- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 21-10-2014

(raw materials / closing price /% change)

Light Crude 83.25 +0.53%

Gold 1,249.60 -0.17%

(index / closing price / change items /% change)

Nikkei 225 14,804.28 -306.95 -2.03%

Hang Seng 23,088.58 +18.32 +0.08%

Shanghai Composite 2,339.66 -17.07 -0.72%

FTSE 100 6,372.33 +105.26 +1.68%

CAC 40 4,081.24 +90.00 +2.25%

Xetra DAX 8,886.96 +169.20 +1.94%

S&P 500 1,941.28 +37.27 +1.96%

NASDAQ Composite 4,419.48 +103.41 +2.40%

Dow Jones 16,614.81 +215.14 +1.31%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2711 -0,66%

GBP/USD $1,6115 -0,27%

USD/CHF Chf0,9491 +0,63%

USD/JPY Y107,07 +0,10%

EUR/JPY Y136,10 -0,55%

GBP/JPY Y172,55 -0,15%

AUD/USD $0,8777 -0,01%

NZD/USD $0,7957 -0,10%

USD/CAD C$1,1224 -0,57%

(time / country / index / period / previous value / forecast)

00:30 Australia CPI, q/q Quarter III +0.5% +0.4%

00:30 Australia CPI, y/y Quarter III +3.0% +2.3%

08:30 United Kingdom Bank of England Minutes

12:30 Canada Retail Sales, m/m August -0.1% +0.2%

12:30 Canada Retail Sales ex Autos, m/m August -0.6% +0.3%

12:30 U.S. CPI, m/m September -0.2% 0.0%

12:30 U.S. CPI, Y/Y September +1.7% +1.7%

12:30 U.S. CPI excluding food and energy, m/m September 0.0% +0.2%

12:30 U.S. CPI excluding food and energy, Y/Y September +1.7% +1.7%

14:00 Canada BOC Rate Statement

14:00 Canada Bank of Canada Rate 1.00% 1.00%

14:00 Canada Bank of Canada Monetary Policy Report

14:30 U.S. Crude Oil Inventories October +8.9

15:15 Canada BOC Press Conference

21:00 Australia RBA's Governor Glenn Stevens Speech

21:45 New Zealand CPI, q/q Quarter III +0.3% +0.5%

21:45 New Zealand CPI, y/y Quarter III +1.6%

Stock indices closed higher on the European Central Bank corporate bonds buying report. Reuters reported today that the ECB considering to start buying corporate bonds. The central bank could discuss the possibility of corporate bond buying program at its December meeting.

The ECB purchased Italian covered bonds today. The central bank bought short-dated French notes and Spanish securities yesterday.

The better-than-estimated corporate earnings also supported the European stock markets.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,372.33 +105.26 +1.68%

DAX 8,886.96 +169.20 +1.94%

CAC 40 4,081.24 +90.00 +2.25%

The price of oil rose slightly today as the news of the increasing demand for oil from China have improved mood. Nevertheless, concerns about the global economic slowdown continued to weigh on prices.

Earlier today it was reported that the estimated consumption of oil in China in September rose by 6.2% compared to August to a seven-month peak due to the growth of oil refining. Average daily consumption rose to 10.3 million barrels, according to calculations based on preliminary official data, from 9.7 million barrels in August and 9.61 million in September last year. In January-September, the demand has increased by 2% compared to the same period last year to 9.91 million barrels per day. Calculation of consumption based on the data of refining and imports of petroleum products, but excluding stocks for which information published irregularly.

"Given the increase in industrial production in the future, we can expect the growth in oil consumption in China. It can push the price up, but global consumption will remain weak in the coming quarter, "- wrote in the report, analysts Phillips Futures in Singapore.

Meanwhile, we add that today the American investment bank Jefferies sharply downgraded the outlook for the price of Brent crude oil on the 2015-2016 years. As stated in the review of the bank's analysts Jason Gammel and Marc Kofler, Jefferies, it is expected that Brent next year on average will cost $ 90 a barrel in 2016 - $ 98 per barrel. Previously forecast for both years was $ 105 per barrel. "The market oversupply due to a combination of weak demand and rising supply, and whilst there was a concerted effort on the part of Saudi Arabia and OPEC to reduce production," - noted in the review.

On market sentiment also affect expectations OPEC meeting. On the eve of the meeting of November 27, some OPEC countries have made it clear that the organization will not reduce the restriction on oil production from the current 30 million barrels per day. However, according to analysts' estimates, the decline in oil prices may affect the production of shale oil in the United States, about a third of which would be unprofitable at the sale price is below $ 80 per barrel.

The cost of the November futures for the American light crude oil WTI (Light Sweet Crude Oil) rose to $ 81.98 a barrel on the New York Mercantile Exchange (NYMEX).

The price of December futures for North Sea Brent crude oil mixture rose $ 0.40 to $ 85.66 a barrel on the London exchange ICE Futures Europe.

The U.S. dollar traded mixed to higher against the most major currencies after the better-than-expected existing home sales in the U.S. Existing home sales in the U.S. climbed 2.4% to a seasonally adjusted annual rate of 5.17 million in September from 5.05 million in August. That was the highest level of the year.

Analysts had expected an increase to 5.11 million.

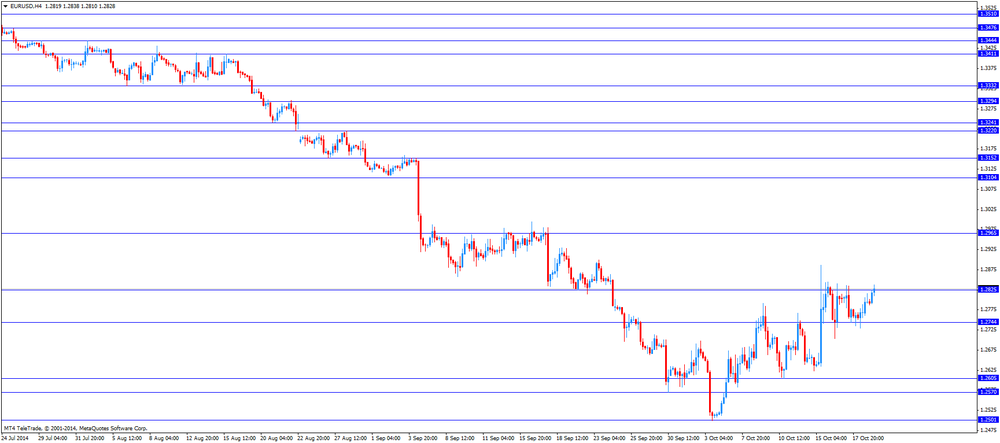

The euro traded lower against the U.S. dollar. The report that the European Central Bank is considering to buy corporate bonds weighed on the euro. Reuters reported today that the European Central Bank (ECB) considering to start buying corporate bonds. The ECB could discuss the possibility of corporate bond buying program at its December meeting.

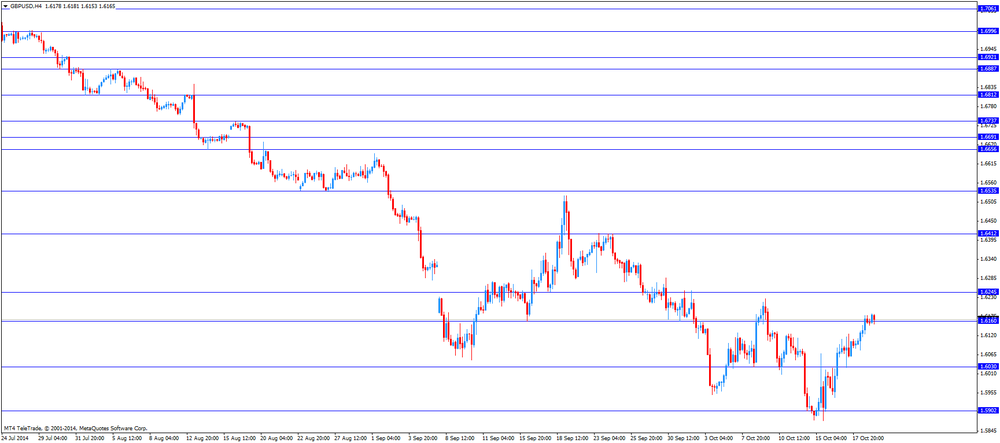

The British pound traded lower against the U.S. dollar. The U.K. public sector net borrowing climbed to £11.8 billion in September from £10.9 billion in August, missing expectations for a decline to £9.3 billion.

The Swiss franc traded lower against the U.S. dollar. Switzerland's trade surplus widened CHF2.45 billion in September from CHF1.33 billion in August, exceeding expectations for a rise to CHF 2.43 billion. August's figure was revised down from a surplus of CHF1.39 billion.

The New Zealand dollar fell against the U.S. dollar. In the overnight trading session, the kiwi rose against the greenback after the better-than-expected Chinese economic data. China's gross domestic product increased 7.3% in the third quarter, exceeding expectations for a 7.2% rise, after a 7.5% gain in the second quarter.

China's industrial production climbed 8.0% in September, beating forecasts of a 7.5% increase, after a 6.9% gain in August.

International visitor numbers in New Zealand climbed 1.2% in September, after a 3.0% drop in August.

Credit card spending in New Zealand increased 4.4% September, after a 4.2% gain in August.

The Australian dollar decreased against the U.S. dollar. In the overnight trading session, the Aussie climbed against the greenback after the better-than-expected Chinese economic data and the Reserve Bank of Australia's minutes of the monetary policy meeting.

The Reserve Bank of Australia (RBA) said nothing new in its minutes of the monetary policy meeting. The RBA reiterated that the Aussie "remained high by historical standards".

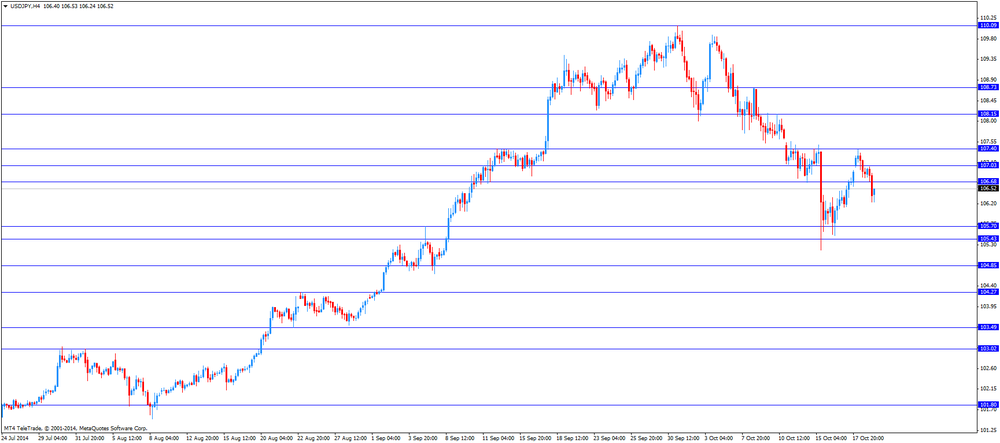

The Japanese yen traded mixed against the U.S. dollar. Japan's all industry activity index decreased 0.1% in August, beating expectations for a 0.3% drop, after 0.4% fall in July. July's figure was revised down from a 0.2% decline.

Gold prices rose slightly today, reaching a six-week high at the same time, due to fears of a global economic slowdown. Also increased speculation that a weaker-than-expected growth could force the Fed to delay raising interest rates. Delay of rising interest rates generally increases the demand for gold, as it reduces the relative value of the precious metal retention, guaranteeing a profit to investors.

The course of trade was also affected by today's data on China. It is learned that China's economy in the 3rd quarter grew minimum for the last 5 years rate - growth in July-September was 7.3% compared to the same period last year. GDP growth is lower than the official forecast of 7.5%, which allowed for the current year, the Chinese authorities. Analysts' average forecast was 7.2%. In the second quarter, the GDP was 7.5%. Since 1998, has never not China's GDP is lower than the official forecast. Thus, the probability of acceptance by Beijing of new measures to stimulate business activity. Compared to the previous quarter the economy grew by 1.9% while the forecast of analysts of 1.8%.

The gold market also reacted to the conflicting reports of the European Central Bank purchases of bonds. There are news that the ECB could start buying corporate bonds of troubled countries such as Spain and Italy. But the media in parallel appeared and reported that while this question has not yet been included in the agenda of the December meeting of the ECB.

Rising gold prices also help expectations higher physical demand in India on the eve of the fall wedding season and the festival of Diwali. Autumn wedding season in India, the period of maximum demand for gold jewelry, lasts from November to December. Recall, India is the second largest consumer of gold in the world after China.

Meanwhile, today it was announced that the assets of the largest gold ETF - SPDR Gold Trust - on Monday showed the biggest fall in a year. It was 1.2% - up to 751.96 tons. The volume of assets of the fund at the minimum level since November 2008. Last year, against the backdrop of the collapse of quotations of precious metals assets SPDR Gold Trust fell by 41%. Since the beginning of this year, they fell a further 5.8%.

The cost of the December gold futures on the COMEX today rose to 1252.80 dollars per ounce.

The Reserve Bank of Australia (RBA) Deputy Governor Philip Lowe said at the Commonwealth Bank of Australia's 7th Annual Australasian Fixed Income Conference on Tuesday that "low rates have boosted asset prices globally", including the housing market in Australia.

He noted the RBA thinks that low interest rates in Australia are appropriate. Lowe pointed out that low interest rates in Australia "are helping boost construction activity and spending".

The RBA deputy governor also said that "very low global interest rates have been with us for some time. And it is likely that they will stay with us for some time yet".

"But the longer it runs on without a pickup in the appetite for real investment, the greater is the potential for new risks to develop", so Lowe.

Lowe noted that it is important to improve the investment climate, and it is the government policy to play the important role.

The National Association of Realtors released existing homes sales figures in the U.S. on Tuesday. Sales of existing homes climbed 2.4% to a seasonally adjusted annual rate of 5.17 million in September from 5.05 million in August. That was the highest level of the year.

Analysts had expected an increase to 5.11 million.

EUR/USD: $1.2600-25(E620mn), $1.2655(E828mn), $1.2685(E400mn), $1.2700(E1.9bn), $1.2750(E794mn), $1.2800(E1.5bn)

USD/JPY: Y107.00($835mn), Y107.50($682mn)

AUD/USD: $0.8650(A$323mn)

NZD/USD: $0.8105(NZ$846mn)

USD/CAD: C$1.1150($335mn), C$1.1250($190mn)

The Reserve Bank of Australia (RBA) released its minutes of the monetary policy meeting on Tuesday. The RBA said nothing new in its minutes of the monetary policy meeting.

The central bank reiterated that the Aussie "remained high by historical standards". The RBA noted that Australia's economy "had grown moderately in the June quarter", and it expects that "moderate growth overall had continued into the September quarter".

U.S. stock futures rose amid earnings from companies including Apple (AAPL) Inc. and Travelers Cos. and as investors speculated Europe's central bank would add stimulus.

Global markets:

Nikkei 14,804.28 -306.95 -2.03%

Hang Seng 23,088.58 +18.32 +0.08%

Shanghai Composite 2,339.66 -17.07 -0.72%

FTSE 6,320.31 +53.24 +0.85%

CAC 4,051.87 +60.63 +1.52%

DAX 8,805.62 +87.86 +1.01%

Crude oil $82.90 (+0.27%)

Gold $1249.10 (+0.36%)

(company / ticker / price / change, % / volume)

| Procter & Gamble Co | PG | 84.24 | +0.07% | 6.9K |

| E. I. du Pont de Nemours and Co | DD | 68.00 | +0.28% | 0.3K |

| 3M Co | MMM | 138.00 | +0.29% | 0.9K |

| Wal-Mart Stores Inc | WMT | 75.40 | +0.35% | 1.1K |

| American Express Co | AXP | 84.37 | +0.43% | 0.3K |

| Pfizer Inc | PFE | 28.05 | +0.43% | 3.9K |

| Cisco Systems Inc | CSCO | 23.03 | +0.44% | 3.9K |

| Merck & Co Inc | MRK | 54.32 | +0.50% | 6.8K |

| Nike | NKE | 89.35 | +0.51% | 1.4K |

| Exxon Mobil Corp | XOM | 92.25 | +0.52% | 2.2K |

| Chevron Corp | CVX | 112.15 | +0.59% | 0.2K |

| Microsoft Corp | MSFT | 44.35 | +0.61% | 9.4K |

| Intel Corp | INTC | 31.78 | +0.63% | 5.3K |

| General Electric Co | GE | 25.19 | +0.64% | 30.4K |

| Goldman Sachs | GS | 179.00 | +0.65% | 1.2K |

| Walt Disney Co | DIS | 86.10 | +0.68% | 2.3K |

| JPMorgan Chase and Co | JPM | 57.03 | +0.71% | 2.5K |

| Johnson & Johnson | JNJ | 100.00 | +0.81% | 0.8K |

| UnitedHealth Group Inc | UNH | 89.42 | +0.99% | 0.6K |

| Boeing Co | BA | 125.68 | +1.10% | 2.0K |

| Caterpillar Inc | CAT | 95.06 | +1.10% | 0.2K |

| Travelers Companies Inc | TRV | 94.49 | +1.38% | 9.0K |

| United Technologies Corp | UTX | 104.01 | +2.49% | 1.2K |

| Visa | V | 207.85 | 0.00% | 0.6K |

| AT&T Inc | T | 34.20 | -0.23% | 11.6K |

| International Business Machines Co... | IBM | 167.73 | -0.81% | 78.8K |

| Verizon Communications Inc | VZ | 48.05 | -0.89% | 14.1K |

| McDonald's Corp | MCD | 89.83 | -1.92% | 0.6K |

| The Coca-Cola Co | KO | 41.15 | -4.94% | 415.2K |

Upgrades:

Downgrades:

IBM downgraded to Hold from Buy at Evercore

Other:

Apple (AAPL) target raised to $143 from $123 at Cantor Fitzgerald

Apple (AAPL) target raised to $118 from $104 at Macquarie; Outperform

Apple (AAPL) target raised to $115 from $110 at Mizuho

Apple (AAPL) target raised to $113 from $110 at Cowen

IBM target lowered to $170 from $190 at RBC Capital Mkts

IBM target lowered to $190 from $218 at Stifel

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia RBA Monetary Policy Statement

02:00 China Retail Sales y/y September +11.9% +11.8% +11.6%

02:00 China Industrial Production y/y September +6.9% +7.5% +8.0%

02:00 China Fixed Asset Investment September +16.5% +16.2% +16.1%

02:00 China GDP y/y Quarter III +7.5% +7.2% +7.3%

02:00 New Zealand Credit Card Spending September +4.2% 4.4%

04:30 Japan All Industry Activity Index, m/m August -0.4% -0.3% -0.1%

06:00 Switzerland Trade Balance September 1.33 Revised From 1.39 2.43 2.45

08:30 United Kingdom PSNB, bln September 10.9 9.3 11.8

08:55 Australia RBA Assist Gov Lowe Speaks

The U.S. dollar traded mixed to higher against the most major currencies ahead of the existing home sales in the U.S. The existing home sales in the U.S. are expected to increase to 5.11 million units in September from 5.05 million units in August.

The euro dropped against the U.S. dollar as the European Central Bank is considering to buy corporate bonds.

Reuters reported today that the European Central Bank (ECB) considering to start buying corporate bonds. The ECB could discuss the possibility of corporate bond buying program at its December meeting.

The British pound traded lower against the U.S. dollar. The U.K. public sector net borrowing climbed to £11.8 billion in September from £10.9 billion in August, missing expectations for a decline to £9.3 billion.

The Swiss franc fell against the U.S. dollar. Switzerland's trade surplus widened CHF2.45 billion in September from CHF1.33 billion in August, exceeding expectations for a rise to CHF 2.43 billion. August's figure was revised down from a surplus of CHF1.39 billion.

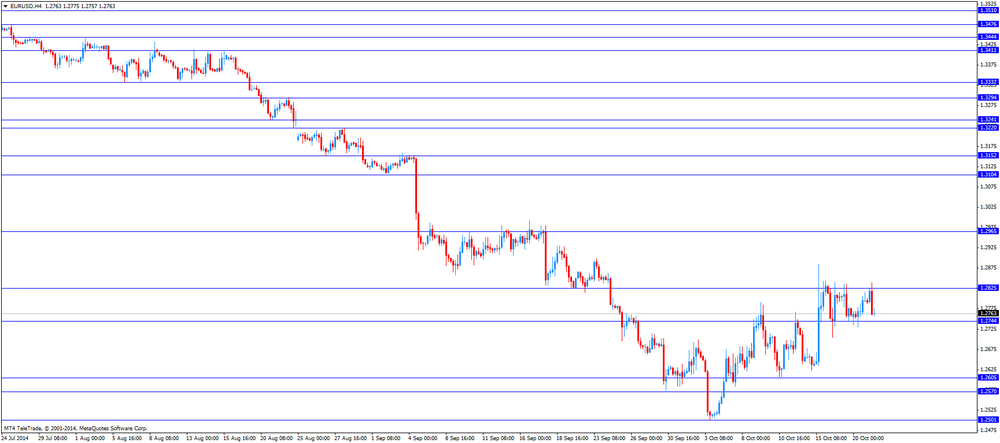

EUR/USD: the currency pair dropped to 1.2760

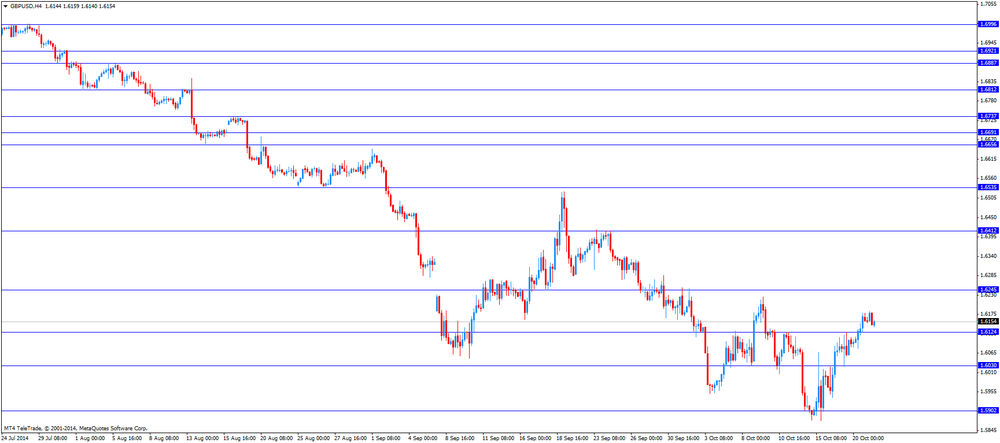

GBP/USD: the currency pair decreased to $1.6140

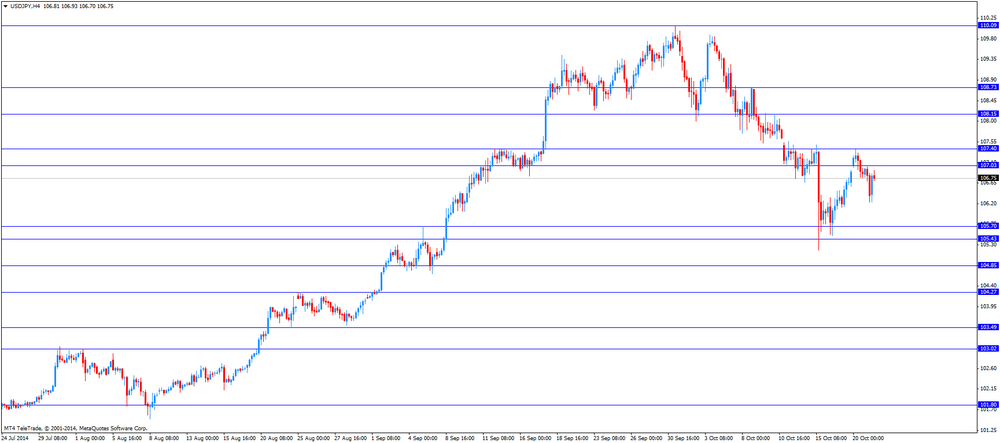

USD/JPY: the currency pair rose to Y106.93

The most important news that are expected (GMT0):

14:00 U.S. Existing Home Sales September 5.05 5.11

23:00 Australia Conference Board Australia Leading Index August +0.5%

23:30 Australia Leading Index September -0.1%

23:50 Japan Adjusted Merchandise Trade Balance, bln September -924.4 -910.0

EUR/USD

Offers $1.2929/30, $1.2900/05, $1.2840/50

Bids $1.2735/30, $1.2700/05, $1.2650

GBP/USD

Offers $1.6320-25, $1.6300, $1.6250, $1.6200

Bids $1.6150

AUD/USD

Offers $0.8950, $0.8900, $0.8840/50

Bids $0.8780, $0.8720/00, $0.8650

EUR/JPY

Offers Y137.50, Y137.20, Y136.80

Bids Y136.10/00, Y135.50, Y135.00

USD/JPY

Offers Y107.80/00, Y107.50, Y107.15/00, Y106.80/85

Bids Y106.10/00, Y105.80, Y105.55/50

EUR/GBP

Offers stg0.8066

Bids stg0.7885/80, stg0.7850

Stock indices traded higher on speculation for additional stimulus measures by the European Central Bank (ECB). Reuters reported today that the ECB considering to start buying corporate bonds. The central bank could discuss the possibility of corporate bond buying program at its December meeting.

The better-than-estimated corporate earnings also supported the European stock markets.

Current figures:

Name Price Change Change %

FTSE 100 6,313.86 +46.79 +0.75%

DAX 8,840.84 +123.08 +1.41%

CAC 40 4,057.71 +66.47 +1.67%

Most Asian stock indices closed lower after the Chinese economic data. China's gross domestic product increased 7.3% in the third quarter, exceeding expectations for a 7.2% rise, after a 7.5% gain in the second quarter.

China's industrial production climbed 8.0% in September, beating forecasts of a 7.5% increase, after a 6.9% gain in August.

Fixed asset investment in China rose 16.1% in September, missing expectations for a 16.2%, after a 16.5% gain in August.

Retail sales in China increased 11.6% in September, missing forecasts of a 11.8% gain, after a 11.9% rise in August.

Investors speculate that these Chinese economic data would not be enough for additional stimulus measures.

Japan's all industry activity index decreased 0.1% in August, beating expectations for a 0.3% drop, after 0.4% fall in July. July's figure was revised down from a 0.2% decline.

Indexes on the close:

Nikkei 225 14,804.28 -306.95 -2.03%

Hang Seng 23,088.58 +18.32 +0.08%

Shanghai Composite 2,339.66 -17.07 -0.72%

EUR/USD: $1.2600-25(E620mn), $1.2655(E828mn), $1.2685(E400mn), $1.2700(E1.9bn), $1.2750(E794mn), $1.2800(E1.5bn)

USD/JPY: Y107.00($835mn), Y107.50($682mn)

AUD/USD: $0.8650(A$323mn)

NZD/USD: $0.8105(NZ$846mn)

USD/CAD: C$1.1150($335mn), C$1.1250($190mn)

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia RBA Monetary Policy Statement

02:00 China Retail Sales y/y September +11.9% +11.8% +11.6%

02:00 China Industrial Production y/y September +6.9% +7.5% +8.0%

02:00 China Fixed Asset Investment September +16.5% +16.2% +16.1%

02:00 China GDP y/y Quarter III +7.5% +7.2% +7.3%

02:00 New Zealand Credit Card Spending September +4.2% 4.4%

04:30 Japan All Industry Activity Index, m/m August -0.4% -0.3% -0.1%

06:00 Switzerland Trade Balance September 1.33 Revised From 1.39 2.43 2.45

08:30 United Kingdom PSNB, bln September 10.9 9.3 11.8

08:55 Australia RBA Assist Gov Lowe Speaks

The U.S. dollar traded lower against the most major currencies. No major economic reports were released in the U.S. yesterday.

The New Zealand dollar rose against the U.S. dollar after the better-than-expected Chinese economic data. China's gross domestic product increased 7.3% in the third quarter, exceeding expectations for a 7.2% rise, after a 7.5% gain in the second quarter.

China's industrial production climbed 8.0% in September, beating forecasts of a 7.5% increase, after a 6.9% gain in August.

International visitor numbers in New Zealand climbed 1.2% in September, after a 3.0% drop in August.

Credit card spending in New Zealand increased 4.4% September, after a 4.2% gain in August.

The Australian dollar increased against the U.S. dollar after the better-than-expected Chinese economic data and the Reserve Bank of Australia's minutes of the monetary policy meeting.

The Reserve Bank of Australia (RBA) said nothing new in its minutes of the monetary policy meeting. The RBA reiterated that the Aussie "remained high by historical standards".

The Japanese yen rose against the U.S. dollar after Japanese stocks declined.

Japan's all industry activity index decreased 0.1% in August, beating expectations for a 0.3% drop, after 0.4% fall in July. July's figure was revised down from a 0.2% decline.

EUR/USD: the currency pair rose to $1.2824

GBP/USD: the currency pair increased to $1.6183

USD/JPY: the currency pair fell to Y106.24

The most important news that are expected (GMT0):

14:00 U.S. Existing Home Sales September 5.05 5.11

23:00 Australia Conference Board Australia Leading Index August +0.5%

23:30 Australia Leading Index September -0.1%

23:50 Japan Adjusted Merchandise Trade Balance, bln September -924.4 -910.0

EUR / USD

Resistance levels (open interest**, contracts)

$1.2958 (6676)

$1.2903 (3108)

$1.2865 (4206)

Price at time of writing this review: $ 1.2821

Support levels (open interest**, contracts):

$1.2783 (1924)

$1.2755 (3190)

$1.2710 (3107)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 55427 contracts, with the maximum number of contracts with strike pric $1,2900 (6678);

- Overall open interest on the PUT options with the expiration date November, 7 is 57285 contracts, with the maximum number of contracts with strike price $1,2600 (6385);

- The ratio of PUT/CALL was 1.03 versus 1.00 from the previous trading day according to data from October, 20

GBP/USD

Resistance levels (open interest**, contracts)

$1.6403 (1490)

$1.6305 (1652)

$1.6209 (1979)

Price at time of writing this review: $1.6181

Support levels (open interest**, contracts):

$1.6092 (1215)

$1.5995 (2112)

$1.5897 (1317)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 26324 contracts, with the maximum number of contracts with strike price $1,6200 (1979);

- Overall open interest on the PUT options with the expiration date November, 7 is 31775 contracts, with the maximum number of contracts with strike price $1,5400 (2398);

- The ratio of PUT/CALL was 1.21 versus 1.21 from the previous trading day according to data from October, 20

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.