- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 31-03-2020

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 | Australia | Building Permits, m/m | February | -15.3% | 4.5% |

| 00:30 | Japan | Manufacturing PMI | March | 47.8 | 44.8 |

| 01:30 | Australia | RBA Meeting's Minutes | |||

| 01:45 | China | Markit/Caixin Manufacturing PMI | March | 40.3 | 46 |

| 06:00 | Germany | Retail sales, real unadjusted, y/y | February | 1.8% | 1.5% |

| 06:00 | Germany | Retail sales, real adjusted | February | 0.9% | 0.1% |

| 07:30 | Switzerland | Manufacturing PMI | March | 49.5 | 40 |

| 07:50 | France | Manufacturing PMI | March | 49.8 | 42.9 |

| 07:55 | Germany | Manufacturing PMI | March | 48 | 45.5 |

| 08:00 | Eurozone | Manufacturing PMI | March | 49.2 | 44.7 |

| 08:30 | United Kingdom | Purchasing Manager Index Manufacturing | March | 51.7 | 47 |

| 09:00 | Eurozone | Unemployment Rate | February | 7.4% | 7.4% |

| 12:15 | U.S. | ADP Employment Report | March | 183 | 216 |

| 13:45 | U.S. | Manufacturing PMI | March | 50.7 | 49.2 |

| 14:00 | U.S. | Construction Spending, m/m | February | 1.8% | 0.5% |

| 14:00 | U.S. | ISM Manufacturing | March | 50.1 | 45 |

| 14:30 | U.S. | Crude Oil Inventories | March | 1.623 | 4.333 |

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 | Australia | Building Permits, m/m | February | -15.3% | 4.5% |

| 00:30 | Japan | Manufacturing PMI | March | 47.8 | 44.8 |

| 01:30 | Australia | RBA Meeting's Minutes | |||

| 01:45 | China | Markit/Caixin Manufacturing PMI | March | 40.3 | 46 |

| 06:00 | Germany | Retail sales, real unadjusted, y/y | February | 1.8% | 1.5% |

| 06:00 | Germany | Retail sales, real adjusted | February | 0.9% | 0.1% |

| 07:30 | Switzerland | Manufacturing PMI | March | 49.5 | 40 |

| 07:50 | France | Manufacturing PMI | March | 49.8 | 42.9 |

| 07:55 | Germany | Manufacturing PMI | March | 48 | 45.5 |

| 08:00 | Eurozone | Manufacturing PMI | March | 49.2 | 44.7 |

| 08:30 | United Kingdom | Purchasing Manager Index Manufacturing | March | 51.7 | 47 |

| 09:00 | Eurozone | Unemployment Rate | February | 7.4% | 7.4% |

| 12:15 | U.S. | ADP Employment Report | March | 183 | 216 |

| 13:45 | U.S. | Manufacturing PMI | March | 50.7 | 49.2 |

| 14:00 | U.S. | Construction Spending, m/m | February | 1.8% | 0.5% |

| 14:00 | U.S. | ISM Manufacturing | March | 50.1 | 45 |

| 14:30 | U.S. | Crude Oil Inventories | March | 1.623 | 4.333 |

FXStreet reports that economists at TD Securities note the Canadian economy began 2020 on a somewhat tepid note, with industry-level GDP rising by 0.1% against expectations for a 0.2% increase.

“Industry-level GDP growth was slightly weaker than expected at 0.1% (TD/ market: 0.2%) in January with output higher in 12 of 20 industries.”

“This data point was lost on the CAD as it should. More importantly, however, the CAD is uniquely positioned to suffer. The loonie has an added drag from oil terms of trade shock, which leaves the CAD a strategic sell.”

“We continue to look for topside in USD/CAD. We are also tactically short CAD/JPY as this week's US data should start to show the early stages of an economic catastrophe, which we think will weigh on risk sentiment.”

FXStreet reports that analysts at Rabobank suggest that, while the CHF is an established safe haven, it has a particular sensitivity to bad news in Europe. EUR/CHF is trading at 1.0574.

“We see the EUR as having held up fairly well earlier this month to the surge in USD demand. However, increased signs of political friction in the region would threaten the outlook for the EUR and weigh on EUR/CHF.”

“Overall, despite the ongoing efforts of the SNB to provide stability in the exchange rate, we see risk of a move lower to 1.04 on a 3 month view.”

FXStreet notes that Canadian January numbers are ancient history now given how the economic landscape has drastically shifted. GDP advanced 0.1% in the first month of the year, Benjamin Reitzes from BMO inform.

“The Canadian economy grew 0.1% in January, slightly below expected, from an unrevised 0.3% increase in the prior month.”

“Gains in manufacturing, wholesale and finance were largely offset by a drop in transportation, education, utilities and mining, oil & gas.”

“January numbers are ancient history now given how the economic landscape has drastically shifted. Even so, today's number will help fine tune Q1 GDP forecasts. (...) With the virus-mitigation measures almost certainly continuing through April, Q2 is going to get hit much, much harder.”

The Conference Board announced on Tuesday its U.S. consumer confidence gauge fell 12.6 points to 120.0 in March from a 132.6 in February. That was the lowest level since July 2017.

Economists had expected consumer confidence to come in at 110.0.

February's consumer confidence reading was revised up from originally estimated 130.7.

The survey showed that the expectations index decreased from 108.1 last month to 88.2 this month, while the present situation index fell from 169.3 to 167.7.

"Consumer confidence declined sharply in March due to a deterioration in the short-term outlook," noted Lynn Franco, Senior Director of Economic Indicators at The Conference Board. "The Present Situation Index remained relatively strong, reflective of an economy that was on solid footing, and prior to the recent surge in unemployment claims. However, the intensification of COVID-19 and extreme volatility in the financial markets have increased uncertainty about the outlook for the economy and jobs. March's decline in confidence is more in line with a severe contraction - rather than a temporary shock - and further declines are sure to follow."

MNI Indicators' report revealed on Tuesday that business activity in Chicago decreases this month, marking a ninth consecutive sub-50 reading.

The MNI Chicago Business Barometer, also known as Chicago purchasing manager's index (PMI) came in at 47.8 in March, down from an unrevised 49.0 in February. That was the lowest level since December 2019.

Economists had forecast the index to come in at 40.0.

A reading above 50 indicates improving conditions, while a reading below this level shows worsening of the situation.

According to the report, only two of five major components of the headline index decline m-o-m in March. Production and New Orders fell sharply amid the COVID-19 pandemic. Meanwhile, Supplier Deliveries recorded the largest gain, climbing to the highest level since November 2018, Order Backlogs increased to the highest level since December 2019 and Employment ticked up.

S&P reported on Tuesday its Case-Shiller Home Price Index, which tracks home prices in 20 U.S. metropolitan areas, rose 3.1 percent y-o-y in January 2020, following a revised 2.8 percent y-o-y increase in December 2019 (originally a 2.9 percent y-o-y climb).

Economists had expected an advance of 3.2 percent y-o-y.

Phoenix (+6.9 percent y-o-y), Seattle (+5.1 percent y-o-y) and Tampa (+5.1 percent y-o-y) recorded the highest y-o-y advances in January. Overall, 14 of the 20 cities reported greater price gains in the year ending January 2020 versus the year ending December 2019.

Meanwhile, the S&P/Case-Shiller U.S. National Home Price Index, which measures all nine U.S. census divisions, surged 3.9 percent y-o-y in January, up from 3.7 percent y-o-y in the previous month.

"The trend of stable growth established in 2019 continued into the first month of the new year," noted Craig J. Lazzara, Managing Director and Global Head of Index Investment Strategy at S&P Dow Jones Indices., He added, however, that "It is important to bear in mind that today's report covers real estate transactions closed during the month of January. The COVID-19 pandemic did not begin to take hold in the U.S. until late February, and thus whatever impact it will have on housing prices is not reflected in today's data."

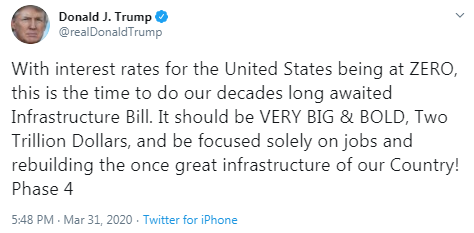

U.S. stock-index futures fell on Tuesday, at the end of one of Wall Street's worst first quarters on record, as the incoming data began to give an idea of the extent of damage caused by the collapse in oil prices and business activity due to coronavirus. Meanwhile, an unexpected expansion in Chinese factory activity and reports that White House officials are preparing a "phase four" stimulus bill were not enough to help the market.

Global Stocks:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Nikkei | 18,917.01 | -167.96 | -0.88% |

| Hang Seng | 23,603.48 | +428.37 | +1.85% |

| Shanghai | 2,750.30 | +3.08 | +0.11% |

| S&P/ASX | 5,076.80 | -104.60 | -2.02% |

| FTSE | 5,574.49 | +10.75 | +0.19% |

| CAC | 4,346.95 | -31.56 | -0.72% |

| DAX | 9,765.19 | -50.78 | -0.52% |

| Crude oil | $20.88 | | +3.93% |

| Gold | $1,621.20 | | -1.34% |

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 6.18 | 0.11(1.81%) | 111377 |

| 3M Co | MMM | 137 | -0.74(-0.54%) | 11646 |

| ALTRIA GROUP INC. | MO | 37.2 | -0.11(-0.29%) | 3716 |

| Amazon.com Inc., NASDAQ | AMZN | 1,952.10 | -11.85(-0.60%) | 48883 |

| American Express Co | AXP | 89.2 | -1.07(-1.19%) | 9591 |

| AMERICAN INTERNATIONAL GROUP | AIG | 25.3 | -0.41(-1.59%) | 2888 |

| Apple Inc. | AAPL | 253.75 | -1.06(-0.42%) | 367771 |

| AT&T Inc | T | 30.51 | 0.28(0.93%) | 85843 |

| Boeing Co | BA | 154.25 | 1.97(1.29%) | 522270 |

| Caterpillar Inc | CAT | 110.03 | -1.68(-1.50%) | 16179 |

| Chevron Corp | CVX | 73.15 | 1.20(1.67%) | 69870 |

| Cisco Systems Inc | CSCO | 39.98 | -0.34(-0.84%) | 55474 |

| Citigroup Inc., NYSE | C | 43.4 | -0.68(-1.54%) | 57412 |

| E. I. du Pont de Nemours and Co | DD | 34.92 | 1.30(3.87%) | 11840 |

| Exxon Mobil Corp | XOM | 38.21 | 0.71(1.89%) | 237872 |

| Facebook, Inc. | FB | 164.75 | -1.20(-0.72%) | 128909 |

| FedEx Corporation, NYSE | FDX | 123.5 | -0.81(-0.65%) | 6749 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 6.3 | 0.06(0.96%) | 56365 |

| Ford Motor Co. | F | 5.05 | 0.02(0.40%) | 440578 |

| General Electric Co | GE | 7.84 | -0.05(-0.63%) | 467722 |

| General Motors Company, NYSE | GM | 21.14 | -0.18(-0.84%) | 18842 |

| Goldman Sachs | GS | 157.7 | -1.92(-1.20%) | 11183 |

| Google Inc. | GOOG | 1,139.00 | -7.82(-0.68%) | 13592 |

| Hewlett-Packard Co. | HPQ | 17.92 | 0.08(0.45%) | 19712 |

| Home Depot Inc | HD | 193.8 | -2.30(-1.17%) | 10742 |

| HONEYWELL INTERNATIONAL INC. | HON | 132 | 0.25(0.19%) | 1657 |

| Intel Corp | INTC | 54.8 | -0.69(-1.24%) | 60511 |

| International Business Machines Co... | IBM | 111.42 | -1.51(-1.34%) | 12609 |

| Johnson & Johnson | JNJ | 136.25 | 3.24(2.44%) | 275710 |

| JPMorgan Chase and Co | JPM | 92.46 | -1.04(-1.11%) | 36235 |

| McDonald's Corp | MCD | 166.95 | -1.18(-0.70%) | 11741 |

| Merck & Co Inc | MRK | 76.3 | -0.65(-0.84%) | 7355 |

| Microsoft Corp | MSFT | 158.62 | -1.61(-1.00%) | 1177114 |

| Nike | NKE | 84.49 | -0.89(-1.04%) | 12784 |

| Pfizer Inc | PFE | 32.4 | -0.27(-0.83%) | 39242 |

| Procter & Gamble Co | PG | 114.35 | -0.65(-0.57%) | 9904 |

| Starbucks Corporation, NASDAQ | SBUX | 67 | -0.86(-1.27%) | 23372 |

| Tesla Motors, Inc., NASDAQ | TSLA | 497.5 | -4.63(-0.92%) | 229533 |

| The Coca-Cola Co | KO | 45.12 | 0.12(0.27%) | 61910 |

| Twitter, Inc., NYSE | TWTR | 25.45 | -0.14(-0.55%) | 25152 |

| United Technologies Corp | UTX | 96.53 | -1.96(-1.99%) | 14989 |

| UnitedHealth Group Inc | UNH | 248 | -3.28(-1.31%) | 7519 |

| Verizon Communications Inc | VZ | 54.45 | -0.32(-0.58%) | 12542 |

| Visa | V | 165.3 | -0.27(-0.16%) | 36149 |

| Wal-Mart Stores Inc | WMT | 113.78 | -1.41(-1.22%) | 18596 |

| Walt Disney Co | DIS | 99.59 | -0.21(-0.21%) | 80057 |

| Yandex N.V., NASDAQ | YNDX | 33.9 | 0.02(0.06%) | 47032 |

Tesla (TSLA) target lowered to $840 from $1060 at JMP Securities

The Federal Reserve on Tuesday announced the establishment of a temporary repurchase agreement facility for foreign and international monetary authorities (FIMA Repo Facility) to help support the smooth functioning of financial markets, including the U.S. Treasury market, and thus maintain the supply of credit to U.S. households and businesses, says the U.S. central bank in its press release.

According to the Fed, "the FIMA Repo Facility will allow FIMA account holders, which consist of central banks and other international monetary authorities with accounts at the Federal Reserve Bank of New York, to enter into repurchase agreements with the Federal Reserve. In these transactions, FIMA account holders temporarily exchange their U.S. Treasury securities held with the Federal Reserve for U.S. dollars, which can then be made available to institutions in their jurisdictions. This facility should help support the smooth functioning of the U.S. Treasury market by providing an alternative temporary source of U.S. dollars other than sales of securities in the open market. It should also serve, along with the U.S. dollar liquidity swap lines the Federal Reserve has established with other central banks, to help ease strains in global U.S. dollar funding markets."

It also added that "the Federal Reserve provides U.S. dollar-denominated banking services to FIMA account holders in support of Federal Reserve objectives and in recognition of the U.S. dollar's predominant role as an international currency. The FIMA Repo Facility, which adds to the range of services the Federal Reserve provides, will be available beginning April 6 and will continue for at least 6 months."

Statistics Canada announced on Tuesday that the country's gross domestic product (GDP) edged up 0.1 percent m-o-m in January 2020, following a 0.3 percent advance in December 2019. That was in line with economists' forecast for a 0.1 percent m-o-m gain.

According to the report, 16 of 26 all sectors recorded gains in January. Manufacturing rose 0.8 percent m-o-m in January, as both durable (+0.1 percent m-o-m) and non-durable (1.7 percent m-o-m) manufacturing increased, while the finance and insurance sector expanded 0.9 percent m-o-m and the wholesale trade sector surged 1.2 percent m-o-m. At the same time, the transportation and warehousing sector decreased 1.7 percent m-o-m in January, the mining, quarrying, and oil and gas extraction sector fell 0.6 percent m-o-m and the retail trade declined 0.4 percent m-o-m.

In y-o-y terms, the Canadian GDP rose 1.8 percent in January.

FXStreet reports that analysts at Natixis believe the economic crisis triggered by the health crisis will be more severe in the United States than in the euro zone or China.

“The weakness of the healthcare system, as many Americans are without health coverage, and due to the low capacity of the healthcare system.”

“Low unemployment benefits, which will lead to a significant decline in Americans’ purchasing power given the inevitable rise in unemployment.”

“The drastic reaction by US companies in reducing employment as soon as activity declines, and which is not cushioned by the short-time working system available in Europe, will lead to a sharp rise in unemployment in the US.”

“Euro-zone companies are financed mainly by banks, US companies mainly in the bond market. It is easier to support bank lending than to keep the bond market open.”

“The rise in unemployment will trigger a banking crisis due to the resulting rise in defaults on household mortgages.”

- Says lack of coronavirus testing remains big problem

- Trump needs to do much more to obtain personal protective equipment

- Fourth piece of coronavirus legislation will focus on recovery

- We will increase 1 trillion yuan of re-lending and re-discount quotas for medium and small banks

- We will issue more local government special bonds

- We will extend subsidies for new energy vehicle (NEV) purchase, exemption from NEV purchase tax for two years

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 06:00 | United Kingdom | Current account, bln | Quarter IV | -19.9 | -7 | -5.6 |

| 06:00 | United Kingdom | GDP, q/q | Quarter IV | 0.5% | 0.0% | 0.0% |

| 06:00 | United Kingdom | GDP, y/y | Quarter IV | 1.3% | 1.1% | 1.1% |

| 06:30 | Switzerland | Retail Sales (MoM) | February | -0.6% | 0.4% | |

| 06:30 | Switzerland | Retail Sales Y/Y | February | 0.0% | -0.7% | 0.3% |

| 06:45 | France | CPI, m/m | March | 0% | 0.0% | |

| 06:45 | France | Consumer spending | February | -1.2% | 0.7% | -0.1% |

| 06:45 | France | CPI, y/y | March | 1.4% | 0.6% | |

| 07:55 | Germany | Unemployment Change | March | -8 | 29 | 1 |

| 07:55 | Germany | Unemployment Rate s.a. | March | 5% | 5.1% | 5% |

| 09:00 | Eurozone | Harmonized CPI ex EFAT, Y/Y | March | 1.2% | 1.1% | 1% |

| 09:00 | Eurozone | Harmonized CPI, Y/Y | March | 1.2% | 0.8% | 0.7% |

GBP traded mixed against other major currencies in the European session on Tuesday as market participants remained preoccupied with the coronavirus situation and its impact on the economy. While the pound fell against USD, which is bought due to its safe-haven properties, it strengthened against the rest of major rivals.

Investors received several important macroeconomic reports. The Office for National Statistics (ONS) reported the UK's economy recorded a flat q/q growth in the fourth quarter of 2019, as initially estimated. According to the report, the UK's GDP remained unchanged q/q in the final quarter of 2019, unrevised from the preliminary estimate, after growing 0.5 percent q/q in the third quarter. That was in line with economists' forecast. On the production side, services output rose 0.2 percent q/q, while production output dropped 0.7 percent q/q, driven by declines in manufacturing and mining and quarrying. Meanwhile, construction output edged down 0.1 percent. On the expenditure side, the household consumption was unchanged in the three months to December and gross fixed capital formation declined 1.2 percent, led by a contraction in business investment. Meanwhile, government consumption grew 1.5 percent, driven by education and health, and net trade contributed positively to the GDP as exports rose more than imports, posting a trade surplus of 1.4 percent of nominal GDP. On a yearly basis, the UK's GDP grew 1.1 percent, also unrevised from the initial estimate. In 2019, the Uk's economy rose 1.4 percent after growing 1.3 percent in 2018.

Another report from the ONS revealed that the UK's current account deficit narrowed significantly in the fourth quarter, to GBP 5.6 billion, or 1.0 percent of GDP, down from an upwardly revised GBP 19.92 billion in the previous quarter. This was the lowest current account shortfall since the second quarter of 2011, mostly because of exports of non-monetary gold and other precious metals and a decrease in the UK's payments to foreign investors.

The survey carried out by the market research group GfK, revealed the UK consumer sentiment weakened moderately in early March ahead of the national lockdown announced to check the spread of coronavirus. The consumer confidence index fell two points to -9 in March. However, the reading was better than economists' forecast of -15.

FXStreet reports that strategists at TD Securities note that oil plunged to its lowest in some 18 years while President Trump will continue his dialog with Russia's Putin about the oil market.

“Demand projections continue to move lower, while Saudi Arabia shows no signs of reconsidering its supply increase in the next few days.”

“We suspect that for any deal to take place, Russia will likely ask for removal of all sanctions on Russian oil interests, and demand that the US must also cut production.”

“We will get a supply decline, one way or another. The oft-cited proposal, between the US, Russia and OPEC could see 4-5 million b/d worth of cuts, representing a 10% cut by these major producers. But, it remains unlikely that even a cut of that magnitude would do much in the short term, when demand is set to drop 15-20 million b/d in the next month or so.”

FXStreet reports that Tim Shaler, an Economist-in-Residence at iTrustCapital, believes the fiscal stimulus package passed by the Senate last week weighed on the USD as he says in an exclusive interview with FXStreet.

“The falling dollar and the very quickly rising stock market on Tuesday, Wednesday and Thursday last week were all driven by speculation and passage of the $2 trillion fiscal stimulus package.”

“The US is about to borrow $2 trillion more dollars than previously expected, foreign exchange participants know that the US might be tempted to allow its currency to depreciate when all this new debt has to be repaid. That risk was immediately ‘priced in’ and the value of the dollar declined.”

“If the US pursues a ‘strong dollar policy’ then the dollar may again rally against other currencies.”

FXStreet reports that economists at TD Securities note that China's manufacturing PMI jumped sharply back up in March, more than reversing its February losses, rising to its strongest since September 2017. USD/CNY is trading at 7.0976.

“The PMI moved sharply back into expansion to 52.0 (mkt 44.8, TD 42.0) from 35.7 in February, its strongest reading since September 2017.”

“The PMI breakdown revealed a major bounce back in output to 54.1, its highest since May 18. New orders also bounced to 52.0, its highest since September 18.”

“The non-manufacturing PMI recorded an even bigger jump to 52.3 from 29.6, with the composite PMI rising to 53.”

- Says rules for PEPP will be set in the future

- Decision on coronabonds is up to governments

FXStreet reports that EUR/USD closely tracks global sentiment, in the opinion of economists at Danske Bank, who see the pair stabilisating in the near-term.

"Recent market stabilisation has clearly been supportive of the spot as markets are arguably front-running economic improvement."

"Global risk stabilisation near term supports EUR/USD at 1.10-1.12 for now."

"EU institutional weakness, doubt as to Fed's reaction function 12M out and virus fears also still make downside risks more pertinent, such that 1.07 will likely act as an anchor and more so than fair-value estimates around 1.20 adding to upside risk."

Bloomberg reports that according to Credit Suisse Group AG, investors are using the stock rally to reset hedges rather than chase upside, signaling little conviction in the rebound.

The S&P 500 Index is up 17% from its March 23 close, after gaining in four of the last five days. But it's been a turbulent time for stocks -- and indeed, all asset classes -- as market gurus and economists struggle to assess the impact of the global coronavirus pandemic. The Cboe Volatility Index, or VIX, ended at 57.08 on Monday and hasn't closed below 40 since March 5. Compare that with its lifetime average of about 19.2.

But it's skew, a measure of how expensive bearish options are compared with bullish ones, that has the attention of Credit Suisse equity-derivatives strategist Mandy Xu.

"Investor sentiment remains extremely cautious as can be seen in equity-skew measures re-steepening significantly," Xu wrote in a note that declared there's "no faith in this rally." "In the options market, investors have taken advantage of the bounce by resetting hedges, rather than adding to longs."

FXStreet reports that based on EIA data published for the week ended 22nd March last week, there were no real issues in terms of storage. However, that is all about to change, in the opinion of Robert Rennie from Westpac Institutional Bank.

"Given the current backdrop of what could be as much as a 15mbpd shock to global demand coinciding with what could be as much as a 5mbpd shock increase to global crude supply, the focus in paper crude markets will very quickly turn to storage capacity."

"Industry anecdotes are suggesting that pipes are beginning to fill and crude that was being piped to the gulf is suddenly becoming landlocked. Such is the case with WTI Midlands.

"Assuming the current supply/ demand picture continues, we tend to see this as a glimpse of what may be to come for WTI - a drop into the 'teens'."

According to a flash estimate from Eurostat, euro area annual inflation is expected to be 0.7% in March 2020, down from 1.2% in February. Economists had expected a 0.8% increase. The core figures arrived at +1.0% in the reported month when compared to 1.1% expectations and +1.2% previous.

Looking at the main components of euro area inflation, food, alcohol & tobacco is expected to have the highest annual rate in March (2.4%, compared with 2.1% in February), followed by services (1.3%, compared with 1.6% in February), non-energy industrial goods (0.5%, stable compared with February) and energy (-4.3%, compared with -0.3% in February).

Bloomberg reports that Japan's ruling party proposed the country's biggest-ever stimulus package worth 60 trillion yen ($554 billion) as the spreading coronavirus locks the economy in a recession.

The sum includes 20 trillion yen in fiscal measures with private initiatives and other elements likely making up the rest, according to the proposal by the Liberal Democratic Party on Tuesday. More than 10 trillion yen, or the equivalent of a 5 percentage point cut in the sales tax rate, would be handed out to the public in a combination of cash, subsidies and coupons, according to the plan.

The proposal puts an initial figure on a stimulus package that Prime Minister Shinzo Abe promised on Saturday would be bigger than the economic support offered in the wake of the global financial crisis. The plan didn't include details of how the package would be funded, though the scale of fiscal measures suggests a sharp increase in the budget deficit would be likely.

More economic measures would be considered if needed, according to the plan. Past experience shows that one package is unlikely to be enough, with as many as five sets of measures unleashed between August 2008 and December 2009 as Japan battled the fallout of the financial crisis.

The latest package would be equivalent to more than 10% of the nation's gross domestic product and calls for corporate funding measures worth more than 40 trillion yen, according to the plan. It also says the party tax panel will consider tax payment deferrals and cuts.

FXStreet reports that FX Strategists at UOB Group see USD/CNH keep the consolidative fashion in the short-term horizon.

24-hour view: "USD traded between 7.0878 and 7.1219 yesterday, narrower than our expected range of 7.0600/7.1300. The price action offers no fresh clues and for today, USD could trade between 7.0950 and 7.1350."

Next 1-3 weeks: "There is not much to add to our update from last Wednesday (25 Mar, spot at 7.0700). As highlighted, USD has not been able to make much headway on the upside after surging to a high of 7.1652. For now, we continue to see chance for USD to break 7.1700 even though the odds have diminished further. However, only a break of 7.0350 (no change in 'strong support' level would indicate that the recent upward pressure has eased."

Due to the corona pandemic, German economic performance has collapsed and public life has increasingly come to a standstill. This leaves clear traces in all areas of the economy. The labour market figures could not yet reflect the current worsening of the Corona crisis, because the figures are up to 12 March and therefore do not include the latest development.

Federal Employment Agency said, the number of unemployed fell from February to march by 60,000 to 2,335,000 due to seasonal factors. The current development on the labour market is not yet reflected in these figures, as the counting day for the statistics was before the aggravation of the Corona crisis. Adjusted for seasonal influences, a slight increase of 1,000 is calculated for March compared to the previous month. Compared to the previous year, the number of unemployed increased by 34,000. The unemployment rate has fallen by 0.2 percentage points to 5.1 percent and has not changed compared to March last year. The unemployment rate determined by the Federal Statistical Office in accordance with the ILO employment concept amounted to 3.4 percent in February.

Underemployment, which also takes into account changes in labour market policy and short-term incapacity for work, increased by 1,000 seasonally adjusted on the previous month. Overall, underemployment in March 2020 was 3,287,000 people. That was 35,000 more than a year ago.

FXStreet reports that late-2008/2009 offers a highly relevant historical analogue for the near term USD outlook, Richard Franulovich from Westpac Institutional Bank reports.

"The parallels with recent USD price action are obvious; the DXY squeezed 9% higher over a more compressed two week period by 20th March, only to give back roughly half those gains by month's end, reflecting broad global policy relief and an easing in USD-funding scarcity."

"But if late 2008/2009 is any guide the USD is likely to stabilise soon and resume a broadly strong tone. Back in 2008/09, once the initial USD squeeze and partial reversal were complete, the USD subsequently regained its footing and held solid well into mid-2009."

"If that scenario plays out again in 2020 that would imply currencies are on the cusp of once again broadly track in line with their sensitivity to risk aversion."

FXStreet reports that with prices significantly lower, markets have at least partially accounted for this demand shock. Strategists at TD Securities analyze is the base metals market has discounted the depth of the problem.

"We find that base metal prices have already accurately discounted the hit to commodity demand thus far observed, with base metals posting returns largely in line with expectations."

"We find that base metal betas to pandemic sentiment are quite low in our cross-asset framework, suggesting that the metals are more likely to be driven by commodity demand than risk sentiment."

"If prices have fully discounted the deterioration in demand, the onus is placed on the ongoing containment measures and suggests that metal prices may not recover with other risk assets in response to the easing of our fear gauge."

CNBC reports that according to the Fitch Ratings, Asia Pacific banks will find it increasingly challenging to maintain their financial performance as economies around the world get hit by the coronavirus pandemic.

The ratings agency earlier this month downgraded the outlook for 10 banking systems in the region to "negative." All 17 banking systems in Asia Pacific that Fitch assesses now have a "negative" outlook.

But the outlook assessment doesn't necessarily indicate that economies in the region face higher risk of financial instability, Fitch's Head of Asia-Pacific Bank Ratings Jonathan Cornish said on Tuesday.

"We wouldn't say that it's a risk. Definitely in terms of the performances of the banks, we expect them to weaken over the course of (2020) and (2021). But still the banks are generally coming off a pretty sound starting point, with the exception, of course, with a few banking systems mainly in emerging markets," he told CNBC.

"But by and large, because of the global financial crisis and the fact that regulators have required banks to build up additional amounts of capital and also improve their liquidity, the starting point is a lot better than what we would have seen otherwise," he added.

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 00:00 | New Zealand | ANZ Business Confidence | March | -19.4 | -24.1 | -63.5 |

| 00:30 | Australia | Private Sector Credit, m/m | February | 0.4% | 0.2% | 0.4% |

| 00:30 | Australia | Private Sector Credit, y/y | February | 2.5% | 2.8% | |

| 01:00 | China | Non-Manufacturing PMI | March | 29.6 | 52.3 | |

| 01:00 | China | Manufacturing PMI | March | 35.7 | 45 | 52 |

| 05:00 | Japan | Construction Orders, y/y | February | 17% | 0.7% | |

| 05:00 | Japan | Housing Starts, y/y | February | -10.1% | -14.7% | -12.3% |

During today's Asian trading, the us dollar rose against the euro and the yen.

The ICE index, which tracks the dollar's performance against six currencies (the euro, swiss franc, yen, canadian dollar, pound sterling and swedish krona), rose 0.2% in trading.

Demand for dollars traditionally increases at the end of the month and, especially, at the end of the quarter, experts say. This time, the increase in demand for the us currency is weaker than expected, thanks to the action of the Federal reserve's swap lines with Central banks of other countries, but it supports the dollar. In the 1st quarter of 2020, the ice dollar index jumped almost 3.1%.

Meanwhile, China on Tuesday said the official PMI for March was 52.0, beating expectations for an economy hit by the coronavirus outbreak. Analysts had expected the official PMI to come in at 45 for the month of March. In February, the official PMI hit a record low of 35.7. PMI readings above 50 indicate expansion, while those below that level signal contraction.

China's National Bureau of Statistics said in its announcement of the PMI reading that there was continued improvement in the prevention and control of the outbreak in March, with a significant acceleration in the resumption of production.

Federal Statistical Office said, turnover adjusted for sales days and holidays fell in the retail sector by 0.4% in nominal terms in February 2020 compared with the previous year. Seasonally adjusted, nominal turnover rose by 0.3% compared with the previous month.

Real turnover adjusted for sales days and holidays rose in the retail sector by 0.3% in February 2020 compared with the previous year. Economists had expected a 0.7% decrease. Real growth takes inflation into consideration. Compared with the previous month, real, seasonally adjusted retail trade turnover registered an increase of 0.4%.

Adjusted for sales days and holidays, the retail sector excluding service stations showed a 0.6% increase in nominal turnover in February 2020 compared with February 2019 (in real terms +1.3%). Retail sales of food, drinks and tobacco registered an increase in nominal turnover of 3.9% (in real terms +4.7%), whereas the non-food sector registered a nominal negative of 2.4% (in real terms -1.5%).

Excluding service stations, the retail sector showed a seasonally adjusted increase in nominal turnover of 0.7% compared with the previous month (in real terms +0.8%). Retail sales of food, drinks and tobacco registered a plus of 2.9% (in real terms +3.0%). The non-food sector showed a minus of 1.0% (in real terms -1.0%).

eFXdata reports that Nordea Research discusses GBP outlook and now expects EUR/GBP to rally through 0.95 over the coming 3 months.

"Turning to the Sterling, we think there are especially three factors why it has been disliked by investors and has traded somewhat in tandem with G10 commodity currencies during the Corona crisis:

-The UK has a twin deficit with the biggest current account deficit (as % of GDP) in G10. A constant capital inflow is therefore needed to underpin the GBP which is challenging in the present "dash for cash situation"

--The UK has a large and systemic important banking sector which is particular exposed in times of credit crunches and disturbances in the global funding system (containing Libor-OIS and basis swaps spreads via more USD liquidity is key)

---After years of Brexit uncertainty and low returns, the sterling has lost some of its appeal as a major reserve currency," Nordea notes.

"We increase our EUR/GBP forecast to levels around 0.95 for the short-term and consider GBP very vulnerable to further setbacks in the Corona crisis," Nordea adds.

-

CNBC reports that the number of coronavirus cases in Germany has increased by 4,615, taking the tally to 61,913, according to the latest data by Robert Koch Institute.

-

Italy's health ministry reported that as of 6 p.m. local time on March 30, there were at least 101,739 total cases of infection among its 60 million citizens.

-

David Nabarro, a special envoy on COVID-19 to the World Health Organization, told CNBC that countries need to act fast and stop the coronavirus outbreak before it grows into an exponential problem.

-

Global cases: More than 786,228

-

Global deaths: At least 37,820

-

Top 5 countries: United States (164,603), Italy (101,739), Spain (87,956), China (82,240), and Germany (66,885)

According to the report from Office for National Statistics, UK gross domestic product (GDP) in volume terms was flat in Quarter 4 (Oct to Dec) 2019, unrevised from the first quarterly estimate.

When compared with the same quarter a year ago, UK GDP increased by 1.1% to Quarter 4 2019, unrevised from the first quarterly estimate.

The services sector provided a positive contribution to growth in the output approach to GDP in Quarter 4 2019, however, this was offset by a negative contribution from the production sector.

Government consumption and trade added to growth in the expenditure approach to GDP in Quarter 4 2019, while private consumption and gross capital formation subtracted from growth.

There were 0.1 percentage point revisions to GDP growth, upwards in Quarter 1 (Jan to Mar) 2019 and downwards in Quarter 2 (Apr to June) 2019, as a result of updated source data.

UK GDP increased by 1.4% between 2018 and 2019, unrevised from the first quarterly estimate.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1256 (2849)

$1.1228 (1312)

$1.1206 (2087)

Price at time of writing this review: $1.1016

Support levels (open interest**, contracts):

$1.0976 (3742)

$1.0933 (3288)

$1.0888 (2406)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date April, 3 is 86816 contracts (according to data from March, 30) with the maximum number of contracts with strike price $1,1000 (4234);

GBP/USD

Resistance levels (open interest**, contracts)

$1.2594 (132)

$1.2554 (87)

$1.2531 (341)

Price at time of writing this review: $1.2345

Support levels (open interest**, contracts):

$1.2156 (31)

$1.1979 (154)

$1.1837 (15)

Comments:

- Overall open interest on the CALL options with the expiration date April, 3 is 18982 contracts, with the maximum number of contracts with strike price $1,3200 (2379);

- Overall open interest on the PUT options with the expiration date April, 3 is 22575 contracts, with the maximum number of contracts with strike price $1,2900 (2837);

- The ratio of PUT/CALL was 1.19 versus 1.20 from the previous trading day according to data from March, 30

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 23.41 | -4.99 |

| WTI | 18.33 | -5.12 |

| Silver | 14.01 | -2.98 |

| Gold | 1620.145 | -0.04 |

| Palladium | 2313.62 | 3.08 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -304.46 | 19084.97 | -1.57 |

| Hang Seng | -309.17 | 23175.11 | -1.32 |

| KOSPI | -0.61 | 1717.12 | -0.04 |

| ASX 200 | 339 | 5181.4 | 7 |

| FTSE 100 | 53.41 | 5563.74 | 0.97 |

| DAX | 183.45 | 9815.97 | 1.9 |

| CAC 40 | 27.02 | 4378.51 | 0.62 |

| Dow Jones | 690.7 | 22327.48 | 3.19 |

| S&P 500 | 85.18 | 2626.65 | 3.35 |

| NASDAQ Composite | 271.77 | 7774.15 | 3.62 |

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.