- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 16-01-2022

- GBP/USD remains depressed, keeps last week’s pullback from 200-DMA.

- Receding bullish bias of MACD, nearly overbought RSI signal further weakness.

- Previous resistance line from September, two-week-old support line limit immediate downside.

- 78.6% Fibonacci retracement level, 100-DMA act as additional trading filters.

GBP/USD bounces off intraday low to 1.3675 during Monday’s Asian session. Even so, the cable pair holds onto the previous week’s U-turn from the 200-DMA.

In addition to the failures to cross the key moving average, easing bullish bias of the MACD and the overbought RSI conditions also hint at the GBP/USD pair’s further declines.

However, a convergence of a four-month-old previous resistance line and an upward sloping trend line from January 03, around 1.3655, becomes the key short-term support.

Also likely to challenge the GBP/USD bears is the 61.8% Fibonacci retracement (Fibo.) of the September-December downturn, near 1.3620, as well as the 100-DMA level of 1.3550.

Meanwhile, recovery moves may attempt to cross the 200-DMA level of 1.3735 whereas the 78.6% Fibo. level surrounding 1.3755 acts as an additional filter to the north.

Should GBP/USD bulls manage to cross the 1.3755 hurdle, tops marked in October and September 2021, respectively around 1.3835 and 1.3915, will be in focus.

GBP/USD: Daily chart

Trend: Further weakness expected

- AUD/USD grinds lower after declining the most in two weeks.

- Hawkish Fedspeak, weekend positioning triggered US Dollar rally the previous day.

- Virus woes, Fed rate hike concerns keep the risk barometer pressured ahead of the key China data.

- China Q4 2021 GDP, December Retail Sales, Industrial Production will be important for today, Australia employment eyed for the week.

AUD/USD stays defensive around 0.7215 during early Monday morning in Asia, following the heaviest daily fall in a fortnight.

The Aussie pair’s slump the previous day could be linked to the overall rally in the US dollar backed by the increased chatters over Fed rate hike, as well as the virus woes. It’s worth noting the market’s caution ahead of China’s key economic data.

The US dollar cheered the last dose of the Fed comments before the policymakers sealed the blackout period ahead of next week’s Federal Open Market Committee (FOMC) meeting. As a result, the US Dollar Index (DXY) gained the most in two weeks following its bounce off the lowest levels since November 10, around 95.16 at the latest.

Talking about the Fedspeak, Federal Reserve Bank of San Francisco President Mary Daly said that the latest Omicron wave will extend the period that inflation will remain high. Fed’s Daly also signaled that officials are “going to have to adjust policy”. On the same line, Federal Reserve Bank of New York President John Williams said Fed is approaching a decision to begin raising interest rates.

Further, US Retail Sales for December printed -1.9% MoM figure versus 0.0% expected and +0.2% prior. Further, the Michigan Consumer Sentiment Index for January also eased to 68.8 versus 70 forecasts and 70.6 previous readouts. The details also suggest that the highest inflation in 40 years weighs on consumer behavior.

It should be noted that Australia’s most populous state New South Wales (NSW) reported the biggest daily covid-linked deaths on Friday with 29 deaths, recently easing to 17 cases. Even so, Australian health authorities are confident NSW will see a plateau in its COVID-19 hospitalizations next week, as the state's numbers track "better than the best-case scenario" predicted, per ABC News.

Amid these plays, Equities also traded mixed while the US 10-yields rose 8.4 basis points (bps) to snap a four-day downtrend while closing at 1.793% on Friday.

Moving on, China’s headline economics will be crucial for the AUD/USD traders ahead of Thursday’s Australia jobs report. That said, China’s Q4 2021 GDP is expected to rise 1.1% QoQ versus 0.2% prior while the Retail Sales may ease to 3.7% versus 3.9% for December. Additionally, Industrial Production for the said month is likely to have softened to 3.6% versus 3.8% YoY.

Given the expectedly mixed data from China, AUD/USD prices are likely to remain at the mercy of the risk catalysts. Among them, Omicron and Fed rate-hike chatters are the key, which in turn could keep the pair pressured.

Technical analysis

AUD/USD remains pressured inside a short-term bullish chart pattern but below the key moving averages. Given the sluggish oscillators, the quote is likely to remain inside a 1.5 month-long bullish channel formation.

However, a convergence of the 20-DMA and 50-DMA restricts the Aussie pair’s immediate downside around 0.7210, a break of which will direct the AUD/USD bears towards the stated channel’s support line, close to 0.7150 at the latest.

Meanwhile, the 100-DMA level of 0.7285 and the channel’s upper line around 0.7330 restrict short-term advances of the AUD/USD prices.

“China's economy likely grew at the slowest pace in 1-1/2 years in the fourth quarter, dragged by weaker demand due to a property downturn, curbs on debt and strict COVID-19 measures, raising the heat on policymakers to roll out more easing steps,” said Reuters ahead of the key data release.

Highlights

Data on Monday is expected to show gross domestic product (GDP) grew 3.6% in October-December from a year earlier - the weakest pace since the second quarter of 2020 and slowing from 4.9% in the third quarter, a Reuters poll showed.

The world's second-largest economy, which cooled over the course of last year, faces multiple headwinds in 2022, including persistent property weakness and a fresh challenge from the recent local spread of the highly-contagious Omicron variant.

Policymakers have vowed to head off a sharper slowdown, ahead of a key Communist Party Congress late this year.

The central bank is set to unveil more easing steps, though it will likely favour injecting more cash into the economy rather than cutting interest rates too aggressively, policy insiders and economists said.

Policymakers have also pledged to step up fiscal support for the economy, speeding up local government special bond issuance to spur infrastructure investment and planning more tax cuts.

Market reaction

Global markets remain lackluster ahead of the key China data, which in turn weigh on the Antipodeans like AUD/USD and NZD/USD.

Read: NZD/USD bears attack 0.6800 on USD rebound, firmer yields, China GDP eyed

Liu Guiping, Deputy Governor of the People’s Bank of China (PBOC) warned that China is facing growing supply chain risk, also raising concerns over rising inflation and tightening monetary policies, during the Global Asset Management Forum speech in Beijing on Saturday.

Key concerns

Growing anti-globalisation and nationalist sentiment that could have an impact on international trade.

Increasingly unpredictable course of the Covid-19 pandemic.

Covid-19 has sped up the shift in the global distribution of production.

In addition to the influence of geopolitical contests, China’s industrial sectors are facing double pressure – industries moving into Southeast Asia and back to developed countries.

Chip shortages and supply chain stoppages threaten supply chain security and competitiveness.

FX implications

The news exerts additional downside pressure on the commodities and Antipodeans ahead of the key Q4 2021 GDP from China.

Read: NZD/USD bears attack 0.6800 on USD rebound, firmer yields, China GDP eyed

- Gold is under pressure near Friday's close while the US dollar corrects.

- The focus will be on Chinese data to start the week following US economic disappointments for December.

The price of gold, XAU/USD, is sat near the close of Friday on Monday's open in what is expected to be a quiet start to the week with only Chinese data eyed later today. The markets reacted defensively to disappointing US economic data for December which could weigh on Asian bourses as well, further supporting the greenback, especially should China disappoint in today's numbers.

US Retail Sales dropped 1.9% MoM, with control group sales down 3.1% MoM. ''The data suggest that the highest inflation in 40 years is impacting consumer behaviour, and this may well extend into the first quarter when the end of the child tax credits will also weigh,'' analysts at ANZ Bank explained.

Manufacturing also disappointed, dropping 0.3% MoM with Industrial Production slipping 0.1% MoM. ''The weakness in manufacturing was driven by a 1.3% drop in auto vehicles and parts,'' the analysts at ANZ Bank noted.

Meanwhile, January preliminary University of Michigan Consumer Sentiment dropped to 68.8 vs 70.6. Of note, current conditions are now at their lowest level in a decade and future conditions are down as well. Inflation expectations edged higher again and this aligns with sentiment surrounding the Federal Reserve.

Somewhat counterintuitively, this is supporting the greenback and weighs on the price of gold. Overall, despite weaker data, the market expectations are suggesting a March Fed funds hike is imminent. Specifically for gold, analysts at TD Securities explained that Shanghai traders are growing their gold length amid a rise in infections across China. ''Alongside an increase in CTA trend follower positioning, this flow appears to have been sufficiently supportive to lift gold prices against the prevailing narrative of a hawkish Fed'

The analysts note that ''levered short positioning, while not broad, remained bloated — which also leaves traders vulnerable to a positioning squeeze. That being said, the ongoing CTA buying program could soon be running out of steam, leaving fewer avenues for speculative length to grow.''

Additionally, the analysts explained, ''in China, aggregate net length in gold has increased towards its average value over the past twelve months, which also reduces the impetus for further purchases. Considering that markets will ultimately remain intensely focused on the Fed's exit, fewer sources of upside flow in the coming weeks could leave gold prices vulnerable to consolidation.''

Gold 4-hour chart

For the open, a correction could be on the cards in what would be a retest of the $1,821 structure. No matter which way, the outlook is bearish across the charts and there are prospects of a move into the depths of the $1,800s to meet the $1,801 prior low as per the illustration on the 4-hour chart above. However, a break above $1,829 and a close in the $1,830's would negate the bearish outlook.

- NZD/USD remains pressured after declining the most in two weeks the previous day.

- DXY bounced off nine-week low as hawkish Fedspeak propelled bond yields.

- US Retail Sales, Michigan Consumer Sentiment dropped, virus fears prevail.

- China Q4 2021 GDP, Retail Sales will be crucial for immediate direction.

NZD/USD fades late Friday’s bounce off 0.6792 while retreating to 0.6808 during early Monday morning in Asia.

The Kiwi pair dropped the most in a fortnight the previous day amid the US dollar’s stellar rebound, backed by the hawkish Fedspeak. The move paid a little attention to softer data, which in turn raised concern that the move could be due to the weekend positioning. The latest weakness in the pair, however, could be linked to the cautious sentiment ahead of the key data from New Zealand’s key customer China.

The US Dollar Index (DXY) gained the most in two weeks following its bounce off the lowest levels since November 10, around 95.16 at the latest. The greenback gauge benefited from the last dose of the Fed comments before the policymakers sealed the blackout period ahead of next week’s Federal Open Market Committee (FOMC) meeting.

Federal Reserve Bank of San Francisco President Mary Daly said that the latest Omicron wave will extend the period that inflation will remain high. Fed’s Daly also signaled that officials are “going to have to adjust policy”. On the same line, Federal Reserve Bank of New York President John Williams said Fed is approaching a decision to begin raising interest rates.

Talking about data, US Retail Sales for December printed -1.9% MoM figure versus 0.0% expected and +0.2% prior. Further, the Michigan Consumer Sentiment Index for January also eased to 68.8 versus 70 forecasts and 70.6 previous readouts. The details also suggest that the highest inflation in 40 years weighs on consumer behavior.

Elsewhere, NZ Prime Minister (PM) Jacinda Ardern crossed wires, via NZ Herald, during the weekend while suggesting the Government's next steps would be cautious, although she did not say whether caution meant remaining at the orange setting, or moving the country down to green, the most permissive setting.

It’s worth noting that the NZD/USD traders paid more attention to the hawkish Fedspeak that’s more likely to have fuelled the DXY, coupled with weekend positioning, than the downbeat US data. Equities also traded mixed while the US 10-yields rose 8.4 basis points (bps) to snap a four-day downtrend while closing at 1.793% on Friday.

Looking forward, NZD/USD traders will pay close attention to China data as the world’s biggest commodity user is struggling with the covid and financial market risks. “China’s industrial production, GDP and retail sales data will be eagerly awaited as the market ponders spill-overs from the real estate slowdown and the battle between the COVID-zero strategy and Omicron,” said ANZ. Forecasts suggest the headline Q4 2021 GDP to rise 1.1% QoQ versus 0.2% prior while the Retail Sales may ease to 3.7% versus 3.9% for December. Additionally, Industrial Production for the said month is likely to have softened to 3.6% versus 3.8% YoY.

Technical analysis

NZD/USD stays below 50-DMA after reversing from a seven-week-old horizontal hurdle surrounding 0.6890. The latest weakness takes clues from the RSI retreat but the bullish MACD signals keep the pair buyers hopeful until the pair breaks a monthly support line, around 0.6750 by the press time.

Alternatively, the 50-DMA level of 0.6855 precedes a seven-week-old horizontal hurdle surrounding 0.6890 to limit short-term advances.

- EUR/USD correcting Friday's drop but bearish while below the 50-hour EMA.

- Eyes on 1.15 the figure while markets access the divergence between the ECB and Fed.

EUR/USD will start the week after a poor end to last following the market's risk-off reaction to key, yet disappointing, US data. EUR/USD ended the day down some 0.35% falling from a high of 1.1482 and breaking the figure to print a low of 1.1398. The pair recovered some ground to end at 1.1415 and remains in technically bullish territory for the week ahead.

US Retail Sales fell a steep 1.9% MoM, with control group sales down 3.1% MoM. ''The data suggest that the highest inflation in 40 years is impacting consumer behaviour, and this may well extend into the first quarter when the end of the child tax credits will also weigh,'' analysts at ANZ Bank explained.

In other data, Manufacturing also disappointed, dropping 0.3% MoM with Industrial Production slipping 0.1% MoM. ''The weakness in manufacturing was driven by a 1.3% drop in auto vehicles and parts,'' the analysts at ANZ Bank noted.

Additionally, January preliminary University of Michigan Consumer Sentiment dropped to 68.8 vs 70.6. Of note, current conditions are now at their lowest level in a decade and future conditions are down as well. Inflation expectations edged higher again and this aligns with sentiment surrounding the Federal Reserve.

The market is pricing for an aggressive Fed in this regard, although the Fed's chairman, Jerome Powell while telling the Senate Banking Committee last week that he is keen to fight inflation, he also implied a very measured course of action. Additionally, Philly Fed President Patrick Harker said last week that he sees the Fed starting to shrink its balance sheet “in late 2022 or early 2023” after the central bank has raised its target rate sufficiently, to around 1 per cent from near zero.

Nevertheless, the divergence between the Fed and the Europen Central Bank is underpinning the greenback. ECB officials are not supporting the notion of a 2022 lift-off. Conversely, the Fed's funds target is expected to rise as early as March and could increase by 1% between now and the end of this year.

EUR/USD drivers for the week

Given the recent slide and corrective behaviour in the US dollar on Friday, the week ahead will offer an interesting technical scenario for EUR/USD on the approach to 1.15 the figure. In the absence of Fed speakers, the key fundamental drivers will be geopolitical tension in Russia and political noise in Italy polished off by the ECB minutes from the December meeting with a focus on the Omicron situation in Europe.

EUR/USD technical analysis

The bears could still emerge to test a touch deeper, potentially all the way to the prior resistance as illustrated in the daily chart above.

From an hourly perspective, following a break below the 50-hour EMA, the price could be stalling in its correction. However, while a 38.2% Fibo has already been hit, there is room still to go to mitigate the imbalance of price to 1.1424 in a 50% mean reversion of the hourly impulse:

1.1395 could be targetted on the next bearish hourly impulse.

- AUD/USD will start the week after a poor performance over the last couple of days.

- The Aussie jobs data will be eyed as bears test 0.72 the figure.

For the start of the week, AUD/USD has been on the backfoot having succumbed to a USD rebound on Friday. The following takes into account the price action in the greenback and the prospects for more upside which could tip the Aussie over the edge for the week ahead.

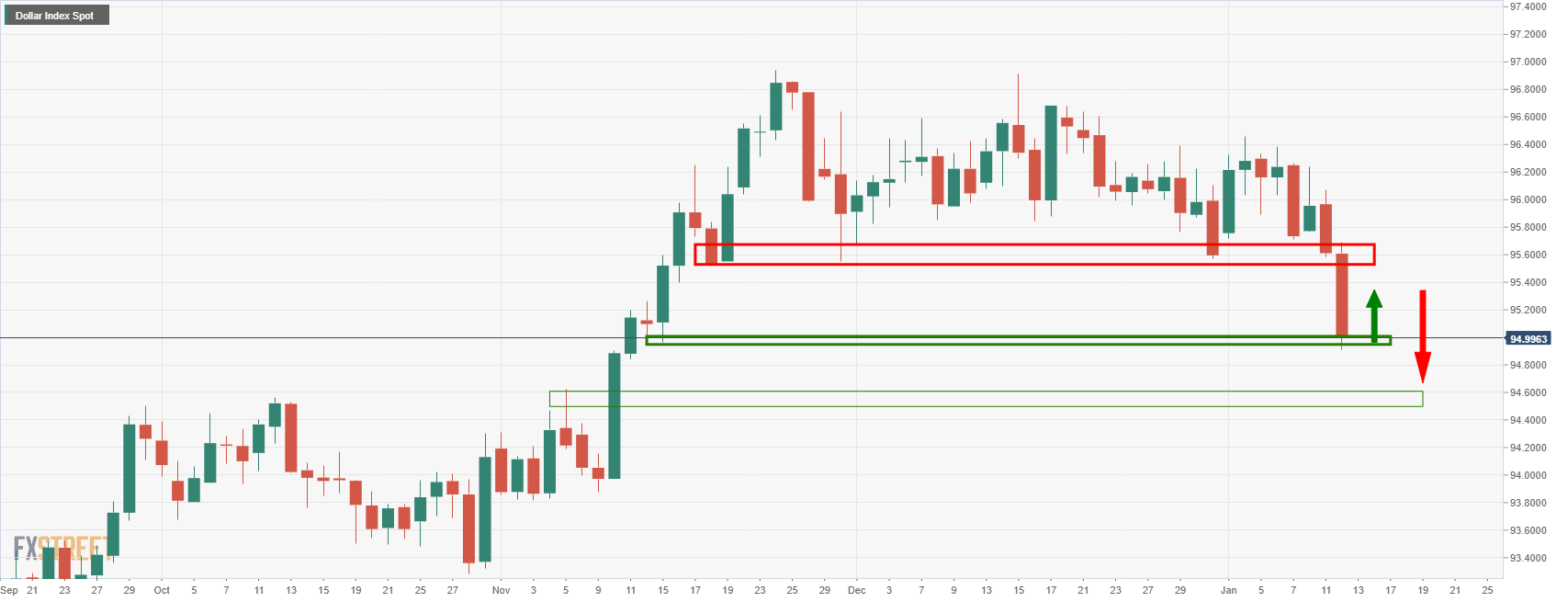

DXY daily charts

While the upside was forecasted, there could still be some more to go on a break of the 38.2% Fibonacci level near 95.24:

The 61.8% Fibonacci level is near 95.63 which has a confluence with prior support as illustrated above making for a compelling target.

This leaves the outlook for AUD/USD bearish, as follows:

A break 0.7200 support would be significant considering the psychological impact of a blowout of the dynamic trendline support. 0.7130 will be the next key support as prior lows ahead of 0.7080 prior lows.

On the other hand, the bullish inverse head and shoulders could play out as follows:

A move to the upside from the trendline support could be the start of the makings of the pattern. A bust through the neckline would be the nail in the coffin for the bears. This level comes in near 0.7320. Likely trigger points, one way or the other, would be with Chinese and Aussie data which is anticipated to be another positive report considering the easing of restrictions heading into the holiday period.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.