- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 20-02-2015

Stock indices closed mixed ahead of new debt talks between Greece and the European Union on late Friday. Greece yesterday submitted a request for an extension of its existing loan agreement. But German Finance Minister Wolfgang Schaeuble replied that the Greek loan proposal was "not a substantial proposal for a solution".

Eurozone's preliminary manufacturing PMI increased to 51.1 in February from 51.0 in January, missing expectations for a rise to 51.6.

Eurozone's preliminary services PMI rose to 53.9 in February from 52.7 in January. Analysts had expected the index to climb to 53.2.

Germany's preliminary manufacturing PMI remained unchanged at 50.9 in February from 51.2 in December, missing forecasts of an increase to 51.8.

Germany's preliminary services PMI increased to 55.5 in February from 54.0 in January, beating expectations for a gain to 54.3.

France's preliminary manufacturing PMI fell to 47.7 in February from 49.2 in January, missing forecasts of a rise to 49.7.

France's preliminary services PMI rose to 53.4 in February from 49.4 in January, exceeding expectations for a gain to 49.9.

Retail sales in the U.K. decreased 0.3% in January, missing expectations for a 0.1% drop, after a 0.2% gain in December. December's figure was revised down from a 0.4% rise.

The increase was driven by lower food, clothing and footwear sales.

On a yearly basis, retail sales in the U.K. climbed 5.4% in January, missing expectations for a 6.0% rise, after a 4.0% increase in December. December's figure was revised down from a 4.3% increase.

The public sector net borrowing in the U.K. dropped by £9.4 billion in January, missing expectations for a decline to £9.5 billion, after a rise by£9.9 billion in December. December's figure was revised down from an increase by £12.5 billion.

The decline was driven by a tax receipts of self-employed workers and top rate taxpayers.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,915.2 +26.30 +0.38%

DAX 11,050.64 +48.70 +0.44%

CAC 40 4,830.9 -2.38 -0.05%

The U.S. dollar traded mixed against the most major currencies after the better-than-expected U.S. preliminary manufacturing purchasing managers' index. The index rose to 54.3 in February from 53.9 in January, beating expectations for a decline to 53.7.

The euro traded higher against the U.S. dollar. Concerns over new debt talks between Greece and the European Union continue to weigh on the euro. Greece yesterday submitted a request for an extension of its existing loan agreement. But German Finance Minister Wolfgang Schaeuble replied that the Greek loan proposal was "not a substantial proposal for a solution".

Another round of talks between Greece and the European Union was scheduled to take place on Friday.

Eurozone's preliminary manufacturing PMI increased to 51.1 in February from 51.0 in January, missing expectations for a rise to 51.6.

Eurozone's preliminary services PMI rose to 53.9 in February from 52.7 in January. Analysts had expected the index to climb to 53.2.

Germany's preliminary manufacturing PMI remained unchanged at 50.9 in February from 51.2 in December, missing forecasts of an increase to 51.8.

Germany's preliminary services PMI increased to 55.5 in February from 54.0 in January, beating expectations for a gain to 54.3.

France's preliminary manufacturing PMI fell to 47.7 in February from 49.2 in January, missing forecasts of a rise to 49.7.

France's preliminary services PMI rose to 53.4 in February from 49.4 in January, exceeding expectations for a gain to 49.9.

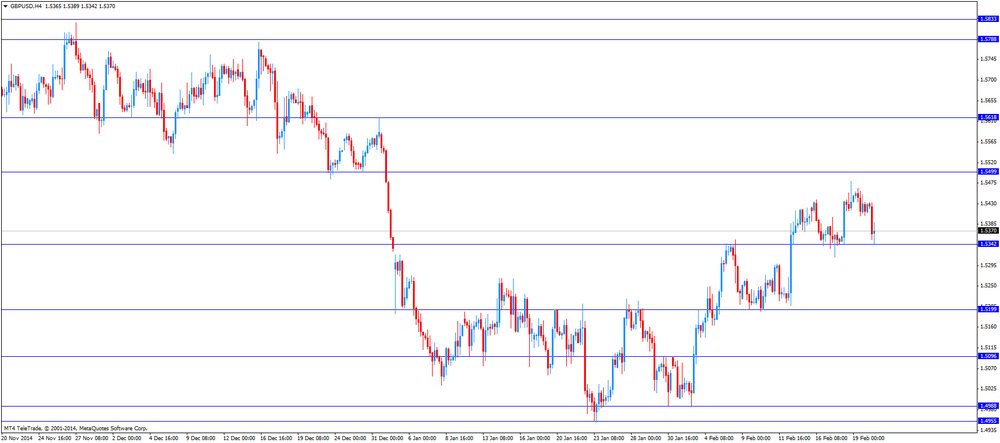

The British pound traded higher against the U.S. dollar. Retail sales in the U.K. decreased 0.3% in January, missing expectations for a 0.1% drop, after a 0.2% gain in December. December's figure was revised down from a 0.4% rise.

The increase was driven by lower food, clothing and footwear sales.

On a yearly basis, retail sales in the U.K. climbed 5.4% in January, missing expectations for a 6.0% rise, after a 4.0% increase in December. December's figure was revised down from a 4.3% increase.

The public sector net borrowing in the U.K. dropped by £9.4 billion in January, missing expectations for a decline to £9.5 billion, after a rise by£9.9 billion in December. December's figure was revised down from an increase by £12.5 billion.

The decline was driven by a tax receipts of self-employed workers and top rate taxpayers.

The Canadian dollar declined against the U.S. dollar after the weaker-than-expected Canadian retail sales data. Canadian retail sales plunged by 2.0% in December, missing expectations for a 0.3% decline, after a 0.4% rise in November.

That was the biggest fall since April 2010.

The drop was driven by lower sales in 9 of 11 subsectors.

Canadian retail sales excluding automobiles dropped 2.3% in December, missing expectations for a 0.7% decrease, after a 0.6% gain in November. November's figure was revised down from a 0.7% increase.

That was the largest drop since December 2008.

The New Zealand dollar traded lower against the U.S. dollar. In the overnight trading session, the kiwi traded higher against the greenback in the absence of any major economic reports from New Zealand.

The Australian dollar traded lower against the U.S. dollar. In the overnight trading session, the Aussie traded higher against the greenback in the absence of any major economic reports from Australia.

The Japanese yen traded lower against the U.S. dollar. In the overnight trading session, the yen traded lower against the greenback after comments by the Bank of Japan Governor Haruhiko Kuroda. He said in parliament on Friday that there are a lot of policy options, and it is possible to achieve the 2% inflation target.

Japan's preliminary manufacturing PMI decreased to 51.5 in February from 52.2 in January, missing expectations for a rise to 52.6.

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the U.S. on Friday. The U.S. preliminary manufacturing purchasing managers' index (PMI) rose to 54.3 in February from 53.9 in January, beating expectations for a decline to 53.7.

A reading above 50 indicates expansion in economic activity.

The Markit Chief Economist Chris Williamson said that "the U.S. economy has entered a slower growth phase".

U.S. stock-index futures fell as creditors raised the pressure on Greece amid efforts to reach a debt agreement.

Global markets:

Nikkei 18,332.3 +67.51 +0.37%

FTSE 6,903.92 +15.02 +0.22%

CAC 4,802.34 -30.94 -0.64%

DAX 10,998.15 -3.79 -0.03%

Crude oil $51.62 (+0.78%)

Gold $1211.80 (+0.35%)

Statistics Canada released retail sales data on Friday. Canadian retail sales plunged by 2.0% in December, missing expectations for a 0.3% decline, after a 0.4% rise in November.

That was the biggest fall since April 2010.

The drop was driven by lower sales in 9 of 11 subsectors. Clothing and clothing accessories sales fell 5.6% in December, while electronic sales decreased 9.2%.

Gasoline sales dropped by 7.4% in December.

Motor vehicles and parts sales fell 1.0% in December.

Canadian retail sales excluding automobiles dropped 2.3% in December, missing expectations for a 0.7% decrease, after a 0.6% gain in November. November's figure was revised down from a 0.7% increase.

That was the largest drop since December 2008.

(company / ticker / price / change, % / volume)

| Procter & Gamble Co | PG | 86.31 | +0.06% | 2.6K |

| Amazon.com Inc., NASDAQ | AMZN | 373.71 | +0.09% | 4.7K |

| FedEx Corporation, NYSE | FDX | 180.01 | +0.13% | 0.1K |

| American Express Co | AXP | 79.90 | +0.15% | 10.2K |

| General Electric Co | GE | 25.июн | +0.16% | 51.7K |

| Deere & Company, NYSE | DE | 92.98 | +0.25% | 5.3K |

| Tesla Motors, Inc., NASDAQ | TSLA | 205.50 | +0.51% | 18.7K |

| Facebook, Inc. | FB | 77.11 | +0.52% | 204.8K |

| Starbucks Corporation, NASDAQ | SBUX | 93.52 | +0.56% | 1.8K |

| Barrick Gold Corporation, NYSE | ABX | дек.65 | +3.43% | 116.7K |

| AT&T Inc | T | 34.49 | 0.00% | 1.9K |

| Cisco Systems Inc | CSCO | 29.49 | 0.00% | 6.0K |

| International Business Machines Co... | IBM | 162.19 | 0.00% | 0.3K |

| Travelers Companies Inc | TRV | 107.98 | 0.00% | 0.1K |

| Visa | V | 269.03 | -0.03% | 3.4K |

| Boeing Co | BA | 151.13 | -0.03% | 4.6K |

| 3M Co | MMM | 167.34 | -0.04% | 0.6K |

| Twitter, Inc., NYSE | TWTR | 47.80 | -0.04% | 26.0K |

| Goldman Sachs | GS | 188.55 | -0.06% | 0.1K |

| Microsoft Corp | MSFT | 43.50 | -0.07% | 5.4K |

| Verizon Communications Inc | VZ | 48.90 | -0.08% | 0.2K |

| Yahoo! Inc., NASDAQ | YHOO | 43.60 | -0.11% | 3.3K |

| Nike | NKE | 93.50 | -0.13% | 2.0K |

| Pfizer Inc | PFE | 34.43 | -0.15% | 1.5K |

| Apple Inc. | AAPL | 128.51 | -0.16% | 192.9K |

| Ford Motor Co. | F | 16.18 | -0.19% | 19.2K |

| JPMorgan Chase and Co | JPM | 59.25 | -0.20% | 7.6K |

| Home Depot Inc | HD | 111.75 | -0.21% | 2.1K |

| Intel Corp | INTC | 34.19 | -0.22% | 8.4K |

| McDonald's Corp | MCD | 94.33 | -0.26% | 1.1K |

| General Motors Company, NYSE | GM | 37.09 | -0.27% | 1.6K |

| Citigroup Inc., NYSE | C | 51.26 | -0.31% | 15.4K |

| Caterpillar Inc | CAT | 84.46 | -0.40% | 3.0K |

| Yandex N.V., NASDAQ | YNDX | 16.75 | -0.59% | 13.8K |

| International Paper Company | IP | 56.88 | -0.66% | 1.3K |

| ALCOA INC. | AA | 15.73 | -0.76% | 20.9K |

| Exxon Mobil Corp | XOM | 89.72 | -1.42% | 61.4K |

| Chevron Corp | CVX | 108.80 | -1.48% | 18.5K |

| Wal-Mart Stores Inc | WMT | 84.94 | -1.56% | 37.6K |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 20.86 | -2.02% | 17.9K |

Upgrades:

Downgrades:

Other:

Boeing (BA) target raised from $164 to $196 at Sterne Agee

Apple (AAPL) target raised from $130 to $145 at Goldman

USD/JPY 114.00 (1.99bn), 117.10-15 (1bn), 118.35, 119.55 (1.46bn), 120.00, 120.30, 120.50 (1bn), 121.00/05 (2.3bn)

EUR/USD 1.1350 (517m), 1.1460 (721m), 1.1500 (582m)

GBP/USD 1.5500 (661m), 1.5600

USD/CAD 1.2350/55 (521m), 1.2365/75 (1.26bn), 1.2400 (900m), 1.2500, 1.2575, 1.2600

AUD/USD 0.7635 (795m) , 0.7650 (780m), 0.7665, 0.7840 (1.77bn), 0.7850 (1.16bn)

USD/CHF 0.9375 (350m), 0.9510 (210m)

AUD/JPY 92.89 (100m)

Deere & Company (DE) earned $1.12 per share in the first fiscal quarter, beating analysts' estimate of $0.82. Revenue in the first fiscal quarter decreased 19.3% year-over-year to $5.61 billion, but beating analysts' estimate of $5.50 billion.

The company announced its forecasts for the second fiscal quarter of 2015. Revenue is expected to be $7.5 billion in the second fiscal quarter of 2015 (analysts' estimate: $7.96 billion).

The company expects revenue of $27.36 billion (-17% y/y) (the previous estimate: -15% y/y) in the full fiscal year 2015 (analysts' estimate: $28.4 billion).

The company downgraded its net income forecast to $1.8 billion from the previous estimate of $1.9 billion.

Deere & Company (DE) shares fell to $91.30 (-0.45%) prior to the opening bell.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 China Bank holiday

01:35 Japan Manufacturing PMI (Preliminary) February 52.2 52.6 51.5

07:00 Germany Producer Price Index (MoM) January -0.7% -0.3% -0.6%

07:00 Germany Producer Price Index (YoY) January -1.7% -2.2%

08:00 France Services PMI (Preliminary) February 49.4 49.9 53.4

08:00 France Manufacturing PMI (Preliminary) February 49.2 49.7 47.7

08:30 Germany Manufacturing PMI (Preliminary) February 50.9 51.8 50.9

08:30 Germany Services PMI (Preliminary) February 54.0 54.3 55.5

09:00 Eurozone Manufacturing PMI (Preliminary) February 51.0 51.6 51.1

09:00 Eurozone Services PMI (Preliminary) February 52.7 53.2 53.9

09:30 United Kingdom Retail Sales (MoM) January +0.2% Revised From +0.4% -0.1% -0.3%

09:30 United Kingdom Retail Sales (YoY) January +4.0% Revised From +4.3% +6.0% +5.4%

09:30 United Kingdom PSNB, bln January 9.8 Revised From 12.5 -9.5 -9.4

The U.S. dollar traded mixed against the most major currencies ahead the U.S. preliminary manufacturing purchasing managers' index. The index is expected to decline to 53.7 in February from 53.9 in January.

The euro fell against the U.S. dollar as concerns over new debt talks between Greece and the European Union weighed on the euro. Greece yesterday submitted a request for an extension of its existing loan agreement. But German Finance Minister Wolfgang Schaeuble replied that the Greek loan proposal was "not a substantial proposal for a solution".

Another round of talks between Greece and the European Union was scheduled to take place on Friday.

Eurozone's preliminary manufacturing PMI increased to 51.1 in February from 51.0 in January, missing expectations for a rise to 51.6.

Eurozone's preliminary services PMI rose to 53.9 in February from 52.7 in January. Analysts had expected the index to climb to 53.2.

Germany's preliminary manufacturing PMI remained unchanged at 50.9 in February from 51.2 in December, missing forecasts of an increase to 51.8.

Germany's preliminary services PMI increased to 55.5 in February from 54.0 in January, beating expectations for a gain to 54.3.

France's preliminary manufacturing PMI fell to 47.7 in February from 49.2 in January, missing forecasts of a rise to 49.7.

France's preliminary services PMI rose to 53.4 in February from 49.4 in January, exceeding expectations for a gain to 49.9.

The British pound dropped against the U.S. dollar after the weaker-than-expected U.K. economic data. Retail sales in the U.K. decreased 0.3% in January, missing expectations for a 0.1% drop, after a 0.2% gain in December. December's figure was revised down from a 0.4% rise.

The increase was driven by lower food, clothing and footwear sales.

On a yearly basis, retail sales in the U.K. climbed 5.4% in January, missing expectations for a 6.0% rise, after a 4.0% increase in December. December's figure was revised down from a 4.3% increase.

The public sector net borrowing in the U.K. dropped by £9.4 billion in January, missing expectations for a decline to £9.5 billion, after a rise by£9.9 billion in December. December's figure was revised down from an increase by £12.5 billion.

The decline was driven by a tax receipts of self-employed workers and top rate taxpayers.

The Canadian dollar traded higher against the U.S. dollar ahead of the Canadian retail sales data. Canadian retail sales are expected to decrease 0.3% in December, after a 0.4% rise in November.

Canadian retail sales excluding automobiles are expected to drop 0.7% in December, after a 0.7% gain in November.

EUR/USD: the currency pair declined to 1.1297

GBP/USD: the currency pair fell to $1.5342

USD/JPY: the currency pair decreased to Y118.53

The most important news that are expected (GMT0):

13:30 Canada Retail Sales, m/m December +0.4% -0.3%

13:30 Canada Retail Sales ex Autos, m/m December +0.7% -0.7%

14:45 U.S. Manufacturing PMI (Preliminary) February 53.9 53.7

EUR/USD

Offers 1.1380 1.1450-55 1.1485 1.1500 1.1530 1.1550

Bids 1.1290 1.1270-75 1.1240-50 1.1200

GBP/USD

Offers 1.5480 1.5500 1.5540 1.5620

Bids 1.5340 1.5300 1.5280 1.5250 1.5200-10 1.5185

EUR/JPY

Offers 135.40 136.20 136.50 136.80 137.00

Bids 133.90 133.60 133.00 132.50-55

USD/JPY

Offers 119.50 119.80 120.00 120.20-30 120.50

Bids 118.20 118.00 117.80 117.50

EUR/GBP

Offers 0.7410 0.7445-50 0.7470 0.7490-7500 0.7510-20

Bids 0.7325 0.7300 0.7200

AUD/USD

Offers 0.7860 0.7880-85 0.7900 0.7920 0.7950

Bids 0.7755 0.7730 0.7700 0.7650 0.7625 0.7600

The Office for National Statistics released public sector net borrowing for the U.K. on Friday. The public sector net borrowing in the U.K. dropped by £9.4 billion in January, missing expectations for a decline to £9.5 billion, after a rise by£9.9 billion in December. December's figure was revised down from an increase by £12.5 billion.

The decline was driven by a tax receipts of self-employed workers and top rate taxpayers.

The Office for National Statistics released the retail sales data for the U.K. on Friday. Retail sales in the U.K. decreased 0.3% in January, missing expectations for a 0.1% drop, after a 0.2% gain in December. December's figure was revised down from a 0.4% rise.

The increase was driven by lower food, clothing and footwear sales.

On a yearly basis, retail sales in the U.K. climbed 5.4% in January, missing expectations for a 6.0% rise, after a 4.0% increase in December. December's figure was revised down from a 4.3% increase.

Average store prices declined 3.1% in January from the year earlier, mostly due to falling petrol prices.

European stocks traded at a seven-year high as Greek Finance Minister Yanis Varoufakis returns to Brussels to meet his euro-area counterparts seeking an agreement that will let Europe's most-indebted country avoid default.

"Markets expect a solution which keeps Greece in the euro zone, but for the moment all news will increase volatility due to uncertainty," said Guillermo Hernandez Sampere, who helps manage about 150 million euros ($170 million) at MPPM EK in Eppstein, Germany. "We will have another day with a lot of noise, which always has short-term effects on markets."

Varoufakis said on Thursday that he would accept the financial and procedural conditions of the existing bailout deal, while asking for negotiations on other elements. German Finance Minister Wolfgang Schaeuble almost immediately rebuffed the proposal. Later, optimism returned after a "positive" conversation between Greek Prime Minister Alexis Tsipras and German Chancellor Angela Merkel.

Euro-area manufacturing and services strengthened this month, with Markit Economics' composite purchasing managers' index for both sectors rising to 53.5 from 52.6 in January. That beat the median forecast of economists for a reading of 53 and is the highest in seven months.

Among equities moving on corporate news, Danone fell 1.2 percent. The world's biggest yogurt maker set a lower sales forecast for 2015 than last year's amid deflationary pressure in Europe and weakening currencies in emerging markets.

Gemalto NV slid 7.2 percent, for the biggest decline on the Stoxx 600. The largest maker of mobile-phone cards said it's investigating a report that U.S. and U.K. spies allegedly hacked into its computer network to steal the keys used to encrypt conversations, messages and data traffic.

Standard Life Plc climbed 3.2 percent after reporting better-than-expected full-year profit.

Gauge of energy stocks and commodity producers posted the biggest gains of the 19 industry groups on the Stoxx 600, as oil trimmed its first weekly decline in a month. Tullow Oil Plc and Premier Oil Plc rose at least 2.8 percent, while Glencore Plc added 1.9 percent.

FTSE 100 6,911.95 +23.05 +0.33%

CAC 40 4,825.73 -7.55 -0.16%

DAX 10,983.57 -18.37 -0.17%

USD/JPY 114.00 (1.99bn), 117.10-15 (1bn), 118.35, 119.55 (1.46bn), 120.00, 120.30, 120.50 (1bn), 121.00/05 (2.3bn)

EUR/USD 1.1350 (517m), 1.1460 (721m), 1.1500 (582m)

GBP/USD 1.5500 (661m), 1.5600

USD/CAD 1.2350/55 (521m), 1.2365/75 (1.26bn), 1.2400 (900m), 1.2500, 1.2575, 1.2600

AUD/USD 0.7635 (795m) , 0.7650 (780m), 0.7665, 0.7840 (1.77bn), 0.7850 (1.16bn)

USD/CHF 0.9375 (350m), 0.9510 (210m)

AUD/JPY 92.89 (100m)

U.S. markets moderately declined on Thursday on mixed U.S. data and worries over Greece. Athens requested an extension of the loan agreement but Germany rejected the Greek proposal with German Finance Minister Wolfgang Schäuble stating it was "not a substantial proposal for a solution". The technology, basic material and health care sector added gains while utilities and the energy sector declined. Yesterday data showed that the Philadelphia Fed Manufacturing Survey declined to 5.2 in February from 6. 3 in January, missing expectations for a rise to 8.8. That was the lowest reading since February 2014. The number of initial jobless claims in the week ending February 14 in the U.S. fell by 21,000 to 283,000 from 304,000 in the previous week, beating expectations for a rise by 1,000. The U.S. leading economic index climbed by 0.2% in January, after a 0.4% increase in December. December's figure was revised down from a 0.6% gain.

Today data on U.S. Manufacturing PMI and Mortgage Delinquencies will in the focus.

The DOW JONES index lost -0.24% closing at 17,985.77 points. The S&P 500 closed -0.11% with a final quote of 2,097.45 further declining from a record high hit 2 days ago.

Chinese markets are closed today for a public holiday as the Lunar New year celebrations take place.

Japanese markets rose for a third day and closed at a fresh 15-year high in today's trading. The Nikkei added gains, closing +0.37% with a final quote of 18,332.30 points - the highest level since 2000. Market sentiment was boosted by strong U.S. jobs data.

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:00 China Bank holiday

01:35 Japan Manufacturing PMI (Preliminary) February 52.2 52.6 51.5

07:00 Germany Producer Price Index (MoM) January -0.7% -0.3% -0.6%

07:00 Germany Producer Price Index (YoY) January -1.7% -2.2%

The U.S. dollar traded mostly lower against its major peers but is heading for a winning week as market participants speculate on a mid-year rate hike after reassessing the FED's dovish minutes and despite mixed U.S. economic data. The greenback weakened on Wednesday after the minutes of the FED's January meeting, where the committee expressed concerns that a rate hike might slow down economic recovery. Yesterday data showed that the Philadelphia Fed Manufacturing Survey declined to 5.2 in February from 6. 3 in January, missing expectations for a rise to 8.8. That was the lowest reading since February 2014. The number of initial jobless claims in the week ending February 14 in the U.S. fell by 21,000 to 283,000 from 304,000 in the previous week, beating expectations for a rise by 1,000. The U.S. leading economic index climbed by 0.2% in January, after a 0.4% increase in December. December's figure was revised down from a 0.6% gain.

Today data on U.S. Manufacturing PMI and Mortgage Delinquencies will be published.

The negotiations about a Greek debt deal will remain in the focus. As time runs out for Greece Athens requested an extension of the loan agreement but German Finance Minister Wolfgang Schäuble said it was "not a substantial proposal for a solution". The single currency lost against the U.S. dollar as the situation weighs.

The Australian dollar rose against the dollar on Thursday with no important data in the region published but worries about low commodity prices limited gains and weigh in the currency.

Chinese markets are closed today for the Lunar New Year holiday celebrations.

New Zealand's dollar advanced against the greenback with no major economic data for the region published.

The Japanese yen traded almost unchanged against the greenback on Friday in a light-data day, many Asian markets are closed for the Lunar New Year celebrations. Japans Manufacturing PMI for February declined from a previous reading of 52.2 to 51.5, below estimates of an increase to 52.6. BoJ Governor Haruhiko Kuroda stated yesterday that the bank is watching the bond market closely and said that negative rates are part of the bank's policy to reach the targeted 2% inflation rate.

EUR/USD: the euro traded weaker against the greenback

(time / country / index / period / previous value / forecast)

08:00 France Services PMI (Preliminary) February 49.4 49.9

08:00 France Manufacturing PMI (Preliminary) February 49.2 49.7

08:30 Germany Manufacturing PMI (Preliminary) February 50.9 51.8

08:30 Germany Services PMI (Preliminary) February 54.0 54.3

09:00 Eurozone Manufacturing PMI (Preliminary) February 51.0 51.6

09:00 Eurozone Services PMI (Preliminary) February 52.7 53.2

09:30 United Kingdom Retail Sales (MoM) January -0.4% -0.1%

09:30 United Kingdom Retail Sales (YoY) January +4.3% +6.0%

09:30 United Kingdom PSNB, bln January 12.5 -9.5

13:30 Canada Retail Sales, m/m December +0.4% -0.3%

13:30 Canada Retail Sales ex Autos, m/m December +0.7% -0.7%

14:45 U.S. Manufacturing PMI (Preliminary) February 53.9 53.7

15:00 U.S. Mortgage Delinquencies Quarter IV 5.85%

EUR / USD

Resistance levels (open interest**, contracts)

$1.1468 (1627)

$1.1433 (749)

$1.1399 (427)

Price at time of writing this review: $1.1345

Support levels (open interest**, contracts):

$1.1299 (2239)

$1.1250 (2233)

$1.1185 (2725)

Comments:

- Overall open interest on the CALL options with the expiration date March, 6 is 104547 contracts, with the maximum number of contracts with strike price $1,1500 (5644);

- Overall open interest on the PUT options with the expiration date March, 6 is 109420 contracts, with the maximum number of contracts with strike price $1,1200 (5672);

- The ratio of PUT/CALL was 1.05 versus 1.05 from the previous trading day according to data from February, 19

GBP/USD

Resistance levels (open interest**, contracts)

$1.5701 (1156)

$1.5603 (2261)

$1.5506 (3083)

Price at time of writing this review: $1.5422

Support levels (open interest**, contracts):

$1.5391 (1129)

$1.5294 (1777)

$1.5197 (2076)

Comments:

- Overall open interest on the CALL options with the expiration date March, 6 is 29540 contracts, with the maximum number of contracts with strike price $1,5500 (3083);

- Overall open interest on the PUT options with the expiration date March, 6 is 33994 contracts, with the maximum number of contracts with strike price $1,5200 (2076);

- The ratio of PUT/CALL was 1.15 versus 1.15 from the previous trading day according to data from February, 19

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.