- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 25-01-2022

- EUR/USD struggles to keep the bounce off two-month-old support line.

- Risk sentiment dwindles amid pre-Fed anxiety, Russia-Ukraine tension and IMF’s growth forecasts.

- ECB’s Lane rejects hawkish calls due to Omicron, adding to bearish bias.

EUR/USD dribbles around 1.1300, following a two-day decline to the five-week low. In doing so, the major currency pair struggles to keep the previous day’s corrective pullback as market players brace for the Federal Open Market Committee (FOMC) meeting.

In addition to the pre-Fed fears, the European Central Bank (ECB) Chief Economist Philip Lane’s rejection of Omicron-linked inflation fears also weighs on the EUR/USD prices. “The coronavirus Omicron variant is not turning out to be a factor that will influence the activity levels for the year,” said the policymaker.

On a different page, firmer German and Eurozone IFO numbers joined downbeat US CB Consumer Confidence and Richmond Fed Manufacturing Index to lift the EUR/USD pair. However, the upbeat US inflation expectations, per the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data, kept sellers in control.

Elsewhere, global ire towards Russia, on not backing down, joins the downbeat economic forecasts by the International Monetary Fund (IMF) to exert additional downside pressure on the EUR/USD prices.

Against this backdrop, Wall Street closed in red and the US 10-year Treasury yields printed the least daily losses after a four-day downtrend. That said, prices of gold and oil gained.

Moving on, second-tier US data relating to housing and trade may entertain EUR/USD traders but the Fed’s verdict is crucial as markets await March rate-hike hints.

Read: Federal Reserve Interest Rate Decision Preview: Inflation, Omicron and equities

Technical analysis

Although EUR/USD bounces off an upward sloping trend line from late November, a one-week-old resistance line and 20-DMA, respectively around 1.1320 and 1.1345, challenge the quote’s short-term recovery moves.

If at all the major currency pair rises past 1.1345, the 38.2% Fibonacci retracement (Fibo.) of October-November 2021 downside, near 1.1380, will be the key as it holds the gate for the pair’s further rally towards the monthly high of 1.1481.

Alternatively, multiple lows marked since late November highlight 1.1230 as the next support following the EUR/USD pair’s clear downside break of 1.1290.

Should the pair bears keep reins past 1.1230, the year 2021 low near 1.1185 will be in focus.

EUR/USD: Daily chart

Trend: Further weakness expected

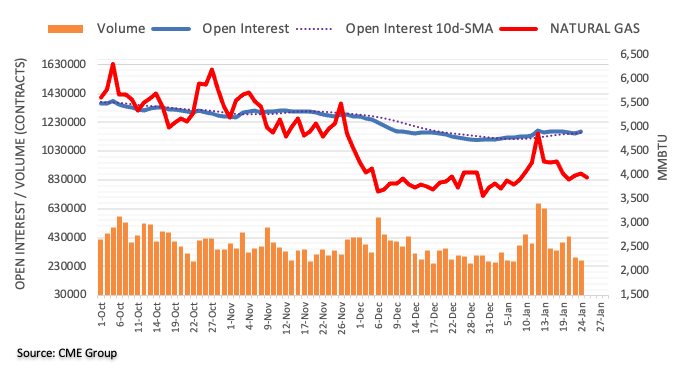

- Geopolitical issues between Ukraine and Russia, and middle-East tensions, triggered the jump in oil prices.

- The International Energy Agency (IEA) reported that OPEC+ missed its production targets.

- The US Department of Energy approved an exchange of 13.4 million barrels of crude oil from the SPR.

- WTI is upward biased, though a break above $85.83 would expose $86.90.

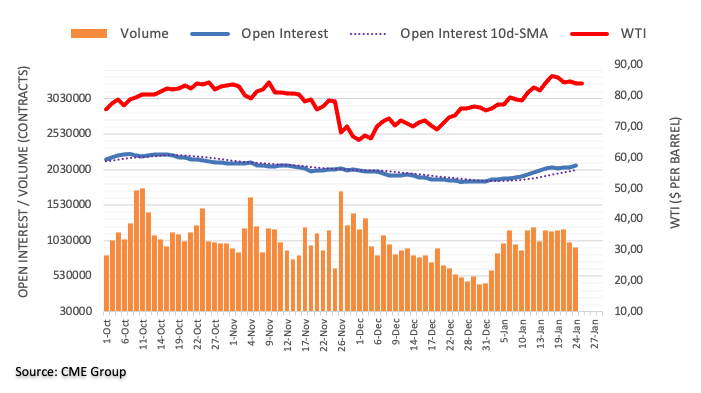

On Tuesday, the Western Texas Intermediate (WTI), US crude oil benchmark, advances some 1.65%, trading at $84.97 per barrel at the time of writing.

The rise in oil prices is attributed to a list of factors. Eastern Europe geopolitical tensions between Ukraine and Russia, and the attack on Monday on a United Arab Emirates US military base, increased worries of a tighter supply of the so-called black gold.

Additionally, the Organization of the Petroleum Exporting Countries and its allies (OPEC+) encountered problems to hit its target of 400K crude oil barrels per day, as reported by Reuters.

The International Energy Agency (IEA) said in the last week that the group missed its production targets by 790,000 barrels per day (BPD) in December as members like West African producers Nigeria and Angola struggled to raise output.

Meanwhile, around 20:00 GMT, the US Department of Energy approved an exchange of 13.4 million barrels of crude oil from the Strategic Petroleum Reserve to seven companies as part of President Joe Biden’s effort to help control oil prices, per Reuters.

WTI Price Forecast: Technical outlook

The black-gold trimmed some of its Monday’s losses but failed to break above $85.83. That said, WTI’s is upward biased. The daily moving averages (DMAs) reside below the spot price, though the 50-DMA is about to close above the 100-DMA, which sits at $76.75.

To the upside, WTI’s first resistance would be January 24 daily high at $85.83. A break above that level would expose the January 20 cycle high at $86.90.

Early Wednesday morning in Asia, House Speaker Nancy came out with the news conveying the US House Democrats’ release of the America COMPETES Act of 2022.

Among major issues, the US readiness to combat China on various manufacturing and supply issues gains major attention.

FX reaction

It’s worth noting that the bill is yet to reach Senate, not to talk about is it a law, which makes it a little less worrisome issue amid the Fed fears and Russia-linked geopolitical tension.

As a result, the risk barometer AUD/USD pays a little heed to the news and takes rounds to 0.7150 by the press time.

Read: AUD/USD hovers around 0.7150 on Australia Day holiday, focus on Fed

- AUD/USD fades bounce off five-week low as pre-Fed anxiety escalates.

- Strong Aussie inflation helped buyers to battle the broad risk-off mood.

- Russia-Ukraine fears, IMF’s growth forecasts add to the bearish bias.

- Second-tier US data may entertain traders but all eyes on FOMC’s verdict amid March rate hike chatters.

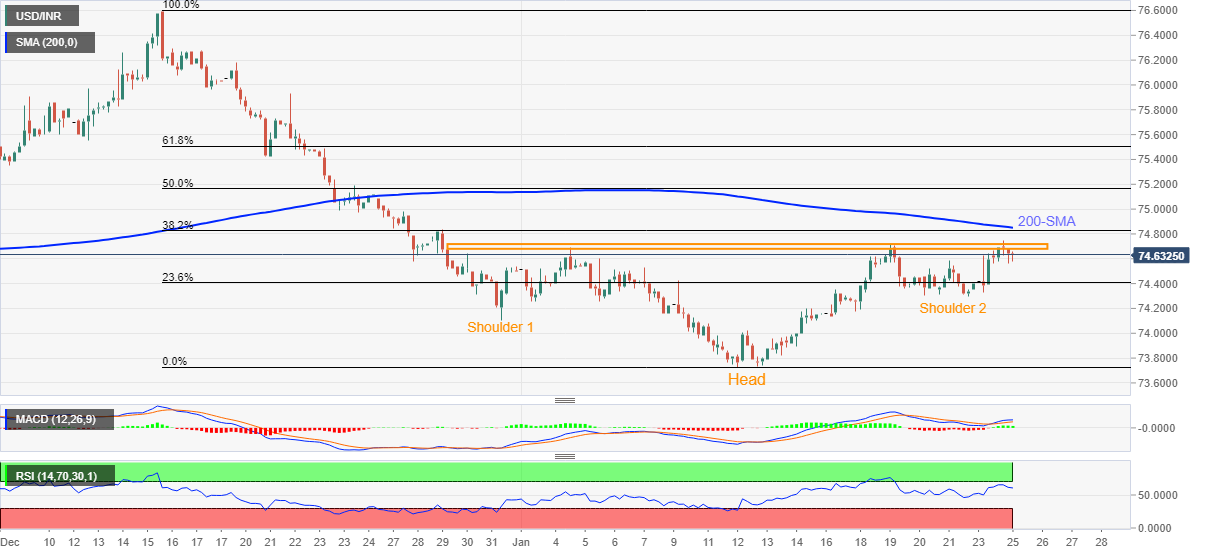

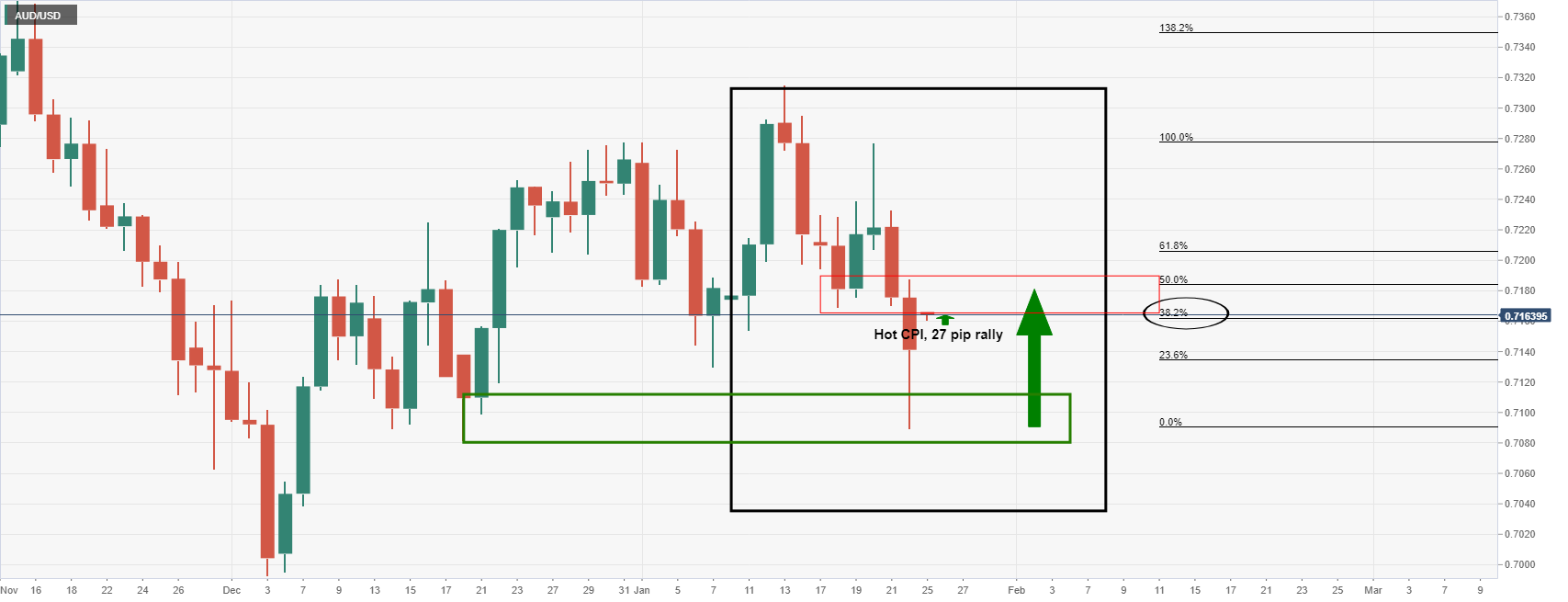

AUD/USD fails to extend the previous day’s corrective pullback from a five-week low, retreats to 0.7150 during early Wednesday morning in Asia.

The risk barometer pair cheered upbeat Australia data the previous day to snap a two-day downtrend. However, fears of the hawkish Fed join geopolitical tensions and downbeat economic forecasts by the International Monetary Fund (IMF) to keep downside pressure on the quote.

That said, Australia's Q4 inflation rose past the Reserve Bank of Australia (RBA) forecasts to 3.5% YoY while the RBA Trimmed Mean CPI also crossed prior and market consensus to 1.0%. Given the already out strong employment data, Australia's inflation enabled AUD/USD traders to expect no major hurdle for the RBA to accept rate hike chances in 2022 versus previous rejections.

Also, the receding cases of Omicron in Australia and confidence in the medical system, as well as vaccine jabbing, added strength to the AUD/USD rebound.

However, the Fed hawks ignore softer US CB Consumer Confidence and Richmond Fed Manufacturing Index figures amid firmer US inflation expectations, per the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data to weigh on AUD/USD. The inflation gauge rose for the third consecutive day on Tuesday after declining to the lowest since September on January 20.

It’s worth observing that the US, the UK and European Union (EU) are determined to levy economic sanctions on Russia if it invades Ukraine, which in turn keeps geopolitical fears on the table and test AUD/USD rebound. However, the latest updates suggest receding fears of an imminent war between Moscow and Kyiv.

Furthermore, the IMF No. 2 official Gita Gopinath conveyed downbeat economic forecasts the previous day as Omicron spreads. “We project global growth this year at 4.4%, 0.5 percentage point lower than previously forecast, mainly because of downgrades for the United States and China,” said IMF’s Gopinath per Reuters.

Against this backdrop, Wall Street closed in red and the US 10-year Treasury yields printed the least daily losses after a four-day downtrend. That said, prices of gold and oil gained.

Considering the off in Australian markets and the pre-Fed fears, AUD/USD may witness a lackluster day in Asia. However, fears of the hawkish Fed keep sellers hopeful.

Read: Federal Reserve Interest Rate Decision Preview: Inflation, Omicron and equities

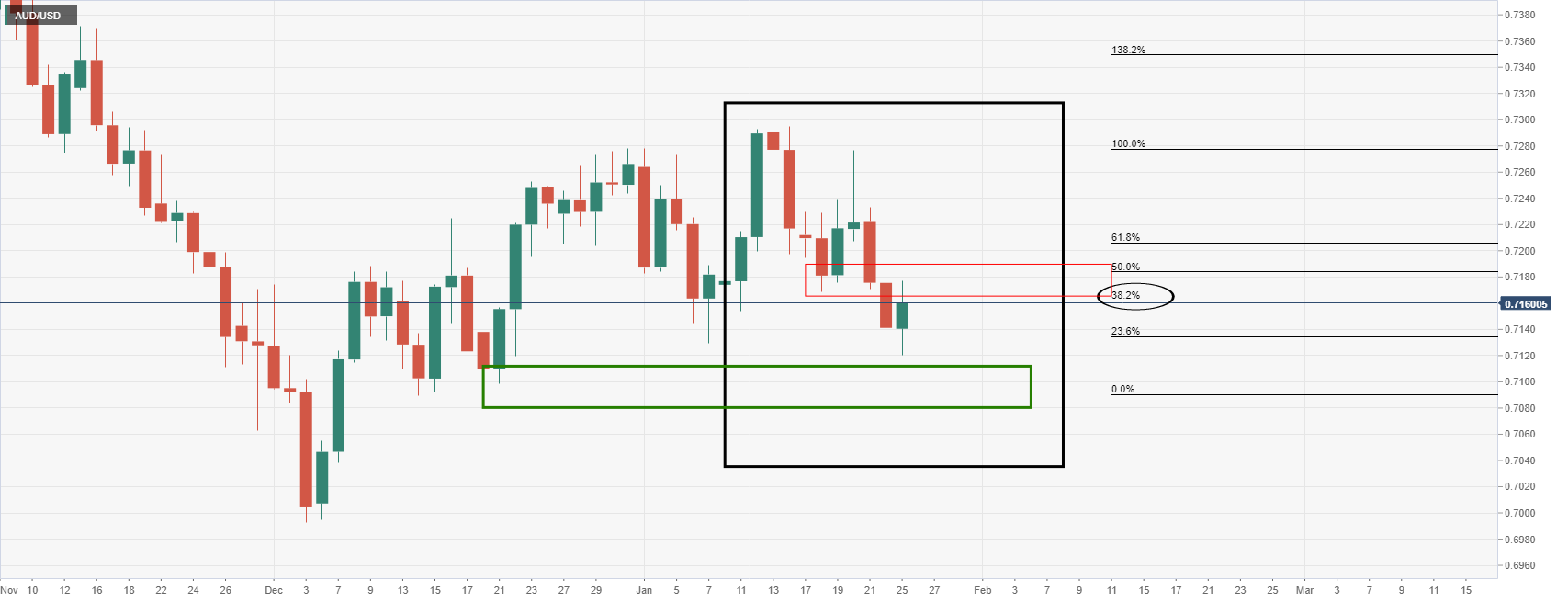

Technical analysis

AUD/USD fades bounce off the 23.6% Fibonacci retracement of late June to December 2021 downside, around 0.7140, below the 50-DMA resistance level of 0.7182. That said, the further downside may halt around 0.7080 before challenging 2021 low near the 0.6995 mark.

- NZD/USD stays pressured around multiday bottom after four-day downtrend.

- Sour sentiment, Omicron woes at home join IMF’s downgrade to China growth to weigh on Kiwi prices.

- Downbeat US data fails to reject upbeat expectations from Fed, Russia-Ukraine tussles stay on the table.

- Yields, DXY stay firmer amid hopes of hawkish Fed, equities print losses.

NZD/USD portrays a corrective pullback from a 14-month low of around 0.6690 but stays depressed after a four-day downtrend to early Wednesday morning in Asia.

The kiwi pair’s latest consolidation could be linked to the day-end bounce in riskier assets after a heavy risk-off session. However, the bears keep control as pre-Fed anxiety escalates. Also weighing on the risk appetite, as well as the NZD/USD prices, are the escalating fears of a Russia-Ukraine was and downbeat economic forecasts by the International Monetary Fund (IMF).

Although the US CB Consumer Confidence and Richmond Fed Manufacturing Index joined the week-start trend of softer data, with Markit PMIs, Fed hawks remain hopeful on upbeat US inflation expectations, per the 10-year breakeven inflation rate per the St. Louis Federal Reserve (FRED) data. The inflation gauge rose for the third consecutive day on Tuesday after declining to the lowest since September on January 20.

Elsewhere, policymakers at the US, the UK and European Union (EU) are determined to levy economic sanctions on Russia if it invades Ukraine. However, the latest updates suggest receding fears of an imminent war between Moscow and Kyiv.

At home, New Zealand (NZ) Prime Minister Jacinda Ardern accepted rising fears of Omicron but stood ready for border reopening in February. The South African variant spreads faster in the Pacific nation and is likely to post 50K cases from the latest below 100 levels. In light of this, NZ Herald said, “The Government will today reveal how it will try to step up the fight against Omicron as the highly infectious Covid-19 variant spreads across the country, with predictions of up to 50,000 cases a day.”

It should be noted that the IMF No. 2 official Gita Gopinath conveyed downbeat economic forecasts the previous day as Omicron spreads. “We project global growth this year at 4.4%, 0.5 percentage point lower than previously forecast, mainly because of downgrades for the United States and China,” said IMF’s Gopinath per Reuters.

Amid these plays, Wall Street closed in red and the US 10-year Treasury yields printed the least daily losses after a four-day downtrend. That said, prices of gold and oil gained.

Looking forward, the pre-Fed caution can keep markets light-lipped but the US housing and trade numbers will join other risk catalysts to entertain NZD/USD traders. Among them will be the NZ government’s more steps to battle Omicron.

Given the highly hawkish hopes from the Fed, odds of a sharp disappointment with a slightly measured tone can’t be ruled out, which in turn could trigger the much-awaited bounce for the NZD/USD.

Read: Federal Reserve Interest Rate Decision Preview: Inflation, Omicron and equities

Technical analysis

Unless crossing a two-week-long resistance line near 0.6735, NZD/USD stays vulnerable to test a descending trend line from late September 2021, around 0.6615 by the press time.

- The AUD/JPY advances for the first day out of the last three, up some 0.09%.

- A risk-off market mood keeps investors flowing through safe-haven assets, thus favoring the Japanese yen.

- The AUD/JPY is downward biased, but the price action is under consolidations as portrayed by the last two trading days.

Despite the financial markets' risk-off mood, the Australian dollar snaps three consecutive days of losses advances some 0.09%. At the time of writing, the AUD/JPY is trading at 81.47.

Market participants are getting ready for the Federal Reserve to unveil its first monetary policy statement of the year. Investors have already priced in a 25 bps rate hike in the March meeting, but the questions that remain to be answered by the Fed are the pace of the Quantitative Tightening (QT) and when it will start. Alongside the uncertainty of the US central bank tightening, geopolitical events keep the USD and the JPY on the right foot, to the detriment of risk-sensitive currencies.

The conflict between Ukraine and Russia has been escalating in the last week. The US Department of Defense maintains 8,500 American troops on heightened alert and could be deployed if Russia invades Ukraine.

On Tuesday, the AUD/JPY remained in the 81.05-81.78 range, seesawing around the 50-hour simple moving average (SMA), with no apparent bias, trapped around the latter and the 100-hour SMA at 81.83.

AUD/JPY Price Forecast: Technical outlook

From a technical perspective, Monday's AUD/JPY price action witnessed a jump from the YTD lows around 80.69, which pushed the pair above the 81.00 handle, courtesy of the recovery of the US stock market by the end of the day. That said, on Tuesday, a doji emerged, which could be the signal of a pause of the downtrend or might be an early signal of a reversal candle pattern.

To the upside, the AUD/JPY first resistance level would be the 50-day moving average (DMA) at 82.05. A breach of the latter would expose the confluence of the January 10 daily low previous support-turned-resistance and the 100-DMA in the 82.33-37 range, that once broken, would give way for a test of the 200-DMA at 82.52.

On the flip side, the first support would be 81.00. A break under that level will keep bears in control and will open the door for further gains. The next demand area would be the January 24 daily low at 80.69, followed by December 20, 2021, daily low at 80.27.

- EUR/JPY has recovered from 128.20 lows to the 128.75 area, but nonetheless trades lower as the recent negative bias continues.

- Many technicians, perhaps in anticipation of continued safe-haven yen demand, will be targetting a test of the December 127.50 lows.

Though the pair has recovered from its earlier session lows in the 128.20s back to the 128.75 area in more recent trade, and thus eroded the day’s losses to a mere 0.25% from as much as 0.6%, EUR/JPY’s negative bias continues. Indeed, EUR/JPY’s lows on Tuesday was a fresh more than one-month low and mark a sixth successive session where the pair has printed a lower low. After Monday’s more overtly defensive bias to FX market trade that saw the yen and euro alike perform well, the euro was an underperformer during Tuesday’s more mixed session.

That underperformance comes despite better-than-expected German Ifo figures released in the European morning, which as analysts have pointed out, was perhaps negated by pessimistic economic commentary from the economic institute. From a technical perspective, the fact that EUR/JPY hasn’t yet been able to muster a recovery back towards prior support now resistance in the 129.50 area, or back to test its 50-day moving average since dropping below it, is a bearish sign.

Many technicians, perhaps in anticipation of continued safe-haven yen demand as global risk appetite remains rocky amid central bank (Fed) tightening and geopolitical risks, will be targetting an eventual test of the December lows in the 127.50 area. It doesn’t seem likely that tensions between NATO/Ukraine/Russia in Eastern Europe will let up any time soon, though as long as war doesn’t break out imminently, there is a chance that markets get fatigued with the situation in the coming weeks.

That might mean central bank (Fed) tightening is the main threat to global risk appetite, meaning much of EUR/JPY’s near-term direction may be determined by Wednesday’s Fed event. For EUR/JPY to stabilise and recover back to earlier annual highs in the 131.00s, a broader recovery in risk appetite is going to be needed (with US equities recovering a decent portion of recently lost ground) and FX market focus is going to need to recalibrate on central bank policy divergence. Here the story could be a long-term EUR/JPY positive, with the Eurozone facing much higher upside inflation risks and, as a result, likely to remove monetary stimulus at a faster pace compared to Japan.

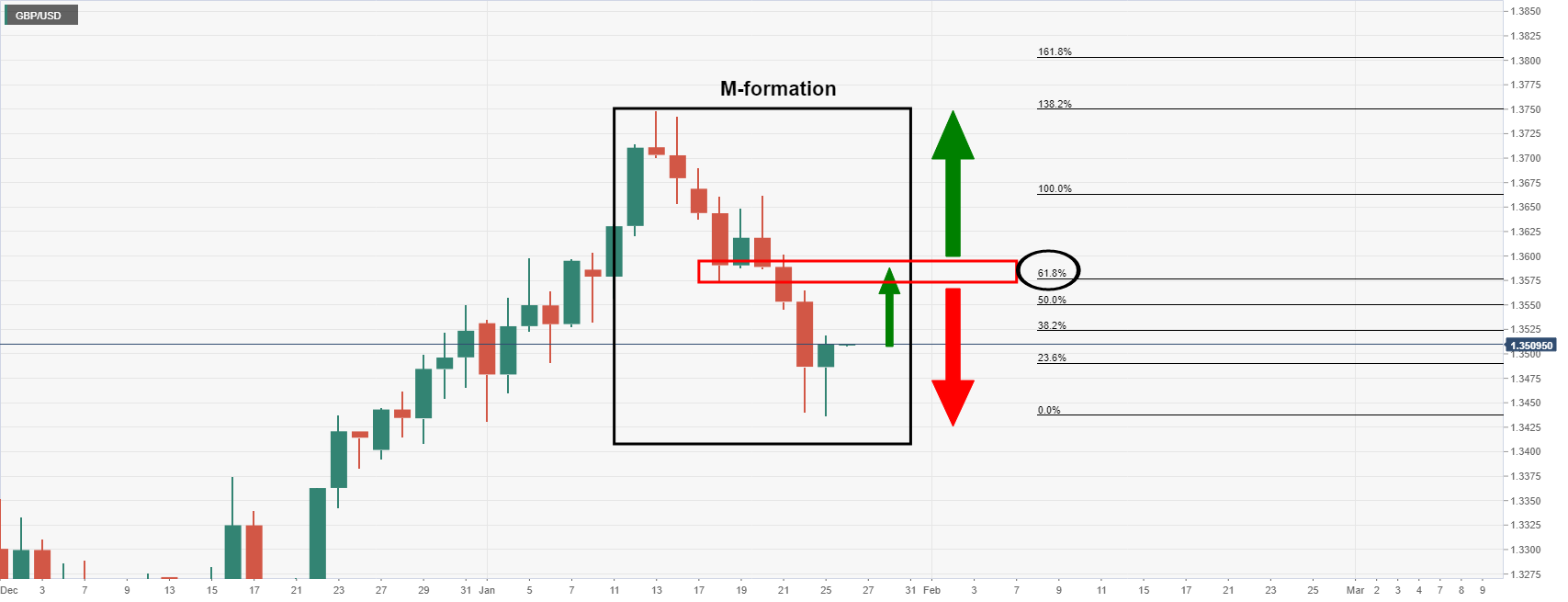

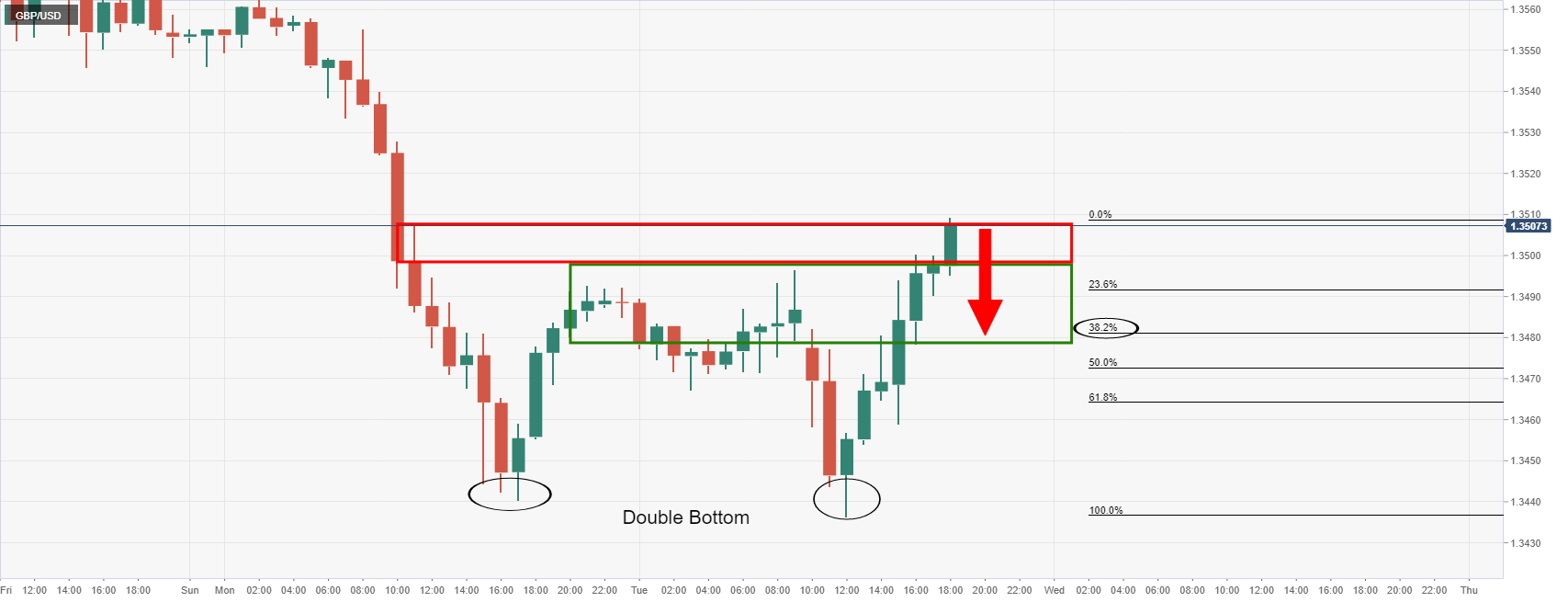

- GBP/USD bulls look to 1.3580s for the days ahead.

- Near-term bears are in anticipaiton of a deeper correction on the lower time frames.

In ealrier analysis in the US sesison, 1.35 the figure was noted as an anchor point from which bulls would be expected to struggle to pull away from. However, a key level of resistance was penertrated and a high high for the day was scoed all of the way towards 1.3520:

GBP/USD, prior analysis

The price had run into a wall of resistance as per the prior analysis on the 15-min chart above. A rejection in the first test there was expected to open risk back to the 61.8% Fibo of the 15-min bullish impulse near 1.35 the figure.

However, the bulls have taken the reigns and pushed on through as follows:

The price rallied to a high of 1.3518 and is about to leave a bullish daily closing candle for the day which opens prospects of a deeper retracement of the bearish daily impulse as per the chart below. In the mean time however, there is now bearish structure forming on the 15-min chart in the form of a potential bearish head and shoulders topping formaiton.

If trhe right hand shoulder forms followed by a subsequent break and close below the neckline near 1.35 the fifure, then the hourly 38.2% % Fibonacci retracement will be eyed for a potential support for the sessions ahead. Should the dollar remain under pressure, then the bulls will be encouraged to renegage at a discount and that could lead to a bullish exptensio into the imbalance of price between the highs and the late 1.3530s.

GBP/USD daily chart

Looking further a field, the daily M-formaiton is compelling, especially given the prospects of today's bullish daily close:

The 61.8% Fibonacci retracement level has a cnfluence with the neckline of the M-formaiton. The W and M patterns have a high completion rate of the price being drawn back into the prior structure, aka, the neckline. In this case, near to 1.3580.

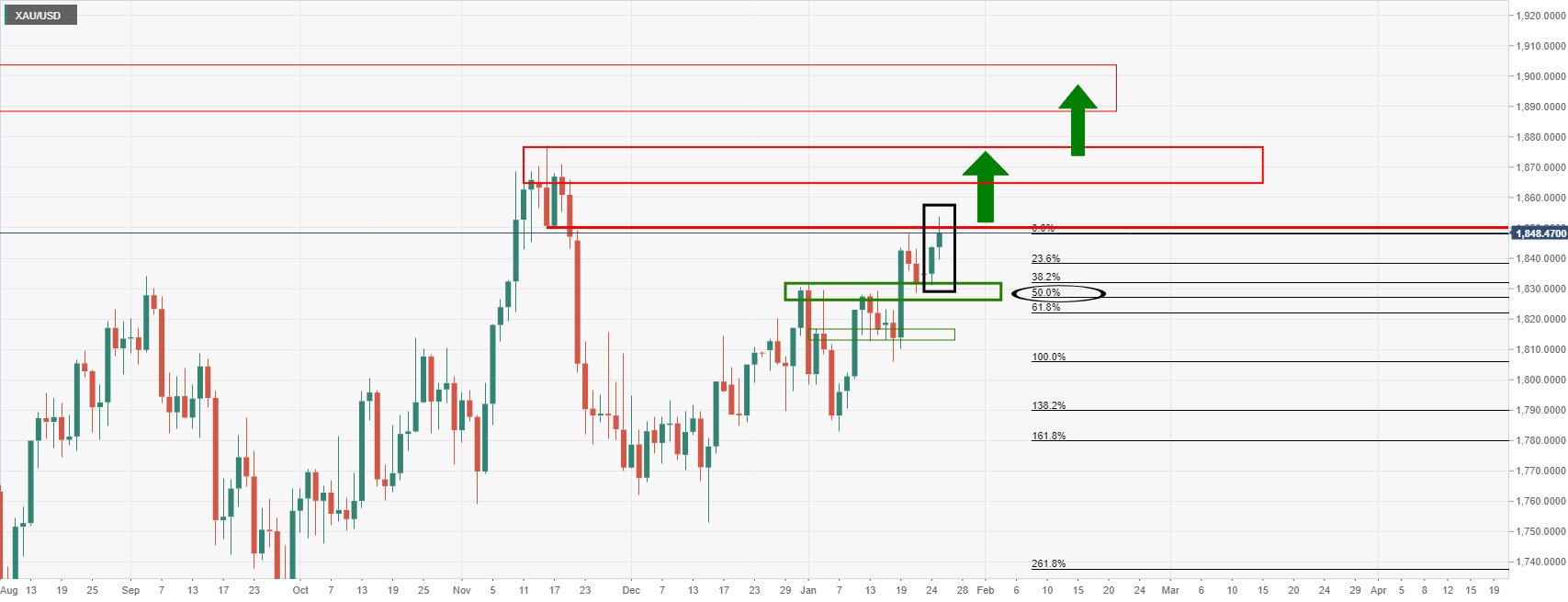

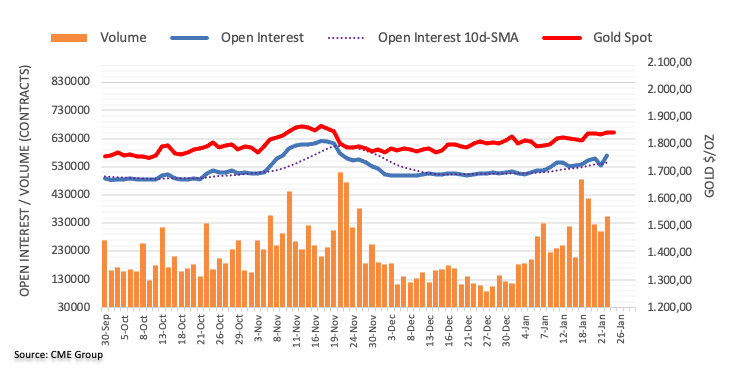

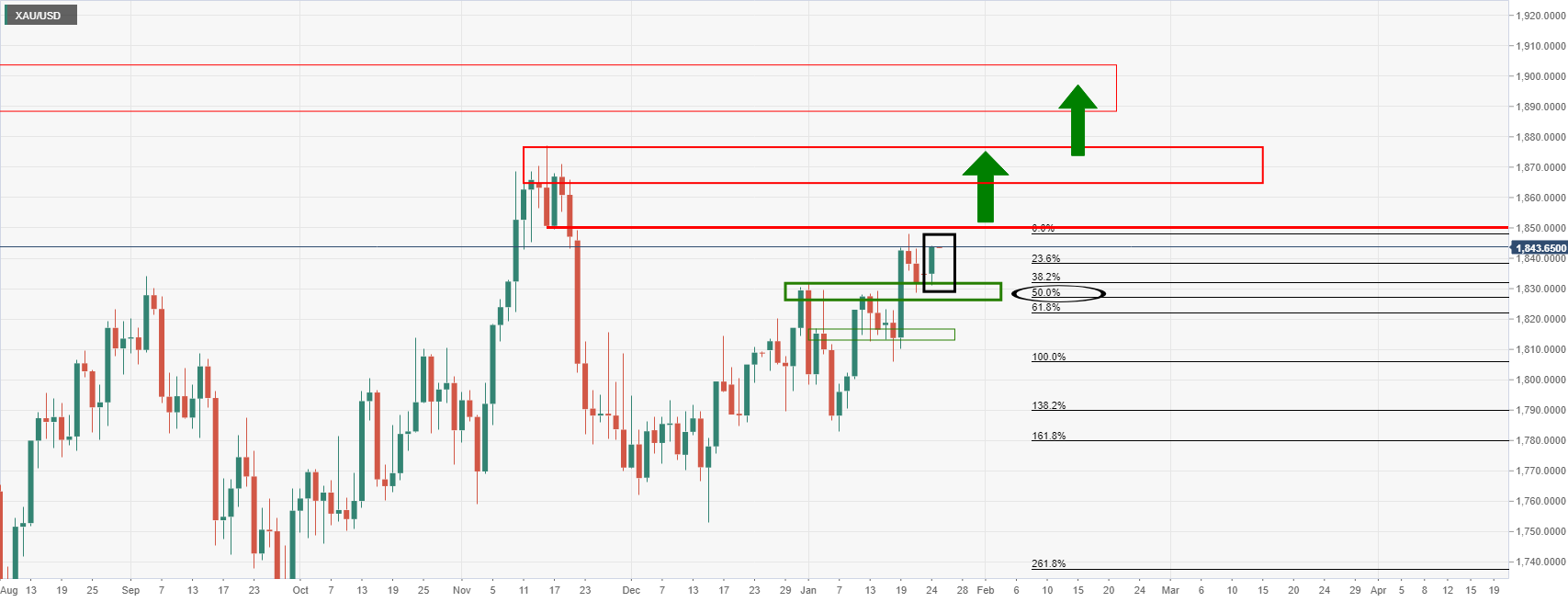

- Gold moves into a key psychlogical area on its northerly trajectory.

- The Fed is what counts for the forthcoming sessions.

Gold (XAU/USD) has rallied on Tuesday, adding around 0.5% to the scale after climning from a low of $1,834.95 to a high of $1,853.88 so far. The US dollar has come under pressure after reaching a a two-week peak over tensions between Russia and the West. However, there was a five-year Treasury auction that has weighed on the US dollar considering the bond market's appatite for US Treasurys at the current coupon.

The angst in centrak Asia took a back seat today to the outcome of the Federal Open Market Committee's two-day meeting that draws to a close on Wednesday. Investor were expecying the Fed to announce the end of QE prematurely and signal a readiness to hike in March.

In turn, there was a focus on today's 5-year Treasury auction. The bid-to cover ratio was high and so too was the yield wth the US selling 5-year notes at 1.533% vs WI 1.547%on a $55 billion sale. That was the highest yield since October 2019. The prior was 1.263% and the bid to cover at 2.50 vs 2.41 prior. This indicates that the market could be pricing the Fed too hawkish for the medium term. This is a bullish theme for gold.

Moreover, markets will be looking to take profit in the Fed which could be playing out in the reenback as we apprach month end as well. Given the recent rout in markets, a growing cohort of participants will be hoping that the Fed will manage to provide a soothing tone for markets.

''Considering that Chair Powell's primary goal is to prevent a de-anchoring of inflation expectations, it's unlikely that the Fed will pivot from their plan to start hiking rates as soon as March, and start quantitative tightening soon after,'' analysts at TD Securities argued.

''Certainly, markets have priced-in a March hike for some time, which takes the sting out of this form of tightening, but participants have begun to question whether the strike on the Fed's put is further from the market in a regime where the central bank is battling inflation.''

''In this context,'' the analysts said, ''evidence that quantitative tightening might be more impactful for asset prices suggests that the Fed could still eventually use this tool to manage the strike on its put, without necessarily causing undue harm to its primary objective of keeping inflation expectations bounded. For precious metals, this signals few immediate avenues for relief.''

The analysts exlained that ''while gold ETFs recorded massive inflows, these may have been distorted by options-related activity, with the concurrent rise in volatility suggesting only some additional safe-haven flows.

The evidence continues to overwhelmingly point to Chinese purchases as the single largest source of inflows, which are vulnerable with Lunar New Year around the corner. CTA trend followers are set to liquidate some gold length should prices break below $1815/oz.''

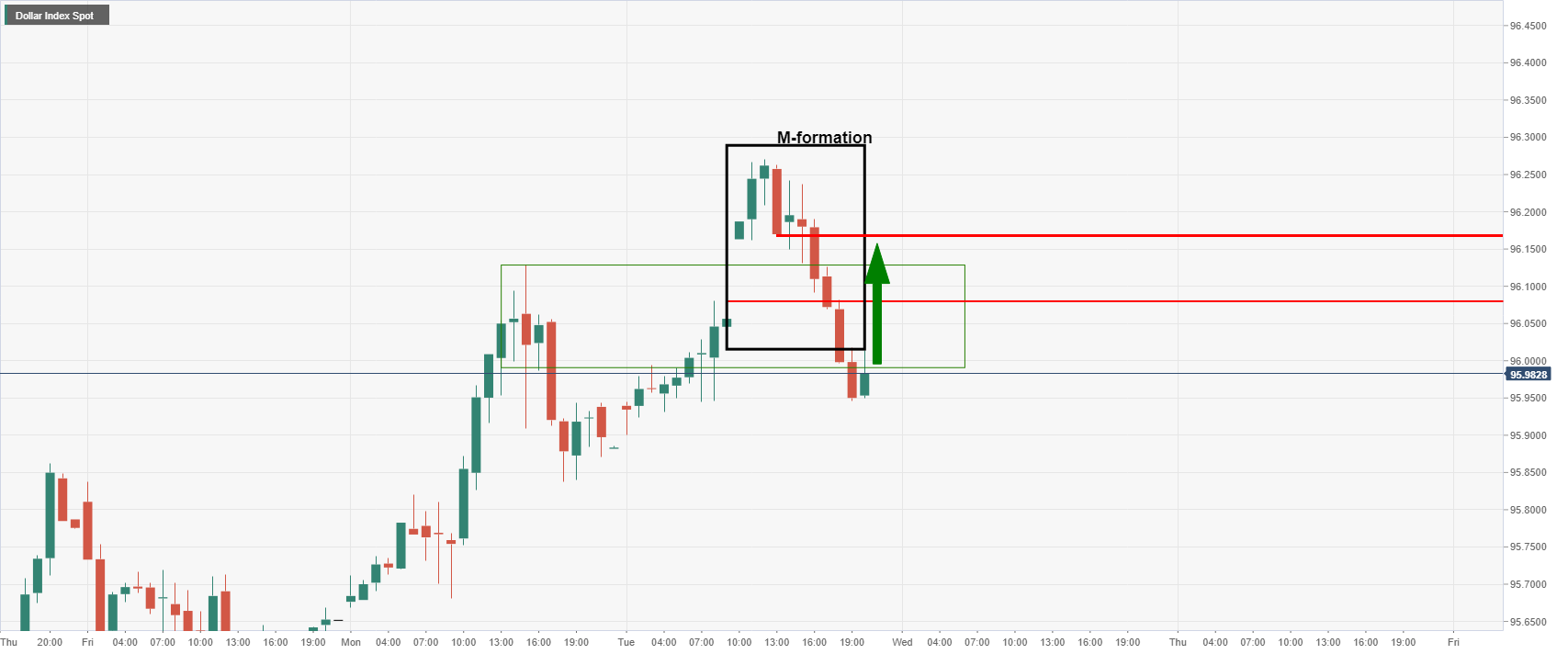

Gold and US dollar technical analysis

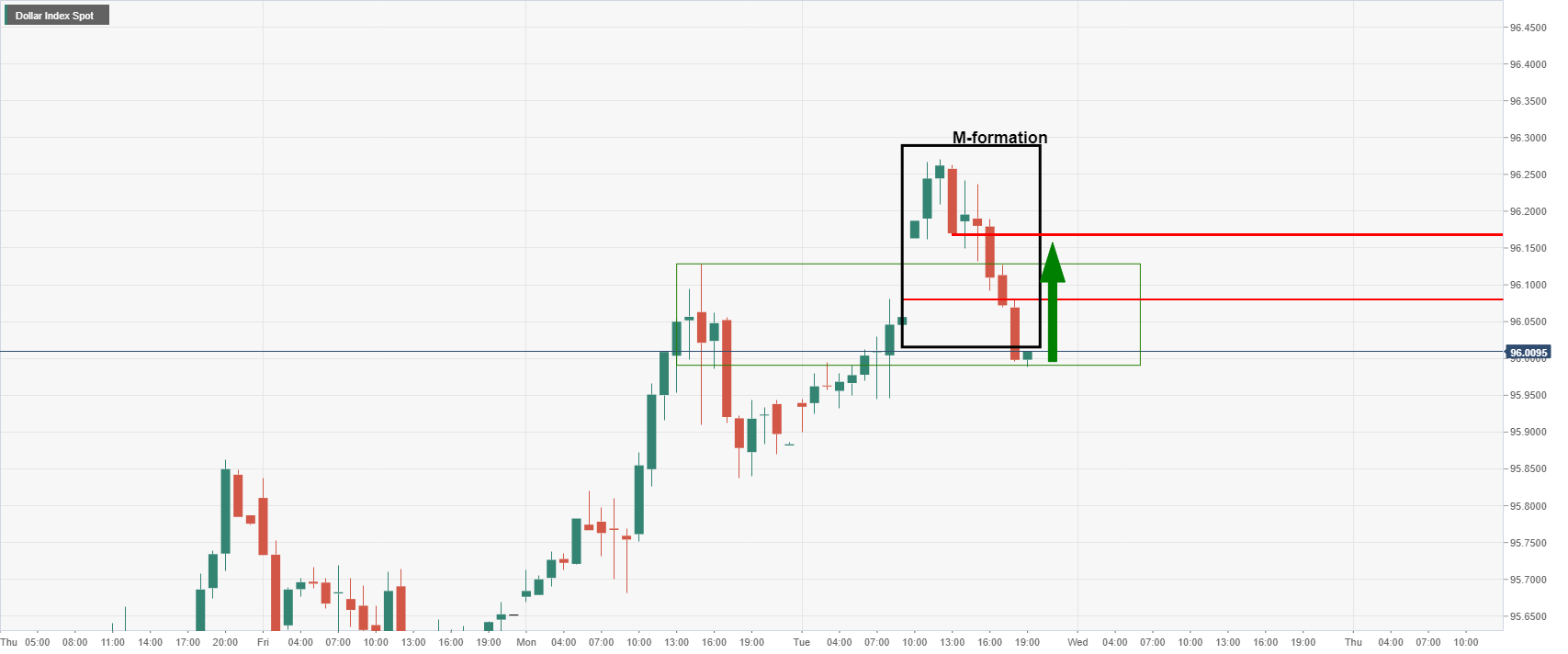

Firsltly, the US dollar could be finding a bid here and the Russian risks remains a supporting factor:

Additionally, the M-formation is a reversion pattern, so a move higher in the greenback could infold in coming hours as markets get set for the Federal Reserve. Therefore, runaway gold prices may not be in strore for the immeaduate future.

Meanwhile, as per the start of the week's analysis, Chart of the Week: Bulls pining for $1,850+, could be just a Fed away, the bulls have reached the psychological $1,850 target. This was forcasted to leave the bulls in good stead towards the $1,870's as last major defence for the $1,900s:

Gold's prior analysis

Gold live market, daily chart

What you need to know on Wednesday, January 26:

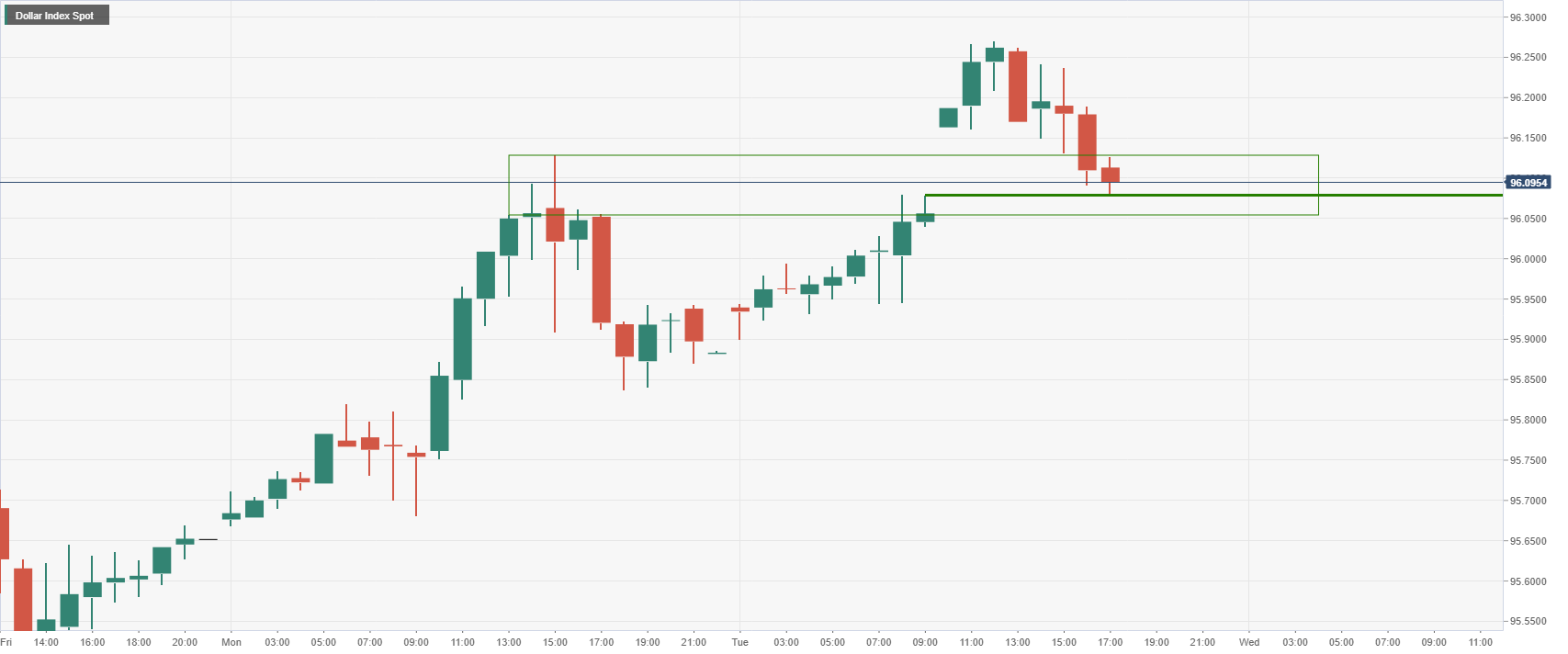

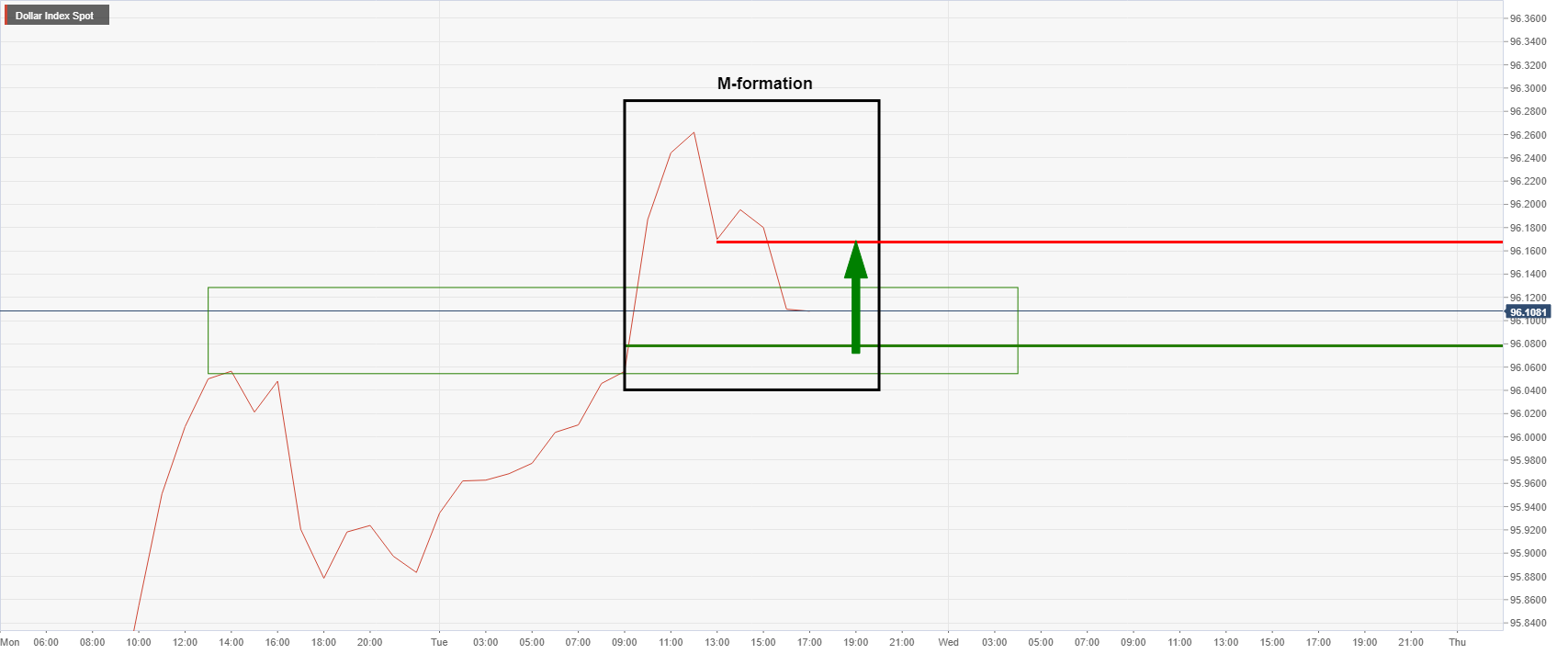

Choppy, unpredictable trading conditions prevailed for a second straight session on Tuesday. Ahead of the US close, the S&P 500 is still trading in the red but has recovered sharply off earlier session lows, giving a sense of De-Ja Vu after yesterday’s ferocious late-session recovery. The net result for G10 FX markets, which have been sensitive to equity market fluctuations as of late, is a slightly pro-risk bias. The Dollar Index (DXY) is trading marginally higher on the day but has pulled back from earlier highs 96.20s to underneath the big figure.

USD shrugged off mixed Consumer Confidence data, the headline index for which saw a slight fall owing to inflation and pandemic (Omicron) worries but not as much as expected, and slightly stronger than expected house price growth in November. The main talking point in markets remains 1) the Fed meeting on Wednesday and 2) geopolitics, with both having been cited as reasons for risk asset underperformance and heightened safe-haven demand.

But one day ahead of what is expected to be a very hawkish sounding Fed meeting (they are expected to give the green light to multiple hikes and QT in 2022), most risk-sensitive G10 currencies did well.

The Australian and Canadian dollars, both gained around 0.3% on the day versus the buck, taking the second and third from the top spot in terms of on-the-day G10 performance, lagging on the high beta NOK, which gained 0.5%. The Aussie, which jumped back above 0.7150/$, was supported by hawkish RBA bets in wake of a hotter than expected Q4 2021 Consumer Price Inflation report that will have come as a big surprise to the central bank.

The loonie is also being supported by hawkish central bank bets, with a minority of analysts calling for the BoC to surprise the consensus with a 25bps rate hike on Wednesday. More likely, the bank will tweak its forward guidance on rate hikes to reflect the recent run of strong economic data to signal a rate hike is coming in March.

Pound sterling was another risk-sensitive G10 currency to perform well on Tuesday, with GBP/USD recovering back above the 1.3500 level as FX markets continue to ignore an uncertain UK political backdrop. With the London police now investigating claims of parties in Downing Street that broke lockdown rules, Boris Johnson’s position as PM looks tenuous, though strategists expect that any potential replacement (like Chancellor Rishi Sunak) will be a “safe pair of hands”.

In terms of the rest of the G10 currencies; JPY and NZD were both flat on the day versus the buck, with USD/JPY just under 114.00 and NZD/USD just under 0.6700 ahead of December New Zealand trade figures.

Despite decent German Ifo survey results out during the European morning, the euro dropped 0.2% versus the buck, with EUR/USD suffering from technical selling amid the break below a key long-term uptrend in play since late November. The pair currently trades on the 1.1300 handle having recovered from earlier lows in the 1.1260s, its lowest level in more than a month.

Finally, CHF was the standout G10 underperformer on the day, with EUR/CHF rallying 0.4% to the 1.0375 area and USD/CHF rallying 0.6% to hit 0.9200 for the first time in nearly two weeks as some speculated about SNB intervention.

- The shared currency slides for the second straight day, down 0.19%.

- The crisis in eastern Europe weighs on the EUR boosts the safe-haven peers.

- The EUR/USD is downward biased, though upside risks remain as the 50-DMA closes to the spot price.

During the North American session, the euro slumps, attributed to a risk-off market mood that has spurred demand for safe-haven assets, meaning a higher USD. Factors like the Ukraine – Russia crisis and the Fed’s first monetary policy meeting of the year maintain market participants uneasy, as portrayed by US equities trading in the red. At the time of writing, the EUR/USD is trading at 1.1300.

In the meantime, the US Dollar Index, a gauge of the greenback’s value versus a basket of its rivals, advances some 0.10%, sitting at 96.01, clinging to the 96.00 threshold.

On Tuesday, during the overnight session for North American traders, the EUR/USD fell from 1.1325 towards the figure, giving way for USD bulls, who secured a 40-pip move to the daily low of the day at 1.1263. However, as the New York session progressed, EUR bulls entered the market, reclaiming the 1.1300 figure.

EUR/USD Price Forecast: Technical outlook

That said, the EUR/USD pair is neutral-downward biased. The 50-day moving average (DMA) moves close to the spot price, leading the way for the longer time-frame ones, with the 100-DMA and the 200-DMA lying at 1.1469 and 1.1708 each. Nevertheless, the bias is downward as long as the exchange rate remains below the former.

On the downside, the EUR/USD first support would be an upslope trendline drawn from December 2021 swing lows, which passes around the 1.1290-1.1300 area. In the outcome of breaking lower, the next support would be December 15, 2021, a daily low at 1.1221, followed by 2021 yearly low at 1.1186.

To the upside, the first resistance would be the 50-DMA at 1.1314. A breach of the latter would expose the January 20 pivot high at 1.1369, followed by the January 14 daily low previous support-turned-resistance at 1.1399.

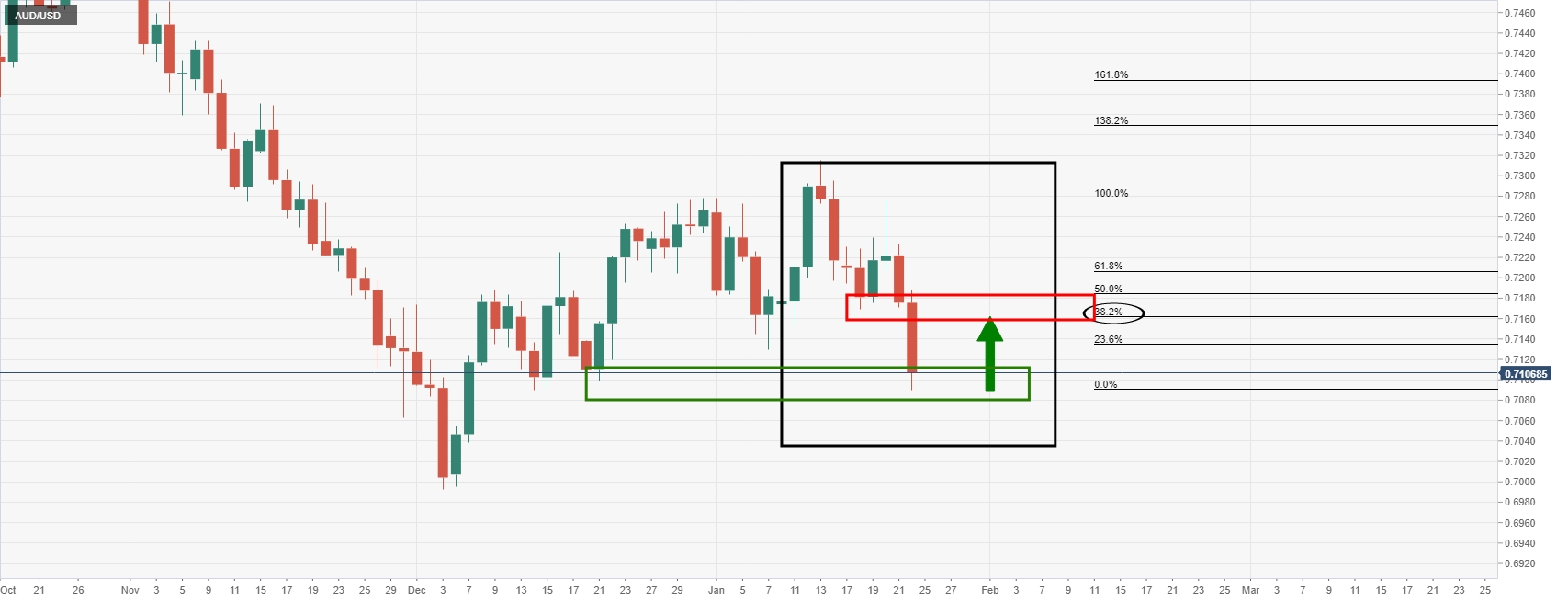

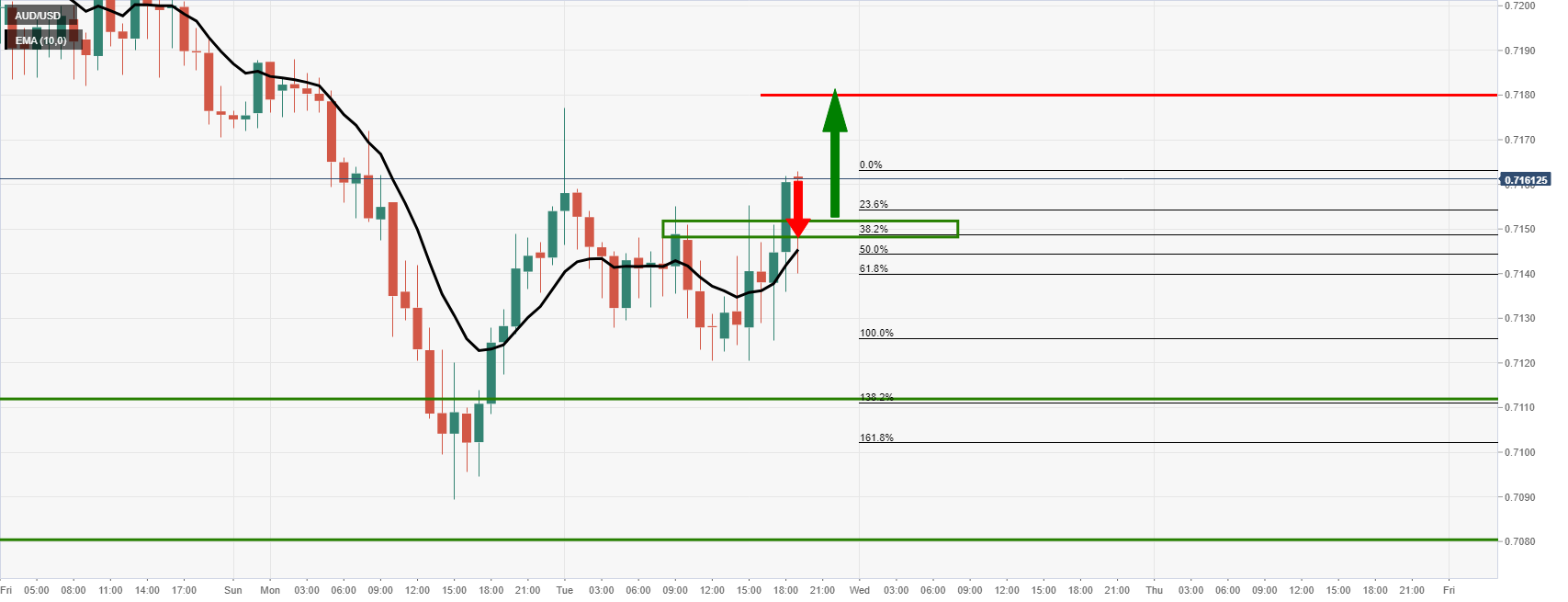

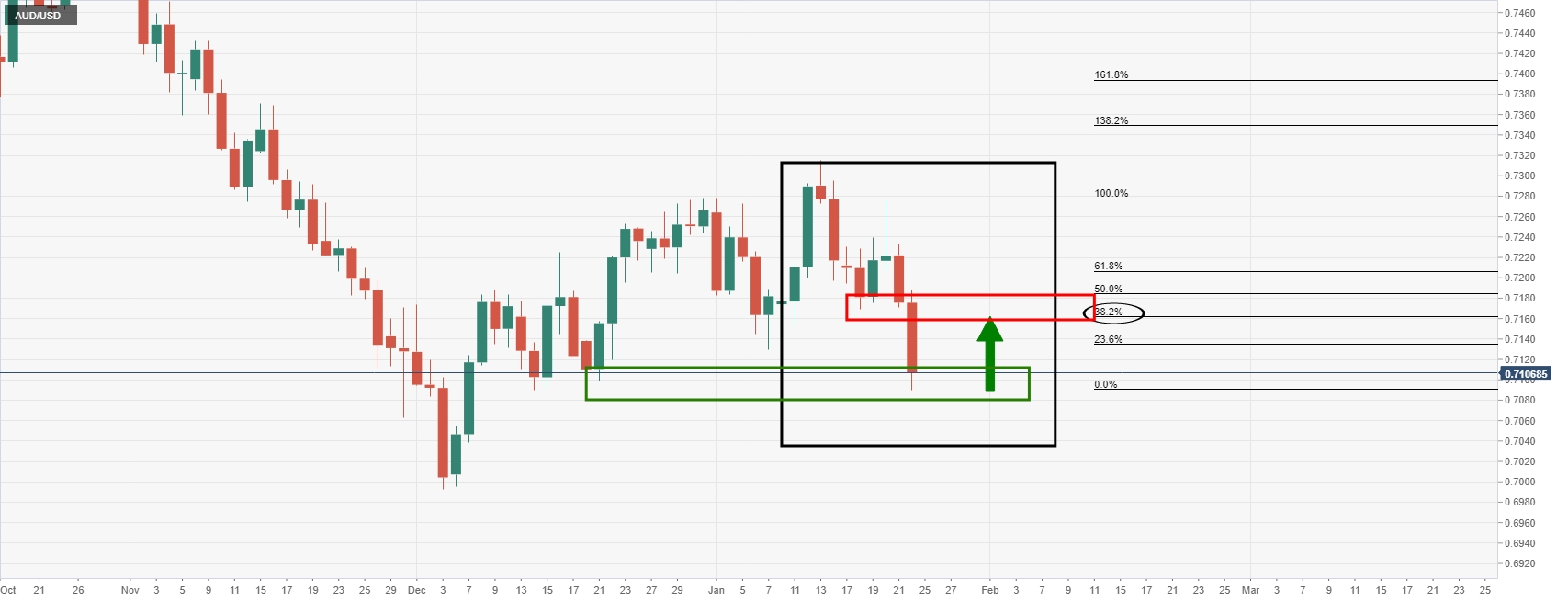

- AUD/USD bulls step in and target the daily M-formation neckline as the greenback slides.

- DXY is testing 96 the figure ahead of the Fed.

As per prior analysis at the start of the week, AUD/USD Price Analysis: Bears move the Aussie to the edge of the abyss, the price has advanced towards an identified daily target area in recent trade.

AUD/USD, prior analysis

It was started that ''AUD/USD's M-formation on the daily chart is a compelling chart pattern for the week ahead.''

AUD/USD live chart

As illustrated, the bulls have homed in n the neckline of the M-formation in trade today. This has occurred in a sharply hourly bullish impulse as follows:

The bullish impulse may not be over yet, but a correction could be in order back towards the prior resistance that has a confluence with the 38.2% Fibonacci retracement of the recent rally that meets with the 10-EMA.

The move has occurred as the US dollar sinks to test deeper liquidity and 96 the figure in the DXY index, breaking prior resistance and support as follows:

However, considering how fluid geopolitics are, if there is a Russian invasion of Ukraine, the US dollar would be expected to continue higher. In turn, this would be taking the Aussie down with it for a test of bullish commitments in the lower end of the 0.70 areas.

Additionally, the M-formation is a reversion pattern, so a move higher in the greenback could infold in coming hours as markets get set for the Federal Reserve.

- GBP/USD bulls are attempting to breakout of hourly consolidation.

- The H1 double bottom is encouraging, but the US dollar bulls have not yet thrown in the towel ahead of the Fed.

Now oscillating around 1.35 the figure, GBP/USD is flat but turning green on the day following a recovery from the lows of 1.3436 and printing a recent double hourly bottom. The US dollar has fallen under pressure as the 10-year yields remain pressured.

The US dollar, as measured by the DXY, an index that compares the greenback to a basket of major currencies, is sliding from the highs of the day of 96.272. It trades near 96.10 at the time of writing and is moving in on a key level of hourly support, as illustrated in the technical analysis below.

Meanwhile, fundamentally, the markets are in high anticipation of the Federal Reserve interest rate decision and accompanying statement. ''A likely March rate hike has been well communicated, so a "prepare for liftoff" signal will not be market-moving,'' analysts at TD Securities explained.

''More important will be guidance on QT as well as the funds rate after March. We don’t expect definitive signals, unfortunately; the next dot plot update is in March. The result could be mixed messages.''

Domestically, the pound has been favoured of late, at least until the extreme risk-off flows started to emerge in the latter part of this month. GBP has been the top daily performer as we entered the New Year. Investors cheered the UKs management of the coronavirus while also investing in marginally higher rates following the Bank of England's first rate hike since the onset of the pandemic, increasing its main interest rate to 0.25%.

Money markets (IRPR) currently price in more than 100 basis points (bps) in interest rate rises in 2022 and an 87% chance of a 25 bps increase in February after data showed last Wednesday that UK inflation rose faster than expected to its highest in nearly 30 years in December. Overall, the BoE tightening story has been supporting the pound, but considering the UK's twin deficits, at times of risk-off, the pound tends to be regarded as a risky asset class.

GBP suffered a steep sell-off when geopolitics unsettled markets at the end of last week and the start of this week's business. For instance, the pound weakened broadly on Friday, pulling back from a 23-month high versus the euro touched in the previous session as weakness in Wall Street prompted investors to take profits after a rally last week.

Then, on Monday, the British pound dropped further and its lowest in three weeks versus the US dollar. If risk sentiment turns around on reduced tensions in central Asia and Ukraine, then profit taking would likely support the pound and weigh on the greenback. However, the situation is fluid and uncertainty still prevails in risk-off markets on Tuesday. US stocks were sharply lower in midday trading, unwinding a portion of Monday's late recovery amid continuing market volatility.

Meanwhile, Prime Minister Boris Johnson has fought to save his premiership amid a deepening revolt inside the Tory party over a series of lockdown shindigs in Downing Street, contrary to the lockdown social distancing laws at the time.

However, "the pound has not paid much heed to recent headlines regarding the position and character of PM Johnson as this can be explained by the fact that no general election is scheduled until 2024 in the UK and whoever is party leader will inherit a large parliamentary majority," Rabobank analysts argued.

US dollar H1 chart

The US dollar is closing the gap but the M-formation being left behind is a reversion pattern and the neckline towards 96.20 could be retested in coming hours:

GBP/USD H1 and M15 charts

This would be expected to keep the pound anchored to 1.35 the figure or thereabouts:

The price has made a double bottom on the hourly chart and the break of the prior corrective highs near 1.3500 the figure is encouraging from a bullish perspective. However, from a lower time frame schematic, a correction would be expected at this juncture:

The price has run into a wall of resistance as per the 15-min chart and rejection in the first test here opens risk back to the 61.8% Fibo if the 51-min bullish impulse near 1.35 the figure. Support is seen into 1.3490. However, the 38.2% Fibonacci level near 1.3480 could come under pressure if the bulls do not commit at 1.35 the figure for the sessions ahead.

- On Tuesday, the GBP/JPY advances 0.12% during the North American session.

- Geopolitical issues and US central bank hawkish expectations dented investors' sentiment.

- GBP/JPY is upward biased, supported by the confluence of the 50, 100, and 200-DMAs around the 152.99-153.37 area.

The British pound snaps five days of losses against the Japanese yen, influenced by dampened market sentiment, spurred by the Ukraine – Russia conflict, alongside US central bank tightening monetary policy conditions, as the Federal Reserve begins its two-day meeting. At the time of writing, the GBP/JPY is trading at 153.78.

The GBP/JPY remained subdued in the overnight session, for North American traders, in the 153.12-70 range. Nevertheless, JPY bulls have been unable to test the YTD low reached on January 24 at 152.90, attributed to the confluence of the daily moving averages (DMAs) in the 152.99-153.37 range that provided support for British pound buyers.

GBP/JPY Price Forecast: Technical outlook

That said, the GBP/JPY daily chart supports an upward bias, despite falling 480 pips since January 12, after reaching a high at around 157.70.

To the upside, the cross-currency first resistance would be the confluence of the 38.2% Fibonacci retracement level, drawn from the 149.45-157.77 range, alongside the January 24 daily high at 154.59. A break above that level would expose the January 21 daily high at 155.22, followed by January 20 daily high at 156.06.

Contrarily, the first support would be the 50-DMA at 153.37, followed by the 100-DMA at 153.32 and then the 200-DMA at 152.99.

- The New Zealand dollar falls for four straight days, attributed to risk-off market sentiment.

- Geopolitical issues weigh on the NZD to boost the greenback prospects.

- US Consumer Confidence came lower than expected though investors mainly ignored it.

The New Zealand dollar slides during the North American session, trading at 0.6679 at the time of writing. A downbeat market sentiment portrayed by US equities trading in the red weighs on the NZD, boosting the safe-haven status of the greenback.

Eastern Europe conflict and FOMC monetary policy meeting dampen investors mood

Factors like the Federal Reserve monetary policy meeting and the Ukraine – Russia conflict keep investors nervous. Safe-haven assets like gold and low-yield currencies tend to benefit in times of geopolitical uncertainty.

During the North American session, the US Department of Defense put 8,500 American troops under high alert and will be deployed IF Russia attacks Ukraine. At press time, the Ukraine President said that the situation is under control. They are working to ensure that the meeting between the Presidents of Ukraine, Russia, Germany, and France takes place as soon as possible, as reported by Reuters.

In the meantime, the US 10-year T-bond yield sits at 1.75% during the day, underpins the greenback with the US dollar index, which measures the buck’s value against its peers, climbs 0.17%, up to 96.080.

The US economic docket featured the Conference Board (CB) Consumer Confidence Index, which came at 113.80, down from December 115.2 reading.

According to Lynn Franco, Senior Director of Economic Indicators at The Conference Board, consumer confidence moderated a bit in January. Regarding inflation concerns, she noted that “… declined for the second straight month, but remain elevated after hitting a 13-year high in November 2021.” Further added that “looking ahead, both confidence and consumer spending may continue to be challenged by rising prices and the ongoing pandemic.”

Therefore, NZD/USD traders will take cues from market sentiment, which has been downbeat, influenced by the eastern Europ conflict. That alongside the Federal Reserve, monetary policy meeting, might keep traders on the sidelines before opening new bets in the pair.

- USD/CHF hit its highest level in nearly two weeks on Tuesday amid CHF underperformance despite risk-off equity market flows.

- The pair is probing 0.9200, a break above which could open the door to a test of annual highs.

- Market commentators speculated that SNB intervention might be behind a portion of Tuesday’s weakness.

USD/CHF hit its highest level in nearly two weeks on Tuesday as the Swiss franc lost its safe-haven shine despite further downside in US (and global) equities and ongoing Italian political uncertainty. The pair broke to the north of its 200 and 21-day moving averages in the 0.9160 area and above last week’s peaks around 0.9180 and is now probing the 0.9200 level and the 50-day moving average just above it. At current levels ever so slightly below the big 0.9200 figure, the pair is trading with gains of about 0.7% o the day, making it the standout worst performer in the G10 FX space on the day.

Market commentators speculated that SNB intervention might be behind a portion of Tuesday’s weakness. Traders should watch next Monday’s weekly Swiss sight deposit balance data for “confirmation”, with a sharp rise usually indicative of increased SNB CHF selling. Focus for the rest of the week will be dominated by Wednesday’s Fed policy announcement. Analysts suspect that the expected hawkish tone to this meeting (where the Fed will give the green light to a March rate hike and then QT later in the year), as well as the continued risk-off tone being seen in US equity markets, suggests upside risks for USD this week.

A big question will be, if markets continue to trade with a risk-off bias for the rest of the week, will safe-haven demand for CHF return? And would any return of safe-haven demand for the franc be enough to shield it from safe-haven demand from the buck? From a technical perspective, if USD/CHF manages a clean break above 0.9200, then a move back to 2022 and December 2021 highs near 0.9300 will be o the cards.

- AUD/USD is stable in the 0.7140 area on Tuesday after Monday’s brief dip below 0.7100.

- Hotter than expected Australian CPI data is helping shield AUD from further risk appetite-related losses as US equities slide.

After coming within a whisker of hitting the December 20 lows just above 0.7080 on Monday but then subsequently recovering back to the 0.7150 area as Wall Street recovered, AUD/USD has remained resilient and trades flat near 0.7140 on Tuesday. That despite sentiment in US equity markets taking a turn for the worse again, which weighed on the pair this time on Monday. Stronger than expected headline US Consumer Confidence figures for January have also not been able to weigh substantially on the pair that has held in the 0.7120-0.7160ish ranges for most of Tuesday’s session thus far.

The Aussie is finding support following a hotter than expected Q4 2021 Consumer Price Inflation report out of Australia that showed the headline rate rising from 3.0% in Q3 to 3.5% versus forecasts for a rise to 3.2%. Importantly, the RBA’s Trimmed Mean measure of inflation rose to 2.6% from 2.1%, much larger than the expected jump to 2.4%, putting core inflationary pressures back above the midpoint of the RBA’s 2-3% target range two years earlier than the central bank forecast. The data helped to stoke RBA tightening bets, thus helping to underpin the Aussie and shield it from the risk appetite-related downside being seen in its antipodean counterpart NZD on Tuesday.

Despite current RBA guidance that there will be no rate hikes until late-2023/2024, money market futures are now nearly pricing a 15bps rate hike in full by May. “Next week the RBA will likely end its QE and bring forward the timing it expects to begin raising rates from late-2023/2024 (according to its current forecasts) to firmly into 2023” noted analysts at Credit Agricole. “At this stage, the RBA is unlikely to give up its forecast of no rate hikes in 2022 until it sees wages data in February” the analysts added.

If the RBA’s meeting next week underwhelms market expectations for a hawkish shift and a signal for rate hikes in 2022, that suggests downside risks for AUD/USD, a cross already hampered recently by deteriorating risk appetite and a strengthening dollar. Bears will be looking for a more sustained break below 0.7100 in the coming days/weeks which would open the door to a move towards December lows at 0.7000.

- The greenback slides against the Japanese yen, despite a mixed market mood.

- Some 8,500 American troops were put under high alert, attributed to the escalation of the Russia – Ukraine conflict.

- USD/JPY is upward biased despite breaking under the 50-DMA, though the longer time-frame ones remain under the spot price.

In the North American session, the USD/JPY extend its advance for two consecutive days, closing to the 114.00 psychological level. At the time of writing, the USD/JPY is trading at 113.90.

Eastern Europe conflict and FOMC meeting, spurred a risk-off market mood

The market sentiment is mixed as European equities trade in the green and the US stock indices post losses. Factors like the Ukraine – Russia conflict and the US central bank signaling the possibility of hiking rates in the March FOMC meeting.

Today, the Federal Reserve will begin its two-day monetary policy meeting, which will be watched closely by market participants, as they assess the central bank’s timeline for hiking rates and the forward guidance regarding Quantitative Tightening (QT).

Regarding the eastern Europ conflict, “the US Department of Defense in Washington said about 8,500 American troops were put on heightened alert and were awaiting orders to deploy to the region if Russia invade Ukraine,” according to Reuters.

In the meantime, the US 10-year Treasury yield declines two basis points, sitting at 1.752%, weighs on the USD/JPY. The US Dollar Index, a measurement of the greenback’s performance against a basket of six rivals, advances 0.28% sits at 96.182.

The US economic docket featured the CB Consumer Confidence decreased to 113.8 from 115.2 December’s reading, revised down. The market expected a reading of 111.2.

USD/JPY Price Forecast: Technical outlook

The USD/JPY is upward biased; despite breaking under the 50-day moving average (DMA) on January 20. The pair broke below the aforementioned, finishing the day at 114.07. That said, the USD/JPY has been unable to reclaim the level, though it fell 15-pips short of reaching it during the day.

To the upside, the USD/JPY first resistance would be the 114.00 figure. The breach of the latter would expose the 50-DMA at 114.28, followed by the January 18 daily high at 115.06.

Contrarily, the first support would be 113.67. A break under that level would expose the January 24 daily low at 113.47, followed by the 100-DMA that could sponsor a recovery for USD bulls at 113.29.

- US equities have turned lower again on Tuesday as markets continue to fret ahead of Wednesday’s Fed policy announcement.

- The S&P 500 is down 1.6%, the Nasdaq 100 2.5% and the Dow 0.8%.

After Monday’s stunning late-session recovery that saw the major US indices post and incredible recovery from intra-day lows, sentiment has taken a turn for the worse again. The S&P 500, which recovered a more than 4.0% dip to as lows as the 4220s on Monday to close above 4400, is trading about 1.6% lower on Tuesday in the 4320 area, though has admittedly recovered from a brief dip under 4300. At current levels, the index now trades with losses of about 1.9% on the week and 9.5% on the month. If the S&P 500 closes at current levels, it will confirm a correction (or 10% drop) from recent record highs printed back at the start of the year above 4800.

Strong Q4 earnings releases from blue-chip companies 3M and IBM failed to lift the mood, with markets instead opting to fret about the potential outcome of Wednesday's Fed policy announcement. The two-day Fed meeting kicks off on Tuesday and the bank is expected to give the green light to multiple rate hikes (starting in March) in 2022 as well some ideas for potential quantitative tightening plans. Ahead of that, earnings from mega-cap tech giant Microsoft after Tuesday’s close offer the opportunity to lift market sentiment ahead of earnings from Apple and Tesla later in the week.

Looking at the other major US indices; with tech leading the equity market decline on Tuesday, the Nasdaq 100 is the underperformer, down 2.5% on the day, taking its on-the-year losses to 13.5%. The Dow, meanwhile, was last down about 0.8% near the 34K level, though did recover from a brief intra-day dip as low as the 33.6K where it traded as much as 2.4% down. The S&P 500 Volatility Index, which nearly went as high as 40.00 on Monday, its highest since November 2020 at the time, was stable in the 32.50 area.

AUD/USD has been on the back foot since the middle of the month. Economists at Rabobank expect the aussie to struggle amid mounting tensions between Russia and Ukraine but improving Australian fundamentals could lift the pair to 0.74 by year-end.

Scope for AUD to outperform the GBP on a six-month view

“The USD is likely to remain on the front foot through the first half of this year as Fed tightening begins.”

“The USD’s dominance in the global payments system suggests it is set to find additional support if the tensions regarding Ukraine worsen further. AUD/USD could struggle to make much headway in this environment particularly given its historical sensitivity to risk appetite.”

“The improvement in Australia fundamentals suggests AUD/USD has to potential to finish the year moderately higher in the 0.74 area.”

“We see scope for AUD to outperform the GBP on a six-month view. This is based on our estimate that the market has priced in too much policy tightening from the BoE.”

“Our six-month GBP/AUD forecast stands at 1.74.”

- Metals and US stocks remain volatile amid concerns across markets.

- XAU/USD rises $10 in a few minutes and then erases gains.

- Positive outlook for gold while above $1830.

A quick drop in US yields boosted XAU/USD that jumped from $1840 to $1853, reaching the highest level since November 19. It then pulled back all the way to $1840 and now is approaching the $1850 area again.

Prices remain volatile in metals, stocks and bonds. The spike in gold took place amid a quick decline in US yields and after US stocks trimmed losses. The Dow Jones is falling 1.08% and the Nasdaq 2.37%, both indices off lows.

Market participants await the outcome of the FOMC meeting. On Wednesday, the central bank is expected to give clear signals of a March rate hike.

Short-term outlook

Volatility across financial markets is also affecting gold that can jump and then reverse sharply in a few minutes. The outlook for gold remains biased to the upside while above $1830. A side below would clear the way for to a test of the 20-day simple moving average at $1820.

A consolidation above $1850 would be a positive development pointing to more gain with a target at the next resistance zone at $1865/70.

- USD/CAD has dropped back from earlier session highs in the 1.2660s to the 1.2640 area.

- The loonie and other risk-sensitive currencies remain highly sensitive to US equity market volatility.

- But traders may be reluctant to sell CAD ahead of Wednesday’s BoC rate decision.

USD/CAD has dropped back from earlier session highs in the 1.2660s to the 1.2640 area, to put it back to trading with Asia Pacific 1.2620-1.2650ish trading ranges. The loonie and other risk-sensitive currencies remain highly sensitive to US equity market volatility. Major US indices have been taking a beating heading into Wednesday’s Fed policy meeting, where the bank is expected to give the green light for as many as four rate hikes in 2022 and also the start of quantitative tightening. After recovering a more than 4.0% drop on Monday, the S&P 500 is reeling again on Tuesday and is down about 1.8%, meaning it is now more than 10% below its recent record highs and in correction territory.

At current levels in the 1.2630s, USD/CAD trades flat on the day, with the loonie holding up better versus the buck than the likes of the euro, Swiss franc, New Zealand dollar and Scandinavian currencies. Traders may be reluctant to sell CAD ahead of Wednesday’s BoC rate decision, where there appears to be an outside chance that the central bank surprises market participants with a 25bps rate hike. In a recent Bloomberg poll, seven out of 31 participants said they think the BoC will hike this week. A surprise hike would cut against the guidance that the bank has given in recent months; currently, the BoC sees the conditions for a rate hike being met in “the middle quarters of 2022”, implying a hike no earlier than April.

But last week’s hot Consumer Price Inflation report and strong quarterly Business Outlook Survey, which pointed to strong growth, high inflationary pressures and a tight labour market, all suggest a hawkish tweak to guidance is coming. In other words, it seems very likely that if the BoC doesn’t go with an outright rate hike on Wednesday, they will at the very least signal that a hike could be coming as soon as March. USD/CAD traders will thus have their hands full for the remainder of the week, juggling what are likely to be hawkish Fed and BoC meetings on Wednesday as well as an ongoing downturn in macro risk appetite. That suggests a mixed outlook for USD/CAD, with arguably some upside risk. Any break above Monday’s 1.2700 highs would open the door for a rally towards the next resistance around 1.2800.

- Rising US T-bond yields underpin the greenback weigh on the precious metals complex.

- Ukraine and Russian tensions keep the markets looking for the safe-haven status of the USD.

- XAG/USD Technical Outlook: Bearish biased unless it breaks above the 200-DMA at $24.61.

Silver slides for the third consecutive trading session, trading at $23.81 during the New York session at the time of writing. The market mood has remained unchanged since the beginning of the week. Ukraine – Russian conflict keeps grabbing the headlines while market participants await the Federal Reserve monetary policy decision.

The white metal – a safe-haven precious metal like gold–failed to appreciate, despite geopolitical issues in part attributed to the US T-bond yields, recovering some of Monday’s losses, when it pierced the 1.70% threshold at press time sits at 1.747%, underpins the greenback. The US Dollar Index, a gauge of the buck’s value against a basket of its rivals, advances 0.28%, up to 96.118 at 14:19GMT.

Analysts at TD securities expressed that a hike to the funds rate at the March FOMC meeting has already been signaled by Fed policymakers, led by Jerome Powell. A lift-off signal from the January meeting should not surprise anyone. Nevertheless, the topic that keeps investors uneasy is Quantitative Tightening (QT), or the balance sheet reduction.

The US economic docket featured the Housing Price Index (HPI), which came at 1.1% in line with expectations. At 15:00 GMT, the Conference Board will release the Consumer Confidence for December, expected at 111.4.

XAG/USD Price Forecast: Technical outlook

On Tuesday, the white metal is trading near the close of Monday, which was $23.98. two cents from the $24.00 threshold. The price action of the last two days approached the 78.6% Fibonacci retracement drawn from the last pivot low at $22.81 to the highest of the year at $24.70. However, the white metal is bearish-biased unless XAG/USD breaks the 200-day moving average (DMA) at $24.61.

To the upside, the first resistance is the 38.2% Fibonacci retracement level at $23.98, unsuccessfully broken one time. The next supply zone would be the January 24 daily high at $24.31, followed by the abovementioned 200-DMA at $24.61.

- EUR/USD remains well on the defensive and drops to 1.1260.

- The dollar keeps pushing higher despite mixed yields.

- US Consumer Confidence comes up next.

Further weakness dragged EUR/USD to fresh 2022 lows in the proximity of the 1.1260 level on Tuesday.

EUR/USD weak on dollar buying

EUR/USD remains under heavy pressure in a context favourable to the greenback, where geopolitical tensions persist and US money markets continue to show a mixed performance.

On the latter, yields in the short end of the curve manage to regain some upside traction as opposed to the continuation of the downtrend in the belly and the long end.

In the meantime, the risk complex remains well under pressure against the backdrop of rising cautiousness ahead of the FOMC meeting on Wednesday, where consensus seems to be tilted towards a hawkish message from the Committee.

Further out, better-than-expected results in the German docket failed to lend some support to the shared currency after the Business Climate tracked by the IFO survey surprised to the upside in January.

Across the pond, house prices measured by the FHFA House Price Index and the S&P/Case-Shiller Index rose 1.1% MoM in November and 18.3% YoY in the same period, respectively. Further data showed the relevant US Consumer Confidence at 113.8 in January (from 115.2) and the Richmond Fed Manufacturing Index retreating to 8 for the same month.

EUR/USD levels to watch

So far, spot is losing 0.43% at 1.1276 and faces the next up barrier at 1.1369 (high Jan.20) seconded by 1.1469 (100-day SMA) and finally 1.1482 (2022 high Jan.14). On the other hand, a break below 1.1263 (2022 low Jan.25) would target 1.1221 (monthly low Dec.15 2021) en route to 1.1186 (2021 low Nov.24).

According to the latest US Conference Board survey, headline Consumer Confidence fell to 113.8 in January from 115.2 (revised lower from 115.8) in December, less than the expected decline to 111.8. The drop slight drop reflects the impact of the rapid spread of the Omicron Covid-19 variant in the US over the last few weeks, but remains substantially above prior pandemic lows in the 80 area, endorsing the Fed's view that the economy has become more resilient to each new Covid wave.

Market Reaction

FX markets do not seem to have reacted to the latest, despite it underpinning the idea of economic resilience in the face of the Omicron variant which should underpin Fed confidence in the economic recovery.

- After chopping within an $82.00-$86.00 range on Monday, WTI futures are a little lower on Tuesday in the mid-$83.00s.

- But WTI’s on-the-year outperformance compared to equities remains remarkable and will likely persist amid bullish crude oil specific factors.

It was a choppy start to the week for global oil markets, with front-month WTI futures swinging within an $82.00-$86.00 range as energy markets were buffeted by extreme volatility in US equity markets. With US equity futures pointing lower heading into the Tuesday, oil prices are also sagging, with WTI down just under 50 cents and trading in the mid-$83.00s, now a good $4.0 below the multi-year highs printed last Wednesday above $87.50. While recent volatility/downside in US equity markets, which analysts have said is being driven by heightened Fed tightening fears ahead of Wednesday's policy announcement, has weighed on oil in recent days, oil continues to outperform on an on-the-year basis.

WTI is up 11% on the year having surged from the mid-$75.00s, S&P 500 futures are (ahead of the open) trading down nearly 9.0% on the year. Crude oil-specific factors have been supporting oil prices. Firstly, expectations for a continued robust recovery in crude oil demand this year remain elevated, with the international spread of Omicron already easing and not seen as dealing a long-term blow to demand. Secondly, OPEC+ supply issues have been a big theme, with smaller producers in the cartel struggling to keep pace with rising output quotas.

Geopolitical tensions have also been amping up increasing the risk-premia embedded in oil prices; Iran-aligned Yemeni militia groups have recently upped attacks on the UAE, near the key Strait of Hormuz global oil supply chokepoint. Meanwhile, NATO has started beefing up its Eastern European military presence in response to the Russian military build-up on the Ukrainian border. The implication for Russia’s oil output/exports (Russia is the world’s third-largest oil producer of more than 11M barrels per day) in case of a military incursion remains unclear. These factors are likely to keep oil prices underpinned relatively well versus equity markets, even if the downturn in the latter continues.

- GBP/USD dropped to a fresh multi-week low, though found support ahead of the monthly low.

- The set-up still favours bearish traders and supports prospects for a further depreciating move.

- Attempted recovery could be seen as a selling opportunity near the 1.3530 support breakpoint.

The GBP/USD pair extended its recent pullback from the vicinity of mid-1.3700s, or a two-month low and witnessed some selling for the fourth successive day on Tuesday.

The downward trajectory dragged spot prices to a fresh three-week low during the mid-European session, though stalled just ahead of the monthly swing low. The GBP/USD pair once again showed some resilience below the 50% Fibonacci retracement level of 1.3161-1.3749 move up and has now recovered to the 1.3465 area.

Given the overnight breakthrough the 100-day SMA and the 38.2% Fibo. confluence and the subsequent slide below the 1.3500 psychological mark, the bias remains tilted in favour of bearish traders. Hence, any attempted recovery runs the risk of fizzling out rather quickly and remain capped amid the UK political crisis.

The near-term negative outlook is reinforced by the fact that technical indicators on the daily chart have just started drifting into the negative territory. A subsequent slide below the monthly swing low, around the 1.3430 region, will reaffirm the bearish bias and set the stage for a further near-term depreciating move.

The GBP/USD pair might then turn vulnerable to accelerate the downfall towards the 1.3400 mark en-route the 61.8% Fibo. level support, around the 1.3380 region. Some follow-through selling has the potential to drag spot prices further towards the next relevant support near the 1.3320 horizontal zone.

On the flip side, the 1.3500 mark now seems to act as an immediate resistance ahead of the 1.3530-1.3535 confluence support breakpoint. A sustained strength beyond could trigger a short-covering bounce and allow bulls to aim back to reclaim the 1.3600 mark, which coincides with the 23.6% Fibo. level resistance.

GBP/USD daily chart

-637787157802188836.png)

Technical levels to watch

Sterling losses are extending for the seventh day in eight to trade in the mid 1.34s. Economists at Scotiabank note that a breach of the 1.34 would clear the way for a slump to the 1.32 area.

Cable has failed at the 1.3495/500 resistance

“GBP/USD is still holding above Monday’s intraday low of 1.3440 that stands as support, followed by the 50-day MA at 1.3421 and the big figure area.”

“A break under 1.34 will spell more trouble ahead for the pound and target a move to the 1.32 zone.”

“Resistance is 1.3495/500 (failed test this morning) followed by the 100-day MA at 1.3536 and the mid-figure area.”

The collapse in the S&P 500 has extended to the 38.2% retracement of the rally from October 2020 at 4213 and the aggressive turnaround higher has seen a near-term bullish reversal pattern complete. Strategists at Credit Suisse look for a consolidation phase into the FOMC on Wednesday, but with 4430/4450 ideally capping.

VIX set to challenge the October 2020 high of 41.16

“We look for a consolidation/recovery phase to emerge prior to the FOMC this Wednesday. We thus look for a test of resistance at 4430/50 – the key 200-day average and 38.2% Fibonacci retracement of the January collapse – but with our bias for this to cap for a phase of consolidation, ahead of a retest of 4213/4164.”

“Whilst we will look for evidence of a floor at 4213/4164 again, should weakness extend we would see scope for further weakness to 4057, potentially 3855/15.”

“A close above 4450 would be seen to mark a further stabilization, with resistance then seen next at 4477 ahead of 4495.”

“VIX continues to surge higher and we look for a test of 41.16/36 – the October 2020 high and 38.2% retracement of the 2020/2021 fall. Beyond here, and we would then see scope for a move to 50.”

EUR/USD slips under 1.13. Economists at Scotiabank expect the pair to find support around the 1.1250 level.

Euro remains at risk of further losses on mounting Russia/Ukraine tensions

“The EUR’s losses since mid-month have today seen it break under the bottom of the upward trending channel where it traded since late-November (at 1.1292). Losses beyond this point may find support at the mid-figure area followed by ~1.1220/35.”

“Resistance is 1.1290/300 followed by ~1.1335.”

“The EUR remains at risk of further losses on escalating risks between Russia and Ukraine (and NATO), as well as tomorrow’s Fed meeting where the bank will likely tee up a rate hike.”

- USD/TRY adds to the recent upside momentum.

- The stronger dollar weighs on the EM FX space.

- Turkey 10y bond yields sink to multi-week lows.

The Turkish currency depreciates further and motivates USD/TRY to advance to new tops near 13.60 on Tuesday.

USD/TRY up on dollar gains, geopolitics

USD/TRY trades with decent gains for the third session in a row in the first half of the week, always amidst the strong rebound in the US dollar and persistent jitters stemming from the Russia-Ukraine front.

The offered stance in the lira seems to have accelerated after finmin N.Nebati said on Monday that around $10B in FX bank deposits could be converted to the Turkish currency, all following last week’s parliamentary decision that gains from such deposits will be exempt from corporate income tax.

It is worth recalling that the Erdogan Administration announced in late December a time-deposit scheme that compensates depositors for losses in case the lira depreciates during the duration of the deposit.

That announcement, coupled with increased FX intervention by the Turkish central bank (CBRT), forced USD/TRY to quickly abandon the area of all-time highs near 18.30 (December 20) and to drop to as low as the vicinity of the psychological 10.00 mark,

where solid contention emerged eventually.

In the calendar, Turkey’s Capacity Utilization eased a tad to 77.6% in January (from 78.7%) and the Manufacturing Confidence improved to 109.5 in the same month (from 106.1).

What to look for around TRY

The pair keeps the multi-session consolidative theme well in place, always within the 13.00-14.00 range. The range bound stance appears reinforced by the recent steady hand by the Turkish central bank, while skepticism keeps running high over the effectiveness of the recently announced plan to promote the de-dollarization of the economy. In the meantime, the reluctance of the CBRT to change the (collision?) course and the omnipresent political pressure to favour lower interest rates in the current context of rampant inflation and (very) negative real interest rates are forecast to keep the domestic currency under pressure for the time being.

Key events in Turkey this week: Capacity Utilization, Manufacturing Confidence (Tuesday) – Economic Confidence Index (Friday).

Eminent issues on the back boiler: Progress (or lack of it) of the government’s new scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Much-needed structural reforms. Growth outlook vs. progress of the coronavirus pandemic. Earlier Presidential/Parliamentary elections?

USD/TRY key levels

So far, the pair is advancing 0.63% at 13.5217 and a drop below 12.7523 (2022 low Jan.3) would expose 10.2027 (monthly low Dec.23) and finally 9.8039 (200-day SMA). On the other hand, the next up barrier lines up at 13.9319 (2022 high Jan.10) followed by 18.2582 (all-time high Dec.20) and then 19.0000 (round level).

- EUR/GBP pulls back to 0.8370 area after hitting near-one-month highs on Tuesday amid equity market turmoil.

- Some traders may continue to use EUR/GBP longs as a means of hedging against equity market weakness.

After Tuesday’s global equity market turmoil that translated into broad weakness in the more risk-sensitive G10 currencies, sending EUR/GBP to near one-month highs in the 0.8420s, the pair has pulled back a tad and stabilised in the 0.8375 area. Sellers appeared to take advantage of the latest rally to add to short positions, perhaps in anticipation that risk appetite-related GBP weakness will prove short-lived and BoE monetary policy tightening in the coming weeks will continue to weigh. Risk appetite stabilisation is far from guaranteed against the backdrop of a highly anticipated Fed policy meeting on Wednesday and rising NATO/Ukraine/Russia tensions. Some traders may continue to use EUR/GBP longs as a means of hedging against equity market weakness.

Elsewhere, the latest stronger than expected German IFO survey results haven't translated into euro strength and didn’t impact EUR/GBP. The economic commentary from IFO was downbeat, with the group saying it is too early to talk about an economic turnaround in Germany. IFO added that there is not yet any easing of prices, with about half of firms surveyed looking to raise prices. Data has taken a back seat as a driver of FX market sentiment this week, with EUR/GBP not responsive to Monday’s mixed Eurozone and weaker than expected UK PMIs either.

That is likely to remain the case when individual Eurozone countries start releasing Q4 2021 GDP data at the end of the week, with focus more on themes like risk appetite, geopolitics and central bank tightening. In the same vein, as calls for UK PM Boris Johnson to resign grow ever louder in the UK as the Downing Street party scandal grows, FX strategists remain confident this won't result in lasting GBP weakness. “Should Johnson leave, his successor would likely be seen as a safe pair of hands and we do not see any political risk premium being built into GBP” say analysts at ING.

- USD/CAD edged higher on Tuesday, albeit lacked any follow-through or bullish conviction.

- Fed rate hike bets, surging US bond yields benefitted the USD and extended some support.

- Weaker crude oil prices undermined the loonie and further acted as a tailwind for the pair.

- Investors, however, seemed reluctant ahead of the FOMC and BoC decision on Wednesday.

The USD/CAD pair traded with a mild positive bias through the early North American session, albeit seemed struggling to capitalize on the move beyond mid-1.2600s.

Following the previous day's pullback from the 1.2700 mark, or a two-week high, the USD/CAD pair edged higher on Tuesday and was supported by a combination of factors. Weaker crude oil prices undermined the commodity-linked loonie and acted as a tailwind for the major. Adding to this, broad-based US dollar strength also extended some support to the pair, though the uptick lacked bullish conviction.

The USD continued drawing support from firming expectations that the Fed will tighten its monetary policy at a faster pace than anticipated. In fact, the markets have fully priced in an eventual lift-off in March and expect a total of four hikes in 2022. This was reaffirmed by a strong pickup in the US Treasury bond yields, which turned out to be another factor that benefitted the greenback.

That said, speculations that the Bank of Canada could increase rates as early as this week – amid a jump in Canada’s annual inflation rate to a three-decade high – helped limit losses for the Canadian dollar. This, in turn, held back traders from placing aggressive bets heading into the key central bank event risks – the BoC policy decision and the outcome of a two-day FOMC meeting on Wednesday.

Hence, it will be prudent to wait for a strong follow-through buying before confirming that the USD/CAD pair has formed a strong base near the 1.2445 region and positioning for any further gains. Market participants now look forward to the release of the Conference Board's US Consumer Confidence Index. This, along with oil price dynamics, might provide some trading impetus to the USD/CAD pair.

Technical levels to watch

Gold ends up closing the second straight week in positive territory. On Wednesday, the Federal Reserve will announce its policy rate decision and release the Monetary Policy Statement following its two-day meeting. In the view of FXStreet’s Eren Sengezer, XAU/USD could turn south on a hawkish Fed surprise.

Dovish scenario

“The Fed adopts a dovish tone by suggesting that it will remain patient with regards to policy tightening. US T-bond yields could fall sharply on such a shift in the policy outlook and provide a boost to XAU/USD. FOMC Chairman Jerome Powell would need to voice renewed concerns over the labour market and the growth outlook to convince investors that they will not rush to continue to lift rates after March.”

Hawkish scenario

“Chairman Powell will definitely have to respond to questions on the possibility of a 50 bps hike in March. If Powell reveals that they have discussed such an option, US T-bond yields could surge higher and force gold to turn south. Moreover, a decision to increase the reductions in monthly asset purchases could also be assessed as a bullish development for the greenback.”

- Spot gold prices have pulled back a little on Tuesday to back under $1840 but remain underpinned amid volatile equities.

- Gold remains resilient to a stronger USD and higher US yields and continue to trade well within recent $1830-$1845 ranges.

Spot gold (XAU/USD) prices have pulled back a little from Asia Pacific highs in the $1843 area over the last few hours and were last trading in the $1838 area, down about 0.3% on the day. That still leaves the precious metal well within recent $1830-$1845ish ranges that have prevailed over the last few sessions. High levels of US equity market volatility is helping underpin gold with safe-haven demand. The S&P 500 was all over the place on Monday, reversing a more than 4.0% drop, and has since dropped over 1.0% in pre-market trade on Tuesday.

That safe-haven demand amid turmoil in the equity space, as well as elevated geopolitical tensions (primarily in Eastern Europe), is helping to shield gold from recent advances in the US dollar and bond yields. As market pre-position ahead what should be a very hawkish Fed meeting on Wednesday, the Dollar Index (DXY) hit fresh three-week highs on Tuesday in the low-96.00s, boosted by higher yields across the US treasury curve (10s +4bps to 1.78%). Typically, this combination would be a negative for gold; a stronger USD makes dollar-denominated gold more expensive for the holders of international currencies and higher yields increase the opportunity cost of holding non-yielding precious metals.

November House Price and January Consumer Confidence data out of the UK on Tuesday is unlikely to shift the narrative much for markets or dissuade the Fed from deeming it appropriate to signal that multiple rate hikes and quantitative tightening in 2022 is appropriate. Indeed, very week flash January US PMI data (primarily the services sector) was shrugged off by markets on Monday as being driven by temporary Omicron factors and this is almost certainly also how the Fed will view things.

What will be most interesting this week will be if gold can continue to hold only a few bucks below multi-month highs near the $1840 if hawkish Fed vibes continue to drive the US dollar and US yields higher. Any move back to and break below support in the $1830 area would open the door to a drop back to the 200 and 50-day moving averages in the $1800 area.

- AUD/USD struggled to preserve stronger Australian CPI-led intraday gains to the 0.7175 region.

- Rebounding US bond yields, Fed rate hike bets underpinned the USD and exerted some pressure.

- Stability in the European equity markets failed to lend any support to the perceived riskier aussie.

The USD continued scaling higher through the mid-European session and dragged the AUD/USD pair to a fresh daily low, around the 0.7125 region in the last hour.

The pair struggled to capitalize on its early uptick supported by hotter-than-expected Australian CPI figures and attracted fresh selling near the 0.7175 area on Tuesday amid sustained US dollar buying. Against the backdrop of expectations for a faster policy tightening by the Fed, a strong rebound in the US Treasury bond yields pushed the greenback to a fresh two-week high. This, in turn, was seen as a key factor that exerted downward pressure on the AUD/USD pair.

Investors now seem convinced that the Fed would begin raising interest rates in March and have been pricing in a total of four hikes in 2022. Apart from this, rising geopolitical risk over Ukraine further benefitted the greenback's relative safe-haven status. The combination of factors, to a larger extent, negated signs of stability in the European equity markets and failed to impress bullish traders or lend any support to the perceived riskier aussie.

With the USD price dynamics turning out to be a key driver of the AUD/USD pair's momentum, traders now look forward to the Conference Board's US Consumer Confidence Index for a fresh impetus. Apart from this, the US bond yields will drive the USD demand. This, along with the broader market risk sentiment, should produce some trading opportunities. The key focus, however, will remain on the outcome of a two-day FOMC meeting, scheduled to be announced on Wednesday.

From a technical perspective, the emergence of fresh selling on Tuesday favours bearish traders and supports prospects for an extension of last week's rejection slide from the 100-day SMA. Sustained weakness below the 0.7100 mark will reaffirm the negative outlook and turn the AUD/USD pair vulnerable. The downward trajectory could then drag spot prices to the 0.7060-50 intermediate support en-route the 2021 swing low, around the key 0.7000 psychological mark.

Technical levels to watch

- EUR/USD drops further and clocks new 2022 low.

- The decline could now extend to the December 2021 low near 1.1220.

EUR/USD remains immersed into the negative territory and drops to new YTD lows in the 1.1270/65 band on Tuesday.

The bias appears tilted to a deeper pullback in the very near term. That said, the next support of note is now seen at the December 2021 low at 1.1221 (December 15) ahead of the 2021 low at 1.1186 (November 24).

The longer term negative outlook for EUR/USD is seen unchanged while below the key 200-day SMA at 1.1708.

EUR/USD daily chart

- DXY gathers extra steam and clinches tops around 96.30.

- The YTD peak at 96.46 emerges as the next key target.

DXY extends Monday’s upbeat tone and advances to multi-day tops in the vicinity of the 96.30 level on Tuesday.

The intense upside in the dollar has recently surpassed the 4-month line, today near 95.40, allowing for the continuation of the rebound in the short-term horizon. That said, the door now remains open to a potential assault of the so far 2022 top at 96.46 (January 4). The surpass of this level should then put the 2021 top at 96.93 (November 24) back on the radar.

Looking at the broader picture, the longer-term positive stance in the dollar remains unchanged above the 200-day SMA at 93.26.

DXY daily chart

- EUR/JPY resumes the downside after Monday’s uptick.

- Next on the way south comes the December 2021 lows near 127.50.

Sellers remain well in control of the sentiment surrounding EUR/JPY on turnaround Tuesday.

Price action in the cross keeps pointing to further retracements for the time being. Indeed, EUR/JPY accelerated the losses following the convincing breakdown of the key 200-day SMA (130.50) in past sessions, opening the door to a potential drop to the December 2021 low near 127.50 (December 3).

While below the 200-day SMA, the outlook for the cross is expected to remain negative.

EUR/JPY daily chart

Barnabas Gan, Economist at UOB Group, reviews the latest inflation figures in Singapore.

Key Takeaways

“Singapore’s consumer prices rose at its fastest rate since Feb 2013 at 4.0% y/y (+0.5% m/m sa) in Dec 2021. This is significantly higher compared to market expectations for a milder headline inflation rate of 3.7% y/y, albeit closer to our outlook of 3.9% y/y.”

“Inflation risks are still being felt at this juncture, given that headline inflation had accelerated for four straight months. Given the recent stronger-than-expected inflation readings, the authorities have refrained from publishing their full-year headline and core inflation outlook for 2022.”