- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 23-10-2018

| Raw materials | Closing price | % change |

| Oil | $66.22 | -0.32% |

| Gold | $1,234.80 | -0.16% |

| Index | Change items | Closing price | % change |

| Nikkei | -604.04 | 22010.78 | -2.67% |

| TOPIX | -44.59 | 1650.72 | -2.63% |

| CSI 300 | -86.84 | 3183.43 | -2.66% |

| KOSPI | -55.61 | 2106.10 | -2.57 |

| FTSE 100 | -87.59 | 6955.21 | -1.24% |

| DAX | -250.06 | 11274.28 | -2.17% |

| CAC 40 | -85.62 | 4967.69 | -1.69% |

| DJIA | -125.98 | 25191.43 | -0.50% |

| S&P 500 | -15.19 | 2740.69 | -0.55% |

| NASDAQ | -31.09 | 7437.54 | -0.42% |

| Pare | Closed | % change |

| EUR/USD | $1,1471 | +0,06% |

| GBP/USD | $1,2981 | +0,15% |

| USD/CHF | Chf0,99475 | -0,10% |

| USD/JPY | Y112,41 | -0,36% |

| EUR/JPY | Y128,95 | -0,30% |

| GBP/JPY | Y145,925 | -0,20% |

| AUD/USD | $0,7084 | +0,05% |

| NZD/USD | $0,6551 | -0,04% |

| USD/CAD | C$1,30846 | -0,13% |

Major US stock indexes fell moderately, as disappointing forecasts from industrial giants Caterpillar and 3M triggered alarm calls about corporate growth and added to concerns about a slowdown in China and diplomatic isolation of Saudi Arabia.

The US data was also in focus. Production activity in the Fifth District expanded moderately in October, according to the results of the Federal Reserve Bank of Richmond millet. The composite index of business activity fell from 29 in September to 15 in October, as sub-indices of supply and new orders fell, and the employment component rose. However, respondents were optimistic, expecting to see a positive increase in most measures in the coming months.

Oil prices fell by more than 4% on Tuesday after Saudi Arabia stated that it could supply more crude if necessary, encouraging investors in anticipation of US sanctions on Iran's oil exports next month.

Most of the components of DOW recorded a decrease (19 of 30). Caterpillar Inc. shares turned out to be an outsider. (CAT, -7.48%). The growth leader was McDonald's Corporation (MCD, + 6.30%).

Almost all sectors of the S & P finished trading in the red. The largest decline was in the commodity sector (-2.2%). The consumer goods sector grew the most (+ 0.5%).

At the time of closing:

Dow 25,191.43 -125.98 -0.50%

S & P 500 2,740.69 -15.19 -0.55%

Nasdaq 100 7,437.54 -31.09 -0.42

Fifth District manufacturing activity expanded moderately in October, according to the results from the most recent survey by the Federal Reserve Bank of Richmond. The composite index fell from 29 in September to 15 in August, as indexes for shipments and new orders dropped, while the third component, employment, rose. However, survey respondents were optimistic, expecting to see positive growth across most measures in the coming months.

The yield on the 10-year Treasury note fell 4.7 basis points to 3.141%, while the 2-year Treasury note yield declined 2.9 basis points to 2.867% and the 30-year Treasury bond yield fell 4.6 basis points to 3.335%. Yields and debt prices move in opposite directions.

U.S. stock-index futures fell sharply on Tuesday, as mixed earnings piled on to concerns over rising global tensions, Italy's budgetary woes. and trade war fears.

Global Stocks:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Nikkei | 22,010.78 | -604.04 | -2.67% |

| Hang Seng | 25,346.55 | -806.60 | -3.08% |

| Shanghai | 2,594.83 | -60.05 | -2.26% |

| S&P/ASX | 5,843.10 | -61.80 | -1.05% |

| FTSE | 6,973.93 | -68.87 | -0.98% |

| CAC | 4,997.20 | -56.11 | -1.11% |

| DAX | 11,310.55 | -213.79 | -1.86% |

| Crude | $68.15 | | -1.74% |

| Gold | $1,241.10 | | +1.35% |

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 187.21 | -14.15(-7.03%) | 183355 |

| ALCOA INC. | AA | 38.85 | -0.61(-1.55%) | 15469 |

| ALTRIA GROUP INC. | MO | 61.37 | 0.06(0.10%) | 801 |

| Amazon.com Inc., NASDAQ | AMZN | 1,755.00 | -34.30(-1.92%) | 79922 |

| American Express Co | AXP | 102.5 | -2.01(-1.92%) | 8979 |

| AMERICAN INTERNATIONAL GROUP | AIG | 44.32 | -0.64(-1.42%) | 2980 |

| Apple Inc. | AAPL | 215.81 | -4.84(-2.19%) | 520329 |

| AT&T Inc | T | 32.6 | -0.07(-0.21%) | 40715 |

| Barrick Gold Corporation, NYSE | ABX | 13.6 | 0.51(3.90%) | 224869 |

| Boeing Co | BA | 348.25 | -7.73(-2.17%) | 22419 |

| Caterpillar Inc | CAT | 118.77 | -9.94(-7.72%) | 538562 |

| Chevron Corp | CVX | 115.4 | -1.81(-1.54%) | 9365 |

| Cisco Systems Inc | CSCO | 45.06 | -0.70(-1.53%) | 24032 |

| Citigroup Inc., NYSE | C | 65.26 | -1.33(-2.00%) | 70777 |

| Deere & Company, NYSE | DE | 141 | -4.44(-3.05%) | 11007 |

| Exxon Mobil Corp | XOM | 79.79 | -1.36(-1.68%) | 11429 |

| Facebook, Inc. | FB | 151.89 | -2.89(-1.87%) | 131366 |

| FedEx Corporation, NYSE | FDX | 215.25 | -3.15(-1.44%) | 1310 |

| Ford Motor Co. | F | 8.3 | -0.11(-1.31%) | 105094 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 11.65 | -0.35(-2.92%) | 75034 |

| General Electric Co | GE | 12.2 | -0.18(-1.45%) | 149431 |

| General Motors Company, NYSE | GM | 30.9 | -0.44(-1.40%) | 21263 |

| Goldman Sachs | GS | 217.62 | -3.98(-1.80%) | 8031 |

| Google Inc. | GOOG | 1,083.50 | -17.66(-1.60%) | 4677 |

| Hewlett-Packard Co. | HPQ | 23.62 | -0.49(-2.03%) | 1200 |

| Home Depot Inc | HD | 176.2 | -2.55(-1.43%) | 12490 |

| HONEYWELL INTERNATIONAL INC. | HON | 150 | -2.61(-1.71%) | 1107 |

| Intel Corp | INTC | 44.17 | -0.84(-1.87%) | 82183 |

| International Business Machines Co... | IBM | 128.72 | -1.30(-1.00%) | 27251 |

| International Paper Company | IP | 40.5 | -0.43(-1.05%) | 200 |

| Johnson & Johnson | JNJ | 137.57 | -1.11(-0.80%) | 5548 |

| JPMorgan Chase and Co | JPM | 104.36 | -2.00(-1.88%) | 64436 |

| McDonald's Corp | MCD | 170.5 | 3.87(2.32%) | 127368 |

| Merck & Co Inc | MRK | 71.78 | -0.79(-1.09%) | 8666 |

| Microsoft Corp | MSFT | 107.92 | -1.71(-1.56%) | 170724 |

| Nike | NKE | 73.9 | -1.00(-1.34%) | 6622 |

| Pfizer Inc | PFE | 43.85 | -0.52(-1.17%) | 5779 |

| Procter & Gamble Co | PG | 85.83 | -0.77(-0.89%) | 10414 |

| Starbucks Corporation, NASDAQ | SBUX | 58 | -0.90(-1.53%) | 4508 |

| Tesla Motors, Inc., NASDAQ | TSLA | 258.07 | -2.88(-1.10%) | 138058 |

| The Coca-Cola Co | KO | 45.41 | -0.56(-1.22%) | 84707 |

| Travelers Companies Inc | TRV | 123.03 | -1.04(-0.84%) | 1909 |

| Twitter, Inc., NYSE | TWTR | 28.5 | -0.68(-2.33%) | 77059 |

| United Technologies Corp | UTX | 125 | -1.40(-1.11%) | 43519 |

| UnitedHealth Group Inc | UNH | 259.81 | -2.38(-0.91%) | 7313 |

| Verizon Communications Inc | VZ | 55.85 | 0.87(1.58%) | 176013 |

| Visa | V | 137.74 | -2.90(-2.06%) | 26537 |

| Wal-Mart Stores Inc | WMT | 95.91 | -1.23(-1.27%) | 18744 |

| Walt Disney Co | DIS | 116.7 | -1.57(-1.33%) | 11647 |

| Yandex N.V., NASDAQ | YNDX | 27.42 | -0.11(-0.40%) | 32930 |

Home Depot (HD) target lowered to $200 from $225 at Morgan Stanley

Int'l Paper (IP) initiated with a Neutral at Seaport Global Securities

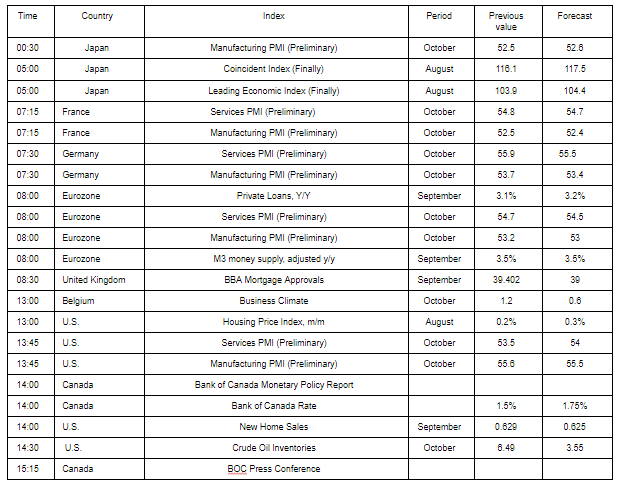

McDonald's (MCD) reported Q3 FY 2018 earnings of $2.10 per share (versus $1.76 in Q3 FY 2017), beating analysts' consensus estimate of $1.99.

The company's quarterly revenues amounted to $5.369 bln (-6.7% y/y), beating analysts' consensus estimate of $5.284 bln.

MCD rose to $171.50 (+2.92%) in pre-market trading.

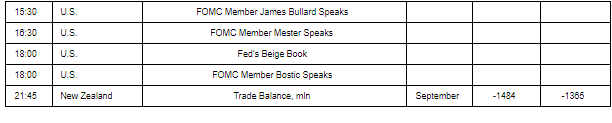

United Tech (UTX) reported Q3 FY 2018 earnings of $1.93 per share (versus $1.73 in Q3 FY 2017), beating analysts' consensus estimate of $1.82.

The company's quarterly revenues amounted to $16.510 bln (+9.6% y/y), beating analysts' consensus estimate of $16.105 bln.

The company also issued in-line guidance for FY 2018, projecting EPS of $7.20-7.30 (compared to its prior guidance of $7.10-7.25 and analysts' consensus estimate of $7.24) at revenues of $64-64.5 bln (compared to its prior guidance of $63.5-64.5 bln and analysts' consensus estimate of $64.47 bln).

UTX rose to $127.00 (+0.47%) in pre-market trading.

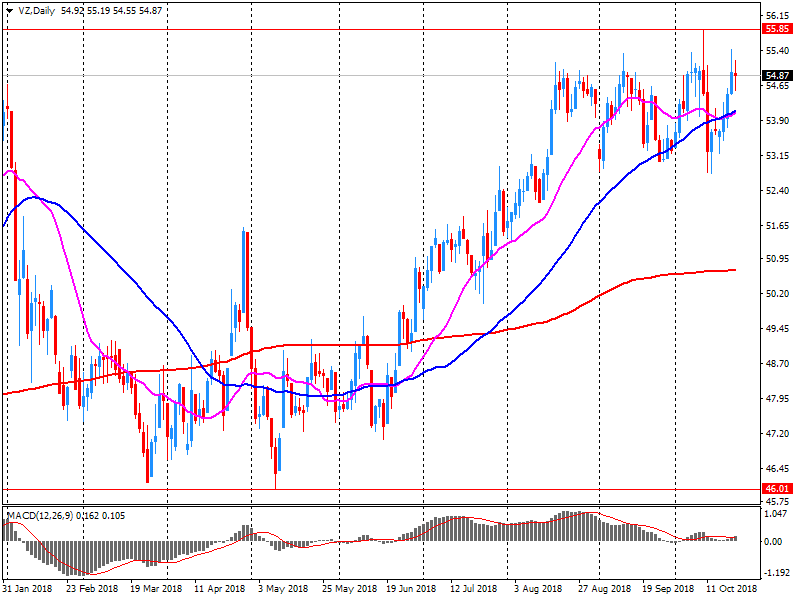

Verizon (VZ) reported Q3 FY 2018 earnings of $1.22 per share (versus $0.98 in Q3 FY 2017), beating analysts' consensus estimate of $1.19.

The company's quarterly revenues amounted to $32.607 bln (+2.8% y/y), generally in-line with analysts' consensus estimate of $32.453 bln.

VZ rose to $55.29 (+0.56%) in pre-market trading.

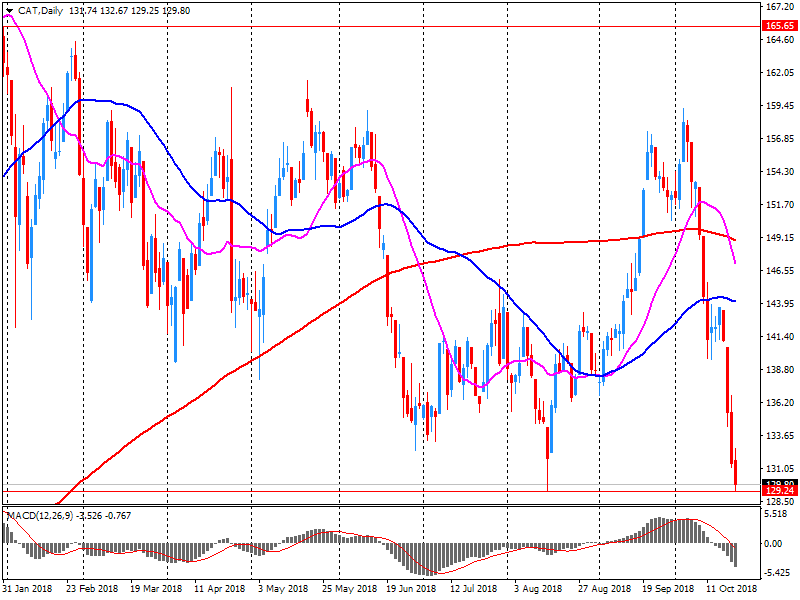

Caterpillar (CAT) reported Q3 FY 2018 earnings of $2.86 per share (versus $1.95 in Q3 FY 2017), beating analysts' consensus estimate of $2.85.

The company's quarterly revenues amounted to $13.510 bln (+18.4% y/y), beating analysts' consensus estimate of $13.277 bln.

The company also reaffirmed FY 2018 EPS guidance at $11.0-12.0 versus analysts' consensus estimate of $11.66.

CAT fell to $119.82 (-6.91%) in pre-market trading.

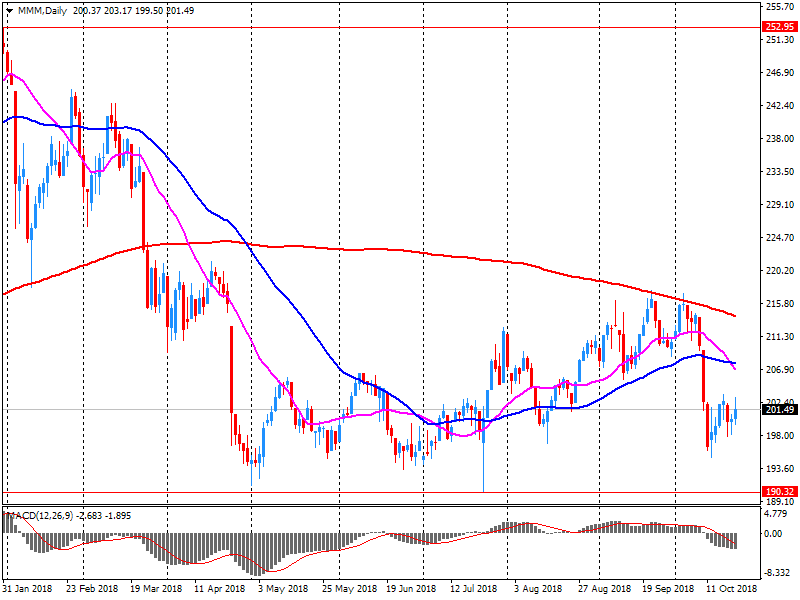

3M (MMM) reported Q3 FY 2018 earnings of $2.58 per share (versus $2.33 in Q3 FY 2017), missing analysts' consensus estimate of $2.70.

The company's quarterly revenues amounted to $8.152 bln (-0.2% y/y), missing analysts' consensus estimate of $8.413 bln.

The company also issued lowered guidance for FY 2018, projected EPS of $9.90-10.00 compared to its prior guidance of $10.20-10.45 and analysts' consensus estimate of $10.28.

MMM fell to $186.50 (-7.38%) in pre-market trading.

Manufacturing new orders fell at the fastest pace in three years in the quarter to October, reflecting falls in both domestic and export orders, according to the latest quarterly CBI Industrial Trends Survey.

The survey of 354 manufacturers showed that output growth was stable at an above-average pace in the three months to October relative to the quarter to September. But output growth is expected to stall in the three months to January 2019 - marking the weakest expectations in around three years. Total new orders are also set to fall a little further in the quarter ahead.

Business optimism tumbled at the fastest pace since the UK's vote to leave the EU, while optimism about export prospects for the year ahead fell at the fastest pace since the Eurozone crisis. Meanwhile, concerns that political and economic conditions were likely to limit export orders over the next three months were the highest since immediately after the EU Referendum.

The United States cannot stop Iran's oil exports by imposing sanctions on Tehran, Iran's oil minister said on Tuesday, warning that such restrictions would ensure market stability.

Washington plans to introduce new sanctions against Iran's oil sector from 4 November in order to stop the country's participation in the military conflicts in Syria and Iraq and bring Tehran to the negotiating table on its ballistic missile program.

"As long as America has targeted sanctions on Iran, one of the largest oil producers, volatility in the oil market will continue," said Iranian oil minister. "The export of Iranian oil cannot be stopped".

US Treasury Secretary Mnuchin, in an interview with Reuters on Sunday, dismissed concerns that oil prices might rise, saying that the market had already taken into account the supply cut.

Iran's regional rival, US ally Saudi Arabia, says that Riyadh has the potential to increase black gold production to 12 million barrels per day from the current 10.7 million barrels per day.

The Organization of Petroleum Exporting Countries, of which Saudi Arabia and Iran are members, agreed to increase supplies in June to compensate for the expected disruption of supplies from Iran.

Chris Beauchamp, Chief Market Analyst at IG wrote:

"European equities are plumbing new depths this morning, while the FTSE 100 is down 60 points in mid-morning trading.

The sell-off has resumed across markets, as yesterday's brief bounce passes quickly into history. As the number of earnings misses rises, investors have continued to flee from European equities. If this was an earlier time, the calls for ECB intervention would probably start around now, but investors are all too aware that the ECB's role of riding to the rescue has come to an end, and the bank seems disinclined to intervene in the Italy budget crisis. All eyes will be on US markets now - a much lower open is on the cards, and we should expect the losses to intensify. Given the corporate and economic backdrop, this is still likely to result in a new move higher, at least for US equities, but we are due some hefty volatility first."

-

Downgrades Exports Assessment To Almost Flat From Recent Pause

-

Maintains Economic Assessment For October

-

Net Easing in Credit Standards Was Stronger Than Expected

-

Banks Expect Standards for Business Loans to Be Broadly Unchanged in 4Q

-

Banks Slightly Eased Standards for Loans for House Purchases in 3Q

-

Banks Expect Net Easing of Credit Standards for Housing Loans in 4Q

-

Standards for Consumer Credit Remained Broadly Unchanged in 3Q

-

Net Loan Demand Continued to Increase Across All Categories in 3Q

EUR/USD

Resistance levels (open interest**, contracts)

$1.1610 (1064)

$1.1586 (833)

$1.1552 (146)

Price at time of writing this review: $1.1456

Support levels (open interest**, contracts):

$1.1400 (6004)

$1.1365 (3324)

$1.1325 (2979)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date November, 19 is 83576 contracts (according to data from October, 22) with the maximum number of contracts with strike price $1,1450 (6004);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3168 (890)

$1.3114 (847)

$1.3093 (707)

Price at time of writing this review: $1.2973

Support levels (open interest**, contracts):

$1.2915 (2080)

$1.2890 (3169)

$1.2861 (1314)

Comments:

- Overall open interest on the CALL options with the expiration date November, 19 is 23953 contracts, with the maximum number of contracts with strike price $1,3500 (3235);

- Overall open interest on the PUT options with the expiration date November, 19 is 30446 contracts, with the maximum number of contracts with strike price $1,3000 (3169);

- The ratio of PUT/CALL was 1.27 versus 1.24 from the previous trading day according to data from October, 22

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

Trump sees 'many' possible penalties for Saudis

-

More details expected in 1-2 days

On Friday, Moody's announced that it had lowered Italy's credit rating to Baa3 (from Baa2), moving to a neutral perspective. A press release from Moody's shows that the downgrade had two driving factors: a significant weakening of Italy's fiscal power and negative implications for medium-term growth due to the breakdown of structural economic and fiscal reform plans.

According to Moody's, the planned fiscal stance of the Italian government will stabilize the debt-to-GDP ratio at 130%, rather than decline in the coming years, which will make Italy vulnerable to external shocks. Regarding growth, Moody's believes that the plans of the Italian government could limit the short-term impact on GDP.

On Friday, S & P will publish an update of the sovereign rating of Italy, which is currently at the BBB level with a neutral outlook. As expected, the S & P will change its outlook to negative.

The downgrade does not seem to have affected the Italian government's approach to negotiations with the EU.

The tensions between the EU Commission and the Italian government, following the submission of the Italian draft budget, are developing rapidly.

It is expected that the commission will appeal to the Government of Italy with a request to submit a revised draft. By not allowing a significant acceleration of market pressure on Italian bonds, the government is likely to accept only limited amendments to the current text, perhaps in the direction of the obligation to resume structural adjustment in 2020, rather than in 2022.

With the imminent European elections of 2019, the risk is that the Italian government will maintain a complex attitude towards Europe over the next few months, not taking the attitude to the extreme. This is an environment that will tend to keep volatility in the Italian government bond market high.

Negative start of trading on the stock markets of Europe is expected, following a decline in the APR trading due to the political situation in Europe and the growing geopolitical tension between the United States and Saudi Arabia.

In September 2018 the index of producer prices for industrial products rose by 3.2% compared with the corresponding month of the preceding year. In August the annual rate of change all over had been 3.1%, as reported by the Federal Statistical Office (Destatis).

Compared with the preceding month August the overall index rose by 0.5% in September 2018 (+0.3 % in August 2018 and +0.2% in July 2018).

In September 2018 the price indices of the most main industrial groups increased compared with September 2017: Energy prices were up 8.5%, though the development of prices of the different energy carriers diverged. Prices of petroleum products were up 18.5%, whereas prices of electricity increased by 9.0% and prices of natural gas (distribution) rose by 7.0%. Prices of intermediate goods were up 2.5%. Prices of durable consumer goods rose by 1.7% and of capital goods by 1.4%, whereas prices of non-durable consumer goods did not change.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.