- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 22-10-2014

(raw materials / closing price /% change)

Light Crude 80.47 -0.06%

Gold 1,242.10 -0.27%

(index / closing price / change items /% change)

Nikkei 225 15,195.77 +391.49 +2.64%

Hang Seng 23,403.97 +315.39 +1.37%

Shanghai Composite 2,326.55 -13.10 -0.56%

FTSE 100 6,399.73 +27.40 +0.43%

CAC 40 4,105.09 +23.85 +0.58%

Xetra DAX 8,940.14 +53.18 +0.60%

S&P 500 1,927.11 -14.17 -0.73%

NASDAQ Composite 4,382.85 -36.63 -0.83%

Dow Jones 16,461.32 -153.49 -0.92%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2644 -0,53%

GBP/USD $1,6041 -0,46%

USD/CHF Chf0,9538 +0,49%

USD/JPY Y107,20 +0,12%

EUR/JPY Y135,55 -0,41%

GBP/JPY Y171,96 -0,34%

AUD/USD $0,8761 -0,18%

NZD/USD $0,7869 -1,12%

USD/CAD C$1,1239 +0,13%

(time / country / index / period / previous value / forecast)

00:30 Australia NAB Quarterly Business Confidence Quarter II 6

01:35 Japan Manufacturing PMI (Preliminary) October 51.7 52.1

01:45 China HSBC Manufacturing PMI (Preliminary) October 50.2 50.2

06:58 France Manufacturing PMI (Preliminary) October 48.8 48.6

06:58 France Services PMI (Preliminary) October 48.4 48.2

07:28 Germany Manufacturing PMI (Preliminary) October 49.9 49.6

07:28 Germany Services PMI (Preliminary) October 55.7 55.0

07:58Eurozone Services PMI (Preliminary) October 52.4 52.0

07:58 Eurozone Manufacturing PMI (Preliminary) October 50.3 50.0

08:30 United Kingdom Retail Sales (MoM) September +0.4% -0.1%

08:30 United Kingdom Retail Sales (YoY) September +3.9% +2.8%

08:30 United Kingdom BBA Mortgage Approvals September 41.6 41.5

09:00 Eurozone EU Economic Summit

10:00 United Kingdom CBI industrial order books balance October -4 -3

12:30 U.S. Initial Jobless Claims October 264 269

13:00 U.S. Housing Price Index, m/m August +0.1% +0.4%

13:00 U.S. Housing Price Index, y/y August +4.4%

13:45 U.S. Manufacturing PMI (Preliminary) October 57.5 57.2

14:00 Eurozone Consumer Confidence October -11 -12

14:00 U.S. Leading Indicators September +0.2% +0.8%

21:45 New Zealand Trade Balance, mln September -472 -620

The Bank of Canada cancelled its press conference with Governor Stephen Poloz after a Canadian soldier was shot at the War Memorial in Ottawa.

Stock indices closed slightly higher. Markets benefited from speculation for additional stimulus measures by the European Central Bank (ECB). Reuters reported yesterday that the ECB considering to start buying corporate bonds. The central bank could discuss the possibility of corporate bond buying program at its December meeting.

The Bank of England (BoE) released its minutes of the monetary policy committee meeting today. Two members, Ian McCafferty and Martin Weale, voted for the third consecutive month to raise interest rates to 0.75% from 0.5%.

Seven of the nine MPC members voted to keep interest rate at 0.5%.

The tone of minutes was bearish. The BoE said that there was a slight loss of momentum in September, and it expects that GDP growth in the fourth quarter would slow to 0.8%.

The central bank pointed out that interest rate hike "might leave the economy vulnerable to shocks".

Indexes on the close:

Name Price Change Change %

FTSE 100 6,399.73 +27.40 +0.43%

DAX 8,940.14 +53.18 +0.60%

CAC 40 4,105.09 +23.85 +0.58%

The cost of WTI crude oil fell slightly today, which was associated with the release of a report on oil stocks, which have more substantial than the expected increase. Prices for Brent, the meanwhile, rose moderately.

Department of Energy reported that commercial oil stocks in the United States in the week October 11 - 17 increased by 7.1 million barrels to 377.7 million barrels, while the average forecast of anticipated increase of 3.1 million barrels. Inventories rose to a maximum with the 4th of July. Oil reserves in the terminal Cushing rose 953,000 barrels to 20.6 million barrels. Gasoline inventories fell by 1.3 million barrels to 204.4 million barrels. Gasoline inventories have reached the lowest level since Nov. 23, 2012. Analysts had expected gasoline inventories are reduced as compared to the previous week by 1.4 million barrels. Distillate inventories rose 1 million barrels to 125.7 million barrels, while analysts had expected a decrease of 1.5 million barrels. We also learned that the utilization of refining capacity has decreased to 86.7% from 88.1%, reaching the lowest level since March 21. Analysts expected a decline of 0.2%.

Yesterday the American Petroleum Institute reported that crude oil inventories increased by 1.2 million barrels for the week ending 17 October. The report also showed that gasoline inventories fell by 532,000 barrels, while distillate stocks fell by 822,000 barrels.

Pressure on prices continues to concern about the weakening global demand, as well as signs that the Organization of Petroleum Exporting Countries will not cut production to support oil prices. Some analysts believe that only a decline in production in the oil cartel will be able to stop the decline in prices.

"If OPEC countries do not come to a common position on the acceptable level of oil and reduce production, it is likely, oil will be around $ 80 to $ 90," - said the expert GHP Group.

Little support is provided by statistics from China, which was better than expected. China's GDP grew in the third quarter of 2014 by 7.3% in annual terms, however, were lower than in the second quarter. At the same time, analysts predicted value of the index of 7.2%.

The cost of the November futures for the American light crude oil WTI (Light Sweet Crude Oil) fell to $ 82.35 a barrel on the New York Mercantile Exchange (NYMEX).

The price of December futures for North Sea Brent crude oil mixture rose $ 0.62 to $ 86.84 a barrel on the London exchange ICE Futures Europe.

The U.S. dollar traded mixed against the most major currencies after the better-than-expected U.S. consumer price inflation. The U.S. consumer price inflation rose 0.1% in September, exceeding expectations for a flat reading, after a 0.2% decrease in August.

On a yearly basis, the U.S. consumer price index increased 1.7% in September, in line with expectations, after a 1.7% gain in August.

The U.S. consumer price inflation excluding food and energy climbed 0.1% in September, missing expectations for a 0.2% rise, after a flat reading in August.

On a yearly basis, the U.S. consumer price index excluding food and energy rose 1.7% in September, in line with expectations, after a 1.7% increase in August.

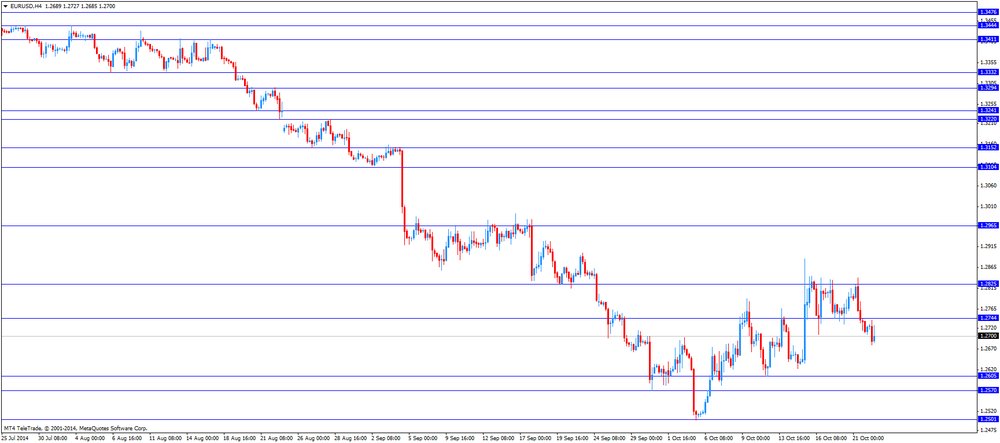

The euro traded lower against the U.S. dollar. News that the European Central Bank is considering to buy corporate bonds still weighed on the euro.

Reuters reported yesterday that the European Central Bank (ECB) considering to start buying corporate bonds. The ECB could discuss the possibility of corporate bond buying program at its December meeting.

News by Spanish newswire Efe also weighed on the euro. Efe reported today that at least 11 banks had failed ECB stress tests. The ECB is expected to announce the results of stress tests on Sunday.

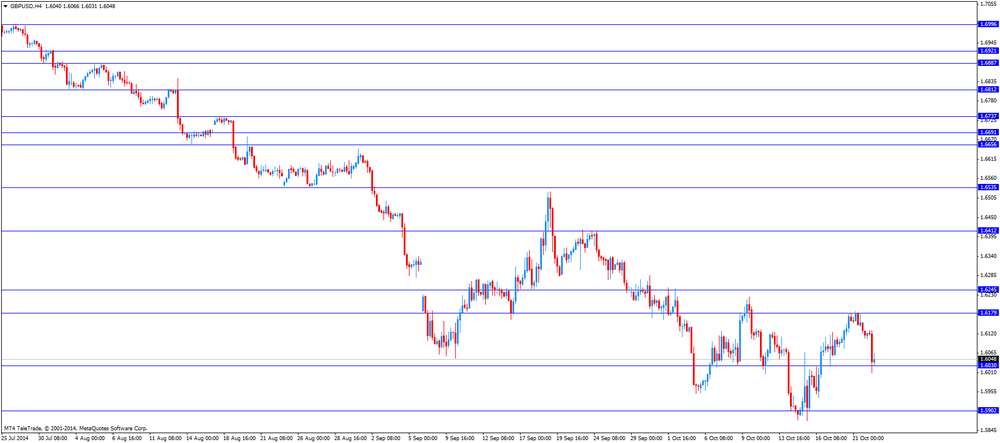

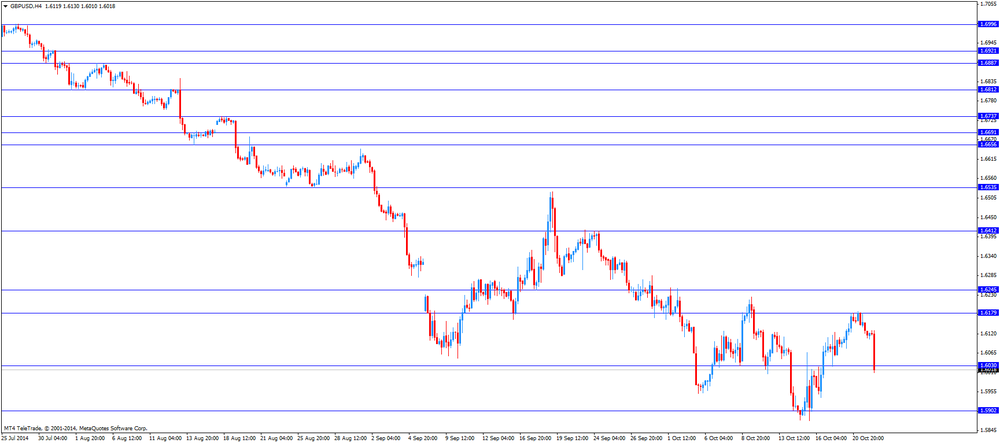

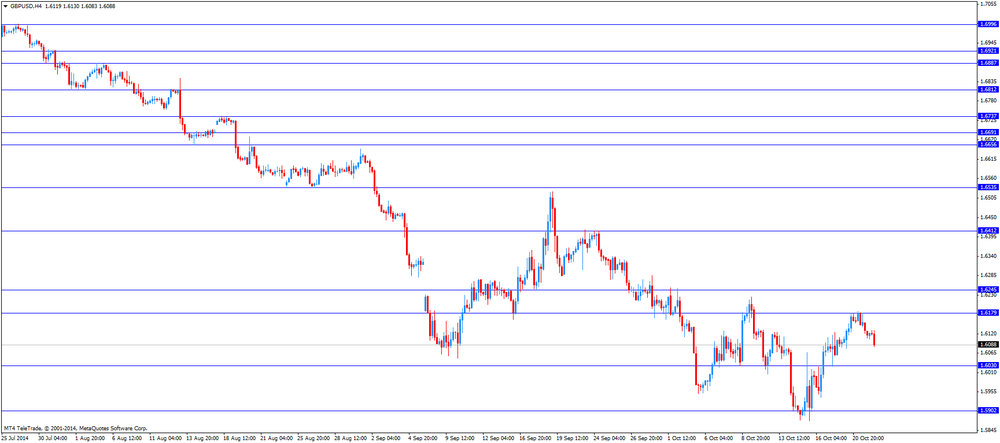

The British pound traded higher against the U.S. dollar. In the morning trading session, the pound dropped against the greenback after the Bank of England's minutes of the monetary policy committee meeting. The Bank of England (BoE) released its minutes of the monetary policy committee meeting today. Two members, Ian McCafferty and Martin Weale, voted for the third consecutive month to raise interest rates to 0.75% from 0.5%.

Seven of the nine MPC members voted to keep interest rate at 0.5%.

The tone of the BoE's minutes was bearish. The BoE said that there was a slight loss of momentum in September, and it expects that GDP growth in the fourth quarter would slow to 0.8%.

The central bank pointed out that interest rate hike "might leave the economy vulnerable to shocks".

The Canadian dollar traded higher against the U.S. dollar after Canadian retail sales and the Bank of Canada's interest rate decision. Canadian retail sales dropped by 0.3% in August, missing expectations for a 0.2% increase, after a 0.1% decline in July. That was the largest drop this year.

Canadian retail sales excluding automobiles fell 0.3% in August, missing forecasts of a 0.3% gain, after 0.5% drop in July. July's figure was revised up from a 0.6% decrease.

The Bank of Canada (BoC) kept its interest rate unchanged at 1.00%. The BoC said in its statement that "the current stance of monetary policy is appropriate".

The New Zealand dollar traded lower against the U.S. dollar in the absence of any major economic reports from New Zealand.

The Australian dollar traded higher against the U.S. dollar. Australia's consumer price index climbed 0.5% in the third quarter, beating forecasts of a 0.4% rise, after a 0.5% increase in the second quarter.

On a yearly basis, Australia's consumer price inflation increased 2.3% in the third quarter, in line with expectations, after a 3.0% gain in the second quarter.

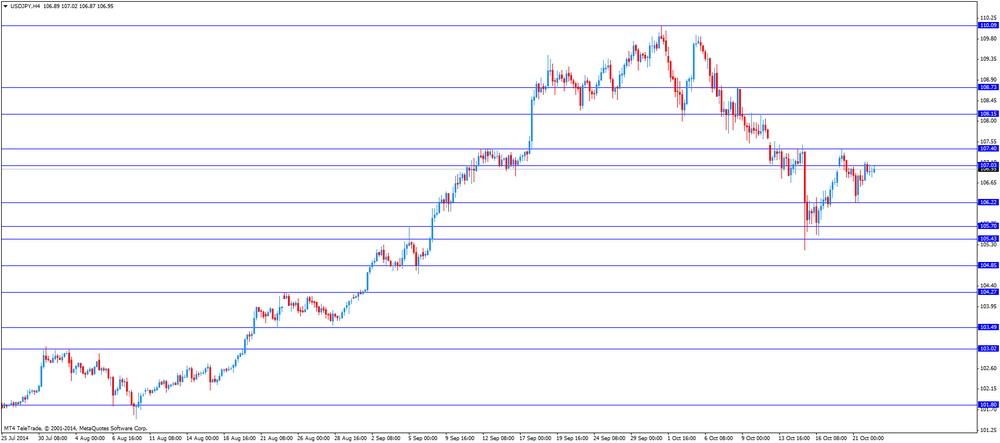

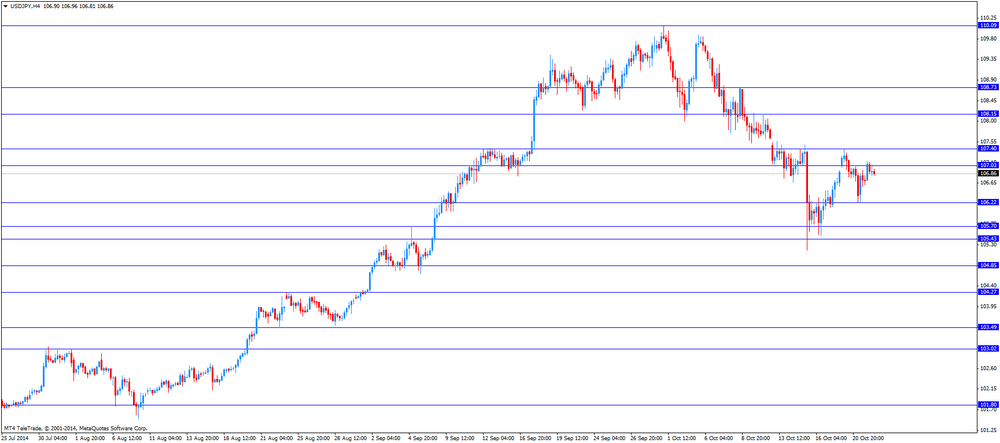

The Japanese yen fell against the U.S. dollar. Japan's adjusted trade deficit widened to ¥1,070.14 billion in September from a deficit of ¥912.40 billion in August. August's figure was revised up from a deficit of ¥924.40 billion. Analysts had expected a deficit of ¥910.0 billion.

Gold prices declined moderately today, departing from the six-week high, which was associated with the strengthening of the dollar to one-week high against the euro and the physical signs of reduced demand.

Market participants are also expected to release the Chinese manufacturing PMI from HSBC for September, which will tell about the health of the economy. On Tuesday, the government data showed that on an annualized basis, China's economy grew in the third quarter by 7.3%, compared with growth of 7.5% in the previous quarter. While the figure exceeded market expectations of growth of 7.2%, it still was a minimum in the first quarter of 2009.

Experts point out that the relatively high price of gold reflects the uncertainty in the health of the global economy. Since the beginning of October, the gold has risen in price by more than 3 percent after a 6 percent drop in September. In the coming days, the market may decline as demand for gold in India and China reduced

"Gold and other metals were slightly oversold, and $ 1,200 - a sustained level of support. This month increased purchases in China, supported the gold, "- said Standard Bank analyst Yuichi Ikemidzu.

The course of trade was also affected by today's inflation data for the United States. As it became known, consumer prices rose slightly in September - this is the last sign of restrained inflationary pressures on the United States amid fears of a global slowdown. The consumer price index rose a seasonally adjusted 0.1% in September compared with the previous month, the Labour Department said. With the exception of volatile categories (food and energy) prices also rose by 0.1%. Economists had forecast the continued importance of the overall consumer price increase of 0.2% so-called core prices. Compared with a year earlier, consumer prices and prices excluding food and energy rose 1.7% each. Overall prices fell 0.2% in August.

The cost of the December gold futures on the COMEX today dropped to 1244.70 dollars per ounce.

The Bank of Canada (BoC) released its interest rate today. The central bank kept its interest rate unchanged at 1.00%.

The BoC said in its statement that "the current stance of monetary policy is appropriate".

The central bank expects the real GDP growth will be about 2.5% over the next year and 2% by the end of 2016.

Canada's economy is expected to reach its full capacity in the second half of 2016, so the BoC.

The central bank noted that the risks are "roughly balanced", but it removed the word "neutral".

The U.S. Labor Department released consumer price inflation data today. The U.S. consumer price inflation rose 0.1% in September, exceeding expectations for a flat reading, after a 0.2% decrease in August.

On a yearly basis, the U.S. consumer price index increased 1.7% in September, in line with expectations, after a 1.7% gain in August.

The U.S. consumer price inflation excluding food and energy climbed 0.1% in September, missing expectations for a 0.2% rise, after a flat reading in August.

On a yearly basis, the U.S. consumer price index excluding food and energy rose 1.7% in September, in line with expectations, after a 1.7% increase in August.

Energy prices declined 0.7% in September, while food prices rose 0.3%.

Shelter costs climbed 0.3% last month, while medical-care services prices rose 0.1%.

EUR/USD: $1.2650(E400mn), $1.2665(E710mn), $1.2675(E276mn), $1.2680(E432mn), $1.2685(E201mn), $1.2750(E294mn), $1.2800(E433mn), $1.2840(E869mn)

USD/JPY: Y106.10($653mn), Y106.15-20($352mn), Y107.50($252mn)

EUR/JPY: Y135.20(E844mn)

EUR/GBP: Stg0.7800(E391mn), stg0.7850(E100mn)

AUD/USD: $0.8700(A$764mn), $0.8790-800(A$745mn)

NZD/USD: $0.7980(NZ$375mn)

USD/CAD: C$1.1200($200mn), C$1.1300($300mn)

(company / ticker / price / change, % / volume)

| JPMorgan Chase and Co | JPM | 57.94 | +0.02% | 0.1K |

| Chevron Corp | CVX | 115.13 | +0.03% | 0.3K |

| General Electric Co | GE | 25.46 | +0.04% | 1.7K |

| Exxon Mobil Corp | XOM | 93.71 | +0.06% | 1.3K |

| Procter & Gamble Co | PG | 84.02 | +0.06% | 0.3K |

| Visa | V | 213.50 | +0.09% | 0.1K |

| Caterpillar Inc | CAT | 96.01 | +0.13% | 1.1K |

| 3M Co | MMM | 141.18 | +0.18% | 0.1K |

| United Technologies Corp | UTX | 102.16 | +0.18% | 0.6K |

| Walt Disney Co | DIS | 87.70 | +0.18% | 2.4K |

| Microsoft Corp | MSFT | 44.97 | +0.20% | 10.6K |

| Intel Corp | INTC | 32.68 | +0.21% | 3.0K |

| Merck & Co Inc | MRK | 55.25 | +0.22% | 0.1K |

| AT&T Inc | T | 34.72 | +0.29% | 7.8K |

| Pfizer Inc | PFE | 28.38 | +0.35% | 1.7K |

| Boeing Co | BA | 127.60 | +0.38% | 130.1K |

| E. I. du Pont de Nemours and Co | DD | 69.23 | +0.60% | 0.1K |

| Johnson & Johnson | JNJ | 101.54 | +1.18% | 5.7K |

| Cisco Systems Inc | CSCO | 23.51 | 0.00% | 0.2K |

| Nike | NKE | 90.64 | 0.00% | 0.5K |

| Goldman Sachs | GS | 180.12 | -0.03% | 0.5K |

| International Business Machines Co... | IBM | 163.01 | -0.13% | 2.1K |

| Verizon Communications Inc | VZ | 48.61 | -0.16% | 7.6K |

| Home Depot Inc | HD | 93.80 | -0.42% | 1.2K |

| McDonald's Corp | MCD | 90.49 | -0.57% | 1.0K |

| The Coca-Cola Co | KO | 40.37 | -0.76% | 64.3K |

U.S. stock futures were little changed as investors weighed corporate results from Yahoo! Inc. to Boeing Co. and data showing the cost of living barely rose last month.

Global markets:

Nikkei 15,195.77 +391.49 +2.64%

Hang Seng 23,403.97 +315.39 +1.37%

Shanghai Composite 2,326.55 -13.10 -0.56%

FTSE 6,391.26 +18.93 +0.30%

CAC 4,097.93 +16.69 +0.41%

DAX 8,934.97 +48.01 +0.54%

Crude oil $82.87 (+0.46%)

Gold $1248.40 (-0.27%)

Statistics Canada released retail sales data today. Canadian retail sales dropped by 0.3% in August, missing expectations for a 0.2% increase, after a 0.1% decline in July. That was the largest drop this year.

The decline was driven by lower gasoline prices. Sales at gasoline stations fell 2.1% in August

Canadian retail sales excluding automobiles fell 0.3% in August, missing forecasts of a 0.3% gain, after 0.5% drop in July. July's figure was revised up from a 0.6% decrease.

Upgrades:

Yahoo! (YHOO) upgraded from Mkt Perform to Outperform at FBR Capital, target raised from $40 to $50

Downgrades:

Coca-Cola (KO) downgraded to Sell from Hold at Societe Generale

Other:

EUR/USD

Offers $1.2800

Bids $1.2680, $1.2650, $1.2625

GBP/USD

Offers $1.6080, $1.6050

Bids $1.6005/95

AUD/USD

Offers $0.8900, $0.8840/50, $0.8800

Bids $0.8720/00, $0.8650

EUR/JPY

Offers Y137.20, Y136.80, Y136.45/50, Y136.00

Bids Y135.50, Y135.00, , Y134.50, Y134.00

USD/JPY

Offers Y107.80/00, Y107.50, Y107.15/20

Bids Y106.50, Y106.10/00, Y105.80

EUR/GBP

Offers stg0.8066

Bids stg0.7870/65, stg0.7850, stg0.7800

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia CPI, q/q Quarter III +0.5% +0.4% +0.5%

00:30 Australia CPI, y/y Quarter III +3.0% +2.3% +2.3%

08:30 United Kingdom Bank of England Minutes

The U.S. dollar traded mixed to higher against the most major currencies ahead of the U.S. consumer price inflation. The U.S. consumer price inflation is expected to be flat in September, after a 0.2% decline in August.

The U.S. consumer price index excluding food and energy is expected to rise 0.2% in September, after a flat reading in August.

The euro traded lower against the U.S. dollar. News that the European Central Bank is considering to buy corporate bonds still weighed on the euro.

Reuters reported yesterday that the European Central Bank (ECB) considering to start buying corporate bonds. The ECB could discuss the possibility of corporate bond buying program at its December meeting.

News by Spanish newswire Efe also weighed on the euro. Efe reported today that at least 11 banks had failed ECB stress tests. The ECB is expected to announce the results of stress tests on Sunday.

The British pound dropped against the U.S. dollar after the Bank of England's minutes of the monetary policy committee meeting. The Bank of England (BoE) released its minutes of the monetary policy committee meeting today. Two members, Ian McCafferty and Martin Weale, voted for the third consecutive month to raise interest rates to 0.75% from 0.5%.

Seven of the nine MPC members voted to keep interest rate at 0.5%.

The tone of the BoE's minutes was bearish. The BoE said that there was a slight loss of momentum in September, and it expects that GDP growth in the fourth quarter would slow to 0.8%.

The central bank pointed out that interest rate hike "might leave the economy vulnerable to shocks".

The Canadian dollar traded lower against the U.S. dollar ahead of Canadian retail sales and the Bank of Canada's interest rate decision. Canadian retail sales are expected to increase 0.2% in August, after 0.1% decline in July.

Canadian retail sales excluding automobiles are expected to rise 0.3% in August, after 0.6% drop in July.

Analysts expect that the Bank of Canada will keep its interest rate unchanged at 1.00%.

EUR/USD: the currency pair fell to 1.2680

GBP/USD: the currency pair dropped to $1.6010

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 Canada Retail Sales, m/m August -0.1% +0.2%

12:30 Canada Retail Sales ex Autos, m/m August -0.6% +0.3%

12:30 U.S. CPI, m/m September -0.2% 0.0%

12:30 U.S. CPI, Y/Y September +1.7% +1.7%

12:30 U.S. CPI excluding food and energy, m/m September 0.0% +0.2%

12:30 U.S. CPI excluding food and energy, Y/Y September +1.7% +1.7%

14:00 Canada BOC Rate Statement

14:00 Canada Bank of Canada Rate 1.00% 1.00%

14:00 Canada Bank of Canada Monetary Policy Report

15:15 Canada BOC Press Conference

21:00 Australia RBA's Governor Glenn Stevens Speech

21:45 New Zealand CPI, q/q Quarter III +0.3% +0.5%

21:45 New Zealand CPI, y/y Quarter III +1.6%

Stock indices traded little changed, markets still supported by speculation for additional stimulus measures by the European Central Bank. Reuters reported yesterday that the ECB considering to start buying corporate bonds. The central bank could discuss the possibility of corporate bond buying program at its December meeting.

Market participants are awaiting some corporate earnings reports today.

The Bank of England (BoE) released its minutes of the monetary policy committee meeting today. Two members, Ian McCafferty and Martin Weale, voted for the third consecutive month to raise interest rates to 0.75% from 0.5%.

Seven of the nine MPC members voted to keep interest rate at 0.5%.

The tone of minutes was bearish. The BoE said that there was a slight loss of momentum in September, and it expects that GDP growth in the fourth quarter would slow to 0.8%.

The central bank pointed out that interest rate hike "might leave the economy vulnerable to shocks".

Current figures:

Name Price Change Change %

FTSE 100 6,364.88 -7.45 -0.12%

DAX 8,900.04 +13.08 +0.15%

CAC 40 4,080.98 -0.26 -0.01%

Most Asian stock indices closed higher, following gains on Wall Street. Markets were supported by speculation the European Central Bank may add new stimulus measures. Reuters reported yesterday that the ECB considering to start buying corporate bonds. The central bank could discuss the possibility of corporate bond buying program at its December meeting.

Japan's adjusted trade deficit widened to ¥1,070.14 billion in September from a deficit of ¥912.40 billion in August. August's figure was revised up from a deficit of ¥924.40 billion. Analysts had expected a deficit of ¥910.0 billion.

Indexes on the close:

Nikkei 225 15,195.77 +391.49 +2.64%

Hang Seng 23,403.97 +315.39 +1.37%

Shanghai Composite 2,326.55 -13.10 -0.56%

The Bank of England (BoE) released its minutes of the monetary policy committee meeting today. Two members, Ian McCafferty and Martin Weale, voted for the third consecutive month to raise interest rates to 0.75% from 0.5%.

Seven of the nine MPC members voted to keep interest rate at 0.5%.

The votes split was not new, but the wording was bearish. The BoE said that there was a slight loss of momentum in September, and it expects that GDP growth in the fourth quarter would slow to 0.8%.

The central bank pointed out that interest rate hike "might leave the economy vulnerable to shocks".

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia CPI, q/q Quarter III +0.5% +0.4% +0.5%

00:30 Australia CPI, y/y Quarter III +3.0% +2.3% +2.3%

08:30 United Kingdom Bank of England Minutes

The U.S. dollar traded mixed to lower against the most major currencies, but remained supported by yesterday's better-than-expected existing home sales in the U.S. Existing home sales in the U.S. climbed 2.4% to a seasonally adjusted annual rate of 5.17 million in September from 5.05 million in August. That was the highest level of the year.

The New Zealand dollar traded higher against the U.S. dollar, following the Australian dollar. No major economic reports were released in New Zealand.

The Australian dollar rose against the U.S. dollar after the Australian consumer price inflation. Australia's consumer price index climbed 0.5% in the third quarter, beating forecasts of a 0.4% rise, after a 0.5% increase in the second quarter.

On a yearly basis, Australia's consumer price inflation increased 2.3% in the third quarter, in line with expectations, after a 3.0% gain in the second quarter.

The Japanese yen traded mixed against the U.S. dollar. Japan's adjusted trade deficit widened to ¥1,070.14 billion in September from a deficit of ¥912.40 billion in August. August's figure was revised up from a deficit of ¥924.40 billion. Analysts had expected a deficit of ¥910.0 billion.

EUR/USD: the currency pair rose to $1.2730

GBP/USD: the currency pair increased to $1.6129

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:30 Canada Retail Sales, m/m August -0.1% +0.2%

12:30 Canada Retail Sales ex Autos, m/m August -0.6% +0.3%

12:30 U.S. CPI, m/m September -0.2% 0.0%

12:30 U.S. CPI, Y/Y September +1.7% +1.7%

12:30 U.S. CPI excluding food and energy, m/m September 0.0% +0.2%

12:30 U.S. CPI excluding food and energy, Y/Y September +1.7% +1.7%

14:00 Canada BOC Rate Statement

14:00 Canada Bank of Canada Rate 1.00% 1.00%

14:00 Canada Bank of Canada Monetary Policy Report

15:15 Canada BOC Press Conference

21:00 Australia RBA's Governor Glenn Stevens Speech

21:45 New Zealand CPI, q/q Quarter III +0.3% +0.5%

21:45 New Zealand CPI, y/y Quarter III +1.6%

EUR / USD

Resistance levels (open interest**, contracts)

$1.2837 (3218)

$1.2793 (1663)

$1.2765 (1665)

Price at time of writing this review: $ 1.2722

Support levels (open interest**, contracts):

$1.2682 (1111)

$1.2643 (2171)

$1.2587 (2137)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 56013 contracts, with the maximum number of contracts with strike pric $1,2900 (6988);

- Overall open interest on the PUT options with the expiration date November, 7 is 57400 contracts, with the maximum number of contracts with strike price $1,2600 (6336);

- The ratio of PUT/CALL was 1.02 versus 1.03 from the previous trading day according to data from October, 21

GBP/USD

Resistance levels (open interest**, contracts)

$1.6402 (1491)

$1.6304 (1640)

$1.6207 (1995)

Price at time of writing this review: $1.6120

Support levels (open interest**, contracts):

$1.6090 (1181)

$1.5994 (2122)

$1.5896 (1312)

Comments:

- Overall open interest on the CALL options with the expiration date November, 7 is 26434 contracts, with the maximum number of contracts with strike price $1,6200 (1995);

- Overall open interest on the PUT options with the expiration date November, 7 is 31818 contracts, with the maximum number of contracts with strike price $1,5400 (2398);

- The ratio of PUT/CALL was 1.20 versus 1.21 from the previous trading day according to data from October, 21

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.