- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 18-04-2018

| raw materials | closing price | % change |

| Oil | 68.75 | +3.35% |

| Gold | 1,352.40 | +0.21% |

| index | closing price | change items | % change |

| Nikkei | +310.61 | 22158.20 | +1.42% |

| TOPIX | +19.69 | 1749.67 | +1.14% |

| Hang Seng | +221.50 | 30284.25 | +0.74% |

| CSI 300 | +17.64 | 3766.28 | +0.47% |

| Euro Stoxx 50 | +12.98 | 3490.89 | +0.37% |

| FTSE 100 | +91.29 | 7317.34 | +1.26% |

| DAX | +5.26 | 12590.83 | +0.04% |

| CAC 40 | +26.63 | 5380.17 | +0.50% |

| DJIA | -38.56 | 24748.07 | -0.16% |

| S&P 500 | +2.25 | 2708.64 | +0.08% |

| NASDAQ | +14.14 | 7295.24 | +0.19% |

| S&P/TSX | +176.67 | 15529.97 | +1.15% |

| Pare | Closed | % change |

| EUR/USD | $1,2377 | +0,03% |

| GBP/USD | $1,4204 | -0,60% |

| USD/CHF | Chf0,96834 | +0,23% |

| USD/JPY | Y107,20 | +0,18% |

| EUR/JPY | Y132,70 | +0,22% |

| GBP/JPY | Y152,288 | -0,41% |

| AUD/USD | $0,7783 | +0,19% |

| NZD/USD | $0,7315 | -0,31% |

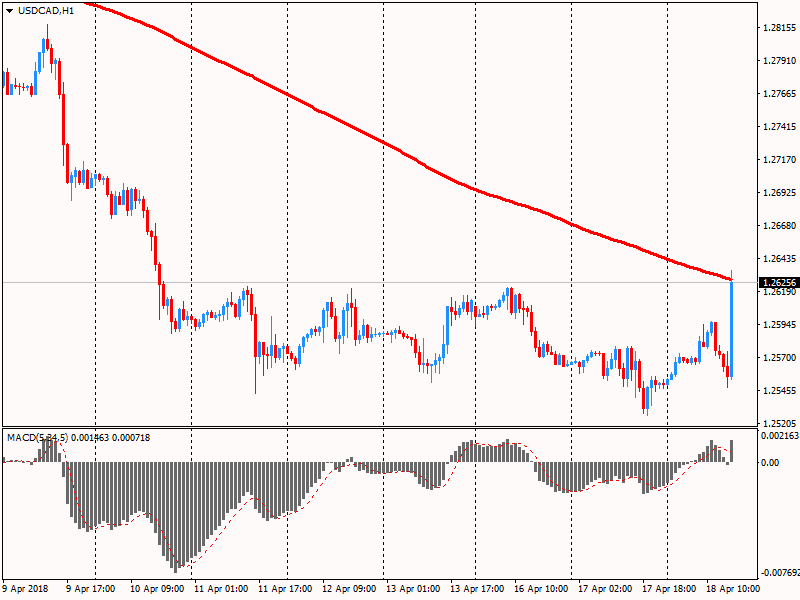

| USD/CAD | C$1,26261 | +0,60% |

| Time | Region | Event | Period | Previous | Forecast |

| 01:45 | New Zealand | CPI, y/y | I quarter | 1.6% | 1.1% |

| 01:45 | New Zealand | CPI, q/q | I quarter | 0.1% | 0.5% |

| 04:30 | Australia | Changing the number of employed | March | 17.5 | 20 |

| 04:30 | Australia | Unemployment rate | March | 5.6% | 5.5% |

| 11:00 | Eurozone | Current account, unadjusted, bln | February | 12.8 | |

| 11:30 | United Kingdom | Retail Sales (MoM) | March | 0.8% | -0.5% |

| 11:30 | United Kingdom | Retail Sales (YoY) | March | 1.5% | 2% |

| 15:00 | USA | FOMC Member Brainard Speaks | | | |

| 15:30 | USA | Continuing Jobless Claims | April | 1871 | 1848 |

| 15:30 | USA | Philadelphia Fed Manufacturing Survey | April | 22.3 | 20.1 |

| 15:30 | USA | Initial Jobless Claims | April | 233 | 230 |

| 16:30 | USA | FOMC Member Quarles Speaks | | | |

| 17:00 | USA | Leading Indicators | March | 0.6% | 0.3% |

| 19:30 | United Kingdom | BOE Deputy Governor for Financial Stability Jon Cunliffe speaks | | |

Major US stock indices showed mixed dynamics, as the growth of shares in the base materials sector was partially offset by negative dynamics of the conglomerate and consumer goods sector.

Oil rose more than 3% on Wednesday, reacting to a report from the US Energy Ministry, which reflected a decline in oil reserves, and sources that the top exporter Saudi Arabia wants to see the price of oil closer to $ 100 per barrel. The US Energy Ministry said that in the week of April 7-13, oil reserves fell by 1.071 million barrels to 427.6 million barrels. Analysts had expected a reduction of 1.429 million barrels. Oil reserves in the Cushing terminal fell by 1.1 million barrels, to 34.9 million barrels.

A certain influence on the dynamics of trading was provided by the Fed's Beige Book. The report reported that in all 12 zones of responsibility of the US Federal Reserve Bank in March-April there was an acceleration of economic activity and employment growth, however, the growth rates of wages for the most part remained modest. Meanwhile, companies in many regions reported high demand for labor, which makes it difficult to find qualified employees.

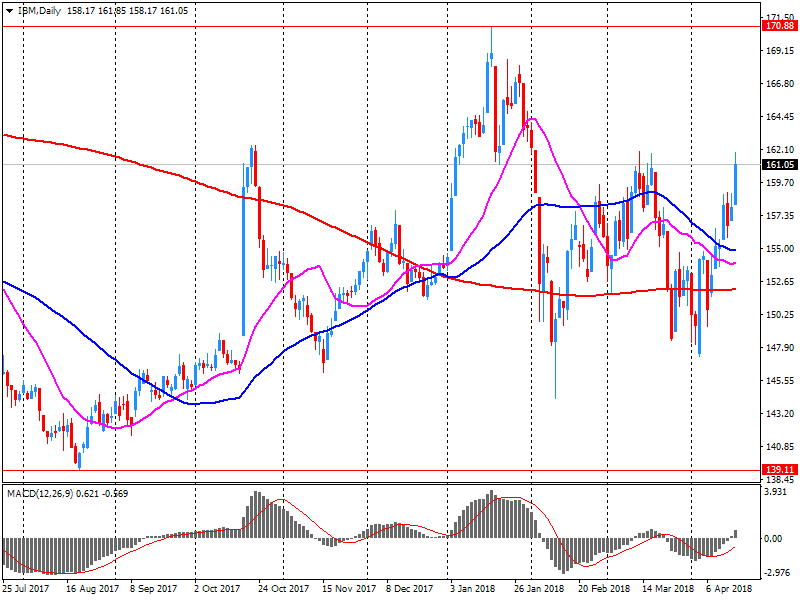

Components of the DOW index finished trading in different directions (17 in the red, 13 in the black). Outsider were the shares of International Business Machines Corporation (IBM, -7.55%). The growth leader was the shares of The Home Depot, Inc. (HD, + 2.90%).

Most sectors of the S & P recorded a rise. The base materials sector grew most (+ 2.0%). The consumer goods sector showed the greatest decrease (-0.4%).

At closing:

Dow 24,748.07 -38.56 -0.16%

S&P 500 2,708.64 +2.25 +0.08%

Nasdaq 100 7,295.24 +14.14 +0.19%

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 1.1 million barrels from the previous week. At 427.6 million barrels, U.S. crude oil inventories are in the lower half of the average range for this time of year.

Total motor gasoline inventories decreased by 3.0 million barrels last week, but are in the upper half of the average range. Both finished gasoline inventories and blending components inventories decreased last week.

Distillate fuel inventories decreased by 3.1 million barrels last week and are in the lower half of the average range for this time of year. Propane/propylene inventories remained unchanged last week, and are in the lower half of the average range. Total commercial petroleum inventories decreased by 10.6 million barrels last week.

-

Q1 gdp forecast to 1.3 pct from 2.5 pct, sees q2 at 2.5 pct; raises potential output growth to 1.8 pct in 2018-20, 1.9 pct in 2021

-

Q1 gdp weaker than forecast, rebound seen in q2; economy to operate above potential over next three years, helped by provincial, federal fiscal measures

-

Inflation in 2018 likely to be modestly higher than expected in jan before returning to target

-

Inflation close to 2 pct as temporary factors have dissipated; rise in core inflation consistent with economy operating with little slack

-

Some policy accommodation will still be needed to keep inflation on target; monitoring economy's sensitivity to rate movements, evolution of economic capacity

"The Bank of Canada today maintained its target for the overnight rate at 1 ¼ per cent. The Bank Rate is correspondingly 1 ½ per cent and the deposit rate is 1 per cent.

Inflation in Canada is close to 2 per cent as temporary factors that have been weighing on inflation have largely dissipated, as expected. Consistent with an economy operating with little slack, core measures of inflation have continued to edge up and are all now close to 2 per cent. The transitory impact of higher gasoline prices and recent minimum wage increases will likely cause inflation in 2018 to be modestly higher than the Bank expected in its January Monetary Policy Report (MPR), returning to the 2 per cent target for the rest of the projection horizon.

The global economy is on a modestly stronger track than forecast in January, with upward revisions to growth and potential output in a number of major advanced economies. The outlook for the U.S. economy has been further boosted by new government spending plans. However, escalating geopolitical and trade conflicts risk undermining the global expansion.

In Canada, GDP growth in the first quarter was weaker than the Bank had expected, but should rebound in the second quarter, resulting in 2 per cent average growth in the first half of 2018. The economy is projected to operate slightly above its potential over the next three years, with real GDP growth of about 2 per cent in both 2018 and 2019, and 1.8 per cent in 2020. This stronger profile for GDP incorporates new provincial and federal fiscal measures announced since January. It also reflects upward revisions to estimates of potential output growth, which suggest the Canadian economy has made some progress in building capacity".

-

Policy to remain accommodative for extended period after qe ends, with sizeable stock of assets

-

Halting asset purchases in september or december 'not a deep existential question' for ECB

-

'High convergence of views' within governing council

-

There are risks rising around protectionism, exchange rates, financial markets

-

Monetary policy is predictable not pre-committed

U.S. stock-index futures rose on Wednesday, as the latest slew of solid quarterly results, including Morgan Stanley (MS; +1.8%), added to optimism about the U.S. corporate earnings season.

Global Stocks:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Nikkei | 22,158.20 | +310.61 | +1.42% |

| Hang Seng | 30,284.25 | +221.50 | +0.74% |

| Shanghai | 3,091.31 | +24.51 | +0.80% |

| S&P/ASX | 5,861.40 | +19.90 | +0.34% |

| FTSE | 7,289.81 | +63.76 | +0.88% |

| CAC | 5,368.48 | +14.94 | +0.28% |

| DAX | 12,568.87 | -16.70 | -0.13% |

| Crude | $67.68 | | +1.74% |

| Gold | $1,356.00 | | +0.48% |

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 220.23 | 0.14(0.06%) | 372 |

| ALCOA INC. | AA | 58.7 | 1.62(2.84%) | 85297 |

| ALTRIA GROUP INC. | MO | 62.7 | -1.28(-2.00%) | 21287 |

| Amazon.com Inc., NASDAQ | AMZN | 1,516.33 | 12.50(0.83%) | 89329 |

| American Express Co | AXP | 94.44 | 0.58(0.62%) | 2462 |

| AMERICAN INTERNATIONAL GROUP | AIG | 54.28 | 0.02(0.04%) | 490 |

| Apple Inc. | AAPL | 178.2 | -0.04(-0.02%) | 55629 |

| AT&T Inc | T | 35.4 | 0.04(0.11%) | 4527 |

| Barrick Gold Corporation, NYSE | ABX | 13.18 | 0.11(0.84%) | 25125 |

| Boeing Co | BA | 337.75 | 1.03(0.31%) | 7841 |

| Caterpillar Inc | CAT | 154.4 | 1.09(0.71%) | 3681 |

| Cisco Systems Inc | CSCO | 44.71 | 0.12(0.27%) | 12799 |

| Citigroup Inc., NYSE | C | 70.14 | 0.40(0.57%) | 24031 |

| Exxon Mobil Corp | XOM | 78.9 | 0.57(0.73%) | 2953 |

| Facebook, Inc. | FB | 166.7 | -1.96(-1.16%) | 330236 |

| Ford Motor Co. | F | 11.43 | 0.05(0.44%) | 58369 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 18.71 | 0.41(2.24%) | 32100 |

| General Electric Co | GE | 13.85 | 0.06(0.44%) | 119652 |

| General Motors Company, NYSE | GM | 39.39 | 0.17(0.43%) | 2544 |

| Goldman Sachs | GS | 254.86 | 1.23(0.49%) | 29247 |

| Google Inc. | GOOG | 1,080.39 | 6.23(0.58%) | 9415 |

| Hewlett-Packard Co. | HPQ | 22.1 | 0.05(0.23%) | 773 |

| Home Depot Inc | HD | 175.38 | 0.47(0.27%) | 366 |

| HONEYWELL INTERNATIONAL INC. | HON | 150 | 1.30(0.87%) | 664 |

| Intel Corp | INTC | 53.77 | 0.23(0.43%) | 47397 |

| International Business Machines Co... | IBM | 151.65 | -9.26(-5.75%) | 236609 |

| Johnson & Johnson | JNJ | 130.4 | -0.14(-0.11%) | 2007 |

| JPMorgan Chase and Co | JPM | 110.6 | 0.39(0.35%) | 24331 |

| McDonald's Corp | MCD | 162.81 | 0.26(0.16%) | 6074 |

| Merck & Co Inc | MRK | 59.29 | 0.02(0.03%) | 1408 |

| Microsoft Corp | MSFT | 96.45 | 0.38(0.40%) | 28250 |

| Nike | NKE | 67.3 | -0.21(-0.31%) | 349 |

| Pfizer Inc | PFE | 36.46 | 0.13(0.36%) | 679 |

| Procter & Gamble Co | PG | 78.64 | 0.21(0.27%) | 2759 |

| Starbucks Corporation, NASDAQ | SBUX | 59.79 | -0.04(-0.07%) | 889 |

| Tesla Motors, Inc., NASDAQ | TSLA | 293.25 | 5.56(1.93%) | 93054 |

| Verizon Communications Inc | VZ | 48.96 | 0.11(0.23%) | 1763 |

| Visa | V | 124.01 | 0.21(0.17%) | 1265 |

| Wal-Mart Stores Inc | WMT | 88.26 | 0.36(0.41%) | 1296 |

| Walt Disney Co | DIS | 102.46 | 0.29(0.28%) | 1415 |

| Yandex N.V., NASDAQ | YNDX | 34.17 | 1.14(3.45%) | 158387 |

Altria (MO) downgraded to Neutral from Buy at Citigroup

Facebook (FB) downgraded to Mixed from Positive at OTR Global

Mike Pompeo met with Kim Jong Un in North Korea last week. Meeting went very smoothly and a good relationship was formed. Details of Summit are being worked out now. Denuclearization will be a great thing for World, but also for North Korea! @realDonaldTrump

Morgan Stanley (MS) reported Q1 FY 2018 earnings of $1.45 per share (versus $1.00 in Q1 FY 2017), beating analysts' consensus estimate of $1.25.

The company's quarterly revenues amounted to $11.077 bln (+13.7% y/y), beating analysts' consensus estimate of $10.369 bln.

MS rose to $54.20 (+1.80%) in pre-market trading.

IBM (IBM) reported Q1 FY 2018 earnings of $2.45 per share (versus $2.38 in Q1 FY 2017), beating analysts' consensus estimate of $2.42.

The company's quarterly revenues amounted to $19.072 bln (+5.1% y/y), beating analysts' consensus estimate of $18.803 bln.

The company reaffirmed guidance for FY 2018, projecting EPS of at least $13.80 versus analysts' consensus estimate of $13.84.

IBM fell to $152.75 (-5.07%) in pre-market trading.

A year earlier, the rate was 1.5%. European Union annual inflation was 1.5% in March 2018, up from 1.4% in February. A year earlier the rate was 1.6%. These figures are published by Eurostat, the statistical office of the European Union.

The lowest annual rates were registered in Cyprus (-0.4%), Greece (0.2%) and Denmark (0.4%). The highest annual rates were recorded in Romania (4.0%), Estonia (2.9%), Slovakia and Lithuania (both 2.5%). Compared with February, annual inflation fell in six Member States, remained stable in six and rose in fifteen. In March 2018, the highest contribution to the annual euro area inflation rate came from services (+0.67 percentage point), followed by food, alcohol & tobacco (+0.41 pp), energy (0.20 pp) and non-energy industrial goods (0.07 pp).

The headline rate of inflation for goods leaving the factory gate (output prices) was 2.4% on the year to March 2018, down from 2.6% in February 2018.

Prices for materials and fuels (input prices) rose 4.2% on the year to March 2018, up from 3.8% in February 2018.

All industries provided upward contributions to output annual inflation; the largest contribution was made by food products.

The rate of input annual inflation increased for the first time in four months, despite the second consecutive decrease on the monthly rate.

The Consumer Prices Index including owner occupiers' housing costs (CPIH) 12-month inflation rate was 2.3% in March 2018, down from 2.5% in February 2018.

Since reaching a recent high of 2.8% towards the end of 2017, the rate has fallen back to its lowest since March 2017.

The largest downward contribution to the change in the rate between February 2018 and March 2018 came from prices for clothing and footwear rising by less than they did a year ago, with the effect coming mainly from a range of items of women's clothing.

Price movements for alcoholic drinks and tobacco also made a downward contribution to the change in the rate; this in part reflects changes to the Budget cycle that were introduced in 2017, with tax changes for tobacco being announced in November 2017 instead of March 2018.

The Consumer Prices Index (CPI) 12-month rate was 2.5% in March 2018, down from 2.7% in February 2018.

EUR/USD

Resistance levels (open interest**, contracts)

$1.2460 (2109)

$1.2446 (1395)

$1.2425 (216)

Price at time of writing this review: $1.2369

Support levels (open interest**, contracts):

$1.2312 (3548)

$1.2276 (3696)

$1.2235 (4410)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date May, 4 is 77407 contracts (according to data from April, 17) with the maximum number of contracts with strike price $1,2250 (4410);

GBP/USD

Resistance levels (open interest**, contracts)

$1.4404 (2144)

$1.4367 (2096)

$1.4345 (2028)

Price at time of writing this review: $1.4304

Support levels (open interest**, contracts):

$1.4263 (208)

$1.4218 (462)

$1.4188 (448)

Comments:

- Overall open interest on the CALL options with the expiration date May, 4 is 22151 contracts, with the maximum number of contracts with strike price $1,4400 (3232);

- Overall open interest on the PUT options with the expiration date May, 4 is 24027 contracts, with the maximum number of contracts with strike price $1,3850 (2494);

- The ratio of PUT/CALL was 1.08 versus 1.06 from the previous trading day according to data from April, 17

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

Says U.S. economy firing on all cylinders

-

Fed can raise rates gradually without risk of inflation surge

-

Job market 'solid,' consumer spending fundamentals 'quite strong'

-

Global growth picking up, sees trade uncertainty

-

U.S. inflation somewhat below target, expected to improve

-

Little risk of accelerating, markedly higher inflation

-

We will let you know fairly soon when and where summit with Kim will take place

-

Makes preliminary finding imports of aluminum sheet from China subsidized

European stocks logged the best close in about seven weeks, taking the lead from an upbeat session the prior day in the U.S., as attention shifted from geopolitical concerns to the earnings season. U.K. stocks erased an earlier loss and swung higher, after a mixed reading on the country's labor market sent the pound lower.

U.S. stocks rallied on Tuesday, with major indexes closing at the highest levels in about a month as the latest round of corporate earnings supported the thesis that valuations are supported by economic activity. The day's gains were broad, with all 11 S&P 500 sectors ending in solidly higher territory, although the technology and consumer-discretionary groups saw the biggest advance on the day.

Asian equities Wednesday largely built on gains in the U.S. and Europe the day before, but Chinese stocks continued to lag behind on concerns about trade and the country's economy. Equities there started higher, but the selling resumed by midmorning, led by small-caps as they extended Tuesday's selloff.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.