- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 25-11-2011

Definitely the euro will not fail.

Sustained high yields would impact Italy econ and need stronger firewalls to stop contagion.

Consolidation should come more from spending cuts than taxes

Gold prices decline under pressure from the dollar growth and the lack of consensus among European leaders on measures to combat the debt crisis.

Italy posted a bond with a two-year maturity for the entire amount of the planned EUR 10 billion at a record yield of 7.814 percent per annum. At the talks the leaders of Germany, France and Italy on Thursday, German Chancellor Angela Merkel continued to resist the release of single Eurozone bonds and strengthen the role of the European Central Bank to combat the crisis.

Against this backdrop, the euro fell to nearly two-month low against the dollar and yen.Strengthening of the dollar had a negative impact on physical demand in India - the world's largest gold market - as the price of gold in rupees rose to almost record levels.

Stocks Funds ETF backed by gold this week rose by more than 300,000 ounces to a historic high 69.978 million ounces. According to UBS, in October, increased purchases of gold by central banks, which in the past year for the first time in 20 years bought more gold than was sold.

December futures for gold on Comex in New York fell to 1672.60 dollars per troy ounce.

Crude headed for a second weekly loss in New York as concern that Europe’s worsening debt crisis will trigger a recession outweighed political tensions in oil- producing Middle East nations.

Futures have lost 2.3 percent this week as Portugal and Hungary’s credit ratings were cut and Germany again ruled out joint euro-area borrowing and an expanded role for the European Central Bank in fighting the turmoil. Prices may jump amid France’s call for an embargo on crude exports from Iran, according to Mirae Asset Securities Ltd. Four people died in clashes this week between Shiite Muslims and Saudi security forces in the oil-rich Eastern Province.

Crude for January delivery fell to as low as $94.99 a barrel in electronic trading on the New York Mercantile Exchange, its lowest since Nov. 9. It was at $95.18 at 1:06 p.m. in London, down 1 percent from the settlement on Nov. 23. Floor trading was closed yesterday for the U.S. Thanksgiving Day holiday and electronic trades will be booked with today’s transactions for settlement purposes.

Brent oil for January settlement on the London-based ICE Futures Europe exchange dropped as much as 1.6 percent, or $1.70, to $106.08 a barrel. Prices are down 1.2 percent this week. The European benchmark was at a premium of $11.07 to New York-traded West Texas Intermediate futures. The spread reached a record $27.88 on Oct. 14.

Extends recovery to Chf1.2350, with traders seen paring back risk off positions, with move also driven by unconfirmed market chat concerning a SNB press conference at 1600GMT. This added to reports of German, Dutch, Finnish finance ministers to make statement at 1615GMT, though no details forthcoming of the latter content. Rumours abound for another euro-Swiss floor hike (currently at Chf1.2000) though UBS sees most likely date for such action as Dec15.

Resistance 3:1195 (38,2 % FIBO 1270-1147)

Resistance 2:1178 (intraday low on Nov 23)

Resistance 1:1174 (Nov 24 high)

Current price: 1169,75

Support 1 : 1159 (area of intraday high)

Support 2 : 1147/45 (session low, Oct 7 low)

Support 3 : 1129 (Oct 6 low)

EUR/USD $1.3300, $1.3350, $1.3385, $1.3400, $1.3500, $1.3545

USD/JPY Y76.65, Y77.00, Y77.35, Y77.75AUD/USD $0.9700, $0.9800, $1.0000

USD/CHF Chf0.9350

GBP/USD $1.5500, $1.5600, $1.5800

U.S. stock index futures fell as fears about the euro zone's debt crisis overshadowed what appeared to be a buoyant start to the holiday shopping season.

Stocks were facing their worst week in two months and their second consecutive week of losses.

Yields on Italy's debt approached recent highs that sparked a sell-off in world markets. Italy paid a record 6.5 percent to borrow money over six months on Friday, and its longer-term funding costs soared far above levels seen as sustainable for public finances, raising the pressure on Rome's new emergency government.

U.S. stock markets were closed for the Thanksgiving holiday on Thursday and will be open on Friday until 1 p.m. The day after Thanksgiving is typically one of the lightest trading volume days of the year.

World markets:

Nikkei 8,160 -5.17 -0.06%

Hang Seng 17,689 -245.62 -1.37%

Shanghai Composite 2,380 -17.33 -0.72%

FTSE 5,131 +3.50 +0.07%

CAC 2,825 +2.88 +0.10%

DAX 5,448 +19.78 +0.36%

Crude oil: $95.36 (-1,7%).

Gold: $1677,80 (-1,0%).

Data:

07:00 Germany Import prices (October) -0.3%

07:00 Germany Import prices (October) Y/Y 6.8%

07:00 Germany Import prices excluding oil (October) Y/Y 3.8%

07:45 France Consumer confidence (November) 79

09:00 Italy Retail sales (September) adjusted -0.4%

09:00 Italy Retail sales (September) Y/Y unadjusted -1.6%

The euro declined as French consumer confidence dropped to the least since 2009 and Italian borrowing costs increased at a sale of six-month bills.

The dollar rose versus all its major peers as stock losses spurred demand for safer assets.

Italy sold 8 billion euros ($10.6 billion) of 183-day bills at a rate of 6.504 percent, the highest since August 1997, and up from 3.535 percent at the prior auction on Oct. 26. Demand dropped to 1.47 times the amount on offer from 1.57 times last month.

The dollar was boosted this week as Germany failed to sell its maximum amount at a bund auction and German Chancellor Angela Merkel ruled out the issuance of joint euro-area bonds.

The pound dropped for a fifth day versus the dollar as an industry group reduced its outlook for U.K. house prices.

EUR/USD: the pair has fallen in $1.3220 area.

GBP/USD: the pair has shown low in $1.5420 area and restored later.

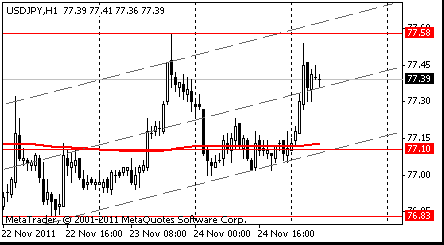

USD/JPY: the pair has trading in Y77.30-Y77.55 area.

EUR/USD

Offers $1.3380/410, $1.3350/55, $1.3320, $1.3295/300, $1.3280

Bids $1.3210/00, $1.3170, $1.3150, $1.3145, $1.3110/00

- France,Austria bond yields not exceptionally high;

- financial market confidence in Germany still intact;

- should not assume that Italy is already bankrupt.

- France,Austria bond yields not exceptionally high;

- financial market confidence in Germany still intact;

- should not assume that Italy is already bankrupt.

Resistance 3: Y78.30 (Nov 4 high)

Resistance 2: Y77.90 (Nov 9 high)

Resistance 1: Y77.50/60 (area of session high and Nov 24 high)

Current price: Y77.42

Support 1:Y77.30 (low of european session)

Support 2:Y77.00 (Nov 24 low, МА (200) for Н1)

Support 3:Y76.80 (Nov 22 low)

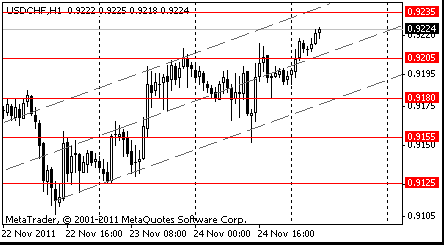

Resistance 3: Chf0.9340 (high of April)

Resistance 2: Chf0.9300/10 (area of high of October)

Resistance 1: Chf0.9270 (session high)

Current price: Chf0.9247

Support 1: Chf0.9230 (earlier resistance, Nov 17 high)

Support 2: Chf0.9180 (МА (200) for Н1, support line from Nov 22)

Support 3: Chf0.9150 (Nov 24 low)

Resistance 3: $ 1.5600 (38,2 % FIBO $1,5890-$ 1,5420)

Resistance 2: $ 1.5560 (Oct 24 high)

Resistance 1: $ 1.5500 (session high)

Current price: $1.5497

Support 1 : $1.5420 (session low)

Support 2 : $1.5380 (the bottom border of downchannel from Nov 14, support line from May’2010)

Support 3 : $1.5270 (low of October)

Resistance 3: $ 1.3420 (area of Nov 24 high, Nov 17 low and resistance line from Oct 27)

Resistance 2: $ 1.3350 (session high)

Resistance 1: $ 1.3320 (high of european session)

Current price: $1.3231

Support 1 : $1.3220 (session low, support line from Jan 2011)

Support 2 : $1.3150 (low of October)

Support 3 : $1.3000 (psychological mark)

Italy sold E2.0bln 2-year zero coupon Sept 2013 CTZ at average yield of 7.814% vs 4.628% and covered 1.59 vs 2.01 previous.

EUR/USD $1.3300, $1.3350, $1.3385, $1.3400, $1.3500, $1.3545

USD/JPY Y76.65, Y77.00, Y77.35, Y77.75AUD/USD $0.9700, $0.9800(large), $1.0000

USD/CHF Chf0.9350

GBP/USD $1.5500, $1.5600, $1.5800

Nikkei 225 8,160 -5.17 -0.06%

Hang Seng 17,725 -210.12 -1.17%

S&P/ASX 3,984 -59.87 -1.48%

Shanghai Composite 2,380 -17.33 -0.72%

The dollar climbed against most major peers, extending this week’s gains, as investors sought the safest assets on concern economies in the euro area will worsen as leaders struggle to halt the region’s debt crisis.

The euro dropped to a seven-week low against the greenback as Italy prepares to sell bills today after the country’s two- year yield soared to a 14-year high yesterday.

Fitch lowered Portugal’s long-term rating to BB+ from BBB- with a negative outlook while Moody’s cut Hungary’s foreign- and local-currency bond ratings to Ba1 from Baa3 yesterday.

Australia’s dollar was set for a fourth week of declines as Asian stocks fell after German Chancellor Angela Merkel’s rejection of joint euro bonds damped optimism about a potential remedy for the region’s woes. The dollar rose against the yen before a U.S. report next week forecast to show consumer confidence improved.

EUR/USD: on Asian session the pair is under pressure.

GBP/USD: on Asian session the pair fell.

USD/JPY: on Asian session the pair gain.

On Friday the output of significant macroeconomic statistics is not planned.

At first half of yesterday the euro strengthened from a seven-week low against the dollar as German reports showed business confidence improved and economic growth accelerated even with Europe’s worsening debt crisis. The Munich-based Ifo institute said its business climate index increased to 106.6 this month from 106.4 in October. The euro also advanced versus the pound amid signs Germany is softening its opposition to allowing issuance of common euro-area bonds. Yesterday Germany received insufficient bids at a bond auction, fueling concern that Europe’s sovereign-debt crisis is driving away investors from the region’s assets. German newspaper editorials and opposition politicians stepped up bids for Chancellor Angela Merkel to shift from an incremental approach after the government sold 35 percent less bonds than its maximum target at yesterday’s auction. Bild newspaper reported Merkel’s coalition is concerned it may have to agree to euro bonds under certain conditions.

But euro fell later. At second half of yesterday Fitch lowers Portugal's growth fcst due European outlook. Sees Portugal 2012 GDP falling 3%. Cites Portugal high debt,large fiscal imbalances. Portugal could be further downgraded if growth disappoints.

EUR/USD: yesterday the pair showed a new week’s low, but restored later.

GBP/USD: yesterday the pair fell.

USD/JPY: yesterday the pair weakened.

On Friday the output of significant macroeconomic statistics is not planned.

Asian stocks outside of Japan rose after falling to a seven-week low yesterday on bets that China may fine tune anti-inflation policies. Japanese shares fell after a public holiday as speculation mounted Standard & Poor’s is preparing to cut the country’s sovereign-debt rating.

Japan's Nikkei 225 closed down 1.8%. Shares of construction equipment manufacturer Komatsu and Fanuc, producing controllers and industrial automation systems, remained under pressure data suggests a slowdown in the growth of Chinese industry. At the end of trading Komatsu and Fanuc closed in negative territory at 4.1% and 3.3% respectively. Oil and gas companies Japan Petroleum Exploration and Inpex decreased by 3.3% and 1.7% respectively.

Hong Kong's Hang Seng index rose 0.4%, while China's Shanghai Composite rose 0.1%.

At auction in Hong Kong stocks showed a positive trend mainly - in the largest developers plus finished China Resources Land (+4,3%) and China Overseas Land & Investment (+5,6%), energy company, China Resources Power Holdings (+5,7 %) and clothing manufacturer Esprit Holdings (+6,4%).

Australia's S & P / ASX 200 fell by 0.2%. Raw materials companies showed mixed trends - Rio Tinto (+0,2%) and BHP Billiton (+0,1%), Oz Minerals (-0,8%).

Shares of retailer David Jones fell 5.4% after management reported a 11% reduction of sales in the first quarter. In addition, according to company forecasts profit in the first half of the year could fall by 15% -20%.

European stocks fell as Chancellor Angela Merkel said joint euro bonds would send a “completely wrong signal,” offsetting a report showing business confidence in Europe’s biggest economy unexpectedly rose in November.

Merkel repeated her opposition to common debt sales and added that joint euro-area bonds would lead to a convergence of interest rates in the region. “Nothing has changed in my position,” Merkel said today at a press conference with Italian Prime Minister Mario Monti and French President Nicolas Sarkozy in Strasbourg, France.

A report today showed German business confidence unexpectedly rose for the first time in five months in November. The Munich-based Ifo institute’s business climate index, based on a survey of 7,000 executives, increased to 106.6 from 106.4 in October. Economists had predicted a decline to 105.2, according to the median of 40 forecasts in a Bloomberg News survey.

France’s CAC 40 Index slipped 0.01 percent. Germany’s DAX Index dropped 0.5 percent. The U.K.’s FTSE 100 Index slid 0.2 percent.

The banking sector in Europe was in the "plus" after the media reported that German banks appealed to the European service supervisor with a request to extend until January 13 application deadline to the program, which sets forth the items to achieve the European targets for capital adequacy. Shares of Deutsche Bank and Commerzbank rose 0.4% and 4.3% respectively, the French lenders BNP Paribas and Credit Agricole rose 3.3% and 1.2% respectively, while the Austrian Erste Group Bank said in its asset 4 of 3%.

Finished in positive territory mining companies trading in Europe: shares of Rio Tinto and BHP Billiton rose 1.5% and 0.9% respectively, Anglo American securities rose in price by 0.3%.

Worse still felt the oil sector, where there was a decline of quotations: the shares of BP and Royal Dutch Shell fell 1.4% and 1.8% respectively.

On Thursday trading on U.S. stocks were not conducted on the occasion of Thanksgiving Day.

Resistance 3: Y78.25 (Nov 4 high)

Resistance 2: Y77.90 (Nov 9-10 high)

Resistance 1: Y77.60 (Nov 23 high)

The current price: Y77.37

Support 1: Y77.10 (support line from Nov 18)

Support 2: Y76.85 (Nov 22 low)

Support 3: Y76.55 (Nov 18 low)

Comments: the pair is on uptrend. In focus resistance Y77.60.

Resistance 3: Chf0.9310 (Oct 6 high)

Resistance 2: Chf0.9285 (Oct 7 high)

Resistance 1: Chf0.9235 (Nov 17 high)

The current price: Chf0.9224

Support 1: Chf0.9205 (middle line from Nov 22)

Support 2: Chf0.9180 (support line from Nov 22)

Support 3: Chf0.9155 (Nov 24 low)

Comments: the pair is on uptrend. In focus resistance Chf0.9235.

Resistance 3: $1.3480 (high of the European session on Nov 23)

Resistance 2: $1.3410 (Nov 24 high)

Resistance 1: $1.3350 (session high)

The current price: $1.3313

Support 1 : $1.3300 (session low)

Support 2 : $1.3240 (Oct 6 low)

Support 3 : $1.3145 (Oct 4 low)

Comments: the pair is on downtrend. In focus support $1.3300.

Change % Change Last

Nikkei 225 8,165 -149.56 -1.80%

Hang Seng 17,935 +70.67 +0.40%

S&P/ASX 200 4,044 -6.81 -0.17%

Shanghai Composite 2,398 +2.49 +0.10%

FTSE 100 5,128 -12.21 -0.24%

CAC 40 2,822 -0.18 -0.01%

DAX 5,428 -29.66 -0.54%

07:00 Germany Import prices October +0.6% -0.1%

07:00 Germany Import prices Y/Y October +6.6% +6.9%

07:45 France Consumer confidence November 82 81

09:00 Italy Retail sales (MoM) September 0.0% -0.2%

09:00 Italy Retail Sales Y/Y September -0.3% +1.5%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.