- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: raw news — 31-03-2014.

(raw materials / closing price /% change)

Gold $1,294.4 +0.10 +0.008%

ICE Brent Crude Oil $108.07 +0.32 +0.30%

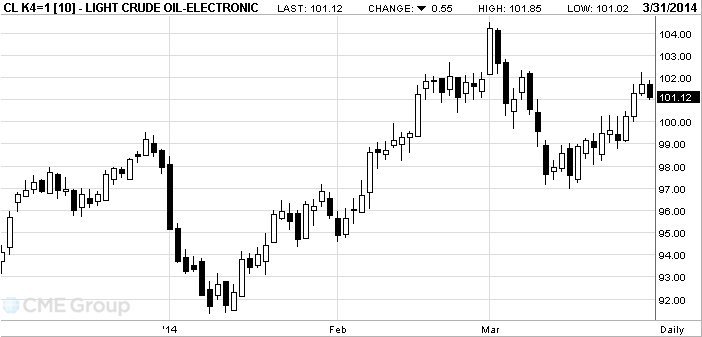

NYMEX Crude Oil $101.67 +0.28 +0.28%

West Texas

Intermediate crude traded near the highest close in three weeks as the

Futures

were little changed in

“There is a

looming tension on

WTI for May

delivery was at $101.31 a barrel in electronic trading on the New York

Mercantile Exchange, down 36 cents, at 12:39 p.m.

Brent for

May settlement was at $107.81 a barrel, down 24 cents on the London-based ICE

Futures Europe exchange. The March 28 close was the highest since March 14. The

European benchmark crude was at a premium of $6.53 to WTI. The spread narrowed

for a third day on March 28 to close at $6.40.

Brent is

poised for a decline of 2.7 percent this quarter.

Gold prices traded within a range close to Friday's six-week low and decline in March due to growing optimism about the U.S. economy and weak demand in the physical markets of Asia.

Kept gold prices rise weak statistics on industrial production in Japan. The volume of industrial production in Japan in February unexpectedly fell 2.3 % on a monthly basis , after rising 3.8 % in January. Analysts , on the contrary , had expected growth of 0.3%.

The analysts point out that the price of gold is under some pressure due to uncertainty about the Fed's policy .

Gold's appeal as a low-risk investments decreased this year due to high U.S. macroeconomic indicators . Fed Chairman Janet Yellen hinted at the beginning of March , the central bank may raise interest rates in the first half of 2015.

" Janet Yellen talked about raising rates , which put pressure on gold, but investors should remember that while the improved statistics , the U.S. economy is far from strong ," - believes macroeconomic strategist at Everbright Futures Co. Sun Yonggang .

"Prices continue to fall , because the factors supporting the gold in the first quarter , for example, geopolitical issues and the crisis in developing countries, now weakened ," - said the precious metals market analyst Jinrui Futures Chen Ming . According to him , the physical demand in Asia may rise when prices fall to $ 1.180-1.200 .

The cost of the April gold futures on the COMEX today dropped to $ 1288.70 per ounce.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.