- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 21-07-2020

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 | Australia | Leading Index | June | 0.2% | |

| 00:30 | Japan | Manufacturing PMI | July | 40.1 | |

| 00:30 | Japan | Nikkei Services PMI | July | 45.0 | |

| 12:30 | Canada | Consumer Price Index m / m | June | 0.3% | 0.4% |

| 12:30 | Canada | Consumer price index, y/y | June | -0.4% | 0.3% |

| 12:30 | Canada | Bank of Canada Consumer Price Index Core, y/y | June | 0.7% | 0.9% |

| 13:00 | U.S. | Housing Price Index, m/m | May | 0.2% | |

| 14:00 | U.S. | Existing Home Sales | June | 3.91 | 4.8 |

| 14:30 | U.S. | Crude Oil Inventories | July | -7.493 |

Bank of Canada announced on Tuesday that, since the strains in the short-term provincial borrowing market had diminished significantly since March and the usage of its Provincial Money Market Purchase (PMMP) program had declined from its peak, it decided to amend the program.

"Effective July 27, 2020, the Bank will purchase up to 20% (previously up to 40%) of each accepted offering of directly issued provincial money market securities with terms to maturity of 12-months or less. The 20 percent limit may be adjusted if market conditions warrant."

In addition, the BoC also reduced the pace of acquisition of the Government of Canada treasury bills acquired at auction, citing improved conditions in short-term funding markets.

"Effective July 27, 2020, the Bank will reduce the amount it purchases at auction from 40 percent to 20 percent of tendered amounts, which is in line with average levels prior to the onset of the COVID-19 pandemic. The Bank may adjust its purchase percentage if market conditions warrant."

According to ActionForex, analysts at RBC Financial Group note that Canada's retail sales recorded a sharp 18.7% rise in May, as more brick-and-mortar stores reopened amid lower virus case counts across Canada and a tick higher in consumer confidence from April lows.

"The rebound was wide-spread across almost all sub-categories, though led by motor vehicle and parts sales. Early industry reports showed the momentum in auto sales continued well into June. Food and beverage sales (from stores) slipped lower relative to April, but remained 11.6% above a year ago as the pandemic kept diners at home. Heightened demand for online purchases has pushed e-commerce sales to account for well over 8% of overall retails sales, compared to just 3% a year ago. Overall e-commerce sales remained elevated in May, up 112.7% year-over-year, and that’s excluding sales made from foreign retailers."

"The bounce back was not large enough to bring activity back to pre-COVID levels. Excluding price impacts, sale volumes declined by almost one third over March and April, and were still 18% below their February levels in May."

"But Statistics Canada also reported a preliminary estimate that (nominal) sales rose another 24.5% in June. That would leave the total in that month 2% above year ago levels. That is similar to trends shown by our own tracking of card purchases, as well as the bounce-back in retail spending observed in the United States to-date."

"Initial data over May and June, including retail and home resale numbers, continued to point to a quicker-than-expected initial rebound in activity early in the economic recovery."

"This initial rebound was likely fueled by substantial government income support measures, and there is still a risk that those measures expire before labour markets are fully recovered. And some degree of safety protocols are likely to remain in place for an extended period, limiting overall services demand. For now, we continue to expect a sharper than expected initial rebound to be followed by more moderate growth beyond June."

Statistics

Canada reported on Tuesday the New Housing Price Index (NHPI) edged up 0.1

percent m-o-m in June, the same pace as in the previous month.

Economists had

forecast the NHPI to increase 0.1 percent m-o-m in June.

According to

the report, new home prices showed little or no change in 17 out of the 27

census metropolitan areas (CMAs) surveyed in June. Meanwhile, St. Catharines-Niagara

(+1.0 percent m-o-m) reported the largest increase in new home prices in June in

response to good market conditions in the region, followed by Kitchener-Cambridge-Waterloo

(+0.7 percent m-o-m) and Guelph (+0.5 percent m-o-m).

On the contrary,

new house prices dropped the most in Regina (-0.5 percent m-o-m) and Edmonton

(-0.2 percent m-o-m) as buyers negotiated lower selling prices.

In y-o-y terms,

NHPI rose 1.3 percent in June, following a 1.1 percent gain in the previous

month.

- High-frequency data suggest Q2 GDP decline will be less than forecast

FXStreet notes that GBP/USD has pushed strongly higher to leave the spotlight back on key resistance from its 200-day average and downtrend from late last year at 1.2704/06. Above this level, the cable would mark a significant break higher with resistance next at 1.2808/17. Eventually, analysts at Credit Suisse target the long-term downtrend from 2015 and February and March highs at 1.3139/1.3215.

“GBP/USD has pushed strongly higher to leave the spotlight back on key resistance from its 200-day average and downtrend from late last year at 1.2704/06. Whilst a fresh rejection from here should be allowed for upside momentum looks to be building and a close above 1.2706 would suggest we are seeing a more important turn higher, opening the door to a retest of 1.2808/17 next – the June high and 78.6% retracement of the entire fall from late last year.”

“Big picture, we think this can clear the way for a challenge on what we view as much more important resistance starting at 1.3139 and stretching up to 1.3200/15 – the long-term downtrend from 2015 and February and March highs – which we look to prove a tougher barrier.”

“Support is seen at 1.2650/43 initially, below which can ease the immediate upside bias with support then at 1.2574/70, with the immediate risk seen staying higher whilst above 1.2512. Below would reinforce the broader sideways range, with support seen next at 1.2480, then more importantly at 1.2463/53.”

U.S. stock-index futures rose on Tuesday, underpinned by positive earnings reports from IBM (IBM; +4.5%) and Coca-Cola (KO; +3.2%), as well as hopes for more stimulus in the U.S.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 22,884.22 | +166.74 | +0.73% |

Hang Seng | 25,635.66 | +577.67 | +2.31% |

Shanghai | 3,320.89 | +6.75 | +0.20% |

S&P/ASX | 6,156.30 | +154.70 | +2.58% |

FTSE | 6,288.75 | +27.23 | +0.43% |

CAC | 5,145.63 | +52.45 | +1.03% |

DAX | 13,255.14 | +208.22 | +1.60% |

Crude oil | $42.03 | +2.71% | |

Gold | $1,842.00 | +1.35% |

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 157.95 | 1.58(1.01%) | 2451 |

ALCOA INC. | AA | 12.96 | 0.24(1.89%) | 16487 |

ALTRIA GROUP INC. | MO | 41 | 0.13(0.32%) | 19273 |

Amazon.com Inc., NASDAQ | AMZN | 3,247.06 | 50.22(1.57%) | 113027 |

American Express Co | AXP | 95.18 | 1.18(1.26%) | 3513 |

AMERICAN INTERNATIONAL GROUP | AIG | 31.82 | 0.41(1.31%) | 2901 |

Apple Inc. | AAPL | 396.19 | 2.76(0.70%) | 235999 |

AT&T Inc | T | 30.02 | 0.17(0.57%) | 115683 |

Boeing Co | BA | 176.69 | 2.27(1.30%) | 165772 |

Caterpillar Inc | CAT | 135.5 | 0.87(0.65%) | 16643 |

Chevron Corp | CVX | 86.58 | 1.31(1.54%) | 28069 |

Cisco Systems Inc | CSCO | 47.27 | 0.30(0.64%) | 21180 |

Citigroup Inc., NYSE | C | 50.62 | 0.48(0.96%) | 121873 |

E. I. du Pont de Nemours and Co | DD | 53.58 | 0.43(0.81%) | 712 |

Exxon Mobil Corp | XOM | 43.2 | 0.70(1.65%) | 67050 |

Facebook, Inc. | FB | 247.14 | 1.72(0.70%) | 80047 |

FedEx Corporation, NYSE | FDX | 166.45 | 2.32(1.41%) | 1764 |

Ford Motor Co. | F | 6.72 | 0.06(0.90%) | 430856 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 13.57 | 0.14(1.04%) | 39807 |

General Electric Co | GE | 6.96 | 0.09(1.31%) | 457496 |

General Motors Company, NYSE | GM | 26.39 | 0.38(1.46%) | 22016 |

Goldman Sachs | GS | 214.1 | 2.39(1.13%) | 9736 |

Google Inc. | GOOG | 1,577.62 | 11.90(0.76%) | 3870 |

Hewlett-Packard Co. | HPQ | 17.89 | 0.24(1.36%) | 5486 |

Home Depot Inc | HD | 262 | 1.83(0.70%) | 20713 |

HONEYWELL INTERNATIONAL INC. | HON | 154.6 | 1.21(0.79%) | 632 |

Intel Corp | INTC | 61.57 | 0.42(0.69%) | 59811 |

International Business Machines Co... | IBM | 132.7 | 6.33(5.01%) | 136156 |

Johnson & Johnson | JNJ | 150.3 | 0.70(0.47%) | 4978 |

JPMorgan Chase and Co | JPM | 98.2 | 0.90(0.93%) | 74446 |

McDonald's Corp | MCD | 192.9 | 1.29(0.67%) | 20050 |

Merck & Co Inc | MRK | 79.95 | 0.54(0.68%) | 38095 |

Microsoft Corp | MSFT | 213.4 | 1.80(0.85%) | 417866 |

Nike | NKE | 97 | 1.35(1.41%) | 6469 |

Pfizer Inc | PFE | 36.88 | 0.38(1.04%) | 232156 |

Procter & Gamble Co | PG | 125.9 | 0.66(0.53%) | 1935 |

Starbucks Corporation, NASDAQ | SBUX | 75.4 | 0.44(0.59%) | 20118 |

Tesla Motors, Inc., NASDAQ | TSLA | 1,664.83 | 21.83(1.33%) | 390444 |

The Coca-Cola Co | KO | 47.45 | 1.33(2.88%) | 348777 |

Travelers Companies Inc | TRV | 119.5 | 0.73(0.61%) | 189 |

Twitter, Inc., NYSE | TWTR | 37.67 | 0.61(1.65%) | 103044 |

UnitedHealth Group Inc | UNH | 303.25 | -0.21(-0.07%) | 14769 |

Verizon Communications Inc | VZ | 56.12 | 0.25(0.45%) | 5648 |

Visa | V | 199.75 | 1.28(0.64%) | 24231 |

Wal-Mart Stores Inc | WMT | 132.1 | 0.63(0.48%) | 15047 |

Walt Disney Co | DIS | 118.81 | 1.02(0.87%) | 17680 |

Yandex N.V., NASDAQ | YNDX | 57.32 | 1.13(2.01%) | 14198 |

The Chicago

Federal Reserve announced on Tuesday the Chicago Fed national activity index

(CFNAI), a weighted average of 85 different economic indicators, came in at 4.11

in June, up from an upwardly revised 3.50 in May (originally 2.61), pointing to

a further increase in economic growth.

At the same

time, the index’s three-month moving average moved up to -3.49 from -6.36 in

May.

According to

the report, three of the four broad categories of indicators used to construct

the index made positive contributions in June, and two of the four categories rose

from May

Production-related

indicators made a positive contribution of 2.22 to the CFNAI in June, up from +0.84

in May. Employment-related indicators contributed +1.74 to the CFNAI in June,

up from +1.73 in May. Meanwhile, the contribution of the sales, orders, and

inventories category to the CFNAI decreased to -0.24 in June from +0.04 in May.

The contribution of the personal consumption and housing category to the CFNAI improved

decreased to +0.40 in June from +0.89 in May.

Tesla (TSLA) downgraded to Mkt Perform from Mkt Outperform at JMP Securities

Statistics

Canada reported on Tuesday that the Canadian retail sales climbed 18.7 percent

m-o-m to CAD41.79 billion in May, following an unrevised 26.4 percent m-o-m

plunge in April. That was the biggest monthly advance on record.

Economists had

forecast a 20.0 percent m-o-m surge for May.

According to

the report, sales increased in 10 out of 11 subsectors, with the motor vehicle and

parts dealers (+66.3 percent m-o-m, the first gain in three months), general

merchandise stores (+20.4 percent m-o-m) and clothing and clothing accessories

stores (+92.6 percent m-o-m) contributing the most to the May increase.

Excluding motor

vehicle and parts dealers, retail sales rose 10.6 percent m-o-m in May compared

to an unrevised 22.0 percent m-o-m decrease in April and economists’ forecast

for a 12.0 percent m-o-m gain. Excluding motor vehicle and parts dealers and

gasoline stations, retail sales increased 9.9 percent m-o-m in May.

In y-o-y terms,

Canadian retail sales declined 18.4 percent in May, following an unrevised 32.5

percent tumble in April.

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 06:00 | Switzerland | Trade Balance | June | 2.68 | 2.8 | |

| 06:00 | United Kingdom | PSNB, bln | June | -44.5 | -34.3 | -34.8 |

USD and JPY depreciated against most other major currencies in the European session on Tuesday as risk appetite improved after the European Union (EU) leaders agreed on a EUR750 billion recovery fund, comprising of EUR390 billion in grants and EUR360 billion in low-interest loans. The fund will be available from January 2021 and there will be no new bridge financing until then. This is because the EU has taken other measures since the coronavirus crisis struck to provide liquidity to the member states if they are needed.

However, the German economy minister Peter Altmaier said today that "it's possible that the EU money could be available earlier than next year". He also noted that the agreement increases the chances of "a cautious, slow recovery" in the second half of the year.

In addition to the recovery fund, the EU officials reached a deal on the bloc's six-year budget worth about EUR1.1 trillion.

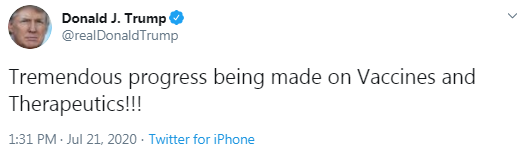

Investor sentiment also remained buoyed by yesterday's reports about positive results for COVID-19 vaccine candidates from Pfizer (PFE)/BioNTech (BNTX) and AstraZeneca (AZN)/the University of Oxford as well as hopes for more stimulus in the U.S.

According to Reuters, aides of the U.S. President Donald Trump and Congressional Democratic lawmakers are set to discuss the next steps in responding to the coronavirus crisis later today, with congressional Republicans saying they are working on a $1 trillion relief bill.

Meanwhile, worsening U.S.-China tensions and rising COVID-19 infections kept optimism in check.

The U.S. Department of Commerce added eleven Chinese companies to a list of entities that are believed to be committing human rights violations in Xinjiang.

According to the Johns Hopkins Center for Systems Science and Engineering, the total number of confirmed global cases of the COVID-19 rose to 14,729,037, with the U.S. recording 3,831,430 coronavirus cases, the most in the world. Growing coronavirus infections forced many businesses and states to reimpose lockdowns, raising concerns about the pace of U.S. economic recovery.

USD and JPY rose slightly against EUR. USD traded marginally lower against JPY.

FXStreet reports that analysts at Credit Suisse apprise that S&P 500 has finally seen a clear break above the June high at 3233 for a resumption of the uptrend with resistance seen next at 3260 above which can see the top of the gap at 3328/38.

“The S&P 500 has finally seen a clear break and close above key resistance from the 3233 June high, albeit on low volume and strength has already extended to next flagged resistance from the bottom of the February ‘pandemic’ gap at 3260. Although this should be respected we look for a clear break in due course with resistance seen next at 3288, ahead of 3318 and then the top of the February gap at 3328/38, which we look to prove a tougher barrier. Should strength directly extend, we think this can clear the way for a move back to the 3394 high.”

“Support is seen at 3233/31 initially, with 3215 now ideally holding to keep the immediate risk higher. Below can see a fall back to price/gap support at 3200/3198, with the key 13-day average now at 3185.”

FXStreet notes that both banks and U.S. consumers have a much stronger financial foundation than they did prior to the 2008 crisis but many investors may remain skeptical that the sector can outperform coming out of the current recession. Lisa Shalett from Morgan Stanley explains three main reasons to add financials to the portfolio.

“Second-quarter earnings for financials have largely beaten expectations: Recently reported financial results included some meaningful upside surprises, with banks reporting credit charge-offs that were better than thought, reserve ratios in good shape and, on average, solid balance sheet health. Unlike previous recessions where capital market activities have slowed, Federal Reserve policy moves seem to have boosted transactions.”

“Valuations seem attractive: As a result of underperforming the S&P 500 since the 2008 crisis, the financial sector now appears sharply undervalued. For the past 20 years, the financial sector has had a price-to-earnings ratio just below the S&P 500. Now the sector trades at nearly half the P/E of the index.”

“Rising interest rates could lift profitability: Financials have tended to earn more money when long-term rates are higher than short-term rates, since they can borrow at low rates and lend at higher rates, allowing for higher net interest margins. The yield curve is nearly flat now, but already, inflation expectations are moving higher, which should eventually lead to rising long-term rates. Interest rates may need to lead the way before financials outperform other sectors, but our confidence is growing that rising rates are coming.”

- Chinese economic recovery leads the world

- We will strive to achieve good results for economic growth this year

- We will make fiscal policy more proactive, prudent monetary policy more flexible

- We will continue to cut taxes and fees

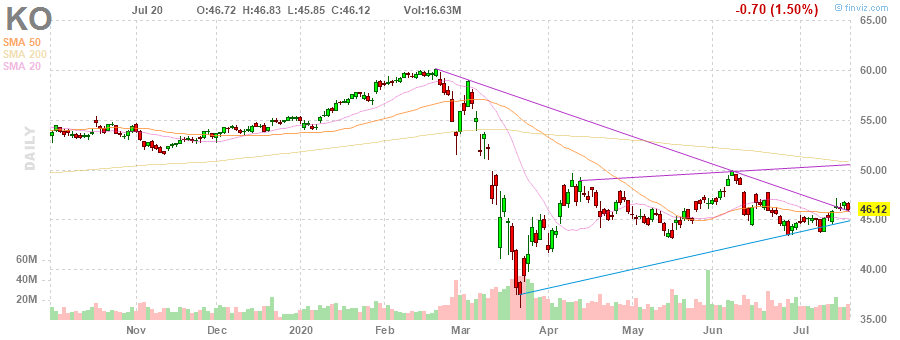

Coca-Cola (KO) reported Q2 FY 2020 earnings of $0.42 per share (versus $0.63 per share in Q2 FY 2019), beating analysts’ consensus estimate of $0.41 per share.

The company’s quarterly revenues amounted to $7.200 bln (-28.0% y/y), generally in line with analysts’ consensus estimate of $7.256 bln.

KO rose to $46.96 (+1.82%) in pre-market trading.

FXStreet reports that analysts at TD Securities note that, after a marathon four-day summit, EU leaders struck a deal on their 7-year budget, which includes €750 billion in support for countries worst-hit by COVID-19. However, EUR/USD registered only a muted reaction to the Recovery Fund deal announcement as an initial spike up to 1.1470 was quickly faded as a ‘sell the fact’ dynamic soon emerged.

“After extending their two day summit to four, all 27 EU leaders signed off on a compromise 7-year budget (the Multiannual Financial Framework, or MFF), that includes a €750 billion recovery package to help economies worst hit by COVID-19, called Next Generation EU.”

“EUR/USD has remained largely stable in the wake of the announcement. Stronger risk appetite has helped offset the typical "sell the fact" dynamic we may otherwise observe. Valuation and positioning are becoming more of a concern near-term as the technical picture also turns less friendly for further gains.”

“EUR/USD can still participate in further USD weakness, however, particularly if risky assets continue their ascent. With an eye on key support around 1.1422 today, a sustained move above 1.15 would keep us on a bullish tactical trajectory.”

FXStreet reports that Alvin Liew, Senior Economist at UOB Group, reviewed the latest data releases from the trade balance sector in the Japanese economy.

“Japan’s exports continued to contract severely by 26.2% y/y in June… the 19th consecutive month of decline since December 2018, the longest stretch of monthly contraction since 1987. In comparison, the decline in imports was a more subdued at -14.4% y/y. That said, imports have been on the decline for 13 straight months since May 2019.”

“In line with the weak exports and a more modest decline in imports, Japan recorded another trade deficit, albeit a smaller one at JPY268.8bn for June (from a deficit of JPY838.2bn in May). On an adjusted basis, the trade balance showed a deficit of JPY423.9bn in June (from a JPY585.7bn in May).”

“While we believe the worst for Japan’s trade collapse to be in 2Q 2020, the subsequent recovery in 2H is likely to be on a gradual trajectory and the recovery path is laden with significant uncertainties in light of the evolving COVID-19 situation. Rising infection rates in the US and elsewhere with potential resurgence in other regions could hamper efforts to reopen economies and temporarily disrupt global supply chains again, leading to material disruptions in Japan’s huge manufacturing base while redeploying restrictions in major economies to contain the spread of COVID-19 will weaken demand for Japanese goods.”

“We have further revised our forecast Japan’s exports lower and will now contract by 16.6% in 2020 from previous forecast of -7.2% (+5.6% in 2019) while imports may contract by 11.7% from previous forecast of -8.7% (+5.0% in 2019). Based on these latest projections, Japan is likely to record a bigger trade deficit, amounting to JPY 7 trillion in 2020 (from a trade deficit of JPY 3.6 trillion in 2019).”

IBM (IBM) reported Q2 FY 2020 earnings of $2.18 per share (versus $3.17 per share in Q2 FY 2019), beating analysts’ consensus estimate of $2.09 per share.

The company’s quarterly revenues amounted to $18.123 bln (-5.4% y/y), beating analysts’ consensus estimate of $17.721 bln.

IBM rose to $133.38 (+5.55%) in pre-market trading.

- Says that agreement in Brussels is good news for millions of people in Germany and Europe

- The likelihood of a gradual economic recovery has "enormously increased"

- It's possible that EU money could be available earlier than next year

- Expects a sustainable recovery in 2021 and 2022

- Expects all European countries to return to growth in 2021

FXStreet reports that Euro Stoxx 50 has opened sharply above its 200-day average and a sustained close above here should confirm a bullish ‘triangle’ continuation pattern, with resistance above 3438/48 seen next at 3532, which economists at Credit Suisse would look to cap at first.

“Euro Stoxx has opened sharply above its 200-day average, currently at 3357, and a sustained close above here and then the 3395/3400 key price resistance should confirm the sideways range from early June has been resolved higher for the completion of a bullish “triangle” continuation pattern, with the market already challenging next resistance at the late February/early March price gap and price resistance at 3438/48.”

“A direct break above 3448 can see resistance next at 3532 – the 78.6% retracement of the entire Q1 collapse – which we would look to cap at first. Above in due course can see resistance then at 3595/96, the December 2019 low.”

“Support at 3404/3392 needs to hold on a closing basis to maintain the break higher. Back below would throw a question mark over the break higher (yet again), with support seen next at 3333/21. Suspect only back below here though curtails thoughts of a bull ‘triangle’.”

FXStreet reports that USD/CAD is breaking lower, removing the crucial 200-day average at 1.3512. A close below this level today would reinforce the downside bias of the Credit Suisse analyst team, with support next at the 1.3486 June low.

“USD/CAD is seeing the expected attempt to break below the pivotal 200-day average, currently at 1.3512, turning the focus onto next support at the June low at 1.3486. Although a rebound from the range bottom should clearly not be excluded, we remain biased lower and look for a close below these key levels.”

“With a large bearish ‘descending triangle’ continuation pattern also still in place and MACD close to crossing lower, our core bias stays bearish and a move below 1.3486 would finally complete a bear ‘wedge’ continuation pattern. The next supports would then be seen back at 1.3402/3398 initially, then the more important 2020 low and retracement support at 1.3331/17.”

“Resistance is seen initially at 1.3511/12, then 1.3539, which ideally holds to keep the immediate downside bias intact. Above here though would see resistance next at 1.3600/07, where we would expect another attempt to cap.”

CNBC reports that there will be little progress in the phase one trade deal ahead of the U.S. presidential election in November, former U.S. ambassador to China Max Baucus said on Tuesday.

President Donald Trump signed the partial trade deal with Beijing in January, but the coronavirus pandemic has since hammered China’s economy. There are now doubts if the Asian giant will be able to fulfill its commitments to large purchases agreed to in the deal.

These “odds are diminishing,” said Baucus, who served as ambassador to China from February 2014 to January 2017, under former President Barack Obama’s administration.

According to a forecast by think tank Center for Strategic and International Studies, the pandemic will likely cause China’s purchases of U.S. goods this year to fall way short of what was agreed to in the phase one trade deal.

With Trump preoccupied with securing a second term and China finding it difficult to live up to its end of the deal, there will be few constructive developments until after the election, Baucus told CNBC’s “Squawk Box.”

“There will be a lot of rhetoric back and forth, but I don’t know that there is going to be a lot of substantive, meaningful agreements for change,” he said.

The former ambassador described U.S. and China relations as falling into a “big abyss” and added that more talks are required between the two sides.

Regarding the upcoming presidential election, Baucus said the U.S. relationship with China could improve if former Vice President Joe Biden wins the election, but tensions will remain.

“It’s probably not going to get worse, maybe it will reach a bottom here,” Baucus said of a Biden win.

It may also get better as Biden is “much more predictable” and is expected to use regular diplomatic channels and practice quiet diplomacy, he explained.

“He knows that to get deals with countries, you have to not criticize them. You can’t force them to dig in their heels publicly, you got to negotiate,” he said.

But there will continue to be signs of tensions between the U.S. and China, with the Asian country now a rising power, he said.

FXStreet reports that UOB Group’s Economist Ho Woei Chen, CFA, assessed the latest interest rate decision by the PBoC.

“The People’s Bank of China (PBoC) kept its benchmark interest rates unchanged in July for the third consecutive month, in line with consensus expectation. At today’s fixing, the 1Y Loan Prime Rate (LPR) and the 5Y & above LPR were set at 3.85% and 4.65% respectively. The interest rate on 1Y medium-term lending facility (MLF) loans to financial institutions which the LPR is pegged to, stands at 2.95% after 30 bps cut year-to-date.”

“This is the longest stretch since the LPR reform in August 2019 that the PBoC has kept the interest rate unchanged, which might suggest that the trajectory lower would be limited from here. Given the economic recovery in 2Q, there is good reason for the central bank to turn more cautious on broad-based easing.”

“Taking into consideration of the domestic growth recovery, risk of more prolonged global recovery from COVID-19 pandemic and US-China tensions, we have adjusted higher our forecast for the 1Y LPR to 3.75% at end-3Q20 and end-4Q20, up from previous outlook of 3.60% end-3Q20 and 3.55% at end-4Q20. This assumes the PBoC will cut the 1Y LPR by another 10 bps for the rest of the year after the 30 bps cut in 1H20. Furthermore, there is also scope for another one to two rounds of reductions to the Reserve Requirement Ratio (RRR) for the remainder of 2020.”

That is as long as we remain in the baseline scenario of our projections

There is no urgency to discuss adding fallen angels to asset purchases, but ECB is of course, aware of the risks

Reuters reports that China’s foreign ministry accused the United States on Tuesday of abusing export control measures, in response to reports that Washington was adding 11 Chinese companies to an economic blacklist over the treatment of Uighurs.

China firmly opposed the move and will take all necessary measures to ensure the legitimate rights of Chinese firms, foreign ministry spokesman Wang Wenbin said during a daily media briefing.

FXStreet reports that USD/CNY is trading just below the 7.00 level and analysts at MUFG Bank expect the Chinese currency to strengthen despiste of a mixed outlook due to risks regarding US-China tensions and doubts about the economic recovery.

“An uneven economic recovery among different sectors, especially within the services sector and the rising geopolitical tension between the US and China; we see a mixed risk signals but the risk-on rally for CNY against the US dollar in the near-term looks set to continue.”

“Should the risk factors cause the market participants to put its risk-off hat on, CNY will quickly move towards the 7.1000 level to test the resistance around that level.”

“While global risk factors will be important for CNY direction, a better macro backdrop in China would be important for near-term CNY direction and like markets more generally lots of good news appears in the CNY price.”

Reuters reports that Prime Minister Giuseppe Conte said on Tuesday the EU stimulus plan would allow his government to transform Italy and help the bloc as a whole face the COVID-19 crisis with “strength and effectiveness”.

Conte said that 28%, or 209 billion euros, of the 750 billion euros agreed at the European summit would be for Italy, of which 81 billion euros will be in grants and 127 billion euros will be in loans.

The deal gives Italy “the opportunity to restart with strength” and the government the responsibility “to change the face of the country,” Conte said.

“Now we have to run and use these funds for investments and structural reforms. We have a real chance to make Italy greener, more digital, more innovative, more sustainable, inclusive. We have the chance to invest in schools, universities, research and infrastructures.”

Conte dismissed rumours that his government was on the verge of breakdown saying that the administration “is strong” and the EU deal “reinforces the Italian government’s action”.

Italy’s ruling parties are divided over whether to use the European Union bailout fund managed by the European Stability Mechanism (ESM), which Italy has always declined to use in the past to avoid tough fiscal conditions.

“My position never changed: ESM is not our goal,” Conte said, adding that he hoped the deal on the Recovery Fund “could contribute to distract morbid attention surrounding the ESM”.

Talking about the long negotiations in Brussels, Conte said that he protected “the dignity of Italy and the autonomy of the EU institutions and rejected insidious attempts to alter the genuine vocation of the European project by cross vetoes”.

FXStreet reports that in OECD countries, financial markets are set to decouple from the real economy as while the economic recovery is vigorous in the short-term, potential growth will be reduced by a number of mechanisms. If inflation normalises, central banks will continue their yield curve control, and persistently negative real long-term interest rates will lead to a sharp rise in asset prices, analysts at Natixis informs.

“The economic recovery in OECD countries is vigorous in the short-term, thanks in particular to an upturn in consumption on the back of public transfer payments and catch-up consumption. But potential growth can be expected to be lower in the wake of the recession, due to the loss of productive capital and human capital, high corporate debt and the growing number of zombie firms. This means that post-recession GDP will never return to the level it would have been at without the recession.”

“We believe that inflation will normalise in OECD countries given the recovery in demand , rising commodity prices and, more structurally, population ageing and the comeback of regional value chains, bearing in mind the high production costs in OECD countries. We also believe that to ensure the solvency of governments in the face of mounting public debt ratios, central banks will continue to use yield curve control. If inflation normalises and nominal long-term interest rates are controlled, real long-term interest rates should be expected to remain persistently negative in the OECD.”

“If real long-term interest rates are persistently negative, the valuation of long-term assets will be increased and investors will rotate into risky assets in search of decent returns. So one should expect a sharp rise in equity valuation and in equity market indices, a sharp rise in real estate prices and a tightening of credit spreads.”

FXStreet reports that in opinion of FX Strategists at UOB Group, USD/CNH still risks a probable decline to the 6.9500 level in the short-term horizon.

24-hour view: “We highlighted yesterday that ‘the current movement is still viewed as a consolidation phase and USD is likely to trade between 6.9870 and 7.0040’. USD subsequently traded within a lower and narrower range than expected (between 6.9825 and 6.9993). Downward momentum has improved a tad and for today, USD could drift lower to 6.9760. In view of the lackluster momentum, the next support at 6.9650 is unlikely to come into the picture. Resistance is at 6.9930 followed by 7.0000.”

Next 1-3 weeks: “There is not much to add to our update from Monday (13 Jul, spot at 7.0050). As highlighted, USD could weaken to 6.9650 with lower odds for extension to 6.9500. Only a break of 7.0180 (‘strong resistance’ level previously at 7.0390) would indicate that the current downward pressure has eased.”

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 06:00 | Switzerland | Trade Balance | June | 2.68 | 2.8 | |

| 06:00 | United Kingdom | PSNB, bln | June | -44.5 | -34.3 | -34.8 |

During today's Asian trading, the euro traded steadily against the US dollar and the yen on news of the agreement of the EU's anti-crisis plan.

EU leaders have reached an agreement on a recovery plan for the economy affected by the coronavirus pandemic and the EU budget for 2021-2027 after four days of talks, European Council President Charles Michel has announced.

"The budget for the next 7 years will be 1.074 trillion euros, and we have decided to mobilize 750 billion euros to support the possibility of economic recovery," he said at a final press conference on Tuesday morning.

The growth of consumer prices in Japan in June, as well as the month before, was 0.1% in annual terms, according to data from the Ministry of internal affairs and communications of the country. Thus, inflation remains at the lowest level in the past three years, against the background of the continuing negative impact of the pandemic on demand.

The ICE Dollar index, which shows the value of the dollar against six major world currencies, fell by 0.08% relative to the previous trading day.

The Australian dollar rose against the US dollar. The Reserve Bank of Australia did not see the need to change monetary policy in the current conditions, according to the report of the meeting of the regulator. In addition, according to the document, a reduction in interest rates in the country below zero is extremely unlikely. The Australian Central Bank at the end of the meeting on July 7, kept the key rate at 0.25% per annum.

Bloomberg reports that U.K. households are experiencing the biggest income shock since the 1970s oil crisis, and the pain is far from over as the government prepares to withdraw the support deployed to help the country through the coronavirus crisis.

The stark assessment from the Resolution Foundation intensifies the pressure on Chancellor of the Exchequer Rishi Sunak, with forecasters warning of mass job cuts this year unless more help is made available beyond October when subsidies supporting the incomes of over 12 million workers are due to end.

In a report published Tuesday, the think tank said real wages have fallen by 4.5% since the coronavirus crisis began, despite the wage support programs. That’s the most since 1975, when the Arab oil embargo sent inflation spriraling, and well above any year during and after the 2008-09 financial crisis.

The scale of the shock may fuel doubts over how quickly the economy can recover from its deepest recession in at least a century.

While Sunak is spending almost 200 billion pounds ($253 billion) to keep people in jobs and businesses afloat, the Office for Budget Responsibility reckons unemployment could hit 12% by year end if just one in seven furloughed workers becomes unemployed, and over 13% in early 2021 under a more pessimistic scenario.

Typical household incomes during the lockdown were no higher than in 2006-07, extending a bleak decade for living standards. Young people and lower-income households, who were hit hard after the financial crisis, are now most at risk from a second wave of unemployment because of their exposure to the retail, hospitality and leisure industries, the Resolution Foundation warned.

According to the report from Office for National Statistics, borrowing (public sector net borrowing excluding public sector banks, PSNB ex) in June 2020 is estimated to have been £35.5 billion, roughly five times (or £28.3 billion more) that in June 2019 and the third highest borrowing in any month on record (records began in 1993).

Provisional estimates indicate that borrowing in the first quarter of the current financial year (April to June 2020) was more than double that borrowed in the whole of the last financial year (April 2019 to March 2020).

Borrowing in the first quarter of this financial year is estimated to have been £127.9 billion, £103.9 billion more than in the same period last year and the highest borrowing in any April to June period on record (records began in 1993), with each of the months from April to June being records.

Borrowing estimates are subject to greater than usual uncertainty; borrowing in May 2020 was revised down by £9.8 billion to £45.5 billion, largely because of stronger than previously estimated tax receipts and National Insurance contributions.

Central government net cash requirement (excluding UK Asset Resolution Ltd, Network Rail and the Covid Corporate Financing Facility) in June 2020 was £47.1 billion, £33.6 billion more than in June 2019 and the highest cash requirement in any June on record (records began in 1984).

Central government net cash requirement in the current financial year-to-date (April to June 2020) was £174.0 billion, £153.7 billion more than in the same period last year and the highest cash requirement in any April to June period on record (records began in 1984).

Debt (public sector net debt excluding public sector banks, PSND ex) at the end of June 2020 was £1,983.8 billion, £195.5 billion more than at the same point last year.

Debt at the end of June 2020 as a percentage of gross domestic product (GDP) was 99.6%, an increase of 18.9 percentage points compared with the same point last year and the highest debt to GDP ratio since the financial year ending March 1961.

Reuters reports that the aim of reaching an agreement between Britain and the European Union on future ties between the two by October is ambitious but achievable, German Foreign Minister Heiko Maas said on Tuesday.

"An agreement on the basis of the Political Declaration is sporty but still possible," he said in a statement.

CNBC reports that the 27 European Union governments have reached a breakthrough agreement over new fiscal stimulus, following marathon talks in Brussels that lasted four days.

The European Commission, the executive arm of the EU, has been tasked with tapping financial markets to raise an unprecedented 750 billion euros ($857 billion). The funds will be distributed among the countries and sectors most impacted by the coronavirus pandemic, and will take the form of grants and loans.

European Council President Charles Michel said early Tuesday that he believes this deal will be seen as a “pivotal moment” for Europe.

“Europe, as a whole, has now a big chance to come out stronger from the crisis,” European Commission President Ursula von der Leyen also said.

The heads of state had been locked in talks since Friday morning to discuss the proposed fund and the EU’s next budget. However, deep differences on how to divide the amount between grants and loans, how to oversee its investment and how to link it with the EU’s democratic values prolonged the talks into one of the longest EU summits in history.

In the end, they agreed to distribute 390 billion euros, out of the total 750 billion fund, in the form of grants — a significant reduction from an initial proposal made by France and Germany in May for 500 billion euros of grants. The EU also agreed to repay all the new debt by 2058.

In the meantime, member states will also have to develop plans outlining how they will invest the new funds. These so-called Reform and Recovery plans will have to be approved by their European counterparts.

They committed 30% of their total expenditure from the recovery fund and the next EU budget to address climate concerns. The EU has said it wants to be climate neutral by 2050.

The fund will be available from January 2021 and there will be no new bridge financing until then. This is because the EU has taken other measures since the crisis struck to provide liquidity to the member states if they are needed.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1547 (1417)

$1.1519 (1196)

$1.1497 (4845)

Price at time of writing this review: $1.1435

Support levels (open interest**, contracts):

$1.1359 (435)

$1.1324 (267)

$1.1285 (691)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date August, 7 is 52282 contracts (according to data from July, 20) with the maximum number of contracts with strike price $1,1400 (4845);

GBP/USD

Resistance levels (open interest**, contracts)

$1.2770 (1798)

$1.2745 (1156)

$1.2725 (1421)

Price at time of writing this review: $1.2669

Support levels (open interest**, contracts):

$1.2510 (254)

$1.2471 (506)

$1.2430 (1154)

Comments:

- Overall open interest on the CALL options with the expiration date August, 7 is 20314 contracts, with the maximum number of contracts with strike price $1,3000 (3057);

- Overall open interest on the PUT options with the expiration date August, 7 is 19475 contracts, with the maximum number of contracts with strike price $1,2400 (1513);

- The ratio of PUT/CALL was 0.96 versus 0.95 from the previous trading day according to data from July, 20

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 43.12 | 0.23 |

| Silver | 19.87 | 3.01 |

| Gold | 1816.748 | 0.42 |

| Palladium | 2045.47 | 2.1 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | 21.06 | 22717.48 | 0.09 |

| Hang Seng | -31.18 | 25057.99 | -0.12 |

| KOSPI | -2.99 | 2198.2 | -0.14 |

| ASX 200 | -32 | 6001.6 | -0.53 |

| FTSE 100 | -28.78 | 6261.52 | -0.46 |

| DAX | 127.31 | 13046.92 | 0.99 |

| CAC 40 | 23.76 | 5093.18 | 0.47 |

| Dow Jones | 8.92 | 26680.87 | 0.03 |

| S&P 500 | 27.11 | 3251.84 | 0.84 |

| NASDAQ Composite | 263.9 | 10767.09 | 2.51 |

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 01:30 | Australia | RBA Meeting's Minutes | |||

| 02:30 | Australia | RBA's Governor Philip Lowe Speaks | |||

| 06:00 | Switzerland | Trade Balance | June | 2.81 | |

| 06:00 | United Kingdom | PSNB, bln | June | -54.5 | -34.3 |

| 12:30 | Canada | Retail Sales YoY | May | -32.5% | |

| 12:30 | Canada | Retail Sales, m/m | May | -26.4% | 21% |

| 12:30 | Canada | New Housing Price Index, YoY | June | 1.1% | |

| 12:30 | Canada | New Housing Price Index, MoM | June | 0.1% | 0.2% |

| 12:30 | U.S. | Chicago Federal National Activity Index | June | 2.61 | |

| 12:30 | Canada | Retail Sales ex Autos, m/m | May | -22% |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.70149 | 0.31 |

| EURJPY | 122.72 | 0.38 |

| EURUSD | 1.14419 | 0.17 |

| GBPJPY | 135.699 | 0.91 |

| GBPUSD | 1.26544 | 0.72 |

| NZDUSD | 0.65728 | 0.32 |

| USDCAD | 1.35331 | -0.36 |

| USDCHF | 0.93912 | 0.03 |

| USDJPY | 107.237 | 0.2 |

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.