- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 22-08-2022

NZD/USD fades the corrective pullback from a five-week low, marked the previous day, as it eases from the intraday high of 0.6182 during Tuesday’s Asian session. In doing so, the Kiwi pair justifies the bearish signals flashed by the options market traders, via the Risk Reversal (RR).

That said, the one-month RR of the NZD/USD pair, the key options market gauge, dropped to the lowest level in a week by the end of Monday’s North American session. It’s worth noting that the RR is the difference between the call options and the put options and hence indicates the market’s bias.

With the latest daily RR of -0.125, the options market gauge dropped for the second consecutive day. Further, the weekly RR marked the biggest slump in two months with a -0.420 figure.

The options market traders are bearish mainly as the Reserve Bank of New Zealand (RBNZ) cited economic woes while the hawkish Fed bets remain intact despite the recession woes.

Also read: NZD/USD weighed by a risk-off start to the week

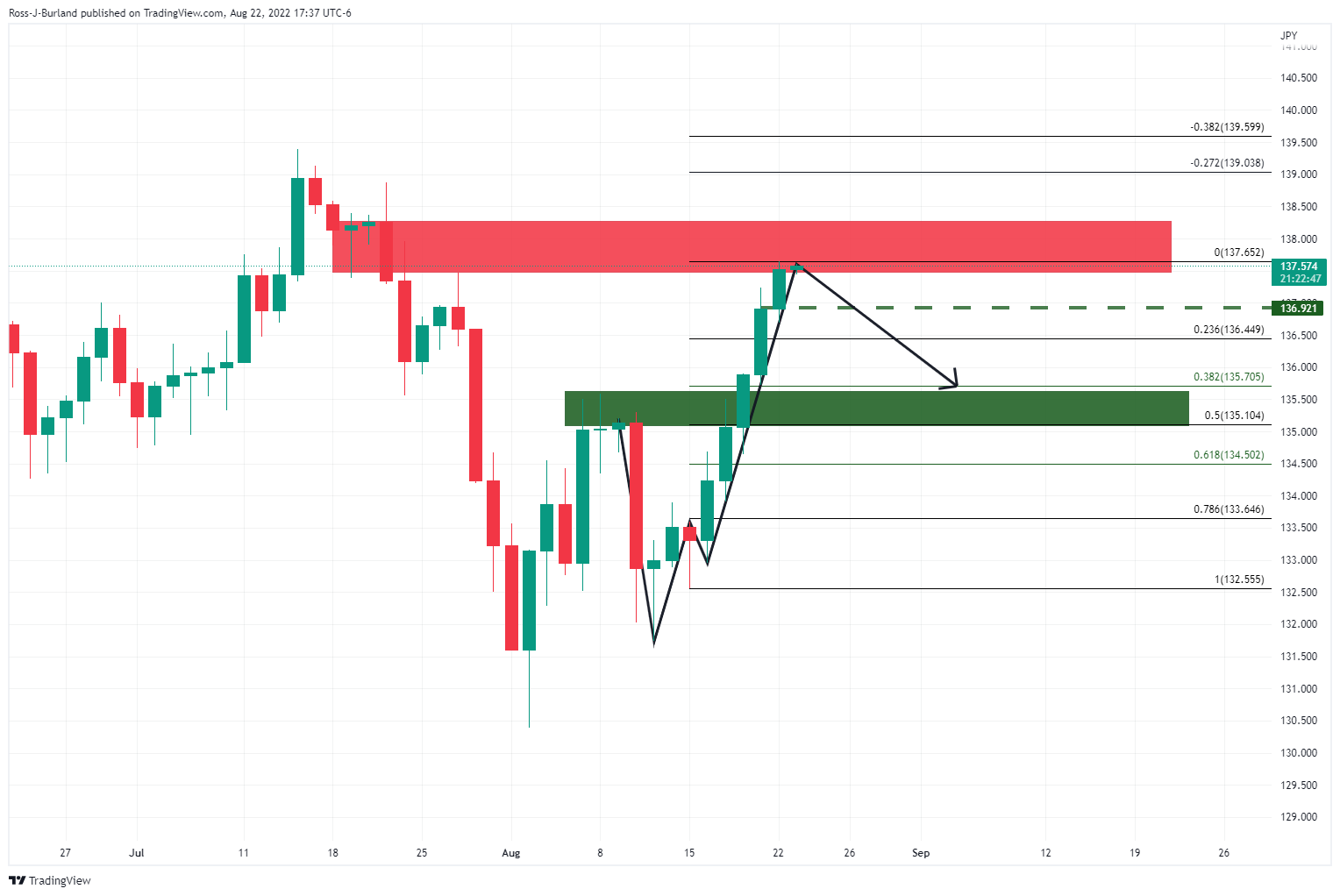

- USD/JPY bulls testing the bear's commitments near the daily resistance area.

- The bears will be looking for a significant retracement in the sessions ahead.

USD/JPY has been relentless on the bid, reaching a daily resistance structure following six consecutive days of higher highs and lows. However, there are higher prospects of a correction the further the rally goes without giving back some ground. The following illustrates this from a daily and hourly perspective.

USD/JPY daily chart

At current levels, the price is reaching into a prior structure that could act as a resistance area and lead to a Fibonacci correction along the scale as illustrated.

USD/JPY H1 chart

For the contrarians, the price could be on the verge of making a peak formation from which the bears will be then seeking a significant correction as a consequence. The price is testing through 137.50 and this could extend into test the 137.80s. However, should the bulls capitulate, then there will be prospects of a move below current support for a run below with 137.13 eyed as an important structure guarding a fall below the 137 round number for a look in below 136.80 in a pump and dump scenario.

- Silver price remains pressured at one-month low after six consecutive days of downside.

- Bearish MACD signals, downbeat RSI keeps sellers hopeful below weekly resistance line.

- 21-DMA adds to the upside filters, yearly low lures the XAG/USD bears.

Silver price (XAG/USD) fades corrective pullback from the monthly low marked the previous day as it renews its daily bottom around $18.95 during Tuesday’s Asian session. In doing so, the bright metal justifies the downbeat oscillators while extending the six-day downtrend below a one-week-old descending resistance line.

That said, the quote’s further weakness eyes the yearly low marked in July at around $18.20, before hitting the $18.00 threshold.

It’s worth noting that the XAG/USD weakness past $18.00 could quickly direct bears towards the 61.8% Fibonacci Expansion (FE) of late April to mid-August moves, around $17.45.

However, a convergence of the downward sloping support line from May 13 and 78.6% FE, near $16.60-50 could challenge the bears afterward.

Meanwhile, recovery moves need validation from the weekly resistance line, at $19.10 by the press time.

Following that, the 21-DMA and the monthly high could challenge the silver buyer at around $19.90 and $20.90 respectively.

It should be observed that the XAG/USD upside past $20.90 should provide a daily closing beyond the $21.00 round figure to recall the buyers.

Silver: Daily chart

Trend: Further downside expected

- The break of the neutral triangle will result in an expansion of volume and tick size.

- A bearish range shift by the RSI (14) is indicating more downside ahead.

- The violation of horizontal support placed from 136.56 has triggered the downside bias for a shorter period.

The EUR/JPY pair has displayed a less-confident pullback after printing a fresh three-day low of 136.40 on Monday. The cross has recovered minutely to near 136.76, however, the downside remains favored as the asset has violated the horizontal support placed from Thursday’s low at 136.56.

On an hourly scale, the asset is auctioning in a symmetrical triangle that signals for slippage in the volatility followed by an expansion in the same. An expansion in volatility results in wider ticks and heavy volume. The upward sloping trendline of the above-mentioned chart pattern is placed from the August 2 low at 133.40 while the downward sloping trendline is plotted from the August 10 high at 138.40.

The 20-and 50-period Exponential Moving Averages (EMAs) at 136.68 and 137.10 respectively are expected to overlap with each other, which will result in consolidation ahead.

Meanwhile, the Relative Strength Index (RSI) (14) has shifted into the bearish range of 20.00-40.00, which indicates more downside ahead.

Should the asset oversteps the round-level resistance of 138.00, the shared currency bulls will drive the asset towards July 29 high at 139.51. A breach of the July 29 high will send the cross towards July 18 high at 140.80.

On the flip side, the yen bulls could gain control if the asset drops below the August 4 low at 135.64. An occurrence of the same will drag the cross towards the previous week’s low at 134.90, followed by an August 2 low at 133.40.

EUR/JPY hourly chart

-637968082924243802.png)

- AUD/USD retreats from intraday high on downbeat flash PMIs for Australia.

- Australia’s preliminary S&P Global PMIs for August arrived softer than expected and prior releases.

- Recession fears underpin the US dollar’s demand ahead of Friday’s key Jackson Hole speech from Fed Chair Powell.

- US activity and housing numbers could entertain the intraday traders, risk catalysts are the key.

AUD/USD struggles to recover from the 12-day low marked the previous day as downbeat activity data from Australia challenge the pair buyers around 0.6880 during Tuesday’s Asian session. While the S&P Global PMIs are the latest challenge for the Aussie pair, recession fears and hopes of the Fed’s aggression, not to forget talks surrounding China’s worries, appear bigger challenges for the quote.

The preliminary readings of Australia’s S&P Global PMIs for August are all down from the previous releases and market consensus. The headline Manufacturing PMI dropped to 54.5 versus 57.3 expected and 55.7 prior whereas the Services PMI fell into the contraction region with 49.6 figures compared to 54 market expectations and 50.9 previous readings. Further, the Composite PMI also marked a contraction in activities to 49.8 versus 51.1 prior.

Elsewhere, S&P 500 Futures print mild gains as traders lick their wounds after Wall Street saw the red and the yields rose to the fresh monthly high.

The latest corrective pullback in the AUD/USD prices could also be linked to the hopes of more rate cuts from the People’s Bank of China (PBOC) as Chinese media signals more such moves. China's Securities Times reported that the PBOC may reduce RRR this year to compensate for medium-term lending facility (MLF) maturity. The article states that reserve requirement ratio (RRR) cuts may lower lending prime rates. It is with noting that this is a state-run agency reporting such opinions.

On the other hand, hawkish Fed bets increased after firmer US data, which in turn drowned the AUD/USD prices the previous day. On the other hand, Chicago Fed National Activity Index improved to 0.27 in July, from a downwardly revised -0.25 prior. “Fed funds futures on Monday have priced in a 54.5% chance of a 50 basis-point (bp) rate hike at the Fed's policy meeting next month. The fed funds rate is seen hitting roughly 3.6% by the end of the year, with a peak rate of nearly 3.8% in March 2023,” mentioned Reuters.

Looking forward, preliminary readings of the US PMIs for August will join the US New Home Sales for July and Richmond Fed Manufacturing Index for August to decorate the calendar. Given the recession fears, the AUD/USD prices are likely to remain pressured ahead of the key Fed Chair Jerome Powell’s speech at the Jackson Hole Symposium, up for publishing on Friday.

Technical analysis

61.8% Fibonacci retracement of July-August upside, around 0.6850, challenges short-term AUD/USD sellers. However, the recovery moves need validation from the one-week-old descending trend line and 200-SMA, respectively around 0.6910 and 0.6920, to convince the bulls.

- USD/CHF is juggling after a decent rally as the focus shifts to Jackson Hole Economic Symposium.

- The spell of an interest rate hike by the Fed won’t get interrupted but the extent of the rate hike will scale down.

- A decline in the US Durable Goods Orders may halt the DXY’s rally.

The USD/CHF pair has shifted into an inventory accumulation phase around 0.9640 after witnessing a juggernaut rally near 0.9580 on Monday. On a broader note, the asset has displayed a seven-day winning streak after printing a fresh four-month low of 0.9371 on August 11. The major is expected to continue its winning streak after violating Monday’s high at 0.9659.

Bulls will stay for a tad longer period as investors are likely to underpin the greenback ahead of the Jackson Hole Economic Symposium. Federal Reserve (Fed) chair Jerome Powell will dictate the economic situation of the US, price pressures, and the consequences of liquidity shrinkage in the economy.

No doubt, the odds of exhaustion in the price pressures are accelerating as oil prices have weakened dramatically. However, the price rise index is still extremely higher than the desired rate of 2%. Therefore, the spell of interest rate hike won’t get interrupted but the extent of the rate hike will definitely scale down.

On the economic data front, the preliminary estimates for the US Durable Goods Orders are painting a rosy picture of the overall demand in the US. The economic data is expected to trim drastically to 0.5% from the prior release of 2%. The investing community is aware of the fact that the US core Consumer Price Index (CPI) remained steady at 5.9%. Despite that, a slump in the Durable Goods Orders indicates a decline in the overall demand.

- GBP/JPY seesaws around the 161.70 area, failing to reach the head-and-shoulders 161.00 target.

- The GBP/JPY 1-hour chart portrays that the head-and-shoulders is still in play, so bears are pilling around further GBP/JPY rallies.

The GBP/JPY is trading almost flat during the Asian Pacific session after Monday’s price action formed a doji, meaning that neither buyers nor sellers are in control. On Tuesday, the AUD/JPY is trading at 161.76, up by 0.03%.

GBP/JPY Price Analysis: Technical outlook

The daily chart is neutral-to-downward biased, with the exchange rate below the 20, 50, and 100-day EMAs. GBP/JPY traders should be aware that price action formed a successive series of lower highs and lows for four consecutive days, sliding steadily. However, the average daily range (ADR) shrank to 110-130 pips a day, meaning that the pair is about to see high volatility levels, which could send the pair towards the 200-day EMA at 158.93.

The GBP/JPY on the hourly scale had not fulfilled the head-and-shoulders target of 161.00, falling short on Monday, when it reached the 161.15 daily low. Since then, the cross bounced off towards the 161.70 area, where the 20-hour EMA lies, in confluence with the daily pivot point. Therefore, a break above will expose the GBP/JPY to higher prices, which is not likely to happen due to the Relative Strength Index (RSI) being in negative territory with a 47.22 reading, aiming lower.

Therefore, the GBP/JPY path of least resistance is downwards, and its first support would be the August 22 low at 161.15. The break below will expose the head-and-shoulders target at 161.00, followed by the S2 daily pivot at 160.43, followed by the August 15 daily low at 160.08.

GBP/JPY Key Technical Levels

US inflation expectations, as per the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data, rose for the fourth consecutive day at the latest as bulls prepare for this week’s Jackson Hole Symposium.

That said, the inflation precursor marched to 2.57% at the latest, after crossing July’s high on Friday.

The jump in the US inflation expectations could be linked to the increased expectations of the Fed’s aggression. “Fed funds futures on Monday have priced in a 54.5% chance of a 50 basis-point (bp) rate hike at the Fed's policy meeting next month. The fed funds rate is seen hitting roughly 3.6% by the end of the year, with a peak rate of nearly 3.8% in March 2023,” said Reuters.

Given the fears of recession dominating the market sentiment, the higher inflation and increasing odds of the Fed’s aggression weigh on the risk appetite. The same fueled the US 10-year Treasury yields to a fresh monthly high of around 3.02% while Wall Street closed in the red on Monday.

Amid these plays, the US dollar cheers the safe-haven appeal as it dropped to the fresh 20-year low versus its European counterpart the previous day.

Also read: EUR/USD dribbles at multi-year low near 0.9950 amid recession fears, focus on EU/US PMIs

After a monthly meeting, the PBOC lowered the one-year loan prime rate by 5 basis points to 3.65% from 3.7%, while the five-year rate was cut by 15 basis points to 4.3% from 4.45%, reducing the cost of payments on existing loans.

Markets reacted negatively to the policymakers trimming the lending rates due to the deepening troubles in the economy. China's economy narrowly avoided a contraction in the second quarter with an expansion of just 0.4% as virus lockdowns weighed on industrial and consumer spending. Nevertheless, despite the economic damage inflicted by its strict virus policies, President Xi Jinping's signature strategy remains in play even as much of the world drops restrictions.

In recent trade, there is news that China's Securities Times reported that China may reduce RRR this year to compensate for MLF maturity. The article states that RRR cuts may lower lending prime rates. It is with noting that this is a state-run agency reporting such opinions.

We saw another slide in the yuan to its lowest since late summer 2020 at 6.8753 overnight. This was good news for the US dollar as the policy gap widens but will likely continue to weigh on the Aussie, reflecting China's position as the largest buyer of Australian resources. The property crisis, which accounts for about a quarter of gross domestic product, is also under pressure, hitting Australia's iron ore export market.

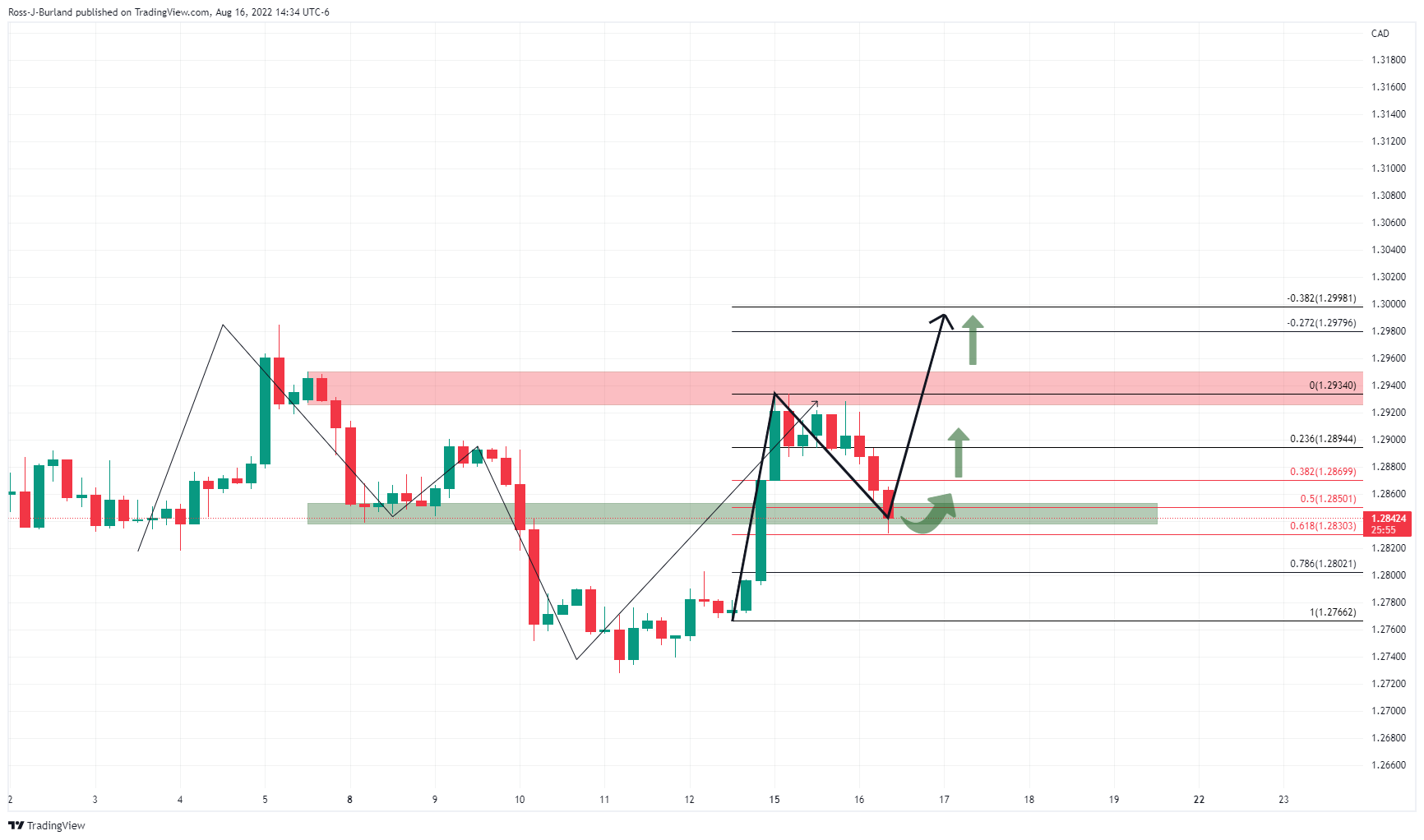

- USD/CAD remains sidelined after refreshing five-week high, probes four-day uptrend.

- Successful break of one-month-old ascending trend line, bullish MACD signals favor buyers.

- Bears stay off the table unless breaking 200-DMA support.

USD/CAD remains sidelined around the monthly high surrounding mid-1.3000s as bulls take a breather after a four-day uptrend to the initial Asian session on Tuesday. Even so, the Loonie pair holds onto the previous day’s upside break of an ascending resistance line from July 25, now support near 1.3030.

In addition to the successful break of the monthly resistance line, bullish MACD signals also keep USD/CAD buyers hopeful.

However, multiple tops marked between early May and early July, around 1.3080-85, offer strong resistance to the bulls.

In a case where the quote rises past 1.3085, the 1.3135 mark may act as an intermediate halt before fueling prices the USD/CAD prices towards the yearly peak of 1.3223.

Alternatively, pullback remains elusive until the quote stays beyond the aforementioned resistance-turned-support near 1.3030. Also acting as an immediate downside filter is the 1.3000 psychological magnet.

It’s worth noting that multiple levels around 1.2935-30 and the 1.2800 threshold could lure USD/CAD bears past 1.3000. Even so, the pair sellers should remain cautious unless witnessing a clear break of the 200-DMA support of 1.2760.

USD/CAD: Daily chart

Trend: Further upside expected

- AUD/JPY extended its rally to four straight days, gaining 0.28% on Tuesday.

- The daily chart illustrates the cross-currency pair seesawing in a 150 pip range.

- The AUD/JPY 4-hour chart shows a rising-wedge emerging, which targets the 93.00 figure.

The AUD/JPY edges lightly lower as the Asian Pacific session begins, but on Monday, it extended its gains for three consecutive days, finishing the session around 94.60, up by 0.47%. At the time of writing, the AUD/JPY is trading at 94.53, below its opening price by 0.08%.

AUD/JPY Price Analysis: Technical outlook

In the last five days, the AUD/JPY has been consolidated within the 93-00-94-50 area, unable to break the top/bottom of the range. Worth noting that from a daily chart perspective, the AUD/JPY is neutral-to-upward bias but unless buyers reclaim the 95.10 August 12 daily high, the cross-currency pair will remain to seesaw amidst a lack of catalyst.

With AUD/JPY buyers reclaiming the abovementioned scenario, their first resistance would be the July 27 high at 95.67, followed by the YTD high at 96.88. Failure to do so, the AUD/JPY might fall towards the bottom of the range at 93.00.

Zooming into the 4-hour chart, the AUD/JPY formed a rising-wedge that targets the 93.23 mark. Further cementing the case, it’s that the RSI crossed below its 7-SMA, signaling that sellers are gathering momentum, despite being above the 50-midline, at 58.46. Therefore, the AUD/JPY first support would be the S1 daily pivot at 94.05. Break below will expose the S2 and S3 pivot points, at 93.57 and 93.17.

AUD/JPY Key Technical Levels

- GBP/USD has shifted into an extremely tight range after printing a fresh two-year low of 1.1742.

- A discussion of 50 bps rate hike by the Fed at Jackson Hole looks certain.

- The vulnerable employment data has trimmed the confidence of the BOE in hiking interest rates.

The GBP/USD pair is auctioning in a minor range of 1.1756-1.1769 in the early Asian session. The asset is displaying a volatility contraction that results in expansion in volume and tick size. The cable has witnessed a short-lived pullback after printing a fresh two-year low of 1.1742 on Monday. The less confident pullback move is expected to turn into a fresh downside move ahead and the asset may fall to near 1.1700.

The mighty US dollar index (DXY) has recaptured the elevated territory of 109.00 and is expected to sustain above the same as investors are awaiting the Federal Reserve (Fed) chair Jerome Powell’s speech at Jackson Hole Economic Symposium.

After observing evidence of exhaustion in the price pressures and accelerating consequences of liquidity shrinkage from the economy, it is likely that the Fed will scale don its hawkish tone on the interest rates. Therefore, a rate hike by 50 basis points (bps) could be discussed at the Economic Symposium.

On the pound front, investors are still in a hangover from the downbeat employment data released last week. The Claimant Count Change landed at -10.5k, significantly lower than the expectations of -32k and the prior release of -26.8k. Also, the Unemployment Rate remained unchanged at 3.8%. The vulnerable employment data has trimmed the confidence of the Bank of England (BOE) in deploying tight quantitative measures unhesitatingly.

- EUR/USD remains sidelined after declining to the lowest levels since December 2002.

- Fears of Eurozone recession escalated after Russia’s unscheduled maintenance of Nord Stream 1 pipeline.

- Yields rose, equities dropped as traders fear more economic hardships ahead, hawkish Fed bets increase.

- Preliminary reading of August S&P Global PMIs for Eurozone, US will decorate calendar.

EUR/USD bears take a breather after renewing a two-decade low near 0.9925 marked the previous day, a 0.9945 by the press time, as they await the flash readings of August PMIs during early Asian session on Tuesday. The major currency pair refreshed the multi-year low as market’s fear of recession, as well as the Fed’s aggression, escalated ahead of this week’s top-tier data/events.

Russia’s unscheduled maintenance of Nord Stream 1 pipeline unveiled a blow to the struggling Eurozone economy amid the energy crisis. The fears grew stronger as the firmer US data signalled the Fed’s aggression.

It’s worth noting that Bundesbank President, as well as the European Central Bank (ECB) policymaker, Joachim Nagel mentioned that the ECB must keep raising interest rates even if a recession in Germany is increasingly likely, as inflation will stay uncomfortably high all through 2023. Also, the Germany’s monthly report from Bundesbank signalled that a recession in Germany is increasingly likely while also suggesting that inflation will continue to accelerate and could peak at more than 10%. On the contrary, German Economy Minister Robert Habeck stated, “A good chance to get through winter without drastic energy measures.”

On the other hand, Chicago Fed National Activity Index improved to 0.27 in July, from a downwardly revised -0.25 prior.

Amid these plays, Reuters mentioned that Fed funds futures on Monday have priced in a 54.5% chance of a 50 basis-point (bp) rate hike at the Fed's policy meeting next month. The fed funds rate is seen hitting roughly 3.6% by the end of the year, with a peak rate of nearly 3.8% in March 2023.

It’s worth noting that the US 10-year Treasury yields rose to the fresh monthly high around 3.02% while Wall Street closed in the red amid the risk-off mood.

Moving on, EUR/USD traders should pay attention to the preliminary readings of German and the US PMIs for August for fresh impulse ahead of the same activity data for the US scheduled to be released later in the day. However, major attention will be given to Fed Chair Jerome Powell’s speech at the Jackson Hole Symposium, up for publishing on Wednesday.

Technical analysis

A daily closing below the previous 20-year low, marked in July around 0.9952, appeared to have opened the door for the EUR/USD slump towards the 61.8% Fibonacci Expansion (FE) of May-August downturn, near 0.9850-45.

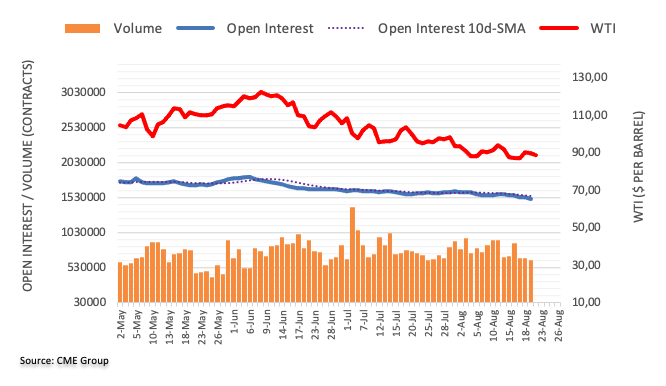

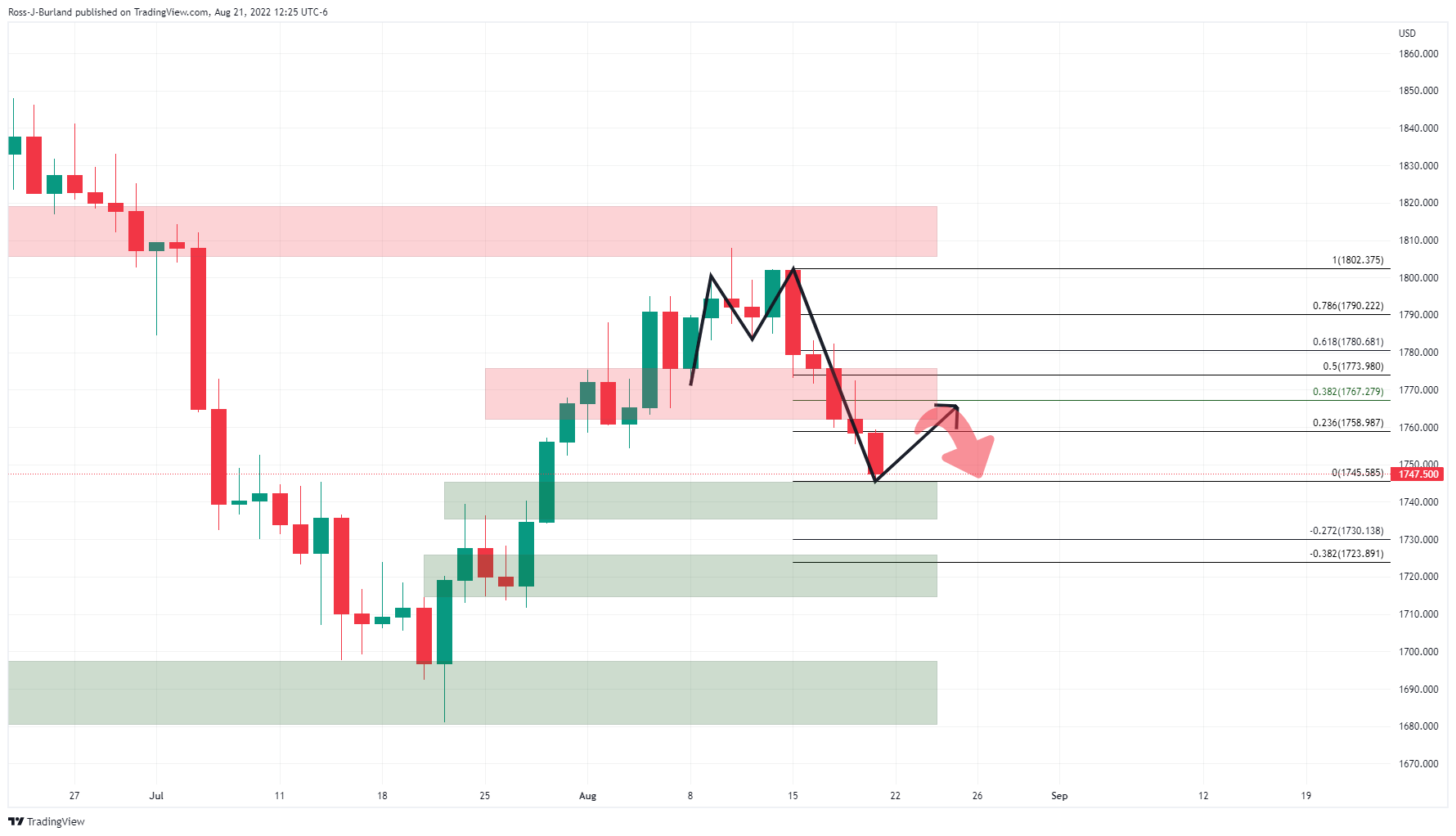

- Gold price is auctioning in a $1,733.40-1,740.00 range ahead of US Durable Goods Orders.

- It is highly expected that Fed’s tone will remain slightly hawkish in Jackson Hole.

- The precious metal has picked bids around 61.8% Fibo retracement but still carries downside bias.

Gold price (XAU/USD) is displaying topsy-turvy moves in a narrow range of $1,733.40-1,740.00 in the early Tokyo session. The precious metal is dealing with volatility contraction after a firmer rebound from a low of $1,727.85 on Monday. The yellow metal is in a fix on mixed commentary over the extent of the hawkish tone to be delivered by Federal Reserve (Fed) chair Jerome Powell at Jackson Hole Economic Symposium.

After a scrutiny of the Fed minutes released last week, one cannot deny the fact that Fed policymakers agreed on the availability of little evidence, which clears that inflation pressures were subsiding and that it would take a considerable time for the situation to be resolved. In addition to that, the Fed is also committed to bringing price stability to the economy. And, in order to cater to the same, the spree of rate hiking should not be abandoned. It would be optimal to go for a 50 basis point (bps) interest rate hike to respect judgments.

But before that, the release of the US Durable Goods Orders is in focus, which is due on Wednesday. As per the market consensus, the economic data is likely to decline to 0.5% from the prior release of 2%. In times, when the US economy has already displayed an unchanged US core Consumer Price Index (CPI), a decline in the economic data is not lucrative for the US dollar index (DXY).

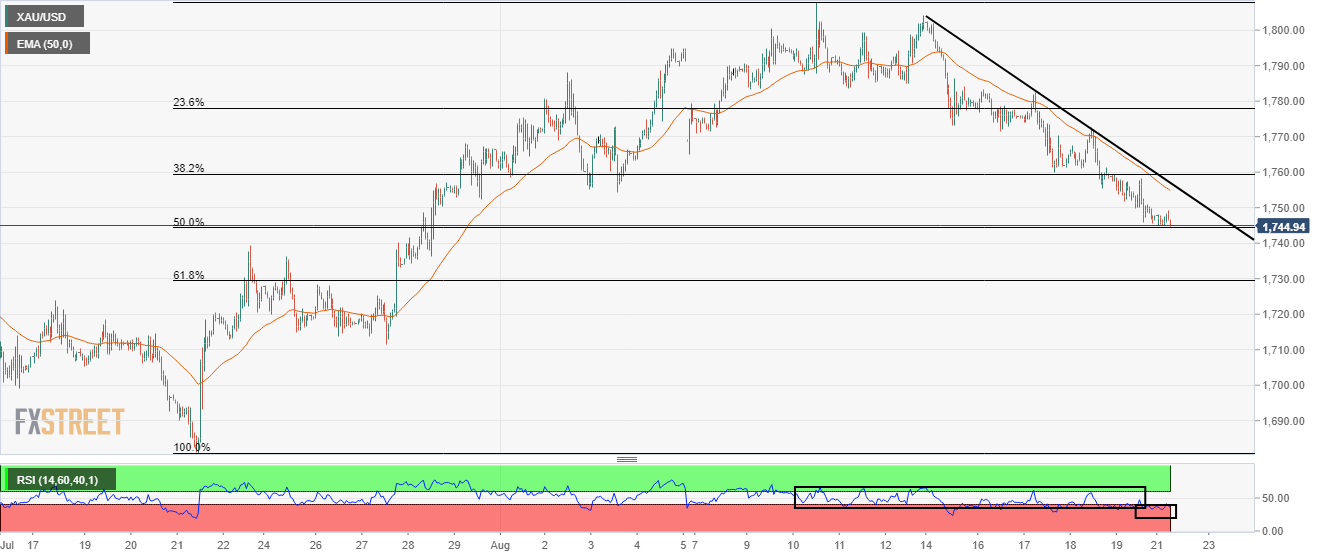

Gold technical analysis

After hitting the 61.8% Fibonacci retracement (placed from July 21 low at $1,680.91 to August 10 high at $1,807.93) at $1,729.44, gold prices have rebounded firmly. The precious metal is continuously facing barricades from the 20-period Exponential Moving Average (EMA) at $1,738.60, which favors the downside bias.

Also, the Relative Strength Index (RSI) (14) is oscillating in a bearish range of 20.00-40.00, which indicates more downside ahead.

Gold hourly chart

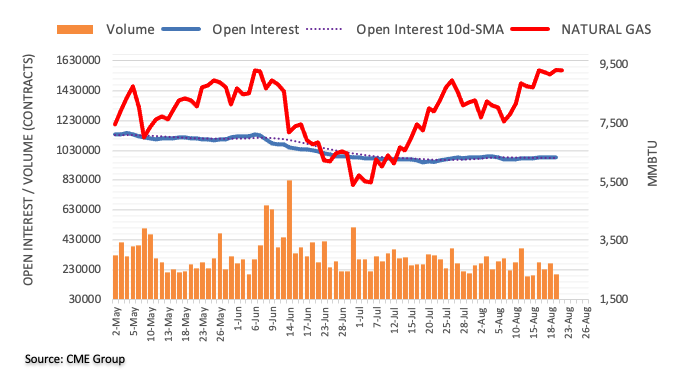

- WTI recovered from reaching a daily low of around $86.29 and finished up 0.80%.

- US Department of State noted that a nuclear deal with Iran is closer now, a headwind for oil prices.

- Oil traders are worried about a possible US recession and China’s economic slowdown.

Western Texas Intermediate (WTI), the US crude oil benchmark, recovered some ground on Monday, rallying late after the Wall Street close, up by 2.36%. At the time of writing, WTI is trading at $90.48 per barrel.

WTI’s price action witnessed the black gold hitting a daily low at $86.29 PB, but as the New York session progressed and news that the OPEC+ saying that they will need to tighten output to stabilize the market augmented oil’s appeal. So WTI rallied since the mid-North American session and trades above its opening price.

Saudi Energy Minister Prince Abdulaziz bin Salman said OPEC+ could cut output against the possibility of a nuclear deal agreement with Iran, which could return the sanctioned country to the oil market.

Meanwhile, discussions between EU members and the US appear to be progressing, as stated by a US Department of State note, saying that a nuclear deal is closer now than It was two weeks ago.

Earlier during the day, oil prices tumbled on worries that China’s demand for oil could diminish, fueled by fears of a possible economic slowdown further cemented by the People’s Bank of China (PBoC) cutting rates from its main lender benchmark rate. Additionally, US recession fears are lingering in traders’ minds, with the US Federal Reserve set to continue tightening monetary policy as they battle to tame inflation towards its 2% goal.

In the meantime, the US Dollar Index is rising 0.78%, sitting at 108.950, its highest level in six weeks, another reason for the US dollar-denominated commodity to extend its losses.

All that said, investors’ focus shifts to Friday’s US Federal Reserve Chair Jerome Powell’s speech, where market participants expect him to reassure that the Fed is committed to tackling inflation, despite ongoing recession fears.

WTI Price Analysis: Technical outlook

From a daily chart perspective, WTI is slightly neutral-to-downward biased, but it could be headed upwards in the near term. Why? Because a falling wedge emerged, and as price action progresses, WTI is about to break upwards, putting into play a test of the 20-day EMA at $91.78, the 200-day EMA at $95.65, and the 50-day EMA at $99.56.

- NZD/USD remains pressured as risk-off markets take hold.

- US stocks end lower in anticipation of higher rates.

NZD/USD has been on the backfoot and will enter the roll-over close to fresh six-day lows near 0.6150. The bears engaged after the People's Bank of China trimmed lending rates was taken as only a minor positive due to the deepening troubles in the economy.

After a monthly meeting, the PBOC lowered the one-year loan prime rate by 5 basis points to 3.65% from 3.7%, while the five-year rate was cut by 15 basis points to 4.3% from 4.45%, reducing the cost of payments on existing loans. Consequently, the yuan cropped and the commodities complex was dragged lower, taking down the antipodeans.

Meanwhile, ''inflation remains at front of mind, and US markets seem to be warming to the idea that it could be harder to tame this time around given energy market woes, dents in supply chains and tight labour markets,'' analysts at ANZ Bank argued. '

'This is, in turn, driving a shift in bond markets, which have of late been content to assume a slowdown might miraculously drive inflation lower; and that, in turn, is driving the USD up (the DXY is only 25bps from July’s 20-year high).''

The US two-year Treasury yield has risen by 3% to 3.346% while the 10-year yield climbed 1.68% to 3.04%, implying the yield curve between the two maturities remains inverted, a bearish signal if sustained. This is fuelling a bid on the greenback. Against a basket of currencies, the US dollar was 0.85% higher at 109.09 DXY, not far from the two-decade high of 109.29 touched in mid-July.

US stocks started the week in negative territory in anticipation of higher rates which has also weighed on the antipodeans. The Dow Jones Industrial Average dropped 2% to 33,063.61 while the S&P 500 was also down 2% to 4,137.99, making Monday's session their worst day since June. The Nasdaq Composite was 2.6% lower at 12,381.57.

Ahead of Jackson Hole, ''financial conditions have continued to ease,'' analysts at TD Securities said. ''Powell's speech will likely aim to reinforce the message that multiple, sizable hikes are still in the pipeline, and easing should not be expected to be on the horizon anytime soon.''

- AUD/USD is back to flat on the day following a risk-off-led drop at the start of the week.

- The bears are lurking with the Jackson Hole around the corner amid Chinese economic woes.

AUD/USD bulls are attempting to stabilise the pair following a test of daily lows at the start of the week. The price dropped from a high of 0.6929 to a low of 0.6862 following a fresh fall in the yuan that has seen the US dollar rise and weigh on commodities.

China on the brink

Despite the Chinese best efforts, markets are alarmed by the implications for world growth as the second largest economy and Australia's biggest trade partner struggles with a resurgence of COVID-19 lockdowns and the property crisis. After a monthly meeting, the PBOC lowered the one-year loan prime rate by 5 basis points to 3.65% from 3.7%, while the five-year rate was cut by 15 basis points to 4.3% from 4.45%, reducing the cost of payments on existing loans. However, the news that policymakers have trimmed lending rates was taken as only a minor positive due to the deepening troubles in the economy.

China's economy narrowly avoided a contraction in the second quarter with an expansion of just 0.4% as virus lockdowns weighed on industrial and consumer spending. Nevertheless, despite the economic damage inflicted by its strict virus policies, President Xi Jinping's signature strategy remains in play even as much of the world drops restrictions.

Another slide in the yuan to its lowest since late 2020 at 6.8520 added to the pressure on the Aussie, reflecting China's position as the largest buyer of Australian resources. The property crisis, which accounts for about a quarter of gross domestic product, is also under pressure, hitting Australia's iron ore export market.

US dollar rises over global economic woes

Overall, global risk aversion combined with the slide in the yuan has overshadowed domestic considerations and the Aussie's higher beta relationship to the stock market has seen the currency on a knife's edge as traders look ahead to risks this week in the Jackson Hole. The hawkish expectations from a speech by the Fed chairman, Jerome Powell, have put a bid on the greenback and are weighing on risk appetite sending the Dow Jones Industrial Average lower1.82% to 33,085, with the S&P 500 also down over 2%.

The US two-year Treasury yield has risen by 3% to 3.346% while the 10-year yield climbed 1.68% to 3.04%, implying the yield curve between the two maturities remains inverted, a bearish signal if sustained. This is fuelling a bid on the greenback. Against a basket of currencies, the US dollar was 0.85% higher at 109.09 DXY, not far from the two-decade high of 109.29 touched in mid-July.

What you need to take care of on Tuesday, August 23:

Risk aversion took over financial markets at the beginning of the week amid recession fears hitting European shores. Gas prices soared in the region to new record highs as Russia announced unscheduled maintenance on the Nord Stream 1 pipeline, announcing it will shut it down for three days starting August 31.

European stocks collapsed, with the German DAX suffering the most. Also, the German Bundesbank released its monthly report, which noted that a recession in Germany is increasingly likely, and that could inflation will continue to accelerate and could peak at more than 10%.

The EUR/USD pair collapsed to a fresh 22-year low of 0.9925, holding nearby early in the Asian session. GBP/USD fell to its lowest since March 2020, trading at around 1.1760. Commodity-linked currencies were also down, with AUD/USD trading at the lower end of its August range in the 0.6870 area and the USD/CAD pair reaching a one-month high of 1.3060.

The greenback appreciated against its safe-haven rivals, with USD/CHF trading at 0.9640 and USD/JPY 137.40. Gold trades at around $1,737 a troy ounce.

Crude oil prices fell sharply ahead of the US opening, recovering afterwards. WTI traded as low as $86.28 a barrel to settle at around $90.60. Saudi Energy Minister said that OPEC+ might need to tighten output to stabilise the market.

Wall Street plunged and had its worst day since mid-June. US indexes lost roughly 2% each. US Treasury yields edged north, with that on the 10-year note currently at 3.03%.

Bitcoin price is at a crossroads – time to buy or should you wait for Jackson Hole Symposium?

Like this article? Help us with some feedback by answering this survey:

- EUR/USD sinks to fresh bear cycle lows as the greenback picks up the risk-off flows.

- The Jackson Hole and prospects of a recession in the eurozone are driving the euro into the ground.

EUR/USD has been marking fresh lows below parity in the New York session. The cross has fallen from a high of 1.0046 to a low of 0.9926 on the day so far and is down by some 1% on the day ahead of the Jackson Hole this week and with eyes on the European Central Bank minutes of the previous meeting that will be released on Thursday.

The ECB meets to discuss monetary policy on Sept. 9. On the weekend, Bundesbank President Joachim Nagel told a German newspaper that the European Central Bank must keep raising rates even if a recession in Germany is increasingly likely, as inflation will stay uncomfortably high through 2023.

Meanwhile, Russia's announcement late on Friday of a three-day halt to European gas supplies via the Nord Stream 1 pipeline at the end of this month has weighed heavily on the euro for fears that this could tip the economy into a recession in the face of higher inflation.

Markets are focused on US events later in the week, with the second estimate of the second quarter growth data in Gross Domestic Product on Thursday, before the release of personal income and spending data for July on Friday. The main event will be the Federal Reserve comments from the Jackson Hole conference Thursday through Saturday. The main event of the Jackson Hole conference will be Fed Chair Jerome Powell's speech at 10:00 am ET Friday.

The hawkish expectations from a speech have put a bid on the greenback and are weighing on risk appetite sending the Dow Jones Industrial Average lower1.82% to 33,085, with the S&P 500 also down over 2%. Weighing on the euro is the rise in the US two-year yield which has risen by 3% to 3.346% while the 10-year yield climbed 1.68% to 3.04%, implying the yield curve between the two maturities remains inverted, a bearish signal if sustained. This is fuelling a bid on the greenback. Against a basket of currencies, the US dollar was 0.85% higher at 109.09 DXY, not far from the two-decade high of 109.29 touched in mid-July.

In the build-up to the Jackson Hole, there has been a chorus of speakers from the Fed, with hawkish rhetoric fueling a surge in the US dollar. The most hawkish of Fed officials were James Bullard. The central banker advocates a 75bp hike at September's meeting and added he isn’t ready to say the economy has seen the worst of the inflation surge.

“We should continue to move expeditiously to a level of the policy rate that will put significant downward pressure on inflation” and “I don’t see why you want to drag out interest rate increases into next year,” Mr Bullard said in a Wall Street Journal interview. The latest of these officials, Richmond Fed President Thomas Barkin, on Friday said the "urge" among central bankers was toward faster, front-loaded rate increases.

''Financial conditions have continued to ease,'' analysts at TD Securities said. ''Powell's speech will likely aim to reinforce the message that multiple, sizable hikes are still in the pipeline, and easing should not be expected to be on the horizon anytime soon.''

- USD/JPY buyers reclaimed the 137.00 figure and prepared to assault 138.87, ahead of the YTD high.

- The 4-hour chart suggests the USD/JPY might dip towards 135.58, before continuing its uptrend.

The USD/JPY advances sharply during the day, above its opening price, after hitting a daily high at 13.7.65, but late as there is one hour left for the Wall Street close, the major surrendered some of its gains amidst a risk-off trading session on Monday. At the time of writing, the USD/JPY is trading at 137.50, up by 0.47%.

USD/JPY Price Analysis: Technical outlook

The USD/JPY is upward biased, shifting from neutral after the pair dipped towards 130.39 on August 2. Nevertheless, that’s been the lowest the pair has traded since three months ago, and when it broke a downslope trendline on August 17, it shifted from neutral bias to upward biased.

That said, the USD/JPY is trading nearby the July 27 daily highs at 137.65, which, once cleared, will send the major rallying towards the July 21 swing high at 138.87, followed by the YTD high at 139.38.

In the four-hour time frame, the USD/JPY faces sold resistance at the R1 daily pivot, which is also the confluence of the July 27 daily high at 137.46. It’s worth nothing that the Relative Strength Index (RSI) is entering overbought conditions. Therefore, the USD/JPY might register a leg-down before continuing upwards.

If that scenario plays out, the USD/JPY first support will be the 20-EMA at 136.25, followed by the confluence of the 200-EMA and the August 7 daily high at 135.58.

USD/JPY 4-Hour chart

USD/JPY Key Technical Levels

- Gold is firmly in the hands of the bears as the US dollar takes off.

- Bears eye $1,710 although, considering the support area, we could see a correction in coming sessions.

- The Jackson Hole will be a key driver for the week.

Gold is being kept under pressure at the start of the week, although the gold price is currently off the lows from the day and attempting to correct. At $1,735, the yellow metal is still down 0.7% on the day so far and has travelled between a low of $1,727.85 and $1,749.09.

Gold is down for the sixth consecutive day on Monday amid an environment that is favouring the US dollar while looming Federal Reserve interest rate hikes weigh on bullion's appeal. The hawkish expectations from a speech at the Jackson Hole, Wyoming central banking conference later this week by Fed Chair Jerome Powell have put a bid on the greenback and are weighing on risk appetite.

Risk-off mood weighs on gold

The Dow Jones Industrial Average dropped 1.82% to 33,085, with the S&P 500 down over 2%. The US two-year yield jumped 3% to 3.346%, and the 10-year yield climbed 1.68% to 3.04%, implying the yield curve between the two maturities remains inverted, a bearish signal if sustained. Meanwhile, against a basket of currencies, the dollar was 0.82% higher at 108.98 DXY, not far from the two-decade high of 109.29 touched in mid-July.

In the build-up to the Jackson Hole, there has been a chorus of speakers from the Fed, and last week was particularly busy in that respect. The most hawkish of Fed officials was Bullard who expressed a desire for a 75bp hike at September's meeting and added he isn’t ready to say the economy has seen the worst of the inflation surge. “We should continue to move expeditiously to a level of the policy rate that will put significant downward pressure on inflation” and “I don’t see why you want to drag out interest rate increases into next year,” Mr Bullard said in a Wall Street Journal interview. The latest of these officials, Richmond Fed President Thomas Barkin, on Friday said the "urge" among central bankers was toward faster, front-loaded rate increases.

Meanwhile adding to the risk-off mood, Russia's announcement late on Friday of a three-day halt to European gas supplies via the Nord Stream 1 pipeline at the end of this month sank the euro, supporting DXY higher. On the weekend, Bundesbank President Joachim Nagel told a German newspaper that the European Central Bank must keep raising rates even if a recession in Germany is increasingly likely, as inflation will stay uncomfortably high through 2023. The combination has sent the euro below parity vs. the greenback again. At the time of writing, EUR/USD is down by over 1% to a low of 0.9926.

Elsewhere in the forex space, China's yuan dropped to its lowest in nearly two years after the country's central bank cut its benchmark lending rate and lowered the mortgage reference by a bigger margin on Monday. The people's Bank of China's move is adding to last week's easing measures to support the ailing economy in the face of a resurgence of COVID-19 and the property crisis. This has also supported the greenback and has weighed on precious metals.

''Shanghai traders have also been unwinding their recent length, with lockdowns and industrial woes likely to weigh on Chinese demand,'' analysts at TD Securities said. ''Our tracking of positioning for the top ten traders in Shanghai suggests they have sold nearly 40,000 SHFE lots of silver over the past month, in contrast with the nation's blockbuster imports of gold from Switzerland in July.''

Gold technical analysis

The price of gold has left behind an M-formation on the daily chart, a reversion pattern that would be expected to see the price revert towards the neckline in due course. However, given the over-extension of the latest impulse, the correction will more probably only reach as far as the prior support near a 38.2% Fibonacci around $1,755. Meanwhile, the bears have their sights on $1,710 support.

- USD/CHF climbs but retreats at the 100-day EMA at 0.9644.

- The 4-hour chart illustrates that the USD/CHF might print a leg-down before resuming upwards.

- A break above the 100-day EMA to open the door for 0.9700.

The USD/CHF rallied in the North American session, bolstered by broad US dollar strength and risk aversion, so traders seeking safety bought the greenback, to the detriment of the Swiss franc. At the time of writing, the USD/CHF is trading at 0.9642 above its opening price by 0.60%.

USD/CHF Price Analysis: Technical outlook

From a daily chart perspective, the USD/CHF is upward biased, testing the 100-day EMA at 0.9644, breaking on its way north the 50-day EMA at 0.9629. USD/CHF traders should be aware that the price is testing the August 3 high at 0.9651, which, once cleared, would pave the way towards the 0.9700 figure, ahead of the July 14 daily high at 0.9886.

Reviewing the four-hour scale, the USD/CHF broke from consolidation around the 0.9574-0.9605 area, exposing the major to higher exchange rates, and on its way, north printed a daily high at 0.9658. Nevertheless, selling pressure entering in August 3 highs sent the pair sliding towards current price levels.

Even though the USD/CHF retreated, it opened the door for further gains. Still, the Relative Strength Index (RSI) entering overbought conditions suggests the pair might record a leg-down towards the 200-EMA at 0.9619 before resuming the uptrend.

Therefore, the USD/CHF first resistance would be the R3 daily pivot at 0.9652. The break above will expose the R4 daily pivot at 0.9680, followed by the August 22 daily high at 0.9704.

USD/CHF Key Technical Levels

- USD/CAD reaches a fresh six-week high at 1.3048 on falling crude oil prices and broad US dollar strength.

- Last week’s Fed hawkish commentary weighed on market mood, with traders preparing for Fed Chair Jerome Powell’s speech.

- Money market futures odds of a 75 bps rate hike by the Fed lie at 82.8%.

The USD/CAD broke to fresh two-month highs above the 1.3000 figure on risk aversion, crude oil prices falling, and broad US dollar strength across the board, as traders brace for US Federal Reserve Economic Symposium at Jackson hole. Amongst those and additional factors, the USD/CAD is trading at 1.3038, up by 0.37% at the time of writing.

Wall Street extended its losses as Fed’s hawkish rhetoric weighed on traders’ mood. US Treasury yields jumped between three-to-six basis points, while the US Dollar Index, a gauge of the buck’s value vs. a basket of currencies, broke the 109.000 barrier up 0.84%.

USD/CAD climbs on buoyant US dollar due to Fed’s hawkish commentary

During the last week, Fed officials reiterated the need to bring inflation down, led by San Francisco Fed’s Mary Daly, who said that it was premature to “declare victory” on inflation while adding that she foresees a 50 or 75 bps for the September meeting. Echoing her comments was the uber-hawk St. Louis Fed President James Bullard, saying he’s leaning towards 75 bps and emphasized the need to get to the 3.75%-4% range by the year’s end. In his view, he added that it will take 18 months to get back prices back to the Fed’s 2% target.

In the meantime, money market future STIRs portray that the Fed will hike a minimum 50 bps rate hike for September, while odds for a 75 bps increase lie at 82.8%.

On the Canada front, an absent Canadian docket left investors adrift to market sentiment and oil prices. Meanwhile, the oil price is staging a comeback, exchanging hands at $89.49 PB, but remains below its opening price by 0.39% after hitting a daily low of $86.29.

Even though expectations are that the Bank of Canada will continue to tighten monetary policy, it will get slightly behind the Federal Reserve, with forecasts of a 50 bps hike which would lift rates to 3%. Aside from this, according to Reuters, speculators have raised their bullish bets on the Loonie to its highest level since July 2021, as shown by US CFTC data released on August 19, with long positions increasing from 21 223 to 26,867.

What to watch

The Canadian economic docket will feature Average Weekly Earnings by Thursday. Meanwhile, by Friday, the US calendar will reveal S&P Global PMIs, Fed speaking led by Minnesota’s Neil Kashkari, alongside inflation figures, ahead of Jerome Powell’s speech at Jackson Hole.

USD/CAD Key Technical Levels

- DXY up by 0.82%, near multi-year highs.

- US yields rise further, 10-year back above 3.0%-

- GBP/USD drops for the fourth consecutive day, below July lows.

The GBP/USD dropped further and printed a fresh two-year low at 1.1736. It is undress pressure amid a stronger US dollar and risk aversion.

Yields up, stocks sharply lower

Equity prices in Wall Street are falling sharply. The Dow Jones is at 12 day lows, falling by 1.44% and the Nasdaq tumbles more than 2%. The FTSE 100 lost 0.22%.

Despite risk aversion, Treasury bonds are adding to last week's losses. The US 10-year stands at 3.02%, the highest since July 21 and the 30-year is at 3.25%, the highest since July 8. The US Dollar Index is testing 109.00, up 0.82%, on its way to the highest daily close since September 2002.

Expectations about more aggressive tightening from the Federal Reserve keeps the dollar on demand ahead of the Jackson Hole symposium. On Friday, Jerome Powell will deliver a speech. A 50 basis point rate hike is fully priced, although a 75 bps hike is also likely according to money markets.

Below 1.1740, the next support could be seen around 1.1710 and then not much until 1.1630. The 2020 low waits near 1.1400 but before a strong area is located at 1.1450. On the upside, 1.1795 has become the immediate resistance, followed by 1.1835 (Aug 22 high).

Technical levels

Citing an interview given to Bloomberg, the Saudi Press Agency (SPA) reported on Monday that Saudi Arabia's energy minister said that OPEC+ has the means to deal with market challenges including cutting production at any time, in different forms.

"Paper oil market has fallen into a self-perpetuating vicious circle of very thin liquidity, extreme volatility undermining market’s essential function of efficient price discovery," the minister added. "OPEC+ will start working on a new agreement behind 2022 building on previous successes."

Market reaction

Crude oil prices rebounded from daily lows on these remarks. As of writing, the barrel of West Texas Intermediate, which dropped to a daily low of $86.25 earlier in the day, was trading at $89, losing 0.8% on the day.

The EUR/USD dropped to the lowest level since December 2002, reaching 0.9942. It remains under pressure, testing levels under the 0.9950 support area.

A stronger US dollar across the board is pushing EUR/USD to the downside on Monday. The combinations of risk aversion and higher US yields support the greenback. Also, technical factors weighed on the euro.

The US Dollar Index (DXY) is up by 0.69%, about to post the highest daily close in years. In Wall Street, the Dow Jones is falling by 1.33% and the Nasdaq drops by 2.13%.

EUR/USD daily chart

- AUD/USD hit a daily low of around 0.6929 but tumbled as sentiment shifted sour.

- Global equities dropped as investors brace for Fed’s Jerome Powell speech on Friday.

- China’s PBoC’s rate cut lifted the AUD/USD just above the 0.6900 figure before dropping towards daily lows.

The AUD/USD slightly declines in the North American session, amidst a risk-off tone in the market, with global equities sliding, as traders brace for Fed Chair Jerome Powell’s speech on Friday. Reflection of the aforementioned is global equities tumbling, led by US stocks, down between 1.40% and 2.30%.

The AUD/USD is trading at 0.6875 below its opening price by 0.02%, after hitting a daily high of 0.6929, just above the 50-day EMA. Nevertheless, the major softened and dropped from the 0.6900 figure due to broad US dollar strength.

Meantime, the US Dollar Index, a gauge of the buck’s value vs. a basket of peers, advances almost 0.60%, up at 108.729, closing to the YTD high at 10.9.294.

In the meantime, a lack of economic data keeps traders focused on the Jackson Hole event. Worth noting that last week’s Fed’s policymakers continued expressing that although inflation data is encouraging, the central bank is far from declaring victory. Even the most dovish, like Kansas City Fed’s Esther George, expressed that additional rate hikes are coming, though she mentioned that the size of increases is open for discussions.

At the time of writing, money market futures STIRs show that investors have fully priced in a 50 bps rate hike by the Federal Reserve, while odds of a 75 bps increase lie at 82.8%.

Aside from this, early in the Asian session, the People’s Bank of China (PBoC) cut its benchmark lending rate by 5 bps from 3.70% to 3.65% to stimulate the economy. The AUD/USD jumped towards 0.6906 on China’s decision, which benefits the Australian economy, as China is one of its largest trading partners.

What to watch

The Australian economic docket will feature the Australian S&P Global PMIs for the August readings, estimated to decrease, except for the Services PMI. On the US side, the calendar will release the S&P Global PMIs, a prelude for next week’s ISM PMI figures, alongside Fed speakers, led by Minnesota Fed’s Neil Kashkari on Tuesday, and the beginning of the Jackson Hole Economic Symposium by Wednesday.

AUD/USD Price Analysis: Technical outlook

From a technical perspective, the AUD/USD pierced the 50-day EMA around 0.6916 but dropped, threatening to turn negative in the day, exacerbating a fall towards the five-month-old downslope trendline, previously a resistance area shifted support around the 0.6800 figure. A daily close below last week’s low at 0.6859 will pave the way for further losses.

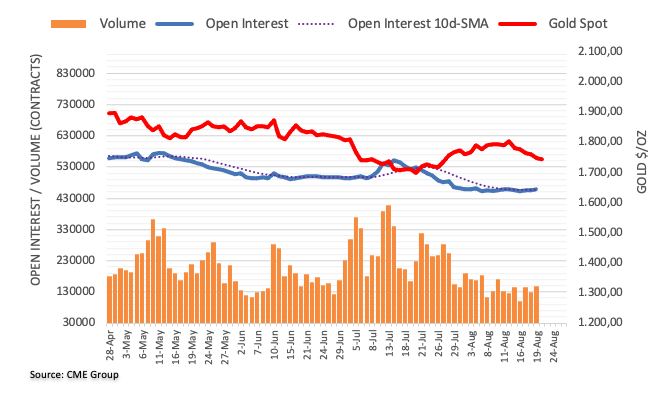

Platinum (XPT/USD) is currently trading below the $900 level. Economists at Commerzbank have adjusted their forecast lower to $1,000 by the end of the year.

Platinum is suffering from continued selling by ETF investors

“We are revising our year-end price forecast for platinum downwards to $1,000 (previously $1,050).”

“Platinum is also suffering from continued selling by ETF investors. Since the beginning of the year, these have now totalled more than 400 thousand ounces. The platinum market could therefore be more oversupplied this year than previously expected.”

Silver has come under pressure in recent months and fell to a two-year low of just over $18 in July. Strategists at Commerzbank are revising their price forecast for silver downwards.

Gold/silver ratio should fall to 76 by end-2023

“We now expect a silver price of $20.50 at the end of the year (previously $24) and a price of $25 at the end of 2023 (previously $27).”

“The gold/silver ratio should fall from the current level of a good 90 to 76 by the end of 2023.”

“In addition to the rising gold price, silver should benefit from the politically forced expansion of photovoltaics, where it is used in solar cells. In a historical comparison, however, silver still remains cheap compared to gold.”

Further tightening of monetary policy may temporarily hamper the current price recovery, which is why strategists at Commerzbank are lowering their gold price forecast for the end of the year to $1,800. The yellow metal is expected to regain a lot of its shine from the turn of the year onwards though.

Too early for a real comeback of gold

“In the short-term, gold could come under pressure again because the US Federal Reserve is likely to raise interest rates further until the end of the year.”

“As soon as it becomes apparent that the rate hike cycle is coming to an end, the gold price should start to rise. This is likely to be the case in the fourth quarter.”

“The price increase should gain momentum when noticeable Fed rate cuts become apparent, which we expect from mid-2023 onwards. Gold should thus regain its strength significantly next year.”

“We are revising our gold price forecast for the end of the year downwards to $1,800 (previous forecast $1,900). Next year, gold should rise to $1,900 (previously $2,000).

- Gold continues losing ground for the sixth straight day and drops to a nearly four-week low.

- Hawkish Fed expectations, rising US bond yields, sustained USD buying exert heavy pressure.

- Recession fears and the risk-off impulse could limit the downside for the safe-haven XAU/USD.

Gold prolongs its recent bearish trajectory for the sixth successive day and drops to a nearly four-week low on Monday. The downfall, however, stalls near the $1,728 area amid the prevalent risk-off environment, which tends to benefit the safe-haven precious metal.

The market sentiment remains fragile amid growing worries over a global economic downturn. This, along with headwinds from COVID lockdowns in China, triggers a fresh wave of the global risk-aversion trade and forces investors to take refuge in traditional safe-haven assets. The anti-risk flow allows gold to trim a part of its heavy intraday losses, though any meaningful recovery still seems elusive.

The relentless US dollar buying remains unabated on the first day of a new week amid expectations that the Fed would continue to tighten its monetary policy to tame surging inflation. In fact, the USD Index, which tracks the greenback's performance against a basket of six other currencies, climbs to its highest level since mid-July and should act as a headwind for the dollar-denominated gold.

The prospects for further interest rate hikes remain supportive of elevated US Treasury bond yields. This turns out to be another factor that should keep a lid on any attempted recovery for the non-yielding yellow metal. The fundamental backdrop suggests that the path of least resistance for gold is to the downside, though bearish traders might prefer to wait for this week's key event risk.

Market participants will closely scrutinize Fed Chair Jerome Powell's speech at the Jackson Hole Symposium on Friday for clues about the possibility of a 75 bps rate hike move at the September meeting. Furthermore, this week's important US macroeconomic releases will play a key role in influencing the USD price dynamics and help determine the next leg of a directional move for gold.

Technical levels to watch

- EUR/USD extends the downside below the parity zone.

- A deeper retracement could see the 2022 in the mid-0.9900s retested.

EUR/USD breaks below the parity level to clinch fresh 6-week lows at the beginning of the week.

Further losses appear in the pipeline for the time being. Against that, the pair could confront the 2022 low at 0.9952 (July 14) in case of a convincing breakdown of the parity region.

In the longer run, the pair’s bearish view is expected to prevail as long as it trades below the 200-day SMA at 1.0852.

EUR/USD daily chart

Senior Economist at UOB Group Alvin Liew assesses the latest publication of the FOMC Minutes.

Key Takeaways

“The key takeaways from the 26-27 Jul FOMC minutes released overnight (18 Aug, 2am) were that as at late Jul, Fed policy makers agreed there was ‘little evidence’ inflation pressures were subsiding and that it would take considerable time for situation to be resolved. The Fed officials were committed to raise rates as high as required to tame inflation - even as they began to recognise explicitly the risk that they might tighten too much and overly curb economic activity.”

“The participants ‘concurred’ future rate hikes would depend on incoming information, and it will be appropriate ‘at some point’ to eventually slow the pace of rate hikes. Participants observed that, following this [July] meeting's policy Fed Funds Target rate (FFTR) hike [of 75bps to 2.25-2.50%], the nominal federal funds rate would be within the range of their estimates of its longer-run neutral level. In their discussion of risks, the policymakers see risk to inflation remaining on the upside while the risks to GDP growth are mainly on the downside.”

“FOMC Outlook – No Change To Our 50bps Rate Hike Expectations For Sep: The latest minutes does not change our Fed view, and we maintain our expectations for the FFTR to be hiked by 50 bps in the Sep 2022 FOMC. We also still expect another one more 50 bps rate hike in Nov FOMC before ending the year with a 25bps hike in Dec, and this implies a cumulative 350bps of increases in 2022, bringing the FFTR higher to the range of 3.50-3.75% by end of 2022, a range largely viewed as well above the neutral stance (which is confirmed in this minutes as 2.25-2.50%, the Fed’s long run projection of FFTR).”

USD/CAD holds near 1.30. Economists at Scotiabank note that the Canadian dollar is unlikely to enjoy gains for now.

Broader USD tone will continue to overshadow the CAD for now

“Weaker stocks and softer oil prices remain headwinds for the CAD and while the BoC policy backdrop remains supportive in broad terms, there is little opportunity for the CAD to differentiate itself from the USD ahead of the key Jackson Hole event at the end of the week at least.”

“USD-bullish, short-term trend indicators suggest the bar to a strong CAD rebound is quite high at the moment.”

“USD losses may be limited to the low/mid 1.29s.”

“Resistance is 1.3020/50.”

There is nothing in terms of good news for the UK or the GBP. Economists at Scotiabank expect the GBP/USD to slump towards the 1.17100/00 region.

Prospects for sterling remain very dim

“Prospects for sterling remain very dim but a lot of bad news may already be priced into the GBP outlook – which might be the best we can say about the pound for now.”

“A drop to the 1.17000/10 is the least we can expect from the GBP in the coming days.”

“Resistance is 1.1840 and 1.1925/30.”

“Key resistance – and safe ground for the GBP – is 1.2005 (double top trigger) but that looks too distant to be relevant from a short-term point of view.”

- DXY advances further north of the 108.00 level to new highs.

- Beyond 109.00 comes the 2022 high near 109.30.

DXY clinches new highs further north of the 108.00 mark at the beginning of the week.

The continuation of the upside momentum looks increasingly likely in the very near term at least. That said, there is an initial hurdle at the round level at 109.00. Once cleared, the YTD high at 109.29 (July 14) should come to the fore ahead of the September 2002 high at 109.77.

In the meantime, the 6-month support line continues hold the upside just above 105.00. Above this zone, the index is expected to keep the short-term positive stance.

Looking at the long-term scenario, the bullish view in the dollar remains in place while above the 200-day SMA at 100.42.

DXY daily chart

EUR/USD edged below par briefly earlier in the session. In the view of economists at Scotiabank, the world’s most popular currency pair looks prone to more persistent softness again.

Minor EUR rallies are a sell

“The par zone did provide a fairly solid base last month, however – aside from a brief break to the 0.9952 low – so a daily close below 1.0000 is likely to be taken as a cue for a further, more sustained, push lower in the EUR.”

“Trend indicators here are solidly bearish. Minor EUR rallies are a sell from a technical point of view.”

“Resistance is 1.0050 and 1.0120.”

- USD/JPY gains traction for the fifth straight day and climbs to a nearly four-week high on Monday.

- The Fed-BoJ policy divergence, elevated US bond yields, sustained USD buying remain supportive.

- Recession fears, the risk-off impulse benefit the safe-haven JPY and seem to cap gains for the pair.

The USD/JPY pair reverses an intraday dip to the 136.70 area and now seems headed back to a three-and-half-week high touched earlier this Monday. The pair holds on to its positive bias for the fifth successive day and is seen trading above the 137.00 mark during the early North American session.

A big divergence in the monetary policy stance adopted by the Bank of Japan and the Federal Reserve turns out to be a key factor acting as a tailwind for the USD/JPY pair. It is worth recalling that the BoJ has repeatedly said that it would retain its ultra-easy policy settings. In contrast, the recent hawkish comments by several Fed officials reaffirmed market expectations that the US central bank would continue to tighten its monetary policy to tame inflation.

The prospects for a further interest rate hike by the Fed remain supportive of elevated US Treasury bond yields, widening the US-Japan rate differential and further weighing on the Japanese yen. In fact, the yield on the benchmark 10-year US government bond is hovering around the 3.0% threshold. This, in turn, pushes the USD to its highest level since mid-July and provides an additional lift to the USD/JPY pair, contributing to the ongoing positive move.

That said, the prevalent risk-off environment offers some support to the safe-haven JPY and caps any further gains for spot prices, at least for the time being. Investors might also prefer to wait for Fed Chair Jerome Powell's speech at the Jackson Hole Symposium on Friday, which will be scrutinized for hints about a 75 bps rate hike move at the September meeting. This will play a key role in influencing the USD and provide a fresh directional impetus to the USD/JPY pair.

Apart from this, investors this week would further take cues from important US macroeconomic releases. In the meantime, traders are likely to refrain from placing aggressive bullish bets amid absent relevant market-moving US economic data on Monday. Nevertheless, the fundamental backdrop remains tilted in favour of bulls and supports prospects for an extension of the recent appreciating move witnessed over the past one-and-a-half week or so.

Technical levels to watch

- Chicago Fed National Activity Index moved into positive territory in July.

- US Dollar Index clings to daily gains above 108.00 after the data.

The Federal Reserve Bank of Chicago's National Activity Index (CFNAI) improved to 0.27 in July from -0.25 (revised from -0.19) in June.

"The CFNAI Diffusion Index, which is also a three-month moving average, edged up to –0.05 in July from –0.08 in June," the publication further read. "Fifty-five of the 85 individual indicators made positive contributions to the CFNAI in July, while 30 made negative contributions. Fifty-five indicators improved from June to July, while 30 indicators deteriorated. Of the indicators that improved, 17 made negative contributions."

Market reaction

This report failed to trigger a noticeable market reaction and the US Dollar Index was last seen rising 0.26% on a daily basis at 108.40.

- NZD/USD stages a goodish recovery from a one-month low touched last Friday.

- The PBoC moves to ease policy further and boosts antipodeans, including kiwi.

- Sustained USD buying, recession fears cap any meaningful upside for the pair.

The NZD/USD pair gains some positive traction on Monday and snaps a five-day losing streak to a one-month low, around the 0.6165 region touched last week. The pair maintains its bid tone through the mid-European session and is currently placed around the 0.6200 mark, though seems to struggle to capitalize on the move.

The People’s Bank of China (PBoC) cut lending rates for the second time in two weeks to stimulate the economy, which, turns out to be a key factor that benefits antipodeans, including the kiwi. Apart from this, the attempted recovery lacks any obvious fundamental catalyst and remains capped amid sustained US dollar buying.

Firming expectations that the Fed will stick to its policy tightening path to tame inflation remains supportive of elevated US Treasury bond yields. In fact, the benchmark 10-year US government bond is holding just below the 3.0% threshold, which, along with the prevalent risk-off mood, continues to underpin the USD.

The market sentiment remains fragile amid growing worries about a global economic slowdown. Apart from this, unease over the Chinese economic headwinds from COVID lockdowns triggers a fresh bout of the risk-aversion trade. This is seen as another factor benefitting the safe-haven buck and capping gains for the risk-sensitive kiwi.

The fundamental backdrop makes it prudent to wait for strong follow-through buying before confirming that the NZD/USD pair has formed a near-term bottom and positioning for any further gains. In the absence of any market-moving US economic data, the broader risk sentiment might influence the USD and provide some impetus to the major.

Technical levels to watch

Flash Purchasing Managers' Indexes (PMIs) start coming out tomorrow. A disappointing figure from Germany could drag the EUR/USD pair sustainably under parity, Kit Juckes, Chief Global FX Strategist at Société Générale, reports.

The Damoclean sword hanging over the European economy is not going away

“In Europe, national surveys have been stronger than the PMI data, which may give some hope for a stronger figure, but in Germany, gas prices, the water level in the Rhine and inflation are having a devastating impact on business confidence.”

“A very bad German PMI might be enough to cement EUR/USD under parity, even if other countries fare patter.”

EUR/USD is on track to test the July 14 cycle low near 0.9950. Below here, the pair could sink as low as the September 2002 low near 0.9615, economists at BBH report.

The Bundesbank offered a worrisome outlook

“The single currency traded below parity today to the lowest level since July 14 and is on track to test that day’s low near 0.9950. After that, the next target is the September 2002 low near 0.9615.”

“The Bundesbank noted that continued normalization of ECB policy is appropriate since inflation risks skewed to the upside. Lastly, the bank warned that the odds of economic contraction this winter have risen significantly due to the outlook for natural gas.”

Economists at ABN Amro have lowered their growth and inflation forecasts for the US, with a significantly weaker recovery in investment now expected. They see the US heading for a mild recession.

Fed to continue hiking interest rates aggressively

“We have halved our forecast for fixed investment to just 2.5% for 2022, down from 5% previously, and made a more modest downward adjustment for 2023 to 1.9% from 3.3% previously. Our expectation for stagnant consumption in H2 2022 remains broadly unchanged. This takes our overall GDP forecast for 2022 down to 1.7% from 2.2% previously, and to 1.0% from 1.3% previously.”

“We do expect the labour market to deteriorate on the back of softening demand, with unemployment expected to begin rising from Q4 onwards. Ultimately, we expect unemployment to rise c.1.5pp to around 5% by end-2023, with the NBER calling a recession perhaps in H2 2023.”

“Our base case remains for the Fed to raise rates in 50 bps steps in September and October, with 25 bps hikes expected in December and February – taking the upper bound of the fed funds rate to 4%.”

“Beyond the hiking cycle, we continue to expect the Fed to begin reversing course in the second half of 2023. Our base case is that the Fed cuts rates in four 25 bps steps in H2 2023, taking the upper bound of the fed funds rate to 3% by end-2023.”

The US dollar continues to gain as the new week begins. Economists at BBH expect the US Dollar Index (DXY) to test the July 14 high around 109.30.

Dollar to remains firm

“DXY is up for the fourth straight day and is coming off of its best week since March 2020, trading near 108.17 currently. This is the highest since July 15 and it is on track to test the July 14 high near 109.294.”

“As risk-off impulses ebb, the dollar should continue to benefit from the relatively strong US economic outlook and heightened Fed tightening expectations. These drivers are likely to persist this week, with Fed Chair Powell expected to deliver a hawkish message at Jackson Hole and eurozone PMIs expected to show further softness in August.”

USD/IDR could extend the rally further and revisit the 14,925 level in the short-term horizon, suggests X Strategist Quek Ser Leang at UOB Group’s Global Economics & Markets Research.

Key Quotes

“The swift and sharp rebound in USD/IDR last week came as a surprise (we were of the view that the weakness in USD/IDR could extend to 14,620 first before stabilization is likely).”

“The rapid rebound has scope to rise above the trend-line resistance at 14,925. While daily MACD is turning positive, overbought shorter-term conditions suggest the next resistance at 14,990 is unlikely to come under threat. Support is at 14,820 followed by 14,750.”

- EUR/JPY seems to have now moved into a consolidative phase.

- Immediately to the upside emerges the August high at 138.40.

EUR/JPY fades Friday’s advance and resumes the downside around the 137.00 region on Monday.

If the cross manages to break above the ongoing range bound theme, the so far August high at 138.39 (August 10) is expected to come into focus once again. Above the latter, EUR/JPY could attempt a move to the 55-day SMA, today at 139.36.

While above the 200-day SMA at 134.08, the prospects for the pair should remain constructive.

EUR/JPY daily chart

Analysts at Natixis show in the cases of the United States and the eurozone that after an inflationary shock, inflation subsides spontaneously. But this does not absolve the central banks from acting against inflation.

Inflation subsides spontaneously, but too slowly to stabilise the price level

“The inflation dynamics is stable: inflationary shocks in the US and the eurozone gradually disappear.”

“In reality, central banks must react to inflation even if it subsides spontaneously. The pace of inflation’s retreat is slow. This means that if the central bank does not act to accelerate the rate of disinflation, inflation expectations may diverge. The price level has time to rise above the reference price level, leading to a loss of cost competitiveness and a loss of credibility for the central bank.”

- USD/CAD struggles to capitalize on its modest intraday gains to over a one-month high.

- An uptick in crude oil prices underpins the loonie and acts as a headwind for spot prices.

- Hawkish Fed expectations, the risk-off mood boosts the USD and limits the downside.

The USD/CAD pair retreats from over a one-month high touched earlier this Monday and drops to the 1.2980-1.2975 area, closer to the daily low during the first half of the European session.

A modest uptick in crude oil prices underpins the commodity-linked loonie, which, in turn, is seen as a key factor acting as a headwind for the USD/CAD pair. Concerns that the European Union embargoes on Russian oil imports could tighten supply offer support to the black liquid. That said, efforts to revive Iran's nuclear deal and worries about a global economic downturn could cap any meaningful gains for the commodity. Apart from this, sustained US dollar buying should help limit the downside for the major, at least for the time being.

Firming expectations that the Fed will retain its aggressive policy tightening path remains supportive of the ongoing USD rally to its highest level since mid-July. Apart from this, the prevalent risk-off environment further drove some haven flows towards the greenback. Growing recession fears continue to weigh on investors' sentiment, which is evident from a generally weaker tone around the equity markets and boosts demand for safe-haven assets. This, in turn, supports prospects for the emergence of some dip-buying around the USD/CAD pair.

Furthermore, traders might also prefer to wait for Fed Chair Jerome Powell's speech at the Jackson Hole Symposium on Friday. Apart from this, traders this week will take cues from important US macro data. This, in turn, should influence the USD demand and provide a fresh directional impetus to the USD/CAD pair. In the meantime, absent relevant economic releases on Monday, either from the US or Canada, should hold back investors from placing aggressive bets.

Technical levels to watch

FX Strategist Quek Ser Leang at UOB Group’s Global Economics & Markets Research suggested USD/MYR could maintain the bullish bias for the time being.

Key Quotes

“While we expected USD/MYR to strengthen last week, we were of the view that ‘a sustained advance above 4.4615 is unlikely’. We did not anticipate the strong rally as USD/MYR soared to 4.4780 last Friday before extending its advance today.”

“Further USD/MYR strength is not ruled out but shorter-term conditions are deeply overbought and the 2017 high at 4.4980 is likely out of reach for now (there is another resistance at 4.4900). On the downside, the ‘break-out’ level at 4.4615 is a solid support level now.”

- USD/CHF gains traction for the sixth straight day and climbs to over a two-week high on Monday.

- Hawkish Fed expectations continue to underpin the USD and remain supportive of the move up.

- Recession fears, the risk-off mood benefits the safe-haven CHF and seems to cap gains for the pair.

The USD/CHF pair prolongs its bullish move witnessed over the past one week or so and edges higher for the sixth successive day on Monday. Spot prices climb to over a two-week high during the first half of the European session, though bulls seem struggling to capitalize on the move beyond the 0.9600 mark.

The US dollar buying remains unabated on the first day of a new week and turns out to be a key factor that continues to act as a tailwind for the USD/CHF pair. In fact, the USD Index climbs to its highest level since mid-July and remains well supported by hawkish Fed expectations. The recent comments by several Fed officials suggest that the US central bank will stick to its aggressive policy tightening path.

Investors, however, remain divided over the size of the next rate hike at the September meeting. Hence, Fed Chair Jerome Powell's speech at the Jackson Hole Symposium on Friday will be looked upon for clues about the central bank's policy outlook. Traders would further take cues from this week's important US macro releases, which will influence the USD and provide a fresh directional impetus to the USD/CHF pair.

In the meantime, growing worries about a global economic downturn continue to weigh on investors' sentiment. This is evident from the prevalent risk-off environment, which offers support to the safe-haven Swiss franc and seems to cap gains for the USD/CHF pair. The mixed fundamental backdrop warrants caution for bullish traders and positioning for any further gains amid absent relevant US economic data on Monday.

Technical levels to watch

Quek Ser Leang at UOB Group’s Global Economics & Markets Research noted USD/THB could advance further in the near term.

Key Quotes

“Last Monday (15 Aug, spot at 35.50), we highlighted ‘35.06 is likely a short-term bottom’ and we expected the rebound in USD/THB to ‘extend to 35.80’. Our view turned out to be correct as USD/THB rose to 35.81 last Friday before extending its advance today.”

“Further USD/THB strength appears likely even though overbought conditions suggest that 36.36 is unlikely to come into the picture, at least for this week. On a shorter-term note, 36.05 is already a strong resistance level. On the downside, a breach of 35.55 would indicate that the current upward pressure has eased.”

- Further weakness prompts EUR/USD to breach the parity level.

- Extra downside could challenge the YTD low near 0.9950.

- The dollar extends the rally further beyond the 108.00 yardstick.

Sellers remain well in control of the sentiment surrounding the European currency and drag EUR/USD to levels just below parity at the beginning of the week.

EUR/USD now looks to a probable test of 2022 low