Index.

AT&T climbed 2 percent to $27.95. The company, which faces regulatory opposition to its acquisition of Deutsche Telekom AG’s U.S. unit, is preparing its biggest antitrust remedy proposal to salvage the deal, according to a person familiar with the plan. AT&T may offer to divest a significantly larger portion of assets than it had planned. That could be as much as 40 percent of T-Mobile USA’s assets, the person said.

Amazon.com rose 6.4 percent to $194.15. The world’s largest Internet retailer said it sold four times more Kindle products on Black Friday compared with last year.

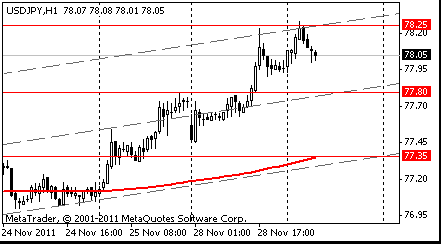

Resistance 3: Y79.50 (Oct 31 high)

Resistance 2: Y79.00 (Nov 1 high)

Resistance 1: Y78.25 (session high)

The current price: Y78.05

Support 1: Y77.80 (middle line from Nov 18)

Support 2: Y77.35 (support line from Nov 18, MA(233) H1)

Support 3: Y76.85 (Nov 22 low)

Comments: the pair is on uptrend. In focus resistance Y78.25.

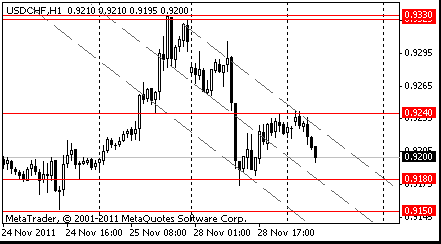

Resistance 3: Chf0.9360 (Mar 10-11 high)

Resistance 2: Chf0.9325/30 (area of Nov 25 high)

Resistance 1: Chf0.9240 (session high)

The current price: Chf0.9200

Support 1: Chf0.9180 (middle line from Nov 25)

Support 2: Chf0.9150 (Nov 24 low)

Support 3: Chf0.9105 (Nov 22 low)

Comments: the pair is on downtrend. In focus support Chf0.9180.

Resistance 3 : $1.5655 (50.0% FIBO $1.5420-$1.5885)

Resistance 2 : $1.5615 (resistance line from Nov 25)

Resistance 1 : $1.5560 (middle line from Nov 25)

The current price: $1.5527

Support 1 : $1.5470 (session low)

Support 2 : $1.5420/25 (area of Nov 24 low)

Support 3 : $1.5340 (Oct 4 low)

Comments: the pair is on uptrend. In focus resistance $1.5560.

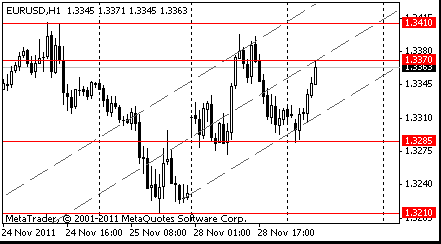

Resistance 3: $1.3480 (high of the European session on Nov 23)

Resistance 2: $1.3410 (Nov 24 high)

Resistance 1: $1.3370 (middle line from Nov 25)

The current price: $1.3363

Support 1 : $1.3285 (session low)

Support 2 : $1.3210 (Nov 25 low)

Support 3 : $1.3145 (Oct 4 low)

Comments: the pair is on uptrend. In focus resistance $1.3370.

Change % Change Last

Nikkei 225 8,287 +127.48 +1.56%

Hang Seng 18,038 +348.33 +1.97%

S&P/ASX 200 4,058 +73.86 +1.85%

Shanghai Composite 2,383 +2.81 +0.12%

FTSE 100 5,313 +148.11 +2.87%

CAC 40 3,013 +155.96 +5.46%

DAX 5,745 +252.46 +4.60%

Dow 11,523.01 +291.23 +2.59%

Nasdaq 2,527.34 +85.83 +3.52%

S&P 500 1,192.55 +33.88 +2.92%

10 Year Yield 1.96% -0.01 --

Oil $97.79 -0.42 -0.43%

Gold $1,709.20 -1.60 -0.09%

00:00 Australia HIA New Home Sales, m/m October -3.5%

07:00 Switzerland UBS Consumption Indicator October 0.84

07:00 United Kingdom Nationwide house price index November +0.4% -0.1%

07:00 United Kingdom Nationwide house price index, y/y November +0.8% +1.3%

09:30 United Kingdom Consumer credit, bln October 0.6 0.5

09:30 United Kingdom Mortgage Approvals October 51.0K 51.8K

10:00 Eurozone Economic sentiment index November 94.8 94.0

10:00 Eurozone Business climate indicator November -0.18 -0.23

12:00 United Kingdom Government Autumn Statement

13:30 Canada Current Account, bln Quarter III -15.3 -11.3

14:00 U.S. S&P/Case-Shiller Home Price Indices, y/y September -3.8% -3.0%

15:00 U.S. Consumer confidence November 39.2

15:00 U.S. Housing Price Index, m/m Septembeк -0.1% +0.1%

16:30 U.S. FOMC Member Yellen Speaks

17:15 U.S. FOMC Member Raskin Speaks

21:45 New Zealand Building Permits, m/m October -17.1%

23:50 Japan Industrial Production (MoM) October -3.3% +1.1%

23:50 Japan Industrial Production (YoY) October -3.3% -1.0%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.