- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: raw news — 03-08-2015.

(raw materials / closing price /% change)

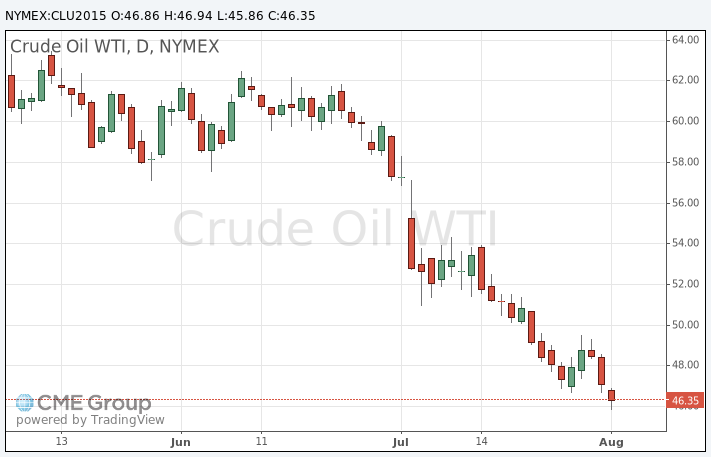

Oil 45.30 +0.29%

Gold 1,085.60 -0.35%

Oil prices decreased on concerns over the global oil oversupply. The oil driller Baker Hughes reported that the number of active U.S. rigs rose by 5 rigs to 664 last week. It was the second consecutive weekly increase.

Combined oil and gas rigs fell by 2 to 874.

The weaker-than-expected Chinese manufacturing data also weighed on oil prices. The Chinese manufacturing PMI declined to 50.0 in July from 50.2 in June. Analysts had expected the index to remain unchanged.

A reading above the 50 mark indicates expansion, a reading below 50 indicates contraction.

The index reflected the weakness in new orders and new export orders, employment and prices for materials.

"Both domestic and external manufacturing remain weak," Zhao Qinghe, an economist at the National Bureau of Statistics, said.

The final Chinese Markit/Caixin manufacturing PMI declined to 47.8 in July from 49.4 in June, missing expectations for a fall to 48.2.

WTI crude oil for September delivery decreased to $45.86 a barrel on the New York Mercantile Exchange.

Brent crude oil for September fell to $50.46 a barrel on ICE Futures Europe.

Gold price declined on a stronger U.S. dollar. Speculation that the Fed starts raising interest rate soon weighed on gold price. St. Louis Federal Reserve President James Bullard said on Friday that the Fed may start raising interest rates in September due to the latest U.S. economic growth data.

Gains of the U.S. dollar were limited due to the weaker-than-expected U.S. economic data. Personal spending rose 0.2% in June, in line with expectations, after a 0.7% increase in May. May's figure was revised down from a 0.9% increase.

Consumer spending makes more than two-thirds of U.S. economic activity.

Personal spending was driven by lower demand for automobiles. Spending on auto mobiles dropped 1.3% in June.

The saving rate rose to 4.8% in June from 4.6% in May.

Personal income increased 0.4% in June, in line with expectations, after a 0.4% gain in May. May's figure was revised down from a 0.5% rise.

The personal consumption expenditures (PCE) price index excluding food and energy rose 0.1% in June, in line with forecasts, after a 0.1% gain in May.

On a yearly basis, the PCE price index excluding food and index increased 1.3% in June, after a 1.3% gain in May. May's figure was revised up from a 1.2% rise.

The PCE index is below the Fed's 2% inflation target. The PCE index is the Fed's preferred measure of inflation.

October futures for gold on the COMEX today declined to 1088.20 dollars per ounce.

The Chinese manufacturing PMI declined to 50.0 in July from 50.2 in June. Analysts had expected the index to remain unchanged.

A reading above the 50 mark indicates expansion, a reading below 50 indicates contraction.

The index reflected the weakness in new orders and new export orders, employment and prices for materials.

"Both domestic and external manufacturing remain weak," Zhao Qinghe, an economist at the National Bureau of Statistics, said.

The final Chinese Markit/Caixin manufacturing PMI declined to 47.8 in July from 49.4 in June, missing expectations for a fall to 48.2.

The oil driller Baker Hughes reported that the number of active U.S. rigs rose by 5 rigs to 664 last week. It was the second consecutive weekly increase.

Combined oil and gas rigs fell by 2 to 874.

West Texas Intermediate futures for September delivery declined to $46.72 (-0.85%), while Brent crude dropped to $51.72 (-0.94%). Iranian Oil Minister Bijan Namdar Zanganeh said the country's output could increase by 500,000 barrels a day within a week after international sanctions are lifted and by 1 million barrels a day within a month after that. According to the Iran oil ministry's news agency, sanctions against Tehran should be lifted by the end of November.

Greater exports from Iran combined with OPEC's market share protection policy would weigh on prices, Zanganeh said.

Gold is currently $1,095.80 (+0.06%). Expectations of an imminent rate hike in the U.S. continue weighing on the non-interest bearing precious metal. Bullion lost 7% in July, marking its greatest decline since June 2013.

Physical demand remained weak. Potential buyers in China postponed purchases expecting further declines in prices.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.