- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 17-01-2022

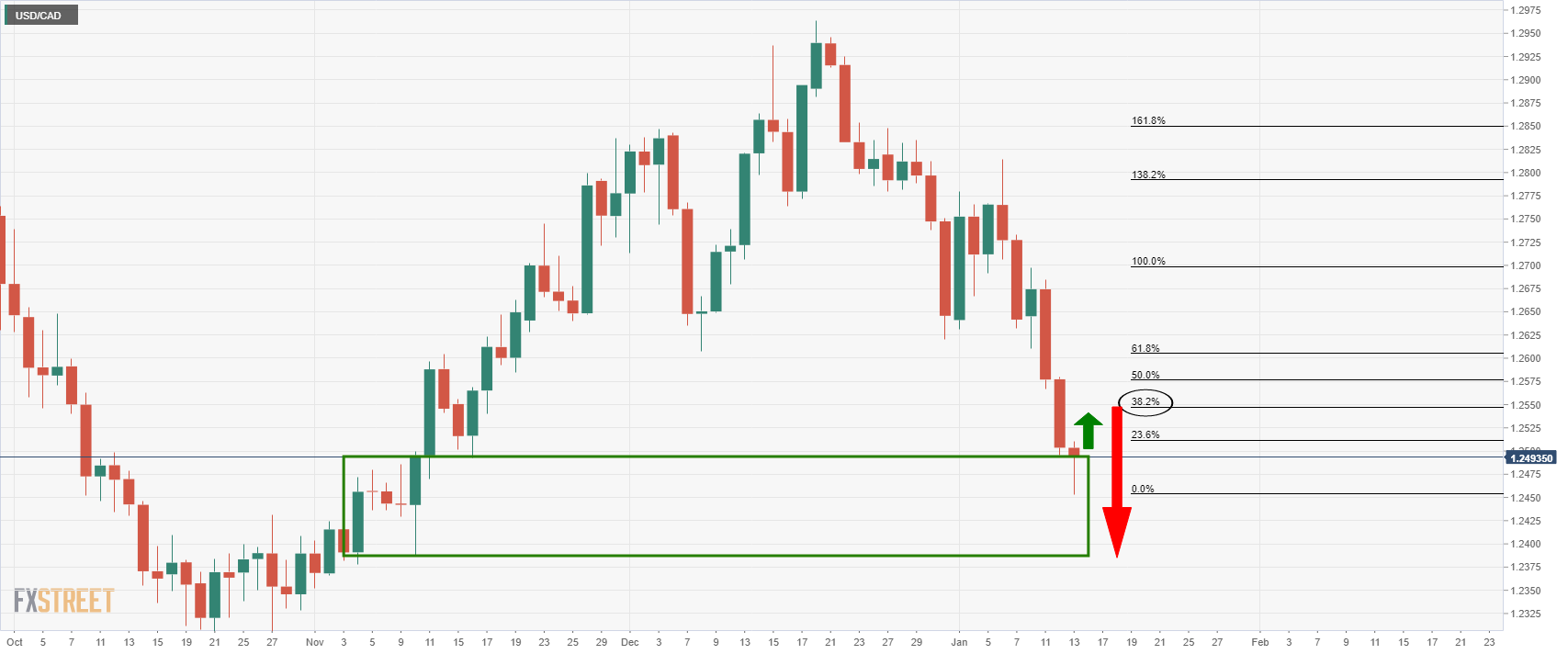

- USD/CAD holds lower grounds after a negative start to the week.

- Weekly support line, 200-DMA test bears before ascending trend line from June.

- Bulls need to cross 200-SMA on 4H to retake the control.

- Receding bullish bias of MACD hints at further weakness of the pair.

USD/CAD fades bounce off 200-DMA while retreating to 1.2517 during the initial Asian session on Tuesday.

The loonie pair dropped during the previous day while extending Friday’s U-turn from 1.2570. However, an upward sloping support line from January 13 and the 200-DMA restrict the quote’s short-term declines around 1.2500 threshold.

Even so, receding bullish bias of the MACD on the four-hour (4H) chart and downbeat RSI on the daily play hints at the quote’s further weakness.

That said, a clear downside break of the 1.2500 round figure will direct the USD/CAD sellers towards an ascending support line from June, near 1.2455 by the press time.

In a case where USD/CAD drops below 1.2455, it becomes vulnerable to test October’s low of 1.2300.

USD/CAD: Daily chart

_D1_18012022-637780607174280616.png)

On the contrary, a descending resistance line from January 07, around 1.2570, restricts the quote’s immediate upside ahead of the 100-SMA level of 1.2680.

It should be noted, however, that the USD/CAD bulls will remain cautious until the quote stays below the monthly resistance line and 200-SMA, respectively around 1.2705 and 1.2740.

USD/CAD: Four-hour chart

Trend: Further weakness expected

The policy has taken a more dovish tilt in China, aimed at "economic stability". China’s cut of two key policy interest rates opens the door to more monetary easing actions ahead. This is despite the sentiment that the Federal Reserve will probably hike rates from March.

On Monday, China cut the one-year medium-term lending facility rate and the seven-day reverse repurchase rate for the first time in almost two years. The one-year tenor was already dropped by five basis points last month, so all eyes are on whether the five-year rate will decline to allow for cheaper mortgages.

''We expect at least another 10bp easing in the LPR this quarter, alongside another 50bp cut in the RRR,'' analysts at TD Securities said. ''However, we don’t think the authorities will rush to ease given signs of stability in the property sector.''

Goldman Sachs Group Inc. economists led by Maggie Wei said, “we see a decent possibility for the five-year loan prime rate to be cut by 5 basis points” when it’s announced Thursday, the economists said in a note Monday. The five-year rate is the reference for mortgages and a cut “would send a signal on broad property policy easing.”

Meanwhile, more cuts are expected throughout the year, although not all analysts anticipate a tidal wave of easing.

Lu Ting, chief China economist at Nomura Holdings Inc argued that “the space left for future rate cuts this year is quite small,” he said. “We expect another 10 basis point rate cut before mid-2022.”

However, he did explain that the PBOC could choose to increase foreign exchange purchases significantly in the coming months. According to Lu, this would contain the yuan’s appreciation, ease concerns over Chinese companies’ offshore dollar bond defaults, and add liquidity to the economy.

Market implications

Meanwhile, though China's fourth-quarter gross domestic product came in hot and exceeded estimates, it was still at its weakest in around one and half years. December Retail Sales also disappointed, highlighting the impact of strict containment measures on the world's second-largest economy.

Any fallout to riskier assets, however, was limited by a surprise cut to some key lending rates by China's central bank.

''We think strong FX inflows might continue on the back of an elevated goods trade surplus and foreign buying of CNY assets, and thus, sudden CNY depreciation pressures and capital outflow pressures remain low," Goldman Sachs analysts said.

- AUD/USD remains pressured after three-day downtrend from the highest levels since mid-November.

- Indecision over virus conditions at home joins softer Aussie consumer confidence data to weigh on the quote.

- US traders’ return after MLK Day shifts market focus on yields amid Fed rate-hike chatters.

AUD/USD sellers attack 0.7200 as the Aussie pair prints a four-day downtrend amid the initial Asian session on Tuesday.

The quote’s latest weakness could be linked to the highest covid-linked deaths from Australia’s most populous state, as well as cautious mood ahead of the bond trading resumption following Martin Luther King’s Birthday. Also responsible for the AUD/USD weakness is the downbeat weekly sentiment data.

Australia’s ANZ Roy Morgan Weekly Consumer Confidence Index for the period ended on January 16 dropped below 106.00 to 97.9.

It’s worth noting that virus numbers in Australia have been declining in the last four days but the death toll jumped in the nation’s most populous state New South Wales (NSW). “NSW has sustained its deadliest day of the pandemic with 36 COVID-19 deaths recorded in the latest reporting period. The number of people with the virus in hospital rose to 2,850, while ICU admissions were up slightly to 209,” per ABC News.

The daily covid infections are also easing in the UK and the US but the death toll ad virus spread among elderly, as well as children, tests policymakers’ success in jabbing.

It’s worth noting that the market’s indecision over the virus conditions and an absence of the US traders stopped AUD/USD traders from cheering the strong China Q4 GDP the previous day. Also positive are the talks over the People’s Bank of China’s (PBOC) key policy rate after the Chinese central bank cut the reverse report and Medium Term Lending Facility (MLF) rate the previous day.

Moving on, the AUD/USD traders will pay close attention to the US Treasury yields amid hopes of the faster Fed rate hikes in 2022, backed by Federal Reserve Bank of San Francisco President Mary Daly and New York Fed President John Williams on Friday. That said, the US Dollar Index (DXY) stretched the previous day’s rebound from a 10-week low before ending Monday with minor gains around 95.23.

Although the economic calendar is mostly silent ahead of Australia’s key jobs report on Thursday, a further surge in the yields can weigh on the AUD/USD prices.

Technical analysis

Failure to cross the 100-DMA, around 0.7285 by the press time, joins the pair’s clear downside below the 100-SMA level of 0.7220 to direct AUD/USD prices towards an ascending support line from January 07, near 0.7200.

Should the quote drop below 0.7200, the 200-SMA level near 0.7180 will test AUD/USD sellers before directing them to upward sloping trend lines from December 03 and December 20, respectively around 0.7170 and 0.7155.

Meanwhile, a clear upside break of the 100-SMA level of 0.7220 will direct the AUD/USD bulls towards another battle with the 100-DMA surrounding 0.7285.

Overall, AUD/USD prices stay depressed with the bumpy road to the south.

- GBP/USD holds lower grounds near one-week low, sidelined after three-day downtrend.

- Over 37% of UK businesses don’t they will survive due to Brexit, UK’s Truss braces for key talks with EU’s Safcovic.

- UK reports less than 85,000 cases, plan B could be reviewed this week.

- British jobs report, US traders’ returns will also be eyed for clear direction.

After a sluggish start to the key week, with the third consecutive loss-making day, GBP/USD prices remain depressed around 1.3645 during the initial hour of Tuesday’s Asian session.

In doing so, the cable pair struggles to cheer positive news from the covid front amid fears emanating from Brexit and politics, as well as cautious sentiment ahead of crucial UK jobs reports.

Global markets witnessed a slower start as the US cash and bond markets were off due to Martin Luther King’s Birthday. Even so, the US Dollar stayed firmer amid hopes of the faster Fed rate hikes in 2022, backed by Federal Reserve Bank of San Francisco President Mary Daly and New York Fed President John Williams on Friday. That said, the US Dollar Index (DXY) stretched the previous day’s rebound from a 10-week low before ending Monday with minor gains around 95.23.

At home, the UK reported 84,429 covid infections and 85 deaths, down from the 142,224 cases reported one week ago. With this, the British scientists turn confident that the virus curve is turning lower, which in turn helps the policymakers to rethink the ‘Plan B’ activity restrictions that are to expire on January 26.

Alternatively, UK PM Boris Johnson is under immense pressure to defend the ‘party gate’ gathering amid the initial days of the pandemic. Some among Britain’s key politicians, including Tories, demand Johnson’s resignation, while his popularity also fades ahead of local elections in England, Scotland and Wales on May 5.

Elsewhere, Liz Truss, Secretary of State for Foreign, Commonwealth and Development Affairs of the United Kingdom braces for another round of key Brexit talks with the European Union (EU) Brexit Minister Maros Sefcovic. The due touched the subject a bit during the last week’s talks in the UK. Following that UK’s Truss tweeted, “practical solutions to protect the Belfast Good Friday Agreement and political stability, ensure free flow of goods between the UK and Northern Ireland, and to defend the sovereignty of decision-making for all.”

It should be noted that a country-wide survey by One World Express revealed that One in three UK business owners fear their company won’t exist anymore in a year as the Brexit onslaught intensifies. The new border checks and struggle to do business with the EU are among the key catalysts.

Looking forward, the UK’s Unemployment Rate for three months to November, expected to remain unchanged at 4.2% will join Claimant Count Change for December, prior -49.8K, to entertain the GBP/USD pair traders. Given the recently firmer UK fundamentals, as well as receding covid fears, the cable prices may witness further upside should the scheduled data flash upbeat readings, which in turn strengthen the Bank of England’s (BOE) hawkish bias.

Technical analysis

In addition to pullback from the 200-DMA, around 1.3740 by the press time, the GBP/USD pair’s downside break of an ascending trend line from December 20, near 1.3680, also directs the quote towards the 100-DMA level of 1.3550.

- 1.1380 eyed by the EUR/USD bears n a break of short term support.

- EUR/USD bulls look for an upside continuation post reaccumulation phase.

As per the prior analysis, EUR/USD Price Analysis: Bulls eye an extended rally towards monthly targets, EUR/USD continues to develop the bullish structure that leaves the forecast on point so far.

EUR/USD, prior analysis

The 4-hour chart showed a period of accumulation that had recently seen a breakout, termed as the ''mark-up''. It was stated that ''should the buyers move in at a discount, then the price would be expected to ''accumulate'' and move higher to mitigate the next imbalance of price towards the monthly M-formation's neckline.''

As it stands, the price has melted as expected in a correction towards the ''reaccumulation'' point as follows:

EUR/USD lower time frames

That's not to say we cannot see any further downside. In fact, the hourly perspective is bearish and a downside extension could be forthcoming:

From a 15-min perspective, the price needs to get below the meanwhile support as follows:

1.1380 will be eyed as a target on such a break.

- NZD/USD’s 21DMA just under 0.6800 acted like a magnet to the price action during Monday’s US holiday-thinned session.

- Cooler New Zealand house price data failed to spur a reaction, with focus now on the NZIER release at 2100GMT.

NZD/USD’s 21-day moving average just below the key 0.6800 level acted like a magnet to the price action on what was an unusually quiet Monday, with trading conditions thinned by US market closures for MLK Day. At current levels just below 0.6800, NZD/USD looks set to close out the session flat and did not react to the latest monthly house price release from the Real Estate Institute of New Zealand (REINZ). The data showed house prices in New Zealand fell 0.3% MoM in December, taking the YoY rate of change to +22.0%.

“While the market remains confident,” said Jen Baird, Chief Executive of REINZ, “the impact of rising interest rates, tighter lending criteria and changes to investor taxation restrictions are starting to shift dynamics”. While the latest drop in prices will be welcomed by RBNZ policymakers, it is unlikely to translate into any less willingness to lift interest rates substantially in the coming years to cool off a very hot economy. NZD traders now turn their focus to the release of quarterly NZIER Business Confidence survey data (Q4) which is scheduled for release at 2100GMT.

The rest of the week doesn’t contain much by way of important US or New Zealand economic releases, nor any notable central bank speak, so the overarching driver or NZD/USD this week is likely to be risk appetite and dollar flows. Regarding the latter, recent upside in US bond yields reflecting increasingly hawkish Fed bets has many strategists calling for dollar strength in the run-up to next week’s Fed meeting. That suggests downside risks to NZD/USD, with bears eyeing a test of recent lows just under 0.6750 and then the December/2021 lows just below that at 0.6700.

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 03:00 (GMT) | Japan | BoJ Interest Rate Decision | -0.1% | -0.1% | |

| 03:00 (GMT) | Japan | BOJ Outlook Report | |||

| 04:30 (GMT) | Japan | Industrial Production (YoY) | November | -4.1% | 5.4% |

| 04:30 (GMT) | Japan | Industrial Production (MoM) | November | 1.8% | 7.2% |

| 07:00 (GMT) | United Kingdom | Average earnings ex bonuses, 3 m/y | November | 4.3% | 3.8% |

| 07:00 (GMT) | United Kingdom | Average Earnings, 3m/y | November | 4.9% | 4.2% |

| 07:00 (GMT) | United Kingdom | ILO Unemployment Rate | November | 4.2% | 4.2% |

| 07:00 (GMT) | United Kingdom | Claimant count | December | -49.8 | |

| 07:30 (GMT) | Switzerland | Producer & Import Prices, y/y | December | 5.8% | |

| 10:00 (GMT) | Eurozone | ZEW Economic Sentiment | January | 26.8 | |

| 10:00 (GMT) | Germany | ZEW Survey - Economic Sentiment | January | 29.9 | 32.7 |

| 13:15 (GMT) | Canada | Housing Starts | December | 301.3 | 270 |

| 13:30 (GMT) | U.S. | NY Fed Empire State manufacturing index | January | 31.9 | 25 |

| 15:00 (GMT) | U.S. | NAHB Housing Market Index | January | 84 | 84 |

| 21:00 (GMT) | U.S. | Net Long-term TIC Flows | November | 7.1 | |

| 21:00 (GMT) | U.S. | Total Net TIC Flows | November | 143 | |

| 23:30 (GMT) | Australia | Westpac Consumer Confidence | January | 104.3 |

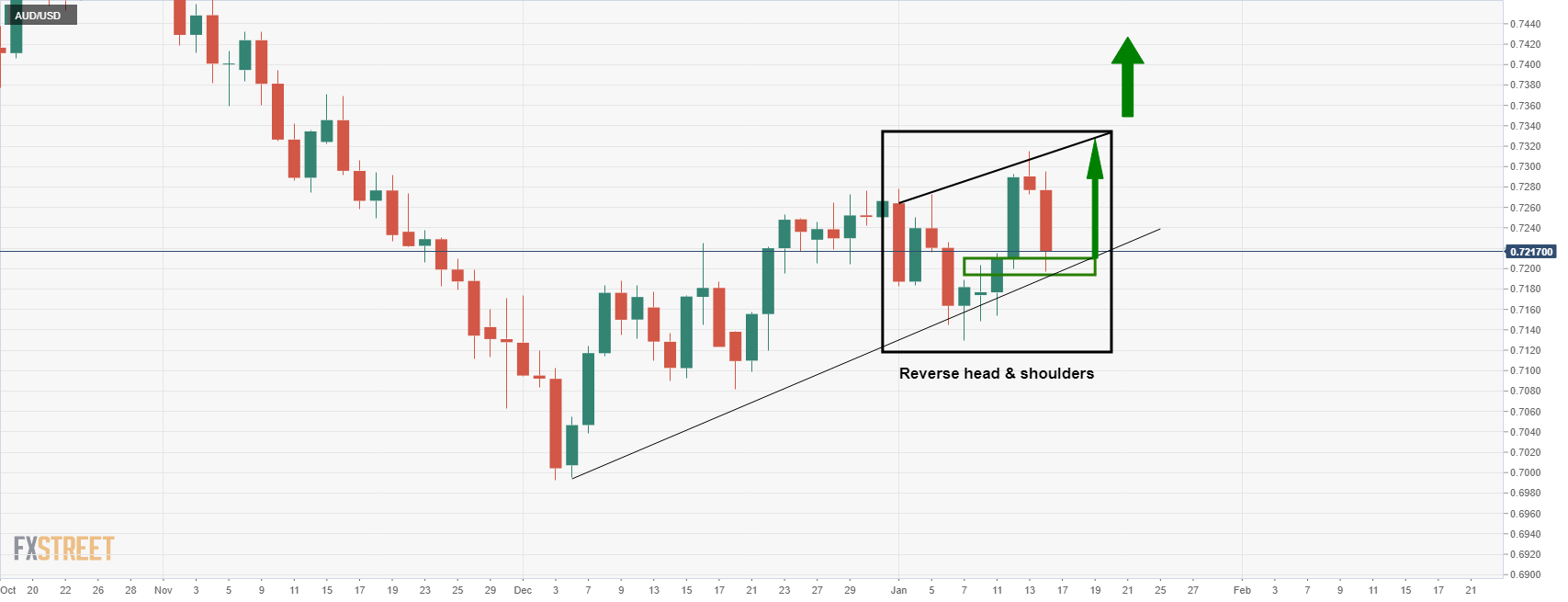

- AUD/USD bulls are guarding 0.7200 areas which could lead to a bullish surge.

- A break of trendline support opens risk to 0.7000 which guards 0.6920 and then 0.6780.

As per the analysis at the start of the week, AUD/USD Price Analysis: Bears pressure 0.72 the figure, eyes on key employment data, the price is stabilising near 0.7200. There has been a low of 0.7195 so far, but this area is expected to be a strong location of support.

If the bulls commit to here in a significant way, a thrust to the upside could come as a consequence and lead to prospects of a bullish continuation towards 0.7400 and beyond channel resistance:

The bulls have committed to around 0.7200 since the prior analysis (above) illustrated in the up to date price action chart as follows:

In doing so, there are prospects of a right-hand shoulder (RHS) being formed. Should this development play out, then the price would be expected to break out from the neckline resistance and move in to challenge the channel resistance thereafter. This could leave the 0.74 figure exposed for a test and the potential for a subsequent break thereof.

On the other hand, should the bears break this current area of support, the dynamic trendline support would be exposed and vulnerable. 0.7150 and 0.7130 recent lows would guard prospects of a weighty breakout to the downside:

0.7000 guards 0.6920 and then much lower towards 0.6780 thereafter.

What you need to know on Tuesday, January 18:

The week started in slow motion, with little action across the FX board. Chinese data released at the beginning of the day provided a modest boost to high-yielding assets, which changed course during European trading hours. US markets were closed due to the celebration of Martin Luther King Day, with no action in stocks and bonds.

The EUR/USD pair trades a handful of pips above the 1.1400 threshold, while GBP/USD hovers around 1.3650. The USD/JPY pair managed to post a modest intraday advance and settled around 114.60 helped by the positive tone of Asian and European equities.

The AUD/USD pair is unchanged at around 0.7210, while USD/CAD eased to 1.2520. Commodities remained within familiar levels, with gold trading at $1,818 a troy ounce and WTI consolidating at $83.70 a barrel.

Market players are still looking for yields, reflecting inflation-related concerns, and equities for directional clues. Later in the week, the EU will publish the final reading of December inflation figures. The European Central Bank still maintains a wait-and-see stance regarding inflation, hoping prices pressures will recede without their intervention, and currently maintaining the ultra-loose financial support.

Shiba Inu price primed for 50% breakout to kick start new bull run

Like this article? Help us with some feedback by answering this survey:

- EUR/JPY held above its 200DMA at 130.58 on Monday in quiet, US holiday-thinned trade due to MLK Day.

- Traders are focused on the upcoming BoJ policy meeting, amid expectations for inflation/growth upgrades and potentially hawkish chatter.

EUR/JPY has stabilised to the north of its 200-day moving average at 130.58 on Monday in quiet trade with US markets shut for MLK Day. Volumes are expected to pick up during the upcoming Asia Pacific session with the BoJ set to announce policy. No changes to the central bank’s ultra-dovish stance is expected, but sources have hinted that 1) inflation and growth forecasts could be lifted and 2) some BoJ policymakers are keen to discuss the conditions for a reduction of stimulus. Indeed, hawkish chatter from BoJ sources last week ahead of the upcoming meeting was one reason why EUR/JPY fell briefly below 130.0 last week.

However, EUR/JPY’s dip last week below the big figure was used as an opportunity to add to long positions by bulls and those seeking to play the range. Seemingly traders did not see hawkish BoJ chatter as reason enough to push EUR/JPY back into its late-November/most-of-December 127.50-129.50ish ranges and the fundamentals do back this up. Yes, global equities have weakened since the start of the year as a result of monetary policy tightening fears (mostly regarding a potentially overly aggressive Fed) and this has contributed to EUR/JPY pulling back from recent highs above 131.50.

But Fed tightening fears, which have pushed US bond yields substantially higher since the start of the year, are also exerting hawkish pressure on Eurozone money and bond markets. Despite assurances from “core” ECB policymakers (like President Christine Lagarde and Chief Economist Philip Lane) that the conditions for a rate hike will not be met in 2022, money markets are pricing 20bps of tightening by the end of 2022 (and 10bps by October). Meanwhile, the German 10-year is probing 0.0%, up nearly 40bps from its December lows. Recent fundamental developments thus clearly favour EUR/JPY remaining in its recent 130.00-131.50ish range, barring a significant turnaround in Eurozone yields or ECB rate hike bets.

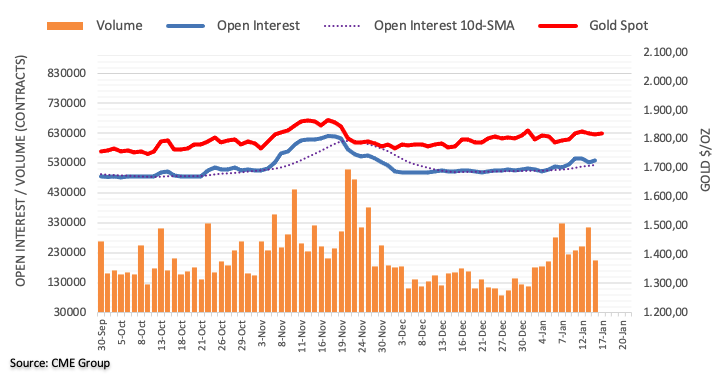

- Gold is in a phase of consolidation although bearish while below $1,830.

- The week is starting out quiet as markets are starved of drivers.

- The Fed's blackout period and light data week leave gold in limbo.

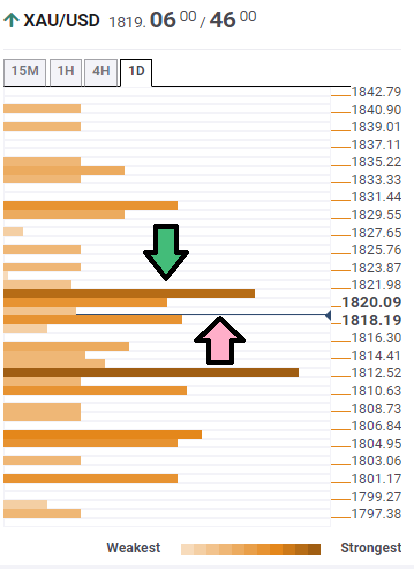

As per the start of the week's analysis, Gold, Chart of the Week: Bearish confluences below $1,830, the yellow metal, XAU/USD, is on the backfoot still and pressured by a more robust US dollar. At $1,818, gold is trading around flat on the day after travelling in a tight range of between $1,813.20 and $1,823.21.

With Wall Street closed on Monday, it's a quiet start to the week in markets with a light economic calendar and the Federal Reserve blackout period before the next interest rate decision later in the month, 26 January. With the coronavirus risk and negative sentiment there abating, there is little out there driving prices. Instead, a phase of consolidation has left the priors metal bounded to familiar territory with the price leaning against a key daily support structure.

In Asia, there was at least key data from China's economy that showed it had rebounded in 2021 from its pandemic-induced slump. However, the pace slowed further in the fourth quarter off the back of weak consumption and a property downturn. This has fallen into the hands of the US dollar bulls that had taken the reigns on Friday in a risk-off market environment.

Additionally, the PBoC was surprised by cutting the 7-day reverse repo rate in addition to cutting the 1-year MLF rate in a shift in policy that reflects the desire from policy makers to quickly stabilise economic growth.

''The PBoC has a limited window for further monetary easing, as it factors in global considerations. In particular, with the Fed looking ready to embark on rate hikes soon, the PBoC will likely intensify its focus on financial stability later this year,'' analysts at ANZ Bank explained. ''The stock market wobbles and capital outflows associated with the last Fed tightening cycle haven’t been forgotten.''

The US dollar index, DXY, which declined sharply last week until Friday's leap, rose 0.1% to 95.346 despite the cash Treasury market being closed as well for a holiday.

We now are seeing 3.7 Fed rate hikes priced in for 2022 and 2.3 for 2023. Goldman Sachs told clients that ''market participants seem to be inferring that the risks to policy pricing are now more balanced,"

Meanwhile, China's appetite for precious metals is growing, analysts at TD Securities explained. ''Tracking positions held by the top participants in Shanghai, we find that Chinese traders have finally increased their appetite for gold and silver amid weakening growth and as domestic infections spread. Alongside an increase in CTA trend follower positioning, this flow has been sufficiently strong to lift gold prices against the prevailing narrative of a hawkish Fed.''

However, the analysts also explained that ''as global markets remain intensely focused on pricing the Fed's exit, we expect fewer sources of upside flow in the coming weeks to leave gold prices vulnerable to a consolidation.''

As for the greenback, bets that the dollar will rise have edged lower in the week's positioning data to Jan. 11. However, they remained close to recent highs, suggesting investors are keen to hold the greenback amid "hawkish rhetoric from the Fed in recent months", Rabobank wrote in a note this week. "However, the sell-off in USDs in the spot market last week suggests that long positions had become crowded," Rabobank analysts added.

All in all, this does leave the outlook consolidative for both the yellow metal and the greenback and the following technical analysis rhymes with such sentiment:

Gold 4-hour chart

At the start of the week, it was indicated that there would be an upside correction before a move lower to test support as per the chart above.

This has played out as follows, so far:

Meanwhile, the outlook is bearish and there are prospects of a move into the depths of the $1,800s to meet the $1,801 prior low. However, a break above $1,829 and a close in the $1,830's would negate the bearish outlook.

- GBP/JPY is consolidating near-156.50 in quiet trade as focus turns to a heavy slate of UK data and the BoJ meeting.

- The pair is also likely to continue to trade as a proxy of global risk appetite this week.

After last Friday’s brief dip below support at the 156.00 level and test of the 155.50 mark, the pair has recovered back to trade in the 156.50 area for most of Monday’s session, up about 0.2% on the day. FX volumes were thinner than usual on Monday given the closure of US markets for MLK Day, making for unusually flat trading conditions. Monday’s modest recovery back above 156.00 sets up the possibility that the pair may be able to this week recover back to test recent highs in the 157.70 area, thus keeping alive GBP/JPY’s bull run that has seen its rally more than 5.0% from its early December near-149.00 lows.

Much of this rally depended upon a sharp improvement in global risk appetite in the final weeks of December as Omicron fears subsided and markets became more confident the BoE’s surprise December rate hike would be followed by more in 2022. But central bank tightening fears (primarily relating to the Fed) have knocked the wind out of US and global equities at the start of 2022, helping support the yen and pull GBP/JPY back from recent highs. GBP/JPY may well continue to track the fortunes of equity markets this week as a proxy for risk appetite.

A heavy slate of UK data, including the latest jobs report on Tuesday, inflation numbers on Wednesday and latest retail sales figures on Friday might provide some upside risk to sterling if strong enough to support BoE rate hike expectations. Traders should also be on notice for what could turn out to be an unusually interesting BoJ meeting on Tuesday, after sources recently hinted that members at the bank are already mulling how the bank might withdraw stimulus in the coming years, even prior to inflation returning to the BoJ’s 2.0% target. Any chatter on this front could pump rate hike expectations for 2023 or beyond and could put some upwards pressure on Japanese yields, though the BoJ’s Yield Curve Control should keep volatility under wraps. Nonetheless, a hawkish BoJ meeting would offer the yen support and will be worth watching.

- EUR/GBP bulls are in charge at the start of the week.

- Bulls testing hourly resistance in a bearish market.

- UK politics are front and centre on a light data week.

EUR/GBP is in the hands of the bulls during the New York session. At 0.8359 currently, the price is 0.27% higher on the day so far after travelling from a low of 0.8338 and reaching a high of 0.8361. The week ahead is relatively quiet as per the economic calendar so sentiment surrounding the central banks and European politics would be expected to be the main drivers.

High up on the list of political themes is Brexit. Liz Truss, Secretary of State for Foreign, Commonwealth and Development Affairs of the United Kingdom, is entering "intense talks" with the EU to renegotiate the Northern Ireland Protocol, as hopes of a Brexit breakthrough loom.

The good news for sterling bulls is that Ms Truss has opted for a softer approach than her predecessor, Lord Frost, inviting Mr Sefcovic to resume talks. Both officials have agreed to hold further talks on January 24, with Ms Truss clarifying in a Tweet that their teams will be working hard to deliver.

"Practical solutions to protect the Belfast Good Friday Agreement and political stability, ensure free flow of goods between the UK and Northern Ireland, and to defend the sovereignty of decision-making for all."

Elsewhere, the UK's Prime Minister Boris Johnson's leadership is under scrutiny. Mr Johnson is facing calls – also from within the Conservative party – to resign. The PM admitted he participated at a gathering in Downing Street in May 2020, when strict containment rules were in place (Partygate). Labour has argued that the PM may scrap the covid restriction to distract from Partygate.

Looking ahead, in just a few months, the PM's popularity and sterling's robustness will be tested again. Local elections are held across England, Scotland and Wales on May 5. However, this could be the lifeline that Johnson needs right now. A civil investigation in Partygate is underway but it is broadly accepted across the party that removing Johnson before this date would be extremely dangerous, as no one could be certain what the consequence would actually be.

Another factor that can go in the pounds favour is down to the Prime Minister's plans to scrap his plan-B Covid restriction in England, the Telegraph on Friday. This could underpin the pound, ultimately, due to prospects of aggressive hawkish actions from the Bank of England. Data will be eyed for heading back to around pre-pandemic levels and inflation will be monitored.

ECB in focus

As for the European Central Bank, analysts at Societe Generale are not expecting a hike this year and instead, they think the market is ahead of itself. ''Bur, '' they said, ''while that leaves us trying to work out where to take a stand against the euro's bounce, maybe the nest hedge against ECB hike enthusiasm is to buy EUR/GBP.'' ''November's Gross Domestic Product data may be as good as it gets here, and even if the current political chaos isn't market-relevant, sterling is overbought.''

UK's Gross Domestic Product being referred to was released on Friday which beat expectations.

- GDP +0.9% in November, Reuters poll +0.4%.

- UK economy 0.7% bigger than in Feb 2020.

The data suggested that Omicron's impact on growth may ultimately prove modest.

- Spot silver prices are consolidating in the $23.00 area on Monday in subdued, holiday-thinned trade.

- The main focus of precious metals will be on the reopening of US bond markets on Tuesday.

- If as many FX strategists suspect, the US dollar recovers this week ahead, that could be another XAG/USD headwind.

Spot silver (XAG/USD) prices are consolidating in the $23.00 area on Monday in subdued, holiday-thinned North American trade as a result of US market closures for MLK Day. That leaves spot prices roughly around the mid-point of last Friday’s $22.80-$23.30ish trading range, with prices still very much sandwiched between support and resistance in the form of the 50-day moving average at $23.20 and the 21-day moving average at $22.77. These ranges are very unlikely to be broken ahead of the upcoming Tuesday Asia Pacific session given the lack of trading volumes at present.

The main focus of precious metals will be on the reopening of US bond markets on Tuesday after the implied yield on US 10-year note futures were reported to have gone as high as 1.86% on Monday. 10-year yields surged back above 1.80% last Friday to close at multi-year highs and, if Monday’s move is replicated on Tuesday, that would mark the highest level since January 2020. The upside last Friday was driven by a rally in underlying real yields, with the 10-year TIPS hitting its highest level since early Q2 2021 above -0.70%.

Higher real yields diminish the appeal of non-yielding precious metals and so if real yields continue to rally this week, perhaps as traders “price in” a hawkish upcoming Fed meeting next week, XAG/USD could be hit. The $22.60s has been an important balance area in recent months and would be a key level of support to watch. Beneath that, $22.00 is the next key area of support to keep an eye on. Compounding silver’s potential headwinds this week could be if the US dollar, as many FX strategists have been predicting, starts to recover some ground this week after getting battered amid a squeeze on over-crowded long-positions last week.

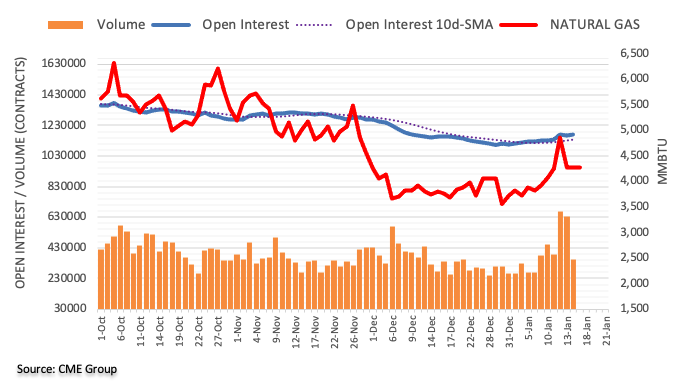

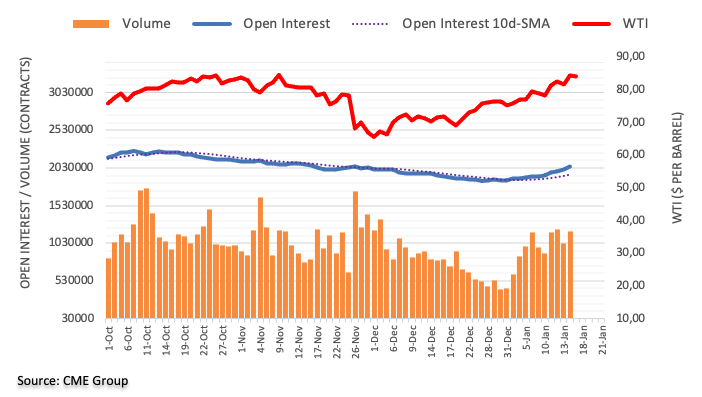

- WTI is trading in the $84.00 per barrel area having dipped back from two-month highs printed earlier in the session.

- China reserve release chatter and Libya output recovery news hasn’t dented optimism, with WTI still up nearly $9.0 in 2022.

- Focus on Monday has been on tight conditions in the physical market.

Amid holiday-thinned trading conditions with US markets shut for MLK Day, oil prices have been broadly stable on the first trading session of the week, with front-month WTI futures subdued near $84.00 per barrel. Prices hit a fresh two-month high in the $84.70s early on during Asia Pacific trade, but profit-taking ahead of the 2021 highs (in the $84.90-$85.50 area) had pushed WTI back to the mid-$83.00s by midway through European trade. Prices have since recovered to near-bang on $84.00, where they trade lower by a very modest 30 cents or so on the day, up near $9.0 (or close to 12%) on the year so far.

“Negative” developments such as news of an upcoming coordinated crude oil reserve release by China and the US as well as a recovery back to normal output levels in Libya hasn’t been able to substantially hurt prices on Monday. Regarding the former; sources told Reuters last Friday that China will release reserves in conjunction with the US between January 31 and February 6, after agreeing to a coordinated release with the US in late 2021. In terms of the output recorvy in Libya; production is back to 1.2M barrels per day (BPD), and near late-2021 levels of around 1.3M BPD, from as low as 700K BPD as recently as two weeks ago.

Focus has instead been on tightness in the physical crude oil market. Various grades of physical crude oil are currently trading at multi-year highs, which analysts at Reuters say suggests “a tight market (that) will push the futures rally on”. Differentials to crude oil future prices of a number of key Atlantic Bassin crude oil grades jumped to 18-month to two-year highs last week. “(It) turns out Omicron wasn’t so bad and supply issues were worse than anticipated," one crude oil trader was quoted as saying, adding that “(Buyers) are snapping up everything no matter what grade”.

Recall that smaller producers (like Libya) within OPEC+ have struggled to keep up with the cartel’s output quota hikes in recent months. “Bullish sentiment (in oil markets) is continuing as OPEC+ is not providing enough supply to meet strong global demand” said an analyst at Fujitomi Securities. In terms of key events to keep an eye on this week, weekly US inventory reports on Tuesday and Wednesday will be the most important. The US Energy Information Agency said last week that crude oil stocks fell to their lowest since October 2018, after data confirmed stocks falling for a seventh consecutive week.

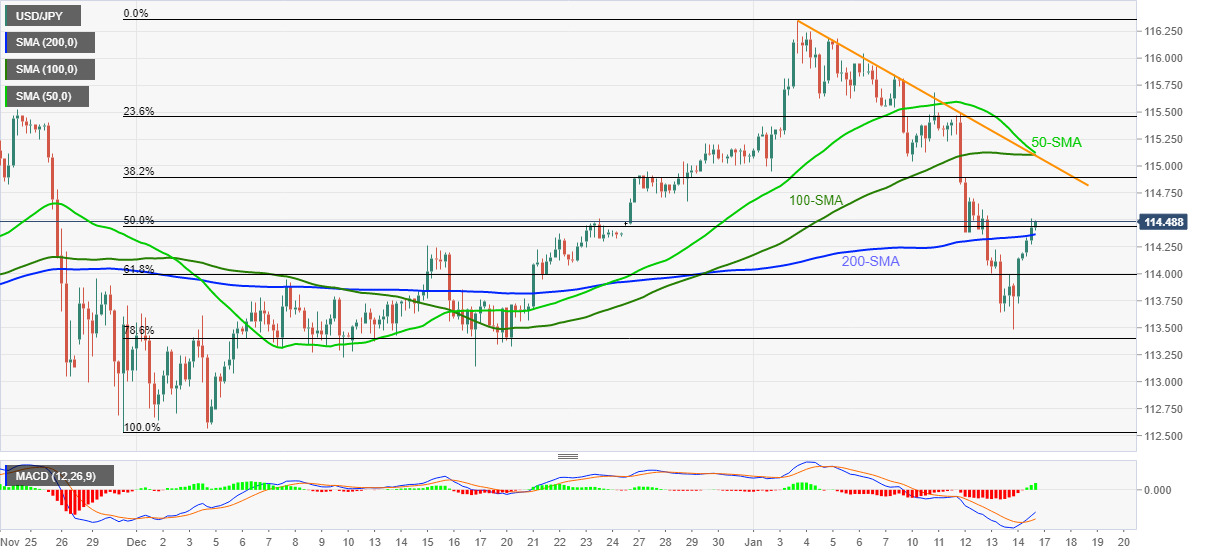

Analysts from Danske Bank see the USD/JPY moving lower over the next months. They warn that a significant change in risk sentiment causing US Treasury yields and commodities to decline significantly could take USD/JPY quicker towards 100.

Key Quotes:

“A rebound in US yields and commodities, in particular oil has weighed heavy on JPY over the recent month, which drove USD/JPY above 116. On broad USD weakness on the back of the December US CPI figures, the cross corrected significantly lower again, though. We see an increasing risk that central banks are forced to tighten significantly to bring demand down while fiscal stimulus wanes, which will move the global economy in to a period with slower growth and less inflation. That will result in flatter yield curves and less pressure on commodity prices including oil. We forecast the cross at 113.5 in 1M, 112 in 3M and 111 in 6M and 109 in 12M.

“Upside risks to USD/JPY primarily comes from further curve steepening if the global economy moves back in reflation mode because COVID-19 and labour market issues are solved and growth beats expectations. Significant change in risk sentiment causing US yields and commodities to decline significantly could take USD/JPY quicker towards 100.”

According to analysts from Danske Bank, the difference between the Federal Reserve (Fed) and the Reserve Bank of Australia (RBA) will likely weigh on the Australian dollar. They forecast AUD/USD at 0.72 in a one-month period and at 0.71 in six months.

Key Quotes:

“AUD has appreciated over the past month despite the record-high infections of the omicron-variant, as Australia’s new Covid-strategy has entailed only very light restrictions relative to the earlier lockdowns.”

“Renewed stimulus in China has supported Australian terms-of-trade, as prices of its key export commodity, iron ore, have recovered moderately on the back of more positive demand outlook. Broad USD weakening has also contributed to higher AUD/USD and stronger commodity prices, although we still think the move is unlikely to last.”

“The Reserve Bank of Australia could potentially end its QE purchases in February, although the omicron-driven combination of weaker consumption and staff shortages complicate the decision. However, with strong recovery in Australian labour force, dovish RBA communication and four hikes already priced in for 2022, we think relative monetary policy is generally likely to weigh on AUD later this year.”

The Federal Reserve, at the January meeting, will likely tee up the fed funds rate to increase as soon as its next meeting, explain analysts at Wells Fargo. They add that any hints that liftoff is likely to come as early as the March meeting will come down to the statement and Chair Jerome Powell's post-meeting press conference.

Key Quotes:

“The FOMC's first meeting of the year is likely be a quieter affair than its December meeting, when the Committee accelerated its taper plans and outlined a more aggressive policy path for 2022. There will not be a fresh Summary of Economic Projections, and we expect the FOMC to reaffirm its current pace of tapering, leaving asset purchases on track to end in mid-March.”

“With the FOMC growing increasingly concerned about inflation, we look for January's post-meeting statement to signal the fed funds rate could be lifted at its next meeting on March 15-16. Such a hint could come by indicating that the labor market is close to maximum employment, the remaining criteria the Committee has laid out for liftoff. We expect the statement and Chair Powell in his press conference to downplay the temporary slowdown in growth due to the most recent wave of the virus and highlight the overall strength of the labor market.”

“To stave off a March rate hike, we believe the FOMC would need to see an abrupt slowdown in inflation. Although hiring is likely to stumble in January under the weight of Omicron, the current wave of cases is likely to worsen the existing supply challenges for labor and goods. If inflation continues to surprise to the upside, a March increase will be all but assured. The optics of standing idle with consumer inflation still at 7% will be difficult.”

“We anticipate the FOMC will raise the fed funds rate 25 bps per quarter through Q3-2023, bringing the target range to 1.75-2.00%. We also look for the FOMC to announce a reduction in its balance sheet at its September meeting this year, with runoff beginning the following month.”

Analysts at Danske Bank point out that the increasingly hawkish stance from the Federal Reserve continues to support their expectations of a stronger dollar with EUR/USD moving to 1.08 in a year from today, although they warn, the pair has predominately traded sideways over the past month.

Key Quotes:

“We lower our 12M forecast from 1.10 to 1.08 as we see policy makers as having become increasingly committed to curtail global inflation by tightening financial conditions; and further, the economic cycle is slowing. The risk remains that inflation fades by its own and supply chain issues are resolved, in which case there is upside risk to EUR/USD.”

“The key risk to see EUR/USD towards 1.20 is seeing global inflation pressures to fade and industrial production increase. However, ‘transitory’ has substantially lost credibility and European industrial production continues to be weak. The risk to take EUR/USD below 1.08 is a scenario where central banks tightens further amid a cyclical slowdown, akin a scenario like seen in early 80’s.”

- USD/CHF is on Monday consolidating near the 0.9150 mark in thin-US holiday-thinned trading conditions.

- USD flows ahead of next week’s Fed meeting are likely to take centre stage this week.

USD/CHF is on Monday consolidating near the 0.9150 mark in thin-US holiday-thinned trading conditions. Looking at the pair from a technical perspective over the very short-term, USD/CHF is being supported by an uptrend that has been in play since last Friday. A break below this trend-line would reignite the prospect of a retest of recent lows in the 0.9100 area. To the upside, the presence of the 200-day moving average at 0.9165 seems to be offering resistance. A break above this area would see USD/CHF quickly run into further resistance in the form of the 21 and 50DMA either side of the 0.9200 level.

In terms of the major drivers for the pair this week; USD flows ahead of next week’s Fed meeting are likely to take centre stage as traders assess whether the surprisingly hawkish Fed will end up being a dollar positive. Most strategists remain bullish on the buck despite recent weakness which many have argued was a result of a squeeze on over-crowded long-positioning. That suggests upside risks for the pair this week, though there won’t be much by way of tier one US data for the bulls to latch onto. The only notable US data are regional Fed manufacturing surveys for January, or data that pertains to the housing market (not of interest to FX markets right now). Switzerland also doesn’t see the release of any notable data, aside from Producer Prices on Tuesday.

Elevated global inflationary pressures haven’t really fed through into Switzerland and so the market’s conviction that the SNB will indefinitely continue with its ultra-accommodative stance remains strong. For USD/CHF traders, that means the SNB remains in the market trying to prevent CHF strength. Sight deposits of domestic banks rose sharply in the week ending on January 14 to CHF 655.103, a sign that the SNB might have been active in FX markets last week. This didn’t seem to impact CHF at the time.

- DXY turns positive and rises for the second day in a row.

- Holiday in the US to favor consolidation in USD/JPY.

- Bank of Japan to announce decision on Tuesday.

The USD/JPY is rising on Monday, trading above 114.50, supported by a stronger US Dollar gains G10 currencies. The pair is having the best day since early January as it continues to recover from the monthly low it reached on Friday at 113.45.

On a quiet session, that includes a holiday in the US (Martin Luther King Jr.) the dollar shows some strength on a day without new information. Equity markets in Europe are modestly higher and so there are US stock futures.

On Tuesday, the Bank of Japan will announce its decision on monetary policy. No change is expected. “While no change is policy is expected, leaks suggest there will be some modest upgrades to the bank’s inflation outlook in its new Outlook Report forecasts. Other reports suggest the BOJ is debating how to prepare markets for eventual liftoff, but we find it extremely hard to believe that the bank is really serious about tightening. Officials are playing with fire here as this will add to strong yen impulses”, explained analysts at Brown Brothers Harriman.

Levels to watch

The sharp rebound weakened the bearish bias, and now technical indicators favor a consolidation of an extension of the recovery. A decline back under 114.00 could increase the bearish pressure again, exposing first 113.75 and then 113.50. The USD/JPY peaked at 114.58 on Monday. The immediate resistance is seen at 114.70, and then the 115.00 zone.

Technical levels

The Bank of Canada's (BoC) Business Outlook Survey (BoS) for the fourth quarter revealed on Monday that the business sentiment in Canada improved again, with the BoS indicator coming in at a new record high of 5.99, up from 4.73 in the third quarter. Note that the data for the latest survey was collected prior to the rapid spread of the Omicron Covid-19 variant in Canada at the end of the quarter.

Key points as summarised by Reuters:

- 77% of firms see labor shortages intensifying; broad-based demand for workers is putting upward pressure on wages.

- A broadening set of firms saw a solid recovery in sales supported by strengthening domestic and foreign demand.

- Strong demand and bottlenecks in supply are expected to put upward pressure on prices over the next year.

- More firms reported impacts from labor shortages and supply chain disruptions, including continued drag on sales.

- In response to capacity pressures, most businesses set to increase investment and plan to raise wages to compete for workers.

- Firms expect some factors behind labor shortages may have a lasting impact, generating persistent tightness in labor markets.

- The balance of opinion on indicators of future sales growth rises to 57 in Q4 from 54 in Q3.

- 67% of firms expect inflation to be above 3% over the next two years and most predict it will return close to target in 1-3 years.

- The separate BoC Q4 survey of consumer expectations says inflation is seen hitting a record high 4.89% over the next 12 months.

- The separate BoC A4 survey of consumer expectations says people were more concerned about inflation now than before the pandemic and believe it has become more difficult to control.

Market Reaction

The loonie seems to have seen some positive ticks in wake of the latest BOS, with USD/CAD now closer to 0.4% lower on the day and again looking to probe the 1.2500 level. The report was undeniably strong, but some might suggest out of date given the deterioration in the Canadian economy due to the rapid spread of Omicron. Whether this, as well as the fact that FX market volumes/liquidity are thin on Monday due to US market closures, is enough to hold USD/CAD above 1.2500 remains to be seen.

The Bank of Japan (BoJ) will announce its policy decision on Tuesday, January 18 at 03:00 GMT. The BoJ is unanimously expected to keep its policy settings at the conclusion of its two-day review and as we get closer to the release time, here are the expectations forecast by the economists and researchers of eight major banks. The quarterly report on price and growth outlook will be critical.

TDS

“BoJ is more upbeat, upgrading the economic view for all 9 regions, which reveals growing confidence that the economy can withstand Omicron. The more positive assessment suggests BoJ will revise higher its growth and inflation forecasts for the coming fiscal year. Rising input costs and rising household inflation expectations also point to a higher inflation forecast.”

Standard Chartered

“We expect it to maintain the policy balance rate at -0.1% and the 10Y yield target at c.0%. Recent macro data such industrial production (IP), exports and job growth indicates that the economy has slowly rebounded from the virus shock and global supply bottlenecks. However, we think the rebound was mild and will need to be watched to ascertain its sustainability, going forward, especially with concerns about the Omicron variant and its impact. We expect the BoJ to discuss the issue of inflation at the meeting. Headline inflation has stayed benign, with no short-term inflation pressure expected. Nonetheless, Japan is unlikely to be immune to global inflation pressure caused by supply bottlenecks. Rising China PPI pressuring import prices and a weak Japanese yen (JPY) are key concerns for future CPI prints.”

Deutsche Bank

“The BoJ is unlikely to see much change now but reputable press reports are suggesting they are ready to become more hawkish in the coming months with a credible Reuters story late last week suggested they are prepared to raise rates before inflation reaches 2%. This is still someway off but if the BoJ can become more hawkish then that says something about the global direction of travel for monetary policy.”

Danske Bank

“Bank of Japan meets on Tuesday where no change is expected but we will listen closely to policy signals given Friday's Reuters story that BoJ may hike policy rates prior to hitting 2% inflation.”

ING

“Like in recent instances, we expect the meeting to be a non-event for JPY: the BoJ should unsurprisingly revise its growth forecasts lower, and its inflation forecasts higher, while signalling no changes in the policy mix.”

UOB

“Our monetary policy outlook is unchanged as the uncertain near-term growth outlook and potentially even weaker inflation outlook (due to crude oil price correction) keeps our view that the BoJ will not be tightening anytime soon and will maintain its massive stimulus, possibly at least until FY2023.”

SocGen

“We expect the BoJ to maintain its current main monetary policy (of YCC and ETF purchases). We are looking for an increase in the core CPI (CPI excluding fresh food) forecast for FY22 from +0.9% in October to +1.1% due to the rise in crude oil prices and the depreciation in the yen. We also expect the BoJ to change its assessment that ‘the downside risk is greater’, reflecting the change currently underway in corporate pricing behaviour and inflation expectations against a backdrop of soaring raw materials prices. However, we believe price outlooks are highly unlikely to reach the 2% target during the forecast period to FY23. Furthermore, even if price risk assessments do not change, this does not necessarily mean there would be a change in the policy of continuing monetary easing. On the other hand, we do expect the growth outlook to be lowered from 3.4% in October to 2.8% in FY21, reflecting the effects of behavioural and supply restrictions due to the spread of the Delta variant over the summer, and the growth outlook for FY22 to be raised from 2.9% to 3.5%, boosted by the government's economic measures.”

Citibank

“Despite media reports indicating the BoJ is debating an interest hike potentially, the BoJ is expected to keep its policy on hold at this week’s monetary policy meeting. It is considering raising the core CPI outlook for FY22 to 1% levels from 0.9% as of October, according to some reports, but in that case we would expect the BoJ to emphasize exogenous contributions such as commodity price spikes.”

- GBP/USD is consolidating just above 1.3650, a tad lower on the day, ahead of a busy week of UK data.

- The pair is testing a key uptrend, a break below which could open the door to a move to 1.3600.

Amid a lack of tier one US data releases or Fed speakers (who are in blackout ahead of the January 25-26 meeting) this week, GBP/USD may well be driven more by the sterling side of the equation this week. Indeed, the latest UK labour market report is out on Tuesday, followed by December Consumer Price Inflation data on Wednesday, ahead of December Retail Sales on Friday. The data will help shape expectations for whether the BoE will hike again in February (money markets are suggesting this is a strong likelihood), with these expectations also set to be directly shaped by remarks from Governor Andrew Bailey himself on Wednesday. BoE’s Catherine Mann, who has in recent months erred more on the dovish side, will also speak on Friday.

Ahead of a busy week of UK economic/central bank events, GBP/USD is consolidating just above 1.3650, a tad lower on the session. Trading conditions have been thin and subdued thus far this Monday give the closure of US markets for Martin Luthar King Jr Day. The recent pullback from last week’s highs at 1.3750, which saw GBP/USD fail to break above its 200DMA, has not yet been deep enough to warrant suggestions that the pair’s bull run from the December lows is over. Indeed, the pair is currently probing but is yet to break below an uptrend linking the January 3, 6, 10 and 11 lows.

Should this trendline hold, that bodes well for a potential recovery back to the north of 1.3650. But should the US dollar, which weakened broadly last week as crowded long-positioning was squeezed, see some recovery this week, triggered perhaps by Fed tightening bets or perhaps by further losses in equities, cable could well be headed lower. Short-term bears would initially look for a test of the 1.3600 level, an important area of both support and resistance in recent months.

- USD/CAD is trading in the 1.2520s, having bounced from a test of 1.2500 ahead of the release of the BOS.

- Trading conditions have been tentative thus far with US markets shut for MLK Day.

USD/CAD recently bounced at 1.2500, a level which coincides with the pair’s 200-day moving average, and is back to trading in the 1.2520s, though is still down about 0.2% on the day. That actually means that the Canadian dollar is the best performing G10 currency on the day, albeit by a slim margin, despite the slight pullback from highs in crude oil markets. The Bank of Canada will release its quarterly Business Outlook Survey (BOS) at 1530GMT, which will be viewed in the context of how likely the bank is to shift its interest rate guidance at the upcoming January 26 policy meeting to signal a potential rate hike in March.

FX markets may be tentatively buying the loonie in anticipation of a hawkish BOS, which may explain some of the current CAD outperformance. ING think that given “today’s survey may not fully mirror the worsening demand outlook as data was mostly collected before the Omicron crisis become severe… the survey’s explanatory power may be somewhat limited, but there are still a few points to keep an eye on”. These, the bank says, include “inflation expectations (and how many firms still believe high inflation is due to temporary factors), hiring intentions and CAPEX investment figures (which had been quite strong earlier in the year)”.

Market commentators may warn not to read too much into the very shallow price action on Monday given low volumes and thin liquidity as a result of US market closures for Martin Luthar King Jr Day. Things will get more interesting for the pair later in the week, with Canada December Consumer Price Inflation and Retail Sales data and US regional Fed manufacturing surveys for January set to be the most closely followed releases. ING suspect that “external factors” like oil prices are likely to continue to prove “supportive to the currency… we expect any rebound in USD/CAD to stall around the 1.2600 region this week”.

- USD/TRY extends the downside near 13.40 on Monday.

- Turkey’s Budget Deficit jumped to $145.74B in December.

- Attention is on the CBRT event on Thursday.

The Turkish currency adds to Friday’s small gains and manages to keep USD/TRY around the familiar range in the 13.40 region so far on Monday.

USD/TRY cautious ahead of the CBRT

USD/TRY sheds ground for the second session in a row at the beginning of the week, although it remains largely within the range bound theme in place since the new year kicked in.

Moving forward, the pair is expected to maintain the side-lined trading in the next sessions pari passu with increasing cautiousness, as the Turkish central bank (CBRT) will meet on Thursday.

In the domestic calendar, the Turkish Budget Balance showed a record deficit of TL145.74B during last month, largely in response to the combination of increased gas imports, soaring prices of the commodity and the collapse of the lira. That said, the total deficit for 2021 reached TL192.2B.

What to look for around TRY

The pair seems to have moved into a consolidative phase within a 13.00-14.00 range since the beginning of the new year. Higher-than-expected inflation figures released earlier in the year put the lira under extra pressure in combination with some cracks in the confidence among Turks regarding the government’s recently announced plan to promote the de-dollarization of the economy. In the meantime, the reluctance of the CBRT to change the (collision?) course and the omnipresent political pressure to favour lower interest rates in the current context of rampant inflation and (very) negative real interest rates are forecast to keep the domestic currency under intense pressure for the time being.

Key events in Turkey this week: Budget Balance (Monday) – CBRT Meeting (Thursday) – Consumer Confidence (Friday).

Eminent issues on the back boiler: Progress (or lack of it) of the government’s new scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Much-needed structural reforms. Growth outlook vs. progress of the coronavirus pandemic. Potential assistance from the IMF in case another currency crisis re-emerges. Earlier Presidential/Parliamentary elections?

USD/TRY key levels

So far, the pair is retreating 0.30% at 13.4259 and a drop below 12.7523 (2022 low Jan.3) would pave the way for a test of 12.4060 (55-day SMA) and finally 10.2027 (monthly low Dec.23). On the other hand, the next up barrier lines up at 13.9319 (2022 high Jan.10) followed by 18.2582 (all-time high Dec.20) and then 19.0000 (round level).

USD/CAD maintains a clear top. Therefore, economists at Credit Suisse still see scope for a break below 1.2455/31 despite the recent stabilization above this level.

Resistance at 1.2608/30 expected to cap

“USD/CAD is back under pressure again and given our view that the broader USD is likely to see a deeper correction lower, we stay biased towards a break below 1.2455/31. Thereafter, we would see scope for a fall all the way to the ‘measured top objective’ at 1.2287, where we would look for a hold to define the bottom end of a broad range.”

“Daily MACD has crossed into bearish territory and continues to accelerate lower, reinforcing the case for further in-range weakness.”

“First resistance moves to 1.2571/77, then 1.2608/30, which should now cap the pair. A break above here would negate the top and turn the risks back higher within the range.”

- AUD/USD remains supported just above the 0.7200 level in thinned US holiday trade.

- The Aussie wasn’t responsive to mixed Chinese data or the PBoC’s latest rate cut.

AUD/USD is currently consolating just above the 0.7200 level, with the pair’s 21 and 50-day moving averages at 0.7211 and 0.7205 acting as magnets to the price action for now. Trading conditions are quiet at the moment given the closure of US markets for Martin Luthar King Jr Day. For now, an uptrend linking the January 7 and 11 lows is helping hold the pair to the north of the 0.7200 level. Should this level and the moving averages be broken to the downside, that would open the door to a swift retest of 2022 lows in the 0.7150 area.

AUD/USD, which currently trades flat on the session, did not react to a batch of mixed Chinese economic data releases during Monday’s Asia Pacific session. Whilst Chinese Retail Sales in December were weaker than expected, growing just 1.7% YoY (versus 3.7% forecasts), the rate of Industrial Production growth for the same month was stronger than expected at 4.0% YoY (versus 3.6% forecasts). China’s Q4 2021 GDP growth estimate was also released and, despite falling to its lowest YoY rate since Q3 2020, came in above expectations at 4.0%.

In response to the latest batch of data, China’s PBoC lowered the interest rate on some CNY 700B (roughly $110.2B) worth of one-year medium-term lending facility loans to financial institutions to 2.85% from 2.95%. The latest move is emblematic of a continued push by Chinese authorities to ease fiscal and monetary conditions in the country to shore up growth – if they are successful in the coming months, this could boost the Aussie. For the rest of the week, amid a lack of tier one US data releases or Fed speak, the main focus for AUD/USD traders will be on Thursday’s Australia December jobs report. The jobs data will be viewed in the context of how it impacts the likelihood that the RBA either axes is QE programme entirely in February, or continues it to May.

Analysts are mixed over what to expect from the meeting as Omicron rages in Australia but central banks elsewhere get more hawkish. On which note, analysts at Westpac said on Monday that “with the Fed's December meeting just over a week away and a likely hawkish outcome, it's hard to see the US$ giving too much more ground”. “We are not convinced that now is the time for a serious break higher in the AUD and see it at risk of probing into the $0.7100/50 region through the week,” they continued.

GBP/USD is little changed ahead of UK jobs and CPI data this week. Strong data should help the cable to challenge the 1.38 level, according to economists at Scotiabank.

Sterling to find support from data

“Tomorrow’s December payrolls figures and Wednesday’s December CPI print (economists expect a 5.2% YoY increase) should firm up expectations for a 25bps hike by the BoE roughly two weeks from now (~90% priced in).

“A perfect combination of strong data and hawkishsounding BoE speakers would likely lead the GBP to a test of 1.38, at least, to then set the 1.40 mark in its sights.”

“Johnson’s declining popularity may act as a drag on the pound as according to The Sunday Times almost three dozen Tories (toward 54 required) are in favour of a no confidence vote on PM Johnson.”

EUR/USD is holding above 1.14. The technical picture suggests the pair needs to break above the 1.15 region to extend its move higher, economists at Scotiabank report.

EUR/USD to test 1.1385/75 on a dip below 1.14

“Support at the 1.14 zone held it up in late-Friday trading and last night to preserve the EUR’s recent uptrend where a break through the high 1.14s and the 1.15 figure (with the 100-day MA at 1.1502) stand as key marks to beat to extend its gains.”

“Below 1.14, we spot support in the ~1.1375/85 area.”

AUD/USD reversed sharply lower on Friday. Nonetheless, economists at Credit Suisse stay biased toward a corrective move higher to 0.7341/49.

Aussie to see a deeper corrective recovery

“We still believe that a deeper corrective recovery is likely, with short-term MACD momentum still outright positive. With this in mind, we look for a move to the back of the broken channel and retracement resistance at 0.7341/49, which we then look to cap for the risks to turn back lower.”

“Only a weekly close above 0.7341/49 would negate the very large topping structure that we have been highlighting recently, which is not our base case.”

“A break below the short-term channel bottom at 0.7163 would be sufficient to end the corrective recovery potential and turn the risks directly lower. Next supports are seen at 0.7129, then 0.7089/82, below which would trigger a retest of next support at 0.6992/91.”

“Below 0.6992/91 would then open up an eventual move to 0.6758, which remains our core medium-term objective.”

Despite completing a bearish “reversal day” on Friday, EUR/USD maintains a near-term base above 1.1387. Analysts at Credit Suisse continue to look for a deeper recovery to 1.1513/24 and eventually 1.1597/1.1631, which ideally caps.

Strength stays seen as corrective

“Resistance is seen initially at 1.1464, then 1.1483/89, above which should see resistance next at the lows from October and November at 1.1513/24. Although we would expect this to cap at first we see scope for a move above here in due course to see a test of what we view as more important resistance at 1.1597/1.1631 – the 38.2% retracement of the May/November 2021 fall, 38.2% of the entire 2021 fall and November highs. Our bias would be for this to then cap for an eventual resumption of the core downtrend.”

“Key support stays seen at the ‘neckline’ to the base and the 13-day exponential and 55-day simple averages at 1.1387/54, which we look to hold. A closing break would suggest the base has already been negated, for a fall back to 1.1280/72.”

Gold remains trapped in the converging rage of the past year, but with US Real Yields and the USD expected to rise, strategists at Credit Suisse see the risk to the downside in 2022.

Rising US Real Yields and a strengthening USD are expected to weigh on gold

“Below $1,759/54 is needed to clear the way for a retest of key price and retracement support from the lower end of the range at $1,691/77. Only below here though would see a major top established to mark an important change of trend lower, with support then seen at $1,620/15 initially, before $1,572/61.”

“A break above $1,877 is needed to ease fears of a top, but with a break above $1,917 needed to suggest we are seeing a more sustainable move higher, potentially back to the $2,075 record high.”

“The completion of a large base for 10yr US Real Yields, as well as a strengthening USD, is expected to exert downside pressure on gold and increase the risk for a top.”

- Gold is subdued in the $1820 area in quite trade with US markets shit for the day.

- Amid a lack of tier one US data, XAU/USD will be looking to FX and bond markets for impetus this week.

It’s been a subdued session thus far for spot gold (XAU/USD) and this is overwhelmingly likely to remain the case for the rest of the day given the closure of US markets for Martin Luthar King Jr Day holidays. US bond markets are shut for the day and FX markets are not trading with much conviction, with the DXY broadly flat on the day in the low 95.00s, thus not giving gold much impetus by way of inter-asset class correlations.

There was some attention on US 10-year bond futures, the implied yield of which hit 1.86% earlier in the day, which some saw as a reflection of hawkish Fed bets ahead of next week’s meeting and in wake of the recent run of hawkish rhetoric from policymakers last week. But this seems not to have had an impact on gold, with traders opting not to read too much into moves in the futures markets plagued by a lack of liquidity this Monday.

XAU/USD is currently trading close to the $1820 level, meaning the precious metal remains nicely contained within the $1812-$1828ish ranges of the past few sessions. It’s a quieter week as far as US economic events is concerned, with no Fed speakers appearing given the central bank has entered blackout ahead of its January 25-26 meeting. Regional Fed manufacturing surveys for January and housing data will attract the most attention but are unlikely to do much to shift the overarching macro-narratives, such as the expectation that the Fed will kick off rate hikes in March.

That suggests gold traders will need to look to FX and bond markets for direction. If the overarching expectation of many strategists is that the dollar could see near-term strength as it recovers from its recent stumble on the expectation of Fed policy tightening, then that suggests gold’s bullish prospects are limited. That means recent highs in the $1830 area may continue to limit XAU/USD upside and a retest of key moving averages in the $1800-$1810 area is on the cards this week.

- EUR/USD is consolidating in the 1.1400 area with US markets shut for Martin Luther King Jr Day.

- Hawkish Fed bets have seen implied yields on US bond futures rise, which might offer the dollar support.

FX market volumes are thinner than usual this Monday, with US markets shut for Martin Luthar King Jr Day, making for more tentative/subdued trading conditions across asset classes. EUR/USD is thus flat on the day in the 1.1400 area, as it consolidates above support in the 1.1380 area in the form of December/late-November highs and below last week’s near-1.1500 highs. Though the Fed has entered blackout ahead of the January 25-26 meeting next week, the debate over the outlook for Fed policy in 2022 and beyond remains the hottest topic in the market right now. With expectations for multiple 2022 rate hikes near-unanimous amongst analysts, the main debate is now how this will impact the economy and assets classes.

US bond markets are closed but the implied yield on the US 10-year treasury note future went as highs as 1.86% in earlier trade, whilst data last Friday from the CFTC showed speculator’s net short bets on the US 10-year future had hit its highest since February 2020. If speculators are right and US yields do resume their march higher this week, this could provide some much-needed assistance for the US dollar, which got battered last week on an unwind of crowded long bets. FX strategists at ING “remain of the view that we have not seen the peak of the dollar yet, and the balance of risks for EUR/USD is still skewed to the downside, primarily on the back of ECB-Fed monetary policy divergence”.

In terms of the main drivers of the euro in the week ahead, the bank notes that “apart from tomorrow’s ZEW Survey in Germany, there is no market-moving data in the eurozone this week... (thus) most focus will instead be on the minutes from the ECB December meeting, as well as speeches by Lagarde, Villeroy and Holtzmann”. The bank also warns euro traders to keep an eye on political developments in Italy, as “ongoing discussions around the candidates for the next President of the Republic (who the parliament is due to elect at the end of this month) risk affecting a BTP-Bund spread which has already widened by some 30bp since October”. A wider spread between German and Italian bond yields can weigh on the appeal of the euro, though ING think any such euro weakness would most likely be expressed through a weaker EUR/CHF.

- EUR/USD alternates gains with losses in the low 1.1400s on Monday.

- Below the 4m line, the upside pressure could lose traction.

EUR/USD remains well supported in the 1.1400 neighbourhood following Friday’s strong retracement.

The inability of the pair to revisit the area of recent tops in the 1.1480/85 band (January 13/14) could spark fresh weakness in the near term. That said, below the 4m support line near 1.1380 the upside pressure should subside and sellers might return to the market and drag spot to, initially, the 55-day SMA, today at 1.1351.

The longer term negative outlook for EUR/USD is seen unchanged while below the key 200-day SMA at 1.1728.

EUR/USD daily chart

UOB Group’s Economist Ho Woei Chan, CFA, assesses the latest exports data results in China.

Key Takeaways

“China’s exports expanded strongly in Dec at 20.9% y/y in USD-terms (Bloomberg est: 20.0% y/y; Nov: 22.0%) while imports slowed to 19.5% y/y (Bloomberg est: 27.8% y/y; Nov: 31.7%).”

“The strong rebound in exports brought the full-year trade surplus to a fresh record high of US$676.43 bn in 2021 from US$523.99 bn in 2020. Its trade surplus with the US ballooned to US$397.14 bn from US$317.06 bn in 2020 as US’ demand recovered.”

“Despite a high comparison base, the resilient export growth suggests that strong external demand may alleviate the downward pressure on the Chinese economy this year, compensating for expected weakness in domestic consumption demand and investment due to the real estate downturn and domestic COVID-19 curbs. However, the wider impact of the Omicron variant on global demand will need to be monitored as infection rates rise. Overall, we expect a more modest growth in China’s exports of around 5% in 2022.”

- DXY looks to add to Friday’s gains above the 95.00 yardstick.

- The 55-day SMA at 95.73 emerges as the next up barrier.

The index struggles for direction in the low-95.00s and looks to extend the recent uptick at the beginning of the week.

If the recovery gathers serious traction, then DXY should leave behind the 4m resistance line near 95.20. Above this area, extra gains are likely with the immediate target at the 55-day SMA at 95.73. Further up, another visit to the 2022 high at 96.46 (January 4) should start shaping up.

Looking at the broader picture, the longer-term positive stance remains unchanged above the 200-day SMA, today at 93.14.

DXY daily chart

Eurozone money markets now price in 20 basis points (bps) of European Central Bank (ECB) rate hikes by December 2022, compared to 17 bps last week, according to Reuters.

Market reaction

This headline doesn't seem to be having a meaningful impact on the shared currency's performance against its major rivals. As of writing, the EUR/USD pair was trading at 1.1420, where it was up only 0.05% on a daily basis.

Meanwhile, the market mood remains upbeat at the start of the week with the Euro Stoxx 50 Index rising more than 0.5% on a daily basis.

- EUR/JPY reverses two daily pullbacks in a row and approaches 131.00.

- The 100-day SMA around 130.00 offers initial contention.

EUR/JPY rebounds from Friday’s lows near 129.80 and looks to regain the 131.00 neighbourhood on Monday.

As long as the cross remains capped by the YTD high at 131.60 (January 5), further consolidation or a move lower should remain in the pipeline. On the latter, the 130.00 area, where the 100-day SMA sits, should hold the initial test ahead of the so far 2022 low at 129.77 (January 14).

While above the 200-day SMA, today at 130.53, the outlook for EUR/JPY should remain constructive.

EUR/JPY daily chart

China's President Xi Jinping noted on Monday that they are fully confident in China's economic development and added that the overall momentum of the economy is sound, as reported by Reuters.

Additional takeaways

"World today is undergoing major changes."

"World has found itself in a new period of turbulence and transformation."

"We need to foster new opportunities amidst crises."

"The world economy still faces constraints."

"Countries should strengthen economic policy coordination."

"Should prevent world economy from dipping again."

"We need to discard cold war mentality."

"Confrontation will lead to disastrous consequences."

"We should stand against all forms of unilateralism or power politics."

"Will continue with reforms and opening-up."

"Will continue to let the market play a decisive role in resource allocation."

"All types of capital are welcome in China in compliance with laws."

Economist at UOB Group Ho Woei Chen, CFA, reviews the latest BoK monetary policy meeting.

Key Takeaways

“In line with market consensus, the Bank of Korea (BOK) raised its benchmark base rate by 25 bps to 1.25% ... This is the third rate increase in four meetings since Aug 2021 and has restored the interest rate to its level before the pandemic. Governor Lee Ju-yeol said the current policy rate is still below the neutral level and signaled that the BOK may raise the benchmark rate beyond 1.50%.”

“The BOK upped its inflation outlook for 2022 and now sees it “above the mid-2% level” compared to its Nov’s forecast of 2.0%. With pressure from commodity, housing and food prices, we have therefore raised our inflation forecast for 2022 to 2.6% from 2.0%.”

“The next meeting will be on 24 Feb which we expect the BOK to stay put. Thereafter, we expect another 50 bps interest rate hike this year given the hawkish posturing, likely with 25 bps each in 2Q and 3Q. Governor Lee’s second term will end on 31 Mar but his successor may be confirmed only after the new government comes into power in May following the presidential election on 9 Mar. This increases the uncertainty of the next rate hike timing.”

USD/CNH returns below 6.35. If the pair breaks below 6.33, the downtrend could extend as low as 6.2940, in the opinion of analysts at Société Générale.

Break above 6.4000 needed to extend the rebound

“Daily MACD has been posting positive divergence however price action has so far not affirmed a bullish breakout. USD/CNH has to cross beyond a multi-month channel at 6.4000 for confirming an extended rebound.”

“Failure to hold 6.3300 would mean continuation in downtrend towards next projections at 6.2940.”

“Immediate resistance is located at 6.3670.”

GBP/USD is seen an initial pullback after challenging the 200-day moving average (DMA) around 1.3740. According to economists at Société Générale, cable may find more support from UK data this week and challenge the 200-DMA again.

Critical support seen at 1.3500/1.3460

“Cable bulls may have another attempt at the 200-DMA (1.3737) this week if stocks don’t languish and labour market and CPI this week cement case for 25bp BoE hike in February.”

“Daily Ichimoku cloud at 1.3500/1.3460 should be an important support near-term.”

“Next potential hurdle is at October high of 1.3840.”

EUR/USD picks up pace and extends the bounce off 1.1400. In the view of economists at Société Générale, the world’s most popular currency pair is set to extend its advance towards the 1.1525/40 region.

1.1380 is first support

“EUR/USD is likely to head higher towards October low of 1.1525/1.1540.”

“Upper limit of the base at 1.1380/1.1350 is short-term support.”

Silver (XAG/USD) below $21.68/42 would confirm a major top is in place and an important change of trend lower. Strategists at Credit Suisse would then see support at $19.65 initially, ahead of $18.69/64.

Silver is closer to establishing a major top

“Silver is seen under more pressure and is already closer to the lower end of its medium-term range at $21.68/42, with recent strength having been capped at its 200-day average and then more recently at its 55-day average.”

“Our bias stays lower for an eventual sustained break of $21.42 to confirm a major top is in place and important change of trend lower. We would then see support at $19.65 initially, ahead of $18.69/64.”

“A close above $25.41 is needed to ease fears of a top and instead set a base, opening the door to a move back to the $30.10 high.”

According to FX Strategists at UOB Group, extra losses in USD/CNH seem unlikely in the short-term horizon.

Key Quotes

24-hour view: “Our expectations for USD to consolidate were incorrect as USD staged a sharp but short-lived drop to 6.3428 before rebounding. While there is room for the rebound to extend, any advance is unlikely to break the strong resistance at 6.3710 (minor resistance is at 6.3660). Support is at 6.3640 followed by 6.3500.”