- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 17-02-2015

(time / country / index / period / previous value / forecast)

00:00 China Bank holiday

03:00 Japan BoJ Interest Rate Decision 0.10% 0.10%

03:00 Japan Bank of Japan Monetary Base Target 275

03:00 Japan BoJ Monetary Policy Statement

06:30 Japan BOJ Press Conference

09:30 United Kingdom Average Earnings, 3m/y December +1.7% +1.7%

09:30 United Kingdom Average earnings ex bonuses, 3 m/y December +1.8%

09:30 United Kingdom Bank of England Minutes

09:30 United Kingdom Claimant count January -29.7 -25.2

09:30 United Kingdom Claimant Count Rate January 2.6%

09:30 United Kingdom ILO Unemployment Rate December 5.8% 5.8%

10:00 Switzerland Credit Suisse ZEW Survey (Expectations) February -10.8

13:30 Canada Wholesale Sales, m/m December -0.3% +0.4%

13:30 U.S. Building Permits, mln January 1060 Revised From 1032 1060

13:30 U.S. Housing Starts, mln January 1089 1070

13:30 U.S. PPI, m/m January -0.3% -0.4%

13:30 U.S. PPI, y/y January +1.1%

13:30 U.S. PPI excluding food and energy, m/m January +0.3% +0.2%

13:30 U.S. PPI excluding food and energy, Y/Y January +2.1%

14:15 U.S. Industrial Production (MoM) January -0.1% +0.5%

14:15 U.S. Capacity Utilization January 79.7% 79.9%

19:00 U.S. FOMC meeting minutes

21:30 U.S. API Crude Oil Inventories February +1.6

21:45 New Zealand PPI Input (QoQ) Quarter IV -1.5% -0.2%

21:45 New Zealand PPI Output (QoQ) Quarter IV -1.1% -0.3%

22:00 U.S. FOMC Member Jerome Powell Speaks

23:50 Japan Adjusted Merchandise Trade Balance, bln January -712.1 -600.0

The Reserve Bank of Australia (RBA) released its minutes from February's monetary policy meeting on Tuesday. The RBA said that it cut its interest rate this month to support demand and to achieve balanced growth.

The central bank is concerned about housing price inflation. It noted that it would monitor closely developments in the housing market.

Australia's central bank reiterated that "a lower exchange rate was likely to be needed to achieve balanced growth in the economy".

The RBA pointed out that it had considered whether to lower its interest rate at the February meeting or to postpone it until March. It decided to cut in February.

The RBA cut its interest rate to a new record low of 2.25% this month, down from 2.50%.

Stock indices closed mixed as debt deal talks between the European Union and Greece broke down on Monday evening.

Germany's ZEW economic sentiment index increased to 53.0 in February from 48.4 in January, but missing expectations for a rise to 56.2. That was the highest reading since February 2014.

The increase was driven by quantitative easing by the European Central Bank and the better-than-expected economic data from the Eurozone.

Eurozone's ZEW economic sentiment index rose to 52.7 in February from 45.5 in January, beating expectations for a gain to 51.3.

The U.K. consumer price index declined to 0.3% in January from 0.5% in December, in line with expectations. That was the lowest level since 1989.

The drop was driven by lower fuel and food prices.

Consumer price inflation excluding food, energy, alcohol and tobacco prices climbed to 1.4% in January from 1.3% the month before.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,898.13 +41.08 +0.60%

DAX 10,895.62 -27.61 -0.25%

CAC 40 4,753.99 +2.04 +0.04%

The U.S. dollar traded higher against the most major currencies despite the weaker-than-expected U.S. economic data. The NAHB housing market index declined to 55 in February from 57 in January. Analysts had expected the index to rise at 58.

The NY Fed Empire State manufacturing index declined to 7.78 in February from 9.95 in January, missing expectations for a fall to 9.1.

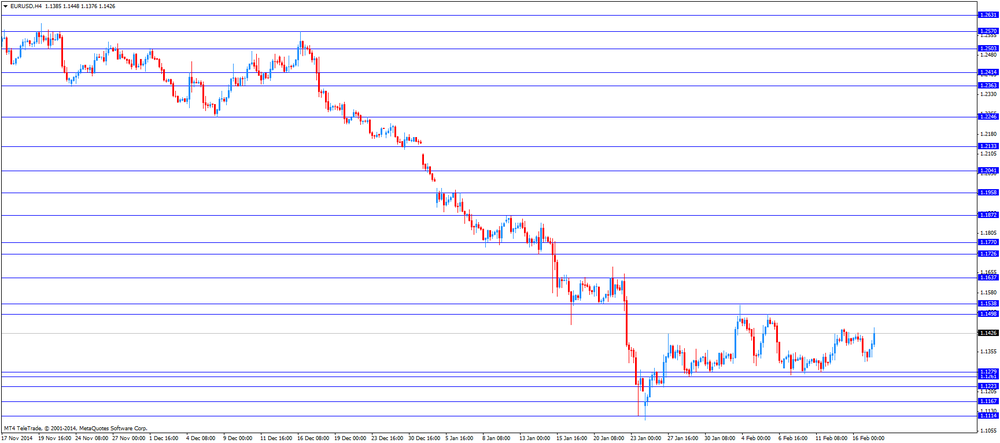

The euro traded lower against the U.S. dollar as investors remained cautious due to new debt deal talks between the European Union and Greece.

Germany's ZEW economic sentiment index increased to 53.0 in February from 48.4 in January, but missing expectations for a rise to 56.2. That was the highest reading since February 2014.

The increase was driven by quantitative easing by the European Central Bank and the better-than-expected economic data from the Eurozone.

Eurozone's ZEW economic sentiment index rose to 52.7 in February from 45.5 in January, beating expectations for a gain to 51.3.

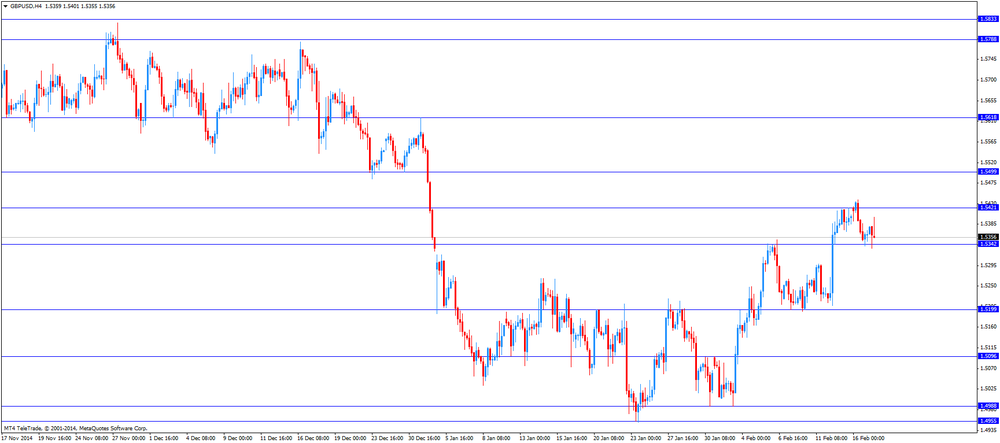

The British pound traded lower against the U.S. dollar. The U.K. consumer price index declined to 0.3% in January from 0.5% in December, in line with expectations. That was the lowest level since 1989.

The drop was driven by lower fuel and food prices.

Consumer price inflation excluding food, energy, alcohol and tobacco prices climbed to 1.4% in January from 1.3% the month before.

The Retail Prices Index declined to 1.1% in January from 1.6% in December.

The Swiss franc traded lower against the U.S. dollar ahead the speech by the Swiss National Bank President Jordan.

The Canadian dollar traded lower against the U.S. dollar after the weaker-than-expected foreign securities purchases from Canada. Foreign securities purchases in Canada dropped by C$13.55 billion in December, missing expectations for a gain by C$5.35 billion, after a rise by C$4.30 billion in November. That was the highest divestment since June 2013.

November's figure was revised up from an increase by C$4.29 billion.

The divestment was driven by the weaker outlook for the Canadian dollar due to lower prices.

The New Zealand dollar traded lower against the U.S. dollar. In the overnight trading session, the kiwi rose against the greenback in the absence of any major economic reports from New Zealand.

The Australian dollar traded lower against the U.S. dollar. In the overnight trading session, the Aussie increased against the greenback after the Reserve Bank of Australia (RBA) monetary policy meeting's minutes. The RBA cut its interest rate this month to support demand and to achieve balanced growth.

The Japanese yen traded lower against the U.S. dollar. In the overnight trading session, the yen traded lower against the greenback in the absence of any major economic reports from Japan.

The National Association of Home Builders (NAHB) released its housing market index for the U.S. on Tuesday. The NAHB housing market index declined to 55 in February from 57 in January. Analysts had expected the index to rise at 58.

A level above 50.0 is considered positive, below indicates a negative outlook.

The NAHB Chairman Tom Woods said that "builder sentiment remains fairly solid, with this slight downturn largely attributable to the unusually high snow levels across much of the nation".

Statistics Canada released foreign investment figures on Tuesday. Foreign securities purchases in Canada dropped by C$13.55 billion in December, missing expectations for a gain by C$5.35 billion, after a rise by C$4.30 billion in November. That was the highest divestment since June 2013.

November's figure was revised up from an increase by C$4.29 billion.

The divestment was driven by the weaker outlook for the Canadian dollar due to lower prices.

International investors sold C$7.05 billion of Canadian stocks, the highest divestment since February 2013.

The New York Federal Reserve released its survey on Tuesday. The NY Fed Empire State manufacturing index declined to 7.78 in February from 9.95 in January, missing expectations for a fall to 9.1.

The new orders index plunged to 1.22 in February from 6.09 in January.

The index for the number of employees decreased to 10.11 in February from 13.68 last month.

"Conditions for New York manufacturers improved modestly for a second consecutive month", the report said.

U.S. stock-index futures fell amid a breakdown in talks between Greece and its European creditors.

Global markets:

Nikkei 17,987.09 -17.68 -0.10%

Hang Seng 24,784.88 +58.35 +0.24%

Shanghai Composite 3,247.43 +25.07 +0.78%

FTSE 6,877.64 +20.59 +0.30%

CAC 4,755.11 +3.16 +0.07%

DAX 10,890.81 -32.42 -0.30%

Crude oil $52.60 (-0.36%)

Gold $1222.70 (-0.36%)

(company / ticker / price / change, % / volume)

| Verizon Communications Inc | VZ | 49.53 | +0.02% | 1.8K |

| JPMorgan Chase and Co | JPM | 59.65 | +0.13% | 2.6K |

| McDonald's Corp | MCD | 95.25 | +0.17% | 0.2K |

| Intel Corp | INTC | 34.20 | +0.22% | 3.1K |

| Google Inc. | GOOG | 544.30 | +0.25% | 0.3K |

| Goldman Sachs | GS | 190.30 | +0.27% | 0.8K |

| Boeing Co | BA | 148.49 | +0.27% | 0.3K |

| Twitter, Inc., NYSE | TWTR | 48.10 | +0.31% | 63.6K |

| General Electric Co | GE | 24.97 | +0.32% | 8.7K |

| Facebook, Inc. | FB | 76.49 | +0.34% | 36.3K |

| General Motors Company, NYSE | GM | 38.15 | +0.34% | 9.2K |

| Microsoft Corp | MSFT | 43.24 | +0.35% | 19.6K |

| Citigroup Inc., NYSE | C | 51.07 | +0.35% | 13.1K |

| AT&T Inc | T | 34.74 | +0.38% | 30.1K |

| Caterpillar Inc | CAT | 83.85 | +0.38% | 0.9K |

| Procter & Gamble Co | PG | 86.42 | +0.45% | 0.1K |

| Apple Inc. | AAPL | 127.05 | +0.47% | 366.1K |

| Johnson & Johnson | JNJ | 99.00 | +0.57% | 0.8K |

| Exxon Mobil Corp | XOM | 93.00 | +0.68% | 22.2K |

| ALCOA INC. | AA | 15.77 | +0.77% | 3.7K |

| Nike | NKE | 92.72 | +0.78% | 1.0K |

| Chevron Corp | CVX | 111.80 | +0.85% | 10.9K |

| Yahoo! Inc., NASDAQ | YHOO | 44.31 | +0.88% | 1.9K |

| Barrick Gold Corporation, NYSE | ABX | 12.28 | +1.24% | 9.9K |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 19.90 | +2.21% | 5.8K |

| Yandex N.V., NASDAQ | YNDX | 16.86 | +2.74% | 26.5K |

| Visa | V | 270.91 | 0.00% | 3.7K |

| Walt Disney Co | DIS | 103.55 | -0.03% | 1K |

| Ford Motor Co. | F | 16.35 | -0.06% | 51.2K |

| Amazon.com Inc., NASDAQ | AMZN | 376.71 | -0.12% | 2.2K |

| The Coca-Cola Co | KO | 42.07 | -0.24% | 5.6K |

| Tesla Motors, Inc., NASDAQ | TSLA | 202.10 | -0.38% | 31.6K |

| Pfizer Inc | PFE | 34.73 | -0.40% | 0.6K |

| Cisco Systems Inc | CSCO | 29.32 | -0.48% | 43.4K |

| American Express Co | AXP | 79.75 | -0.91% | 51.4K |

| AMERICAN INTERNATIONAL GROUP | AIG | 51.50 | -1.81% | 22.8K |

Upgrades:

Travelers (TRV) upgraded to Neutral from Sell at Citigroup

Downgrades:

American Express (AXP) downgrade from Buy to Neutral at Guggenheim

Other:

EURUSD 1.1335 (EUR 292m) 1.1450 (EUR 1bln)

USDCHF 0.9000 (USD 900m)

USDCAD 1.2430 (USD 540m) 1.2500 (USD 606m)

AUDUSD 0.7715 (AUD 404m) 0.7750 (AUD 305m) 0.7800-05 (AUD 400m) 0.7890 (AUD 703m)

EURCHF 1.0400 (EUR 300m)

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia RBA Meeting's Minutes

09:30 United Kingdom Retail Price Index, m/m January +0.2% -0.8%

09:30 United Kingdom Retail prices, Y/Y January +1.6% +1.2% +1.1%

09:30 United Kingdom RPI-X, Y/Y January +1.7% +1.2%

09:30 United Kingdom Producer Price Index - Input (YoY) January -11.6% Revised From -0.3% -14.2%

09:30 United Kingdom Producer Price Index - Input (MoM) January -3.3% Revised From -2.4% -2.1% -3.7%

09:30 United Kingdom Producer Price Index - Output (MoM) January -0.5% Revised From -0.3% -0.2% -0.5%

09:30 United Kingdom Producer Price Index - Output (YoY) January -1.1% Revised From -0.8% -1.8%

09:30 United Kingdom HICP, m/m January 0.0% -0.9%

09:30 United Kingdom HICP, Y/Y January +0.5% +0.3% +0.3%

09:30 United Kingdom HICP ex EFAT, Y/Y January +1.3% +1.3% +1.4%

10:00 Eurozone ZEW Economic Sentiment February 45.2 51.3 52.7

10:00 Eurozone ECOFIN Meetings

10:00 Germany ZEW Survey - Economic Sentiment February 48.4 56.2 53.0

The U.S. dollar traded mixed to lower against the most major currencies ahead the U.S. economic data. The NY Fed Empire State manufacturing index is expected to decline to 9.1 in February from 10.0 in January.

The NAHB housing market index is expected to climb to 58 in February from 57 in January.

The euro traded higher against the U.S. dollar after the positive ZEW economic sentiment data. Germany's ZEW economic sentiment index increased to 53.0 in February from 48.4 in January, but missing expectations for a rise to 56.2. That was the highest reading since February 2014.

The increase was driven by quantitative easing by the European Central Bank and the better-than-expected economic data from the Eurozone.

Eurozone's ZEW economic sentiment index rose to 52.7 in February from 45.5 in January, beating expectations for a gain to 51.3.

Investors remained cautious due to new debt deal talks between the European Union and Greece.

The British pound traded mixed against the U.S. dollar after the consumer price inflation data from the U.K. The U.K. consumer price index declined to 0.3% in January from 0.5% in December, in line with expectations. That was the lowest level since 1989.

The drop was driven by lower fuel and food prices.

Consumer price inflation excluding food, energy, alcohol and tobacco prices climbed to 1.4% in January from 1.3% the month before.

The Retail Prices Index declined to 1.1% in January from 1.6% in December.

The Swiss franc rose against the U.S. dollar ahead the speech by the Swiss National Bank President Jordan.

The Canadian dollar increased against the U.S. dollar ahead of foreign securities purchases from Canada. Foreign securities purchases in Canada are expected to rise by C$5.35 billion in December, after a C$4.29 increase in November.

EUR/USD: the currency pair rose to 1.1448

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair climbed to Y118.93

The most important news that are expected (GMT0):

13:30 Canada Foreign Securities Purchases December 4.29 5.35

13:30 U.S. NY Fed Empire State manufacturing index February 10.0 9.1

15:00 U.S. Mortgage Delinquencies Quarter IV 5.85%

15:00 U.S. NAHB Housing Market Index February 57 58

17:00 Switzerland SNB Chairman Jordan Speaks

EUR/USD

Offers 1.1450-55 1.1485 1.1500 1.1530 1.1550

Bids 1.1370 1.1320 1.1300 1.1270-75 1.1240-50 1.1200

GBP/USD

Offers 1.5450 1.5465 1.5480 1.5500

Bids 1.5325-30 1.5300 1.5280 1.5250 1.5200-10 1.5185

EUR/JPY

Offers 136.00-10 136.50 136.80 137.00

Bids 134.95-00 133.90 133.60 133.00 132.50-55

USD/JPY

Offers 119.00 119.20 119.50 119.80 120.00 120.20-30 120.50

Bids 118.20 118.00 117.80 117.50

EUR/GBP

Offers 0.7445-50 0.7470 0.7490-7500 0.7510-20

Bids 0.7370-75 0.7350 0.7325 0.7300

AUD/USD

Offers 0.7840 0.7860 0.7880-85 0.7900 0.7920 0.7950

Bids 0.7730 0.7700 0.7650 0.7625 0.7600

The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index declined to 0.3% in January from 0.5% in December, in line with expectations. That was the lowest level since 1989.

The drop was driven by lower fuel and food prices. Fuel prices decreased 8.5% in January, while food prices fell 2.8%.

Consumer price inflation excluding food, energy, alcohol and tobacco prices climbed to 1.4% in January from 1.3% the month before.

The Retail Prices Index declined to 1.1% in January from 1.6% in December.

The Bank of England's target is about 2%.

The ZEW Center for European Economic Research released its economic sentiment index for Germany and the Eurozone on Tuesday. Germany's ZEW economic sentiment index increased to 53.0 in February from 48.4 in January, but missing expectations for a rise to 56.2. That was the highest reading since February 2014.

The increase was driven by quantitative easing by the European Central Bank and the better-than-expected economic data from the Eurozone.

The ZEW President Clemens Fuest said that "quantitative easing by the European Central Bank and unexpectedly high economic growth in the fourth quarter of 2014" had a positive effect on the sentiment. He added that the escalation of the Ukraine crisis and new debt deal talks between the European Union and Greece are dampening expectations.

Eurozone's ZEW economic sentiment index rose to 52.7 in February from 45.5 in January, beating expectations for a gain to 51.3.

EURUSD 1.1335 (EUR 292m) 1.1450 (EUR 1bln)

USDCHF 0.9000 (USD 900m)

USDCAD 1.2430 (USD 540m) 1.2500 (USD 606m)

AUDUSD 0.7715 (AUD 404m) 0.7750 (AUD 305m) 0.7800-05 (AUD 400m) 0.7890 (AUD 703m)

EURCHF 1.0400 (EUR 300m)

U.S. markets were closed yesterday. On Friday U.S. indices added gains, ending the second consecutive week with a plus with oil above USD60 and strong fourth quarter earnings and despite U.S. consumer sentiment unexpectedly worsened in February.

On Friday the DOW JONES index added +0.26% closing at 18,019.35 points, above the psychologically important level of 18,000. The S&P 500 closed higher with a final quote of 2,096.99, +0.41%, hitting a record high.

Today U.S. futures point to a lower open as Greece worries weigh on the markets. Talks between Greece and the Eurozone's finance ministers broke down yesterday as Athens did not accept a proposal for a six-month extension of its bailout. Now the Greek government has until Friday to request the extension. If Greece chooses not to do so the bailout will expire at the end of February.

Chinese shares added gains on Tuesday in the wake of the Chinese New Year where volumes are expected to remain low. Speculations on further monetary easing supported the markets. Hong Kong's Hang Seng is trading +0.24% at 24,787.08 points. China's Shanghai Composite closed at 3,247.43 points +0.78%, heading for the longest winning streak since late November last year. Markets were supported by speculations on further monetary stimulus by the Peoples Bank of China to reive growth.

Japanese markets retreated from 8-year highs in today's trading. The Nikkei declined, closing -0.10% with a final quote of 17,987.09 points after Asia's second largest economy exited recession in the final quarter of last year according to data published over the weekend although growth was weaker than expected. Last week insiders said the Bank of Japan sees further monetary easing as counterproductive for now as more stimulus would further hurt the currency. Now all eyes are on BoJ Governor Kuroda's speech scheduled for tomorrow, Wednesday.

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia RBA Meeting's Minutes

The U.S. dollar traded flat to lower against the most major currencies as recent disappointing U.S. data on retail sales and the Michigan consumer sentiment continued to weigh. Yesterday U.S. markets were closed for President's holiday. Today the greenback traded flat against the euro after yesterday's gains as talks between Greece and the Eurozone's finance ministers broke down yesterday as Athens did not accept a proposal for a six-month extension of its bailout. Now the Greek government has until Friday to request the extension. If Greece chooses not to do so the bailout will expire at the end of February.

The Australian dollar traded stronger on Tuesday after the minutes of the RBA meeting were published. The bank named a lower growth and inflation outlook and Chinese demand for commodities as reasons for this month's decision to lower interest rates after a 17-month pause. Recently the unemployment rate in Australia rose to a 12 ½ year high. Australia's economy is struggling as prices for key export commodities slumped and demand in China, Australia's biggest trade partner, is declining.

New Zealand's dollar advanced for a fourth day against the greenback in Asian trade with no major economic data published.

The Japanese yen traded almost flat against the greenback on Tuesday after Asia's second largest economy exited recession in the final quarter of last year according to data published over the weekend although growth was weaker than expected. Last week the yen rose as insiders said the BoJ sees further monetary easing as counterproductive for now as more stimulus would further hurt the currency. Now all eyes are on BoJ Governor Kuroda's speech scheduled for Wednesday.

EUR/USD: the euro traded slightly stronger against the greenback

(time / country / index / period / previous value / forecast)

09:30 United Kingdom Retail Price Index, m/m January +0.2%

09:30 United Kingdom Retail prices, Y/YJanuary+1.6% +1.2%

09:30 United Kingdom RPI-X, Y/Y January +1.7%

09:30 United Kingdom Producer Price Index - Input (YoY) January -0.3%

09:30 United Kingdom Producer Price Index - Input (MoM) January -2.4% -2.1%

09:30 United Kingdom Producer Price Index - Output (MoM) January -0.3% -0.2%

09:30 United Kingdom Producer Price Index - Output (YoY) January -0.8%

09:30 United Kingdom HICP, m/m January 0.0%

09:30 United Kingdom HICP, Y/Y January +0.5% +0.3%

09:30 United Kingdom HICP ex EFAT, Y/Y January +1.3% +1.3%

10:00 Eurozone ZEW Economic Sentiment February 45.2 51.3

10:00 Eurozone ECOFIN Meetings

10:00 Germany ZEW Survey - Economic Sentiment February 48.4 56.2

13:30 Canada Foreign Securities Purchases December 4.29 5.35

13:30 U.S. NY Fed Empire State manufacturing index January 10.0 9.1

15:00 U.S. Mortgage Delinquencies Quarter IV 5.85%

15:00 U.S. NAHB Housing Market Index February 57 58

17:00 Switzerland SNB Chairman Jordan Speaks

21:00 U.S. Net Long-term TIC Flows December 33.5 41.3

21:00 U.S. Total Net TIC Flows December -6.3

23:00 Australia Conference Board Australia Leading Index December +0.1%

23:30 Australia Leading Index January 0.0%

EUR / USD

Resistance levels (open interest**, contracts)

$1.1574 (5738)

$1.1520 (2859)

$1.1450 (427)

Price at time of writing this review: $1.1362

Support levels (open interest**, contracts):

$1.1321 (3685)

$1.1275 (3945)

$1.1216 (3994)

Comments:

- Overall open interest on the CALL options with the expiration date March, 6 is 102527 contracts, with the maximum number of contracts with strike price $1,1500 (5738);

- Overall open interest on the PUT options with the expiration date March, 6 is 105158 contracts, with the maximum number of contracts with strike price $1,1200 (5456);

- The ratio of PUT/CALL was 1.03 versus 1.03 from the previous trading day according to data from February, 13

GBP/USD

Resistance levels (open interest**, contracts)

$1.5702 (960)

$1.5604 (1992)

$1.5507 (2698)

Price at time of writing this review: $1.5378

Support levels (open interest**, contracts):

$1.5292 (1763)

$1.5195 (2087)

$1.5097 (1765)

Comments:

- Overall open interest on the CALL options with the expiration date March, 6 is 27121 contracts, with the maximum number of contracts with strike price $1,5500 (2698);

- Overall open interest on the PUT options with the expiration date March, 6 is 32976 contracts, with the maximum number of contracts with strike price $1,5200 (2087);

- The ratio of PUT/CALL was 1.22 versus 1.21 from the previous trading day according to data from February, 13

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

(raw materials / closing price /% change)

Oil 52.78 +3.07%

Gold 1,232.80 +0.46%

(index / closing price / change items /% change)

S&P/ASX 200 5,888.66 +11.19 +0.19%

TOPIX 1,459.43 +10.05 +0.69%

SHANGHAI COMP 3,223.16 +19.33 +0.60%

HANG SENG 24,724.31 +41.77 +0.17%

FTSE 100и6,857.05 -16.47 -0.24%

CAC 40 4,751.95 -7.41 -0.16%

Xetra DAX 10,923.23 -40.17 -0.37%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1354 -0,39%

GBP/USD $1,5363 -0,25%

USD/CHF Chf0,9316 -0,08%

USD/JPY Y118,47 -0,26%

EUR/JPY Y134,51 -0,65%

GBP/JPY Y181,99 -0,52%

AUD/USD $0,7771 +0,08%

NZD/USD $0,7500 +0,56%

USD/CAD C$1,2465 +0,04%

(time / country / index / period / previous value / forecast)

00:30 Australia RBA Meeting's Minutes

09:30 United Kingdom Retail Price Index, m/m January +0.2%

09:30 United Kingdom Retail prices, Y/Y January +1.6% +1.2%

09:30 United Kingdom RPI-X, Y/Y January +1.7%

09:30 United Kingdom Producer Price Index - Input (YoY) January -0.3%

09:30 United Kingdom Producer Price Index - Input (MoM) January -2.4% -2.1%

09:30 United Kingdom Producer Price Index - Output (MoM) January -0.3% -0.2%

09:30 United Kingdom Producer Price Index - Output (YoY) January -0.8%

09:30 United Kingdom HICP, m/m January 0.0%

09:30 United Kingdom HICP, Y/Y January +0.5% +0.3%

09:30 United Kingdom HICP ex EFAT, Y/Y January +1.3% +1.3%

10:00 Eurozone ZEW Economic Sentiment February 45.2 51.3

10:00 Eurozone ECOFIN Meetings

10:00 Germany ZEW Survey - Economic Sentiment February 48.4 56.2

13:30 Canada Foreign Securities Purchases December 4.29 5.35

13:30 U.S. NY Fed Empire State manufacturing index January 10.0 9.1

15:00 U.S. Mortgage Delinquencies Quarter IV 5.85%

15:00 U.S. NAHB Housing Market Index February 57 58

17:00 Switzerland SNB Chairman Jordan Speaks

21:00 U.S. Net Long-term TIC Flows December 33.5 41.3

21:00 U.S. Total Net TIC Flows December -6.3

23:00 Australia Conference Board Australia Leading Index December +0.1%

23:30 Australia Leading Index January 0.0%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.