- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 26-02-2018

(raw materials / closing price /% change)

Oil 64.00 +0.71%

Gold 1,334.90 +0.35%

(index / closing price / change items /% change)

Nikkei +260.85 22153.63 +1.19%

TOPIX +14.28 1774.81 +0.81%

Hang Seng +231.43 31498.60 +0.74%

CSI 300 +47.33 4118.42 +1.16%

Euro Stoxx 50 +21.72 3463.18 +0.63%

FTSE 100 +45.17 7289.58 +0.62%

DAX +43.25 12527.04 +0.35%

CAC 40 +26.89 5344.26 +0.51%

DJIA +399.28 25709.27 +1.58%

S&P 500 +32.30 2779.60 +1.18%

NASDAQ +84.07 7421.47 +1.15%

S&P/TSX +76.21 15714.66 +0.49%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2317 +0,17%

GBP/USD $1,3966 -0,01%

USD/CHF Chf0,93794 +0,14%

USD/JPY Y106,94 +0,08%

EUR/JPY Y131,73 +0,26%

GBP/JPY Y149,362 +0,07%

AUD/USD $0,7853 +0,24%

NZD/USD $0,7303 +0,15%

USD/CAD C$1,2683 +0,19%

07:45 France Consumer confidence February 104 103

08:40 Eurozone ECB's Yves Mersch Speaks

09:00 Eurozone Private Loans, Y/Y January 2.8% 2.9%

09:00 Eurozone M3 money supply, adjusted y/y January 4.6% 4.6%

10:00 Eurozone Consumer Confidence (Finally) February 1.4 0.1

10:00 Eurozone Industrial confidence February 9.1 8.0

10:00 Eurozone Economic sentiment index February 114.7 114.0

10:00 Eurozone Business climate indicator February 1.54 1.48

13:00 Germany CPI, m/m (Preliminary) February -0.7% 0.5%

13:00 Germany CPI, y/y (Preliminary) February 1.6% 1.5%

13:30 U.S. Goods Trade Balance, $ bln. January -71.6 -72.3

13:30 U.S. Durable goods orders ex defense January 2.2% 0.3%

13:30 U.S. Durable Goods Orders ex Transportation January 0.6% 0.4%

13:30 U.S. Durable Goods Orders January 2.9% -2.2%

14:00 U.S. Housing Price Index, m/m December 0.4% 0.4%

14:00 U.S. S&P/Case-Shiller Home Price Indices, y/y December 6.4% 6.3%

15:00 U.S. Richmond Fed Manufacturing Index February 14 15

15:00 U.S. Consumer confidence February 125.4 126.3

21:45 New Zealand Visitor Arrivals January 3.9%

23:50 Japan Retail sales, y/y January 3.6% 2.6%

23:50 Japan Industrial Production (YoY) (Preliminary) January 4.4%

23:50 Japan Industrial Production (MoM) (Preliminary) January 2.9% -4.1%

-

The euro area economy is expanding robustly

-

Given the uncertainty surrounding the measurement of economic slack, the true amount may be larger than estimated

-

At the same time, inflation has yet to show more convincing signs of a sustained upward adjustment

-

We anticipate that headline inflation will resume its gradual upward adjustment

-

Relationship between growth and inflation remains largely intact, even if it has temporarily weakened

-

These factors should wane as the economic expansion continues

Sales of new single-family houses in January 2018 were at a seasonally adjusted annual rate of 593,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 7.8 percent below the revised December rate of 643,000 and is 1.0 percent below the January 2017 estimate of 599,000.

The median sales price of new houses sold in January 2018 was $323,000. The average sales price was $382,700.

U.S. stock-index futures advanced on Monday, amid increased belief that the new Federal Reserve's Chairman Jerome Powell will signal the U.S. central bank remains on a steady course of monetary tightening in the short-term perspective.

Global Stocks:

Nikkei 22,153.63 +260.85 +1.19%

Hang Seng 31,498.60 +231.43 +0.74%

Shanghai 3,330.25 +41.23 +1.25%

S&P/ASX 6,042.20 +42.40 +0.71%

FTSE 7,282.44 +38.03 +0.52%

CAC 5,348.72 +31.35 +0.59%

DAX 12,530.24 +46.45 +0.37%

Crude $63.34 (-0.33%)

Gold $1,338.80 (+0.64%)

-

'Substantially' raising target interest rate from current level could make Fed policy too restrictive

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 238.81 | 1.79(0.76%) | 2157 |

| ALCOA INC. | AA | 47.6 | 0.90(1.93%) | 22638 |

| ALTRIA GROUP INC. | MO | 64.7 | 0.11(0.17%) | 2546 |

| Amazon.com Inc., NASDAQ | AMZN | 1,512.42 | 12.42(0.83%) | 94639 |

| American Express Co | AXP | 99.38 | 0.58(0.59%) | 1500 |

| AMERICAN INTERNATIONAL GROUP | AIG | 60.24 | 0.17(0.28%) | 5284 |

| Apple Inc. | AAPL | 176.4 | 0.90(0.51%) | 269536 |

| AT&T Inc | T | 36.93 | 0.21(0.57%) | 17827 |

| Barrick Gold Corporation, NYSE | ABX | 12.33 | 0.15(1.23%) | 12318 |

| Boeing Co | BA | 358.59 | 1.93(0.54%) | 14105 |

| Caterpillar Inc | CAT | 163.6 | 1.19(0.73%) | 8912 |

| Chevron Corp | CVX | 113.28 | 0.69(0.61%) | 4418 |

| Cisco Systems Inc | CSCO | 44.32 | 0.32(0.73%) | 16675 |

| Citigroup Inc., NYSE | C | 77.2 | 0.12(0.16%) | 12216 |

| Deere & Company, NYSE | DE | 166.92 | 0.68(0.41%) | 130 |

| Exxon Mobil Corp | XOM | 77.75 | 0.22(0.28%) | 5985 |

| Facebook, Inc. | FB | 184.4 | 1.11(0.61%) | 84074 |

| FedEx Corporation, NYSE | FDX | 255.55 | 3.33(1.32%) | 307 |

| Ford Motor Co. | F | 10.75 | 0.05(0.47%) | 29479 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 19.71 | 0.16(0.82%) | 10361 |

| General Electric Co | GE | 14.52 | 0.03(0.21%) | 400515 |

| General Motors Company, NYSE | GM | 41.15 | 0.24(0.59%) | 5567 |

| Goldman Sachs | GS | 268.5 | 1.73(0.65%) | 1792 |

| Google Inc. | GOOG | 1,132.07 | 5.28(0.47%) | 16774 |

| Hewlett-Packard Co. | HPQ | 22.5 | 0.37(1.67%) | 38844 |

| Home Depot Inc | HD | 189.5 | 1.15(0.61%) | 4655 |

| Intel Corp | INTC | 48.15 | 0.42(0.88%) | 46973 |

| International Business Machines Co... | IBM | 156.3 | 0.78(0.50%) | 2535 |

| Johnson & Johnson | JNJ | 131.73 | 0.55(0.42%) | 3802 |

| JPMorgan Chase and Co | JPM | 117.91 | 0.60(0.51%) | 11437 |

| McDonald's Corp | MCD | 163.7 | 0.64(0.39%) | 3374 |

| Merck & Co Inc | MRK | 55.03 | 0.16(0.29%) | 6887 |

| Microsoft Corp | MSFT | 94.51 | 0.45(0.48%) | 69350 |

| Nike | NKE | 68.38 | 0.22(0.32%) | 4250 |

| Pfizer Inc | PFE | 36.3 | 0.04(0.11%) | 18720 |

| Procter & Gamble Co | PG | 81.52 | 0.47(0.58%) | 4183 |

| Starbucks Corporation, NASDAQ | SBUX | 56.41 | 0.27(0.48%) | 3438 |

| Tesla Motors, Inc., NASDAQ | TSLA | 353.75 | 1.70(0.48%) | 21309 |

| The Coca-Cola Co | KO | 44.18 | 0.14(0.32%) | 15468 |

| Travelers Companies Inc | TRV | 140.66 | 0.92(0.66%) | 1496 |

| Twitter, Inc., NYSE | TWTR | 32.86 | 0.20(0.61%) | 44052 |

| United Technologies Corp | UTX | 133.71 | 0.56(0.42%) | 1601 |

| UnitedHealth Group Inc | UNH | 231.47 | 1.31(0.57%) | 3107 |

| Verizon Communications Inc | VZ | 48.4 | 0.11(0.23%) | 9687 |

| Visa | V | 123.55 | 0.62(0.50%) | 7421 |

| Wal-Mart Stores Inc | WMT | 93.18 | 0.29(0.31%) | 30616 |

| Walt Disney Co | DIS | 107.66 | 0.41(0.38%) | 5701 |

| Yandex N.V., NASDAQ | YNDX | 43.38 | 0.89(2.09%) | 5932 |

Wal-Mart (WMT) initiated with a Neutral at Credit Suisse

Intel (INTC) target raised to $60 from $50 at Nomura; reiterated Buy

-

Important that state's share in banking sector does not increase further

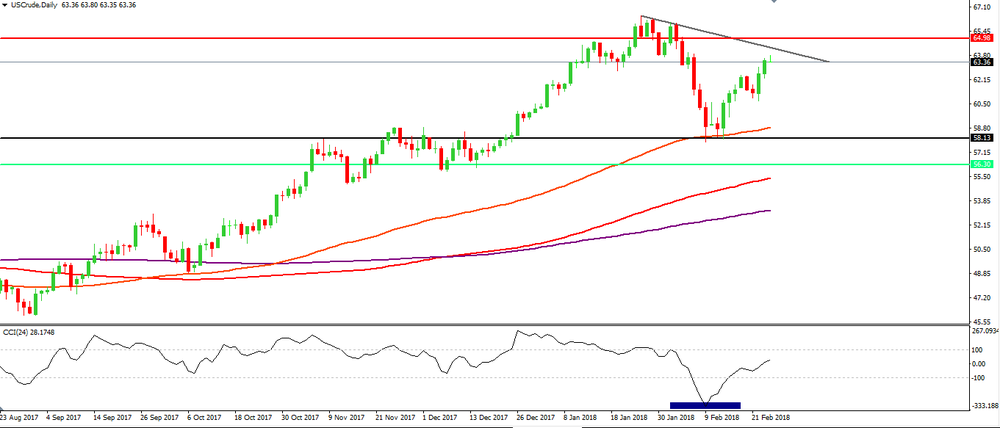

Crude oil Analysis

On daily time frame chart we can see that the price is (again) close to the downside trend line.

This trend line may be interesting for entry opportunities because if the price starts to reject it as it did the last few times then it might be interesting for short entries.

On the other hand, if the price breaks that same line, then we can also consider a good opportunity for long entries.

Note that in weekly time frame chart we are faced with an inverted head and shoulders - Chart Pattern

-

Sight deposits of domestic banks at 460.158 bln chf in week ending february 23 versus 461.998 bln chf a week earlier

-

Says it is not too late for common decency

-

Told polish PM the situation was very serious and affected Poland's standing in the world

-

Russia's positive outlook reflects continued progress in strengthening economic policy framework underpinned by more flexible exchange rate

-

Russia's positive outlook also reflects strong commitment to inflation-targeting and a prudent fiscal strategy

-

Really need to address questions of how to respond to next recession

-

Monitoring narrow credit risk spreads, could reflect complacency

-

Overall financial system looks good, banking system highly capitalized

-

No plan to conduct another comprehensive review of BoJ's policy

-

Appropriate to keep targeting 2 pct inflation given Japan's economic, price situation

EUR/USD

Resistance levels (open interest**, contracts)

$1.2398 (5061)

$1.2378 (2614)

$1.2350 (1072)

Price at time of writing this review: $1.2327

Support levels (open interest**, contracts):

$1.2262 (6354)

$1.2242 (2168)

$1.2216 (5723)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date March, 9 is 128832 contracts (according to data from February, 23) with the maximum number of contracts with strike price $1,2400 (6354);

GBP/USD

Resistance levels (open interest**, contracts)

$1.4119 (2298)

$1.4090 (1901)

$1.4047 (3690)

Price at time of writing this review: $1.4015

Support levels (open interest**, contracts):

$1.3892 (1827)

$1.3866 (770)

$1.3835 (2304)

Comments:

- Overall open interest on the CALL options with the expiration date March, 9 is 50618 contracts, with the maximum number of contracts with strike price $1,3900 (3690);

- Overall open interest on the PUT options with the expiration date March, 9 is 47982 contracts, with the maximum number of contracts with strike price $1,3900 (2304);

- The ratio of PUT/CALL was 0.95 versus 0.94 from the previous trading day according to data from February, 23

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.