- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 30-05-2014

Most stock

indices traded lower due to the weak German retail sales and speculations over

further stimulus measures from the European Central Bank.

The German

adjusted retail sales dropped 0.9% in April, after a 0.7% decline in March.

Analysts had expected a 0.4% rise.

The

unadjusted retail sales in Germany climbed 3.4% in April, after a decrease of

1.9% in March.

Societe

Generale SA shares decreased 2.1% after its Russian unit posted a drop in

first-quarter profit.

BNP Paribas

SA shares declined 2.9% due to the company may be forced to pay a penalty

exceeding $10 billion in the U.S.

Indexes on

the close:

Name Price Change Change %

FTSE

100 6,844.51 -26.78 -0.39%

DAX 9,943.27 +4.37 +0.04%

CAC 40 4,519.57 -10.94 -0.24%

West

Texas Intermediate headed for its first monthly advance since February as crude

inventories shrank at the delivery point for New York contracts. Brent was

steady in London, poised for a second monthly gain amid violence in Ukraine.

Futures

were little changed after rising 0.8 percent yesterday. Stockpiles at Cushing,

Oklahoma, the biggest U.S. oil-storage hub, dropped by 1.53 million barrels

last week to the lowest level since November 2008, according to the Energy

Information Administration. Supplies nationwide expanded by 1.66 million,

compared with a 500,000 barrel gain estimated in a Bloomberg News survey.

“WTI has

been supported during the month of May by strong stock draws in Cushing and by

short covering from large speculators,” Olivier Jakob, managing director at

Petromatrix GmbH in Zug, Switzerland, said by e-mail.

WTI for

July delivery was at $103.04 a barrel in electronic trading on the New York

Mercantile Exchange, down 54 cents, at 12:59 p.m. London time. The volume of

all futures traded was about 36 percent below the 100-day average for the time

of day. Prices are up 3.3 percent this month.

Brent

for July settlement was 43 cents lower at $109.54 a barrel on the London-based

ICE Futures Europe exchange. The European benchmark crude traded at a premium

of $6.49 to WTI, compared with $8.33 at the end of April.

The U.S.

dollar traded lower against the most major currencies after the release of mixed

U.S. economic data. The personal spending in the U.S. declined 0.1% in April,

after a 0.9% in March. Analysts had expected a rise of 0.2%.

The

personal income in the U.S. increased 0.3% in April, meeting expectations,

after a 0.5% gain in March.

Reuters/Michigan

consumer sentiment index declined to 81.9 in May, from 82.8 in April. Analysts

had forecasted the index to climb to 82.9.

The Chicago

purchasing managers' index climbed to a seven-month high of 65.5 in May, from

63.0 in March. Analysts had expected a decrease to 60.2.

The euro increased

against the U.S. dollar. The German adjusted retail sales dropped 0.9% in

April, after a 0.7% decline in March. Analysts had expected a 0.4% rise.

The

unadjusted retail sales in Germany climbed 3.4% in April, after a decrease of

1.9% in March.

The British

pound climbed against the U.S. dollar in the absence of any major economic

reports in the U.K.

The Swiss

franc traded higher against the U.S. dollar. KOF leading indicator for

Switzerland dropped to 99.8 in May from 101.8 in April. April’s figure was

revised down to 101.8 from 102.04. Analysts had expected an increase to 102.05.

The

Canadian dollar declined against the U.S. dollar due to the weak Canadian gross

domestic product. The Canadian gross domestic product increased 0.1% in March,

meeting analysts’ expectations, after a 0.2% gain in February. This data means

that the Bank of Canada will likely keep interest rates unchanged next week.

The raw

material price index in Canada climbed 0.1% in April, after a 0.6% rise in

March. Analysts had expected a 1.2% gain.

The New

Zealand dollar traded mixed against the U.S dollar. The number of new dwellings

excluding apartments in New Zealand climbed 2.7% on year. That is the highest

level since September 2007.

The

building permits in New Zealand increased 1.5% in April, after an 8.3% gain in

March.

The

Australian dollar was up against the U.S. dollar after the release of the

better-than-expected private sector credit data in Australia, but later lost

its gains. The private sector credit data in Australia increased 0.5% in April,

from a 0.4% rise in March. Analysts had expected a 0.4% gain. On a yearly

basis, the private sector credit data in Australia rose 4.6% in April, from a

4.4% rise in March.

The

Japanese yen traded mixed against the U.S. dollar after release of mixed

economic data in Japan. Japan's core consumer price index excluding fresh food

climbed at an annual rate of 3.2% in April, after a 1.3% increase in March.

That was the fastest pace since February 1991. Analysts had expected 3.1% rise.

Household

spending in Japan declined by an annualized rate of 4.6% in April, after a 7.2%

rise in March. Analysts had forecasted a 3.2% decrease.

The

industrial production in Japan decreased 2.5% in April, after a 0.7% gain in

March. Analysts had expected a 1.9% drop.

Gold prices fell to a four-month low amid data on personal spending and income Americans.

Consumer spending in the U.S. fell in April , despite the forecasts of experts at a moderate increase , which reinforces concerns about the strength of economic recovery.

Ministry of Commerce announced that the seasonally adjusted volume of personal spending fell in April by 0.1 % , compared to the upwardly revised figure for the previous month at 1.0 % (originally reported +0.9 %). We add that the March growth was highest since August 2009. Economists had expected the figure to grow in April by 0.2%.

Many indicators have been volatile over the past few months , which was due to weather factors . Most economists say that the recession in the first quarter is likely to be followed by a moderate increase .

The Ministry of Commerce also reported that the annualized consumer spending rose by 3.1% in the first quarter , helped by rising health care costs .

Meanwhile , the report showed that in April, consumer spending on utilities fell 0.1 % after rising 0.8% in the previous month , while spending on goods fell 0.1 % after increasing 1.4% in March.

At the same time the amount of personal income rose in April by 0.3 % in April, which was slightly lower than the March increase - at 0.5% . Last change coincided with forecasts .

The price index for personal consumption expenditures , which is the preferred sensor for Fed inflation rose to a seasonally adjusted 0.2% compared to March and by 0.2% excluding prices for food and energy . In annual terms, the index increased by 1.6 % and 1.4% , respectively.

The cost of the June gold futures on the COMEX today dropped to $ 1243.8 per ounce.

EUR/USD $1.3550-60, $1.3600, $1.3620-30, $1.3650

USD/JPY Y100.90-101.00, Y101.90-Y102.00, Y102.05, Y102.20

GBP/USD $1.6660, $1.6700, $1.6775

AUD/USD $0.9200, $0.9235, $0.9290, $0.9300

NZD/USD $0.8400, $0.8520

U.S. stock-index futures fell slightly as a report showed an unexpected decline in consumer spending last month.

Global markets:

Nikkei 14,632.38 -49.34 -0.34%

Hang Seng 23,081.65 +71.51 +0.31%

Shanghai Composite 2,039.21 -1.38 -0.07%

FTSE 6,859.74 -11.55 -0.17%

CAC 4,514.42 -16.09 -0.36%

DAX 9,942.48 +3.58 +0.04%

Crude oil $102.93 (-0.63%)

Gold $1254.20 (-0.17%)

The

Canadian gross domestic product increased 0.1% in March, meeting analysts’

expectations, after a 0.2% gain in February. The reason for this weak economy

growth is a slowdown of activity in many sectors: final domestic demand, household final

consumption, business capital formation overall and in residential structures, in

inventories and in exports.

This data

means that the Bank of Canada will likely keep interest rates unchanged next

week.

(company / ticker / price / change, % / volume)

Johnson & Johnson | JNJ | 100.82 | +0.06% | 0.4K |

Procter & Gamble Co | PG | 80.49 | +0.11% | 0.2K |

Cisco Systems Inc | CSCO | 24.68 | 0.00% | 0.1K |

Home Depot Inc | HD | 79.89 | -0.01% | 0.1K |

Intel Corp | INTC | 26.95 | -0.04% | 2.0K |

Verizon Communications Inc | VZ | 49.70 | -0.04% | 3.5K |

Walt Disney Co | DIS | 84.00 | -0.04% | 0.4K |

AT&T Inc | T | 35.36 | -0.08% | 0.8K |

International Business Machines Co... | IBM | 183.56 | -0.11% | 0.1K |

Microsoft Corp | MSFT | 40.29 | -0.12% | 5.5K |

JPMorgan Chase and Co | JPM | 55.60 | -0.22% | 1.0K |

Exxon Mobil Corp | XOM | 101.03 | -0.24% | 4.0K |

General Electric Co | GE | 26.67 | -0.26% | 1.0K |

Caterpillar Inc | CAT | 103.31 | -0.28% | 0.4K |

The

personal spending in the U.S. declined 0.1% in April, after a 0.9% in March.

Analysts had expected a rise of 0.2%.

The

personal income in the U.S. increased 0.3% in April, meeting expectations,

after a 0.5% gain in March.

Upgrades:

Downgrades:

Other:

Apple (AAPL) target raised to $720 from $635 at Goldman; reiterated at Buy

Walt Disney (DIS) target raised to $83 from $77 at Wunderlich, reiterated at Hold

Economic

calendar (GMT0):

01:30 Australia Private Sector Credit, m/m April +0.4%

+0.4% +0.5%

01:30 Australia Private Sector Credit, y/y April

+4.4% +4.6%

05:00 Japan Housing Starts, y/y April -2.9%

-8.2% -3.3%

06:00 Germany Retail sales, real adjusted April -0.7%

+0.4% -0.9%

06:00 Germany

Retail sales, real

unadjusted, y/y April -1.9% +3.4%

07:00 Switzerland KOF Leading Indicator May 101.8

102.05 99.8

The U.S.

dollar traded mixed against the most major currencies ahead of the release of the

U.S. economic data. Personal income in the U.S. should increase 0.3% in April, after

0.5% gain in March. Personal spending in the U.S. should rise 0.2% in April,

after a 0.9% increase in March. Chicago Purchasing Managers' Index should

decline to 60.2 in May from 63.0 in April. Reuters/Michigan Consumer Sentiment

Index should increase to 82.9 in May from 82.8 in April.

The euro traded

higher against the U.S. dollar. The German adjusted retail sales dropped 0.9%

in April, after a 0.7% decline in March. Analysts had expected a 0.4% rise.

The

unadjusted retail sales in Germany climbed 3.4% in April, after a decrease of

1.9% in March.

The British

pound traded higher against the U.S. dollar in the absence of any major

economic reports in the U.K.

The Swiss

franc traded mixed against the U.S. dollar. KOF leading indicator for

Switzerland dropped to 99.8 in May from 101.8 in April. April’s figure was

revised down to 101.8 from 102.04. Analysts had expected an increase to 102.05.

The

Canadian dollar traded higher against the U.S. dollar amid the Canadian gross

domestic product. The Canadian GDP should increase 0.1% in March, after a 0.2%

gain in February.

The raw material

price index in Canada should climb 1.2% in April, after a 0.6% rise in March.

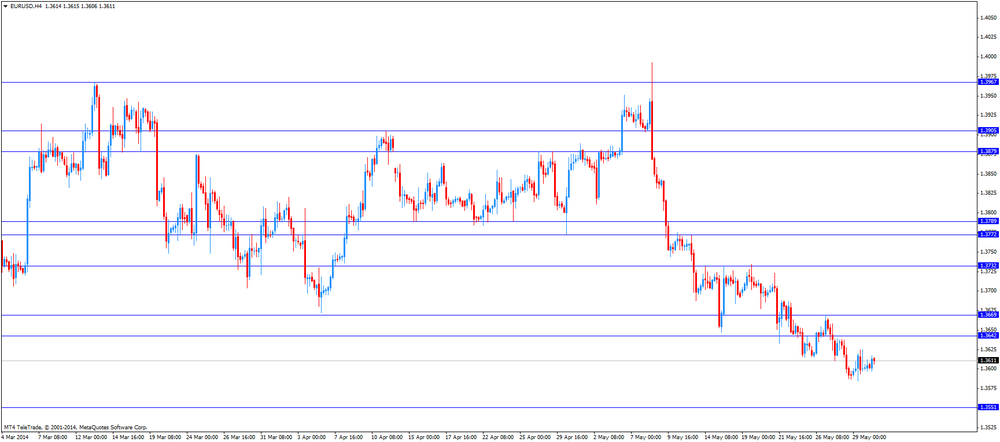

EUR/USD:

the currency pair increased to $1.3617

GBP/USD:

the currency pair climbed to $1.6757

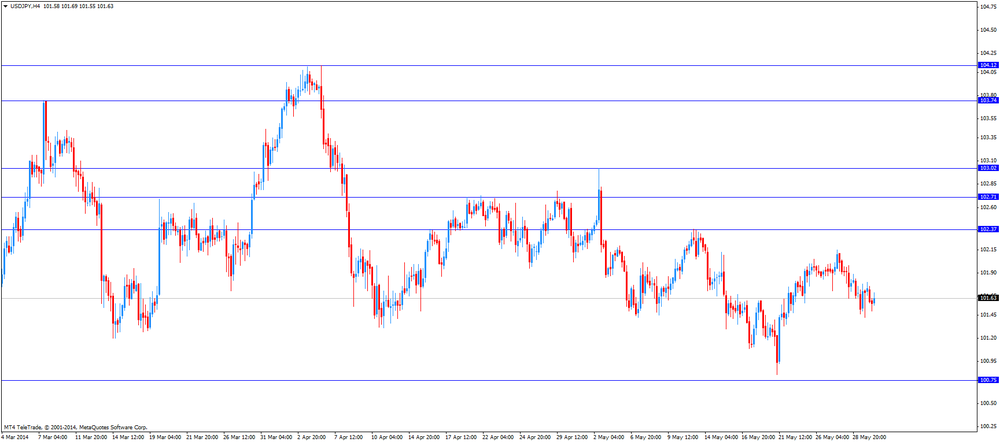

USD/JPY:

the currency pair traded mixed

The most

important news that are expected (GMT0):

12:30 Canada

Raw Material Price Index April +0.6%

+1.2%

12:30 Canada

GDP (m/m)

March +0.2% +0.1%

12:30 U.S.

Personal Income, m/m

April +0.5% +0.3%

12:30 U.S.

Personal spending

April +0.9% +0.2%

12:30 U.S.

PCE price index ex food, energy, m/m April +0.2%

+0.2%

12:30 U.S.

PCE price index ex food, energy,

Y/Y April +1.2%

13:45 U.S.

Chicago Purchasing Managers' Index May 63.0

60.2

13:55 U.S.

Reuters/Michigan Consumer Sentiment Index (Finally) May

82.8 82.9

21:00 U.S.

FOMC Member Charles Plosser Speaks

EUR/USD

Offers $1.3800, $1.3775, $1.3735, $1.3685/90, $1.3640/45

Bids $1.3550, $1.3525/20, $1.3500

GBP/USD

Offers $1.6950, $1.6930/35, $1.6900, $1.6885, $1.6840, $1.6815

Bids $1.6690, $1.6660, $1.6600, $1.6550

AUD/USD

Offers $0.9410, $0.9390, $0.9370, $0.9335

Bids $0.9270, $0.9200, $0.9150, $0.9100

EUR/JPY

Offers Y140.00, Y139.75/80, Y139.50, Y139.30, Y138.80

Bids Y137.50, Y137.00, Y136.70, Y136.50

USD/JPY

Offers Y103.00, Y102.40, Y102.15, Y101.90

Bids Y101.35, Y101.05/00, Y100.80

EUR/GBP

Offers stg0.8200, stg0.8170, stg0.8150

Bids stg0.8080, stg0.8050, stg0.8035/30, stg0.8005/000

Most stock

indices traded lower due to the weak German retail sales and speculations over

further stimulus measures from the European Central Bank.

The German adjusted

retail sales dropped 0.9% in April, after a 0.7% decline in March. Analysts had

expected a 0.4% rise.

The

unadjusted retail sales in Germany climbed 3.4% in April, after a decrease of

1.9% in March.

Societe

Generale SA shares decreased 2.3% after its Russian unit posted a drop in

first-quarter profit.

BNP Paribas

SA shares declined 5.1% due to the company may be forced to pay a penalty

exceeding $10 billion in the U.S.

Current

figures:

Name Price Change Change %

FTSE

100 6,860.87 -10.42 -0.15%

DAX 9,940.58 +1.68 +0.02%

CAC 40 4,501.89 -28.62 -0.63%

Most Asian

stock indices declined after the release of the weak U.S. economic growth data.

The U.S. gross domestic product dropped 1.0% in the first quarter, after a 0.1%

rise the previous quarter. Analysts had expected a 0.6% decline. That was the

first drop in U.S. GDP since the first quarter of 2011.

Mixed

economic data was released in Japan. Japan's core consumer price index

excluding fresh food climbed at an annual rate of 3.2% in April, after a 1.3%

increase in March. That was the fastest pace since February 1991. Analysts had

expected 3.1% rise.

Household

spending in Japan declined by an annualized rate of 4.6% in April, after a 7.2%

rise in March. Analysts had forecasted a 3.2% decrease.

The

industrial production in Japan decreased 2.5% in April, after a 0.7% gain in

March. Analysts had expected a 1.9% drop.

Indexes on

the close:

Nikkei

225 14,632.38 -49.34 -0.34%

Hang

Seng 23,081.65 +71.51 +0.31%

Shanghai

Composite 2,039.21 -1.38 -0.07%

EUR/USD $1.3550-60, $1.3600, $1.3620-30, $1.3650

USD/JPY Y100.90-101.00, Y101.90-Y102.00, Y102.05, Y102.20

GBP/USD $1.6660, $1.6700, $1.6775

AUD/USD $0.9200, $0.9235, $0.9290, $0.9300

NZD/USD $0.8400, $0.8520

Economic calendar (GMT0):

01:30 Australia Private Sector Credit, m/m April +0.4% +0.4% +0.5%

01:30 Australia Private Sector Credit, y/y April +4.4% +4.6%

05:00 Japan Housing Starts, y/y April -2.9% -8.2% -3.3%

06:00 Germany Retail sales, real adjusted April -0.7% +0.4% -0.9%

06:00 Germany Retail sales, real unadjusted, y/y April -1.9% +3.4%

07:00 Switzerland KOF Leading Indicator May 101.8 102.05 99.8

The U.S. dollar traded lower against the most major currencies after Thursday's weak U.S. economic growth data. The U.S. gross domestic product dropped 1.0% in the first quarter, after a 0.1% rise the previous quarter. Analysts had expected a 0.6% decline. That was the first drop in U.S. GDP since the first quarter of 2011.

The New Zealand dollar traded higher against the U.S dollar after the release of domestic building consents data in New Zealand. The number of new dwellings excluding apartments in New Zealand climbed 2.7% on year. That is the highest level since September 2007.

The building permits in New Zealand increased 1.5% in April, after an 8.3% gain in March.

The Australian dollar was up against the U.S. dollar after the release of the better-than-expected private sector credit data in Australia. The private sector credit data in Australia increased 0.5% in April, from a 0.4% rise in March. Analysts had expected a 0.4% gain. On a yearly basis, the private sector credit data in Australia rose 4.6% in April, from a 4.4% rise in March.

The Japanese yen traded higher against the U.S. dollar after release of mixed economic data in Japan. Japan's core consumer price index excluding fresh food climbed at an annual rate of 3.2% in April, after a 1.3% increase in March. That was the fastest pace since February 1991. Analysts had expected 3.1% rise.

Household spending in Japan declined by an annualized rate of 4.6% in April, after a 7.2% rise in March. Analysts had forecasted a 3.2% decrease.

The industrial production in Japan decreased 2.5% in April, after a 0.7% gain in March. Analysts had expected a 1.9% drop.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair climbed to $1.6740

USD/JPY: the currency pair declined to Y101.50

The most important news that are expected (GMT0):

12:30 Canada Raw Material Price Index April +0.6% +1.2%

12:30 Canada GDP (m/m) March +0.2% +0.1%

12:30 U.S. Personal Income, m/m April +0.5% +0.3%

12:30 U.S. Personal spending April +0.9% +0.2%

12:30 U.S. PCE price index ex food, energy, m/m April +0.2% +0.2%

12:30 U.S. PCE price index ex food, energy, Y/Y April +1.2%

13:45 U.S. Chicago Purchasing Managers' Index May 63.0 60.2

13:55 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) May 82.8 82.9

21:00 U.S. FOMC Member Charles Plosser Speaks

EUR / USD

Resistance levels (open interest**, contracts)

$1.3728 (4576)

$1.3695 (1601)

$1.3648 (322)

Price at time of writing this review: $ 1.3604

Support levels (open interest**, contracts):

$1.3470 (6987)

$1.3430 (3750)

$1.3388 (4973)

Comments:

- Overall open interest on the CALL options with the expiration date June, 6 is 57243 contracts, with the maximum number of contracts with strike price $1,3850 (6050);

- Overall open interest on the PUT optionswith the expiration date June, 6 is 75539 contracts, with the maximum number of contractswith strike price $1,3500 (6987);

- The ratio of PUT/CALL was 1.32 versus 1.32 from the previous trading day according to data from May, 29

GBP/USD

Resistance levels (open interest**, contracts)

$1.7000 (2763)

$1.6901 (2056)

$1.6803 (1372)

Price at time of writing this review: $1.6735

Support levels (open interest**, contracts):

$1.6695 (2652)

$1.6598 (2524)

$1.6499 (969)

Comments:

- Overall open interest on the CALL options with the expiration date June, 6 is 24273 contracts, with the maximum number of contracts with strike price $1,7000 (2763);

- Overall open interest on the PUT optionswith the expiration date June, 6 is 27176 contracts, with the maximum number of contracts with strike price $1,6700 (2652);

- The ratio of PUT/CALL was 1.12 versus 1.11 from the previous trading day according to data from May, 29

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.