- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: raw news — 02-04-2014.

Gold $1,290.9 +8.40 +0.65%

ICE Brent Crude Oil $104.79 -0.83 -0.79%

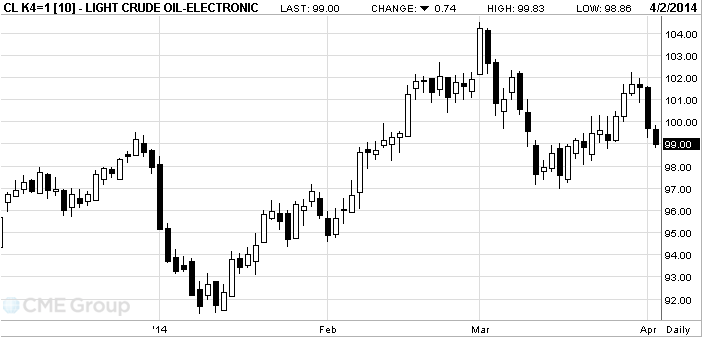

NYMEX Crude Oil $99.29 -0.49 -0.49%

West Texas Intermediate oil maintained losses after a government report showed that U.S. crude inventories unexpectedly dropped.

Futures slid as much as 0.9 percent in New York. Supplies decreased 2.38 million barrels to 380.1 million last week, according to the Energy Information Administration. U.S. crude stockpiles were projected to climb 2.5 million barrels, according to the median of analyst responses in a Bloomberg survey. The Houston Ship Channel, home to the nations’s largest petrochemical complex and export port, reopened March 26 after an oil spill shut it for four days.

U.S. crude production increased 2,000 barrels a day to 8.19 million, the EIA said. Output has surged to the highest level since 1988 this year as a combination of horizontal drilling and hydraulic fracturing, or fracking, which has unlocked supplies trapped in shale formations.

Crude supplies at Cushing, Oklahoma, the delivery point for WTI, decreased 1.22 million barrels to a four-year low of 27.3 million, the report showed. Stockpiles at the hub have fallen since the southern portion of the Keystone XL pipeline began moving oil to the Texas Gulf Coast from Cushing in January.

Refineries operated at 87.7 percent of capacity in the seven days ended March 28, up 1.7 percentage points from the prior week, according to the EIA, the Energy Department’s statistical arm.

WTI for May delivery decreased 63 cents, or 0.6 percent, to $99.11 a barrel at 10:46 a.m. on the New York Mercantile Exchange. The contract traded at $99.23 before the release of the report at 10:30 a.m. in Washington. The volume of all futures traded was 6.1 percent above the 100-day average for the time of day.

Brent for May settlement fell $1.32, or 1.3 percent, to $104.30 a barrel on the London-based ICE Futures Europe exchange. Futures touched $104.12, the lowest level since Nov. 8. Volume was 83 percent above the 100-day average. The European benchmark grade traded at a $5.19 premium to WTI. The spread shrank to the narrowest level since October.

Gold prices rose after two days of sales, but remain near seven-week low after reporting growth in manufacturing activity and employment in the United States .

Some analysts predict a decline in prices because of the rise in stock markets , while others believe that prices , on the contrary , will increase due to increased demand in the physical market and geopolitical tensions in the Ukraine. Analyst Ed Meir INTL FCStone believes that the rise of stock price does not necessarily cause the outflow of funds from the gold market.

" In addition, although the situation in Ukraine is not so critical , tensions remain , given the accumulation of Russian troops from the Ukrainian border," - he said. "In the medium term charts are negative, but it should be noted that the market moves to the mark when it is resold. We expect that in April, prices will fluctuate in the range of $ 1.250 -$ 1.330 ."

Support gold prices have data on the growth of employment in the United States . As shown by recent data that were presented Automatic Data Processing (ADP), in March of private sector employment increased markedly , came close to the forecasted values.

According to a report last month, the number of employees increased by 191 thousand people, compared with a revised upward figure for the previous month at 178 million ( initially reported growth of 139 thousand ) . Add that, according to the average forecast of this indicator would grow by 192 thousand

Stocks of the world's largest exchange-traded fund backed by gold (ETF) SPDR Gold Trust on Tuesday declined by 2.1 tons to 810.98 tons. Price 99.99 fine gold on the Shanghai Gold Exchange is comparable to the spot price in London. In January, prices in Shanghai have been $ 20 higher than in London, but in March, prices reached $ 08.10 per ounce.

The cost of the June gold futures on the COMEX today rose to $ 1294.90 per ounce.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.