- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 24-10-2018

| Raw materials | Closing price | % change |

| Oil | $66.39 | -0.64% |

| Gold | $1,237.20 | +0.50% |

| Index | Change items | Closing price | % change |

| Nikkei | +80.40 | 22091.18 | +0.37% |

| TOPIX | +1.35 | 1652.07 | +0.08% |

| CSI 300 | +4.77 | 3188.20 | +0.15% |

| KOSPI | -8.52 | 2097.58 | -0.40% |

| FTSE 100 | +7.77 | 6962.98 | +0.11% |

| DAX | -82.65 | 11191.63 | -0.73% |

| CAC 40 | -14.60 | 4953.09 | -0.29% |

| DJIA | -608.01 | 24583.42 | -2.41% |

| S&P 500 | -84.59 | 2656.10 | -3.09% |

| NASDAQ | -329.14 | 7108.40 | -4.43% |

| Pare | Closed | % change |

| EUR/USD | $1,1397 | -0,65% |

| GBP/USD | $1,2880 | -0,78% |

| USD/CHF | Chf0,99717 | +0,14% |

| USD/JPY | Y112,13 | -0,25% |

| EUR/JPY | Y128,80 | -0,11% |

| GBP/JPY | Y144,448 | -1,02% |

| AUD/USD | $0,7063 | -0,30% |

| NZD/USD | $0,6523 | -0,43% |

| USD/CAD | C$1,30404 | -0,34% |

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 06:00 | Germany | Gfk Consumer Confidence Survey | November | 10.6 | 10.5 |

| 08:00 | Germany | IFO - Expectations | October | 101 | 100.3 |

| 08:00 | Germany | IFO - Current Assessment | October | 106.4 | 106 |

| 08:00 | Germany | IFO - Business Climate | October | 103.7 | 103 |

| 11:45 | Eurozone | ECB Interest Rate Decision | 0% | 0% | |

| 12:30 | U.S. | Goods Trade Balance, $ bln. | September | -75.8 | -74.9 |

| 12:30 | U.S. | Continuing Jobless Claims | October | 1640 | 1653 |

| 12:30 | U.S. | Initial Jobless Claims | October | 210 | 214 |

| 12:30 | U.S. | Durable goods orders ex defense | September | 2.6% | 0.1% |

| 12:30 | U.S. | Durable Goods Orders ex Transportation | September | 0.1% | 0.5% |

| 12:30 | U.S. | Durable Goods Orders | September | 4.5% | -1% |

| 12:30 | Eurozone | ECB Press Conference | |||

| 14:00 | U.S. | Pending Home Sales (MoM) | September | -1.8% | -0.1% |

| 16:15 | U.S. | FOMC Member Clarida Speaks | |||

| 23:00 | U.S. | FOMC Member Mester Speaks | |||

| 23:30 | Japan | Tokyo CPI ex Fresh Food, y/y | October | 1% | 1% |

| 23:30 | Japan | Tokyo Consumer Price Index, y/y | October | 1.3% |

Major US stock indexes have declined significantly, as weak quarterly results from AT&T and poor forecasts from chip makers overshadowed optimism from Boeing results for the quarter.

In addition, investors were disappointed data on the US housing market. As it became known, sales of single-family homes fell to almost 2-year lows in September, and the data for the previous three months were revised down, which is the last sign that rising mortgage rates and higher prices are undermining the country's housing market . The Commerce Department reported that new home sales fell 5.5% to a seasonally adjusted annual figure of 553,000 units. It was the lowest level since December 2016. The pace of sales in August was revised to 585,000 units from 629,000 units.

The focus was also on the Fed Beige Book. The paper said that companies are still optimistic about the economic growth trajectory, but they pointed to concerns that prices will continue to rise due to import duties. Most of the 12 regions in the zone of responsibility of the Fed reported moderate or modest economic growth in early autumn. The beige book was based on information received before October 15 inclusive.

Most of the components of DOW finished trading in the red (24 of 30). Outsiders were United Technologies Corporation (UTX, -5.44%). The growth leader was the shares of The Procter & Gamble Company (PG, + 2.76%).

Almost all sectors of the S & P recorded a decline. The largest decline was shown by the technology sector (-3.8%). The utility sector grew the most (+ 1.8%).

At the time of closing:

Index

Dow 24,581.28 -610.15 -2.42%

S & P 500 2,656.18 -84.51 -3.08%

Nasdaq 100 7,108.40 -329.14 -4.43%

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 6.3 million barrels from the previous week. At 422.8 million barrels, U.S. crude oil inventories are about 2% above the five year average for this time of year.

Total motor gasoline inventories decreased by 4.8 million barrels last week and are about 6% above the five year average for this time of year. Finished gasoline and blending components inventories both decreased last week.

Distillate fuel inventories decreased by 2.3 million barrels last week and are about 4% below the five year average for this time of year. Propane/propylene inventories decreased by 0.3 million barrels last week and are about 4% below the five year average for this time of year. Total commercial petroleum inventories decreased last week by 8.0 million barrels last week

Sales of new single‐family houses in September 2018 were at a seasonally adjusted annual rate of 553,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 5.5 percent below the revised August rate of 585,000 and is 13.2 percent below the September 2017 estimate of 637,000.

The median sales price of new houses sold in September 2018 was $320,000. The average sales price was $377,200.

-

It is necessary to raise the interest rate to a neutral level to achieve the target level of inflation.

-

The neutral rate range is 2.5% -3.5%

-

New trade agreement will reduce uncertainty, increase company confidence and investment

-

US-China trade conflict puts pressure on growth and commodity prices

-

Company investment and export prospects improved due to new trade agreement

-

Adjusting the economy for higher rates and world trade policy will determine further rates of rate increases.

-

Real GDP will grow by 2.1% in 2018 and 2019, but will slow to 1.9% in 2020

-

Canadian economy growth is close to potential

-

Household risks are decreasing, although still high

-

Temporary factors pushing inflation up will weaken in early 2019

-

Inflation will remain near the target level of 2% until the end of 2020

"The Bank of Canada today increased its target for the overnight rate to 1 ¾ per cent. The Bank Rate is correspondingly 2 per cent and the deposit rate is 1 ½ per cent.

The global economic outlook remains solid. The US economy is especially robust and is expected to moderate over the projection horizon, as forecast in the Bank's July Monetary Policy Report (MPR). The new US-Mexico-Canada Agreement (USMCA) will reduce trade policy uncertainty in North America, which has been an important curb on business confidence and investment. However, trade conflict, particularly between the United States and China, is weighing on global growth and commodity prices. Financial market volatility has resurfaced and some emerging markets are under stress but, overall, global financial conditions remain accommodative.

The Canadian economy continues to operate close to its potential and the composition of growth is more balanced. Despite some quarterly fluctuations, growth is expected to average about 2 per cent over the second half of 2018. Real GDP is projected to grow by 2.1 per cent this year and next before slowing to 1.9 per cent in 2020".

U.S. stock-index futures traded flat on Wednesday, as investors assessed a slew of corporate earnings reports.

Global Stocks:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Nikkei | 22,091.18 | +80.40 | +0.37% |

| Hang Seng | 25,249.78 | -96.77 | -0.38% |

| Shanghai | 2,603.30 | +8.47 | +0.33% |

| S&P/ASX | 5,829.00 | -14.10 | -0.24% |

| FTSE | 7,036.04 | +80.83 | +1.16% |

| CAC | 5,035.52 | +67.83 | +1.37% |

| DAX | 11,358.94 | +84.66 | +0.75% |

| Crude | $66.96 | | +0.80% |

| Gold | $1,232.40 | | -0.36% |

The FHFA House Price Index (HPI) reported a 0.3 percent increase in U.S. house prices in August from the previous month. From August 2017 to August 2018, house prices were up 6.1 percent. For the nine census divisions, seasonally adjusted monthly price changes from July 2018 to August 2018 ranged from -0.7 percent in the Middle Atlantic division to +0.8 percent in the Pacific division. The 12-month changes were all positive, ranging from +4.0 percent in the Middle Atlantic division to +8.4 percent in the Mountain division.

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 37.28 | -0.04(-0.11%) | 2421 |

| ALTRIA GROUP INC. | MO | 62 | 0.15(0.24%) | 1679 |

| Amazon.com Inc., NASDAQ | AMZN | 1,777.25 | 8.55(0.48%) | 52314 |

| AMERICAN INTERNATIONAL GROUP | AIG | 44.2 | 0.02(0.05%) | 2580 |

| Apple Inc. | AAPL | 222.75 | 0.02(0.01%) | 271655 |

| AT&T Inc | T | 31.96 | -1.06(-3.21%) | 1687199 |

| Barrick Gold Corporation, NYSE | ABX | 13.3 | -0.04(-0.30%) | 18930 |

| Boeing Co | BA | 366.43 | 16.38(4.68%) | 161221 |

| Caterpillar Inc | CAT | 120.06 | 1.08(0.91%) | 45993 |

| Cisco Systems Inc | CSCO | 45.26 | -0.16(-0.35%) | 23379 |

| Exxon Mobil Corp | XOM | 80.02 | 0.18(0.23%) | 2500 |

| Facebook, Inc. | FB | 154.5 | 0.11(0.07%) | 75201 |

| FedEx Corporation, NYSE | FDX | 216.06 | -2.32(-1.06%) | 989 |

| Ford Motor Co. | F | 8.58 | -0.01(-0.12%) | 12733 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 12.15 | 0.54(4.65%) | 164599 |

| General Electric Co | GE | 12.65 | -0.04(-0.32%) | 30569 |

| General Motors Company, NYSE | GM | 32 | -0.12(-0.37%) | 4557 |

| Google Inc. | GOOG | 1,107.00 | 3.31(0.30%) | 2519 |

| Home Depot Inc | HD | 178 | -0.53(-0.30%) | 748 |

| HONEYWELL INTERNATIONAL INC. | HON | 151 | 0.40(0.27%) | 1520 |

| Intel Corp | INTC | 44.3 | -0.20(-0.45%) | 25826 |

| International Business Machines Co... | IBM | 131.35 | 0.14(0.11%) | 1830 |

| International Paper Company | IP | 41.55 | 0.17(0.41%) | 1001 |

| Johnson & Johnson | JNJ | 139.03 | 0.10(0.07%) | 1403 |

| JPMorgan Chase and Co | JPM | 105.26 | 0.01(0.01%) | 7711 |

| McDonald's Corp | MCD | 176.35 | -0.80(-0.45%) | 21773 |

| Microsoft Corp | MSFT | 108.5 | 0.40(0.37%) | 155698 |

| Nike | NKE | 73.34 | -0.01(-0.01%) | 2571 |

| Pfizer Inc | PFE | 43.86 | -0.24(-0.54%) | 2978 |

| Procter & Gamble Co | PG | 87.03 | -0.13(-0.15%) | 6645 |

| Tesla Motors, Inc., NASDAQ | TSLA | 300.8 | 6.66(2.26%) | 411943 |

| Twitter, Inc., NYSE | TWTR | 28.8 | 0.03(0.10%) | 49702 |

| United Technologies Corp | UTX | 130.63 | 0.61(0.47%) | 2211 |

| UnitedHealth Group Inc | UNH | 265.68 | 0.82(0.31%) | 1321 |

| Verizon Communications Inc | VZ | 57.09 | -0.12(-0.21%) | 10859 |

| Visa | V | 139.47 | 0.35(0.25%) | 12153 |

| Walt Disney Co | DIS | 117.4 | -0.45(-0.38%) | 3449 |

| Yandex N.V., NASDAQ | YNDX | 27.6 | 0.82(3.06%) | 54519 |

Tesla (TSLA) initiated with a Mkt Outperform at JMP Securities; target $350

Verizon (VZ) coverage resumed with Buy at Guggenheim

McDonald's (MCD) target raised to $195 at Telsey Advisory Group

Morgan Stanley (MS) upgraded to Outperform from Market Perform at Wells Fargo

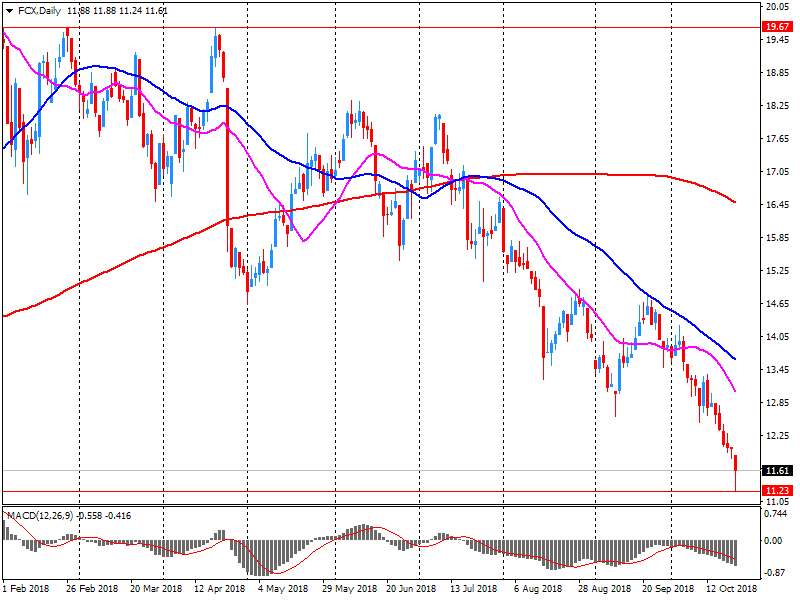

Freeport-McMoRan (FCX) reported Q3 FY 2018 earnings of $0.35 per share (versus $0.34 in Q3 FY 2017), beating analysts' consensus estimate of $0.32.

The company's quarterly revenues amounted to $4.908 bln (+13.9% y/y), beating analysts' consensus estimate of $4.499 bln.

FCX rose to $12.00 (+3.36%) in pre-market trading.

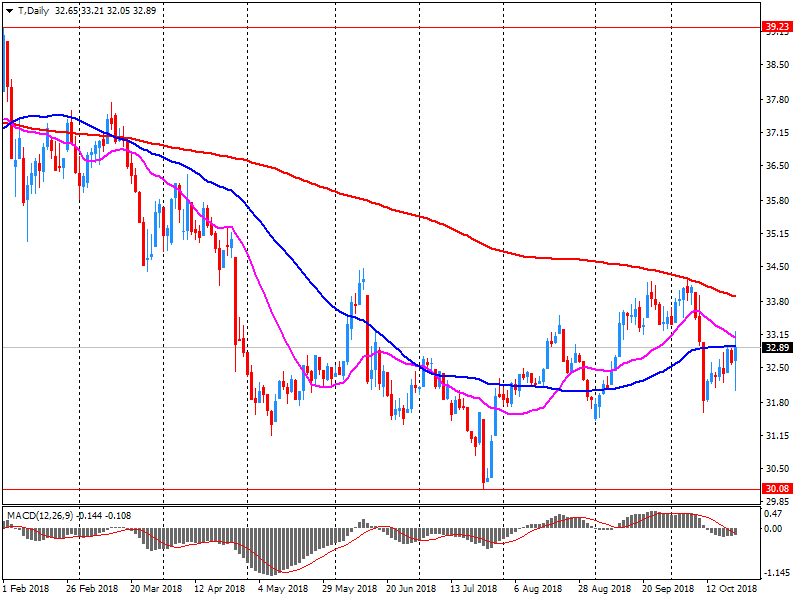

AT&T (T) reported Q3 FY 2018 earnings of $0.90 per share (versus $0.74 in Q3 FY 2017), missing analysts' consensus estimate of $0.95.

The company's quarterly revenues amounted to $45.739 bln (+15.3% y/y), generally in line with analysts' consensus estimate of $45.733 bln.

The company also reaffirmed guidance for FY 2018, projecting EPS of $3.50 versus analysts' consensus estimate of $3.53.

T fell to $32.00 (-3.09%) in pre-market trading.

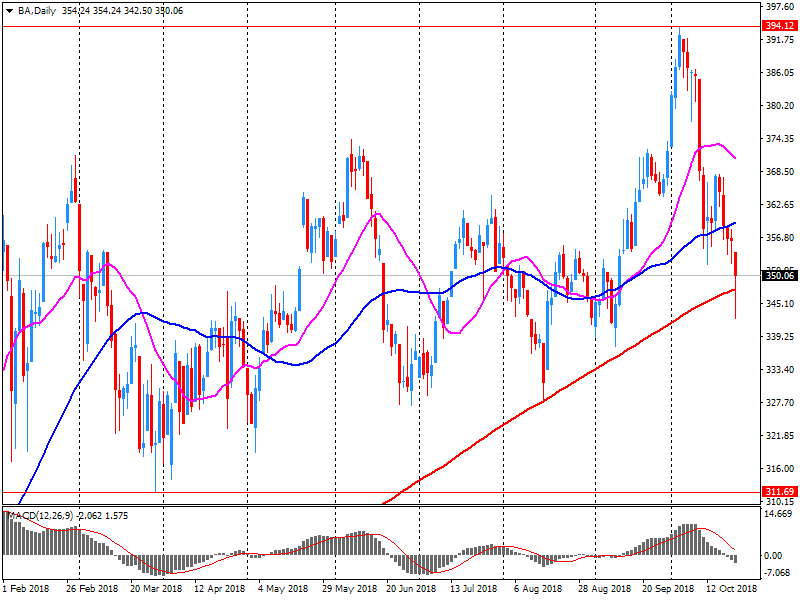

Boeing (BA) reported Q3 FY 2018 earnings of $3.58 per share (versus $2.72 in Q3 FY 2017), beating analysts' consensus estimate of $3.47.

The company's quarterly revenues amounted to $25.146 bln (+3.8% y/y), beating analysts' consensus estimate of $23.839 bln.

The company also issued upside guidance for FY 2018, projecting EPS of $14.90-15.10 (versus analysts' consensus estimate of $14.64 and its prior guidance of $14.30-14.50) and revenues of $98-100 bln (versus analysts' consensus estimate of $98.48 bln and its prior guidance of $97-99 bln).

BA rose to $365.50 (+4.41%) in pre-market trading.

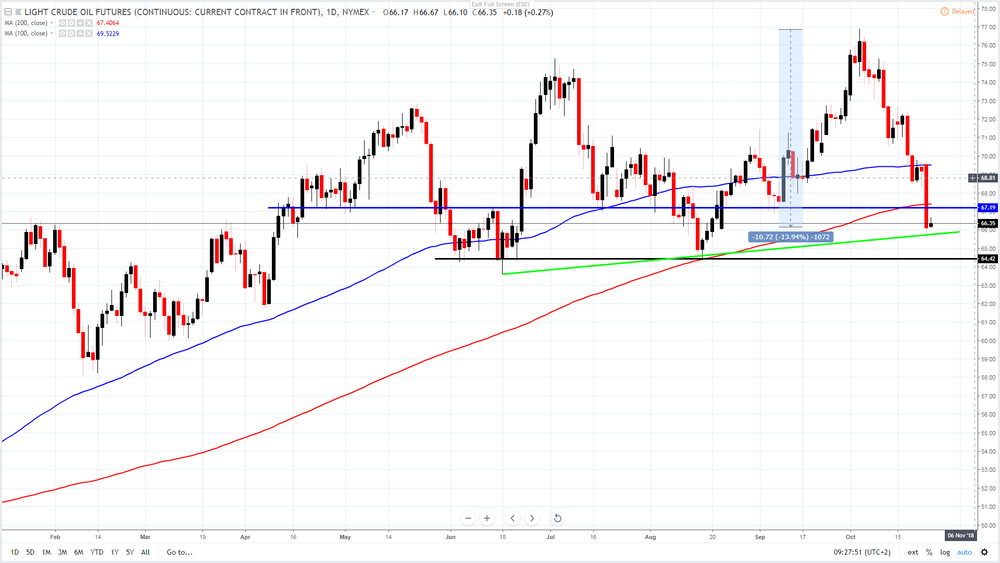

The price of oil fell sharply by nearly 5 per cent on Tuesday after comments that Saudis are ready to boost production to counterbalance missing barrels from Iran. This has caused a panic sell-off and the WTI benchmark dropped more than 3 USD. The price of oil was trying to consolidate on Wednesday and it was 0.30 per cent stronger during the London session, trading at around 66.30 USD.

The price dropped below the important level of 67.25 USD, where previous lows were converged with the 200-day moving average. The trend, therefore, switched to bearish and oil is now officially located in the correction territory, as the commodity is down 14 per cent from its October highs.

Bears will probably defend the mentioned level of 67.25 USD and if this resistance falls, further rise toward the 100-day moving average at 69.60 USD could occur.

On the downside, bulls are trying to hold the bullish trend line near yesterday's lows at 65.80 USD and if this support cracks, another stronger demand zone could be at June and August lows near 64.40 USD. The outlook seems bearish, as long as oil trades below 67.25 USD. Also, the outlook points to the possibility of rallies being sold.

Disclaimer:

Analysis and opinions provided herein are intended solely for informational and educational purposes and don't represent a recommendation or an investment advice by TeleTrade. Indiscriminate reliance on illustrative or informational materials may lead to losses.

-

Gross mortgage lending across the residential market in September was £21.5bn, some 1.2 per cent lower than last September.

-

The number of mortgages approved by the main high street banks in September was 9.1 per cent lower than last September; approvals for house purchase were 10.1 per cent lower, remortgage approvals were 7.4 per cent lower and approvals for other secured borrowing were 9.8 per cent lower.

-

The £10.0bn of credit card spending in September was 3.4 per cent higher than last September. Over the past twelve months, the outstanding level of credit card borrowing grew by 5.7 per cent. Personal borrowing through loans and overdrafts grew by 2.3 per cent in the year to September, although it has seen a net contraction in the last two months.

-

Personal deposits in total grew by 0.9 per cent over the past twelve months. A consumer preference to hold cash for immediate use is reflected in instant access deposit levels being 3.1 per cent higher than last September.

The annual growth rate of the broad monetary aggregate M3 stood at 3.5% in September 2018, after 3.4% in August, averaging 3.6% in the three months up to September. The components of M3 showed the following developments. The annual growth rate of the narrower aggregate M1, which comprises currency in circulation and overnight deposits, increased to 6.8% in September from 6.4% in August. The annual growth rate of short-term deposits other than overnight deposits (M2-M1) stood at -1.5% in September, unchanged from the previous month. The annual growth rate of marketable instruments (M3-M2) was -8.9% in September, compared with -4.0% in August.

Flash PMI survey data indicated that the eurozone economy grew at the slowest rate for over two years in October as an export-led slowdown continued to broaden-out to the service sector. In a sign that the slowdown has further to run, companies' expectations of future growth slipped to the lowest for nearly four years, with a near six-year low seen in manufacturing. Reduced optimism further dented hiring, hitting jobs growth. Price pressures meanwhile remained elevated, close to seven-year highs.

The IHS Markit Eurozone Composite PMI fell to 52.7 in October, down from 54.1 in September and reaching its lowest since September 2016, according to the flash reading (which is based on approximately 85% of usual monthly replies).

Business activity in the German private sector grew at the slowest rate for almost three-and-a-half years in October, according to the latest PMI® survey data, with both the manufacturing and service sectors showing notable losses of momentum at the start of the fourth quarter.

October saw the IHS Markit Flash Germany Composite Output Index slip from 55.0 in September to 52.7, its lowest reading since May 2015. The drop in the index, to a level below its long-run average (53.4), reflected weaker increases in both services business activity and manufacturing output. In the case of the former, growth eased to a five-month low (although was still solid overall), while goods production expanded at a marginal rate that was the weakest in almost four years.

-

Flash France Composite Output Index at 54.3 in October from 54.0 in September (2-month high)

-

Services Activity Index up to 55.6 in October (54.8 in September), 4-month high

-

Manufacturing Output Index at 48.8 in October (50.3 in September), 27-month low

-

Manufacturing PMI down to 51.2 in October (52.5 in September), 25-month low

Commenting on the Flash PMI data, Sam Teague, Economist at IHS Markit said: "October data signalled a mixed picture for the French private sector. On one hand, service sector activity growth accelerated to a four-month high thanks to stronger new business growth. On the other hand, the manufacturing sector shifted down a gear in October, as firms reported the first fall of output for over two years".

EUR/USD

Resistance levels (open interest**, contracts)

$1.1583 (872)

$1.1564 (120)

$1.1532 (107)

Price at time of writing this review: $1.1464

Support levels (open interest**, contracts):

$1.1434 (2889)

$1.1403 (5981)

$1.1367 (3317)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date November, 19 is 82613 contracts (according to data from October, 23) with the maximum number of contracts with strike price $1,1450 (5981);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3117 (851)

$1.3081 (388)

$1.3047 (621)

Price at time of writing this review: $1.2971

Support levels (open interest**, contracts):

$1.2925 (2239)

$1.2899 (3155)

$1.2869 (1350)

Comments:

- Overall open interest on the CALL options with the expiration date November, 19 is 23910 contracts, with the maximum number of contracts with strike price $1,3500 (3229);

- Overall open interest on the PUT options with the expiration date November, 19 is 30442 contracts, with the maximum number of contracts with strike price $1,3000 (3155);

- The ratio of PUT/CALL was 1.27 versus 1.27 from the previous trading day according to data from October, 23

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

A positive start to trading in the stock markets of Europe is expected, following the recovery of quotations at the APR trading mainly in China, as Beijing announced that it plans to take measures aimed at supporting local stock markets.

-

Nordea 3Q Net Interest Income EUR1.07B

-

3Q Revenues Were Disappointing and Characterised by Seasonality

-

3Q Net Pft EUR684M

-

Expect to Reach Cost Base Below EUR4.8B in 2018, To Be Further Reduced in Local Currencies in 2019

-

Growing Lending Volumes Improved Net Interest Income But Was Offset by Margin Pressure

-

Low Activity Impacted Ancillary Income, Low Spreads, Interest Rates and Volatility Hit Capital Markets Income

"Unless the data talk me out of it, I view a continued, gradual removal of policy accommodation as appropriate until we get to a neutral policy rate," Mr. Bostic said in the text of a speech to be delivered in Baton Rouge, La.

-

Trump says 'too early to tell, but maybe' regrets hiring Powell - WSJ

-

Times sees cabinet papers revealing next stage of brexit Plan

-

Plan A WILL involve NI in separate VAT area. Officials admit "uncomfortable"

-

Flash Japan Manufacturing PMI rises to 53.1 in October, from 52.5 in September.

-

Growth of key macroeconomic variables (output, new orders and employment) all accelerate.

-

Rates of input cost and output price inflation both quicken to multi-year highs.

Commenting on the Japanese Manufacturing PMI survey data, Joe Hayes, Economist at IHS Markit, which compiles the survey, said: "Following a rather disappointing slew of PMI data over the third quarter, Japan's manufacturing sector looks set to start Q4 on a more upbeat note. The latest survey indicated stronger expansions in all the key barometers of macroeconomic health, with output, new order and employment growth quickening since September. Furthermore, export sales rose for the first time since May, despite several respondents highlighting problems arising from global trade tensions. "That said, next month's data will be important to assess whether the latest growth rebound is a transitory response to weakness resulting from recent natural disasters."

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.